Global Financial Crisis Analysis

VerifiedAdded on 2020/05/28

|13

|2954

|174

AI Summary

This assignment delves into the multifaceted aspects of the Global Financial Crisis (2008-2009). It requires an in-depth analysis of various contributing factors, including subprime mortgages, credit booms, lax lending standards, and the role of multinational banks. Students are expected to evaluate policy responses implemented by central banks and governments worldwide. Additionally, the assignment encourages exploration of the crisis's impact on international trade, capital flows, and economic growth across different countries.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CORPORPORATE FINANCE MANAGEMENT

CORPORATE FINANCE MANAGEMENT

Name of the Student

Name of the University

Author’s Note

CORPORATE FINANCE MANAGEMENT

Name of the Student

Name of the University

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1CORPORATE FINANCE MANAGEMENT

Table of Content

Introduction......................................................................................................................................4

Discussion........................................................................................................................................5

Possible causes of global financial crisis (GFC).........................................................................5

Possibility of occurrence of GFC................................................................................................7

Impact of GFC in economies of various countries......................................................................8

Examples of financial crisis events............................................................................................10

Indentifying some of the proposed reforms that eventuated during GFC.................................11

Conclusion.................................................................................................................................11

References......................................................................................................................................13

Table of Content

Introduction......................................................................................................................................4

Discussion........................................................................................................................................5

Possible causes of global financial crisis (GFC).........................................................................5

Possibility of occurrence of GFC................................................................................................7

Impact of GFC in economies of various countries......................................................................8

Examples of financial crisis events............................................................................................10

Indentifying some of the proposed reforms that eventuated during GFC.................................11

Conclusion.................................................................................................................................11

References......................................................................................................................................13

2CORPORATE FINANCE MANAGEMENT

Introduction

The assignment provides an overview about the causes and impact of global financial

crisis (GFC) among various countries. The study also focuses on the examples of the GFC

events that occurred during this period. The financial crisis during the period 2007-2008, also

termed as GFC and is also considered as the worst crisis since the occurrence of great depression

of 1929. It is the most significant economic catastrophe that adversely influenced several

countries in the world (Ait-Sahalia et al. 2012). This crisis started in the year 2007 with the

subprime mortgage crisis in the US, which further developed into international banking crisis

along with collapse of investment bank named as Lehman Brothers. Owing to this subprime

mortgage crisis, several investors in US lost their confidence in making their investment in

business, which in turn caused liquidity crisis. This GFC had also worsened owing to crash and

high volatility of the stock market. In fact, huge bail out of the financial organizations and other

monetary as well as fiscal policies had been integrated by the policymakers in order to prevent

collapse of the global financial system (Berkmen et al. 2012). This global crisis was followed by

the economic downturn also known as Great Recession. In fact, the individuals having fear of

their wealth also contributed to this GFC by demanding that the financial institutions as well as

banks repay their money as much as possible. By meeting the demand of customers causes these

banks to liquidate financial assets holdings. In fact, some of the reforms that eventuated during

this period are also highlighted in this study.

Introduction

The assignment provides an overview about the causes and impact of global financial

crisis (GFC) among various countries. The study also focuses on the examples of the GFC

events that occurred during this period. The financial crisis during the period 2007-2008, also

termed as GFC and is also considered as the worst crisis since the occurrence of great depression

of 1929. It is the most significant economic catastrophe that adversely influenced several

countries in the world (Ait-Sahalia et al. 2012). This crisis started in the year 2007 with the

subprime mortgage crisis in the US, which further developed into international banking crisis

along with collapse of investment bank named as Lehman Brothers. Owing to this subprime

mortgage crisis, several investors in US lost their confidence in making their investment in

business, which in turn caused liquidity crisis. This GFC had also worsened owing to crash and

high volatility of the stock market. In fact, huge bail out of the financial organizations and other

monetary as well as fiscal policies had been integrated by the policymakers in order to prevent

collapse of the global financial system (Berkmen et al. 2012). This global crisis was followed by

the economic downturn also known as Great Recession. In fact, the individuals having fear of

their wealth also contributed to this GFC by demanding that the financial institutions as well as

banks repay their money as much as possible. By meeting the demand of customers causes these

banks to liquidate financial assets holdings. In fact, some of the reforms that eventuated during

this period are also highlighted in this study.

