NEXTDC & Computershare: A Financial Statement & Ratio Analysis

VerifiedAdded on 2023/06/05

|23

|4624

|449

Report

AI Summary

This report provides a detailed analysis of the financial statements of Computershare Limited and NEXTDC Limited, focusing on key elements such as equity and cash flow statements. The equity analysis dissects contributed equity, reserves, accumulated losses, and retained earnings, highlighting changes in these items over the years for both companies. A comparative analysis of debt and equity positions reveals the debt-to-equity ratios, indicating the financial stability of each company. The cash flow statement analysis examines operating, investing, and financing activities, noting significant changes and trends in cash inflows and outflows. The report concludes with a comparative assessment of the cash flow categories between the two companies, providing a comprehensive overview of their financial performance. Desklib offers similar solved assignments and past papers for students.

Running head: CORPORATE ACCOUNTING

Corporate Accounting

Name of the Student:

Name of the University:

Authors Note:

Corporate Accounting

Name of the Student:

Name of the University:

Authors Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1

CORPORATE ACCOUNTING

Executive Summary:

It is imperative to have basic knowledge of accounting and financial reporting for a user

of financial reports to understand the meaning of different items provided by an entity in its

financial reports. Generally, the users of financial reports are interested parties and have their

interests associated with the functioning of an organization. In order to take informed decisions

that will have significant impact on the interests of stakeholders it is important to have relevant

understanding of items reported in financial reports.

CORPORATE ACCOUNTING

Executive Summary:

It is imperative to have basic knowledge of accounting and financial reporting for a user

of financial reports to understand the meaning of different items provided by an entity in its

financial reports. Generally, the users of financial reports are interested parties and have their

interests associated with the functioning of an organization. In order to take informed decisions

that will have significant impact on the interests of stakeholders it is important to have relevant

understanding of items reported in financial reports.

2

CORPORATE ACCOUNTING

Contents

Executive Summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Equity:..............................................................................................................................................3

Cash flow statements:......................................................................................................................7

Other comprehensive income:.......................................................................................................13

Corporate taxation and accounting:...............................................................................................15

Conclusion:....................................................................................................................................18

References:....................................................................................................................................19

CORPORATE ACCOUNTING

Contents

Executive Summary:........................................................................................................................1

Introduction:....................................................................................................................................3

Equity:..............................................................................................................................................3

Cash flow statements:......................................................................................................................7

Other comprehensive income:.......................................................................................................13

Corporate taxation and accounting:...............................................................................................15

Conclusion:....................................................................................................................................18

References:....................................................................................................................................19

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3

CORPORATE ACCOUNTING

Introduction:

Computershare Limited and NEXTDC Limited are two well-known entities in

information technology industry in the country. A detailed investigation of the annual reports of

these two companies shall be conducted to identify the different items disclosed under different

elements of financial statements of these companies.

Equity:

Equity also refers to as owners’ equity is the combined amount of share capital, profit

attributable to shareholders, retained earnings and other reserves. A brief discussion on the

different items of equity and the changes in these item balances over the years would help in

dissecting owners’ equity effectively (Weygandt, Kimmel and Kieso, 2015).

(i) Items of equity and changes in each items:

Contributed equity: An organization needs capital to operate. In case of entities established under

the Corporations Act 2001 they can issue equity shares in the market to raise funds for business.

Contributed equity represents the face value received from issue of equity shares of an

organization. NEXTDC and Computershare Limited, both companies have showed contributed

equity under owners’ equity (Mathuva, 2015).

Reserves: Amount transferred to different reserves by an organization is accumulated and shown

under reserves. Both companies have disclosed reserves under owners’ equity. It is important to

note that except free reserves no other reserves are allowed to be used to issue dividend and

bonus shares of an organization (Brown et. al. 2015).

Accumulated Losses: An organization that fails to earn profit from its business operations for

more than a year and instead incurs losses from business operations for number of years

CORPORATE ACCOUNTING

Introduction:

Computershare Limited and NEXTDC Limited are two well-known entities in

information technology industry in the country. A detailed investigation of the annual reports of

these two companies shall be conducted to identify the different items disclosed under different

elements of financial statements of these companies.

Equity:

Equity also refers to as owners’ equity is the combined amount of share capital, profit

attributable to shareholders, retained earnings and other reserves. A brief discussion on the

different items of equity and the changes in these item balances over the years would help in

dissecting owners’ equity effectively (Weygandt, Kimmel and Kieso, 2015).

(i) Items of equity and changes in each items:

Contributed equity: An organization needs capital to operate. In case of entities established under

the Corporations Act 2001 they can issue equity shares in the market to raise funds for business.

Contributed equity represents the face value received from issue of equity shares of an

organization. NEXTDC and Computershare Limited, both companies have showed contributed

equity under owners’ equity (Mathuva, 2015).

Reserves: Amount transferred to different reserves by an organization is accumulated and shown

under reserves. Both companies have disclosed reserves under owners’ equity. It is important to

note that except free reserves no other reserves are allowed to be used to issue dividend and

bonus shares of an organization (Brown et. al. 2015).

Accumulated Losses: An organization that fails to earn profit from its business operations for

more than a year and instead incurs losses from business operations for number of years

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4

CORPORATE ACCOUNTING

accumulates such losses. The accumulation of such losses is shown under accumulated losses in

the Balance sheet under owners’ equity. Since NEXTDC has incurred significant losses over the

years hence, the company has disclosed accumulated losses to reduce the owners’ equity

(Berzkalne and Zelgalve, 2014).

