Comprehensive Corporate Finance Analysis of Dechra Pharmaceuticals

VerifiedAdded on 2023/01/18

Paraphrase This Document

INTRODUCTION...........................................................................................................................3

TASK 1............................................................................................................................................3

Current Market Capitalisation of Dechra Pharmaceuticals:........................................................3

Book Value of Shareholders' fund of Dechra-Pharmaceuticals:.................................................3

Discussion on Market Value and Book Value Difference:..........................................................3

Main Shareholders of Dechra-Pharmaceuticals:..........................................................................4

Total Borrowings:........................................................................................................................5

Debt to Equity Ratio:...................................................................................................................5

Quoted Beta:................................................................................................................................6

Competitor Information:..............................................................................................................6

Recent Financial News:...............................................................................................................7

TASK 2............................................................................................................................................8

Dividend Policy:..........................................................................................................................8

Theories of Modigliani & Miller:..............................................................................................10

Practical Issues in company:......................................................................................................10

TASK 3..........................................................................................................................................11

WACC:......................................................................................................................................11

TASK 4............................................................................................................................................1

Part a) Estimation of share’s value of Dechra Pharmaceutical through SVA model..................1

Part b) Rationale for adjustment made to the particular data.......................................................3

TASK 5............................................................................................................................................5

Recent merger and acquisition by Dechra Pharmaceutical..........................................................5

Potential sources of synergy among parents and acquired company...........................................7

Premium paid for the target company..........................................................................................8

CONCLUSION................................................................................................................................8

REFERENCES................................................................................................................................9

Corporate finance relates to finance area which interacts with funding's sources, financial

capital-structure, the measures executives take to maximize the company's value to investors, as

well as methods and evaluation used to distribute financial resources. This study comprises

complete analysis of Dechra Pharmaceuticals along with theories like Modigliani & Miller,

CAPM, SVA etc. with aim to assess the overall financial performance of company. Study also

focuses on evaluation of company's dividend policy and pattern and comprehensive analysi of

company's capital structure.

Dechra Pharmaceuticals plc is UK based manufacturing corporation which has head

office in Northwich. Company is engaged in production of veterinary products. Company is

listed on London-Stock-Exchange and has significant place in FTSE 250 Index (About Us:

Dechra Pharmaceuticals PLC, 2019).

TASK 1

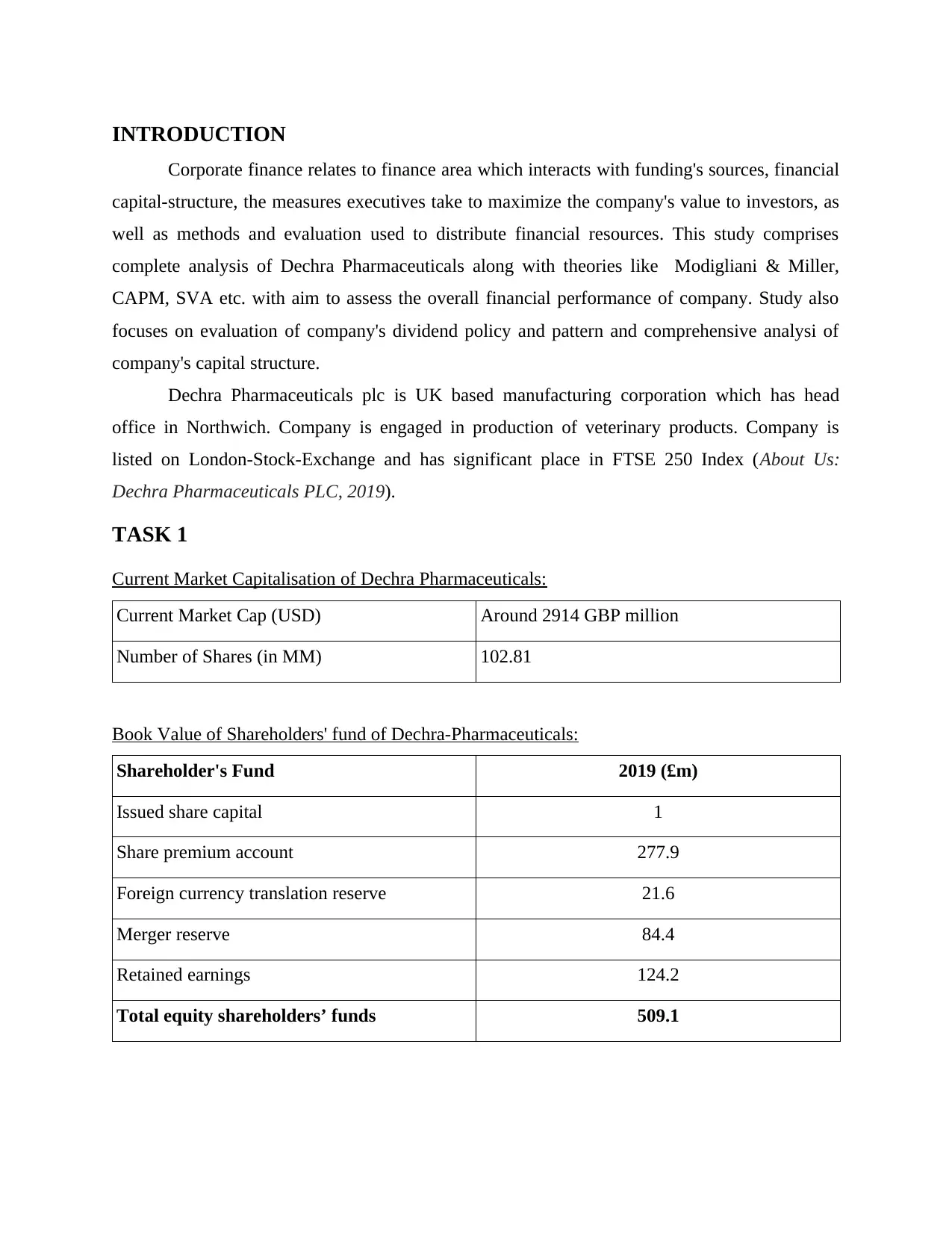

Current Market Capitalisation of Dechra Pharmaceuticals:

Current Market Cap (USD) Around 2914 GBP million

Number of Shares (in MM) 102.81

Book Value of Shareholders' fund of Dechra-Pharmaceuticals:

Shareholder's Fund 2019 (£m)

Issued share capital 1

Share premium account 277.9

Foreign currency translation reserve 21.6

Merger reserve 84.4

Retained earnings 124.2

Total equity shareholders’ funds 509.1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Book value is simple difference among total assets and external liabilities. While market

value of company is assessed by multiplying market-price of each share with aggregate number

of outstanding shares. As in case of Dechra Pharmaceuticals, book value of shareholders' fund is

498.7 which is difference between company's aggregate assets and external-liabilities while

Market value is 2914 GBP million with 102.81 million outstanding share (Annual Report of

Dechra Pharmaceuticals PLC, 2019).