3CORPORATE FINANCE MANAGEMENT

Discussion

Possible causes of global financial crisis (GFC)

The global financial crisis was mainly caused owing to deregulation in financial sector. This

allowed the banks and financial institutions to engage in trading hedge fund with the derivatives.

The banks in turn demanded higher mortgages in order to support profitable derivatives sale. In

fact, these banks in turn created interest on loan, which became affordable to the borrowers

(Barakova, Calem and Wachter 2014). In the year 2004, this nation’s Federal Reserve increased

the funds rates on these mortgages reset. The housing prices began to decline as supply of houses

outpaced demand. This in turn trapped those households who couldn’t afford to make the

payments as well as sell their residence. However, when these derivatives value deteriorated, the

banks and financial organizations stopped lending the money to each other. The four underlying

reasons that caused global financial crisis includes-

Deregulation- Historical evidences reflected that the regulation of bank based on Bassel

accords motivated unconventional business practices and this reinforced financial crisis.

There are some cases where the laws had been changed in the parts of financial system.

For example, in the year 1999, the president of US has signed a law (Gramm-Leach –

BilleyAct) that repealed Glass Steagall Act provisions, which restricted the bank holding

institutions from owing other organizations. This repeal in turn removed division, which

existed previously between the investment banks and the depository banks. However,

investment banks trusted into competition with the scheduled commercial banks. Thus,

this repeal contributed to GFC.

Housing bubble growth- During the period 1998-2006, the house price increased by near

about 124%. This resulted to numerous homeowners to refinance their residence at lower

Discussion

Possible causes of global financial crisis (GFC)

The global financial crisis was mainly caused owing to deregulation in financial sector. This

allowed the banks and financial institutions to engage in trading hedge fund with the derivatives.

The banks in turn demanded higher mortgages in order to support profitable derivatives sale. In

fact, these banks in turn created interest on loan, which became affordable to the borrowers

(Barakova, Calem and Wachter 2014). In the year 2004, this nation’s Federal Reserve increased

the funds rates on these mortgages reset. The housing prices began to decline as supply of houses

outpaced demand. This in turn trapped those households who couldn’t afford to make the

payments as well as sell their residence. However, when these derivatives value deteriorated, the

banks and financial organizations stopped lending the money to each other. The four underlying

reasons that caused global financial crisis includes-

Deregulation- Historical evidences reflected that the regulation of bank based on Bassel

accords motivated unconventional business practices and this reinforced financial crisis.

There are some cases where the laws had been changed in the parts of financial system.

For example, in the year 1999, the president of US has signed a law (Gramm-Leach –

BilleyAct) that repealed Glass Steagall Act provisions, which restricted the bank holding

institutions from owing other organizations. This repeal in turn removed division, which

existed previously between the investment banks and the depository banks. However,

investment banks trusted into competition with the scheduled commercial banks. Thus,

this repeal contributed to GFC.

Housing bubble growth- During the period 1998-2006, the house price increased by near

about 124%. This resulted to numerous homeowners to refinance their residence at lower

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4CORPORATE FINANCE MANAGEMENT

rate of interest or financing consumer expenditure by taking mortgages (Cheng, Raina

and Xiong 2012). The huge amount of money sought higher yields than that offered by

treasury bonds. The investment banks connected this money to this nation’s mortgage

market. In the year 2003, the mortgage supply exhausted and hence huge demand

reducing lending standards. By the year 2008, this housing prices declined by 20% and

hence borrowers face difficulty to refinance for avoiding higher payments relating to

higher interest rates. Hence, all outstanding mortgages became delinquent.

Easier credit conditions- Low rate of interest in banks encouraged borrowing. During the

period 2000-2003, the US Federal Reserve decreased their funds rate from 6.5% to 1%.

