Corporate and Financial Accounting Report on Wesfarmers & Woolworths

VerifiedAdded on 2022/10/19

|13

|3268

|10

Report

AI Summary

This report provides a comprehensive analysis of the corporate and financial accounting practices of Wesfarmers and Woolworths, two prominent ASX-listed companies. The study focuses on how these companies raise funds to achieve their long-term objectives and maintain a strong market presence. The report delves into the owner's equity sections of both companies' balance sheets, examining movements over a three-year period from 2016 to 2018. It also analyzes the total liabilities sections, explaining the components and changes within these sections during the same timeframe. Furthermore, the report explores the concepts of small and large proprietary companies, outlining their compliance and reporting requirements. The analysis includes detailed examinations of common stock, retained earnings, treasury stock, and unrealized gains and losses, offering insights into the financial strategies and performance of Wesfarmers and Woolworths. The report highlights key trends, such as the impact of share issuances, dividend payments, and changes in debt levels on the companies' financial positions. The findings provide a clear understanding of the financial health and management strategies employed by these major corporations.

RUNNING HEAD: CORPORATE AND FINANCIAL ACCOUNTING

0

Corporate and Financial Accounting

Report

System 0032

[Pick the date]

0

Corporate and Financial Accounting

Report

System 0032

[Pick the date]

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate and Financial Accounting

1

Abstract

This report consists of the ways Wesfarmers and Woolworths raise funds in order to meet their long

term goals and to sustain in the market. Further sections of report highlights the owners’ equity section

of both the companies and movement in this sections for three consecutive years starting from 2016.

The total liabilities sections of both the companies are also analyzed and all the items in these sections of

balance sheet are explained. The e movements in the liabilities section of companies with the reasons

are provided for three years. Further in next part the concept of small and large proprietary company is

explained with the terms of compliance and reporting requirement.

1

Abstract

This report consists of the ways Wesfarmers and Woolworths raise funds in order to meet their long

term goals and to sustain in the market. Further sections of report highlights the owners’ equity section

of both the companies and movement in this sections for three consecutive years starting from 2016.

The total liabilities sections of both the companies are also analyzed and all the items in these sections of

balance sheet are explained. The e movements in the liabilities section of companies with the reasons

are provided for three years. Further in next part the concept of small and large proprietary company is

explained with the terms of compliance and reporting requirement.

Corporate and Financial Accounting

2

Table of Contents

Introduction.................................................................................................................................................3

Assignments................................................................................................................................................3

Part A......................................................................................................................................................3

Part B.....................................................................................................................................................10

Conclusion.................................................................................................................................................11

References.................................................................................................................................................14

2

Table of Contents

Introduction.................................................................................................................................................3

Assignments................................................................................................................................................3

Part A......................................................................................................................................................3

Part B.....................................................................................................................................................10

Conclusion.................................................................................................................................................11

References.................................................................................................................................................14

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate and Financial Accounting

3

Introduction

Corporate financing is the area that is concerned with the capital structure of the companies, sources of

funds, tools used to allocate financial resources and the actions that management takes for wealth

maximization. Corporate and financial accounting describes the two main areas in finance that are

capital budgeting and working capital management (Warren and Jones, 2018). Capital budgeting include

a part that states about whether company should finance investment with debt capital or equity that

means which source of raising fund prove to be beneficial . The concept of corporate finance is mainly

related to the transactions by which the companies raise capital in order to develop, create, acquire and

grow their businesses (Shi, 2015).

The aim of this report is to know the sources that company use in order to raise funds. To understand

this concept of raising funds two companies has been chosen that are Woolworths and Wesfarmers both

are ASX listed companies. To know the movement of funds and sources of funds to raise capital in these

companies’ data for 3 years from 2015 to 2018 is analyzed and on the basis of that all the questions of

the assessment are answered in below sections. Further, analysis on the concepts of large proprietary

company, reporting entities and small proprietary company is done and implications of these types are

identified as per the “terms of compliance and reporting requirements”.

Assignments

Part A

i. Owner’s equity is the section in balance sheet which represents the investment of owners in the

business and all the transactions that are done by the owner. The company’s balance sheet

discloses the liabilities, assets and owners’ equity. Owners’ equity in the company is the

shareholders fund or the amount raise through the issue of shares to public (Datta and Fuad,

2017). The broad classification of owners fund is that it includes common stock, retained

earnings and unrealized gain.

3

Introduction

Corporate financing is the area that is concerned with the capital structure of the companies, sources of

funds, tools used to allocate financial resources and the actions that management takes for wealth

maximization. Corporate and financial accounting describes the two main areas in finance that are

capital budgeting and working capital management (Warren and Jones, 2018). Capital budgeting include

a part that states about whether company should finance investment with debt capital or equity that

means which source of raising fund prove to be beneficial . The concept of corporate finance is mainly

related to the transactions by which the companies raise capital in order to develop, create, acquire and

grow their businesses (Shi, 2015).

The aim of this report is to know the sources that company use in order to raise funds. To understand

this concept of raising funds two companies has been chosen that are Woolworths and Wesfarmers both

are ASX listed companies. To know the movement of funds and sources of funds to raise capital in these

companies’ data for 3 years from 2015 to 2018 is analyzed and on the basis of that all the questions of

the assessment are answered in below sections. Further, analysis on the concepts of large proprietary

company, reporting entities and small proprietary company is done and implications of these types are

identified as per the “terms of compliance and reporting requirements”.

