Corporate Accounting: Detailed Analysis of AASB 136 on Asset Valuation

VerifiedAdded on 2023/06/11

|10

|2727

|409

Report

AI Summary

This report provides a comprehensive analysis of AASB 136, focusing on the accounting provisions for the impairment of assets. It includes a detailed evaluation of how to compute the recoverable amount, value in use, and fair value of an asset, considering the cost of disposal. The study incorporates journal entries for recording impairment losses of cash-generating units, adhering to AASB 136 guidelines. Part A discusses the standard's specifications, emphasizing the importance of ensuring assets are recognized at their recoverable amounts and addressing the accounting for reversal of impairment losses. Part B delves into the accounting of impairment losses for cash-generating units, covering the recognition, measurement, and allocation of these losses, including practical examples and relevant journal entries. The report concludes by summarizing the key aspects of AASB 136 and its application in corporate accounting.

Corporate accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Introduction................................................................................................................................3

Part A.........................................................................................................................................3

Part B..........................................................................................................................................6

Conclusion..................................................................................................................................9

References................................................................................................................................10

Introduction................................................................................................................................3

Part A.........................................................................................................................................3

Part B..........................................................................................................................................6

Conclusion..................................................................................................................................9

References................................................................................................................................10

Introduction

AASB 136 states the accounting provisions for the Impairment of Assets supported by

amendments incorporated by IAS 36 Impairment of Assets as provided by the IASB

(Kuzmina and Kozlovska, 2012). The present study provides descriptive evaluation for

computation of recoverable amount, the value in use and fair value of asset by rducing cost of

disposable by considering relevant subsections. The study further incorporates journal entries

for recording impairment loss of cash generating unit by considering appropriate provisions

of AASB 136.

Part A

AASB 136 provides specification relating to the impairment of assets. The main aim behind

specified standard is to stipulate the process that entities pertain to make sure that its assets

are conceded in comparison to their recoverable amount (Impairment of Asset. AASB 136,

2016). Impairment loss for asset is recorded in situation where carrying book amount is

higher in comparison to this recoverable value. If this condition is said to be satisfied, than

the concerned asset is illustrated to record loss due impairment and as per the provision of

cited standard decrease in value is shown as loss in books of accounts. It also indicates in

situation where organization is required to do accounting for reversal of loss shown as

impairment AASB 136 is applied for accounting all the assets except the following:

Inventories (the same is dealt as AASB 102)

Assets relating to construction contracts

Deferred tax asset

Financial assets which are covered under AASB 139.

Non-current asset

Investment property

Assets covered under AASB 141and AASB 1023

Impairment of revaluing asset depends on the basis which is being applied for ascertaining

the fair value of the asset (HUANG, WANG and JI, 2017). In case the fair value of asset is its

market value than the variation between fair value deducted by the cost to sell and asset’s fair

value is believed as the direct incremental cost for selling of the asset. However, in case of

disposal cost is equal to negligible amount than the recoverable amount of revalued asset is

AASB 136 states the accounting provisions for the Impairment of Assets supported by

amendments incorporated by IAS 36 Impairment of Assets as provided by the IASB

(Kuzmina and Kozlovska, 2012). The present study provides descriptive evaluation for

computation of recoverable amount, the value in use and fair value of asset by rducing cost of

disposable by considering relevant subsections. The study further incorporates journal entries

for recording impairment loss of cash generating unit by considering appropriate provisions

of AASB 136.

Part A

AASB 136 provides specification relating to the impairment of assets. The main aim behind

specified standard is to stipulate the process that entities pertain to make sure that its assets

are conceded in comparison to their recoverable amount (Impairment of Asset. AASB 136,

2016). Impairment loss for asset is recorded in situation where carrying book amount is

higher in comparison to this recoverable value. If this condition is said to be satisfied, than

the concerned asset is illustrated to record loss due impairment and as per the provision of

cited standard decrease in value is shown as loss in books of accounts. It also indicates in

situation where organization is required to do accounting for reversal of loss shown as

impairment AASB 136 is applied for accounting all the assets except the following:

Inventories (the same is dealt as AASB 102)

Assets relating to construction contracts

Deferred tax asset

Financial assets which are covered under AASB 139.

Non-current asset

Investment property

Assets covered under AASB 141and AASB 1023

Impairment of revaluing asset depends on the basis which is being applied for ascertaining

the fair value of the asset (HUANG, WANG and JI, 2017). In case the fair value of asset is its

market value than the variation between fair value deducted by the cost to sell and asset’s fair

value is believed as the direct incremental cost for selling of the asset. However, in case of

disposal cost is equal to negligible amount than the recoverable amount of revalued asset is

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

higher in comparison to the revalued amount. In case cost of selling the asset is not negligible

that in this case revalue asset will be impaired only in case the value is used is less than the

revalued amount.

Recoverable amount

In accordance with provision specified in AASB 136, the recoverable amount can be referred

as the amount greater of assets fair value adjusted by selling costs and value in its use. Under

paragraph 19-57 states the needs to be considered for calculation of recoverable amount.

