Analysis of FTSE 100 Diversification and Corporate Finance Report

VerifiedAdded on 2020/01/28

|16

|5106

|46

Report

AI Summary

This report delves into the realm of corporate finance, with a specific focus on the FTSE 100 index. It explores the significance of corporate finance in making informed investment decisions, capital structure, and raising funds. The report emphasizes the modern portfolio theory, with risk and return as core components. It analyzes the impact of adding new assets to the FTSE 100, concluding that diversification benefits are limited due to the index's existing sector diversification. The report also discusses diversification strategies, the FTSE 100's composition, and the advantages and disadvantages of diversification. Empirical evidence, including opportunity cost, index funds, and market volatility, is also discussed, providing a comprehensive overview of financial concepts in relation to the FTSE 100 and investment strategies.

CORPORATE FINANCE

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

INTRODUCTION

In the financial sector there are corporate finance having an integral place which helps to

a business organisation in order to take investing decisions in the highly appropriate manner. By

considering the corporate finance aspect management of an entity able to deal with the financing

sources and make the capital structure in the proper way. If it not considers the capital structure

and corporate finance then not able to raise fund by making profitable proportion like as debt as

well as equity financing. The current study is about the FTSE 100 which is an index of the

London Stock Exchange market and diversified in several kinds of segments. On the basis of the

present report the reader able to understand and analyse that when the current index add the new

and additional assets in its existing portfolio then it will not generate the benefits in term of

diversification. The reason and causes behind not affecting new assets to the FTSE 100 is to be

provided along with the empirical evidence in through the respective report. The current report

of the corporate finance shows and focuses on the modern portfolio theory which relies with the

main two aspects of the investment and portfolio which are like as risk and return. There are

three kinds of empirical evidences are to be discussed of the FTSE 100 statement at here which

are like as opportunity cost, index fund and volatility of the stock market.

MAIN BODY OF ESSAY

At the every kind of business entities there are corporate finance having a key part in

order to assess the appropriate funding sources and make the investment as well. With the help

of this respective method the management able to make the portfolio for putting money in

various aspects and avenues of the investment which are available in the market. In the portfolio

different investment avenues are considered which are like as equity shares, preference shares,

debentures, real estate, commodity, precious items, gold, silver etc. In the corporate finance

mainly four kinds of steps are followed and adopted by the company for making investment it

(Vernimmen and et.al., 2014). Further, the stages and phases are like as planning, raising the

finance, investing as well as monitoring that whether it providing return in the positive ways or

not. In the stock market there are different indexes available where the investors put money and

generate return or loss as per the market condition. In the current case study there is FTSE 100

indices is to be analysed which is one of the highly traded in the London Stock Exchange market.

The current kind of the index is diversified in several types of the companies which are operating

in the different number of sector such as oil and gas, energy, retail, telecommunication, banking,

1

In the financial sector there are corporate finance having an integral place which helps to

a business organisation in order to take investing decisions in the highly appropriate manner. By

considering the corporate finance aspect management of an entity able to deal with the financing

sources and make the capital structure in the proper way. If it not considers the capital structure

and corporate finance then not able to raise fund by making profitable proportion like as debt as

well as equity financing. The current study is about the FTSE 100 which is an index of the

London Stock Exchange market and diversified in several kinds of segments. On the basis of the

present report the reader able to understand and analyse that when the current index add the new

and additional assets in its existing portfolio then it will not generate the benefits in term of

diversification. The reason and causes behind not affecting new assets to the FTSE 100 is to be

provided along with the empirical evidence in through the respective report. The current report

of the corporate finance shows and focuses on the modern portfolio theory which relies with the

main two aspects of the investment and portfolio which are like as risk and return. There are

three kinds of empirical evidences are to be discussed of the FTSE 100 statement at here which

are like as opportunity cost, index fund and volatility of the stock market.

MAIN BODY OF ESSAY

At the every kind of business entities there are corporate finance having a key part in

order to assess the appropriate funding sources and make the investment as well. With the help

of this respective method the management able to make the portfolio for putting money in

various aspects and avenues of the investment which are available in the market. In the portfolio

different investment avenues are considered which are like as equity shares, preference shares,

debentures, real estate, commodity, precious items, gold, silver etc. In the corporate finance

mainly four kinds of steps are followed and adopted by the company for making investment it

(Vernimmen and et.al., 2014). Further, the stages and phases are like as planning, raising the

finance, investing as well as monitoring that whether it providing return in the positive ways or

not. In the stock market there are different indexes available where the investors put money and

generate return or loss as per the market condition. In the current case study there is FTSE 100

indices is to be analysed which is one of the highly traded in the London Stock Exchange market.

The current kind of the index is diversified in several types of the companies which are operating

in the different number of sector such as oil and gas, energy, retail, telecommunication, banking,

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

service, consultancy, food processing, manufacturing, infrastructure etc. At this point it has been

said that if the FTSE 100 add one more kind of asset and company in the existing portfolio then

it will not gain any kind of benefits and advantages because of already diversified in he several

sectors.

In the market index of the FTSE 100 there are huge number of the companies are listed

which issue their shares in the market with the help of stock exchange market. There are several

kinds of shares like as equity, preferred, preference, debentures etc. issued by the companies

using two processes such as initial public offering and follow on public offering which are

different up to some extent (Kumar and Mishra, 2016). Among these both the processes there is a

similarity that these help to the business entity in order to issue equity shares in the market. The

company when gone through the listing process in stock market then issue equity shares at the

first time that will consider as initial public offer. On the other side when a company issue its

shares and stock in the market for raising fund at the second or more time, then the process is

known as follow up public offer. Motive of adopting both the processes at the workplace is to

raise fund and enhance capital in the company for business expansion, purchase new plant and

machinery or any other business purposes. This is one of the key and important part of the

corporate finance and implied using the different indices of the stock market like as FTSE 100.

By using the diversification strategy the investor able to reduce overall risks of the investment

which they made in different kinds of avenues. Along with this level of the profit and amount in

terms of the return also generates up to the higher level. When comparing and analysing both the

aspects of the investment such as risk and return then it can be said that higher the risk taken by

the investor able to generate more return (Jorda, Schularick and Taylor, 2016).

