HI5020 Corporate Accounting Assessment: Retail Food Group (RFG) Review

VerifiedAdded on 2023/06/11

|8

|1572

|88

Report

AI Summary

This report provides a comprehensive analysis of Retail Food Group's (RFG) financial statements, focusing on the cash flow statement, other comprehensive income (OCI) statement, and accounting for corporate income tax. The analysis of the cash flow statement includes a breakdown of receipts fro...

HI5020 Corporate Accounting

Assessment 2 – Retail Food Group

STUDENT ID:

[Pick the date]

Assessment 2 – Retail Food Group

STUDENT ID:

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Accounting

The ASX listed company selected for performing the given task is RFG (Retail Food Group).

CASH FLOWS STATEMENT

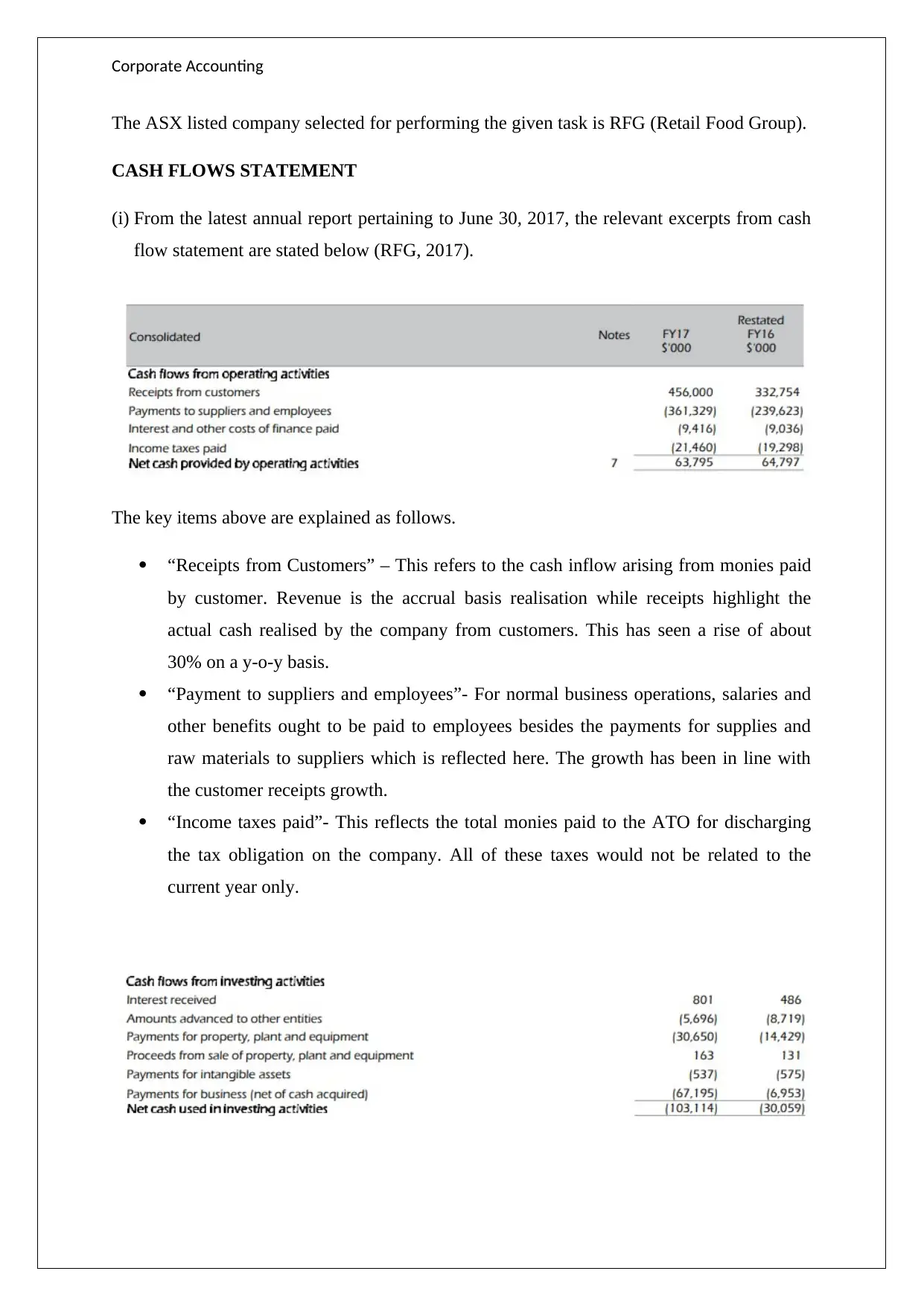

(i) From the latest annual report pertaining to June 30, 2017, the relevant excerpts from cash

flow statement are stated below (RFG, 2017).