Ascertainment of market value adjusted by selling costs, and fair value of the asset is not

always necessary to be calculated (Feige and Reichman, 2015). As in case any of these two

amounts exceeds the written down value than in such situation impairment loss is not

recorded, and due to the same reason, then computation of other amount is not necessary. In

case asset is not traded in the active market, then in such scenario fair value is ascertained

through making an appropriate estimate of the value by considering its selling price as per

arm’s length transaction within well-informed and interested individuals. In specified

situation, the recoverable amount is also considered to be fair value if active market for asset

does not exist.

Recoverable amount can be ascertained for a single asset in the situation where it does not

create inflows of cash that are mostly sovereign of the assets or group of assets. In such

situation, recoverable amounts are resolved for the cash producing unit to which the assets

belong till:

Market Value of disposal must be more than its carrying value.

Computation of value in use of asset is done by adjusting selling cost from the fair

value of asset or market value less cost of disposal.

In few cases, approximation, averages and evaluation shortcuts might offer an appropriate

estimation of the enlarged computations described under Standard for an influential fair value

of asset adjusted by selling costs or value in use.

Value in use

As per AASB 136, in order to ascertain value in use, there are some variants which shall be

considered are as follows:

that in this case revalue asset will be impaired only in case the value is used is less than the

revalued amount.

Recoverable amount

In accordance with provision specified in AASB 136, the recoverable amount can be referred

as the amount greater of assets fair value adjusted by selling costs and value in its use. Under

paragraph 19-57 states the needs to be considered for calculation of recoverable amount.

Ascertainment of market value adjusted by selling costs, and fair value of the asset is not

always necessary to be calculated (Feige and Reichman, 2015). As in case any of these two

amounts exceeds the written down value than in such situation impairment loss is not

recorded, and due to the same reason, then computation of other amount is not necessary. In

case asset is not traded in the active market, then in such scenario fair value is ascertained

through making an appropriate estimate of the value by considering its selling price as per

arm’s length transaction within well-informed and interested individuals. In specified

situation, the recoverable amount is also considered to be fair value if active market for asset

does not exist.

Recoverable amount can be ascertained for a single asset in the situation where it does not

create inflows of cash that are mostly sovereign of the assets or group of assets. In such

situation, recoverable amounts are resolved for the cash producing unit to which the assets

belong till:

Market Value of disposal must be more than its carrying value.

Computation of value in use of asset is done by adjusting selling cost from the fair

value of asset or market value less cost of disposal.

In few cases, approximation, averages and evaluation shortcuts might offer an appropriate

estimation of the enlarged computations described under Standard for an influential fair value

of asset adjusted by selling costs or value in use.

Value in use

As per AASB 136, in order to ascertain value in use, there are some variants which shall be

considered are as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Approximate value of the cash flows for future years of the entity anticipates

obtaining from the asset.

Anticipation regarding probable variant into the amount or timing of prospected cash

inflows.

Time value of money, symbolize by the present market threat liberated interest rate

(Bond, Govendir and Wells, 2016).

Price for demeanour the ambiguity inbuilt into an asset.

Other factors like liquidity, market applicants would imitate in pricing the future cash

flows the entity anticipate constraining from the market.

For the computation of value in use there are few steps which are to be followed as per

Para31 of AASB 136, the same have been specified below:

Calculating the future inflows and outflows of cash to be derived from enduring

utilizing of the assets and from its eventual disposal.

Application of viable rate of discounting to adjust future cash flows to determine

present value of asset.

The factors that are recognized under provisions of (b), (d) and (e) of paragraph 30 can be

referred either as an adjustment the FCF or as an adjustment by using the discounting rate.

Whatever way is being implement to reflect prospect about probable alternatives in the

amount or time value of FCF the consequence should replicate present value of asset by

considering the weighted average of computed inflow that will be derived in future.

Fair value less cost in disposal

As per the views of Rennekamp, Rupar and Seybert, (2014) the most appropriate evidence

which can be applied for determination of fair value of non-current asset reduced by cost to

sale is the amount present in sale agreement in arm’s length transaction. The same is

adjusted by adding the amount which is being paid directly in order to dispose of the asset.

In case agreement abiding the sale is not available due to the absence of lively market of an

asset than fair value less cost to the asset is ascertained through reducing disposal cost from

the fair value. The current bid price is taken as the market price of the asset.

Cost of selling off other than which has been identified as liabilities are eliminated in

calculating fair value lesser than costs of disposal. This cost is inclusive of, stamp duty,

operation taxes, legal costs, expenses of elimination of the asset and direct incremental costs

obtaining from the asset.

Anticipation regarding probable variant into the amount or timing of prospected cash

inflows.

Time value of money, symbolize by the present market threat liberated interest rate

(Bond, Govendir and Wells, 2016).

Price for demeanour the ambiguity inbuilt into an asset.

Other factors like liquidity, market applicants would imitate in pricing the future cash

flows the entity anticipate constraining from the market.

For the computation of value in use there are few steps which are to be followed as per

Para31 of AASB 136, the same have been specified below:

Calculating the future inflows and outflows of cash to be derived from enduring

utilizing of the assets and from its eventual disposal.

Application of viable rate of discounting to adjust future cash flows to determine

present value of asset.

The factors that are recognized under provisions of (b), (d) and (e) of paragraph 30 can be

referred either as an adjustment the FCF or as an adjustment by using the discounting rate.

Whatever way is being implement to reflect prospect about probable alternatives in the

amount or time value of FCF the consequence should replicate present value of asset by

considering the weighted average of computed inflow that will be derived in future.

