HI5020 Corporate Accounting: Financial Statement Analysis of CBA & NAB

VerifiedAdded on 2023/06/07

|23

|4408

|280

Report

AI Summary

This report provides a comparative analysis of Commonwealth Bank of Australia (CBA) and National Australia Bank (NAB), focusing on key aspects of corporate accounting. It examines owners' equity, including ordinary share capital, other equity instruments, reserves, and retained profits, highlighting changes and trends in these components. The report also analyzes cash flow statements, detailing operating, investing, and financing activities, and compares the net cash flows and free cash flows of both banks. Furthermore, it discusses accounting for corporate income tax, including the differences between effective tax rates and deferred tax assets. The analysis uses data from the companies' annual reports to assess their financial positions and performance.

Running Head: CORPORATE ACCOUNTING 0

Corporate Accounting

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

Executive Summary

Corporate accounting is a special branch of the accounting which deals with the accounting

companies, preparation of the accounts and the preparations of the financial statements for

specific events are the amalgamation, absorption and the preparation of the consolidated

balance sheets.

A detailed comparison of Commonwealth Bank of Australia and the National Bank of

Australia has been carried out and the other comprehensive statement of income has been

recorded. A comparative analysis has also been considered. The below report talks about the

owner’s equity and its components, cash flow statements and the each item is described in

detail. The accounting corporate income tax has also been shown and the difference between

the effective rate and the deferred tax assets and the companies has also recorded the tax

expense treatment as well.

Executive Summary

Corporate accounting is a special branch of the accounting which deals with the accounting

companies, preparation of the accounts and the preparations of the financial statements for

specific events are the amalgamation, absorption and the preparation of the consolidated

balance sheets.

A detailed comparison of Commonwealth Bank of Australia and the National Bank of

Australia has been carried out and the other comprehensive statement of income has been

recorded. A comparative analysis has also been considered. The below report talks about the

owner’s equity and its components, cash flow statements and the each item is described in

detail. The accounting corporate income tax has also been shown and the difference between

the effective rate and the deferred tax assets and the companies has also recorded the tax

expense treatment as well.

Running Head: CORPORATE ACCOUNTING

Table of Contents

Executive Summary...................................................................................................................1

Introduction................................................................................................................................3

Owners’ Equity..........................................................................................................................3

Ordinary Share capital............................................................................................................4

Other Equity Instruments.......................................................................................................4

Reserves..................................................................................................................................4

Retained profits......................................................................................................................4

Comparative Analysis................................................................................................................5

Cash flow statements..................................................................................................................5

Operating Activities................................................................................................................5

Income statement.....................................................................................................................13

Accounting for Corporate Income Tax....................................................................................16

References................................................................................................................................19

Table of Contents

Executive Summary...................................................................................................................1

Introduction................................................................................................................................3

Owners’ Equity..........................................................................................................................3

Ordinary Share capital............................................................................................................4

Other Equity Instruments.......................................................................................................4

Reserves..................................................................................................................................4

Retained profits......................................................................................................................4

Comparative Analysis................................................................................................................5

Cash flow statements..................................................................................................................5

Operating Activities................................................................................................................5

Income statement.....................................................................................................................13

Accounting for Corporate Income Tax....................................................................................16

References................................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: CORPORATE ACCOUNTING

Introduction

Commonwealth bank of Australia and the National Bank of Australia is the multinational

bank with the businesses across New Zealand, Asia the United States. On the other hand

National Bank of Australia is also the Australian based bank which is engaged in the business

of the financial services and the investment services (National Bank of Australia, 2018). The

current revenue of the commonwealth bank of Australia is $26.005 billion and that of the

National Bank of Australia A$20.176 billion (Commonwealth Bank, 2018).

