Corporate Finance

VerifiedAdded on 2022/11/25

|17

|2344

|341

AI Summary

This document explores the objectives and practices of Computershare Limited and Evolution Mining Limited in achieving wealth and profit maximization. It discusses the importance of ethical practices, compliance with environmental issues, and social responsibilities in corporate finance. The document also includes a detailed analysis of the financial achievements and operational success of both companies.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CORPORATE FINANCE

Corporate Finance

Name of the Student:

Name of the University:

Authors Note:

Corporate Finance

Name of the Student:

Name of the University:

Authors Note:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1

CORPORATE FINANCE

Contents

Introduction:....................................................................................................................................2

Part A:..............................................................................................................................................2

Computershare Limited:..............................................................................................................2

Evolution Mining Limited:..........................................................................................................4

Part B:............................................................................................................................................11

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

CORPORATE FINANCE

Contents

Introduction:....................................................................................................................................2

Part A:..............................................................................................................................................2

Computershare Limited:..............................................................................................................2

Evolution Mining Limited:..........................................................................................................4

Part B:............................................................................................................................................11

Conclusion:....................................................................................................................................14

References:....................................................................................................................................15

2

CORPORATE FINANCE

Introduction:

Wealth maximization and profit maximization are the two primary objectives of business

organizations. However, since a business organization operates within the society, it has certain

responsibilities towards the society and environment. Wealth and profit maximization objectives

have to be achieved but not at the expense of environmental issues and unethical practices.

Computershare Limited and Evolution Mining Limited are the two companies selected for the

purpose of assessment of its annual reports to find out whether they have practiced ethically to

achieve wealth and profit maximization.

Part A:

Company objectives:

A stock share company, Computershare Limited provides stock related and corporate trust

services in Australia and other parts of the world. As per the information contained in the official

website of the company as well as in annual reports of the company, the objectives of the

company explained here.

Computershare Limited:

Creating value:

Creating value through top quality stock transfer, corporate trust and other such services is one of

the main objectives of the company. Creating value for the shareholders as well as customers is

the main objective of the company. This will help in maximizing the wealth of the shareholders

of the company.

Maximizing profit:

CORPORATE FINANCE

Introduction:

Wealth maximization and profit maximization are the two primary objectives of business

organizations. However, since a business organization operates within the society, it has certain

responsibilities towards the society and environment. Wealth and profit maximization objectives

have to be achieved but not at the expense of environmental issues and unethical practices.

Computershare Limited and Evolution Mining Limited are the two companies selected for the

purpose of assessment of its annual reports to find out whether they have practiced ethically to

achieve wealth and profit maximization.

Part A:

Company objectives:

A stock share company, Computershare Limited provides stock related and corporate trust

services in Australia and other parts of the world. As per the information contained in the official

website of the company as well as in annual reports of the company, the objectives of the

company explained here.

Computershare Limited:

Creating value:

Creating value through top quality stock transfer, corporate trust and other such services is one of

the main objectives of the company. Creating value for the shareholders as well as customers is

the main objective of the company. This will help in maximizing the wealth of the shareholders

of the company.

Maximizing profit:

3

CORPORATE FINANCE

Maximizing profit of the company is another important objective as it will help the company to

sustain its operations in the long run. Maximizing profit is possible to be achieved by reducing

the cost of business operations (Computershare.com, 2019).

Complying with environmental issues:

Computershare has committed towards improving the environment by using clean and

sustainable energy. As an artificial but social person it is the responsibility of the company to

improve the environment by conserving natural resources and the management as can be seen in

the Board of Directors’ report.

Ethical practices:

The company has clear goal of using ethical practices to achieve its objectives. No unethical

practices shall be allowed and strict actions shall be taken against anyone found to have

committed unethical practices. The company aims to be an ethical supplier and it has achieved

operational efficiency by being and ethical supplier over the years (BROWN, 2009).

Providing employees with all necessary facilities:

The company has a standard policy to provide its employees and workers suitable working

condition. The workplace should be conducive for employees and workers to discharge their

duties and functions towards the organization. Ensuring safety and security to the workers and

employees of the company is a compulsory objective of the company.

No discrimination against women and gender equality:

CORPORATE FINANCE

Maximizing profit of the company is another important objective as it will help the company to

sustain its operations in the long run. Maximizing profit is possible to be achieved by reducing

the cost of business operations (Computershare.com, 2019).

Complying with environmental issues:

Computershare has committed towards improving the environment by using clean and

sustainable energy. As an artificial but social person it is the responsibility of the company to

improve the environment by conserving natural resources and the management as can be seen in

the Board of Directors’ report.

Ethical practices:

The company has clear goal of using ethical practices to achieve its objectives. No unethical

practices shall be allowed and strict actions shall be taken against anyone found to have

committed unethical practices. The company aims to be an ethical supplier and it has achieved

operational efficiency by being and ethical supplier over the years (BROWN, 2009).

Providing employees with all necessary facilities:

The company has a standard policy to provide its employees and workers suitable working

condition. The workplace should be conducive for employees and workers to discharge their

duties and functions towards the organization. Ensuring safety and security to the workers and

employees of the company is a compulsory objective of the company.

No discrimination against women and gender equality:

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4

CORPORATE FINANCE

The mission statement of the company clearly states that the company will never discriminate

employees and workers on the basis of their gender and will treat everybody equally irrespective

of their gender, caste, religion and other social attributes.

Social responsibility:

Social responsibilities of the company include spending on social welfare and awareness to

improve the quality of lives in and around the country in which the company operates. It is an

important objective for the company and must be taken seriously while assessing the overall

performance of the company.

Evolution Mining Limited:

Wealth and profit maximization:

Maximizing the wealth of the shareholders as well as profit maximization are the two common

objectives of all business organizations. Evolution Mining Limited also have the same objectives

in these regard.

Environment sustainable business operations:

The company is in the business of gold mining and considering the immense environmental

effects of mining it is of huge priority for the company to ensure environment sustainable

business operations.

Conservation of energy and use of clean energy:

Conservation of energy and use of clean energy are again part of overall business objectives of

the company. Instituting technologically advanced equipment within the mines to produce

required energy is an important objective of the company (Evolutionmining.com.au, 2019).

CORPORATE FINANCE

The mission statement of the company clearly states that the company will never discriminate

employees and workers on the basis of their gender and will treat everybody equally irrespective

of their gender, caste, religion and other social attributes.

