Corporate Accounting Report: Retail Company Financial Analysis

VerifiedAdded on 2020/11/23

Paraphrase This Document

EXECUTIVE SUMMARY.............................................................................................................4

INTRODUCTION...........................................................................................................................1

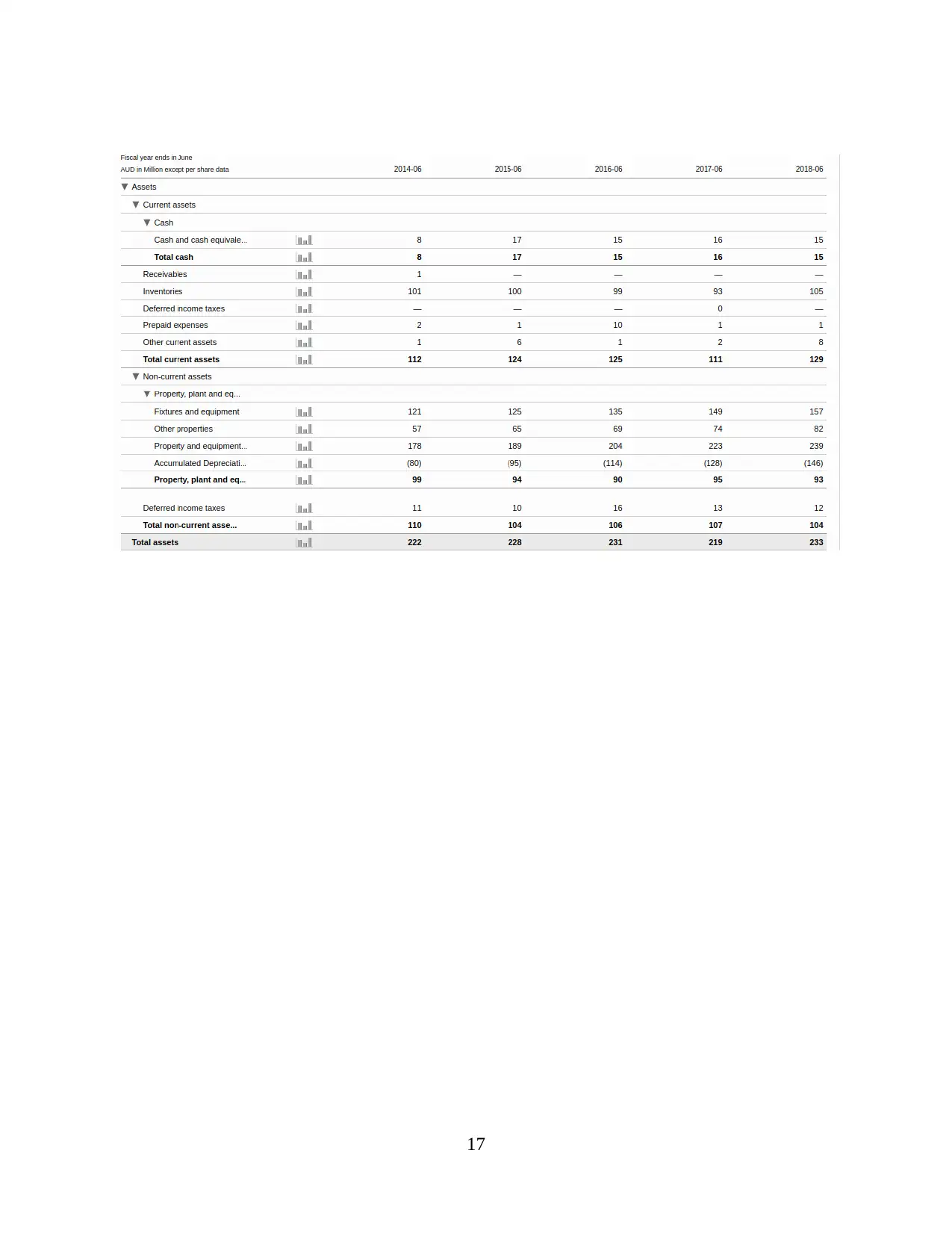

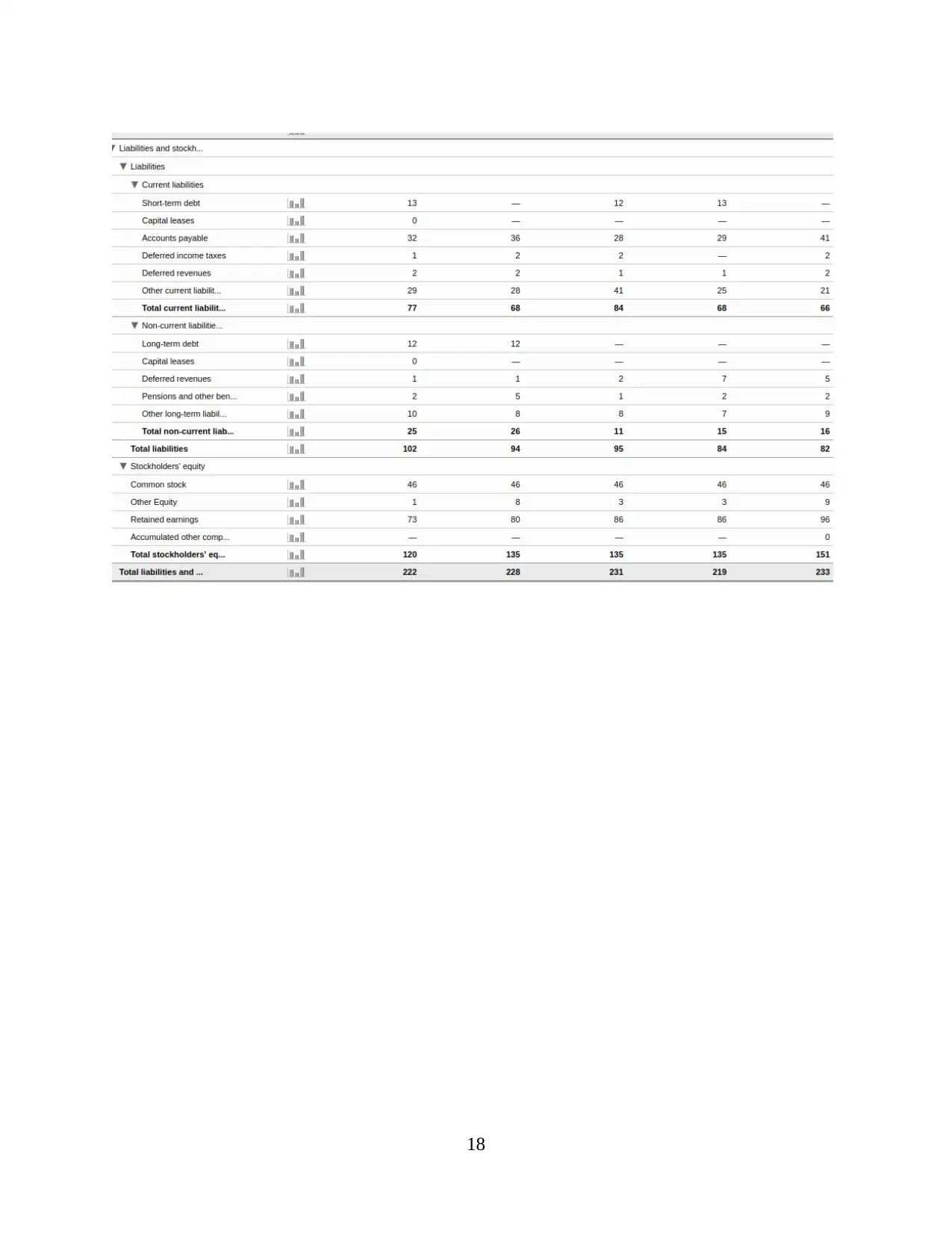

EQUITY AND LIABILITIES.........................................................................................................1

(i) Item of equity and associated information about the companies:...........................................1

(ii) Item of Liabilities and associated information about the companies:...................................2

(iii) Comparative analysis............................................................................................................5