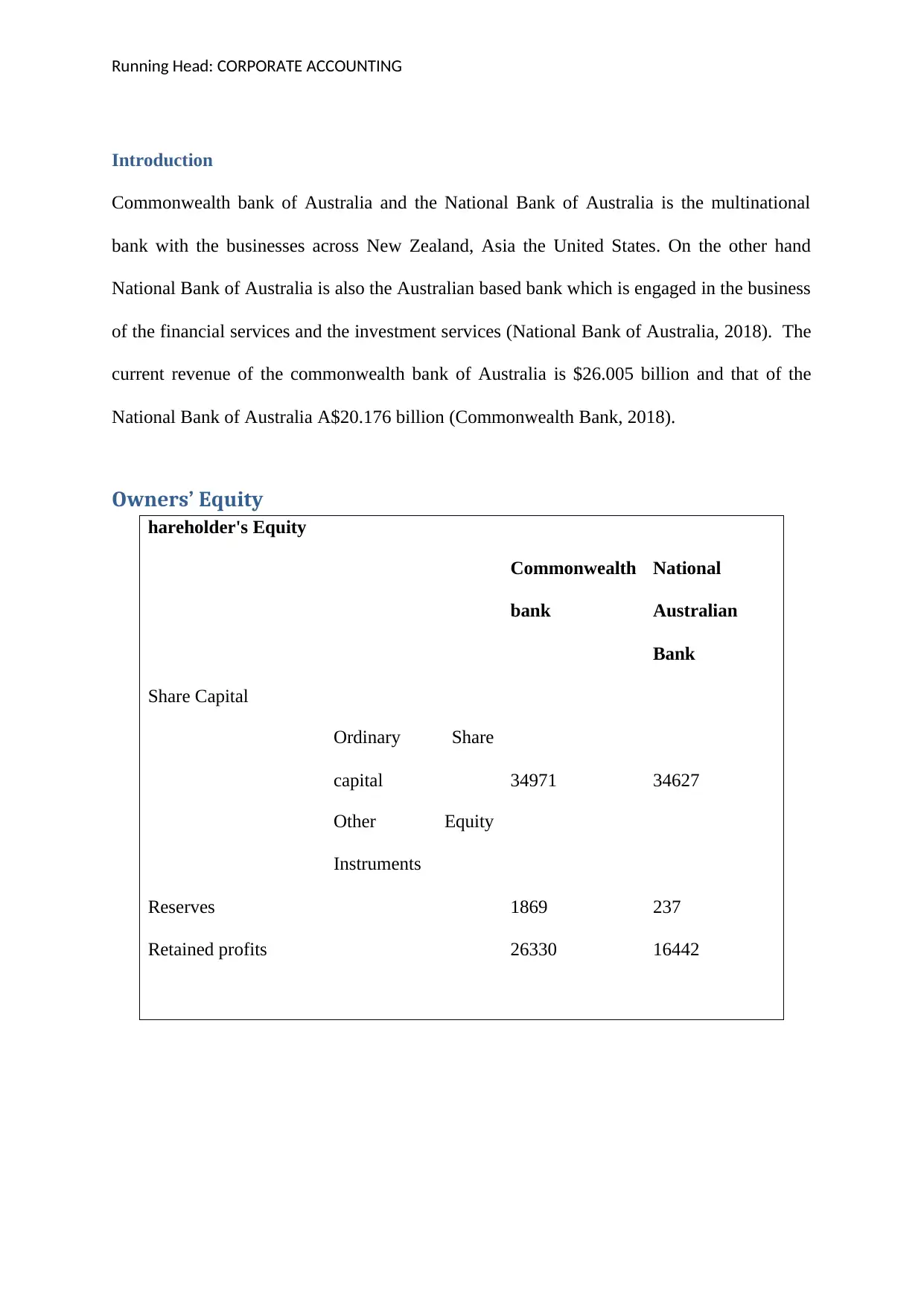

Owners’ Equity

hareholder's Equity

Commonwealth

bank

National

Australian

Bank

Share Capital

Ordinary Share

capital 34971 34627

Other Equity

Instruments

Reserves 1869 237

Retained profits 26330 16442

Introduction

Commonwealth bank of Australia and the National Bank of Australia is the multinational

bank with the businesses across New Zealand, Asia the United States. On the other hand

National Bank of Australia is also the Australian based bank which is engaged in the business

of the financial services and the investment services (National Bank of Australia, 2018). The

current revenue of the commonwealth bank of Australia is $26.005 billion and that of the

National Bank of Australia A$20.176 billion (Commonwealth Bank, 2018).

Owners’ Equity

hareholder's Equity

Commonwealth

bank

National

Australian

Bank

Share Capital

Ordinary Share

capital 34971 34627

Other Equity

Instruments

Reserves 1869 237

Retained profits 26330 16442

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

I) Ordinary Share capital

Ordinary share capital is the capital which is provided by the owners of the business in return

of shares. Ordinary shares are ranked after the preference shares. The ordinary share capital

of the Commonwealth Bank of Australia is A$34971 and that of the National Australian

Bank is A$34627 which is lower as compared to the previous bank. The shareholder capital

of both the banks have been accelerated as compared to the previous year from the annual

reports, possibly because the companies might have sold the shares which raised the revenue

and decreased the expenses. The share capital of Commonwealth bank increased from

A$33845 to A$34971 and that of the National Bnak of Australia is A$34285 to A$34627,

which is still a slow raise.

Other Equity Instruments

Other Equity instruments are generally a document which serves as a legal evidence of the

ownership right in a firm like a share certificate. They are issued to the shareholders of the

company and are used to fund the business (Schaltegger, Etxeberria and Ortas, 2017).

Reserves

Reserves are the money which has been kept aside by the company for the specific purposes.

The reserves of the Commonwealth bank are A$1869 and on the other hand the National

Australian Bank is having reserves of A$237. The reserves have been decreased in case of

Commonwealth Bank of Australia due to payment of debts (Suzuki, 2015).

Retained profits

A portion of surplus always ends up in the retained earnings or retained profits. The retained

profits of the company are the amount earned to date after any dividends or distributions are

paid to the investors. It can be used by the company to pay the debts as well as the future

dividends. The increase retained earnings means the companies are stable and profitable. The

I) Ordinary Share capital

Ordinary share capital is the capital which is provided by the owners of the business in return

of shares. Ordinary shares are ranked after the preference shares. The ordinary share capital

of the Commonwealth Bank of Australia is A$34971 and that of the National Australian

Bank is A$34627 which is lower as compared to the previous bank. The shareholder capital

of both the banks have been accelerated as compared to the previous year from the annual

reports, possibly because the companies might have sold the shares which raised the revenue

and decreased the expenses. The share capital of Commonwealth bank increased from

A$33845 to A$34971 and that of the National Bnak of Australia is A$34285 to A$34627,

which is still a slow raise.

