TFIN603 - Corporate Finance: Analysis of Share Prices and Investment

VerifiedAdded on 2023/06/15

|11

|2475

|145

Report

AI Summary

This corporate finance report analyzes the share prices of QBE Ltd. and IAG Ltd., examining their evolution and volatility based on systematic and unsystematic risks. It evaluates various investment scenarios using methods like future value calculation, effective annual rate (EAR), present value of annuity, payback period, net present value (NPV), and equivalent annual annuity (EAA). The report also assesses return on investment and discusses the preference of financial analysts for NPV over IRR and discounted payback models. The analysis leads to conclusions about the relative performance of QBE and IAG, the suitability of different investment projects, and the importance of NPV in determining investment value. Desklib provides students access to a variety of solved assignments and resources for similar topics.

Corporate Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

INTRODUCTION ..........................................................................................................................3

PART A...........................................................................................................................................3

Question 1........................................................................................................................................3

a) Determine the current ordinary share price of IAG Ltd. and QBE Ltd. And give a graphs of

the evolvement of the last 5 years of the company.....................................................................3

b) Define the systematic an unsystematic risk and determine whose share price is more

volatile, IAG or QBE..................................................................................................................4

PART B............................................................................................................................................5

Question 1........................................................................................................................................5

a) Calculate the future value on a compounded quarterly interest rate.......................................5

b) Determine the Effective annual rate of return (EAR).............................................................5

c) Determine the present value of annuity, compounded semi – annually.................................5

d) Calculate the annual rate of interest on bank account............................................................6

e) Evaluate the approximate real interest rate.............................................................................6

Question 2........................................................................................................................................6

a) Give a decision based on the payback technique which the projects should be accepted or

not................................................................................................................................................6

b) Evaluate the NPV and give a decision....................................................................................7

c) Give a decision that which project should be selected based of the EAA technique..............8

Question 3........................................................................................................................................8

a) Evaluate the return on investment for the holding period.......................................................8

b) Determine the value of Huawei's shares.................................................................................8

c) Calculate the required rate of return of ANZ shares, using CAPM........................................8

Question 4........................................................................................................................................9

Briefly discuss that what academic analysts prefer IRR or no discounted payback mode above

NPV.............................................................................................................................................9

CONCLUSION .............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION ..........................................................................................................................3

PART A...........................................................................................................................................3

Question 1........................................................................................................................................3

a) Determine the current ordinary share price of IAG Ltd. and QBE Ltd. And give a graphs of

the evolvement of the last 5 years of the company.....................................................................3

b) Define the systematic an unsystematic risk and determine whose share price is more

volatile, IAG or QBE..................................................................................................................4

PART B............................................................................................................................................5

Question 1........................................................................................................................................5

a) Calculate the future value on a compounded quarterly interest rate.......................................5

b) Determine the Effective annual rate of return (EAR).............................................................5

c) Determine the present value of annuity, compounded semi – annually.................................5

d) Calculate the annual rate of interest on bank account............................................................6

e) Evaluate the approximate real interest rate.............................................................................6

Question 2........................................................................................................................................6

a) Give a decision based on the payback technique which the projects should be accepted or

not................................................................................................................................................6

b) Evaluate the NPV and give a decision....................................................................................7

c) Give a decision that which project should be selected based of the EAA technique..............8

Question 3........................................................................................................................................8

a) Evaluate the return on investment for the holding period.......................................................8

b) Determine the value of Huawei's shares.................................................................................8

c) Calculate the required rate of return of ANZ shares, using CAPM........................................8

Question 4........................................................................................................................................9

Briefly discuss that what academic analysts prefer IRR or no discounted payback mode above

NPV.............................................................................................................................................9

CONCLUSION .............................................................................................................................10

REFERENCES..............................................................................................................................11

INTRODUCTION

Corporate finance is an area which deals which the funds, capital budgeting, share prices,

and helps in measuring the volatility of the company (Alter and Elekdag, 2020). In this report,

The current market price of two companies called QBE and IAG is determined by noting the

important points of their evolvement. Then the volatility of both the organisations are evaluated

based on the systematic and unsystematic risks. Further, The different types rate of return and the

future value of the investment were assessed. Moreover, the payback period, NPV and IRR was

calculated and decision will be made based on the present value of both the projects C & D.

Then, the return on investment is calculated based on different methods. Furthermore, the

preference of financial analysts on the basis of NPV, payback and IRR.

PART A

Question 1

a) Determine the current ordinary share price of IAG Ltd. and QBE Ltd. And give a graphs of the

evolvement of the last 5 years of the company.

The Current market price of IAG LTD = $ 4.37

QBE Ltd. = $ 11.60

Corporate finance is an area which deals which the funds, capital budgeting, share prices,

and helps in measuring the volatility of the company (Alter and Elekdag, 2020). In this report,

The current market price of two companies called QBE and IAG is determined by noting the

important points of their evolvement. Then the volatility of both the organisations are evaluated

based on the systematic and unsystematic risks. Further, The different types rate of return and the

future value of the investment were assessed. Moreover, the payback period, NPV and IRR was

calculated and decision will be made based on the present value of both the projects C & D.

Then, the return on investment is calculated based on different methods. Furthermore, the

preference of financial analysts on the basis of NPV, payback and IRR.

PART A

Question 1

a) Determine the current ordinary share price of IAG Ltd. and QBE Ltd. And give a graphs of the

evolvement of the last 5 years of the company.

