Dakota Office Products Case Study: Profitability Analysis and Costing

VerifiedAdded on 2022/08/13

|10

|1303

|12

Case Study

AI Summary

This assignment analyzes the Dakota Office Products (DOP) case, focusing on its financial performance and costing methods. The analysis begins by identifying the inadequacies of DOP's existing pricing system, which led to financial losses despite increased sales. An activity-based costing (ABC) system is developed, and activity cost-driver rates are calculated. The profitability of two customers, Customer A and Customer B, is then calculated using the ABC system. Differences in profitability are explained by analyzing the activities and costs associated with each customer, such as order sizes, delivery methods, and data entry requirements. The limitations of the profitability estimates are discussed, and additional information needed for a more comprehensive analysis is suggested. The analysis concludes with recommendations for price adjustments and operational changes to improve DOP's profitability, including shifting to EDI orders and incentivizing large orders. The student's analysis provides insights into cost management, pricing strategies, and customer profitability within a distribution business.

Running Head: ACCOUNTING 0

Accounting

(Student Name)

Accounting

(Student Name)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 1

Table of Contents

Question 1........................................................................................................................................2

Question 2........................................................................................................................................2

Question 3........................................................................................................................................3

Question 4........................................................................................................................................4

Question 5........................................................................................................................................4

Question 6........................................................................................................................................5

Question 7........................................................................................................................................5

Question 8........................................................................................................................................5

References........................................................................................................................................7

Table of Contents

Question 1........................................................................................................................................2

Question 2........................................................................................................................................2

Question 3........................................................................................................................................3

Question 4........................................................................................................................................4

Question 5........................................................................................................................................4

Question 6........................................................................................................................................5

Question 7........................................................................................................................................5

Question 8........................................................................................................................................5

References........................................................................................................................................7