Assignments

Part A

i. Owner’s equity is the section in balance sheet which represents the investment of owners in the

business and all the transactions that are done by the owner. The company’s balance sheet

discloses the liabilities, assets and owners’ equity. Owners’ equity in the company is the

shareholders fund or the amount raise through the issue of shares to public (Datta and Fuad,

2017). The broad classification of owners fund is that it includes common stock, retained

earnings and unrealized gain.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate and Financial Accounting

4

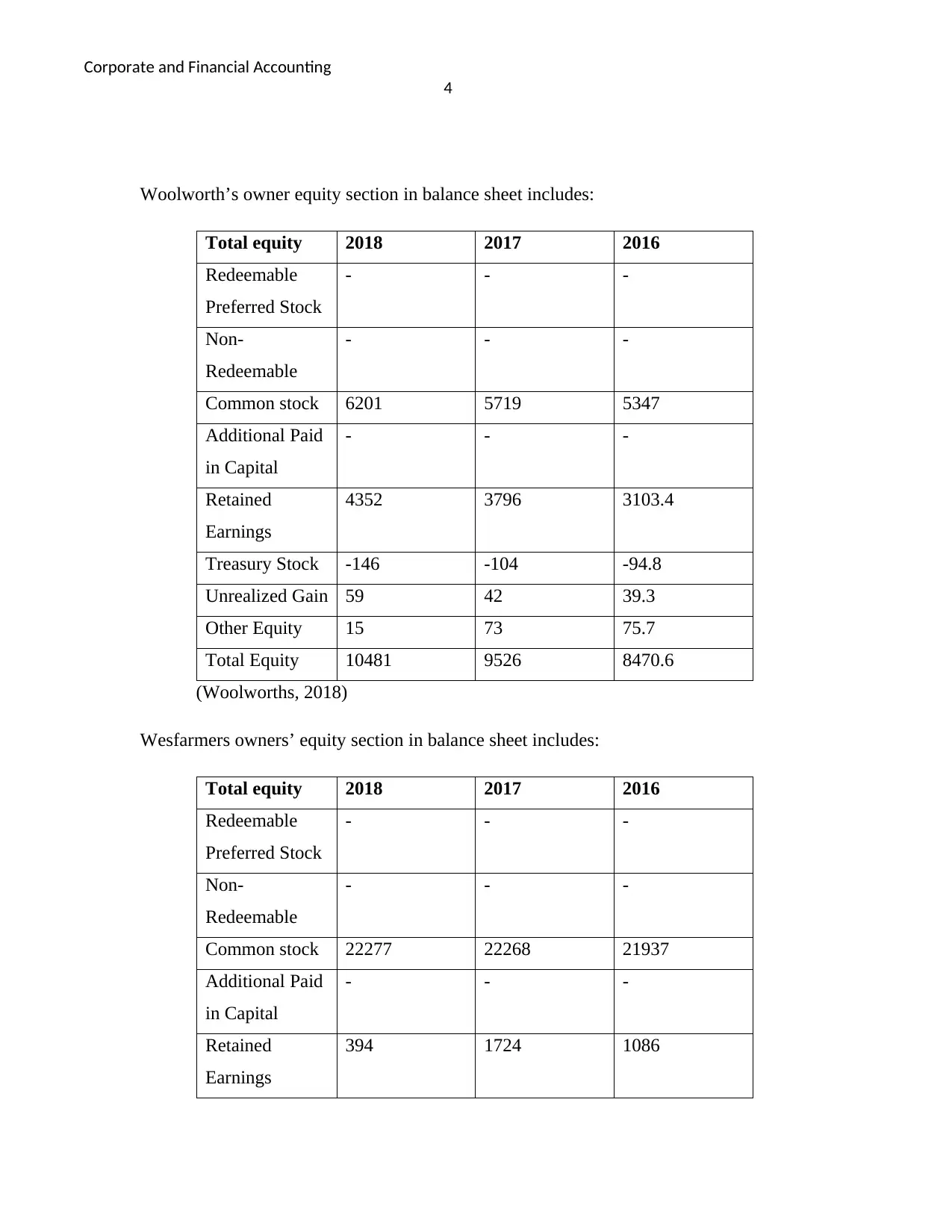

Woolworth’s owner equity section in balance sheet includes:

Total equity 2018 2017 2016

Redeemable

Preferred Stock

- - -

Non-

Redeemable

- - -

Common stock 6201 5719 5347

Additional Paid

in Capital

- - -

Retained

Earnings

4352 3796 3103.4

Treasury Stock -146 -104 -94.8

Unrealized Gain 59 42 39.3

Other Equity 15 73 75.7

Total Equity 10481 9526 8470.6

(Woolworths, 2018)

Wesfarmers owners’ equity section in balance sheet includes:

Total equity 2018 2017 2016

Redeemable

Preferred Stock

- - -

Non-

Redeemable

- - -

Common stock 22277 22268 21937

Additional Paid

in Capital

- - -

Retained

Earnings

394 1724 1086

4

Woolworth’s owner equity section in balance sheet includes:

Total equity 2018 2017 2016

Redeemable

Preferred Stock

- - -

Non-

Redeemable

- - -

Common stock 6201 5719 5347

Additional Paid

in Capital

- - -

Retained

Earnings

4352 3796 3103.4

Treasury Stock -146 -104 -94.8

Unrealized Gain 59 42 39.3

Other Equity 15 73 75.7

Total Equity 10481 9526 8470.6

(Woolworths, 2018)

Wesfarmers owners’ equity section in balance sheet includes:

Total equity 2018 2017 2016

Redeemable

Preferred Stock

- - -

Non-

Redeemable

- - -

Common stock 22277 22268 21937

Additional Paid

in Capital

- - -

Retained

Earnings

394 1724 1086

Corporate and Financial Accounting

5

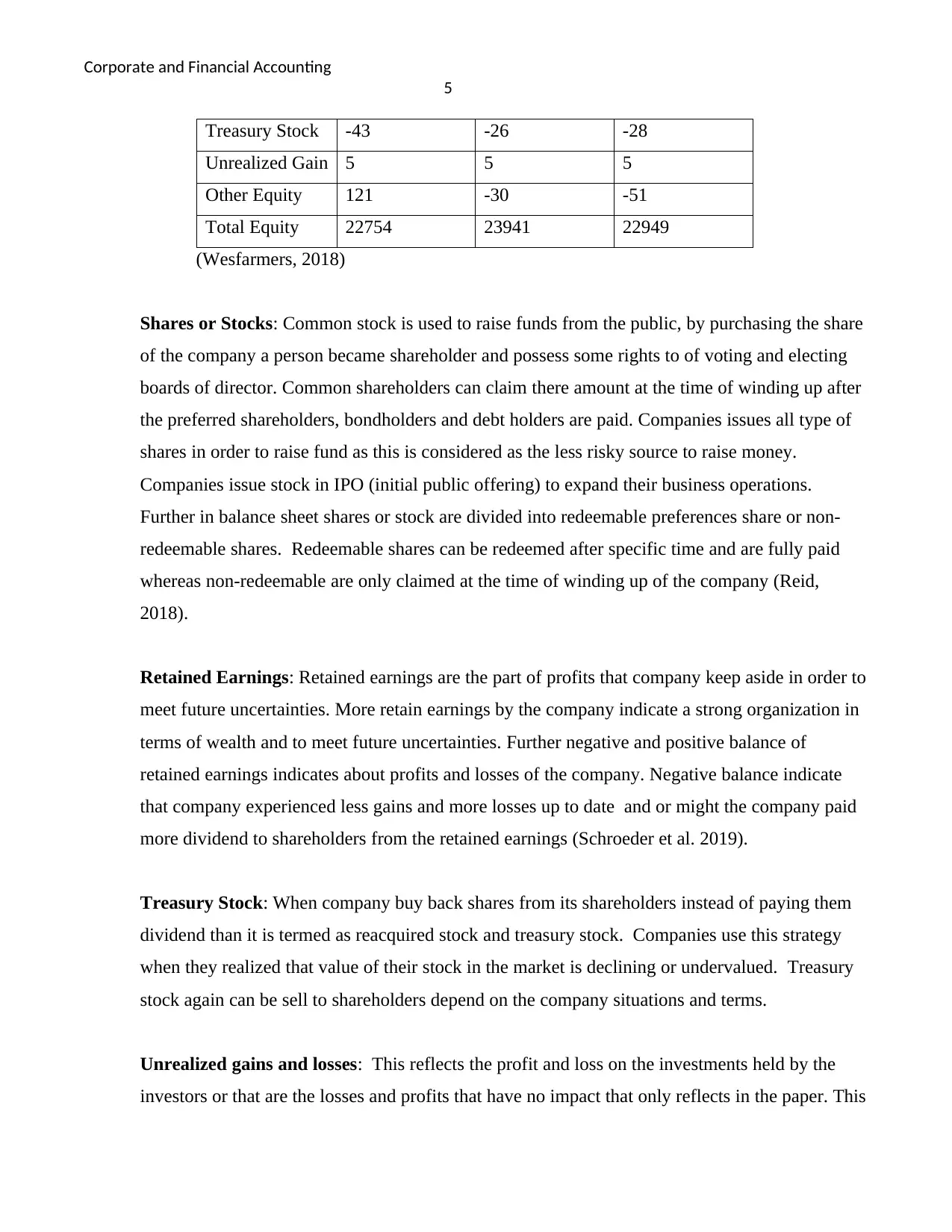

Treasury Stock -43 -26 -28

Unrealized Gain 5 5 5

Other Equity 121 -30 -51

Total Equity 22754 23941 22949

(Wesfarmers, 2018)

Shares or Stocks: Common stock is used to raise funds from the public, by purchasing the share

of the company a person became shareholder and possess some rights to of voting and electing

boards of director. Common shareholders can claim there amount at the time of winding up after

the preferred shareholders, bondholders and debt holders are paid. Companies issues all type of

shares in order to raise fund as this is considered as the less risky source to raise money.

Companies issue stock in IPO (initial public offering) to expand their business operations.

Further in balance sheet shares or stock are divided into redeemable preferences share or non-

redeemable shares. Redeemable shares can be redeemed after specific time and are fully paid

whereas non-redeemable are only claimed at the time of winding up of the company (Reid,

2018).

Retained Earnings: Retained earnings are the part of profits that company keep aside in order to

meet future uncertainties. More retain earnings by the company indicate a strong organization in

terms of wealth and to meet future uncertainties. Further negative and positive balance of

retained earnings indicates about profits and losses of the company. Negative balance indicate

that company experienced less gains and more losses up to date and or might the company paid

more dividend to shareholders from the retained earnings (Schroeder et al. 2019).

Treasury Stock: When company buy back shares from its shareholders instead of paying them

dividend than it is termed as reacquired stock and treasury stock. Companies use this strategy

when they realized that value of their stock in the market is declining or undervalued. Treasury

stock again can be sell to shareholders depend on the company situations and terms.

Unrealized gains and losses: This reflects the profit and loss on the investments held by the

investors or that are the losses and profits that have no impact that only reflects in the paper. This

5

Treasury Stock -43 -26 -28

Unrealized Gain 5 5 5

Other Equity 121 -30 -51

Total Equity 22754 23941 22949

(Wesfarmers, 2018)

Shares or Stocks: Common stock is used to raise funds from the public, by purchasing the share

of the company a person became shareholder and possess some rights to of voting and electing

boards of director. Common shareholders can claim there amount at the time of winding up after

the preferred shareholders, bondholders and debt holders are paid. Companies issues all type of

shares in order to raise fund as this is considered as the less risky source to raise money.

Companies issue stock in IPO (initial public offering) to expand their business operations.

Further in balance sheet shares or stock are divided into redeemable preferences share or non-

redeemable shares. Redeemable shares can be redeemed after specific time and are fully paid

whereas non-redeemable are only claimed at the time of winding up of the company (Reid,

2018).

