Analysis of Impairment of Assets in Corporate Financial Reporting

VerifiedAdded on 2023/06/04

|7

|1465

|272

Report

AI Summary

This report provides a detailed analysis of impairment loss in corporate accounting and financial reporting, focusing on the computation of recoverable amounts, fair value less cost of disposal, and value in use as per AASB 136. It explains how impairment loss is determined when the carrying amount of an asset or cash-generating unit (CGU) exceeds its recoverable amount, emphasizing the importance of considering both fair value less cost of disposal and value in use. The report also includes journal entries for impairment loss computation, offering practical insights. Desklib provides access to this and many other solved assignments for students.

Running head: CORPORATE ACCOUNTING AND FINANCIAL REPORTING

Corporate Accounting and Financial Reporting

Name of the Student

Name of the University

Author Note

Corporate Accounting and Financial Reporting

Name of the Student

Name of the University

Author Note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE ACCOUNTING AND FINANCIAL REPORTING

Part A

Computation of recoverable amount, fair value less cost of disposal and value

in use

Impairment loss amount is the value by which carrying amount of the asset or

the carrying amount of the cash generating unit (CGU) exceeds the recoverable

amount. While computing the amount of impairment loss various amounts of the

asset like recoverable amount, value in use and fair value reduced by cost of

disposal are taken into consideration. Recoverable amount of CGU or any particular

asset is the higher value among the fair value reduced by cost of disposal and its

value in use (Bond, Govendir and Wells 2016). Value in use is present value of

future cash inflows likely to be generated from the CGU or any particular asset. Fair

value reduced by cost of disposal is obtainable amount from sale of the CGU or

asset at arm’s length transaction price among willing and knowledgeable parties

reduced by the disposal cost.

AASB 136 on Impairment of assets defined the recoverable amount as higher

among the value in use and fair value reduced by cost of disposal. Para 19-57 set

out the out requirement to measure the recoverable amount. The requirement

applies the term ‘an asset’. However, practically it is applied to individual asset or

CGU both equally. This is not necessary always to determine the fair value reduced

by cost of disposal and the value in use. If any of these 2 amounts exceeds the

carrying amount of the asset, the asset will not be impaired rather it will then be

necessary to compute the other estimated amount. Sometimes even if the particular

asset is not dealt in active market, determination of the fair value reduced by cost of

disposal (Guthrie and Pang 2013). However, in some instances it will not be possible

Part A

Computation of recoverable amount, fair value less cost of disposal and value

in use

Impairment loss amount is the value by which carrying amount of the asset or

the carrying amount of the cash generating unit (CGU) exceeds the recoverable

amount. While computing the amount of impairment loss various amounts of the

asset like recoverable amount, value in use and fair value reduced by cost of

disposal are taken into consideration. Recoverable amount of CGU or any particular

asset is the higher value among the fair value reduced by cost of disposal and its

value in use (Bond, Govendir and Wells 2016). Value in use is present value of

future cash inflows likely to be generated from the CGU or any particular asset. Fair

value reduced by cost of disposal is obtainable amount from sale of the CGU or

asset at arm’s length transaction price among willing and knowledgeable parties

reduced by the disposal cost.

AASB 136 on Impairment of assets defined the recoverable amount as higher

among the value in use and fair value reduced by cost of disposal. Para 19-57 set

out the out requirement to measure the recoverable amount. The requirement

applies the term ‘an asset’. However, practically it is applied to individual asset or

CGU both equally. This is not necessary always to determine the fair value reduced

by cost of disposal and the value in use. If any of these 2 amounts exceeds the

carrying amount of the asset, the asset will not be impaired rather it will then be

necessary to compute the other estimated amount. Sometimes even if the particular

asset is not dealt in active market, determination of the fair value reduced by cost of

disposal (Guthrie and Pang 2013). However, in some instances it will not be possible

