Corporate Accounting

VerifiedAdded on 2020/12/31

|16

|4479

|253

AI Summary

Change in common stock – (2016-17) = 57/1524*100 = 3.74% (2017-18) = 14/1581*100 = 0.89% As per above calculations it is understand that change in common stock is due to increase in other comprehensive income. Change in common stock – (2016-17) = 57/1524*100 = 3.74% (2017-18) = 14/1581*100 = 0.89% As per above calculations it is understand that change in common stock is due to increase in

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE

ACCOUNTING

ACCOUNTING

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION ..........................................................................................................................1

MAIN BODY...................................................................................................................................1

Overview of the company...........................................................................................................1

Evaluation of equities..................................................................................................................1

Other Comprehensive Income Statement:..................................................................................9

Accounting for corporate income tax .......................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION ..........................................................................................................................1

MAIN BODY...................................................................................................................................1

Overview of the company...........................................................................................................1

Evaluation of equities..................................................................................................................1

Other Comprehensive Income Statement:..................................................................................9

Accounting for corporate income tax .......................................................................................12

CONCLUSION..............................................................................................................................13

REFERENCES..............................................................................................................................14

INTRODUCTION

Corporate Accounting is a process of measurement, recording and interpretation of

financial statements of company. It is carried out specifically for large company not for small

company, sole traders and partnership firms. There are following topics are covered such as

overview of the company, owners equity evaluation in describe each item of equity and changes

in last 3 years. Abacus property group and BWP trust are the companies that deals in real state

business are taken to assess the concept of corporate accounting. It shows comparative analysis

of debt and equity, cash flow statement analysis in showing financial statement and comparative

analysis, evaluation of other comprehensive income statement and corporate income tax analysis

for both the companies (Bennett, Schaltegger and Zvezdov, 2013).

MAIN BODY

Overview of the company

Abacus property group -

Abacus property group was established in 1996 and listed in ASX in 2002, company are

also included in S&P/ASX 200 index (Epstein, 2018). This company is a leading wide-ranging

property group and specialize in investing in core group property in Australia. Company have

investment objective for investors with increasing returns and reliable. They are provide

opportunities to maximize security holder value and total returns for long term.

BWP group -

This company are related to strategic marketing practice with a different variation. BWP

was founded by retailers for the understanding of consumer markets, retail and it's challenge.

company realize that to actuation of behavioral change, and they firstly connect with hearts and

minds. They believe in to create and domain with human connections (Feng, and et. al., 2011).

Evaluation of equities

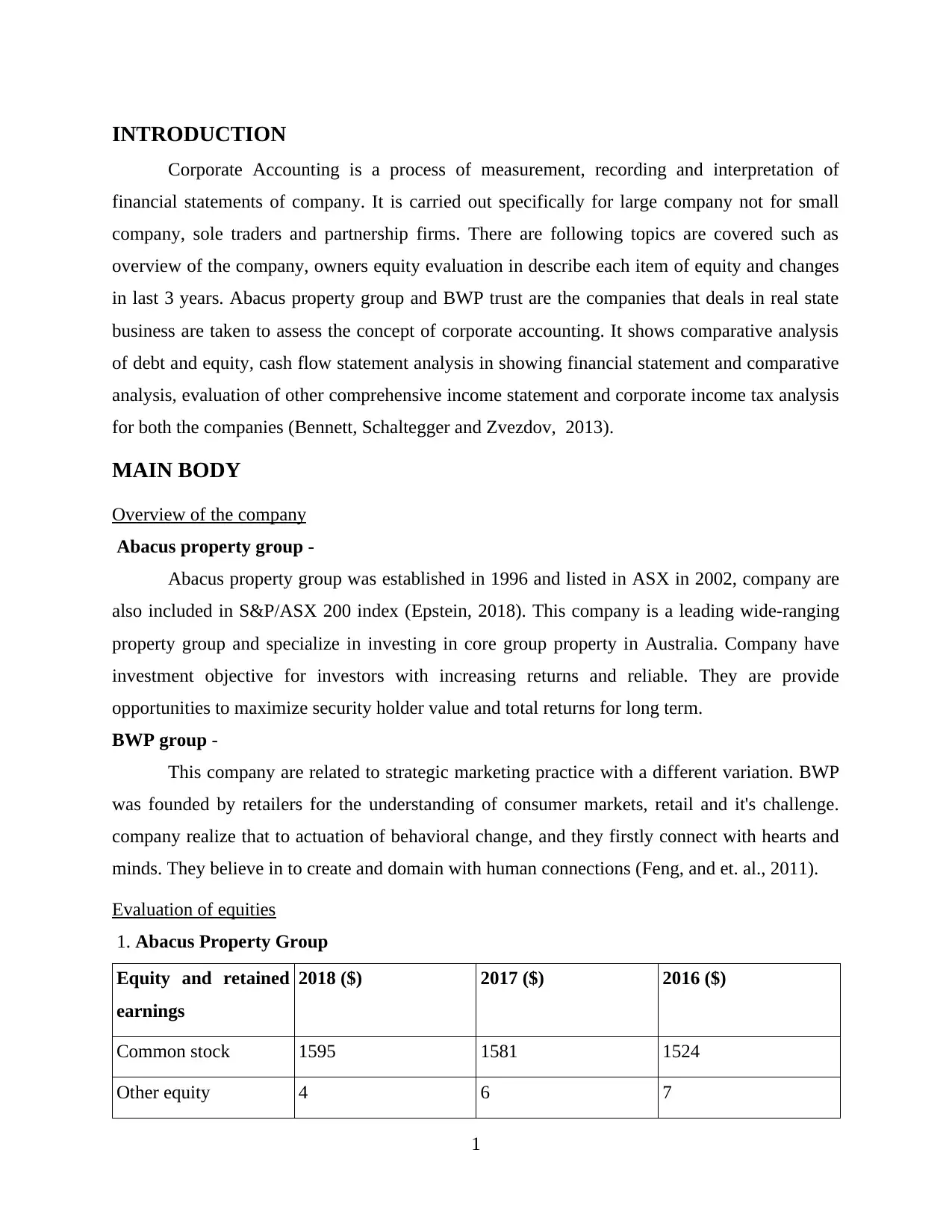

1. Abacus Property Group

Equity and retained

earnings

2018 ($) 2017 ($) 2016 ($)

Common stock 1595 1581 1524

Other equity 4 6 7

1

Corporate Accounting is a process of measurement, recording and interpretation of

financial statements of company. It is carried out specifically for large company not for small

company, sole traders and partnership firms. There are following topics are covered such as

overview of the company, owners equity evaluation in describe each item of equity and changes

in last 3 years. Abacus property group and BWP trust are the companies that deals in real state

business are taken to assess the concept of corporate accounting. It shows comparative analysis

of debt and equity, cash flow statement analysis in showing financial statement and comparative

analysis, evaluation of other comprehensive income statement and corporate income tax analysis

for both the companies (Bennett, Schaltegger and Zvezdov, 2013).

MAIN BODY

Overview of the company

Abacus property group -

Abacus property group was established in 1996 and listed in ASX in 2002, company are

also included in S&P/ASX 200 index (Epstein, 2018). This company is a leading wide-ranging

property group and specialize in investing in core group property in Australia. Company have

investment objective for investors with increasing returns and reliable. They are provide

opportunities to maximize security holder value and total returns for long term.

BWP group -

This company are related to strategic marketing practice with a different variation. BWP

was founded by retailers for the understanding of consumer markets, retail and it's challenge.

company realize that to actuation of behavioral change, and they firstly connect with hearts and

minds. They believe in to create and domain with human connections (Feng, and et. al., 2011).

Evaluation of equities

1. Abacus Property Group

Equity and retained

earnings

2018 ($) 2017 ($) 2016 ($)

Common stock 1595 1581 1524

Other equity 4 6 7

1

Retained earnings 253 164 -23

Accumulated other

comprehensive income

18 14 8

Interpretation – common stock continuously increased from last three years, other

equity decreased in 1% from 2016 to 2018, retained earnings frequently increase change past

three years and accumulated other comprehensive income increases from 2016 to 2018.