Other Equity Instruments

Other Equity instruments are generally a document which serves as a legal evidence of the

ownership right in a firm like a share certificate. They are issued to the shareholders of the

company and are used to fund the business (Schaltegger, Etxeberria and Ortas, 2017).

Reserves

Reserves are the money which has been kept aside by the company for the specific purposes.

The reserves of the Commonwealth bank are A$1869 and on the other hand the National

Australian Bank is having reserves of A$237. The reserves have been decreased in case of

Commonwealth Bank of Australia due to payment of debts (Suzuki, 2015).

Retained profits

A portion of surplus always ends up in the retained earnings or retained profits. The retained

profits of the company are the amount earned to date after any dividends or distributions are

paid to the investors. It can be used by the company to pay the debts as well as the future

dividends. The increase retained earnings means the companies are stable and profitable. The

Running Head: CORPORATE ACCOUNTING

retained earnings of the National Australian Bank have increased from A$16376 to A$16442,

whereas that of the Commonwealth Bank has also increased from A$23435 to A$26330

(Commonwealth Bank, 2018).

II)

Comparative Analysis

The comparative analysis of the shareholders equity of both the companies showcases the

financial position of the company. The above factors determine how much the owners has

invested in the business and how they are performing in comparison to the past years and the

competitors as well. The share capital of Commonwealth bank increased from A$33845 to

A$34971 and that of the National Bank of Australia is A$34285 to A$34627, which is still a

slow raise (National Bank of Australia, 2018)

Cash flow statements

Operating Activities

Operating activities are the operations of the business which are directly related to the supply

of the goods and the services to the market. These activities are considered as the core

activities of the company and examples of such activities are distributing, marketing and

selling of a product or a service (Miao, Teoh and Zhu, 2016).

III)

Funds from operations

Funds from operations are the amount which is used by the real estate investment trusts to

define the cash flow from their operations. The funds from operations are calculated by

retained earnings of the National Australian Bank have increased from A$16376 to A$16442,

whereas that of the Commonwealth Bank has also increased from A$23435 to A$26330

(Commonwealth Bank, 2018).

II)

Comparative Analysis

The comparative analysis of the shareholders equity of both the companies showcases the

financial position of the company. The above factors determine how much the owners has

invested in the business and how they are performing in comparison to the past years and the

competitors as well. The share capital of Commonwealth bank increased from A$33845 to

A$34971 and that of the National Bank of Australia is A$34285 to A$34627, which is still a

slow raise (National Bank of Australia, 2018)

Cash flow statements

Operating Activities

Operating activities are the operations of the business which are directly related to the supply

of the goods and the services to the market. These activities are considered as the core

activities of the company and examples of such activities are distributing, marketing and

selling of a product or a service (Miao, Teoh and Zhu, 2016).

III)

Funds from operations

Funds from operations are the amount which is used by the real estate investment trusts to

define the cash flow from their operations. The funds from operations are calculated by

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: CORPORATE ACCOUNTING

adding back the depreciation value and subtracting any profit on sale (Collins Hribar and

Tian, 2014).

Changes in the Working Capital

Net Working Capital is defined as the difference between the current assets and current

liabilities. Therefore a change in the amount of the working capital will be reflected.

Net Operating Cash Flow

Net Operating cash flow refers to the cash amount generated by the company through the

revenue it brings in, excluding costs which are in relation to the long term investment on

capital items (Gordon, Henry, Jorgensen and Linthicum, 2017).

Investing Activities

Investing activities are those activities which will provide the future benefit to the company.

The cash flow from the investing activities is an item which reports the change in the

aggregate position of the company whether via investment in the assets and sale of the assets.

Capital Expenditures

The amount a company spends in order to attain the fixed assets, land, buildings and the

equipment. It is understood that the expenditure on the capital items will provide the benefit

to the company in the long run (Campbell, 2015).

Capital Expenditures (Fixed Assets)

A capital expenditure is considered as an asset rather than treating it as an expense. The fixed

assets are then charged over their useful life with the assistance of the depreciation.

Capital Expenditures (Other Assets)

adding back the depreciation value and subtracting any profit on sale (Collins Hribar and

Tian, 2014).

Changes in the Working Capital

Net Working Capital is defined as the difference between the current assets and current

liabilities. Therefore a change in the amount of the working capital will be reflected.

Net Operating Cash Flow

Net Operating cash flow refers to the cash amount generated by the company through the

revenue it brings in, excluding costs which are in relation to the long term investment on

capital items (Gordon, Henry, Jorgensen and Linthicum, 2017).

Investing Activities

Investing activities are those activities which will provide the future benefit to the company.

The cash flow from the investing activities is an item which reports the change in the

aggregate position of the company whether via investment in the assets and sale of the assets.

Capital Expenditures

The amount a company spends in order to attain the fixed assets, land, buildings and the

equipment. It is understood that the expenditure on the capital items will provide the benefit

to the company in the long run (Campbell, 2015).

Capital Expenditures (Fixed Assets)

A capital expenditure is considered as an asset rather than treating it as an expense. The fixed

assets are then charged over their useful life with the assistance of the depreciation.