2CORPORATE ACCOUNTING AND FINANCIAL REPORTING

as no basis can be established to make a reliable estimate for projecting the

obtainable amount from selling of the asset. This situation generally arises when the

asset is held for the purpose of disposal. The reason behind this is the value in use

for the asset held for the purpose of disposal consists of the net proceeds from

disposal as future cash flows from asset’s continuous use till disposal is of negligible

value. For the individual asset the recoverable amount is established except where

the asset dies not create any cash inflows that is highly dependent on other asset or

other group of asset (Legislation.gov.au 2018). In this case, the recoverable amount

is established for CGU under which the asset falls. Exception to this situation is (i)

when the fair value reduced by cost of disposal of the asset is higher as compared to

carrying amount or (ii) when the value in use of the asset can be established to be

close to the fair value reduced by cost of disposal and the fair value reduced by cost

of disposal is determinable (Rennekamp, Rupar and Seybert 2014). In some of the

instances, the average, estimates and the computational short cuts provides with

reasonable approximations of detailed computation to determine the value in use or

fair value reduced by cost of disposal.

While measuring the fair value reduced by cost of sell, best evidence for the

amount is the price mentioned in the binding sale agreement as per the arm’s length

price. The amount is arrived at after adjusting for the incremental cost that will be

directly attributable for disposing the asset (Kang and Gray 2013). However, if no

binding agreement for sale is there however, the asset is dealt in the active market;

fair value reduced by cost of disposal will be the market price of the asset less the

disposal cost. Here, the bid price is considered as the market price. However, if the

bid price also is not available price of the most recent transaction will be considered

for estimating the fair value reduced by cost of disposal. However, this amount can

as no basis can be established to make a reliable estimate for projecting the

obtainable amount from selling of the asset. This situation generally arises when the

asset is held for the purpose of disposal. The reason behind this is the value in use

for the asset held for the purpose of disposal consists of the net proceeds from

disposal as future cash flows from asset’s continuous use till disposal is of negligible

value. For the individual asset the recoverable amount is established except where

the asset dies not create any cash inflows that is highly dependent on other asset or

other group of asset (Legislation.gov.au 2018). In this case, the recoverable amount

is established for CGU under which the asset falls. Exception to this situation is (i)

when the fair value reduced by cost of disposal of the asset is higher as compared to

carrying amount or (ii) when the value in use of the asset can be established to be

close to the fair value reduced by cost of disposal and the fair value reduced by cost

of disposal is determinable (Rennekamp, Rupar and Seybert 2014). In some of the

instances, the average, estimates and the computational short cuts provides with

reasonable approximations of detailed computation to determine the value in use or

fair value reduced by cost of disposal.

While measuring the fair value reduced by cost of sell, best evidence for the

amount is the price mentioned in the binding sale agreement as per the arm’s length

price. The amount is arrived at after adjusting for the incremental cost that will be

directly attributable for disposing the asset (Kang and Gray 2013). However, if no

binding agreement for sale is there however, the asset is dealt in the active market;

fair value reduced by cost of disposal will be the market price of the asset less the

disposal cost. Here, the bid price is considered as the market price. However, if the

bid price also is not available price of the most recent transaction will be considered

for estimating the fair value reduced by cost of disposal. However, this amount can

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE ACCOUNTING AND FINANCIAL REPORTING

be considered if there is no significant change taken place in the economic

circumstances recently. However, the active market as well as binding agreement

both are not found in that case fair value reduced by cost of disposal is estimated on

the basis of best available information that can be obtained by the company on the

date of reporting. In determination of this amount the entity takes into consideration

the outcome of the similar asset’s recent transaction under same industry. Fair value

reduced by cost of sale does not mean the forced sale unless the management is

required to sell immediately (Christensen and Nikolaev 2013). Disposal or selling

cost includes the stamp duty, legal cost, transaction taxes, cost involved in removing

the asset and direct incremental cost required for bringing the asset in the status of

its sale.

While measuring the amount of value in use the elements those are

considered are – (i) estimation of future cash flows expected by the company to be

obtained from the asset (ii) time value of the money that is represented by risk free

interest rate prevailing in the market at present (iii) expected variation in market

regarding the timing or amount of future cash flows (iv) price contributed to bearing

of the inherent uncertainties of asset and (v) other factors like liquidity that will be

reflected by the market participants for pricing the future cash inflows estimated to be

generated from the asset (Ji 2013). While estimating value in use, steps followed are

– (i) estimating future cash outflows and inflows to be generated from the asset’s

continuous use and eventual disposal and (ii) application of appropriate rate of

discount to the future cash flows (Bond, Govendir and Wells 2016). For estimating

the value in use, basis used for estimating the future cash flows is the projections of

base cash flows on supportable and reasonable assumption that will represent the

best estimate of the management.