The key items above are explained as follows.

“Receipts from Customers” – This refers to the cash inflow arising from monies paid

by customer. Revenue is the accrual basis realisation while receipts highlight the

actual cash realised by the company from customers. This has seen a rise of about

30% on a y-o-y basis.

“Payment to suppliers and employees”- For normal business operations, salaries and

other benefits ought to be paid to employees besides the payments for supplies and

raw materials to suppliers which is reflected here. The growth has been in line with

the customer receipts growth.

“Income taxes paid”- This reflects the total monies paid to the ATO for discharging

the tax obligation on the company. All of these taxes would not be related to the

current year only.

The ASX listed company selected for performing the given task is RFG (Retail Food Group).

CASH FLOWS STATEMENT

(i) From the latest annual report pertaining to June 30, 2017, the relevant excerpts from cash

flow statement are stated below (RFG, 2017).

The key items above are explained as follows.

“Receipts from Customers” – This refers to the cash inflow arising from monies paid

by customer. Revenue is the accrual basis realisation while receipts highlight the

actual cash realised by the company from customers. This has seen a rise of about

30% on a y-o-y basis.

“Payment to suppliers and employees”- For normal business operations, salaries and

other benefits ought to be paid to employees besides the payments for supplies and

raw materials to suppliers which is reflected here. The growth has been in line with

the customer receipts growth.

“Income taxes paid”- This reflects the total monies paid to the ATO for discharging

the tax obligation on the company. All of these taxes would not be related to the

current year only.

