Corporate Accounting: Cash Flows, OCI Statement, and Income Tax

VerifiedAdded on 2023/06/11

|7

|1497

|100

AI Summary

This article discusses the cash flows statement, other comprehensive income statement, and accounting for corporate income tax of BC Iron Limited. It includes trends, key observations, and computations of tax expenses.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE ACCOUNTING

Assessment Task 2

STUDENT ID:

[Pick the date]

Assessment Task 2

STUDENT ID:

[Pick the date]

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Selected company – BCI or BC Iron Limited

CASH FLOWS STATEMENT

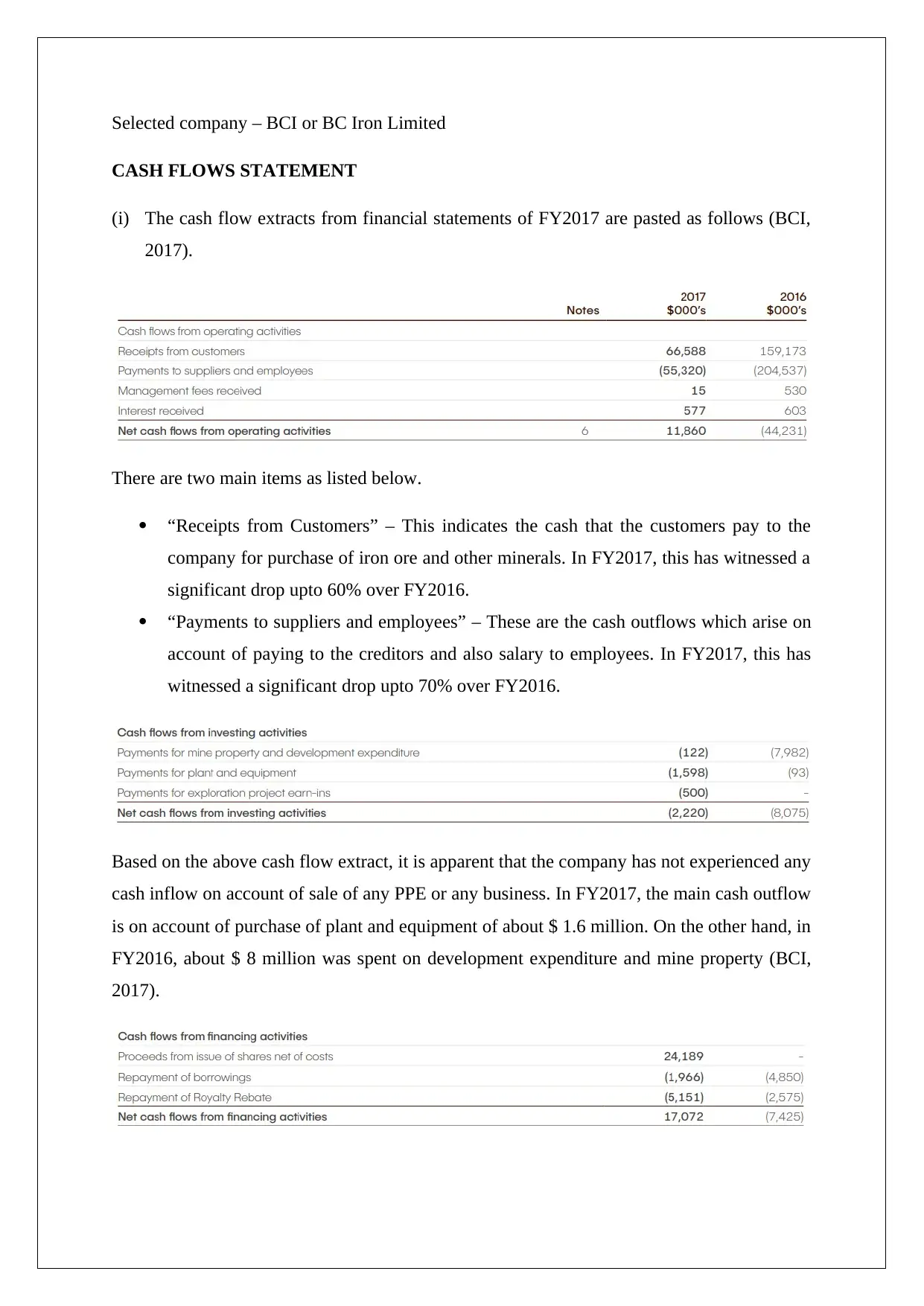

(i) The cash flow extracts from financial statements of FY2017 are pasted as follows (BCI,

2017).

