HI5020 Corporate Accounting: Comprehensive Analysis of CSR Limited

VerifiedAdded on 2023/06/11

|11

|2723

|297

Report

AI Summary

This report provides a detailed analysis of CSR Limited's financial statements from 2015 to 2017, focusing on the cash flow statement, other comprehensive income statement, and accounting for corporate income tax. The analysis of the cash flow statement includes a breakdown of operating, investing, and financing activities, highlighting changes and trends over the three-year period. The report also discusses the components of the other comprehensive income statement, such as hedging, foreign currency translation, and cash flow hedge reserves. Furthermore, it examines CSR Limited's income tax expenses, deferred tax assets and liabilities, and the differences between income tax expenses reported in the income statement and cash flow statement. The report uses data from CSR Limited's annual reports to provide a comprehensive overview of the company's financial performance and tax position.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student

Name of the University

Author’s Note

Corporate Accounting

Name of the Student

Name of the University

Author’s Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING

Cash Flow Statement

Requirement [i]

The following discussion sheds light on each of the items listed in the 2017 Cash Flow

Statement of CSR Limited along with their increase or decrease over the past year with possible

reason:

Cash Flow from Operating Activities: In CSR Limited, the five crucial items listed under this

head of cash flow are receipts from customers, payment to suppliers and employees, dividend

received, interest received and income tax paid.

CSR Limited receives certain amount of money as a result of credit sales from their

customers and there is increase in this income in 2017; $2726 million in 2017 and $2499.5 in

2016 (csr.com.au, 2018). The only reason for the increase in this item can be the increase in

credit sales. On the contrary, CSR Limited is payable to their suppliers for the purchase of raw

materials and they also require to provide the compensation to their employees. An increasing

trend is also here in this item; $2424.6 million in 2017 from $2246.4 million in the past year

(csr.com.au, 2018). Business expansion might lead the company to take more orders from

customers that increases the raw material purchase; in addition, increase in employees might lead

to the increase in this payment. CSR Limited has their shares purchased in other companies that

generate dividend for the company and this income has increased over the past year that is $14.2

million in 2017 and $11.2 million in the past year. CSR Limited receives certain amount as

interest in every year and this income has decreased over the last year that is $1.9 million and

$2.5 million in 2017 and 2016 respectively. Increase in the profit margin of CSR Limited has led

Cash Flow Statement

Requirement [i]

The following discussion sheds light on each of the items listed in the 2017 Cash Flow

Statement of CSR Limited along with their increase or decrease over the past year with possible

reason:

Cash Flow from Operating Activities: In CSR Limited, the five crucial items listed under this

head of cash flow are receipts from customers, payment to suppliers and employees, dividend

received, interest received and income tax paid.

CSR Limited receives certain amount of money as a result of credit sales from their

customers and there is increase in this income in 2017; $2726 million in 2017 and $2499.5 in

2016 (csr.com.au, 2018). The only reason for the increase in this item can be the increase in

credit sales. On the contrary, CSR Limited is payable to their suppliers for the purchase of raw

materials and they also require to provide the compensation to their employees. An increasing

trend is also here in this item; $2424.6 million in 2017 from $2246.4 million in the past year

(csr.com.au, 2018). Business expansion might lead the company to take more orders from

customers that increases the raw material purchase; in addition, increase in employees might lead

to the increase in this payment. CSR Limited has their shares purchased in other companies that

generate dividend for the company and this income has increased over the past year that is $14.2

million in 2017 and $11.2 million in the past year. CSR Limited receives certain amount as

interest in every year and this income has decreased over the last year that is $1.9 million and

$2.5 million in 2017 and 2016 respectively. Increase in the profit margin of CSR Limited has led

2CORPORATE ACCOUNTING

to the increase in their income tax payment; and it is $52.7 million and $14.6 million in the years

2017 and 2016 respectively (csr.com.au, 2018).

Cash Flow from Investing Activities: The reported items under this head of cash flow for CSR

Limited are purchase of property, plant and equipment and other assets, proceed from sales of

the same, businesses or other controlled entities purchased, payment of acquisition cost and loan

and receivable repayment.

