Corporate Accounting for Jacky Ltd

VerifiedAdded on 2023/06/12

|11

|2003

|151

AI Summary

This article covers the Corporate Accounting for Jacky Ltd including Deferred Tax Worksheet, Journal Entries, and Computation of Revaluation Gain/Loss and Deferred Tax. It also explains the situations faced by the accountant of Jacky Ltd while preparing the financial accounts of the business.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note

Corporate Accounting

Name of the Student:

Name of the University:

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

CORPORATE ACCOUNTING

Table of Contents

Answer to Question 1......................................................................................................................2

Requirement a..............................................................................................................................2

Answer to Question 2......................................................................................................................3

Journal Entries.............................................................................................................................3

Answer to Question 3......................................................................................................................6

Reference.........................................................................................................................................9

CORPORATE ACCOUNTING

Table of Contents

Answer to Question 1......................................................................................................................2

Requirement a..............................................................................................................................2

Answer to Question 2......................................................................................................................3

Journal Entries.............................................................................................................................3

Answer to Question 3......................................................................................................................6

Reference.........................................................................................................................................9

2

CORPORATE ACCOUNTING

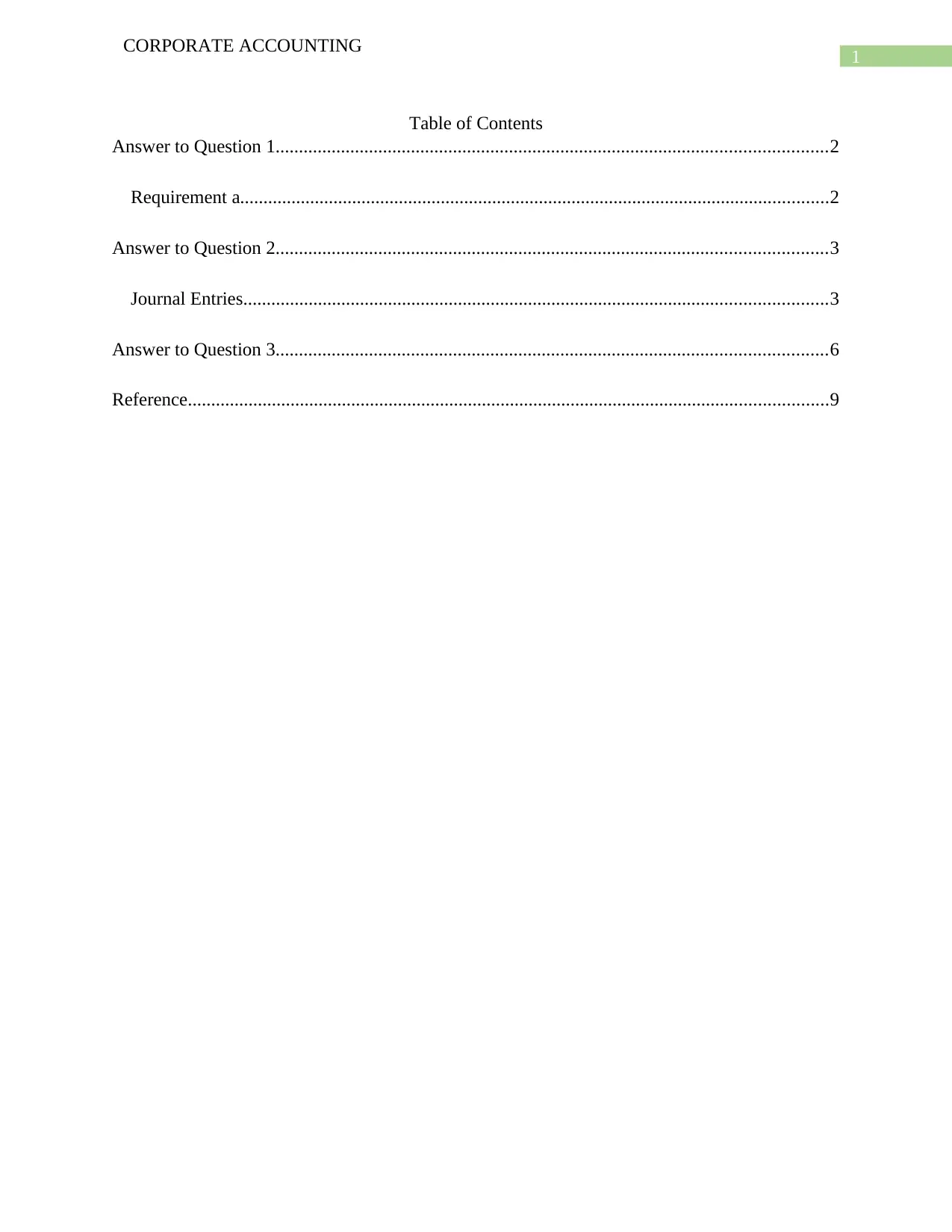

Answer to Question 1

Requirement a

Deferred Tax Worksheet

Particulars Carrying Amount Tax Base Taxable

Temp’y Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash $20,000 $20,000

Accounts Receivables $80,000 $80,000

Allowance for Doubtful Debts ($4,000) $0 $4,000

Inventories $85,900 $85,900

Prepaid Insurance $3,000 $3,000

Equipment $4,00,000 $4,00,000

Accumulated Depreciation ($40,000) ($60,000) ($20,000)

Motor Vehicles $60,000 $60,000

Accumulated Depreciation ($15,000) ($12,000) $3,000

Liabilities

Accounts Payables $50,250 $50,250

Provision for Warranties $6,900 $6,900

Provision for Annual Leave $11,000 $11,000

Rent Payable $6,000 $6,000

Loan $25,000 $25,000

Total Temporary differences $3,000 $10,900

Deferred tax liability (30%) $900

Deferred tax asset (30%) $3,270

Deferred Tax Worksheet:

Figure 1: (Statement showing Deferred Tax Worksheet)

Source: (Created by Author)

CORPORATE ACCOUNTING

Answer to Question 1

Requirement a

Deferred Tax Worksheet

Particulars Carrying Amount Tax Base Taxable

Temp’y Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Cash $20,000 $20,000

Accounts Receivables $80,000 $80,000

Allowance for Doubtful Debts ($4,000) $0 $4,000

Inventories $85,900 $85,900

Prepaid Insurance $3,000 $3,000

Equipment $4,00,000 $4,00,000

Accumulated Depreciation ($40,000) ($60,000) ($20,000)

