Group Report: Cash Flow Statement Analysis of Three Companies (HI5020)

VerifiedAdded on 2023/03/30

|20

|3740

|125

Report

AI Summary

This report presents a comprehensive analysis of the cash flow statements of Funtastic Ltd, BHP Ltd, and Santos Ltd. It begins with an introduction to the importance of cash flow statements in assessing a company's financial performance, particularly for investors. The report then delves into the components of the income statement, emphasizing its role in identifying revenue, expenses, and net profit. It examines the significance of cash flow from operating, investing, and financing activities. The analysis compares the sources and applications of cash for each company, including the trends of cash flows from continuing operations. It investigates the relationship between cash flow from operations and net income, exploring the reasons for any differences. The report also assesses each company's ability to generate sufficient cash from operations to cover capital expenditures and dividend payments, examining how surplus cash can be utilized. The study reveals that BHP Ltd. and Santos Ltd are financially stronger than Funtastic Ltd. The report uses tables to present financial data, including cash flow trends and capital expenditure details for each company, providing a clear and structured analysis.

Corporate Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Abstract

Present report provides detail assessment of cash flow statement of three companies i.e. Funtastic

Ltd, BHP Ltd. and Santos Ltd. Income Statement assists the company to identify their revenue,

expenses, and net profit or loss throughout the particular time. Cash flow statement prepared by

the company to know the actual position of the cash, with respect to the operational aspects,

investment aspects, and financial aspect. Further, Income Statement as well as financial

statement is very useful for the investors, by which they can analyze the performance of

company and make proper investment decision. The study revealed that BHP Ltd. and Santos

Ltd are financially strong in comparison to Funtastic Ltd.

Present report provides detail assessment of cash flow statement of three companies i.e. Funtastic

Ltd, BHP Ltd. and Santos Ltd. Income Statement assists the company to identify their revenue,

expenses, and net profit or loss throughout the particular time. Cash flow statement prepared by

the company to know the actual position of the cash, with respect to the operational aspects,

investment aspects, and financial aspect. Further, Income Statement as well as financial

statement is very useful for the investors, by which they can analyze the performance of

company and make proper investment decision. The study revealed that BHP Ltd. and Santos

Ltd are financially strong in comparison to Funtastic Ltd.

Table of Contents

Introduction......................................................................................................................................4

Part A...............................................................................................................................................4

Part B...............................................................................................................................................6

Answer 1......................................................................................................................................6

Answer 2....................................................................................................................................16

Answer 3....................................................................................................................................18

Conclusion.....................................................................................................................................18

References......................................................................................................................................20

Introduction......................................................................................................................................4

Part A...............................................................................................................................................4

Part B...............................................................................................................................................6

Answer 1......................................................................................................................................6

Answer 2....................................................................................................................................16

Answer 3....................................................................................................................................18

Conclusion.....................................................................................................................................18

References......................................................................................................................................20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

INTRODUCTION

Every company prepares the financial report for assessment of the financial performance of the

company. With this aspect, statement of cash flow is significant part of the financial statement of

the company (Reid, and Myddelton, 2017). Given study revolves around the content of

information provided in the statement of cash flows. Further, importance of statement for the

investors is also prescribed in this report. Along with this, report describes the several matters

related with the inflows and outflows of cash of three companies, namely Funtastic Limited,

BHP Limited, and Santos Limited. By observation of the cash flow statement, various aspect like

sources of cash in each firm, trend of cash flow, capability of the companies to generate the cash,

items which affect the cash flows, dividend trend, and others matters evaluated.

PART A

The income statement is prepared by the company for the ascertainment of profitability. It assists

the company to measure the performance by identification of the revenue, direct expenses, and

indirect expenses over specific period of time (Saleh, 2017). It also considers the non-cash

expenses incurred by company such as depreciation. Along with this, performance of the

company in the coming years and the capability of generating the cash flows of company also

determine by the income statement. It consists of the revenue, which are generated form core

business activities or other income (Wolf, Nabin, and Bhattacharya, 2018). It is considered as top

line. Further it takes into account the expenses, along with resulting Income or loss during a

particular time because of earning activities. The information content of profit and loss account

is as follows –

Every company prepares the financial report for assessment of the financial performance of the

company. With this aspect, statement of cash flow is significant part of the financial statement of

the company (Reid, and Myddelton, 2017). Given study revolves around the content of

information provided in the statement of cash flows. Further, importance of statement for the

investors is also prescribed in this report. Along with this, report describes the several matters

related with the inflows and outflows of cash of three companies, namely Funtastic Limited,

BHP Limited, and Santos Limited. By observation of the cash flow statement, various aspect like

sources of cash in each firm, trend of cash flow, capability of the companies to generate the cash,

items which affect the cash flows, dividend trend, and others matters evaluated.

PART A

The income statement is prepared by the company for the ascertainment of profitability. It assists

the company to measure the performance by identification of the revenue, direct expenses, and

indirect expenses over specific period of time (Saleh, 2017). It also considers the non-cash

expenses incurred by company such as depreciation. Along with this, performance of the

company in the coming years and the capability of generating the cash flows of company also

determine by the income statement. It consists of the revenue, which are generated form core

business activities or other income (Wolf, Nabin, and Bhattacharya, 2018). It is considered as top

line. Further it takes into account the expenses, along with resulting Income or loss during a

particular time because of earning activities. The information content of profit and loss account

is as follows –

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Operating revenue and expenses – it is refers as gross revenue, which consist of inflows of cash

and other enhancement of the assets of company. Expenses consist of outflow of the cash and

other expenses incurred in relation with assets or liabilities. Further, cost of goods sold, research

and development expenses, depreciation and amortization, and selling and organizational

expenditure are included in the information content of expenses (Miao, Teoh, and Zhu, 2016).

Non-Operating Revenue and Expenses – it consists of revenue or profit from non-operating

business, such as income from rent. Further, in the non-operating expenses, the expenses

incurred by the company for non-operating expenses such as payment of interest, borrowing cost

and others (Campbell & et.al 2019).

Along with the above aspects, Income statement is significant part of financial statement. It is

very useful for the investor, as they can assess the financial performance of the company relating

to particular period. It clearly states about the profit or loss of a company. They can identify

whether the company can carry out its operations in a well manner in the future. Thus, the above

information can be only found in the Income Statement, therefore it is very useful (Gordon &

et.al 2017).