However, in the year 2002, it was seen that this credit conditions was fueling housing

rather than business investment (Haas and Lelyveld 2014). Moreover, rising current

account deficit created downward pressure on banks interest rate. This deficit in current

account increased by around $650 billion and hence recovering this deficit required them

to borrow money from other nation. Huge amount of capital reached this financial market

and hence US households utilized these funds borrowed from foreigners for financing

consumption. However, Fed increased funds rate in the year 2006, which in turn

increased adjustable rate mortgage (ARM) rates.

Predatory lending- This refers to as the unscrupulous lenders practice that entice

borrowers to move into unsafe secured loans for bad purposes. The US banks provided

loans to several borrowers who have taken money for unfair business practices. However,

this deteriorated financial condition of this nation.

rate of interest or financing consumer expenditure by taking mortgages (Cheng, Raina

and Xiong 2012). The huge amount of money sought higher yields than that offered by

treasury bonds. The investment banks connected this money to this nation’s mortgage

market. In the year 2003, the mortgage supply exhausted and hence huge demand

reducing lending standards. By the year 2008, this housing prices declined by 20% and

hence borrowers face difficulty to refinance for avoiding higher payments relating to

higher interest rates. Hence, all outstanding mortgages became delinquent.

Easier credit conditions- Low rate of interest in banks encouraged borrowing. During the

period 2000-2003, the US Federal Reserve decreased their funds rate from 6.5% to 1%.

However, in the year 2002, it was seen that this credit conditions was fueling housing

rather than business investment (Haas and Lelyveld 2014). Moreover, rising current

account deficit created downward pressure on banks interest rate. This deficit in current

account increased by around $650 billion and hence recovering this deficit required them

to borrow money from other nation. Huge amount of capital reached this financial market

and hence US households utilized these funds borrowed from foreigners for financing

consumption. However, Fed increased funds rate in the year 2006, which in turn

increased adjustable rate mortgage (ARM) rates.

Predatory lending- This refers to as the unscrupulous lenders practice that entice

borrowers to move into unsafe secured loans for bad purposes. The US banks provided

loans to several borrowers who have taken money for unfair business practices. However,

this deteriorated financial condition of this nation.