Motor Vehicles $60,000 $60,000

Accumulated Depreciation ($15,000) ($12,000) $3,000

Liabilities

Accounts Payables $50,250 $50,250

Provision for Warranties $6,900 $6,900

Provision for Annual Leave $11,000 $11,000

Rent Payable $6,000 $6,000

Loan $25,000 $25,000

Total Temporary differences $3,000 $10,900

Deferred tax liability (30%) $900

Deferred tax asset (30%) $3,270

Deferred Tax Worksheet:

Figure 1: (Statement showing Deferred Tax Worksheet)

Source: (Created by Author)

3

CORPORATE ACCOUNTING

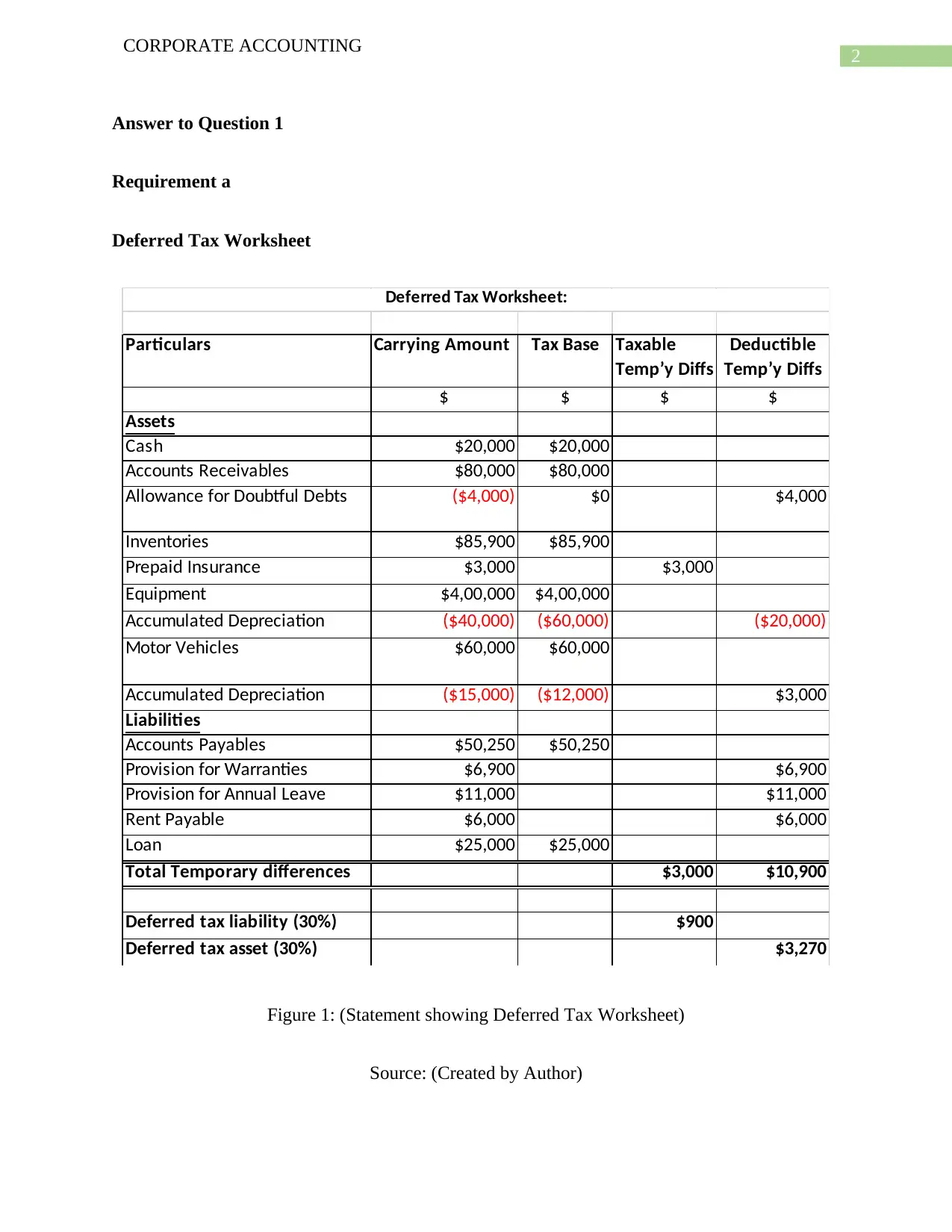

Journal Entries Relating to Current and Deferred Tax Assets and Liabilities

Dr. Cr.

Date Amount Amount

30-06-2016 Income Tax Expense A/c. Dr. $51,945

Income Tax Refundable A/c. Dr. $1,73,355

To, Advance Tax Paid A/c. $2,25,300

Deferred Tax Assets A/c. Dr. $3,270

To, Deferred Tax Liability A/c. $900

To, Income Tax Expense A/c. $2,370

Profit & loss A/c. $51,045

To, Income Tax Expense A/c. $51,045

(Being income tax expense transferred to P/L A/c.)

(Being deferred tax assets and deferred tax liabilities

recorded)

Particulars

(Being Income tax expenses adjusterd with advance tax

paid and income tax refundable recorded)

Figure 2: (Statement showing Journal Entries)

Source: (Created by Author)

Answer to Question 2

Journal Entries

In the books of XYZ Ltd.

Journal Entries

Dr. Cr

Date Particulars Amount Amount

CORPORATE ACCOUNTING

Journal Entries Relating to Current and Deferred Tax Assets and Liabilities

Dr. Cr.

Date Amount Amount

30-06-2016 Income Tax Expense A/c. Dr. $51,945

Income Tax Refundable A/c. Dr. $1,73,355

To, Advance Tax Paid A/c. $2,25,300

Deferred Tax Assets A/c. Dr. $3,270

To, Deferred Tax Liability A/c. $900

To, Income Tax Expense A/c. $2,370

Profit & loss A/c. $51,045

To, Income Tax Expense A/c. $51,045

(Being income tax expense transferred to P/L A/c.)

(Being deferred tax assets and deferred tax liabilities

recorded)

Particulars

(Being Income tax expenses adjusterd with advance tax

paid and income tax refundable recorded)

Figure 2: (Statement showing Journal Entries)

Source: (Created by Author)

Answer to Question 2

Journal Entries

In the books of XYZ Ltd.

