Corporate Finance: Beta Analysis of RHP Company - Assessment 2 Report

VerifiedAdded on 2022/12/26

|7

|1194

|40

Report

AI Summary

This report provides a comprehensive analysis of the beta of RHP Company, focusing on the calculation of risk and return using market data from two sub-periods: June 2012 to July 2014 and February 2016 to January 2018. The analysis includes the calculation of returns for share prices and market returns, along with the risk-free rate. The report calculates and interprets the mean, standard deviation, variance, and correlation coefficient for both periods. The beta values are estimated and interpreted, reflecting the sensitivity of the stock to market changes. The report also includes a brief overview of RHP Company's business operations and provides references to the data sources used in the analysis, including Yahoo Finance and the Australian Securities Exchange.

Running head: CORPORATE FINANCE

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Corporate Finance

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1CORPORATE FINANCE

Table of Contents

Question 1........................................................................................................................................2

References........................................................................................................................................6

Table of Contents

Question 1........................................................................................................................................2

References........................................................................................................................................6

2CORPORATE FINANCE

Question 1

a) The market price index for the All-Ordinaries Index and RHP Company was taken for a

different time periods. The two sub-periods taken into consideration was from the Period

1: June 2012 to July 2014; Period 2: February 2016 to January 2018. The data undertaken

will be considered for the purpose of calculating the risk and return generated along with

the monthly risk free data period for two different set of data period taken into

consideration for the purpose of analysis.