Corporate Accounting

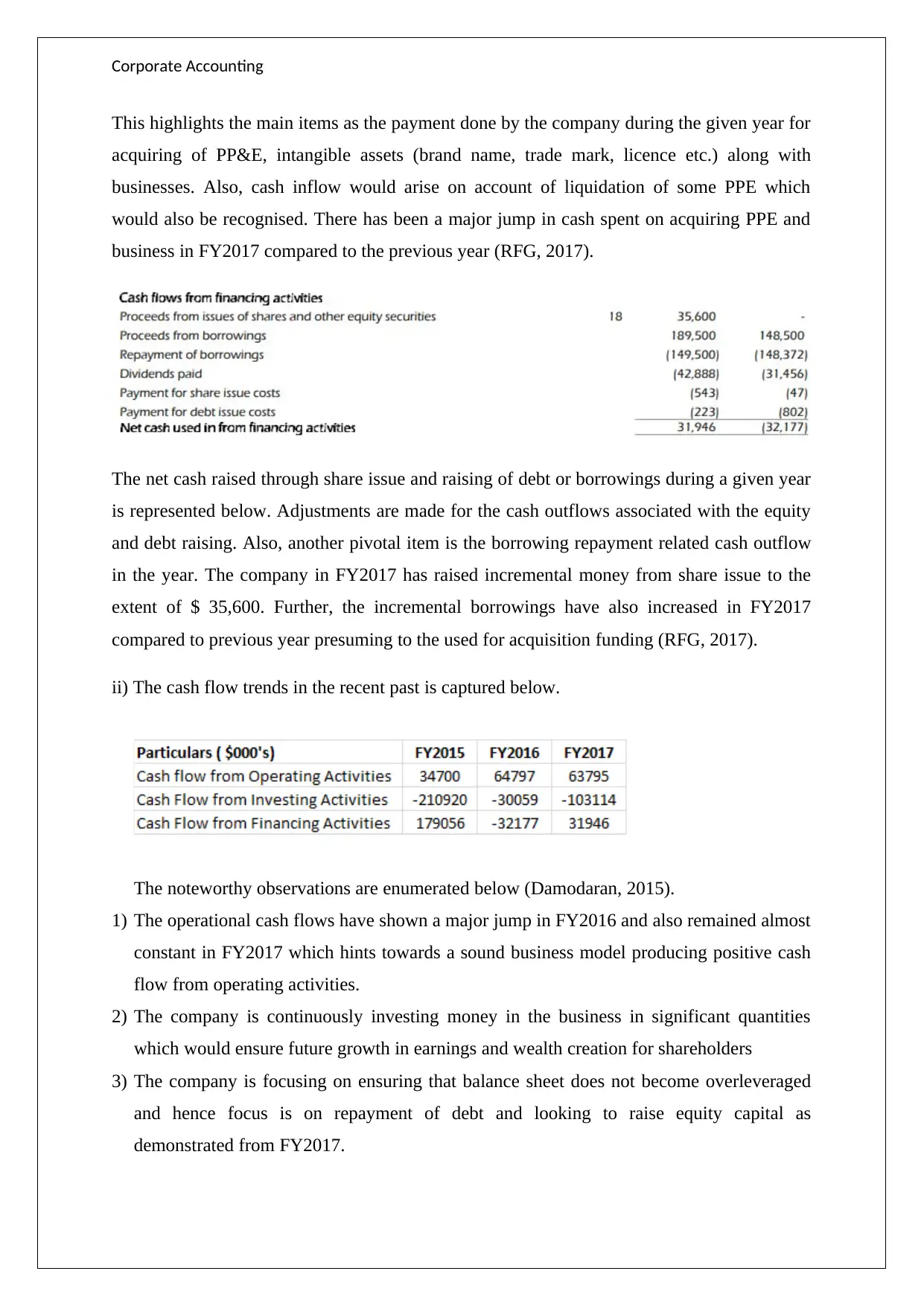

This highlights the main items as the payment done by the company during the given year for

acquiring of PP&E, intangible assets (brand name, trade mark, licence etc.) along with

businesses. Also, cash inflow would arise on account of liquidation of some PPE which

would also be recognised. There has been a major jump in cash spent on acquiring PPE and

business in FY2017 compared to the previous year (RFG, 2017).

The net cash raised through share issue and raising of debt or borrowings during a given year

is represented below. Adjustments are made for the cash outflows associated with the equity

and debt raising. Also, another pivotal item is the borrowing repayment related cash outflow

in the year. The company in FY2017 has raised incremental money from share issue to the

extent of $ 35,600. Further, the incremental borrowings have also increased in FY2017

compared to previous year presuming to the used for acquisition funding (RFG, 2017).

ii) The cash flow trends in the recent past is captured below.

The noteworthy observations are enumerated below (Damodaran, 2015).

1) The operational cash flows have shown a major jump in FY2016 and also remained almost

constant in FY2017 which hints towards a sound business model producing positive cash

flow from operating activities.

2) The company is continuously investing money in the business in significant quantities

which would ensure future growth in earnings and wealth creation for shareholders

3) The company is focusing on ensuring that balance sheet does not become overleveraged

and hence focus is on repayment of debt and looking to raise equity capital as

demonstrated from FY2017.

This highlights the main items as the payment done by the company during the given year for

acquiring of PP&E, intangible assets (brand name, trade mark, licence etc.) along with

businesses. Also, cash inflow would arise on account of liquidation of some PPE which

would also be recognised. There has been a major jump in cash spent on acquiring PPE and

business in FY2017 compared to the previous year (RFG, 2017).

The net cash raised through share issue and raising of debt or borrowings during a given year

is represented below. Adjustments are made for the cash outflows associated with the equity

and debt raising. Also, another pivotal item is the borrowing repayment related cash outflow

in the year. The company in FY2017 has raised incremental money from share issue to the

extent of $ 35,600. Further, the incremental borrowings have also increased in FY2017

compared to previous year presuming to the used for acquisition funding (RFG, 2017).

ii) The cash flow trends in the recent past is captured below.

The noteworthy observations are enumerated below (Damodaran, 2015).

1) The operational cash flows have shown a major jump in FY2016 and also remained almost

constant in FY2017 which hints towards a sound business model producing positive cash

flow from operating activities.

