HI5020 Corporate Accounting: Detailed Financial Analysis of Farmpride

VerifiedAdded on 2023/06/12

|11

|2708

|356

Report

AI Summary

This report provides a comprehensive analysis of Farmpride Foods Limited's financial statements, focusing on the cash flow statement, comprehensive income statement, and taxation. It examines the changes in cash flow from operating, investing, and financing activities over three years (2015-2017), explains the items reported in the comprehensive income statement, and discusses the concepts of impairment, employee benefits, finance costs, and depreciation. The report also analyzes the income tax expense, deferred tax assets, and the differences between accounting profit and taxable income. Furthermore, it evaluates the company's treatment of taxation in its financial statements, highlighting proper disclosures and assumptions made regarding tax legislation and future assessable income. Desklib offers a wide range of solved assignments and past papers for students seeking additional resources.

Running head: CORPORATE ACCOUNTING

Corporate accounting

Name of the Student

Name of the University

Author Note

Corporate accounting

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING

Table of Contents

Requirement i)............................................................................................................................2

Requirement ii)...........................................................................................................................3

Requirement iii).........................................................................................................................3

Requirement iv)..........................................................................................................................4

Requirement v)...........................................................................................................................5

Requirement vi)..........................................................................................................................5

Requirement vii).........................................................................................................................5

Requirement viii).......................................................................................................................6

Requirement ix)..........................................................................................................................6

Requirement x)...........................................................................................................................7

Requirement xi)..........................................................................................................................8

References list:.........................................................................................................................10

Appendix:.................................................................................................................................12

Table of Contents

Requirement i)............................................................................................................................2

Requirement ii)...........................................................................................................................3

Requirement iii).........................................................................................................................3

Requirement iv)..........................................................................................................................4

Requirement v)...........................................................................................................................5

Requirement vi)..........................................................................................................................5

Requirement vii).........................................................................................................................5

Requirement viii).......................................................................................................................6

Requirement ix)..........................................................................................................................6

Requirement x)...........................................................................................................................7

Requirement xi)..........................................................................................................................8

References list:.........................................................................................................................10

Appendix:.................................................................................................................................12

CORPORATE ACCOUNTING

Requirement i)

Cash flow statement analysis:

The cash flow of Farmpride Foods limited has been segmented into three parts

comprising of cash flow from operating activities, cash flow from investing activities and

cash flow from financing activities. Items under the cash flow from operating activities

include payments made to suppliers, receipt from customers, income tax paid, income tax

received and finance costs. Net cash provided by operating activities has reduced from $

13687 in year 2016 to $ 7661 in year 2017. This decline in net cash provided from operating

activities is attributable to increase in payment from employees and suppliers. Cash flow

from investing activities comprise of payment from property, equipment and plant and

proceeds generated from sale of property, equipment and plant. The net cash used in

investing activities has decline from $ 6416 to $ 2267 in year 2016 (Farmpride.com.au 2018).

This is due to decrease in payment made for such assets and increase in proceeds from sale of

equipment, property and plant. Cash flow from financing activities includes repayment of

finance leases and repayment of borrowings. Net cash used in financing activities has

declined from $ 4419 in year 2016 to $ 794 in year 2017 respectively because of decrease in

repayment of finance lease. It can be seen that total amount of cash and cash equivalent has

increased in year 2017 to $ 8038 as against $ 3438 (Farmpride.com.au 2018).

Requirement ii)

Comparative analysis of cash flow items for three years:

Particular

($000)

2015

($000)

2016

($000)

2017

Net cash flows from operating activities 9233 13,687 7,661

Net cash flows used in investing

activities -535

-

6,416

-

2,267

Requirement i)

Cash flow statement analysis:

The cash flow of Farmpride Foods limited has been segmented into three parts

comprising of cash flow from operating activities, cash flow from investing activities and

cash flow from financing activities. Items under the cash flow from operating activities

include payments made to suppliers, receipt from customers, income tax paid, income tax

received and finance costs. Net cash provided by operating activities has reduced from $

13687 in year 2016 to $ 7661 in year 2017. This decline in net cash provided from operating

activities is attributable to increase in payment from employees and suppliers. Cash flow

from investing activities comprise of payment from property, equipment and plant and

proceeds generated from sale of property, equipment and plant. The net cash used in

investing activities has decline from $ 6416 to $ 2267 in year 2016 (Farmpride.com.au 2018).