There are two main items as listed below.

“Receipts from Customers” – This indicates the cash that the customers pay to the

company for purchase of iron ore and other minerals. In FY2017, this has witnessed a

significant drop upto 60% over FY2016.

“Payments to suppliers and employees” – These are the cash outflows which arise on

account of paying to the creditors and also salary to employees. In FY2017, this has

witnessed a significant drop upto 70% over FY2016.

Based on the above cash flow extract, it is apparent that the company has not experienced any

cash inflow on account of sale of any PPE or any business. In FY2017, the main cash outflow

is on account of purchase of plant and equipment of about $ 1.6 million. On the other hand, in

FY2016, about $ 8 million was spent on development expenditure and mine property (BCI,

2017).

CASH FLOWS STATEMENT

(i) The cash flow extracts from financial statements of FY2017 are pasted as follows (BCI,

2017).

There are two main items as listed below.

“Receipts from Customers” – This indicates the cash that the customers pay to the

company for purchase of iron ore and other minerals. In FY2017, this has witnessed a

significant drop upto 60% over FY2016.

“Payments to suppliers and employees” – These are the cash outflows which arise on

account of paying to the creditors and also salary to employees. In FY2017, this has

witnessed a significant drop upto 70% over FY2016.

Based on the above cash flow extract, it is apparent that the company has not experienced any

cash inflow on account of sale of any PPE or any business. In FY2017, the main cash outflow

is on account of purchase of plant and equipment of about $ 1.6 million. On the other hand, in

FY2016, about $ 8 million was spent on development expenditure and mine property (BCI,

2017).

