Corporate Finance Analysis and Project Report - WACC, NPV, Scenarios

VerifiedAdded on 2023/03/21

|9

|871

|54

Report

AI Summary

This report provides a comprehensive analysis of corporate finance principles. It begins by calculating the Weighted Average Cost of Capital (WACC) for a company, interpreting its financial position based on the costs of equity and debt. The report then evaluates the profitability of a proposed project using Net Present Value (NPV) analysis, considering sales, costs, and depreciation to determine cash flows and present values. Furthermore, the report assesses the project's viability under both best-case and worst-case scenarios, analyzing the impact of varying sales revenues and costs on the NPV. Finally, the report defines the role of a finance analyst in the context of the project, emphasizing the importance of efficiency, revenue growth, and investor relations. The report references key academic sources to support its findings.

Corporate Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

A Ascertaining the weighted average cost of capital..................................................................3

B Analysing the condition of the proposed project in a favourable state...................................4

C Determining the project must go ahead as per the case scenario............................................5

D Determining the role of finance analyst..................................................................................6

REFERENCES................................................................................................................................8

A Ascertaining the weighted average cost of capital..................................................................3

B Analysing the condition of the proposed project in a favourable state...................................4

C Determining the project must go ahead as per the case scenario............................................5

D Determining the role of finance analyst..................................................................................6

REFERENCES................................................................................................................................8