5CORPORATE FINANCE MANAGEMENT

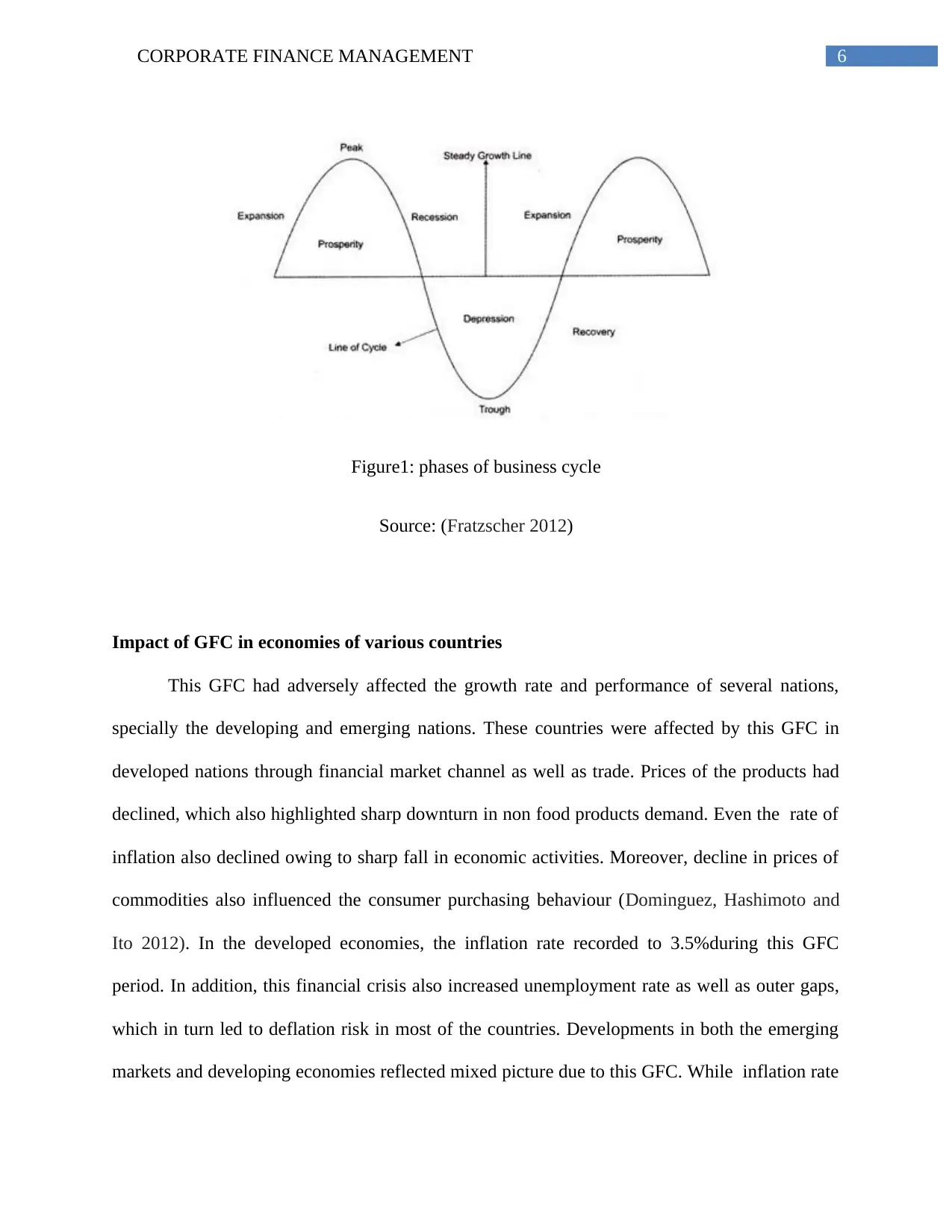

Possibility of occurrence of GFC

According to my opinion, there is a possibility of occurrence of GFC in future. The

reason behind this is the ‘business cycle’, which basically signifies terms of expansion or

recession periods. It is referred to as the variation in economic activity, which the nation

experiences over certain time period. There are mainly five phases of business cycle namely-

expansion, peak, recession, trough and recovery. During the expansionary phase, the economy

of the specific nation grows at steady rate and this continues until conditions in economy are

favorable. The peak phase arises when the growth in expansion phase slows down and business

cycle growth rate achieves maximum limit (Fratzscher 2012). In this phase, the demand for

products decreases owing to rise in its prices. Recessionary phase occurs when decrease in

product demand becomes rapid and all economic factors including prices, investment, production

begins to decline. In the trough stage, economic activity of a particular nation decreased below

normal level and hence economic growth rate becomes negative. Once the economy reaches

lowest level, it again starts to recover. This in turn leads to reversal of business cycle procedure,

which in turn completes the business cycle. As the economy is stable and stronger, it signifies

that it is in expansionary phase. However, it is predicted that after the economy reaches the peak

phase, it will again move towards recessionary phase. Hence, GFC might occur again.

Possibility of occurrence of GFC

According to my opinion, there is a possibility of occurrence of GFC in future. The

reason behind this is the ‘business cycle’, which basically signifies terms of expansion or

recession periods. It is referred to as the variation in economic activity, which the nation

experiences over certain time period. There are mainly five phases of business cycle namely-

expansion, peak, recession, trough and recovery. During the expansionary phase, the economy

of the specific nation grows at steady rate and this continues until conditions in economy are

favorable. The peak phase arises when the growth in expansion phase slows down and business

cycle growth rate achieves maximum limit (Fratzscher 2012). In this phase, the demand for

products decreases owing to rise in its prices. Recessionary phase occurs when decrease in

product demand becomes rapid and all economic factors including prices, investment, production

begins to decline. In the trough stage, economic activity of a particular nation decreased below

normal level and hence economic growth rate becomes negative. Once the economy reaches

lowest level, it again starts to recover. This in turn leads to reversal of business cycle procedure,

which in turn completes the business cycle. As the economy is stable and stronger, it signifies

that it is in expansionary phase. However, it is predicted that after the economy reaches the peak

phase, it will again move towards recessionary phase. Hence, GFC might occur again.