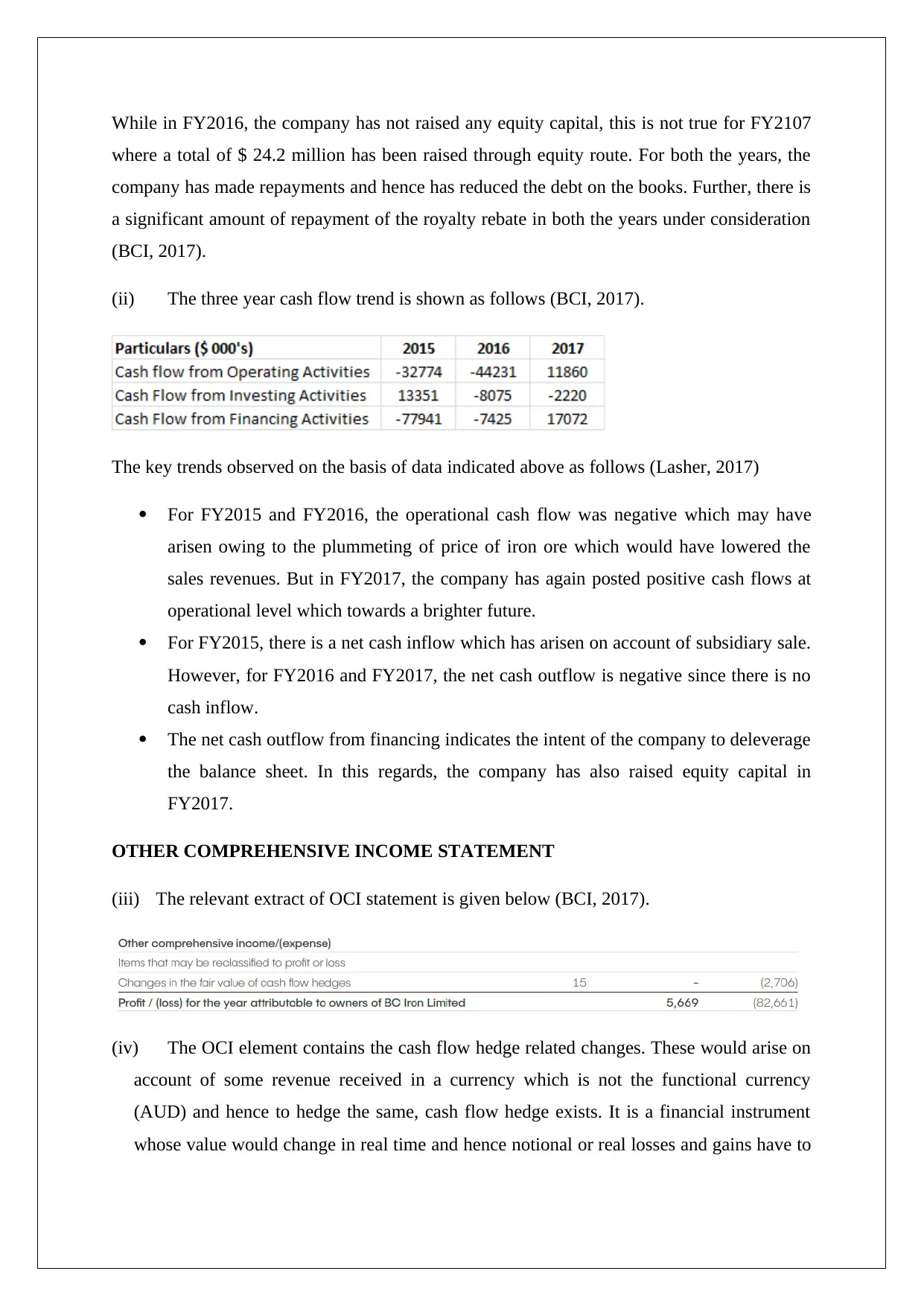

While in FY2016, the company has not raised any equity capital, this is not true for FY2107

where a total of $ 24.2 million has been raised through equity route. For both the years, the

company has made repayments and hence has reduced the debt on the books. Further, there is

a significant amount of repayment of the royalty rebate in both the years under consideration

(BCI, 2017).

(ii) The three year cash flow trend is shown as follows (BCI, 2017).

The key trends observed on the basis of data indicated above as follows (Lasher, 2017)

For FY2015 and FY2016, the operational cash flow was negative which may have

arisen owing to the plummeting of price of iron ore which would have lowered the

sales revenues. But in FY2017, the company has again posted positive cash flows at

operational level which towards a brighter future.

For FY2015, there is a net cash inflow which has arisen on account of subsidiary sale.

However, for FY2016 and FY2017, the net cash outflow is negative since there is no

cash inflow.

The net cash outflow from financing indicates the intent of the company to deleverage

the balance sheet. In this regards, the company has also raised equity capital in

FY2017.