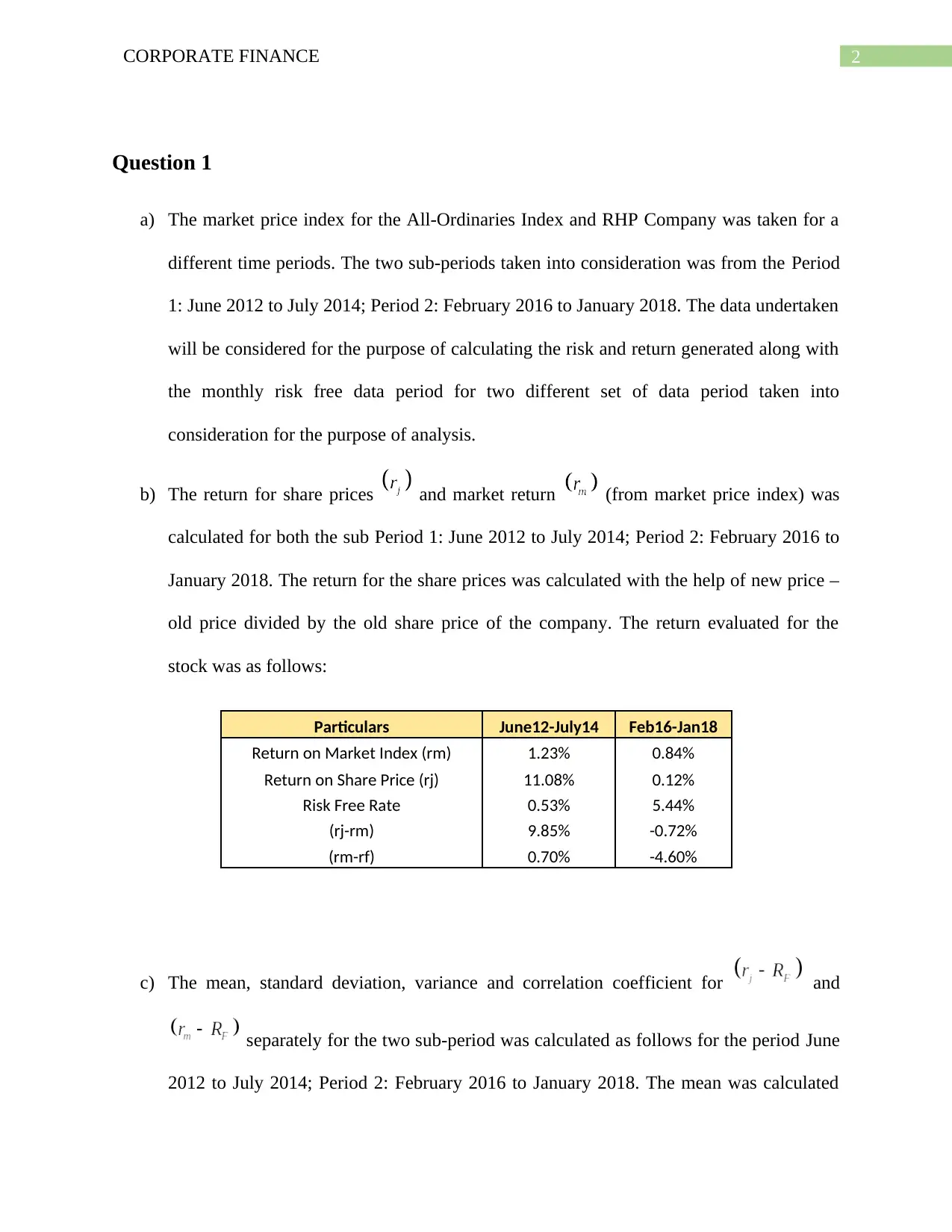

b) The return for share prices and market return (from market price index) was

calculated for both the sub Period 1: June 2012 to July 2014; Period 2: February 2016 to

January 2018. The return for the share prices was calculated with the help of new price –

old price divided by the old share price of the company. The return evaluated for the

stock was as follows:

Particulars June12-July14 Feb16-Jan18

Return on Market Index (rm) 1.23% 0.84%

Return on Share Price (rj) 11.08% 0.12%

Risk Free Rate 0.53% 5.44%

(rj-rm) 9.85% -0.72%

(rm-rf) 0.70% -4.60%

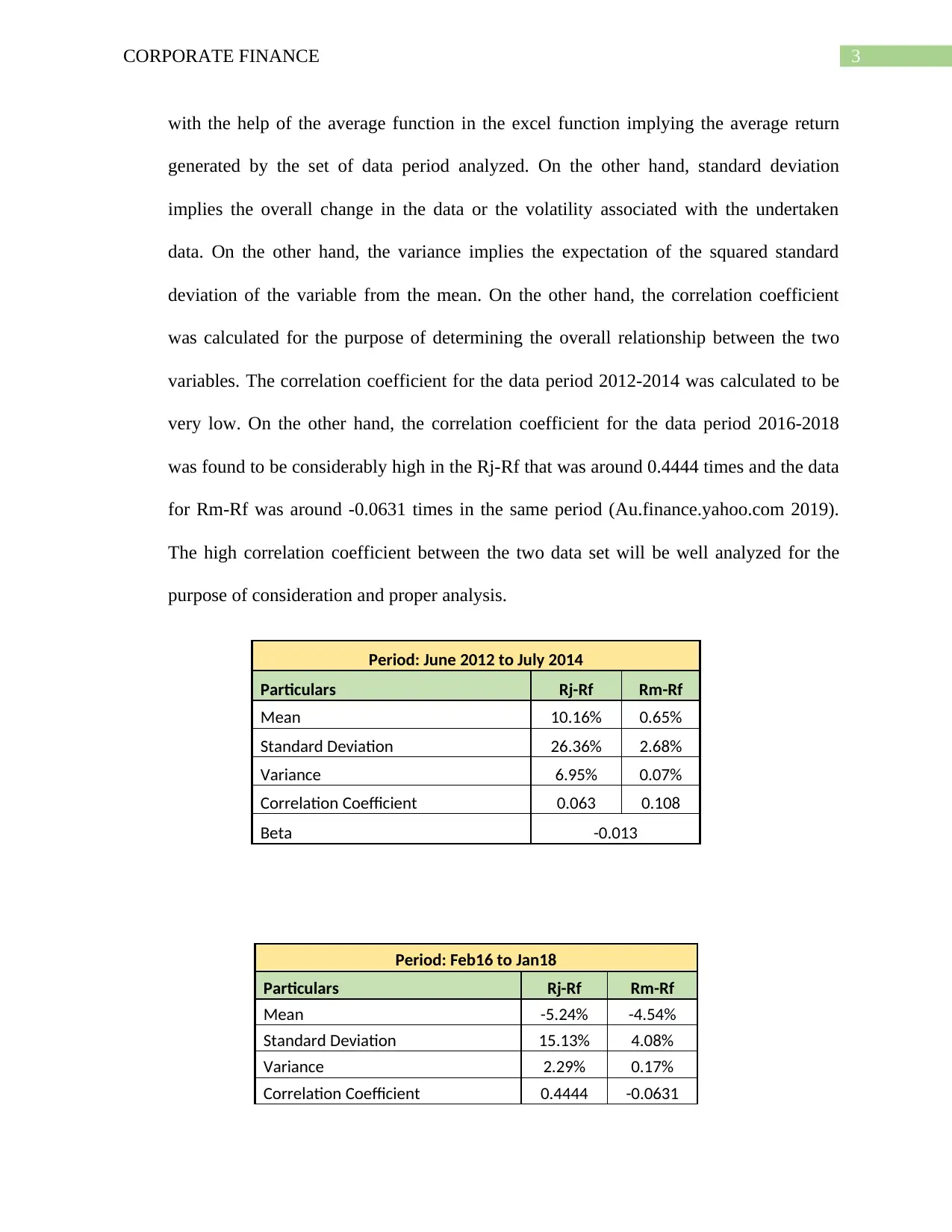

c) The mean, standard deviation, variance and correlation coefficient for and

separately for the two sub-period was calculated as follows for the period June

2012 to July 2014; Period 2: February 2016 to January 2018. The mean was calculated

Question 1

a) The market price index for the All-Ordinaries Index and RHP Company was taken for a

different time periods. The two sub-periods taken into consideration was from the Period

1: June 2012 to July 2014; Period 2: February 2016 to January 2018. The data undertaken

will be considered for the purpose of calculating the risk and return generated along with

the monthly risk free data period for two different set of data period taken into

consideration for the purpose of analysis.

b) The return for share prices and market return (from market price index) was

calculated for both the sub Period 1: June 2012 to July 2014; Period 2: February 2016 to

January 2018. The return for the share prices was calculated with the help of new price –

old price divided by the old share price of the company. The return evaluated for the

stock was as follows:

Particulars June12-July14 Feb16-Jan18

Return on Market Index (rm) 1.23% 0.84%

Return on Share Price (rj) 11.08% 0.12%

Risk Free Rate 0.53% 5.44%

(rj-rm) 9.85% -0.72%

(rm-rf) 0.70% -4.60%

c) The mean, standard deviation, variance and correlation coefficient for and

separately for the two sub-period was calculated as follows for the period June

2012 to July 2014; Period 2: February 2016 to January 2018. The mean was calculated

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3CORPORATE FINANCE

with the help of the average function in the excel function implying the average return

generated by the set of data period analyzed. On the other hand, standard deviation

implies the overall change in the data or the volatility associated with the undertaken

data. On the other hand, the variance implies the expectation of the squared standard

deviation of the variable from the mean. On the other hand, the correlation coefficient

was calculated for the purpose of determining the overall relationship between the two

variables. The correlation coefficient for the data period 2012-2014 was calculated to be

very low. On the other hand, the correlation coefficient for the data period 2016-2018

was found to be considerably high in the Rj-Rf that was around 0.4444 times and the data

for Rm-Rf was around -0.0631 times in the same period (Au.finance.yahoo.com 2019).

The high correlation coefficient between the two data set will be well analyzed for the

purpose of consideration and proper analysis.