2) The company is continuously investing money in the business in significant quantities

which would ensure future growth in earnings and wealth creation for shareholders

3) The company is focusing on ensuring that balance sheet does not become overleveraged

and hence focus is on repayment of debt and looking to raise equity capital as

demonstrated from FY2017.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Accounting

OTHER COMPREHENSIVE INCOME STATEMENT

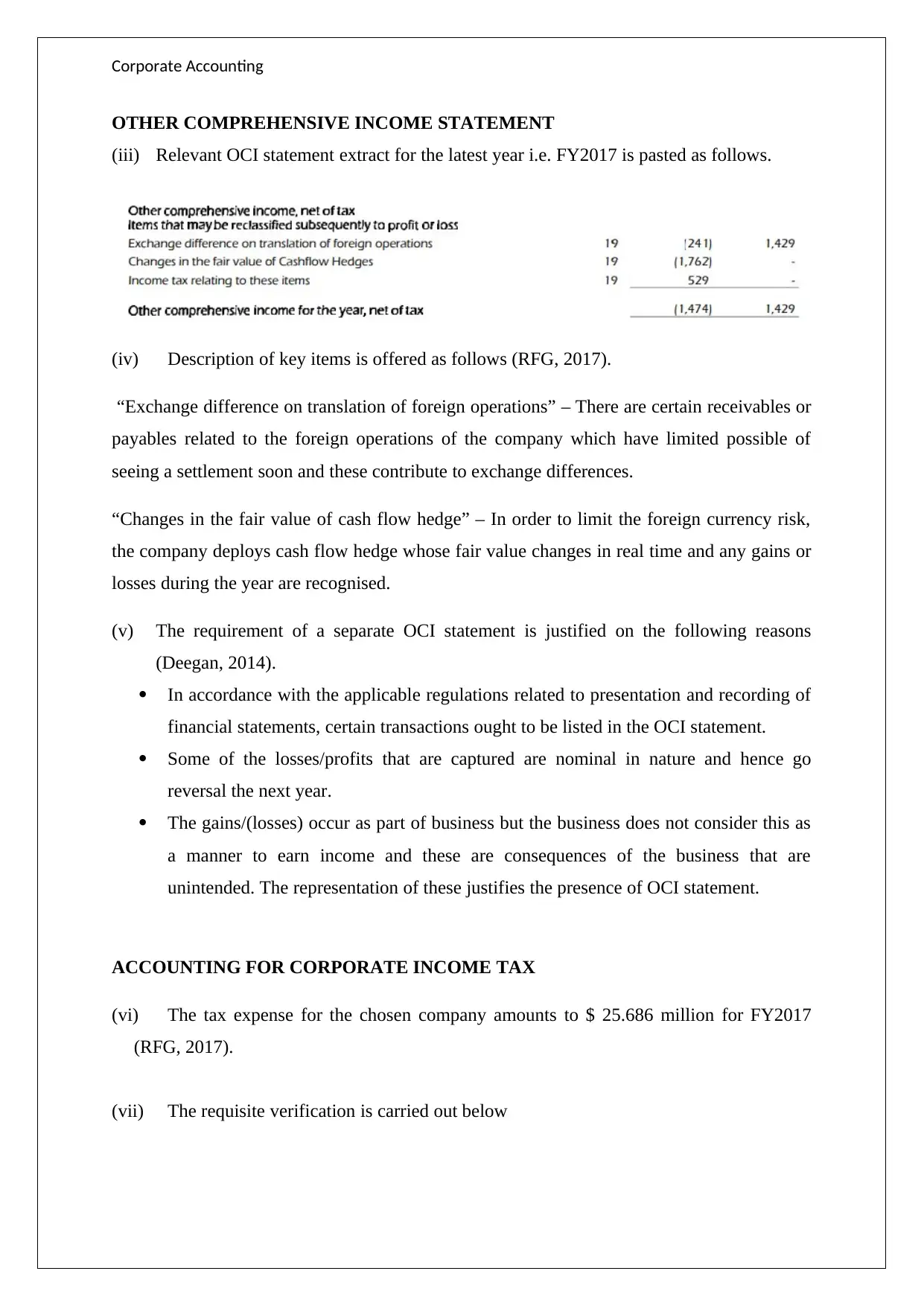

(iii) Relevant OCI statement extract for the latest year i.e. FY2017 is pasted as follows.