ACCOUNTING 2

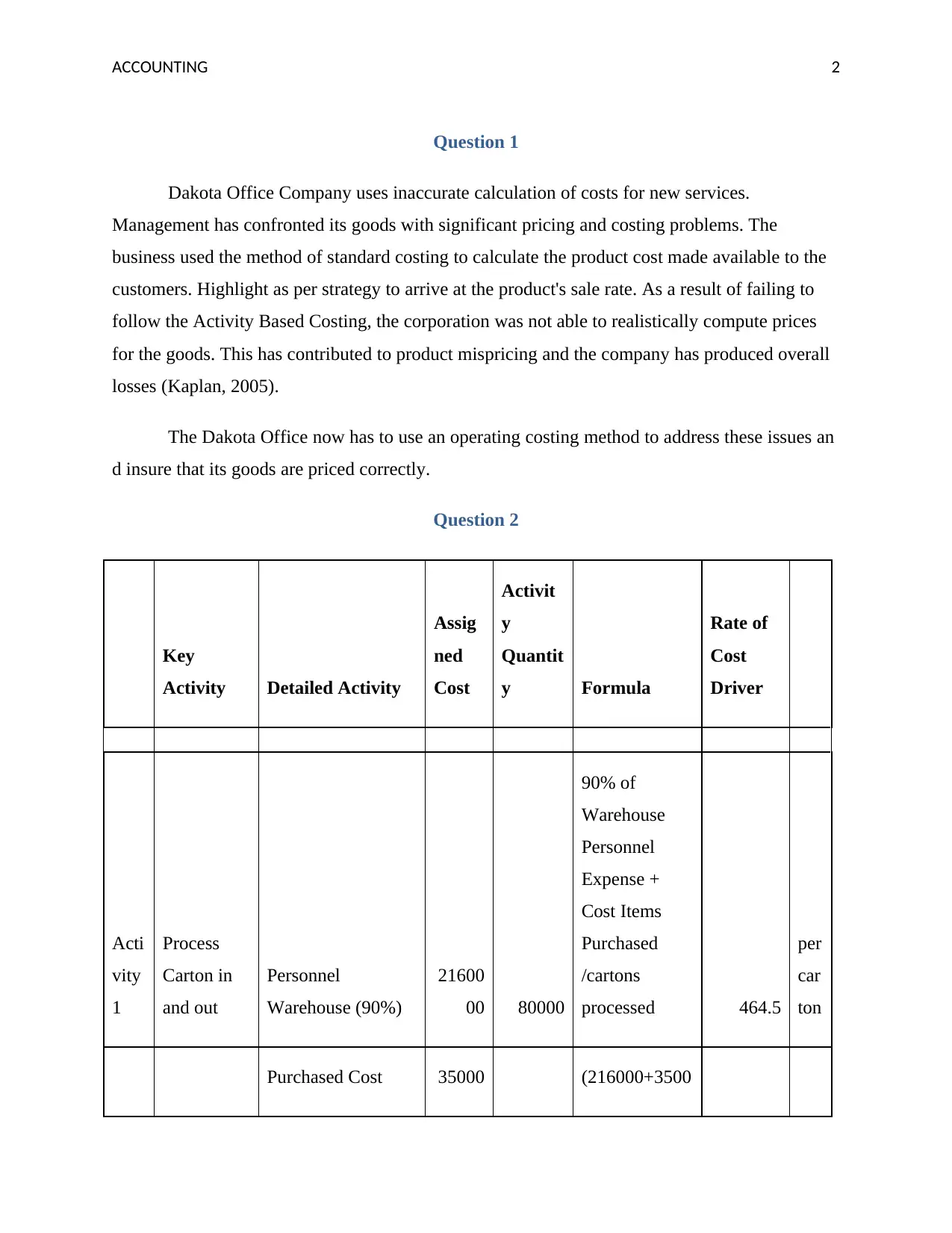

Question 1

Dakota Office Company uses inaccurate calculation of costs for new services.

Management has confronted its goods with significant pricing and costing problems. The

business used the method of standard costing to calculate the product cost made available to the

customers. Highlight as per strategy to arrive at the product's sale rate. As a result of failing to

follow the Activity Based Costing, the corporation was not able to realistically compute prices

for the goods. This has contributed to product mispricing and the company has produced overall

losses (Kaplan, 2005).

The Dakota Office now has to use an operating costing method to address these issues an

d insure that its goods are priced correctly.

Question 2

Key

Activity Detailed Activity

Assig

ned

Cost

Activit

y

Quantit

y Formula

Rate of

Cost

Driver

Acti

vity

1

Process

Carton in

and out

Personnel

Warehouse (90%)

21600

00 80000

90% of

Warehouse

Personnel

Expense +

Cost Items

Purchased

/cartons

processed 464.5

per

car

ton

Purchased Cost 35000 (216000+3500

Question 1

Dakota Office Company uses inaccurate calculation of costs for new services.

Management has confronted its goods with significant pricing and costing problems. The

business used the method of standard costing to calculate the product cost made available to the

customers. Highlight as per strategy to arrive at the product's sale rate. As a result of failing to

follow the Activity Based Costing, the corporation was not able to realistically compute prices

for the goods. This has contributed to product mispricing and the company has produced overall

losses (Kaplan, 2005).

The Dakota Office now has to use an operating costing method to address these issues an

d insure that its goods are priced correctly.

Question 2

Key

Activity Detailed Activity

Assig

ned

Cost

Activit

y

Quantit

y Formula

Rate of

Cost

Driver

Acti

vity

1

Process

Carton in

and out

Personnel

Warehouse (90%)

21600

00 80000

90% of

Warehouse

Personnel

Expense +

Cost Items

Purchased

/cartons

processed 464.5

per

car

ton

Purchased Cost 35000 (216000+3500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

