Financial Statements Analysis

VerifiedAdded on 2020/04/07

|10

|1190

|31

AI Summary

This assignment focuses on analyzing a set of financial statements. It presents a balance sheet, an income statement, and detailed notes explaining various items within the financial reports. The student is tasked with understanding the information presented in these statements to gain insights into the company's financial health, performance, and position.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

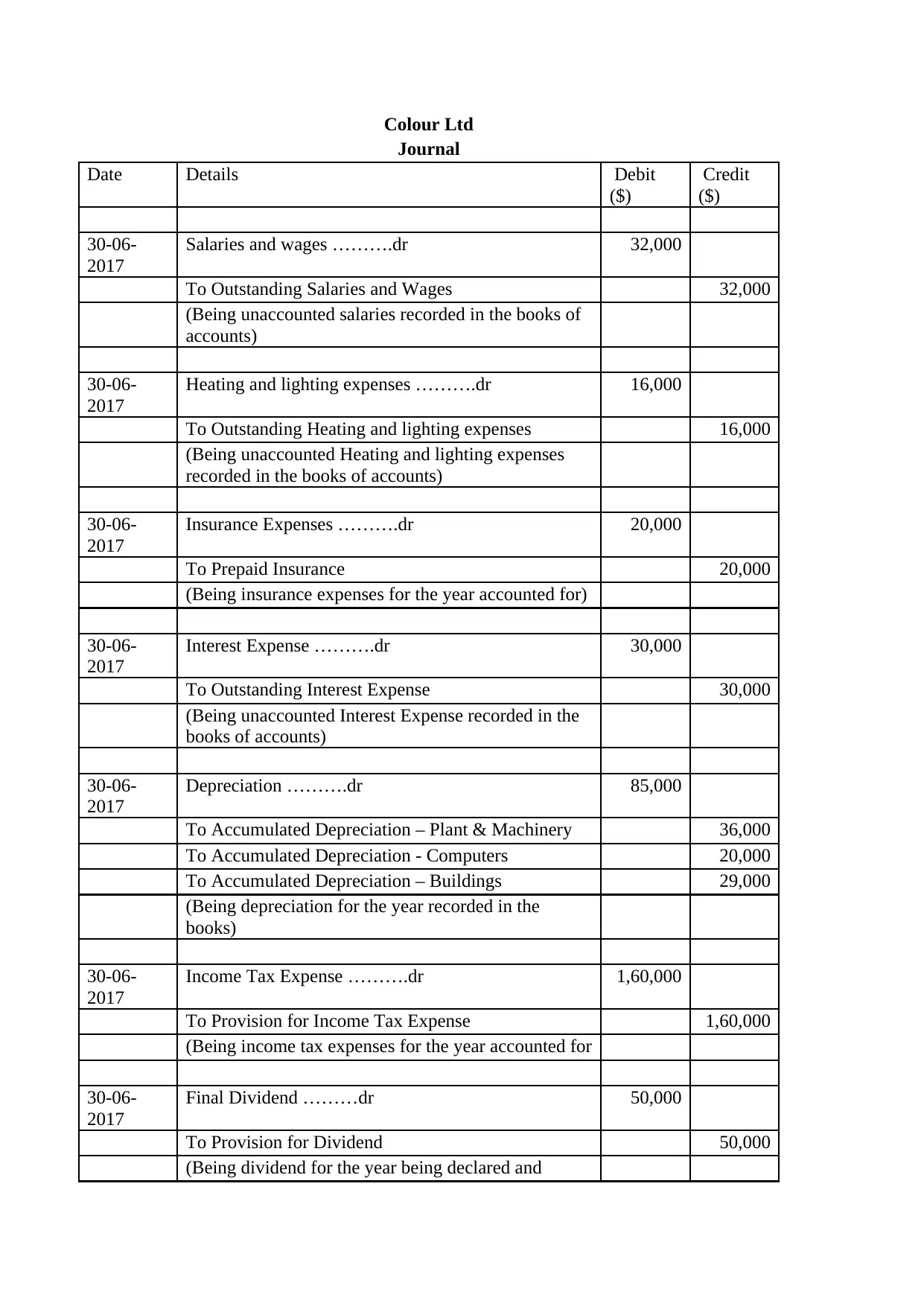

Colour Ltd

Journal

Date Details Debit

($)

Credit

($)

30-06-

2017

Salaries and wages ……….dr 32,000

To Outstanding Salaries and Wages 32,000

(Being unaccounted salaries recorded in the books of

accounts)

30-06-

2017

Heating and lighting expenses ……….dr 16,000

To Outstanding Heating and lighting expenses 16,000

(Being unaccounted Heating and lighting expenses

recorded in the books of accounts)

30-06-

2017

Insurance Expenses ……….dr 20,000

To Prepaid Insurance 20,000

(Being insurance expenses for the year accounted for)