The Current market price of IAG LTD = $ 4.37

QBE Ltd. = $ 11.60

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

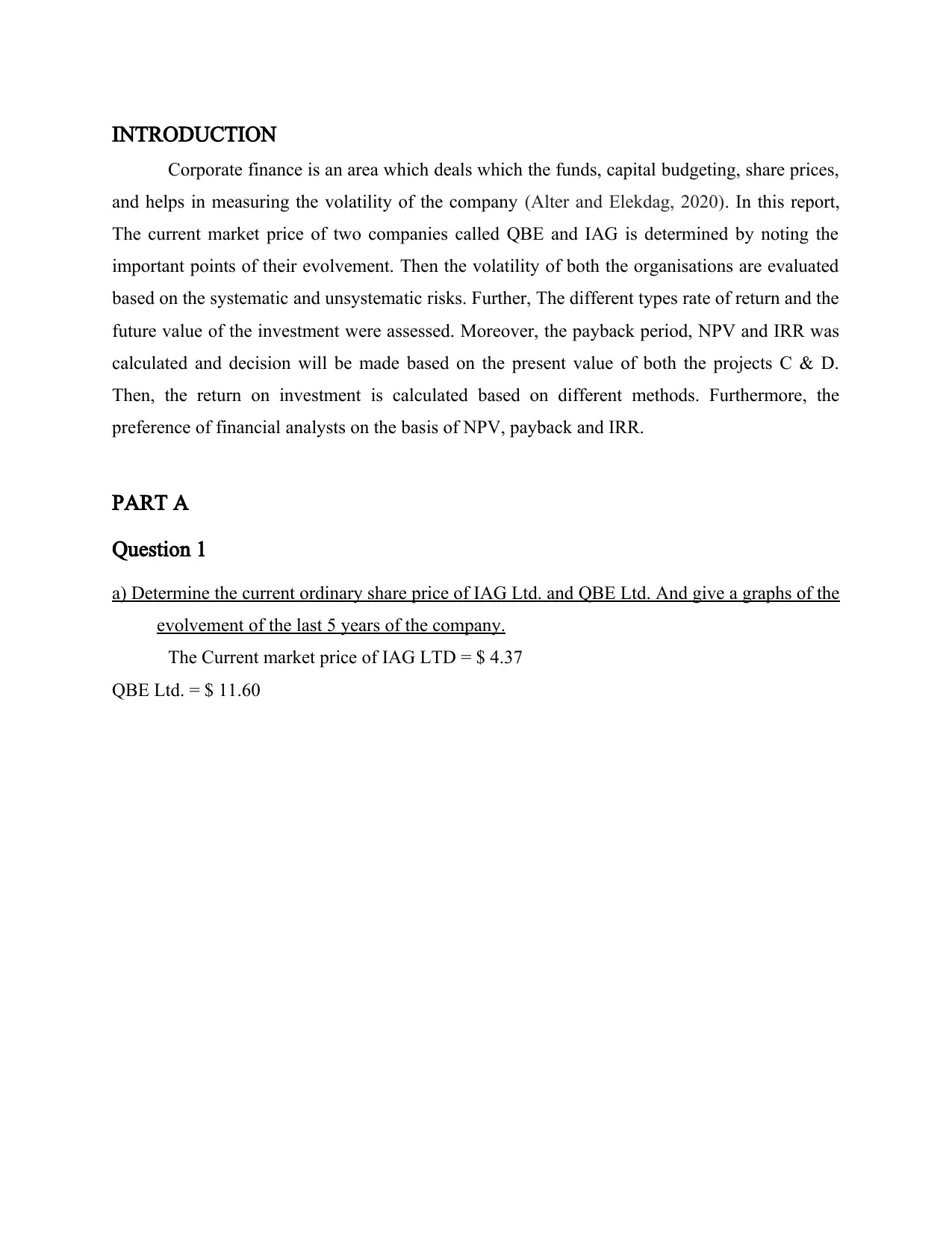

Both the companies have evolved over the years. The QBE Ltd. has a fluctuation performant If

see the market prices of the company. It has not shown a major growth in the last 5 years. In

2020, its market price went high which was around $ 11.600 but then again it slowed down. It is

not showing a constant growth. So, it needs to work on its financial strategy to get more

investors and to increase the monetary health of the organisation.

However, IAG Ltd. has shown a growth in this share price. But, in 2020, it has decreased so

much less. But now it is recovering and is able to increase its market price.

b) Define the systematic an unsystematic risk and determine whose share price is more volatile,

IAG or QBE.

Systematic Risk: This type of risks are non – diversifiable and are inherent to the whole

market.

Unsystematic Risk: This is a risk which is diversifiable or residual. It means it can be reduced

through the diversification.

Drawing : IAG Share price, 2021

Drawin

g 1: Trading Economics, QBE, 2021

see the market prices of the company. It has not shown a major growth in the last 5 years. In

2020, its market price went high which was around $ 11.600 but then again it slowed down. It is

not showing a constant growth. So, it needs to work on its financial strategy to get more

investors and to increase the monetary health of the organisation.

However, IAG Ltd. has shown a growth in this share price. But, in 2020, it has decreased so

much less. But now it is recovering and is able to increase its market price.

b) Define the systematic an unsystematic risk and determine whose share price is more volatile,

IAG or QBE.

Systematic Risk: This type of risks are non – diversifiable and are inherent to the whole

market.

Unsystematic Risk: This is a risk which is diversifiable or residual. It means it can be reduced

through the diversification.

Drawing : IAG Share price, 2021

Drawin

g 1: Trading Economics, QBE, 2021

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Factors of the systematic risk

1. Inflation: The whole North – America wr4e severely troubled when the pandemic rose.

Even due to the hurricane in the Atlantic cause many accidents, run – off their portfolios

(Asmala and Kushendar, 2020).

2. Fall in prices: It results in the fall of prices.

From the analysis of the share prices, it can be said that that the IAG Ltd. Share price

value is more volatile..

PART B

Question 1

a) Calculate the future value on a compounded quarterly interest rate.

Investment = $ 1200

Interest rate = 6 % p.a.

Time period = 3 years

Future Value = Present Value * [1 + (i / 4)]4n

= 1200 * [ 1 + 0.06 / 4]4*3

= 1200 * [ 1 + 0.015]12

= 1200 * (1.015)12 = 1200 * 1.1956

= $ 1434.74.

b) Determine the Effective annual rate of return (EAR).