Social responsibility:

Social responsibilities of the company include spending on social welfare and awareness to

improve the quality of lives in and around the country in which the company operates. It is an

important objective for the company and must be taken seriously while assessing the overall

performance of the company.

Evolution Mining Limited:

Wealth and profit maximization:

Maximizing the wealth of the shareholders as well as profit maximization are the two common

objectives of all business organizations. Evolution Mining Limited also have the same objectives

in these regard.

Environment sustainable business operations:

The company is in the business of gold mining and considering the immense environmental

effects of mining it is of huge priority for the company to ensure environment sustainable

business operations.

Conservation of energy and use of clean energy:

Conservation of energy and use of clean energy are again part of overall business objectives of

the company. Instituting technologically advanced equipment within the mines to produce

required energy is an important objective of the company (Evolutionmining.com.au, 2019).

5

CORPORATE FINANCE

Environmental protection measures:

One of most important objectives for the company is to use advanced technology and equipment

to protect the environment. Ensuring that the harmful impact of mining is reduced to minimum

all necessary measures must be taken by the company.

Ethical supplier:

Ethical supplier of gold across the globe is one of objectives of the company as it is important to

ensure that the gold extracted from the mine are sold in the market at correct price as it has a

huge demand in all the emerging, developed and under developed markets.

Safety and security of the employees:

The employees must be provided with safe and secure work environment to ensure mining

operations are carried out properly and there is no harm to the employees and workers in the

mine (Ceil, 2012).

Gender equality:

Gender equality:

Ensuring gender equality is part of the overall culture of the company. It is one of the most

important objectives of the company to ensure there is no discrimination within the company on

the basis of gender or for that matter any other social issues.

Responsibility towards the society:

Ensuring equal distribution of property, increasing awareness about social cause contributing to

other social causes is an essential element of overall objectives of the company (Efni, 2017).

CORPORATE FINANCE

Environmental protection measures:

One of most important objectives for the company is to use advanced technology and equipment

to protect the environment. Ensuring that the harmful impact of mining is reduced to minimum

all necessary measures must be taken by the company.

Ethical supplier:

Ethical supplier of gold across the globe is one of objectives of the company as it is important to

ensure that the gold extracted from the mine are sold in the market at correct price as it has a

huge demand in all the emerging, developed and under developed markets.

Safety and security of the employees:

The employees must be provided with safe and secure work environment to ensure mining

operations are carried out properly and there is no harm to the employees and workers in the

mine (Ceil, 2012).

Gender equality:

Gender equality:

Ensuring gender equality is part of the overall culture of the company. It is one of the most

important objectives of the company to ensure there is no discrimination within the company on

the basis of gender or for that matter any other social issues.

Responsibility towards the society:

Ensuring equal distribution of property, increasing awareness about social cause contributing to

other social causes is an essential element of overall objectives of the company (Efni, 2017).

6

CORPORATE FINANCE

Reconciliation of shareholders’ wealth maximization:

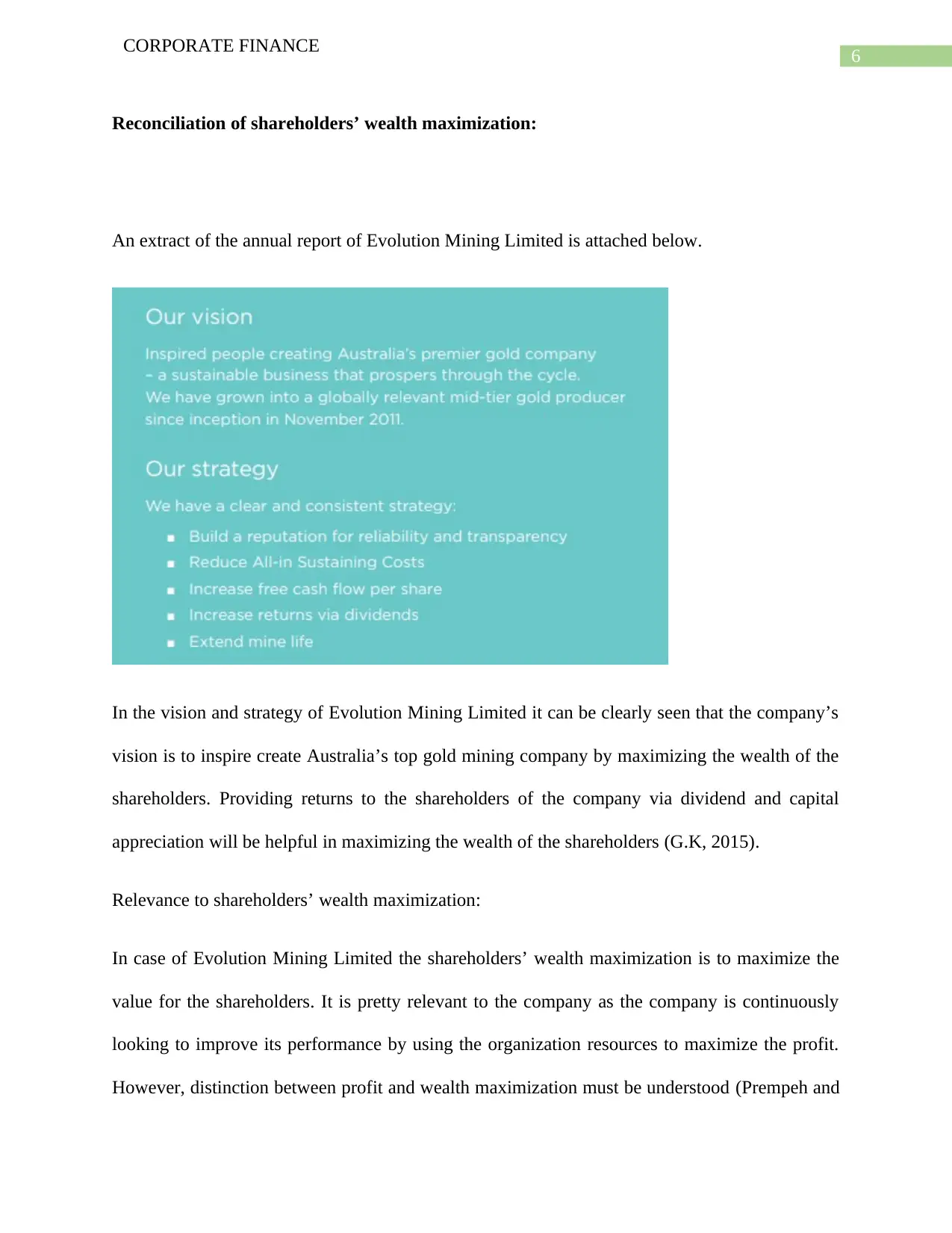

An extract of the annual report of Evolution Mining Limited is attached below.