30-06-

2017

Interest Expense ……….dr 30,000

To Outstanding Interest Expense 30,000

(Being unaccounted Interest Expense recorded in the

books of accounts)

30-06-

2017

Depreciation ……….dr 85,000

To Accumulated Depreciation – Plant & Machinery 36,000

To Accumulated Depreciation - Computers 20,000

To Accumulated Depreciation – Buildings 29,000

(Being depreciation for the year recorded in the

books)

30-06-

2017

Income Tax Expense ……….dr 1,60,000

To Provision for Income Tax Expense 1,60,000

(Being income tax expenses for the year accounted for

30-06-

2017

Final Dividend ………dr 50,000

To Provision for Dividend 50,000

(Being dividend for the year being declared and

Journal

Date Details Debit

($)

Credit

($)

30-06-

2017

Salaries and wages ……….dr 32,000

To Outstanding Salaries and Wages 32,000

(Being unaccounted salaries recorded in the books of

accounts)

30-06-

2017

Heating and lighting expenses ……….dr 16,000

To Outstanding Heating and lighting expenses 16,000

(Being unaccounted Heating and lighting expenses

recorded in the books of accounts)

30-06-

2017

Insurance Expenses ……….dr 20,000

To Prepaid Insurance 20,000

(Being insurance expenses for the year accounted for)

30-06-

2017

Interest Expense ……….dr 30,000

To Outstanding Interest Expense 30,000

(Being unaccounted Interest Expense recorded in the

books of accounts)

30-06-

2017

Depreciation ……….dr 85,000

To Accumulated Depreciation – Plant & Machinery 36,000

To Accumulated Depreciation - Computers 20,000

To Accumulated Depreciation – Buildings 29,000

(Being depreciation for the year recorded in the

books)

30-06-

2017

Income Tax Expense ……….dr 1,60,000

To Provision for Income Tax Expense 1,60,000

(Being income tax expenses for the year accounted for

30-06-

2017

Final Dividend ………dr 50,000

To Provision for Dividend 50,000

(Being dividend for the year being declared and

approved by board)