EAR = [ 1 – (interest rate / Compounding periods)Compounding Periods – 1]

= [ 1 – (0.06 / 4)4 – 1]

= [ 1 – (0.015)4 – 1] = 6.1 %.

c) Determine the present value of annuity, compounded semi – annually.

Present value of annuity = Each annuity payment * { 1 – [1 / (1 + r)n] /r}

= 265 * { 1 – [1 / (1+ 0.09) ^ 24] / 0.09}

= 265 * { 1 - [ 1 / 7.91] / 0.09}

1. Inflation: The whole North – America wr4e severely troubled when the pandemic rose.

Even due to the hurricane in the Atlantic cause many accidents, run – off their portfolios

(Asmala and Kushendar, 2020).

2. Fall in prices: It results in the fall of prices.

From the analysis of the share prices, it can be said that that the IAG Ltd. Share price

value is more volatile..

PART B

Question 1

a) Calculate the future value on a compounded quarterly interest rate.

Investment = $ 1200

Interest rate = 6 % p.a.

Time period = 3 years

Future Value = Present Value * [1 + (i / 4)]4n

= 1200 * [ 1 + 0.06 / 4]4*3

= 1200 * [ 1 + 0.015]12

= 1200 * (1.015)12 = 1200 * 1.1956

= $ 1434.74.

b) Determine the Effective annual rate of return (EAR).

EAR = [ 1 – (interest rate / Compounding periods)Compounding Periods – 1]

= [ 1 – (0.06 / 4)4 – 1]

= [ 1 – (0.015)4 – 1] = 6.1 %.

c) Determine the present value of annuity, compounded semi – annually.

Present value of annuity = Each annuity payment * { 1 – [1 / (1 + r)n] /r}

= 265 * { 1 – [1 / (1+ 0.09) ^ 24] / 0.09}

= 265 * { 1 - [ 1 / 7.91] / 0.09}

= 265 * {(1 – 0.126 )/ 0.09}

= 265 * (0.874 / 0.09) = 265 * 9.711

= $ 2573.415.

d) Calculate the annual rate of interest on bank account.

Rate = amount / Principle * time

= 183.85 / 100 * 9

= 183.85 / 900 = 0.204 * 100 = 20.42 %.

e) Evaluate the approximate real interest rate.

Real interest rate = Nominal interest rate – Expected inflation

= 11 – 8 = 3 %.

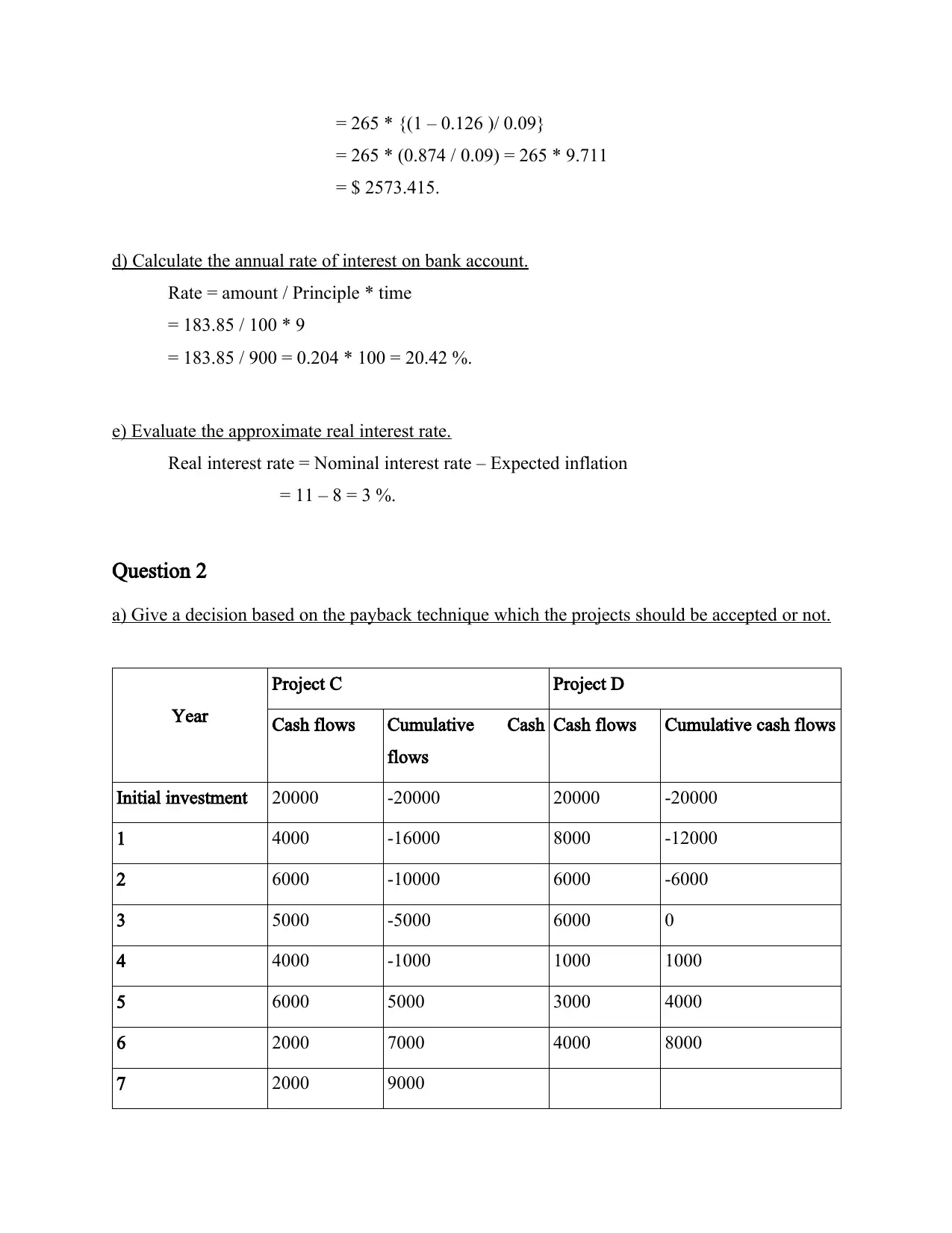

Question 2

a) Give a decision based on the payback technique which the projects should be accepted or not.

