Corporate Finance: Dividend Hypothesis, Repurchase Analysis, Returns

VerifiedAdded on 2020/03/16

|7

|1228

|33

Homework Assignment

AI Summary

This corporate finance assignment explores the dividend hypothesis, reasons for stock repurchases over dividends under a classical tax system, and return calculations. The assignment delves into the information content or signaling hypothesis, free cash flow hypothesis, and clientele effect related to dividends. It analyzes the advantages of stock repurchases, particularly their tax efficiency and flexibility compared to dividends. The document includes a calculation of returns for a given stock, demonstrating the practical application of financial concepts. The analysis also highlights the irrelevance of dividend-related theories due to the company's dividend history. The student has provided a complete analysis of the subject, making it a good resource for students to understand the concepts.

Running head: CORPORATE FINANCE

Corporate finance

Name of the student

Name of the university

Author note

Corporate finance

Name of the student

Name of the university

Author note

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCE

Table of Contents

(a) Dividend hypothesis........................................................................................................2

(b) Reasons behind choosing repurchase against dividend under classical tax system........3

(c) Calculation of return.......................................................................................................4

Reference....................................................................................................................................6

Table of Contents

(a) Dividend hypothesis........................................................................................................2

(b) Reasons behind choosing repurchase against dividend under classical tax system........3

(c) Calculation of return.......................................................................................................4

Reference....................................................................................................................................6

2CORPORATE FINANCE

(a) Dividend hypothesis

i. Information content or signalling hypothesis

The with regard to information among the outsiders and may lead to the actual

intrinsic value of the organization not to be available in the market. In accordance with that

the share price may not be accurate measure all the time for computing the organization’s

value. The M&M approach recommends that while the markets are not perfect, the price of

the shares may respond to the changes in the dividend. To be more specific, the

announcement of dividend may seem to communicate the implicit information regarding the

potential of the organization’s future earnings (Anwar, Singh & Jain, 2016). This proposition

of dividend hypothesis is known as the information content of the dividends or the signalling

hypothesis.

ii. Free cash flow hypothesis

Under this approach, all things being equal the organization make the payment of

dividend from the cash flows that are not available for reinvestment in the projects associated

with positive (NPV) net present value that have the higher values as compared to the free

cash flow retained by the organization.

iii. Clientele effect

As the investors are generally interested regarding the after tax return of the

investment, the capital gains and various tax treatment of the dividend has an impact on the

preference of the investor for capital gain versus dividends. This is actually the characteristics

of the Clientele effect. For instance, people with lower level of tax will have preference for

stable and high level of dividend (Kawano, 2014). On the contrary, people with high level of

(a) Dividend hypothesis

i. Information content or signalling hypothesis

The with regard to information among the outsiders and may lead to the actual

intrinsic value of the organization not to be available in the market. In accordance with that

the share price may not be accurate measure all the time for computing the organization’s

value. The M&M approach recommends that while the markets are not perfect, the price of

the shares may respond to the changes in the dividend. To be more specific, the

announcement of dividend may seem to communicate the implicit information regarding the

potential of the organization’s future earnings (Anwar, Singh & Jain, 2016). This proposition

of dividend hypothesis is known as the information content of the dividends or the signalling

hypothesis.

ii. Free cash flow hypothesis

Under this approach, all things being equal the organization make the payment of

dividend from the cash flows that are not available for reinvestment in the projects associated

with positive (NPV) net present value that have the higher values as compared to the free

cash flow retained by the organization.

iii. Clientele effect

As the investors are generally interested regarding the after tax return of the

investment, the capital gains and various tax treatment of the dividend has an impact on the

preference of the investor for capital gain versus dividends. This is actually the characteristics

of the Clientele effect. For instance, people with lower level of tax will have preference for

stable and high level of dividend (Kawano, 2014). On the contrary, people with high level of

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCE

tax may have preference for the capital gains. However, some of the clienteles are

indifference for the capital gain and dividends.