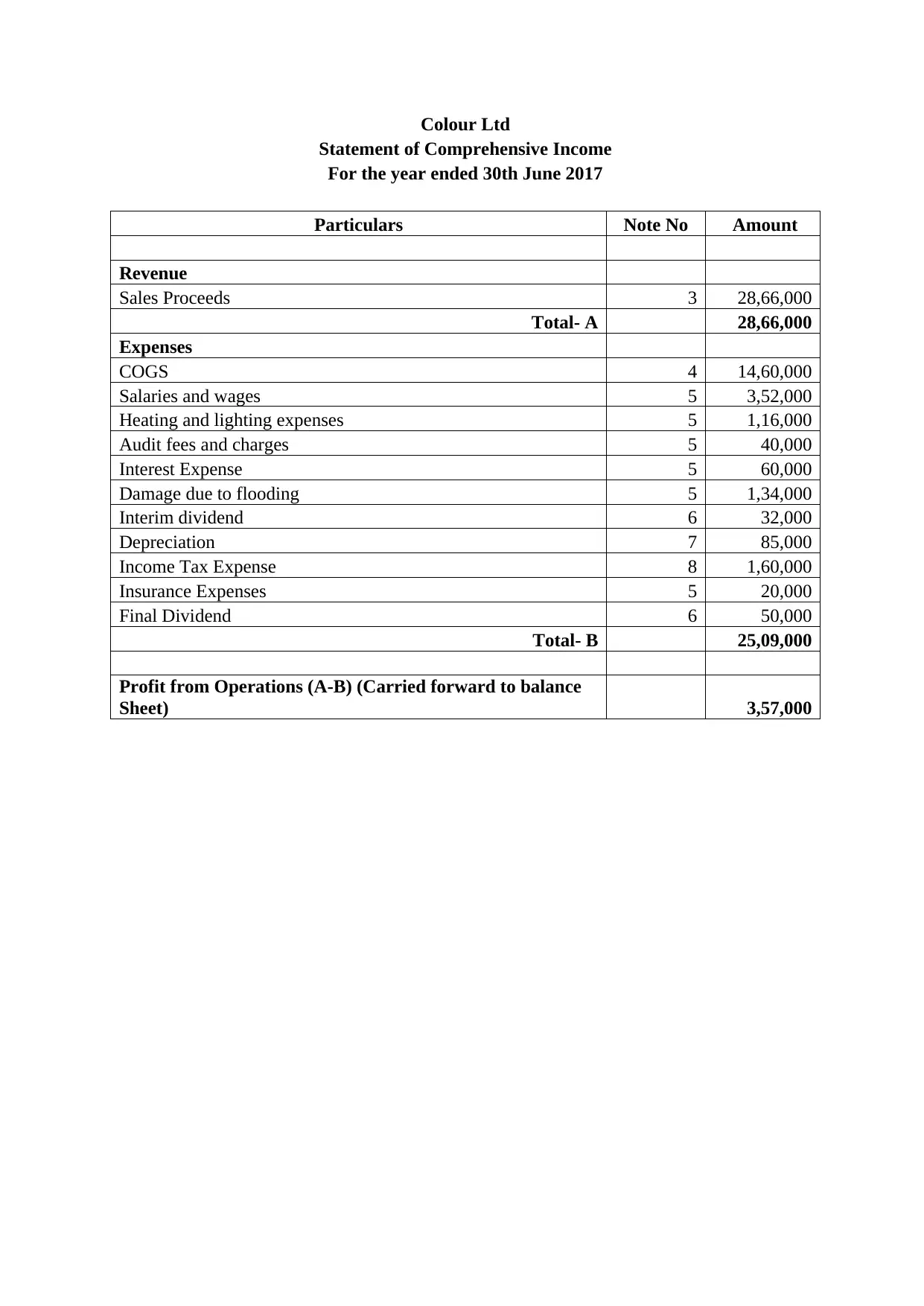

Colour Ltd

Statement of Comprehensive Income

For the year ended 30th June 2017

Particulars Note No Amount

Revenue

Sales Proceeds 3 28,66,000

Total- A 28,66,000

Expenses

COGS 4 14,60,000

Salaries and wages 5 3,52,000

Heating and lighting expenses 5 1,16,000

Audit fees and charges 5 40,000

Interest Expense 5 60,000

Damage due to flooding 5 1,34,000

Interim dividend 6 32,000

Depreciation 7 85,000

Income Tax Expense 8 1,60,000

Insurance Expenses 5 20,000

Final Dividend 6 50,000

Total- B 25,09,000

Profit from Operations (A-B) (Carried forward to balance

Sheet) 3,57,000

Statement of Comprehensive Income

For the year ended 30th June 2017

Particulars Note No Amount

Revenue

Sales Proceeds 3 28,66,000

Total- A 28,66,000

Expenses

COGS 4 14,60,000

Salaries and wages 5 3,52,000

Heating and lighting expenses 5 1,16,000

Audit fees and charges 5 40,000

Interest Expense 5 60,000

Damage due to flooding 5 1,34,000

Interim dividend 6 32,000

Depreciation 7 85,000

Income Tax Expense 8 1,60,000

Insurance Expenses 5 20,000

Final Dividend 6 50,000

Total- B 25,09,000

Profit from Operations (A-B) (Carried forward to balance

Sheet) 3,57,000

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

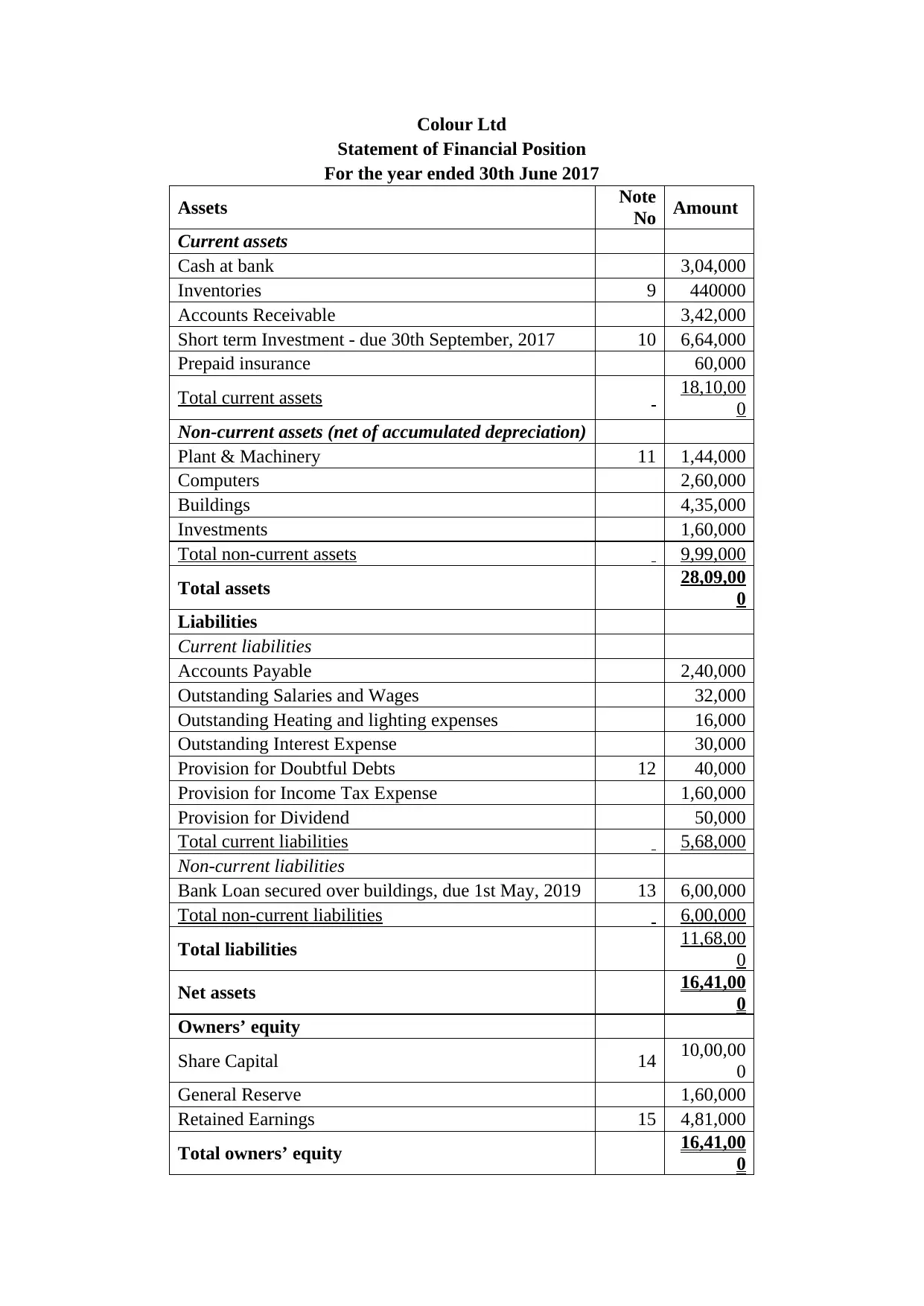

Colour Ltd

Statement of Financial Position

For the year ended 30th June 2017

Assets Note

No Amount

Current assets