What is Diversification:

In Finance diversification is the process of allocation capital in a way that reduce the

exposure to any any one particular assets or risk. A common path or way towards diversification

is to reduce risk or volatile by investing in varieties of assets. If assets price do note change in

perfect synchrony a diversified portfolio will have less variance then weighted average. Variance

of its constituent assets, and often less volatile then least volatile.

It is risk management technique that mixes a wide variety of investment within a portfolio.

rational behind the technique contends that portfolio constructed of different kinds of investment,

2

said that if the FTSE 100 add one more kind of asset and company in the existing portfolio then

it will not gain any kind of benefits and advantages because of already diversified in he several

sectors.

In the market index of the FTSE 100 there are huge number of the companies are listed

which issue their shares in the market with the help of stock exchange market. There are several

kinds of shares like as equity, preferred, preference, debentures etc. issued by the companies

using two processes such as initial public offering and follow on public offering which are

different up to some extent (Kumar and Mishra, 2016). Among these both the processes there is a

similarity that these help to the business entity in order to issue equity shares in the market. The

company when gone through the listing process in stock market then issue equity shares at the

first time that will consider as initial public offer. On the other side when a company issue its

shares and stock in the market for raising fund at the second or more time, then the process is

known as follow up public offer. Motive of adopting both the processes at the workplace is to

raise fund and enhance capital in the company for business expansion, purchase new plant and

machinery or any other business purposes. This is one of the key and important part of the

corporate finance and implied using the different indices of the stock market like as FTSE 100.

By using the diversification strategy the investor able to reduce overall risks of the investment

which they made in different kinds of avenues. Along with this level of the profit and amount in

terms of the return also generates up to the higher level. When comparing and analysing both the

aspects of the investment such as risk and return then it can be said that higher the risk taken by

the investor able to generate more return (Jorda, Schularick and Taylor, 2016).

What is Diversification:

In Finance diversification is the process of allocation capital in a way that reduce the

exposure to any any one particular assets or risk. A common path or way towards diversification

is to reduce risk or volatile by investing in varieties of assets. If assets price do note change in

perfect synchrony a diversified portfolio will have less variance then weighted average. Variance

of its constituent assets, and often less volatile then least volatile.

It is risk management technique that mixes a wide variety of investment within a portfolio.

rational behind the technique contends that portfolio constructed of different kinds of investment,

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

will on average high yield return, and pose a low risk then any individual investment found

within the portfolio (D'Aurizio, Oliviero and Romano, 2015).

Diversification strives to smooth out unsystematic risk events in portfolio so the positive

performance of some investment neutralise the negative performance of other. Therefore the

benefits of diversification holds only if the securities in the portfolio are not perfectly correlated.

Studies have shown that by mathematical mode as well as diversified portfolio of 25-30 stocks

yield the most cost effective level of risk reduction. Investing in more yields further

diversification benefits abide all drastic same rate. Further diversification benefits can be gained

by investing in foreign securities because they tend to be loss closely corrected with domestic

investment. For ex, an economic down in us economy may not might affect Japan's economy in

the same way, therefore having Japan's investment gives an investor a small cushion of

protection against losses due to American economic downturn. If the prior expectation of the

return on all the assets in the portfolio and identical, expected return on all the assets and

portfolio are identical, expected return on diversified portfolio will be identical to that on an

undiversified portfolio.

Need of diversification:

Diversification is technique that reduce risk by allocating investment among various

financial instruments, industries and other categories. It aims to maximise return by investing its

different areas that would each react differently to the same events. Most investment professional

agrees that although it does not guarantees against loss. Diversification is long term tool to

achieve goal by minimising risk. So need or importance of diversification are

11 Help reduce risk: No one can predict how assets or class of assets will behave or give

return in future. So by spreading your investment across different class of investment like

equities, bonds, cash and real estate can reduce the portfolio risk. A portfolio can be

diversified with each categories of investment. For ex even in equity, investing in

different stocks across varied sectors or market capital would mean different categories.

This will ensure that lose in one sector will cover by high return in another stocks.

11 Help to avoid the loss arises during bad timing or bad decisions: The advantage of well

diversified portfolio can certainly be seen over long period. (Davidson, Dey and Smith,

3

within the portfolio (D'Aurizio, Oliviero and Romano, 2015).

Diversification strives to smooth out unsystematic risk events in portfolio so the positive

performance of some investment neutralise the negative performance of other. Therefore the

benefits of diversification holds only if the securities in the portfolio are not perfectly correlated.

Studies have shown that by mathematical mode as well as diversified portfolio of 25-30 stocks

yield the most cost effective level of risk reduction. Investing in more yields further

diversification benefits abide all drastic same rate. Further diversification benefits can be gained

by investing in foreign securities because they tend to be loss closely corrected with domestic

investment. For ex, an economic down in us economy may not might affect Japan's economy in

the same way, therefore having Japan's investment gives an investor a small cushion of

protection against losses due to American economic downturn. If the prior expectation of the

return on all the assets in the portfolio and identical, expected return on all the assets and

portfolio are identical, expected return on diversified portfolio will be identical to that on an

undiversified portfolio.

Need of diversification:

Diversification is technique that reduce risk by allocating investment among various

financial instruments, industries and other categories. It aims to maximise return by investing its

different areas that would each react differently to the same events. Most investment professional

agrees that although it does not guarantees against loss. Diversification is long term tool to

achieve goal by minimising risk. So need or importance of diversification are

11 Help reduce risk: No one can predict how assets or class of assets will behave or give

return in future. So by spreading your investment across different class of investment like

equities, bonds, cash and real estate can reduce the portfolio risk. A portfolio can be

diversified with each categories of investment. For ex even in equity, investing in

different stocks across varied sectors or market capital would mean different categories.

This will ensure that lose in one sector will cover by high return in another stocks.

11 Help to avoid the loss arises during bad timing or bad decisions: The advantage of well

diversified portfolio can certainly be seen over long period. (Davidson, Dey and Smith,

3

2015) Many investors get carried away by market movement and take emotional

decisions rather then financial planned decisions.