(b) Reasons behind choosing repurchase against dividend under classical tax system

Stock repurchases are considered as the alternative for payment of dividends under the

classical tax systems. The stock repurchase takes place while the company asks the

shareholders for tendering their shares for the purpose of repurchase by them. Various

advantages of repurchase against dividend payment are as follows –

1. Generally most of the companies start with the share price that they feel as the good

point for entry and this point is considered when the shares are estimated as

undervalued. Further, if the company is aware about their business and the relative

price of the stock the company will not purchase the stock price at higher level as the

leading investors will believe that the management will perceive the stock price at the

lower level (Floyd, Li & Skinner, 2015).

2. Unlike the cash dividend the repurchase offers the investors to take their decision. The

shareholder has the option to decide regarding repurchasing the shares, accept

payment and make the payment for the taxes. However, with the cash dividend, the

shareholder does not have the option and are forced to accept dividend and make the

payment for taxes.

3. Sometimes the shares are blocked from 1 or more bigger shareholders in the market

and the timing is not predictable. The problem keeps away the potential shareholders

as they may get worried regarding the share flooding in the market and reducing the

value of the stock (Golden & Kohlbeck, 2017). Under such circumstances, share

repurchase is useful option.

tax may have preference for the capital gains. However, some of the clienteles are

indifference for the capital gain and dividends.

(b) Reasons behind choosing repurchase against dividend under classical tax system

Stock repurchases are considered as the alternative for payment of dividends under the

classical tax systems. The stock repurchase takes place while the company asks the

shareholders for tendering their shares for the purpose of repurchase by them. Various

advantages of repurchase against dividend payment are as follows –

1. Generally most of the companies start with the share price that they feel as the good

point for entry and this point is considered when the shares are estimated as

undervalued. Further, if the company is aware about their business and the relative

price of the stock the company will not purchase the stock price at higher level as the

leading investors will believe that the management will perceive the stock price at the

lower level (Floyd, Li & Skinner, 2015).

2. Unlike the cash dividend the repurchase offers the investors to take their decision. The

shareholder has the option to decide regarding repurchasing the shares, accept

payment and make the payment for the taxes. However, with the cash dividend, the

shareholder does not have the option and are forced to accept dividend and make the

payment for taxes.

3. Sometimes the shares are blocked from 1 or more bigger shareholders in the market

and the timing is not predictable. The problem keeps away the potential shareholders

as they may get worried regarding the share flooding in the market and reducing the

value of the stock (Golden & Kohlbeck, 2017). Under such circumstances, share

repurchase is useful option.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE FINANCE

4. Further, the repurchase is preferred against dividend as the company has to pay lower

level of tax as compared to dividend. Therefore, the repurchase is tax efficient as

compared to dividend (Lai et al., 2017)

5. If the equity grants or large stock options are issued to the management and the

employees, repurchase will maximize the neutralization of negative impact over the

diluted EPS. Further, actual outstanding share will not be reduced.

