Corporate Accounting: Concepts and Analysis

VerifiedAdded on 2023/01/11

|22

|4039

|98

AI Summary

This report provides an overview of corporate accounting, covering topics such as accounting profit, taxable profit, deferred tax assets and liabilities. It evaluates the tax expense of a selected company and identifies the deferred tax assets and liabilities reported in the balance sheet. The report also discusses the recognition criteria for deferred tax assets and liabilities.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Corporate Accounting

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Abstract

This report summarised that corporate accounting is essential

for the organization which cover several aspects regarding

financial reporting. This assessment covers several topics which is

required to understand by the managers for reporting purpose or

produce financial statements for stakeholders.

This report summarised that corporate accounting is essential

for the organization which cover several aspects regarding

financial reporting. This assessment covers several topics which is

required to understand by the managers for reporting purpose or

produce financial statements for stakeholders.

Abstract............................................................................................2

INTRODUCTION...........................................................................1

MAIN BODY...................................................................................1

1. Explain the concept of accounting profit, taxable profit

and the other following terms..................................................1

2. Explain the recognition criteria of deferred tax assets

and deferred tax liability...........................................................3

3. Evaluate their firm’s tax expense in its latest financial

statements..................................................................................4

4. Selected company’s tax rate times in the firm’s

accounting income....................................................................6

5. Identify the deferred tax assets or liabilities that are

reported in the balance sheet articulating the possible

reasons why they have been recorded..................................7

6. Find that, there any current tax assets or income tax

payable recorded by your company and evaluate that Why

is the income tax payable not the same as income tax

expense....................................................................................11

7. Is the income tax expense shown in the income

statement same as the income tax paid shown in the cash

flow statement? If not, why is the difference.......................12

8. Evaluate the concepts of temporary difference and

permanent difference. Identify any permanent differences

INTRODUCTION...........................................................................1

MAIN BODY...................................................................................1

1. Explain the concept of accounting profit, taxable profit

and the other following terms..................................................1

2. Explain the recognition criteria of deferred tax assets

and deferred tax liability...........................................................3

3. Evaluate their firm’s tax expense in its latest financial

statements..................................................................................4

4. Selected company’s tax rate times in the firm’s

accounting income....................................................................6

5. Identify the deferred tax assets or liabilities that are

reported in the balance sheet articulating the possible

reasons why they have been recorded..................................7

6. Find that, there any current tax assets or income tax

payable recorded by your company and evaluate that Why

is the income tax payable not the same as income tax

expense....................................................................................11

7. Is the income tax expense shown in the income

statement same as the income tax paid shown in the cash

flow statement? If not, why is the difference.......................12

8. Evaluate the concepts of temporary difference and

permanent difference. Identify any permanent differences

that your company may have................................................14

9. What do you find interesting, confusing, surprising or

difficult to understand about the treatment of tax in your

firm’s financial statements.....................................................15

CONCLUSION.............................................................................16

REFERENCES............................................................................17

9. What do you find interesting, confusing, surprising or

difficult to understand about the treatment of tax in your

firm’s financial statements.....................................................15

CONCLUSION.............................................................................16

REFERENCES............................................................................17

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

Corporate Accounting is a particular financial reporting

branch that deals with corporate accounting, preparing their

accounting reports and cash flow statements, analyzing and

interpreting the sales figures of corporations and accounting

for particular events such as amalgamation, uptake and

consolidated time to prepare (Edwards, 2013). Investors are

particularly curious to know the company's financial

resilience in which they should have bought a certain stock.

Corporate accounting is thus performed to interact to them

that the firm's assets and liabilities. This report is based on

the ASX listed company that is Wesfarmer Ltd which is

Australia based Conglomerate Company. This assignment

covers the several topics such as accounting profit, taxable

profit, differed tax liabilities and assets. In addition, all the

treatment of this accounting aspect discussed with the help

of financial statement.

MAIN BODY

1. Explain the concept of accounting profit, taxable profit and

the other following terms

Accounting profit: It is the net profits of a corporation,

measured on the basis of GAAP (Generally Accepted

Accounting Principles). This contains the basic company

1

Corporate Accounting is a particular financial reporting

branch that deals with corporate accounting, preparing their

accounting reports and cash flow statements, analyzing and

interpreting the sales figures of corporations and accounting

for particular events such as amalgamation, uptake and

consolidated time to prepare (Edwards, 2013). Investors are

particularly curious to know the company's financial

resilience in which they should have bought a certain stock.

Corporate accounting is thus performed to interact to them

that the firm's assets and liabilities. This report is based on

the ASX listed company that is Wesfarmer Ltd which is

Australia based Conglomerate Company. This assignment

covers the several topics such as accounting profit, taxable

profit, differed tax liabilities and assets. In addition, all the

treatment of this accounting aspect discussed with the help

of financial statement.

MAIN BODY

1. Explain the concept of accounting profit, taxable profit and

the other following terms

Accounting profit: It is the net profits of a corporation,

measured on the basis of GAAP (Generally Accepted

Accounting Principles). This contains the basic company

1

expenses, such as overhead costs, depreciation, debt, and

taxation. It is used to calculate the overall profit which helps

the investor to make their investment related decisions.