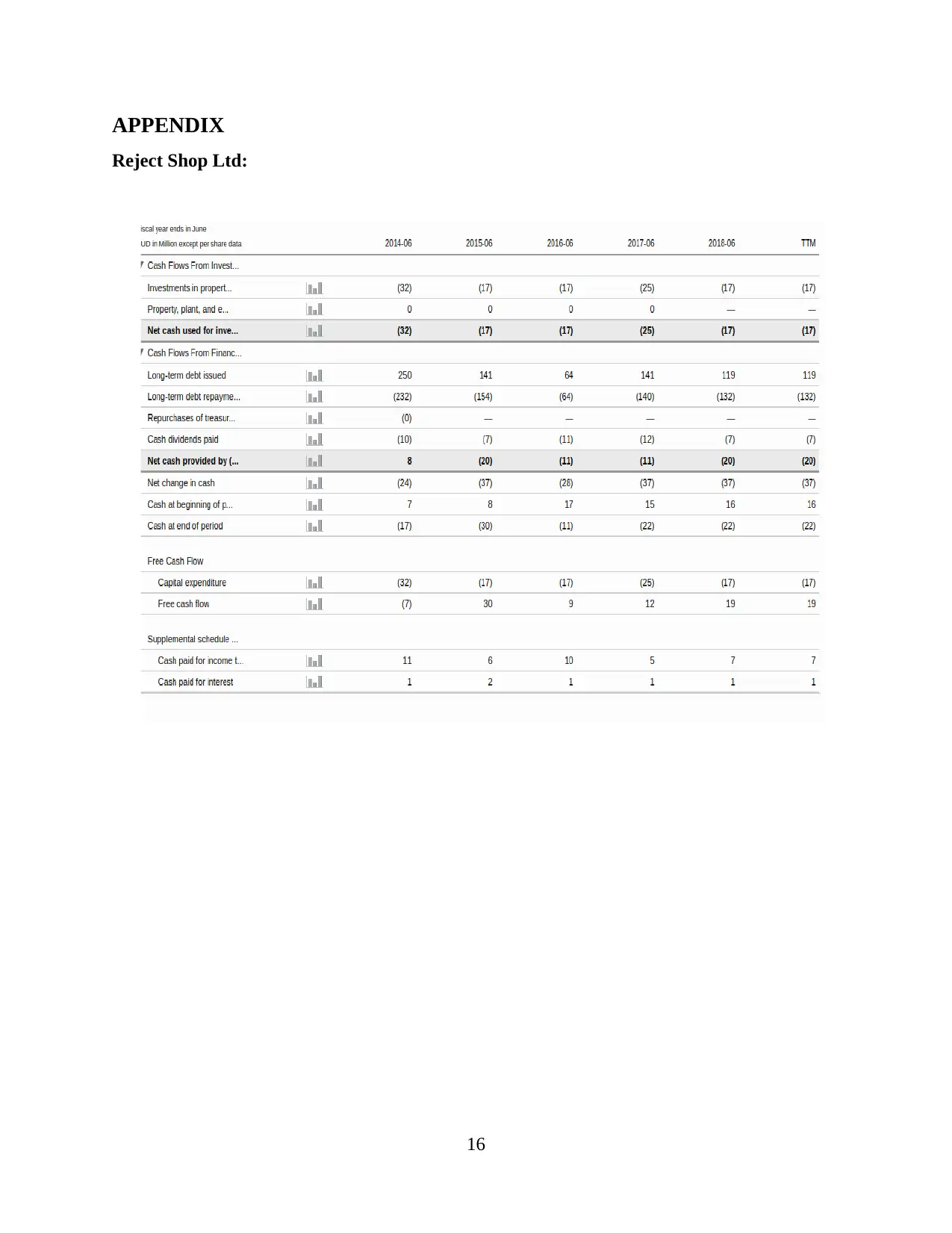

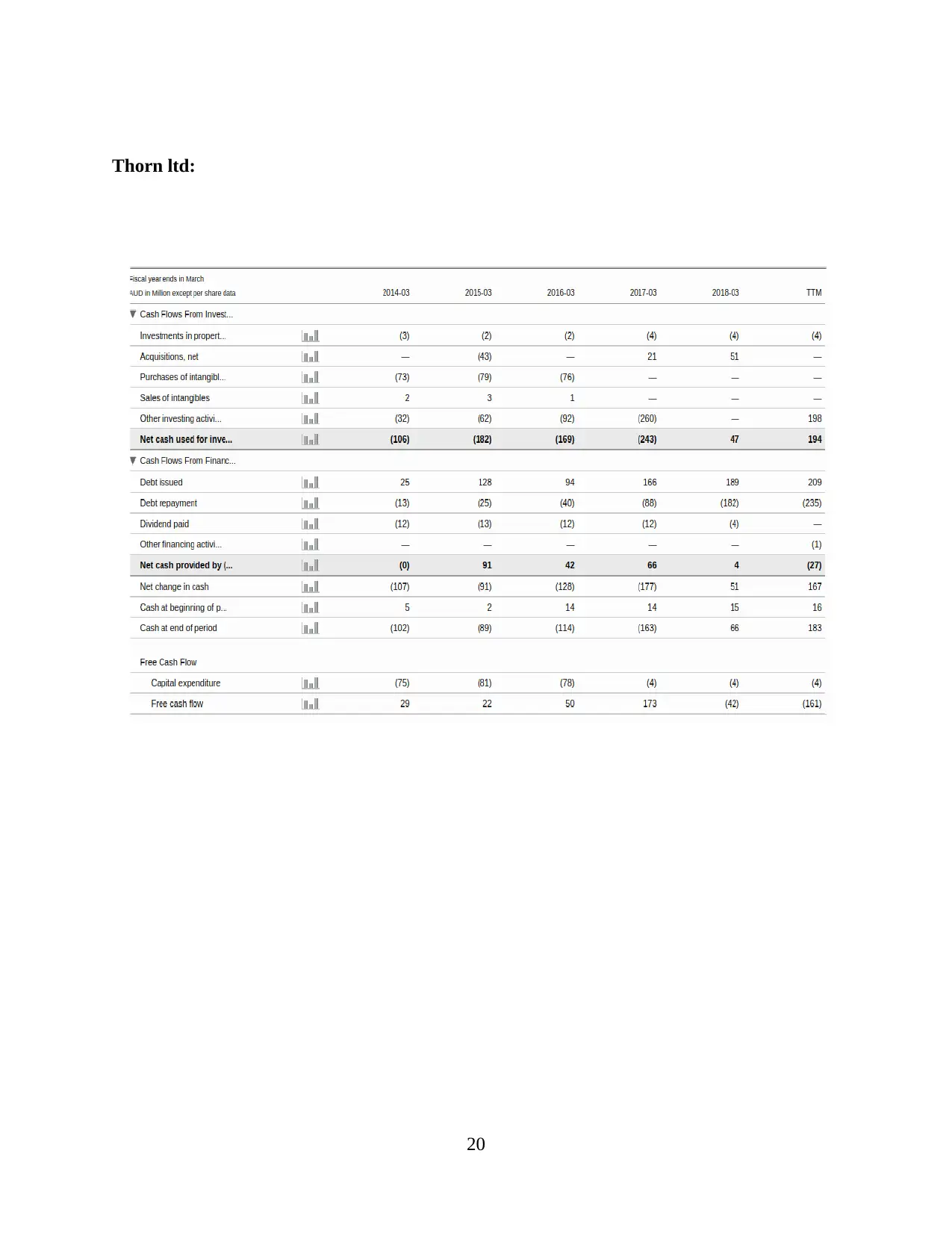

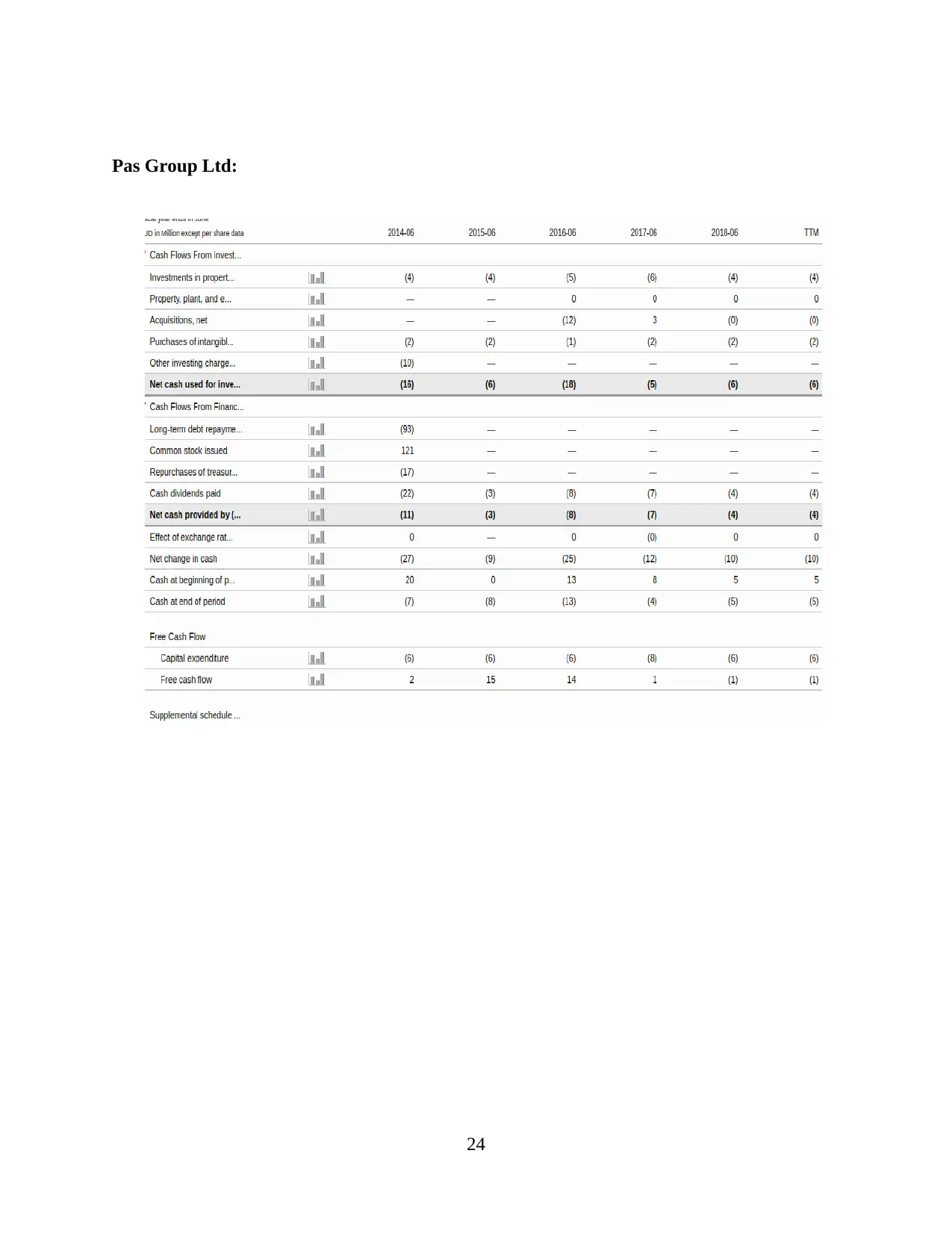

CASH FLOW STATEMENT..........................................................................................................6

(iv) Major items of cash flow statements....................................................................................6

(v) Comparative analysis:............................................................................................................7

(vi) Comparative analysis of selected companies along with proper insight..............................9

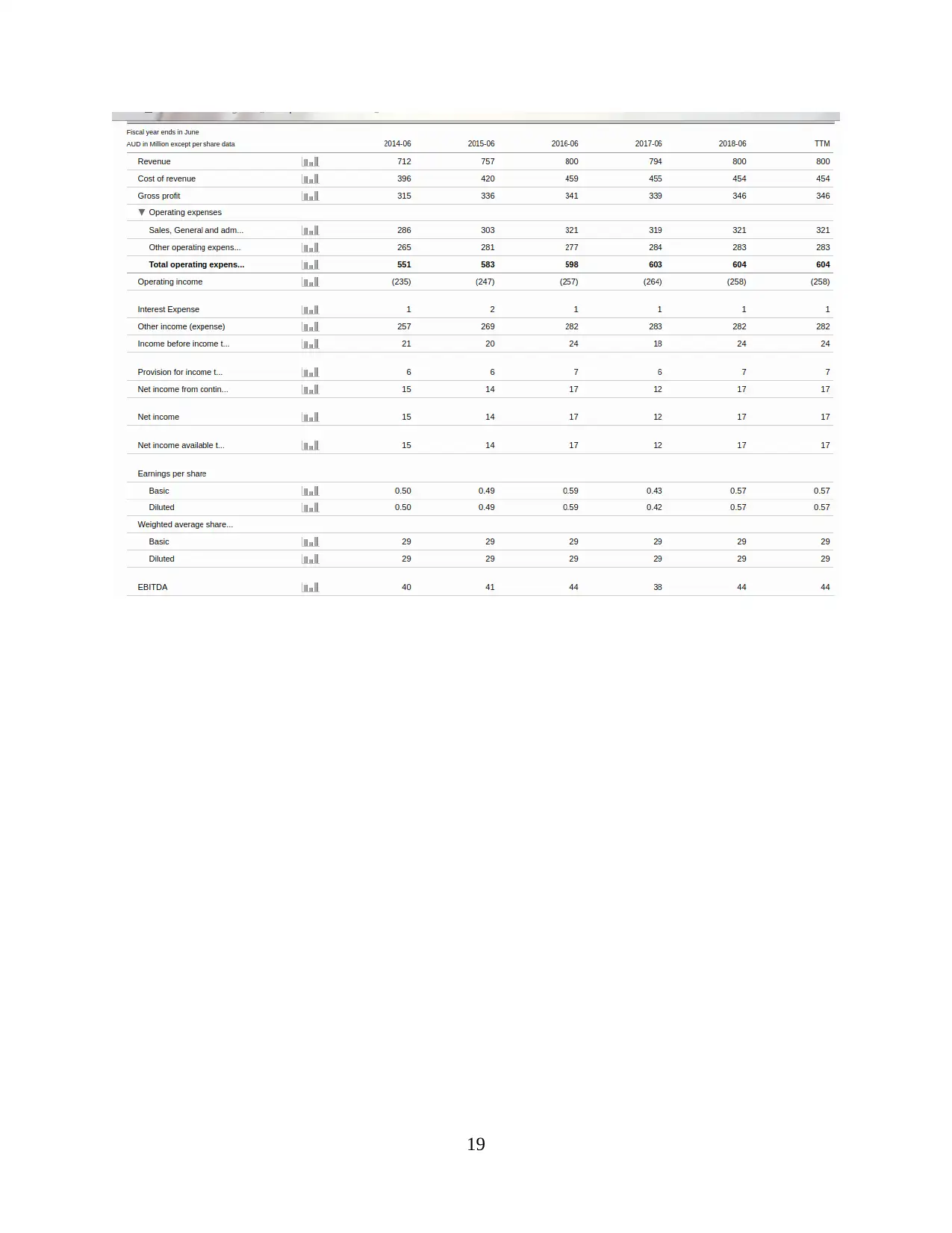

OTHER COMPREHENSIVE INCOME STATEMENT................................................................9

(vii) Items in comprehensive profit and loss statements of both company.................................9

(viii) Reason why such items not been reported in Income Statement......................................10

(ix) Comparative analysis:.........................................................................................................10

(x) Comprehensive income to be included in evaluating the performance of manager............11

ACCOUNTING FOR CORPORATE INCOME TAX.................................................................11

(xi) Tax expenses shown in financial statements of selected companies:.................................11

(xii) Effective tax rate................................................................................................................11

(xiii) Deferred tax assets / liabilities and evaluation of changes:..............................................12

(xiv) increase or decrease in the deferred tax assets or in the deferred tax liability reported by

each of your selected companies:..............................................................................................12

(xv) & (xvi) Calculation of cash tax amount:............................................................................13

(xvii) Difference between cash tax rate and book rate:.............................................................13

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................15

APPENDIX....................................................................................................................................16

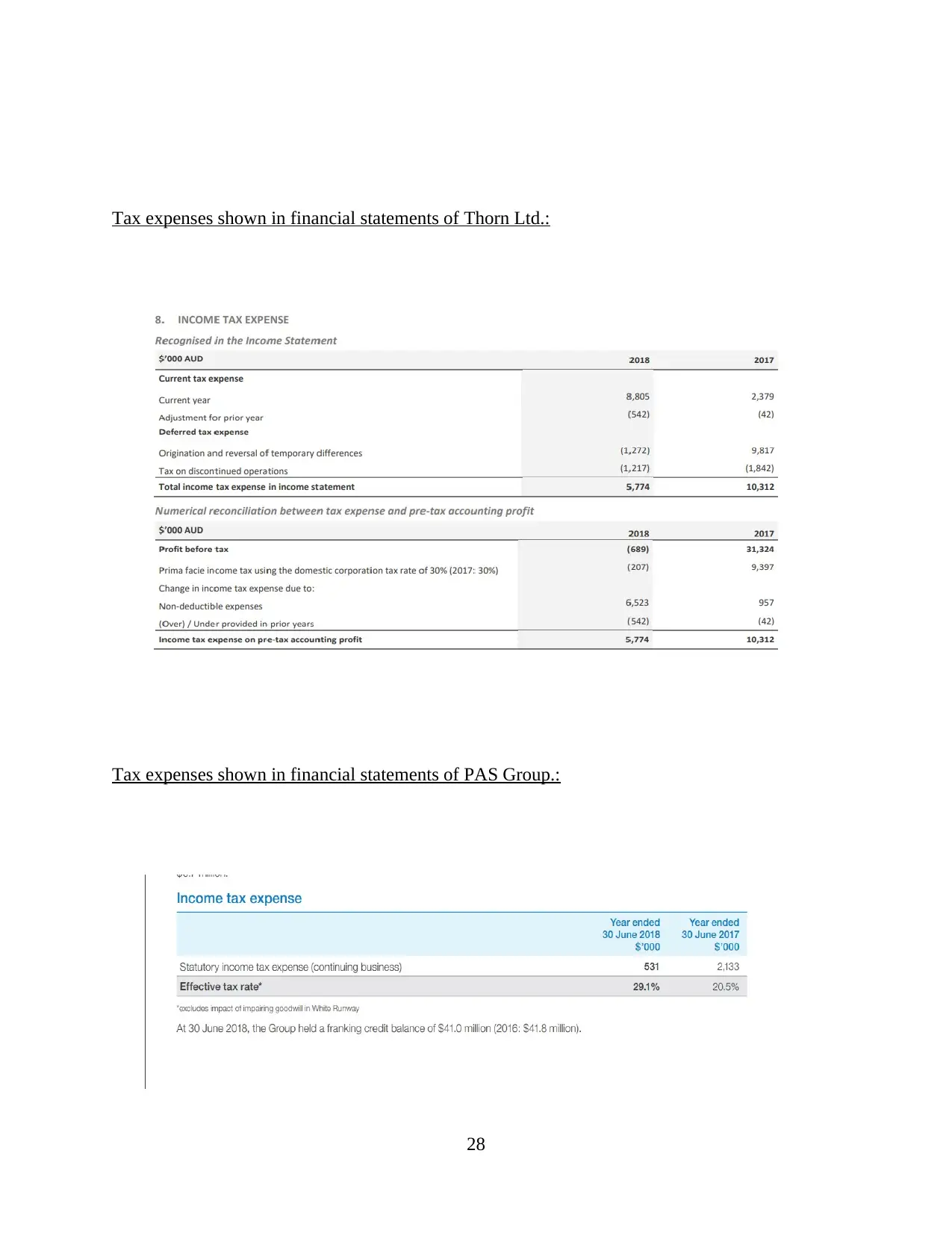

Tax expenses shown in financial statements of Thorn Ltd.:.....................................................28

Tax expenses shown in financial statements of PAS Group.:...................................................28

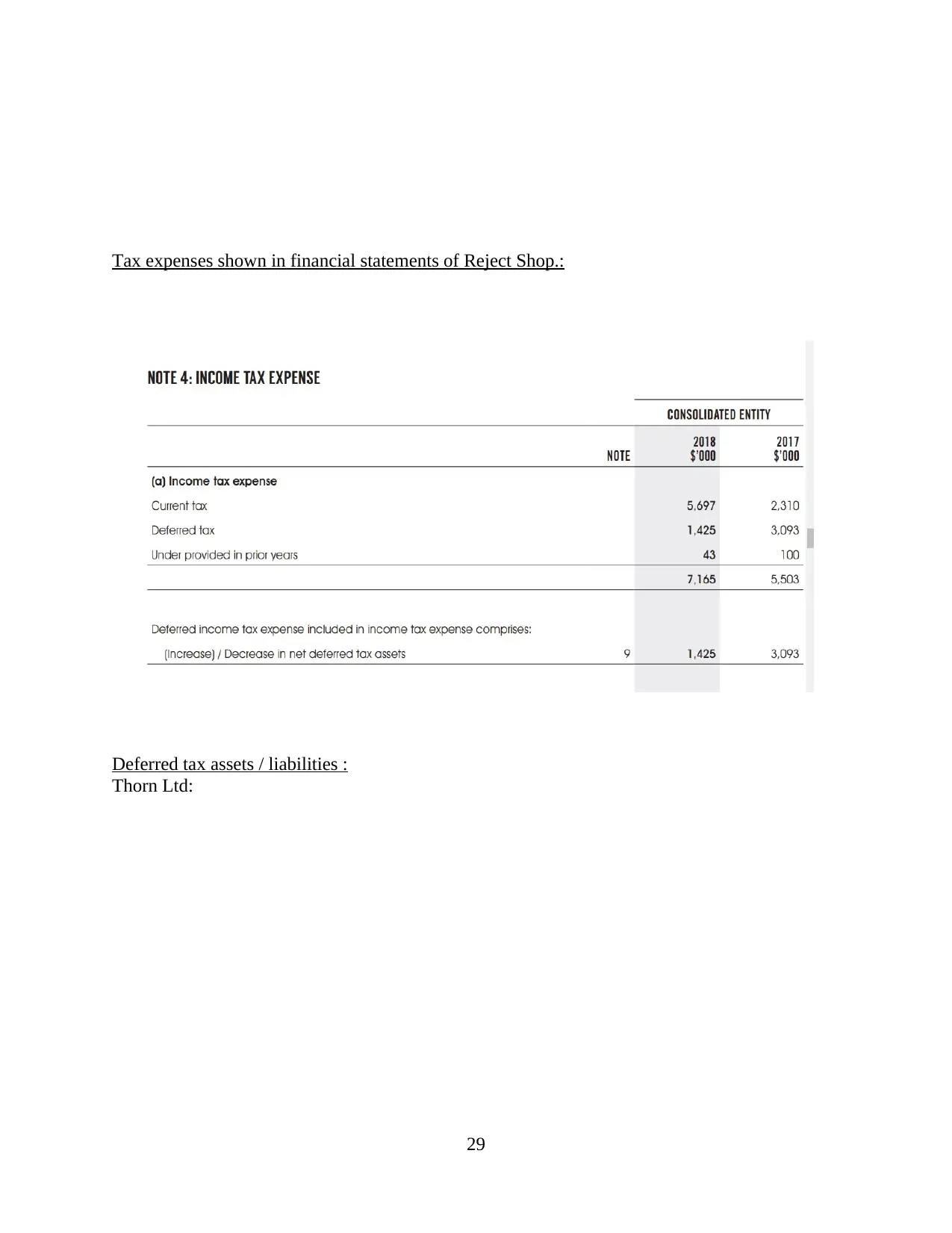

Tax expenses shown in financial statements of Reject Shop.:..................................................29

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

This report summarises different aspects of the corporate accounting along with various

rules and regulation that can assists in analysing performance of selected public limited

companies in retail sector i.e. Thorn Group, PAS Group and The Reject Shop Ltd. In order to

analyse, this report exhibits each item of equity and liabilities, items of cash flow statements,

comprehensive income statement and tax calculation. This report also describes Cash Tax and

Book tax and reasons of variation between them. A deep analysis is done in this report to get

specific outcomes so the effective decisions can be made in near future.

Paraphrase This Document

Corporate accounting is a major division of accounting which mainly concerned with the

accounting aspects of a particular company. Process of corporate accounting includes finalisation

of annual accounts, cash flow statements and change in equity (DeBusk, 2012). Corporate

accounting is about maintaining information related to finance in order to give direction for

compliance of regulations and policies. In this report three public limited companies i.e. Thorn

group ltd, Pas group ltd and reject shop ltd of Australia in retail sector is critically analysed by

using their three-year balance sheet, income statement, statement of changes in owner’s equity

and cash flow statement, in the context of corporate accounting. Apart from this, accounting for

corporate income tax is also effectively discussed in this report.