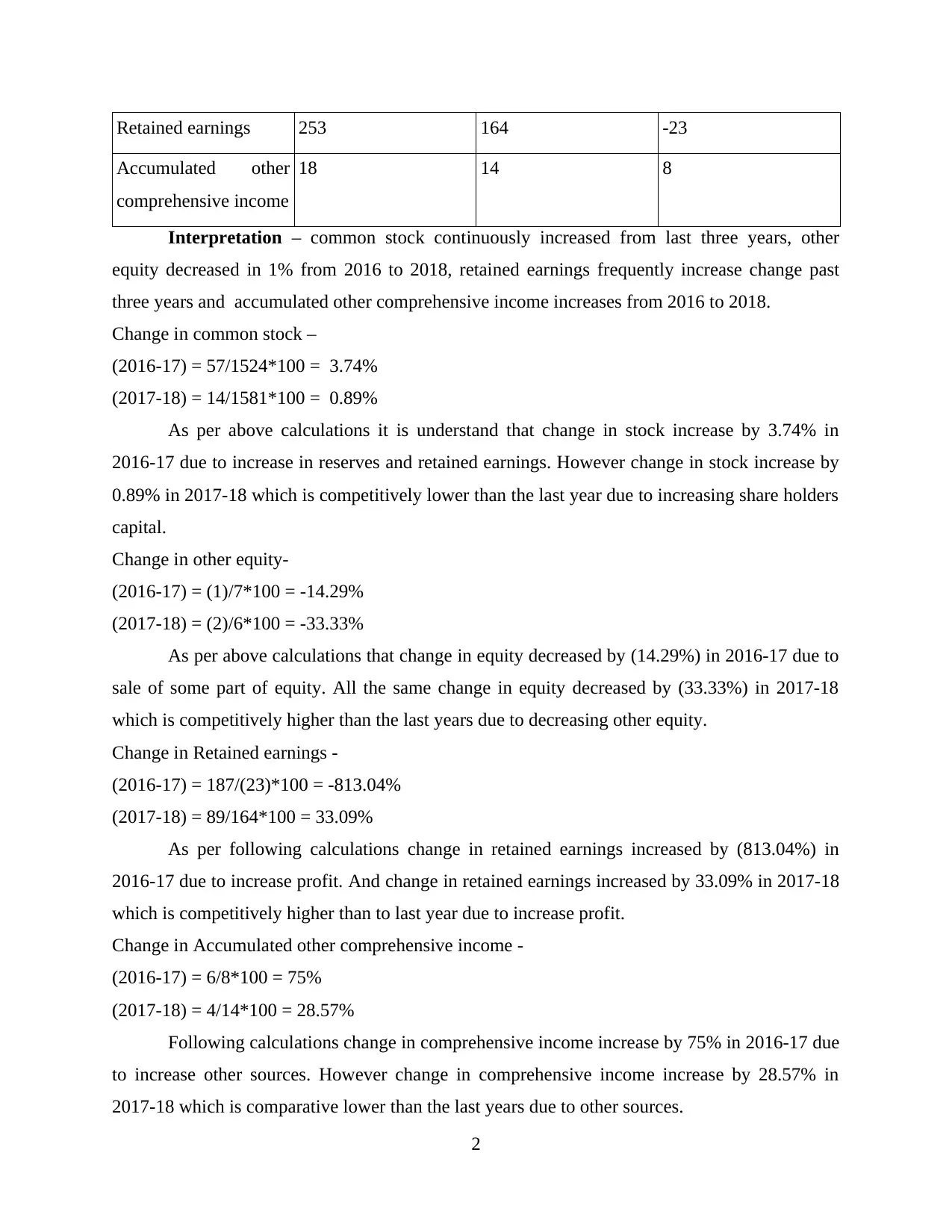

Change in common stock –

(2016-17) = 57/1524*100 = 3.74%

(2017-18) = 14/1581*100 = 0.89%

As per above calculations it is understand that change in stock increase by 3.74% in

2016-17 due to increase in reserves and retained earnings. However change in stock increase by

0.89% in 2017-18 which is competitively lower than the last year due to increasing share holders

capital.

Change in other equity-

(2016-17) = (1)/7*100 = -14.29%

(2017-18) = (2)/6*100 = -33.33%

As per above calculations that change in equity decreased by (14.29%) in 2016-17 due to

sale of some part of equity. All the same change in equity decreased by (33.33%) in 2017-18

which is competitively higher than the last years due to decreasing other equity.

Change in Retained earnings -

(2016-17) = 187/(23)*100 = -813.04%

(2017-18) = 89/164*100 = 33.09%

As per following calculations change in retained earnings increased by (813.04%) in

2016-17 due to increase profit. And change in retained earnings increased by 33.09% in 2017-18

which is competitively higher than to last year due to increase profit.

Change in Accumulated other comprehensive income -

(2016-17) = 6/8*100 = 75%

(2017-18) = 4/14*100 = 28.57%

Following calculations change in comprehensive income increase by 75% in 2016-17 due

to increase other sources. However change in comprehensive income increase by 28.57% in

2017-18 which is comparative lower than the last years due to other sources.

2

Accumulated other

comprehensive income

18 14 8

Interpretation – common stock continuously increased from last three years, other

equity decreased in 1% from 2016 to 2018, retained earnings frequently increase change past

three years and accumulated other comprehensive income increases from 2016 to 2018.

Change in common stock –

(2016-17) = 57/1524*100 = 3.74%

(2017-18) = 14/1581*100 = 0.89%

As per above calculations it is understand that change in stock increase by 3.74% in

2016-17 due to increase in reserves and retained earnings. However change in stock increase by

0.89% in 2017-18 which is competitively lower than the last year due to increasing share holders

capital.

Change in other equity-

(2016-17) = (1)/7*100 = -14.29%

(2017-18) = (2)/6*100 = -33.33%

As per above calculations that change in equity decreased by (14.29%) in 2016-17 due to

sale of some part of equity. All the same change in equity decreased by (33.33%) in 2017-18

which is competitively higher than the last years due to decreasing other equity.

Change in Retained earnings -

(2016-17) = 187/(23)*100 = -813.04%

(2017-18) = 89/164*100 = 33.09%

As per following calculations change in retained earnings increased by (813.04%) in

2016-17 due to increase profit. And change in retained earnings increased by 33.09% in 2017-18

which is competitively higher than to last year due to increase profit.

Change in Accumulated other comprehensive income -

(2016-17) = 6/8*100 = 75%

(2017-18) = 4/14*100 = 28.57%

Following calculations change in comprehensive income increase by 75% in 2016-17 due

to increase other sources. However change in comprehensive income increase by 28.57% in

2017-18 which is comparative lower than the last years due to other sources.

2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

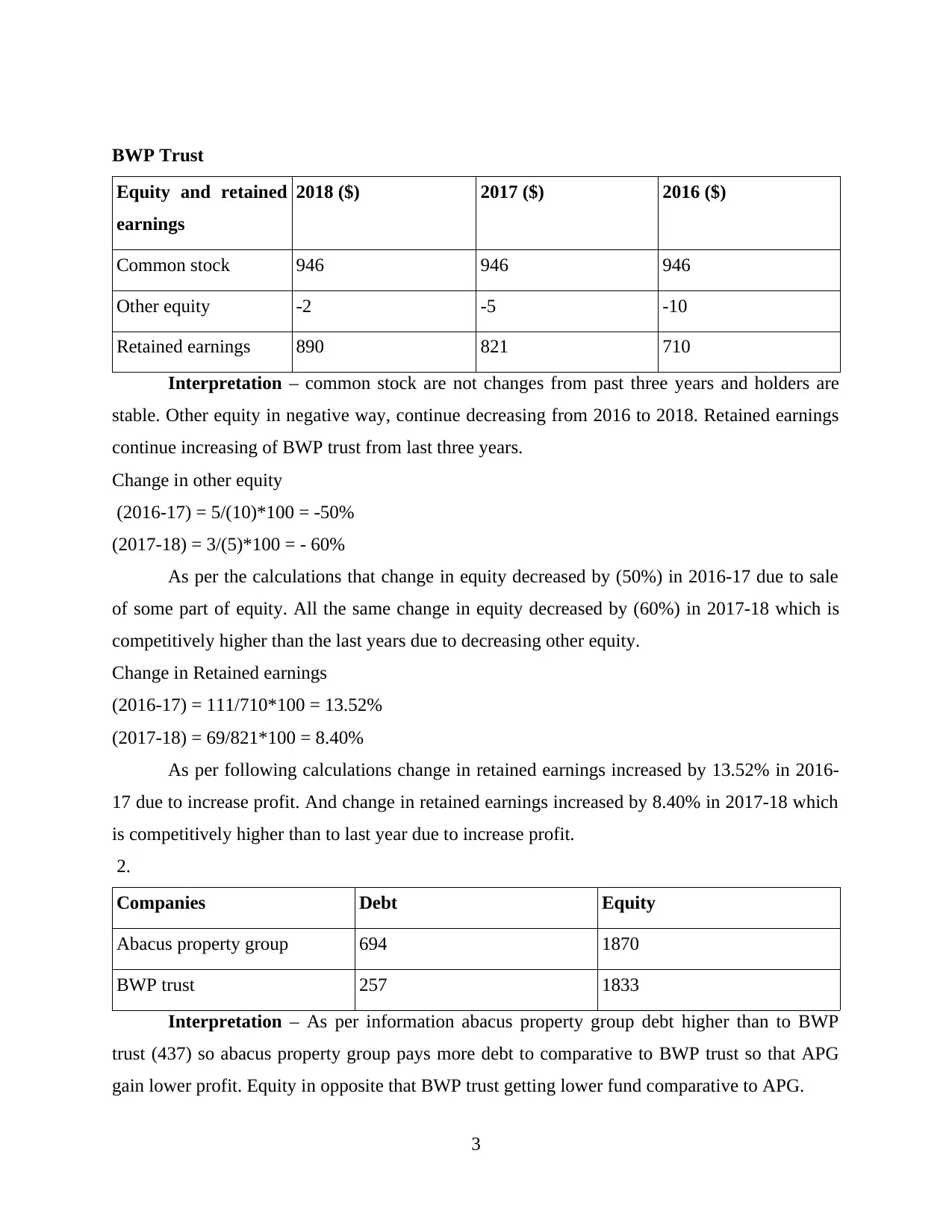

BWP Trust

Equity and retained

earnings

2018 ($) 2017 ($) 2016 ($)

Common stock 946 946 946

Other equity -2 -5 -10

Retained earnings 890 821 710

Interpretation – common stock are not changes from past three years and holders are

stable. Other equity in negative way, continue decreasing from 2016 to 2018. Retained earnings

continue increasing of BWP trust from last three years.

Change in other equity

(2016-17) = 5/(10)*100 = -50%

(2017-18) = 3/(5)*100 = - 60%

As per the calculations that change in equity decreased by (50%) in 2016-17 due to sale

of some part of equity. All the same change in equity decreased by (60%) in 2017-18 which is

competitively higher than the last years due to decreasing other equity.

Change in Retained earnings

(2016-17) = 111/710*100 = 13.52%

(2017-18) = 69/821*100 = 8.40%

As per following calculations change in retained earnings increased by 13.52% in 2016-

17 due to increase profit. And change in retained earnings increased by 8.40% in 2017-18 which

is competitively higher than to last year due to increase profit.

2.

Companies Debt Equity

Abacus property group 694 1870

BWP trust 257 1833

Interpretation – As per information abacus property group debt higher than to BWP

trust (437) so abacus property group pays more debt to comparative to BWP trust so that APG

gain lower profit. Equity in opposite that BWP trust getting lower fund comparative to APG.

3

Equity and retained

earnings

2018 ($) 2017 ($) 2016 ($)

Common stock 946 946 946

Other equity -2 -5 -10

Retained earnings 890 821 710

Interpretation – common stock are not changes from past three years and holders are

stable. Other equity in negative way, continue decreasing from 2016 to 2018. Retained earnings

continue increasing of BWP trust from last three years.