Cash at bank 3,04,000

Inventories 9 440000

Accounts Receivable 3,42,000

Short term Investment - due 30th September, 2017 10 6,64,000

Prepaid insurance 60,000

Total current assets 18,10,00

0

Non-current assets (net of accumulated depreciation)

Plant & Machinery 11 1,44,000

Computers 2,60,000

Buildings 4,35,000

Investments 1,60,000

Total non-current assets 9,99,000

Total assets 28,09,00

0

Liabilities

Current liabilities

Accounts Payable 2,40,000

Outstanding Salaries and Wages 32,000

Outstanding Heating and lighting expenses 16,000

Outstanding Interest Expense 30,000

Provision for Doubtful Debts 12 40,000

Provision for Income Tax Expense 1,60,000

Provision for Dividend 50,000

Total current liabilities 5,68,000

Non-current liabilities

Bank Loan secured over buildings, due 1st May, 2019 13 6,00,000

Total non-current liabilities 6,00,000

Total liabilities 11,68,00

0

Net assets 16,41,00

0

Owners’ equity

Share Capital 14 10,00,00

0

General Reserve 1,60,000

Retained Earnings 15 4,81,000

Total owners’ equity 16,41,00

0

Statement of Financial Position

For the year ended 30th June 2017

Assets Note

No Amount

Current assets

Cash at bank 3,04,000

Inventories 9 440000

Accounts Receivable 3,42,000

Short term Investment - due 30th September, 2017 10 6,64,000

Prepaid insurance 60,000

Total current assets 18,10,00

0

Non-current assets (net of accumulated depreciation)