Year

Project C Project D

Cash flows Cumulative Cash

flows

Cash flows Cumulative cash flows

Initial investment 20000 -20000 20000 -20000

1 4000 -16000 8000 -12000

2 6000 -10000 6000 -6000

3 5000 -5000 6000 0

4 4000 -1000 1000 1000

5 6000 5000 3000 4000

6 2000 7000 4000 8000

7 2000 9000

= 265 * (0.874 / 0.09) = 265 * 9.711

= $ 2573.415.

d) Calculate the annual rate of interest on bank account.

Rate = amount / Principle * time

= 183.85 / 100 * 9

= 183.85 / 900 = 0.204 * 100 = 20.42 %.

e) Evaluate the approximate real interest rate.

Real interest rate = Nominal interest rate – Expected inflation

= 11 – 8 = 3 %.

Question 2

a) Give a decision based on the payback technique which the projects should be accepted or not.

Year

Project C Project D

Cash flows Cumulative Cash

flows

Cash flows Cumulative cash flows

Initial investment 20000 -20000 20000 -20000

1 4000 -16000 8000 -12000

2 6000 -10000 6000 -6000

3 5000 -5000 6000 0

4 4000 -1000 1000 1000

5 6000 5000 3000 4000

6 2000 7000 4000 8000

7 2000 9000

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

8 2000 11000

Payback Formula = The period up to n – 1 + (Cumulative cash flow of n – 1 year / Cash flow n

year)

Project C = 4 + (1000 / 6000)

= 4 + 0.167 = 4.167 years

= 4 years and 2 months approximately.

Project D = 2 + ( 6000 / 6000)

= 2 + 1 = 3 years.

Decision: By calculating the payback period for the project C & D, it can be evaluated that

Project D should be selected and Project C should be rejected. As, the maximum time for pay

back was 4 years by the Project C is giving return in more than 4 years and Project D is giving

return in only 3 years.

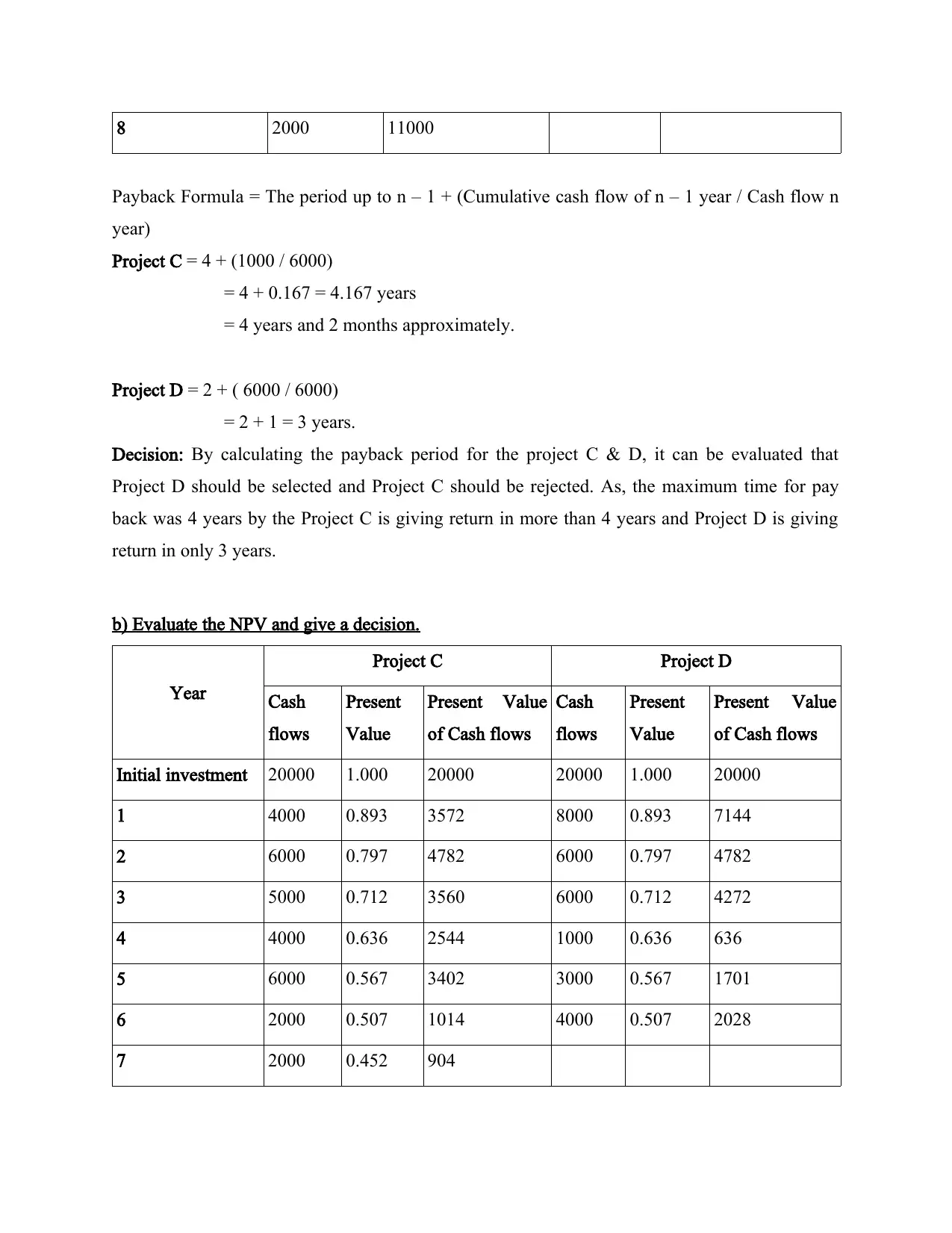

b) Evaluate the NPV and give a decision.