Taxable profit: It is the amount used to estimating

income taxes. Taxable income may vary from recorded

profits for a variety of reasons that might be greater or

lesser. Financial statements on companies often differentiate

between profits before tax (PBT) and profit after tax (PAT).

Taxable temporary difference: It is the difference

among the value of balance sheet in asset or liability, and its

tax base. One temporary difference could be either

deductible or taxable (DeBusk, 2012). A temporary

deductible contrast is the yield amounts which can be

subtracted when evaluating taxable profit or loss in the long

term. A temporary taxable variation is a temporary

difference, which in future yields chargeable amounts when

assessing taxable profit or loss.

Deductible temporary difference: temporary

deductible gap is a conditional discrepancy which may yield

sums which can be excluded in the future when assessing

taxable income or loss. A temporary difference is created

between the balance sheet carrying value of an asset or

liability, and its tax base. For such deductible temporary

discrepancies a deferred tax benefit is acknowledged

2

taxation. It is used to calculate the overall profit which helps

the investor to make their investment related decisions.

Taxable profit: It is the amount used to estimating

income taxes. Taxable income may vary from recorded

profits for a variety of reasons that might be greater or

lesser. Financial statements on companies often differentiate

between profits before tax (PBT) and profit after tax (PAT).

Taxable temporary difference: It is the difference

among the value of balance sheet in asset or liability, and its

tax base. One temporary difference could be either

deductible or taxable (DeBusk, 2012). A temporary

deductible contrast is the yield amounts which can be

subtracted when evaluating taxable profit or loss in the long

term. A temporary taxable variation is a temporary

difference, which in future yields chargeable amounts when

assessing taxable profit or loss.

Deductible temporary difference: temporary

deductible gap is a conditional discrepancy which may yield

sums which can be excluded in the future when assessing

taxable income or loss. A temporary difference is created

between the balance sheet carrying value of an asset or

liability, and its tax base. For such deductible temporary

discrepancies a deferred tax benefit is acknowledged

2

because there is expected to be a taxable income available

that can be balanced against the deductible variations.

Deferred tax assets: It is the items in a balance sheet

of a company which may be included in the long term to

decrease taxable income are termed deferred tax assets.

The condition can arise when a company's balance sheet

has highly paid taxes or paid income tax in advance. Those

taxes are ultimately taken in the form of tax savings to the

company. So, extra tax to the industry is known an asset

(Hoskin, Fizzell and Cherry, 2014). A deferred tax benefit is

the reverse to a deferred tax obligation and will increase a

corporation's income tax rate.

Deferred tax liability: It is a tax appraised or due for

the current cycle but not yet paid. The revocation stems from

the timing difference between when the tax is accumulated

and then when the tax is paid. A deferred tax payment

documents the fact that the corporation must pay further

income tax in the future due to a trade that happened during

the present time, such as a receivable for selling in

instalments.

2. Explain the recognition criteria of deferred tax assets and

deferred tax liability

With regard to timing discrepancies due to unabsorbed

depreciation or carry forward risks, Differed tax assets is

3

that can be balanced against the deductible variations.

Deferred tax assets: It is the items in a balance sheet

of a company which may be included in the long term to

decrease taxable income are termed deferred tax assets.

The condition can arise when a company's balance sheet

has highly paid taxes or paid income tax in advance. Those

taxes are ultimately taken in the form of tax savings to the

company. So, extra tax to the industry is known an asset

(Hoskin, Fizzell and Cherry, 2014). A deferred tax benefit is

the reverse to a deferred tax obligation and will increase a

corporation's income tax rate.

Deferred tax liability: It is a tax appraised or due for

the current cycle but not yet paid. The revocation stems from

the timing difference between when the tax is accumulated

and then when the tax is paid. A deferred tax payment

documents the fact that the corporation must pay further

income tax in the future due to a trade that happened during

the present time, such as a receivable for selling in

instalments.

2. Explain the recognition criteria of deferred tax assets and

deferred tax liability

With regard to timing discrepancies due to unabsorbed

depreciation or carry forward risks, Differed tax assets is

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

only accepted if technological confidence occurs in the

future. It means that DTA can only be realized when the firm

accurately forecasts sufficiently potential taxable profits

(Edgerton, 2012). This virtual confidence check must be

done on balance sheet date every year and, if the

requirement is not fulfilled, then DTA / DTL will be written off.

At the time of estimating potential taxable revenue only

companies and technical earnings but not other levels of

revenue will be included (Rogoff, 2017). Deferred tax

liability will be a typical example of depreciation. When the

rate of depreciation per Income Tax Act is greater than the

rate of deduction per corporation act (usually in the early

phases), the business will end up having to pay less tax for

the present period. It might create deferred tax liability for

variability affects in books in which there are no DTA or DTL

implicit understanding for. So, e.g. Fines and fines for tax

purposes which are part of book income but are rarely

required. Therefore the generated disparity would be a

permanent disparity.