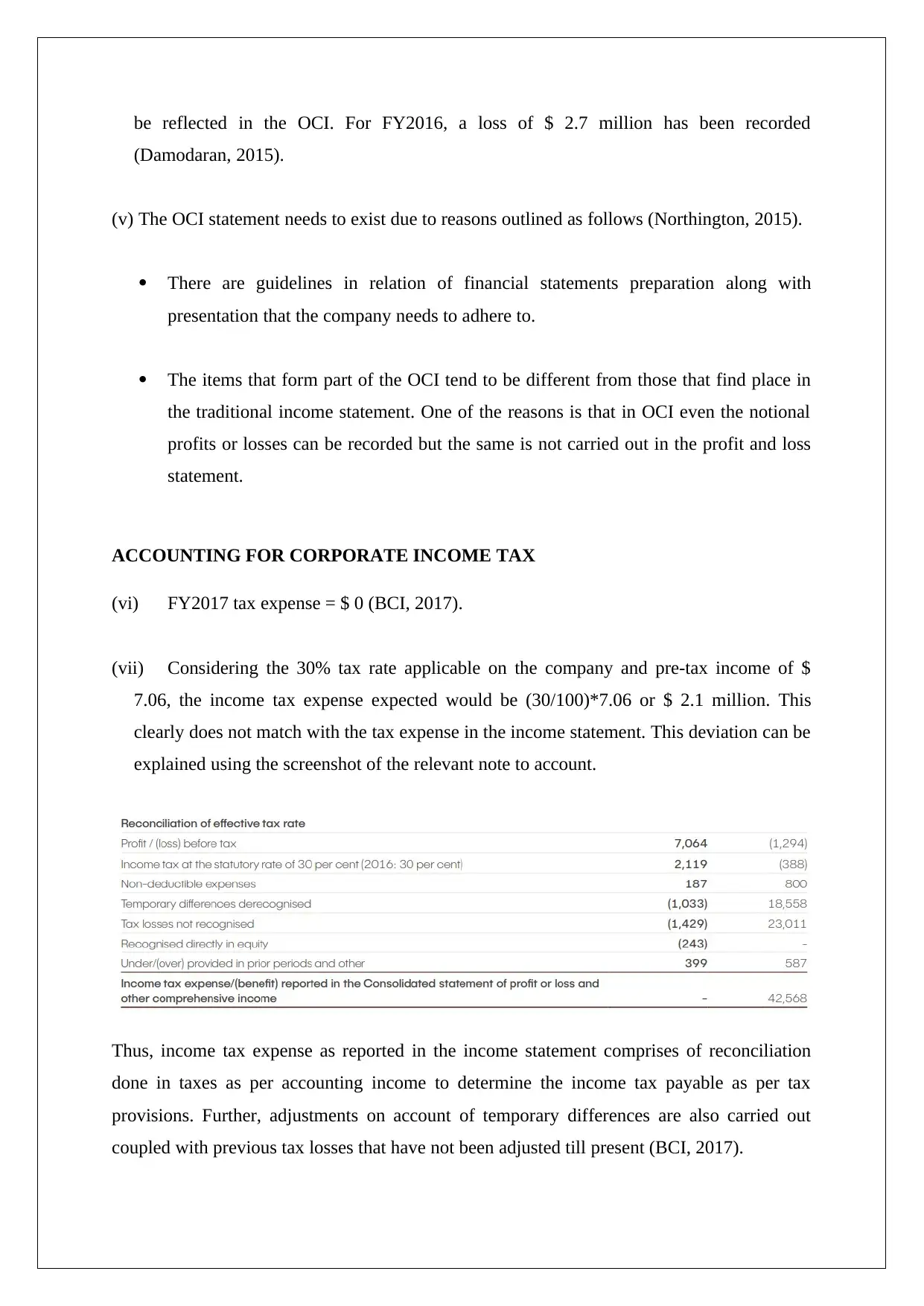

OTHER COMPREHENSIVE INCOME STATEMENT

(iii) The relevant extract of OCI statement is given below (BCI, 2017).

(iv) The OCI element contains the cash flow hedge related changes. These would arise on

account of some revenue received in a currency which is not the functional currency

(AUD) and hence to hedge the same, cash flow hedge exists. It is a financial instrument

whose value would change in real time and hence notional or real losses and gains have to

where a total of $ 24.2 million has been raised through equity route. For both the years, the

company has made repayments and hence has reduced the debt on the books. Further, there is

a significant amount of repayment of the royalty rebate in both the years under consideration

(BCI, 2017).

(ii) The three year cash flow trend is shown as follows (BCI, 2017).

The key trends observed on the basis of data indicated above as follows (Lasher, 2017)

For FY2015 and FY2016, the operational cash flow was negative which may have

arisen owing to the plummeting of price of iron ore which would have lowered the

sales revenues. But in FY2017, the company has again posted positive cash flows at

operational level which towards a brighter future.

For FY2015, there is a net cash inflow which has arisen on account of subsidiary sale.

However, for FY2016 and FY2017, the net cash outflow is negative since there is no

cash inflow.