be considered if there is no significant change taken place in the economic

circumstances recently. However, the active market as well as binding agreement

both are not found in that case fair value reduced by cost of disposal is estimated on

the basis of best available information that can be obtained by the company on the

date of reporting. In determination of this amount the entity takes into consideration

the outcome of the similar asset’s recent transaction under same industry. Fair value

reduced by cost of sale does not mean the forced sale unless the management is

required to sell immediately (Christensen and Nikolaev 2013). Disposal or selling

cost includes the stamp duty, legal cost, transaction taxes, cost involved in removing

the asset and direct incremental cost required for bringing the asset in the status of

its sale.

While measuring the amount of value in use the elements those are

considered are – (i) estimation of future cash flows expected by the company to be

obtained from the asset (ii) time value of the money that is represented by risk free

interest rate prevailing in the market at present (iii) expected variation in market

regarding the timing or amount of future cash flows (iv) price contributed to bearing

of the inherent uncertainties of asset and (v) other factors like liquidity that will be

reflected by the market participants for pricing the future cash inflows estimated to be

generated from the asset (Ji 2013). While estimating value in use, steps followed are

– (i) estimating future cash outflows and inflows to be generated from the asset’s

continuous use and eventual disposal and (ii) application of appropriate rate of

discount to the future cash flows (Bond, Govendir and Wells 2016). For estimating

the value in use, basis used for estimating the future cash flows is the projections of

base cash flows on supportable and reasonable assumption that will represent the

best estimate of the management.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE ACCOUNTING AND FINANCIAL REPORTING