Retained Earnings: Retained earnings are the part of profits that company keep aside in order to

meet future uncertainties. More retain earnings by the company indicate a strong organization in

terms of wealth and to meet future uncertainties. Further negative and positive balance of

retained earnings indicates about profits and losses of the company. Negative balance indicate

that company experienced less gains and more losses up to date and or might the company paid

more dividend to shareholders from the retained earnings (Schroeder et al. 2019).

Treasury Stock: When company buy back shares from its shareholders instead of paying them

dividend than it is termed as reacquired stock and treasury stock. Companies use this strategy

when they realized that value of their stock in the market is declining or undervalued. Treasury

stock again can be sell to shareholders depend on the company situations and terms.

Unrealized gains and losses: This reflects the profit and loss on the investments held by the

investors or that are the losses and profits that have no impact that only reflects in the paper. This

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate and Financial Accounting

6

help in the perspective of tax and companies can benefit from unrealized gains and losses from

tax perspective.

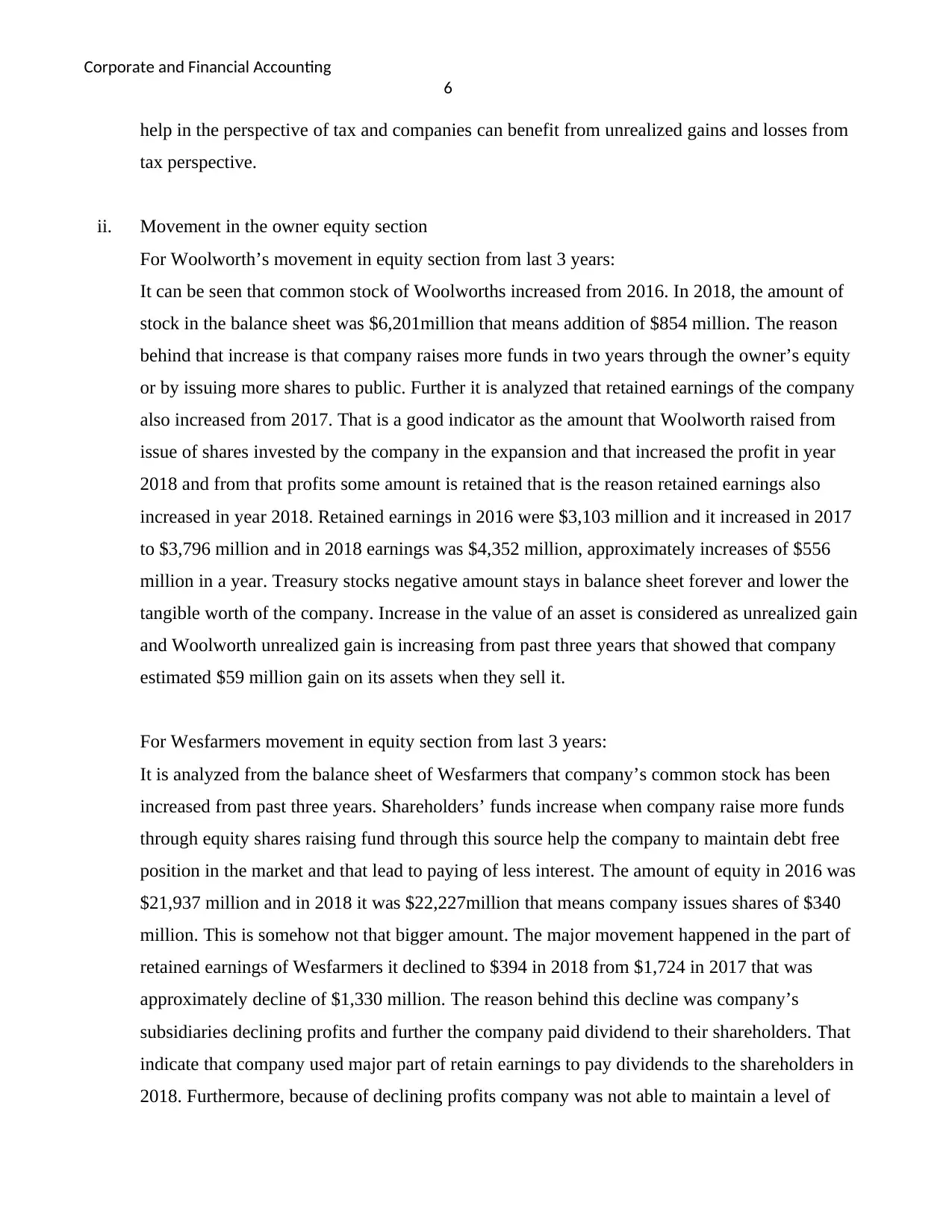

ii. Movement in the owner equity section

For Woolworth’s movement in equity section from last 3 years:

It can be seen that common stock of Woolworths increased from 2016. In 2018, the amount of

stock in the balance sheet was $6,201million that means addition of $854 million. The reason

behind that increase is that company raises more funds in two years through the owner’s equity

or by issuing more shares to public. Further it is analyzed that retained earnings of the company

also increased from 2017. That is a good indicator as the amount that Woolworth raised from

issue of shares invested by the company in the expansion and that increased the profit in year

2018 and from that profits some amount is retained that is the reason retained earnings also

increased in year 2018. Retained earnings in 2016 were $3,103 million and it increased in 2017

to $3,796 million and in 2018 earnings was $4,352 million, approximately increases of $556

million in a year. Treasury stocks negative amount stays in balance sheet forever and lower the

tangible worth of the company. Increase in the value of an asset is considered as unrealized gain

and Woolworth unrealized gain is increasing from past three years that showed that company

estimated $59 million gain on its assets when they sell it.