Change in other equity

(2016-17) = 5/(10)*100 = -50%

(2017-18) = 3/(5)*100 = - 60%

As per the calculations that change in equity decreased by (50%) in 2016-17 due to sale

of some part of equity. All the same change in equity decreased by (60%) in 2017-18 which is

competitively higher than the last years due to decreasing other equity.

Change in Retained earnings

(2016-17) = 111/710*100 = 13.52%

(2017-18) = 69/821*100 = 8.40%

As per following calculations change in retained earnings increased by 13.52% in 2016-

17 due to increase profit. And change in retained earnings increased by 8.40% in 2017-18 which

is competitively higher than to last year due to increase profit.

2.

Companies Debt Equity

Abacus property group 694 1870

BWP trust 257 1833

Interpretation – As per information abacus property group debt higher than to BWP

trust (437) so abacus property group pays more debt to comparative to BWP trust so that APG

gain lower profit. Equity in opposite that BWP trust getting lower fund comparative to APG.

3

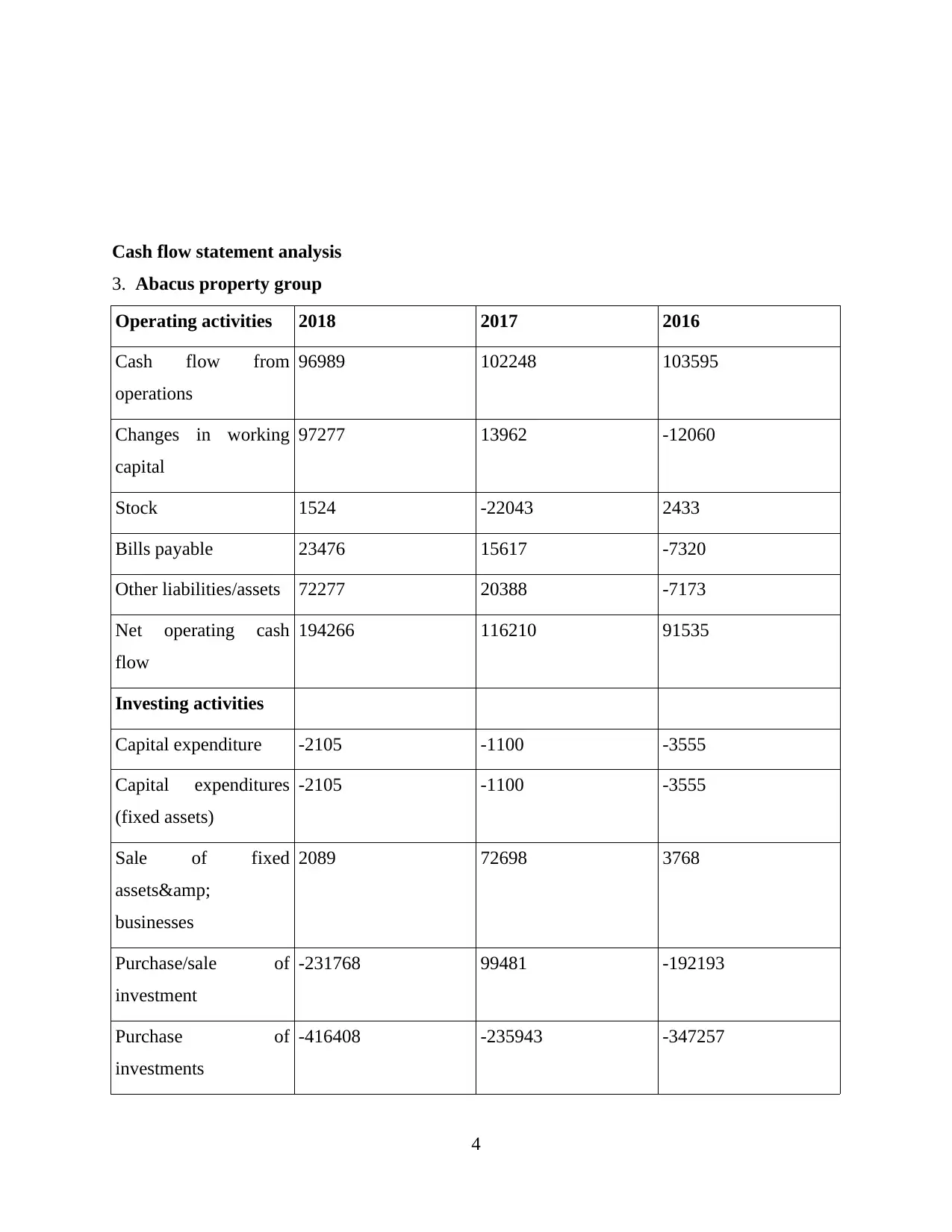

Cash flow statement analysis

3. Abacus property group

Operating activities 2018 2017 2016

Cash flow from

operations

96989 102248 103595

Changes in working

capital

97277 13962 -12060

Stock 1524 -22043 2433

Bills payable 23476 15617 -7320

Other liabilities/assets 72277 20388 -7173

Net operating cash

flow

194266 116210 91535

Investing activities

Capital expenditure -2105 -1100 -3555

Capital expenditures

(fixed assets)

-2105 -1100 -3555

Sale of fixed

assets&

businesses

2089 72698 3768

Purchase/sale of

investment

-231768 99481 -192193

Purchase of

investments

-416408 -235943 -347257

4

3. Abacus property group

Operating activities 2018 2017 2016

Cash flow from

operations

96989 102248 103595

Changes in working

capital

97277 13962 -12060

Stock 1524 -22043 2433

Bills payable 23476 15617 -7320

Other liabilities/assets 72277 20388 -7173

Net operating cash

flow

194266 116210 91535

Investing activities

Capital expenditure -2105 -1100 -3555

Capital expenditures

(fixed assets)

-2105 -1100 -3555

Sale of fixed

assets&

businesses

2089 72698 3768

Purchase/sale of

investment

-231768 99481 -192193

Purchase of

investments

-416408 -235943 -347257

4

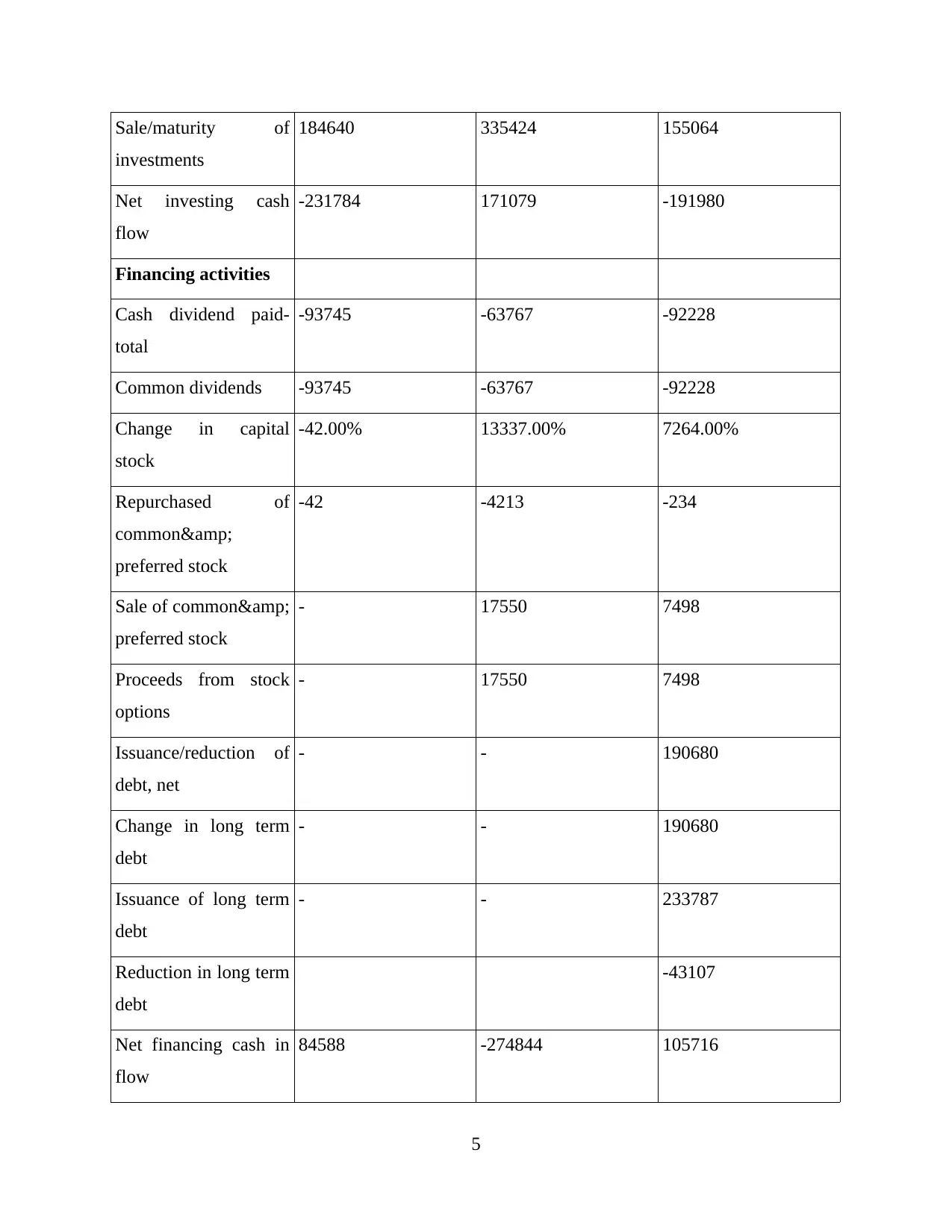

Sale/maturity of

investments

184640 335424 155064

Net investing cash

flow

-231784 171079 -191980

Financing activities

Cash dividend paid-

total

-93745 -63767 -92228

Common dividends -93745 -63767 -92228

Change in capital

stock

-42.00% 13337.00% 7264.00%

Repurchased of

common&

preferred stock

-42 -4213 -234

Sale of common&

preferred stock

- 17550 7498

Proceeds from stock

options

- 17550 7498

Issuance/reduction of

debt, net

- - 190680

Change in long term

debt

- - 190680

Issuance of long term

debt

- - 233787

Reduction in long term

debt

-43107

Net financing cash in

flow

84588 -274844 105716

5

investments

184640 335424 155064

Net investing cash

flow

-231784 171079 -191980

Financing activities

Cash dividend paid-

total

-93745 -63767 -92228

Common dividends -93745 -63767 -92228

Change in capital

stock

-42.00% 13337.00% 7264.00%

Repurchased of

common&

preferred stock

-42 -4213 -234

Sale of common&

preferred stock

- 17550 7498

Proceeds from stock

options

- 17550 7498

Issuance/reduction of

debt, net

- - 190680

Change in long term

debt

- - 190680

Issuance of long term

debt

- - 233787

Reduction in long term

debt

-43107

Net financing cash in

flow

84588 -274844 105716

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Net change in cash 46989 12475 5404