This is due to decrease in payment made for such assets and increase in proceeds from sale of

equipment, property and plant. Cash flow from financing activities includes repayment of

finance leases and repayment of borrowings. Net cash used in financing activities has

declined from $ 4419 in year 2016 to $ 794 in year 2017 respectively because of decrease in

repayment of finance lease. It can be seen that total amount of cash and cash equivalent has

increased in year 2017 to $ 8038 as against $ 3438 (Farmpride.com.au 2018).

Requirement ii)

Comparative analysis of cash flow items for three years:

Particular

($000)

2015

($000)

2016

($000)

2017

Net cash flows from operating activities 9233 13,687 7,661

Net cash flows used in investing

activities -535

-

6,416

-

2,267

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING

Net cash flows used in financing

activities -8619

-

4,419

-

794

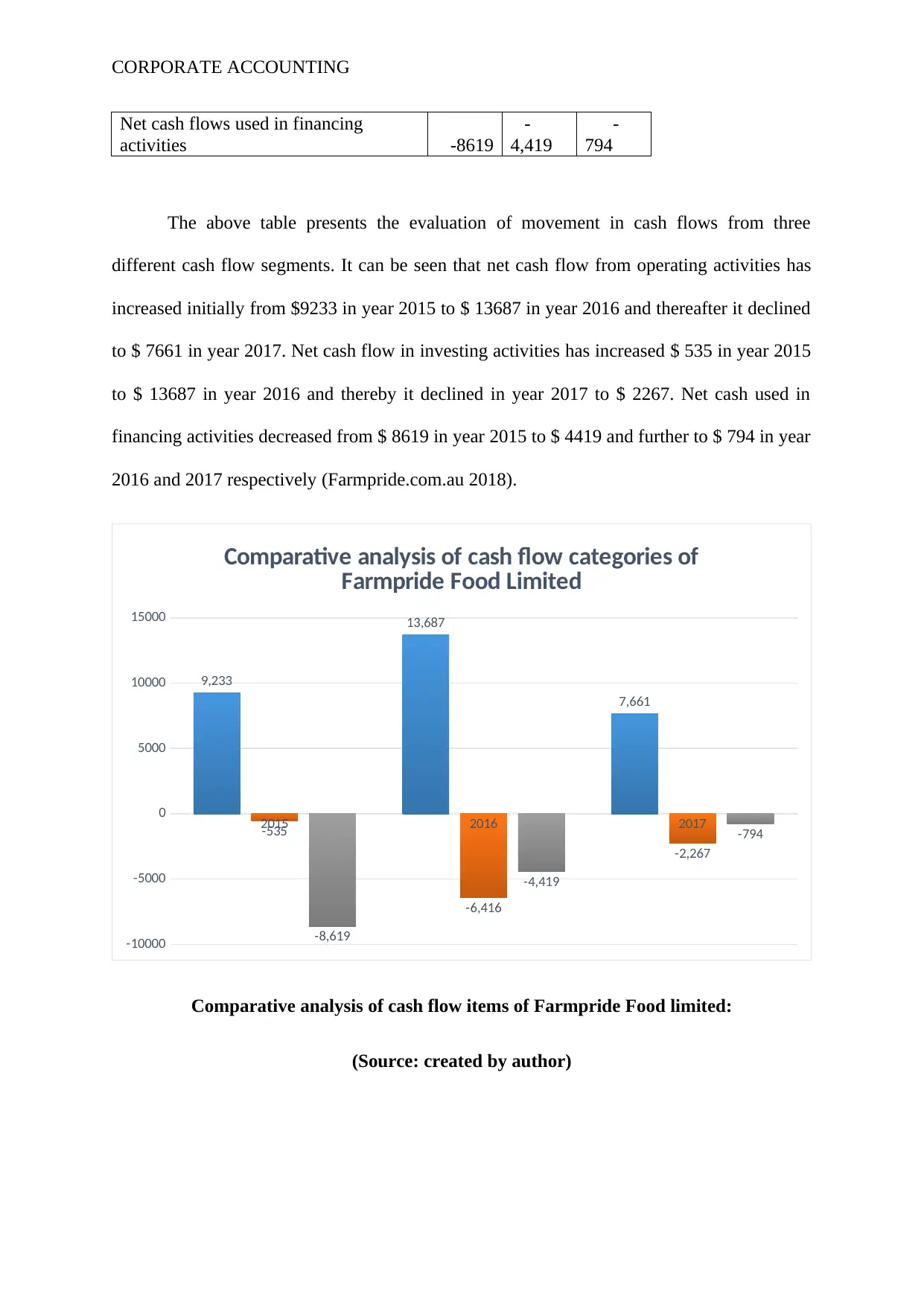

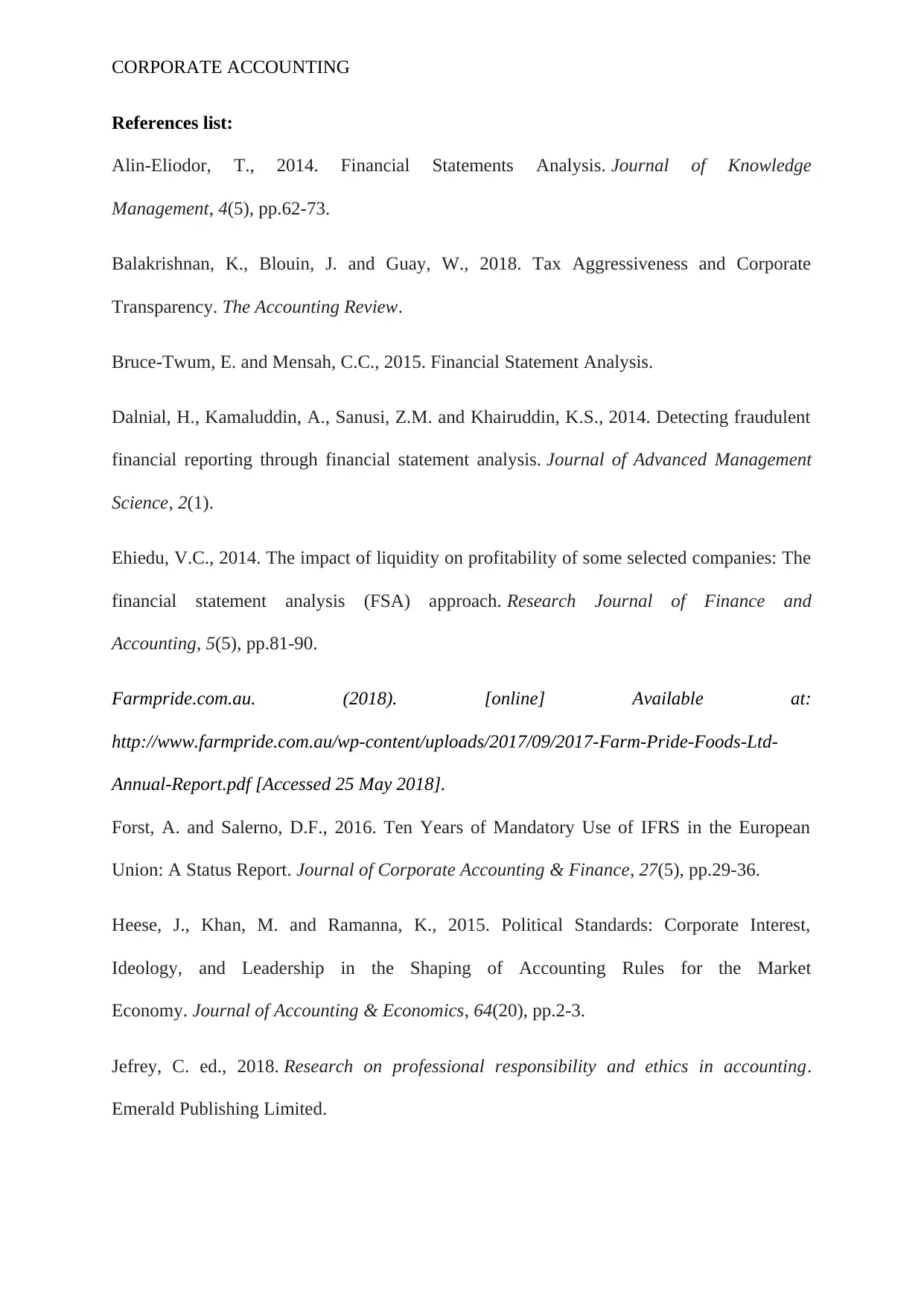

The above table presents the evaluation of movement in cash flows from three

different cash flow segments. It can be seen that net cash flow from operating activities has

increased initially from $9233 in year 2015 to $ 13687 in year 2016 and thereafter it declined

to $ 7661 in year 2017. Net cash flow in investing activities has increased $ 535 in year 2015

to $ 13687 in year 2016 and thereby it declined in year 2017 to $ 2267. Net cash used in

financing activities decreased from $ 8619 in year 2015 to $ 4419 and further to $ 794 in year

2016 and 2017 respectively (Farmpride.com.au 2018).

