Company Financial Statements Analysis

VerifiedAdded on 2020/04/01

|15

|2434

|193

AI Summary

This assignment presents a set of financial statements for a company. It outlines the company's financial position with details on current and non-current assets, liabilities, and shareholder's equity. The provided figures allow for an analysis of the company's overall financial health and performance.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CORPORATE ACCOUNTING

Corporate accounting

Name of the University

Name of the student

Authors note

Corporate accounting

Name of the University

Name of the student

Authors note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1CORPORATE ACCOUNTING

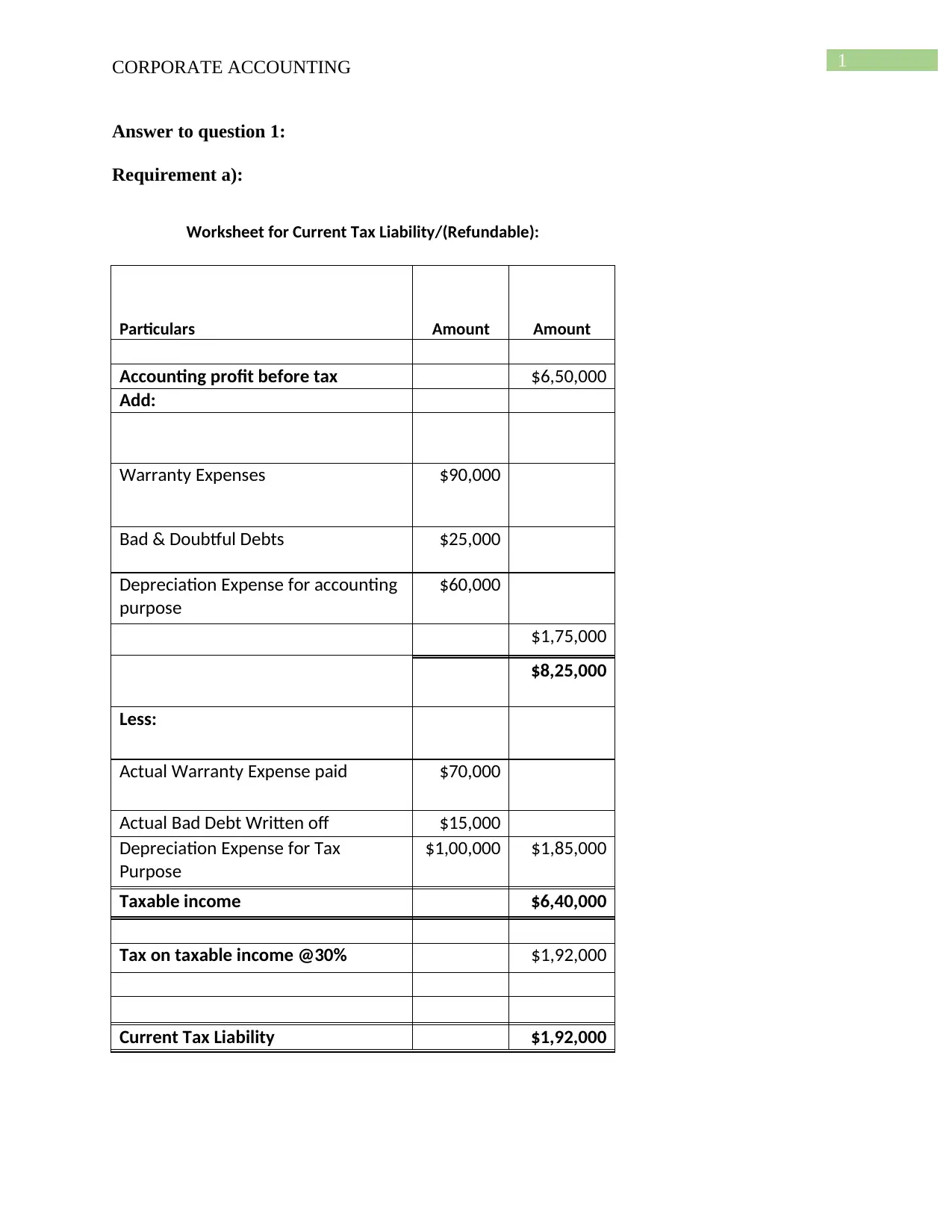

Answer to question 1:

Requirement a):

Worksheet for Current Tax Liability/(Refundable):

Particulars Amount Amount

Accounting profit before tax $6,50,000

Add:

Warranty Expenses $90,000

Bad & Doubtful Debts $25,000

Depreciation Expense for accounting

purpose

$60,000

$1,75,000

$8,25,000

Less:

Actual Warranty Expense paid $70,000

Actual Bad Debt Written off $15,000

Depreciation Expense for Tax

Purpose

$1,00,000 $1,85,000

Taxable income $6,40,000

Tax on taxable income @30% $1,92,000

Current Tax Liability $1,92,000

Answer to question 1:

Requirement a):

Worksheet for Current Tax Liability/(Refundable):

Particulars Amount Amount

Accounting profit before tax $6,50,000

Add:

Warranty Expenses $90,000

Bad & Doubtful Debts $25,000

Depreciation Expense for accounting

purpose

$60,000

$1,75,000

$8,25,000

Less:

