Corporate Finance Homework: NPV, WACC, and Option Pricing

VerifiedAdded on 2020/10/22

|23

|2152

|217

Homework Assignment

AI Summary

This document provides a comprehensive solution to a corporate finance assignment. The solution covers various aspects of corporate finance, including the computation of net cash flow, assessing Net Present Value (NPV) and conducting sensitivity analysis. It delves into calculations related to NPV, Internal Rate of Return (IRR), share price valuation, and the assessment of beta values for different entities. The assignment also explores the Weighted Average Cost of Capital (WACC) calculation, unlevered cost of capital, and the justification behind variations in equity costs of capital. Furthermore, it examines option pricing, including call and put options, and provides recommendations based on different scenarios with discounted cash flow analysis. The document offers detailed calculations and explanations, making it a valuable resource for students studying corporate finance.

Corporate Finance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

QUESTION 1.......................................................................................................................................4

a. Computation of net cash flow .................................................................................................4

b. Assessing NPV as per the case situation ................................................................................5

c. Sensitivity analysis ..................................................................................................................6

QUESTION 2.......................................................................................................................................7

QUESTION 3.......................................................................................................................................8

a....................................................................................................................................................8

b...................................................................................................................................................9

QUESTION 4.......................................................................................................................................9

QUESTION 5.....................................................................................................................................10

QUESTION 6.....................................................................................................................................12

QUESTION 7.....................................................................................................................................14

A. Measuring WACC for MLC.................................................................................................14

B. Unlevered cost of capital:......................................................................................................16

C. Justifying the reason behind variations in equity costs of capital, unlevered costs of capital and WACC......................................17

QUESTION 8.....................................................................................................................................17

QUESTION 1.......................................................................................................................................4

a. Computation of net cash flow .................................................................................................4

b. Assessing NPV as per the case situation ................................................................................5

c. Sensitivity analysis ..................................................................................................................6

QUESTION 2.......................................................................................................................................7

QUESTION 3.......................................................................................................................................8

a....................................................................................................................................................8

b...................................................................................................................................................9

QUESTION 4.......................................................................................................................................9

QUESTION 5.....................................................................................................................................10

QUESTION 6.....................................................................................................................................12

QUESTION 7.....................................................................................................................................14

A. Measuring WACC for MLC.................................................................................................14

B. Unlevered cost of capital:......................................................................................................16

C. Justifying the reason behind variations in equity costs of capital, unlevered costs of capital and WACC......................................17

QUESTION 8.....................................................................................................................................17

QUESTION 9.....................................................................................................................................18

QUESTION 10...................................................................................................................................21

QUESTION 10...................................................................................................................................21