3. Evaluate their firm’s tax expense in its latest financial

statements

In an organizational context, tax expenses are liability

which are required to calculate by the multiplying person's or

company' suitable tax rate after receiving or generating

4

future. It means that DTA can only be realized when the firm

accurately forecasts sufficiently potential taxable profits

(Edgerton, 2012). This virtual confidence check must be

done on balance sheet date every year and, if the

requirement is not fulfilled, then DTA / DTL will be written off.

At the time of estimating potential taxable revenue only

companies and technical earnings but not other levels of

revenue will be included (Rogoff, 2017). Deferred tax

liability will be a typical example of depreciation. When the

rate of depreciation per Income Tax Act is greater than the

rate of deduction per corporation act (usually in the early

phases), the business will end up having to pay less tax for

the present period. It might create deferred tax liability for

variability affects in books in which there are no DTA or DTL

implicit understanding for. So, e.g. Fines and fines for tax

purposes which are part of book income but are rarely

required. Therefore the generated disparity would be a

permanent disparity.

3. Evaluate their firm’s tax expense in its latest financial

statements

In an organizational context, tax expenses are liability

which are required to calculate by the multiplying person's or

company' suitable tax rate after receiving or generating

4

income before taxes, after taking into account in different

factors such as non - taxable items, tax assets and tax

liabilities. Financial reports are deemed significant document

for the firm when they're used to show internal managers

and external shareholders the real financial position and

strength. Business accountant can compile financial

statements including cash flow accounts, balance sheets,

revenue accounts and asset statements.

There are many different classifications of tax

payments, such as: existing taxes and accrued taxes are

reported in financial statements by the Wesfarmers auditor

to take important decisions (Huseynov and Klamm,

2012). Differed tax assets and liabilities could be defined in

the value that is expected to be collected or charged to tax

office in compliance with tax laws and rules, and their

influence can be reflected in company income. Deferred

taxation is those enforced using the full technique of liability.

In case of assets, deferred taxes assets and losses may be

regarded for all unused tax differences which carry forward

in the future.

In case of Wesfarmers' financial reports, it has been

observed that income tax published in the profit &

loss statement for the period of 2017 was $ 1169

million which was enhanced during the year 2018 that is

5

factors such as non - taxable items, tax assets and tax

liabilities. Financial reports are deemed significant document

for the firm when they're used to show internal managers

and external shareholders the real financial position and

strength. Business accountant can compile financial

statements including cash flow accounts, balance sheets,

revenue accounts and asset statements.

There are many different classifications of tax

payments, such as: existing taxes and accrued taxes are

reported in financial statements by the Wesfarmers auditor

to take important decisions (Huseynov and Klamm,

2012). Differed tax assets and liabilities could be defined in

the value that is expected to be collected or charged to tax

office in compliance with tax laws and rules, and their

influence can be reflected in company income. Deferred

taxation is those enforced using the full technique of liability.

In case of assets, deferred taxes assets and losses may be

regarded for all unused tax differences which carry forward

in the future.

In case of Wesfarmers' financial reports, it has been

observed that income tax published in the profit &

loss statement for the period of 2017 was $ 1169

million which was enhanced during the year 2018 that is

5

$ 1246 million (Annual reports of Wesfarmers. 2018). The

income tax noted in the 2017 financial year was $ 15

million but in 2018 it was increased and remained at $ 72

million.

In addition, income tax on PBT was $ 1169 million in

2017 but it was increased in 2018 that is $ 1246 million. In

the balance sheet, deferred tax assets were $ 971 million

was in 2017 but this is $ 692 million in the 2018 financial

year which demonstrates the reduction in the overall figures.

Deferred tax expenditures were $ (7) million in 2017 but it is

$ (29) million in the 2018 which indicates the growing

figures.

4. Selected company’s tax rate times in the firm’s accounting

income

Tax expenses contribute in the tax which can be due

over a financial period. Key aspects of Wesfarmer Ltd's tax

expenses are, present and accrued income tax payments,

income tax declared in assets, income before tax, DTA, DTL

and other expenditures. Tax periods for businesses are

determined by calculating income between interest and

taxation expenditures by earnings. According to the financial

reports of Wesfarmer Ltd, revenue for the 2018 year

was 66,883 million and earning before interest and tax that

6

income tax noted in the 2017 financial year was $ 15

million but in 2018 it was increased and remained at $ 72

million.

In addition, income tax on PBT was $ 1169 million in

2017 but it was increased in 2018 that is $ 1246 million. In

the balance sheet, deferred tax assets were $ 971 million

was in 2017 but this is $ 692 million in the 2018 financial

year which demonstrates the reduction in the overall figures.

Deferred tax expenditures were $ (7) million in 2017 but it is

$ (29) million in the 2018 which indicates the growing

figures.

4. Selected company’s tax rate times in the firm’s accounting

income

Tax expenses contribute in the tax which can be due

over a financial period. Key aspects of Wesfarmer Ltd's tax

expenses are, present and accrued income tax payments,

income tax declared in assets, income before tax, DTA, DTL

and other expenditures. Tax periods for businesses are

determined by calculating income between interest and

taxation expenditures by earnings. According to the financial

reports of Wesfarmer Ltd, revenue for the 2018 year

was 66,883 million and earning before interest and tax that

6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

is EBIT was 4061 million. The method of calculating the

corporation tax rate times is mentioned below:

Tax rates = Revenue / EBIT = 66883 / 4061 = 16.46

times

But, the corporate tax periods and financial income

estimates are not the same. As financial reporting income is

profit that has been met using full accrual basis. While the

rate imposed on Wesfarmer Ltd's net income (Schaltegger,

Burritt and Petersen, 2017). The tax rate periods and

monitoring tax expenses are not the same because

preceding and current year tax rates are not the same but

the tax rate time will be different than income taxes.