Year

Project C Project D

Cash

flows

Present

Value

Present Value

of Cash flows

Cash

flows

Present

Value

Present Value

of Cash flows

Initial investment 20000 1.000 20000 20000 1.000 20000

1 4000 0.893 3572 8000 0.893 7144

2 6000 0.797 4782 6000 0.797 4782

3 5000 0.712 3560 6000 0.712 4272

4 4000 0.636 2544 1000 0.636 636

5 6000 0.567 3402 3000 0.567 1701

6 2000 0.507 1014 4000 0.507 2028

7 2000 0.452 904

Payback Formula = The period up to n – 1 + (Cumulative cash flow of n – 1 year / Cash flow n

year)

Project C = 4 + (1000 / 6000)

= 4 + 0.167 = 4.167 years

= 4 years and 2 months approximately.

Project D = 2 + ( 6000 / 6000)

= 2 + 1 = 3 years.

Decision: By calculating the payback period for the project C & D, it can be evaluated that

Project D should be selected and Project C should be rejected. As, the maximum time for pay

back was 4 years by the Project C is giving return in more than 4 years and Project D is giving

return in only 3 years.

b) Evaluate the NPV and give a decision.

Year

Project C Project D

Cash

flows

Present

Value

Present Value

of Cash flows

Cash

flows

Present

Value

Present Value

of Cash flows

Initial investment 20000 1.000 20000 20000 1.000 20000

1 4000 0.893 3572 8000 0.893 7144

2 6000 0.797 4782 6000 0.797 4782

3 5000 0.712 3560 6000 0.712 4272

4 4000 0.636 2544 1000 0.636 636

5 6000 0.567 3402 3000 0.567 1701

6 2000 0.507 1014 4000 0.507 2028

7 2000 0.452 904

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8 2000 0.404 808

Totals 20586 20563

NPV = Present value Cash flows – Initial Investment

Project C = 20586 – 20000 = $ 586.

Project D = 20563 – 20000 = $ 563.

Decision: based on the above calculation of NPV, project C with NPV $ 586 should be selected

as its net prevent Value is more than that of Project D which is $ 563.

c) Give a decision that which project should be selected based of the EAA technique.

EAA = ( r * NPV) / [ 1 – (1 + r) -n]

Project C = (12 % * $ 586) / [1 - ( 1 + 12 % )-8]

= 70.2 / [1 – (1.12)-8]

= 70.2 / 1 – 0.404

= 70.2 / 0.596 = 117.79

Project D = (12 % * $ 563) / [ 1 – (1+ 12 %)-6]

= 67.56 / [ 1 – (1.12)-6]

= 67.56 / 1 – 0.507

= 67.56 / 0.493 = 137.04

Decision: It tell the average cash flow from each project will be. The EAA of Project D is more,

so this will be selected.

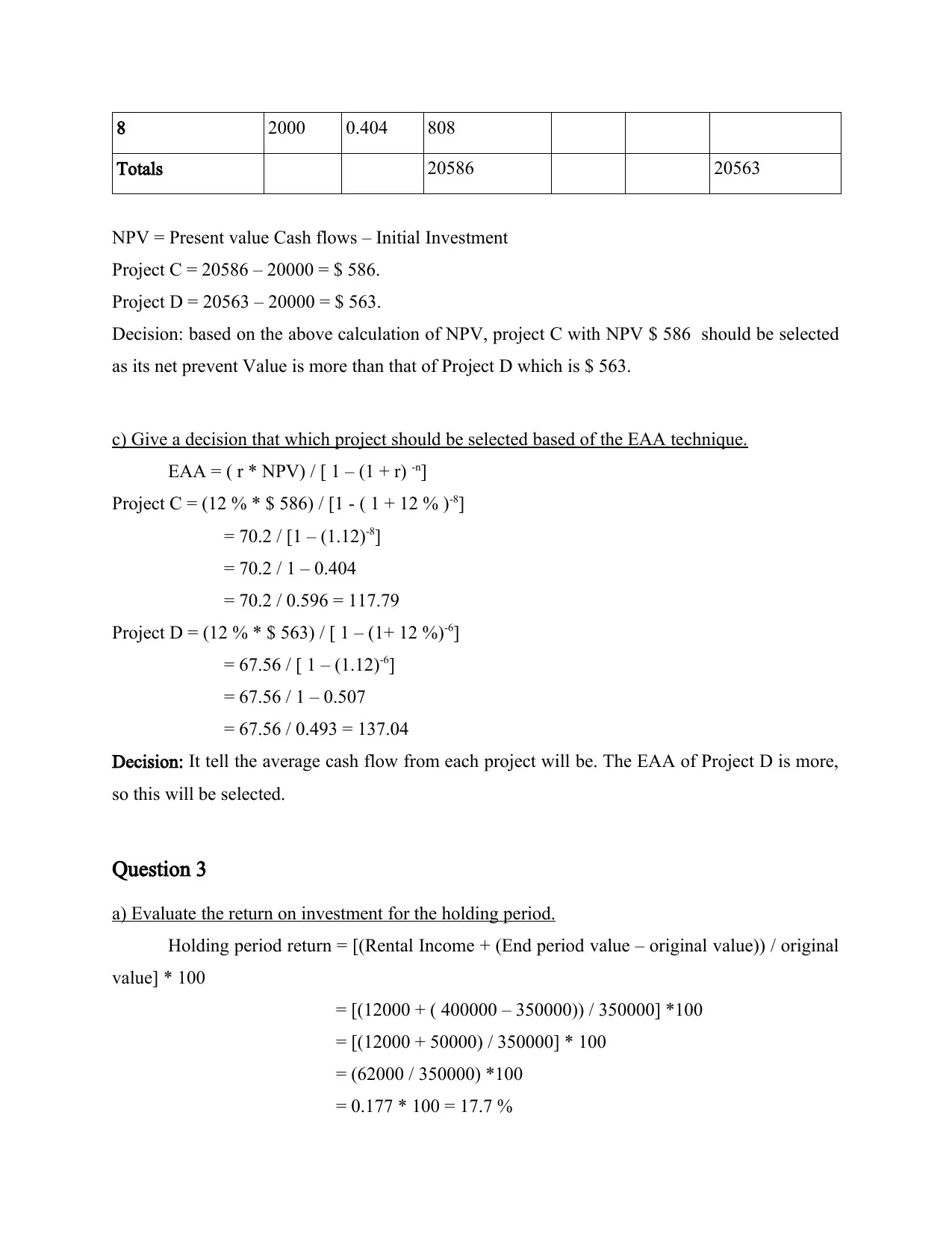

Question 3

a) Evaluate the return on investment for the holding period.