2015 2016 2017

-10000

-5000

0

5000

10000

15000

9,233

13,687

7,661

-535

-6,416

-2,267

-8,619

-4,419

-794

Comparative analysis of cash flow categories of

Farmpride Food Limited

Comparative analysis of cash flow items of Farmpride Food limited:

(Source: created by author)

Net cash flows used in financing

activities -8619

-

4,419

-

794

The above table presents the evaluation of movement in cash flows from three

different cash flow segments. It can be seen that net cash flow from operating activities has

increased initially from $9233 in year 2015 to $ 13687 in year 2016 and thereafter it declined

to $ 7661 in year 2017. Net cash flow in investing activities has increased $ 535 in year 2015

to $ 13687 in year 2016 and thereby it declined in year 2017 to $ 2267. Net cash used in

financing activities decreased from $ 8619 in year 2015 to $ 4419 and further to $ 794 in year

2016 and 2017 respectively (Farmpride.com.au 2018).

2015 2016 2017

-10000

-5000

0

5000

10000

15000

9,233

13,687

7,661

-535

-6,416

-2,267

-8,619

-4,419

-794

Comparative analysis of cash flow categories of

Farmpride Food Limited

Comparative analysis of cash flow items of Farmpride Food limited:

(Source: created by author)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING

Requirement iii)

The items that are reported in the comprehensive statement include revenue and other

income, expenses, profit before income, profit from continuing operations and profit. Items

listed under the expenses comprised of depreciation, employee benefits expenses, changes in

inventories of finished goods, finance cost, other expenses and impairment of property,

equipment and plant. Revenue and other income include other income and sales revenue

(Forst et al. 2016).

Requirement iv)

Impairment of plant, equipment and property is the amount by which the carrying

value of such assets exceeds their recoverable amount. The carrying amount of assets is their

recognized amount in the balance sheet after taking into account accumulated depreciation

and accumulated impairment losses.

Employee benefits are the expenses that are associated with the value of fringe

benefits that is provided by employer to employees along with some other benefits such as

leave entitlement, tax components such as contribution component and superannuation

(Shapiro 2015).

Finance costs are the costs that are incurred by organization on the amount of loan

that is borrowed in the form of interest. Such costs are mainly applicable to debt capital that

is paid by organization on year to year basis. Depreciation on other hand is the reduction in

value of assets due to their obsolescence (Richard 2014).

Requirement v)

The items that are recorded in the comprehensive income statement are not included

in the profit and loss statement. This is so because the profits are directly attributable to

Requirement iii)

The items that are reported in the comprehensive statement include revenue and other

income, expenses, profit before income, profit from continuing operations and profit. Items

listed under the expenses comprised of depreciation, employee benefits expenses, changes in

inventories of finished goods, finance cost, other expenses and impairment of property,

equipment and plant. Revenue and other income include other income and sales revenue

(Forst et al. 2016).

Requirement iv)

Impairment of plant, equipment and property is the amount by which the carrying

value of such assets exceeds their recoverable amount. The carrying amount of assets is their

recognized amount in the balance sheet after taking into account accumulated depreciation

and accumulated impairment losses.

Employee benefits are the expenses that are associated with the value of fringe

benefits that is provided by employer to employees along with some other benefits such as

leave entitlement, tax components such as contribution component and superannuation

(Shapiro 2015).

Finance costs are the costs that are incurred by organization on the amount of loan

that is borrowed in the form of interest. Such costs are mainly applicable to debt capital that

is paid by organization on year to year basis. Depreciation on other hand is the reduction in

value of assets due to their obsolescence (Richard 2014).