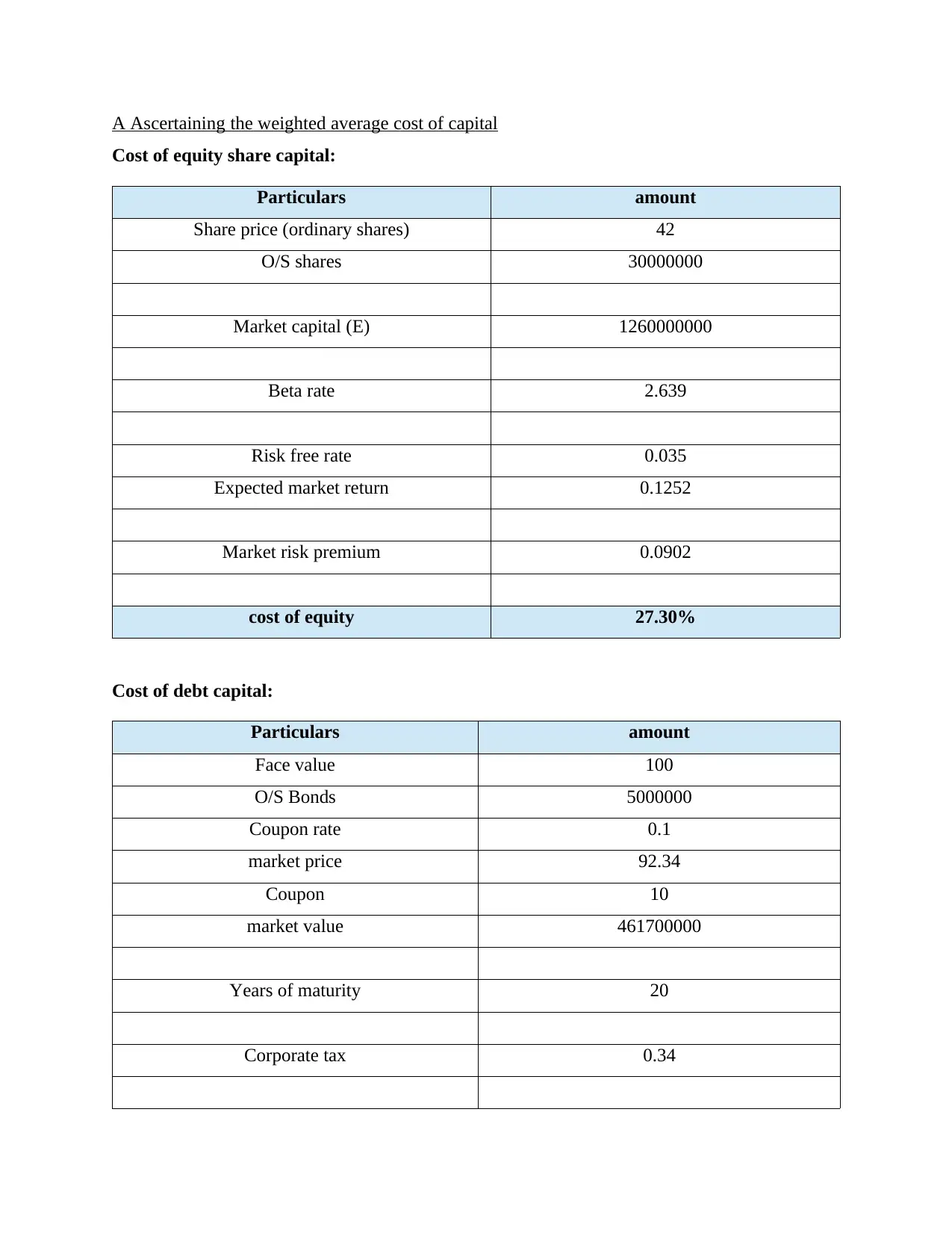

A Ascertaining the weighted average cost of capital

Cost of equity share capital:

Particulars amount

Share price (ordinary shares) 42

O/S shares 30000000

Market capital (E) 1260000000

Beta rate 2.639

Risk free rate 0.035

Expected market return 0.1252

Market risk premium 0.0902

cost of equity 27.30%

Cost of debt capital:

Particulars amount

Face value 100

O/S Bonds 5000000

Coupon rate 0.1

market price 92.34

Coupon 10

market value 461700000

Years of maturity 20

Corporate tax 0.34

Cost of equity share capital:

Particulars amount

Share price (ordinary shares) 42

O/S shares 30000000

Market capital (E) 1260000000

Beta rate 2.639

Risk free rate 0.035

Expected market return 0.1252

Market risk premium 0.0902

cost of equity 27.30%

Cost of debt capital:

Particulars amount

Face value 100

O/S Bonds 5000000

Coupon rate 0.1

market price 92.34

Coupon 10

market value 461700000

Years of maturity 20

Corporate tax 0.34

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

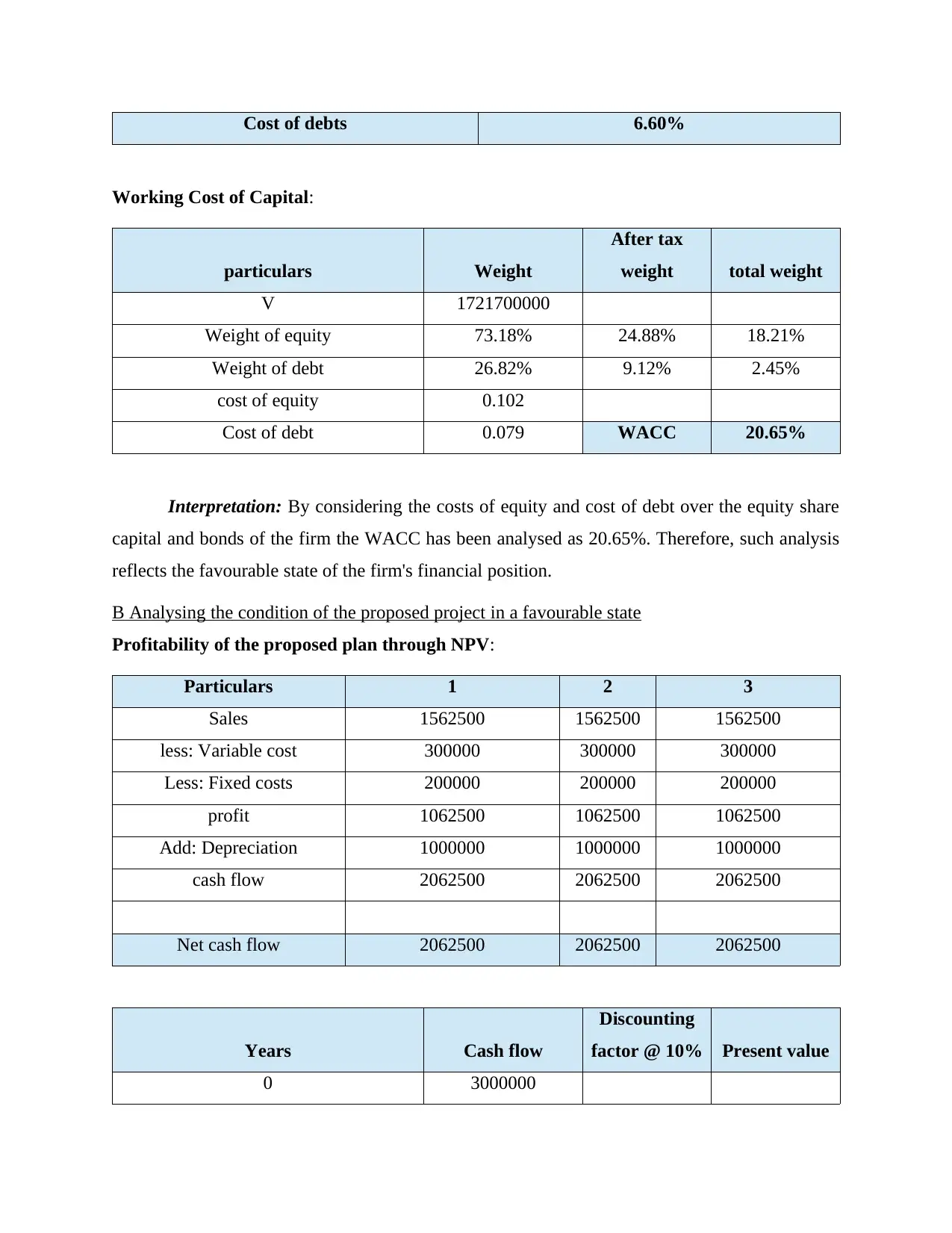

Cost of debts 6.60%

Working Cost of Capital:

particulars Weight

After tax

weight total weight

V 1721700000

Weight of equity 73.18% 24.88% 18.21%

Weight of debt 26.82% 9.12% 2.45%

cost of equity 0.102

Cost of debt 0.079 WACC 20.65%

Interpretation: By considering the costs of equity and cost of debt over the equity share

capital and bonds of the firm the WACC has been analysed as 20.65%. Therefore, such analysis

reflects the favourable state of the firm's financial position.

B Analysing the condition of the proposed project in a favourable state

Profitability of the proposed plan through NPV:

Particulars 1 2 3

Sales 1562500 1562500 1562500

less: Variable cost 300000 300000 300000

Less: Fixed costs 200000 200000 200000

profit 1062500 1062500 1062500

Add: Depreciation 1000000 1000000 1000000

cash flow 2062500 2062500 2062500

Net cash flow 2062500 2062500 2062500

Years Cash flow

Discounting

factor @ 10% Present value

0 3000000

Working Cost of Capital:

particulars Weight

After tax

weight total weight

V 1721700000

Weight of equity 73.18% 24.88% 18.21%

Weight of debt 26.82% 9.12% 2.45%

cost of equity 0.102

Cost of debt 0.079 WACC 20.65%

Interpretation: By considering the costs of equity and cost of debt over the equity share

capital and bonds of the firm the WACC has been analysed as 20.65%. Therefore, such analysis

reflects the favourable state of the firm's financial position.

B Analysing the condition of the proposed project in a favourable state

Profitability of the proposed plan through NPV:

Particulars 1 2 3

Sales 1562500 1562500 1562500

less: Variable cost 300000 300000 300000

Less: Fixed costs 200000 200000 200000

profit 1062500 1062500 1062500

Add: Depreciation 1000000 1000000 1000000

cash flow 2062500 2062500 2062500

Net cash flow 2062500 2062500 2062500

Years Cash flow

Discounting

factor @ 10% Present value

0 3000000

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

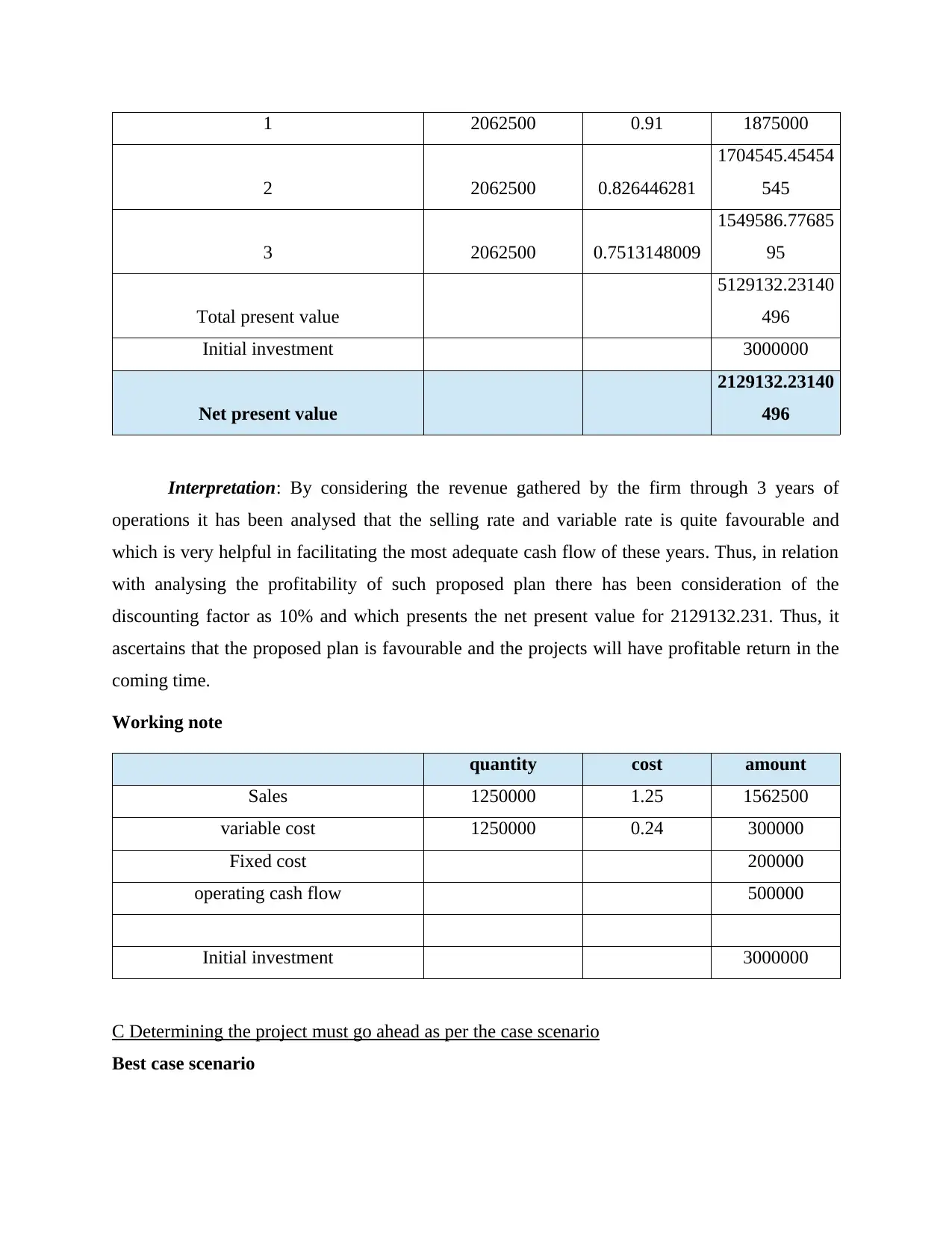

1 2062500 0.91 1875000

2 2062500 0.826446281

1704545.45454

545

3 2062500 0.7513148009

1549586.77685

95

Total present value

5129132.23140

496

Initial investment 3000000

Net present value

2129132.23140

496

Interpretation: By considering the revenue gathered by the firm through 3 years of

operations it has been analysed that the selling rate and variable rate is quite favourable and

which is very helpful in facilitating the most adequate cash flow of these years. Thus, in relation

with analysing the profitability of such proposed plan there has been consideration of the

discounting factor as 10% and which presents the net present value for 2129132.231. Thus, it

ascertains that the proposed plan is favourable and the projects will have profitable return in the

coming time.

Working note

quantity cost amount

Sales 1250000 1.25 1562500

variable cost 1250000 0.24 300000

Fixed cost 200000

operating cash flow 500000

Initial investment 3000000

C Determining the project must go ahead as per the case scenario

Best case scenario

2 2062500 0.826446281

1704545.45454

545

3 2062500 0.7513148009

1549586.77685

95

Total present value

5129132.23140

496

Initial investment 3000000

Net present value

2129132.23140

496

Interpretation: By considering the revenue gathered by the firm through 3 years of

operations it has been analysed that the selling rate and variable rate is quite favourable and

which is very helpful in facilitating the most adequate cash flow of these years. Thus, in relation

with analysing the profitability of such proposed plan there has been consideration of the

discounting factor as 10% and which presents the net present value for 2129132.231. Thus, it

ascertains that the proposed plan is favourable and the projects will have profitable return in the

coming time.