In the vision and strategy of Evolution Mining Limited it can be clearly seen that the company’s

vision is to inspire create Australia’s top gold mining company by maximizing the wealth of the

shareholders. Providing returns to the shareholders of the company via dividend and capital

appreciation will be helpful in maximizing the wealth of the shareholders (G.K, 2015).

Relevance to shareholders’ wealth maximization:

In case of Evolution Mining Limited the shareholders’ wealth maximization is to maximize the

value for the shareholders. It is pretty relevant to the company as the company is continuously

looking to improve its performance by using the organization resources to maximize the profit.

However, distinction between profit and wealth maximization must be understood (Prempeh and

CORPORATE FINANCE

Reconciliation of shareholders’ wealth maximization:

An extract of the annual report of Evolution Mining Limited is attached below.

In the vision and strategy of Evolution Mining Limited it can be clearly seen that the company’s

vision is to inspire create Australia’s top gold mining company by maximizing the wealth of the

shareholders. Providing returns to the shareholders of the company via dividend and capital

appreciation will be helpful in maximizing the wealth of the shareholders (G.K, 2015).

Relevance to shareholders’ wealth maximization:

In case of Evolution Mining Limited the shareholders’ wealth maximization is to maximize the

value for the shareholders. It is pretty relevant to the company as the company is continuously

looking to improve its performance by using the organization resources to maximize the profit.

However, distinction between profit and wealth maximization must be understood (Prempeh and

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7

CORPORATE FINANCE

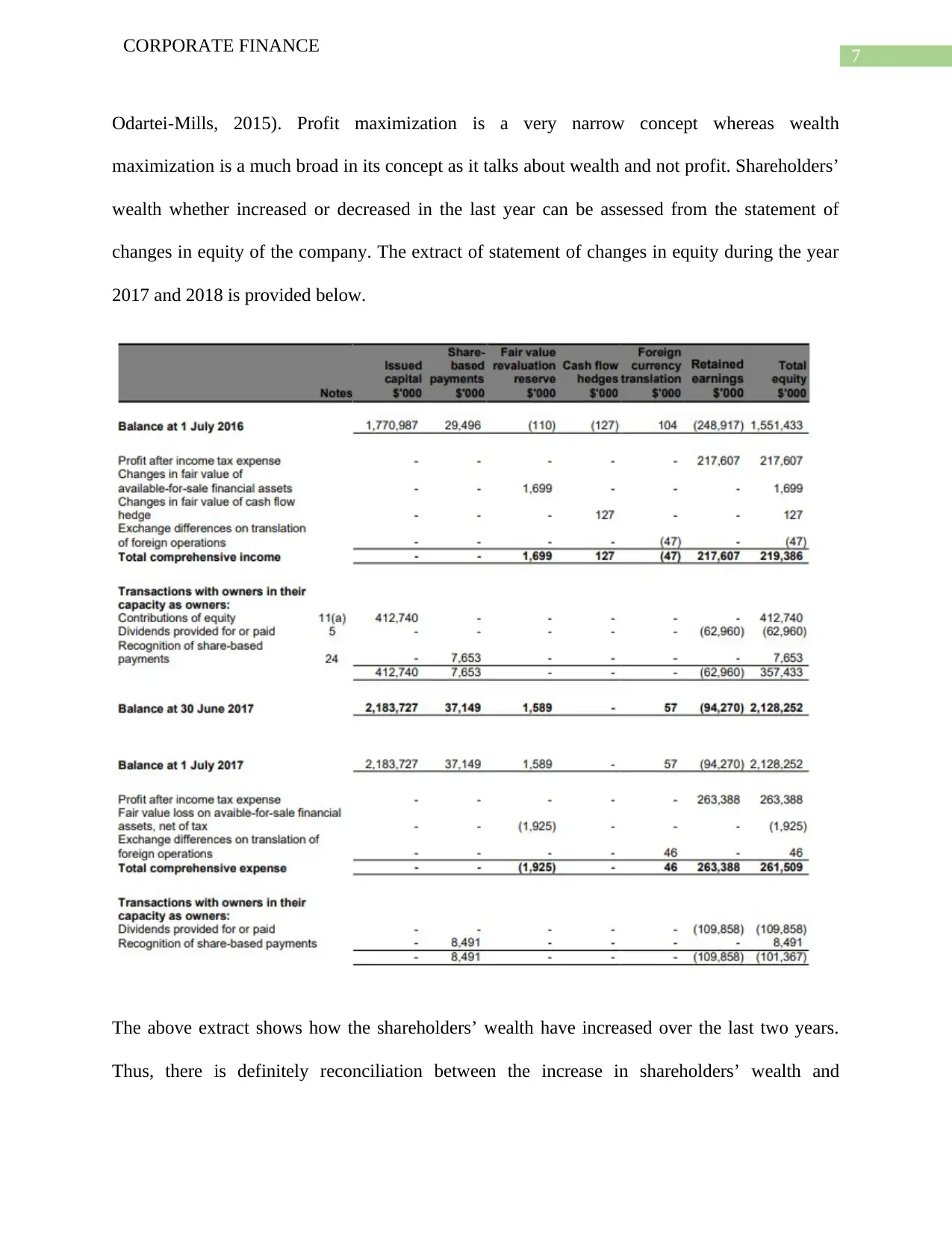

Odartei-Mills, 2015). Profit maximization is a very narrow concept whereas wealth

maximization is a much broad in its concept as it talks about wealth and not profit. Shareholders’

wealth whether increased or decreased in the last year can be assessed from the statement of

changes in equity of the company. The extract of statement of changes in equity during the year

2017 and 2018 is provided below.

The above extract shows how the shareholders’ wealth have increased over the last two years.

Thus, there is definitely reconciliation between the increase in shareholders’ wealth and

CORPORATE FINANCE

Odartei-Mills, 2015). Profit maximization is a very narrow concept whereas wealth

maximization is a much broad in its concept as it talks about wealth and not profit. Shareholders’

wealth whether increased or decreased in the last year can be assessed from the statement of

changes in equity of the company. The extract of statement of changes in equity during the year

2017 and 2018 is provided below.