Free cash flow 192161 115110 87980

Interpretation As above the table in this cash flow every year coming changes in each

item from 2016 to 2018. In operating activities cash flow operations decreasing from last three

years because changes in current assets and current liabilities and that are also reason for changes

in working capital (Fisher and Krumwiede, 2012). Increasing stock, bills payable and other

liabilities cause of increase in current assets and decrease in current liabilities from 2016 to 2018.

changes in current assets and current liabilities effected to net operating cash flow. In investing

activities capital expenditures increases on fixed assets foe the reason of maintenance. Capital

expenditure growth 2.34%(2016), 69.06%(2017), -91.36% (2018). Purchase and sale of

investments are increasing because change in company's cash position.

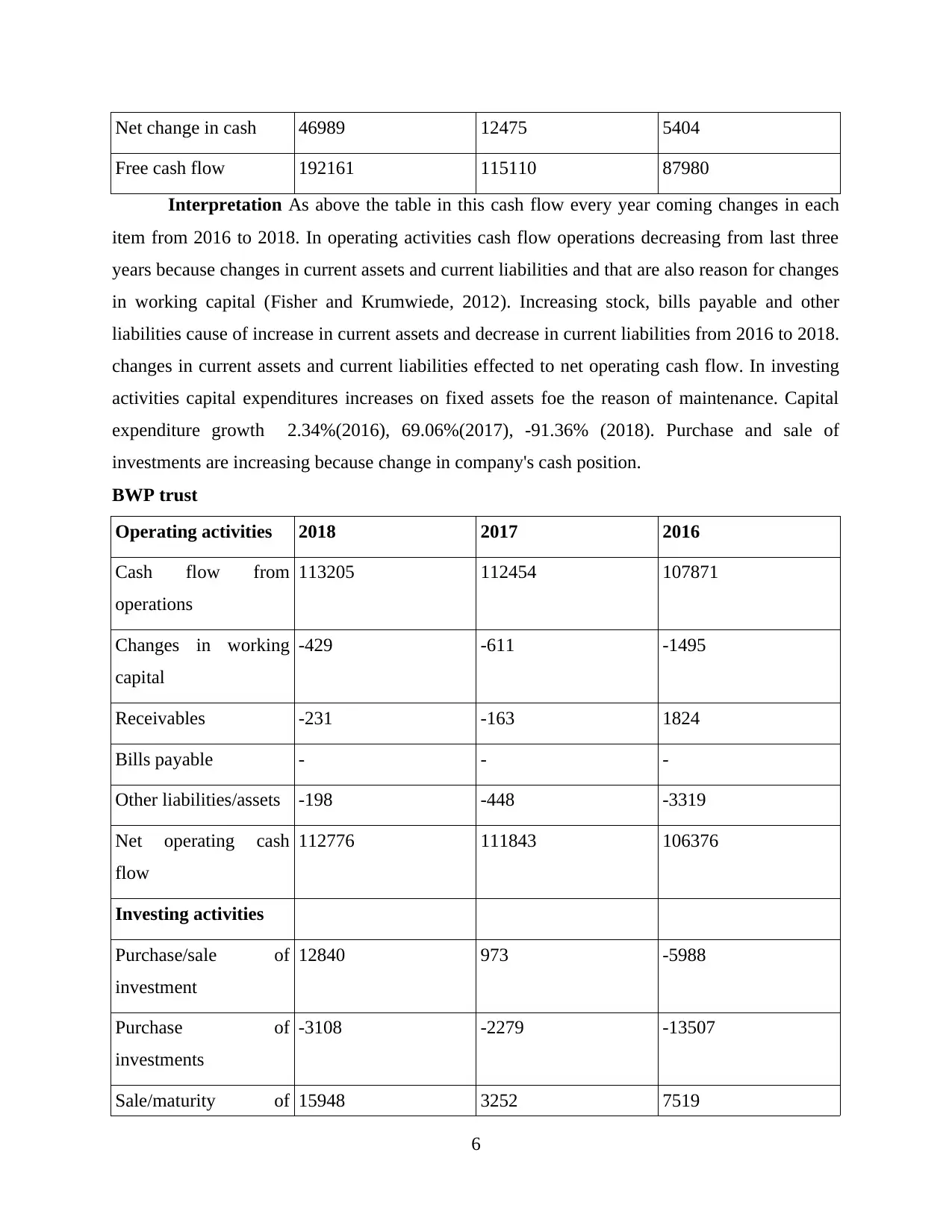

BWP trust

Operating activities 2018 2017 2016

Cash flow from

operations

113205 112454 107871

Changes in working

capital

-429 -611 -1495

Receivables -231 -163 1824

Bills payable - - -

Other liabilities/assets -198 -448 -3319

Net operating cash

flow

112776 111843 106376

Investing activities

Purchase/sale of

investment

12840 973 -5988

Purchase of

investments

-3108 -2279 -13507

Sale/maturity of 15948 3252 7519

6

Free cash flow 192161 115110 87980

Interpretation As above the table in this cash flow every year coming changes in each

item from 2016 to 2018. In operating activities cash flow operations decreasing from last three

years because changes in current assets and current liabilities and that are also reason for changes

in working capital (Fisher and Krumwiede, 2012). Increasing stock, bills payable and other

liabilities cause of increase in current assets and decrease in current liabilities from 2016 to 2018.

changes in current assets and current liabilities effected to net operating cash flow. In investing

activities capital expenditures increases on fixed assets foe the reason of maintenance. Capital

expenditure growth 2.34%(2016), 69.06%(2017), -91.36% (2018). Purchase and sale of

investments are increasing because change in company's cash position.