(iv) Description of key items is offered as follows (RFG, 2017).

“Exchange difference on translation of foreign operations” – There are certain receivables or

payables related to the foreign operations of the company which have limited possible of

seeing a settlement soon and these contribute to exchange differences.

“Changes in the fair value of cash flow hedge” – In order to limit the foreign currency risk,

the company deploys cash flow hedge whose fair value changes in real time and any gains or

losses during the year are recognised.

(v) The requirement of a separate OCI statement is justified on the following reasons

(Deegan, 2014).

In accordance with the applicable regulations related to presentation and recording of

financial statements, certain transactions ought to be listed in the OCI statement.

Some of the losses/profits that are captured are nominal in nature and hence go

reversal the next year.

The gains/(losses) occur as part of business but the business does not consider this as

a manner to earn income and these are consequences of the business that are

unintended. The representation of these justifies the presence of OCI statement.

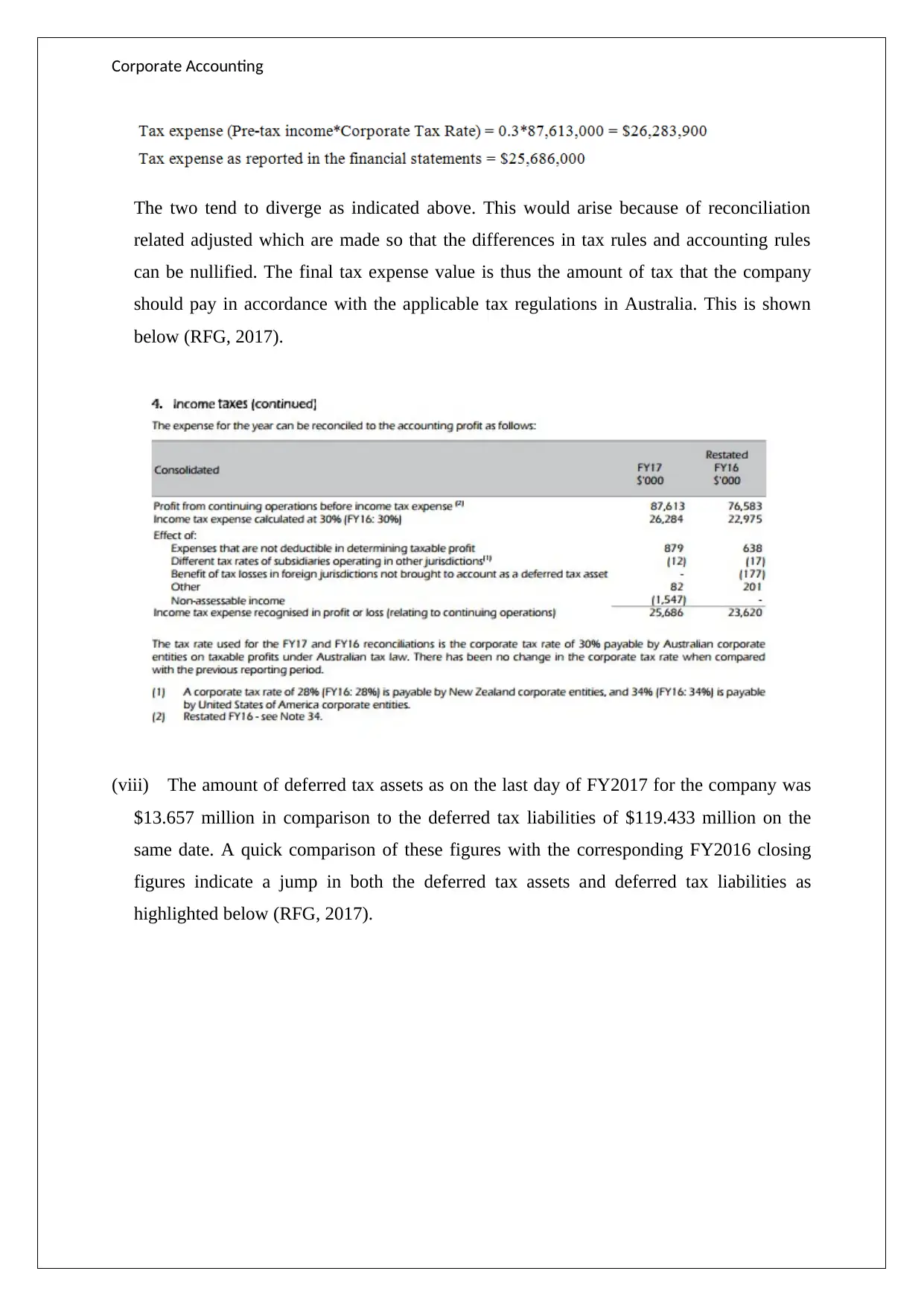

ACCOUNTING FOR CORPORATE INCOME TAX

(vi) The tax expense for the chosen company amounts to $ 25.686 million for FY2017

(RFG, 2017).

(vii) The requisite verification is carried out below

OTHER COMPREHENSIVE INCOME STATEMENT

(iii) Relevant OCI statement extract for the latest year i.e. FY2017 is pasted as follows.

(iv) Description of key items is offered as follows (RFG, 2017).

“Exchange difference on translation of foreign operations” – There are certain receivables or

payables related to the foreign operations of the company which have limited possible of

seeing a settlement soon and these contribute to exchange differences.

“Changes in the fair value of cash flow hedge” – In order to limit the foreign currency risk,

the company deploys cash flow hedge whose fair value changes in real time and any gains or

losses during the year are recognised.

(v) The requirement of a separate OCI statement is justified on the following reasons

(Deegan, 2014).

In accordance with the applicable regulations related to presentation and recording of

financial statements, certain transactions ought to be listed in the OCI statement.

Some of the losses/profits that are captured are nominal in nature and hence go

reversal the next year.

The gains/(losses) occur as part of business but the business does not consider this as

a manner to earn income and these are consequences of the business that are

unintended. The representation of these justifies the presence of OCI statement.

ACCOUNTING FOR CORPORATE INCOME TAX

(vi) The tax expense for the chosen company amounts to $ 25.686 million for FY2017

(RFG, 2017).

(vii) The requisite verification is carried out below

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Accounting

The two tend to diverge as indicated above. This would arise because of reconciliation

related adjusted which are made so that the differences in tax rules and accounting rules

can be nullified. The final tax expense value is thus the amount of tax that the company

should pay in accordance with the applicable tax regulations in Australia. This is shown

below (RFG, 2017).