The net cash outflow from financing indicates the intent of the company to deleverage

the balance sheet. In this regards, the company has also raised equity capital in

FY2017.

OTHER COMPREHENSIVE INCOME STATEMENT

(iii) The relevant extract of OCI statement is given below (BCI, 2017).

(iv) The OCI element contains the cash flow hedge related changes. These would arise on

account of some revenue received in a currency which is not the functional currency

(AUD) and hence to hedge the same, cash flow hedge exists. It is a financial instrument

whose value would change in real time and hence notional or real losses and gains have to

be reflected in the OCI. For FY2016, a loss of $ 2.7 million has been recorded

(Damodaran, 2015).

(v) The OCI statement needs to exist due to reasons outlined as follows (Northington, 2015).

There are guidelines in relation of financial statements preparation along with

presentation that the company needs to adhere to.

The items that form part of the OCI tend to be different from those that find place in

the traditional income statement. One of the reasons is that in OCI even the notional

profits or losses can be recorded but the same is not carried out in the profit and loss

statement.

ACCOUNTING FOR CORPORATE INCOME TAX

(vi) FY2017 tax expense = $ 0 (BCI, 2017).

(vii) Considering the 30% tax rate applicable on the company and pre-tax income of $

7.06, the income tax expense expected would be (30/100)*7.06 or $ 2.1 million. This

clearly does not match with the tax expense in the income statement. This deviation can be

explained using the screenshot of the relevant note to account.

Thus, income tax expense as reported in the income statement comprises of reconciliation

done in taxes as per accounting income to determine the income tax payable as per tax

provisions. Further, adjustments on account of temporary differences are also carried out

coupled with previous tax losses that have not been adjusted till present (BCI, 2017).

(Damodaran, 2015).

(v) The OCI statement needs to exist due to reasons outlined as follows (Northington, 2015).

There are guidelines in relation of financial statements preparation along with

presentation that the company needs to adhere to.

The items that form part of the OCI tend to be different from those that find place in

the traditional income statement. One of the reasons is that in OCI even the notional

profits or losses can be recorded but the same is not carried out in the profit and loss

statement.

ACCOUNTING FOR CORPORATE INCOME TAX

(vi) FY2017 tax expense = $ 0 (BCI, 2017).

(vii) Considering the 30% tax rate applicable on the company and pre-tax income of $

7.06, the income tax expense expected would be (30/100)*7.06 or $ 2.1 million. This

clearly does not match with the tax expense in the income statement. This deviation can be

explained using the screenshot of the relevant note to account.

Thus, income tax expense as reported in the income statement comprises of reconciliation

done in taxes as per accounting income to determine the income tax payable as per tax

provisions. Further, adjustments on account of temporary differences are also carried out

coupled with previous tax losses that have not been adjusted till present (BCI, 2017).