The above extract shows how the shareholders’ wealth have increased over the last two years.

Thus, there is definitely reconciliation between the increase in shareholders’ wealth and

8

CORPORATE FINANCE

shareholders’ wealth maximization. Increase in shareholders wealth is a clear indication of

successful implementation of organizational objectives by the management. Wealth

maximization is about increasing the value of business through different steps to increase the

value of shares held by the shareholders. Thus, reconciliation of wealth maximization with the

other objectives of an organization is not contradictory. The management takes necessary steps

to improve the business functions to create value for the business. Creation of value for the

business is in line with the concept of wealth maximization. The highlights of 2018 financial

year as given in the Annual report of the company shows that the company has number of

different objectives which ave all contributed to the cause of wealth maximization (Rubin, 2013).

CORPORATE FINANCE

shareholders’ wealth maximization. Increase in shareholders wealth is a clear indication of

successful implementation of organizational objectives by the management. Wealth

maximization is about increasing the value of business through different steps to increase the

value of shares held by the shareholders. Thus, reconciliation of wealth maximization with the

other objectives of an organization is not contradictory. The management takes necessary steps

to improve the business functions to create value for the business. Creation of value for the

business is in line with the concept of wealth maximization. The highlights of 2018 financial

year as given in the Annual report of the company shows that the company has number of

different objectives which ave all contributed to the cause of wealth maximization (Rubin, 2013).

9

CORPORATE FINANCE

All the above achievements of business are in line with value creation for the business to

increase the value of the shares held by the shareholders to achieve the objective of wealth

maximization.

Computershare Limited:

The annual report of the company for 2018 shall be thoroughly assessed to understand the

financial achievements of the company along with operational success or lack of it to determine

whether the objective of wealth maximization can be reconciled.

CORPORATE FINANCE

All the above achievements of business are in line with value creation for the business to

increase the value of the shares held by the shareholders to achieve the objective of wealth

maximization.

Computershare Limited:

The annual report of the company for 2018 shall be thoroughly assessed to understand the

financial achievements of the company along with operational success or lack of it to determine

whether the objective of wealth maximization can be reconciled.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10

CORPORATE FINANCE

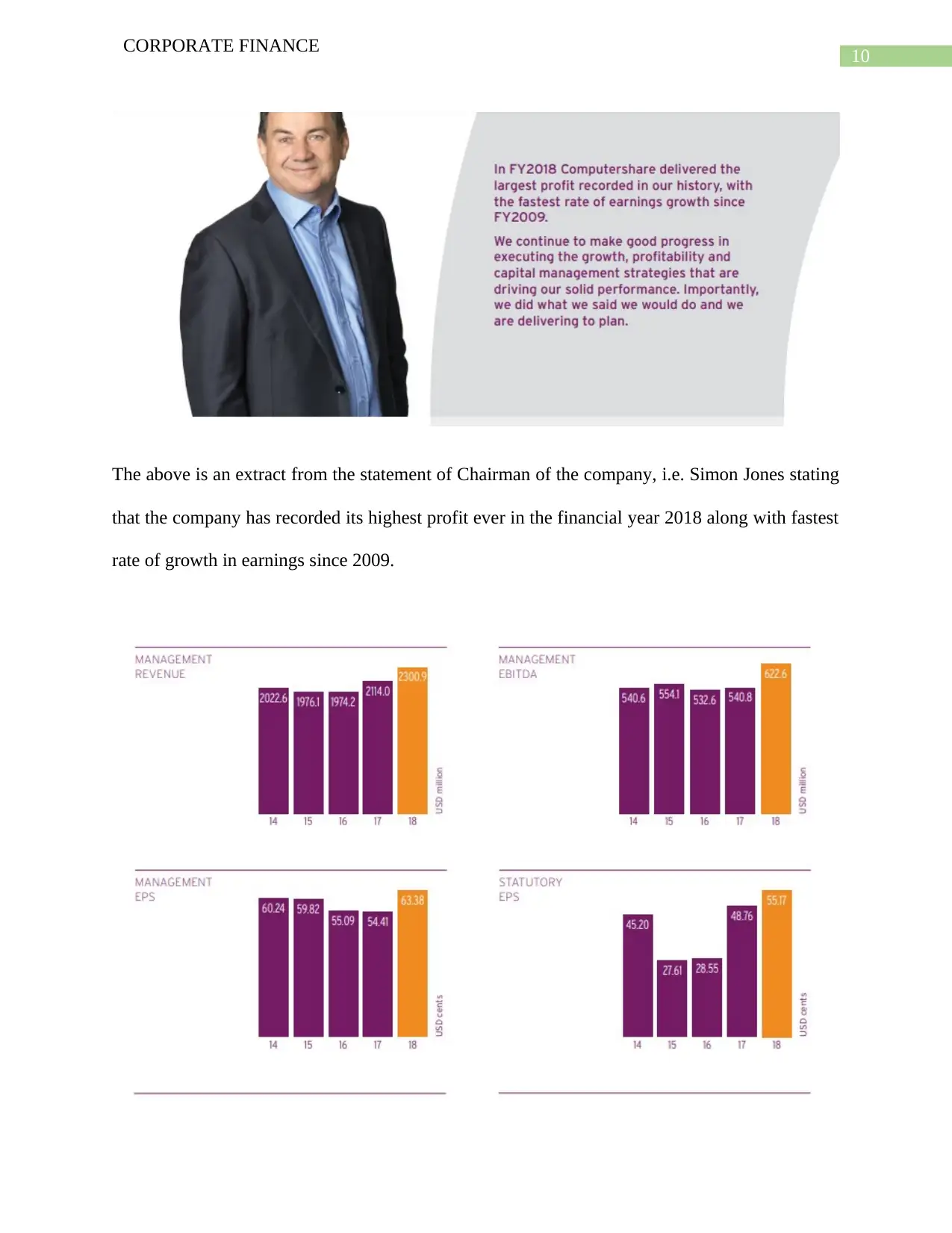

The above is an extract from the statement of Chairman of the company, i.e. Simon Jones stating

that the company has recorded its highest profit ever in the financial year 2018 along with fastest

rate of growth in earnings since 2009.

CORPORATE FINANCE

The above is an extract from the statement of Chairman of the company, i.e. Simon Jones stating

that the company has recorded its highest profit ever in the financial year 2018 along with fastest

rate of growth in earnings since 2009.