Everything could not be calculated by comparing effective

tax rate with tax liability, whereas tax rate periods are

determined by calculating income from EBIT.

5. Identify the deferred tax assets or liabilities that are

reported in the balance sheet articulating the possible

reasons why they have been recorded

Deferred tax assets and liabilities: that's an

accounting method which shown in the balance sheet and it

is documented when tax is paid in large amounts of its actual

tax proportion. It generates when taxes for the existing year

are not compensated in the same fiscal year. It takes the

remaining tax revenue and remaining tax liabilities forward.

7

corporation tax rate times is mentioned below:

Tax rates = Revenue / EBIT = 66883 / 4061 = 16.46

times

But, the corporate tax periods and financial income

estimates are not the same. As financial reporting income is

profit that has been met using full accrual basis. While the

rate imposed on Wesfarmer Ltd's net income (Schaltegger,

Burritt and Petersen, 2017). The tax rate periods and

monitoring tax expenses are not the same because

preceding and current year tax rates are not the same but

the tax rate time will be different than income taxes.

Everything could not be calculated by comparing effective

tax rate with tax liability, whereas tax rate periods are

determined by calculating income from EBIT.

5. Identify the deferred tax assets or liabilities that are

reported in the balance sheet articulating the possible

reasons why they have been recorded

Deferred tax assets and liabilities: that's an

accounting method which shown in the balance sheet and it

is documented when tax is paid in large amounts of its actual

tax proportion. It generates when taxes for the existing year

are not compensated in the same fiscal year. It takes the

remaining tax revenue and remaining tax liabilities forward.

7

Deferred tax obligations arise when net revenue is smaller

than the number already reported on the statement of

income. It emphasizes the change between revenue and

expenditures. Deferred tax, calculated at tax rates for the

single year in which profits are obtained or losses are

covered. Such assets and liabilities will affect the financial

performance as well as the operating income of the

company.

Every type of income and expenditure are not recorded

in the income statement for the purpose of deducting amount

for tax. Income tax and corporate finance are not the same

that is why the tax liability income and net income results

differ. These taxes are adjusted at the end of the current

year and when books close.