Working note

quantity cost amount

Sales 1250000 1.25 1562500

variable cost 1250000 0.24 300000

Fixed cost 200000

operating cash flow 500000

Initial investment 3000000

C Determining the project must go ahead as per the case scenario

Best case scenario

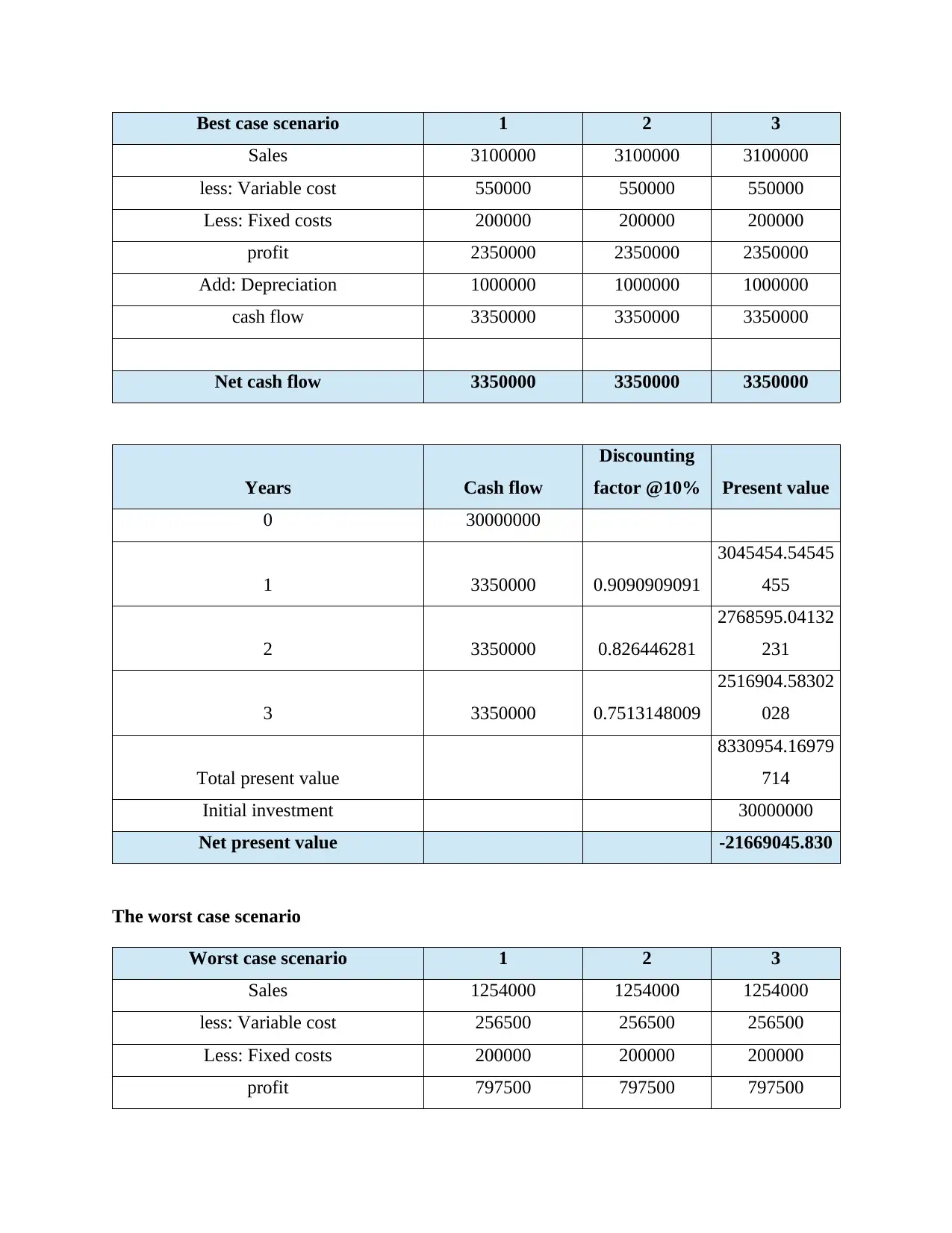

Best case scenario 1 2 3

Sales 3100000 3100000 3100000

less: Variable cost 550000 550000 550000

Less: Fixed costs 200000 200000 200000

profit 2350000 2350000 2350000

Add: Depreciation 1000000 1000000 1000000

cash flow 3350000 3350000 3350000

Net cash flow 3350000 3350000 3350000

Years Cash flow

Discounting

factor @10% Present value

0 30000000

1 3350000 0.9090909091

3045454.54545

455

2 3350000 0.826446281

2768595.04132

231

3 3350000 0.7513148009

2516904.58302

028

Total present value

8330954.16979

714

Initial investment 30000000

Net present value -21669045.830

The worst case scenario

Worst case scenario 1 2 3

Sales 1254000 1254000 1254000

less: Variable cost 256500 256500 256500

Less: Fixed costs 200000 200000 200000

profit 797500 797500 797500

Sales 3100000 3100000 3100000

less: Variable cost 550000 550000 550000

Less: Fixed costs 200000 200000 200000

profit 2350000 2350000 2350000

Add: Depreciation 1000000 1000000 1000000

cash flow 3350000 3350000 3350000

Net cash flow 3350000 3350000 3350000

Years Cash flow

Discounting

factor @10% Present value

0 30000000

1 3350000 0.9090909091

3045454.54545

455

2 3350000 0.826446281

2768595.04132

231

3 3350000 0.7513148009

2516904.58302

028

Total present value

8330954.16979

714

Initial investment 30000000

Net present value -21669045.830

The worst case scenario

Worst case scenario 1 2 3

Sales 1254000 1254000 1254000