6CORPORATE FINANCE MANAGEMENT

Figure1: phases of business cycle

Source: (Fratzscher 2012)

Impact of GFC in economies of various countries

This GFC had adversely affected the growth rate and performance of several nations,

specially the developing and emerging nations. These countries were affected by this GFC in

developed nations through financial market channel as well as trade. Prices of the products had

declined, which also highlighted sharp downturn in non food products demand. Even the rate of

inflation also declined owing to sharp fall in economic activities. Moreover, decline in prices of

commodities also influenced the consumer purchasing behaviour (Dominguez, Hashimoto and

Ito 2012). In the developed economies, the inflation rate recorded to 3.5%during this GFC

period. In addition, this financial crisis also increased unemployment rate as well as outer gaps,

which in turn led to deflation risk in most of the countries. Developments in both the emerging

markets and developing economies reflected mixed picture due to this GFC. While inflation rate

Figure1: phases of business cycle

Source: (Fratzscher 2012)

Impact of GFC in economies of various countries

This GFC had adversely affected the growth rate and performance of several nations,

specially the developing and emerging nations. These countries were affected by this GFC in

developed nations through financial market channel as well as trade. Prices of the products had

declined, which also highlighted sharp downturn in non food products demand. Even the rate of

inflation also declined owing to sharp fall in economic activities. Moreover, decline in prices of

commodities also influenced the consumer purchasing behaviour (Dominguez, Hashimoto and

Ito 2012). In the developed economies, the inflation rate recorded to 3.5%during this GFC

period. In addition, this financial crisis also increased unemployment rate as well as outer gaps,

which in turn led to deflation risk in most of the countries. Developments in both the emerging

markets and developing economies reflected mixed picture due to this GFC. While inflation rate

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7CORPORATE FINANCE MANAGEMENT

has reduced in several nations, the pressure of price in few nations remained strong. This

however highlighted that stickiness of price in the commodity market and lagged affect of

increasing wages as well as input cost. This turmoil in the financial market had spread across the

emerging and developing countries. The corporate industry of these countries was also largely

affected by increasing funding issues and lossess in foreign exchange. As the exporters in many

nations had taken open currency positions against US currency, it gave rise to issues relating to

liquidity as well as solvency in the non financial industry. Another vital impact of GFC is

substantial decline in the exports of the countries because of increasing pace of expansion in

trade declined sharply. It has been projected by IMF that, the volumes of world trade during this

period reduced to 4.1%in the year 2009 from 9.3% in the year 2006. However, this GFC also led

to adverse shocks of investment in the emerging economies. In addition, FDI( foreign direct

investment) also declined at huge amount due to this economic shocks. It has been also noted

from the historical data that, the GFC reduced demand for products, which in turn led to decrease

in export earnings.

The impact of GFC on Australia had been significantly less as compared to other nations.

This nation had recorded better growth outcomes in comparison with other advanced economies

(Frankel and Saravelos 2012). The Australian bank had continued to remain profitable and even

did not require additional capital from government. But this crisis affected several Australian

households owing to huge decrease in the equity prices. This in turn decreased the wealth of this

nation’s households by near about 10% during the year 2009. Additionally, this nation’s

currency depreciated rapidly as GFC intensified, thereby decreasing by over 30%.

has reduced in several nations, the pressure of price in few nations remained strong. This

however highlighted that stickiness of price in the commodity market and lagged affect of

increasing wages as well as input cost. This turmoil in the financial market had spread across the

emerging and developing countries. The corporate industry of these countries was also largely

affected by increasing funding issues and lossess in foreign exchange. As the exporters in many

nations had taken open currency positions against US currency, it gave rise to issues relating to

liquidity as well as solvency in the non financial industry. Another vital impact of GFC is

substantial decline in the exports of the countries because of increasing pace of expansion in

trade declined sharply. It has been projected by IMF that, the volumes of world trade during this

period reduced to 4.1%in the year 2009 from 9.3% in the year 2006. However, this GFC also led

to adverse shocks of investment in the emerging economies. In addition, FDI( foreign direct

investment) also declined at huge amount due to this economic shocks. It has been also noted

from the historical data that, the GFC reduced demand for products, which in turn led to decrease

in export earnings.

The impact of GFC on Australia had been significantly less as compared to other nations.