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

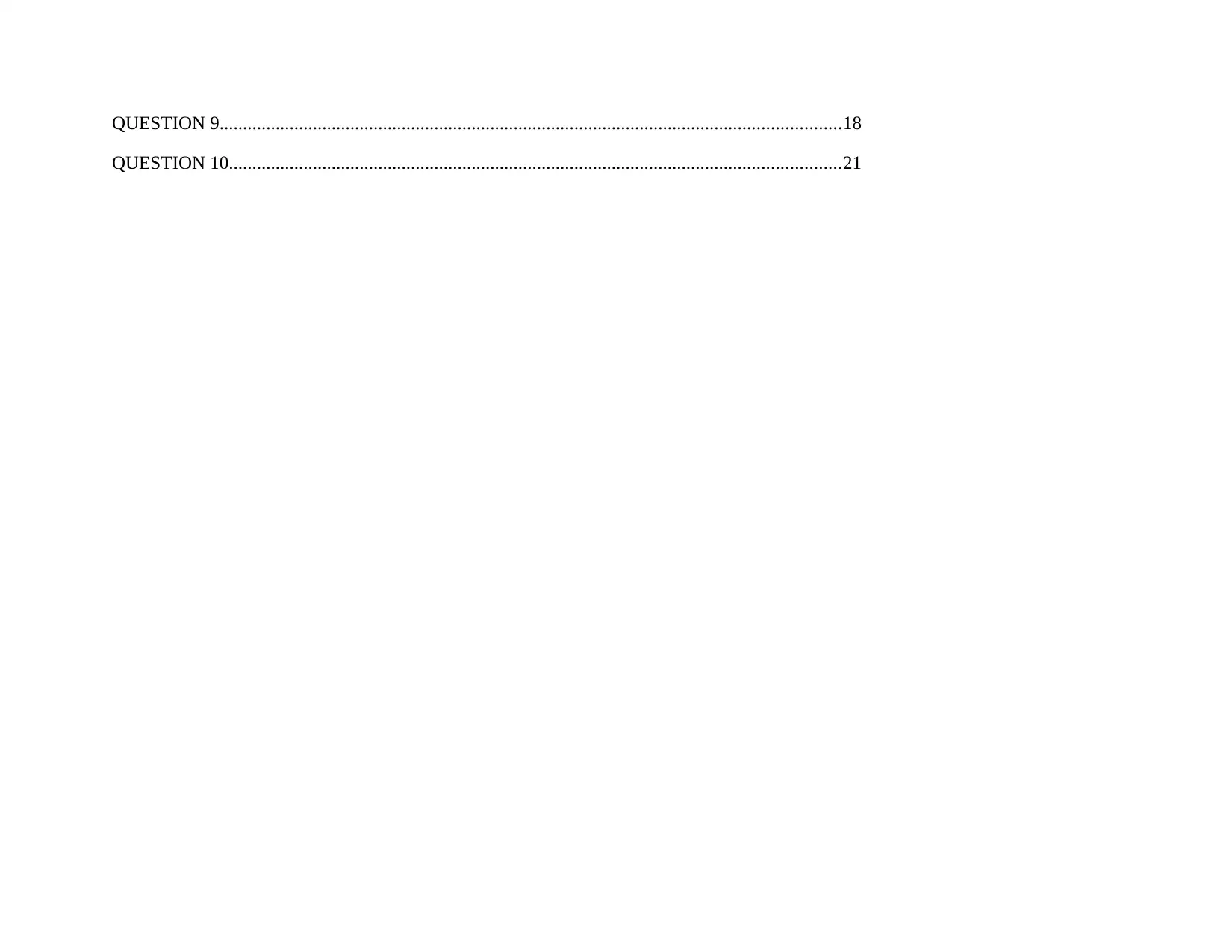

QUESTION 1

a. Computation of net cash flow

Year 0

Year

1

Year

2 Year 4

Year

5

Year

6

Year

7

Year

8

Year

9 Year 10

Sales revenue

105.0

0

105.0

0 105.00

105.0

0

105.0

0

105.0

0

105.0

0

105.0

0 105.00

Manufacturing expenses other

than depreciation 35.00 35.00 35.00 35.00 35.00 35.00 35.00 35.00 35.00

Marketing expenses 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00

Depreciation 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00

Equals net operating income

$44.0

0

$44.0

0 $44.00

$44.0

0

$44.0

0

$44.0

0

$44.0

0

$44.0

0 $44.00

Minus income tax 15.40 15.40 15.40 15.40 15.40 15.40 15.40 15.40 15.40

Equals Unlevered Net income

$28.6

0

$28.6

0 $28.60

$28.6

0

$28.6

0

$28.6

0

$28.6

0

$28.6

0 $28.60

Plus depreciation 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00

Additions to net working

capital (5.00) (5.00) (5.00) (5.00) (5.00) (5.00) (5.00)

(5.00

) (5.00)

Capital Expenditures (160.00)