Fair value less cost in disposal

As per the views of Rennekamp, Rupar and Seybert, (2014) the most appropriate evidence

which can be applied for determination of fair value of non-current asset reduced by cost to

sale is the amount present in sale agreement in arm’s length transaction. The same is

adjusted by adding the amount which is being paid directly in order to dispose of the asset.

In case agreement abiding the sale is not available due to the absence of lively market of an

asset than fair value less cost to the asset is ascertained through reducing disposal cost from

the fair value. The current bid price is taken as the market price of the asset.

Cost of selling off other than which has been identified as liabilities are eliminated in

calculating fair value lesser than costs of disposal. This cost is inclusive of, stamp duty,

operation taxes, legal costs, expenses of elimination of the asset and direct incremental costs

to fetch an asset into circumstance for its sale. Though standstill gains which are described

under AASB 119 and costs related to dropping or restructuring business following the

disposal of an asset are no express additional costs to organize of the asset. Sometimes the

selling off of an asset would involve the purchaser to presume a liability and only a solitary

fair value cost of disposal is accessible for assets as well as liability. Paragraph 78 of AASB

113 specifies the manner of dealing such issues.

Part B

Impairment loss of cash generating unit can be defined as the amount which shows an excess

of the recoverable amount in comparison to the written down value of the asset. Accounting

of impairment loss is covered under Paragraphs 58-64 of AASB 136 for the purpose

ascertainment and evaluation of impairment losses (Deegan, 2012). However, these

provisions will not be applicable for goodwill. Further, in this aspect, Paragraphs 12-14

shows an indication that any impairment loss has been incurred or not and if any of those

indications exists then the company is required to make an estimation of the recoverable

amount (Bowen and Khan, 2014). However, there is an exception to this provisions in

paragraph 10 in which entity is not required to make a formal estimation of the recoverable

amount if there is no hint of impairment loss in present scenario.

According to the provision of paragraph 59, even in the recoverable amount of an asset is

comparatively lower than the carrying amount than in such situation carrying value of CGU

is reduced to its recoverable value (Olante, 2013). This reduction value is recorded as an

impairment loss. Further, paragraph 60 the standard states that impairment loss is recorded in

profit and loss account on immediate basis until the asset is carried at the revalued amount as

per another standard like AASB 116 which deals with revaluation model of the assets. This

paragraph also states that impairment loss associated with the revalued asset will be

considered as decreased in revalued amount. Further, paragraph 61 of the asset states that

impairment loss of the assets which have not been revalued will be recorded profit and loss

account (Weil, Schipper and Francis, 2013). On the contrary, impairment loss of revalued

assets will be shown in other comprehensive income statement. In this amount to be shown

will be restricted to the quantum of loss of impairment does not surpass the value of

revaluation surplus for that specific asset. In a situation where loss of impairment is higher

than carrying amount that entity is required to recognise liability only if it is required by any

other section.

under AASB 119 and costs related to dropping or restructuring business following the

disposal of an asset are no express additional costs to organize of the asset. Sometimes the

selling off of an asset would involve the purchaser to presume a liability and only a solitary

fair value cost of disposal is accessible for assets as well as liability. Paragraph 78 of AASB

113 specifies the manner of dealing such issues.

Part B

Impairment loss of cash generating unit can be defined as the amount which shows an excess

of the recoverable amount in comparison to the written down value of the asset. Accounting

of impairment loss is covered under Paragraphs 58-64 of AASB 136 for the purpose

ascertainment and evaluation of impairment losses (Deegan, 2012). However, these

provisions will not be applicable for goodwill. Further, in this aspect, Paragraphs 12-14

shows an indication that any impairment loss has been incurred or not and if any of those

indications exists then the company is required to make an estimation of the recoverable

amount (Bowen and Khan, 2014). However, there is an exception to this provisions in

paragraph 10 in which entity is not required to make a formal estimation of the recoverable

amount if there is no hint of impairment loss in present scenario.

According to the provision of paragraph 59, even in the recoverable amount of an asset is

comparatively lower than the carrying amount than in such situation carrying value of CGU

is reduced to its recoverable value (Olante, 2013). This reduction value is recorded as an

impairment loss. Further, paragraph 60 the standard states that impairment loss is recorded in

profit and loss account on immediate basis until the asset is carried at the revalued amount as

per another standard like AASB 116 which deals with revaluation model of the assets. This

paragraph also states that impairment loss associated with the revalued asset will be

considered as decreased in revalued amount. Further, paragraph 61 of the asset states that

impairment loss of the assets which have not been revalued will be recorded profit and loss

account (Weil, Schipper and Francis, 2013). On the contrary, impairment loss of revalued

assets will be shown in other comprehensive income statement. In this amount to be shown

will be restricted to the quantum of loss of impairment does not surpass the value of

revaluation surplus for that specific asset. In a situation where loss of impairment is higher

than carrying amount that entity is required to recognise liability only if it is required by any

other section.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

As per para 63, the depreciation (amortisation) after the accounting of impairment loss is to

be charged for the concerned asset, or CGU shall be adjusted in future years to be allocated

for revised carrying amount of asset after making an adjustment of residual value on a

systematic basis (Cotter, 2012).