less: Variable cost 256500 256500 256500

Less: Fixed costs 200000 200000 200000

profit 797500 797500 797500

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

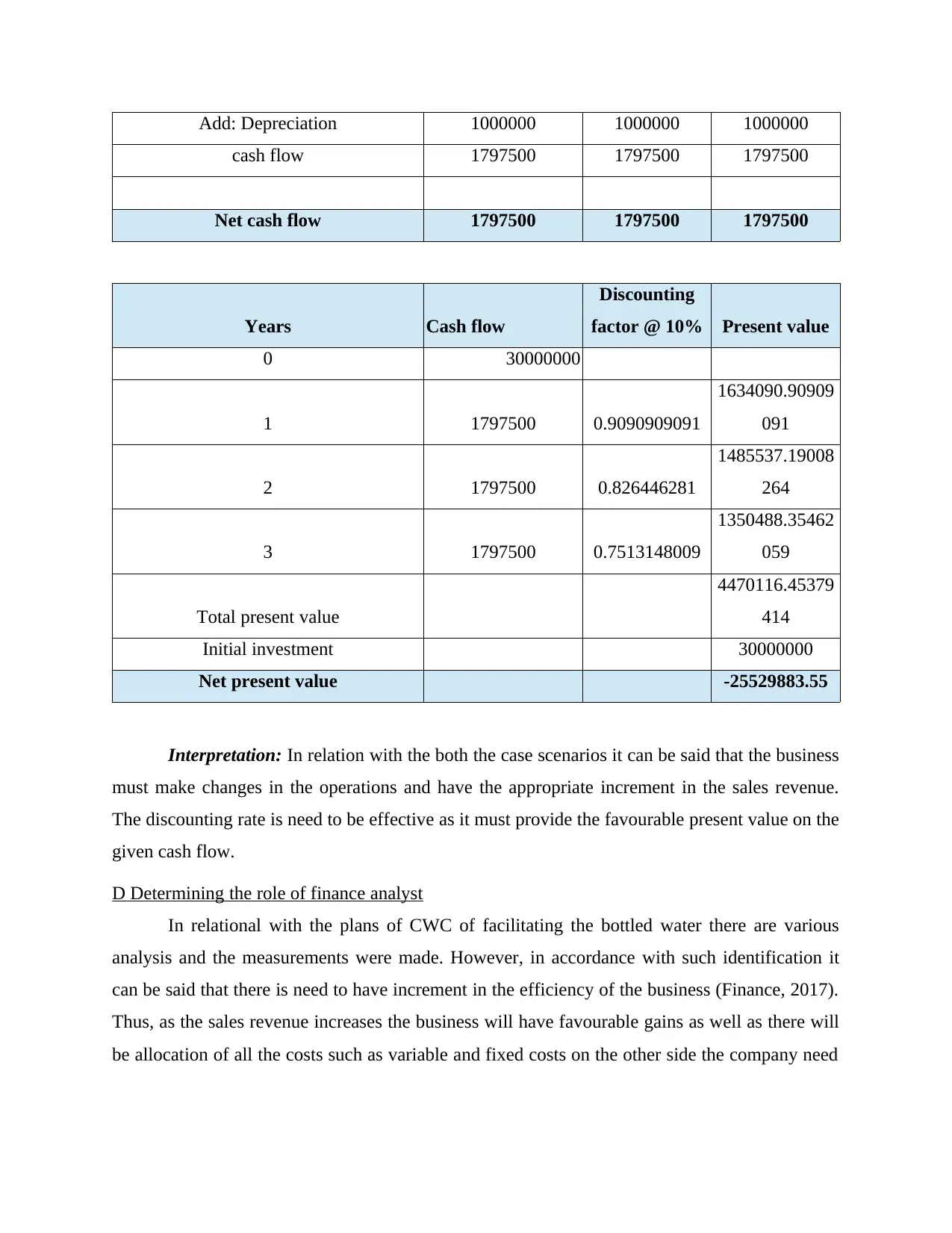

Add: Depreciation 1000000 1000000 1000000

cash flow 1797500 1797500 1797500

Net cash flow 1797500 1797500 1797500

Years Cash flow

Discounting

factor @ 10% Present value

0 30000000

1 1797500 0.9090909091

1634090.90909

091

2 1797500 0.826446281

1485537.19008

264

3 1797500 0.7513148009

1350488.35462

059

Total present value

4470116.45379

414

Initial investment 30000000

Net present value -25529883.55

Interpretation: In relation with the both the case scenarios it can be said that the business

must make changes in the operations and have the appropriate increment in the sales revenue.

The discounting rate is need to be effective as it must provide the favourable present value on the

given cash flow.

D Determining the role of finance analyst

In relational with the plans of CWC of facilitating the bottled water there are various

analysis and the measurements were made. However, in accordance with such identification it

can be said that there is need to have increment in the efficiency of the business (Finance, 2017).

Thus, as the sales revenue increases the business will have favourable gains as well as there will

be allocation of all the costs such as variable and fixed costs on the other side the company need

cash flow 1797500 1797500 1797500

Net cash flow 1797500 1797500 1797500

Years Cash flow

Discounting

factor @ 10% Present value

0 30000000

1 1797500 0.9090909091

1634090.90909

091

2 1797500 0.826446281

1485537.19008

264

3 1797500 0.7513148009

1350488.35462

059