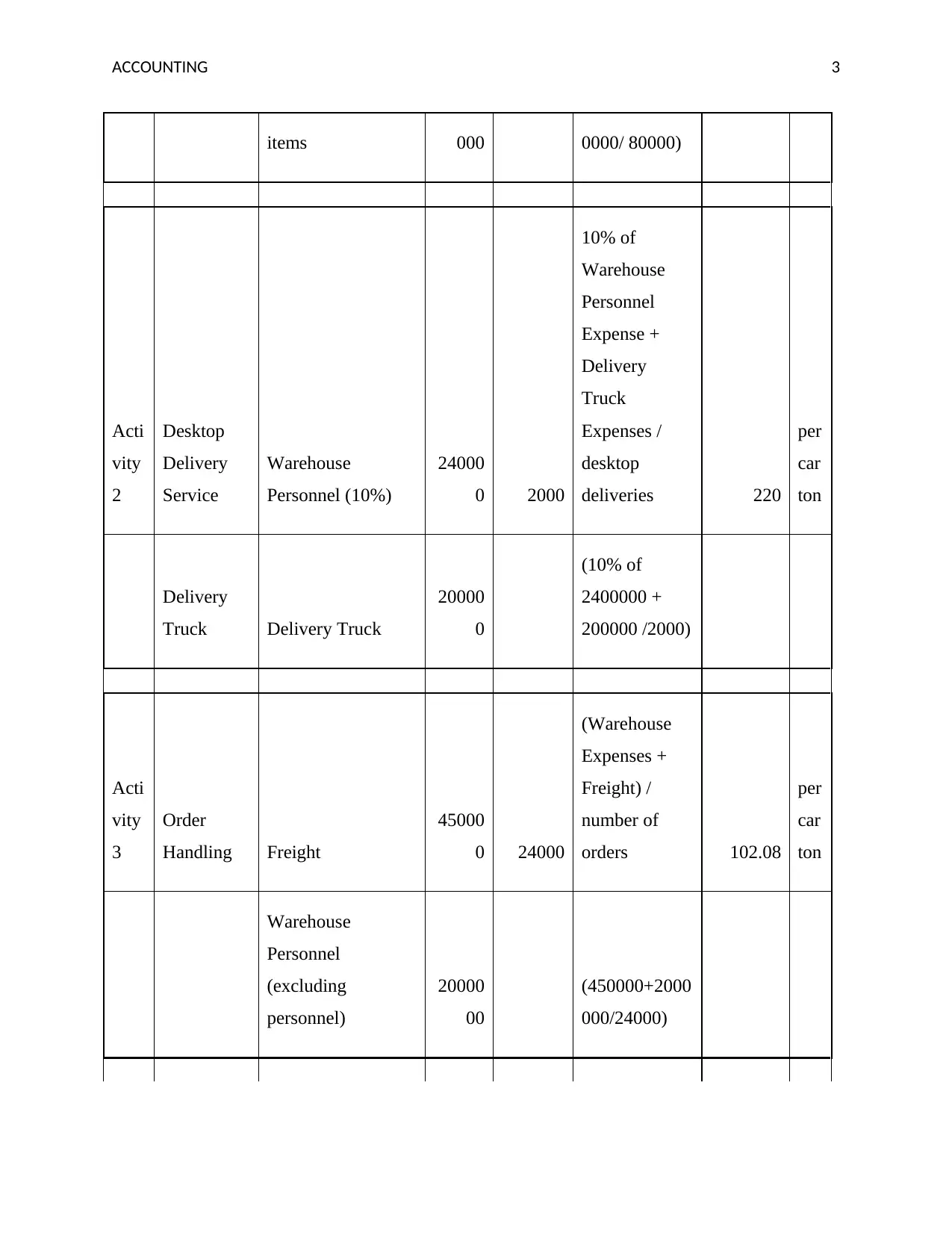

ACCOUNTING 3

items 000 0000/ 80000)

Acti

vity

2

Desktop

Delivery

Service

Warehouse

Personnel (10%)

24000

0 2000

10% of

Warehouse

Personnel

Expense +

Delivery

Truck

Expenses /

desktop

deliveries 220

per

car

ton

Delivery

Truck Delivery Truck

20000

0

(10% of

2400000 +

200000 /2000)

Acti

vity

3

Order

Handling Freight

45000

0 24000

(Warehouse

Expenses +

Freight) /

number of

orders 102.08

per

car

ton

Warehouse

Personnel

(excluding

personnel)

20000

00

(450000+2000

000/24000)

items 000 0000/ 80000)

Acti

vity

2

Desktop

Delivery

Service

Warehouse

Personnel (10%)

24000

0 2000

10% of

Warehouse

Personnel

Expense +

Delivery

Truck

Expenses /

desktop

deliveries 220

per

car

ton

Delivery

Truck Delivery Truck

20000

0

(10% of

2400000 +

200000 /2000)

Acti

vity

3

Order

Handling Freight

45000

0 24000

(Warehouse

Expenses +

Freight) /

number of

orders 102.08

per

car

ton

Warehouse

Personnel

(excluding

personnel)