Retained earnings: An entity operating with efficiency in all probability will earn profit from

business operations. Such profits are available for distribution to the shareholders of the entity.

The excess amount of profits remaining after distribution to the shareholders will be accumulated

in retained earnings and to be shown in the Balance sheet under owners’ equity. Computershare

Limited has disclosed the amount of retained earnings to increase the owner’s’ equity (Barth et.

al. 2014).

Changes in items of equity:

Extract from financial reports of NEXTDC provided below would be helpful in analysing the

changes in each items of owners’ equity over the past year.

CORPORATE ACCOUNTING

accumulates such losses. The accumulation of such losses is shown under accumulated losses in

the Balance sheet under owners’ equity. Since NEXTDC has incurred significant losses over the

years hence, the company has disclosed accumulated losses to reduce the owners’ equity

(Berzkalne and Zelgalve, 2014).

Retained earnings: An entity operating with efficiency in all probability will earn profit from

business operations. Such profits are available for distribution to the shareholders of the entity.

The excess amount of profits remaining after distribution to the shareholders will be accumulated

in retained earnings and to be shown in the Balance sheet under owners’ equity. Computershare

Limited has disclosed the amount of retained earnings to increase the owner’s’ equity (Barth et.

al. 2014).

Changes in items of equity:

Extract from financial reports of NEXTDC provided below would be helpful in analysing the

changes in each items of owners’ equity over the past year.

5

CORPORATE ACCOUNTING

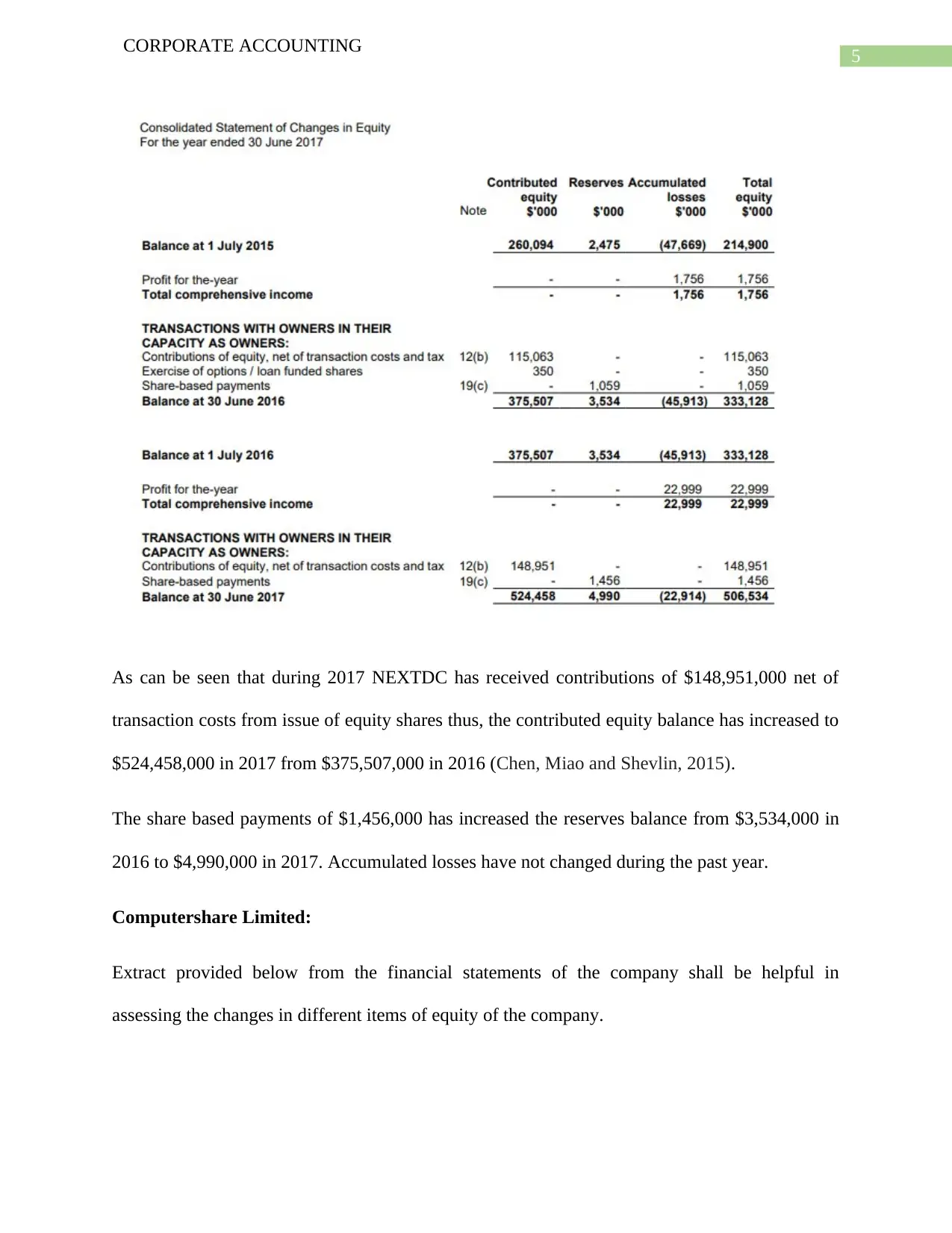

As can be seen that during 2017 NEXTDC has received contributions of $148,951,000 net of

transaction costs from issue of equity shares thus, the contributed equity balance has increased to

$524,458,000 in 2017 from $375,507,000 in 2016 (Chen, Miao and Shevlin, 2015).