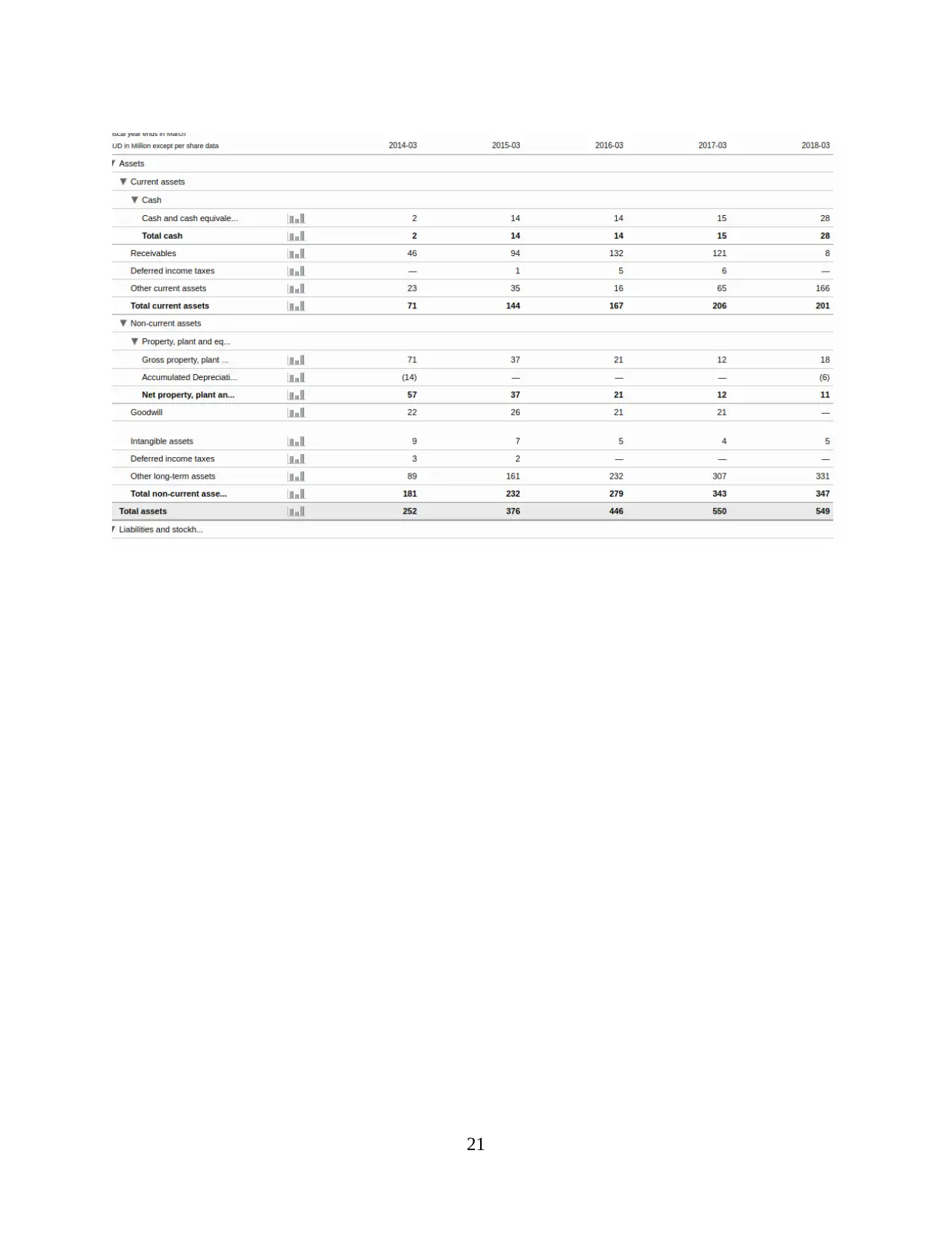

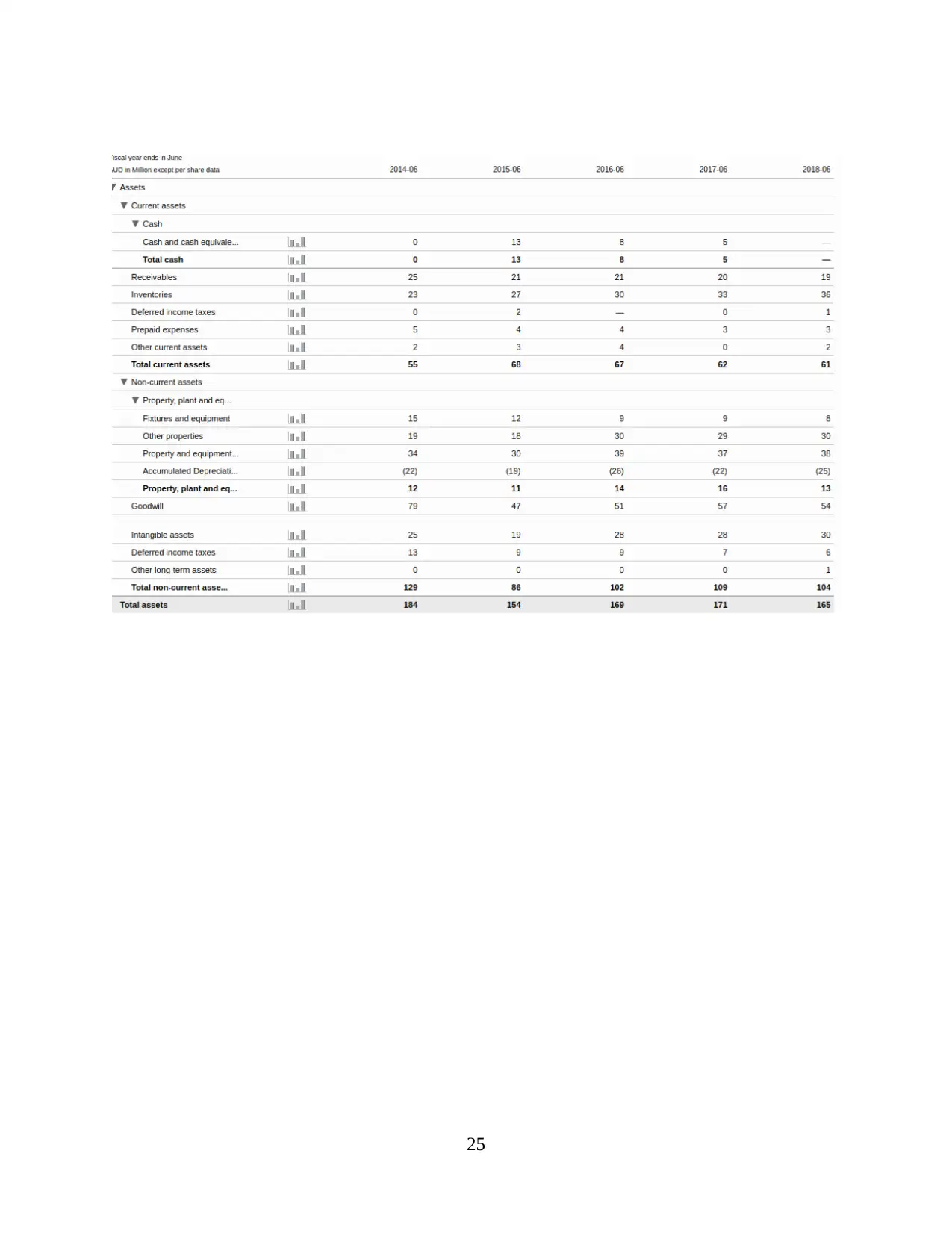

EQUITY AND LIABILITIES

(i) Item of equity and associated information about the companies:

Equity: In accounting terms Equity is difference between total assets and external

liabilities. In a limited company equity means shareholder's fund which includes share capital,

share premium and Retained earning which includes profits after distribution of dividends.

Following are the major items of Equity along with reasons of changes in equity during three

previous years as stated in financial statement of selected companies, are as follows:

Common stock: Common stock refers to ownerships within in a company. Common

stock includes securities, shares, bonds and debentures issued by company. Change in

common stock is found due to market conditions, economic conditions or dividend

distribution policy of company. In case of Thorn Group there is increase in common

stock due to issue of securities in market and in case of PAS Group and Reject Shop Ltd

common stock has no changes. Holders of common stock or equity have right to appoint

directors by exercising their voting powers (Zadek, Evans and Pruzan, 2013).

Retain earnings: Retained earnings is part of equity that contain amount remain after

providing dividends to shareholders. This is net amount of profit available after dividend

distribution for company to pay their all-time debts. Due to increased net profit in 2017

and 2018 Retained earnings of Thorn Group and Reject Ltd has increased respectively

where as in case of PAS Group there is negative retained earnings due to payment of

dividends.

1

general reserves, capital reserves, debenture redemption reserves and other reserves

created by company as per requirements. Major change in reserves occurs due to sale of

any fixed assets, amalgamation, reconstruction etc (Edgerton, 2012). Reserves of Thorn

Group has increased from 2016 to 2018 due to share premium whereas reserves of Reject

Shop Ltd have increased due to creation of general reserve and in case of PAS group

there is decreasing negative reserve due to appropriation from Foreign currency

translation reserve and Corporate reorganisation reserve.

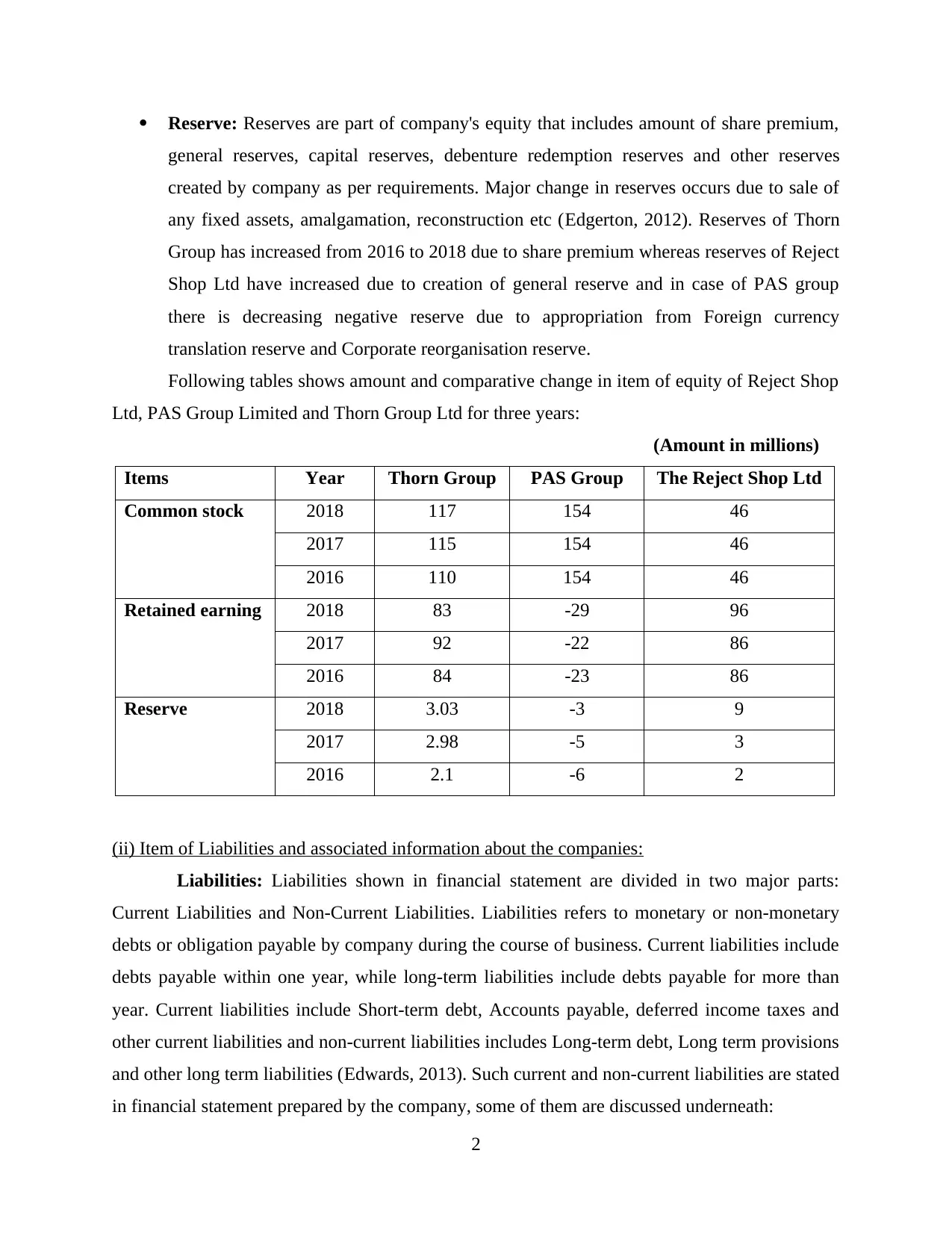

Following tables shows amount and comparative change in item of equity of Reject Shop

Ltd, PAS Group Limited and Thorn Group Ltd for three years:

(Amount in millions)