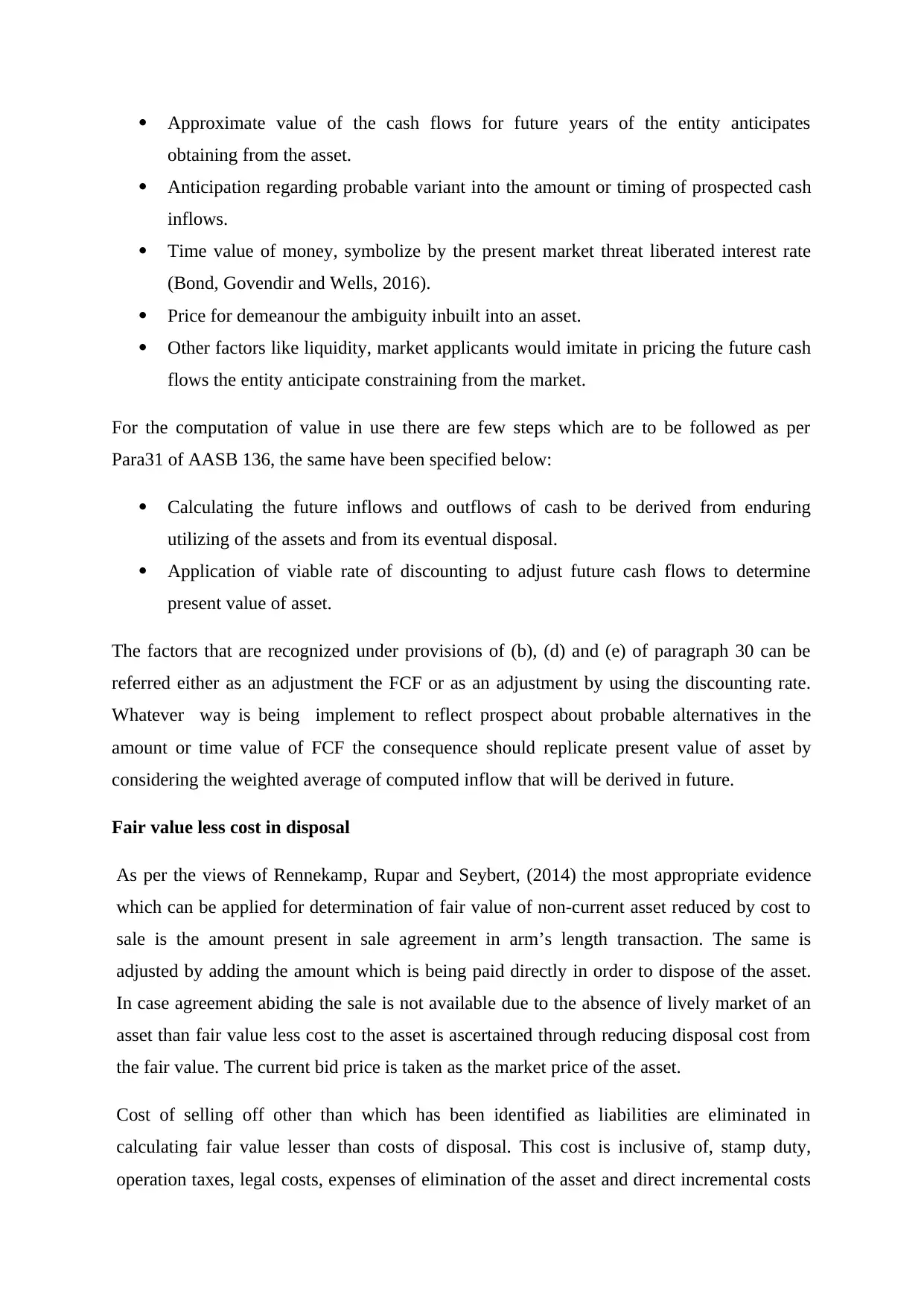

Recognising and measurement of an impairment loss

In a situation where the recoverable amount of asset is not higher in comparison to the

carrying amount then an impairment loss is recorded in the books of account. It is because;

carrying value is required to be reduced to the extent of the recoverable amount (Deegan,

2012). Therefore, the variation between the amount of carrying value and recoverable loss is

known as impairment loss (Impairment of Asset. AASB 136, 2016). This loss is recognized as

deficit in the income statement. In a situation where there is a reduction in value of specific

asset than impairment loss is recorded by considering the provision of a specific standard.

Further, in case of cash generating unit (CGU) impairment loss is recorded and apportioned

in the following manner:

Initially, there is a requirement to make a reduction in carrying the amount of

goodwill allocating to the CGU (AASB 136 - Impairment of Assets - August 2015,

2015).

Further, the remaining loss is apportioned to the remaining assets in the CGU as per

pro rata basis by considering carrying amount of each asset.

In such computation, it is required to be considered that carrying value of individual assets

within a cash-generating unit cannot be reduced below than maximum of fair value after

making adjustment of costs of disposal (if it can be determined ), value in use (if it can be

determined) or zero (Bond, Govendir and Wells, 2015).

Table 1: Statement showing the calculation of impairment loss for Alex Ltd

Particulars Amount

Asset Carried Value in books of account $266,200

Less: Value in use of assets $239,200

Impairment loss $27,000

be charged for the concerned asset, or CGU shall be adjusted in future years to be allocated

for revised carrying amount of asset after making an adjustment of residual value on a

systematic basis (Cotter, 2012).