This nation had recorded better growth outcomes in comparison with other advanced economies

(Frankel and Saravelos 2012). The Australian bank had continued to remain profitable and even

did not require additional capital from government. But this crisis affected several Australian

households owing to huge decrease in the equity prices. This in turn decreased the wealth of this

nation’s households by near about 10% during the year 2009. Additionally, this nation’s

currency depreciated rapidly as GFC intensified, thereby decreasing by over 30%.

8CORPORATE FINANCE MANAGEMENT

Examples of financial crisis events

Subprime mortgages crisis- The subprime mortgage crisis was mainly triggered by huge

decline in prices of residence after the crumple of housing bubble. This lead to mortgage

delinquencies and devaluation of securities relaying to housing (Brueckner, Calem and

Nakamura 2012) There were several reasons of this crisis, out of which subprime lending

and rise in speculation of housing were two proximate reasons. Other causes includes –

homeowners inability to make mortgage payments, risky mortgage goods, high level of

corporate as well as personal debt, bad housing policies, imbalances in international trade

and improper regulation of government of this nation.

Collapse of Lehman Brothers- During the GFC, Lehman Brothers was filed for

bankruptcy. With more than $639 billion in total assets and $619 billion in debt, this

investment bank collapsed as their assets surpassed that of the bankrupt giants. This

seminal event had contributed to erosion of $10 trillion in the capitalization of market

from the world equity markets. Eruption of credit crisis with failure of hedge funds, the

stock process of this investment bank fell sharply. During that period, this bank

eliminated more than 2500 mortgage related jobs and also shut down their BNC unit. In

the last quarter of 2007, their stock rebounded as the world equity market had reached at

new height and their fixed income assets prices took temporary rebound (Cukierman

2013). Their high level of leverage as well as huge mortgage securities portfolio made it

vulnerable to the market conditions. However, their shares fell to near about 48% and

hence led to collapse.

Examples of financial crisis events

Subprime mortgages crisis- The subprime mortgage crisis was mainly triggered by huge

decline in prices of residence after the crumple of housing bubble. This lead to mortgage

delinquencies and devaluation of securities relaying to housing (Brueckner, Calem and

Nakamura 2012) There were several reasons of this crisis, out of which subprime lending

and rise in speculation of housing were two proximate reasons. Other causes includes –

homeowners inability to make mortgage payments, risky mortgage goods, high level of

corporate as well as personal debt, bad housing policies, imbalances in international trade

and improper regulation of government of this nation.

Collapse of Lehman Brothers- During the GFC, Lehman Brothers was filed for

bankruptcy. With more than $639 billion in total assets and $619 billion in debt, this

investment bank collapsed as their assets surpassed that of the bankrupt giants. This

seminal event had contributed to erosion of $10 trillion in the capitalization of market

from the world equity markets. Eruption of credit crisis with failure of hedge funds, the

stock process of this investment bank fell sharply. During that period, this bank

eliminated more than 2500 mortgage related jobs and also shut down their BNC unit. In

the last quarter of 2007, their stock rebounded as the world equity market had reached at

new height and their fixed income assets prices took temporary rebound (Cukierman

2013). Their high level of leverage as well as huge mortgage securities portfolio made it

vulnerable to the market conditions. However, their shares fell to near about 48% and

hence led to collapse.

9CORPORATE FINANCE MANAGEMENT

Indentifying some of the proposed reforms that eventuated during GFC

Some of the proposed reforms eventuated during GFC in order to understand their

shortcomings. These reforms included-

Adoption of Basel III requirement of capital, that includes countercyclical capital shield

as well as surcharge for vital financial institutions (Haas and Lelyveld 2014).

They have reached the agreement in adopting the liquidity standards including -The

Liquidity Coverage Ratio ( LCR).

Improvement of the securitization framework

Implementation of principles for the compensation practices for avoiding perverse risk

taking incentives.

Agreement in few principle on some kind of US financial transactions that includes-

GAAP (Generally Accepted Accounting Principle) and IFRS ( International Financial

Reporting Standards).

Closure of few data gaps for example, beginning of gathering of consolidated data mainly

on bilateral counterparty, risk of credit of huge systematic banks etc.