Moreover, cash flows statement of the company shows the exact amount of cash inflow and cash

outflow of the company. It is prepared by the company for the identification of liquidity of the

funds, viability for the short term period, and for the ascertainment of its position to make the

payment of its bill to the seller (Clubb, 2015). In the statement of the cash flows three are three

main activities, which are described as below –

and other enhancement of the assets of company. Expenses consist of outflow of the cash and

other expenses incurred in relation with assets or liabilities. Further, cost of goods sold, research

and development expenses, depreciation and amortization, and selling and organizational

expenditure are included in the information content of expenses (Miao, Teoh, and Zhu, 2016).

Non-Operating Revenue and Expenses – it consists of revenue or profit from non-operating

business, such as income from rent. Further, in the non-operating expenses, the expenses

incurred by the company for non-operating expenses such as payment of interest, borrowing cost

and others (Campbell & et.al 2019).

Along with the above aspects, Income statement is significant part of financial statement. It is

very useful for the investor, as they can assess the financial performance of the company relating

to particular period. It clearly states about the profit or loss of a company. They can identify

whether the company can carry out its operations in a well manner in the future. Thus, the above

information can be only found in the Income Statement, therefore it is very useful (Gordon &

et.al 2017).

Moreover, cash flows statement of the company shows the exact amount of cash inflow and cash

outflow of the company. It is prepared by the company for the identification of liquidity of the

funds, viability for the short term period, and for the ascertainment of its position to make the

payment of its bill to the seller (Clubb, 2015). In the statement of the cash flows three are three

main activities, which are described as below –

Cash flow from operating activities – it analyze the cash flow of the entity from the net profit or

losses, and make the reconciliation of the net profit or loss from the real cash received or paid by

the entity from the operating activities (Alfonso & et.al 2018).

Cash flows from investing activities – it shows the how much money is received by company

from sale of investment and how much money used by the company for buying the investment

(Donleavy, & et.al 2018).

Cash flows from financing activities – it shows about the cash inflow and outflow from the

financing activities of the business such as cash avail because of issue of debenture, cash inflows

from borrowing by bank or financial institutions and others (Gordon &et al. 2016).

Cash generation capability of the entity can be ascertained by the statement of cash flows,

therefore investor can determine the amount of cash generated by entity by observation of the

statement of cash flows. Further, this investor can also analyze whether the cash flows belong

from the operating activities, investing activities, and financing activities separately (Weber,

2018). An investor can observe how the company spends its cash. Along with this, key

performance indicators also identified by the evaluation of the inflows and outflows of cash.

Therefore, it is very useful for investors while making the investing decision.

PART B

Answer 1

Major sources and application of cash in each firm

In the case of Funtastic Limited, company generates the cash from receipt from the customers,

interest and other income; cash received from the issue of shares, cash from borrowings. In the

losses, and make the reconciliation of the net profit or loss from the real cash received or paid by

the entity from the operating activities (Alfonso & et.al 2018).

Cash flows from investing activities – it shows the how much money is received by company

from sale of investment and how much money used by the company for buying the investment

(Donleavy, & et.al 2018).

Cash flows from financing activities – it shows about the cash inflow and outflow from the

financing activities of the business such as cash avail because of issue of debenture, cash inflows

from borrowing by bank or financial institutions and others (Gordon &et al. 2016).

Cash generation capability of the entity can be ascertained by the statement of cash flows,

therefore investor can determine the amount of cash generated by entity by observation of the

statement of cash flows. Further, this investor can also analyze whether the cash flows belong

from the operating activities, investing activities, and financing activities separately (Weber,

2018). An investor can observe how the company spends its cash. Along with this, key

performance indicators also identified by the evaluation of the inflows and outflows of cash.

Therefore, it is very useful for investors while making the investing decision.

PART B

Answer 1

Major sources and application of cash in each firm

In the case of Funtastic Limited, company generates the cash from receipt from the customers,

interest and other income; cash received from the issue of shares, cash from borrowings. In the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

year 2018, the company generated cash by sale of an international subsidiary. Further, the

company utilizes its cash for payment to supplier, interest and another cost of finance, buying of

assets, cost incurred forthe issue of shares and another cost (Ketz, 2016).

In case of BHP Limited, company generated cash by receipt from customers, dividend, interest

and other income, sale of assets, interest bearing liabilities. The company utilizes this case for

payment to supplier, interest payment, purchasing of the assets, expenditure on exploration, and

repayment of the liabilities (Baik, & et al. 2016).

In the case of Santos Limited, cash generated by the company from receipt of customers,

dividend, the tariff of the pipeline, sale of assets, borrowings and another receipt. The company

utilizes this cash for payment to supplier, cost of borrowing, buying of assets, royal and excise

payment, repayment of liabilities, and other payment.