20000

00

(450000+2000

000/24000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 4

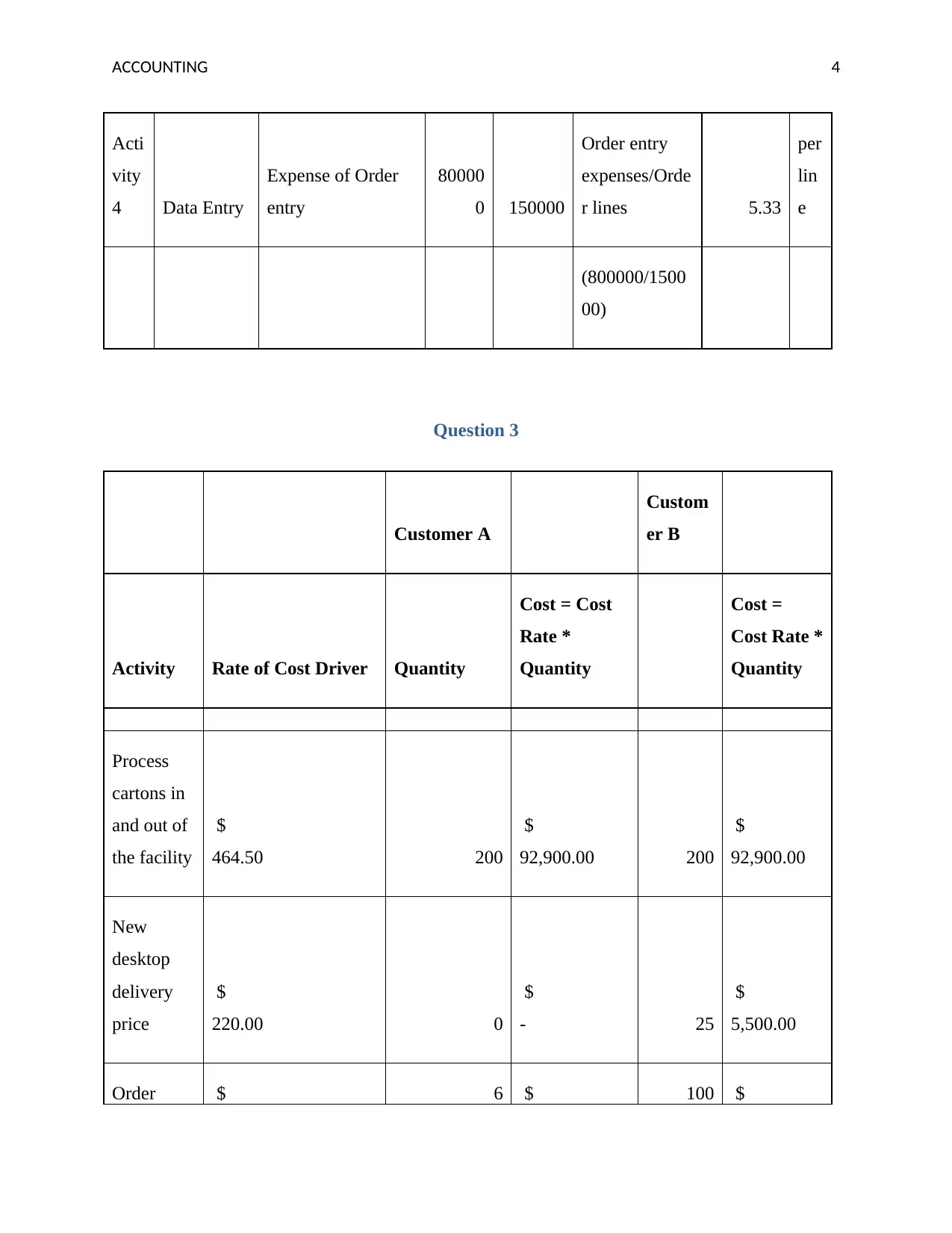

Acti

vity

4 Data Entry

Expense of Order

entry

80000

0 150000

Order entry

expenses/Orde

r lines 5.33

per

lin

e

(800000/1500

00)