Period: June 2012 to July 2014

Particulars Rj-Rf Rm-Rf

Mean 10.16% 0.65%

Standard Deviation 26.36% 2.68%

Variance 6.95% 0.07%

Correlation Coefficient 0.063 0.108

Beta -0.013

Period: Feb16 to Jan18

Particulars Rj-Rf Rm-Rf

Mean -5.24% -4.54%

Standard Deviation 15.13% 4.08%

Variance 2.29% 0.17%

Correlation Coefficient 0.4444 -0.0631

with the help of the average function in the excel function implying the average return

generated by the set of data period analyzed. On the other hand, standard deviation

implies the overall change in the data or the volatility associated with the undertaken

data. On the other hand, the variance implies the expectation of the squared standard

deviation of the variable from the mean. On the other hand, the correlation coefficient

was calculated for the purpose of determining the overall relationship between the two

variables. The correlation coefficient for the data period 2012-2014 was calculated to be

very low. On the other hand, the correlation coefficient for the data period 2016-2018

was found to be considerably high in the Rj-Rf that was around 0.4444 times and the data

for Rm-Rf was around -0.0631 times in the same period (Au.finance.yahoo.com 2019).

The high correlation coefficient between the two data set will be well analyzed for the

purpose of consideration and proper analysis.

Period: June 2012 to July 2014

Particulars Rj-Rf Rm-Rf

Mean 10.16% 0.65%

Standard Deviation 26.36% 2.68%

Variance 6.95% 0.07%

Correlation Coefficient 0.063 0.108

Beta -0.013

Period: Feb16 to Jan18

Particulars Rj-Rf Rm-Rf

Mean -5.24% -4.54%

Standard Deviation 15.13% 4.08%

Variance 2.29% 0.17%

Correlation Coefficient 0.4444 -0.0631

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4CORPORATE FINANCE

Beta -0.010

d) The beta for your selected company in the period June 2012 to July 2014 was around -

0.013 and the beta for the period February 2016 to January 2018 was calculated to be

around -0.010. The beta for both the time period was calculated with the help of

regressing the return of share price on the market index for the time period taken into

consideration. The excel function that has been applied for the purpose of calculating the

stock beta was the slope function for the purpose of determining the undertaken beta for

both the time period analyzed. The application of the beta will be done for analyzing and

estimating the sensitivity of the stock with respect to the market data index under the time

period taken into consideration (Editorial, 2019).

e) The beta calculated for the two sub-period shows the amount of sensitivity for the stocks

with respect to the market index where the changes in the stock prices can be well

predicted with the help of the changes in the market index. The beta in the time period of

June 2012 to July 2014 was around -0.013, implying that if market changes by 1% then

the stock price is expected to change by -0.013% on the opposite side. On the other the

beta calculated for the time period of February 2016 to January 2018 was calculated to be

around -0.010 implying that if the market changes by 1% then the stock is expected to

move in the opposite direction by around -0.010 times. The beta for each of the time

period shows the sensitivity of the stock when market index changes by 1%

(Markets.theaustralian.com.au 2019).

f) RHP Company formerly known for providing wholesale subscription software license to

a growing number of IT Services provider in the Asia Pacific Region. The software

subscription services for the products are primarily from the world leading software such

Beta -0.010

d) The beta for your selected company in the period June 2012 to July 2014 was around -

0.013 and the beta for the period February 2016 to January 2018 was calculated to be

around -0.010. The beta for both the time period was calculated with the help of

regressing the return of share price on the market index for the time period taken into

consideration. The excel function that has been applied for the purpose of calculating the

stock beta was the slope function for the purpose of determining the undertaken beta for

both the time period analyzed. The application of the beta will be done for analyzing and

estimating the sensitivity of the stock with respect to the market data index under the time

period taken into consideration (Editorial, 2019).

e) The beta calculated for the two sub-period shows the amount of sensitivity for the stocks

with respect to the market index where the changes in the stock prices can be well

predicted with the help of the changes in the market index. The beta in the time period of