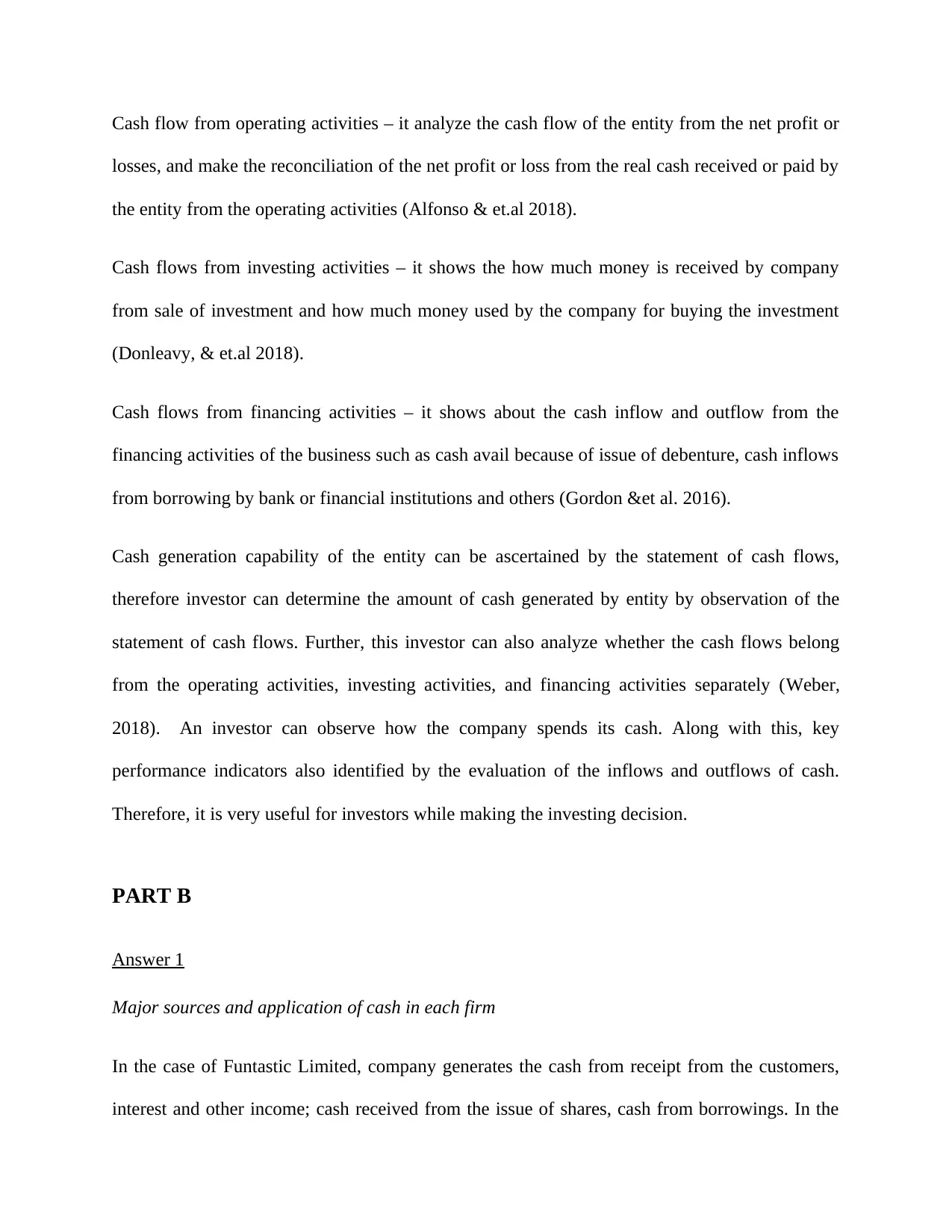

The trend of cash flows from continuing operations for each firm

Table 1 Funtastic Limited

Particulars 2018 (in AU $ 000) 2017 (in AU $ 000) 2016 (in AU $ 000)

Cash flows from

operating activities

(continue)

(10182) (2750) (7329)

Table 2 BHP Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

(continue)

17561 15876 9840

company utilizes its cash for payment to supplier, interest and another cost of finance, buying of

assets, cost incurred forthe issue of shares and another cost (Ketz, 2016).

In case of BHP Limited, company generated cash by receipt from customers, dividend, interest

and other income, sale of assets, interest bearing liabilities. The company utilizes this case for

payment to supplier, interest payment, purchasing of the assets, expenditure on exploration, and

repayment of the liabilities (Baik, & et al. 2016).

In the case of Santos Limited, cash generated by the company from receipt of customers,

dividend, the tariff of the pipeline, sale of assets, borrowings and another receipt. The company

utilizes this cash for payment to supplier, cost of borrowing, buying of assets, royal and excise

payment, repayment of liabilities, and other payment.

The trend of cash flows from continuing operations for each firm

Table 1 Funtastic Limited

Particulars 2018 (in AU $ 000) 2017 (in AU $ 000) 2016 (in AU $ 000)

Cash flows from

operating activities

(continue)

(10182) (2750) (7329)

Table 2 BHP Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

(continue)

17561 15876 9840

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table 3 Santos Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

(continue)

1578 1248 840

In the case of Funtastic Limited, there are no inflows of cash, even the outflow of cash from

operating activities is an increasing trend. Further, in the case of BHP Limited, the trend of cash

flows is upward from operations. In case of Santos Limited, from the operational activities, the

trend of cash flows is upward side, which is due to increase in the receipt from customers, and

another receipt from operations (Lewellen, and Lewellen, 2016).