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

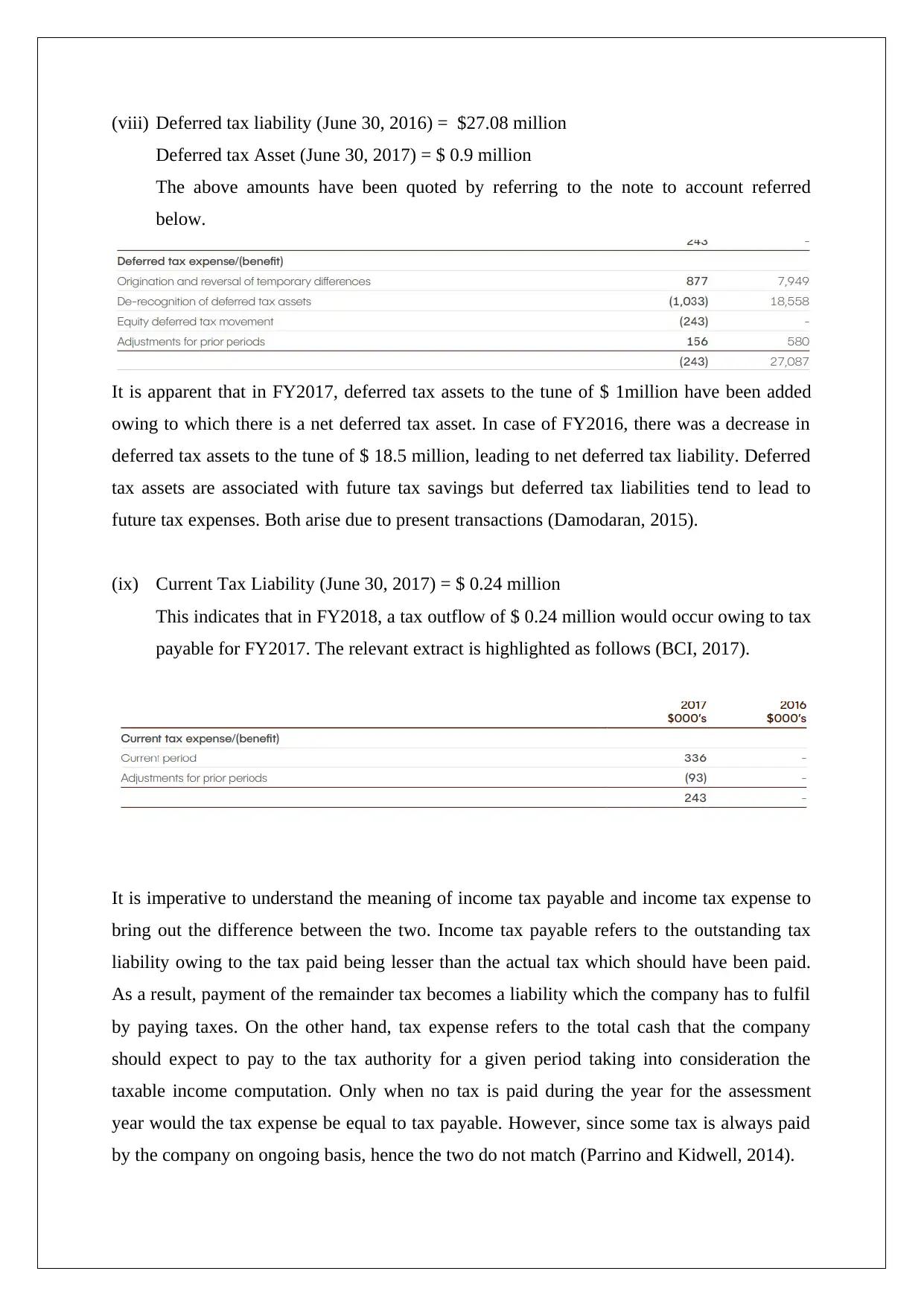

(viii) Deferred tax liability (June 30, 2016) = $27.08 million

Deferred tax Asset (June 30, 2017) = $ 0.9 million

The above amounts have been quoted by referring to the note to account referred

below.

It is apparent that in FY2017, deferred tax assets to the tune of $ 1million have been added

owing to which there is a net deferred tax asset. In case of FY2016, there was a decrease in

deferred tax assets to the tune of $ 18.5 million, leading to net deferred tax liability. Deferred

tax assets are associated with future tax savings but deferred tax liabilities tend to lead to

future tax expenses. Both arise due to present transactions (Damodaran, 2015).

(ix) Current Tax Liability (June 30, 2017) = $ 0.24 million

This indicates that in FY2018, a tax outflow of $ 0.24 million would occur owing to tax

payable for FY2017. The relevant extract is highlighted as follows (BCI, 2017).

It is imperative to understand the meaning of income tax payable and income tax expense to

bring out the difference between the two. Income tax payable refers to the outstanding tax

liability owing to the tax paid being lesser than the actual tax which should have been paid.

As a result, payment of the remainder tax becomes a liability which the company has to fulfil

by paying taxes. On the other hand, tax expense refers to the total cash that the company

should expect to pay to the tax authority for a given period taking into consideration the

taxable income computation. Only when no tax is paid during the year for the assessment

year would the tax expense be equal to tax payable. However, since some tax is always paid

by the company on ongoing basis, hence the two do not match (Parrino and Kidwell, 2014).