In the year 2017, CSR Limited has not purchased many property, plant and equipment

with other assets when compared to the last year; that is ($92.2 million) in 2017 and ($120.2

million) in 2016. It might happen that CSR Limited has these assets as per their requirements

(csr.com.au, 2018). At the same time, the company has not made much sales of these assets in

2017 when compared to 2016; that is $44.7 million and $71.2 million in the years 2017 and 2016

respectively. The reason for this can be the intention of CSR Limited to increase their asset base

for generating better business. CSR Limited does the acquisition of businesses if there is any

good opportunity. The 2017 figures show that the company has not made any large acquisition in

this as large decrease in this outflow in evident; that is ($3.5 million) and ($12.8 million) in the

year 2017 and 2016 respectively (csr.com.au, 2018). It is the obligation on the company to bear

the necessary expenses at the time of business acquisition. Decrease in this expenses in 2017 is

there due to the decrease in business acquisition; that is ($ 3.4 million) and ($ 12.8) million in

2017 and 2016 (csr.com.au, 2018). On the term of maturity, CSR Limited is liable to make the

repayment of their advances on loans and the company has made large repayment in 2017 as

compared to 2016; that is ($5.3 million) and $0.1 million in 2016. However, CSR Limited took

advance loan in the year 2016.

to the increase in their income tax payment; and it is $52.7 million and $14.6 million in the years

2017 and 2016 respectively (csr.com.au, 2018).

Cash Flow from Investing Activities: The reported items under this head of cash flow for CSR

Limited are purchase of property, plant and equipment and other assets, proceed from sales of

the same, businesses or other controlled entities purchased, payment of acquisition cost and loan

and receivable repayment.

In the year 2017, CSR Limited has not purchased many property, plant and equipment

with other assets when compared to the last year; that is ($92.2 million) in 2017 and ($120.2

million) in 2016. It might happen that CSR Limited has these assets as per their requirements

(csr.com.au, 2018). At the same time, the company has not made much sales of these assets in

2017 when compared to 2016; that is $44.7 million and $71.2 million in the years 2017 and 2016

respectively. The reason for this can be the intention of CSR Limited to increase their asset base

for generating better business. CSR Limited does the acquisition of businesses if there is any

good opportunity. The 2017 figures show that the company has not made any large acquisition in

this as large decrease in this outflow in evident; that is ($3.5 million) and ($12.8 million) in the

year 2017 and 2016 respectively (csr.com.au, 2018). It is the obligation on the company to bear

the necessary expenses at the time of business acquisition. Decrease in this expenses in 2017 is

there due to the decrease in business acquisition; that is ($ 3.4 million) and ($ 12.8) million in

2017 and 2016 (csr.com.au, 2018). On the term of maturity, CSR Limited is liable to make the

repayment of their advances on loans and the company has made large repayment in 2017 as

compared to 2016; that is ($5.3 million) and $0.1 million in 2016. However, CSR Limited took

advance loan in the year 2016.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE ACCOUNTING

Cash Flow from Financing Activities: In CSR Limited, the items recorded under this head of

cash flow are share buy-back, borrowings repayment, dividend payment, acquisition of shares,

interest and other transaction cost payment and transitions with the non-controlling interests

(csr.com.au, 2018).

There are instances when CSR Limited repurchase their issued shares and the increase in

this buy-back of share can be seen in the year 2017 and compared to 2016; that is ($4.3 million)

in 2017 and ($ 1.1 million) in the year 2016. From the cash flow statement, it can be observed

that CSR Limited has drawn their borrowings in the year 2017 where the company concentrated

on the payment of borrowings in 2016; the amounts are $28.3 million in 2017 and ($10.4

million) in the year 2016 (csr.com.au, 2018). In the year 2017, the company decided to increase

the dividend for their shareholders for the year 2017 as a result of increase in profitability; that is

($146.7 million) in 2017 and ($144.9 million) in the year 2016. CSR Limited does the

acquisition of shares from the share trust from the CSR employees and decrease in this outflow

can be seen in the year 2017 as compared to 2016; that is ($5.4 million) and ($7.1 million) in the

years 2017 and 2016 respectively (csr.com.au, 2018). Increase in the payment of interest and

other costs can be seen in 2017 as compared to 2016; that is ($3.4 million) and ($3.2 million) in

2017 and 2016 respectively (csr.com.au, 2018).