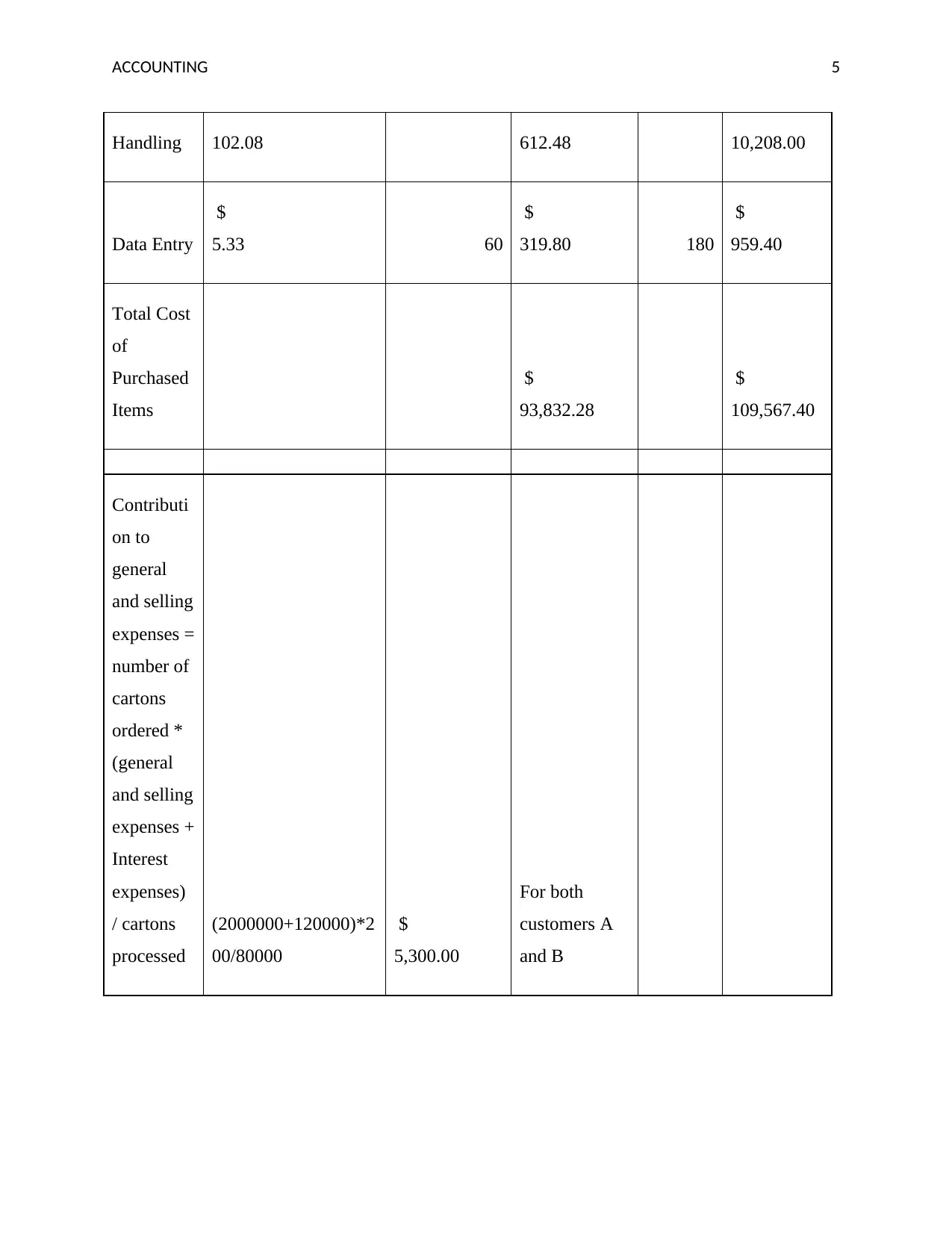

Question 3

Customer A

Custom

er B

Activity Rate of Cost Driver Quantity

Cost = Cost

Rate *

Quantity

Cost =

Cost Rate *

Quantity

Process

cartons in

and out of

the facility

$

464.50 200

$

92,900.00 200

$

92,900.00

New

desktop

delivery

price

$

220.00 0

$

- 25

$

5,500.00

Order $ 6 $ 100 $

Acti

vity

4 Data Entry

Expense of Order

entry

80000

0 150000

Order entry

expenses/Orde

r lines 5.33

per

lin

e

(800000/1500

00)