BWP trust

Operating activities 2018 2017 2016

Cash flow from

operations

113205 112454 107871

Changes in working

capital

-429 -611 -1495

Receivables -231 -163 1824

Bills payable - - -

Other liabilities/assets -198 -448 -3319

Net operating cash

flow

112776 111843 106376

Investing activities

Purchase/sale of

investment

12840 973 -5988

Purchase of

investments

-3108 -2279 -13507

Sale/maturity of 15948 3252 7519

6

investments

Net investing cash

flow

12840 973 -5988

Financing activities

Cash dividend paid-

total

-113446 -110041 -105736

Common dividends -113446 -110041 -105736

Change in capital

stock

- - -

Sale of common&

preferred stock

- - -

Proceeds from stock

options

- - -

Issuance/reduction of

debt, net

- -113446 -110041

Change in long term

debt

- -113446 -110041

Issuance of long term

debt

- - -

Reduction in long term

debt

- -1193 -13068

Net financing cash in

flow

-126997 -111234 -118804

Net change in cash -1381 1582 -18416

Free cash flow 112776 111843 106376

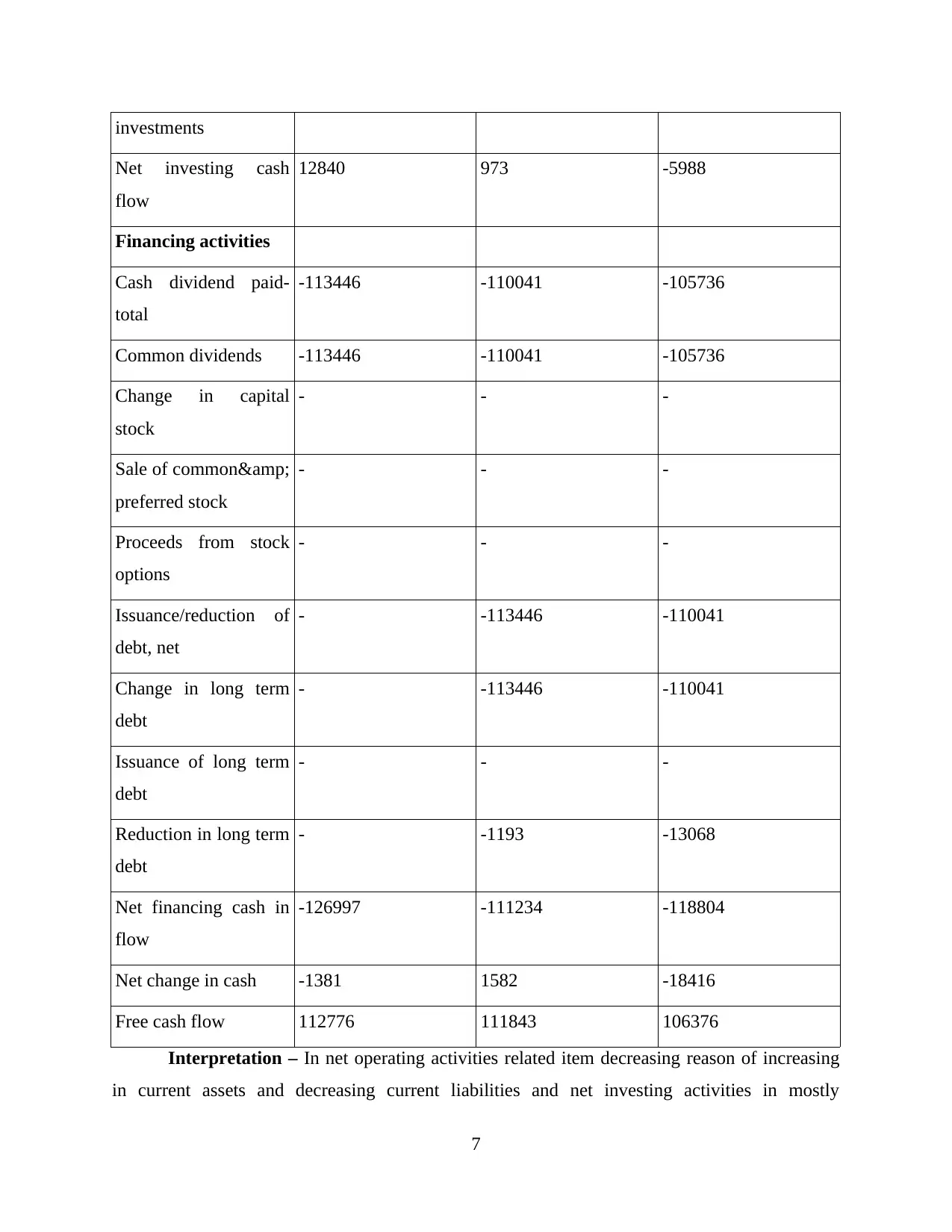

Interpretation – In net operating activities related item decreasing reason of increasing

in current assets and decreasing current liabilities and net investing activities in mostly

7

Net investing cash

flow

12840 973 -5988

Financing activities

Cash dividend paid-

total

-113446 -110041 -105736

Common dividends -113446 -110041 -105736

Change in capital

stock

- - -

Sale of common&

preferred stock

- - -

Proceeds from stock

options

- - -

Issuance/reduction of

debt, net

- -113446 -110041

Change in long term

debt

- -113446 -110041

Issuance of long term

debt

- - -

Reduction in long term

debt

- -1193 -13068

Net financing cash in

flow

-126997 -111234 -118804

Net change in cash -1381 1582 -18416

Free cash flow 112776 111843 106376

Interpretation – In net operating activities related item decreasing reason of increasing

in current assets and decreasing current liabilities and net investing activities in mostly

7

decreasing item and many items will be in negative reason of investment in securities and not

invested in right security (Gallhofer, 2011). Net financial activities cash dividend, common

dividend are decreasing and paid to firstly investors and loans from the year 2016-2018.

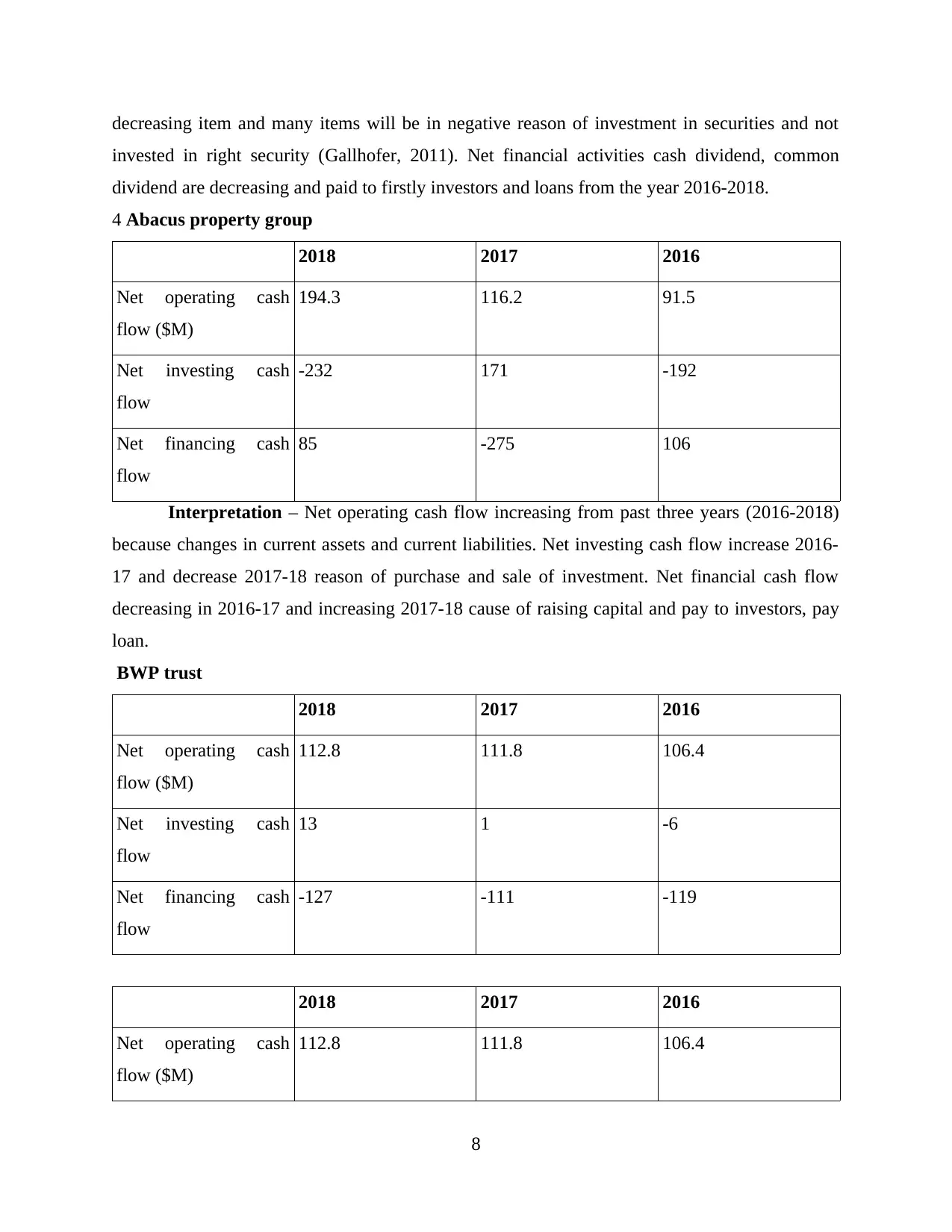

4 Abacus property group

2018 2017 2016

Net operating cash

flow ($M)

194.3 116.2 91.5

Net investing cash

flow

-232 171 -192

Net financing cash

flow

85 -275 106

Interpretation – Net operating cash flow increasing from past three years (2016-2018)

because changes in current assets and current liabilities. Net investing cash flow increase 2016-

17 and decrease 2017-18 reason of purchase and sale of investment. Net financial cash flow

decreasing in 2016-17 and increasing 2017-18 cause of raising capital and pay to investors, pay

loan.

BWP trust

2018 2017 2016

Net operating cash

flow ($M)

112.8 111.8 106.4

Net investing cash

flow

13 1 -6

Net financing cash

flow

-127 -111 -119

2018 2017 2016

Net operating cash

flow ($M)

112.8 111.8 106.4

8

invested in right security (Gallhofer, 2011). Net financial activities cash dividend, common

dividend are decreasing and paid to firstly investors and loans from the year 2016-2018.

4 Abacus property group

2018 2017 2016

Net operating cash

flow ($M)

194.3 116.2 91.5

Net investing cash

flow

-232 171 -192

Net financing cash

flow

85 -275 106

Interpretation – Net operating cash flow increasing from past three years (2016-2018)

because changes in current assets and current liabilities. Net investing cash flow increase 2016-

17 and decrease 2017-18 reason of purchase and sale of investment. Net financial cash flow

decreasing in 2016-17 and increasing 2017-18 cause of raising capital and pay to investors, pay

loan.

BWP trust

2018 2017 2016

Net operating cash

flow ($M)

112.8 111.8 106.4

Net investing cash

flow

13 1 -6

Net financing cash

flow

-127 -111 -119

2018 2017 2016

Net operating cash

flow ($M)

112.8 111.8 106.4

8

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Net investing cash

flow

13 1 -6

Net financing cash

flow

-127 -111 -119

Interpretation – Net operating activities continue increasing from 2016 to 2018 and

reason of current assets and current liabilities. In investment cash flow purchase and sale

securities, net financial activities continue decreasing paying to investors and pays loans

(Grinblatt, Hillier and Titman, 2011).

5. Insights from comparative analysis of cash flow statements of both the companies namely

Abacus Property Group and BWP Trust:

Total net cash flow from operating activities in current year is $112,776,000,

from investing activities is $12,840,000 and from financing activities is

$126,997,000 of BWP Trust.

Total net cash flow from operating activities is about $194,266,000 for 2018,

from investing activities is about (-$232 millions), cash flow from financing

activities is around $85 millions of Abacus Property Group.

Difference of cash flow from operating activities between these two

companies is about $81490000.

Difference of cash flow from investing activities between these two

companies is about (-$244840000) which is negative cash flow.

Difference of cash flow from financing activities between these two

companies is around $41997000.

So, as we can see cash flow from operating activities of Abacus Property

Group is more than from BWP Trust. Net cash flow from investing activities

of BWP Trust is more than from Abacus Property Group (Jones, 2011). And

cash flow from financing activities of BWP Trust is more than from Abacus

Property Group.

Cash flow shows the movement of cash inflow and cash outflow. Negative

cash flow of Abacus Property Group is not a good sign because it can lead to

bankruptcy. From analysis of overall cash flow statement, BWP Trust stands

at strong position as compared to Abacus Property Trust.

9

flow

13 1 -6

Net financing cash

flow

-127 -111 -119

Interpretation – Net operating activities continue increasing from 2016 to 2018 and

reason of current assets and current liabilities. In investment cash flow purchase and sale

securities, net financial activities continue decreasing paying to investors and pays loans

(Grinblatt, Hillier and Titman, 2011).