For Wesfarmers movement in equity section from last 3 years:

It is analyzed from the balance sheet of Wesfarmers that company’s common stock has been

increased from past three years. Shareholders’ funds increase when company raise more funds

through equity shares raising fund through this source help the company to maintain debt free

position in the market and that lead to paying of less interest. The amount of equity in 2016 was

$21,937 million and in 2018 it was $22,227million that means company issues shares of $340

million. This is somehow not that bigger amount. The major movement happened in the part of

retained earnings of Wesfarmers it declined to $394 in 2018 from $1,724 in 2017 that was

approximately decline of $1,330 million. The reason behind this decline was company’s

subsidiaries declining profits and further the company paid dividend to their shareholders. That

indicate that company used major part of retain earnings to pay dividends to the shareholders in

2018. Furthermore, because of declining profits company was not able to maintain a level of

6

help in the perspective of tax and companies can benefit from unrealized gains and losses from

tax perspective.

ii. Movement in the owner equity section

For Woolworth’s movement in equity section from last 3 years:

It can be seen that common stock of Woolworths increased from 2016. In 2018, the amount of

stock in the balance sheet was $6,201million that means addition of $854 million. The reason

behind that increase is that company raises more funds in two years through the owner’s equity

or by issuing more shares to public. Further it is analyzed that retained earnings of the company

also increased from 2017. That is a good indicator as the amount that Woolworth raised from

issue of shares invested by the company in the expansion and that increased the profit in year

2018 and from that profits some amount is retained that is the reason retained earnings also

increased in year 2018. Retained earnings in 2016 were $3,103 million and it increased in 2017

to $3,796 million and in 2018 earnings was $4,352 million, approximately increases of $556

million in a year. Treasury stocks negative amount stays in balance sheet forever and lower the

tangible worth of the company. Increase in the value of an asset is considered as unrealized gain

and Woolworth unrealized gain is increasing from past three years that showed that company

estimated $59 million gain on its assets when they sell it.

For Wesfarmers movement in equity section from last 3 years:

It is analyzed from the balance sheet of Wesfarmers that company’s common stock has been

increased from past three years. Shareholders’ funds increase when company raise more funds

through equity shares raising fund through this source help the company to maintain debt free

position in the market and that lead to paying of less interest. The amount of equity in 2016 was

$21,937 million and in 2018 it was $22,227million that means company issues shares of $340

million. This is somehow not that bigger amount. The major movement happened in the part of

retained earnings of Wesfarmers it declined to $394 in 2018 from $1,724 in 2017 that was

approximately decline of $1,330 million. The reason behind this decline was company’s

subsidiaries declining profits and further the company paid dividend to their shareholders. That

indicate that company used major part of retain earnings to pay dividends to the shareholders in

2018. Furthermore, because of declining profits company was not able to maintain a level of

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate and Financial Accounting

7

retained earnings in 2018. Unrealized gains remain constant for three years that indicate that the

company doesn’t anticipate any gains on its holding assets in near future. Treasury stock showed

negative balance that reduced the worth of equity and for year 2016 and 2017 the amount of

other equity was also negative that also reduced the worth of the company equity.

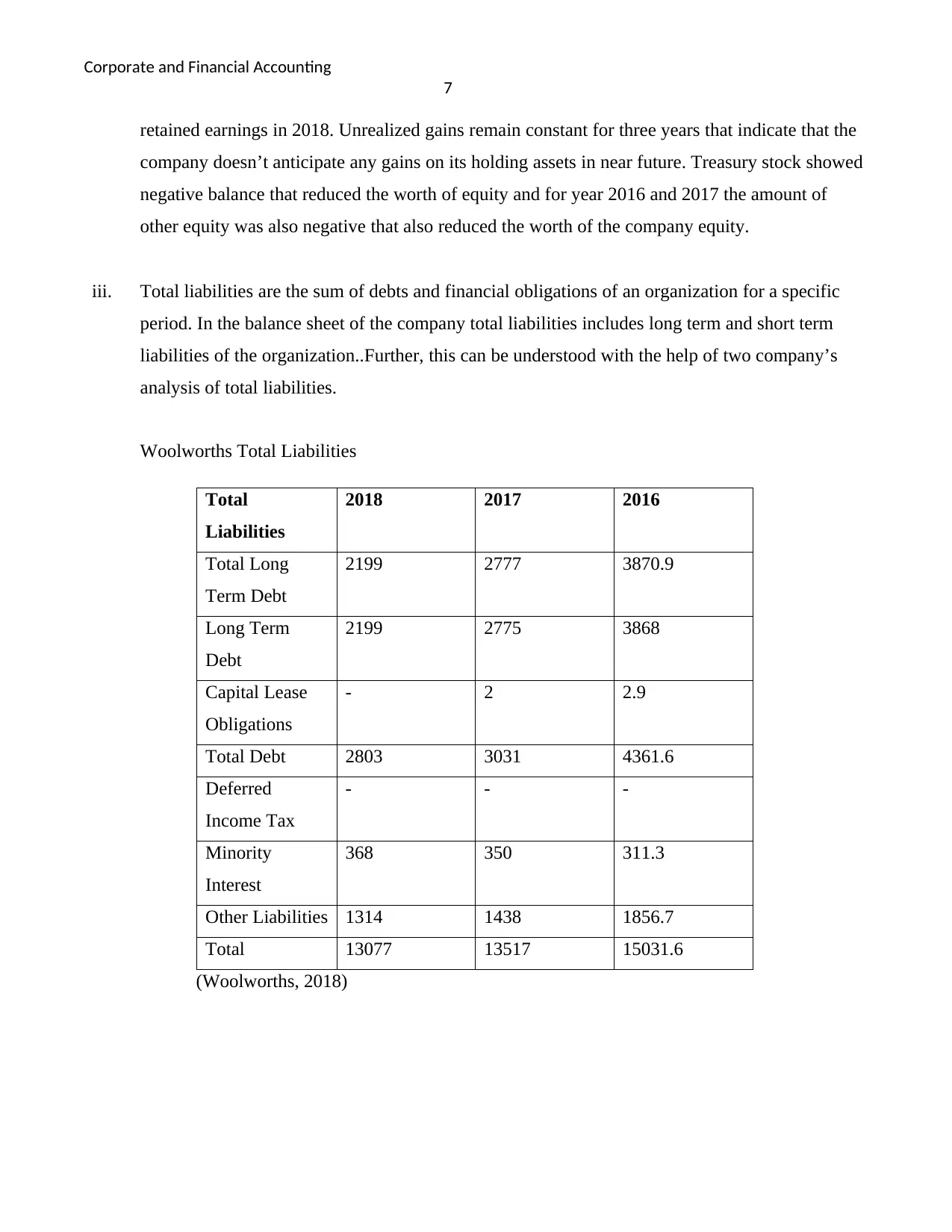

iii. Total liabilities are the sum of debts and financial obligations of an organization for a specific