Capital Expenditures (Other Assets)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Running Head: CORPORATE ACCOUNTING

The other assets include the current assets and probably the advance from the customers and

the deposits. The cost or the values of an asset is adjusted for the purpose of the tax.

Net Assets from Acquisitions

The net assets from acquisitions are basically the amount which is arrived after adding up all

the above assets and expenditures.

Sale of Fixed Assets & Businesses

The sale of the fixed assets is a normal process which is undertaken either to gain an

advantage when the price is right and can enables the earnings and profits or when the part of

the asset or an entire asset becomes useless. The sale of the business also involves transfer of

the ownership to the other party (Weber, 2018).

Purchase/Sale of Investments

Generally the investment transactions are made through the brokers and the purchase of the

investment is done basically to secure the company. The right market price or the favourable

market price when arrives the company sells the investment.

Financing Activities

The financing activities involve the transactions with creditors or investors. These activities

help in either expansion of the operations of the company or help the existing operations.

These transactions are the third set of the activities which are used while forming the cash

flow statement.

The examples of the financing activities are Cash Dividends Paid – Total, Common

Dividends, Cash Dividend Growth, Change in Capital Stock, Repurchase of Common &

Preferred Stock, Sale of Common & Preferred Stock, Proceeds from Stock Options,

The other assets include the current assets and probably the advance from the customers and

the deposits. The cost or the values of an asset is adjusted for the purpose of the tax.

Net Assets from Acquisitions

The net assets from acquisitions are basically the amount which is arrived after adding up all

the above assets and expenditures.

Sale of Fixed Assets & Businesses

The sale of the fixed assets is a normal process which is undertaken either to gain an

advantage when the price is right and can enables the earnings and profits or when the part of

the asset or an entire asset becomes useless. The sale of the business also involves transfer of

the ownership to the other party (Weber, 2018).

Purchase/Sale of Investments

Generally the investment transactions are made through the brokers and the purchase of the

investment is done basically to secure the company. The right market price or the favourable

market price when arrives the company sells the investment.

Financing Activities

The financing activities involve the transactions with creditors or investors. These activities

help in either expansion of the operations of the company or help the existing operations.

These transactions are the third set of the activities which are used while forming the cash

flow statement.

The examples of the financing activities are Cash Dividends Paid – Total, Common

Dividends, Cash Dividend Growth, Change in Capital Stock, Repurchase of Common &

Preferred Stock, Sale of Common & Preferred Stock, Proceeds from Stock Options,

Running Head: CORPORATE ACCOUNTING

Issuance/Reduction of Debt, Net, Change in Long-Term Debt, Issuance of Long-Term Debt,

Reduction in Long-Term Debt, Other Funds and sources (Huang, Lin and Raghunandan,