11 Diversify based on assets allocation that is right for investors: Assets allocation is an

essential tools in diversifying investment portfolio. I refers to getting the right mix of

investment options aligned to risk profile, life stage time zone. making regular check

rebalancing insurance that risk is maintained and portfolio meets investment goals.

Advantages and Disadvantages of Diversification:

Diversifying investment portfolio can protect from localised dip in market but it can also

help in making big money in market. So Advantages of diversification is

1. Risk Reduction: When your assets are widely diversified, portfolio tends to perform in

simple way to market as a whole. Of anyone owns a stock in 20 different areas and one of

them takes dive its likely that portfolio will suffer. So Diversification is the best way to

increase the stability of investment and decrease in value. Although diversification won't

protect from general slowdown. It will maintain your portfolio stability over time.

2. Assets choice: When investor hold wide variety of stocks, we can spread them over wide

diverged form of assets, Including activities such as stock and bonds, Commodities such

as oil and minerals, real estate or cash. Each of these stock holds different strength and

weakness in term of risk and profitability (Thune, 2016). Maintaining and holding all

these areas helps to create stable portfolio that will increase the value in long run.

3. Low maintenance: Investment require certain amount of care and attention to keep that

performing well. If investor is playing high stack games with your assets and moving

them around through risky venture, you will be planing a fair amount of time in watching

tha market and keeping eye on financial budget. A diversified portfolio is less exciting

and more stable. Once we have investment settled into wide variety of stocks and

securities they can remain their for long period without too much maintenance.

Disadvantages:

1. Increased exposure: When holding are widely diversified, an investor will suffer some

amount of loss whenever some part of portfolio dips. If whole market is declining. It is

4

decisions rather then financial planned decisions.

11 Diversify based on assets allocation that is right for investors: Assets allocation is an

essential tools in diversifying investment portfolio. I refers to getting the right mix of

investment options aligned to risk profile, life stage time zone. making regular check

rebalancing insurance that risk is maintained and portfolio meets investment goals.

Advantages and Disadvantages of Diversification:

Diversifying investment portfolio can protect from localised dip in market but it can also

help in making big money in market. So Advantages of diversification is

1. Risk Reduction: When your assets are widely diversified, portfolio tends to perform in

simple way to market as a whole. Of anyone owns a stock in 20 different areas and one of

them takes dive its likely that portfolio will suffer. So Diversification is the best way to

increase the stability of investment and decrease in value. Although diversification won't

protect from general slowdown. It will maintain your portfolio stability over time.

2. Assets choice: When investor hold wide variety of stocks, we can spread them over wide

diverged form of assets, Including activities such as stock and bonds, Commodities such

as oil and minerals, real estate or cash. Each of these stock holds different strength and

weakness in term of risk and profitability (Thune, 2016). Maintaining and holding all

these areas helps to create stable portfolio that will increase the value in long run.

3. Low maintenance: Investment require certain amount of care and attention to keep that

performing well. If investor is playing high stack games with your assets and moving

them around through risky venture, you will be planing a fair amount of time in watching

tha market and keeping eye on financial budget. A diversified portfolio is less exciting

and more stable. Once we have investment settled into wide variety of stocks and

securities they can remain their for long period without too much maintenance.

Disadvantages:

1. Increased exposure: When holding are widely diversified, an investor will suffer some

amount of loss whenever some part of portfolio dips. If whole market is declining. It is

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

more likely that the holding will also decline. So when an investor diversify his

investment an investor need to protect himself from excessive financial exposure.

2. reduce Quality: There are so many quality companies and even less are priced at levels

that provide margin of safety. The more stock put in portfolio the less concentrated your

portfolio will be in the best opportunity.

3. Too complicated: Many investors include so many assets in their portfolio that they don't

really understand what's in them. Diversification in investing is important but keeping it

simple to stay on top of investment is difficult.

Describe the FTSE

FTSE is financial time stock exchange 100 index also called FTSE 100 index. It was

founded in 1984 and operates in London stock exchange. In it 100 companies are listed in

London Stock exchange with highest market capitalisation. It is sign of prosperity for business

regulatory by UK company law. It is maintained by FTSE group a subsidiary of London Stock

Exchange company. It was originated as Financial times and London stock exchange Joint

venture. In it 100 companies are qualifying with full form market values and mostly companies

are international focused. So the index movement are fairly weak indicator of how UK economy

is fairing as seen in recent trends against starlings. FTSE 100 represents the 81% of the entire

market capitalisation of London Stock Exchange. even though the FTSE all share index is more

comprehensive FTSE 100 is by far the most widely used UK stock market indicators.

component companies must meet a number of requirement set out by FTSE group,

including have a full list of LSE with sterling or Euro denominated price on stock exchange

Electronic trading service, meeting certain test on nationality and free float and liquidity.

Weighting: In the FTSE index, share price are weighted by market capitalisation, so that

larger companies make more of the difference to the index than smaller companies (Ehrhardt and

Brigham, 2016) . Basic formulae of these indices are

Index level= ∑i Price of stock * Number of Share * free float adjustment factor / index divisor

FTSE isn't diverse:

In FTSE top 100 companies are listed adn each companies belong to different sectors like

Aerospace and Defence, Alternative energies, Auto mobile parts, banks, beverages, chemical,

5

investment an investor need to protect himself from excessive financial exposure.

2. reduce Quality: There are so many quality companies and even less are priced at levels

that provide margin of safety. The more stock put in portfolio the less concentrated your

portfolio will be in the best opportunity.

3. Too complicated: Many investors include so many assets in their portfolio that they don't

really understand what's in them. Diversification in investing is important but keeping it

simple to stay on top of investment is difficult.