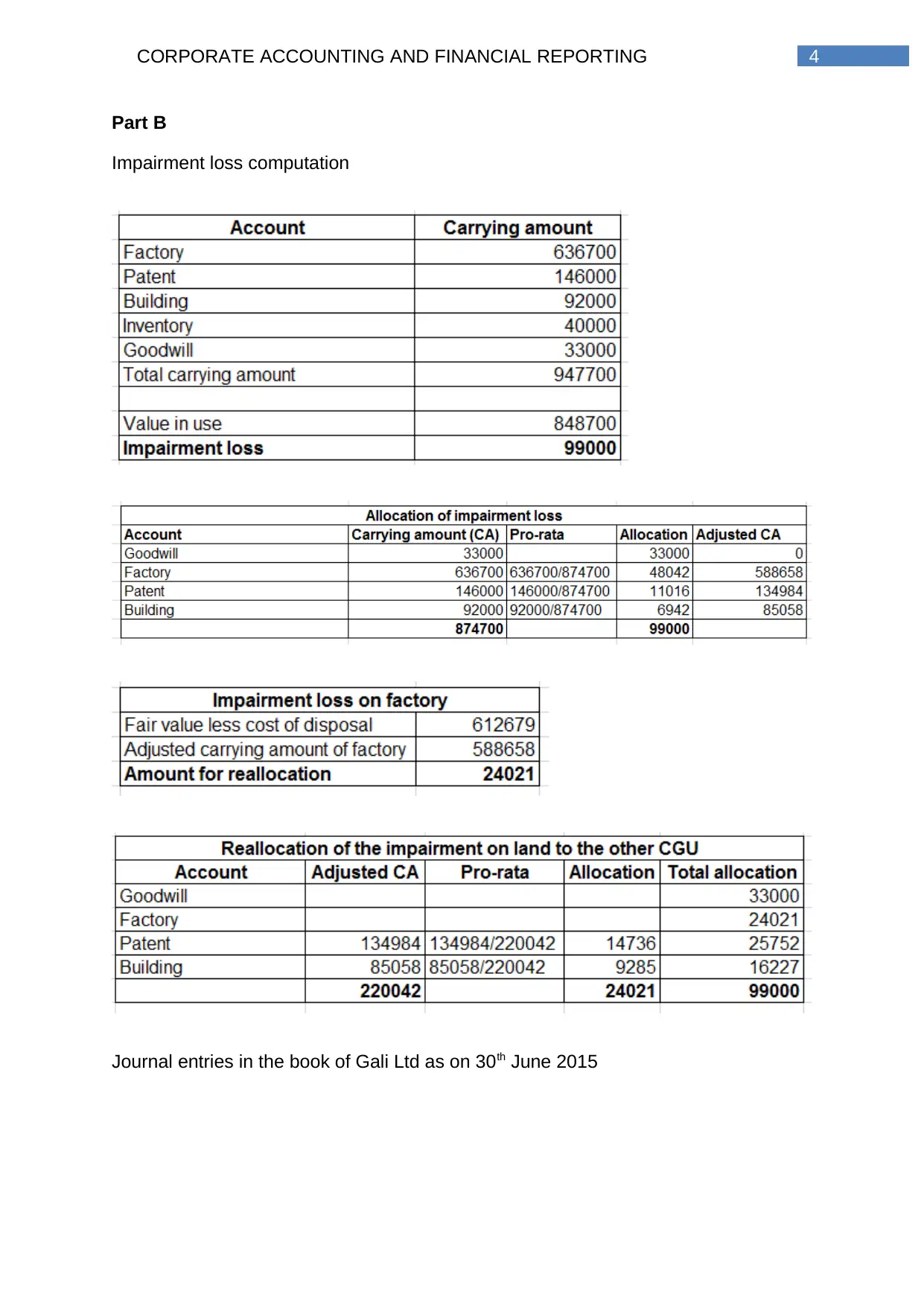

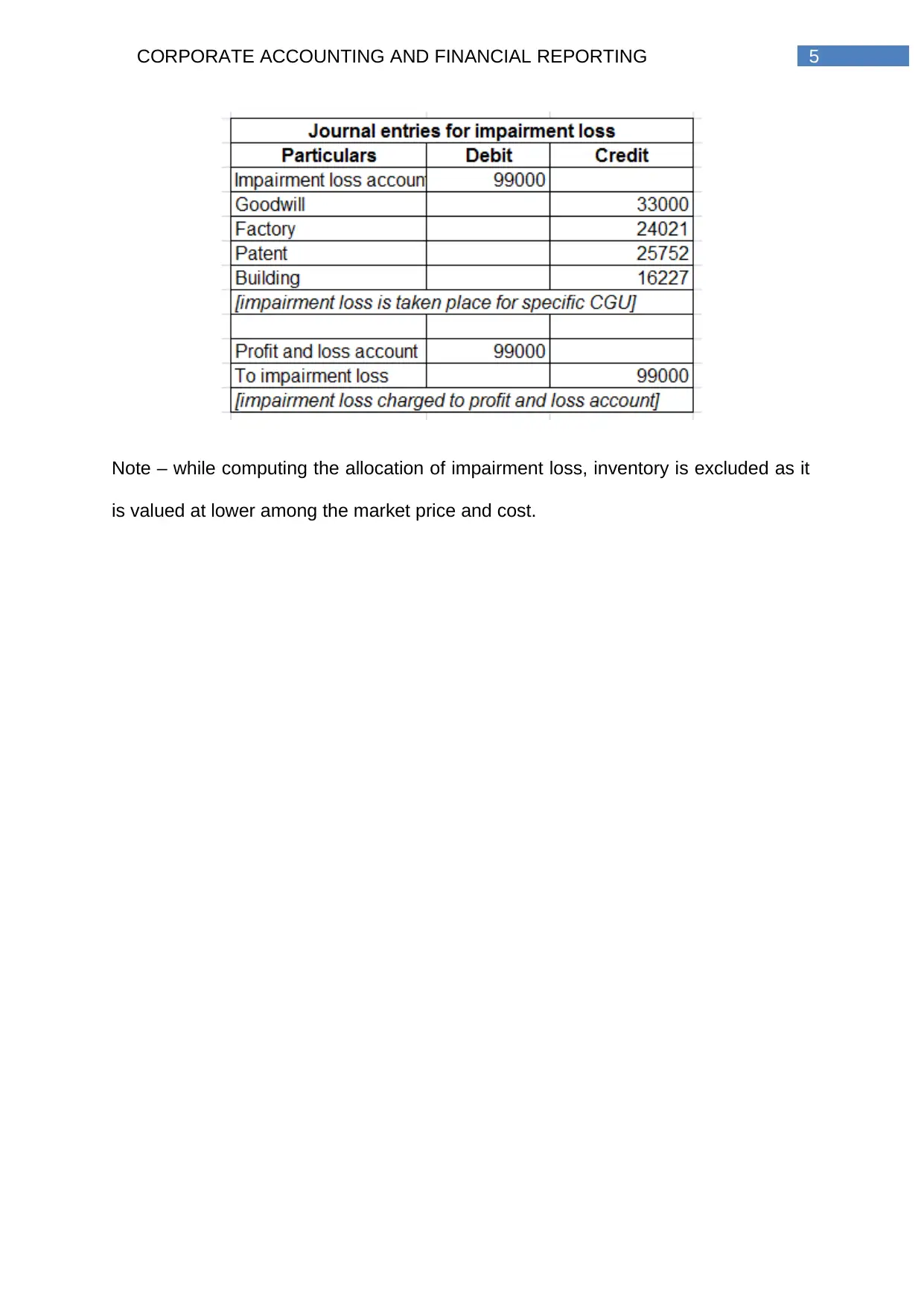

Part B

Impairment loss computation

Journal entries in the book of Gali Ltd as on 30th June 2015

Part B

Impairment loss computation

Journal entries in the book of Gali Ltd as on 30th June 2015

5CORPORATE ACCOUNTING AND FINANCIAL REPORTING

Note – while computing the allocation of impairment loss, inventory is excluded as it

is valued at lower among the market price and cost.

Note – while computing the allocation of impairment loss, inventory is excluded as it

is valued at lower among the market price and cost.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE ACCOUNTING AND FINANCIAL REPORTING

References

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairments by

Australian firms and whether they were impacted by AASB 136. Accounting &

Finance, 56(1), pp.259-288.

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairment

decisions by Australian firms and whether this was impacted by AASB 136.

Christensen, H.B. and Nikolaev, V.V., 2013. Does fair value accounting for non-

financial assets pass the market test?. Review of Accounting Studies, 18(3), pp.734-

775.

Guthrie, J. and Pang, T.T., 2013. Disclosure of Goodwill Impairment under AASB

136 from 2005–2010. Australian Accounting Review, 23(3), pp.216-231.

Ji, K., 2013. Better late than never, the timing of goodwill impairment testing in

Australia. Australian Accounting Review, 23(4), pp.369-379.

Kang, H. and Gray, S.J., 2013. Segment reporting practices in Australia: Has IFRS 8

made a difference?. Australian Accounting Review, 23(3), pp.232-243.

Legislation.gov.au., 2018. AASB 136 - Impairment of Assets - August 2015 . [online]