Items Year Thorn Group PAS Group The Reject Shop Ltd

Common stock 2018 117 154 46

2017 115 154 46

2016 110 154 46

Retained earning 2018 83 -29 96

2017 92 -22 86

2016 84 -23 86

Reserve 2018 3.03 -3 9

2017 2.98 -5 3

2016 2.1 -6 2

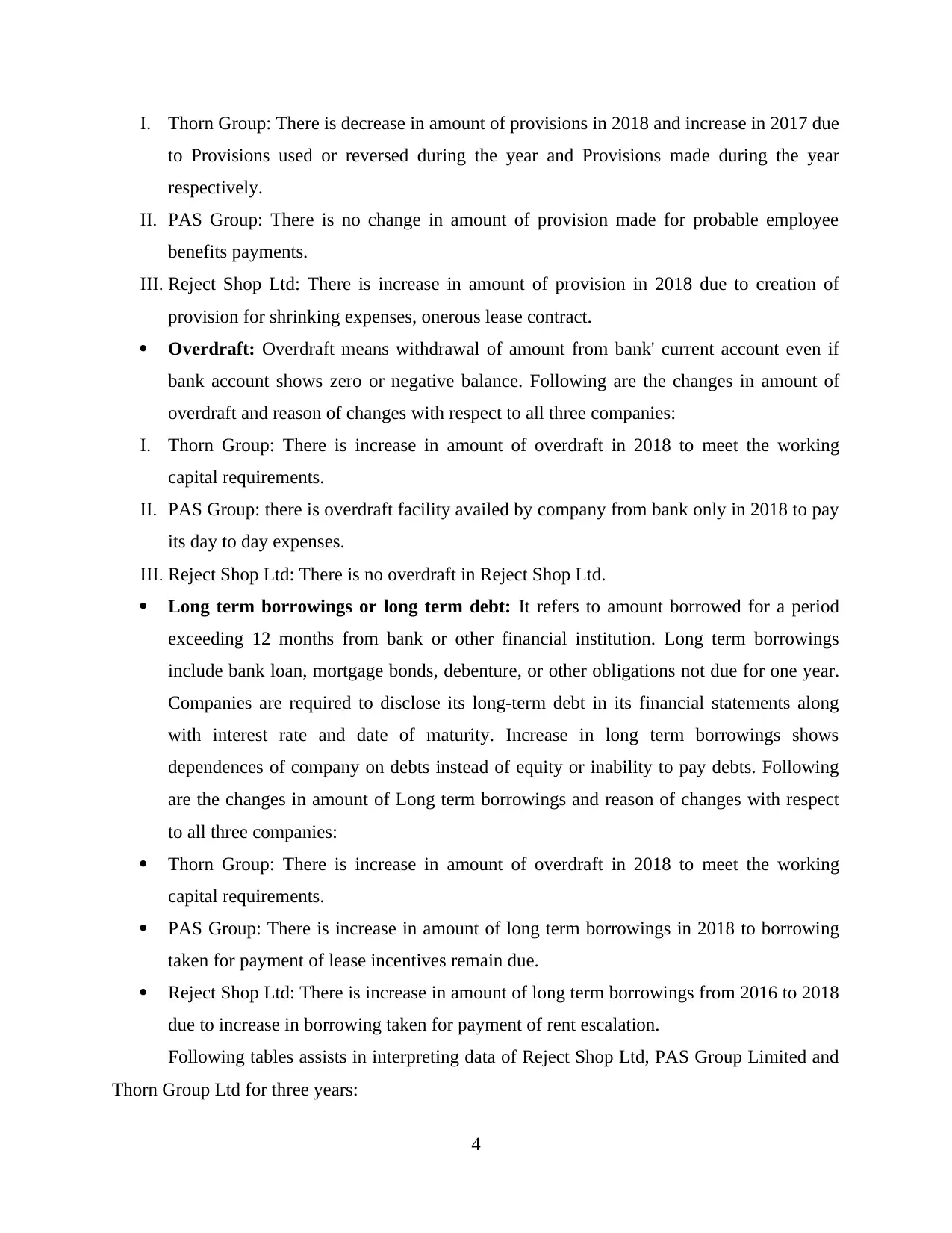

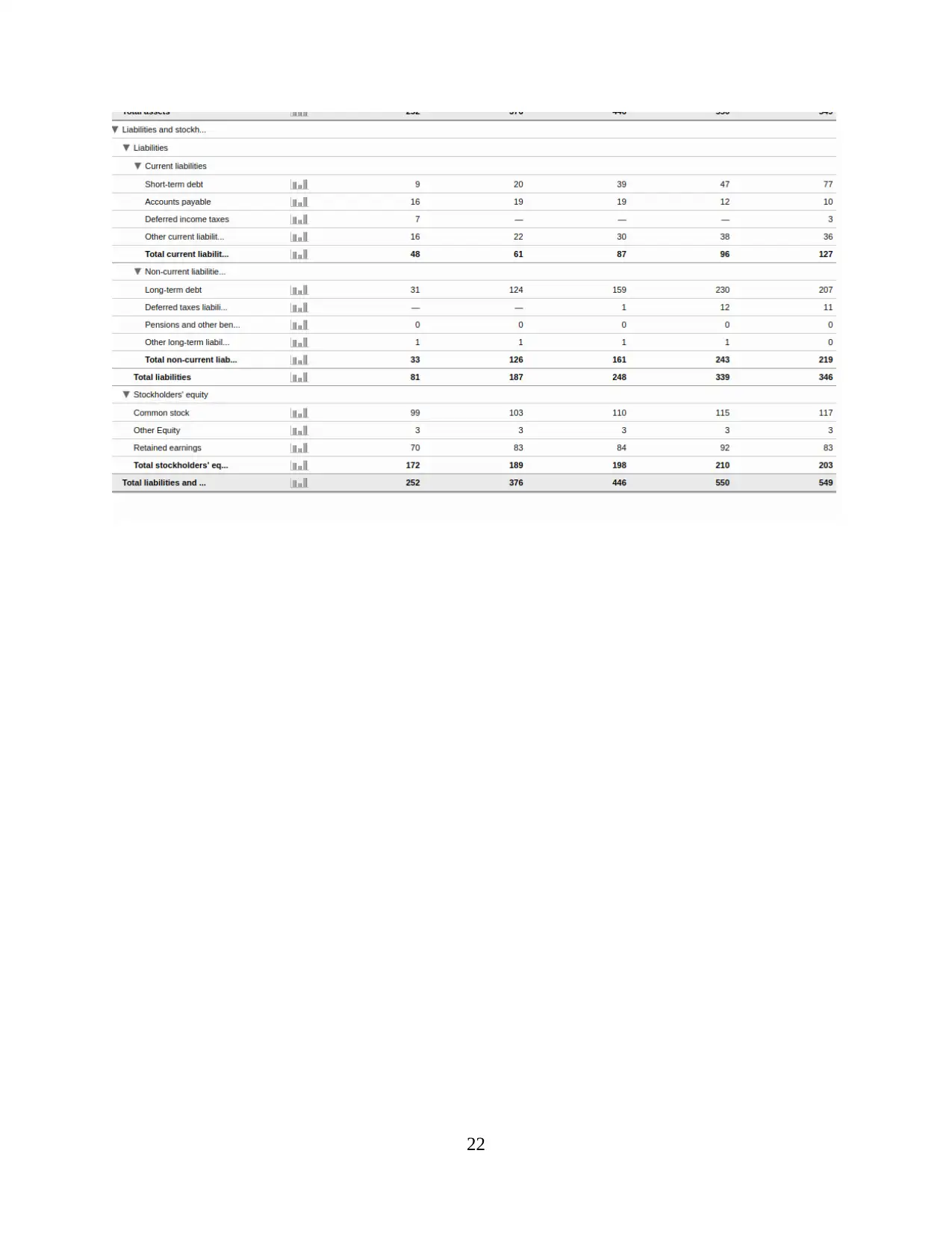

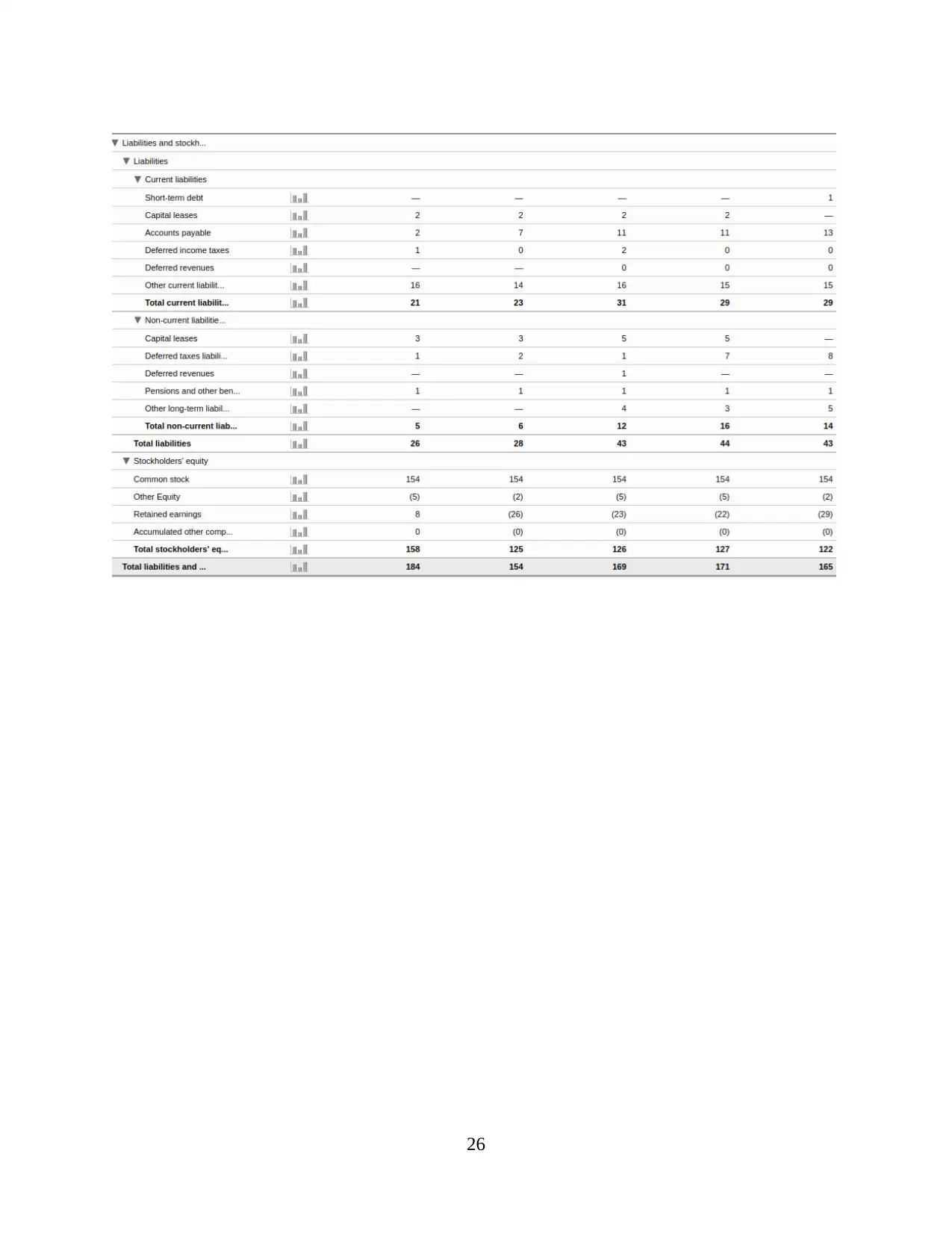

(ii) Item of Liabilities and associated information about the companies:

Liabilities: Liabilities shown in financial statement are divided in two major parts:

Current Liabilities and Non-Current Liabilities. Liabilities refers to monetary or non-monetary

debts or obligation payable by company during the course of business. Current liabilities include

debts payable within one year, while long-term liabilities include debts payable for more than

year. Current liabilities include Short-term debt, Accounts payable, deferred income taxes and

other current liabilities and non-current liabilities includes Long-term debt, Long term provisions

and other long term liabilities (Edwards, 2013). Such current and non-current liabilities are stated

in financial statement prepared by the company, some of them are discussed underneath:

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

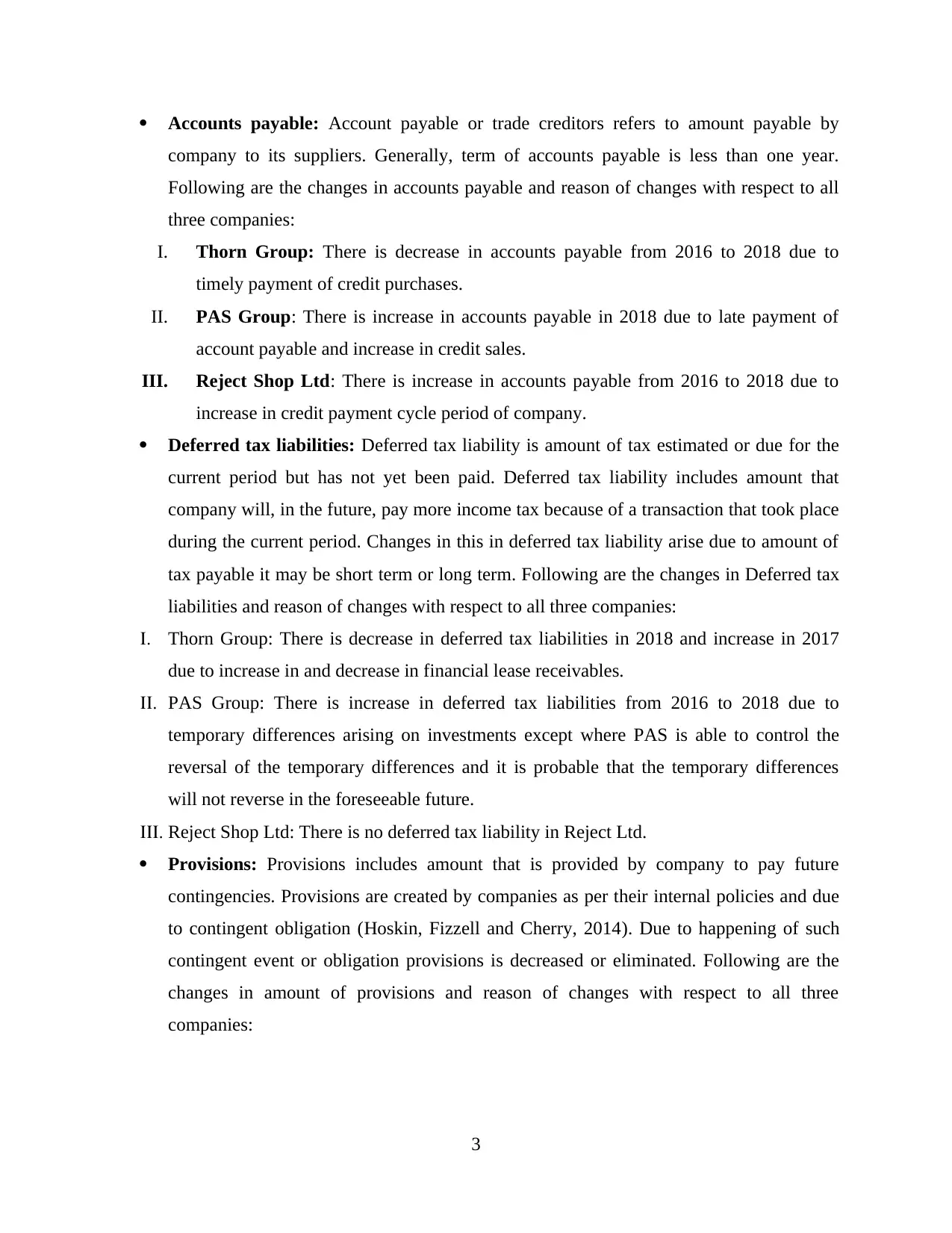

company to its suppliers. Generally, term of accounts payable is less than one year.

Following are the changes in accounts payable and reason of changes with respect to all

three companies:

I. Thorn Group: There is decrease in accounts payable from 2016 to 2018 due to

timely payment of credit purchases.

II. PAS Group: There is increase in accounts payable in 2018 due to late payment of

account payable and increase in credit sales.

III. Reject Shop Ltd: There is increase in accounts payable from 2016 to 2018 due to

increase in credit payment cycle period of company.

Deferred tax liabilities: Deferred tax liability is amount of tax estimated or due for the

current period but has not yet been paid. Deferred tax liability includes amount that

company will, in the future, pay more income tax because of a transaction that took place

during the current period. Changes in this in deferred tax liability arise due to amount of

tax payable it may be short term or long term. Following are the changes in Deferred tax

liabilities and reason of changes with respect to all three companies:

I. Thorn Group: There is decrease in deferred tax liabilities in 2018 and increase in 2017

due to increase in and decrease in financial lease receivables.

II. PAS Group: There is increase in deferred tax liabilities from 2016 to 2018 due to

temporary differences arising on investments except where PAS is able to control the

reversal of the temporary differences and it is probable that the temporary differences

will not reverse in the foreseeable future.

III. Reject Shop Ltd: There is no deferred tax liability in Reject Ltd.

Provisions: Provisions includes amount that is provided by company to pay future

contingencies. Provisions are created by companies as per their internal policies and due

to contingent obligation (Hoskin, Fizzell and Cherry, 2014). Due to happening of such

contingent event or obligation provisions is decreased or eliminated. Following are the

changes in amount of provisions and reason of changes with respect to all three

companies:

3

Paraphrase This Document

to Provisions used or reversed during the year and Provisions made during the year

respectively.

II. PAS Group: There is no change in amount of provision made for probable employee

benefits payments.

III. Reject Shop Ltd: There is increase in amount of provision in 2018 due to creation of

provision for shrinking expenses, onerous lease contract.

Overdraft: Overdraft means withdrawal of amount from bank' current account even if

bank account shows zero or negative balance. Following are the changes in amount of

overdraft and reason of changes with respect to all three companies:

I. Thorn Group: There is increase in amount of overdraft in 2018 to meet the working

capital requirements.

II. PAS Group: there is overdraft facility availed by company from bank only in 2018 to pay

its day to day expenses.

III. Reject Shop Ltd: There is no overdraft in Reject Shop Ltd.

Long term borrowings or long term debt: It refers to amount borrowed for a period

exceeding 12 months from bank or other financial institution. Long term borrowings

include bank loan, mortgage bonds, debenture, or other obligations not due for one year.

Companies are required to disclose its long-term debt in its financial statements along

with interest rate and date of maturity. Increase in long term borrowings shows

dependences of company on debts instead of equity or inability to pay debts. Following

are the changes in amount of Long term borrowings and reason of changes with respect

to all three companies:

Thorn Group: There is increase in amount of overdraft in 2018 to meet the working

capital requirements.

PAS Group: There is increase in amount of long term borrowings in 2018 to borrowing

taken for payment of lease incentives remain due.

Reject Shop Ltd: There is increase in amount of long term borrowings from 2016 to 2018

due to increase in borrowing taken for payment of rent escalation.