The share based payments of $1,456,000 has increased the reserves balance from $3,534,000 in

2016 to $4,990,000 in 2017. Accumulated losses have not changed during the past year.

Computershare Limited:

Extract provided below from the financial statements of the company shall be helpful in

assessing the changes in different items of equity of the company.

CORPORATE ACCOUNTING

As can be seen that during 2017 NEXTDC has received contributions of $148,951,000 net of

transaction costs from issue of equity shares thus, the contributed equity balance has increased to

$524,458,000 in 2017 from $375,507,000 in 2016 (Chen, Miao and Shevlin, 2015).

The share based payments of $1,456,000 has increased the reserves balance from $3,534,000 in

2016 to $4,990,000 in 2017. Accumulated losses have not changed during the past year.

Computershare Limited:

Extract provided below from the financial statements of the company shall be helpful in

assessing the changes in different items of equity of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6

CORPORATE ACCOUNTING

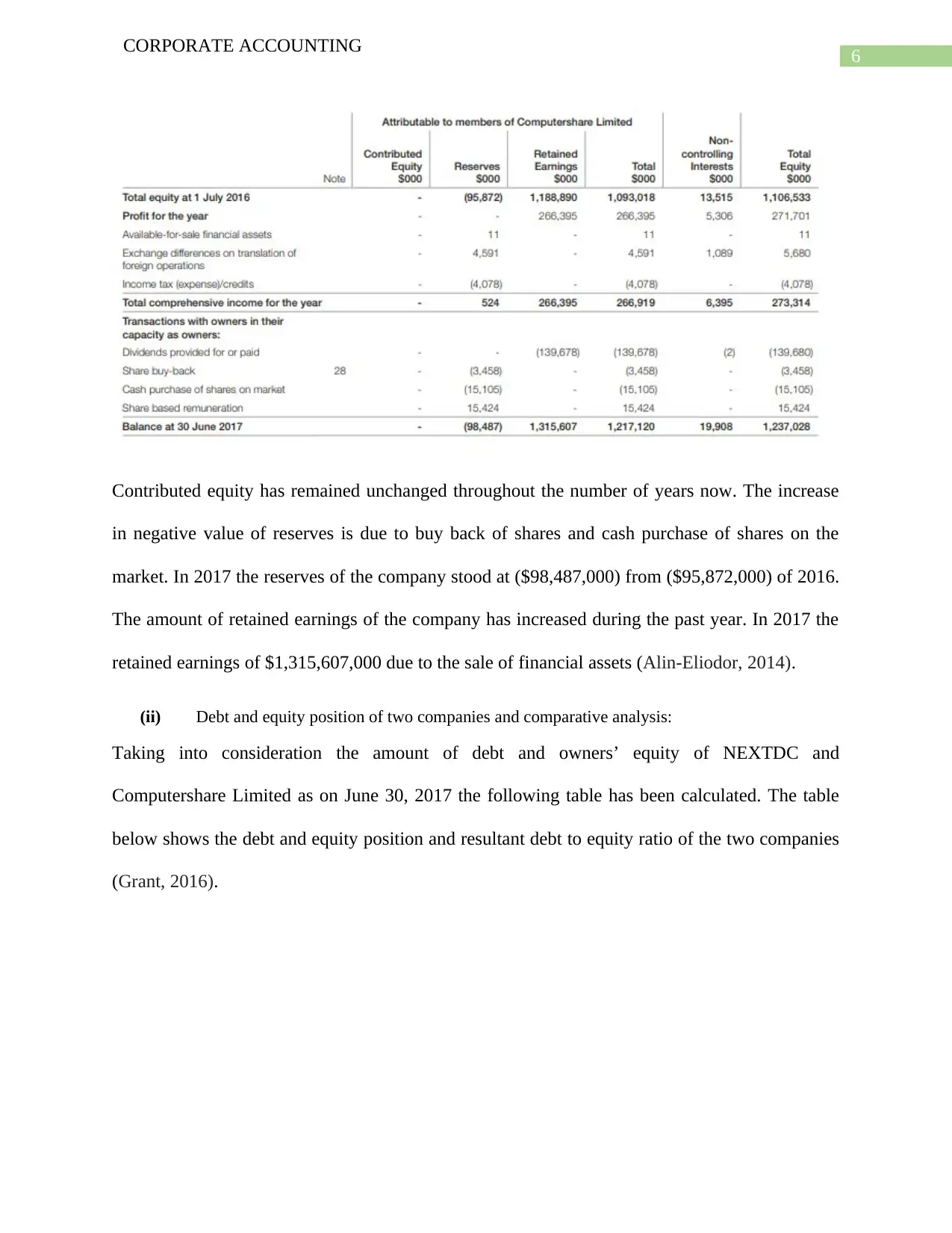

Contributed equity has remained unchanged throughout the number of years now. The increase

in negative value of reserves is due to buy back of shares and cash purchase of shares on the

market. In 2017 the reserves of the company stood at ($98,487,000) from ($95,872,000) of 2016.

The amount of retained earnings of the company has increased during the past year. In 2017 the

retained earnings of $1,315,607,000 due to the sale of financial assets (Alin-Eliodor, 2014).