period. In the balance sheet of the company total liabilities includes long term and short term

liabilities of the organization..Further, this can be understood with the help of two company’s

analysis of total liabilities.

Woolworths Total Liabilities

Total

Liabilities

2018 2017 2016

Total Long

Term Debt

2199 2777 3870.9

Long Term

Debt

2199 2775 3868

Capital Lease

Obligations

- 2 2.9

Total Debt 2803 3031 4361.6

Deferred

Income Tax

- - -

Minority

Interest

368 350 311.3

Other Liabilities 1314 1438 1856.7

Total 13077 13517 15031.6

(Woolworths, 2018)

7

retained earnings in 2018. Unrealized gains remain constant for three years that indicate that the

company doesn’t anticipate any gains on its holding assets in near future. Treasury stock showed

negative balance that reduced the worth of equity and for year 2016 and 2017 the amount of

other equity was also negative that also reduced the worth of the company equity.

iii. Total liabilities are the sum of debts and financial obligations of an organization for a specific

period. In the balance sheet of the company total liabilities includes long term and short term

liabilities of the organization..Further, this can be understood with the help of two company’s

analysis of total liabilities.

Woolworths Total Liabilities

Total

Liabilities

2018 2017 2016

Total Long

Term Debt

2199 2777 3870.9

Long Term

Debt

2199 2775 3868

Capital Lease

Obligations

- 2 2.9

Total Debt 2803 3031 4361.6

Deferred

Income Tax

- - -

Minority

Interest

368 350 311.3

Other Liabilities 1314 1438 1856.7

Total 13077 13517 15031.6

(Woolworths, 2018)

Corporate and Financial Accounting

8

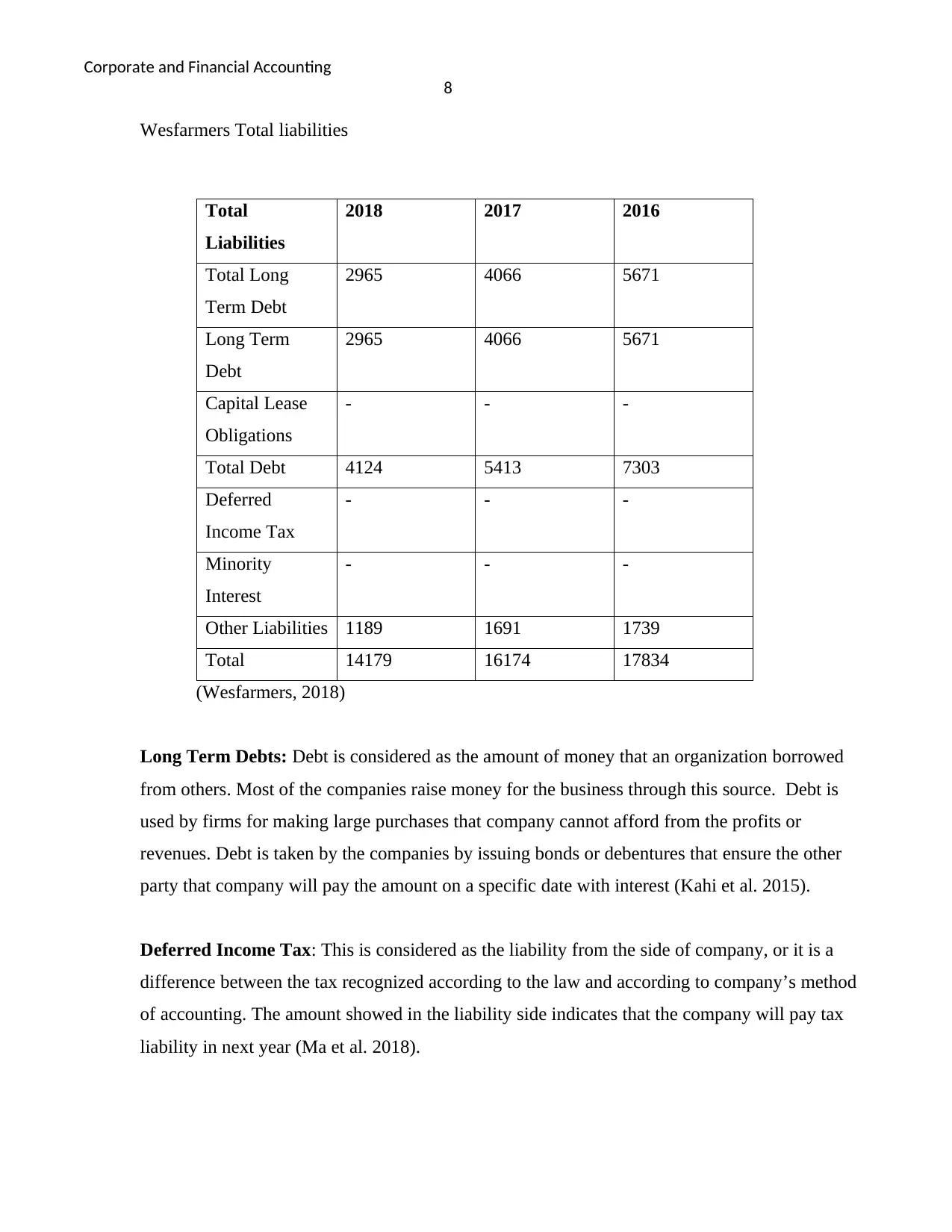

Wesfarmers Total liabilities

Total

Liabilities

2018 2017 2016

Total Long

Term Debt

2965 4066 5671

Long Term

Debt

2965 4066 5671

Capital Lease

Obligations

- - -

Total Debt 4124 5413 7303

Deferred

Income Tax

- - -

Minority

Interest

- - -

Other Liabilities 1189 1691 1739

Total 14179 16174 17834

(Wesfarmers, 2018)