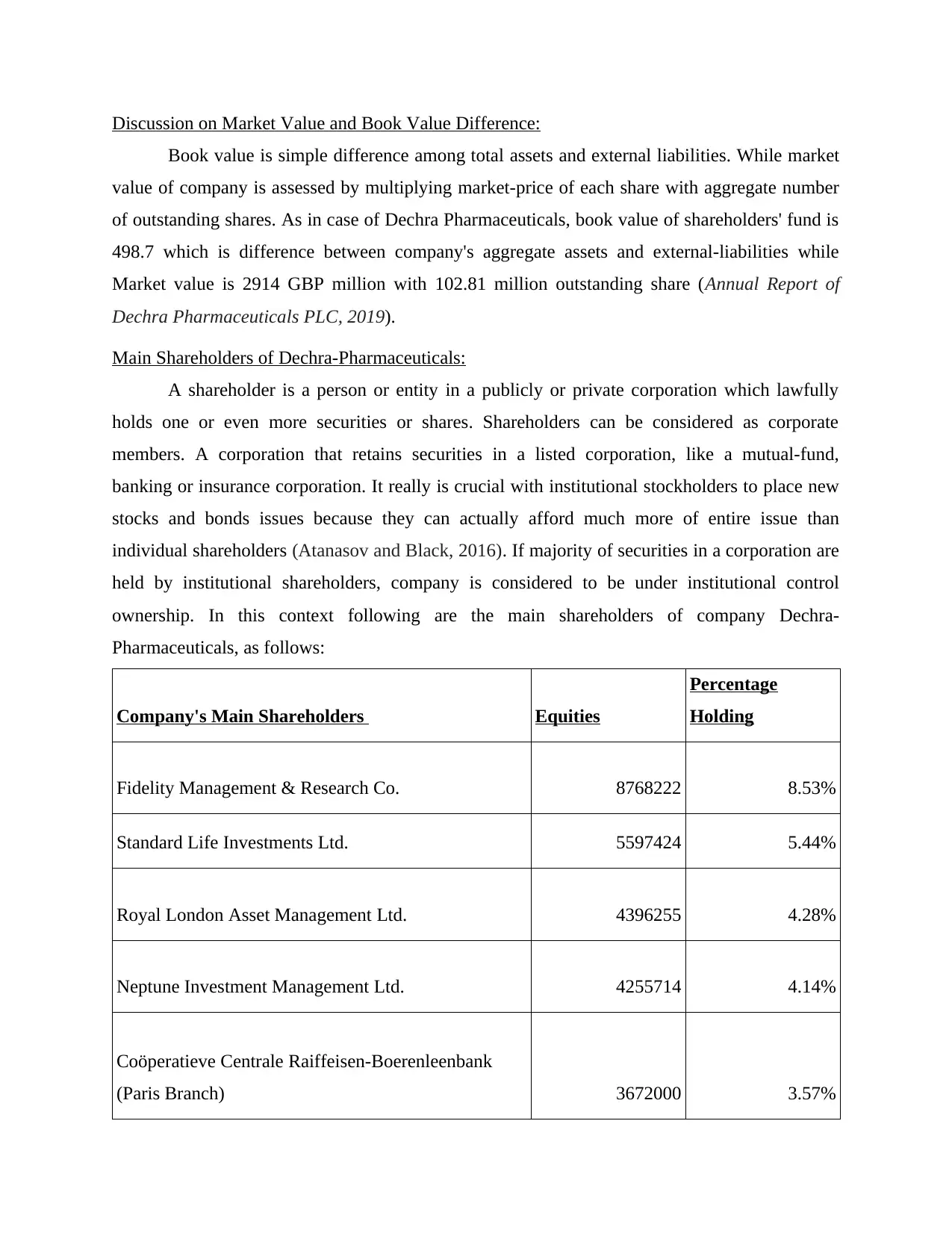

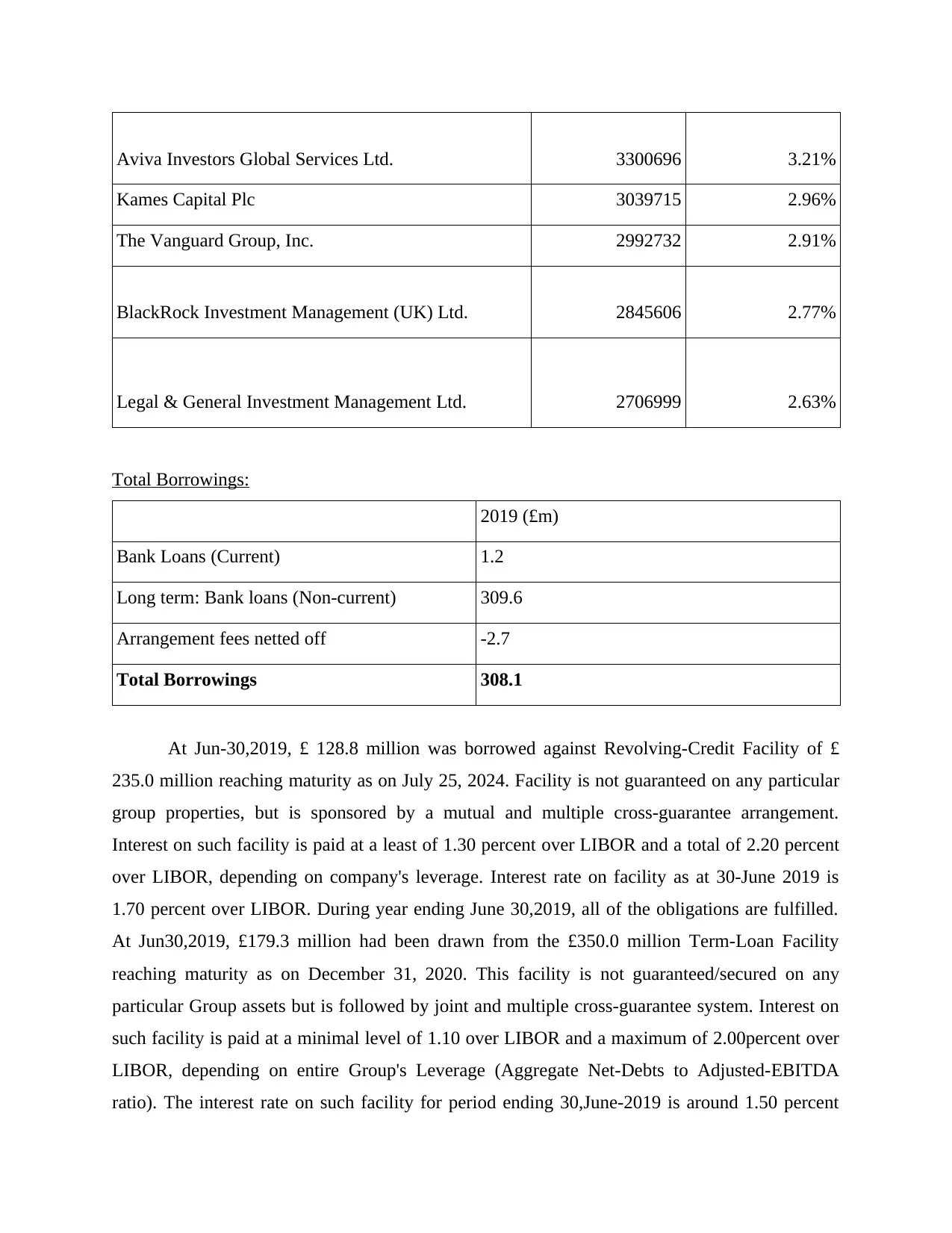

Main Shareholders of Dechra-Pharmaceuticals:

A shareholder is a person or entity in a publicly or private corporation which lawfully

holds one or even more securities or shares. Shareholders can be considered as corporate

members. A corporation that retains securities in a listed corporation, like a mutual-fund,

banking or insurance corporation. It really is crucial with institutional stockholders to place new

stocks and bonds issues because they can actually afford much more of entire issue than

individual shareholders (Atanasov and Black, 2016). If majority of securities in a corporation are

held by institutional shareholders, company is considered to be under institutional control

ownership. In this context following are the main shareholders of company Dechra-

Pharmaceuticals, as follows:

Company's Main Shareholders Equities

Percentage

Holding

Fidelity Management & Research Co. 8768222 8.53%

Standard Life Investments Ltd. 5597424 5.44%

Royal London Asset Management Ltd. 4396255 4.28%

Neptune Investment Management Ltd. 4255714 4.14%

Coöperatieve Centrale Raiffeisen-Boerenleenbank

(Paris Branch) 3672000 3.57%

Paraphrase This Document

Kames Capital Plc 3039715 2.96%

The Vanguard Group, Inc. 2992732 2.91%

BlackRock Investment Management (UK) Ltd. 2845606 2.77%

Legal & General Investment Management Ltd. 2706999 2.63%

Total Borrowings:

2019 (£m)

Bank Loans (Current) 1.2

Long term: Bank loans (Non-current) 309.6

Arrangement fees netted off -2.7

Total Borrowings 308.1

At Jun-30,2019, £ 128.8 million was borrowed against Revolving-Credit Facility of £

235.0 million reaching maturity as on July 25, 2024. Facility is not guaranteed on any particular

group properties, but is sponsored by a mutual and multiple cross-guarantee arrangement.

Interest on such facility is paid at a least of 1.30 percent over LIBOR and a total of 2.20 percent

over LIBOR, depending on company's leverage. Interest rate on facility as at 30-June 2019 is

1.70 percent over LIBOR. During year ending June 30,2019, all of the obligations are fulfilled.

At Jun30,2019, £179.3 million had been drawn from the £350.0 million Term-Loan Facility

reaching maturity as on December 31, 2020. This facility is not guaranteed/secured on any

particular Group assets but is followed by joint and multiple cross-guarantee system. Interest on

such facility is paid at a minimal level of 1.10 over LIBOR and a maximum of 2.00percent over

LIBOR, depending on entire Group's Leverage (Aggregate Net-Debts to Adjusted-EBITDA

ratio). The interest rate on such facility for period ending 30,June-2019 is around 1.50 percent

Facility's maturity period will end on 31st Dec.-2020.