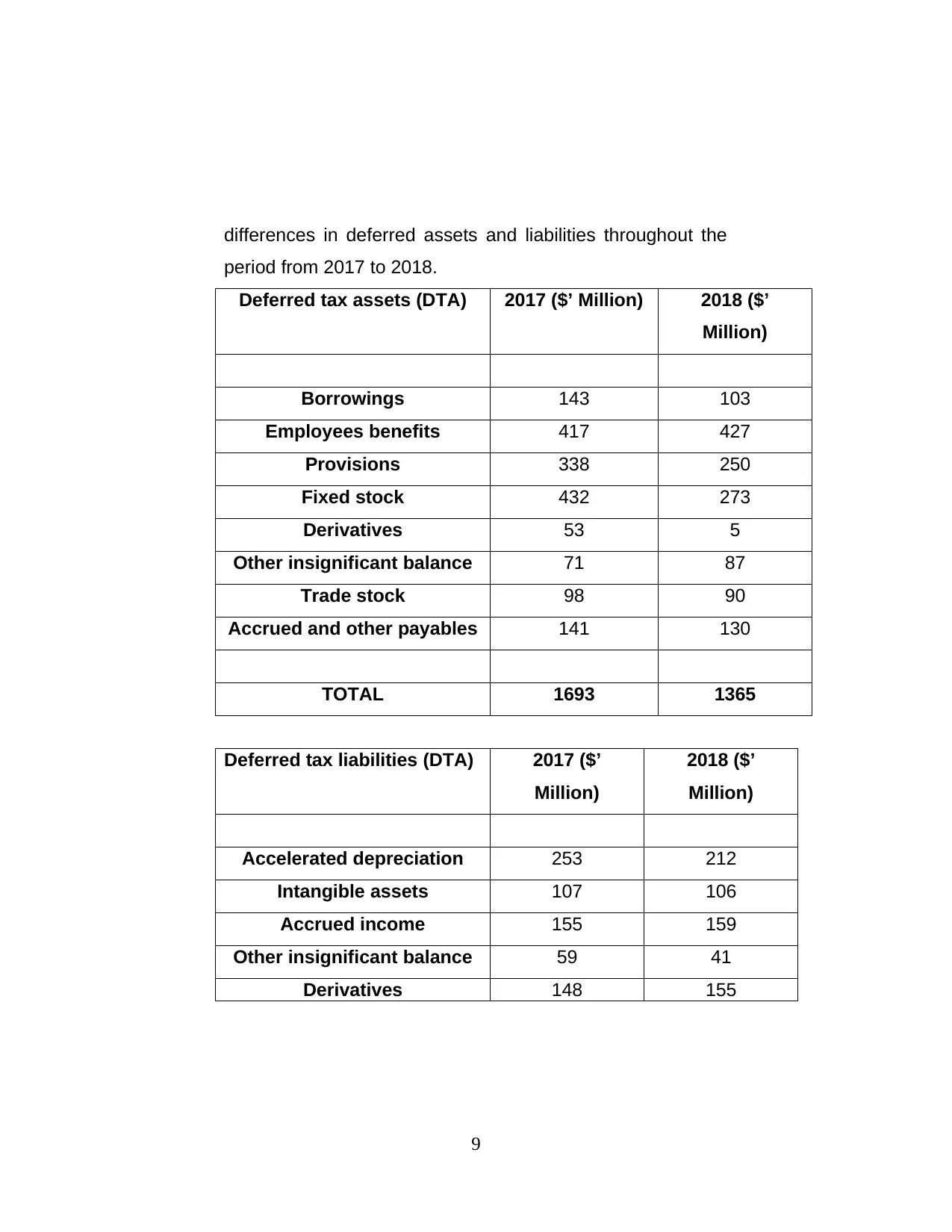

Balance sheet: In this financial statement, deferred tax

assets elements drop from $ 1693 million to $1365 million in

2018 due to adjustments in borrowings, selling stocks,

contracts, employee insurance, options and fixed assets,

according to Wesfarmer's financial report (Raiborn and

Sivitanides, 2015). Another side deferred tax liabilities items

are also reduced from $ 722 million to $673 million owing to

valuation adjustments, accrual profits, intangible assets and

depreciation. Below mentioned table represents the

8

than the number already reported on the statement of

income. It emphasizes the change between revenue and

expenditures. Deferred tax, calculated at tax rates for the

single year in which profits are obtained or losses are

covered. Such assets and liabilities will affect the financial

performance as well as the operating income of the

company.

Every type of income and expenditure are not recorded

in the income statement for the purpose of deducting amount

for tax. Income tax and corporate finance are not the same

that is why the tax liability income and net income results

differ. These taxes are adjusted at the end of the current

year and when books close.

Balance sheet: In this financial statement, deferred tax

assets elements drop from $ 1693 million to $1365 million in

2018 due to adjustments in borrowings, selling stocks,

contracts, employee insurance, options and fixed assets,

according to Wesfarmer's financial report (Raiborn and

Sivitanides, 2015). Another side deferred tax liabilities items

are also reduced from $ 722 million to $673 million owing to

valuation adjustments, accrual profits, intangible assets and

depreciation. Below mentioned table represents the

8

differences in deferred assets and liabilities throughout the

period from 2017 to 2018.

Deferred tax assets (DTA) 2017 ($’ Million) 2018 ($’

Million)

Borrowings 143 103

Employees benefits 417 427

Provisions 338 250

Fixed stock 432 273

Derivatives 53 5

Other insignificant balance 71 87

Trade stock 98 90

Accrued and other payables 141 130

TOTAL 1693 1365

Deferred tax liabilities (DTA) 2017 ($’

Million)

2018 ($’

Million)

Accelerated depreciation 253 212

Intangible assets 107 106

Accrued income 155 159

Other insignificant balance 59 41

Derivatives 148 155

9

period from 2017 to 2018.

Deferred tax assets (DTA) 2017 ($’ Million) 2018 ($’

Million)

Borrowings 143 103

Employees benefits 417 427

Provisions 338 250

Fixed stock 432 273

Derivatives 53 5

Other insignificant balance 71 87

Trade stock 98 90

Accrued and other payables 141 130

TOTAL 1693 1365

Deferred tax liabilities (DTA) 2017 ($’

Million)

2018 ($’

Million)

Accelerated depreciation 253 212

Intangible assets 107 106

Accrued income 155 159

Other insignificant balance 59 41

Derivatives 148 155

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TOTAL 722 673

Reasons for recording deferred tax:

Deferred tax reported because of the disparity in

duration between the book income and taxable profit. A few

other items are permitted to charge for tax purposes and are

forbidden. Such variations are called variations in pacing,

and are divided into two sections. The first would be

transitory and the next is long lasting (Schaltegger,

Etxeberria and Ortas, 2017). Temporary includes the

difference between book revenue and taxable revenue that

will be compensated for next year. Permanent requires the

disparity that cannot be offset in the next year. It will create

provisional difference in the records of the business, and

develop deferred tax liability. If net income is higher than

taxable profit, then in the present year the corporation will

pay less tax and in the future pay more tax. Regardless of

the disparity, accountants must establish deferred account

for tax liability. In the other hand, if net income is less than

gross profit as a result of which businesses charge massive

tax in the present year and in the future, they charge low

taxes. Organization has to create deferred tax assets

10

Reasons for recording deferred tax:

Deferred tax reported because of the disparity in

duration between the book income and taxable profit. A few

other items are permitted to charge for tax purposes and are

forbidden. Such variations are called variations in pacing,

and are divided into two sections. The first would be

transitory and the next is long lasting (Schaltegger,

Etxeberria and Ortas, 2017). Temporary includes the

difference between book revenue and taxable revenue that

will be compensated for next year. Permanent requires the

disparity that cannot be offset in the next year. It will create

provisional difference in the records of the business, and

develop deferred tax liability. If net income is higher than

taxable profit, then in the present year the corporation will

pay less tax and in the future pay more tax. Regardless of

the disparity, accountants must establish deferred account

for tax liability. In the other hand, if net income is less than

gross profit as a result of which businesses charge massive

tax in the present year and in the future, they charge low

taxes. Organization has to create deferred tax assets

10

account for this purpose. The distinction in scheduling also

involves take forward failures and unthinking depreciation.