June 2012 to July 2014 was around -0.013, implying that if market changes by 1% then

the stock price is expected to change by -0.013% on the opposite side. On the other the

beta calculated for the time period of February 2016 to January 2018 was calculated to be

around -0.010 implying that if the market changes by 1% then the stock is expected to

move in the opposite direction by around -0.010 times. The beta for each of the time

period shows the sensitivity of the stock when market index changes by 1%

(Markets.theaustralian.com.au 2019).

f) RHP Company formerly known for providing wholesale subscription software license to

a growing number of IT Services provider in the Asia Pacific Region. The software

subscription services for the products are primarily from the world leading software such

5CORPORATE FINANCE

as Microsoft, VMware and Citrix. The RHP Group Company provides various consulting

and support to the vendors and IT service Providers transitioning their own clients to

cloud and various other subscription centre business environment. The operations of the

company is widespread diversified into the global regions in the Asia-Pacific Region

allowing the company to cater various business needs and increase the overall operations

of the company in the defined time-period for the company (Asx.com.au, 2019).

g) The estimated value of beta compared for the two sub-period has been materially

different due to changes in the data period taken into consideration. The beta value for the

first periods was around -0.013 and on the other hand, the beta for the second period was

around -0.010 for the undertaken analysis. The changes and the estimated value of beta

for the two period has changed due to the changes in the market rate and associated share

price of the company where relevant changes in the factor data would be affecting the

overall return generated.

as Microsoft, VMware and Citrix. The RHP Group Company provides various consulting

and support to the vendors and IT service Providers transitioning their own clients to

cloud and various other subscription centre business environment. The operations of the

company is widespread diversified into the global regions in the Asia-Pacific Region

allowing the company to cater various business needs and increase the overall operations

of the company in the defined time-period for the company (Asx.com.au, 2019).

g) The estimated value of beta compared for the two sub-period has been materially

different due to changes in the data period taken into consideration. The beta value for the

first periods was around -0.013 and on the other hand, the beta for the second period was

around -0.010 for the undertaken analysis. The changes and the estimated value of beta

for the two period has changed due to the changes in the market rate and associated share

price of the company where relevant changes in the factor data would be affecting the

overall return generated.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6CORPORATE FINANCE

References

Asx.com.au. (2019). [online] Available at:

https://www.asx.com.au/asx/share-price-research/company/RHP [Accessed 2 Sep. 2019].

Au.finance.yahoo.com. (2019). Yahoo is now a part of Oath. [online] Available at:

https://au.finance.yahoo.com/quote/RHP.AX/history?

period1=1330540200&period2=1406745000&interval=1mo&filter=history&frequency=1mo

[Accessed 2 Sep. 2019].

Editorial, R. (2019). ${Instrument_CompanyName} ${Instrument_Ric} Company Profile |

Reuters.com. [online] U.S. Available at:

https://www.reuters.com/finance/stocks/companyProfile/RHP.AX [Accessed 2 Sep. 2019].

Markets.theaustralian.com.au. (2019). The Australian - RHP Profile. [online] Available at:

https://markets.theaustralian.com.au/shares/RHP/rhipe-limited [Accessed 2 Sep. 2019].

References

Asx.com.au. (2019). [online] Available at:

https://www.asx.com.au/asx/share-price-research/company/RHP [Accessed 2 Sep. 2019].

Au.finance.yahoo.com. (2019). Yahoo is now a part of Oath. [online] Available at:

https://au.finance.yahoo.com/quote/RHP.AX/history?

period1=1330540200&period2=1406745000&interval=1mo&filter=history&frequency=1mo

[Accessed 2 Sep. 2019].

Editorial, R. (2019). ${Instrument_CompanyName} ${Instrument_Ric} Company Profile |

Reuters.com. [online] U.S. Available at:

https://www.reuters.com/finance/stocks/companyProfile/RHP.AX [Accessed 2 Sep. 2019].

Markets.theaustralian.com.au. (2019). The Australian - RHP Profile. [online] Available at:

https://markets.theaustralian.com.au/shares/RHP/rhipe-limited [Accessed 2 Sep. 2019].

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.