Journal Entries

Dr. Cr

Date Particulars Amount Amount

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

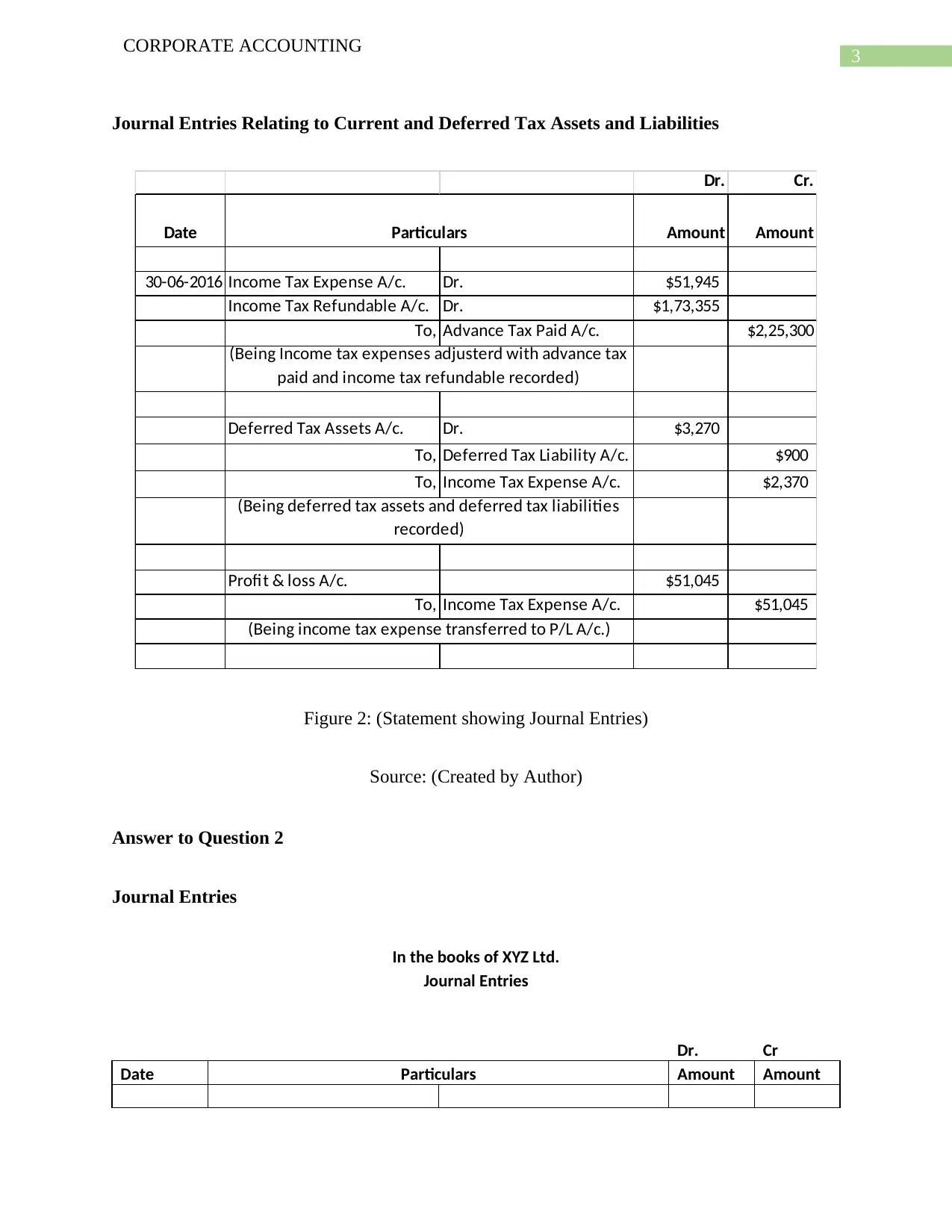

CORPORATE ACCOUNTING

01-07-

2013 Equipment A/c.

$8,00,00

0

Bank A/c.

$8,00,00

0

(Being equipment acquired for cash)

30-06-

2014 Depreciation Expense A/c.

$1,52,00

0

Accum. Dep. - Equipment A/c.

$1,52,00

0

(Being depreciation charged on equipment)

01-07-

2014 Accum. Dep. - Equipment A/c.

$1,52,00

0

Equipment A/c. $70,000

Profit on Revaluation A/c. $82,000

(Being Equipment revalued at fair value and profit on

revaluation recorded)

30-06-

2015 Profit on Revaluation A/c. $82,000

Asset Revaluation Reserve

A/c. $82,000

(Being the gain on revaluation transferred to asset revaluation

reserve)

Deferred Tax Assets A/c. $24,600

Income Tax Expense A/c. $24,600

(Being deferred tax recorded for the asset revaluation)

Depreciation Expense A/c.

$1,15,00

0

Accum. Dep. - Equipment A/c.

$1,15,00

0

(Being depreciation charged on equipment)

Profit & Loss A/c.

$1,15,00

0

Depreciation Expense A/c.

$1,15,00

0

(Being depreciation expenses closed)

30-06-

2016 Depreciation Expense A/c.

$1,15,00

0

CORPORATE ACCOUNTING

01-07-

2013 Equipment A/c.

$8,00,00

0

Bank A/c.

$8,00,00

0

(Being equipment acquired for cash)

30-06-

2014 Depreciation Expense A/c.

$1,52,00

0

Accum. Dep. - Equipment A/c.

$1,52,00

0

(Being depreciation charged on equipment)

01-07-

2014 Accum. Dep. - Equipment A/c.

$1,52,00

0

Equipment A/c. $70,000

Profit on Revaluation A/c. $82,000

(Being Equipment revalued at fair value and profit on

revaluation recorded)

30-06-

2015 Profit on Revaluation A/c. $82,000

Asset Revaluation Reserve

A/c. $82,000

(Being the gain on revaluation transferred to asset revaluation

reserve)

Deferred Tax Assets A/c. $24,600

Income Tax Expense A/c. $24,600

(Being deferred tax recorded for the asset revaluation)

Depreciation Expense A/c.

$1,15,00

0

Accum. Dep. - Equipment A/c.

$1,15,00

0

(Being depreciation charged on equipment)

Profit & Loss A/c.

$1,15,00

0

Depreciation Expense A/c.