Cash Flow from Financing Activities: In CSR Limited, the items recorded under this head of

cash flow are share buy-back, borrowings repayment, dividend payment, acquisition of shares,

interest and other transaction cost payment and transitions with the non-controlling interests

(csr.com.au, 2018).

There are instances when CSR Limited repurchase their issued shares and the increase in

this buy-back of share can be seen in the year 2017 and compared to 2016; that is ($4.3 million)

in 2017 and ($ 1.1 million) in the year 2016. From the cash flow statement, it can be observed

that CSR Limited has drawn their borrowings in the year 2017 where the company concentrated

on the payment of borrowings in 2016; the amounts are $28.3 million in 2017 and ($10.4

million) in the year 2016 (csr.com.au, 2018). In the year 2017, the company decided to increase

the dividend for their shareholders for the year 2017 as a result of increase in profitability; that is

($146.7 million) in 2017 and ($144.9 million) in the year 2016. CSR Limited does the

acquisition of shares from the share trust from the CSR employees and decrease in this outflow

can be seen in the year 2017 as compared to 2016; that is ($5.4 million) and ($7.1 million) in the

years 2017 and 2016 respectively (csr.com.au, 2018). Increase in the payment of interest and

other costs can be seen in 2017 as compared to 2016; that is ($3.4 million) and ($3.2 million) in

2017 and 2016 respectively (csr.com.au, 2018).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING

Requirement [ii]

2017 ($m) 2016 ($m) 2015 ($m)

(300.0)

(200.0)

(100.0)

-

100.0

200.0

300.0 264.8 252.2 234.3

(60.7) (80.8)

(45.4)

(257.9)

(166.7)

(126.8)

Cash Flow Operating

Activities

Cash Flow Investing

Activities

Cash Flow Financing

Activities

Figure 1: Comparative Analysis of Cash Flows of CSR Limited

(Source: csr.com.au, 2018)