Requirement v)

The items that are recorded in the comprehensive income statement are not included

in the profit and loss statement. This is so because the profits are directly attributable to

CORPORATE ACCOUNTING

shareholders but the items under comprehensive income statement services serves specific

purpose of organization. It can be explained with the help of example, any loss and gains

generated from items such as impairment of property, equipment and plant are not adjusted in

the profit and loss statement. This is so because it is kept aside by organization for making

adjustments in the future revaluation of assets. Such items do not shareholders wealth

generation directly. Shareholders received dividend on their shares based on the profit

generated for a particular reporting period (Magalhães 2014).

Requirement vi)

The income tax expense reported by Farmpride Food limited is recorded at $ 3751 in

year 2017 compared to $ 3358 in year 2016. It is suggested by figures that there is decline in

the amount of taxes paid. Income tax expense incurred by organization in year 2015 stood at

$ 2165. It is suggested by the figures that the amount of income tax expense incurred by

organization has increased year on year.

Requirement vii)

Accounting profit recorded by organization stood at $ 3751 in year 2017 compared to

$ 3358 in year 2016. The corporate tax rate that is applicable to organization in the current

year stood at 30% (Farmpride.com.au 2018). Therefore, the accounting income generated by

organization times the income tax rate is computed at (30% of 12232= 3669.6) and (30% of

11485= 3445.5) for year 2017 and 2017 respectively. Therefore, the amount of income tax

paid is not equal to the amount of accounting income time’s taxation rate. The reason is

attributable to the fact that the accounting profit is calculated based on accounting rules

compared to income tax expense that is computed based on the taxation rules to which the

organization adheres to (Heese et al. 2016).

shareholders but the items under comprehensive income statement services serves specific

purpose of organization. It can be explained with the help of example, any loss and gains

generated from items such as impairment of property, equipment and plant are not adjusted in

the profit and loss statement. This is so because it is kept aside by organization for making

adjustments in the future revaluation of assets. Such items do not shareholders wealth

generation directly. Shareholders received dividend on their shares based on the profit

generated for a particular reporting period (Magalhães 2014).

Requirement vi)

The income tax expense reported by Farmpride Food limited is recorded at $ 3751 in

year 2017 compared to $ 3358 in year 2016. It is suggested by figures that there is decline in

the amount of taxes paid. Income tax expense incurred by organization in year 2015 stood at

$ 2165. It is suggested by the figures that the amount of income tax expense incurred by

organization has increased year on year.

Requirement vii)

Accounting profit recorded by organization stood at $ 3751 in year 2017 compared to

$ 3358 in year 2016. The corporate tax rate that is applicable to organization in the current

year stood at 30% (Farmpride.com.au 2018). Therefore, the accounting income generated by

organization times the income tax rate is computed at (30% of 12232= 3669.6) and (30% of

11485= 3445.5) for year 2017 and 2017 respectively. Therefore, the amount of income tax

paid is not equal to the amount of accounting income time’s taxation rate. The reason is

attributable to the fact that the accounting profit is calculated based on accounting rules

compared to income tax expense that is computed based on the taxation rules to which the

organization adheres to (Heese et al. 2016).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING

The direct impact of deferred taxes is occurrence of deferred tax assets and deferred

tax liabilities that are based on the temporary differences between in expenses and revenue

that is recorded tax returns and accounting returns. There can be a tax difference between the

income tax expense recorded for income tax payable and accounting books for tax returns.

Deferred tax expenses is recorded when income tax payable is more than income tax

expenses resulting from deduction of non cash expenses in the books of account. Deferred tax

assets are created in this case because of large amount of income tax payable on tax returns

(Forst and Salerno 2016). However, deferred tax assets are recorded under the noncurrent

assets of the balance sheet items.

Requirement viii)

The balance sheet of Farmpride Food limited depicts that there is no deferred tax

liabilities recorded. However, the amount of deferred tax assets that is recorded under the

heading noncurrent assets stood at $ 859 in year 2017 compared to $ 777 in year 2016

(Farmpride.com.au 2018).

Recognition of deferred tax liabilities and deferred tax assets are done for the

temporary differences when liabilities are to be settled and assets are expected to be

recovered at the applicable tax rate. The reason why the deferred tax liabilities have not been

recorded if they arise from initial recognition of goodwill. Recognition of deferred tax assets

are done for deductible differences and any unused amount of tax losses. This is only because

if such temporary difference or losses are utilized by the availability of future taxable

amount. Deferred and current tax balances are attributable to the amount that is directly

recognized in the equity (Peters and Romi 2014).