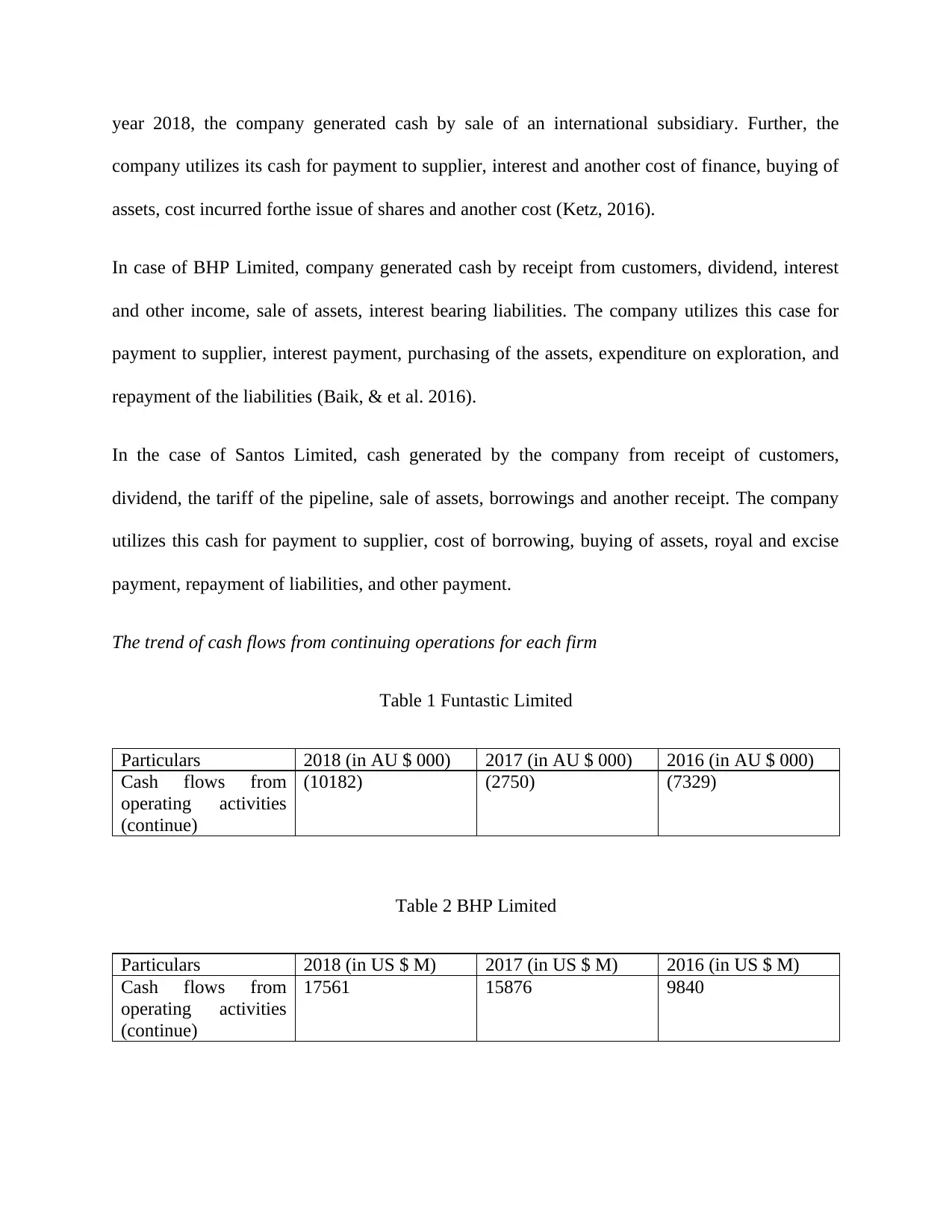

Cash flows from the operation is more than or less than net income and reasons for the

difference

Table 4 BHP Limited

Particulars 2018 (in US $M) 2017 (in US $M) 2016 (in US $M)

Net Income 14751 11137 1791

Cash Flows From

Operations

18461 16804 10624

For BHP Limited, cash inflows from operations are more than the net income of the profit. In the

computation of the net income of the company, non-cash expenses such as depreciation,

amortization, and impairment of assets also considered. However, while computation of the cash

inflows, the non-cash expenses in not taken into account because of no outflow of cash. This is

one of the reasons behind the increment in the cash flows as compared with the net income.

Along with this, change in working capital like current assets and current liability is not

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

(continue)

1578 1248 840

In the case of Funtastic Limited, there are no inflows of cash, even the outflow of cash from

operating activities is an increasing trend. Further, in the case of BHP Limited, the trend of cash

flows is upward from operations. In case of Santos Limited, from the operational activities, the

trend of cash flows is upward side, which is due to increase in the receipt from customers, and

another receipt from operations (Lewellen, and Lewellen, 2016).

Cash flows from the operation is more than or less than net income and reasons for the

difference

Table 4 BHP Limited

Particulars 2018 (in US $M) 2017 (in US $M) 2016 (in US $M)

Net Income 14751 11137 1791

Cash Flows From

Operations

18461 16804 10624

For BHP Limited, cash inflows from operations are more than the net income of the profit. In the

computation of the net income of the company, non-cash expenses such as depreciation,

amortization, and impairment of assets also considered. However, while computation of the cash

inflows, the non-cash expenses in not taken into account because of no outflow of cash. This is

one of the reasons behind the increment in the cash flows as compared with the net income.

Along with this, change in working capital like current assets and current liability is not

considered in the profit and loss account, and the same is considered in the cash flow statement,

which makes the difference in the cash flows from operations and net profit of the company

(Kraft, and Schwartz, 2015).