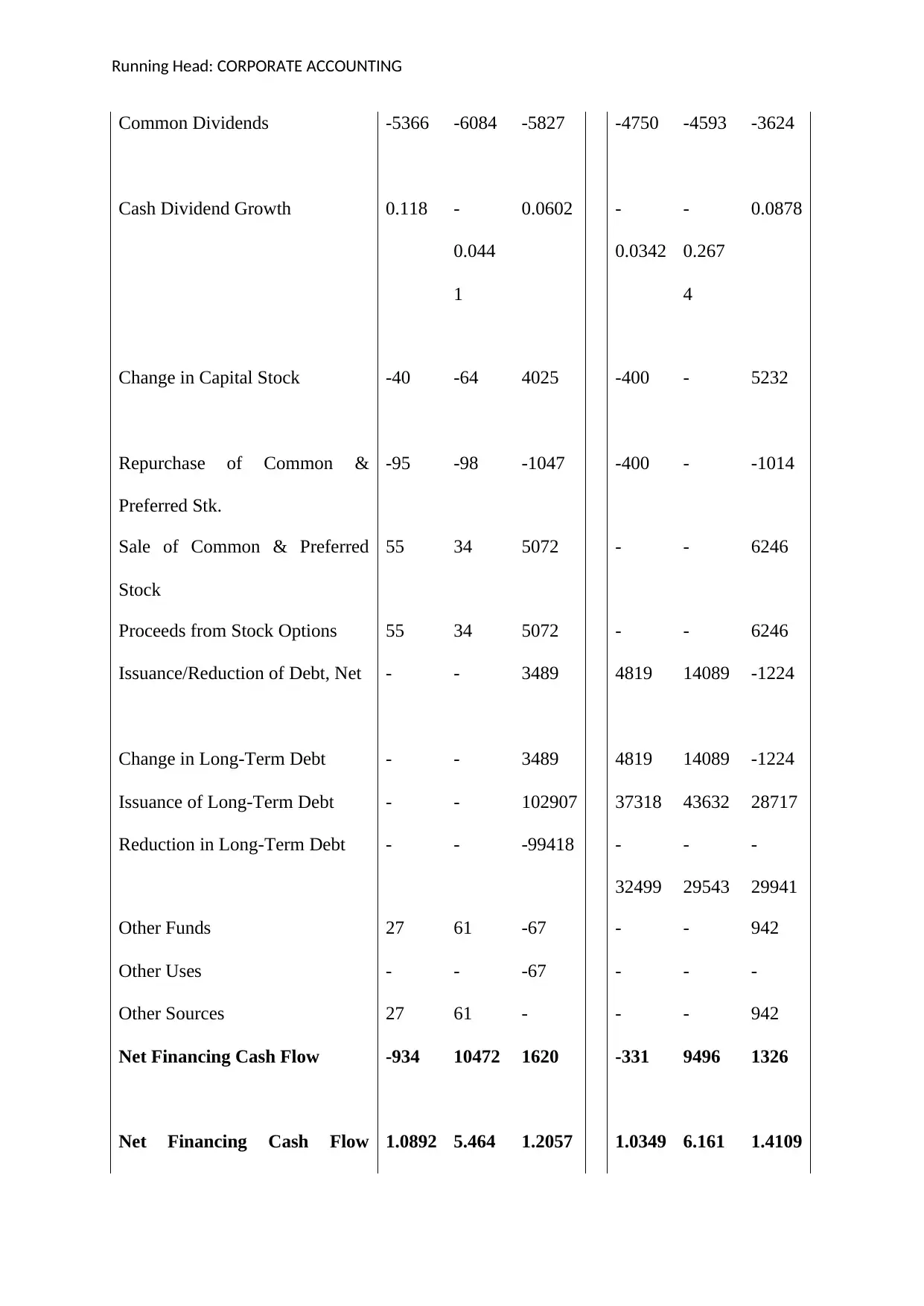

2015).

Net Change in Cash

The net change in the cash reflects the increase or decrease in the cash and the cash

equivalents from the starting point to the end point of a year. The net change is calculated as

a result of cash from operating, investing and the financing activities (Graham and Lin,

2018).

Free Cash Flow

The free cash flow is measured by how much amount of the cash the company is able to

generate after paying off for all the expenses and can be used for the expansion, dividends,

reduction of the debts and for other purposes (Free cash flow, 2017).

From the cash flow below it can be analysed and observed that in case of the Commonwealth

bank the net cash from operating activities has been improved and reached to 2.651 from

0.841 as compared to the previous year mainly because of the increase in the funds from

operations and that of the National Australian Bank have been reduced to 569 from (2327),

the company is trying to improve (Talebnia, Jaberzadeh and Salehi, 2015)

Net cash flow from the investing activities

IV)