Actual Warranty Expense paid $70,000

Actual Bad Debt Written off $15,000

Depreciation Expense for Tax

Purpose

$1,00,000 $1,85,000

Taxable income $6,40,000

Tax on taxable income @30% $1,92,000

Current Tax Liability $1,92,000

2CORPORATE ACCOUNTING

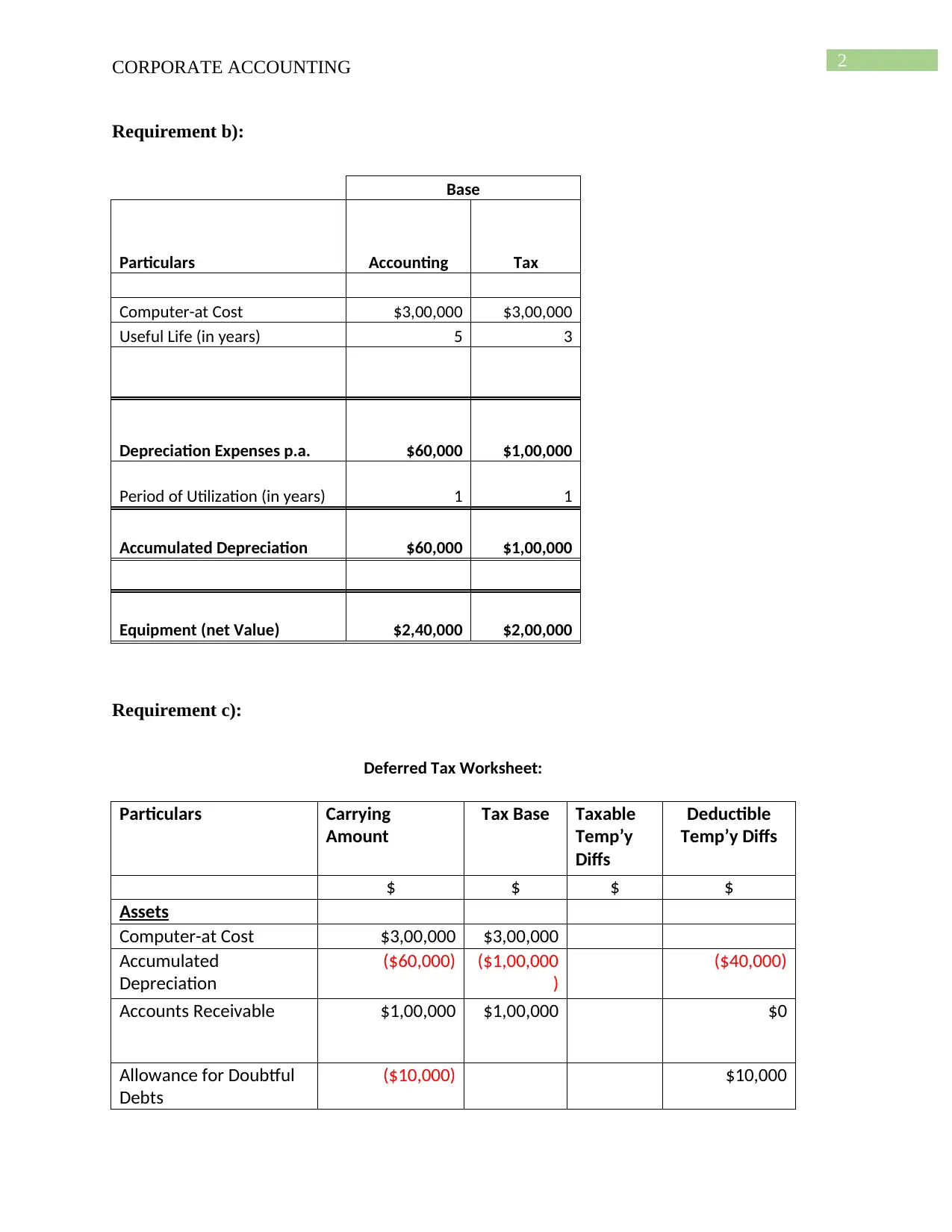

Requirement b):

Base

Particulars Accounting Tax

Computer-at Cost $3,00,000 $3,00,000

Useful Life (in years) 5 3

Depreciation Expenses p.a. $60,000 $1,00,000

Period of Utilization (in years) 1 1

Accumulated Depreciation $60,000 $1,00,000

Equipment (net Value) $2,40,000 $2,00,000

Requirement c):

Deferred Tax Worksheet:

Particulars Carrying

Amount

Tax Base Taxable

Temp’y

Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Computer-at Cost $3,00,000 $3,00,000

Accumulated

Depreciation

($60,000) ($1,00,000

)

($40,000)

Accounts Receivable $1,00,000 $1,00,000 $0

Allowance for Doubtful

Debts

($10,000) $10,000

Requirement b):

Base

Particulars Accounting Tax

Computer-at Cost $3,00,000 $3,00,000

Useful Life (in years) 5 3

Depreciation Expenses p.a. $60,000 $1,00,000

Period of Utilization (in years) 1 1

Accumulated Depreciation $60,000 $1,00,000

Equipment (net Value) $2,40,000 $2,00,000

Requirement c):

Deferred Tax Worksheet:

Particulars Carrying

Amount

Tax Base Taxable

Temp’y

Diffs

Deductible

Temp’y Diffs

$ $ $ $

Assets

Computer-at Cost $3,00,000 $3,00,000

Accumulated

Depreciation

($60,000) ($1,00,000

)

($40,000)

Accounts Receivable $1,00,000 $1,00,000 $0

Allowance for Doubtful

Debts

($10,000) $10,000

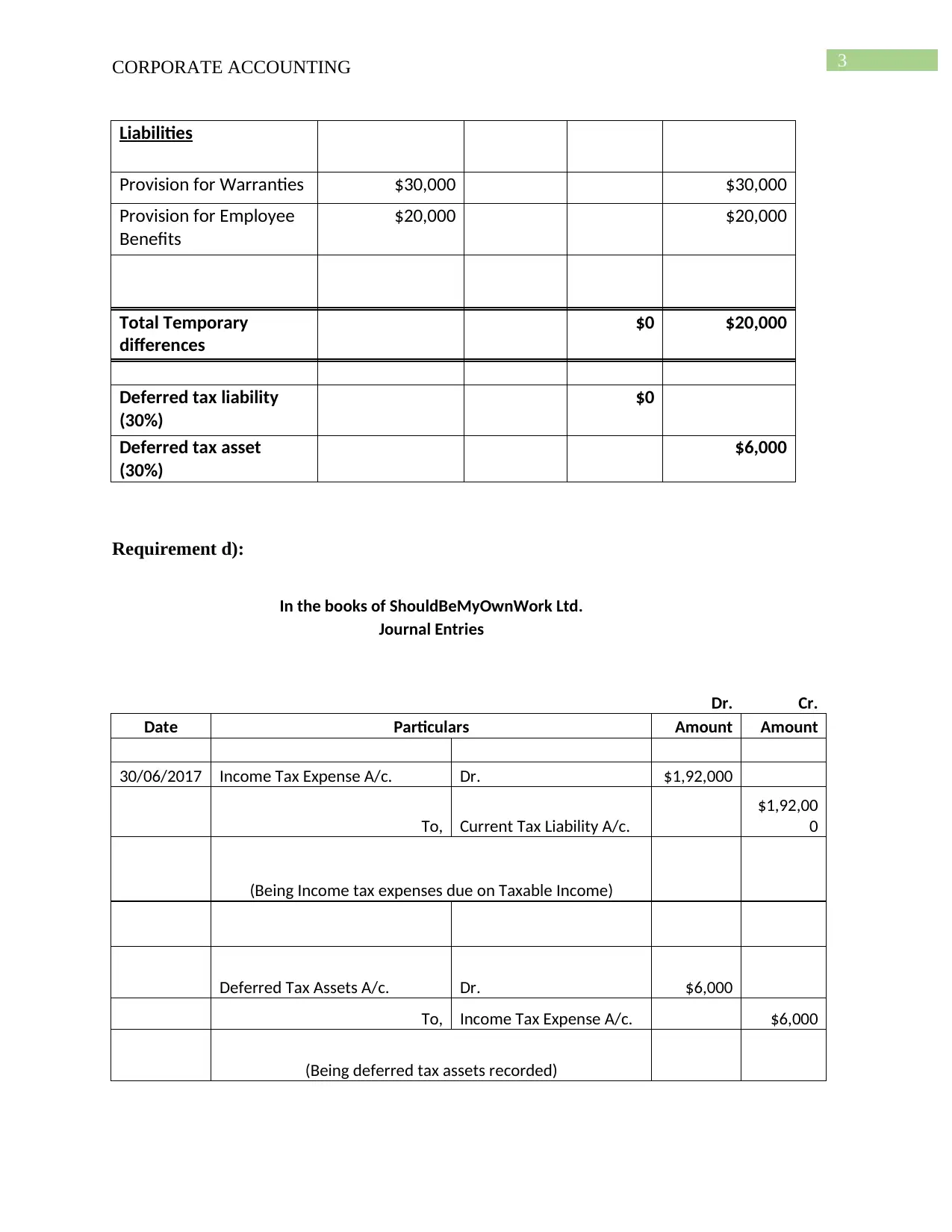

3CORPORATE ACCOUNTING

Liabilities

Provision for Warranties $30,000 $30,000

Provision for Employee

Benefits

$20,000 $20,000

Total Temporary

differences

$0 $20,000

Deferred tax liability

(30%)

$0

Deferred tax asset

(30%)

$6,000

Requirement d):

In the books of ShouldBeMyOwnWork Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

30/06/2017 Income Tax Expense A/c. Dr. $1,92,000

To, Current Tax Liability A/c.

$1,92,00

0

(Being Income tax expenses due on Taxable Income)

Deferred Tax Assets A/c. Dr. $6,000

To, Income Tax Expense A/c. $6,000

(Being deferred tax assets recorded)

Liabilities

Provision for Warranties $30,000 $30,000

Provision for Employee

Benefits

$20,000 $20,000

Total Temporary

differences

$0 $20,000

Deferred tax liability

(30%)

$0

Deferred tax asset

(30%)

$6,000

Requirement d):

In the books of ShouldBeMyOwnWork Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

30/06/2017 Income Tax Expense A/c. Dr. $1,92,000

To, Current Tax Liability A/c.