Long Term Debts: Debt is considered as the amount of money that an organization borrowed

from others. Most of the companies raise money for the business through this source. Debt is

used by firms for making large purchases that company cannot afford from the profits or

revenues. Debt is taken by the companies by issuing bonds or debentures that ensure the other

party that company will pay the amount on a specific date with interest (Kahi et al. 2015).

Deferred Income Tax: This is considered as the liability from the side of company, or it is a

difference between the tax recognized according to the law and according to company’s method

of accounting. The amount showed in the liability side indicates that the company will pay tax

liability in next year (Ma et al. 2018).

8

Wesfarmers Total liabilities

Total

Liabilities

2018 2017 2016

Total Long

Term Debt

2965 4066 5671

Long Term

Debt

2965 4066 5671

Capital Lease

Obligations

- - -

Total Debt 4124 5413 7303

Deferred

Income Tax

- - -

Minority

Interest

- - -

Other Liabilities 1189 1691 1739

Total 14179 16174 17834

(Wesfarmers, 2018)

Long Term Debts: Debt is considered as the amount of money that an organization borrowed

from others. Most of the companies raise money for the business through this source. Debt is

used by firms for making large purchases that company cannot afford from the profits or

revenues. Debt is taken by the companies by issuing bonds or debentures that ensure the other

party that company will pay the amount on a specific date with interest (Kahi et al. 2015).

Deferred Income Tax: This is considered as the liability from the side of company, or it is a

difference between the tax recognized according to the law and according to company’s method

of accounting. The amount showed in the liability side indicates that the company will pay tax

liability in next year (Ma et al. 2018).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate and Financial Accounting

9

Minority Interest: The minor interest is the ownership of others in the business except the

parent company. It is sort of an investor who invested in the company in less than 50% stake.

This is also considered as the liability of an organization as it is the proportion of the subsidiary.

Other Liabilities: This amount is smaller that cannot be included in a separate account, for all

the miscellaneous activities the amount is posted in the other liability part. Some items are debts,

sales tax payable etc.

iv. Movements in the liability section

For Woolworth’s movement in liability section from last 3 years:

From the analysis of the company total liabilities it is analyzed that total debt portion has been

declined from last three years that indicate that company reduced its borrowing and paid its

borrowers during these three years. In 2016, total debt of the company was $4,361 million but in

2018 it was $2,803 million. The reason behind this decline was that company wanted to reduce

its portion of debt from the balance sheet and because of it company paid $1,558 million in two

years to its debtors. Further, the reason behind this can be that the company wanted to reduce its

interest expenses due to that Woolworths paid huge amount to clear its debt. Further, minority

interest amount has increased and other liabilities decreased. Overall the movement in liabilities

was that Woolworths paid its liabilities and total liabilities of company decreased by $1,954

million in three years.

For Wesfarmers movement in liability section from last 3 years:

Wesfarmers total liabilities declined year by year in 2016, total liabilities recorded $17,834

million and in 2017, liabilities declined to $16,174 million. In a year company paid its $1,660

million debts that was a good indicator as portion of debt in the company should be lesser than

the equity this will help the company to strengthen its liquidity position as well as to reduce its

interest expenses. In 2018, further total liabilities decline as recorded at $14,179 million and that

indicate that company paid $1,995 million in this tenure. Wesfarmers total liabilities declined by

$3,355 million that indicate that company is in good financial position in these three years as

Wesfarmers paid huge amount to its debtors.

9

Minority Interest: The minor interest is the ownership of others in the business except the

parent company. It is sort of an investor who invested in the company in less than 50% stake.

This is also considered as the liability of an organization as it is the proportion of the subsidiary.

Other Liabilities: This amount is smaller that cannot be included in a separate account, for all

the miscellaneous activities the amount is posted in the other liability part. Some items are debts,

sales tax payable etc.

iv. Movements in the liability section

For Woolworth’s movement in liability section from last 3 years:

From the analysis of the company total liabilities it is analyzed that total debt portion has been

declined from last three years that indicate that company reduced its borrowing and paid its

borrowers during these three years. In 2016, total debt of the company was $4,361 million but in

2018 it was $2,803 million. The reason behind this decline was that company wanted to reduce

its portion of debt from the balance sheet and because of it company paid $1,558 million in two

years to its debtors. Further, the reason behind this can be that the company wanted to reduce its

interest expenses due to that Woolworths paid huge amount to clear its debt. Further, minority

interest amount has increased and other liabilities decreased. Overall the movement in liabilities

was that Woolworths paid its liabilities and total liabilities of company decreased by $1,954

million in three years.