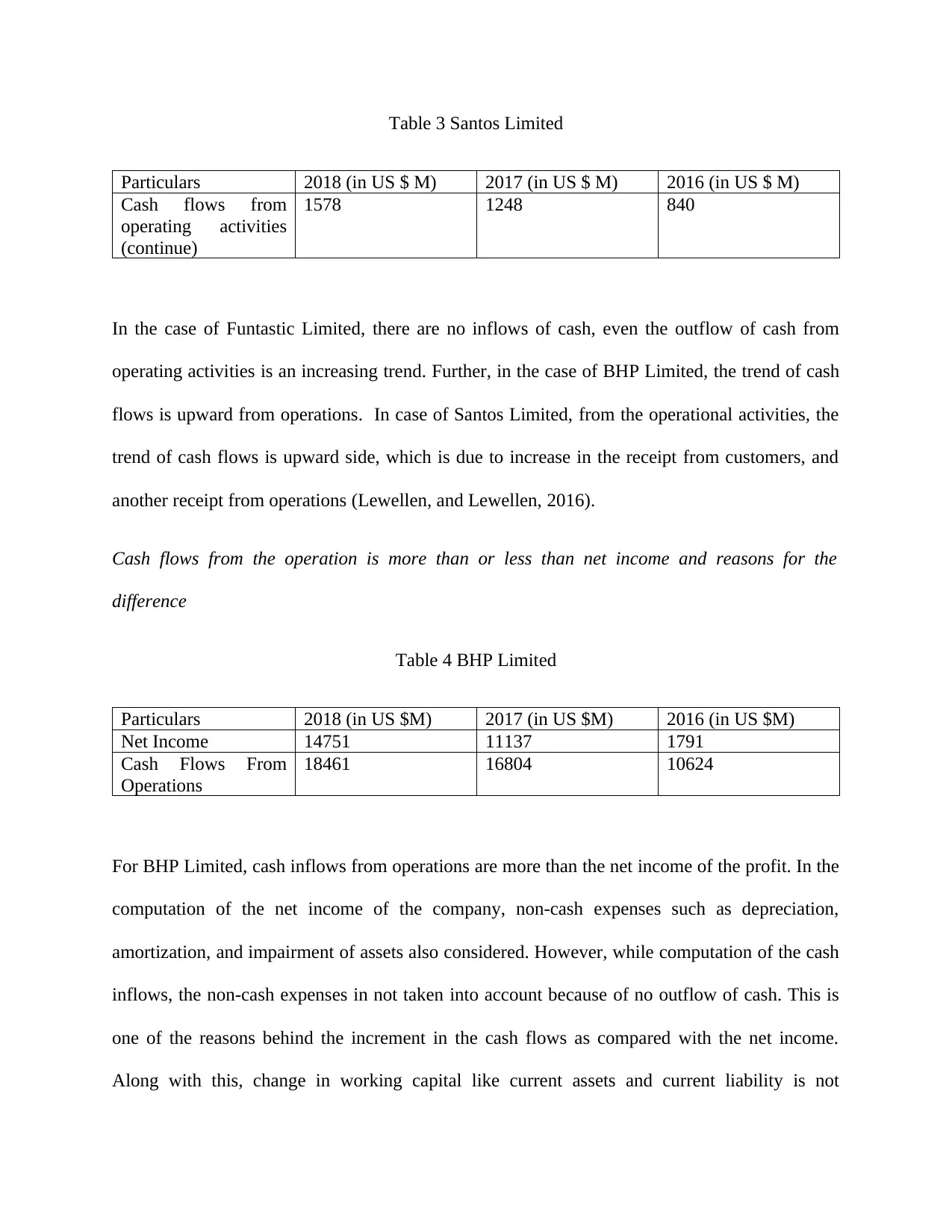

The ability of the company to generate sufficient cash from operations in order to accomplish

obligation relating to its capital expenditures

Table 5 Funtastic Limited

Particulars 2018 (in AU $ 000) 2017 (in AU $ 000) 2016 (in AU $ 000)

Cash flows from

operating activities

(10182) (2750) (7329)

Capital Expenditure

of company

Payment for plant and

equipment

145 888 884

Payment for other

intangible assets

281 540 325

On the basis of the above table, there are no cash inflows generated by the company from its

operations. Therefore Funtastic Limited is not capable for the payment of capital expenditure out

of its operations.

Table 6 BHP Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

18461 16804 10625

Capital Expenditure

of company

Purchases of

property, plant and

equipment

4979 3697 5707

Exploration

expenditure

874 966 752

Other investing 141 153 20

which makes the difference in the cash flows from operations and net profit of the company

(Kraft, and Schwartz, 2015).

The ability of the company to generate sufficient cash from operations in order to accomplish

obligation relating to its capital expenditures

Table 5 Funtastic Limited

Particulars 2018 (in AU $ 000) 2017 (in AU $ 000) 2016 (in AU $ 000)

Cash flows from

operating activities

(10182) (2750) (7329)

Capital Expenditure

of company

Payment for plant and

equipment

145 888 884

Payment for other

intangible assets

281 540 325

On the basis of the above table, there are no cash inflows generated by the company from its

operations. Therefore Funtastic Limited is not capable for the payment of capital expenditure out

of its operations.

Table 6 BHP Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

18461 16804 10625

Capital Expenditure

of company

Purchases of

property, plant and

equipment

4979 3697 5707

Exploration

expenditure

874 966 752

Other investing 141 153 20

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

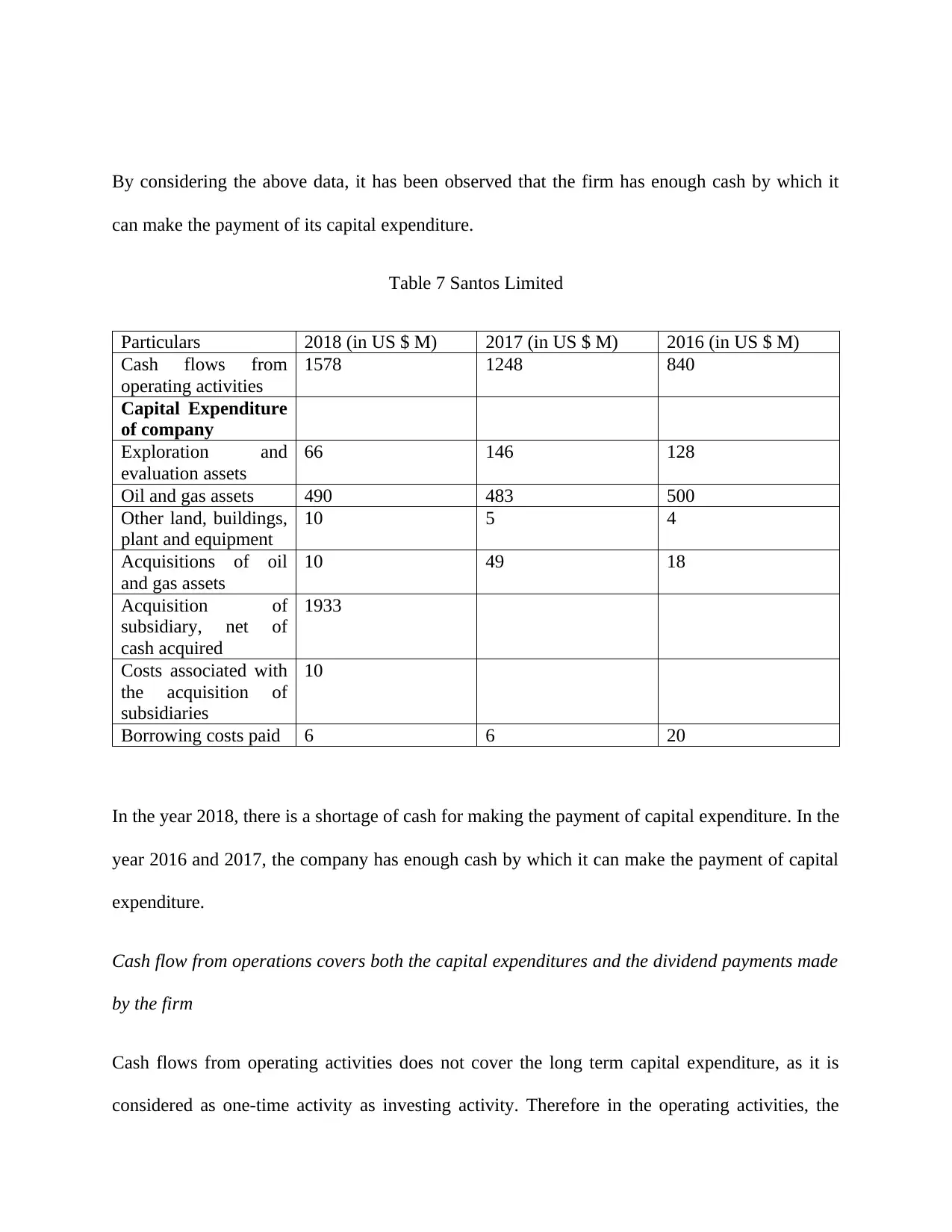

By considering the above data, it has been observed that the firm has enough cash by which it

can make the payment of its capital expenditure.