Continuation value 12.00

Free cash flow

($160.00

)

$39.6

0

$39.6

0 $39.60

$39.6

0

$39.6

0

$39.6

0

$39.6

0

$39.6

0 $51.60

a. Computation of net cash flow

Year 0

Year

1

Year

2 Year 4

Year

5

Year

6

Year

7

Year

8

Year

9 Year 10

Sales revenue

105.0

0

105.0

0 105.00

105.0

0

105.0

0

105.0

0

105.0

0

105.0

0 105.00

Manufacturing expenses other

than depreciation 35.00 35.00 35.00 35.00 35.00 35.00 35.00 35.00 35.00

Marketing expenses 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00 10.00

Depreciation 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00

Equals net operating income

$44.0

0

$44.0

0 $44.00

$44.0

0

$44.0

0

$44.0

0

$44.0

0

$44.0

0 $44.00

Minus income tax 15.40 15.40 15.40 15.40 15.40 15.40 15.40 15.40 15.40

Equals Unlevered Net income

$28.6

0

$28.6

0 $28.60

$28.6

0

$28.6

0

$28.6

0

$28.6

0

$28.6

0 $28.60

Plus depreciation 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00 16.00

Additions to net working

capital (5.00) (5.00) (5.00) (5.00) (5.00) (5.00) (5.00)