5. Insights from comparative analysis of cash flow statements of both the companies namely

Abacus Property Group and BWP Trust:

Total net cash flow from operating activities in current year is $112,776,000,

from investing activities is $12,840,000 and from financing activities is

$126,997,000 of BWP Trust.

Total net cash flow from operating activities is about $194,266,000 for 2018,

from investing activities is about (-$232 millions), cash flow from financing

activities is around $85 millions of Abacus Property Group.

Difference of cash flow from operating activities between these two

companies is about $81490000.

Difference of cash flow from investing activities between these two

companies is about (-$244840000) which is negative cash flow.

Difference of cash flow from financing activities between these two

companies is around $41997000.

So, as we can see cash flow from operating activities of Abacus Property

Group is more than from BWP Trust. Net cash flow from investing activities

of BWP Trust is more than from Abacus Property Group (Jones, 2011). And

cash flow from financing activities of BWP Trust is more than from Abacus

Property Group.

Cash flow shows the movement of cash inflow and cash outflow. Negative

cash flow of Abacus Property Group is not a good sign because it can lead to

bankruptcy. From analysis of overall cash flow statement, BWP Trust stands

at strong position as compared to Abacus Property Trust.

9

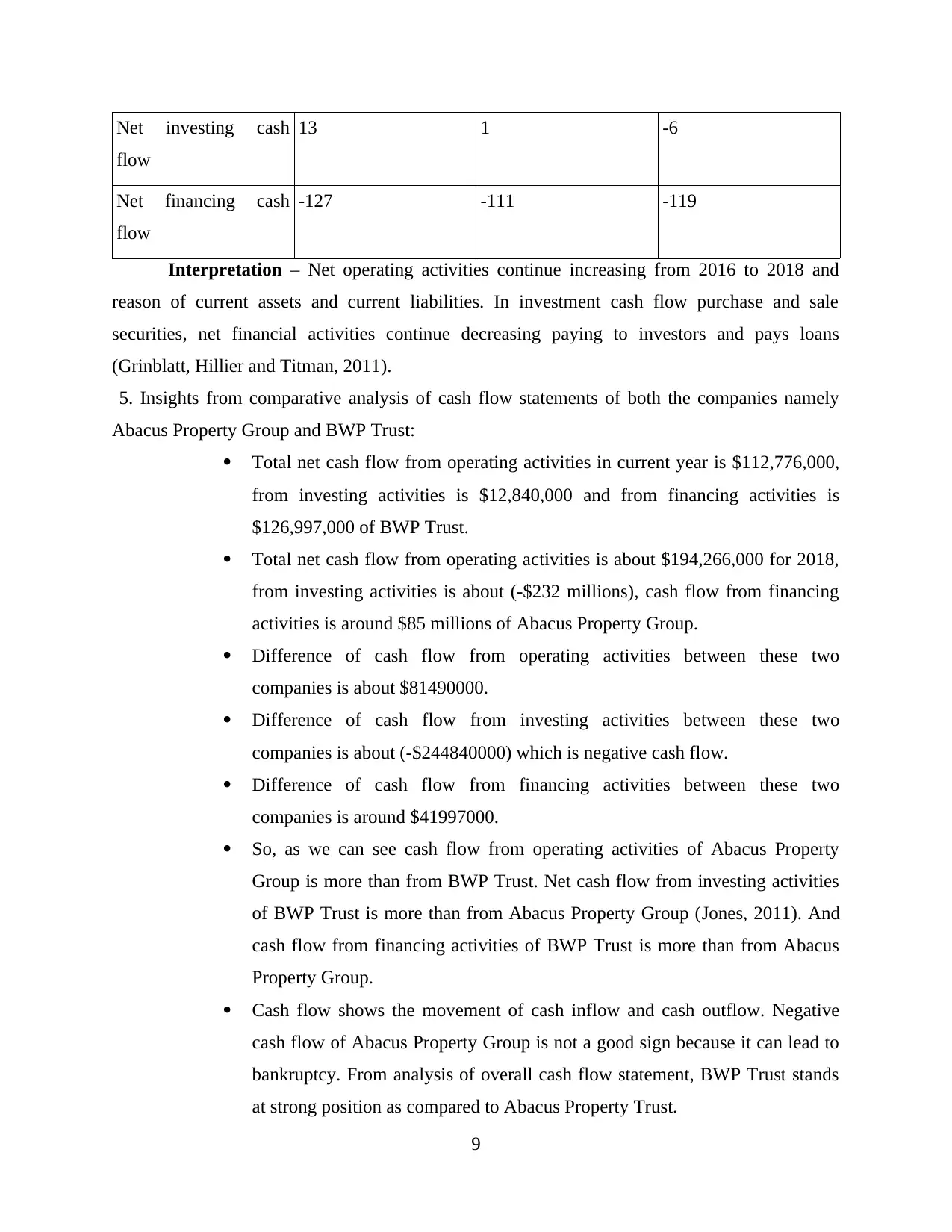

Other Comprehensive Income Statement:

For analysis and comparison of other comprehensive income statement of two public

limited companies, Abacus Property Group and BWP Trust are being taken operating in

real estate industry. Items that have been reported in other comprehensive income

statement of Abacus Group are:

Net gain/(loss) in fair value of investment properties and property, plant and equipment

held at balance date

Net change in property, plant and equipment remeasured at fair value

Net change in fair values of investments and financial instruments held at balanced date

Net change in fair value of derivatives

Net change in fair value of investment properties, inventory and property, plant and

equipment included in equity accounted investments (Leventis, 2013).

Impairment of land development at Muswellbrook

Items that have been reported in other comprehensive income statements of BWP Trust are:

Realised losses transferred to profit or loss (this portion of gain or loss is from derivative

financial instruments in the form of interest rate swap agreements)

Unrealised gains/(losses) on cash flow hedges

VII) Above items of other comprehensive income statement have not been recorded in

Income Statements/Profit and Loss Statements because income statements records only

regular line items or one can say profit and loss items according to IASB but in case if

these items will disclosed under profit and loss statement that it could mislead users of

financial statements. Other comprehensive income statement includes those changes of

profit and loss which have not been realised yet. It starts with the profit or loss

recognized through profit and loss statements. Gains/losses included in other

comprehensive income statement are changes in company's net assets from non-owner

sources. Elements of other comprehensive income that cannot be included in income

statements are:

Gains/losses in revaluation of property, plant and equipment and intangible assets

(Schaltegger, 2017)

Gains/losses originate from equity instruments and derivative hedging instruments in a

cash flow hedge

10

For analysis and comparison of other comprehensive income statement of two public

limited companies, Abacus Property Group and BWP Trust are being taken operating in

real estate industry. Items that have been reported in other comprehensive income

statement of Abacus Group are:

Net gain/(loss) in fair value of investment properties and property, plant and equipment

held at balance date

Net change in property, plant and equipment remeasured at fair value

Net change in fair values of investments and financial instruments held at balanced date

Net change in fair value of derivatives

Net change in fair value of investment properties, inventory and property, plant and

equipment included in equity accounted investments (Leventis, 2013).

Impairment of land development at Muswellbrook

Items that have been reported in other comprehensive income statements of BWP Trust are:

Realised losses transferred to profit or loss (this portion of gain or loss is from derivative

financial instruments in the form of interest rate swap agreements)

Unrealised gains/(losses) on cash flow hedges

VII) Above items of other comprehensive income statement have not been recorded in

Income Statements/Profit and Loss Statements because income statements records only

regular line items or one can say profit and loss items according to IASB but in case if

these items will disclosed under profit and loss statement that it could mislead users of

financial statements. Other comprehensive income statement includes those changes of

profit and loss which have not been realised yet. It starts with the profit or loss

recognized through profit and loss statements. Gains/losses included in other

comprehensive income statement are changes in company's net assets from non-owner

sources. Elements of other comprehensive income that cannot be included in income

statements are:

Gains/losses in revaluation of property, plant and equipment and intangible assets

(Schaltegger, 2017)

Gains/losses originate from equity instruments and derivative hedging instruments in a