Another reason for creating deferred tax liability is

that, this is a product on credit bases when an institution's

sale. In that case, the quantity will be earned in the long term

but the corporation acknowledges as full money due to the

accounting standards. But it considers maximum profit as

the instalment in the series is completely rendered as per tax

regulations. This should create temporary differentiation in

the balances of the Wesfarmer Company, and create

deferred tax liability.

6. Find that, there any current tax assets or income tax

payable recorded by your company and evaluate that

Why is the income tax payable not the same as income

tax expense

In an organizational context, current tax assets are

recorded at that sum that is expected to be realized under

tax laws by tax office, and taxes are adopted by date of the

balance sheet. Indeed, income tax due is reported in

Wesfarmer Ltd's 2018 Annual Report. Corporate tax liability

is reported within current liabilities in business balance

sheet. Corporate tax expenses mentioned in the income

statement accounts that are used by companies to

document income tax state and federal costs. Income tax

11

involves take forward failures and unthinking depreciation.

Another reason for creating deferred tax liability is

that, this is a product on credit bases when an institution's

sale. In that case, the quantity will be earned in the long term

but the corporation acknowledges as full money due to the

accounting standards. But it considers maximum profit as

the instalment in the series is completely rendered as per tax

regulations. This should create temporary differentiation in

the balances of the Wesfarmer Company, and create

deferred tax liability.

6. Find that, there any current tax assets or income tax

payable recorded by your company and evaluate that

Why is the income tax payable not the same as income

tax expense

In an organizational context, current tax assets are

recorded at that sum that is expected to be realized under

tax laws by tax office, and taxes are adopted by date of the

balance sheet. Indeed, income tax due is reported in

Wesfarmer Ltd's 2018 Annual Report. Corporate tax liability

is reported within current liabilities in business balance

sheet. Corporate tax expenses mentioned in the income

statement accounts that are used by companies to

document income tax state and federal costs. Income tax

11

payable is known as an element of liabilities that is reflected

in the balance sheet of Wesfarmer Ltd. Using it to document

the amount in taxes owed but not yet paid to the proper

taxing authority by the corporation.

As per the Wesfarmer Ltd's 2018 Annual

Report, income tax payable was $ 299 million, and income

tax expenses are (1246) million, but this is the number that is

not actually considered to be anticipated to be paid (Uyar,

2016). Corporation need to form a full disclosure on this

amount of tax expenditures and tax payable are not always

the same because tax expenditures are the value that the

business wishes to pay while tax payable is the actual

amount which government decides. This can be seen in the

statement of revenue, and the tax payments made is

measured in the balance sheet underneath the account of

liability. It is valuable to document the amount in taxes owed

but not yet payable to the tax department.

7. Is the income tax expense shown in the income statement

same as the income tax paid shown in the cash flow

statement? If not, why is the difference

In the profit and loss statement of the company is used

for reporting purpose and identifying the firm's financial

position for the specific financial period. Preparing this

accounting report is important for each company because it

12

in the balance sheet of Wesfarmer Ltd. Using it to document

the amount in taxes owed but not yet paid to the proper

taxing authority by the corporation.

As per the Wesfarmer Ltd's 2018 Annual

Report, income tax payable was $ 299 million, and income

tax expenses are (1246) million, but this is the number that is

not actually considered to be anticipated to be paid (Uyar,

2016). Corporation need to form a full disclosure on this

amount of tax expenditures and tax payable are not always

the same because tax expenditures are the value that the

business wishes to pay while tax payable is the actual

amount which government decides. This can be seen in the

statement of revenue, and the tax payments made is

measured in the balance sheet underneath the account of

liability. It is valuable to document the amount in taxes owed

but not yet payable to the tax department.

7. Is the income tax expense shown in the income statement

same as the income tax paid shown in the cash flow

statement? If not, why is the difference

In the profit and loss statement of the company is used

for reporting purpose and identifying the firm's financial

position for the specific financial period. Preparing this

accounting report is important for each company because it

12

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

demonstrates the firm’s productivity as well as

overall performance. Cash flow statement represents the

balance of different items in from balance sheet of

the company or changes in the cash and cash equivalents

as well. Income tax is levied by the govt on profits generated

by persons or businesses with their constitutional

jurisdiction. In the 2018, income statement of Wesfarmer

Ltd., income tax expenditures are recorded as (1246)

million and income tax payable is 1308 million in cash flow

statement. Income tax should be included in both

income statement as well as cash flow statements.