Plant & Machinery 11 1,44,000

Computers 2,60,000

Buildings 4,35,000

Investments 1,60,000

Total non-current assets 9,99,000

Total assets 28,09,00

0

Liabilities

Current liabilities

Accounts Payable 2,40,000

Outstanding Salaries and Wages 32,000

Outstanding Heating and lighting expenses 16,000

Outstanding Interest Expense 30,000

Provision for Doubtful Debts 12 40,000

Provision for Income Tax Expense 1,60,000

Provision for Dividend 50,000

Total current liabilities 5,68,000

Non-current liabilities

Bank Loan secured over buildings, due 1st May, 2019 13 6,00,000

Total non-current liabilities 6,00,000

Total liabilities 11,68,00

0

Net assets 16,41,00

0

Owners’ equity

Share Capital 14 10,00,00

0

General Reserve 1,60,000

Retained Earnings 15 4,81,000

Total owners’ equity 16,41,00

0

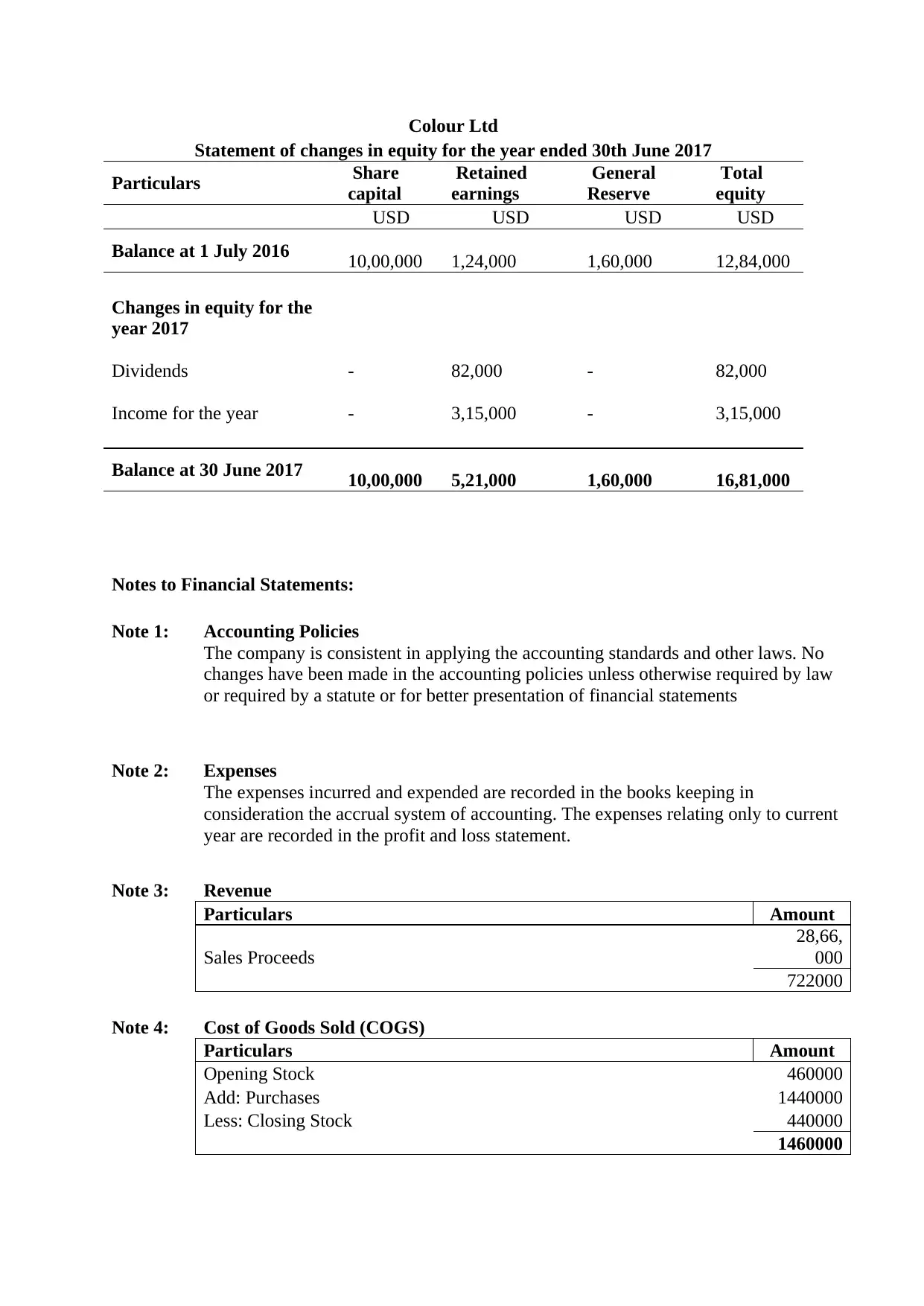

Colour Ltd

Statement of changes in equity for the year ended 30th June 2017

Particulars Share

capital

Retained

earnings

General

Reserve

Total

equity

USD USD USD USD

Balance at 1 July 2016 10,00,000 1,24,000 1,60,000 12,84,000

Changes in equity for the

year 2017

Dividends - 82,000 - 82,000

Income for the year - 3,15,000 - 3,15,000

Balance at 30 June 2017 10,00,000 5,21,000 1,60,000 16,81,000

Notes to Financial Statements:

Note 1: Accounting Policies

The company is consistent in applying the accounting standards and other laws. No

changes have been made in the accounting policies unless otherwise required by law

or required by a statute or for better presentation of financial statements

Note 2: Expenses

The expenses incurred and expended are recorded in the books keeping in

consideration the accrual system of accounting. The expenses relating only to current

year are recorded in the profit and loss statement.