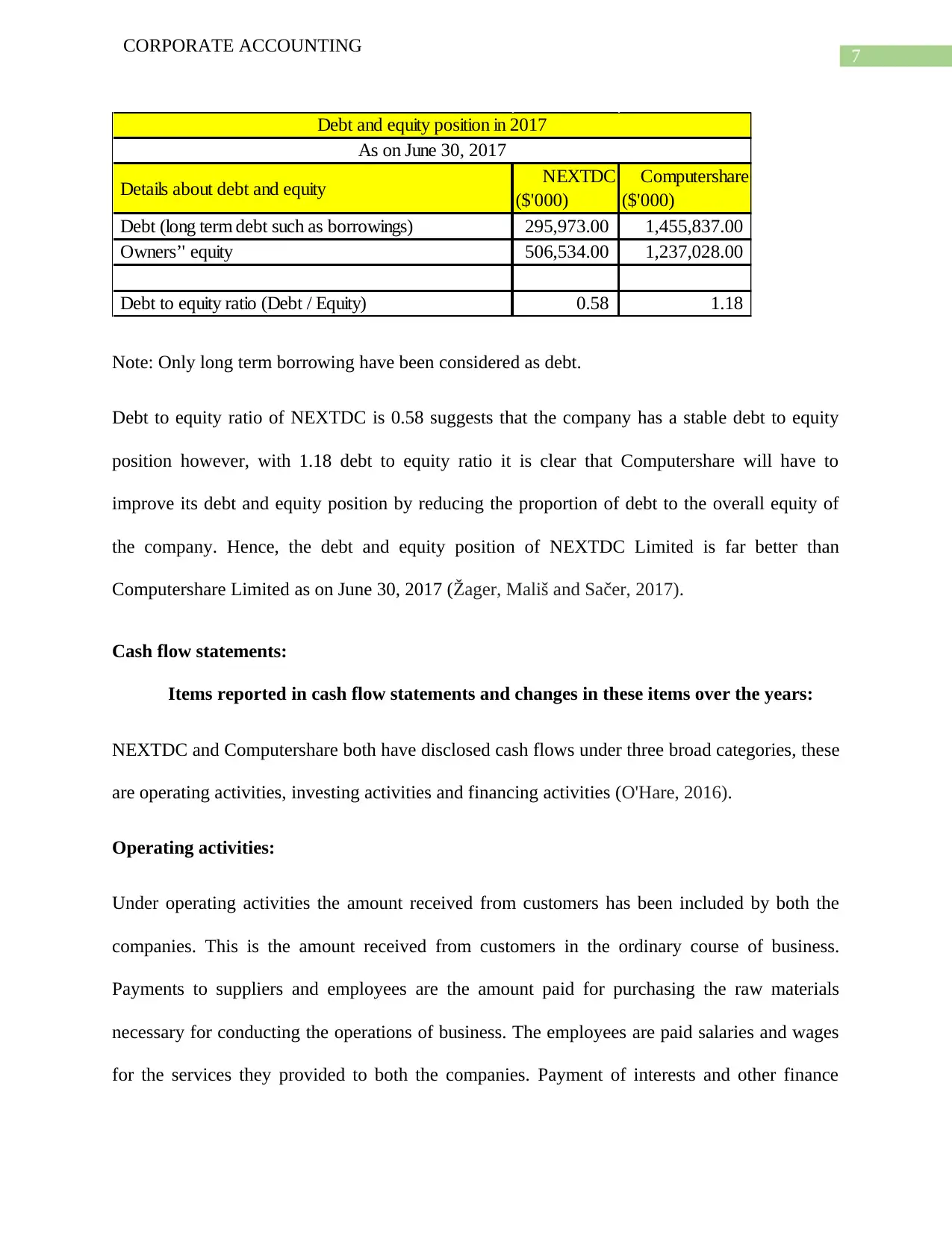

(ii) Debt and equity position of two companies and comparative analysis:

Taking into consideration the amount of debt and owners’ equity of NEXTDC and

Computershare Limited as on June 30, 2017 the following table has been calculated. The table

below shows the debt and equity position and resultant debt to equity ratio of the two companies

(Grant, 2016).

CORPORATE ACCOUNTING

Contributed equity has remained unchanged throughout the number of years now. The increase

in negative value of reserves is due to buy back of shares and cash purchase of shares on the

market. In 2017 the reserves of the company stood at ($98,487,000) from ($95,872,000) of 2016.

The amount of retained earnings of the company has increased during the past year. In 2017 the

retained earnings of $1,315,607,000 due to the sale of financial assets (Alin-Eliodor, 2014).

(ii) Debt and equity position of two companies and comparative analysis:

Taking into consideration the amount of debt and owners’ equity of NEXTDC and

Computershare Limited as on June 30, 2017 the following table has been calculated. The table

below shows the debt and equity position and resultant debt to equity ratio of the two companies

(Grant, 2016).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE ACCOUNTING

Details about debt and equity NEXTDC

($'000)

Computershare

($'000)

Debt (long term debt such as borrowings) 295,973.00 1,455,837.00

Owners’' equity 506,534.00 1,237,028.00

Debt to equity ratio (Debt / Equity) 0.58 1.18

Debt and equity position in 2017

As on June 30, 2017

Note: Only long term borrowing have been considered as debt.

Debt to equity ratio of NEXTDC is 0.58 suggests that the company has a stable debt to equity

position however, with 1.18 debt to equity ratio it is clear that Computershare will have to

improve its debt and equity position by reducing the proportion of debt to the overall equity of

the company. Hence, the debt and equity position of NEXTDC Limited is far better than

Computershare Limited as on June 30, 2017 (Žager, Mališ and Sačer, 2017).