11

CORPORATE FINANCE

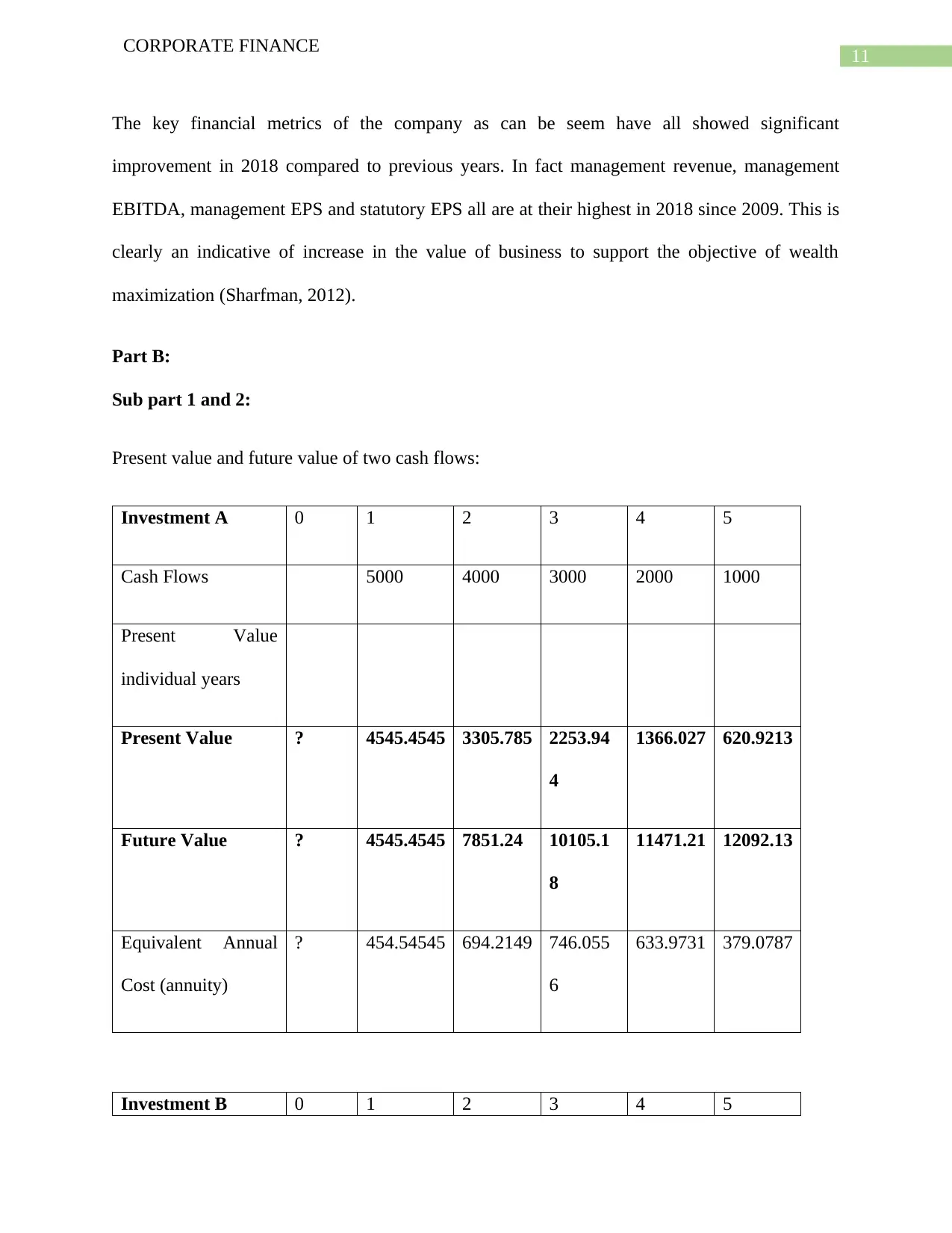

The key financial metrics of the company as can be seem have all showed significant

improvement in 2018 compared to previous years. In fact management revenue, management

EBITDA, management EPS and statutory EPS all are at their highest in 2018 since 2009. This is

clearly an indicative of increase in the value of business to support the objective of wealth

maximization (Sharfman, 2012).

Part B:

Sub part 1 and 2:

Present value and future value of two cash flows:

Investment A 0 1 2 3 4 5

Cash Flows 5000 4000 3000 2000 1000

Present Value

individual years

Present Value ? 4545.4545 3305.785 2253.94

4

1366.027 620.9213

Future Value ? 4545.4545 7851.24 10105.1

8

11471.21 12092.13

Equivalent Annual

Cost (annuity)

? 454.54545 694.2149 746.055

6

633.9731 379.0787

Investment B 0 1 2 3 4 5

CORPORATE FINANCE

The key financial metrics of the company as can be seem have all showed significant

improvement in 2018 compared to previous years. In fact management revenue, management

EBITDA, management EPS and statutory EPS all are at their highest in 2018 since 2009. This is

clearly an indicative of increase in the value of business to support the objective of wealth

maximization (Sharfman, 2012).

Part B:

Sub part 1 and 2:

Present value and future value of two cash flows:

Investment A 0 1 2 3 4 5

Cash Flows 5000 4000 3000 2000 1000

Present Value

individual years

Present Value ? 4545.4545 3305.785 2253.94

4

1366.027 620.9213

Future Value ? 4545.4545 7851.24 10105.1

8

11471.21 12092.13

Equivalent Annual

Cost (annuity)