(5.00

) (5.00)

Capital Expenditures (160.00)

Continuation value 12.00

Free cash flow

($160.00

)

$39.6

0

$39.6

0 $39.60

$39.6

0

$39.6

0

$39.6

0

$39.6

0

$39.6

0 $51.60

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

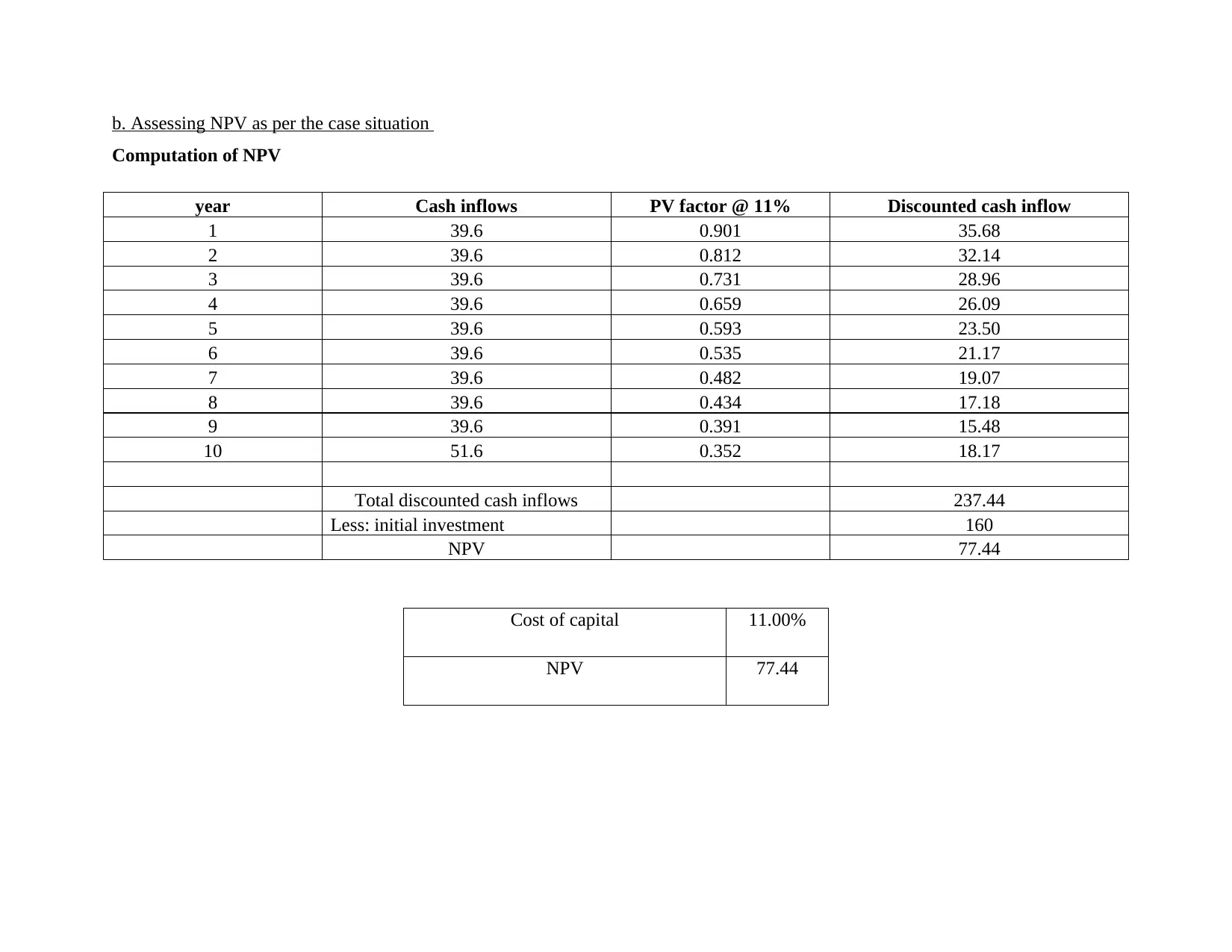

b. Assessing NPV as per the case situation

Computation of NPV

year Cash inflows PV factor @ 11% Discounted cash inflow

1 39.6 0.901 35.68

2 39.6 0.812 32.14

3 39.6 0.731 28.96

4 39.6 0.659 26.09

5 39.6 0.593 23.50

6 39.6 0.535 21.17

7 39.6 0.482 19.07

8 39.6 0.434 17.18

9 39.6 0.391 15.48

10 51.6 0.352 18.17

Total discounted cash inflows 237.44

Less: initial investment 160

NPV 77.44

Cost of capital 11.00%

NPV 77.44

Computation of NPV

year Cash inflows PV factor @ 11% Discounted cash inflow

1 39.6 0.901 35.68

2 39.6 0.812 32.14

3 39.6 0.731 28.96

4 39.6 0.659 26.09

5 39.6 0.593 23.50

6 39.6 0.535 21.17

7 39.6 0.482 19.07

8 39.6 0.434 17.18

9 39.6 0.391 15.48