Cash flow statements:

Items reported in cash flow statements and changes in these items over the years:

NEXTDC and Computershare both have disclosed cash flows under three broad categories, these

are operating activities, investing activities and financing activities (O'Hare, 2016).

Operating activities:

Under operating activities the amount received from customers has been included by both the

companies. This is the amount received from customers in the ordinary course of business.

Payments to suppliers and employees are the amount paid for purchasing the raw materials

necessary for conducting the operations of business. The employees are paid salaries and wages

for the services they provided to both the companies. Payment of interests and other finance

CORPORATE ACCOUNTING

Details about debt and equity NEXTDC

($'000)

Computershare

($'000)

Debt (long term debt such as borrowings) 295,973.00 1,455,837.00

Owners’' equity 506,534.00 1,237,028.00

Debt to equity ratio (Debt / Equity) 0.58 1.18

Debt and equity position in 2017

As on June 30, 2017

Note: Only long term borrowing have been considered as debt.

Debt to equity ratio of NEXTDC is 0.58 suggests that the company has a stable debt to equity

position however, with 1.18 debt to equity ratio it is clear that Computershare will have to

improve its debt and equity position by reducing the proportion of debt to the overall equity of

the company. Hence, the debt and equity position of NEXTDC Limited is far better than

Computershare Limited as on June 30, 2017 (Žager, Mališ and Sačer, 2017).

Cash flow statements:

Items reported in cash flow statements and changes in these items over the years:

NEXTDC and Computershare both have disclosed cash flows under three broad categories, these

are operating activities, investing activities and financing activities (O'Hare, 2016).

Operating activities:

Under operating activities the amount received from customers has been included by both the

companies. This is the amount received from customers in the ordinary course of business.

Payments to suppliers and employees are the amount paid for purchasing the raw materials

necessary for conducting the operations of business. The employees are paid salaries and wages

for the services they provided to both the companies. Payment of interests and other finance

8

CORPORATE ACCOUNTING

costs are for loans taken for operating purposes. Apart from that tax paid has been deducted from

gross operating cash flows to determine the net cash flow from operating activities in case of

Computershare Limited. No such tax has been paid by NEXTDC as it has incurred losses

(Penman, 2016).

Investing activities:

Investing activities are the acquisition and disposal of non-current assets such property, plant,

equipment, machinery and other investments. The payment of cash for acquisition of non-current

assets including PPE and other investment assets have been deducted from proceeds received

from sale of non-current assets and investment properties by the companies to compute the net

cash flow or used in investing activities of the respective companies (Nobes, 2014).

Financing activities:

Cash received from issue of equity shares, proceeds received from borrowings are the inflows

from financing activities. Cash paid for repayment of borrowings, buy back of shares, payment

of dividend and payment of finance leases are the main items where cash has been paid under

financing activities (Cooper, 2017).

Changes in items of cash flow statements:

In case of NEXTDC let’s have the cash flow statement of the company before discussing about

the changes in the items of the company:

CORPORATE ACCOUNTING

costs are for loans taken for operating purposes. Apart from that tax paid has been deducted from

gross operating cash flows to determine the net cash flow from operating activities in case of

Computershare Limited. No such tax has been paid by NEXTDC as it has incurred losses

(Penman, 2016).

Investing activities:

Investing activities are the acquisition and disposal of non-current assets such property, plant,

equipment, machinery and other investments. The payment of cash for acquisition of non-current

assets including PPE and other investment assets have been deducted from proceeds received

from sale of non-current assets and investment properties by the companies to compute the net

cash flow or used in investing activities of the respective companies (Nobes, 2014).

Financing activities:

Cash received from issue of equity shares, proceeds received from borrowings are the inflows

from financing activities. Cash paid for repayment of borrowings, buy back of shares, payment

of dividend and payment of finance leases are the main items where cash has been paid under

financing activities (Cooper, 2017).

Changes in items of cash flow statements:

In case of NEXTDC let’s have the cash flow statement of the company before discussing about

the changes in the items of the company:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9