The direct impact of deferred taxes is occurrence of deferred tax assets and deferred

tax liabilities that are based on the temporary differences between in expenses and revenue

that is recorded tax returns and accounting returns. There can be a tax difference between the

income tax expense recorded for income tax payable and accounting books for tax returns.

Deferred tax expenses is recorded when income tax payable is more than income tax

expenses resulting from deduction of non cash expenses in the books of account. Deferred tax

assets are created in this case because of large amount of income tax payable on tax returns

(Forst and Salerno 2016). However, deferred tax assets are recorded under the noncurrent

assets of the balance sheet items.

Requirement viii)

The balance sheet of Farmpride Food limited depicts that there is no deferred tax

liabilities recorded. However, the amount of deferred tax assets that is recorded under the

heading noncurrent assets stood at $ 859 in year 2017 compared to $ 777 in year 2016

(Farmpride.com.au 2018).

Recognition of deferred tax liabilities and deferred tax assets are done for the

temporary differences when liabilities are to be settled and assets are expected to be

recovered at the applicable tax rate. The reason why the deferred tax liabilities have not been

recorded if they arise from initial recognition of goodwill. Recognition of deferred tax assets

are done for deductible differences and any unused amount of tax losses. This is only because

if such temporary difference or losses are utilized by the availability of future taxable

amount. Deferred and current tax balances are attributable to the amount that is directly

recognized in the equity (Peters and Romi 2014).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING

Requirement ix)

Yes, Farmpride Limited has recorded deferred tax assets of amount $ 859 and $ 777

in year 2017 and 2016 (Farmpride.com.au 2018). The current tax payable for year 2017 and

2016 stood at $ 1115 and $ 2121 and the amount of income tax expenses stood at $ 3751 in

year 2017 compared to $ 3358 in year 2016 indicating that there is considerable differences

between the reported figures. Such difference between income tax expense and income tax

payable is due to difference in their rules of treating such accounts. Computation of income

Tax expenses is done based on accounting rules that is recorded in the income statement.

Income tax payable on other hand, is computed based on the rules of taxation and it appears

under the heading liability of the balance sheet (Ehiedu 2014). This is so because the amount

is due and is yet to be paid and hence they appear on the liability side of balance sheet.

Requirement x)

The total amount of income tax paid by Farmpride food limited stood at $ 4839 in

year 2017 compared to $ 3365 in year 2016 indicating that there is increase in amount of

income tax paid. On other hand, the amount of income tax expense as recorded in the

statement of comprehensive income stood at $ 3751 in year 2017 compared to $ 3358 in year

2016. It is depicted from the figures that there exist fewer difference between the amount of

income tax expense and total amount of income tax paid for the reporting period. Amount of

income tax expense is less than the amount of income tax paid. Usually, the amount of

income tax expense is higher than the amount of income tax paid unlike the case of

Farmpride food limited. The difference in the amount of figures reported is because of

difference in accounting system with difference being created by the factor such as time. In

addition to this, the difference in amount of tax expense and income tax paid is because of

difference between the accounting and taxation rules (Alin-Eliodor 2014).

Requirement ix)

Yes, Farmpride Limited has recorded deferred tax assets of amount $ 859 and $ 777

in year 2017 and 2016 (Farmpride.com.au 2018). The current tax payable for year 2017 and

2016 stood at $ 1115 and $ 2121 and the amount of income tax expenses stood at $ 3751 in

year 2017 compared to $ 3358 in year 2016 indicating that there is considerable differences

between the reported figures. Such difference between income tax expense and income tax

payable is due to difference in their rules of treating such accounts. Computation of income

Tax expenses is done based on accounting rules that is recorded in the income statement.

Income tax payable on other hand, is computed based on the rules of taxation and it appears

under the heading liability of the balance sheet (Ehiedu 2014). This is so because the amount

is due and is yet to be paid and hence they appear on the liability side of balance sheet.