Following tables assists in interpreting data of Reject Shop Ltd, PAS Group Limited and

Thorn Group Ltd for three years:

4

Accounts payable 2018 10 13 41

2017 12 11 29

2016 19 11 28

Provisions 2018 7 0.08 2

2017 9 0.08 1

2016 8 0.08 -

Deferred tax

liabilities

2018 11 8 -

2017 12 7 -

2016 10 6 -

Overdraft 2018 23 0.07 -

2017 23 - -

2016 21 - -

Long term

borrowings or

long term debt

2018 207 5 9

2017 230 4 7

2016 159 4 8

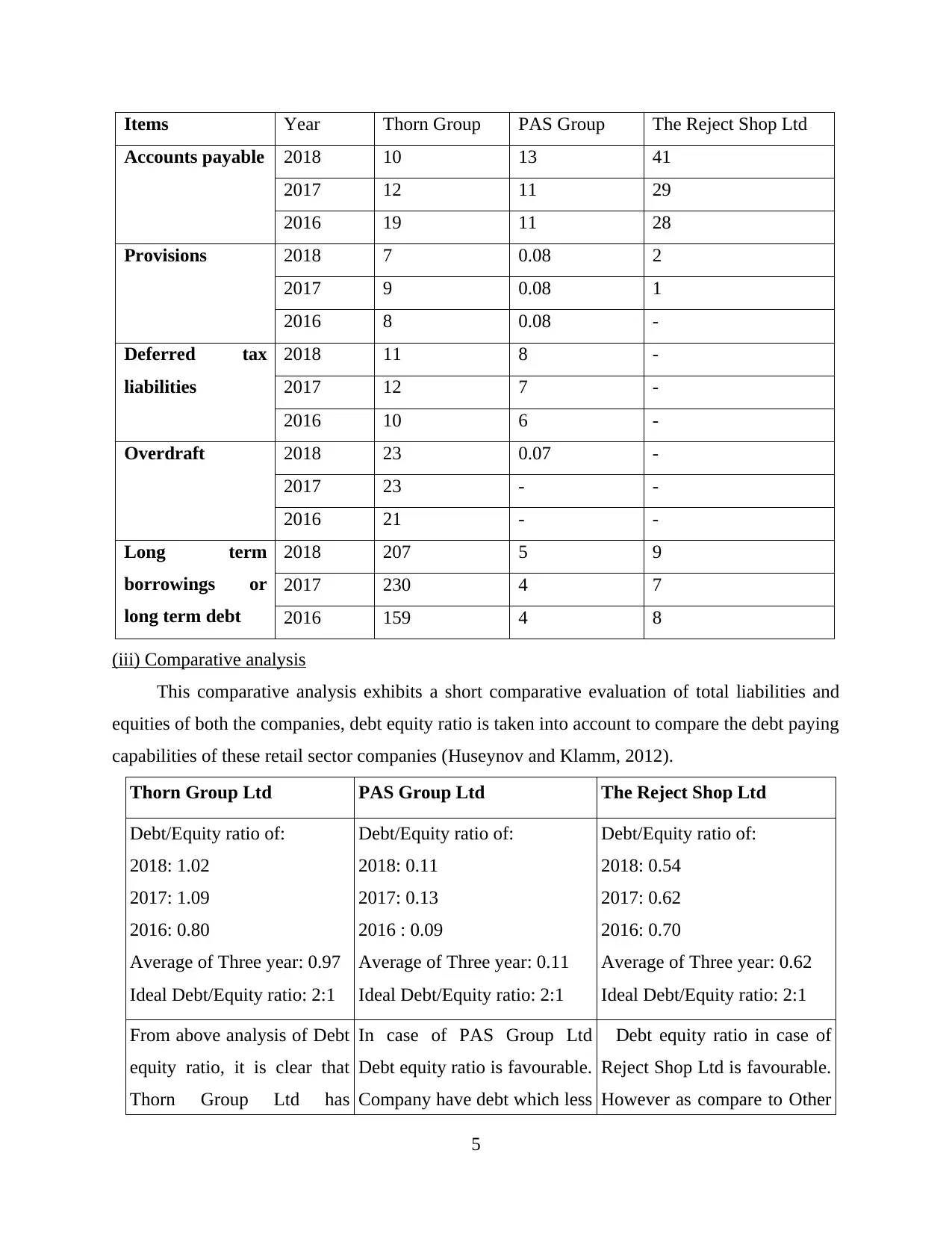

(iii) Comparative analysis

This comparative analysis exhibits a short comparative evaluation of total liabilities and

equities of both the companies, debt equity ratio is taken into account to compare the debt paying

capabilities of these retail sector companies (Huseynov and Klamm, 2012).

Thorn Group Ltd PAS Group Ltd The Reject Shop Ltd

Debt/Equity ratio of:

2018: 1.02

2017: 1.09

2016: 0.80

Average of Three year: 0.97

Ideal Debt/Equity ratio: 2:1

Debt/Equity ratio of:

2018: 0.11

2017: 0.13

2016 : 0.09

Average of Three year: 0.11

Ideal Debt/Equity ratio: 2:1

Debt/Equity ratio of:

2018: 0.54

2017: 0.62

2016: 0.70

Average of Three year: 0.62

Ideal Debt/Equity ratio: 2:1

From above analysis of Debt

equity ratio, it is clear that

Thorn Group Ltd has

In case of PAS Group Ltd

Debt equity ratio is favourable.

Company have debt which less

Debt equity ratio in case of

Reject Shop Ltd is favourable.

However as compare to Other

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Company have debt which is

less than twice of the

company's equity. However

as compare to other

companies in retail sector

has highest debt equity ratio.

than twice of the company's

equity. However as compare to

other companies in retail

sector has minimum debt

equity ratio.

two companies has medium

debt equity ratio.

CASH FLOW STATEMENT

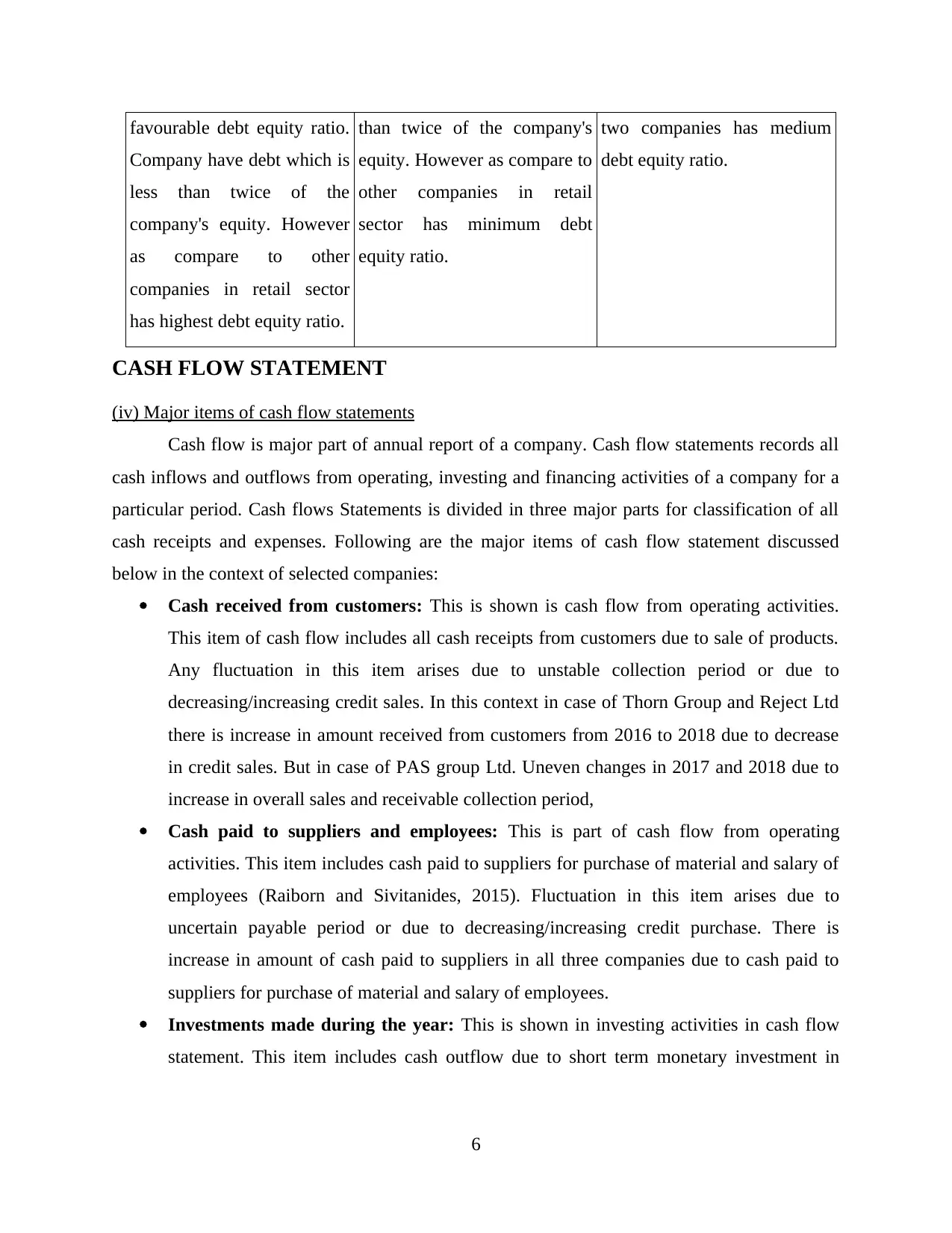

(iv) Major items of cash flow statements

Cash flow is major part of annual report of a company. Cash flow statements records all

cash inflows and outflows from operating, investing and financing activities of a company for a

particular period. Cash flows Statements is divided in three major parts for classification of all

cash receipts and expenses. Following are the major items of cash flow statement discussed

below in the context of selected companies:

Cash received from customers: This is shown is cash flow from operating activities.

This item of cash flow includes all cash receipts from customers due to sale of products.

Any fluctuation in this item arises due to unstable collection period or due to

decreasing/increasing credit sales. In this context in case of Thorn Group and Reject Ltd

there is increase in amount received from customers from 2016 to 2018 due to decrease

in credit sales. But in case of PAS group Ltd. Uneven changes in 2017 and 2018 due to

increase in overall sales and receivable collection period,

Cash paid to suppliers and employees: This is part of cash flow from operating

activities. This item includes cash paid to suppliers for purchase of material and salary of

employees (Raiborn and Sivitanides, 2015). Fluctuation in this item arises due to

uncertain payable period or due to decreasing/increasing credit purchase. There is

increase in amount of cash paid to suppliers in all three companies due to cash paid to

suppliers for purchase of material and salary of employees.

Investments made during the year: This is shown in investing activities in cash flow

statement. This item includes cash outflow due to short term monetary investment in

6

Paraphrase This Document

which shown increase in 2017.

Purchase of property and equipment: this is part of cash flow from investment

activities which includes cash out flow due to acquisition of property and equipment. In

case of Thorn Ltd, PAS group and Reject Ltd increase or decrease shows net effect due to

purchase or sale of property, plant and equipment and software.

Following tables exhibits the changes in above items of cash flow in the context of Reject

Shop Ltd, PAS Group Limited and Thorn Group Ltd for three years:

Items Thorn Group PAS Group The Reject Shop Ltd

2018 2017 2016 2018 2017 2016 2018 2017 2016

Cash received from

customers

785 621 585 283 295 286 880 873 855

Cash paid to

suppliers and

employees

-545 -425 -357 -277 -283 -275 -836 -830 -810

Investments made

during the year

- -260 -92 - - - - - -

Purchase of

property and

equipment

-4 -4 -4 -4 -6 -5 -17 -25 -17

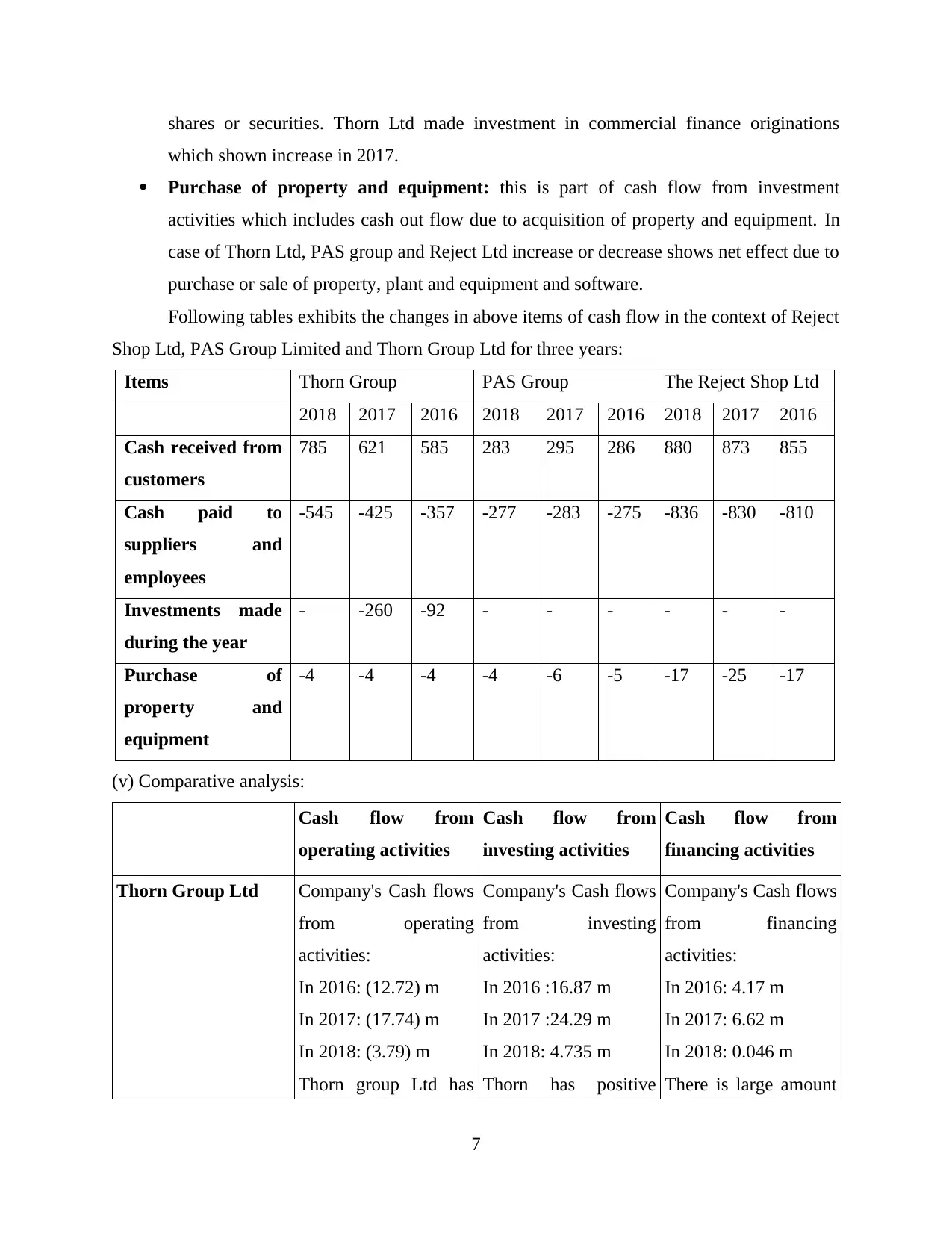

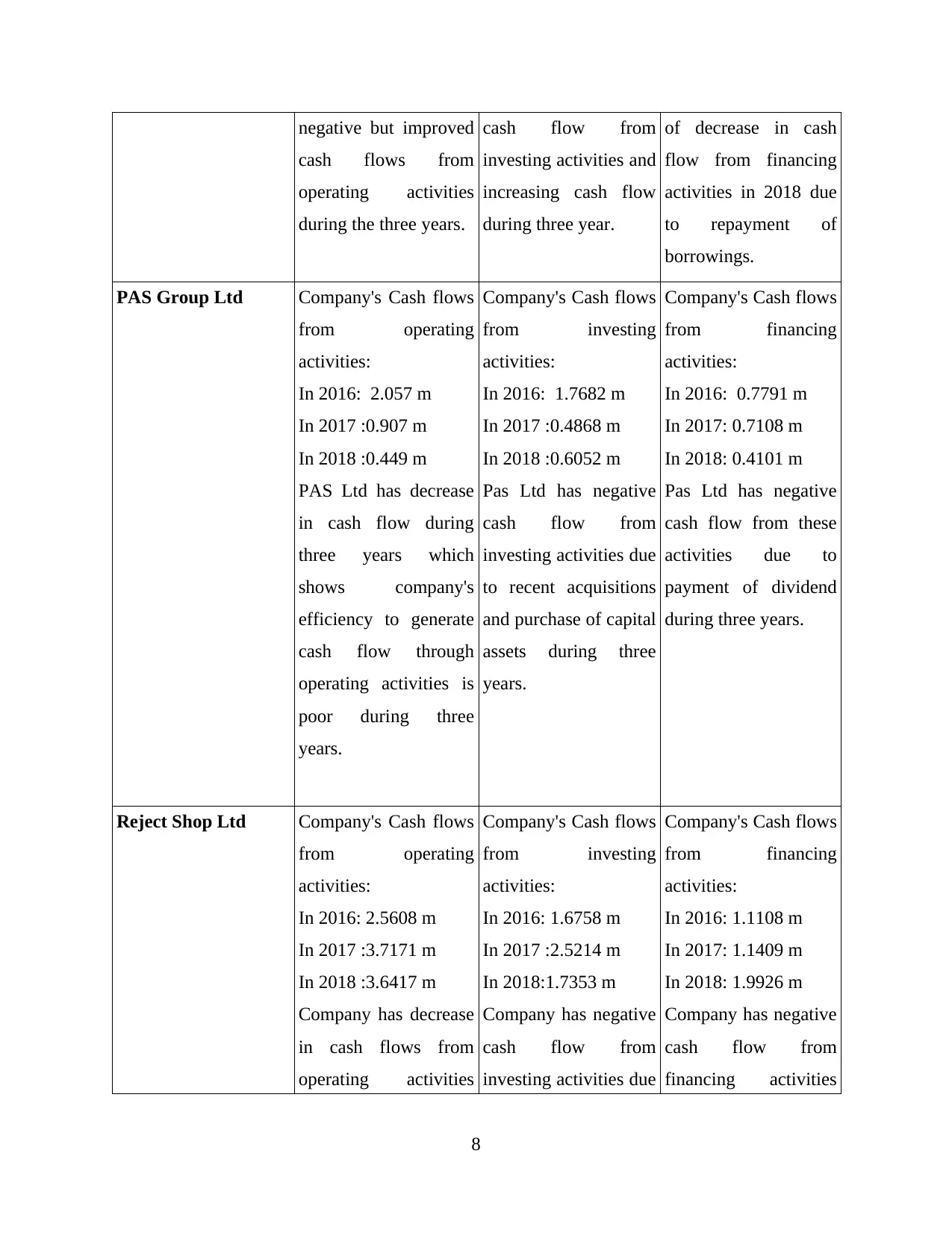

(v) Comparative analysis:

Cash flow from

operating activities

Cash flow from

investing activities

Cash flow from

financing activities

Thorn Group Ltd Company's Cash flows

from operating

activities:

In 2016: (12.72) m

In 2017: (17.74) m

In 2018: (3.79) m

Thorn group Ltd has

Company's Cash flows

from investing

activities:

In 2016 :16.87 m

In 2017 :24.29 m

In 2018: 4.735 m

Thorn has positive

Company's Cash flows

from financing

activities:

In 2016: 4.17 m

In 2017: 6.62 m

In 2018: 0.046 m

There is large amount

7

cash flows from

operating activities

during the three years.

cash flow from

investing activities and

increasing cash flow

during three year.

of decrease in cash

flow from financing

activities in 2018 due

to repayment of

borrowings.

PAS Group Ltd Company's Cash flows

from operating

activities:

In 2016: 2.057 m

In 2017 :0.907 m

In 2018 :0.449 m

PAS Ltd has decrease

in cash flow during

three years which

shows company's

efficiency to generate

cash flow through

operating activities is

poor during three

years.

Company's Cash flows

from investing

activities:

In 2016: 1.7682 m

In 2017 :0.4868 m

In 2018 :0.6052 m

Pas Ltd has negative

cash flow from

investing activities due

to recent acquisitions

and purchase of capital

assets during three

years.

Company's Cash flows

from financing

activities:

In 2016: 0.7791 m

In 2017: 0.7108 m

In 2018: 0.4101 m

Pas Ltd has negative

cash flow from these

activities due to

payment of dividend

during three years.

Reject Shop Ltd Company's Cash flows

from operating

activities:

In 2016: 2.5608 m

In 2017 :3.7171 m

In 2018 :3.6417 m

Company has decrease

in cash flows from

operating activities

Company's Cash flows

from investing

activities:

In 2016: 1.6758 m

In 2017 :2.5214 m

In 2018:1.7353 m

Company has negative

cash flow from

investing activities due

Company's Cash flows

from financing

activities:

In 2016: 1.1108 m

In 2017: 1.1409 m

In 2018: 1.9926 m

Company has negative

cash flow from

financing activities

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

increase in cash

payments and tax paid

during three years.

to heavy payments

towards purchase of

plant and property

during three years.

due to repayment of

borrowings during

three years.

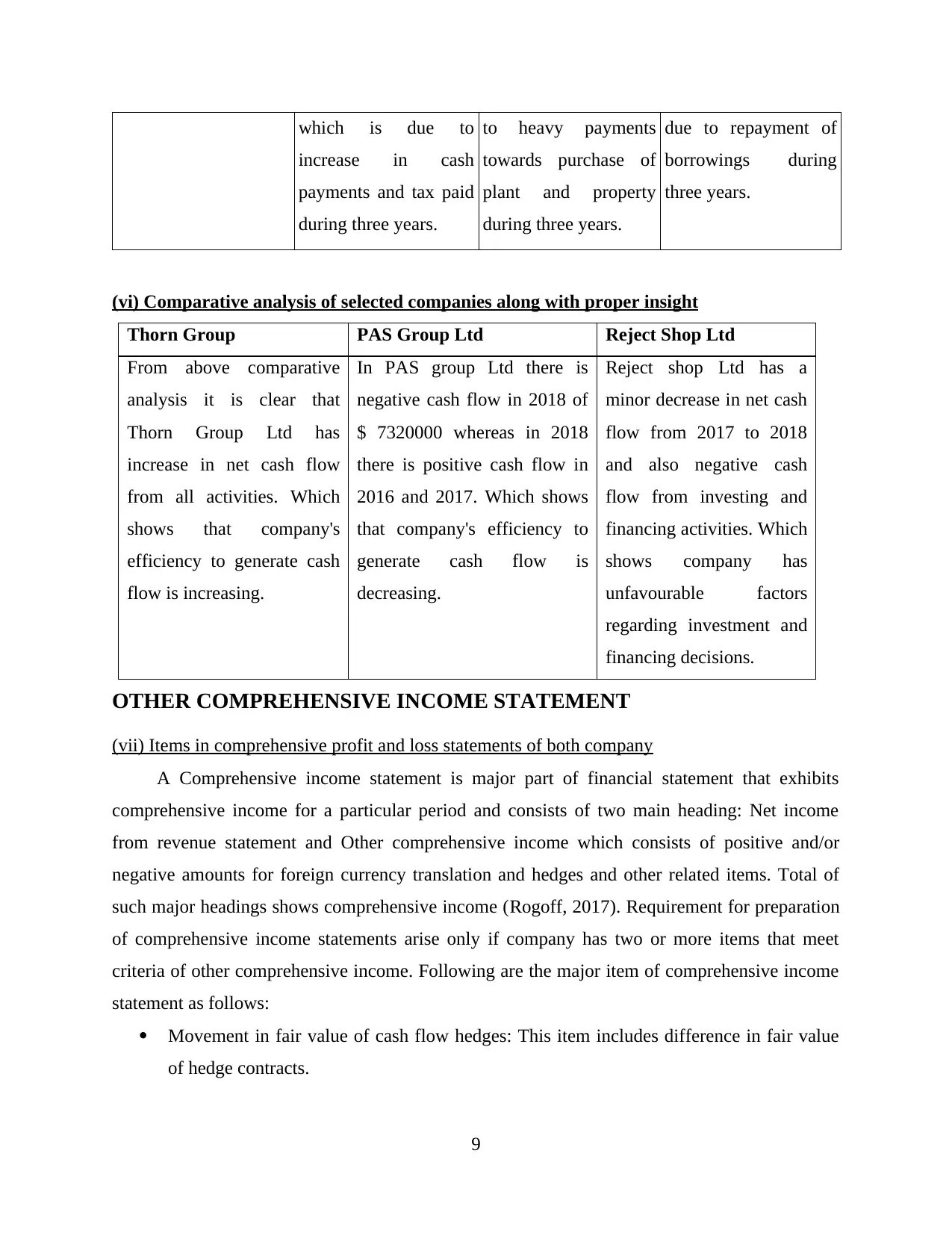

(vi) Comparative analysis of selected companies along with proper insight

Thorn Group PAS Group Ltd Reject Shop Ltd

From above comparative

analysis it is clear that

Thorn Group Ltd has

increase in net cash flow

from all activities. Which

shows that company's

efficiency to generate cash

flow is increasing.

In PAS group Ltd there is

negative cash flow in 2018 of

$ 7320000 whereas in 2018

there is positive cash flow in

2016 and 2017. Which shows

that company's efficiency to

generate cash flow is

decreasing.

Reject shop Ltd has a

minor decrease in net cash

flow from 2017 to 2018

and also negative cash

flow from investing and

financing activities. Which

shows company has

unfavourable factors

regarding investment and

financing decisions.