Income tax proportion is not the same in both

documents, since income tax expenditures are shows in the

income statement. Those amounts are mentioned in this

which are not did pay. It is approximated amounts that were

created to support what the company needs to pay. But the

true or real quantity that Wesfarmer Ltd. earns in taxes is

regarded in cash flow statement as paid income tax. Just the

current amount of periods was included in income statement,

and that is why the amount is separate in both the

declarations.

13

overall performance. Cash flow statement represents the

balance of different items in from balance sheet of

the company or changes in the cash and cash equivalents

as well. Income tax is levied by the govt on profits generated

by persons or businesses with their constitutional

jurisdiction. In the 2018, income statement of Wesfarmer

Ltd., income tax expenditures are recorded as (1246)

million and income tax payable is 1308 million in cash flow

statement. Income tax should be included in both

income statement as well as cash flow statements.

Income tax proportion is not the same in both

documents, since income tax expenditures are shows in the

income statement. Those amounts are mentioned in this

which are not did pay. It is approximated amounts that were

created to support what the company needs to pay. But the

true or real quantity that Wesfarmer Ltd. earns in taxes is

regarded in cash flow statement as paid income tax. Just the

current amount of periods was included in income statement,

and that is why the amount is separate in both the

declarations.

13

8. Evaluate the concepts of temporary difference and

permanent difference. Identify any permanent

differences that your company may have

Temporary differences are split into temporary taxable

differences and temporary deductible differences. Taxable

temporary differences are transient gaps at the time

of calculating the taxable income when the related balance

sheet element is retrieved or resolved, results in a taxable

sum in future (Zadek, Evans and Pruzan, 2013). Temporary

deductible variation are short term differences that result in a

long term reduction or exemption of taxable income

whenever the appropriate balance sheet object is healed or

decided to settle.

Because they're not same, permanent gap do not result

in deferred tax assets or liabilities. Examples of assets that

result in lifelong discrepancies are revenue or cost items

which are not permitted under tax legislation and tax

deductions on other purchases that explicitly decrease

taxation. Both lasting differences may result in a discrepancy

between the effective tax rate of a corporation and the

standard tax rate. It is also observed that, there is no

permanent difference in the financial statement of the

selected organizations.

14

permanent difference. Identify any permanent

differences that your company may have

Temporary differences are split into temporary taxable

differences and temporary deductible differences. Taxable

temporary differences are transient gaps at the time

of calculating the taxable income when the related balance

sheet element is retrieved or resolved, results in a taxable

sum in future (Zadek, Evans and Pruzan, 2013). Temporary

deductible variation are short term differences that result in a

long term reduction or exemption of taxable income

whenever the appropriate balance sheet object is healed or

decided to settle.

Because they're not same, permanent gap do not result

in deferred tax assets or liabilities. Examples of assets that

result in lifelong discrepancies are revenue or cost items

which are not permitted under tax legislation and tax

deductions on other purchases that explicitly decrease

taxation. Both lasting differences may result in a discrepancy

between the effective tax rate of a corporation and the

standard tax rate. It is also observed that, there is no

permanent difference in the financial statement of the

selected organizations.

14

9. What do you find interesting, confusing, surprising or

difficult to understand about the treatment of tax in your

firm’s financial statements

It has been observed the Wesfarmer Ltd's financial

statements, it is explicitly indicated that the company's

income rises with faster rate and it can be seen through to

the taxable value reported in the financial statement of 2017

and 2018 financial year. That could also be examined by the

firm's income tax due on the earnings before tax among two

year period which is approximately $ 1169 million and

$ 1246 million (Watson, 2015). This is fascinating to see that

decrease in deferred tax assets, which shows that either

business receives the reimbursement of the surplus amount

paid in the past year or it can offset via deferred tax

liabilities.

This is very shocking to see a massive decrease in

corporation borrowings, derivative products over a period of

one year. It's also surprising that how fixed assets of the

company suddenly decrease, that is $ 432 million in 2017

and reduces in 2018 and remained at $ 272 million. All

aspects should be evaluated to make businesses more

competitive, such as capital assets, invested income and

accrued expenditures and other relevant areas. It is

essential to review those amounts which are listed and

15

difficult to understand about the treatment of tax in your

firm’s financial statements

It has been observed the Wesfarmer Ltd's financial

statements, it is explicitly indicated that the company's

income rises with faster rate and it can be seen through to

the taxable value reported in the financial statement of 2017

and 2018 financial year. That could also be examined by the

firm's income tax due on the earnings before tax among two

year period which is approximately $ 1169 million and

$ 1246 million (Watson, 2015). This is fascinating to see that

decrease in deferred tax assets, which shows that either

business receives the reimbursement of the surplus amount

paid in the past year or it can offset via deferred tax

liabilities.

This is very shocking to see a massive decrease in

corporation borrowings, derivative products over a period of

one year. It's also surprising that how fixed assets of the

company suddenly decrease, that is $ 432 million in 2017

and reduces in 2018 and remained at $ 272 million. All

aspects should be evaluated to make businesses more

competitive, such as capital assets, invested income and

accrued expenditures and other relevant areas. It is

essential to review those amounts which are listed and

15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

which are not started paying. That is an approximate sum

that was generated to cover what the organization wants to

pay for.