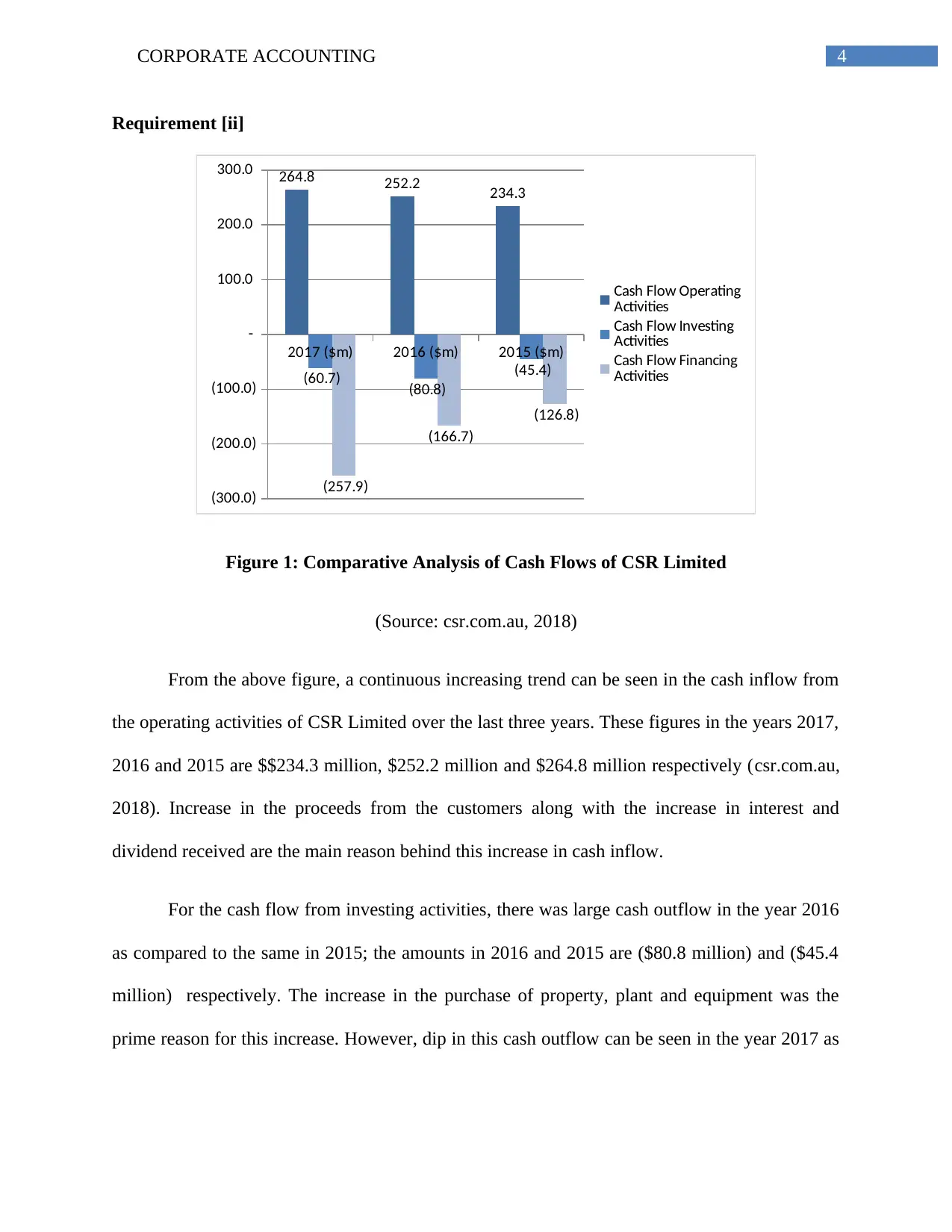

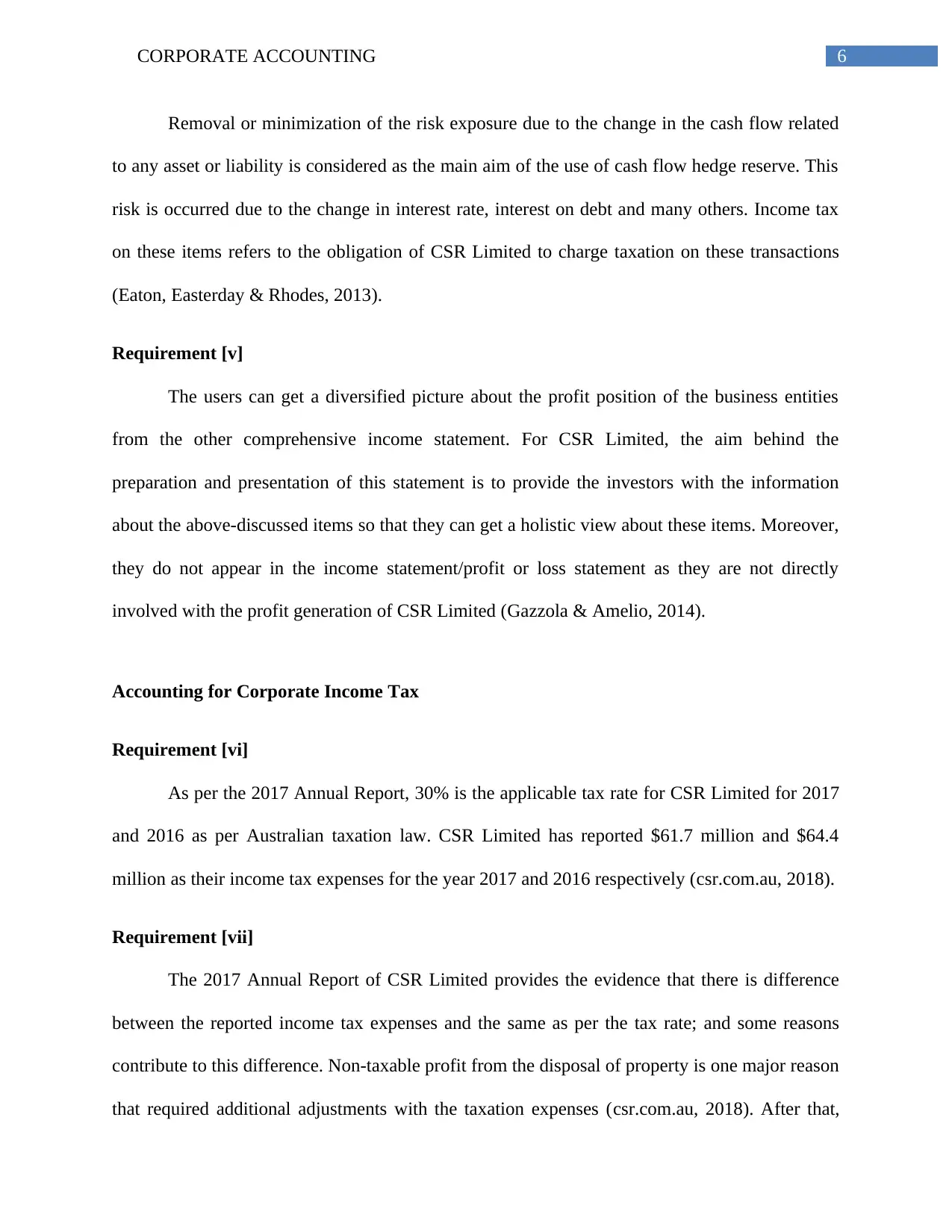

From the above figure, a continuous increasing trend can be seen in the cash inflow from

the operating activities of CSR Limited over the last three years. These figures in the years 2017,

2016 and 2015 are $$234.3 million, $252.2 million and $264.8 million respectively (csr.com.au,

2018). Increase in the proceeds from the customers along with the increase in interest and

dividend received are the main reason behind this increase in cash inflow.

For the cash flow from investing activities, there was large cash outflow in the year 2016

as compared to the same in 2015; the amounts in 2016 and 2015 are ($80.8 million) and ($45.4

million) respectively. The increase in the purchase of property, plant and equipment was the

prime reason for this increase. However, dip in this cash outflow can be seen in the year 2017 as

Requirement [ii]

2017 ($m) 2016 ($m) 2015 ($m)

(300.0)

(200.0)

(100.0)

-

100.0

200.0

300.0 264.8 252.2 234.3

(60.7) (80.8)

(45.4)

(257.9)

(166.7)

(126.8)

Cash Flow Operating

Activities

Cash Flow Investing

Activities

Cash Flow Financing

Activities

Figure 1: Comparative Analysis of Cash Flows of CSR Limited

(Source: csr.com.au, 2018)

From the above figure, a continuous increasing trend can be seen in the cash inflow from

the operating activities of CSR Limited over the last three years. These figures in the years 2017,

2016 and 2015 are $$234.3 million, $252.2 million and $264.8 million respectively (csr.com.au,