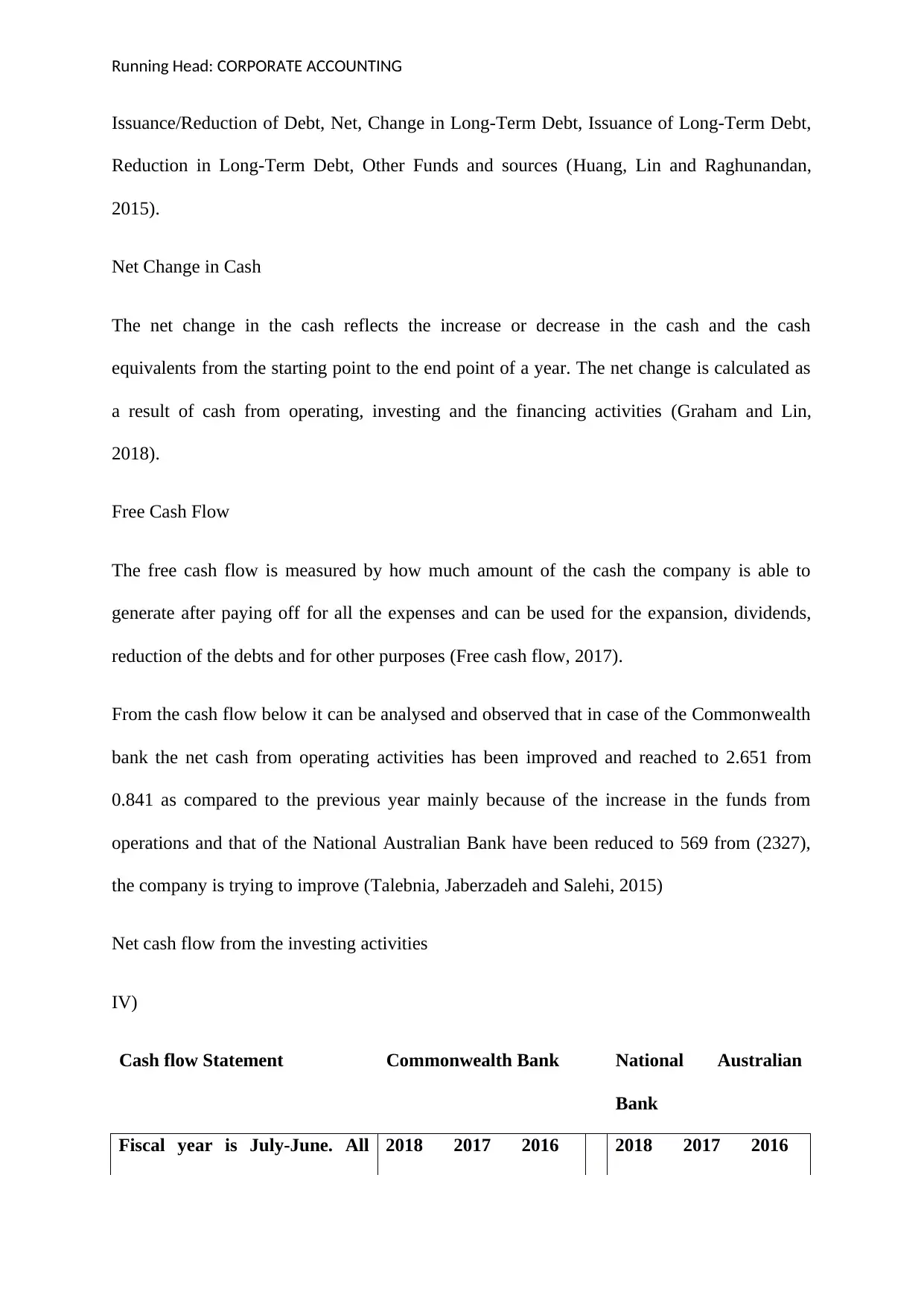

Cash flow Statement Commonwealth Bank National Australian

Bank

Fiscal year is July-June. All 2018 2017 2016 2018 2017 2016

Issuance/Reduction of Debt, Net, Change in Long-Term Debt, Issuance of Long-Term Debt,

Reduction in Long-Term Debt, Other Funds and sources (Huang, Lin and Raghunandan,

2015).

Net Change in Cash

The net change in the cash reflects the increase or decrease in the cash and the cash

equivalents from the starting point to the end point of a year. The net change is calculated as

a result of cash from operating, investing and the financing activities (Graham and Lin,

2018).

Free Cash Flow

The free cash flow is measured by how much amount of the cash the company is able to

generate after paying off for all the expenses and can be used for the expansion, dividends,

reduction of the debts and for other purposes (Free cash flow, 2017).

From the cash flow below it can be analysed and observed that in case of the Commonwealth

bank the net cash from operating activities has been improved and reached to 2.651 from

0.841 as compared to the previous year mainly because of the increase in the funds from

operations and that of the National Australian Bank have been reduced to 569 from (2327),

the company is trying to improve (Talebnia, Jaberzadeh and Salehi, 2015)

Net cash flow from the investing activities

IV)

Cash flow Statement Commonwealth Bank National Australian

Bank

Fiscal year is July-June. All 2018 2017 2016 2018 2017 2016

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Running Head: CORPORATE ACCOUNTING

values AUD Millions.

Funds from Operations 15800 12389 17215 12648 16787 -

13818

Funds from Operations Growth 0.2753 -

0.280

3

0.3469 -

0.2466

2.214

9

-

1.4251

Changes in Working Capital -

14623

-

13102

-21698 569 -2327 728

Net Operating Cash Flow 1177 -713 -4483 13217 14460 -

13090

Net Operating Cash Flow

Growth

2.6508 0.841 -1.618 -0.086 2.104

7

-0.809

Net Operating Cash Flow /

Interest Income

0.0341 0.021

4

0.1314 0.4818 0.523 0.4614

Investing Activities

Capital Expenditures -980 -1097 -1768 -1028 -875 -976

Capital Expenditures (Fixed

Assets)

-477 -602 -1259 -1028 -875 -976

values AUD Millions.

Funds from Operations 15800 12389 17215 12648 16787 -

13818

Funds from Operations Growth 0.2753 -

0.280

3

0.3469 -

0.2466

2.214

9

-

1.4251

Changes in Working Capital -

14623

-

13102

-21698 569 -2327 728

Net Operating Cash Flow 1177 -713 -4483 13217 14460 -

13090

Net Operating Cash Flow

Growth

2.6508 0.841 -1.618 -0.086 2.104

7

-0.809

Net Operating Cash Flow /

Interest Income

0.0341 0.021

4

0.1314 0.4818 0.523 0.4614

Investing Activities

Capital Expenditures -980 -1097 -1768 -1028 -875 -976

Capital Expenditures (Fixed

Assets)