Holding period return = [(Rental Income + (End period value – original value)) / original

value] * 100

= [(12000 + ( 400000 – 350000)) / 350000] *100

= [(12000 + 50000) / 350000] * 100

= (62000 / 350000) *100

= 0.177 * 100 = 17.7 %

Totals 20586 20563

NPV = Present value Cash flows – Initial Investment

Project C = 20586 – 20000 = $ 586.

Project D = 20563 – 20000 = $ 563.

Decision: based on the above calculation of NPV, project C with NPV $ 586 should be selected

as its net prevent Value is more than that of Project D which is $ 563.

c) Give a decision that which project should be selected based of the EAA technique.

EAA = ( r * NPV) / [ 1 – (1 + r) -n]

Project C = (12 % * $ 586) / [1 - ( 1 + 12 % )-8]

= 70.2 / [1 – (1.12)-8]

= 70.2 / 1 – 0.404

= 70.2 / 0.596 = 117.79

Project D = (12 % * $ 563) / [ 1 – (1+ 12 %)-6]

= 67.56 / [ 1 – (1.12)-6]

= 67.56 / 1 – 0.507

= 67.56 / 0.493 = 137.04

Decision: It tell the average cash flow from each project will be. The EAA of Project D is more,

so this will be selected.

Question 3

a) Evaluate the return on investment for the holding period.

Holding period return = [(Rental Income + (End period value – original value)) / original

value] * 100

= [(12000 + ( 400000 – 350000)) / 350000] *100

= [(12000 + 50000) / 350000] * 100

= (62000 / 350000) *100

= 0.177 * 100 = 17.7 %

The Yin Zhang's holding period rerun on investment is 17.7 %.

b) Determine the value of Huawei's shares.

Stock Value = Dividend per share / ( Required rate of return – dividend growth rate)

= 0.90 / (15 % - 10 %)

= 0.90 / 5% = $ 18.

c) Calculate the required rate of return of ANZ shares, using CAPM.

Rf = 3 %

Beta = 1.2

RM = 12 %

RRR = Risk free rate of return + Beta * ( Market rate – risk free rate)

= 0.03 + 1.2 * (1.2 – 0.03)

= 0.03 + 1.2 * 1.17

= 0.03 + 1.404 = 1.434%

The required rate of return for ANZ share should be 1.434 %.