For Wesfarmers movement in liability section from last 3 years:

Wesfarmers total liabilities declined year by year in 2016, total liabilities recorded $17,834

million and in 2017, liabilities declined to $16,174 million. In a year company paid its $1,660

million debts that was a good indicator as portion of debt in the company should be lesser than

the equity this will help the company to strengthen its liquidity position as well as to reduce its

interest expenses. In 2018, further total liabilities decline as recorded at $14,179 million and that

indicate that company paid $1,995 million in this tenure. Wesfarmers total liabilities declined by

$3,355 million that indicate that company is in good financial position in these three years as

Wesfarmers paid huge amount to its debtors.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate and Financial Accounting

10

v. Advantages and Disadvantages of different sources of fund

Sources of funds for an organization are debt, equity and retained earnings. It is important for the

companies to choose mixed proportion of the funds. In the above companies main source of funds are

equity that is owners funds and debt that is borrowed funds. Debts and equity are long term source of

raising fund (Kieschnick and Moussawi, 2018). Advantages of raising fund through equity are that the

company don’t have to pay them the interest on regular basis and this is the less riskier way of raising

fund, the dividend is paid on the equity shares only when company is earning profits whereas debts are

the riskier way of raising funds as the company has to pay interest to the debtors on the principle amount

even when there is losses in the year. On other side fund raising through debts give tax advantage to the

company. Further, the proportion of borrower fund in the company should always be less than the equity

this shows the strong position of the company in the market. In both the companies that are discussed

above the proportion of owners fund is more than the borrowed fund. In a nutshell, which source of fund

is best suitable depend on the company situation and position but an ideal proportion of equity and debt

is 2:1(Huang et al. 2016).

Part B

A proprietary company is classified into large and small. A large proprietary company should complete

these criteria that are

First and foremost criteria are that the consolidated revenue of the entities will be more than $50

million for a financial year.

The value of its gross assets of the company at the year-end should be $25 million or more than

that.

The company should have more than 100 employees including all entities at the end of financial

year.

If any entity or company is not able to meet two of the criteria mentioned above than it is considered as

the small proprietary company. As per the ASIC guidelines, small proprietary company has to present

financial report at the end of financial year. Further, another type is reporting entity and this is an entity

where users such as shareholders, employees, members, creditors and investors are dependent on the

10

v. Advantages and Disadvantages of different sources of fund

Sources of funds for an organization are debt, equity and retained earnings. It is important for the

companies to choose mixed proportion of the funds. In the above companies main source of funds are

equity that is owners funds and debt that is borrowed funds. Debts and equity are long term source of

raising fund (Kieschnick and Moussawi, 2018). Advantages of raising fund through equity are that the

company don’t have to pay them the interest on regular basis and this is the less riskier way of raising

fund, the dividend is paid on the equity shares only when company is earning profits whereas debts are

the riskier way of raising funds as the company has to pay interest to the debtors on the principle amount

even when there is losses in the year. On other side fund raising through debts give tax advantage to the

company. Further, the proportion of borrower fund in the company should always be less than the equity

this shows the strong position of the company in the market. In both the companies that are discussed

above the proportion of owners fund is more than the borrowed fund. In a nutshell, which source of fund

is best suitable depend on the company situation and position but an ideal proportion of equity and debt

is 2:1(Huang et al. 2016).

Part B

A proprietary company is classified into large and small. A large proprietary company should complete

these criteria that are

First and foremost criteria are that the consolidated revenue of the entities will be more than $50

million for a financial year.

The value of its gross assets of the company at the year-end should be $25 million or more than

that.

The company should have more than 100 employees including all entities at the end of financial

year.

If any entity or company is not able to meet two of the criteria mentioned above than it is considered as

the small proprietary company. As per the ASIC guidelines, small proprietary company has to present

financial report at the end of financial year. Further, another type is reporting entity and this is an entity

where users such as shareholders, employees, members, creditors and investors are dependent on the

Corporate and Financial Accounting

11

GPFR (General Purpose Financial Report). When an entity is considered as reporting entity they have to

prepare the financial report by applying the entire Australian Accounting standard.

Reporting requirement of large and small companies are that, the small proprietary company not

required to prepare financial statement with ASIC unless and until the company have foreign control,

and shareholder direction or request to prepare financial report. A significant global entity is required to

lodge and prepare a GPFR with ASIC. The large proprietary company lodge and prepare financial

statement unless they are member of closed group or wholly owned subsidiary. Reporting entity

compliance according to GPFR and compliance with all applicable AASB standards and non-entity give

special purpose financial report compliance with the applicable recognition and measurement

requirements in AASB standards (Buck, 2019).

Conclusion

Sources of fund raising for a company can be owner’s funds that is equity and borrower fund that is

debt. Equity and debt are two main sources by which a company raise fund for long term. Debt is

considered as the riskier and most expensive way of raising funds as liability of the company increases.

On other side, equity is the most preferred way by the companies to raise funds for their expansion

whenever required for a long term as the risk of the company becomes less in this source and company

is only liable to pay at the time of winding up. Both of these funds are used in the above mentioned

companies and this is analyzed from the Woolworths and Wesfarmers owners’ equity section and total

liabilities section.

11

GPFR (General Purpose Financial Report). When an entity is considered as reporting entity they have to

prepare the financial report by applying the entire Australian Accounting standard.

Reporting requirement of large and small companies are that, the small proprietary company not

required to prepare financial statement with ASIC unless and until the company have foreign control,

and shareholder direction or request to prepare financial report. A significant global entity is required to

lodge and prepare a GPFR with ASIC. The large proprietary company lodge and prepare financial

statement unless they are member of closed group or wholly owned subsidiary. Reporting entity

compliance according to GPFR and compliance with all applicable AASB standards and non-entity give

special purpose financial report compliance with the applicable recognition and measurement

requirements in AASB standards (Buck, 2019).

Conclusion

Sources of fund raising for a company can be owner’s funds that is equity and borrower fund that is

debt. Equity and debt are two main sources by which a company raise fund for long term. Debt is

considered as the riskier and most expensive way of raising funds as liability of the company increases.

On other side, equity is the most preferred way by the companies to raise funds for their expansion

whenever required for a long term as the risk of the company becomes less in this source and company

is only liable to pay at the time of winding up. Both of these funds are used in the above mentioned

companies and this is analyzed from the Woolworths and Wesfarmers owners’ equity section and total

liabilities section.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.