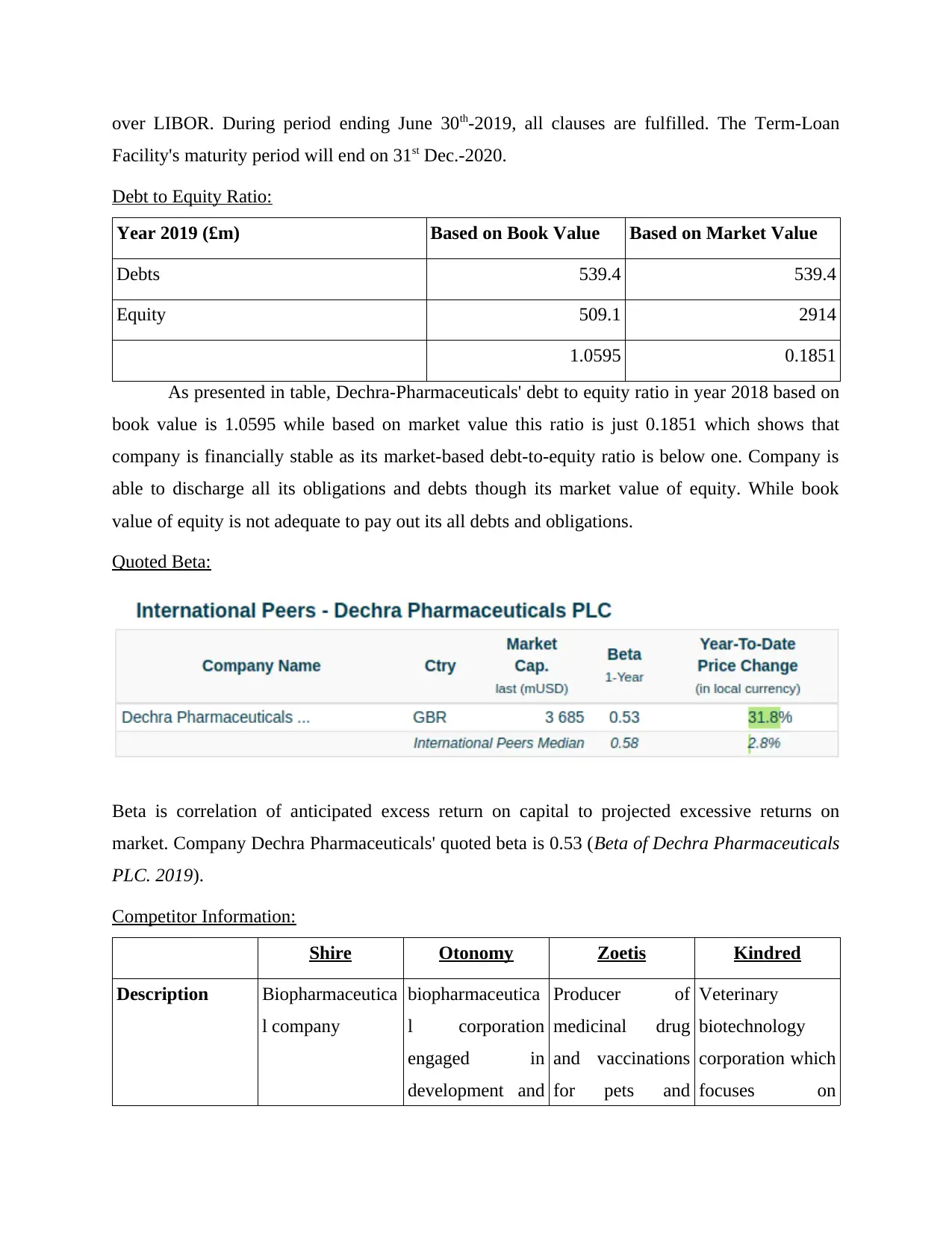

Debt to Equity Ratio:

Year 2019 (£m) Based on Book Value Based on Market Value

Debts 539.4 539.4

Equity 509.1 2914

1.0595 0.1851

As presented in table, Dechra-Pharmaceuticals' debt to equity ratio in year 2018 based on

book value is 1.0595 while based on market value this ratio is just 0.1851 which shows that

company is financially stable as its market-based debt-to-equity ratio is below one. Company is

able to discharge all its obligations and debts though its market value of equity. While book

value of equity is not adequate to pay out its all debts and obligations.

Quoted Beta:

Beta is correlation of anticipated excess return on capital to projected excessive returns on

market. Company Dechra Pharmaceuticals' quoted beta is 0.53 (Beta of Dechra Pharmaceuticals

PLC. 2019).

Competitor Information:

Shire Otonomy Zoetis Kindred

Description Biopharmaceutica

l company

biopharmaceutica

l corporation

engaged in

development and

Producer of

medicinal drug

and vaccinations

for pets and

Veterinary

biotechnology

corporation which

focuses on

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

treatments of

diseases of:

Middle/inner ear.

livestock. development of

therapies for pets

specially dogs,

cats and horses.

Since Year 1986 Year 2008 Year 1952 Year 2013

No. of

Employees

(Approx)

23044 49 10000 146

Valuation ($ in

million)

54.8 73.6 52.8 310.5

Turnover

(During Year

2018)

£43m $745k $5.8b $2m

Net Profit

(During Year

2018)

£3.4m ($50.4m) $1.4b ($49.7m)

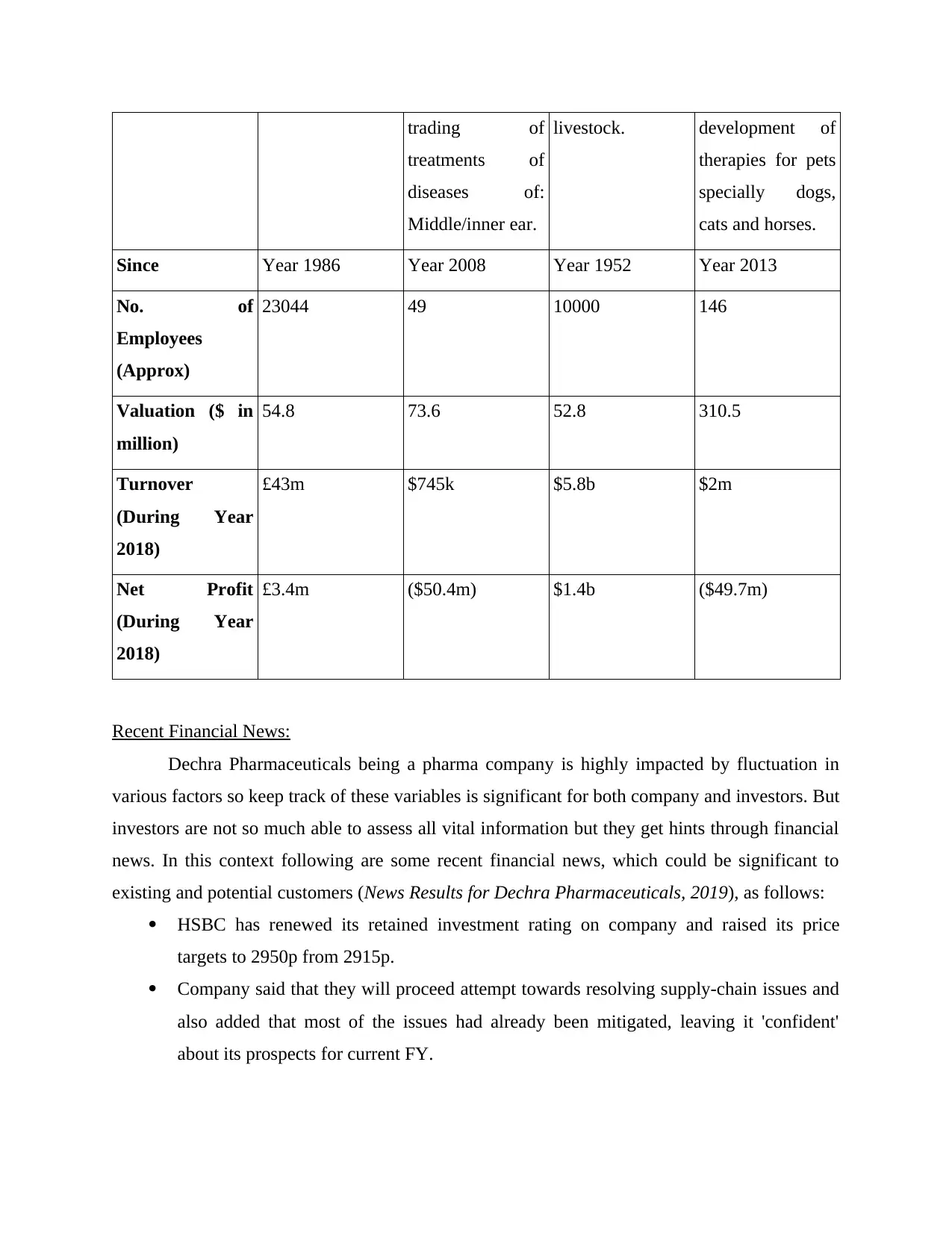

Recent Financial News:

Dechra Pharmaceuticals being a pharma company is highly impacted by fluctuation in

various factors so keep track of these variables is significant for both company and investors. But

investors are not so much able to assess all vital information but they get hints through financial

news. In this context following are some recent financial news, which could be significant to

existing and potential customers (News Results for Dechra Pharmaceuticals, 2019), as follows:

HSBC has renewed its retained investment rating on company and raised its price

targets to 2950p from 2915p.

Company said that they will proceed attempt towards resolving supply-chain issues and

also added that most of the issues had already been mitigated, leaving it 'confident'

about its prospects for current FY.

Paraphrase This Document

73,260shares at price of 0.00p and holding reached to 659,910 shares. And on 20th

September 2019, he has sold post-exercise 34,536shares at price of around 2789.37p.

Dechra Pharmaceutical announced a small decrease in earnings, even though the

animal-drug manufacturer outperformed in markets, including United States, where

organic-growth was extraordinary.