Note 3: Revenue

Particulars Amount

Sales Proceeds

28,66,

000

722000

Note 4: Cost of Goods Sold (COGS)

Particulars Amount

Opening Stock 460000

Add: Purchases 1440000

Less: Closing Stock 440000

1460000

Statement of changes in equity for the year ended 30th June 2017

Particulars Share

capital

Retained

earnings

General

Reserve

Total

equity

USD USD USD USD

Balance at 1 July 2016 10,00,000 1,24,000 1,60,000 12,84,000

Changes in equity for the

year 2017

Dividends - 82,000 - 82,000

Income for the year - 3,15,000 - 3,15,000

Balance at 30 June 2017 10,00,000 5,21,000 1,60,000 16,81,000

Notes to Financial Statements:

Note 1: Accounting Policies

The company is consistent in applying the accounting standards and other laws. No

changes have been made in the accounting policies unless otherwise required by law

or required by a statute or for better presentation of financial statements

Note 2: Expenses

The expenses incurred and expended are recorded in the books keeping in

consideration the accrual system of accounting. The expenses relating only to current

year are recorded in the profit and loss statement.

Note 3: Revenue

Particulars Amount

Sales Proceeds

28,66,

000

722000

Note 4: Cost of Goods Sold (COGS)

Particulars Amount

Opening Stock 460000

Add: Purchases 1440000

Less: Closing Stock 440000

1460000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

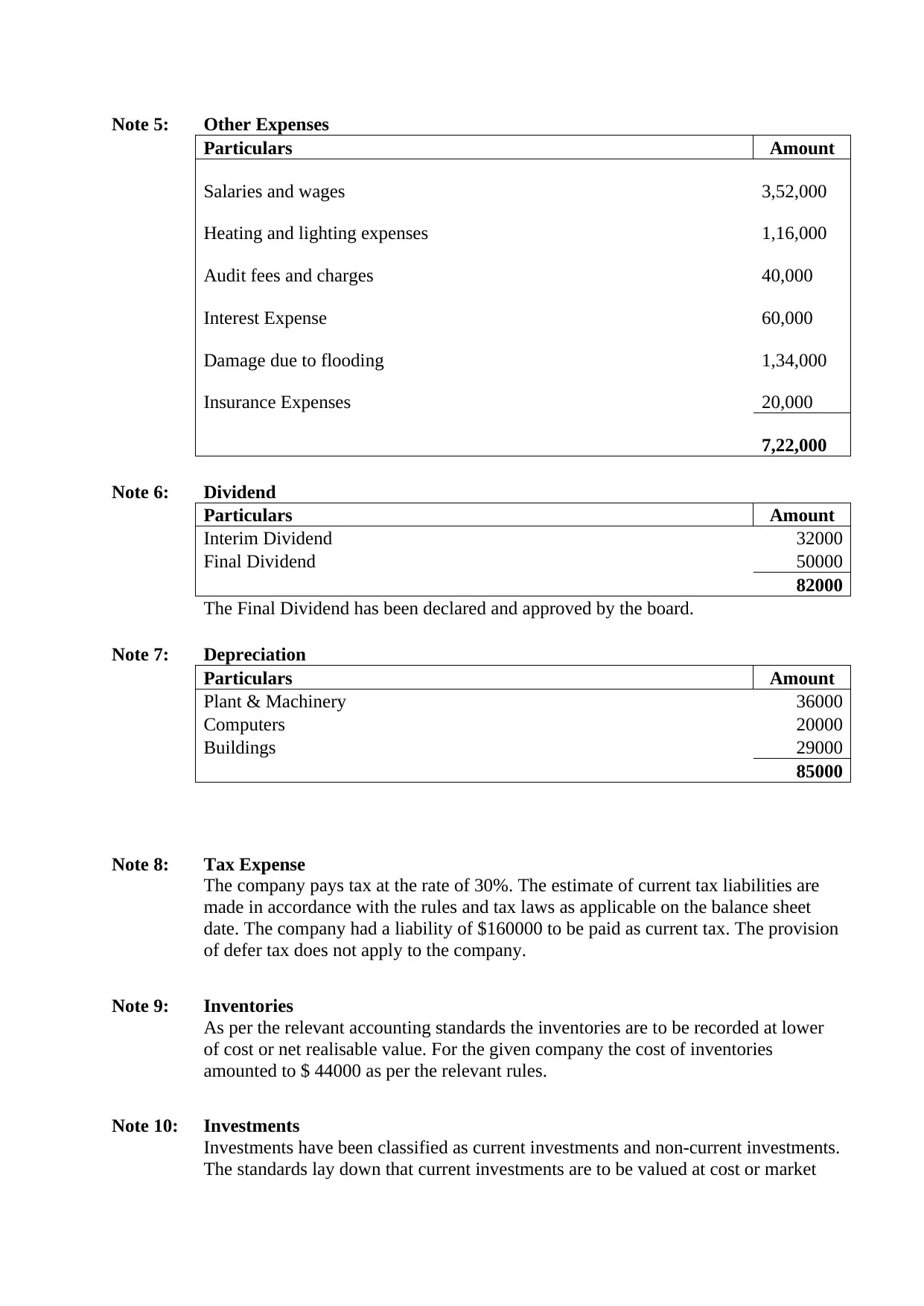

Note 5: Other Expenses

Particulars Amount

Salaries and wages 3,52,000

Heating and lighting expenses 1,16,000

Audit fees and charges 40,000

Interest Expense 60,000

Damage due to flooding 1,34,000

Insurance Expenses 20,000

7,22,000

Note 6: Dividend

Particulars Amount

Interim Dividend 32000

Final Dividend 50000

82000

The Final Dividend has been declared and approved by the board.