2018). Increase in the proceeds from the customers along with the increase in interest and

dividend received are the main reason behind this increase in cash inflow.

For the cash flow from investing activities, there was large cash outflow in the year 2016

as compared to the same in 2015; the amounts in 2016 and 2015 are ($80.8 million) and ($45.4

million) respectively. The increase in the purchase of property, plant and equipment was the

prime reason for this increase. However, dip in this cash outflow can be seen in the year 2017 as

5CORPORATE ACCOUNTING

compared to 2016; that is ($ 60.7) million in 2017 from the last year. The main reason might be

the decrease in the purchase of the above-mentioned assets (csr.com.au, 2018).

The above figure also shows a major increasing trend in the cash outflow from investing

activities over the last three years; that is ($126.8) million in 2015, ($166.7 million) in2016 and

($257.9 million) in 2017 (csr.com.au, 2018). Increase in the payment of dividend can be

articulated the prime reason for this increasing trend. At the same time, major repayment of

borrowings can also be considered as the reason for this increase.

Other Comprehensive Income Statement

Requirement [iii]

The items recorded in the Other Comprehensive Income Statement 2017 of CSR Limited

are recognition of profit or loss related to hedging, transfer of this hedge profit or loss in the

statement of financial performance, difference of exchange in the transactions related to foreign

operations, fair value change in cash flow reserve and income tax benefits from these items

(csr.com.au, 2018).