Recognising and measurement of an impairment loss

In a situation where the recoverable amount of asset is not higher in comparison to the

carrying amount then an impairment loss is recorded in the books of account. It is because;

carrying value is required to be reduced to the extent of the recoverable amount (Deegan,

2012). Therefore, the variation between the amount of carrying value and recoverable loss is

known as impairment loss (Impairment of Asset. AASB 136, 2016). This loss is recognized as

deficit in the income statement. In a situation where there is a reduction in value of specific

asset than impairment loss is recorded by considering the provision of a specific standard.

Further, in case of cash generating unit (CGU) impairment loss is recorded and apportioned

in the following manner:

Initially, there is a requirement to make a reduction in carrying the amount of

goodwill allocating to the CGU (AASB 136 - Impairment of Assets - August 2015,

2015).

Further, the remaining loss is apportioned to the remaining assets in the CGU as per

pro rata basis by considering carrying amount of each asset.

In such computation, it is required to be considered that carrying value of individual assets

within a cash-generating unit cannot be reduced below than maximum of fair value after

making adjustment of costs of disposal (if it can be determined ), value in use (if it can be

determined) or zero (Bond, Govendir and Wells, 2015).

Table 1: Statement showing the calculation of impairment loss for Alex Ltd

Particulars Amount

Asset Carried Value in books of account $266,200

Less: Value in use of assets $239,200

Impairment loss $27,000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

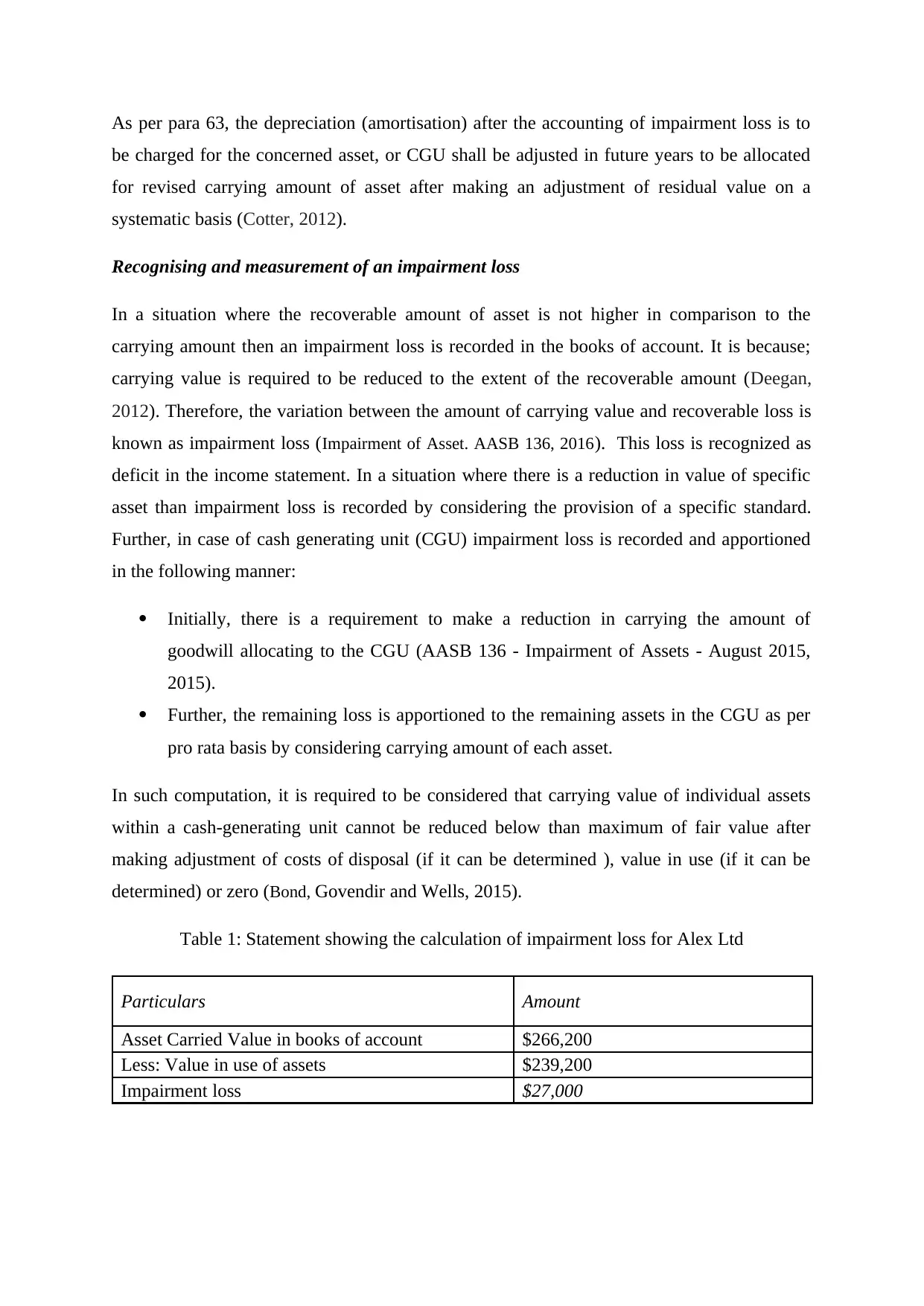

Table 2: Statement showing apportioned impairment losses to the assets in cash generating