Note 7: Depreciation

Particulars Amount

Plant & Machinery 36000

Computers 20000

Buildings 29000

85000

Note 8: Tax Expense

The company pays tax at the rate of 30%. The estimate of current tax liabilities are

made in accordance with the rules and tax laws as applicable on the balance sheet

date. The company had a liability of $160000 to be paid as current tax. The provision

of defer tax does not apply to the company.

Note 9: Inventories

As per the relevant accounting standards the inventories are to be recorded at lower

of cost or net realisable value. For the given company the cost of inventories

amounted to $ 44000 as per the relevant rules.

Note 10: Investments

Investments have been classified as current investments and non-current investments.

The standards lay down that current investments are to be valued at cost or market

Particulars Amount

Salaries and wages 3,52,000

Heating and lighting expenses 1,16,000

Audit fees and charges 40,000

Interest Expense 60,000

Damage due to flooding 1,34,000

Insurance Expenses 20,000

7,22,000

Note 6: Dividend

Particulars Amount

Interim Dividend 32000

Final Dividend 50000

82000

The Final Dividend has been declared and approved by the board.

Note 7: Depreciation

Particulars Amount

Plant & Machinery 36000

Computers 20000

Buildings 29000

85000

Note 8: Tax Expense

The company pays tax at the rate of 30%. The estimate of current tax liabilities are

made in accordance with the rules and tax laws as applicable on the balance sheet

date. The company had a liability of $160000 to be paid as current tax. The provision

of defer tax does not apply to the company.

Note 9: Inventories

As per the relevant accounting standards the inventories are to be recorded at lower

of cost or net realisable value. For the given company the cost of inventories

amounted to $ 44000 as per the relevant rules.

Note 10: Investments

Investments have been classified as current investments and non-current investments.

The standards lay down that current investments are to be valued at cost or market

price whichever is lower. The non-current investments on the other hand are to be

valued at cost. The market values of non-current investments are available, but they

have been valued at cost as per the rules laid down by the accounting standards.