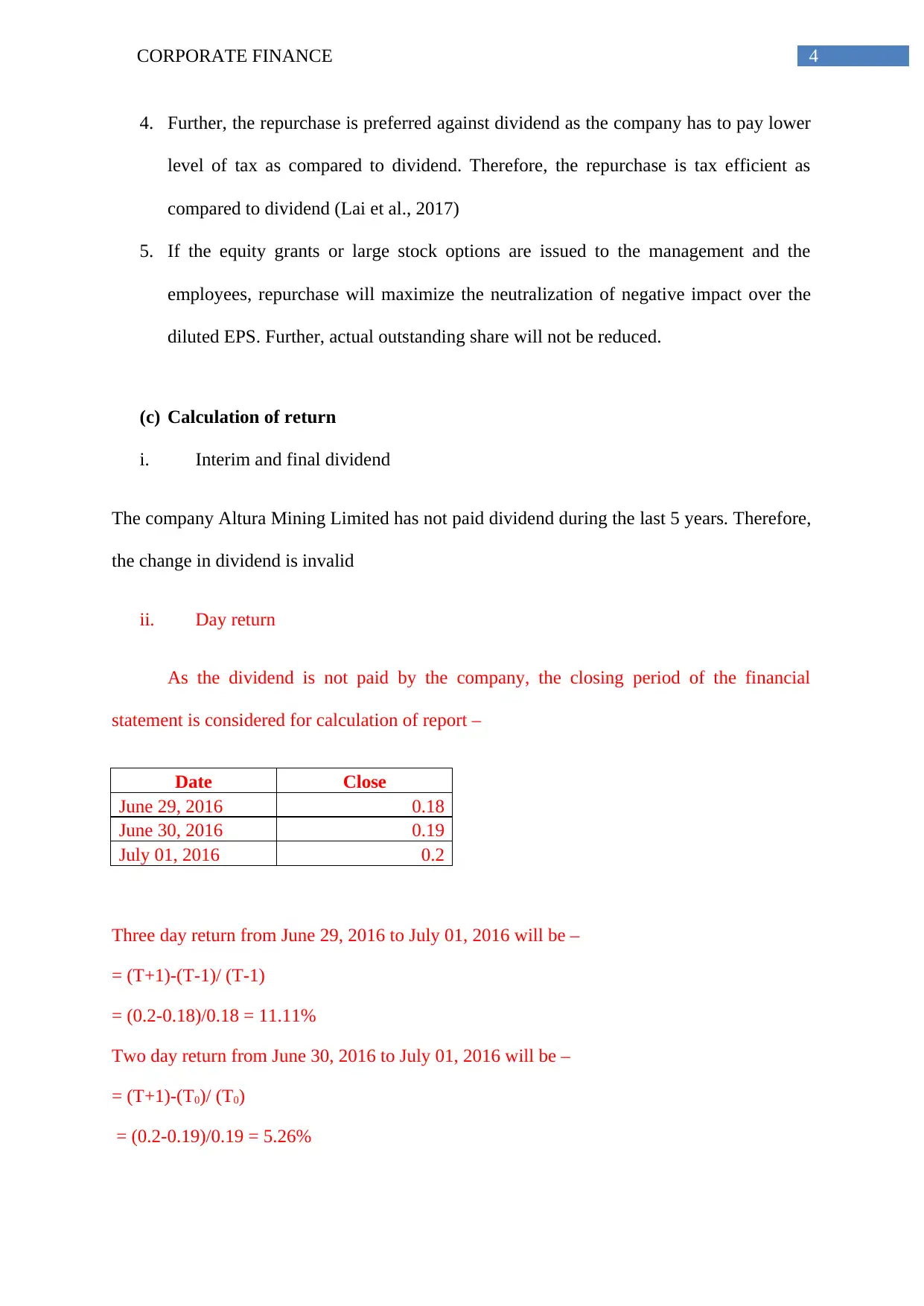

(c) Calculation of return

i. Interim and final dividend

The company Altura Mining Limited has not paid dividend during the last 5 years. Therefore,

the change in dividend is invalid

ii. Day return

As the dividend is not paid by the company, the closing period of the financial

statement is considered for calculation of report –

Date Close

June 29, 2016 0.18

June 30, 2016 0.19

July 01, 2016 0.2

Three day return from June 29, 2016 to July 01, 2016 will be –

= (T+1)-(T-1)/ (T-1)

= (0.2-0.18)/0.18 = 11.11%

Two day return from June 30, 2016 to July 01, 2016 will be –

= (T+1)-(T0)/ (T0)

= (0.2-0.19)/0.19 = 5.26%

4. Further, the repurchase is preferred against dividend as the company has to pay lower

level of tax as compared to dividend. Therefore, the repurchase is tax efficient as

compared to dividend (Lai et al., 2017)

5. If the equity grants or large stock options are issued to the management and the

employees, repurchase will maximize the neutralization of negative impact over the

diluted EPS. Further, actual outstanding share will not be reduced.