Requirement [iv]

The conversion of the financial results of the foreign subsidiaries of CSR Limited to the

currency in which the financial reporting has done is the main purpose of foreign currency

translation reserve. This aspect is regarded as an important concern at the time of business

consolidation for the transformation of foreign currency in the reporting currency. After the re-

measurement of these currencies, they are recorded in the profit or loss account of CSR Limited

(Cao, 2017).

compared to 2016; that is ($ 60.7) million in 2017 from the last year. The main reason might be

the decrease in the purchase of the above-mentioned assets (csr.com.au, 2018).

The above figure also shows a major increasing trend in the cash outflow from investing

activities over the last three years; that is ($126.8) million in 2015, ($166.7 million) in2016 and

($257.9 million) in 2017 (csr.com.au, 2018). Increase in the payment of dividend can be

articulated the prime reason for this increasing trend. At the same time, major repayment of

borrowings can also be considered as the reason for this increase.

Other Comprehensive Income Statement

Requirement [iii]

The items recorded in the Other Comprehensive Income Statement 2017 of CSR Limited

are recognition of profit or loss related to hedging, transfer of this hedge profit or loss in the

statement of financial performance, difference of exchange in the transactions related to foreign

operations, fair value change in cash flow reserve and income tax benefits from these items

(csr.com.au, 2018).

Requirement [iv]

The conversion of the financial results of the foreign subsidiaries of CSR Limited to the

currency in which the financial reporting has done is the main purpose of foreign currency

translation reserve. This aspect is regarded as an important concern at the time of business

consolidation for the transformation of foreign currency in the reporting currency. After the re-

measurement of these currencies, they are recorded in the profit or loss account of CSR Limited

(Cao, 2017).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING

Removal or minimization of the risk exposure due to the change in the cash flow related

to any asset or liability is considered as the main aim of the use of cash flow hedge reserve. This

risk is occurred due to the change in interest rate, interest on debt and many others. Income tax

on these items refers to the obligation of CSR Limited to charge taxation on these transactions

(Eaton, Easterday & Rhodes, 2013).

Requirement [v]

The users can get a diversified picture about the profit position of the business entities

from the other comprehensive income statement. For CSR Limited, the aim behind the

preparation and presentation of this statement is to provide the investors with the information

about the above-discussed items so that they can get a holistic view about these items. Moreover,

they do not appear in the income statement/profit or loss statement as they are not directly

involved with the profit generation of CSR Limited (Gazzola & Amelio, 2014).

Accounting for Corporate Income Tax

Requirement [vi]

As per the 2017 Annual Report, 30% is the applicable tax rate for CSR Limited for 2017

and 2016 as per Australian taxation law. CSR Limited has reported $61.7 million and $64.4

million as their income tax expenses for the year 2017 and 2016 respectively (csr.com.au, 2018).

Requirement [vii]

The 2017 Annual Report of CSR Limited provides the evidence that there is difference

between the reported income tax expenses and the same as per the tax rate; and some reasons

contribute to this difference. Non-taxable profit from the disposal of property is one major reason

that required additional adjustments with the taxation expenses (csr.com.au, 2018). After that,

Removal or minimization of the risk exposure due to the change in the cash flow related

to any asset or liability is considered as the main aim of the use of cash flow hedge reserve. This

risk is occurred due to the change in interest rate, interest on debt and many others. Income tax

on these items refers to the obligation of CSR Limited to charge taxation on these transactions

(Eaton, Easterday & Rhodes, 2013).

Requirement [v]

The users can get a diversified picture about the profit position of the business entities

from the other comprehensive income statement. For CSR Limited, the aim behind the

preparation and presentation of this statement is to provide the investors with the information

about the above-discussed items so that they can get a holistic view about these items. Moreover,

they do not appear in the income statement/profit or loss statement as they are not directly

involved with the profit generation of CSR Limited (Gazzola & Amelio, 2014).

Accounting for Corporate Income Tax

Requirement [vi]

As per the 2017 Annual Report, 30% is the applicable tax rate for CSR Limited for 2017

and 2016 as per Australian taxation law. CSR Limited has reported $61.7 million and $64.4

million as their income tax expenses for the year 2017 and 2016 respectively (csr.com.au, 2018).