$1,15,00

0

(Being depreciation expenses closed)

30-06-

2016 Depreciation Expense A/c.

$1,15,00

0

5

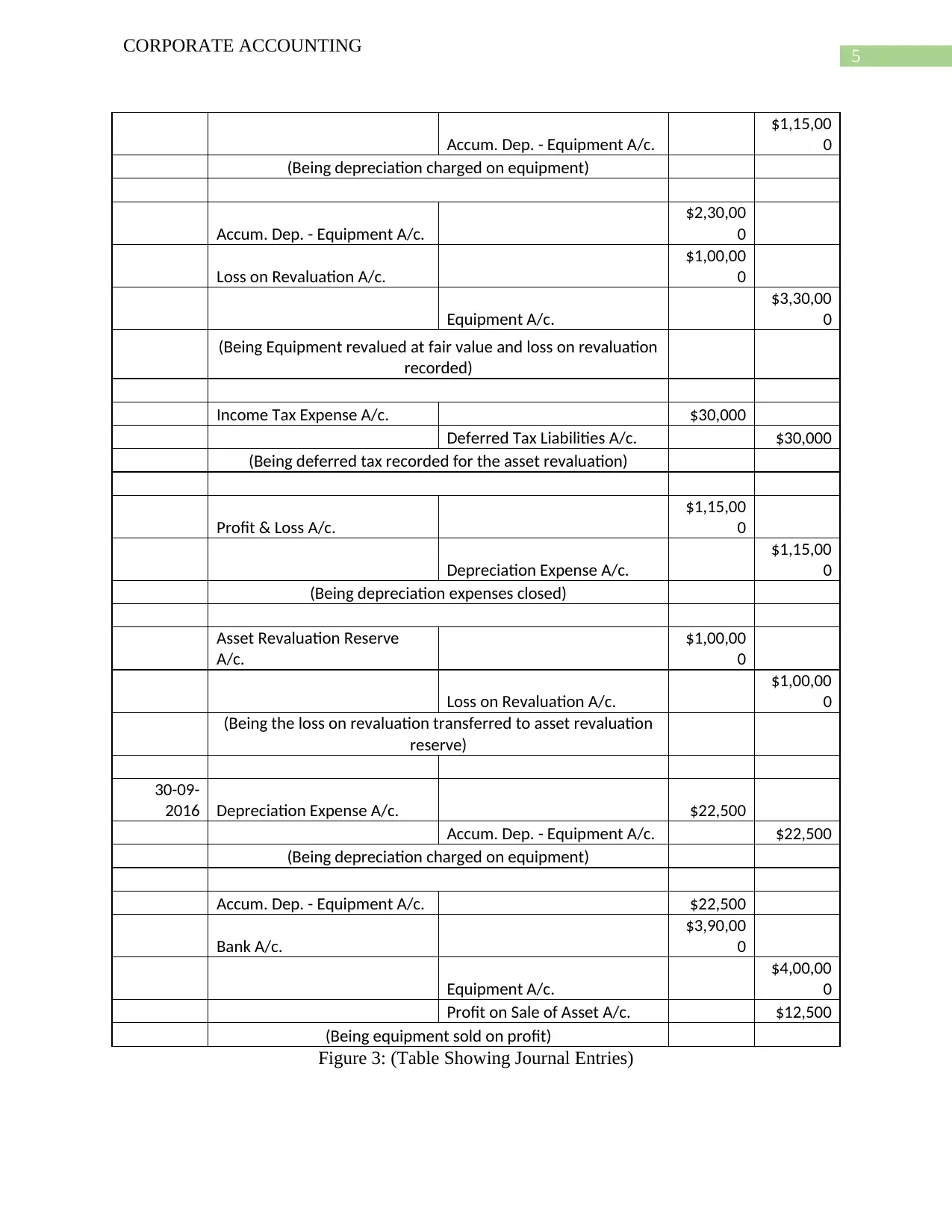

CORPORATE ACCOUNTING

Accum. Dep. - Equipment A/c.

$1,15,00

0

(Being depreciation charged on equipment)

Accum. Dep. - Equipment A/c.

$2,30,00

0

Loss on Revaluation A/c.

$1,00,00

0

Equipment A/c.

$3,30,00

0

(Being Equipment revalued at fair value and loss on revaluation

recorded)

Income Tax Expense A/c. $30,000

Deferred Tax Liabilities A/c. $30,000

(Being deferred tax recorded for the asset revaluation)

Profit & Loss A/c.

$1,15,00

0

Depreciation Expense A/c.

$1,15,00

0

(Being depreciation expenses closed)

Asset Revaluation Reserve

A/c.

$1,00,00

0

Loss on Revaluation A/c.

$1,00,00

0

(Being the loss on revaluation transferred to asset revaluation

reserve)

30-09-

2016 Depreciation Expense A/c. $22,500

Accum. Dep. - Equipment A/c. $22,500

(Being depreciation charged on equipment)

Accum. Dep. - Equipment A/c. $22,500

Bank A/c.

$3,90,00

0

Equipment A/c.

$4,00,00

0

Profit on Sale of Asset A/c. $12,500

(Being equipment sold on profit)

Figure 3: (Table Showing Journal Entries)

CORPORATE ACCOUNTING

Accum. Dep. - Equipment A/c.

$1,15,00

0

(Being depreciation charged on equipment)

Accum. Dep. - Equipment A/c.

$2,30,00

0

Loss on Revaluation A/c.

$1,00,00

0

Equipment A/c.

$3,30,00

0

(Being Equipment revalued at fair value and loss on revaluation

recorded)

Income Tax Expense A/c. $30,000

Deferred Tax Liabilities A/c. $30,000

(Being deferred tax recorded for the asset revaluation)

Profit & Loss A/c.

$1,15,00

0

Depreciation Expense A/c.

$1,15,00

0

(Being depreciation expenses closed)

Asset Revaluation Reserve

A/c.

$1,00,00

0

Loss on Revaluation A/c.

$1,00,00

0

(Being the loss on revaluation transferred to asset revaluation

reserve)

30-09-

2016 Depreciation Expense A/c. $22,500

Accum. Dep. - Equipment A/c. $22,500

(Being depreciation charged on equipment)

Accum. Dep. - Equipment A/c. $22,500

Bank A/c.

$3,90,00

0

Equipment A/c.