Total present value

4470116.45379

414

Initial investment 30000000

Net present value -25529883.55

Interpretation: In relation with the both the case scenarios it can be said that the business

must make changes in the operations and have the appropriate increment in the sales revenue.

The discounting rate is need to be effective as it must provide the favourable present value on the

given cash flow.

D Determining the role of finance analyst

In relational with the plans of CWC of facilitating the bottled water there are various

analysis and the measurements were made. However, in accordance with such identification it

can be said that there is need to have increment in the efficiency of the business (Finance, 2017).

Thus, as the sales revenue increases the business will have favourable gains as well as there will

be allocation of all the costs such as variable and fixed costs on the other side the company need

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

to seek for the funds and make the appropriate dividend policy which will be attractive to the

investors to make the secured and long term investments in the organisation (Harford, 2018).

investors to make the secured and long term investments in the organisation (Harford, 2018).

REFERENCES

Books and Journals

Finance, C., 2017. Empirical Corporate Finance. Volume A.

Harford, J., 2018. Connections and Context in Finance Research. Asia‐Pacific Journal of

Financial Studies.47(1). pp.7-20.

Books and Journals

Finance, C., 2017. Empirical Corporate Finance. Volume A.

Harford, J., 2018. Connections and Context in Finance Research. Asia‐Pacific Journal of

Financial Studies.47(1). pp.7-20.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.