Describe the FTSE

FTSE is financial time stock exchange 100 index also called FTSE 100 index. It was

founded in 1984 and operates in London stock exchange. In it 100 companies are listed in

London Stock exchange with highest market capitalisation. It is sign of prosperity for business

regulatory by UK company law. It is maintained by FTSE group a subsidiary of London Stock

Exchange company. It was originated as Financial times and London stock exchange Joint

venture. In it 100 companies are qualifying with full form market values and mostly companies

are international focused. So the index movement are fairly weak indicator of how UK economy

is fairing as seen in recent trends against starlings. FTSE 100 represents the 81% of the entire

market capitalisation of London Stock Exchange. even though the FTSE all share index is more

comprehensive FTSE 100 is by far the most widely used UK stock market indicators.

component companies must meet a number of requirement set out by FTSE group,

including have a full list of LSE with sterling or Euro denominated price on stock exchange

Electronic trading service, meeting certain test on nationality and free float and liquidity.

Weighting: In the FTSE index, share price are weighted by market capitalisation, so that

larger companies make more of the difference to the index than smaller companies (Ehrhardt and

Brigham, 2016) . Basic formulae of these indices are

Index level= ∑i Price of stock * Number of Share * free float adjustment factor / index divisor

FTSE isn't diverse:

In FTSE top 100 companies are listed adn each companies belong to different sectors like

Aerospace and Defence, Alternative energies, Auto mobile parts, banks, beverages, chemical,

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

construction, insurance,health life insurance and many more so. In FTSE all these sectors have

many companies and further these sectors are not classed and all small and medium and large

stocks are listed in particular sectors. So These sectors need to be classified for making proper

portfolio. Investors are often told that key to success is long term portfolio is diversified and all

stock dont have in one portfolio. It is fair to say that most investors uses UK Funds, be it growth

or income fund, as their core exposure to the equity market then to try and make sure to fate of

savings isent the mercy of FTSE. All Share performance, they use global fund for purpose of

diversification. This market sense, given that large majority of fund, IA global and Global equity

income sector have low weighted to the market (Fazzari and Papadimitriou, 2015). These market

sense, given that large majority of funds, IA and global equity income sector have low weighted

to the UK market. Data from FE analyst shows that just because investors use global or even

regional fund to sit alongside their UK exposure, it doesn't mean that holdings won't move up

and down at same time. Diversification through gold, minerals, silver, property (BTL and Funds)

and cash can be done through diversity.

MODERN PORTFOLIO THEORY

In the stock market there are number of indices available and in which different number

of the companies are listed for raising fund and other objectives. In the current study there is

FTSE 100 which has full name is such as Financial Times Stock Exchange 100 is to be

addressed under which various segment's firms are listed and taking financial services such as

raising fund, issuing shares etc. At the investment market there are huge number of avenues are

available which are used by the investors in order to put and invest money. When the investor

going to make investment then analyse all the available criterias that which will give the better

and profitable return. After making analysis of such all the avenues the investor make portfolio

where it considers various criterias and the make investment which lead to manage both the

aspects associated with the investment. With each and every kind of investment whether it is

equity shares, real estate, debentures or any other than there are risk and return both are always

associated which are considered by the individuals who are going to make investment (Li, 2015).

In this context there are Modern Portfolio Theory is to be consider and imply where diversified

portfolio is to be prepared and then decision for investment making is to be taken in the

appropriate manner. The portfolio under which different aspects of the investment are considered

and then money is to be invested is called as diversified portfolio which is necessity for each and

6

many companies and further these sectors are not classed and all small and medium and large

stocks are listed in particular sectors. So These sectors need to be classified for making proper

portfolio. Investors are often told that key to success is long term portfolio is diversified and all

stock dont have in one portfolio. It is fair to say that most investors uses UK Funds, be it growth

or income fund, as their core exposure to the equity market then to try and make sure to fate of

savings isent the mercy of FTSE. All Share performance, they use global fund for purpose of

diversification. This market sense, given that large majority of fund, IA global and Global equity

income sector have low weighted to the market (Fazzari and Papadimitriou, 2015). These market

sense, given that large majority of funds, IA and global equity income sector have low weighted

to the UK market. Data from FE analyst shows that just because investors use global or even

regional fund to sit alongside their UK exposure, it doesn't mean that holdings won't move up

and down at same time. Diversification through gold, minerals, silver, property (BTL and Funds)

and cash can be done through diversity.

MODERN PORTFOLIO THEORY

In the stock market there are number of indices available and in which different number

of the companies are listed for raising fund and other objectives. In the current study there is

FTSE 100 which has full name is such as Financial Times Stock Exchange 100 is to be

addressed under which various segment's firms are listed and taking financial services such as

raising fund, issuing shares etc. At the investment market there are huge number of avenues are

available which are used by the investors in order to put and invest money. When the investor

going to make investment then analyse all the available criterias that which will give the better

and profitable return. After making analysis of such all the avenues the investor make portfolio

where it considers various criterias and the make investment which lead to manage both the

aspects associated with the investment. With each and every kind of investment whether it is

equity shares, real estate, debentures or any other than there are risk and return both are always

associated which are considered by the individuals who are going to make investment (Li, 2015).

In this context there are Modern Portfolio Theory is to be consider and imply where diversified

portfolio is to be prepared and then decision for investment making is to be taken in the

appropriate manner. The portfolio under which different aspects of the investment are considered

and then money is to be invested is called as diversified portfolio which is necessity for each and

6

every investor. The reason is that it provides the highly proper instructions and helpful for

minimize level of risks and maximize level of return. In the modern portfolio theory balance is to

made among the level of return on investment and risks.

By using the modern portfolio theory the investor able to reduce the overall risk and

manage the return up to better extent. In the portfolio there are all kinds of avenues not provide

same return, some provides the higher and positive return but some cannot (Modern Portfolio

Theory (MPT), 2013). When the investor put money in the equity and preference shares the

return can be positive or negative both because of depending on the fluctuation of stock market

and FTSE 100's value. Further, there are T-bills and real estate not having the negative return,

they always provide positive and higher return as the time passes. Further, when relating to the

return with the time factor then there is positive and direct relationship. When the investor make

investment for the longer period then get the amount of return at the higher level which is

profitable for the individuals. In the modern portfolio theory there is mainly two assumptions are

made while making the portfolio for investing money which are like as risk and return (Cole and

Sokolyk, 2016). In the equity as well as preference shares the return is in form of dividend

amount which is on the basis of index value as well as profit of the company. Moreover, the

current presented theory is highly helpful for the investors for reducing the risks and improving

return on consistent basis. By making portfolio if one or two avenue give negative or lower

return and other provide positive and higher return then overall amount of the return comes

under the balance. Along with this the investor not needs to take the risk because it leads to

reduce the overall risk associated with the portfolio.