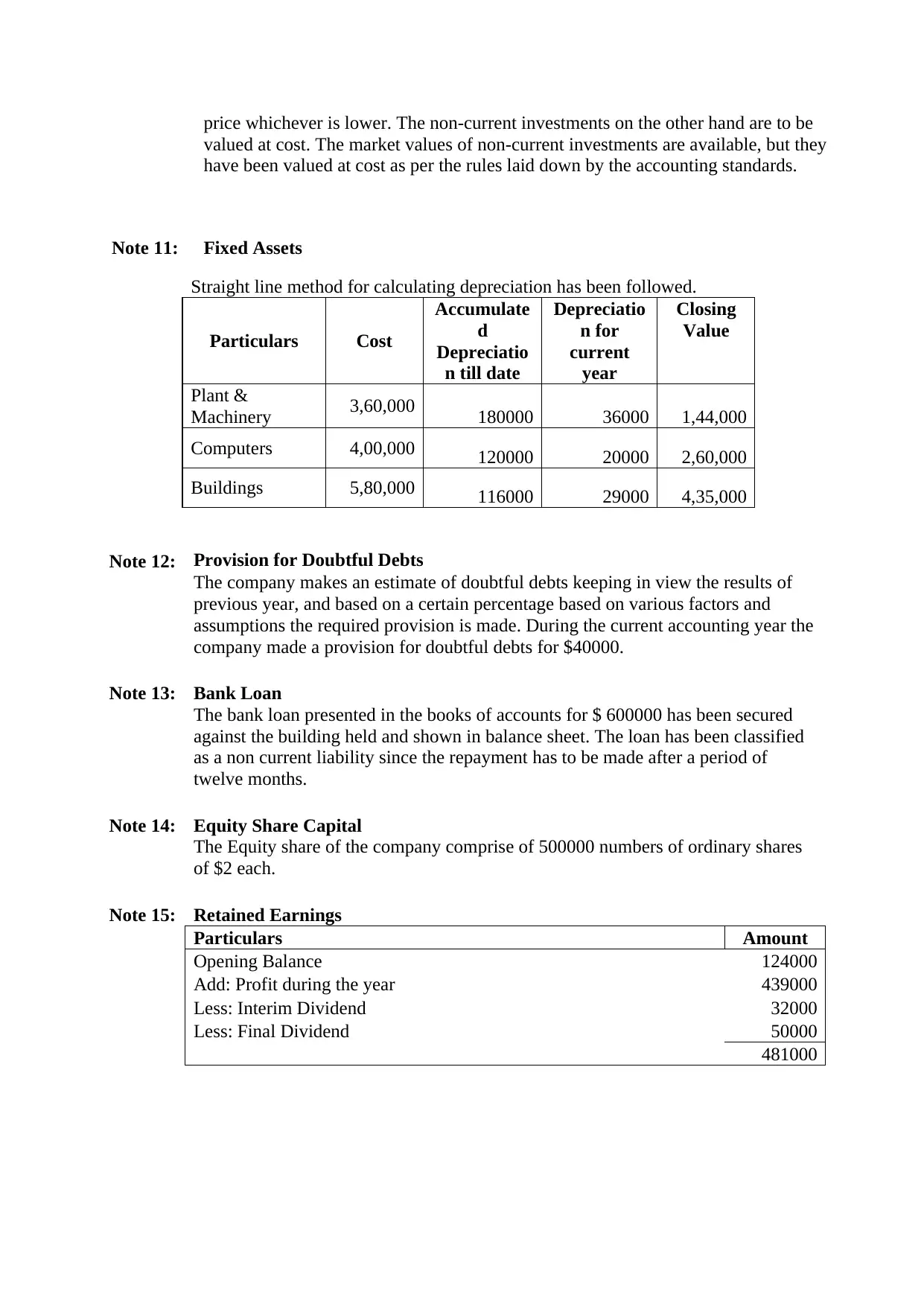

Note 11: Fixed Assets

Straight line method for calculating depreciation has been followed.

Particulars Cost

Accumulate

d

Depreciatio

n till date

Depreciatio

n for

current

year

Closing

Value

Plant &

Machinery 3,60,000 180000 36000 1,44,000

Computers 4,00,000 120000 20000 2,60,000

Buildings 5,80,000 116000 29000 4,35,000

Note 12: Provision for Doubtful Debts

The company makes an estimate of doubtful debts keeping in view the results of

previous year, and based on a certain percentage based on various factors and

assumptions the required provision is made. During the current accounting year the

company made a provision for doubtful debts for $40000.

Note 13: Bank Loan

The bank loan presented in the books of accounts for $ 600000 has been secured

against the building held and shown in balance sheet. The loan has been classified

as a non current liability since the repayment has to be made after a period of

twelve months.

Note 14: Equity Share Capital

The Equity share of the company comprise of 500000 numbers of ordinary shares

of $2 each.

Note 15: Retained Earnings

Particulars Amount

Opening Balance 124000

Add: Profit during the year 439000

Less: Interim Dividend 32000

Less: Final Dividend 50000

481000

valued at cost. The market values of non-current investments are available, but they

have been valued at cost as per the rules laid down by the accounting standards.

Note 11: Fixed Assets

Straight line method for calculating depreciation has been followed.

Particulars Cost

Accumulate

d

Depreciatio

n till date

Depreciatio

n for

current

year

Closing

Value

Plant &

Machinery 3,60,000 180000 36000 1,44,000

Computers 4,00,000 120000 20000 2,60,000

Buildings 5,80,000 116000 29000 4,35,000

Note 12: Provision for Doubtful Debts

The company makes an estimate of doubtful debts keeping in view the results of

previous year, and based on a certain percentage based on various factors and

assumptions the required provision is made. During the current accounting year the

company made a provision for doubtful debts for $40000.

Note 13: Bank Loan

The bank loan presented in the books of accounts for $ 600000 has been secured

against the building held and shown in balance sheet. The loan has been classified

as a non current liability since the repayment has to be made after a period of

twelve months.

Note 14: Equity Share Capital

The Equity share of the company comprise of 500000 numbers of ordinary shares

of $2 each.

Note 15: Retained Earnings

Particulars Amount

Opening Balance 124000

Add: Profit during the year 439000

Less: Interim Dividend 32000

Less: Final Dividend 50000

481000

References:

Bruner, R., Eades, K. and Schill, M. (2017). Case studies in finance. Dubuque, IA: McGraw-

Hill Education.

Khan, M. and Jain, P. (2014). Financial management. New Delhi: McGraw Hill Education.

Saunders, A. and Cornett, M. (2017). Financial institutions management. New York:

McGraw-Hill Education.

Shim, J. and Siegel, J. (2008). Financial management. Hauppauge, N.Y.: Barron's

Educational Series.

Bruner, R., Eades, K. and Schill, M. (2017). Case studies in finance. Dubuque, IA: McGraw-

Hill Education.

Khan, M. and Jain, P. (2014). Financial management. New Delhi: McGraw Hill Education.

Saunders, A. and Cornett, M. (2017). Financial institutions management. New York:

McGraw-Hill Education.

Shim, J. and Siegel, J. (2008). Financial management. Hauppauge, N.Y.: Barron's

Educational Series.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.