cash flow hedge

10

Gains/losses from benefit plans like retirement plan, pension plan

Changes in foreign currency transactions

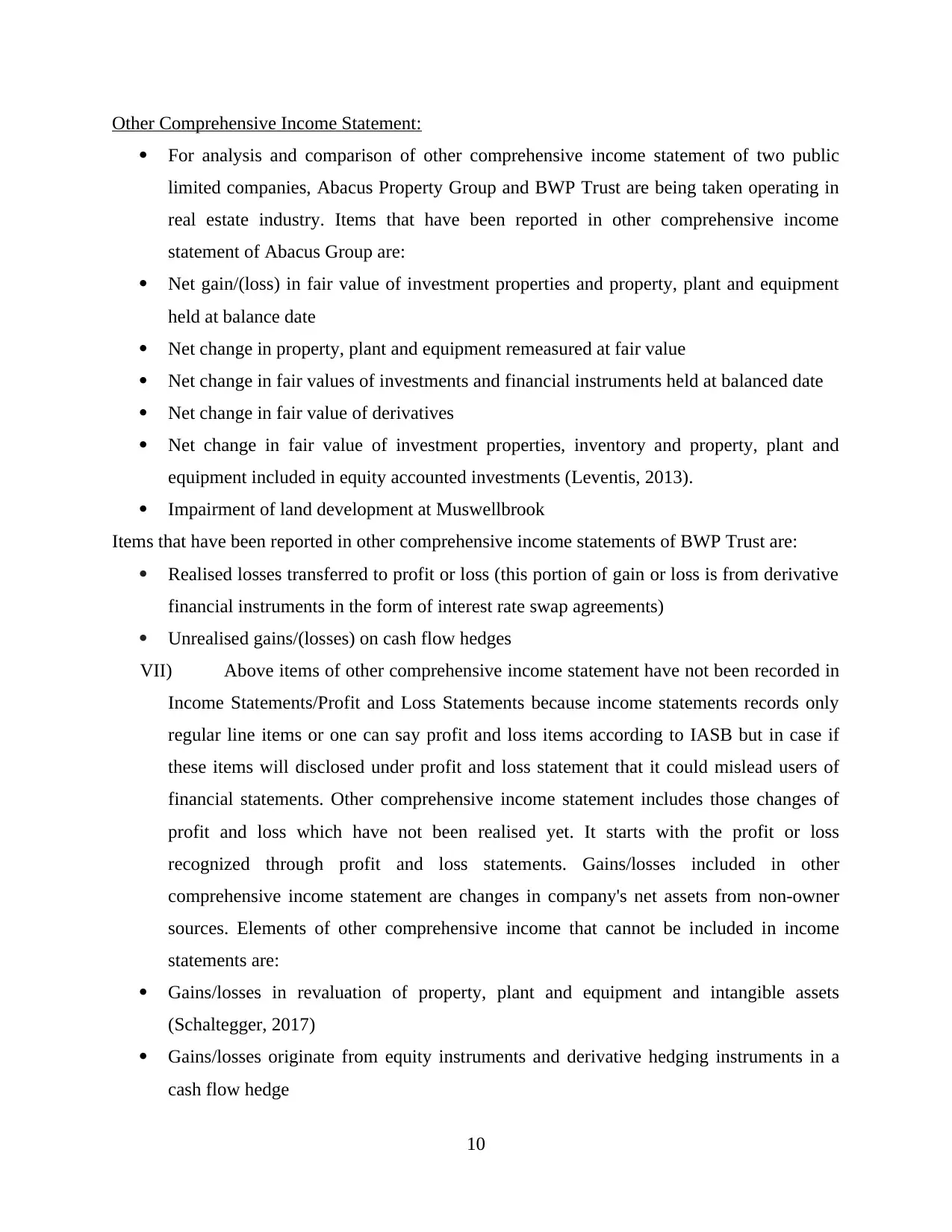

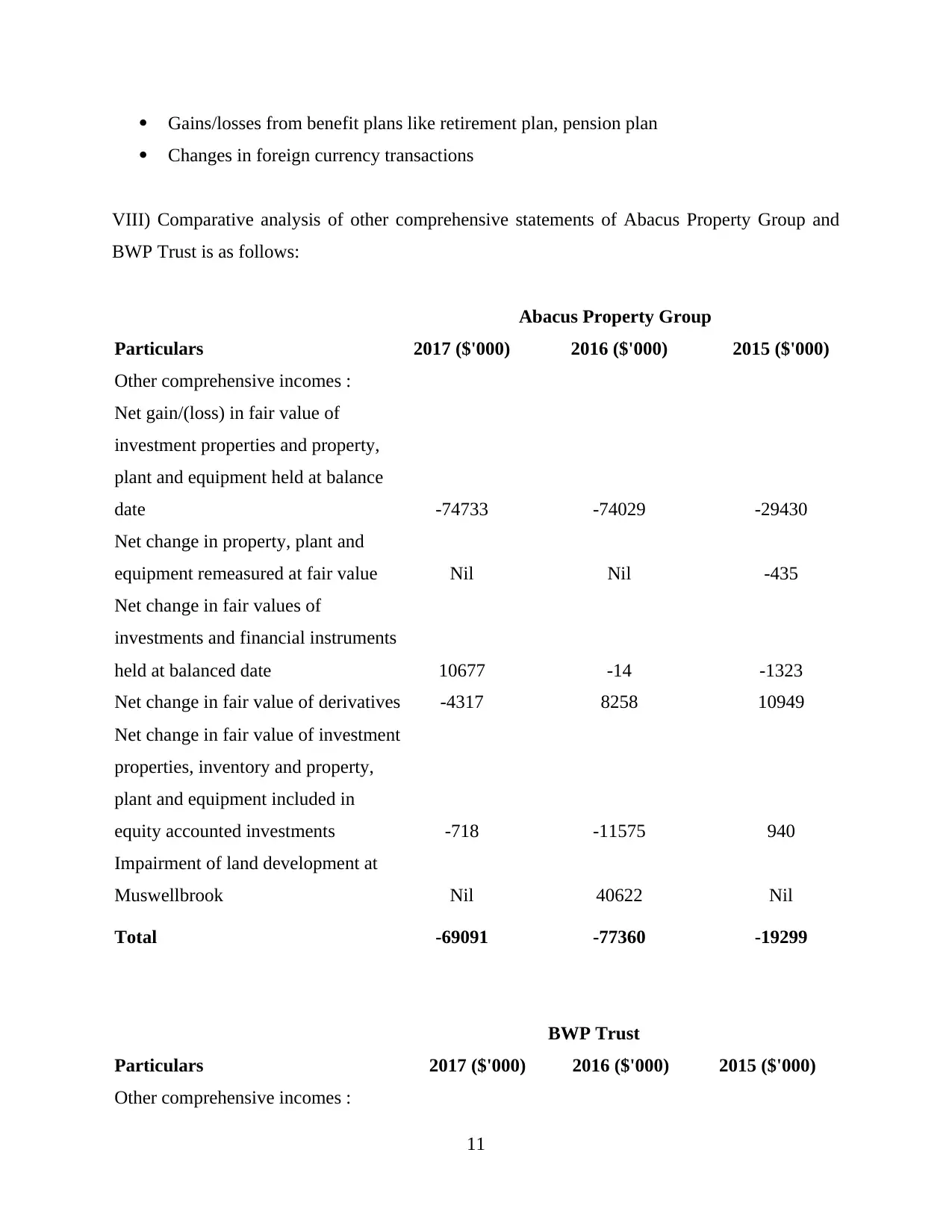

VIII) Comparative analysis of other comprehensive statements of Abacus Property Group and

BWP Trust is as follows:

Abacus Property Group

Particulars 2017 ($'000) 2016 ($'000) 2015 ($'000)

Other comprehensive incomes :

Net gain/(loss) in fair value of

investment properties and property,

plant and equipment held at balance

date -74733 -74029 -29430

Net change in property, plant and

equipment remeasured at fair value Nil Nil -435

Net change in fair values of

investments and financial instruments

held at balanced date 10677 -14 -1323

Net change in fair value of derivatives -4317 8258 10949

Net change in fair value of investment

properties, inventory and property,

plant and equipment included in

equity accounted investments -718 -11575 940

Impairment of land development at

Muswellbrook Nil 40622 Nil

Total -69091 -77360 -19299

BWP Trust

Particulars 2017 ($'000) 2016 ($'000) 2015 ($'000)

Other comprehensive incomes :

11

Changes in foreign currency transactions

VIII) Comparative analysis of other comprehensive statements of Abacus Property Group and

BWP Trust is as follows:

Abacus Property Group

Particulars 2017 ($'000) 2016 ($'000) 2015 ($'000)

Other comprehensive incomes :

Net gain/(loss) in fair value of

investment properties and property,

plant and equipment held at balance

date -74733 -74029 -29430

Net change in property, plant and

equipment remeasured at fair value Nil Nil -435

Net change in fair values of

investments and financial instruments

held at balanced date 10677 -14 -1323

Net change in fair value of derivatives -4317 8258 10949

Net change in fair value of investment

properties, inventory and property,

plant and equipment included in

equity accounted investments -718 -11575 940

Impairment of land development at

Muswellbrook Nil 40622 Nil

Total -69091 -77360 -19299

BWP Trust

Particulars 2017 ($'000) 2016 ($'000) 2015 ($'000)

Other comprehensive incomes :

11

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

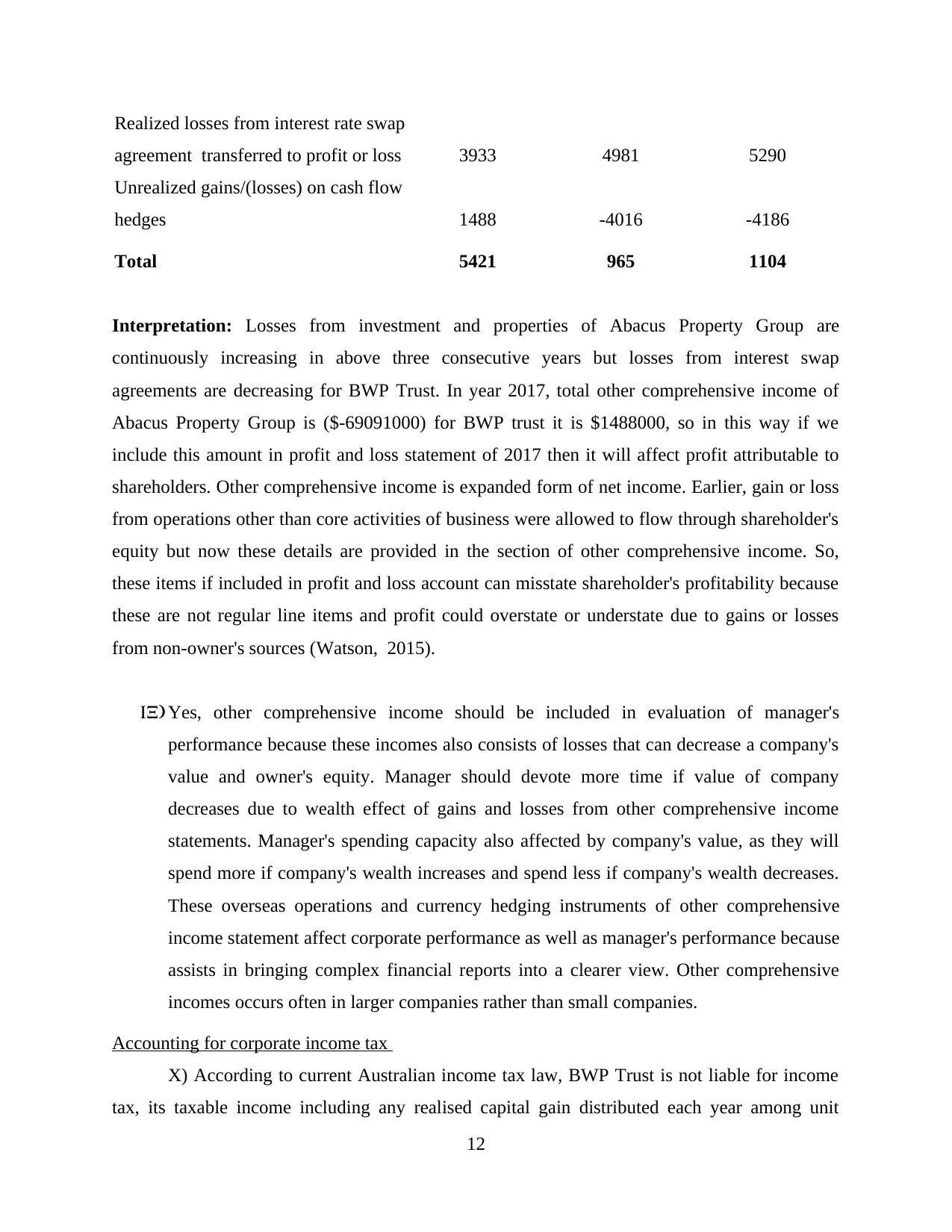

Realized losses from interest rate swap

agreement transferred to profit or loss 3933 4981 5290

Unrealized gains/(losses) on cash flow

hedges 1488 -4016 -4186

Total 5421 965 1104

Interpretation: Losses from investment and properties of Abacus Property Group are

continuously increasing in above three consecutive years but losses from interest swap

agreements are decreasing for BWP Trust. In year 2017, total other comprehensive income of