? 454.54545 694.2149 746.055

6

633.9731 379.0787

Investment B 0 1 2 3 4 5

12

CORPORATE FINANCE

Cash Flows 1000 2000 3000 4000 5000

Present Value ? 909.09091 1652.893 2253.94

4

2732.054 3104.607

Future Value ? 909.09091 2561.983 4815.92

8

7547.982 10652.59

Equivalent Annual

Cost

? 90.909091 347.1074 746.055

6

1267.946 1895.393

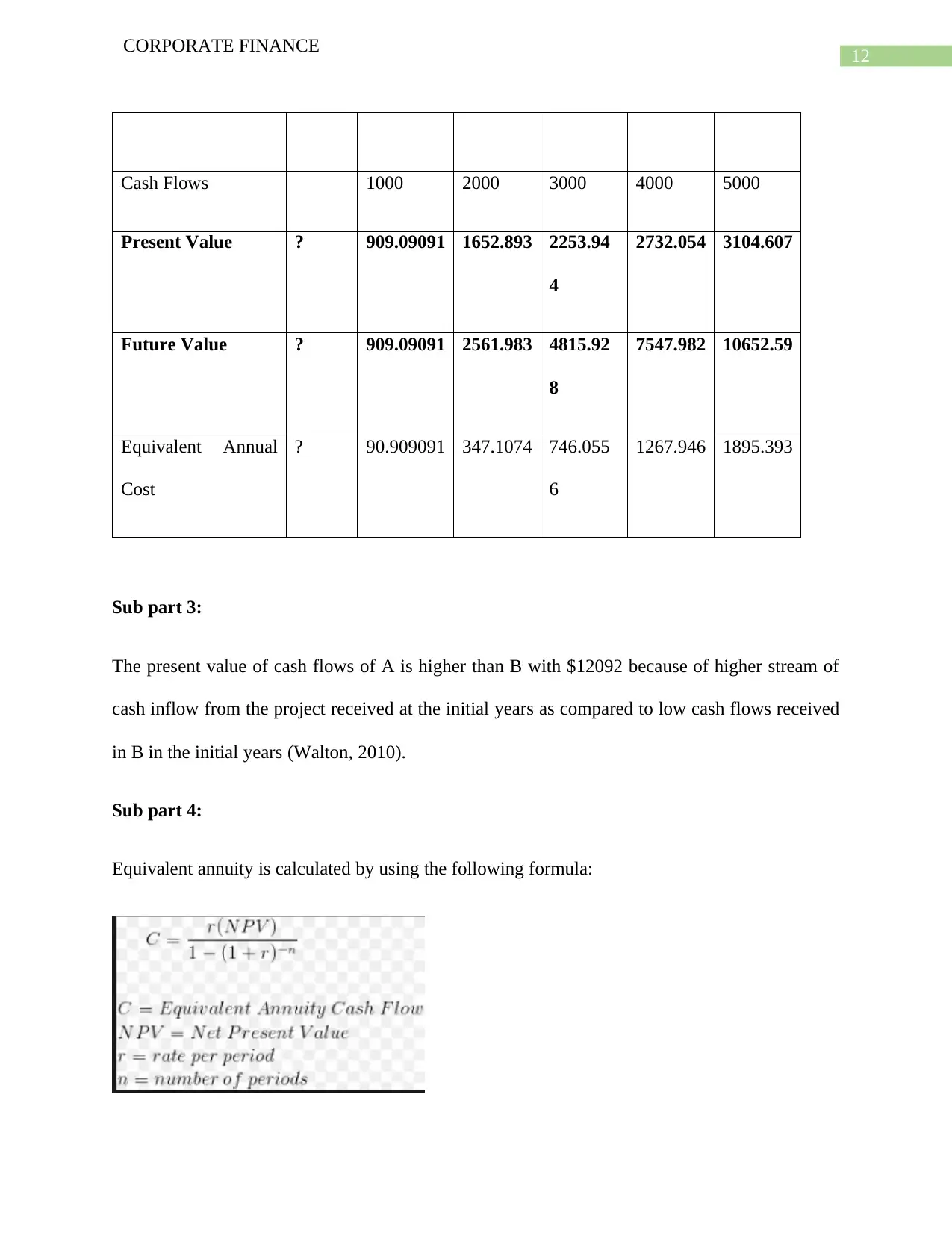

Sub part 3:

The present value of cash flows of A is higher than B with $12092 because of higher stream of

cash inflow from the project received at the initial years as compared to low cash flows received

in B in the initial years (Walton, 2010).

Sub part 4:

Equivalent annuity is calculated by using the following formula:

CORPORATE FINANCE

Cash Flows 1000 2000 3000 4000 5000

Present Value ? 909.09091 1652.893 2253.94

4

2732.054 3104.607

Future Value ? 909.09091 2561.983 4815.92

8

7547.982 10652.59

Equivalent Annual

Cost

? 90.909091 347.1074 746.055

6

1267.946 1895.393

Sub part 3:

The present value of cash flows of A is higher than B with $12092 because of higher stream of

cash inflow from the project received at the initial years as compared to low cash flows received

in B in the initial years (Walton, 2010).

Sub part 4:

Equivalent annuity is calculated by using the following formula:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

13

CORPORATE FINANCE

Thus, equivalent annuity amount for A is $3,189.87 and equivalent annuity amount for B is

$2,810.13.