CONCLUSION

It has been observed that organization uses corporate

accounting to analyze the profitability of a company. With the

help of producing financial report, organizations able

to evaluate the profit margin for the specific time period.

It helps to maintain, obtain huge market share in

the worldwide. After careful review, Wesfarmers ltd was said

to be quite effective and efficient when it comes to handling

tax liabilities. Shape the yearly different items that help to

assess the real current status of the respective organization

have also been described.

16

that was generated to cover what the organization wants to

pay for.

CONCLUSION

It has been observed that organization uses corporate

accounting to analyze the profitability of a company. With the

help of producing financial report, organizations able

to evaluate the profit margin for the specific time period.

It helps to maintain, obtain huge market share in

the worldwide. After careful review, Wesfarmers ltd was said

to be quite effective and efficient when it comes to handling

tax liabilities. Shape the yearly different items that help to

assess the real current status of the respective organization

have also been described.

16

REFERENCES

Books & Journals

Edwards, J. R., 2013. A History of Financial Accounting

(RLE Accounting). Routledge.

Rogoff, K. S., 2017. The Curse of Cash: How Large-

Denomination Bills Aid Crime and Tax Evasion and

Constrain Monetary Policy. Princeton University

Press.

Hoskin, R. E., Fizzell, M. R. and Cherry, D. C., 2014.

Financial Accounting: a user perspective. Wiley

Global Education.

DeBusk, G. K., 2012. Use lean accounting to add value to

the organization. Journal of Corporate Accounting &

Finance. 23(3). pp.35-41.

Edgerton, J., 2012. Investment, accounting, and the salience

of the corporate income tax (No. w18472). National

Bureau of Economic Research.

Huseynov, F. and Klamm, B.K., 2012. Tax avoidance, tax

management and corporate social responsibility.

Journal of Corporate Finance. 18(4). pp.804-827.

Schaltegger, S., Burritt, R. and Petersen, H., 2017. An

introduction to corporate environmental management:

Striving for sustainability. Routledge.

Raiborn, C. and Sivitanides, M., 2015. Accounting issues

related to Bitcoins. Journal of Corporate Accounting &

Finance. 26(2). pp.25-34.

Schaltegger, S., Etxeberria, I. Á. and Ortas, E., 2017.

Innovating corporate accounting and reporting for

sustainability–attributes and challenges. Sustainable

Development. 25(2). pp.113-122.

Uyar, A., 2016. Evolution of corporate reporting and

emerging trends. Journal of Corporate Accounting &

Finance. 27(4). pp.27-30.

17

Books & Journals

Edwards, J. R., 2013. A History of Financial Accounting

(RLE Accounting). Routledge.

Rogoff, K. S., 2017. The Curse of Cash: How Large-

Denomination Bills Aid Crime and Tax Evasion and

Constrain Monetary Policy. Princeton University

Press.

Hoskin, R. E., Fizzell, M. R. and Cherry, D. C., 2014.

Financial Accounting: a user perspective. Wiley

Global Education.

DeBusk, G. K., 2012. Use lean accounting to add value to

the organization. Journal of Corporate Accounting &

Finance. 23(3). pp.35-41.

Edgerton, J., 2012. Investment, accounting, and the salience

of the corporate income tax (No. w18472). National

Bureau of Economic Research.

Huseynov, F. and Klamm, B.K., 2012. Tax avoidance, tax

management and corporate social responsibility.

Journal of Corporate Finance. 18(4). pp.804-827.

Schaltegger, S., Burritt, R. and Petersen, H., 2017. An

introduction to corporate environmental management:

Striving for sustainability. Routledge.

Raiborn, C. and Sivitanides, M., 2015. Accounting issues

related to Bitcoins. Journal of Corporate Accounting &

Finance. 26(2). pp.25-34.

Schaltegger, S., Etxeberria, I. Á. and Ortas, E., 2017.

Innovating corporate accounting and reporting for

sustainability–attributes and challenges. Sustainable

Development. 25(2). pp.113-122.

Uyar, A., 2016. Evolution of corporate reporting and

emerging trends. Journal of Corporate Accounting &

Finance. 27(4). pp.27-30.

17

Zadek, S., Evans, R. and Pruzan, P., 2013. Building

corporate accountability: Emerging practice in social

and ethical accounting and auditing. Routledge.

Watson, L., 2015. Corporate social responsibility research in

accounting. Journal of Accounting Literature. 34.

pp.1-16.

Online

Annual reports of Wesfarmers. 2018. [Online] Avaliable

Through:

<https://www.wesfarmers.com.au/docs/default-

source/asx-announcements/2018-annual-report.pdf?

sfvrsn>.

18

corporate accountability: Emerging practice in social

and ethical accounting and auditing. Routledge.

Watson, L., 2015. Corporate social responsibility research in

accounting. Journal of Accounting Literature. 34.

pp.1-16.

Online

Annual reports of Wesfarmers. 2018. [Online] Avaliable

Through:

<https://www.wesfarmers.com.au/docs/default-

source/asx-announcements/2018-annual-report.pdf?

sfvrsn>.

18

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.