Available at: https://www.legislation.gov.au/Details/F2017C00297/Download

[Accessed 21 Sep. 2018].

Rennekamp, K., Rupar, K.K. and Seybert, N., 2014. Impaired judgment: The effects

of asset impairment reversibility and cognitive dissonance on future investment. The

Accounting Review, 90(2), pp.739-759.

References

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairments by

Australian firms and whether they were impacted by AASB 136. Accounting &

Finance, 56(1), pp.259-288.

Bond, D., Govendir, B. and Wells, P., 2016. An evaluation of asset impairment

decisions by Australian firms and whether this was impacted by AASB 136.

Christensen, H.B. and Nikolaev, V.V., 2013. Does fair value accounting for non-

financial assets pass the market test?. Review of Accounting Studies, 18(3), pp.734-

775.

Guthrie, J. and Pang, T.T., 2013. Disclosure of Goodwill Impairment under AASB

136 from 2005–2010. Australian Accounting Review, 23(3), pp.216-231.

Ji, K., 2013. Better late than never, the timing of goodwill impairment testing in

Australia. Australian Accounting Review, 23(4), pp.369-379.

Kang, H. and Gray, S.J., 2013. Segment reporting practices in Australia: Has IFRS 8

made a difference?. Australian Accounting Review, 23(3), pp.232-243.

Legislation.gov.au., 2018. AASB 136 - Impairment of Assets - August 2015 . [online]

Available at: https://www.legislation.gov.au/Details/F2017C00297/Download

[Accessed 21 Sep. 2018].

Rennekamp, K., Rupar, K.K. and Seybert, N., 2014. Impaired judgment: The effects

of asset impairment reversibility and cognitive dissonance on future investment. The

Accounting Review, 90(2), pp.739-759.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.