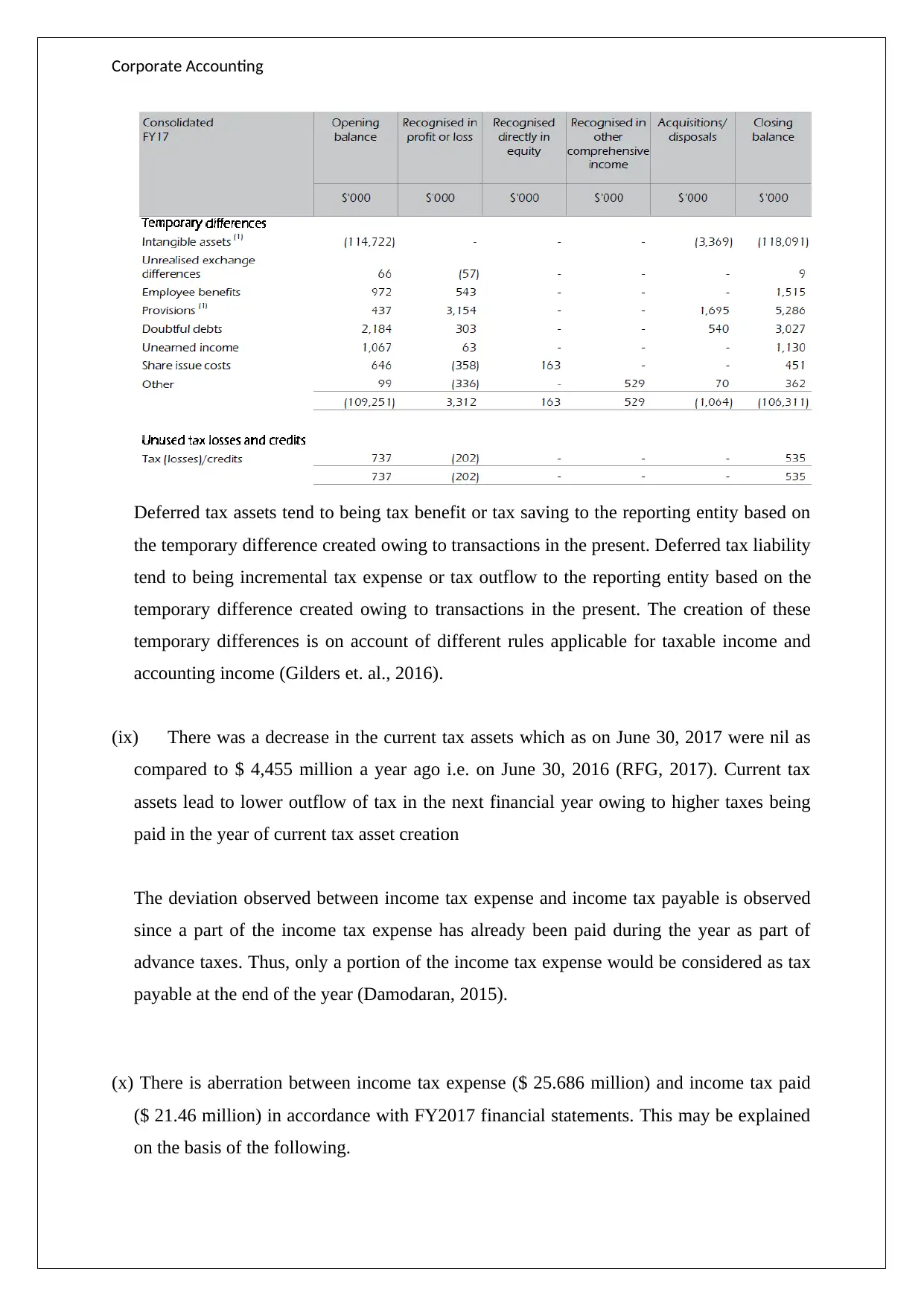

(viii) The amount of deferred tax assets as on the last day of FY2017 for the company was

$13.657 million in comparison to the deferred tax liabilities of $119.433 million on the

same date. A quick comparison of these figures with the corresponding FY2016 closing

figures indicate a jump in both the deferred tax assets and deferred tax liabilities as

highlighted below (RFG, 2017).

The two tend to diverge as indicated above. This would arise because of reconciliation

related adjusted which are made so that the differences in tax rules and accounting rules

can be nullified. The final tax expense value is thus the amount of tax that the company

should pay in accordance with the applicable tax regulations in Australia. This is shown

below (RFG, 2017).

(viii) The amount of deferred tax assets as on the last day of FY2017 for the company was

$13.657 million in comparison to the deferred tax liabilities of $119.433 million on the

same date. A quick comparison of these figures with the corresponding FY2016 closing

figures indicate a jump in both the deferred tax assets and deferred tax liabilities as

highlighted below (RFG, 2017).

Corporate Accounting

Deferred tax assets tend to being tax benefit or tax saving to the reporting entity based on

the temporary difference created owing to transactions in the present. Deferred tax liability

tend to being incremental tax expense or tax outflow to the reporting entity based on the

temporary difference created owing to transactions in the present. The creation of these

temporary differences is on account of different rules applicable for taxable income and

accounting income (Gilders et. al., 2016).

(ix) There was a decrease in the current tax assets which as on June 30, 2017 were nil as

compared to $ 4,455 million a year ago i.e. on June 30, 2016 (RFG, 2017). Current tax

assets lead to lower outflow of tax in the next financial year owing to higher taxes being

paid in the year of current tax asset creation

The deviation observed between income tax expense and income tax payable is observed

since a part of the income tax expense has already been paid during the year as part of

advance taxes. Thus, only a portion of the income tax expense would be considered as tax

payable at the end of the year (Damodaran, 2015).