$1,92,00

0

(Being Income tax expenses due on Taxable Income)

Deferred Tax Assets A/c. Dr. $6,000

To, Income Tax Expense A/c. $6,000

(Being deferred tax assets recorded)

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

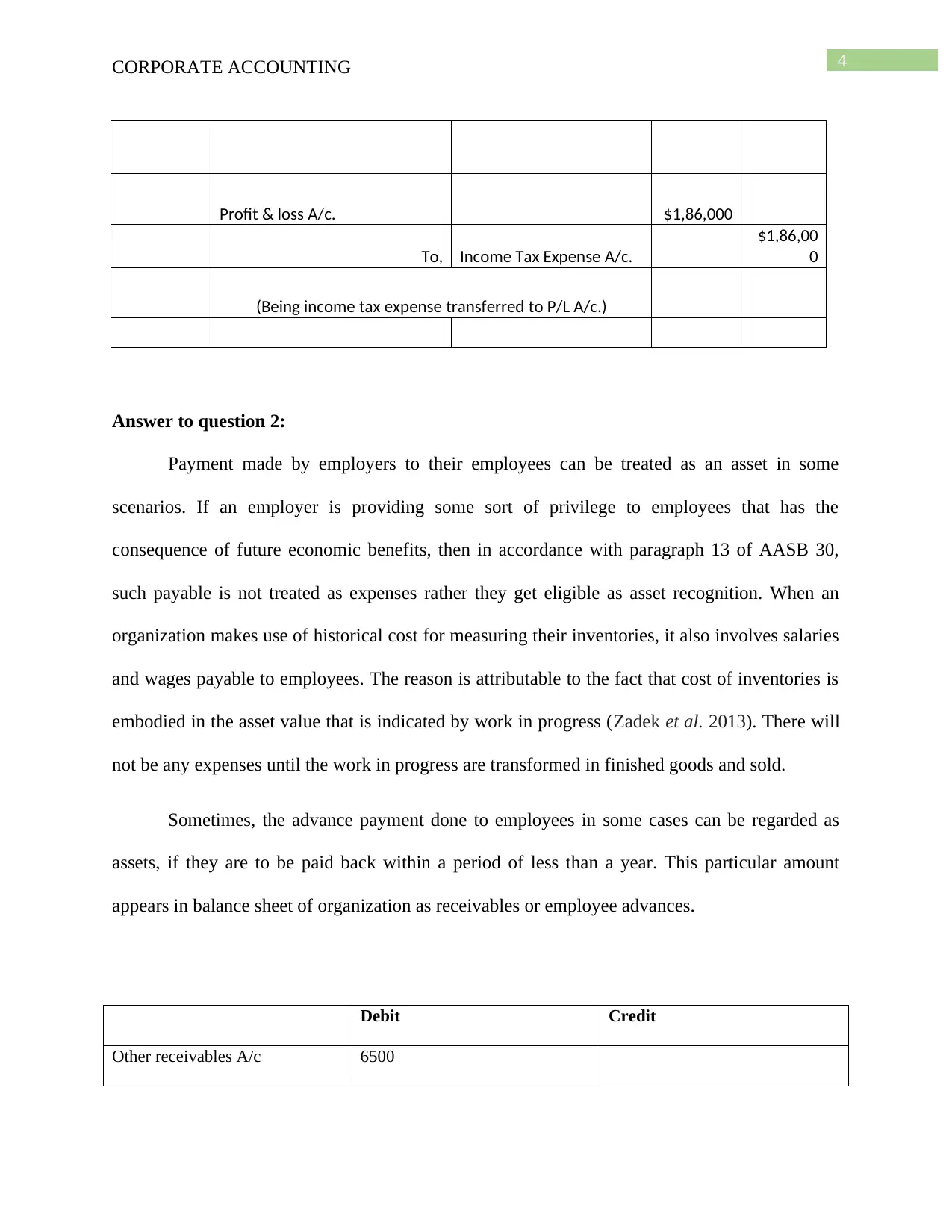

4CORPORATE ACCOUNTING

Profit & loss A/c. $1,86,000

To, Income Tax Expense A/c.

$1,86,00

0

(Being income tax expense transferred to P/L A/c.)

Answer to question 2:

Payment made by employers to their employees can be treated as an asset in some

scenarios. If an employer is providing some sort of privilege to employees that has the

consequence of future economic benefits, then in accordance with paragraph 13 of AASB 30,

such payable is not treated as expenses rather they get eligible as asset recognition. When an

organization makes use of historical cost for measuring their inventories, it also involves salaries

and wages payable to employees. The reason is attributable to the fact that cost of inventories is

embodied in the asset value that is indicated by work in progress (Zadek et al. 2013). There will

not be any expenses until the work in progress are transformed in finished goods and sold.

Sometimes, the advance payment done to employees in some cases can be regarded as

assets, if they are to be paid back within a period of less than a year. This particular amount

appears in balance sheet of organization as receivables or employee advances.

Debit Credit

Other receivables A/c 6500

Profit & loss A/c. $1,86,000

To, Income Tax Expense A/c.

$1,86,00

0

(Being income tax expense transferred to P/L A/c.)

Answer to question 2:

Payment made by employers to their employees can be treated as an asset in some

scenarios. If an employer is providing some sort of privilege to employees that has the

consequence of future economic benefits, then in accordance with paragraph 13 of AASB 30,

such payable is not treated as expenses rather they get eligible as asset recognition. When an

organization makes use of historical cost for measuring their inventories, it also involves salaries

and wages payable to employees. The reason is attributable to the fact that cost of inventories is

embodied in the asset value that is indicated by work in progress (Zadek et al. 2013). There will

not be any expenses until the work in progress are transformed in finished goods and sold.

Sometimes, the advance payment done to employees in some cases can be regarded as

assets, if they are to be paid back within a period of less than a year. This particular amount

appears in balance sheet of organization as receivables or employee advances.

Debit Credit

Other receivables A/c 6500

5CORPORATE ACCOUNTING

Cash/ Bank 6500

Answer to question 3:

Scenario a):

A masthead has been developed by Nt News On the Go for its newspaper and it is

considered as the valuable assets of business. This particular asset of business is developed

internally and it would fetch $ 3 million on selling. In such situation, there is no requirement for

revaluing the assets.

Scenario b):

A publishing title has been purchased two years ago by John Wiley and sons and it is

believed by the management that an amount of 1.5 million would be fetched by selling this book.

Organization is not required to revalue as selling of this intangible assets would generate profit

(Yao et al. 2015).

Scenario c)

In this scenario, the current market price of franchise of ice cream is more than the cost at

which it was acquired. Therefore, it is required by Booz your Juice limited to revalue their

franchise asset.

Scenario d):

Cash/ Bank 6500

Answer to question 3:

Scenario a):

A masthead has been developed by Nt News On the Go for its newspaper and it is

considered as the valuable assets of business. This particular asset of business is developed

internally and it would fetch $ 3 million on selling. In such situation, there is no requirement for

revaluing the assets.

Scenario b):

A publishing title has been purchased two years ago by John Wiley and sons and it is

believed by the management that an amount of 1.5 million would be fetched by selling this book.

Organization is not required to revalue as selling of this intangible assets would generate profit

(Yao et al. 2015).

Scenario c)

In this scenario, the current market price of franchise of ice cream is more than the cost at

which it was acquired. Therefore, it is required by Booz your Juice limited to revalue their

franchise asset.