In this context when the FTSE 100 consider the modern portfolio theory then able to

manage the overall assets and sectors which are listed in the stock market's current index (Macve

, 2015). By this the management of the stock market able to know that in which proportion the

sector will be divided. The respective kind of theory of portfolio highly better for the investors

which lead to provide them more return and make them more financially sound. With the

investors when there are level of risks are higher, then it will provide more return of the

portfolio. There are different kinds of the risks associated with the portfolio which are such as

market, systematic, unsystematic, stock etc. To reduce and avoid the risks of investment and

portfolio there are the current analysed theory is highly better for the investors.

7

minimize level of risks and maximize level of return. In the modern portfolio theory balance is to

made among the level of return on investment and risks.

By using the modern portfolio theory the investor able to reduce the overall risk and

manage the return up to better extent. In the portfolio there are all kinds of avenues not provide

same return, some provides the higher and positive return but some cannot (Modern Portfolio

Theory (MPT), 2013). When the investor put money in the equity and preference shares the

return can be positive or negative both because of depending on the fluctuation of stock market

and FTSE 100's value. Further, there are T-bills and real estate not having the negative return,

they always provide positive and higher return as the time passes. Further, when relating to the

return with the time factor then there is positive and direct relationship. When the investor make

investment for the longer period then get the amount of return at the higher level which is

profitable for the individuals. In the modern portfolio theory there is mainly two assumptions are

made while making the portfolio for investing money which are like as risk and return (Cole and

Sokolyk, 2016). In the equity as well as preference shares the return is in form of dividend

amount which is on the basis of index value as well as profit of the company. Moreover, the

current presented theory is highly helpful for the investors for reducing the risks and improving

return on consistent basis. By making portfolio if one or two avenue give negative or lower

return and other provide positive and higher return then overall amount of the return comes

under the balance. Along with this the investor not needs to take the risk because it leads to

reduce the overall risk associated with the portfolio.

In this context when the FTSE 100 consider the modern portfolio theory then able to

manage the overall assets and sectors which are listed in the stock market's current index (Macve

, 2015). By this the management of the stock market able to know that in which proportion the

sector will be divided. The respective kind of theory of portfolio highly better for the investors

which lead to provide them more return and make them more financially sound. With the

investors when there are level of risks are higher, then it will provide more return of the

portfolio. There are different kinds of the risks associated with the portfolio which are such as

market, systematic, unsystematic, stock etc. To reduce and avoid the risks of investment and

portfolio there are the current analysed theory is highly better for the investors.

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

By considering these all when the FTSE 100 add one more asset and company within the

market and index then not generate any kind of benefit ad well as profit because proportion for

every sector are already been fixed (McCahery, Sautner and Starks, 2016). When each and every

shareholder and investor going to make the highly appropriate and profitable investment the they

mus need to consider the modern portfolio theory. Because of this current theory as well as

approach the individuals who make investment able to generate as well as earn the higher return

along with the reducing risks of portfolio. Apart from this there are huge number of business

entities of every segment are listed by which it can be said that the FTSE 100 indices is

diversified in the existing condition (Cassar, Ittner and Cavalluzzo, 2015). Hence, it can be

clearly said that due to adding one more firm and asset FTSE 100 will not be profitable and

beneficial in any context. Evidences of the current statements are explained as below:

VOLATILITY

In the market if there are more number of companies listed in then the level of prices

fluctuate up to the higher level which is not good and profitable for the FTSE as well as investors

both. Higher the companies lead to create burden on the management of stock market in terms of

issuing shares, completing listing process, providing dividend amount to the shareholders etc. If

there are number of assets are at the huge number then the stock market will not able to manage

the smooth functioning of the market. In addition to this, there are companies also not able to

assess the appropriate prices of the shares and stock which is issued in the market place. Because

of fluctuating and volatile in the huge numbers then company cannot predict that in the future

times prices of its shares will be increases and reduces (Johnstone, 2015). On the basis of this

management of the public and private listing business entity determine that level of investors in

order to invest money will be improve or not. When there are stock prices will enhance along

with the profit level of the firm then higher number of the shareholders start to purchase its stock

and shares. Due to this condition the business able to raise amount of the capital and fund up to

the better and higher level. Furthermore, due to the higher volatility the management of the

FTSE 100 will not capable to manage which is the negative impact on it rather than become

advantageous in terms of diversification.

Lagoarde-Segot, (2015) critically evaluated that when the Financial Times Stock

Exchange 100 include as well as add the new and additional assets in it then prices of the overall

8

market and index then not generate any kind of benefit ad well as profit because proportion for

every sector are already been fixed (McCahery, Sautner and Starks, 2016). When each and every

shareholder and investor going to make the highly appropriate and profitable investment the they

mus need to consider the modern portfolio theory. Because of this current theory as well as

approach the individuals who make investment able to generate as well as earn the higher return

along with the reducing risks of portfolio. Apart from this there are huge number of business

entities of every segment are listed by which it can be said that the FTSE 100 indices is

diversified in the existing condition (Cassar, Ittner and Cavalluzzo, 2015). Hence, it can be

clearly said that due to adding one more firm and asset FTSE 100 will not be profitable and

beneficial in any context. Evidences of the current statements are explained as below:

VOLATILITY

In the market if there are more number of companies listed in then the level of prices

fluctuate up to the higher level which is not good and profitable for the FTSE as well as investors

both. Higher the companies lead to create burden on the management of stock market in terms of

issuing shares, completing listing process, providing dividend amount to the shareholders etc. If

there are number of assets are at the huge number then the stock market will not able to manage

the smooth functioning of the market. In addition to this, there are companies also not able to

assess the appropriate prices of the shares and stock which is issued in the market place. Because

of fluctuating and volatile in the huge numbers then company cannot predict that in the future

times prices of its shares will be increases and reduces (Johnstone, 2015). On the basis of this

management of the public and private listing business entity determine that level of investors in

order to invest money will be improve or not. When there are stock prices will enhance along

with the profit level of the firm then higher number of the shareholders start to purchase its stock

and shares. Due to this condition the business able to raise amount of the capital and fund up to

the better and higher level. Furthermore, due to the higher volatility the management of the

FTSE 100 will not capable to manage which is the negative impact on it rather than become

advantageous in terms of diversification.