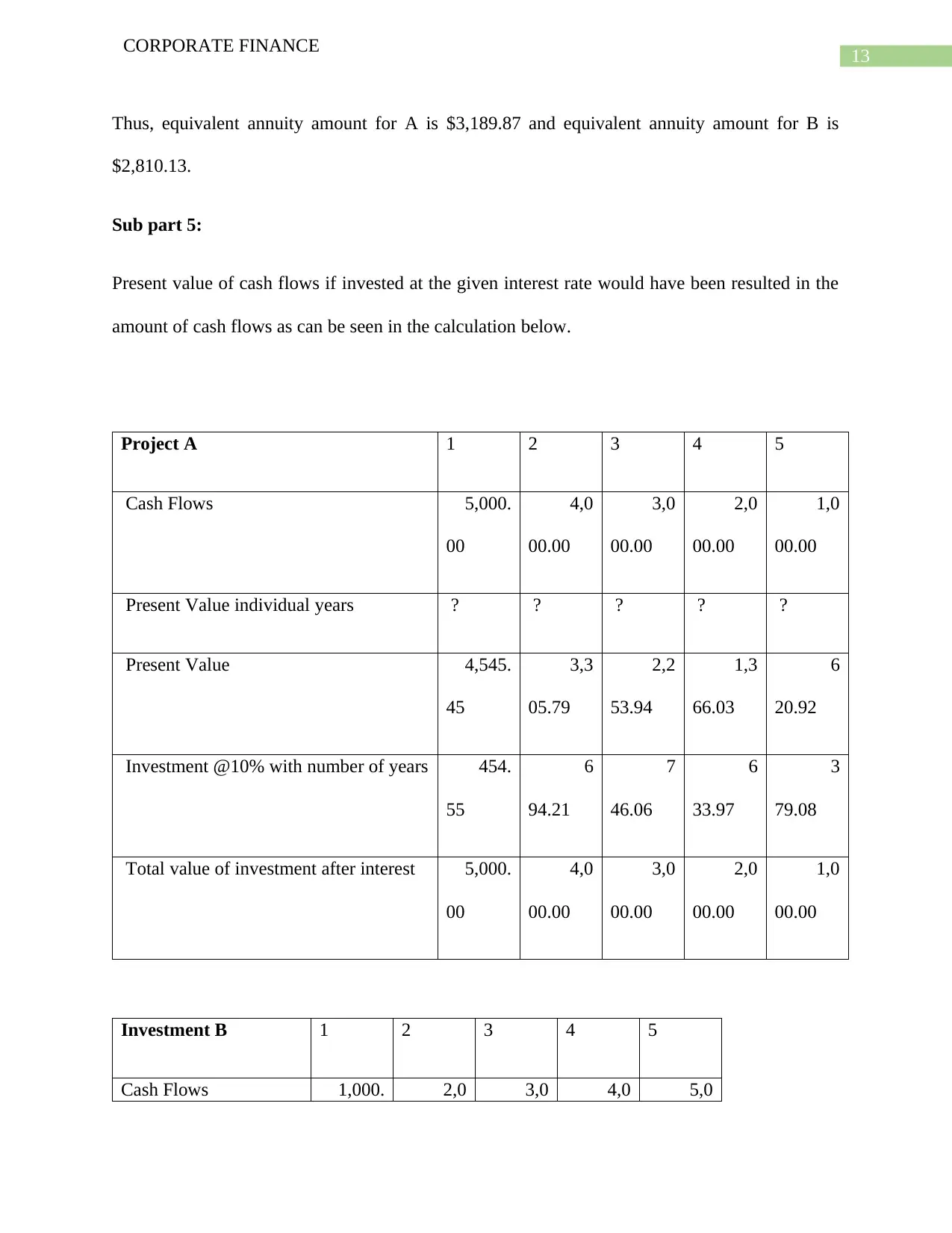

Sub part 5:

Present value of cash flows if invested at the given interest rate would have been resulted in the

amount of cash flows as can be seen in the calculation below.

Project A 1 2 3 4 5

Cash Flows 5,000.

00

4,0

00.00

3,0

00.00

2,0

00.00

1,0

00.00

Present Value individual years ? ? ? ? ?

Present Value 4,545.

45

3,3

05.79

2,2

53.94

1,3

66.03

6

20.92

Investment @10% with number of years 454.

55

6

94.21

7

46.06

6

33.97

3

79.08

Total value of investment after interest 5,000.

00

4,0

00.00

3,0

00.00

2,0

00.00

1,0

00.00

Investment B 1 2 3 4 5

Cash Flows 1,000. 2,0 3,0 4,0 5,0

CORPORATE FINANCE

Thus, equivalent annuity amount for A is $3,189.87 and equivalent annuity amount for B is

$2,810.13.

Sub part 5:

Present value of cash flows if invested at the given interest rate would have been resulted in the

amount of cash flows as can be seen in the calculation below.

Project A 1 2 3 4 5

Cash Flows 5,000.

00

4,0

00.00

3,0

00.00

2,0

00.00

1,0

00.00

Present Value individual years ? ? ? ? ?

Present Value 4,545.

45

3,3

05.79

2,2

53.94

1,3

66.03

6

20.92

Investment @10% with number of years 454.

55

6

94.21

7

46.06

6

33.97

3

79.08

Total value of investment after interest 5,000.

00

4,0

00.00

3,0

00.00

2,0

00.00

1,0

00.00

Investment B 1 2 3 4 5

Cash Flows 1,000. 2,0 3,0 4,0 5,0

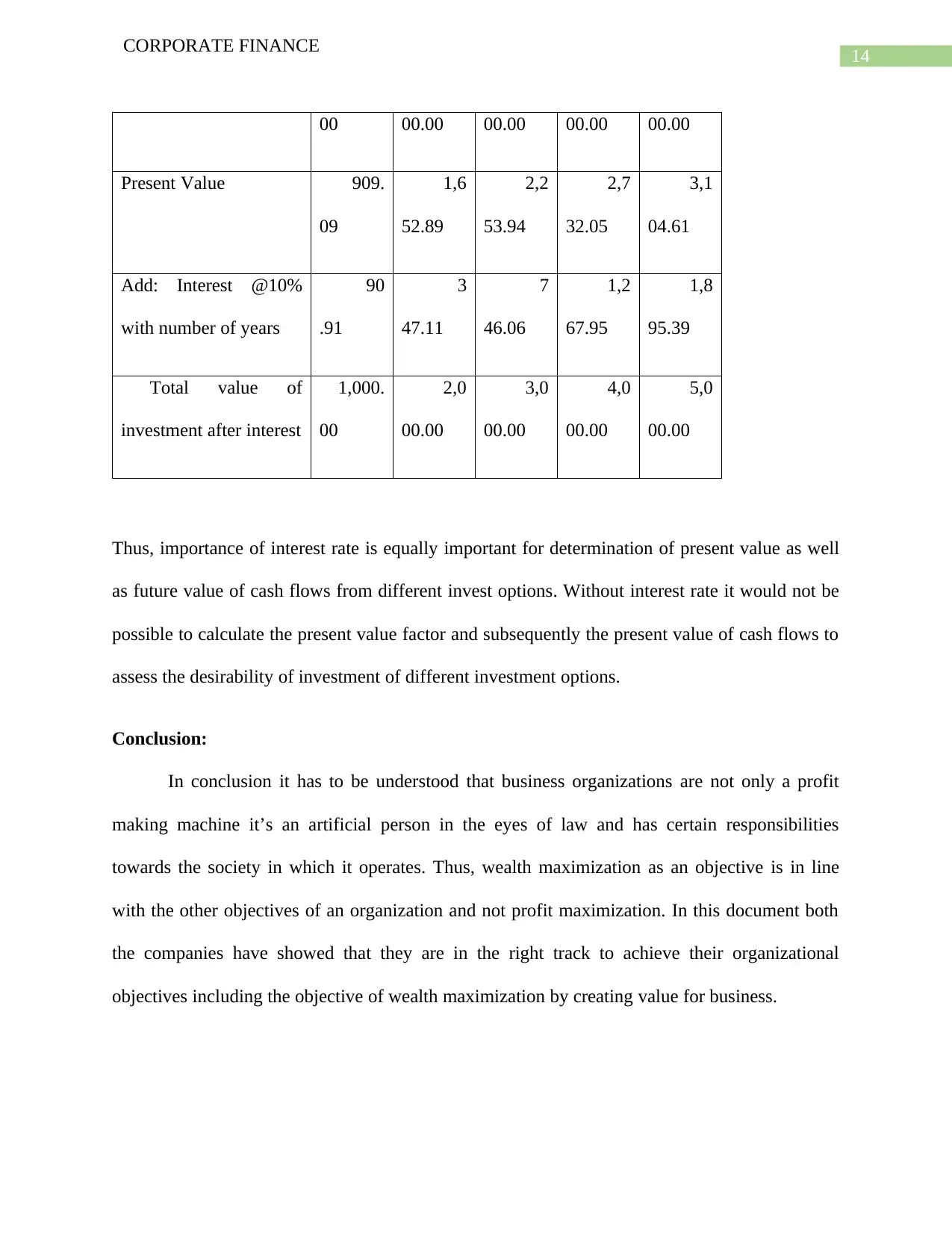

14

CORPORATE FINANCE

00 00.00 00.00 00.00 00.00

Present Value 909.