Scenario d):

6CORPORATE ACCOUNTING

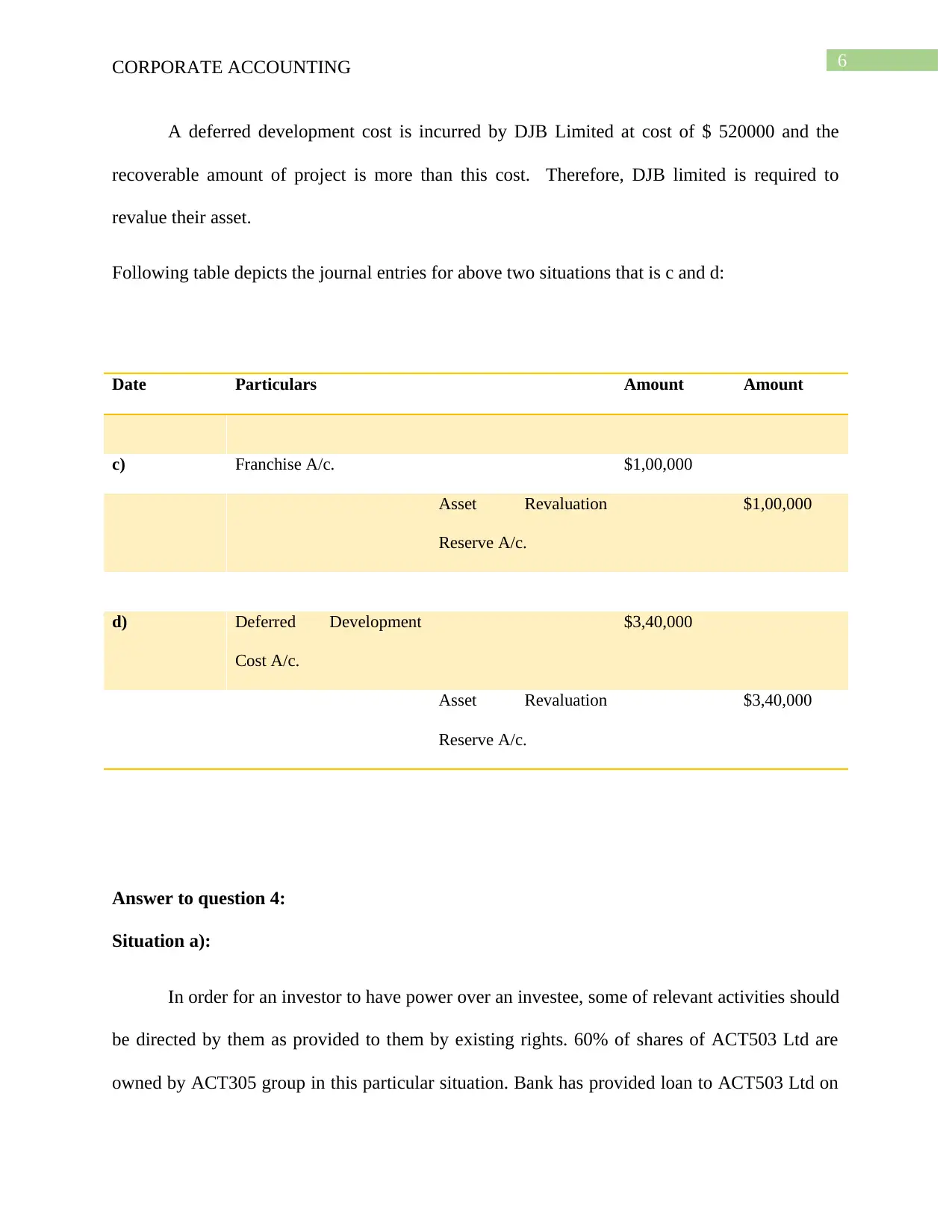

A deferred development cost is incurred by DJB Limited at cost of $ 520000 and the

recoverable amount of project is more than this cost. Therefore, DJB limited is required to

revalue their asset.

Following table depicts the journal entries for above two situations that is c and d:

Date Particulars Amount Amount

c) Franchise A/c. $1,00,000

Asset Revaluation

Reserve A/c.

$1,00,000

d) Deferred Development

Cost A/c.

$3,40,000

Asset Revaluation

Reserve A/c.

$3,40,000

Answer to question 4:

Situation a):

In order for an investor to have power over an investee, some of relevant activities should

be directed by them as provided to them by existing rights. 60% of shares of ACT503 Ltd are

owned by ACT305 group in this particular situation. Bank has provided loan to ACT503 Ltd on

A deferred development cost is incurred by DJB Limited at cost of $ 520000 and the

recoverable amount of project is more than this cost. Therefore, DJB limited is required to

revalue their asset.

Following table depicts the journal entries for above two situations that is c and d:

Date Particulars Amount Amount

c) Franchise A/c. $1,00,000

Asset Revaluation

Reserve A/c.

$1,00,000

d) Deferred Development

Cost A/c.

$3,40,000

Asset Revaluation

Reserve A/c.

$3,40,000

Answer to question 4:

Situation a):

In order for an investor to have power over an investee, some of relevant activities should

be directed by them as provided to them by existing rights. 60% of shares of ACT503 Ltd are

owned by ACT305 group in this particular situation. Bank has provided loan to ACT503 Ltd on

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE ACCOUNTING

agreement that for obtaining loan repayment, they would be monitoring activities and all the

expenditures would be authorized by bank. Rights possessed by banks needs to be assessed

whether they are protective rights for evaluating the rights of bank to exercise control. Investors

possessing protective rights cannot exercise control and do not have power according to

paragraph 13 of AASB 10 and therefore, bank cannot control ACT503 Ltd. However, assets of

ACT503 Ltd can be seized by bank if they are failing to make repayment in accordance with

paragraph B28 of AASB 10 (Aasb.gov.au 2017).

Situation b):

In this situation, performance of GyK Limited is not efficient compared to its competitors

as they have failed to produce quality materials. Poor performance of GyK Limited has resulted

in its asset acquisition and conversion of all debt into equity by bank. Two directors of bank have

been appointed in the seat of board of directors of organization. In this case, bank has possession

of all liabilities and assets of GyK Limited plus it has majority of voting rights, power of

controlling organization rests with bank provided according to paragraph B 15 of AASB 10

(Aasb.gov.au 2017).

Situation c):

Investment co Pty limited is owned by few shareholders and the majority of shares are

held by one its investor that is ACT 502 Ltd holding 60% of shares. Two non-executive seats in

the board of directors are filled by ACT 502 Ltd while remaining seats are taken by other

shareholders of organization. Members of majority shareholders are active in attending annual

general meeting while other executives are not interest in attending meeting and are always busy.

Such directors have say in decision making, although they are not involved in managing the

agreement that for obtaining loan repayment, they would be monitoring activities and all the

expenditures would be authorized by bank. Rights possessed by banks needs to be assessed

whether they are protective rights for evaluating the rights of bank to exercise control. Investors

possessing protective rights cannot exercise control and do not have power according to

paragraph 13 of AASB 10 and therefore, bank cannot control ACT503 Ltd. However, assets of

ACT503 Ltd can be seized by bank if they are failing to make repayment in accordance with

paragraph B28 of AASB 10 (Aasb.gov.au 2017).

Situation b):

In this situation, performance of GyK Limited is not efficient compared to its competitors

as they have failed to produce quality materials. Poor performance of GyK Limited has resulted

in its asset acquisition and conversion of all debt into equity by bank. Two directors of bank have

been appointed in the seat of board of directors of organization. In this case, bank has possession

of all liabilities and assets of GyK Limited plus it has majority of voting rights, power of

controlling organization rests with bank provided according to paragraph B 15 of AASB 10

(Aasb.gov.au 2017).

Situation c):

Investment co Pty limited is owned by few shareholders and the majority of shares are

held by one its investor that is ACT 502 Ltd holding 60% of shares. Two non-executive seats in

the board of directors are filled by ACT 502 Ltd while remaining seats are taken by other

shareholders of organization. Members of majority shareholders are active in attending annual

general meeting while other executives are not interest in attending meeting and are always busy.

Such directors have say in decision making, although they are not involved in managing the

8CORPORATE ACCOUNTING

activities of business. Therefore, it can be said that ACT 502 Ltd holds maximum shareholders

of Investment co Pty limited and in addition to this they have majority of voting rights. In such

scenario, it is quite possible that criteria of exercising control and resting power is fulfilled by

ACT 502 Ltd and hence, there is the possibility that control exists.