CORPORATE ACCOUNTING

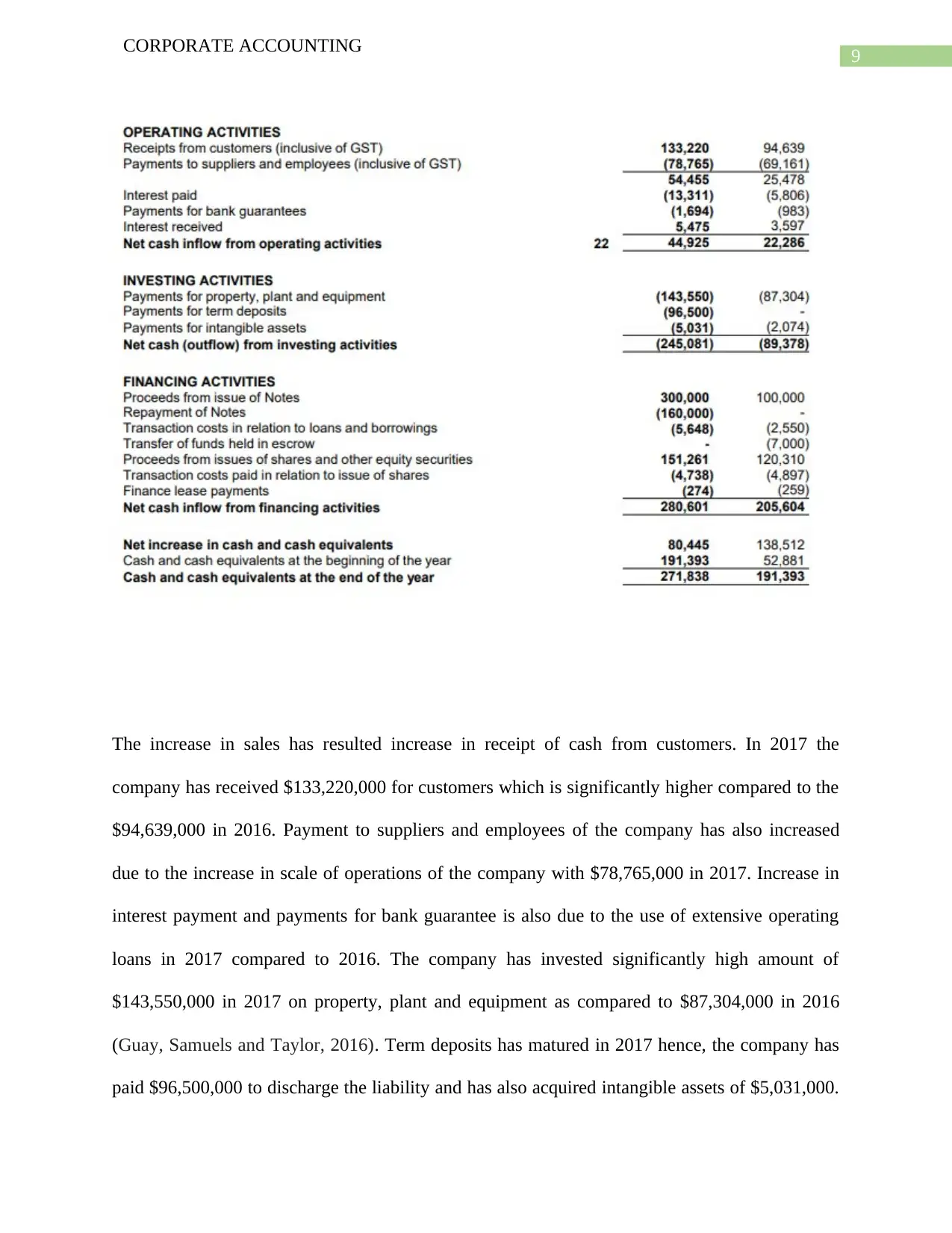

The increase in sales has resulted increase in receipt of cash from customers. In 2017 the

company has received $133,220,000 for customers which is significantly higher compared to the

$94,639,000 in 2016. Payment to suppliers and employees of the company has also increased

due to the increase in scale of operations of the company with $78,765,000 in 2017. Increase in

interest payment and payments for bank guarantee is also due to the use of extensive operating

loans in 2017 compared to 2016. The company has invested significantly high amount of

$143,550,000 in 2017 on property, plant and equipment as compared to $87,304,000 in 2016

(Guay, Samuels and Taylor, 2016). Term deposits has matured in 2017 hence, the company has

paid $96,500,000 to discharge the liability and has also acquired intangible assets of $5,031,000.

CORPORATE ACCOUNTING

The increase in sales has resulted increase in receipt of cash from customers. In 2017 the

company has received $133,220,000 for customers which is significantly higher compared to the

$94,639,000 in 2016. Payment to suppliers and employees of the company has also increased

due to the increase in scale of operations of the company with $78,765,000 in 2017. Increase in

interest payment and payments for bank guarantee is also due to the use of extensive operating

loans in 2017 compared to 2016. The company has invested significantly high amount of

$143,550,000 in 2017 on property, plant and equipment as compared to $87,304,000 in 2016

(Guay, Samuels and Taylor, 2016). Term deposits has matured in 2017 hence, the company has

paid $96,500,000 to discharge the liability and has also acquired intangible assets of $5,031,000.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10

CORPORATE ACCOUNTING

These are the major changes in items of investing activities in cash flow statement. Net cash flow

from financing activities is $280,601,000 in 2017 has increased from $205,604,000 of 2016 due

to the increase amount of proceeds receipts from issue of notes. Also the company has paid cash

of $160,000,000 to repayment notes.