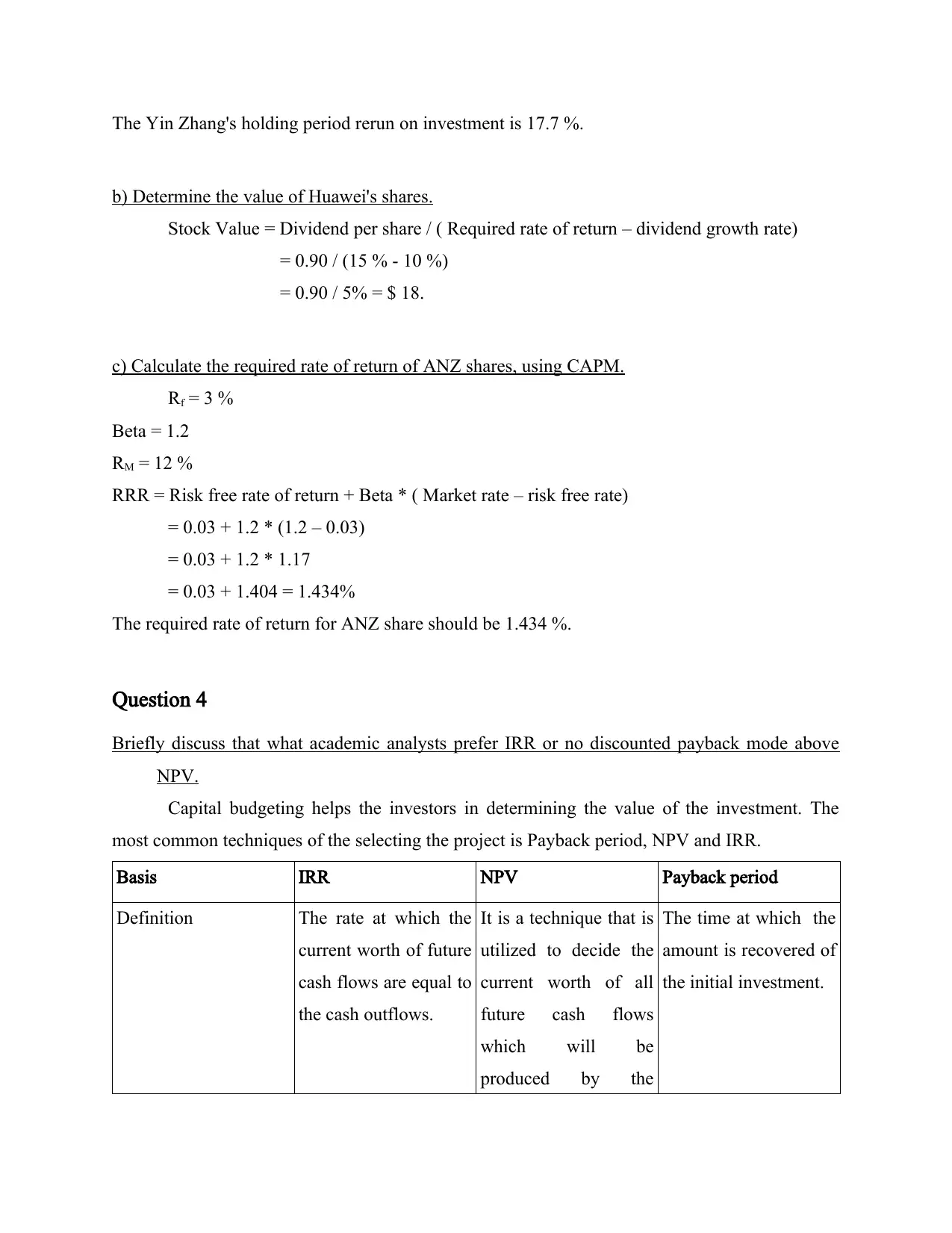

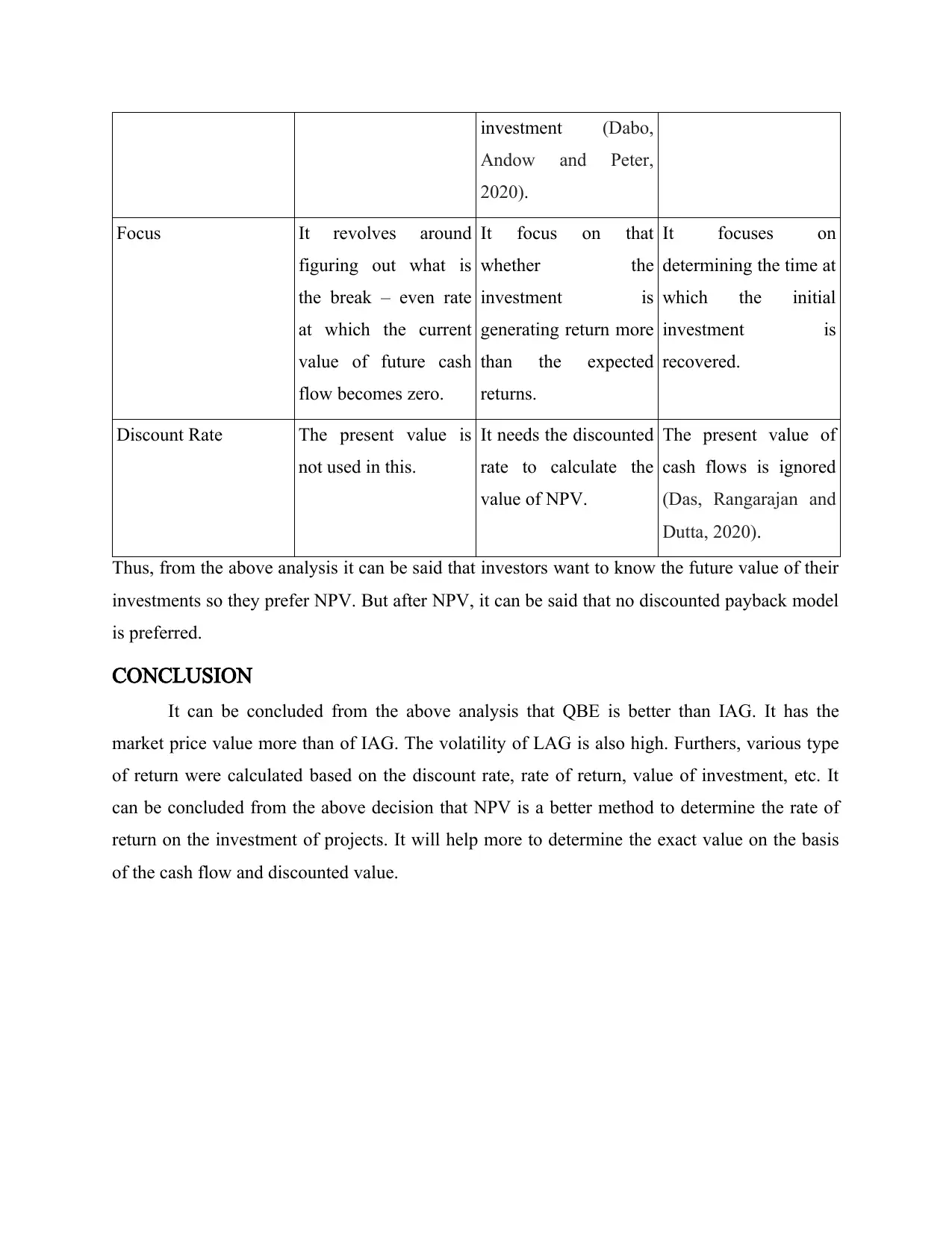

Question 4

Briefly discuss that what academic analysts prefer IRR or no discounted payback mode above

NPV.

Capital budgeting helps the investors in determining the value of the investment. The

most common techniques of the selecting the project is Payback period, NPV and IRR.

Basis IRR NPV Payback period

Definition The rate at which the

current worth of future

cash flows are equal to

the cash outflows.

It is a technique that is

utilized to decide the

current worth of all

future cash flows

which will be

produced by the

The time at which the

amount is recovered of

the initial investment.

b) Determine the value of Huawei's shares.

Stock Value = Dividend per share / ( Required rate of return – dividend growth rate)

= 0.90 / (15 % - 10 %)

= 0.90 / 5% = $ 18.

c) Calculate the required rate of return of ANZ shares, using CAPM.

Rf = 3 %

Beta = 1.2

RM = 12 %

RRR = Risk free rate of return + Beta * ( Market rate – risk free rate)

= 0.03 + 1.2 * (1.2 – 0.03)

= 0.03 + 1.2 * 1.17

= 0.03 + 1.404 = 1.434%

The required rate of return for ANZ share should be 1.434 %.

Question 4

Briefly discuss that what academic analysts prefer IRR or no discounted payback mode above

NPV.