Question 3

Customer A

Custom

er B

Activity Rate of Cost Driver Quantity

Cost = Cost

Rate *

Quantity

Cost =

Cost Rate *

Quantity

Process

cartons in

and out of

the facility

$

464.50 200

$

92,900.00 200

$

92,900.00

New

desktop

delivery

price

$

220.00 0

$

- 25

$

5,500.00

Order $ 6 $ 100 $

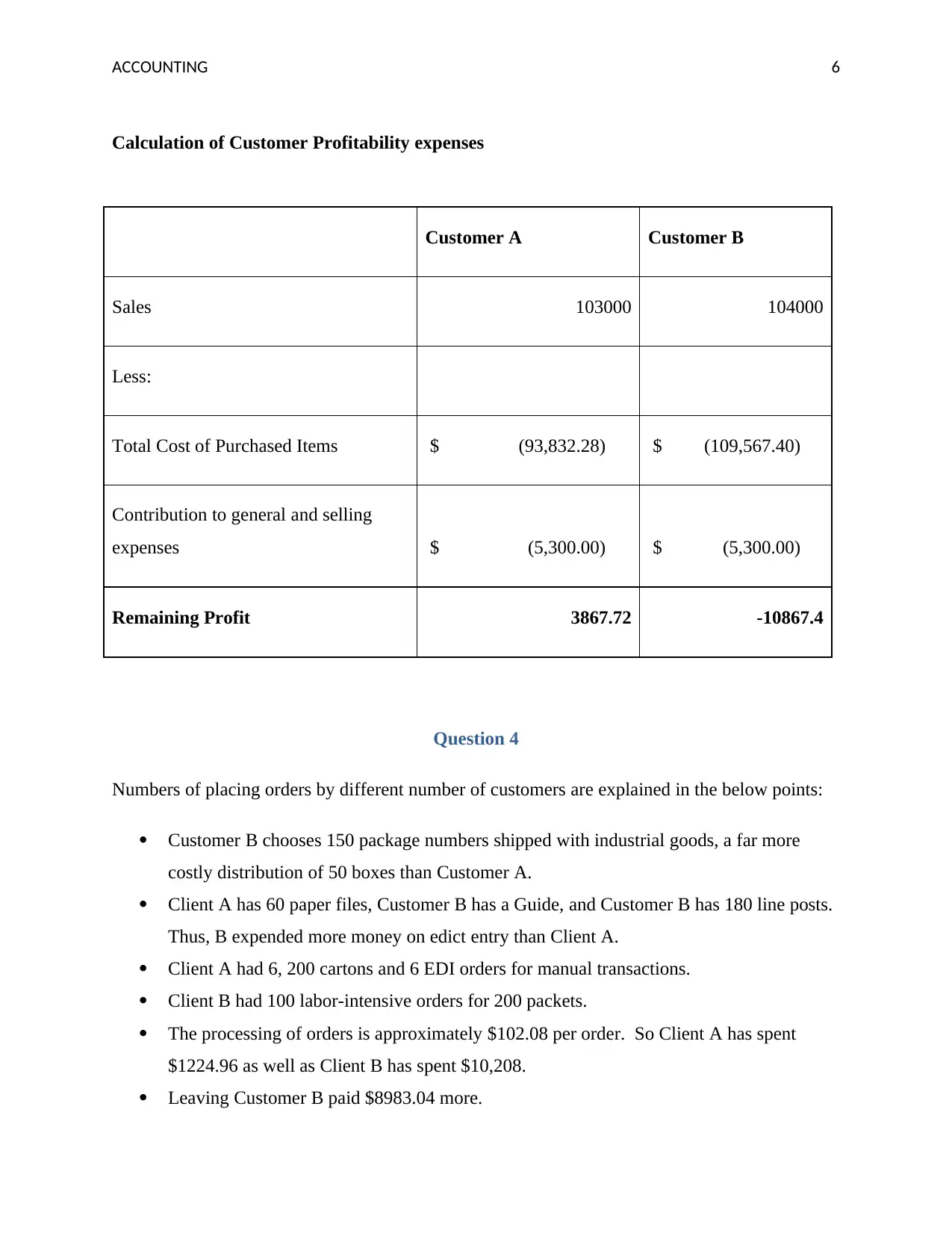

ACCOUNTING 5

Handling 102.08 612.48 10,208.00

Data Entry

$

5.33 60

$

319.80 180

$

959.40

Total Cost

of

Purchased

Items

$

93,832.28

$

109,567.40

Contributi

on to

general

and selling

expenses =

number of

cartons

ordered *

(general

and selling

expenses +

Interest

expenses)

/ cartons

processed

(2000000+120000)*2

00/80000

$

5,300.00

For both

customers A

and B

Handling 102.08 612.48 10,208.00

Data Entry

$

5.33 60

$

319.80 180

$

959.40

Total Cost

of

Purchased

Items

$

93,832.28

$

109,567.40

Contributi

on to

general

and selling

expenses =

number of

cartons

ordered *

(general

and selling

expenses +

Interest

expenses)