10 51.6 0.352 18.17

Total discounted cash inflows 237.44

Less: initial investment 160

NPV 77.44

Cost of capital 11.00%

NPV 77.44

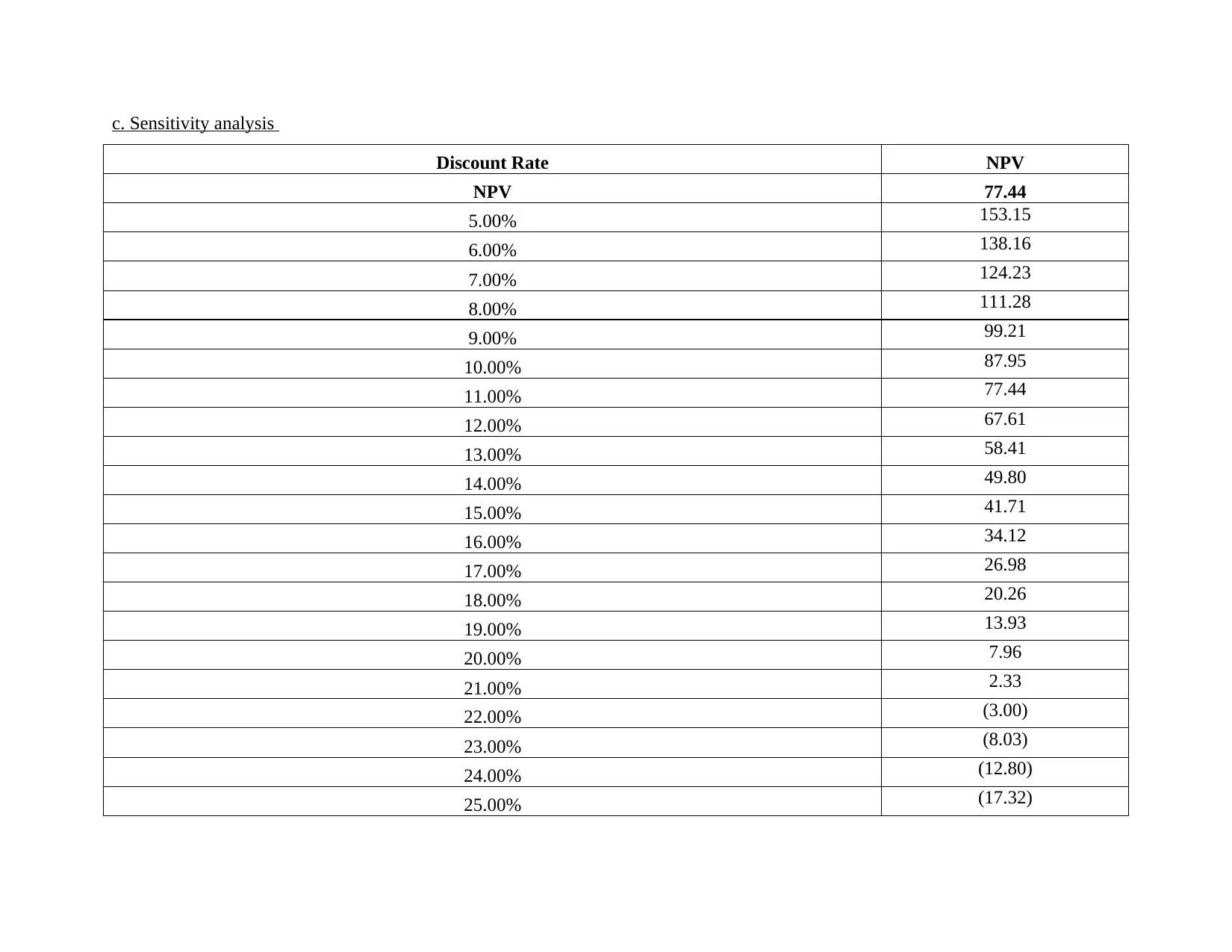

c. Sensitivity analysis

Discount Rate NPV

NPV 77.44

5.00% 153.15

6.00% 138.16

7.00% 124.23

8.00% 111.28

9.00% 99.21

10.00% 87.95

11.00% 77.44

12.00% 67.61

13.00% 58.41

14.00% 49.80

15.00% 41.71

16.00% 34.12

17.00% 26.98

18.00% 20.26

19.00% 13.93

20.00% 7.96

21.00% 2.33

22.00% (3.00)

23.00% (8.03)

24.00% (12.80)

25.00% (17.32)

Discount Rate NPV

NPV 77.44

5.00% 153.15

6.00% 138.16

7.00% 124.23

8.00% 111.28

9.00% 99.21

10.00% 87.95

11.00% 77.44

12.00% 67.61

13.00% 58.41

14.00% 49.80

15.00% 41.71

16.00% 34.12

17.00% 26.98

18.00% 20.26

19.00% 13.93

20.00% 7.96

21.00% 2.33

22.00% (3.00)

23.00% (8.03)

24.00% (12.80)

25.00% (17.32)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

26.00% (21.60)

27.00% (25.67)

28.00% (29.53)

29.00% (33.21)

30.00% (36.70)