(c) Calculation of return

i. Interim and final dividend

The company Altura Mining Limited has not paid dividend during the last 5 years. Therefore,

the change in dividend is invalid

ii. Day return

As the dividend is not paid by the company, the closing period of the financial

statement is considered for calculation of report –

Date Close

June 29, 2016 0.18

June 30, 2016 0.19

July 01, 2016 0.2

Three day return from June 29, 2016 to July 01, 2016 will be –

= (T+1)-(T-1)/ (T-1)

= (0.2-0.18)/0.18 = 11.11%

Two day return from June 30, 2016 to July 01, 2016 will be –

= (T+1)-(T0)/ (T0)

= (0.2-0.19)/0.19 = 5.26%

5CORPORATE FINANCE

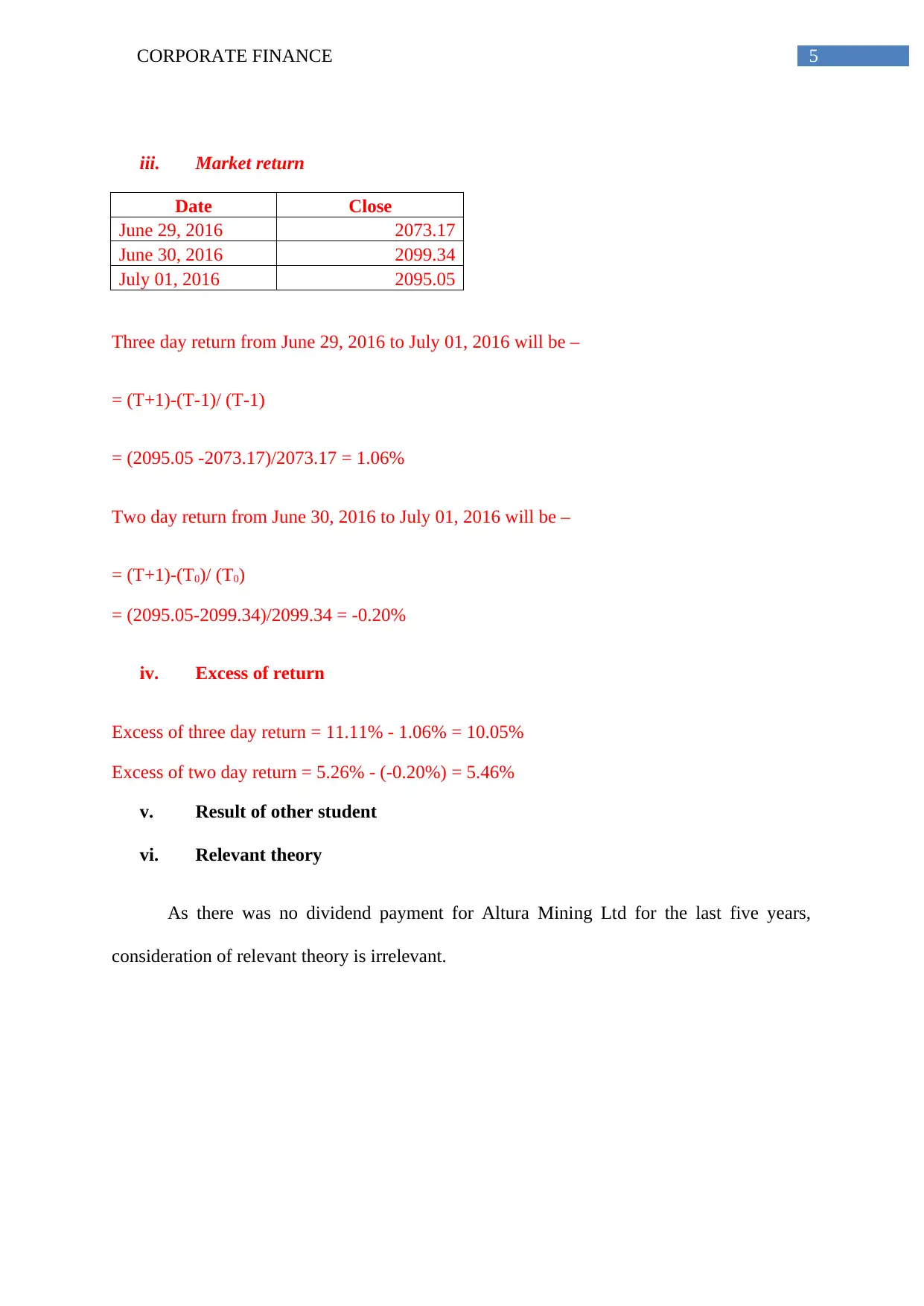

iii. Market return

Date Close

June 29, 2016 2073.17

June 30, 2016 2099.34

July 01, 2016 2095.05

Three day return from June 29, 2016 to July 01, 2016 will be –

= (T+1)-(T-1)/ (T-1)