Situation d):

B1 ltd and B2 ltd are equal shareholders of S Ltd holding 50% of shares each. In order to

assess where control rests and determining power, potential voting rights are required to be

considered by investors. 10 options are held by B1 limited that can be exercised any time at a

discount to shares fair value. As per paragraph B 47 of AASB 10, investors can have potential

voting rights that would arise from any convertible instruments or any options. Some of the

relevant activities of S limited such as appointment of managing director is handled by B1

limited. From the analysis of the given situation, it can be said that the possibility of exercising

power and sufficient control is held by B1 limited. In addition to this, B1 limited can purchase

additional voting rights by exercising the options held by them. These additional voting rights

according to paragraph 23 of AASB 10 can be purchased on the condition that conditions and

terms of options are not regarded as substantive (Aasb.gov.au 2017). It is required to take into

consideration of facts and circumstances and judgment for consideration that rights are

substantive.

Situation e):

There are two shareholder owning Chaitime tea limited that is Trampoline limited

holding 49% of shares and Boost Juice Limited having 51% of shares. It can be seen that

majority of shares are held by Boost juice. Boost Juice is a passive investor and trampoline

activities of business. Therefore, it can be said that ACT 502 Ltd holds maximum shareholders

of Investment co Pty limited and in addition to this they have majority of voting rights. In such

scenario, it is quite possible that criteria of exercising control and resting power is fulfilled by

ACT 502 Ltd and hence, there is the possibility that control exists.

Situation d):

B1 ltd and B2 ltd are equal shareholders of S Ltd holding 50% of shares each. In order to

assess where control rests and determining power, potential voting rights are required to be

considered by investors. 10 options are held by B1 limited that can be exercised any time at a

discount to shares fair value. As per paragraph B 47 of AASB 10, investors can have potential

voting rights that would arise from any convertible instruments or any options. Some of the

relevant activities of S limited such as appointment of managing director is handled by B1

limited. From the analysis of the given situation, it can be said that the possibility of exercising

power and sufficient control is held by B1 limited. In addition to this, B1 limited can purchase

additional voting rights by exercising the options held by them. These additional voting rights

according to paragraph 23 of AASB 10 can be purchased on the condition that conditions and

terms of options are not regarded as substantive (Aasb.gov.au 2017). It is required to take into

consideration of facts and circumstances and judgment for consideration that rights are

substantive.

Situation e):

There are two shareholder owning Chaitime tea limited that is Trampoline limited

holding 49% of shares and Boost Juice Limited having 51% of shares. It can be seen that

majority of shares are held by Boost juice. Boost Juice is a passive investor and trampoline

9CORPORATE ACCOUNTING

limited is involved in managing daily business activities of Chaitime tea limited and they have

majority of voting rights as they two seats in board of directors. It is certainly possible that an

investor being passive might have more that such interest in organization according to paragraph

B19 of AASB 10 (Aasb.gov.au 2017). However, it is not indicative of the fact that control rests

in hand of such investors. Some other related rights should be there for giving such investors to

exercise power and consequently controlling the investee. As per paragraph B38 of AASB 10,

power can be exercised by Trampoline limited although they do not have majority voting rights.

This is so because the majority of shareholders of Boost limited are happy the way trampoline is

managing the business.

Situation f):

PGH Pty Limited has three shareholders and all of them have equal shares held by them

that is 33.3%. G limited is in involved in running day-to-day business and they do not have

majority of voting rights that is they have only on seat in board of directors. On other hand, other

two investors that is G ltd and H ltd also have one seat in board of directors but they are passive

investors and do not look after daily business activities. However, G limited has more than

passive interest and it has a special relationship for managing PGH Pty Limited business.

Sufficient power for controlling investee’s business can be exercised by investors in accordance

with paragraph B-19 of AASB 10. Therefore, it can be said that business of PGH Pty Limited

can be controlled by G limited as they are meeting the criteria as per standard.

Answer to question 5:

Requirement a):

limited is involved in managing daily business activities of Chaitime tea limited and they have

majority of voting rights as they two seats in board of directors. It is certainly possible that an

investor being passive might have more that such interest in organization according to paragraph

B19 of AASB 10 (Aasb.gov.au 2017). However, it is not indicative of the fact that control rests

in hand of such investors. Some other related rights should be there for giving such investors to

exercise power and consequently controlling the investee. As per paragraph B38 of AASB 10,

power can be exercised by Trampoline limited although they do not have majority voting rights.

This is so because the majority of shareholders of Boost limited are happy the way trampoline is

managing the business.

Situation f):

PGH Pty Limited has three shareholders and all of them have equal shares held by them

that is 33.3%. G limited is in involved in running day-to-day business and they do not have

majority of voting rights that is they have only on seat in board of directors. On other hand, other

two investors that is G ltd and H ltd also have one seat in board of directors but they are passive

investors and do not look after daily business activities. However, G limited has more than

passive interest and it has a special relationship for managing PGH Pty Limited business.

Sufficient power for controlling investee’s business can be exercised by investors in accordance

with paragraph B-19 of AASB 10. Therefore, it can be said that business of PGH Pty Limited

can be controlled by G limited as they are meeting the criteria as per standard.

Answer to question 5:

Requirement a):

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10CORPORATE ACCOUNTING

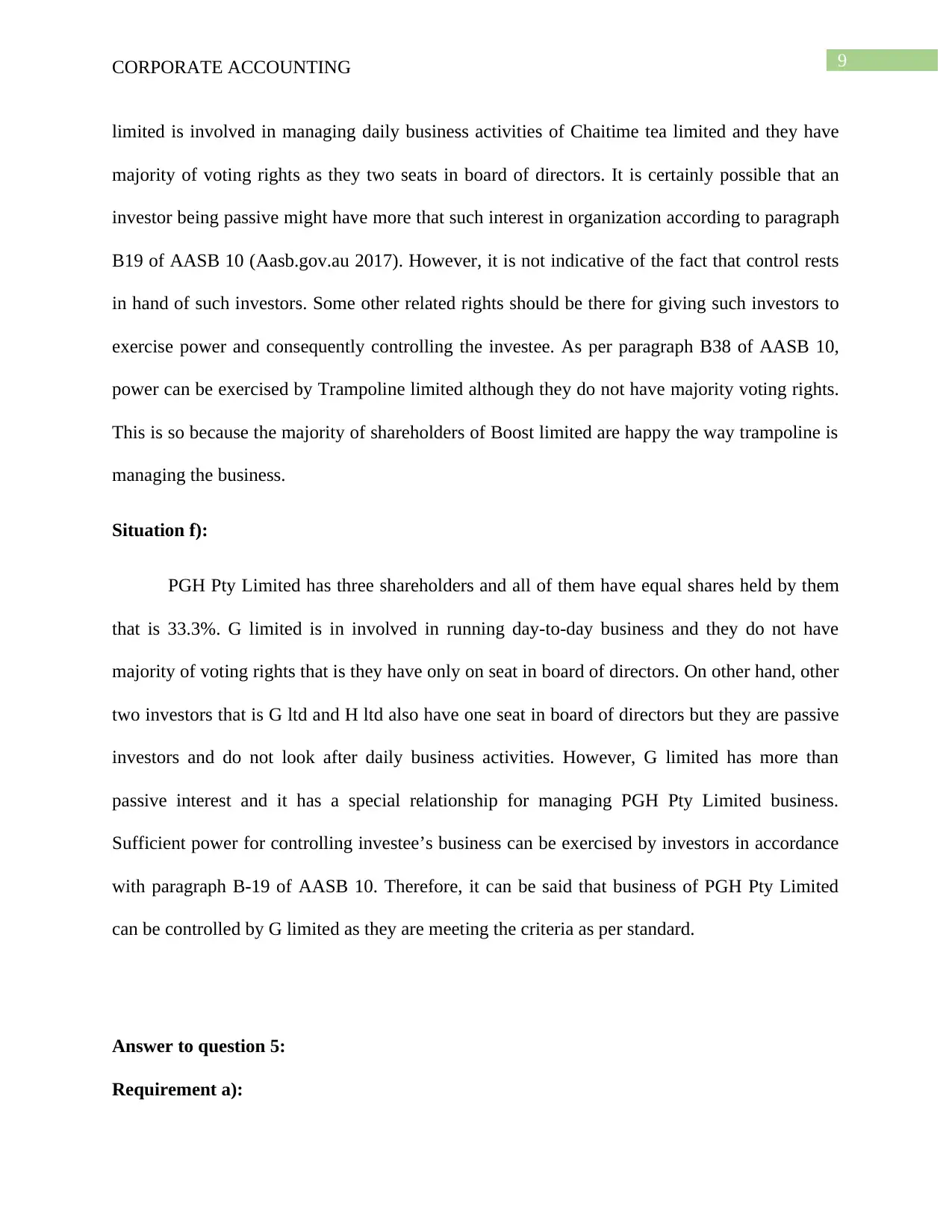

Acquisition Analysis:

Particulars

Carrying

Amount Fair Value

Net Fair

Value

Share Capital $0 $5,00,000

$5,00,00

0

Retained Earnings $0 $2,00,000

$2,00,00

0

Property, Plant & Equipment $4,30,000 $5,30,000

$1,00,00

0

Net Fair Value of Identifiable

Assets & Liabilities A

$8,00,00

0

Purchase Consideration B

$9,00,00

0

Goodwill C=B-A

$1,00,00

0

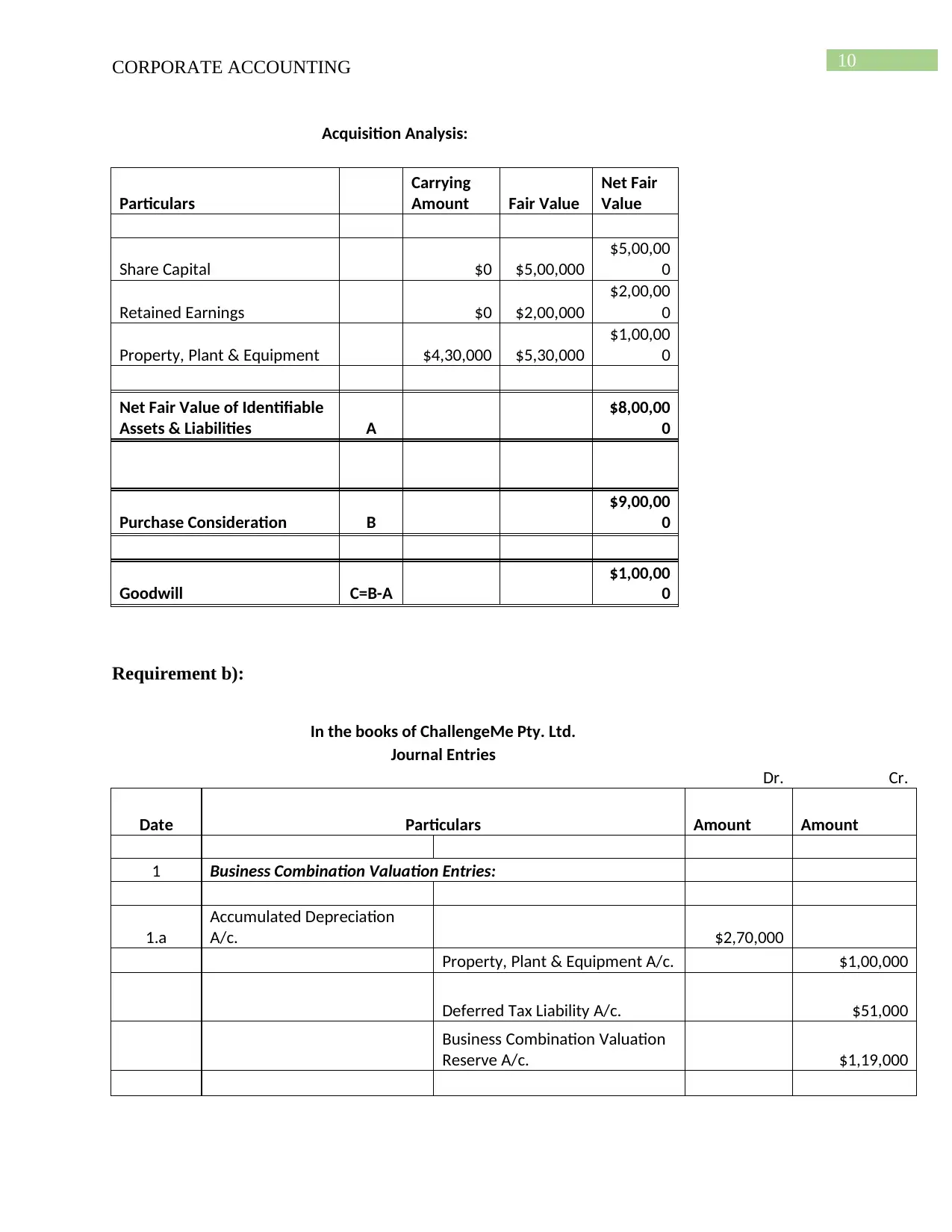

Requirement b):

In the books of ChallengeMe Pty. Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

1 Business Combination Valuation Entries:

1.a

Accumulated Depreciation

A/c. $2,70,000

Property, Plant & Equipment A/c. $1,00,000

Deferred Tax Liability A/c. $51,000

Business Combination Valuation

Reserve A/c. $1,19,000

Acquisition Analysis:

Particulars

Carrying

Amount Fair Value

Net Fair

Value

Share Capital $0 $5,00,000

$5,00,00

0

Retained Earnings $0 $2,00,000

$2,00,00

0

Property, Plant & Equipment $4,30,000 $5,30,000

$1,00,00

0

Net Fair Value of Identifiable

Assets & Liabilities A

$8,00,00

0

Purchase Consideration B

$9,00,00

0

Goodwill C=B-A

$1,00,00

0

Requirement b):

In the books of ChallengeMe Pty. Ltd.

Journal Entries

Dr. Cr.

Date Particulars Amount Amount

1 Business Combination Valuation Entries:

1.a

Accumulated Depreciation

A/c. $2,70,000

Property, Plant & Equipment A/c. $1,00,000

Deferred Tax Liability A/c. $51,000

Business Combination Valuation

Reserve A/c. $1,19,000

11CORPORATE ACCOUNTING

1.b Profit after Tax A/c. $17,000

Accumulated Depreciation A/c. $17,000

1.c Deferred Tax Liability A/c. $5,100

Profit after Tax A/c. $5,100

1.d Goodwill A/c. $1,00,000

Business Combination Valuation

Reserve A/c. $1,00,000

2 Pre-Acquisition Entries:

30/7/201

8 Share Capital A/c. $5,00,000

Retained Earnings (30/7/2018)

A/c. $2,00,000

Business Combination

Valuation Reserve A/c. $2,00,000

Investment in Beach Ltd. A/c. $9,00,000

3 Goodwill Impairment:

Profit after Tax A/c. $40,000

Accumulated Impairment Loss-

Goodwill A/c. $40,000

4 Interim Dividend:

Profit after Tax A/c. $28,000

Deferred Tax Assets A/c. $12,000

Interim Dividend A/c. $40,000

5 Final Dividend:

5.a Profit after Tax A/c. $35,000

Deferred Tax Assets A/c. $15,000

Final Dividend A/c. $50,000

5.b Dividend Payable A/c. $50,000

Accounts Receivable A/c. $50,000

1.b Profit after Tax A/c. $17,000

Accumulated Depreciation A/c. $17,000

1.c Deferred Tax Liability A/c. $5,100

Profit after Tax A/c. $5,100

1.d Goodwill A/c. $1,00,000

Business Combination Valuation

Reserve A/c. $1,00,000

2 Pre-Acquisition Entries:

30/7/201

8 Share Capital A/c. $5,00,000

Retained Earnings (30/7/2018)