Requirement [vii]

The 2017 Annual Report of CSR Limited provides the evidence that there is difference

between the reported income tax expenses and the same as per the tax rate; and some reasons

contribute to this difference. Non-taxable profit from the disposal of property is one major reason

that required additional adjustments with the taxation expenses (csr.com.au, 2018). After that,

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

advanced payment and under payment of income taxes is another major reason as the advanced

tax or less paid tax is required to be adjusted with the current year’s taxation expenses. Lastly,

share of net profit on the entities of joint venture is another major reason as CSR Limited had to

do the adjustments of the extra payment of tax.

Requirement [viii]

The reported deferred tax assets by CSR Limited are $201.2 million in 2017 and $239.3

million in 2016. CSR Limited has no deferred tax liabilities in 2017 and the deferred tax liability

in 2016 is $20.9 million (csr.com.au, 2018). Both in 2017 and 2016, CSR Limited has paid

advances taxes as compared to the actual taxation expenses; and hence, this advance tax amount

is considered as differed tax assets for CSR Limited. On the contrary, the different in the rules of

financial accounting and taxation accounting contributed towards the less payment of tax on

depreciation by CSR Limited as compared to the actual. Hence, this less paid tax amount is

considered as the deferred tax liabilities (Chytis, 2015).

Requirement [ix]

The reported current tax assets of CSR Limited are of $0.5 million for both 2017 and

2016. For the year 2017 and 2016, CSR Limited has $10.3 million and $38.1 million as current

tax liabilities respectively (csr.com.au, 2018). There is difference between the income tax

expenses and income tax payable. The inclusion of all the taxation related expenses of CSR

Limited is there under the income tax expenses of CSR Limited. However, the occurrence of

income tax payable can be seen due to the less payment of income tax by the company in the last

year. This reason creates the difference (Harding, 2013).

advanced payment and under payment of income taxes is another major reason as the advanced

tax or less paid tax is required to be adjusted with the current year’s taxation expenses. Lastly,

share of net profit on the entities of joint venture is another major reason as CSR Limited had to

do the adjustments of the extra payment of tax.

Requirement [viii]

The reported deferred tax assets by CSR Limited are $201.2 million in 2017 and $239.3

million in 2016. CSR Limited has no deferred tax liabilities in 2017 and the deferred tax liability

in 2016 is $20.9 million (csr.com.au, 2018). Both in 2017 and 2016, CSR Limited has paid

advances taxes as compared to the actual taxation expenses; and hence, this advance tax amount

is considered as differed tax assets for CSR Limited. On the contrary, the different in the rules of

financial accounting and taxation accounting contributed towards the less payment of tax on

depreciation by CSR Limited as compared to the actual. Hence, this less paid tax amount is

considered as the deferred tax liabilities (Chytis, 2015).

Requirement [ix]

The reported current tax assets of CSR Limited are of $0.5 million for both 2017 and

2016. For the year 2017 and 2016, CSR Limited has $10.3 million and $38.1 million as current

tax liabilities respectively (csr.com.au, 2018). There is difference between the income tax

expenses and income tax payable. The inclusion of all the taxation related expenses of CSR

Limited is there under the income tax expenses of CSR Limited. However, the occurrence of

income tax payable can be seen due to the less payment of income tax by the company in the last

year. This reason creates the difference (Harding, 2013).

8CORPORATE ACCOUNTING

Requirement [x]

CSR Limited has reported $61.7 million and $64.4 million as their income tax expenses

for the year 2017 and 2016 respectively in the income statement; and $52.7 million and $14.6

million as their income tax expenses in the cash flow statement for 2017 and 2016 respectively

(csr.com.au, 2018). Thus, difference can be seen in the income tax expenses in income statement

and cash flow statement. CSR Limited records the income tax expenses for the current year in

the income statement and the obligation is to make the payment of this in the next year.

However, the income tax expenses in cash flow include the current year income tax payment by

CSR Limited; and it can be advance income tax payment or payment of income tax for the last

year. Hence, difference can be seen (Tanzi, 2014).

Requirement [xi]

CSR Limited carries out their income tax accounting as per the required regulations and

provides all the necessary clarification and justification of income tax treatment in the notes to

the financial statements. This aspect eliminates the chances for confusion in the income tax

treatment. Moreover, the users can gain effective insight about how the large organizations carry

out their income tax treatment by observing the income tax treatment of CSR Limited.