TASK 2

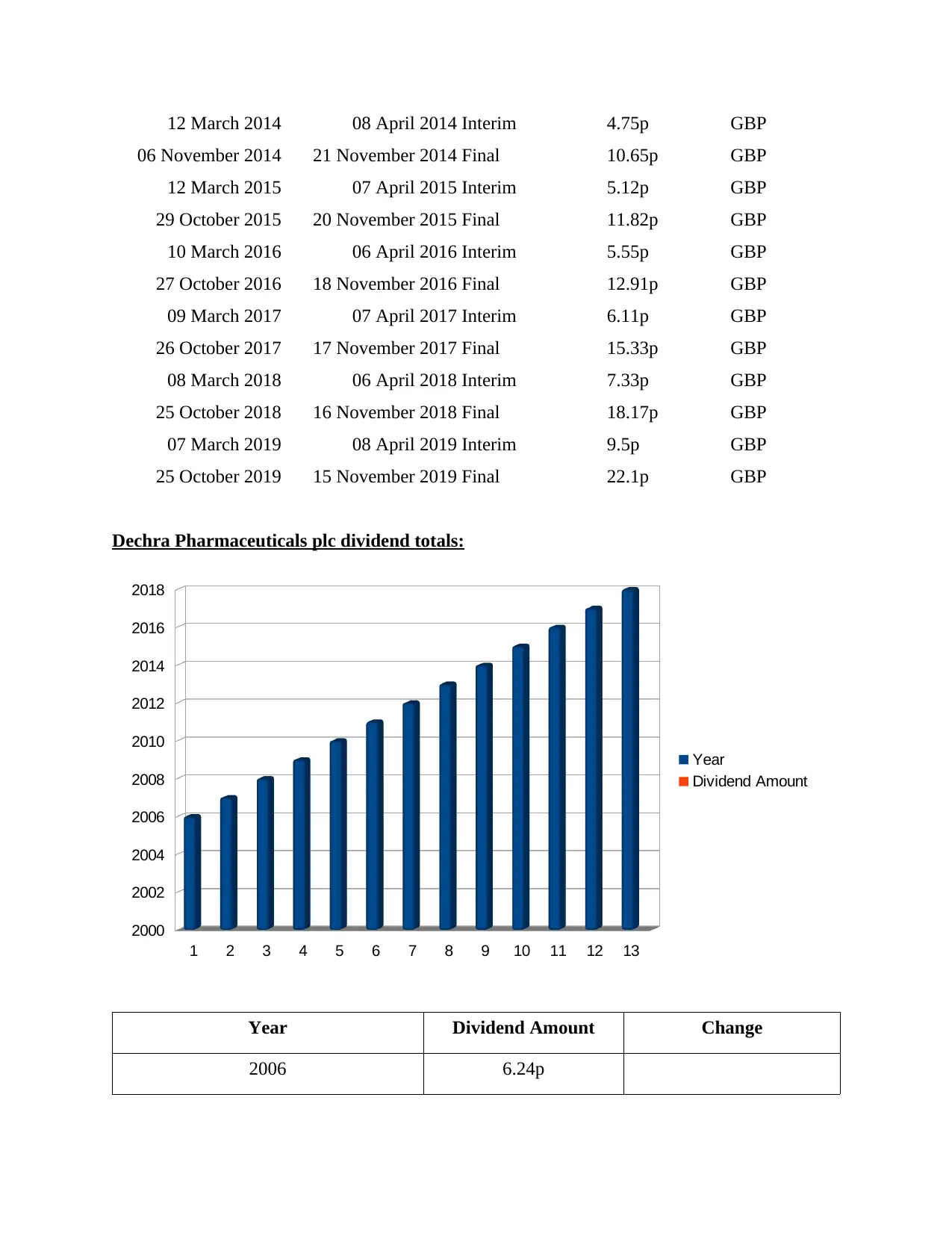

Dividend Policy:

Dechra Pharmaceuticals' dividend history is fair because company is regularly paying

dividend on its shares. As shows in above table company has recently paid GBP 22.1 p dividend

as on 15 November 2019 which was declared by company on 25th October 2019. Company has

not made any default in payment of dividend and almost every year company's directors pays

interim dividend. Generally dividend payment pattern of company shows that it pays interim

dividend in April month while final dividend is paid regularly paid by company in

November/December month. It also a strength of company which attracts stakeholders and

investors to make investment in company's securities (Bancel and Mittoo, 2014). Here following

table contains dividend payment history of company from year 2010 to 2019, as follows:

Past Dechra Pharmaceuticals plc dividends

Ex-Div Date Pay Date Type

Amount per

share Currency

03 March 2010 01 April 2010 Interim 3.3p GBP

10 November 2010 10 December 2010 Final 7.2p GBP

09 March 2011 07 April 2011 Interim 3.7p GBP

09 November 2011 25 November 2011 Final 8.4p GBP

07 March 2012 10 April 2012 Interim 4.1p GBP

07 November 2012 23 November 2012 Final 8.5p GBP

13 March 2013 09 April 2013 Interim 4.34p GBP

06 November 2013 22 November 2013 Final 9.66p GBP

06 November 2014 21 November 2014 Final 10.65p GBP

12 March 2015 07 April 2015 Interim 5.12p GBP

29 October 2015 20 November 2015 Final 11.82p GBP

10 March 2016 06 April 2016 Interim 5.55p GBP

27 October 2016 18 November 2016 Final 12.91p GBP

09 March 2017 07 April 2017 Interim 6.11p GBP

26 October 2017 17 November 2017 Final 15.33p GBP

08 March 2018 06 April 2018 Interim 7.33p GBP

25 October 2018 16 November 2018 Final 18.17p GBP

07 March 2019 08 April 2019 Interim 9.5p GBP

25 October 2019 15 November 2019 Final 22.1p GBP

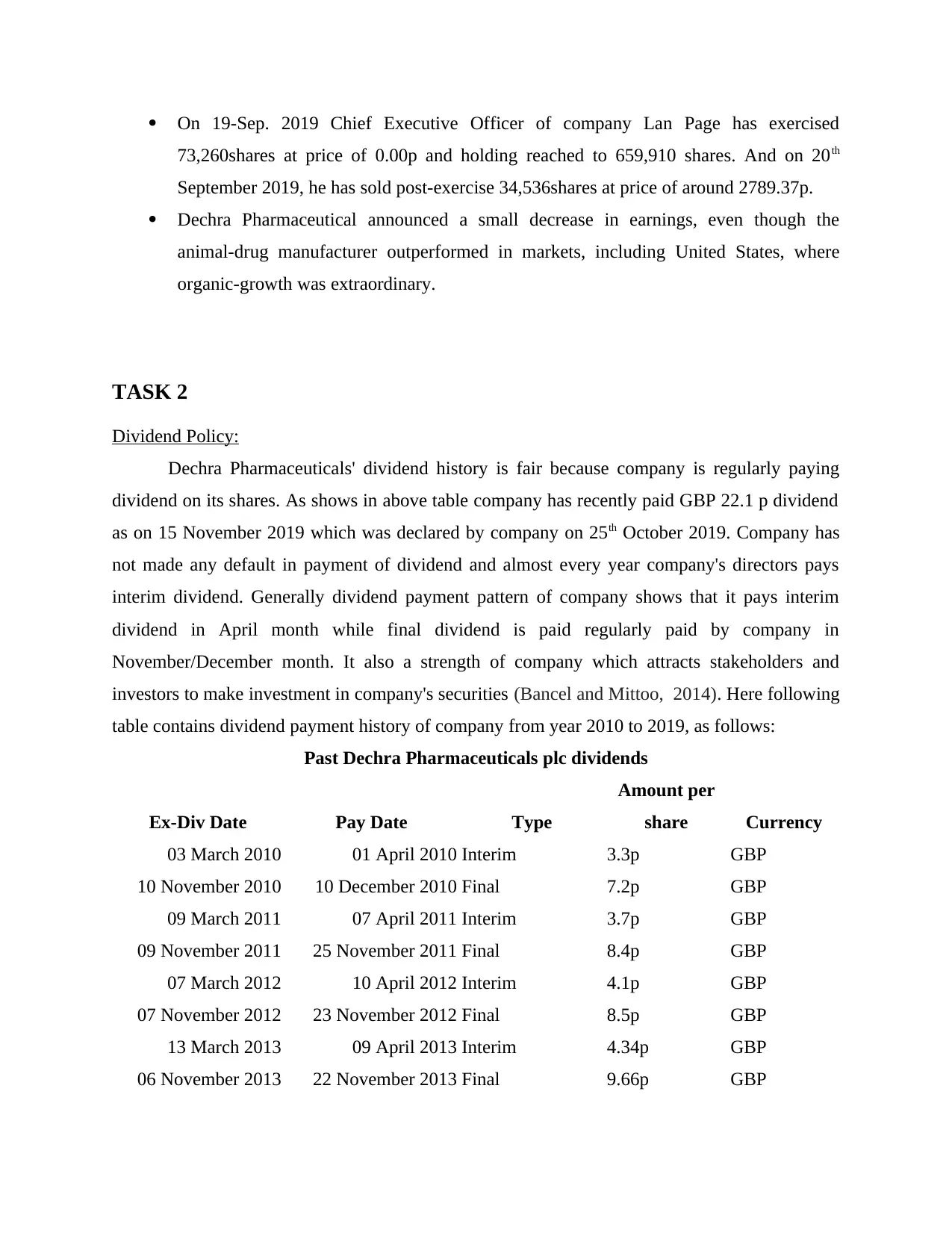

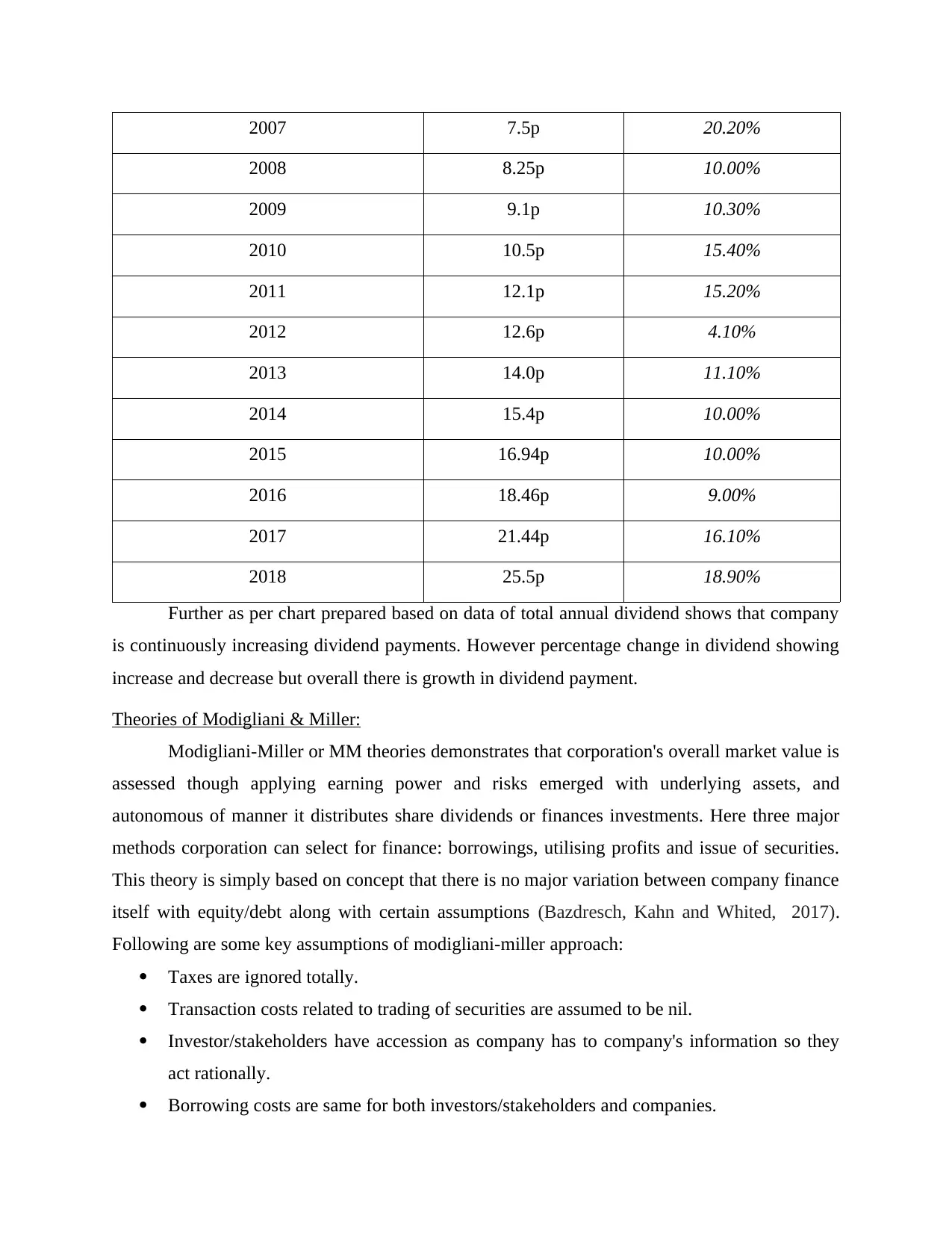

Dechra Pharmaceuticals plc dividend totals:

Year Dividend Amount Change

2006 6.24p

1 2 3 4 5 6 7 8 9 10 11 12 13

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

Year

Dividend Amount

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

2008 8.25p 10.00%

2009 9.1p 10.30%

2010 10.5p 15.40%

2011 12.1p 15.20%

2012 12.6p 4.10%

2013 14.0p 11.10%

2014 15.4p 10.00%

2015 16.94p 10.00%

2016 18.46p 9.00%

2017 21.44p 16.10%

2018 25.5p 18.90%

Further as per chart prepared based on data of total annual dividend shows that company

is continuously increasing dividend payments. However percentage change in dividend showing

increase and decrease but overall there is growth in dividend payment.

Theories of Modigliani & Miller:

Modigliani-Miller or MM theories demonstrates that corporation's overall market value is

assessed though applying earning power and risks emerged with underlying assets, and

autonomous of manner it distributes share dividends or finances investments. Here three major

methods corporation can select for finance: borrowings, utilising profits and issue of securities.

This theory is simply based on concept that there is no major variation between company finance

itself with equity/debt along with certain assumptions (Bazdresch, Kahn and Whited, 2017).

Following are some key assumptions of modigliani-miller approach:

Taxes are ignored totally.

Transaction costs related to trading of securities are assumed to be nil.

Investor/stakeholders have accession as company has to company's information so they

act rationally.

Borrowing costs are same for both investors/stakeholders and companies.

Paraphrase This Document

merchant bankers, promotional expenses etc.

Also here no corporate-dividend tax exists.

As in case of Dechra Pharmaceuticals this theory points that value of leveraged-company

has both debts and equities, is same if company is considered as unleveraged by considering only

equity when overall operating profits and future projection are matched. Company's capital

structure is proper and company is leveraged-firm which has both debt funds and equity funds

(Berg, Saunders and Steffen, 2016).

Practical Issues in company:

During September-2019 month after publishing full-year outcomes/results about

performance company indicated that it is struggling with supply-chain problems at several sites

or units and with contract-manufacturers. As company has wider range of distributors and

suppliers along with contractual manufacture, managing and tracking them is tuff task for

company. In several units company's inventories are lost, improper supply and excessive storage

which is directly affecting company's operating cost. Company is also faced problem of shortage

of supply which impacted company's sales in respective area.

TASK 3

WACC:

Weighted Average Cost-of-capital or WACC implies to assessment of corporation's cost

of capital whereby each class or form of capital is proportionally classified or weighted. Origin

of capital involves company's common stocks, preferred stocks, bond issued and other long-term

debts are generally used in WACC computation (Damodaran, 2016). With increment in WACC

percent, company's beta as well as return percentage on equity employed also increases since

increment in WACC leads to decline in company's valuation and increment in involved risk.

Following is key formula for deriving WACC, as follows:

WACC = VE x Re + VD x Rd x (1− t)

Here in in above formula:

Re (%) = Cost-of equity

Rd (%) = Cost-of debt

E indicates to Market-value of corporation's equity

V => E+D => Aggregate market-value of company's capital structure

E/V = % of financing through equity

D/V = % of financing though debt

t = Average Tax Rate

Cost of Debt: It simply regarded as rate or percentage a corporation pays against its overall

debts, like term loans, bonds. Crucial difference in cost-of-debt and cost-of-debt(after-tax) is

concept that interest-costs are tax-deductible. It is denoted by Rd and for computation of it

company's average interest rate is assessed first (Dang and Yang, 2018). Following is

computation of cost of debt of company Dechra Pharmaceuticals, as follows:

Interest expense (As of June,2019) = $ 13.3079847909 Million

While company's overall Book Value of Debt (D)= $ 388.797680204 Million

Cost of Debt = 13.3079847909/ 388.797680204

= 3.4229%.

Cost of Equity: It relates to return in percentage form a corporation requires to determine in case

investments meets targets of capital return. Corporation generally apply it as tool of capital

budgeting with respect to required/expected rate of return. Corporation's cost-of-equity shows

compensation market-demands with exchange for asset and ownership-risk. Generally CAPM

model is applied to assess the cost of equity (Dang and Shin, 2015). Following is formula for

deriving cost-of equity as follows:

Cost of Equity = Rf (Risk-Free Rate of Return) + Beta of Asset * (Expected Return of the

Market - Risk-Free Rate of Return)

In this context here is the computation of cost-of-equity of Dechra Pharmaceuticals, as follows:

Current risk-free rate = 0.63730000%

Beta = 0.53

Market Premium or (Expected Return of the Market - Risk-Free Rate of Return)= 6%

Cost of Equity = 0.63730000% + 0.53 * 6% = 3.8173%

Based on the outcomes of cost-of-debt and cost of equity following is computation of WACC of

Dechra Pharmaceuticals, as follows:

Weighted equity = E/(E +D) = 3686.796 / (3686.796 + 388.797680204) = 0.9046

Weighted debt = D /(E +D) = 388.797680204 / (3686.796} + 388.797680204) = 0.0954

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

So,

WACC = 0.9046 * 3.82% + 0.0954 * 3.4229% * (1 - 18.03%)

= 3.72%

Comment: Higher percentage of WACC, normally an indication of higher risk connected with

corporation's performance. Investors or stakeholders requires extra return to neutralise extra risk.

Here as per above computation company's WACC is around 3.72% which below the reported

ROIC % i.e. 6.94% of Dechra Pharmaceuticals. Which shows that company has no additional

risk since WACC is below the return on invested capital. The WACC of a corporation could be

considered to predict all its funding costs anticipated. This involves loan repayments (cost of

debt-financing) as well as the required rate-of-return generated by holding or equity financing.

Paraphrase This Document

Part a) Estimation of share’s value of Dechra Pharmaceutical through SVA model

The Shareholder Value Analysis is one of the key approach to management of financial

development in 1980 it extracts on the formation of the financial value for shareholders

calculated by share price performance and fund flows. This helps in understanding the

investment decisions and strategical approach identified to analyse the impact of value creation

for shareholders. It remains essential to calculate the shareholder value analysis in order to

understand the financial performance of entity (Dewally and Shao, 2014).