A/c. $2,00,000

Business Combination

Valuation Reserve A/c. $2,00,000

Investment in Beach Ltd. A/c. $9,00,000

3 Goodwill Impairment:

Profit after Tax A/c. $40,000

Accumulated Impairment Loss-

Goodwill A/c. $40,000

4 Interim Dividend:

Profit after Tax A/c. $28,000

Deferred Tax Assets A/c. $12,000

Interim Dividend A/c. $40,000

5 Final Dividend:

5.a Profit after Tax A/c. $35,000

Deferred Tax Assets A/c. $15,000

Final Dividend A/c. $50,000

5.b Dividend Payable A/c. $50,000

Accounts Receivable A/c. $50,000

12CORPORATE ACCOUNTING

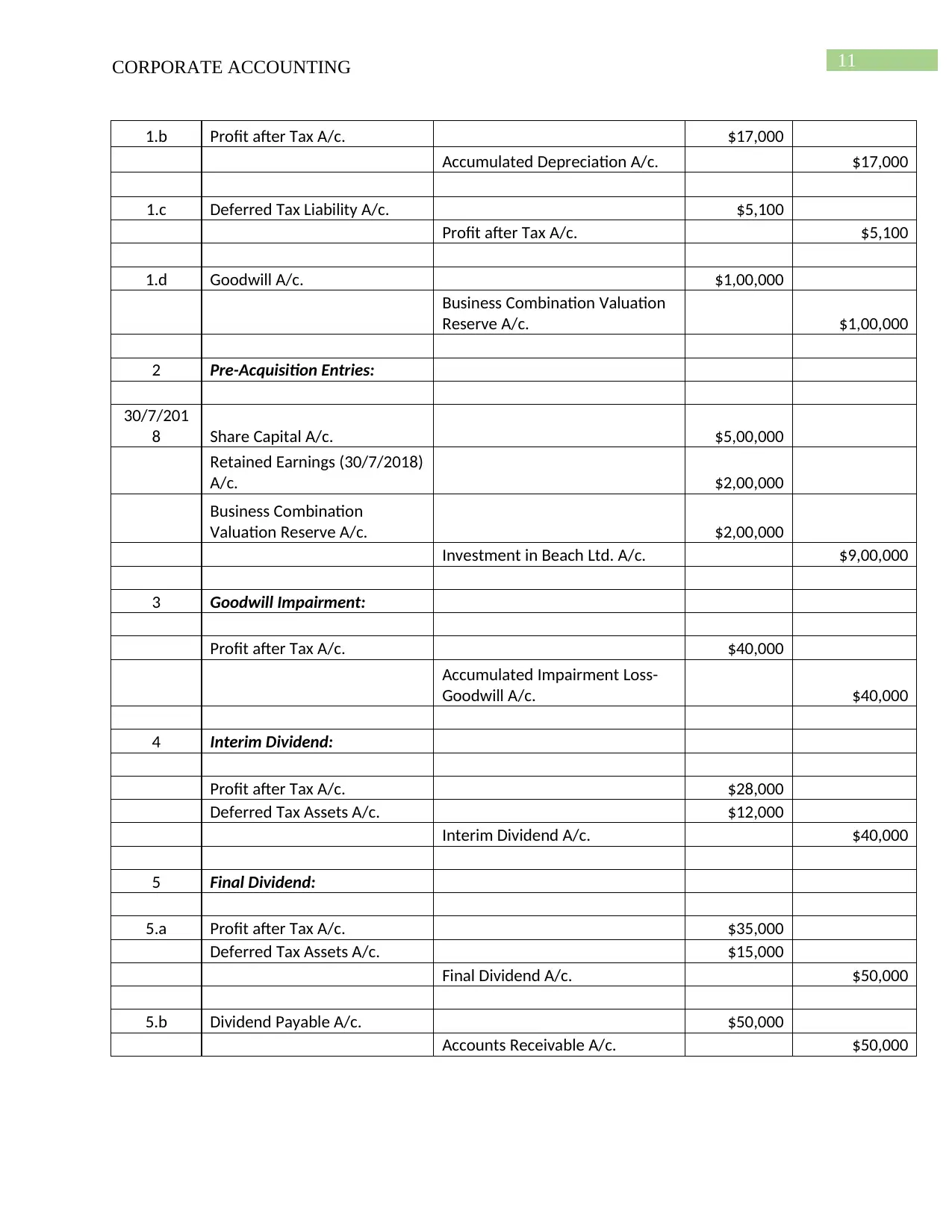

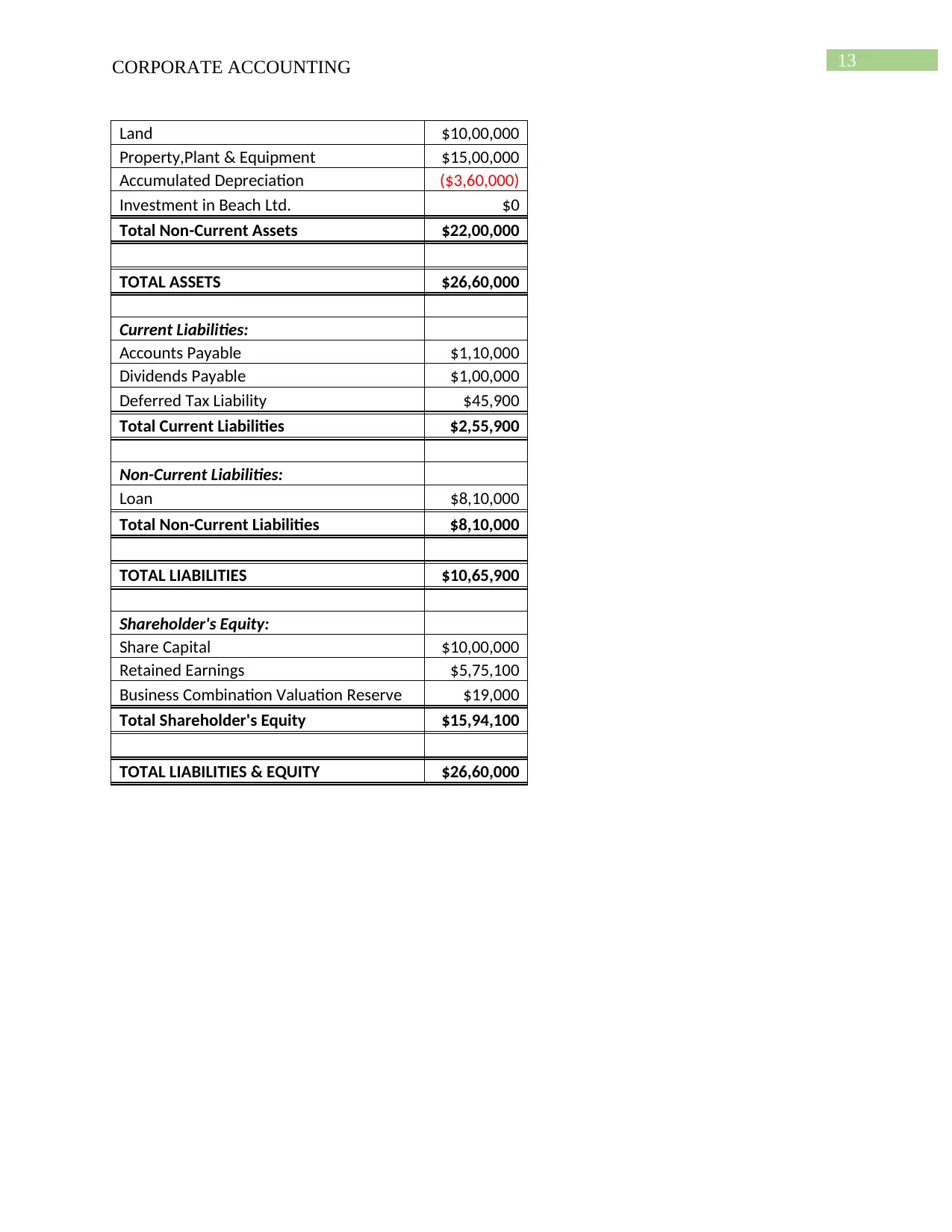

Requirement c):