/ cartons

processed

(2000000+120000)*2

00/80000

$

5,300.00

For both

customers A

and B

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

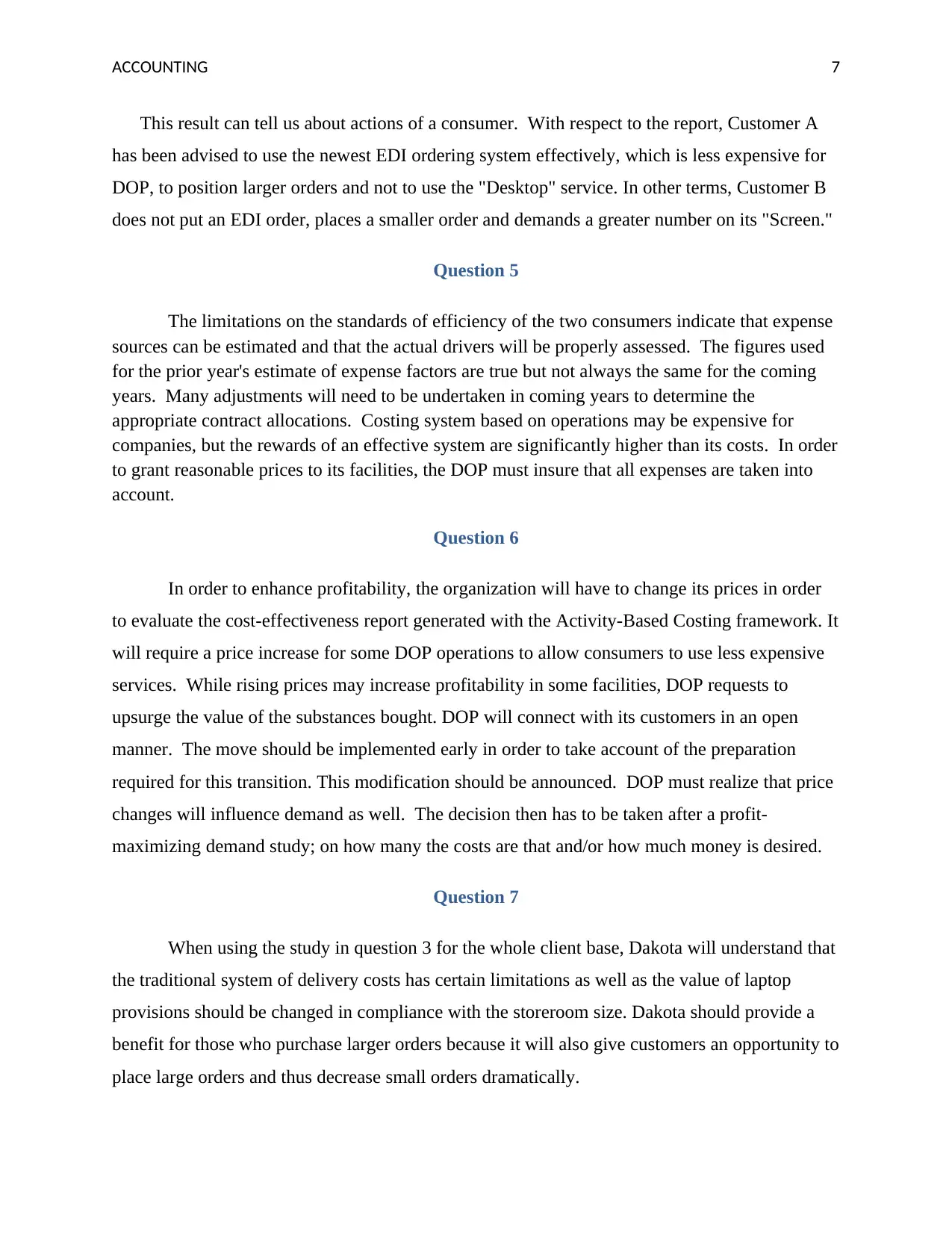

ACCOUNTING 6

Calculation of Customer Profitability expenses

Customer A Customer B

Sales 103000 104000

Less:

Total Cost of Purchased Items $ (93,832.28) $ (109,567.40)

Contribution to general and selling

expenses $ (5,300.00) $ (5,300.00)

Remaining Profit 3867.72 -10867.4

Question 4

Numbers of placing orders by different number of customers are explained in the below points:

Customer B chooses 150 package numbers shipped with industrial goods, a far more

costly distribution of 50 boxes than Customer A.

Client A has 60 paper files, Customer B has a Guide, and Customer B has 180 line posts.

Thus, B expended more money on edict entry than Client A.

Client A had 6, 200 cartons and 6 EDI orders for manual transactions.

Client B had 100 labor-intensive orders for 200 packets.

The processing of orders is approximately $102.08 per order. So Client A has spent

$1224.96 as well as Client B has spent $10,208.

Leaving Customer B paid $8983.04 more.

Calculation of Customer Profitability expenses

Customer A Customer B

Sales 103000 104000

Less:

Total Cost of Purchased Items $ (93,832.28) $ (109,567.40)

Contribution to general and selling

expenses $ (5,300.00) $ (5,300.00)

Remaining Profit 3867.72 -10867.4

Question 4

Numbers of placing orders by different number of customers are explained in the below points:

Customer B chooses 150 package numbers shipped with industrial goods, a far more

costly distribution of 50 boxes than Customer A.

Client A has 60 paper files, Customer B has a Guide, and Customer B has 180 line posts.

Thus, B expended more money on edict entry than Client A.

Client A had 6, 200 cartons and 6 EDI orders for manual transactions.

Client B had 100 labor-intensive orders for 200 packets.

The processing of orders is approximately $102.08 per order. So Client A has spent

$1224.96 as well as Client B has spent $10,208.

Leaving Customer B paid $8983.04 more.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ACCOUNTING 7

This result can tell us about actions of a consumer. With respect to the report, Customer A

has been advised to use the newest EDI ordering system effectively, which is less expensive for

DOP, to position larger orders and not to use the "Desktop" service. In other terms, Customer B

does not put an EDI order, places a smaller order and demands a greater number on its "Screen."

Question 5

The limitations on the standards of efficiency of the two consumers indicate that expense

sources can be estimated and that the actual drivers will be properly assessed. The figures used

for the prior year's estimate of expense factors are true but not always the same for the coming

years. Many adjustments will need to be undertaken in coming years to determine the

appropriate contract allocations. Costing system based on operations may be expensive for

companies, but the rewards of an effective system are significantly higher than its costs. In order

to grant reasonable prices to its facilities, the DOP must insure that all expenses are taken into

account.

Question 6

In order to enhance profitability, the organization will have to change its prices in order

to evaluate the cost-effectiveness report generated with the Activity-Based Costing framework. It

will require a price increase for some DOP operations to allow consumers to use less expensive

services. While rising prices may increase profitability in some facilities, DOP requests to

upsurge the value of the substances bought. DOP will connect with its customers in an open

manner. The move should be implemented early in order to take account of the preparation

required for this transition. This modification should be announced. DOP must realize that price

changes will influence demand as well. The decision then has to be taken after a profit-

maximizing demand study; on how many the costs are that and/or how much money is desired.