unit

Particulars Amount

Impairment loss $27,000.00

Less: Goodwill $9,000.00

Less: Impairment loss allocated to Land $6,551.00

$11,449.00

Table 3: Statement showing the apportionment of Impairment loss to the assets in cash

generating unit

Asset Value in

Use

Calculation

of Allocable

Impairment

loss

New Amount to be carried

in Balance Sheet

Franchise $41,000.00

11449*(4100

0/78000) 6018.064 $ 34,981.94

Furniture $ 26,000.00

11449*(2600

0/78000) 3816.333 $ 22,183.67

Inventory $ 11,000.00

11449*(1100

0/78000) 1614.603 $ 9,385.40

$78,000.00 $ 66,551.00

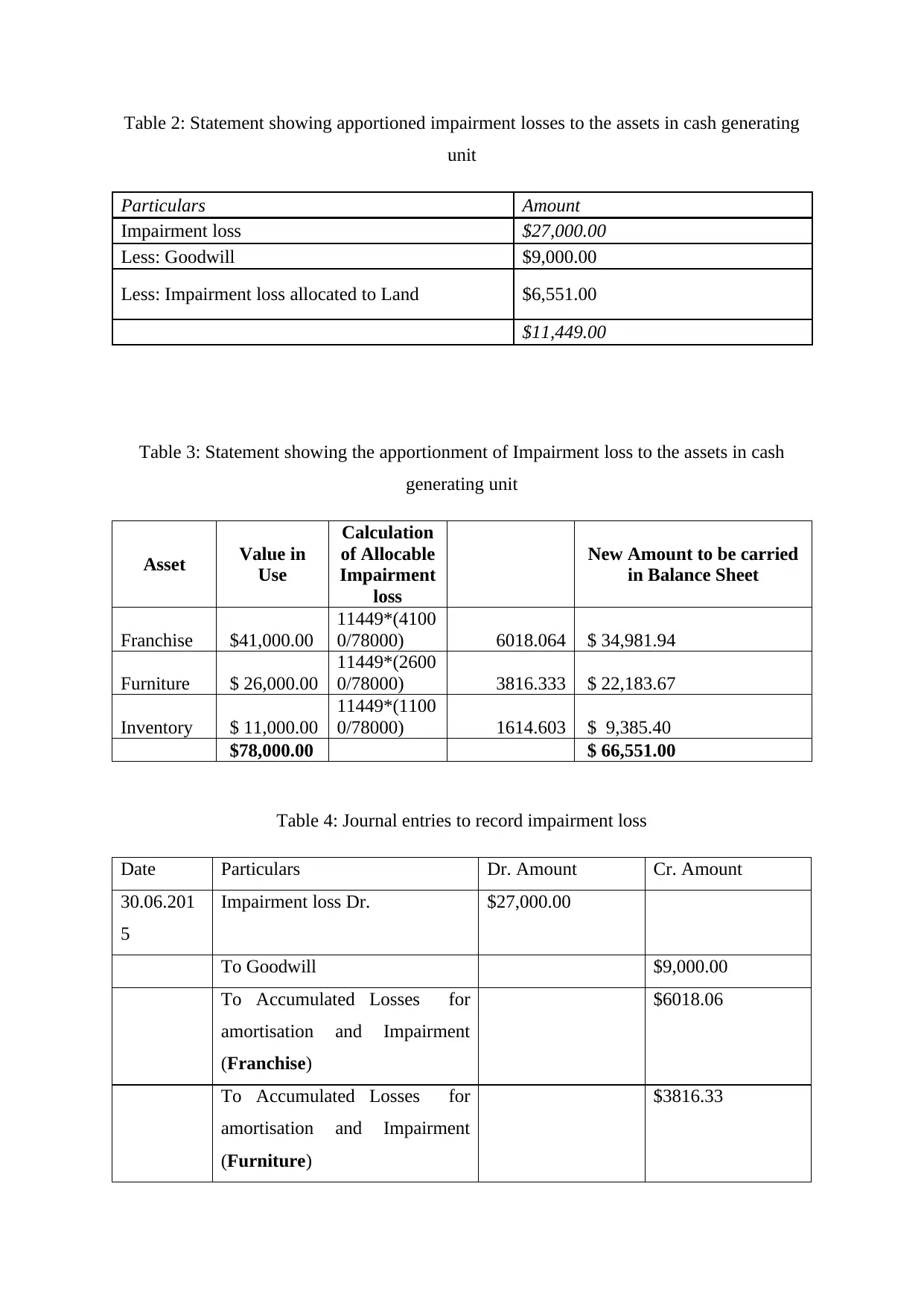

Table 4: Journal entries to record impairment loss

Date Particulars Dr. Amount Cr. Amount

30.06.201

5

Impairment loss Dr. $27,000.00

To Goodwill $9,000.00

To Accumulated Losses for

amortisation and Impairment

(Franchise)

$6018.06

To Accumulated Losses for

amortisation and Impairment

(Furniture)