Requirement [x]

CSR Limited has reported $61.7 million and $64.4 million as their income tax expenses

for the year 2017 and 2016 respectively in the income statement; and $52.7 million and $14.6

million as their income tax expenses in the cash flow statement for 2017 and 2016 respectively

(csr.com.au, 2018). Thus, difference can be seen in the income tax expenses in income statement

and cash flow statement. CSR Limited records the income tax expenses for the current year in

the income statement and the obligation is to make the payment of this in the next year.

However, the income tax expenses in cash flow include the current year income tax payment by

CSR Limited; and it can be advance income tax payment or payment of income tax for the last

year. Hence, difference can be seen (Tanzi, 2014).

Requirement [xi]

CSR Limited carries out their income tax accounting as per the required regulations and

provides all the necessary clarification and justification of income tax treatment in the notes to

the financial statements. This aspect eliminates the chances for confusion in the income tax

treatment. Moreover, the users can gain effective insight about how the large organizations carry

out their income tax treatment by observing the income tax treatment of CSR Limited.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9CORPORATE ACCOUNTING

References

(2018). Csr.com.au. Retrieved 24 May 2018, from

http://www.csr.com.au/-/media/corporate/files/annual-reports/2015_annual-report-for-31-

march-2015.pdf

(2018). Csr.com.au. Retrieved 24 May 2018, from

http://www.csr.com.au/-/media/corporate/files/annual-reports/2016_annual-report-for-31-

march-2016.pdf

Annual Meetings and Reports. (2018). Corporate. Retrieved 22 May 2018, from

http://www.csr.com.au/investor-relations-and-news/annual-meetings-and-reports

Cao, Y. (2017). Performance reporting of comprehensive income and earnings

management (Doctoral dissertation, Boston University).

Chytis, E. (2015, February). Deferred Tax Assets from unused Tax Losses under the prism of

Financial Crisis. In International Conference on Business & Economics of the Hellenic

Open University, Athens. Retrieved from http://193.108 (Vol. 160).

Eaton, T. V., Easterday, K. E., & Rhodes, M. R. (2013). The presentation of other

comprehensive income. The CPA Journal, 83(3), 32.

Gazzola, P., & Amelio, S. (2014). The impact of comprehensive income on the financial ratios in

a period of crises. Procedia Economics and Finance, 12, 174-183.

Harding, M. (2013). Taxation of dividend, interest, and capital gain income.

References

(2018). Csr.com.au. Retrieved 24 May 2018, from

http://www.csr.com.au/-/media/corporate/files/annual-reports/2015_annual-report-for-31-

march-2015.pdf

(2018). Csr.com.au. Retrieved 24 May 2018, from

http://www.csr.com.au/-/media/corporate/files/annual-reports/2016_annual-report-for-31-

march-2016.pdf

Annual Meetings and Reports. (2018). Corporate. Retrieved 22 May 2018, from

http://www.csr.com.au/investor-relations-and-news/annual-meetings-and-reports

Cao, Y. (2017). Performance reporting of comprehensive income and earnings

management (Doctoral dissertation, Boston University).

Chytis, E. (2015, February). Deferred Tax Assets from unused Tax Losses under the prism of

Financial Crisis. In International Conference on Business & Economics of the Hellenic

Open University, Athens. Retrieved from http://193.108 (Vol. 160).

Eaton, T. V., Easterday, K. E., & Rhodes, M. R. (2013). The presentation of other

comprehensive income. The CPA Journal, 83(3), 32.

Gazzola, P., & Amelio, S. (2014). The impact of comprehensive income on the financial ratios in

a period of crises. Procedia Economics and Finance, 12, 174-183.

Harding, M. (2013). Taxation of dividend, interest, and capital gain income.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10CORPORATE ACCOUNTING

Tanzi, V. (2014). Inflation, indexation and interest income taxation. PSL Quarterly

Review, 29(116).

Tanzi, V. (2014). Inflation, indexation and interest income taxation. PSL Quarterly

Review, 29(116).

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.