Lagoarde-Segot, (2015) critically evaluated that when the Financial Times Stock

Exchange 100 include as well as add the new and additional assets in it then prices of the overall

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

business entity's shares fluctuate up to the higher level which is negative impact for it. Because

of enhancing the price volatility of the shares the management of FTSE 100 will not capable to

manage and run the overall index in the proper ways. Due to the reasons of more volatility the

stock market will not generate any kind of benefit but because of adding new asset it will come

under the negative condition. Volatility of the stock market lead to reduce taking appropriate

investment decisions up to the higher level as well amount of the return also fluctuate up to the

greater extent. Higher the proportion of volatility lead to increase risk of the portfolio and

investment as well as less number of the stockholders attract for put money in stock market index

such as FTSE 100 (Abroud and et.al., 2015). The volatility of the stock and shares is based on

the different kinds of prices which are fluctuated in every three seconds. Because of this to add

more number of assets in the current index of stock market there are rather than generating profit

it affects in the negative way. Due to which it has been assessed and analysed that while adding

more assets the Financial Times Stock Exchange 100 is not beneficial in terms of the

diversification. Volatility is considered at that situation where the market condition and values

goes up and down within very fewer time such as two, three or four minutes. Because of this to

manage the smooth functioning of the whole stock market gets hamper up to the higher extent

and lead to reduce capability of taking appropriate investment decisions by the investors

(Musacchio, Lazzarini and Aguilera, 2015).

Apart from this all it can be said from the point of views of shareholders as well as

investors that because of adding more assets the price volatility in the market improves and

enhances. Because of this current situation there are investors and shareholders cannot make the

decisions for investing money in the share market because of fluctuating the prices. When the

prices are volatile in the higher number then the individual cannot assess that in the future there

will be what kind of condition arises. It may be happen that sue to higher stock market volatility

the investor will generate lower return along with the high risk (Andriosopoulos and Lasfer,

2015). On the other side, there are anyone cannot predict that in the upcoming scenario level of

the return will go higher or lower because of based on the stock market fluctuations. In addition

to this, because of the price and stock market volatility there are return of the investment also

affects in the negative way up to the higher extent along with enhancing the risks. Hence, it can

be critically said that Financial Times Stock Exchange 100 (FTSE 100) is not profitable as well

as beneficial after adding and enhancing assets in the index. In context to this, there is the current

9

of enhancing the price volatility of the shares the management of FTSE 100 will not capable to

manage and run the overall index in the proper ways. Due to the reasons of more volatility the

stock market will not generate any kind of benefit but because of adding new asset it will come

under the negative condition. Volatility of the stock market lead to reduce taking appropriate

investment decisions up to the higher level as well amount of the return also fluctuate up to the

greater extent. Higher the proportion of volatility lead to increase risk of the portfolio and

investment as well as less number of the stockholders attract for put money in stock market index

such as FTSE 100 (Abroud and et.al., 2015). The volatility of the stock and shares is based on

the different kinds of prices which are fluctuated in every three seconds. Because of this to add

more number of assets in the current index of stock market there are rather than generating profit

it affects in the negative way. Due to which it has been assessed and analysed that while adding

more assets the Financial Times Stock Exchange 100 is not beneficial in terms of the

diversification. Volatility is considered at that situation where the market condition and values

goes up and down within very fewer time such as two, three or four minutes. Because of this to

manage the smooth functioning of the whole stock market gets hamper up to the higher extent

and lead to reduce capability of taking appropriate investment decisions by the investors

(Musacchio, Lazzarini and Aguilera, 2015).

Apart from this all it can be said from the point of views of shareholders as well as

investors that because of adding more assets the price volatility in the market improves and

enhances. Because of this current situation there are investors and shareholders cannot make the

decisions for investing money in the share market because of fluctuating the prices. When the

prices are volatile in the higher number then the individual cannot assess that in the future there

will be what kind of condition arises. It may be happen that sue to higher stock market volatility

the investor will generate lower return along with the high risk (Andriosopoulos and Lasfer,

2015). On the other side, there are anyone cannot predict that in the upcoming scenario level of

the return will go higher or lower because of based on the stock market fluctuations. In addition

to this, because of the price and stock market volatility there are return of the investment also

affects in the negative way up to the higher extent along with enhancing the risks. Hence, it can

be critically said that Financial Times Stock Exchange 100 (FTSE 100) is not profitable as well

as beneficial after adding and enhancing assets in the index. In context to this, there is the current

9

index of London Stock Exchange market is already diversified as well as companies of many

more sectors are to be listed in it. Moreover, there is no benefit and advantages for the FTSE 100

index after taking and listing more number of the firms in its stock market (Bacchetta and

Benhima, 2015).