= (2095.05 -2073.17)/2073.17 = 1.06%

Two day return from June 30, 2016 to July 01, 2016 will be –

= (T+1)-(T0)/ (T0)

= (2095.05-2099.34)/2099.34 = -0.20%

iv. Excess of return

Excess of three day return = 11.11% - 1.06% = 10.05%

Excess of two day return = 5.26% - (-0.20%) = 5.46%

v. Result of other student

vi. Relevant theory

As there was no dividend payment for Altura Mining Ltd for the last five years,

consideration of relevant theory is irrelevant.

iii. Market return

Date Close

June 29, 2016 2073.17

June 30, 2016 2099.34

July 01, 2016 2095.05

Three day return from June 29, 2016 to July 01, 2016 will be –

= (T+1)-(T-1)/ (T-1)

= (2095.05 -2073.17)/2073.17 = 1.06%

Two day return from June 30, 2016 to July 01, 2016 will be –

= (T+1)-(T0)/ (T0)

= (2095.05-2099.34)/2099.34 = -0.20%

iv. Excess of return

Excess of three day return = 11.11% - 1.06% = 10.05%

Excess of two day return = 5.26% - (-0.20%) = 5.46%

v. Result of other student

vi. Relevant theory

As there was no dividend payment for Altura Mining Ltd for the last five years,

consideration of relevant theory is irrelevant.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE FINANCE

Reference

Anwar, S., Singh, S., & Jain, P. K. (2016). Signalling power of cash dividend announcements

and risk: evidence from India. International Journal of Management Practice, 9(3),

257-281.

Floyd, E., Li, N., & Skinner, D. J. (2015). Payout policy through the financial crisis: The

growth of repurchases and the resilience of dividends. Journal of Financial

Economics, 118(2), 299-316.

Golden, J., & Kohlbeck, M. (2017). The Unintended Effects of Financial Accounting

Standard 123R on Stock Repurchase and Dividend Activity. Journal of Accounting,

Auditing & Finance, 0148558X17721087.

Kawano, L. (2014). The dividend clientele hypothesis: Evidence from the 2003 tax

act. American Economic Journal: Economic Policy, 6(1), 114-136.

Lai, H. H., Lin, S. H., Hsu, A. C., & Chang, C. J. (2017). SHARE REPURCHASE, CASH

DIVIDEND AND FUTURE PROFITABILITY. International Journal of

Organizational Innovation (Online), 9(3), 101C.

Reference

Anwar, S., Singh, S., & Jain, P. K. (2016). Signalling power of cash dividend announcements

and risk: evidence from India. International Journal of Management Practice, 9(3),

257-281.

Floyd, E., Li, N., & Skinner, D. J. (2015). Payout policy through the financial crisis: The

growth of repurchases and the resilience of dividends. Journal of Financial

Economics, 118(2), 299-316.

Golden, J., & Kohlbeck, M. (2017). The Unintended Effects of Financial Accounting

Standard 123R on Stock Repurchase and Dividend Activity. Journal of Accounting,

Auditing & Finance, 0148558X17721087.

Kawano, L. (2014). The dividend clientele hypothesis: Evidence from the 2003 tax

act. American Economic Journal: Economic Policy, 6(1), 114-136.

Lai, H. H., Lin, S. H., Hsu, A. C., & Chang, C. J. (2017). SHARE REPURCHASE, CASH

DIVIDEND AND FUTURE PROFITABILITY. International Journal of

Organizational Innovation (Online), 9(3), 101C.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.