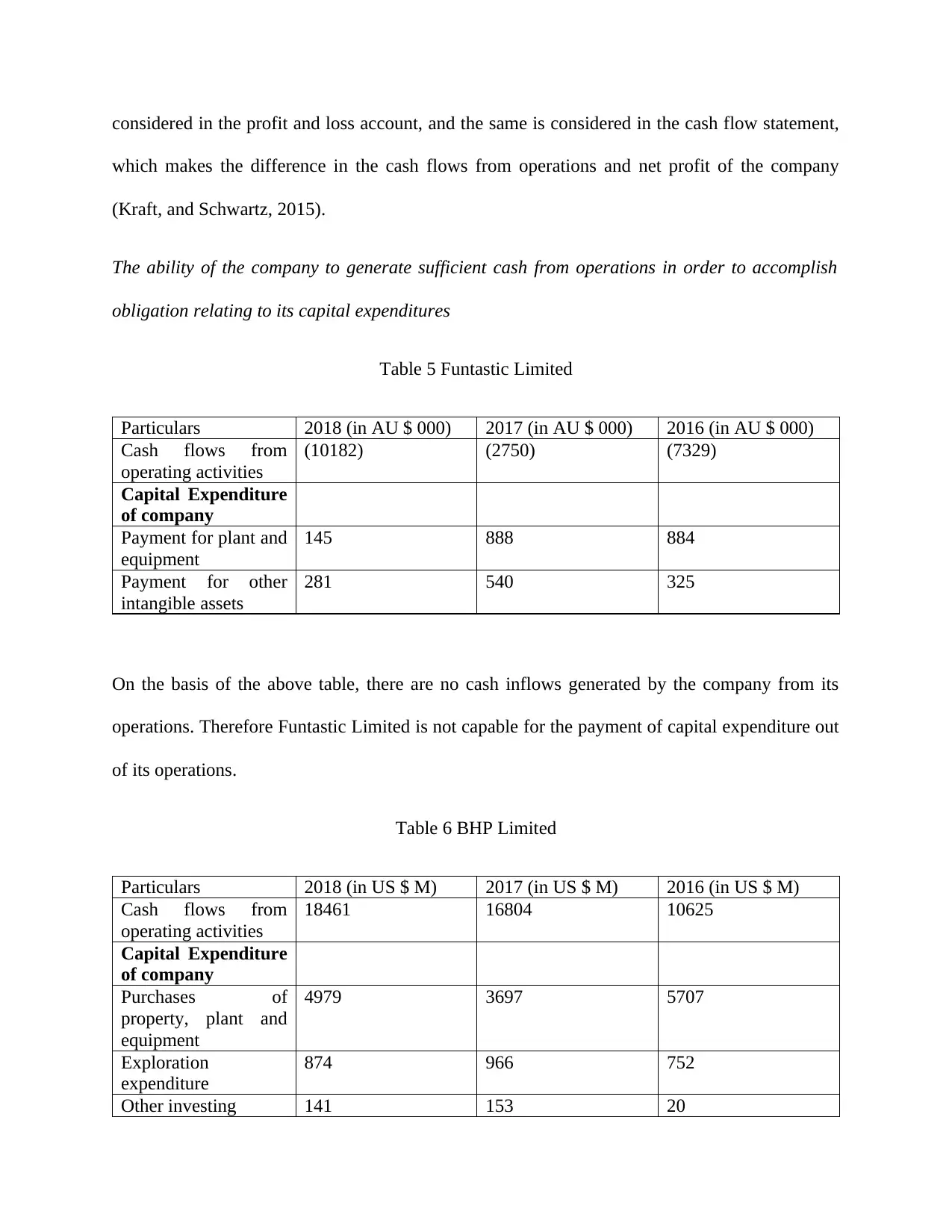

Table 7 Santos Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

1578 1248 840

Capital Expenditure

of company

Exploration and

evaluation assets

66 146 128

Oil and gas assets 490 483 500

Other land, buildings,

plant and equipment

10 5 4

Acquisitions of oil

and gas assets

10 49 18

Acquisition of

subsidiary, net of

cash acquired

1933

Costs associated with

the acquisition of

subsidiaries

10

Borrowing costs paid 6 6 20

In the year 2018, there is a shortage of cash for making the payment of capital expenditure. In the

year 2016 and 2017, the company has enough cash by which it can make the payment of capital

expenditure.

Cash flow from operations covers both the capital expenditures and the dividend payments made

by the firm

Cash flows from operating activities does not cover the long term capital expenditure, as it is

considered as one-time activity as investing activity. Therefore in the operating activities, the

can make the payment of its capital expenditure.

Table 7 Santos Limited

Particulars 2018 (in US $ M) 2017 (in US $ M) 2016 (in US $ M)

Cash flows from

operating activities

1578 1248 840

Capital Expenditure

of company

Exploration and

evaluation assets

66 146 128

Oil and gas assets 490 483 500

Other land, buildings,

plant and equipment

10 5 4

Acquisitions of oil

and gas assets

10 49 18

Acquisition of

subsidiary, net of

cash acquired

1933

Costs associated with

the acquisition of

subsidiaries

10

Borrowing costs paid 6 6 20

In the year 2018, there is a shortage of cash for making the payment of capital expenditure. In the

year 2016 and 2017, the company has enough cash by which it can make the payment of capital

expenditure.

Cash flow from operations covers both the capital expenditures and the dividend payments made

by the firm

Cash flows from operating activities does not cover the long term capital expenditure, as it is

considered as one-time activity as investing activity. Therefore in the operating activities, the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

capital expenditure is not included. Further, the payment of the dividend is regarded as the

financing activity of the business; therefore in the operating activities, it is also not considered.