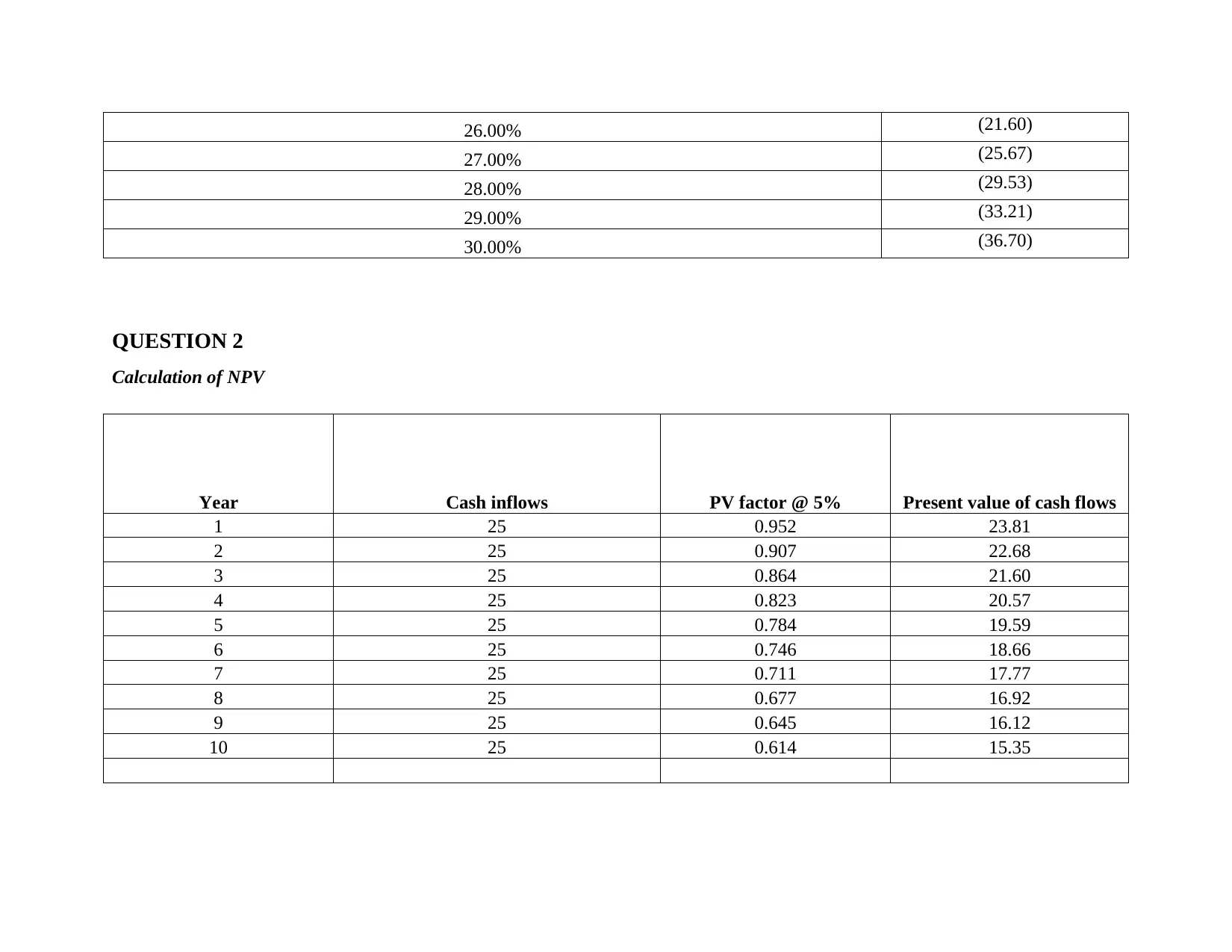

QUESTION 2

Calculation of NPV

Year Cash inflows PV factor @ 5% Present value of cash flows

1 25 0.952 23.81

2 25 0.907 22.68

3 25 0.864 21.60

4 25 0.823 20.57

5 25 0.784 19.59

6 25 0.746 18.66

7 25 0.711 17.77

8 25 0.677 16.92

9 25 0.645 16.12

10 25 0.614 15.35

27.00% (25.67)

28.00% (29.53)

29.00% (33.21)

30.00% (36.70)

QUESTION 2

Calculation of NPV

Year Cash inflows PV factor @ 5% Present value of cash flows

1 25 0.952 23.81

2 25 0.907 22.68

3 25 0.864 21.60

4 25 0.823 20.57

5 25 0.784 19.59

6 25 0.746 18.66

7 25 0.711 17.77

8 25 0.677 16.92

9 25 0.645 16.12

10 25 0.614 15.35

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Total discounted cash inflow 193.04

less: initial investment 150.00

NPV 43.04

Less: cost at perpetuity (2.2/.05) 44

Net value -0.96

IRR: From assessment, it has found that rule pertaining to IRR does not apply in the case of multiple variables

QUESTION 3

a.

G

i

v

e

n

E

s

t

i

m

a

less: initial investment 150.00

NPV 43.04

Less: cost at perpetuity (2.2/.05) 44

Net value -0.96

IRR: From assessment, it has found that rule pertaining to IRR does not apply in the case of multiple variables

QUESTION 3

a.

