Ask a question from expert

BUS704 Finance and Accounting for Managers

14 Pages2584 Words157 Views

Finance and Accounting for Managers (BUS704)

Added on 2020-04-21

BUS704 Finance and Accounting for Managers

Finance and Accounting for Managers (BUS704)

Added on 2020-04-21

BookmarkShareRelated Documents

Running head: CORPORATE FINANCECorporate FinanceName of the Student:Name of the University:Author’s Note:Course ID:

1CORPORATE FINANCETable of ContentsQuestion 1: Depicting how discount rate is derived and evaluating its significance in relation toother factors.....................................................................................................................................3Question 2:.......................................................................................................................................3a. Evaluating the alternatives for depicting the effect on price per share and shareholders wealth:.........................................................................................................................................................3b. Depicting the EPS and PER of Mustang’s under two different scenarios:..................................4c. Depicting in real world scenario the actions that could be recommended:.................................5d. Discussing whether company’s dividend policy is not as important as its capital structurepolicy:..............................................................................................................................................6Question 3:.......................................................................................................................................6a. Depicting the process and amount by which increment in income could be conducted withoutincreasing the risk:...........................................................................................................................6b. Depicting the potential advantage and disadvantage to a company’s owner for increasingproportion of debt in capital market:...............................................................................................7Question 4:.......................................................................................................................................7a. Depicting how much has Connor made or lost:...........................................................................7b. Depicting how much has Milly made or lost in total:.................................................................8c. Depicting how much has Michelle made or lost in total:............................................................8d. Explaining the determinants of future prices and factors that might cause future market price atmaturity to be different from the spot market prices:......................................................................9Question 5:.......................................................................................................................................9a. Calculating theoretical value of a right to one new share:...........................................................9

2CORPORATE FINANCEb. Calculating ex-rights price and the amount of right per share:.................................................10c. Depicting what will happen if subscription price was $26:.......................................................10d. Depicting the minimum possible subscription price:................................................................10e. Discuss if company conducts share issue then overall value of investors shareholding isreduced:..........................................................................................................................................11Question 6: Describing and evaluating the range of agency relationships that exist for anincorporated entity, while describing the extent to which value is incorporated in the entity:.....11References and Bibliographies:.....................................................................................................13