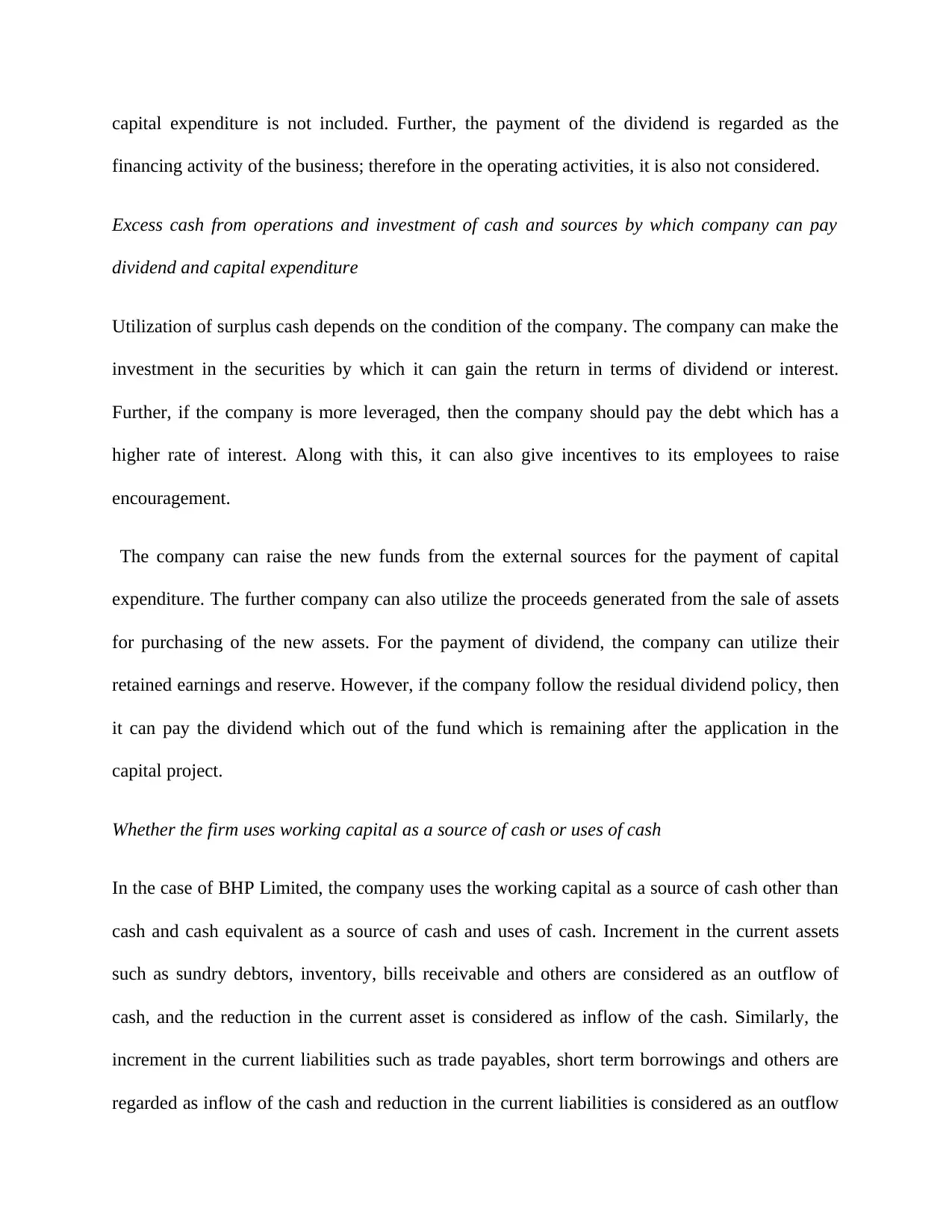

Excess cash from operations and investment of cash and sources by which company can pay

dividend and capital expenditure

Utilization of surplus cash depends on the condition of the company. The company can make the

investment in the securities by which it can gain the return in terms of dividend or interest.

Further, if the company is more leveraged, then the company should pay the debt which has a

higher rate of interest. Along with this, it can also give incentives to its employees to raise

encouragement.

The company can raise the new funds from the external sources for the payment of capital

expenditure. The further company can also utilize the proceeds generated from the sale of assets

for purchasing of the new assets. For the payment of dividend, the company can utilize their

retained earnings and reserve. However, if the company follow the residual dividend policy, then

it can pay the dividend which out of the fund which is remaining after the application in the

capital project.

Whether the firm uses working capital as a source of cash or uses of cash

In the case of BHP Limited, the company uses the working capital as a source of cash other than

cash and cash equivalent as a source of cash and uses of cash. Increment in the current assets

such as sundry debtors, inventory, bills receivable and others are considered as an outflow of

cash, and the reduction in the current asset is considered as inflow of the cash. Similarly, the

increment in the current liabilities such as trade payables, short term borrowings and others are

regarded as inflow of the cash and reduction in the current liabilities is considered as an outflow

financing activity of the business; therefore in the operating activities, it is also not considered.

Excess cash from operations and investment of cash and sources by which company can pay

dividend and capital expenditure

Utilization of surplus cash depends on the condition of the company. The company can make the

investment in the securities by which it can gain the return in terms of dividend or interest.

Further, if the company is more leveraged, then the company should pay the debt which has a

higher rate of interest. Along with this, it can also give incentives to its employees to raise

encouragement.

The company can raise the new funds from the external sources for the payment of capital

expenditure. The further company can also utilize the proceeds generated from the sale of assets

for purchasing of the new assets. For the payment of dividend, the company can utilize their

retained earnings and reserve. However, if the company follow the residual dividend policy, then

it can pay the dividend which out of the fund which is remaining after the application in the

capital project.