Question 7

When using the study in question 3 for the whole client base, Dakota will understand that

the traditional system of delivery costs has certain limitations as well as the value of laptop

provisions should be changed in compliance with the storeroom size. Dakota should provide a

benefit for those who purchase larger orders because it will also give customers an opportunity to

place large orders and thus decrease small orders dramatically.

This result can tell us about actions of a consumer. With respect to the report, Customer A

has been advised to use the newest EDI ordering system effectively, which is less expensive for

DOP, to position larger orders and not to use the "Desktop" service. In other terms, Customer B

does not put an EDI order, places a smaller order and demands a greater number on its "Screen."

Question 5

The limitations on the standards of efficiency of the two consumers indicate that expense

sources can be estimated and that the actual drivers will be properly assessed. The figures used

for the prior year's estimate of expense factors are true but not always the same for the coming

years. Many adjustments will need to be undertaken in coming years to determine the

appropriate contract allocations. Costing system based on operations may be expensive for

companies, but the rewards of an effective system are significantly higher than its costs. In order

to grant reasonable prices to its facilities, the DOP must insure that all expenses are taken into

account.

Question 6

In order to enhance profitability, the organization will have to change its prices in order

to evaluate the cost-effectiveness report generated with the Activity-Based Costing framework. It

will require a price increase for some DOP operations to allow consumers to use less expensive

services. While rising prices may increase profitability in some facilities, DOP requests to

upsurge the value of the substances bought. DOP will connect with its customers in an open

manner. The move should be implemented early in order to take account of the preparation

required for this transition. This modification should be announced. DOP must realize that price

changes will influence demand as well. The decision then has to be taken after a profit-

maximizing demand study; on how many the costs are that and/or how much money is desired.

Question 7

When using the study in question 3 for the whole client base, Dakota will understand that

the traditional system of delivery costs has certain limitations as well as the value of laptop

provisions should be changed in compliance with the storeroom size. Dakota should provide a

benefit for those who purchase larger orders because it will also give customers an opportunity to

place large orders and thus decrease small orders dramatically.

ACCOUNTING 8

Question 8

When there is a scenario where the full number of consumers would be sorry to put all

orders manually via the internet, otherwise company 1 would be affected: cartons inside and out

of the facility would shift and the rates would be changed by driver suit.

Price = EDI orders / EDI operating hours Rate= 8,000 / 500 = 16 orders per hour

Total orders / hour orders = 24,000 / 16 = 1500 working hours and 8,500 working hours

fewer than 10000 spent hours. Therefore, it invested 85% less on salaries.

Activity 4: data entry would be impacted because the expense of EDI would be decreased

while using and the same cost per line will be reduced.

The cost drivers have reduced, as defined by Question 2 of the 4 operation, so that the

consumer increases income. A better way should also be to receive payments from consumers, so

that the loan interest rate is not equivalent and reduces annual profit.

The Cost-effectiveness would be much developed since the distribution of two out of four

vile operation outlays would decline to increase income per company, and the benefit would also

be decreased by the number of customers making smaller orders (Jiambalvo, 2015).

Question 8

When there is a scenario where the full number of consumers would be sorry to put all

orders manually via the internet, otherwise company 1 would be affected: cartons inside and out

of the facility would shift and the rates would be changed by driver suit.

Price = EDI orders / EDI operating hours Rate= 8,000 / 500 = 16 orders per hour

Total orders / hour orders = 24,000 / 16 = 1500 working hours and 8,500 working hours

fewer than 10000 spent hours. Therefore, it invested 85% less on salaries.

Activity 4: data entry would be impacted because the expense of EDI would be decreased

while using and the same cost per line will be reduced.

The cost drivers have reduced, as defined by Question 2 of the 4 operation, so that the

consumer increases income. A better way should also be to receive payments from consumers, so

that the loan interest rate is not equivalent and reduces annual profit.

The Cost-effectiveness would be much developed since the distribution of two out of four

vile operation outlays would decline to increase income per company, and the benefit would also

be decreased by the number of customers making smaller orders (Jiambalvo, 2015).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ACCOUNTING 9

References

Jiambalvo, J. (2015). Managerial Accounting, Binder Ready Version (Sixth Edition Ed.). United

States: John Wiley & Sons.

Kaplan, R. S. (2005). Dakota Office Products Harvard Business School, Boston, MA.

References

Jiambalvo, J. (2015). Managerial Accounting, Binder Ready Version (Sixth Edition Ed.). United

States: John Wiley & Sons.

Kaplan, R. S. (2005). Dakota Office Products Harvard Business School, Boston, MA.

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.