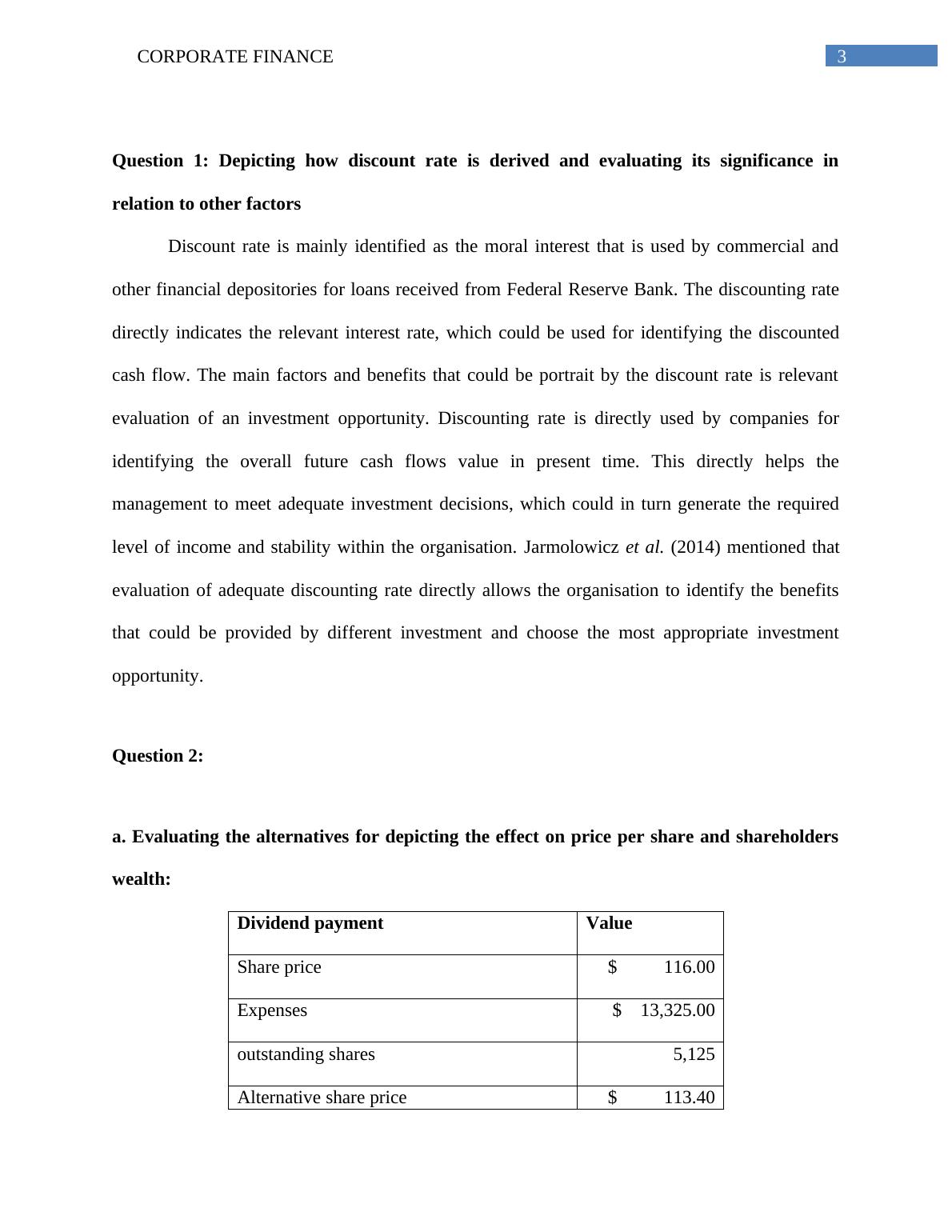

3CORPORATE FINANCEQuestion 1: Depicting how discount rate is derived and evaluating its significance inrelation to other factorsDiscount rate is mainly identified as the moral interest that is used by commercial andother financial depositories for loans received from Federal Reserve Bank. The discounting ratedirectly indicates the relevant interest rate, which could be used for identifying the discountedcash flow. The main factors and benefits that could be portrait by the discount rate is relevantevaluation of an investment opportunity. Discounting rate is directly used by companies foridentifying the overall future cash flows value in present time. This directly helps themanagement to meet adequate investment decisions, which could in turn generate the requiredlevel of income and stability within the organisation. Jarmolowiczet al. (2014) mentioned thatevaluation of adequate discounting rate directly allows the organisation to identify the benefitsthat could be provided by different investment and choose the most appropriate investmentopportunity.Question 2:a. Evaluating the alternatives for depicting the effect on price per share and shareholderswealth:Dividend paymentValueShare price $ 116.00 Expenses $ 13,325.00 outstanding shares 5,125 Alternative share price $ 113.40 Alternative share price$ 113.40Dividend $ 2.60

End of preview

Want to access all the pages? Upload your documents or become a member.

Related Documents

Fundamentals of Finance: Valuation Models, Shareholder Returns, and Market Efficiencylg...

|12

|3552

|47

BUS704 Finance and Accounting for Managers Assignmentlg...

|6

|403

|66

Business Finance Assignment - (Doc)lg...

|12

|1687

|174

Fundamentals of Corporate Finance - Multiple Choice, Short Answer and Analytical Questionslg...

|14

|2739

|423

GA514/ MA514 - Business Finance assignmentlg...

|15

|2233

|166

Report on Dividend Relevance Theory and Dividend Irrelevance Theorylg...

|13

|4109

|180