Whether the firm uses working capital as a source of cash or uses of cash

In the case of BHP Limited, the company uses the working capital as a source of cash other than

cash and cash equivalent as a source of cash and uses of cash. Increment in the current assets

such as sundry debtors, inventory, bills receivable and others are considered as an outflow of

cash, and the reduction in the current asset is considered as inflow of the cash. Similarly, the

increment in the current liabilities such as trade payables, short term borrowings and others are

regarded as inflow of the cash and reduction in the current liabilities is considered as an outflow

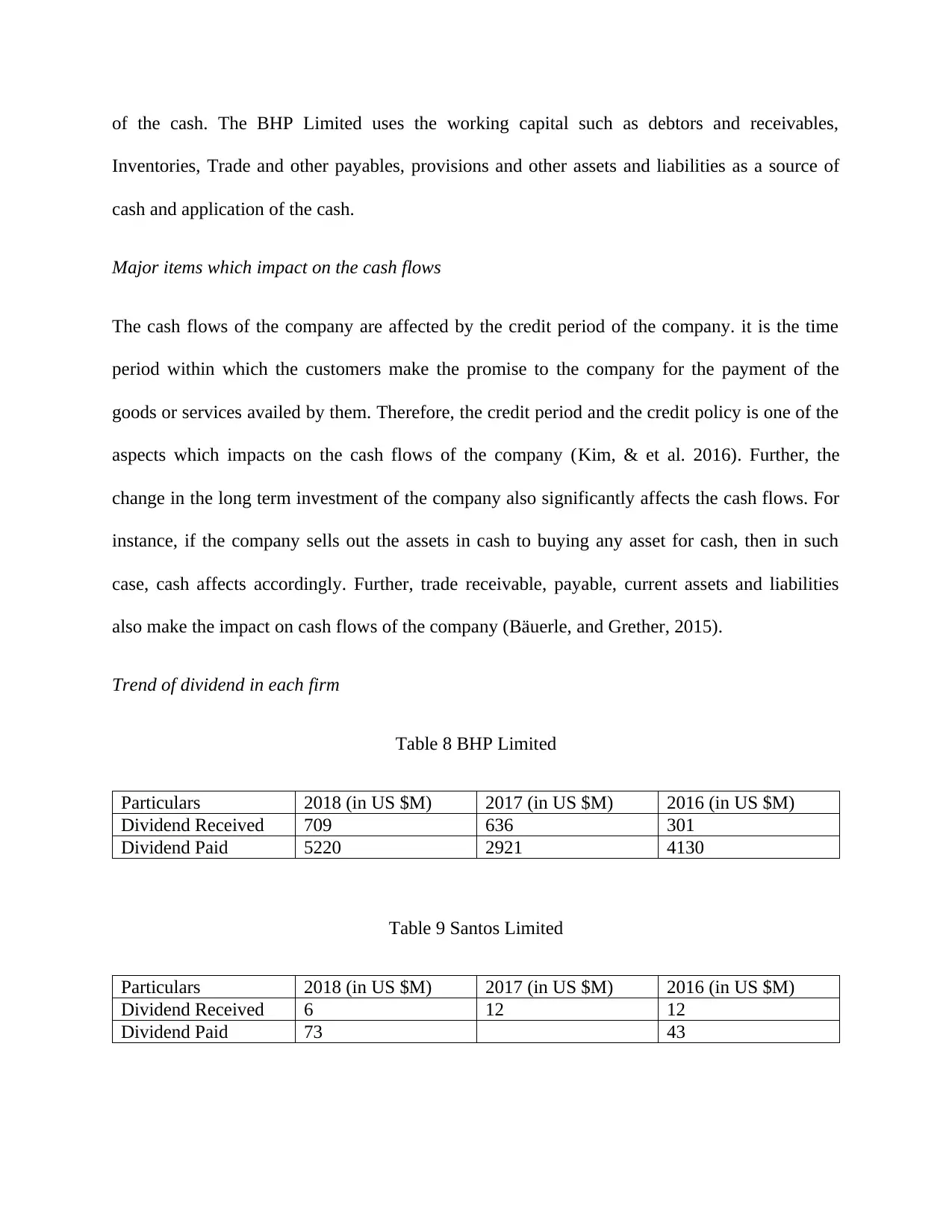

of the cash. The BHP Limited uses the working capital such as debtors and receivables,

Inventories, Trade and other payables, provisions and other assets and liabilities as a source of

cash and application of the cash.

Major items which impact on the cash flows

The cash flows of the company are affected by the credit period of the company. it is the time

period within which the customers make the promise to the company for the payment of the

goods or services availed by them. Therefore, the credit period and the credit policy is one of the

aspects which impacts on the cash flows of the company (Kim, & et al. 2016). Further, the

change in the long term investment of the company also significantly affects the cash flows. For

instance, if the company sells out the assets in cash to buying any asset for cash, then in such

case, cash affects accordingly. Further, trade receivable, payable, current assets and liabilities

also make the impact on cash flows of the company (Bäuerle, and Grether, 2015).

Trend of dividend in each firm

Table 8 BHP Limited

Particulars 2018 (in US $M) 2017 (in US $M) 2016 (in US $M)

Dividend Received 709 636 301

Dividend Paid 5220 2921 4130

Table 9 Santos Limited

Particulars 2018 (in US $M) 2017 (in US $M) 2016 (in US $M)

Dividend Received 6 12 12

Dividend Paid 73 43

Inventories, Trade and other payables, provisions and other assets and liabilities as a source of

cash and application of the cash.

Major items which impact on the cash flows

The cash flows of the company are affected by the credit period of the company. it is the time

period within which the customers make the promise to the company for the payment of the

goods or services availed by them. Therefore, the credit period and the credit policy is one of the

aspects which impacts on the cash flows of the company (Kim, & et al. 2016). Further, the

change in the long term investment of the company also significantly affects the cash flows. For

instance, if the company sells out the assets in cash to buying any asset for cash, then in such

case, cash affects accordingly. Further, trade receivable, payable, current assets and liabilities

also make the impact on cash flows of the company (Bäuerle, and Grether, 2015).

Trend of dividend in each firm

Table 8 BHP Limited

Particulars 2018 (in US $M) 2017 (in US $M) 2016 (in US $M)

Dividend Received 709 636 301

Dividend Paid 5220 2921 4130

Table 9 Santos Limited

Particulars 2018 (in US $M) 2017 (in US $M) 2016 (in US $M)

Dividend Received 6 12 12

Dividend Paid 73 43

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 20

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.