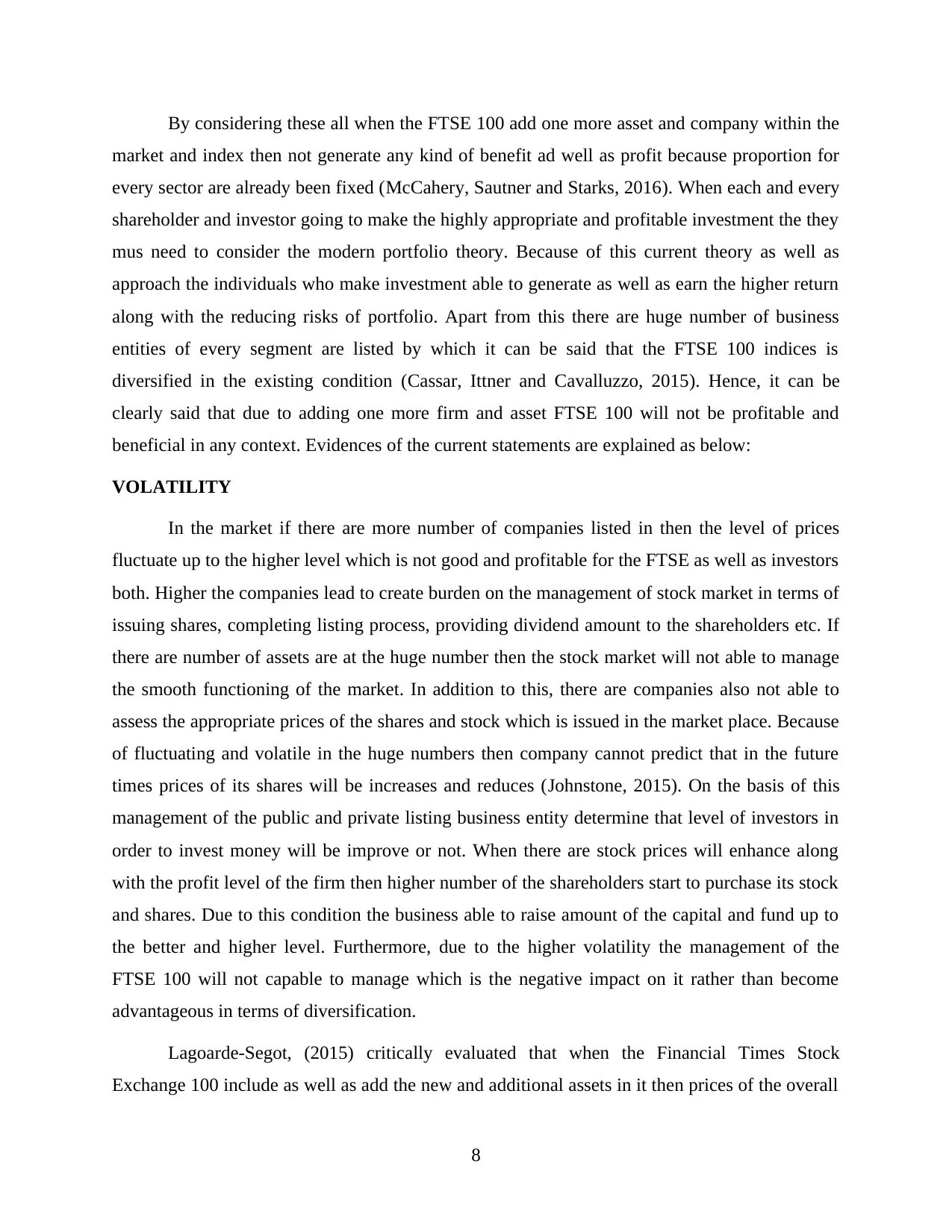

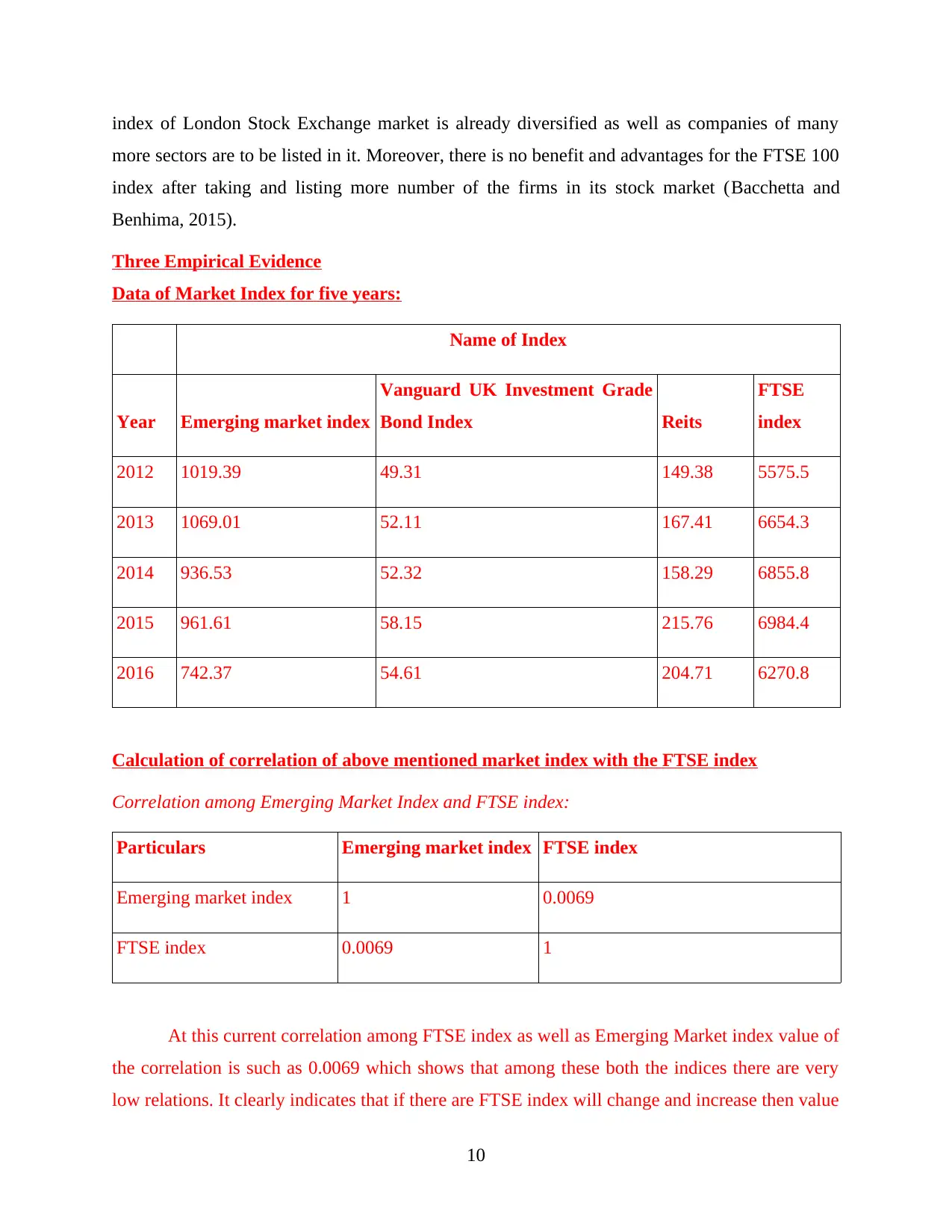

Three Empirical Evidence

Data of Market Index for five years:

Name of Index

Year Emerging market index

Vanguard UK Investment Grade

Bond Index Reits

FTSE

index

2012 1019.39 49.31 149.38 5575.5

2013 1069.01 52.11 167.41 6654.3

2014 936.53 52.32 158.29 6855.8

2015 961.61 58.15 215.76 6984.4

2016 742.37 54.61 204.71 6270.8

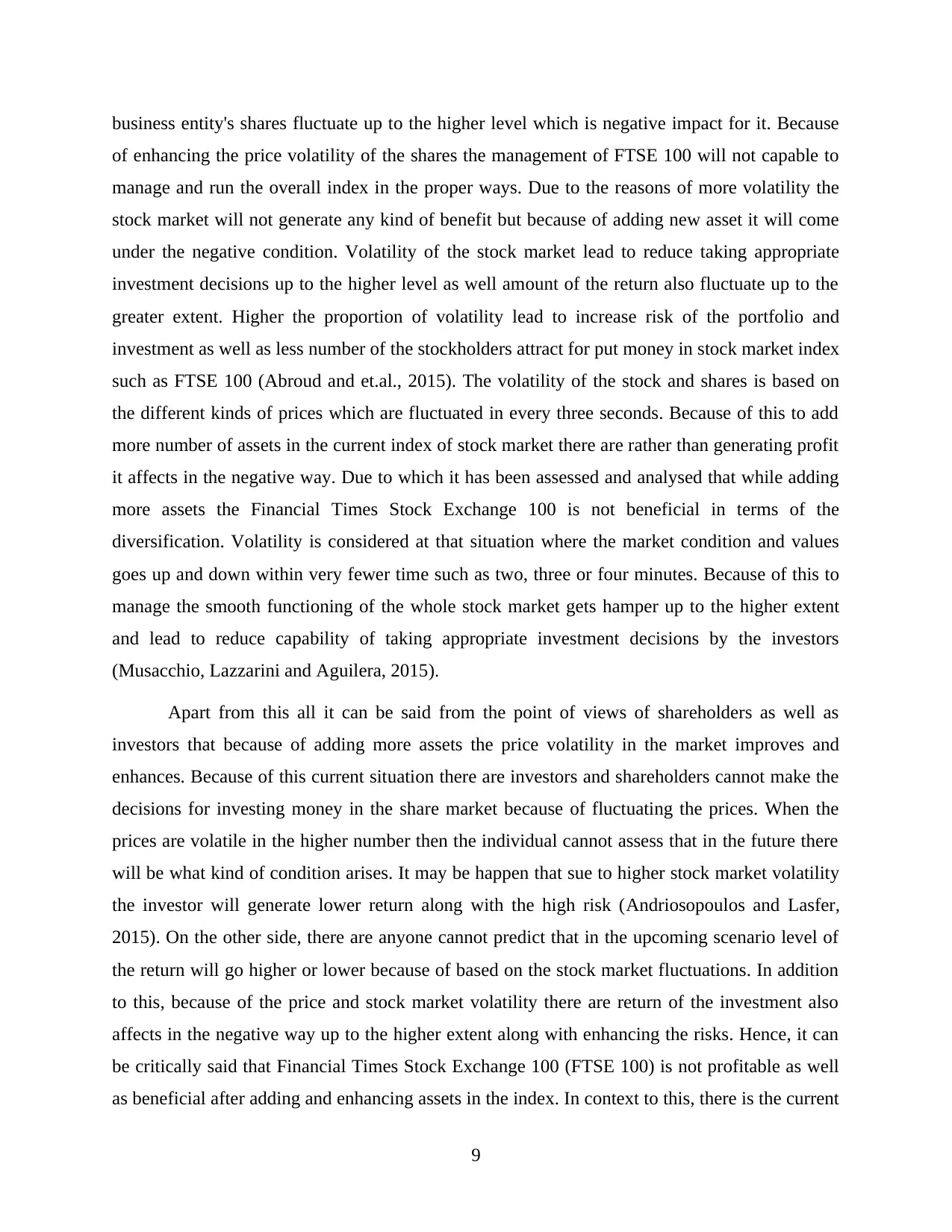

Calculation of correlation of above mentioned market index with the FTSE index

Correlation among Emerging Market Index and FTSE index:

Particulars Emerging market index FTSE index

Emerging market index 1 0.0069

FTSE index 0.0069 1

At this current correlation among FTSE index as well as Emerging Market index value of

the correlation is such as 0.0069 which shows that among these both the indices there are very

low relations. It clearly indicates that if there are FTSE index will change and increase then value

10

more sectors are to be listed in it. Moreover, there is no benefit and advantages for the FTSE 100

index after taking and listing more number of the firms in its stock market (Bacchetta and

Benhima, 2015).

Three Empirical Evidence

Data of Market Index for five years:

Name of Index

Year Emerging market index

Vanguard UK Investment Grade

Bond Index Reits

FTSE

index

2012 1019.39 49.31 149.38 5575.5

2013 1069.01 52.11 167.41 6654.3

2014 936.53 52.32 158.29 6855.8

2015 961.61 58.15 215.76 6984.4

2016 742.37 54.61 204.71 6270.8

Calculation of correlation of above mentioned market index with the FTSE index

Correlation among Emerging Market Index and FTSE index:

Particulars Emerging market index FTSE index

Emerging market index 1 0.0069

FTSE index 0.0069 1

At this current correlation among FTSE index as well as Emerging Market index value of

the correlation is such as 0.0069 which shows that among these both the indices there are very

low relations. It clearly indicates that if there are FTSE index will change and increase then value

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 16

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.