Abacus Property Group is ($-69091000) for BWP trust it is $1488000, so in this way if we

include this amount in profit and loss statement of 2017 then it will affect profit attributable to

shareholders. Other comprehensive income is expanded form of net income. Earlier, gain or loss

from operations other than core activities of business were allowed to flow through shareholder's

equity but now these details are provided in the section of other comprehensive income. So,

these items if included in profit and loss account can misstate shareholder's profitability because

these are not regular line items and profit could overstate or understate due to gains or losses

from non-owner's sources (Watson, 2015).

IX) Yes, other comprehensive income should be included in evaluation of manager's

performance because these incomes also consists of losses that can decrease a company's

value and owner's equity. Manager should devote more time if value of company

decreases due to wealth effect of gains and losses from other comprehensive income

statements. Manager's spending capacity also affected by company's value, as they will

spend more if company's wealth increases and spend less if company's wealth decreases.

These overseas operations and currency hedging instruments of other comprehensive

income statement affect corporate performance as well as manager's performance because

assists in bringing complex financial reports into a clearer view. Other comprehensive

incomes occurs often in larger companies rather than small companies.

Accounting for corporate income tax

X) According to current Australian income tax law, BWP Trust is not liable for income

tax, its taxable income including any realised capital gain distributed each year among unit

12

agreement transferred to profit or loss 3933 4981 5290

Unrealized gains/(losses) on cash flow

hedges 1488 -4016 -4186

Total 5421 965 1104

Interpretation: Losses from investment and properties of Abacus Property Group are

continuously increasing in above three consecutive years but losses from interest swap

agreements are decreasing for BWP Trust. In year 2017, total other comprehensive income of

Abacus Property Group is ($-69091000) for BWP trust it is $1488000, so in this way if we

include this amount in profit and loss statement of 2017 then it will affect profit attributable to

shareholders. Other comprehensive income is expanded form of net income. Earlier, gain or loss

from operations other than core activities of business were allowed to flow through shareholder's

equity but now these details are provided in the section of other comprehensive income. So,

these items if included in profit and loss account can misstate shareholder's profitability because

these are not regular line items and profit could overstate or understate due to gains or losses

from non-owner's sources (Watson, 2015).

IX) Yes, other comprehensive income should be included in evaluation of manager's

performance because these incomes also consists of losses that can decrease a company's

value and owner's equity. Manager should devote more time if value of company

decreases due to wealth effect of gains and losses from other comprehensive income

statements. Manager's spending capacity also affected by company's value, as they will

spend more if company's wealth increases and spend less if company's wealth decreases.

These overseas operations and currency hedging instruments of other comprehensive

income statement affect corporate performance as well as manager's performance because

assists in bringing complex financial reports into a clearer view. Other comprehensive

incomes occurs often in larger companies rather than small companies.

Accounting for corporate income tax

X) According to current Australian income tax law, BWP Trust is not liable for income

tax, its taxable income including any realised capital gain distributed each year among unit

12

holders. Abacus Property Group paid income taxes of about 29 millions. BWP Trust's deferred

payables are worth $18,587,000 till June 2018.

XI) Effective tax rate includes only income tax but not sales, excise or other types of

taxes. Formula for calculating is:

=Income tax expenses / earnings before tax

Effective tax rate of BWP Trust can not be calculated. But effective tax rate of Abacus Property

Group is 10.45%. Income before income taxes are 276 millions for the year 2018.

Xii) Deferred tax is the amount of tax due but yet not paid. It is difference between tax

accrued and paid and represents future tax payment liability of a company. Opposite to deferred

tax liability, deferred tax asset is the amount of taxes paid in advance as they are paid but not yet

recognized in income statements. Deferred payable liabilities of BWP Trust for the year 2018 is

about $18,587,000. Deferred incomes like rent received in advance of about $10,787,000. Due to

short-term nature of loans and receivables, and payables and deferred income, their carry

forward amount is calculated on the basis of their fair values (Zadek, Evans and Pruzan, 2013).

Xiii) Yes, there was an increase in deferred tax liability of Abacus Property Group from

$17,923,000 to $18,587,000 and decrease in deferred income from $10,869,000 to $10,787,000.

XIV) Cash tax amount is the amount of tax paid to income tax department mentioned in

tax return each year according to income tax laws book tax amount is the total of tax expenses

recorded in financial statements of a company prepared according to IAS's to interpret financial

performance and health of a company. Differences of amount between these two occurred due to

difference in time period of recording tax expenses in tax return and in books of accounts. Cash

tax amount for Abacus Property Group is about $8 million and book tax amount is around 29

million.

XV) As BWP Trust is not liable to pay income tax so cash tax rate can not be calculated.

Cash tax rate for a company is calculated as:

= Total cash tax paid / Net taxable income available to common shareholders * 100

Cash tax rate of Abacus Property Group is as follows:

= $8 million / $244 million * 100

= 3.278%

XVI) There are two ways to measure income tax payable by a company and these are cash tax

and book tax payable. Cash tax amount is calculated according to tax laws to satisfy tax

13

payables are worth $18,587,000 till June 2018.

XI) Effective tax rate includes only income tax but not sales, excise or other types of

taxes. Formula for calculating is:

=Income tax expenses / earnings before tax

Effective tax rate of BWP Trust can not be calculated. But effective tax rate of Abacus Property

Group is 10.45%. Income before income taxes are 276 millions for the year 2018.

Xii) Deferred tax is the amount of tax due but yet not paid. It is difference between tax

accrued and paid and represents future tax payment liability of a company. Opposite to deferred

tax liability, deferred tax asset is the amount of taxes paid in advance as they are paid but not yet

recognized in income statements. Deferred payable liabilities of BWP Trust for the year 2018 is

about $18,587,000. Deferred incomes like rent received in advance of about $10,787,000. Due to

short-term nature of loans and receivables, and payables and deferred income, their carry

forward amount is calculated on the basis of their fair values (Zadek, Evans and Pruzan, 2013).

Xiii) Yes, there was an increase in deferred tax liability of Abacus Property Group from

$17,923,000 to $18,587,000 and decrease in deferred income from $10,869,000 to $10,787,000.

XIV) Cash tax amount is the amount of tax paid to income tax department mentioned in

tax return each year according to income tax laws book tax amount is the total of tax expenses

recorded in financial statements of a company prepared according to IAS's to interpret financial

performance and health of a company. Differences of amount between these two occurred due to

difference in time period of recording tax expenses in tax return and in books of accounts. Cash

tax amount for Abacus Property Group is about $8 million and book tax amount is around 29

million.

XV) As BWP Trust is not liable to pay income tax so cash tax rate can not be calculated.

Cash tax rate for a company is calculated as:

= Total cash tax paid / Net taxable income available to common shareholders * 100

Cash tax rate of Abacus Property Group is as follows:

= $8 million / $244 million * 100

= 3.278%

XVI) There are two ways to measure income tax payable by a company and these are cash tax

and book tax payable. Cash tax amount is calculated according to tax laws to satisfy tax

13

obligations to government. Book tax amount is calculated according to financial accounting rules

to mention in company's financial statements. Difference between these two are due to time

duration taken for calculation, as in cash tax system tax is determined taken into consideration

current year but in book tax system both future and current tax liabilities. Then the difference

between items of cash tax and book tax are classified as temporary and permanent. At last, both

these taxes will be equal because it just a difference because of method (Kim, 2012).

CONCLUSION

This report summarises comparison analysis of overall financial statements of Abacus

Property Group and BWP Trust which includes owner's equity, cash flow statements, other

comprehensive income statements and corporate income tax accounting for last three

consecutive years. Owner's equity statement shows movement in shareholder's reserves, cash

flow statements measure cash flow from operating activities, investing and financing activities,

other comprehensive income statements helps to show true picture of financial position of a

company and also tax expenses are accounted from corporate tax accounting.

14

to mention in company's financial statements. Difference between these two are due to time

duration taken for calculation, as in cash tax system tax is determined taken into consideration

current year but in book tax system both future and current tax liabilities. Then the difference

between items of cash tax and book tax are classified as temporary and permanent. At last, both

these taxes will be equal because it just a difference because of method (Kim, 2012).

CONCLUSION

This report summarises comparison analysis of overall financial statements of Abacus

Property Group and BWP Trust which includes owner's equity, cash flow statements, other

comprehensive income statements and corporate income tax accounting for last three

consecutive years. Owner's equity statement shows movement in shareholder's reserves, cash

flow statements measure cash flow from operating activities, investing and financing activities,

other comprehensive income statements helps to show true picture of financial position of a

company and also tax expenses are accounted from corporate tax accounting.

14

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.