Shareholder value analysis of Dechra Pharmaceutical

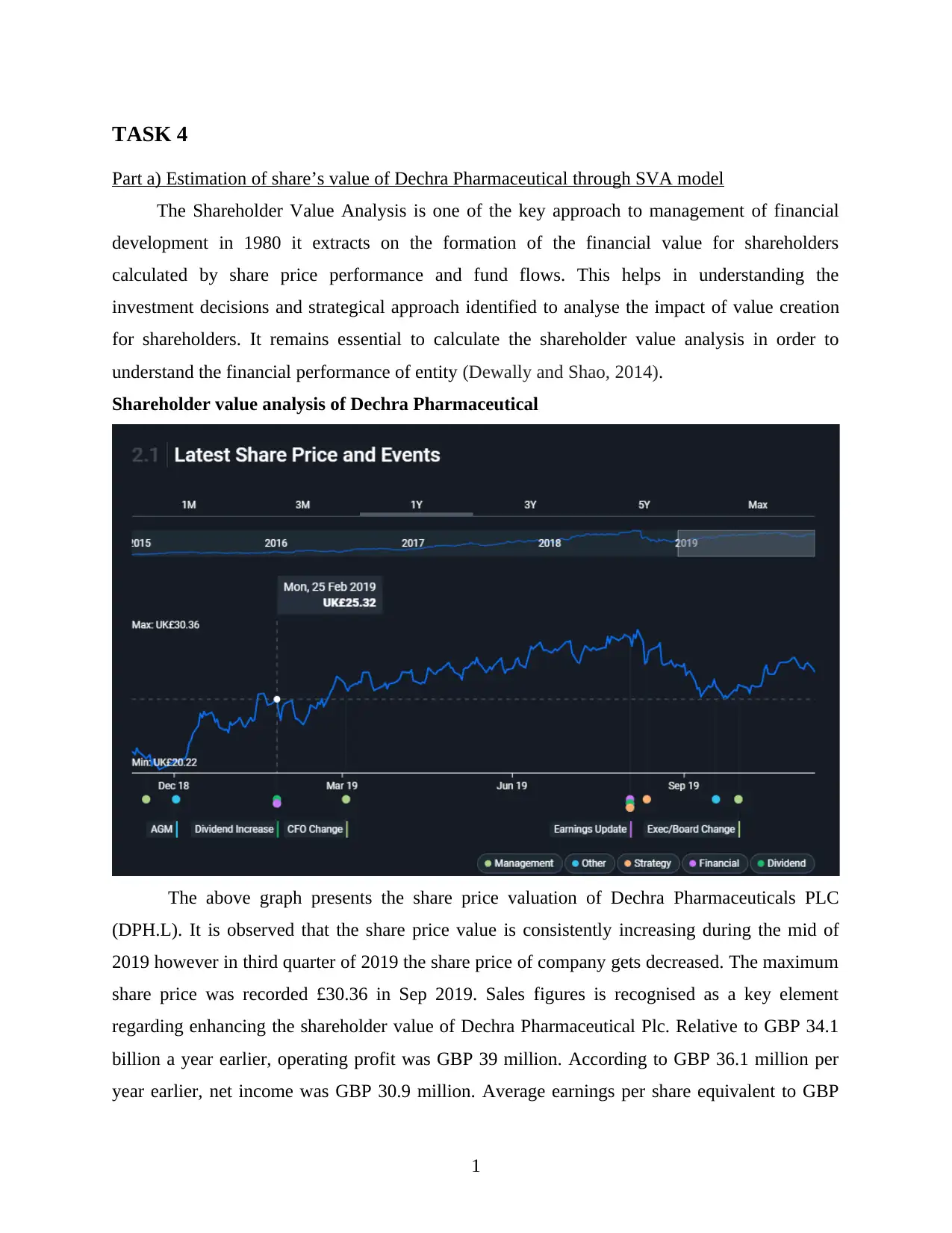

The above graph presents the share price valuation of Dechra Pharmaceuticals PLC

(DPH.L). It is observed that the share price value is consistently increasing during the mid of

2019 however in third quarter of 2019 the share price of company gets decreased. The maximum

share price was recorded £30.36 in Sep 2019. Sales figures is recognised as a key element

regarding enhancing the shareholder value of Dechra Pharmaceutical Plc. Relative to GBP 34.1

billion a year earlier, operating profit was GBP 39 million. According to GBP 36.1 million per

year earlier, net income was GBP 30.9 million. Average earnings per share equivalent to GBP

1

earnings per share were GBP 0.3007.

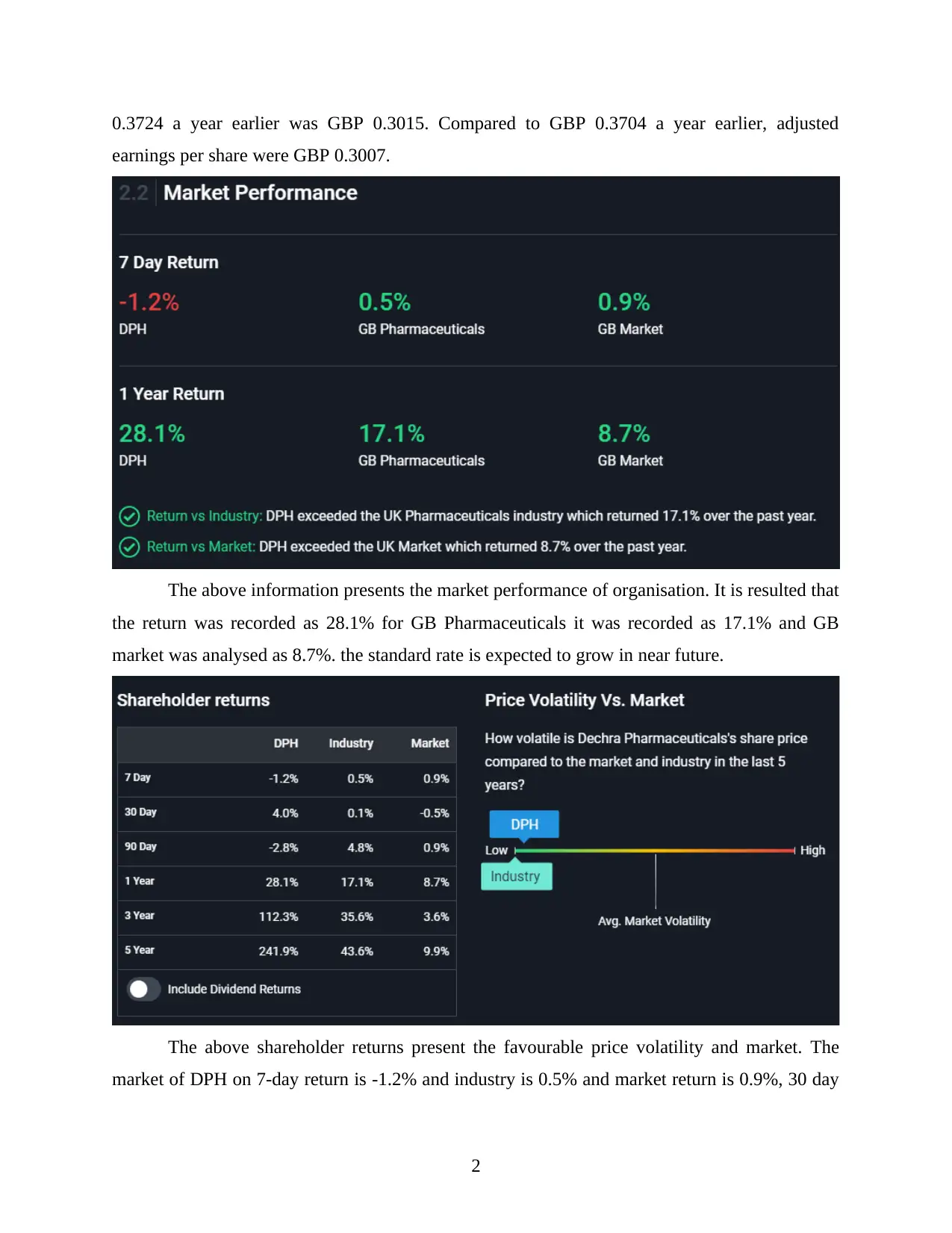

The above information presents the market performance of organisation. It is resulted that

the return was recorded as 28.1% for GB Pharmaceuticals it was recorded as 17.1% and GB

market was analysed as 8.7%. the standard rate is expected to grow in near future.

The above shareholder returns present the favourable price volatility and market. The

market of DPH on 7-day return is -1.2% and industry is 0.5% and market return is 0.9%, 30 day

2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Day 90 return presents the following results as -2.8% and 4.8% for industry and market return of

0.9%, the figures for the market return for one year presents 8.7%, for industry it states 17.1%

and DPH market return was recoded as 28.1%. the three-year return was recoded as 112.3% and

industry evaluation was made as 35.6% and market value recorded as 3.6%.