09

1,6

52.89

2,2

53.94

2,7

32.05

3,1

04.61

Add: Interest @10%

with number of years

90

.91

3

47.11

7

46.06

1,2

67.95

1,8

95.39

Total value of

investment after interest

1,000.

00

2,0

00.00

3,0

00.00

4,0

00.00

5,0

00.00

Thus, importance of interest rate is equally important for determination of present value as well

as future value of cash flows from different invest options. Without interest rate it would not be

possible to calculate the present value factor and subsequently the present value of cash flows to

assess the desirability of investment of different investment options.

Conclusion:

In conclusion it has to be understood that business organizations are not only a profit

making machine it’s an artificial person in the eyes of law and has certain responsibilities

towards the society in which it operates. Thus, wealth maximization as an objective is in line

with the other objectives of an organization and not profit maximization. In this document both

the companies have showed that they are in the right track to achieve their organizational

objectives including the objective of wealth maximization by creating value for business.

CORPORATE FINANCE

00 00.00 00.00 00.00 00.00

Present Value 909.

09

1,6

52.89

2,2

53.94

2,7

32.05

3,1

04.61

Add: Interest @10%

with number of years

90

.91

3

47.11

7

46.06

1,2

67.95

1,8

95.39

Total value of

investment after interest

1,000.

00

2,0

00.00

3,0

00.00

4,0

00.00

5,0

00.00

Thus, importance of interest rate is equally important for determination of present value as well

as future value of cash flows from different invest options. Without interest rate it would not be

possible to calculate the present value factor and subsequently the present value of cash flows to

assess the desirability of investment of different investment options.

Conclusion:

In conclusion it has to be understood that business organizations are not only a profit

making machine it’s an artificial person in the eyes of law and has certain responsibilities

towards the society in which it operates. Thus, wealth maximization as an objective is in line

with the other objectives of an organization and not profit maximization. In this document both

the companies have showed that they are in the right track to achieve their organizational

objectives including the objective of wealth maximization by creating value for business.

15

CORPORATE FINANCE

References:

BROWN, H. (2009). THE PRESENT THEORY OF INVESTMENT APPRAISAL: A

CRITICAL ANALYSIS*. Bulletin of the Oxford University Institute of Economics &

Statistics, 31(2), pp.105-131.

Ceil, C. (2012). Corporate Social Responsibility and Wealth Maximization. SSRN Electronic

Journal, 2(5), pp.13-32.

Computershare.com. (2019). [online] Available at:

https://www.computershare.com/News/FY2018_CPU_Annual_Report.pdf [Accessed 18

May 2019].

Efni, Y. (2017). The mediating effect of investment decisions and financing decisions on the

effect of corporate risk and dividend policy against corporate value. Investment

Management and Financial Innovations, 14(2), pp.27-37.

Evolutionmining.com.au. (2019). [online] Available at: https://evolutionmining.com.au/wp-

content/uploads/2018/10/1858627.pdf [Accessed 18 May 2019].

G.K, O. (2015). Effect of Organizational Politics on Organizational Goals and

Objectives. International Journal of Academic Research in Economics and Management

Sciences, 4(3), p.23.

Prempeh, K. and Odartei-Mills, E. (2015). Corporate governance structure and shareholder

wealth maximization. Perspectives of Innovations, Economics and Business, 15(1), pp.1-30.

Rubin, E. (2013). Assessing Your Leadership Style to Achieve Organizational

Objectives. Global Business and Organizational Excellence, 32(6), pp.55-66.

CORPORATE FINANCE

References:

BROWN, H. (2009). THE PRESENT THEORY OF INVESTMENT APPRAISAL: A

CRITICAL ANALYSIS*. Bulletin of the Oxford University Institute of Economics &

Statistics, 31(2), pp.105-131.

Ceil, C. (2012). Corporate Social Responsibility and Wealth Maximization. SSRN Electronic

Journal, 2(5), pp.13-32.

Computershare.com. (2019). [online] Available at:

https://www.computershare.com/News/FY2018_CPU_Annual_Report.pdf [Accessed 18

May 2019].

Efni, Y. (2017). The mediating effect of investment decisions and financing decisions on the

effect of corporate risk and dividend policy against corporate value. Investment

Management and Financial Innovations, 14(2), pp.27-37.

Evolutionmining.com.au. (2019). [online] Available at: https://evolutionmining.com.au/wp-

content/uploads/2018/10/1858627.pdf [Accessed 18 May 2019].

G.K, O. (2015). Effect of Organizational Politics on Organizational Goals and

Objectives. International Journal of Academic Research in Economics and Management

Sciences, 4(3), p.23.

Prempeh, K. and Odartei-Mills, E. (2015). Corporate governance structure and shareholder

wealth maximization. Perspectives of Innovations, Economics and Business, 15(1), pp.1-30.

Rubin, E. (2013). Assessing Your Leadership Style to Achieve Organizational

Objectives. Global Business and Organizational Excellence, 32(6), pp.55-66.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

16

CORPORATE FINANCE

Sharfman, B. (2012). Shareholder Wealth Maximization and Its Role in Corporate Law. SSRN

Electronic Journal, 2(3), pp.13-22.

Walton, T. (2010). Managing Design to Leverage Organizational Objectives. Design

Management Review, 15(3), pp.6-9.

CORPORATE FINANCE

Sharfman, B. (2012). Shareholder Wealth Maximization and Its Role in Corporate Law. SSRN

Electronic Journal, 2(3), pp.13-22.

Walton, T. (2010). Managing Design to Leverage Organizational Objectives. Design

Management Review, 15(3), pp.6-9.

1 out of 17

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.