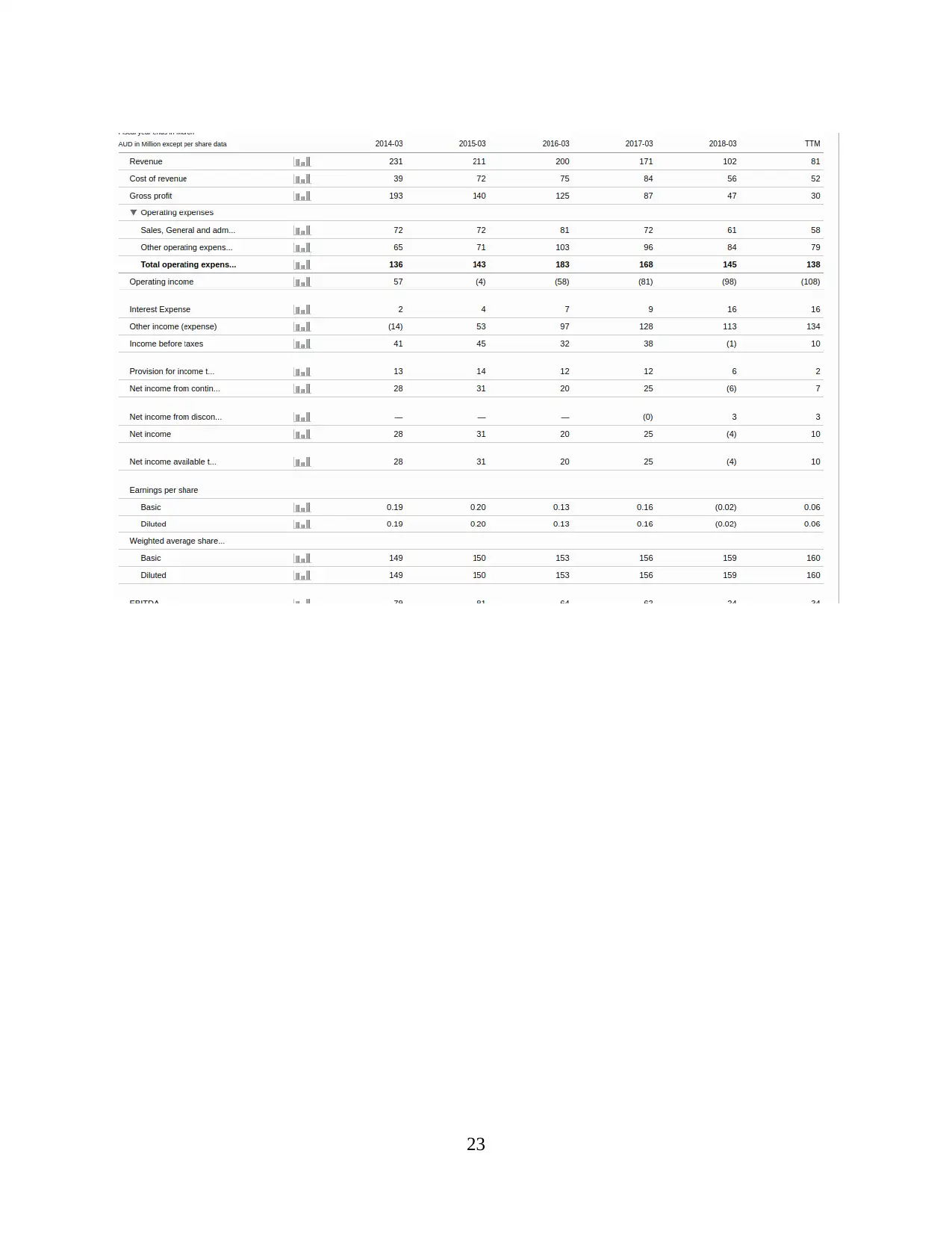

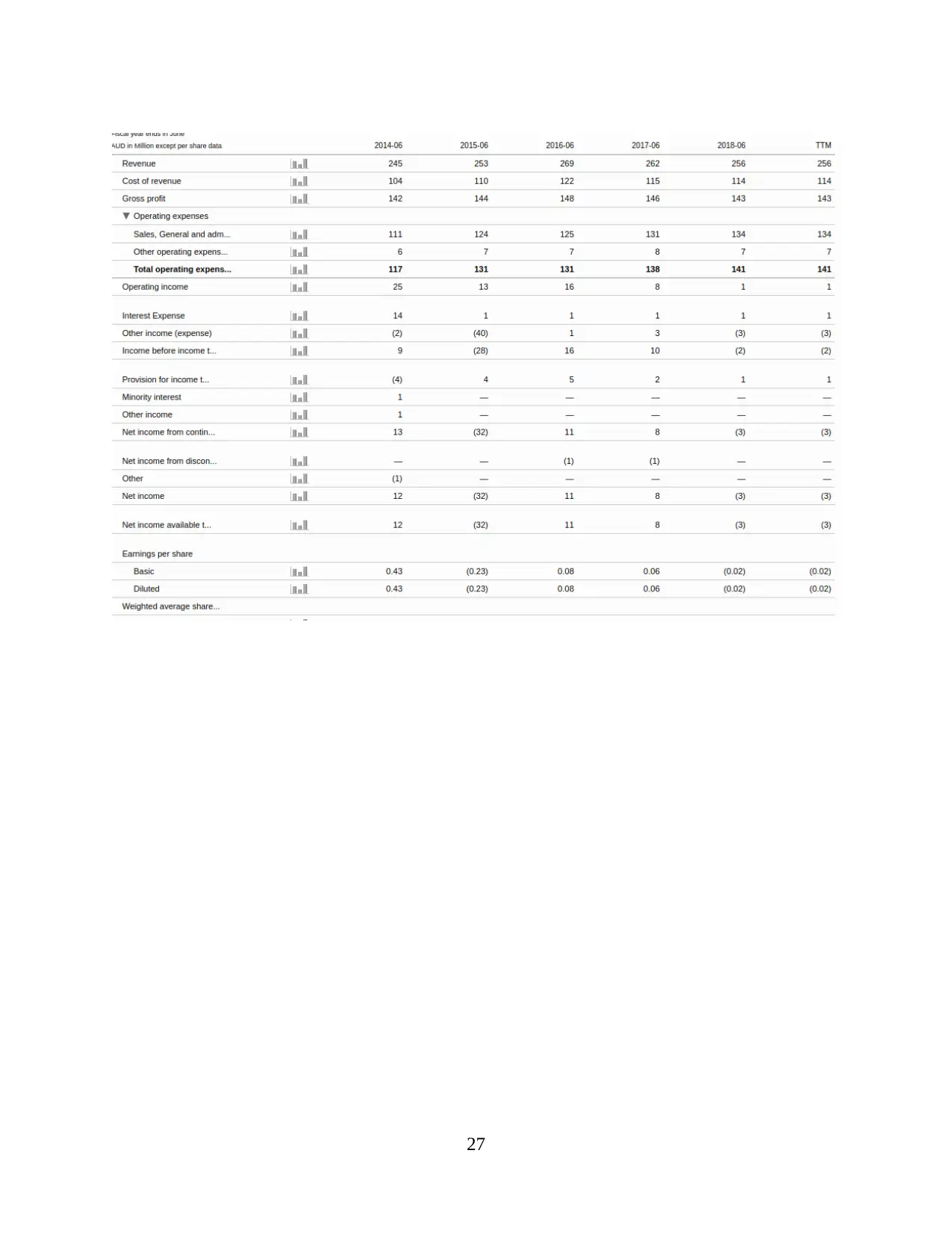

OTHER COMPREHENSIVE INCOME STATEMENT

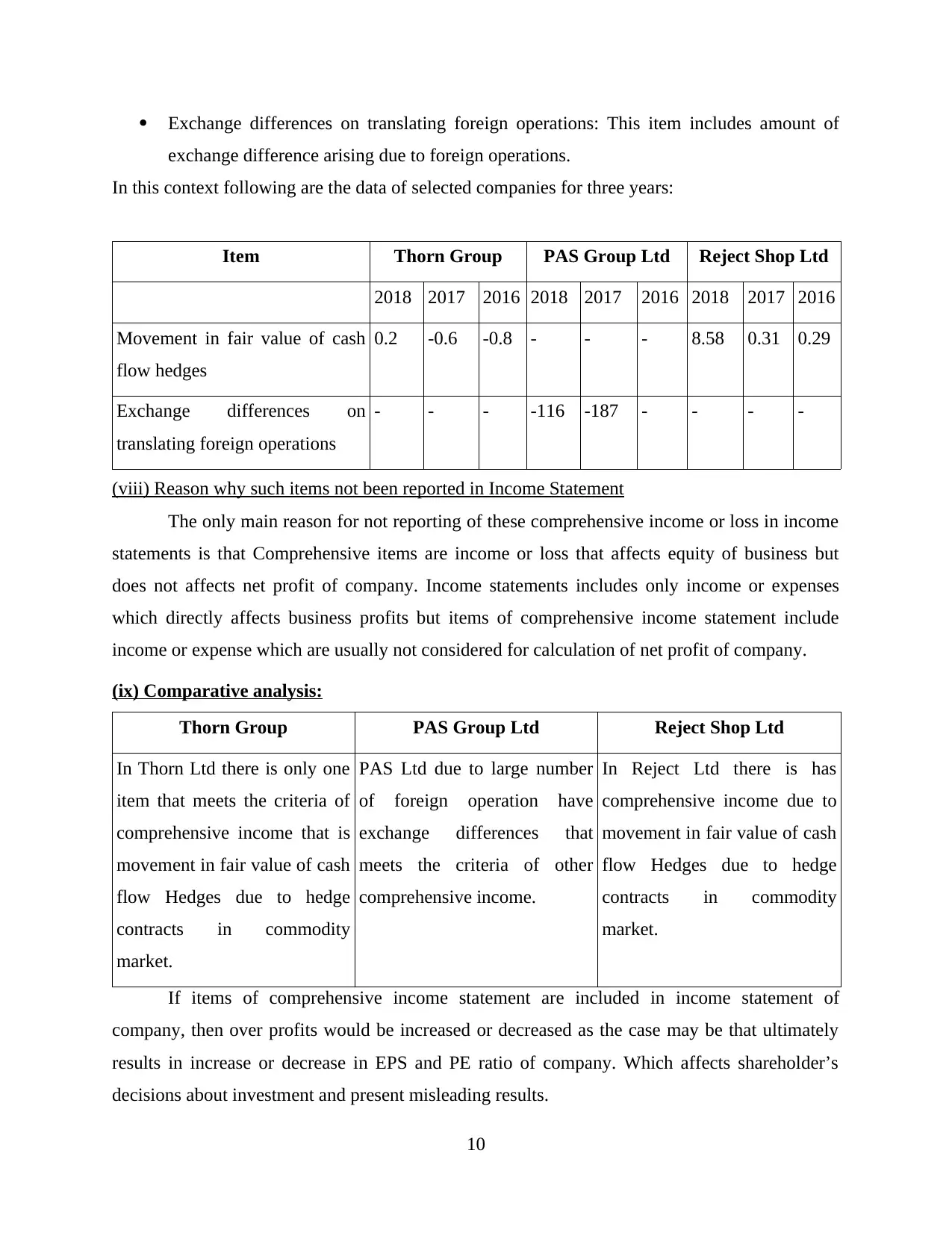

(vii) Items in comprehensive profit and loss statements of both company

A Comprehensive income statement is major part of financial statement that exhibits

comprehensive income for a particular period and consists of two main heading: Net income

from revenue statement and Other comprehensive income which consists of positive and/or

negative amounts for foreign currency translation and hedges and other related items. Total of

such major headings shows comprehensive income (Rogoff, 2017). Requirement for preparation

of comprehensive income statements arise only if company has two or more items that meet

criteria of other comprehensive income. Following are the major item of comprehensive income

statement as follows:

Movement in fair value of cash flow hedges: This item includes difference in fair value

of hedge contracts.

9

Paraphrase This Document

exchange difference arising due to foreign operations.

In this context following are the data of selected companies for three years:

Item Thorn Group PAS Group Ltd Reject Shop Ltd

2018 2017 2016 2018 2017 2016 2018 2017 2016

Movement in fair value of cash

flow hedges

0.2 -0.6 -0.8 - - - 8.58 0.31 0.29

Exchange differences on

translating foreign operations

- - - -116 -187 - - - -

(viii) Reason why such items not been reported in Income Statement

The only main reason for not reporting of these comprehensive income or loss in income

statements is that Comprehensive items are income or loss that affects equity of business but

does not affects net profit of company. Income statements includes only income or expenses

which directly affects business profits but items of comprehensive income statement include

income or expense which are usually not considered for calculation of net profit of company.

(ix) Comparative analysis:

Thorn Group PAS Group Ltd Reject Shop Ltd

In Thorn Ltd there is only one

item that meets the criteria of

comprehensive income that is

movement in fair value of cash

flow Hedges due to hedge

contracts in commodity

market.

PAS Ltd due to large number

of foreign operation have

exchange differences that

meets the criteria of other

comprehensive income.

In Reject Ltd there is has

comprehensive income due to

movement in fair value of cash

flow Hedges due to hedge

contracts in commodity

market.

If items of comprehensive income statement are included in income statement of

company, then over profits would be increased or decreased as the case may be that ultimately

results in increase or decrease in EPS and PE ratio of company. Which affects shareholder’s

decisions about investment and present misleading results.

10

Comprehensive income covers net income and other items related to the overall income

statement because they have not been realised. Unrealised holding profit or losses, available for

sale securities and international currency translation gains are also part of comprehensive

income. Managers associated with foreign integral operations of an organisation prepares this

statement by using their experience and skills. Although to evaluate managers' performance

different appraisal methods are taken into account but comprehensive profit and loss statements

can be taken as basis to analyse their performance in foreign integral and hedging operations.

(Hoskin, Fizzell and Cherry, 2014).

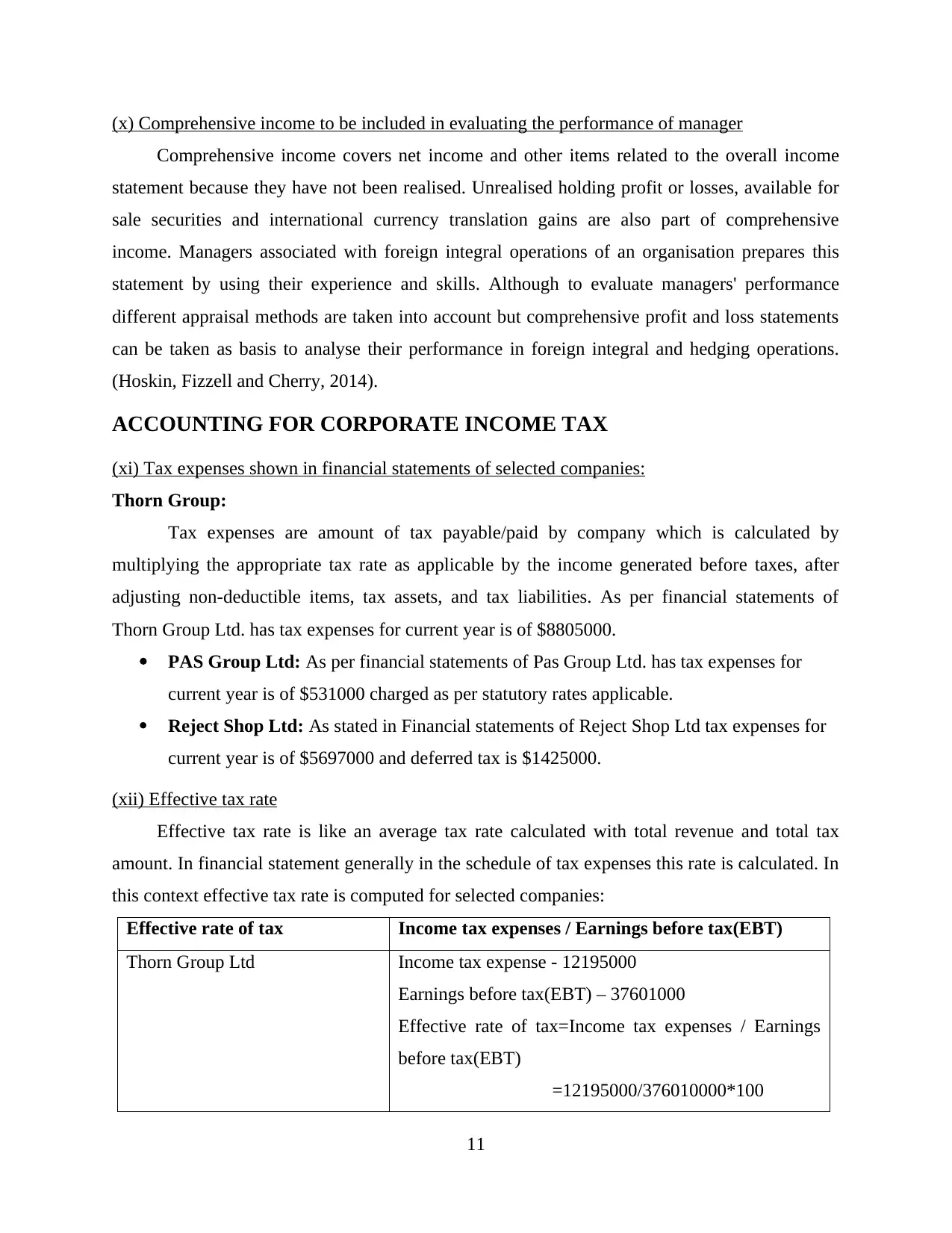

ACCOUNTING FOR CORPORATE INCOME TAX

(xi) Tax expenses shown in financial statements of selected companies:

Thorn Group:

Tax expenses are amount of tax payable/paid by company which is calculated by

multiplying the appropriate tax rate as applicable by the income generated before taxes, after

adjusting non-deductible items, tax assets, and tax liabilities. As per financial statements of

Thorn Group Ltd. has tax expenses for current year is of $8805000.

PAS Group Ltd: As per financial statements of Pas Group Ltd. has tax expenses for

current year is of $531000 charged as per statutory rates applicable.

Reject Shop Ltd: As stated in Financial statements of Reject Shop Ltd tax expenses for

current year is of $5697000 and deferred tax is $1425000.

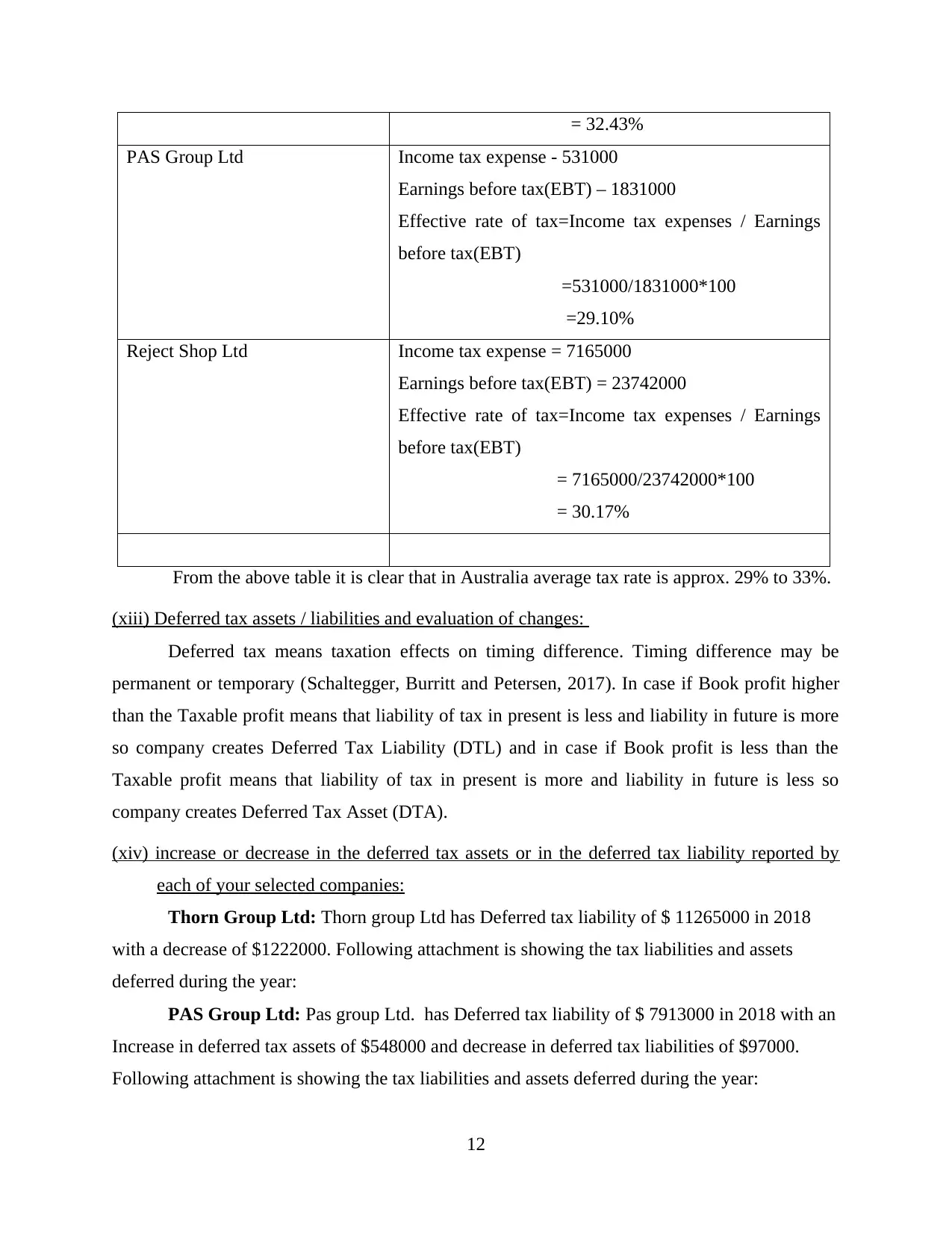

(xii) Effective tax rate

Effective tax rate is like an average tax rate calculated with total revenue and total tax

amount. In financial statement generally in the schedule of tax expenses this rate is calculated. In

this context effective tax rate is computed for selected companies:

Effective rate of tax Income tax expenses / Earnings before tax(EBT)

Thorn Group Ltd Income tax expense - 12195000

Earnings before tax(EBT) – 37601000

Effective rate of tax=Income tax expenses / Earnings

before tax(EBT)

=12195000/376010000*100

11

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

PAS Group Ltd Income tax expense - 531000

Earnings before tax(EBT) – 1831000

Effective rate of tax=Income tax expenses / Earnings

before tax(EBT)

=531000/1831000*100

=29.10%

Reject Shop Ltd Income tax expense = 7165000

Earnings before tax(EBT) = 23742000

Effective rate of tax=Income tax expenses / Earnings

before tax(EBT)

= 7165000/23742000*100

= 30.17%

From the above table it is clear that in Australia average tax rate is approx. 29% to 33%.