Conclusion

This GFC had influenced the countries both positively and negatively. The positive

effects of this financial crisis were- end to domination of magnate in foreign financial relations,

redrafting of laws as well as rules that regulated world financial institutions mainly IMF

(International Monetary Fund), WTO ( World Trade Organization),absence of large financial

organization that dominated stock market around the globe. The negative effects include collapse

of banks as well as financial sector, decline in GDP growth rate, rise in unemployment rate etc.

Overall, this crisis lowered the economic growth of several countries. In addition, it enabled the

Indentifying some of the proposed reforms that eventuated during GFC

Some of the proposed reforms eventuated during GFC in order to understand their

shortcomings. These reforms included-

Adoption of Basel III requirement of capital, that includes countercyclical capital shield

as well as surcharge for vital financial institutions (Haas and Lelyveld 2014).

They have reached the agreement in adopting the liquidity standards including -The

Liquidity Coverage Ratio ( LCR).

Improvement of the securitization framework

Implementation of principles for the compensation practices for avoiding perverse risk

taking incentives.

Agreement in few principle on some kind of US financial transactions that includes-

GAAP (Generally Accepted Accounting Principle) and IFRS ( International Financial

Reporting Standards).

Closure of few data gaps for example, beginning of gathering of consolidated data mainly

on bilateral counterparty, risk of credit of huge systematic banks etc.

Conclusion

This GFC had influenced the countries both positively and negatively. The positive

effects of this financial crisis were- end to domination of magnate in foreign financial relations,

redrafting of laws as well as rules that regulated world financial institutions mainly IMF

(International Monetary Fund), WTO ( World Trade Organization),absence of large financial

organization that dominated stock market around the globe. The negative effects include collapse

of banks as well as financial sector, decline in GDP growth rate, rise in unemployment rate etc.

Overall, this crisis lowered the economic growth of several countries. In addition, it enabled the

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10CORPORATE FINANCE MANAGEMENT

government of various nations to change their regulatory policies and implement stimulus

measures.

government of various nations to change their regulatory policies and implement stimulus

measures.

11CORPORATE FINANCE MANAGEMENT

References

Ait-Sahalia, Y., Andritzky, J., Jobst, A., Nowak, S. and Tamirisa, N., 2012. Market response to

policy initiatives during the global financial crisis. Journal of International Economics, 87(1),

pp.162-177.

Barakova, I., Calem, P.S. and Wachter, S.M., 2014. Borrowing constraints during the housing

bubble. Journal of Housing Economics, 24, pp.4-20.

Bekaert, G., Ehrmann, M., Fratzscher, M. and Mehl, A., 2014. The global crisis and equity

market contagion. The Journal of Finance, 69(6), pp.2597-2649.

Berkmen, S.P., Gelos, G., Rennhack, R. and Walsh, J.P., 2012. The global financial crisis:

Explaining cross-country differences in the output impact. Journal of International Money and

Finance, 31(1), pp.42-59.

Brueckner, J.K., Calem, P.S. and Nakamura, L.I., 2012. Subprime mortgages and the housing

bubble. Journal of Urban Economics, 71(2), pp.230-243.

Cheng, I.H., Raina, S. and Xiong, W., 2013. Wall Street and the housing bubble (No. w18904).

National Bureau of Economic Research.

Chor, D. and Manova, K., 2012. Off the cliff and back? Credit conditions and international trade

during the global financial crisis. Journal of international economics, 87(1), pp.117-133.

Cukierman, A., 2013. Monetary policy and institutions before, during, and after the global

financial crisis. Journal of Financial Stability, 9(3), pp.373-384.

Dell’Ariccia, G., Igan, D. and Laeven, L.U., 2012. Credit booms and lending standards:

Evidence from the subprime mortgage market. Journal of Money, Credit and Banking, 44(2‐3),

pp.367-384.

Dominguez, K.M., Hashimoto, Y. and Ito, T., 2012. International reserves and the global

financial crisis. Journal of International Economics, 88(2), pp.388-406.

Feldkircher, M., 2014. The determinants of vulnerability to the global financial crisis 2008 to

2009: Credit growth and other sources of risk. Journal of international Money and Finance, 43,

pp.19-49.