-477 -602 -1259 -1028 -875 -976

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

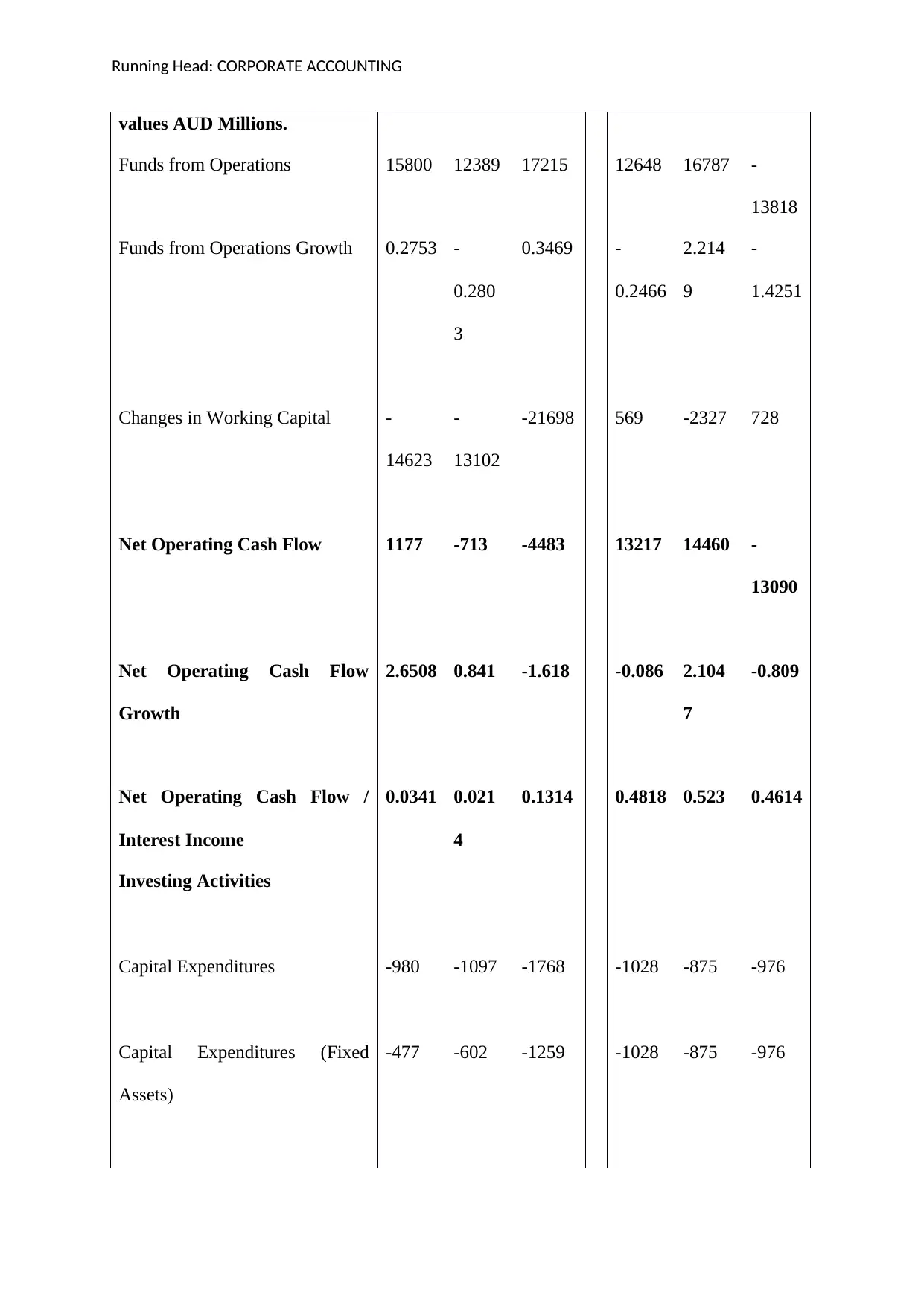

Running Head: CORPORATE ACCOUNTING

Capital Expenditures (Other

Assets)

-503 -495 -509 - - -

Net Assets from Acquisitions - -31 -857 - -

11782

-33

Sale of Fixed Assets &

Businesses

181 382 515 2269 52 382

Purchase/Sale of Investments -271 -25 - -1554 2635 -1203

Purchase of Investments -271 -25 - -

23396

-

22084

-

25174

Sale of investments 21842 24719 23971

Other Sources - - -

Net Investing Cash Flow -1070 -771 -2110 -313 -9970 -1830

Net Investing Cash Flow

Growth

0.3878 0.634

6

0.6407 0.9686 4.448

1

0.7402

Net Investing Cash Flow /

Interest Income

-0.031 -

0.023

1

-

0.0619

-

0.0114

-

0.360

6

-

0.0645

Cash Dividends Paid - Total -5366 -6084 -5827 -4750 -4593 -3624

Capital Expenditures (Other

Assets)