G

i

v

e

n

E

s

t

i

m

a

t

e

d

o

r

p

r

o

j

e

c

t

e

d

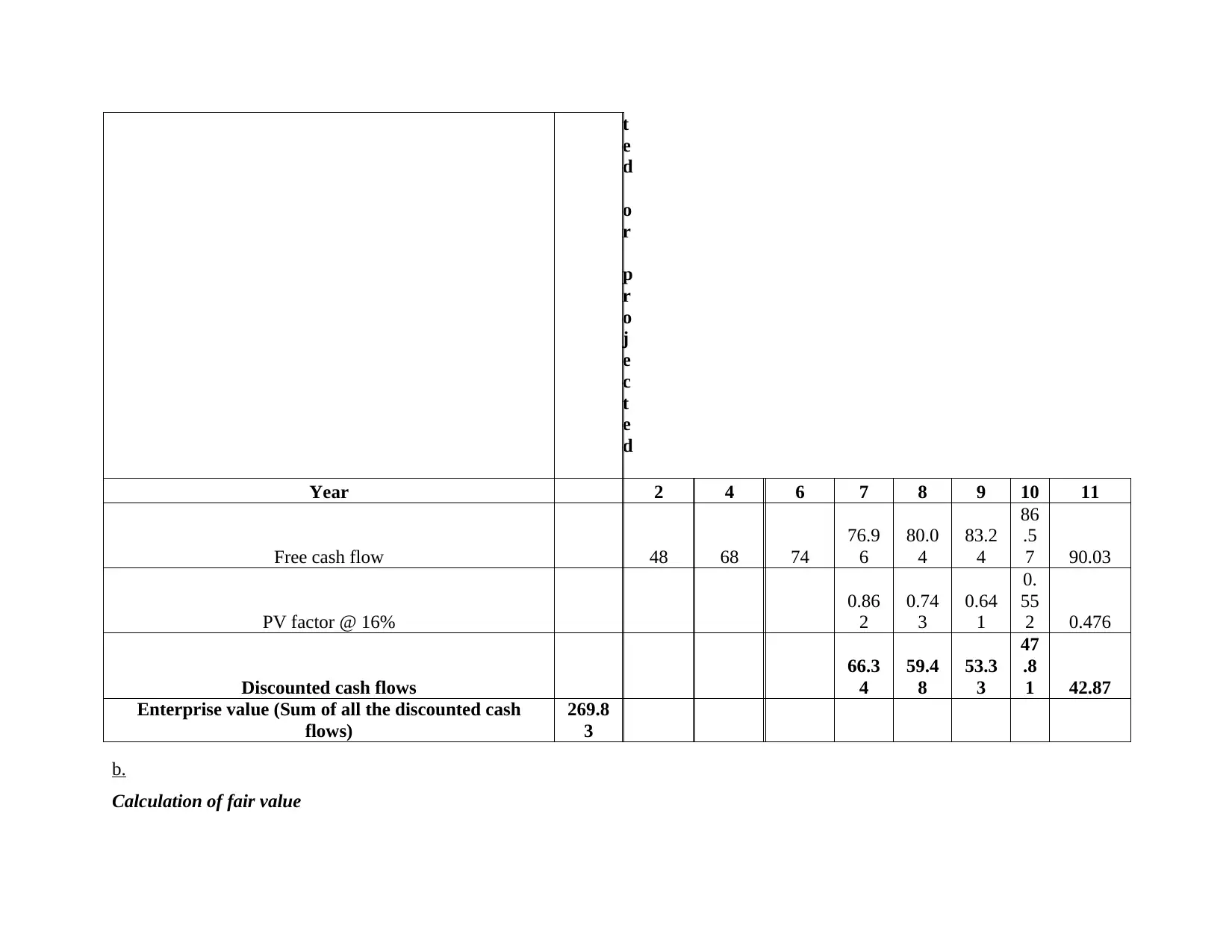

Year 2 4 6 7 8 9 10 11

Free cash flow 48 68 74

76.9

6

80.0

4

83.2

4

86

.5

7 90.03

PV factor @ 16%

0.86

2

0.74

3

0.64

1

0.

55

2 0.476

Discounted cash flows

66.3

4

59.4

8

53.3

3

47

.8

1 42.87

Enterprise value (Sum of all the discounted cash

flows)

269.8

3

b.

Calculation of fair value

e

d

o

r

p

r

o

j

e

c

t

e

d

Year 2 4 6 7 8 9 10 11

Free cash flow 48 68 74

76.9

6

80.0

4

83.2

4

86

.5

7 90.03

PV factor @ 16%

0.86

2

0.74

3

0.64

1

0.

55

2 0.476

Discounted cash flows

66.3

4

59.4

8

53.3

3

47

.8

1 42.87

Enterprise value (Sum of all the discounted cash

flows)

269.8

3

b.

Calculation of fair value

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Particulars Figures (in €)