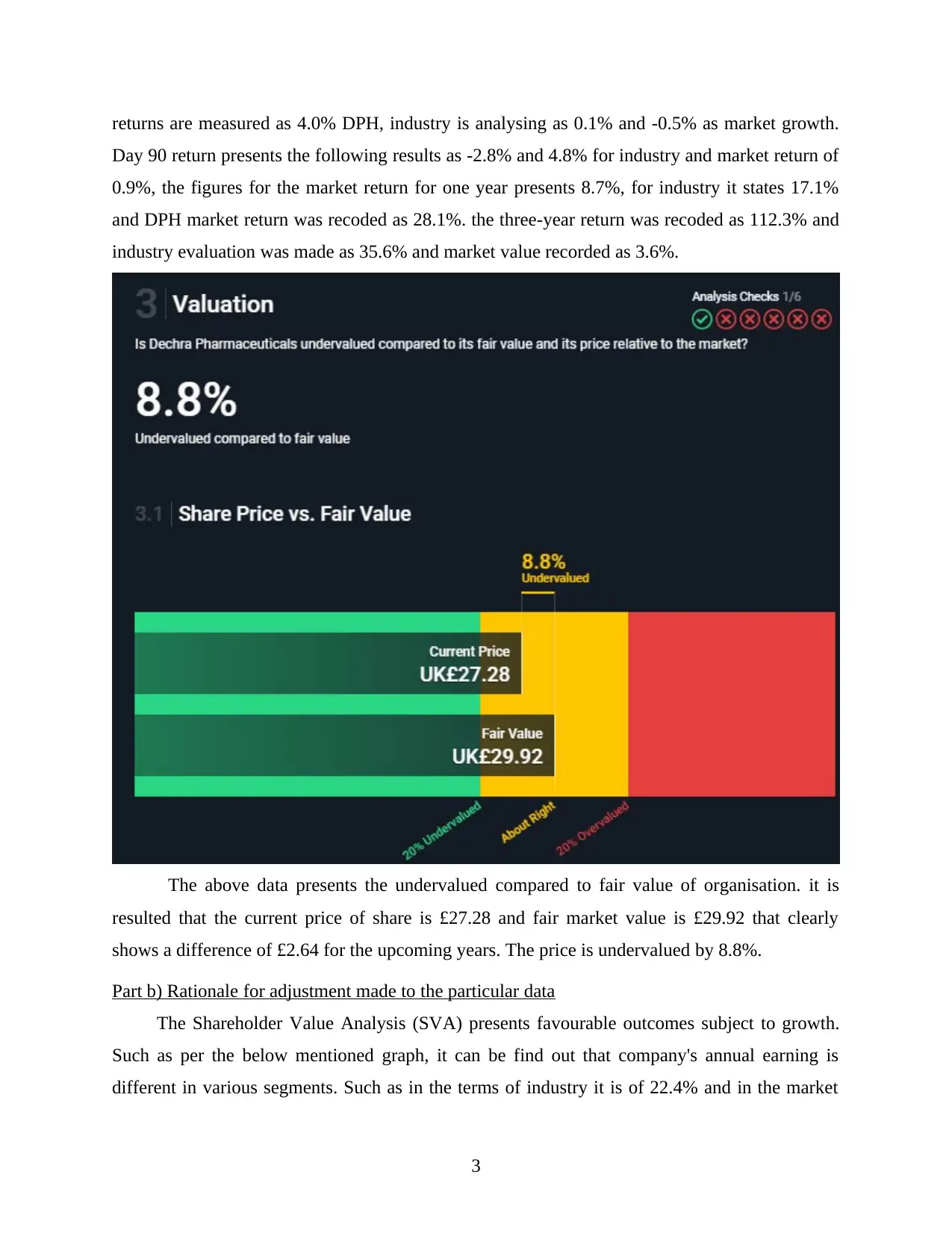

The above data presents the undervalued compared to fair value of organisation. it is

resulted that the current price of share is £27.28 and fair market value is £29.92 that clearly

shows a difference of £2.64 for the upcoming years. The price is undervalued by 8.8%.

Part b) Rationale for adjustment made to the particular data

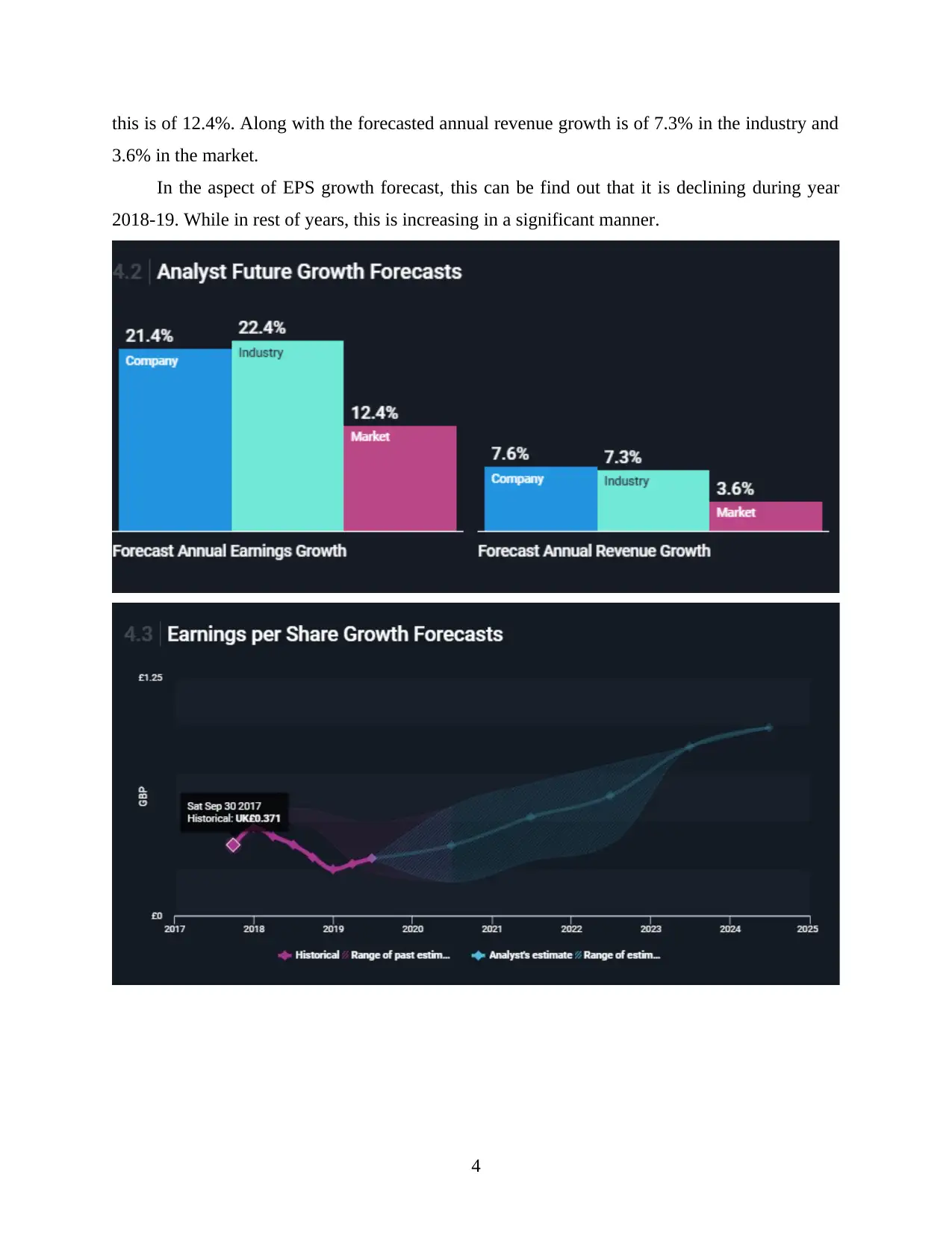

The Shareholder Value Analysis (SVA) presents favourable outcomes subject to growth.

Such as per the below mentioned graph, it can be find out that company's annual earning is

different in various segments. Such as in the terms of industry it is of 22.4% and in the market

3

Paraphrase This Document

3.6% in the market.

In the aspect of EPS growth forecast, this can be find out that it is declining during year

2018-19. While in rest of years, this is increasing in a significant manner.

4

Recent merger and acquisition by Dechra Pharmaceutical

Consolidation of organisations are commonly recognised as Mergers and acquisitions

(M&A). Consolidation is the merger of two firms to become one, distinguishing the two

concepts, while Purchases are one company that is bought over by the other company. M&A is

among the most important aspects of corporate finance (Ehrhardt and Brigham, 2016).

Typically, the rationale underneath M&A is that two different companies around each other

create more wealth than they are on a stand. With both the goal of maximizing assets, businesses

continue to evaluate different prospects via the merger or acquisitions path.