Requirement x)

The total amount of income tax paid by Farmpride food limited stood at $ 4839 in

year 2017 compared to $ 3365 in year 2016 indicating that there is increase in amount of

income tax paid. On other hand, the amount of income tax expense as recorded in the

statement of comprehensive income stood at $ 3751 in year 2017 compared to $ 3358 in year

2016. It is depicted from the figures that there exist fewer difference between the amount of

income tax expense and total amount of income tax paid for the reporting period. Amount of

income tax expense is less than the amount of income tax paid. Usually, the amount of

income tax expense is higher than the amount of income tax paid unlike the case of

Farmpride food limited. The difference in the amount of figures reported is because of

difference in accounting system with difference being created by the factor such as time. In

addition to this, the difference in amount of tax expense and income tax paid is because of

difference between the accounting and taxation rules (Alin-Eliodor 2014).

CORPORATE ACCOUNTING

Requirement xi)

The treatment of taxation in the financial statement of Farmpride Food limited has

been found to be quite interesting as there is segregated and proper disclosure of the

treatment of taxation. There have been proper disclosure of the elements of taxation such as

income tax paid, income tax payable, income tax expenses for which they are presented in the

financial statements such as statement of comprehensive income and statement of profit and

loss. Information about deferred tax assets and deferred tax liabilities are properly presented

in the statement of financial position. From the analysis of annual report of the company, it

has been found that the tax consolidated legislation has been implemented and a tax

consolidated group has been formed from July 1, 2005. Allocation approach has been

implemented by the group in determining the appropriate amount of deferred tax and current

tax for allocating the taxes to the member group. The current tax assets and current tax

liabilities have been recognized by Farmpride Food limited that arises from unused tax

credits and unused tax losses that are assumed by the tax consolidated group. The current pre

tax rates are used by organization for discounting the provisions when there is material

impact of time value of money. Furthermore, with reference to the taxation there has been

proper disclosure of the assumptions that has been made by organization. The assumption of

deferred tax assets and deferred tax liabilities assumed that the income tax legislation is not

faced with any adverse changes along with the anticipation that sufficient future assessable

income will be derived by the consolidated entity that will enable them to employ and realize

with the deductibility conditions that the law imposes. The proper disclosure of the treatment

of taxation is of great use to the users of financial statement and investors seeking investment

in the company (Dalnial et al. 2014).

Requirement xi)

The treatment of taxation in the financial statement of Farmpride Food limited has

been found to be quite interesting as there is segregated and proper disclosure of the

treatment of taxation. There have been proper disclosure of the elements of taxation such as

income tax paid, income tax payable, income tax expenses for which they are presented in the

financial statements such as statement of comprehensive income and statement of profit and

loss. Information about deferred tax assets and deferred tax liabilities are properly presented

in the statement of financial position. From the analysis of annual report of the company, it

has been found that the tax consolidated legislation has been implemented and a tax

consolidated group has been formed from July 1, 2005. Allocation approach has been

implemented by the group in determining the appropriate amount of deferred tax and current

tax for allocating the taxes to the member group. The current tax assets and current tax

liabilities have been recognized by Farmpride Food limited that arises from unused tax

credits and unused tax losses that are assumed by the tax consolidated group. The current pre

tax rates are used by organization for discounting the provisions when there is material

impact of time value of money. Furthermore, with reference to the taxation there has been

proper disclosure of the assumptions that has been made by organization. The assumption of

deferred tax assets and deferred tax liabilities assumed that the income tax legislation is not

faced with any adverse changes along with the anticipation that sufficient future assessable

income will be derived by the consolidated entity that will enable them to employ and realize

with the deductibility conditions that the law imposes. The proper disclosure of the treatment

of taxation is of great use to the users of financial statement and investors seeking investment

in the company (Dalnial et al. 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

CORPORATE ACCOUNTING

References list:

Alin-Eliodor, T., 2014. Financial Statements Analysis. Journal of Knowledge

Management, 4(5), pp.62-73.

Balakrishnan, K., Blouin, J. and Guay, W., 2018. Tax Aggressiveness and Corporate

Transparency. The Accounting Review.

Bruce-Twum, E. and Mensah, C.C., 2015. Financial Statement Analysis.

Dalnial, H., Kamaluddin, A., Sanusi, Z.M. and Khairuddin, K.S., 2014. Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced Management

Science, 2(1).

Ehiedu, V.C., 2014. The impact of liquidity on profitability of some selected companies: The

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), pp.81-90.

Farmpride.com.au. (2018). [online] Available at:

http://www.farmpride.com.au/wp-content/uploads/2017/09/2017-Farm-Pride-Foods-Ltd-

Annual-Report.pdf [Accessed 25 May 2018].