Requirement d):

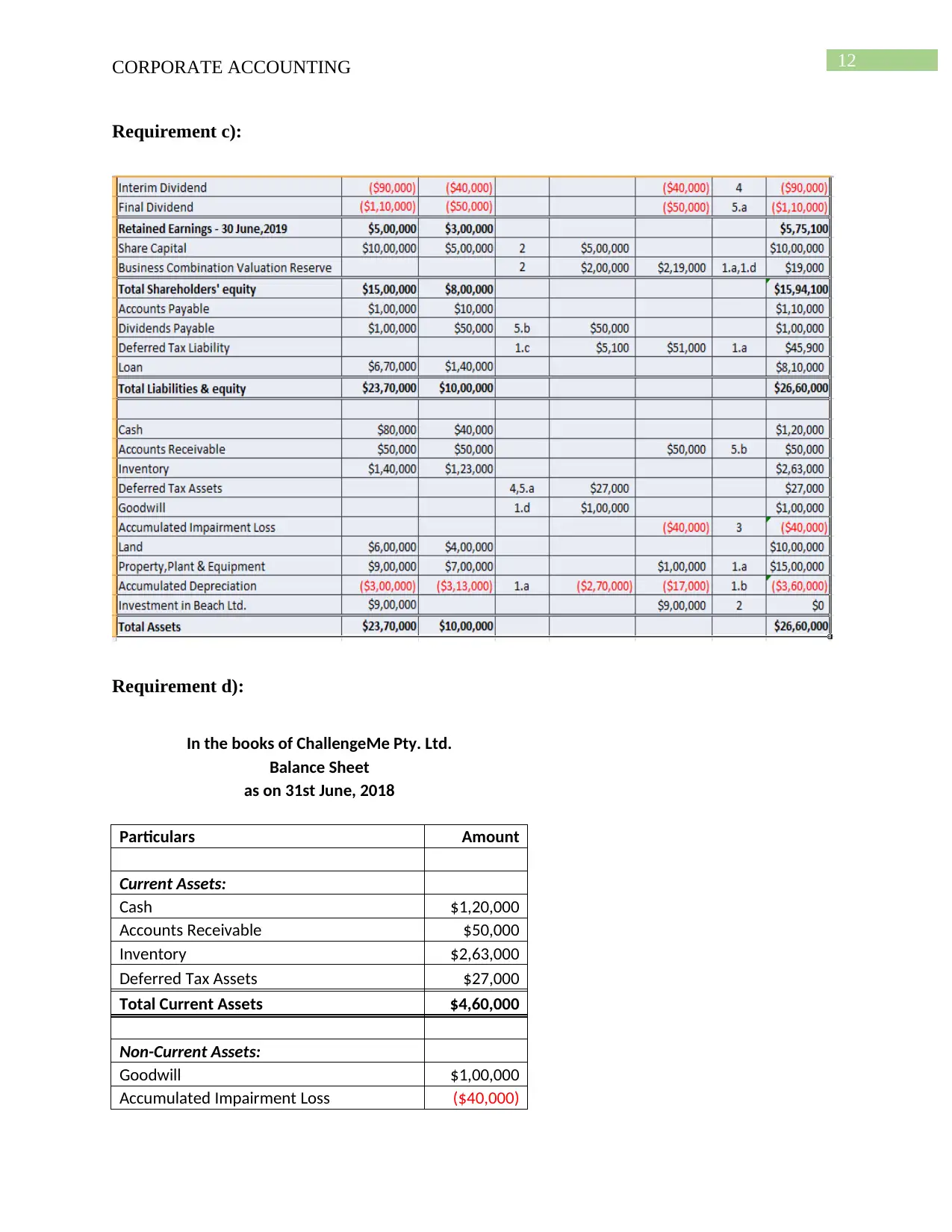

In the books of ChallengeMe Pty. Ltd.

Balance Sheet

as on 31st June, 2018

Particulars Amount

Current Assets:

Cash $1,20,000

Accounts Receivable $50,000

Inventory $2,63,000

Deferred Tax Assets $27,000

Total Current Assets $4,60,000

Non-Current Assets:

Goodwill $1,00,000

Accumulated Impairment Loss ($40,000)

Requirement c):

Requirement d):

In the books of ChallengeMe Pty. Ltd.

Balance Sheet

as on 31st June, 2018

Particulars Amount

Current Assets:

Cash $1,20,000

Accounts Receivable $50,000

Inventory $2,63,000

Deferred Tax Assets $27,000

Total Current Assets $4,60,000

Non-Current Assets:

Goodwill $1,00,000

Accumulated Impairment Loss ($40,000)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13CORPORATE ACCOUNTING

Land $10,00,000

Property,Plant & Equipment $15,00,000

Accumulated Depreciation ($3,60,000)

Investment in Beach Ltd. $0

Total Non-Current Assets $22,00,000

TOTAL ASSETS $26,60,000

Current Liabilities:

Accounts Payable $1,10,000

Dividends Payable $1,00,000

Deferred Tax Liability $45,900

Total Current Liabilities $2,55,900

Non-Current Liabilities:

Loan $8,10,000

Total Non-Current Liabilities $8,10,000

TOTAL LIABILITIES $10,65,900

Shareholder's Equity:

Share Capital $10,00,000

Retained Earnings $5,75,100

Business Combination Valuation Reserve $19,000

Total Shareholder's Equity $15,94,100

TOTAL LIABILITIES & EQUITY $26,60,000

Land $10,00,000

Property,Plant & Equipment $15,00,000

Accumulated Depreciation ($3,60,000)

Investment in Beach Ltd. $0

Total Non-Current Assets $22,00,000

TOTAL ASSETS $26,60,000

Current Liabilities:

Accounts Payable $1,10,000

Dividends Payable $1,00,000

Deferred Tax Liability $45,900

Total Current Liabilities $2,55,900

Non-Current Liabilities:

Loan $8,10,000

Total Non-Current Liabilities $8,10,000

TOTAL LIABILITIES $10,65,900

Shareholder's Equity:

Share Capital $10,00,000

Retained Earnings $5,75,100

Business Combination Valuation Reserve $19,000

Total Shareholder's Equity $15,94,100

TOTAL LIABILITIES & EQUITY $26,60,000

14CORPORATE ACCOUNTING

References:

Aasb.gov.au. (2017). [online] Available at:

http://www.aasb.gov.au/admin/file/content105/c9/AASB3_03-08_COMPoct10_01-11.pdf

[Accessed 30 Sep. 2017].

Wang, P., Che, F., Fan, S. and Gu, C., 2014. Ownership governance, institutional pressures and

circular economy accounting information disclosure: An institutional theory and corporate

governance theory perspective. Chinese Management Studies, 8(3), pp.487-501.

Yao, D.F.T., Percy, M. and Hu, F., 2015. Fair value accounting for non-current assets and audit

fees: Evidence from Australian companies. Journal of Contemporary Accounting &

Economics, 11(1), pp.31-45.

Zadek, S., Evans, R. and Pruzan, P., 2013. Building corporate accountability: Emerging practice

in social and ethical accounting and auditing. Routledge.

References:

Aasb.gov.au. (2017). [online] Available at:

http://www.aasb.gov.au/admin/file/content105/c9/AASB3_03-08_COMPoct10_01-11.pdf

[Accessed 30 Sep. 2017].

Wang, P., Che, F., Fan, S. and Gu, C., 2014. Ownership governance, institutional pressures and

circular economy accounting information disclosure: An institutional theory and corporate

governance theory perspective. Chinese Management Studies, 8(3), pp.487-501.

Yao, D.F.T., Percy, M. and Hu, F., 2015. Fair value accounting for non-current assets and audit

fees: Evidence from Australian companies. Journal of Contemporary Accounting &

Economics, 11(1), pp.31-45.

Zadek, S., Evans, R. and Pruzan, P., 2013. Building corporate accountability: Emerging practice

in social and ethical accounting and auditing. Routledge.

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.