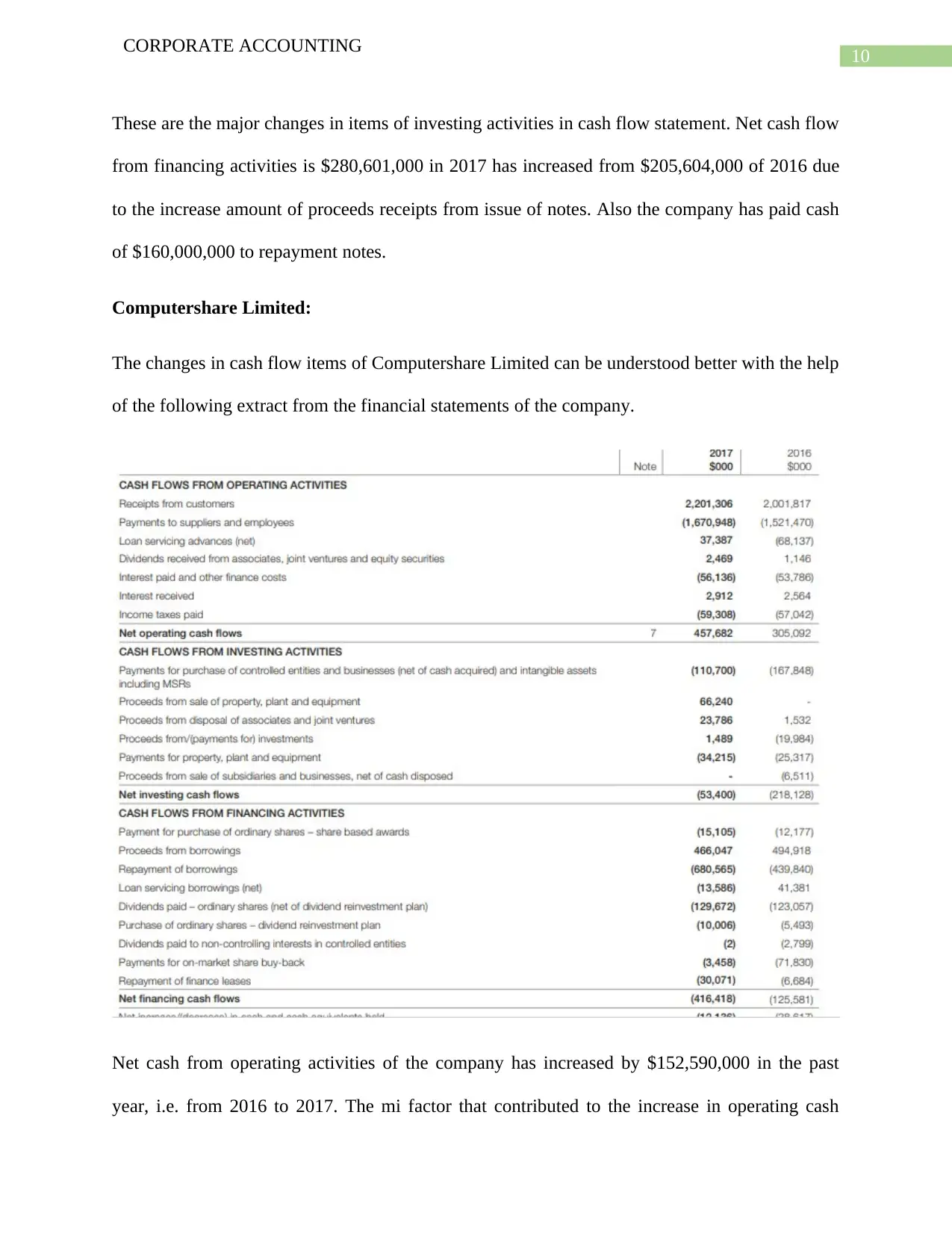

Computershare Limited:

The changes in cash flow items of Computershare Limited can be understood better with the help

of the following extract from the financial statements of the company.

Net cash from operating activities of the company has increased by $152,590,000 in the past

year, i.e. from 2016 to 2017. The mi factor that contributed to the increase in operating cash

CORPORATE ACCOUNTING

These are the major changes in items of investing activities in cash flow statement. Net cash flow

from financing activities is $280,601,000 in 2017 has increased from $205,604,000 of 2016 due

to the increase amount of proceeds receipts from issue of notes. Also the company has paid cash

of $160,000,000 to repayment notes.

Computershare Limited:

The changes in cash flow items of Computershare Limited can be understood better with the help

of the following extract from the financial statements of the company.

Net cash from operating activities of the company has increased by $152,590,000 in the past

year, i.e. from 2016 to 2017. The mi factor that contributed to the increase in operating cash

11

CORPORATE ACCOUNTING

inflows of the company in 2017 is the increased amount of cash received from the customers of

the company during the year (Coates IV, 2014). The investment in investing activities have

reduced significantly in 2017 as the company only invested a net of $53,400,000 in investing

activities as compared to $218,128,000 in 2016. It is due to reduced amount paid to acquire

business combination as well as proceeds received from sale of non-current assets of the

company. The net cash used in financing activities in 2017 has increased due to increase in

repayment of borrowings from $439,840,000 in 2016 to $680,565,000 in 2017.