Forst, A. and Salerno, D.F., 2016. Ten Years of Mandatory Use of IFRS in the European

Union: A Status Report. Journal of Corporate Accounting & Finance, 27(5), pp.29-36.

Heese, J., Khan, M. and Ramanna, K., 2015. Political Standards: Corporate Interest,

Ideology, and Leadership in the Shaping of Accounting Rules for the Market

Economy. Journal of Accounting & Economics, 64(20), pp.2-3.

Jefrey, C. ed., 2018. Research on professional responsibility and ethics in accounting.

Emerald Publishing Limited.

References list:

Alin-Eliodor, T., 2014. Financial Statements Analysis. Journal of Knowledge

Management, 4(5), pp.62-73.

Balakrishnan, K., Blouin, J. and Guay, W., 2018. Tax Aggressiveness and Corporate

Transparency. The Accounting Review.

Bruce-Twum, E. and Mensah, C.C., 2015. Financial Statement Analysis.

Dalnial, H., Kamaluddin, A., Sanusi, Z.M. and Khairuddin, K.S., 2014. Detecting fraudulent

financial reporting through financial statement analysis. Journal of Advanced Management

Science, 2(1).

Ehiedu, V.C., 2014. The impact of liquidity on profitability of some selected companies: The

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), pp.81-90.

Farmpride.com.au. (2018). [online] Available at:

http://www.farmpride.com.au/wp-content/uploads/2017/09/2017-Farm-Pride-Foods-Ltd-

Annual-Report.pdf [Accessed 25 May 2018].

Forst, A. and Salerno, D.F., 2016. Ten Years of Mandatory Use of IFRS in the European

Union: A Status Report. Journal of Corporate Accounting & Finance, 27(5), pp.29-36.

Heese, J., Khan, M. and Ramanna, K., 2015. Political Standards: Corporate Interest,

Ideology, and Leadership in the Shaping of Accounting Rules for the Market

Economy. Journal of Accounting & Economics, 64(20), pp.2-3.

Jefrey, C. ed., 2018. Research on professional responsibility and ethics in accounting.

Emerald Publishing Limited.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CORPORATE ACCOUNTING

Kaur, M., Aggarwal, N. and Gupta, M., 2017. An Investigation into Returns from Financial

Statement Analysis among High Book-to-Market Stocks. Indian Journal of Economics and

Development, 13(2), pp.353-358.

Lee, T.A. and Parker, R.H. eds., 2014. Evolution of Corporate Financial Reporting (RLE

Accounting). Routledge.

Magalhães, M.M.C., 2014. Value investing and financial statement analysis (Doctoral

dissertation).

Peters, G.F. and Romi, A.M., 2014. Does the voluntary adoption of corporate governance

mechanisms improve environmental risk disclosures? Evidence from greenhouse gas

emission accounting. Journal of Business Ethics, 125(4), pp.637-666.

Richard, P., 2014. The Role of the Accounting Rate of Return in Financial Statement

Analysis. The Continuing Debate Over Depreciation, Capital and Income (RLE

Accounting), 67(2), p.235.

Shapiro, D.M., 2015. Assessing Corporate Governance in M&As. Journal of Corporate

Accounting & Finance, 26(2), pp.35-39.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

Kaur, M., Aggarwal, N. and Gupta, M., 2017. An Investigation into Returns from Financial

Statement Analysis among High Book-to-Market Stocks. Indian Journal of Economics and

Development, 13(2), pp.353-358.

Lee, T.A. and Parker, R.H. eds., 2014. Evolution of Corporate Financial Reporting (RLE

Accounting). Routledge.

Magalhães, M.M.C., 2014. Value investing and financial statement analysis (Doctoral

dissertation).

Peters, G.F. and Romi, A.M., 2014. Does the voluntary adoption of corporate governance

mechanisms improve environmental risk disclosures? Evidence from greenhouse gas

emission accounting. Journal of Business Ethics, 125(4), pp.637-666.

Richard, P., 2014. The Role of the Accounting Rate of Return in Financial Statement

Analysis. The Continuing Debate Over Depreciation, Capital and Income (RLE

Accounting), 67(2), p.235.

Shapiro, D.M., 2015. Assessing Corporate Governance in M&As. Journal of Corporate

Accounting & Finance, 26(2), pp.35-39.

Warren, C.S. and Jones, J., 2018. Corporate financial accounting. Cengage Learning.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.