-503 -495 -509 - - -

Net Assets from Acquisitions - -31 -857 - -

11782

-33

Sale of Fixed Assets &

Businesses

181 382 515 2269 52 382

Purchase/Sale of Investments -271 -25 - -1554 2635 -1203

Purchase of Investments -271 -25 - -

23396

-

22084

-

25174

Sale of investments 21842 24719 23971

Other Sources - - -

Net Investing Cash Flow -1070 -771 -2110 -313 -9970 -1830

Net Investing Cash Flow

Growth

0.3878 0.634

6

0.6407 0.9686 4.448

1

0.7402

Net Investing Cash Flow /

Interest Income

-0.031 -

0.023

1

-

0.0619

-

0.0114

-

0.360

6

-

0.0645

Cash Dividends Paid - Total -5366 -6084 -5827 -4750 -4593 -3624

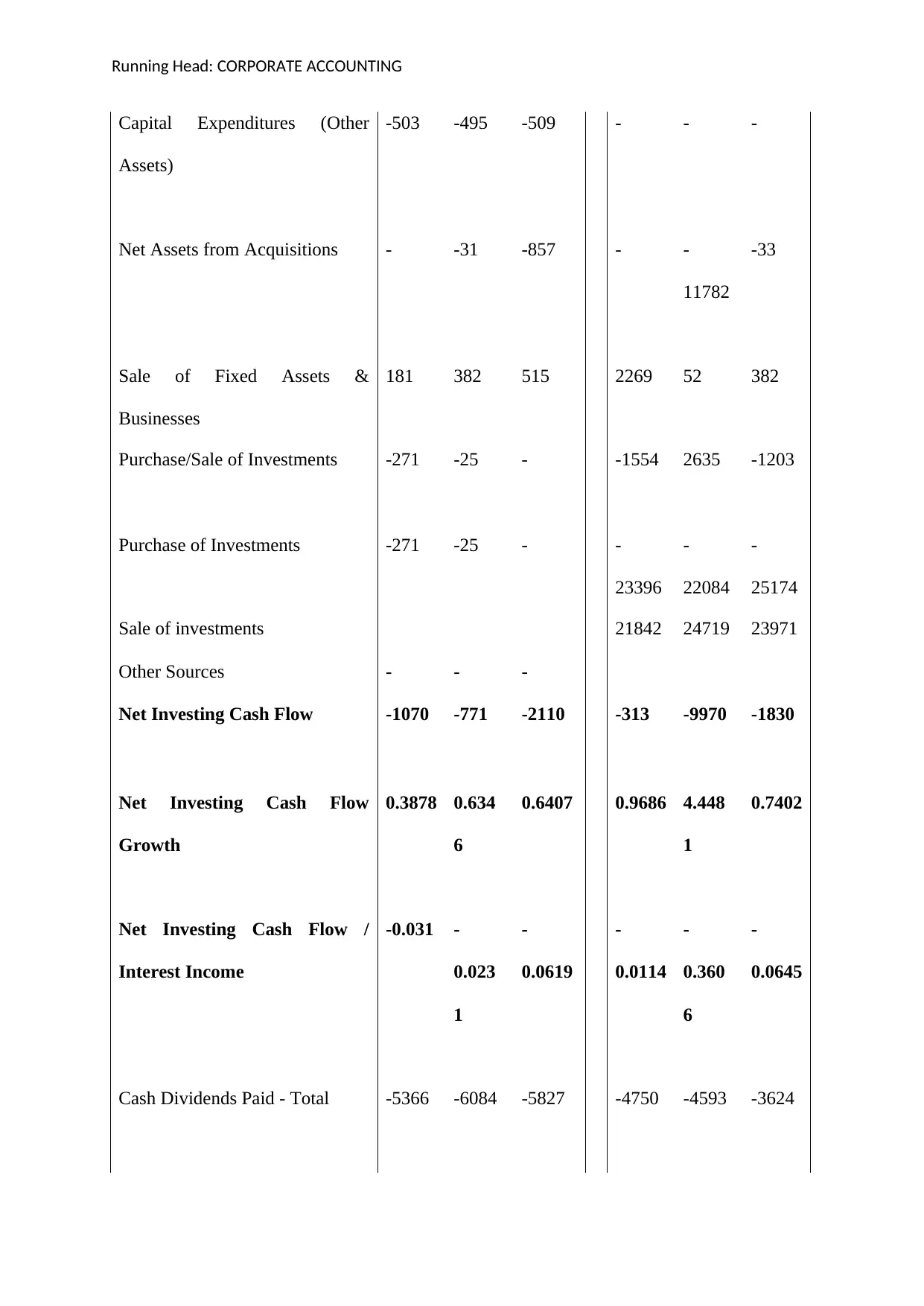

Running Head: CORPORATE ACCOUNTING

Common Dividends -5366 -6084 -5827 -4750 -4593 -3624

Cash Dividend Growth 0.118 -

0.044

1

0.0602 -

0.0342

-

0.267

4

0.0878

Change in Capital Stock -40 -64 4025 -400 - 5232

Repurchase of Common &

Preferred Stk.

-95 -98 -1047 -400 - -1014

Sale of Common & Preferred

Stock

55 34 5072 - - 6246

Proceeds from Stock Options 55 34 5072 - - 6246

Issuance/Reduction of Debt, Net - - 3489 4819 14089 -1224

Change in Long-Term Debt - - 3489 4819 14089 -1224

Issuance of Long-Term Debt - - 102907 37318 43632 28717

Reduction in Long-Term Debt - - -99418 -

32499

-

29543

-

29941

Other Funds 27 61 -67 - - 942

Other Uses - - -67 - - -

Other Sources 27 61 - - - 942

Net Financing Cash Flow -934 10472 1620 -331 9496 1326

Net Financing Cash Flow 1.0892 5.464 1.2057 1.0349 6.161 1.4109

Common Dividends -5366 -6084 -5827 -4750 -4593 -3624

Cash Dividend Growth 0.118 -

0.044

1

0.0602 -

0.0342

-

0.267

4

0.0878

Change in Capital Stock -40 -64 4025 -400 - 5232

Repurchase of Common &

Preferred Stk.

-95 -98 -1047 -400 - -1014

Sale of Common & Preferred

Stock

55 34 5072 - - 6246

Proceeds from Stock Options 55 34 5072 - - 6246

Issuance/Reduction of Debt, Net - - 3489 4819 14089 -1224

Change in Long-Term Debt - - 3489 4819 14089 -1224

Issuance of Long-Term Debt - - 102907 37318 43632 28717

Reduction in Long-Term Debt - - -99418 -

32499

-

29543

-

29941

Other Funds 27 61 -67 - - 942

Other Uses - - -67 - - -

Other Sources 27 61 - - - 942

Net Financing Cash Flow -934 10472 1620 -331 9496 1326

Net Financing Cash Flow 1.0892 5.464 1.2057 1.0349 6.161 1.4109

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.