$4,00,00

0

Profit on Sale of Asset A/c. $12,500

(Being equipment sold on profit)

Figure 3: (Table Showing Journal Entries)

6

CORPORATE ACCOUNTING

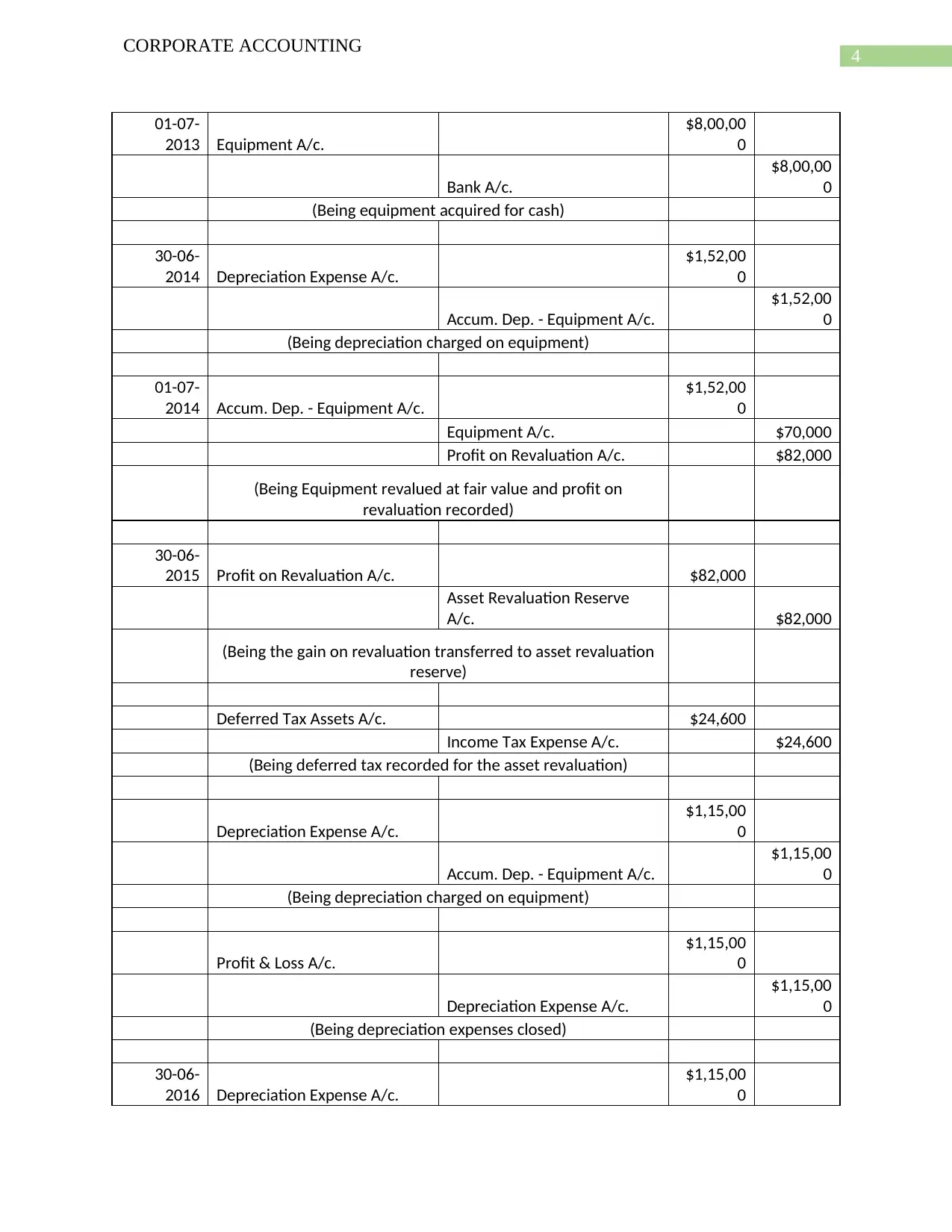

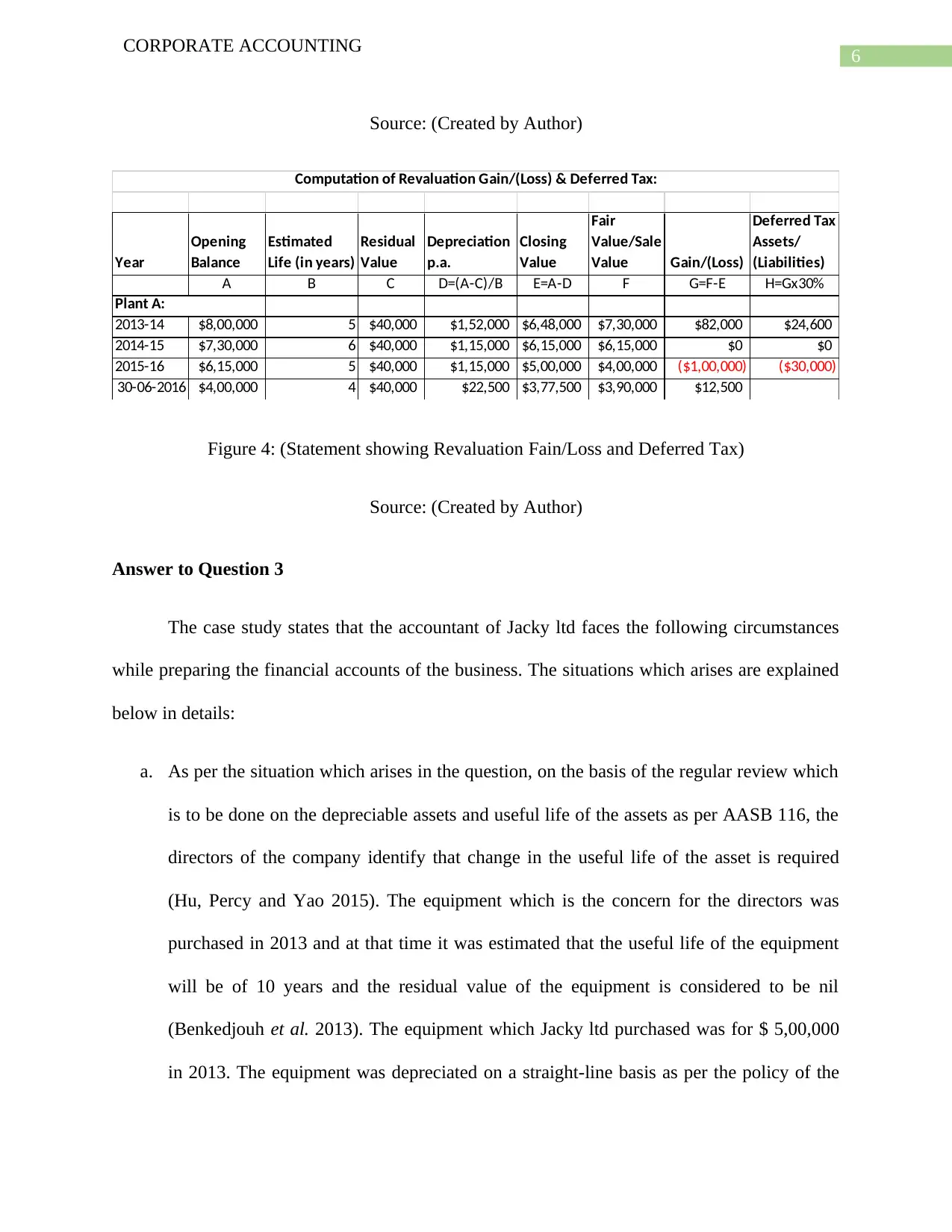

Source: (Created by Author)

Year

Opening

Balance

Estimated

Life (in years)

Residual

Value

Depreciation

p.a.