Recent mergers and acquisitions by Dechra Pharmaceutical

5

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

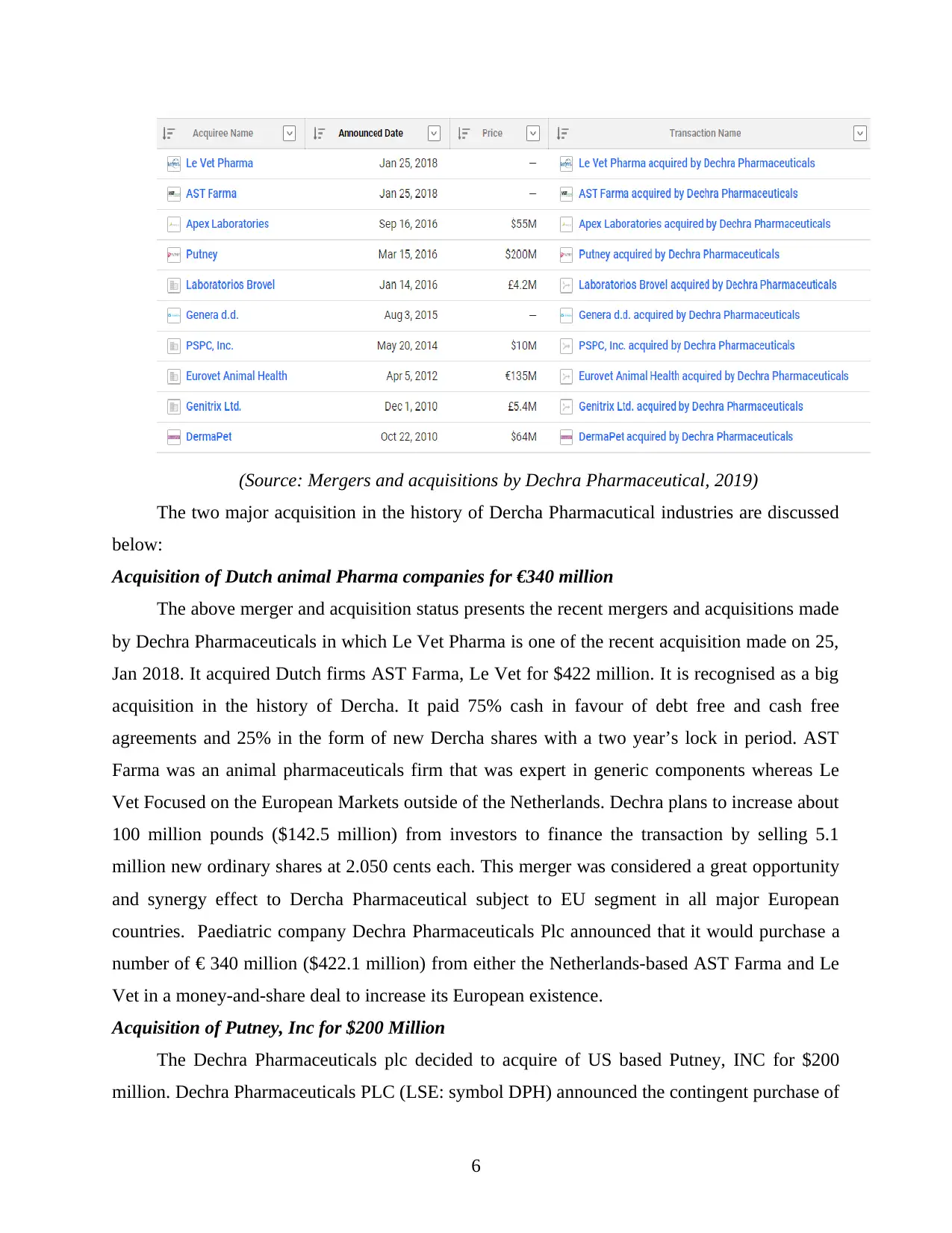

The two major acquisition in the history of Dercha Pharmacutical industries are discussed

below:

Acquisition of Dutch animal Pharma companies for €340 million

The above merger and acquisition status presents the recent mergers and acquisitions made

by Dechra Pharmaceuticals in which Le Vet Pharma is one of the recent acquisition made on 25,

Jan 2018. It acquired Dutch firms AST Farma, Le Vet for $422 million. It is recognised as a big

acquisition in the history of Dercha. It paid 75% cash in favour of debt free and cash free

agreements and 25% in the form of new Dercha shares with a two year’s lock in period. AST

Farma was an animal pharmaceuticals firm that was expert in generic components whereas Le

Vet Focused on the European Markets outside of the Netherlands. Dechra plans to increase about

100 million pounds ($142.5 million) from investors to finance the transaction by selling 5.1

million new ordinary shares at 2.050 cents each. This merger was considered a great opportunity

and synergy effect to Dercha Pharmaceutical subject to EU segment in all major European

countries. Paediatric company Dechra Pharmaceuticals Plc announced that it would purchase a

number of € 340 million ($422.1 million) from either the Netherlands-based AST Farma and Le

Vet in a money-and-share deal to increase its European existence.

Acquisition of Putney, Inc for $200 Million

The Dechra Pharmaceuticals plc decided to acquire of US based Putney, INC for $200

million. Dechra Pharmaceuticals PLC (LSE: symbol DPH) announced the contingent purchase of

6

Paraphrase This Document

located in Portland, Maine, USA. "In accordance with existing approach, Putney's purchase will

dramatically improve Dechra's role of the us, include Health canada-approved veterinarian

services of good quality and extend the portfolio. it is leased to capture this rare opportunity that

brings scope and extensive experience to the North American sector."

This merger conveyed various opportunities regarding expanding the operations

significantly. The strategic significance of this acquisition is as follows;

The critical mass to Dechra in the global companion animal market.

Enhancing the Dechra’s North American operational strategy and make a potential

business planning horizon.

The key strength of the business group’s pipeline for the US

Forming Putney’s regulatory expertise and commercial team

Delivering the synergies while containing the resources required in Portland (Acquisition

of US-based Putney, 2016).

Potential sources of synergy among parents and acquired company

The acquisition of Le Vet Farma lead Dercha Pharmaceutical to capture pharmaceutical

market in the starting of 2018. The share price of Dechra increased by 3.8% and share priced

reached up to 2140 pence. The company also issued 3.67 million new ordinary shares to

stakeholders. This acquisition builds a strong hold on market and capital structure for Dercha.

Acquisition and placement anticipated to be earnings improving in fiscal year 2017 and

substantially improving income in fiscal year 2018 as well as subsequently (on the grounds of

the fundamental result) Development meets the economic return requirements of Dercha

Pharmaceutical. Takeover subject to review by U.S. regulatory bodies. it is observed that Putney

has centralised towards targeting the veterinary products subject to limited competition and the

large market demand. The organisation has a veteran regulatory team with an effective track

history that provides clear sources of synergies among the Dechra and Putney Inc. Company

achieved over 40% of the overall US companion animal basic endorsements since 2012. It also

outsources manufacturing services with significant market share agreements on a fee for service

basis.

Dechra claims that, although retaining the resources in Portland, there will be potential for

synergies. It could also be possible to make in-house goods in the system in the potential, that are

7

investment prospect found in the United States for Dechra for whatever period. The purchase

gives access to the current Putney product line and growth portfolio, including heavy-quality and

compatible therapeutic target areas, while bringing mass to the existing US activities and assets

of Dechra. It will be able to utilize its product development departments and distribution from

Putney, and share methodologies in product design and compliance fields. Therefore, for the

company, Discount charged.

Premium paid for the target company

At finalization on a mortgage-free / money-free basis, its complete examination receivable

for Putney adds up to $200 billion (£ 139 million) in cash. Established in 2006, Putney released

its first Carprofen caplet veterinary brand in 2009. The development is subject to Dechra being

granted clearance under that same Hart-Scott-Rodino Regulatory Enhancements Act, which is

anticipated to be obtained by mid-April 2016 at the latest. Furthermore, Dechra proclaims that

this has positioned 4,398,600 current normal shares at 1100 cents per share to increase about £

47.1 million, net of expenditures, to express the purchase. It was a leading international

manufacturer of pet generic drugs in the United States, centred in Portland, Maine, and

employing about 60 staff. Putney currently markets 11 drugs in adjacent therapeutic fields to

Dechra, like pain control, anti-infective and dermatology, that have gained strong market shares

but continue to expand.

CONCLUSION

As per above report it has been articulated that Dercha Pharmacutical is well financial

structured corporation. Company's market cap is major as compare to its competitors. However

company is facing problem regarding supply-chain but company's recent statement indicates that

company has overcome this problem. Also company's WACC is favourable and assured dividend

policy are key factors which attacks investors. However it has been recommended to improve

their supply-chain shortly to maintain current market cap and brand value in industry. Alos

company has mentioned this issue as confidential in annual report which may distract company's

existing and potential investors.

8

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Atanasov, V .A. and Black, B. S., 2016. Shock-based causal inference in corporate finance and

accounting research. Critical Finance Review. 5. pp. 207-304.

Bancel, F. and Mittoo, U. R., 2014. The gap between the theory and practice of corporate

valuation: Survey of European experts. Journal of Applied Corporate Finance. 26(4).

pp. 106-117.

Bazdresch, S., Kahn, R. J. and Whited, T. M., 2017. Estimating and testing dynamic corporate

finance models. The Review of Financial Studies. 31(1). pp. 322-361.

Berg, T., Saunders, A. and Steffen, S., 2016. The total cost of corporate borrowing in the loan

market: Don't ignore the fees. The Journal of Finance. 71(3). pp. 1357-1392.

Damodaran, A., 2016. Damodaran on valuation: security analysis for investment and corporate

finance (Vol. 324). John Wiley & Sons.

Dang, C., Li, Z. F. and Yang, C., 2018. Measuring firm size in empirical corporate finance.

Journal of Banking & Finance. 86. pp. 159-176.

Dang, V. A., Kim, M. and Shin, Y., 2015. In search of robust methods for dynamic panel data

models in empirical corporate finance. Journal of Banking & Finance. 53. pp.84-98.

Dewally, M. and Shao, Y., 2014. Liquidity crisis, relationship lending and corporate finance.

Journal of Banking & Finance. 39. pp. 223-239.

Ehrhardt, M. C. and Brigham, E. F., 2016. Corporate finance: A focused approach. Cengage

learning.

Online

About Us: Dechra Pharmaceuticals PLC, 2019. [Online]. Available through:

<http://dechra.annualreport2019.com/overview/welcome-to-dechra-pharmaceuticals-plc

Annual Report of Dechra Pharmaceuticals PLC, 2019. [Online]. Available through:

<http://dechra.annualreport2019.com/financial-statements/consolidated-statement-of-

financial-position>

Beta of Dechra Pharmaceuticals PLC, 2019. [Online]. Available through:

<https://www.infrontanalytics.com/fe-EN/32014EX/Dechra-Pharmaceuticals-PLC/

Beta>.

News Results for Dechra Pharmaceuticals, 2019. [Online]. Available through:

<https://www.stockmarketwire.com/company-news/DPH/Dechra-Pharmaceuticals>.

Acquisition of US-based Putney, 2016. [online]. Available through:<

https://www.prnewswire.com/news-releases/dechra-pharmaceuticals-plc-agrees-

acquisitionof-us-based-putney-inc-for-200-million-572081591.html>.

Mergers and acquisitions by Dechra Pharmaceutical, 2019. [online]. Available

through:<https://www.crunchbase.com/organization/dechrapharmaceuticals/

acquisitions/acquisitions_list#section-acquisitions>.

9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.