(x) There is aberration between income tax expense ($ 25.686 million) and income tax paid

($ 21.46 million) in accordance with FY2017 financial statements. This may be explained

on the basis of the following.

Deferred tax assets tend to being tax benefit or tax saving to the reporting entity based on

the temporary difference created owing to transactions in the present. Deferred tax liability

tend to being incremental tax expense or tax outflow to the reporting entity based on the

temporary difference created owing to transactions in the present. The creation of these

temporary differences is on account of different rules applicable for taxable income and

accounting income (Gilders et. al., 2016).

(ix) There was a decrease in the current tax assets which as on June 30, 2017 were nil as

compared to $ 4,455 million a year ago i.e. on June 30, 2016 (RFG, 2017). Current tax

assets lead to lower outflow of tax in the next financial year owing to higher taxes being

paid in the year of current tax asset creation

The deviation observed between income tax expense and income tax payable is observed

since a part of the income tax expense has already been paid during the year as part of

advance taxes. Thus, only a portion of the income tax expense would be considered as tax

payable at the end of the year (Damodaran, 2015).

(x) There is aberration between income tax expense ($ 25.686 million) and income tax paid

($ 21.46 million) in accordance with FY2017 financial statements. This may be explained

on the basis of the following.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate Accounting

The tax expense for the year can only be computed after the closing of year and hence

tax paid can never accurately estimate the tax expense before-hand and hence tax is

paid based on estimates (Deegan, 2014).

Also, tax paid in a given year usually also contains the payment for tax payable from

previous financial year besides the payment of taxes for the current year which is

responsible for deviation from tax expense (Petty, et. al., 2015).

(xi) One of the most confusing aspects in the financial statements of RFG pertained to the

computation of temporary differences between the carrying value and the usage of the

same for creation of tax assets and liabilities of deferred nature. Only after repeated

attempts could I fathom the crux and theoretical underpinning of the computations.

Earlier, I used to assume that tax expense reported in the income statement would be

corporate tax times the pre-tax accounting earnings. But, though this task I understood that

owing to reconciliation, the tax expense shows a deviation from the expected value.

The tax expense for the year can only be computed after the closing of year and hence

tax paid can never accurately estimate the tax expense before-hand and hence tax is

paid based on estimates (Deegan, 2014).

Also, tax paid in a given year usually also contains the payment for tax payable from

previous financial year besides the payment of taxes for the current year which is

responsible for deviation from tax expense (Petty, et. al., 2015).

(xi) One of the most confusing aspects in the financial statements of RFG pertained to the

computation of temporary differences between the carrying value and the usage of the

same for creation of tax assets and liabilities of deferred nature. Only after repeated

attempts could I fathom the crux and theoretical underpinning of the computations.

Earlier, I used to assume that tax expense reported in the income statement would be

corporate tax times the pre-tax accounting earnings. But, though this task I understood that

owing to reconciliation, the tax expense shows a deviation from the expected value.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate Accounting

References

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Deegan, C. (2014). Financial Accounting Theory, 4th ed. Sydney: McGraw-Hill

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2016) Understanding taxation

law 2016, 9th ed. Sydney: LexisNexis/Butterworths.

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2012)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia.

RFG (2017), Annual Report FY2017, [online] Available at

http://www.rfg.com.au/index.php/110-general-pages/investor-news/816-2017-annual-report

(Accessed on May 24, 2018)

References

Damodaran, A. (2015). Applied corporate finance: A user’s manual 3rd ed. New York:

Wiley, John & Sons.

Deegan, C. (2014). Financial Accounting Theory, 4th ed. Sydney: McGraw-Hill

Gilders, F., Taylor, J., Walpole, M., Burton, M. and Ciro, T. (2016) Understanding taxation

law 2016, 9th ed. Sydney: LexisNexis/Butterworths.

Petty, J.W., Titman, S., Keown, A., Martin, J.D., Martin, P., Burrow, M., and Nguyen, H. (2012)

Financial Management, Principles and Applications. 6th ed. NSW: Pearson Education, French

Forest Australia.

RFG (2017), Annual Report FY2017, [online] Available at

http://www.rfg.com.au/index.php/110-general-pages/investor-news/816-2017-annual-report

(Accessed on May 24, 2018)

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.