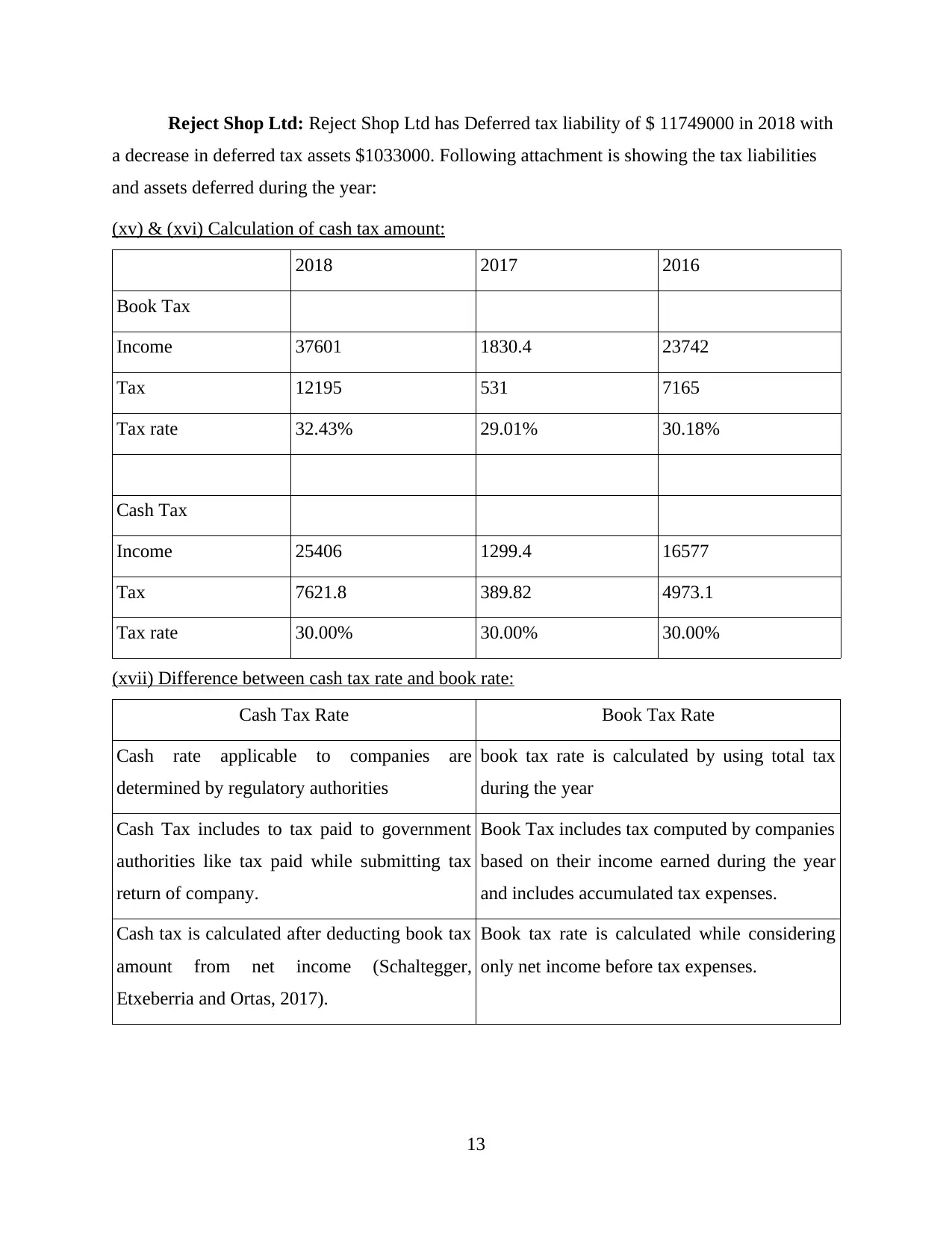

(xiii) Deferred tax assets / liabilities and evaluation of changes:

Deferred tax means taxation effects on timing difference. Timing difference may be

permanent or temporary (Schaltegger, Burritt and Petersen, 2017). In case if Book profit higher

than the Taxable profit means that liability of tax in present is less and liability in future is more

so company creates Deferred Tax Liability (DTL) and in case if Book profit is less than the

Taxable profit means that liability of tax in present is more and liability in future is less so

company creates Deferred Tax Asset (DTA).

(xiv) increase or decrease in the deferred tax assets or in the deferred tax liability reported by

each of your selected companies:

Thorn Group Ltd: Thorn group Ltd has Deferred tax liability of $ 11265000 in 2018

with a decrease of $1222000. Following attachment is showing the tax liabilities and assets

deferred during the year:

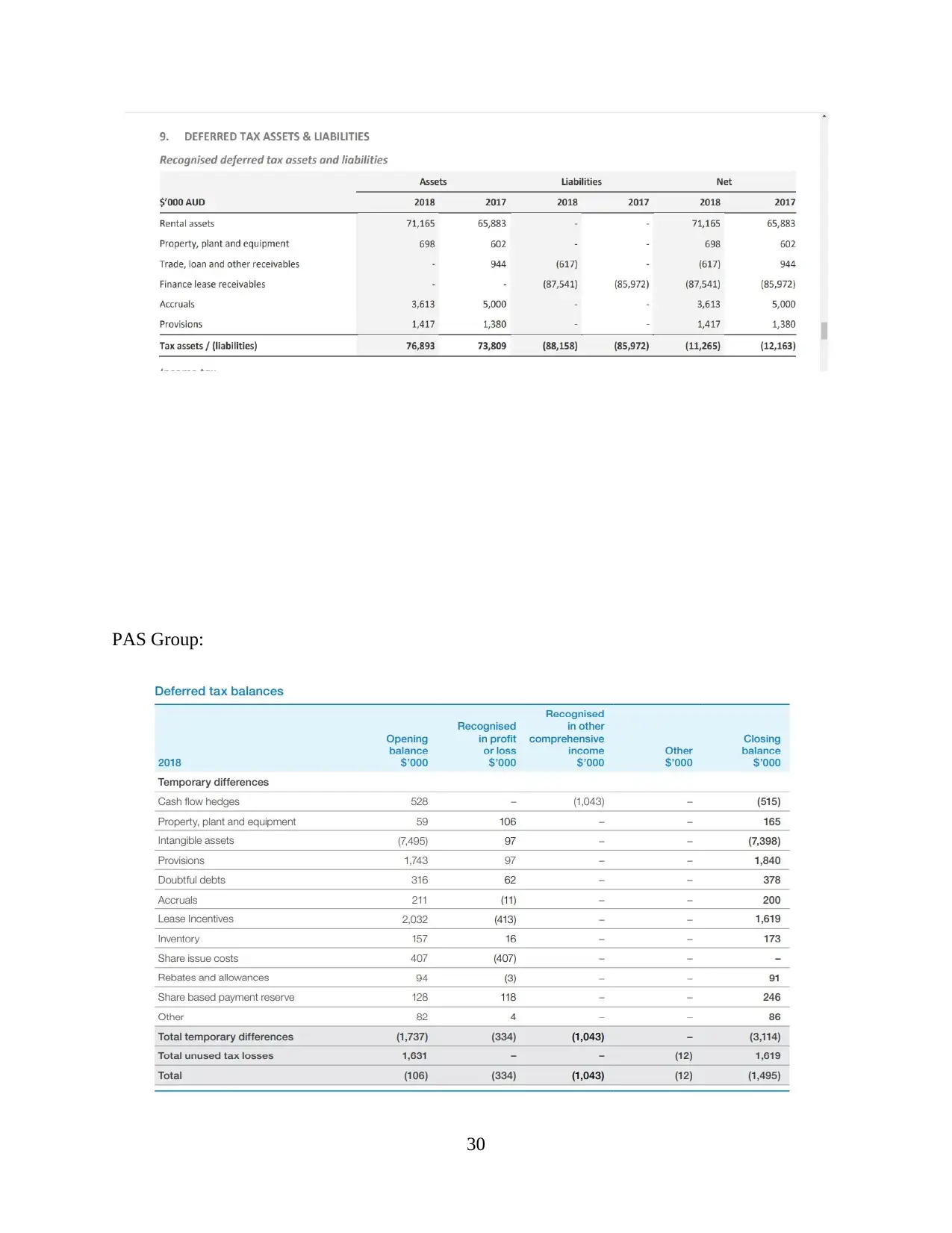

PAS Group Ltd: Pas group Ltd. has Deferred tax liability of $ 7913000 in 2018 with an

Increase in deferred tax assets of $548000 and decrease in deferred tax liabilities of $97000.

Following attachment is showing the tax liabilities and assets deferred during the year:

12

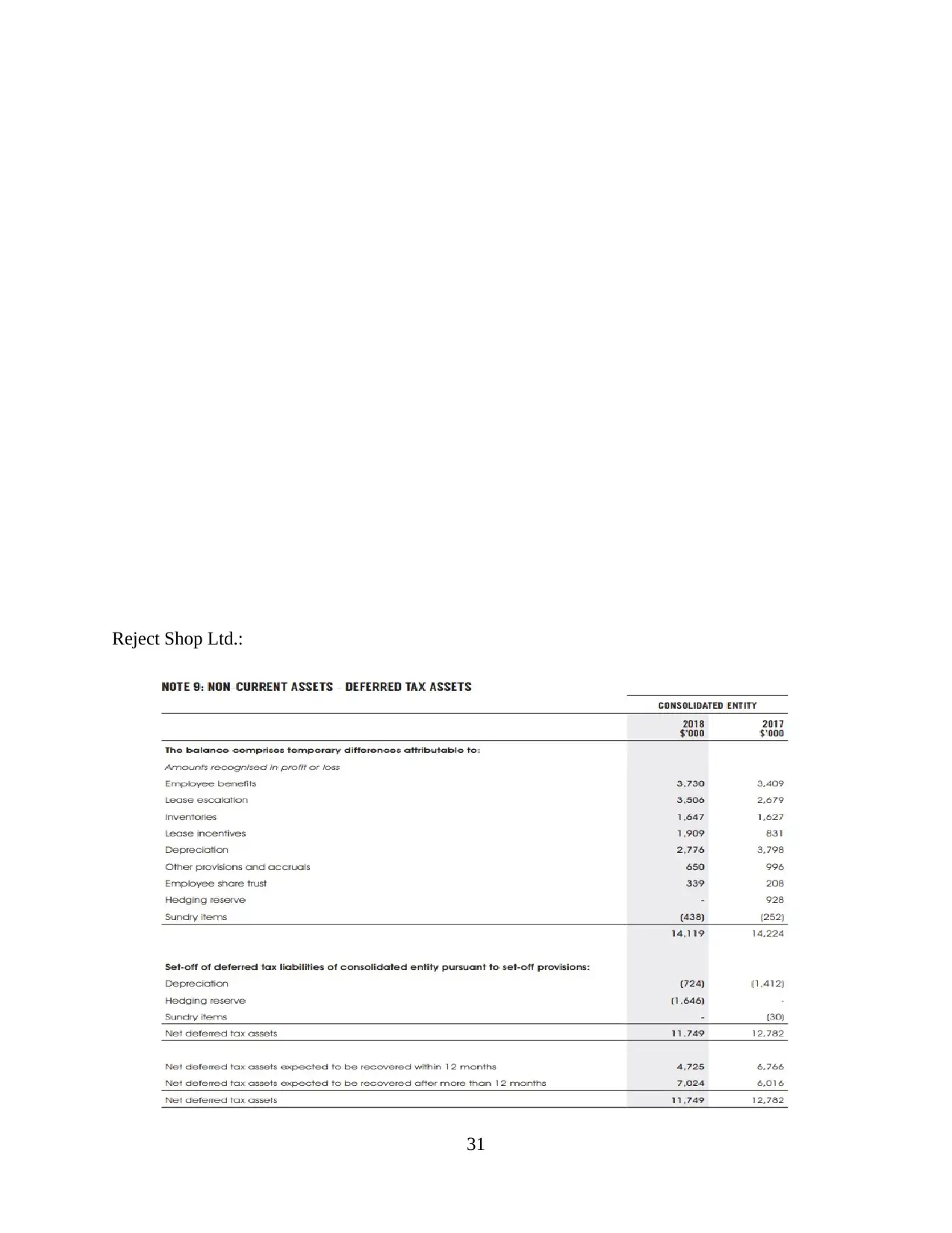

Paraphrase This Document

a decrease in deferred tax assets $1033000. Following attachment is showing the tax liabilities

and assets deferred during the year:

(xv) & (xvi) Calculation of cash tax amount:

2018 2017 2016

Book Tax

Income 37601 1830.4 23742

Tax 12195 531 7165

Tax rate 32.43% 29.01% 30.18%

Cash Tax

Income 25406 1299.4 16577

Tax 7621.8 389.82 4973.1

Tax rate 30.00% 30.00% 30.00%

(xvii) Difference between cash tax rate and book rate:

Cash Tax Rate Book Tax Rate

Cash rate applicable to companies are

determined by regulatory authorities

book tax rate is calculated by using total tax

during the year

Cash Tax includes to tax paid to government

authorities like tax paid while submitting tax

return of company.

Book Tax includes tax computed by companies

based on their income earned during the year

and includes accumulated tax expenses.

Cash tax is calculated after deducting book tax

amount from net income (Schaltegger,

Etxeberria and Ortas, 2017).

Book tax rate is calculated while considering

only net income before tax expenses.

13

From the above project report, it has been articulated that corporate accounting is used by

an organisation in order to analyse the financial performance of the company. Pas Group Ltd and

Thorn Group Ltd are facing losses in current year are profitable and only Reject Shop Ltd is

profitable in retail sector. In all three selected companies Reject Shop Ltd. is growing in retail

industries where as other companies in 2018 facing negative growth due to net loss. Pas Group

Ltd and Thorn Group Ltd have net loss in 2018 whereas these two companies were doing great

in 2017.

14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Books and Journal:

DeBusk, G. K., 2012. Use lean accounting to add value to the organization. Journal of Corporate

Accounting & Finance. 23(3). pp.35-41.

Edgerton, J., 2012. Investment, accounting, and the salience of the corporate income tax (No.

w18472). National Bureau of Economic Research.

Edwards, J. R., 2013. A History of Financial Accounting (RLE Accounting). Routledge.

Hoskin, R. E., Fizzell, M. R. and Cherry, D. C., 2014. Financial Accounting: a user perspective.

Wiley Global Education.

Huseynov, F. and Klamm, B.K., 2012. Tax avoidance, tax management and corporate social

responsibility. Journal of Corporate Finance. 18(4). pp.804-827.

Raiborn, C. and Sivitanides, M., 2015. Accounting issues related to Bitcoins. Journal of

Corporate Accounting & Finance. 26(2). pp.25-34.

Rogoff, K. S., 2017. The Curse of Cash: How Large-Denomination Bills Aid Crime and Tax

Evasion and Constrain Monetary Policy. Princeton University Press.

Schaltegger, S., Burritt, R. and Petersen, H., 2017. An introduction to corporate environmental

management: Striving for sustainability. Routledge.

Schaltegger, S., Etxeberria, I. Á. and Ortas, E., 2017. Innovating corporate accounting and

reporting for sustainability–attributes and challenges. Sustainable Development. 25(2).

pp.113-122.

Uyar, A., 2016. Evolution of corporate reporting and emerging trends. Journal of Corporate

Accounting & Finance. 27(4). pp.27-30.

Watson, L., 2015. Corporate social responsibility research in accounting. Journal of Accounting

Literature. 34. pp.1-16.

Zadek, S., Evans, R. and Pruzan, P., 2013. Building corporate accountability: Emerging practice

in social and ethical accounting and auditing. Routledge.

Online

Annual Report of Thron ltd. to Shareholders., 2018. [Online]. Annual report. Retrieve from

<http://www.thorn.com.au/irm/PDF/2476_0/AnnualReporttoShareholders2018>.

Annual Report of Reject Shop Ltd to Shareholders. 2018. [Online]. Annual report. Retrieve from

<https://www.rejectshop.com.au/medias/Appendix-4E-and-Annual-Report.pdf>.

Annual Report of the Pas Group Ltd to Shareholders. 2018. [Online]. Annual report. Retrieve

from < https://thepasgroup.com.au/wp-content/uploads/2018/09/20180921_PGR-Annual-

Report-to-Shareholders.pdf>

15

Paraphrase This Document

Reject Shop Ltd:

16

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

24

Paraphrase This Document

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Paraphrase This Document

Tax expenses shown in financial statements of PAS Group.:

28

Deferred tax assets / liabilities :

Thorn Ltd:

29

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

30

Paraphrase This Document

31

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.