Closing

Value

Fair

Value/Sale

Value Gain/(Loss)

Deferred Tax

Assets/

(Liabilities)

A B C D=(A-C)/B E=A-D F G=F-E H=Gx30%

2013-14 $8,00,000 5 $40,000 $1,52,000 $6,48,000 $7,30,000 $82,000 $24,600

2014-15 $7,30,000 6 $40,000 $1,15,000 $6,15,000 $6,15,000 $0 $0

2015-16 $6,15,000 5 $40,000 $1,15,000 $5,00,000 $4,00,000 ($1,00,000) ($30,000)

30-06-2016 $4,00,000 4 $40,000 $22,500 $3,77,500 $3,90,000 $12,500

Computation of Revaluation Gain/(Loss) & Deferred Tax:

Plant A:

Figure 4: (Statement showing Revaluation Fain/Loss and Deferred Tax)

Source: (Created by Author)

Answer to Question 3

The case study states that the accountant of Jacky ltd faces the following circumstances

while preparing the financial accounts of the business. The situations which arises are explained

below in details:

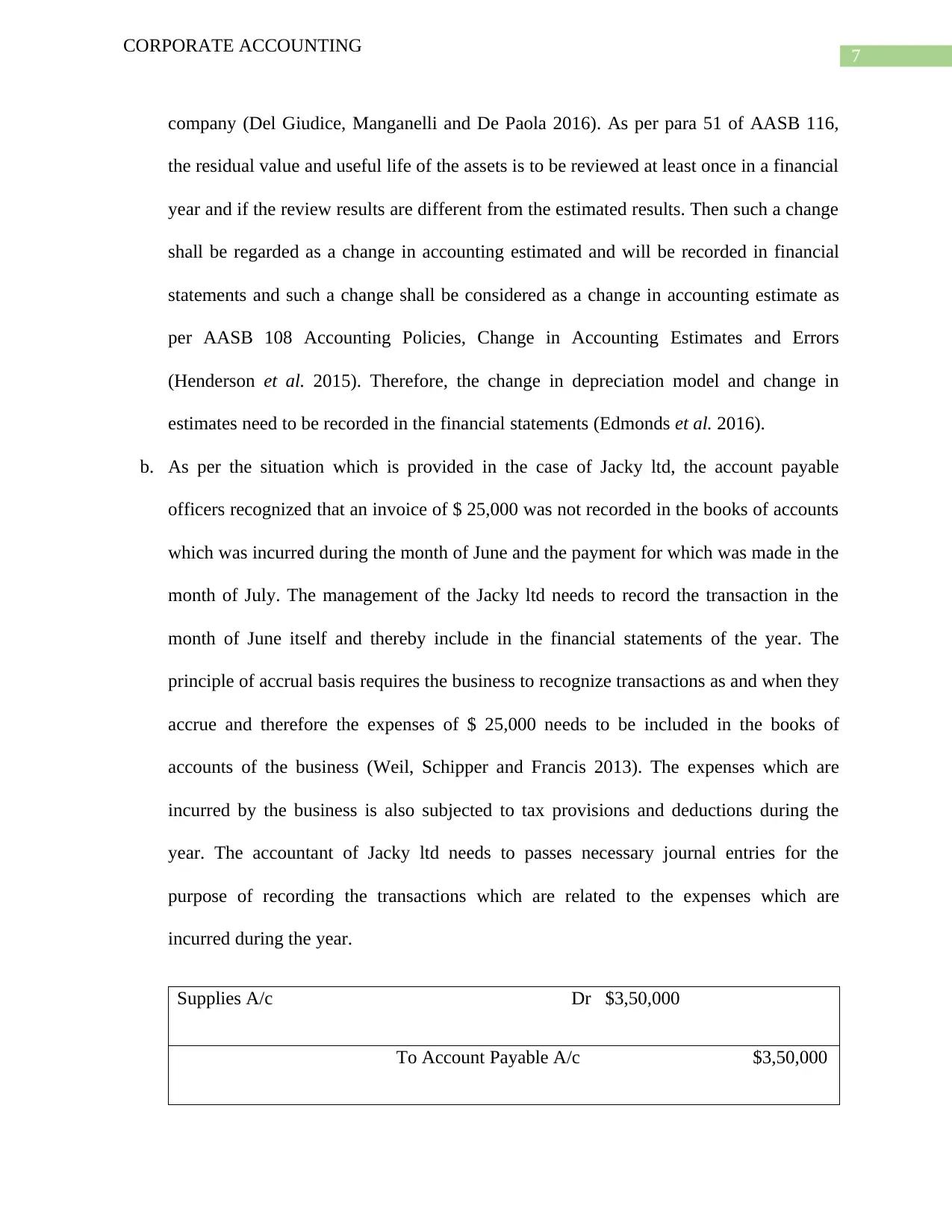

a. As per the situation which arises in the question, on the basis of the regular review which

is to be done on the depreciable assets and useful life of the assets as per AASB 116, the

directors of the company identify that change in the useful life of the asset is required

(Hu, Percy and Yao 2015). The equipment which is the concern for the directors was

purchased in 2013 and at that time it was estimated that the useful life of the equipment

will be of 10 years and the residual value of the equipment is considered to be nil

(Benkedjouh et al. 2013). The equipment which Jacky ltd purchased was for $ 5,00,000

in 2013. The equipment was depreciated on a straight-line basis as per the policy of the

CORPORATE ACCOUNTING

Source: (Created by Author)

Year

Opening

Balance

Estimated

Life (in years)

Residual

Value

Depreciation

p.a.