Capital budgeting helps the investors in determining the value of the investment. The

most common techniques of the selecting the project is Payback period, NPV and IRR.

Basis IRR NPV Payback period

Definition The rate at which the

current worth of future

cash flows are equal to

the cash outflows.

It is a technique that is

utilized to decide the

current worth of all

future cash flows

which will be

produced by the

The time at which the

amount is recovered of

the initial investment.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

investment (Dabo,

Andow and Peter,

2020).

Focus It revolves around

figuring out what is

the break – even rate

at which the current

value of future cash

flow becomes zero.

It focus on that

whether the

investment is

generating return more

than the expected

returns.

It focuses on

determining the time at

which the initial

investment is

recovered.

Discount Rate The present value is

not used in this.

It needs the discounted

rate to calculate the

value of NPV.

The present value of

cash flows is ignored

(Das, Rangarajan and

Dutta, 2020).

Thus, from the above analysis it can be said that investors want to know the future value of their

investments so they prefer NPV. But after NPV, it can be said that no discounted payback model

is preferred.

CONCLUSION

It can be concluded from the above analysis that QBE is better than IAG. It has the

market price value more than of IAG. The volatility of LAG is also high. Furthers, various type

of return were calculated based on the discount rate, rate of return, value of investment, etc. It

can be concluded from the above decision that NPV is a better method to determine the rate of

return on the investment of projects. It will help more to determine the exact value on the basis

of the cash flow and discounted value.

Andow and Peter,

2020).

Focus It revolves around

figuring out what is

the break – even rate

at which the current

value of future cash

flow becomes zero.

It focus on that

whether the

investment is

generating return more

than the expected

returns.

It focuses on

determining the time at

which the initial

investment is

recovered.

Discount Rate The present value is

not used in this.

It needs the discounted

rate to calculate the

value of NPV.

The present value of

cash flows is ignored

(Das, Rangarajan and

Dutta, 2020).

Thus, from the above analysis it can be said that investors want to know the future value of their

investments so they prefer NPV. But after NPV, it can be said that no discounted payback model

is preferred.

CONCLUSION

It can be concluded from the above analysis that QBE is better than IAG. It has the

market price value more than of IAG. The volatility of LAG is also high. Furthers, various type

of return were calculated based on the discount rate, rate of return, value of investment, etc. It

can be concluded from the above decision that NPV is a better method to determine the rate of

return on the investment of projects. It will help more to determine the exact value on the basis

of the cash flow and discounted value.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Alter, A. and Elekdag, S., 2020. Emerging market corporate leverage and global financial

conditions.

Journal of Corporate Finance. 62. p.101590.

Asmala, T. and Kushendar, D.H., 2020. Proyek Pengembangan Kebun Binatang (Analisis

Investasi Kebun Binatang Tamansari Bandung, Jawa Barat, Indonesia)[Zoo

Development Project (Analysis of Tamansari Zoo Investment in Bandung, West Java,

Indonesia)].

Jurnal Bina Administrasi. 7(1).pp.1-15.

Dabo, Z., Andow, H.A. and Peter, A.A., 2020. ASSESSMENT OF WORKING CAPITAL

MANAGEMENT ON PROFITABILITY OF LISTED MANUFACTURING FIRMS

IN NIGERIA.

Ilorin Journal of Human Resource Management. 4(1). pp.12-22.

Das, M., Rangarajan, K. and Dutta, G., 2020. Corporate sustainability in SMEs: an Asian

perspective.

Journal of Asia Business Studies.

Liu, Z. and et. al., 2021. Corporate environmental performance and financing constraints: An

empirical study in the Chinese context.

Corporate Social Responsibility and

Environmental Management. 28(2). pp.616-629.

Patel, H. and et. al., 2020. Economic evaluation of solar-driven thermochemical conversion of

empty cotton boll biomass to syngas and potassic fertilizer.

Energy Conversion and

Management. 209. p.112631.

Pham, H., Pham, T. and Dang, C.N., 2021. Barriers to corporate social responsibility practices in

construction and roles of education and government support.

Engineering, Construction

and Architectural Management.

Wong, E. and Swei, O., 2021. New Construction Cost Indices to Improve Highway

Management.

Journal of Management in Engineering. 37(4). p.04021030.

Books and Journals

Alter, A. and Elekdag, S., 2020. Emerging market corporate leverage and global financial

conditions.

Journal of Corporate Finance. 62. p.101590.

Asmala, T. and Kushendar, D.H., 2020. Proyek Pengembangan Kebun Binatang (Analisis

Investasi Kebun Binatang Tamansari Bandung, Jawa Barat, Indonesia)[Zoo

Development Project (Analysis of Tamansari Zoo Investment in Bandung, West Java,

Indonesia)].

Jurnal Bina Administrasi. 7(1).pp.1-15.

Dabo, Z., Andow, H.A. and Peter, A.A., 2020. ASSESSMENT OF WORKING CAPITAL

MANAGEMENT ON PROFITABILITY OF LISTED MANUFACTURING FIRMS

IN NIGERIA.

Ilorin Journal of Human Resource Management. 4(1). pp.12-22.

Das, M., Rangarajan, K. and Dutta, G., 2020. Corporate sustainability in SMEs: an Asian

perspective.

Journal of Asia Business Studies.

Liu, Z. and et. al., 2021. Corporate environmental performance and financing constraints: An

empirical study in the Chinese context.

Corporate Social Responsibility and

Environmental Management. 28(2). pp.616-629.

Patel, H. and et. al., 2020. Economic evaluation of solar-driven thermochemical conversion of

empty cotton boll biomass to syngas and potassic fertilizer.

Energy Conversion and

Management. 209. p.112631.

Pham, H., Pham, T. and Dang, C.N., 2021. Barriers to corporate social responsibility practices in

construction and roles of education and government support.

Engineering, Construction

and Architectural Management.

Wong, E. and Swei, O., 2021. New Construction Cost Indices to Improve Highway

Management.

Journal of Management in Engineering. 37(4). p.04021030.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.