$3816.33

unit

Particulars Amount

Impairment loss $27,000.00

Less: Goodwill $9,000.00

Less: Impairment loss allocated to Land $6,551.00

$11,449.00

Table 3: Statement showing the apportionment of Impairment loss to the assets in cash

generating unit

Asset Value in

Use

Calculation

of Allocable

Impairment

loss

New Amount to be carried

in Balance Sheet

Franchise $41,000.00

11449*(4100

0/78000) 6018.064 $ 34,981.94

Furniture $ 26,000.00

11449*(2600

0/78000) 3816.333 $ 22,183.67

Inventory $ 11,000.00

11449*(1100

0/78000) 1614.603 $ 9,385.40

$78,000.00 $ 66,551.00

Table 4: Journal entries to record impairment loss

Date Particulars Dr. Amount Cr. Amount

30.06.201

5

Impairment loss Dr. $27,000.00

To Goodwill $9,000.00

To Accumulated Losses for

amortisation and Impairment

(Franchise)

$6018.06

To Accumulated Losses for

amortisation and Impairment

(Furniture)

$3816.33

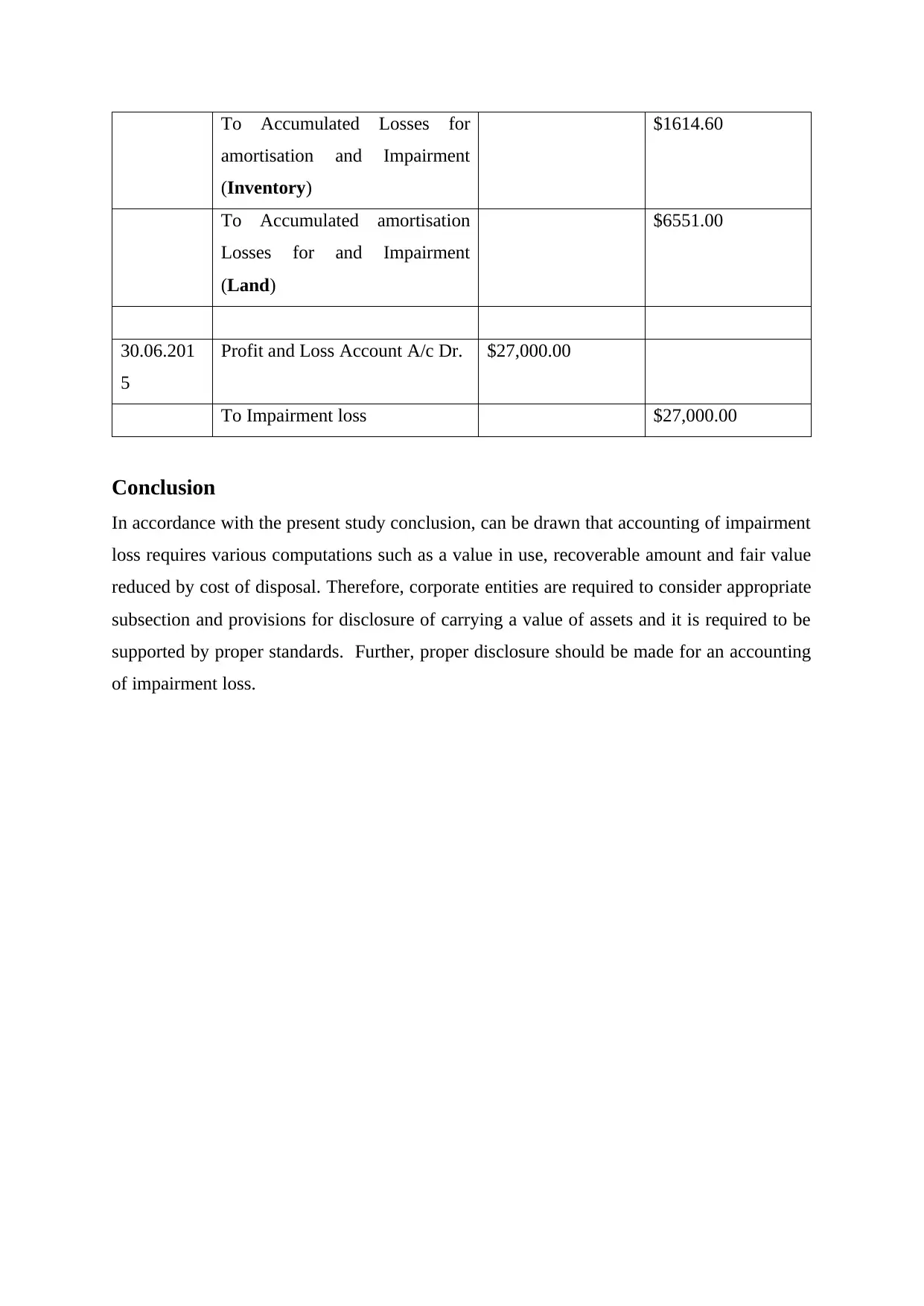

To Accumulated Losses for

amortisation and Impairment

(Inventory)

$1614.60

To Accumulated amortisation

Losses for and Impairment

(Land)

$6551.00

30.06.201

5

Profit and Loss Account A/c Dr. $27,000.00

To Impairment loss $27,000.00

Conclusion

In accordance with the present study conclusion, can be drawn that accounting of impairment

loss requires various computations such as a value in use, recoverable amount and fair value

reduced by cost of disposal. Therefore, corporate entities are required to consider appropriate

subsection and provisions for disclosure of carrying a value of assets and it is required to be

supported by proper standards. Further, proper disclosure should be made for an accounting

of impairment loss.