Closing

Value

Fair

Value/Sale

Value Gain/(Loss)

Deferred Tax

Assets/

(Liabilities)

A B C D=(A-C)/B E=A-D F G=F-E H=Gx30%

2013-14 $8,00,000 5 $40,000 $1,52,000 $6,48,000 $7,30,000 $82,000 $24,600

2014-15 $7,30,000 6 $40,000 $1,15,000 $6,15,000 $6,15,000 $0 $0

2015-16 $6,15,000 5 $40,000 $1,15,000 $5,00,000 $4,00,000 ($1,00,000) ($30,000)

30-06-2016 $4,00,000 4 $40,000 $22,500 $3,77,500 $3,90,000 $12,500

Computation of Revaluation Gain/(Loss) & Deferred Tax:

Plant A:

Figure 4: (Statement showing Revaluation Fain/Loss and Deferred Tax)

Source: (Created by Author)

Answer to Question 3

The case study states that the accountant of Jacky ltd faces the following circumstances

while preparing the financial accounts of the business. The situations which arises are explained

below in details:

a. As per the situation which arises in the question, on the basis of the regular review which

is to be done on the depreciable assets and useful life of the assets as per AASB 116, the

directors of the company identify that change in the useful life of the asset is required

(Hu, Percy and Yao 2015). The equipment which is the concern for the directors was

purchased in 2013 and at that time it was estimated that the useful life of the equipment

will be of 10 years and the residual value of the equipment is considered to be nil

(Benkedjouh et al. 2013). The equipment which Jacky ltd purchased was for $ 5,00,000

in 2013. The equipment was depreciated on a straight-line basis as per the policy of the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE ACCOUNTING

company (Del Giudice, Manganelli and De Paola 2016). As per para 51 of AASB 116,

the residual value and useful life of the assets is to be reviewed at least once in a financial

year and if the review results are different from the estimated results. Then such a change

shall be regarded as a change in accounting estimated and will be recorded in financial

statements and such a change shall be considered as a change in accounting estimate as

per AASB 108 Accounting Policies, Change in Accounting Estimates and Errors

(Henderson et al. 2015). Therefore, the change in depreciation model and change in

estimates need to be recorded in the financial statements (Edmonds et al. 2016).

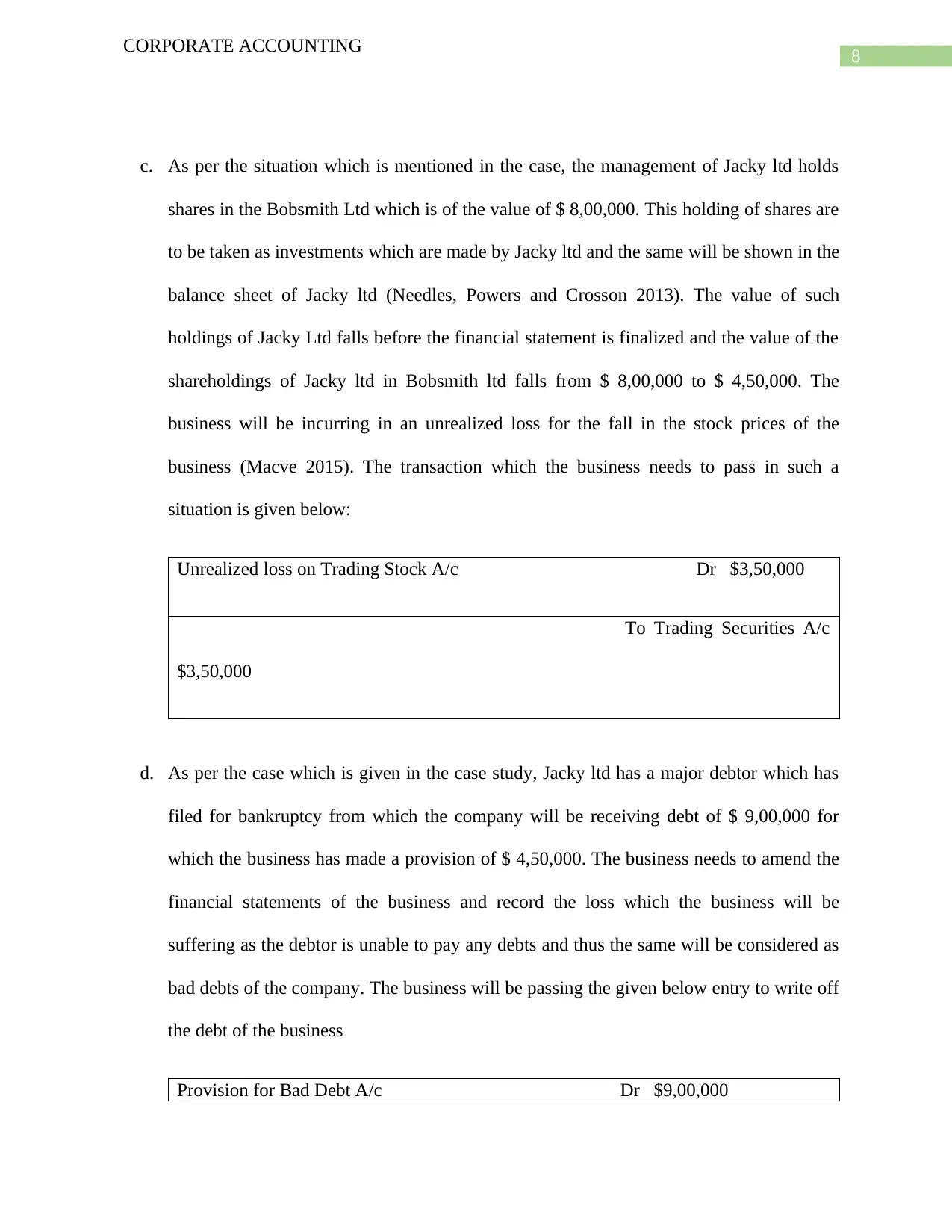

b. As per the situation which is provided in the case of Jacky ltd, the account payable

officers recognized that an invoice of $ 25,000 was not recorded in the books of accounts

which was incurred during the month of June and the payment for which was made in the

month of July. The management of the Jacky ltd needs to record the transaction in the

month of June itself and thereby include in the financial statements of the year. The

principle of accrual basis requires the business to recognize transactions as and when they

accrue and therefore the expenses of $ 25,000 needs to be included in the books of

accounts of the business (Weil, Schipper and Francis 2013). The expenses which are

incurred by the business is also subjected to tax provisions and deductions during the

year. The accountant of Jacky ltd needs to passes necessary journal entries for the

purpose of recording the transactions which are related to the expenses which are

incurred during the year.