Frankel, J. and Saravelos, G., 2012. Can leading indicators assess country vulnerability?

Evidence from the 2008–09 global financial crisis. Journal of International Economics, 87(2),

pp.216-231.

References

Ait-Sahalia, Y., Andritzky, J., Jobst, A., Nowak, S. and Tamirisa, N., 2012. Market response to

policy initiatives during the global financial crisis. Journal of International Economics, 87(1),

pp.162-177.

Barakova, I., Calem, P.S. and Wachter, S.M., 2014. Borrowing constraints during the housing

bubble. Journal of Housing Economics, 24, pp.4-20.

Bekaert, G., Ehrmann, M., Fratzscher, M. and Mehl, A., 2014. The global crisis and equity

market contagion. The Journal of Finance, 69(6), pp.2597-2649.

Berkmen, S.P., Gelos, G., Rennhack, R. and Walsh, J.P., 2012. The global financial crisis:

Explaining cross-country differences in the output impact. Journal of International Money and

Finance, 31(1), pp.42-59.

Brueckner, J.K., Calem, P.S. and Nakamura, L.I., 2012. Subprime mortgages and the housing

bubble. Journal of Urban Economics, 71(2), pp.230-243.

Cheng, I.H., Raina, S. and Xiong, W., 2013. Wall Street and the housing bubble (No. w18904).

National Bureau of Economic Research.

Chor, D. and Manova, K., 2012. Off the cliff and back? Credit conditions and international trade

during the global financial crisis. Journal of international economics, 87(1), pp.117-133.

Cukierman, A., 2013. Monetary policy and institutions before, during, and after the global

financial crisis. Journal of Financial Stability, 9(3), pp.373-384.

Dell’Ariccia, G., Igan, D. and Laeven, L.U., 2012. Credit booms and lending standards:

Evidence from the subprime mortgage market. Journal of Money, Credit and Banking, 44(2‐3),

pp.367-384.

Dominguez, K.M., Hashimoto, Y. and Ito, T., 2012. International reserves and the global

financial crisis. Journal of International Economics, 88(2), pp.388-406.

Feldkircher, M., 2014. The determinants of vulnerability to the global financial crisis 2008 to

2009: Credit growth and other sources of risk. Journal of international Money and Finance, 43,

pp.19-49.

Frankel, J. and Saravelos, G., 2012. Can leading indicators assess country vulnerability?

Evidence from the 2008–09 global financial crisis. Journal of International Economics, 87(2),

pp.216-231.

12CORPORATE FINANCE MANAGEMENT

Fratzscher, M., 2012. Capital flows, push versus pull factors and the global financial

crisis. Journal of International Economics, 88(2), pp.341-356

Haas, R. and Lelyveld, I., 2014. Multinational banks and the global financial crisis: Weathering

the perfect storm?. Journal of Money, Credit and Banking, 46(s1), pp.333-364.

McDonald, J.F. and Stokes, H.H., 2013. Monetary policy and the housing bubble. The Journal of

Real Estate Finance and Economics, 46(3), pp.437-451.

Peicuti, C., 2013. Securitization and the subprime mortgage crisis. Journal of Post Keynesian

Economics, 35(3), pp.443-456.

Shiller, R.J., 2012. The subprime solution: how today's global financial crisis happened, and

what to do about it. Princeton University Press.

Fratzscher, M., 2012. Capital flows, push versus pull factors and the global financial

crisis. Journal of International Economics, 88(2), pp.341-356

Haas, R. and Lelyveld, I., 2014. Multinational banks and the global financial crisis: Weathering

the perfect storm?. Journal of Money, Credit and Banking, 46(s1), pp.333-364.

McDonald, J.F. and Stokes, H.H., 2013. Monetary policy and the housing bubble. The Journal of

Real Estate Finance and Economics, 46(3), pp.437-451.

Peicuti, C., 2013. Securitization and the subprime mortgage crisis. Journal of Post Keynesian

Economics, 35(3), pp.443-456.

Shiller, R.J., 2012. The subprime solution: how today's global financial crisis happened, and

what to do about it. Princeton University Press.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.