amortisation and Impairment

(Inventory)

$1614.60

To Accumulated amortisation

Losses for and Impairment

(Land)

$6551.00

30.06.201

5

Profit and Loss Account A/c Dr. $27,000.00

To Impairment loss $27,000.00

Conclusion

In accordance with the present study conclusion, can be drawn that accounting of impairment

loss requires various computations such as a value in use, recoverable amount and fair value

reduced by cost of disposal. Therefore, corporate entities are required to consider appropriate

subsection and provisions for disclosure of carrying a value of assets and it is required to be

supported by proper standards. Further, proper disclosure should be made for an accounting

of impairment loss.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

AASB 136 - Impairment of Assets - August 2015, 2015. [Online]. Available through <

https://www.legislation.gov.au/Details/F2017C00297/Download>. [Accessed on 28th May 2018]

Bond, D., Govendir, D., and Wells, P., 2015. [Online]. Available through <

https://www.ifrs.org/-/media/feature/events-and-conferences/2015/iasb-research-forum/evaluation-of-

asset.pdf?la=en&hash=44C2B6A87C6E38DC8782D2C96565521CDB958770>. [Accessed on 28th

May 2018]

Bowen, R.M. and Khan, U., 2014. Market reactions to policy deliberations on fair value

accounting and impairment rules during the financial crisis of 2008–2009. Journal of

Accounting and Public Policy, 33(3), pp.233-259.

Cotter, D., 2012. Advanced financial reporting: A complete guide to IFRS. Financial

Times/Prentice Hall.

Deegan, C., 2012. Australian financial accounting. McGraw-Hill Education Australia.

Feige, U. and Reichman, D., 2015. Recoverable values for independent sets. Random Structures &

Algorithms, 46(1), pp.142-159.

HUANG, B., WANG, M. and JI, J., 2017. The supervision of institutional investors,“Big Bath” and

cost stickiness: a perspective of asset impairment. Journal of Nanjing University of Finance and

Economics, 4, p.006.

Impairment of Asset. AASB 136. 2016. [Online]. Available through <

http://www.aasb.gov.au/admin/file/content105/c9/AASB136_07-04_COMPjun09_01-10.pdf>.

[Accessed on 28th May 2018]

Kuzmina, I. and Kozlovska, I., 2012. ACCOUNTING MEASUREMENT OF LONG-LIVED

ASSETS: A CASE OF IMPAIRMENT PRACTICE. Journal of Business Management, (5).

Olante, M.E., 2013. Overpaid acquisitions and goodwill impairment losses—Evidence from

the US. Advances in Accounting, 29(2), pp.243-254.

Rennekamp, K., Rupar, K.K. and Seybert, N., 2014. Impaired judgment: The effects of asset

impairment reversibility and cognitive dissonance on future investment. The Accounting

Review, 90(2), pp.739-759.

Weil, R.L., Schipper, K. and Francis, J., 2013. Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

AASB 136 - Impairment of Assets - August 2015, 2015. [Online]. Available through <

https://www.legislation.gov.au/Details/F2017C00297/Download>. [Accessed on 28th May 2018]

Bond, D., Govendir, D., and Wells, P., 2015. [Online]. Available through <

https://www.ifrs.org/-/media/feature/events-and-conferences/2015/iasb-research-forum/evaluation-of-

asset.pdf?la=en&hash=44C2B6A87C6E38DC8782D2C96565521CDB958770>. [Accessed on 28th

May 2018]

Bowen, R.M. and Khan, U., 2014. Market reactions to policy deliberations on fair value

accounting and impairment rules during the financial crisis of 2008–2009. Journal of

Accounting and Public Policy, 33(3), pp.233-259.

Cotter, D., 2012. Advanced financial reporting: A complete guide to IFRS. Financial

Times/Prentice Hall.

Deegan, C., 2012. Australian financial accounting. McGraw-Hill Education Australia.

Feige, U. and Reichman, D., 2015. Recoverable values for independent sets. Random Structures &

Algorithms, 46(1), pp.142-159.

HUANG, B., WANG, M. and JI, J., 2017. The supervision of institutional investors,“Big Bath” and

cost stickiness: a perspective of asset impairment. Journal of Nanjing University of Finance and

Economics, 4, p.006.

Impairment of Asset. AASB 136. 2016. [Online]. Available through <

http://www.aasb.gov.au/admin/file/content105/c9/AASB136_07-04_COMPjun09_01-10.pdf>.

[Accessed on 28th May 2018]

Kuzmina, I. and Kozlovska, I., 2012. ACCOUNTING MEASUREMENT OF LONG-LIVED

ASSETS: A CASE OF IMPAIRMENT PRACTICE. Journal of Business Management, (5).

Olante, M.E., 2013. Overpaid acquisitions and goodwill impairment losses—Evidence from

the US. Advances in Accounting, 29(2), pp.243-254.

Rennekamp, K., Rupar, K.K. and Seybert, N., 2014. Impaired judgment: The effects of asset

impairment reversibility and cognitive dissonance on future investment. The Accounting

Review, 90(2), pp.739-759.

Weil, R.L., Schipper, K. and Francis, J., 2013. Financial accounting: an introduction to

concepts, methods and uses. Cengage Learning.

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.