Supplies A/c Dr $3,50,000

To Account Payable A/c $3,50,000

CORPORATE ACCOUNTING

company (Del Giudice, Manganelli and De Paola 2016). As per para 51 of AASB 116,

the residual value and useful life of the assets is to be reviewed at least once in a financial

year and if the review results are different from the estimated results. Then such a change

shall be regarded as a change in accounting estimated and will be recorded in financial

statements and such a change shall be considered as a change in accounting estimate as

per AASB 108 Accounting Policies, Change in Accounting Estimates and Errors

(Henderson et al. 2015). Therefore, the change in depreciation model and change in

estimates need to be recorded in the financial statements (Edmonds et al. 2016).

b. As per the situation which is provided in the case of Jacky ltd, the account payable

officers recognized that an invoice of $ 25,000 was not recorded in the books of accounts

which was incurred during the month of June and the payment for which was made in the

month of July. The management of the Jacky ltd needs to record the transaction in the

month of June itself and thereby include in the financial statements of the year. The

principle of accrual basis requires the business to recognize transactions as and when they

accrue and therefore the expenses of $ 25,000 needs to be included in the books of

accounts of the business (Weil, Schipper and Francis 2013). The expenses which are

incurred by the business is also subjected to tax provisions and deductions during the

year. The accountant of Jacky ltd needs to passes necessary journal entries for the

purpose of recording the transactions which are related to the expenses which are

incurred during the year.

Supplies A/c Dr $3,50,000

To Account Payable A/c $3,50,000

8

CORPORATE ACCOUNTING

c. As per the situation which is mentioned in the case, the management of Jacky ltd holds

shares in the Bobsmith Ltd which is of the value of $ 8,00,000. This holding of shares are

to be taken as investments which are made by Jacky ltd and the same will be shown in the

balance sheet of Jacky ltd (Needles, Powers and Crosson 2013). The value of such

holdings of Jacky Ltd falls before the financial statement is finalized and the value of the

shareholdings of Jacky ltd in Bobsmith ltd falls from $ 8,00,000 to $ 4,50,000. The

business will be incurring in an unrealized loss for the fall in the stock prices of the

business (Macve 2015). The transaction which the business needs to pass in such a

situation is given below:

Unrealized loss on Trading Stock A/c Dr $3,50,000

To Trading Securities A/c

$3,50,000

d. As per the case which is given in the case study, Jacky ltd has a major debtor which has

filed for bankruptcy from which the company will be receiving debt of $ 9,00,000 for

which the business has made a provision of $ 4,50,000. The business needs to amend the

financial statements of the business and record the loss which the business will be

suffering as the debtor is unable to pay any debts and thus the same will be considered as

bad debts of the company. The business will be passing the given below entry to write off

the debt of the business

Provision for Bad Debt A/c Dr $9,00,000

CORPORATE ACCOUNTING

c. As per the situation which is mentioned in the case, the management of Jacky ltd holds

shares in the Bobsmith Ltd which is of the value of $ 8,00,000. This holding of shares are

to be taken as investments which are made by Jacky ltd and the same will be shown in the

balance sheet of Jacky ltd (Needles, Powers and Crosson 2013). The value of such

holdings of Jacky Ltd falls before the financial statement is finalized and the value of the

shareholdings of Jacky ltd in Bobsmith ltd falls from $ 8,00,000 to $ 4,50,000. The

business will be incurring in an unrealized loss for the fall in the stock prices of the

business (Macve 2015). The transaction which the business needs to pass in such a

situation is given below:

Unrealized loss on Trading Stock A/c Dr $3,50,000

To Trading Securities A/c

$3,50,000

d. As per the case which is given in the case study, Jacky ltd has a major debtor which has

filed for bankruptcy from which the company will be receiving debt of $ 9,00,000 for

which the business has made a provision of $ 4,50,000. The business needs to amend the

financial statements of the business and record the loss which the business will be

suffering as the debtor is unable to pay any debts and thus the same will be considered as

bad debts of the company. The business will be passing the given below entry to write off

the debt of the business

Provision for Bad Debt A/c Dr $9,00,000

9

CORPORATE ACCOUNTING

To Account Receivable A/c

$9,00,000

Reference

Benkedjouh, T., Medjaher, K., Zerhouni, N. and Rechak, S., 2013. Remaining useful life

estimation based on nonlinear feature reduction and support vector regression. Engineering

Applications of Artificial Intelligence, 26(7), pp.1751-1760.

Del Giudice, V., Manganelli, B. and De Paola, P., 2016, July. Depreciation methods for firm’s

assets. In International Conference on Computational Science and Its Applications(pp. 214-227).

Springer, Cham.

Edmonds, T.P., Edmonds, C.D., Tsay, B.Y. and Olds, P.R., 2016. Fundamental managerial

accounting concepts. McGraw-Hill Education.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting.

Pearson Higher Education AU.

Hu, F., Percy, M. and Yao, D., 2015. Asset revaluations and earnings management: Evidence

from Australian companies. Corporate Ownership and Control, 13(1), pp.930-939.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision,

Tool, Or Threat?. Routledge.

CORPORATE ACCOUNTING

To Account Receivable A/c

$9,00,000

Reference

Benkedjouh, T., Medjaher, K., Zerhouni, N. and Rechak, S., 2013. Remaining useful life

estimation based on nonlinear feature reduction and support vector regression. Engineering

Applications of Artificial Intelligence, 26(7), pp.1751-1760.

Del Giudice, V., Manganelli, B. and De Paola, P., 2016, July. Depreciation methods for firm’s

assets. In International Conference on Computational Science and Its Applications(pp. 214-227).

Springer, Cham.

Edmonds, T.P., Edmonds, C.D., Tsay, B.Y. and Olds, P.R., 2016. Fundamental managerial

accounting concepts. McGraw-Hill Education.

Henderson, S., Peirson, G., Herbohn, K. and Howieson, B., 2015. Issues in financial accounting.

Pearson Higher Education AU.

Hu, F., Percy, M. and Yao, D., 2015. Asset revaluations and earnings management: Evidence

from Australian companies. Corporate Ownership and Control, 13(1), pp.930-939.

Macve, R., 2015. A Conceptual Framework for Financial Accounting and Reporting: Vision,

Tool, Or Threat?. Routledge.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

CORPORATE ACCOUNTING

Needles, B.E., Powers, M. and Crosson, S.V., 2013. Principles of accounting. Cengage

Learning.

Weil, R.L., Schipper, K. and Francis, J., 2013. Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

CORPORATE ACCOUNTING

Needles, B.E., Powers, M. and Crosson, S.V., 2013. Principles of accounting. Cengage

Learning.

Weil, R.L., Schipper, K. and Francis, J., 2013. Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.