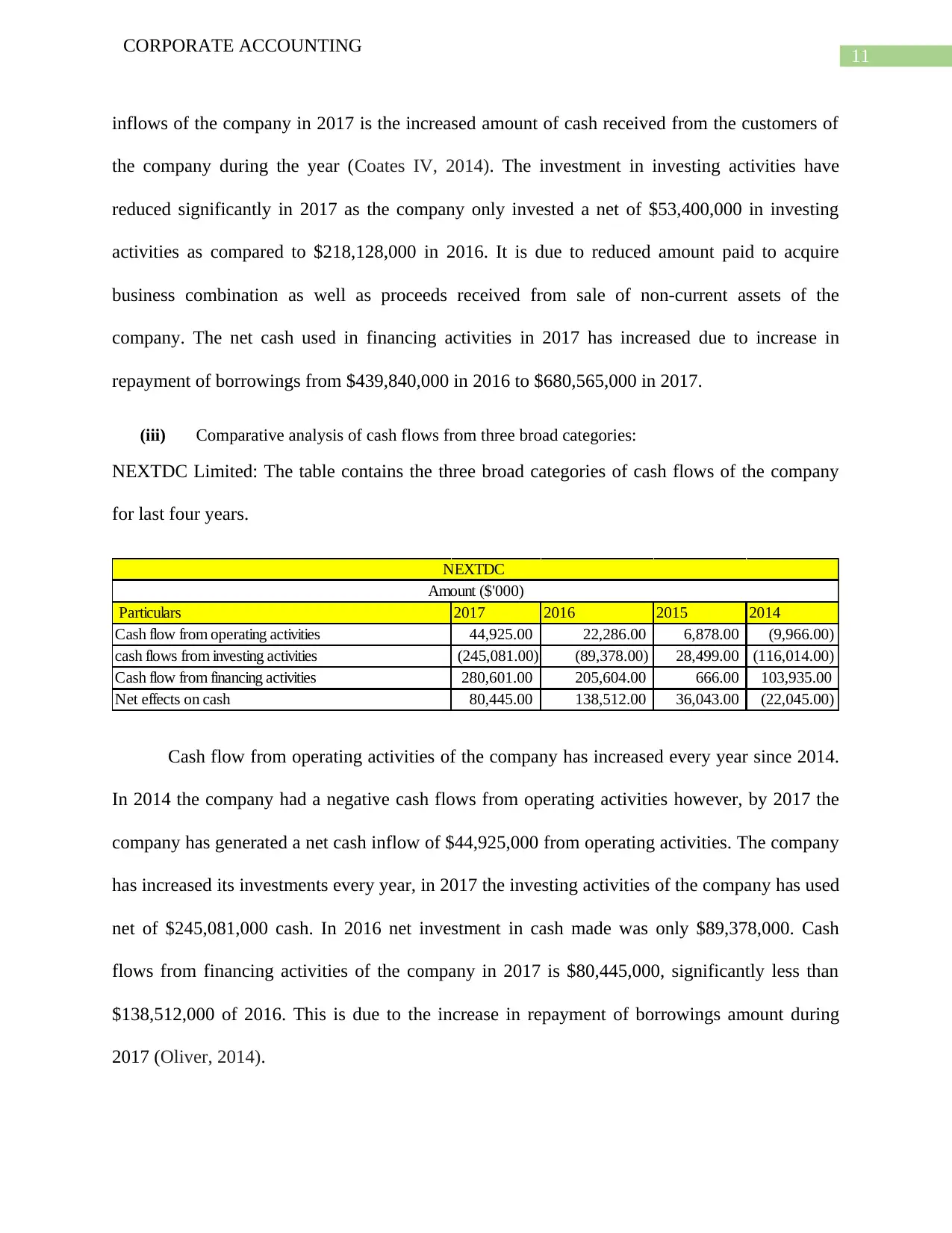

(iii) Comparative analysis of cash flows from three broad categories:

NEXTDC Limited: The table contains the three broad categories of cash flows of the company

for last four years.

Particulars 2017 2016 2015 2014

Cash flow from operating activities 44,925.00 22,286.00 6,878.00 (9,966.00)

cash flows from investing activities (245,081.00) (89,378.00) 28,499.00 (116,014.00)

Cash flow from financing activities 280,601.00 205,604.00 666.00 103,935.00

Net effects on cash 80,445.00 138,512.00 36,043.00 (22,045.00)

NEXTDC

Amount ($'000)

Cash flow from operating activities of the company has increased every year since 2014.

In 2014 the company had a negative cash flows from operating activities however, by 2017 the

company has generated a net cash inflow of $44,925,000 from operating activities. The company

has increased its investments every year, in 2017 the investing activities of the company has used

net of $245,081,000 cash. In 2016 net investment in cash made was only $89,378,000. Cash

flows from financing activities of the company in 2017 is $80,445,000, significantly less than

$138,512,000 of 2016. This is due to the increase in repayment of borrowings amount during

2017 (Oliver, 2014).

CORPORATE ACCOUNTING

inflows of the company in 2017 is the increased amount of cash received from the customers of

the company during the year (Coates IV, 2014). The investment in investing activities have

reduced significantly in 2017 as the company only invested a net of $53,400,000 in investing

activities as compared to $218,128,000 in 2016. It is due to reduced amount paid to acquire

business combination as well as proceeds received from sale of non-current assets of the

company. The net cash used in financing activities in 2017 has increased due to increase in

repayment of borrowings from $439,840,000 in 2016 to $680,565,000 in 2017.

(iii) Comparative analysis of cash flows from three broad categories:

NEXTDC Limited: The table contains the three broad categories of cash flows of the company

for last four years.

Particulars 2017 2016 2015 2014

Cash flow from operating activities 44,925.00 22,286.00 6,878.00 (9,966.00)

cash flows from investing activities (245,081.00) (89,378.00) 28,499.00 (116,014.00)

Cash flow from financing activities 280,601.00 205,604.00 666.00 103,935.00

Net effects on cash 80,445.00 138,512.00 36,043.00 (22,045.00)

NEXTDC

Amount ($'000)

Cash flow from operating activities of the company has increased every year since 2014.

In 2014 the company had a negative cash flows from operating activities however, by 2017 the

company has generated a net cash inflow of $44,925,000 from operating activities. The company

has increased its investments every year, in 2017 the investing activities of the company has used

net of $245,081,000 cash. In 2016 net investment in cash made was only $89,378,000. Cash

flows from financing activities of the company in 2017 is $80,445,000, significantly less than

$138,512,000 of 2016. This is due to the increase in repayment of borrowings amount during

2017 (Oliver, 2014).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.