Deferred tax Asset (June 30, 2017) = $ 0.9 million

The above amounts have been quoted by referring to the note to account referred

below.

It is apparent that in FY2017, deferred tax assets to the tune of $ 1million have been added

owing to which there is a net deferred tax asset. In case of FY2016, there was a decrease in

deferred tax assets to the tune of $ 18.5 million, leading to net deferred tax liability. Deferred

tax assets are associated with future tax savings but deferred tax liabilities tend to lead to

future tax expenses. Both arise due to present transactions (Damodaran, 2015).

(ix) Current Tax Liability (June 30, 2017) = $ 0.24 million

This indicates that in FY2018, a tax outflow of $ 0.24 million would occur owing to tax

payable for FY2017. The relevant extract is highlighted as follows (BCI, 2017).

It is imperative to understand the meaning of income tax payable and income tax expense to

bring out the difference between the two. Income tax payable refers to the outstanding tax

liability owing to the tax paid being lesser than the actual tax which should have been paid.

As a result, payment of the remainder tax becomes a liability which the company has to fulfil

by paying taxes. On the other hand, tax expense refers to the total cash that the company

should expect to pay to the tax authority for a given period taking into consideration the

taxable income computation. Only when no tax is paid during the year for the assessment

year would the tax expense be equal to tax payable. However, since some tax is always paid

by the company on ongoing basis, hence the two do not match (Parrino and Kidwell, 2014).

(x) In the case of the given company, both tax expense and tax paid tend to match. This is

because even before the completion of the financial year the management of the

company is aware than irrespective of the profits generated by the company, the tax

expense would be zero owing to the existence of the previous losses and other aspects.

However, usually this is not the case since the two do not match (Brealey, Myers and

Allen, 2014).

(xi) The computation of tax expense was quite interesting for me as I was initially quite

shocked to see that despite the presence of sizable profits, the tax expense is zero.

However, reconciliation needs to be carried out on the basis of the various parameters

which is never an easy process as exhibited in this task also. Based on this, new insight

has been provided to compute the outgoing tax in case of corporates using various

adjustments. As a result, both practical and theoretical understanding is desired.

References

Brealey, R. A., Myers, S. C., & Allen, F. (2014) Principles of corporate finance, 2nd ed. New

York: McGraw-Hill Inc.

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Lasher, W. R., (2017) Practical Financial Management 5th ed. London: South- Western

College Publisher.

Northington, S. (2015) Finance, 4th ed. New York: Ferguson

because even before the completion of the financial year the management of the

company is aware than irrespective of the profits generated by the company, the tax

expense would be zero owing to the existence of the previous losses and other aspects.

However, usually this is not the case since the two do not match (Brealey, Myers and

Allen, 2014).

(xi) The computation of tax expense was quite interesting for me as I was initially quite

shocked to see that despite the presence of sizable profits, the tax expense is zero.

However, reconciliation needs to be carried out on the basis of the various parameters

which is never an easy process as exhibited in this task also. Based on this, new insight

has been provided to compute the outgoing tax in case of corporates using various

adjustments. As a result, both practical and theoretical understanding is desired.

References

Brealey, R. A., Myers, S. C., & Allen, F. (2014) Principles of corporate finance, 2nd ed. New

York: McGraw-Hill Inc.

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Lasher, W. R., (2017) Practical Financial Management 5th ed. London: South- Western

College Publisher.

Northington, S. (2015) Finance, 4th ed. New York: Ferguson

Parrino, R. and Kidwell, D. (2014) Fundamentals of Corporate Finance, 3rd ed. London:

Wiley Publications

BCI (2017) Annual Report FY2017, [online] available at

https://www.bciminerals.com.au/images/files/annual-report/BC_Iron_Annual_Report_2017.p

df (Accessed May 25, 2018)

Wiley Publications

BCI (2017) Annual Report FY2017, [online] available at

https://www.bciminerals.com.au/images/files/annual-report/BC_Iron_Annual_Report_2017.p

df (Accessed May 25, 2018)

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.