Enterprise value 269.83

Net debt 150

Fair value 119.83

Shares outstanding 40

Share price 2.99 or 3

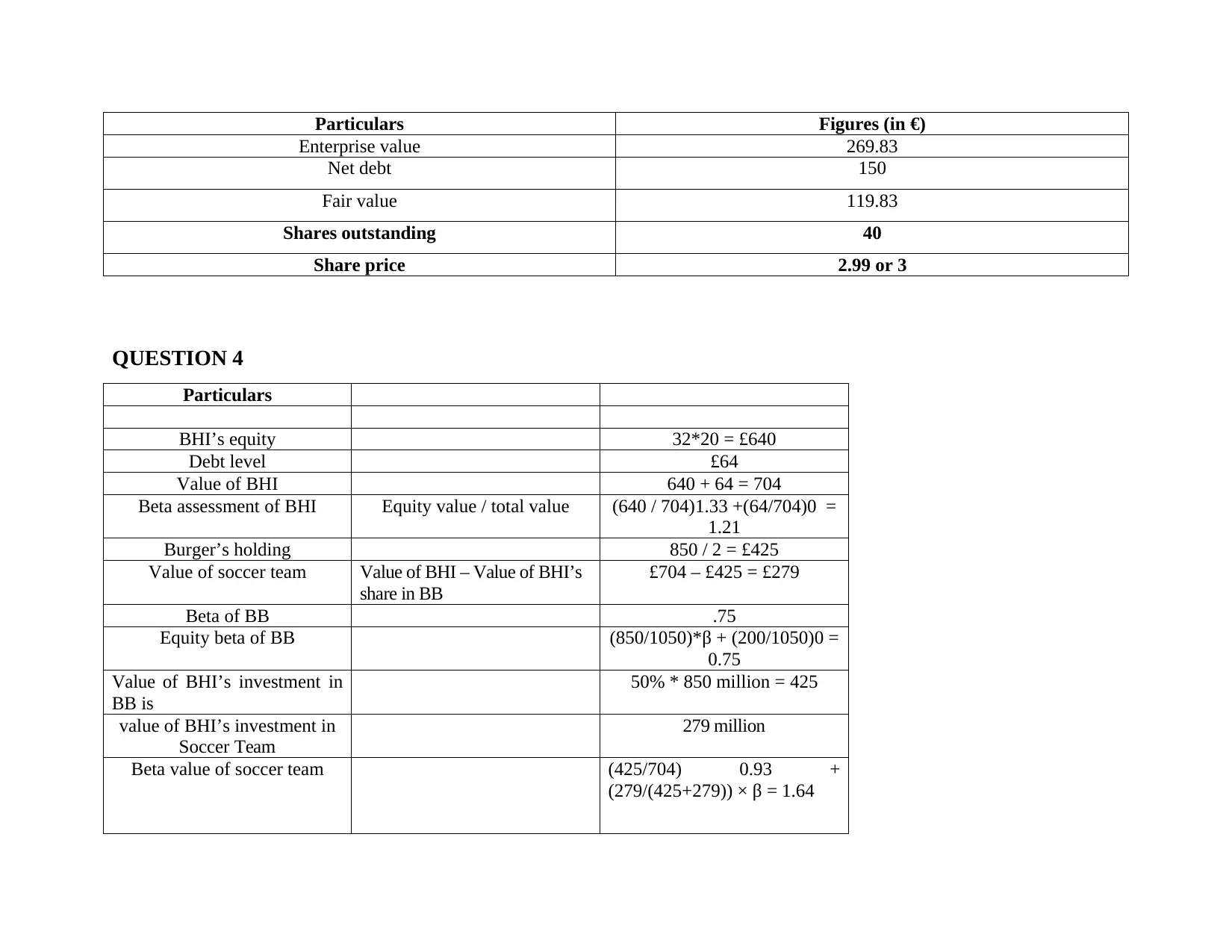

QUESTION 4

Particulars

BHI’s equity 32*20 = £640

Debt level £64

Value of BHI 640 + 64 = 704

Beta assessment of BHI Equity value / total value (640 / 704)1.33 +(64/704)0 =

1.21

Burger’s holding 850 / 2 = £425

Value of soccer team Value of BHI – Value of BHI’s

share in BB

£704 – £425 = £279

Beta of BB .75

Equity beta of BB (850/1050)*β + (200/1050)0 =

0.75

Value of BHI’s investment in

BB is

50% * 850 million = 425

value of BHI’s investment in

Soccer Team

279 million

Beta value of soccer team (425/704) 0.93 +

(279/(425+279)) × β = 1.64

Enterprise value 269.83

Net debt 150

Fair value 119.83

Shares outstanding 40

Share price 2.99 or 3

QUESTION 4

Particulars

BHI’s equity 32*20 = £640

Debt level £64

Value of BHI 640 + 64 = 704

Beta assessment of BHI Equity value / total value (640 / 704)1.33 +(64/704)0 =

1.21

Burger’s holding 850 / 2 = £425

Value of soccer team Value of BHI – Value of BHI’s

share in BB

£704 – £425 = £279

Beta of BB .75

Equity beta of BB (850/1050)*β + (200/1050)0 =

0.75

Value of BHI’s investment in

BB is

50% * 850 million = 425

value of BHI’s investment in

Soccer Team

279 million

Beta value of soccer team (425/704) 0.93 +

(279/(425+279)) × β = 1.64

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

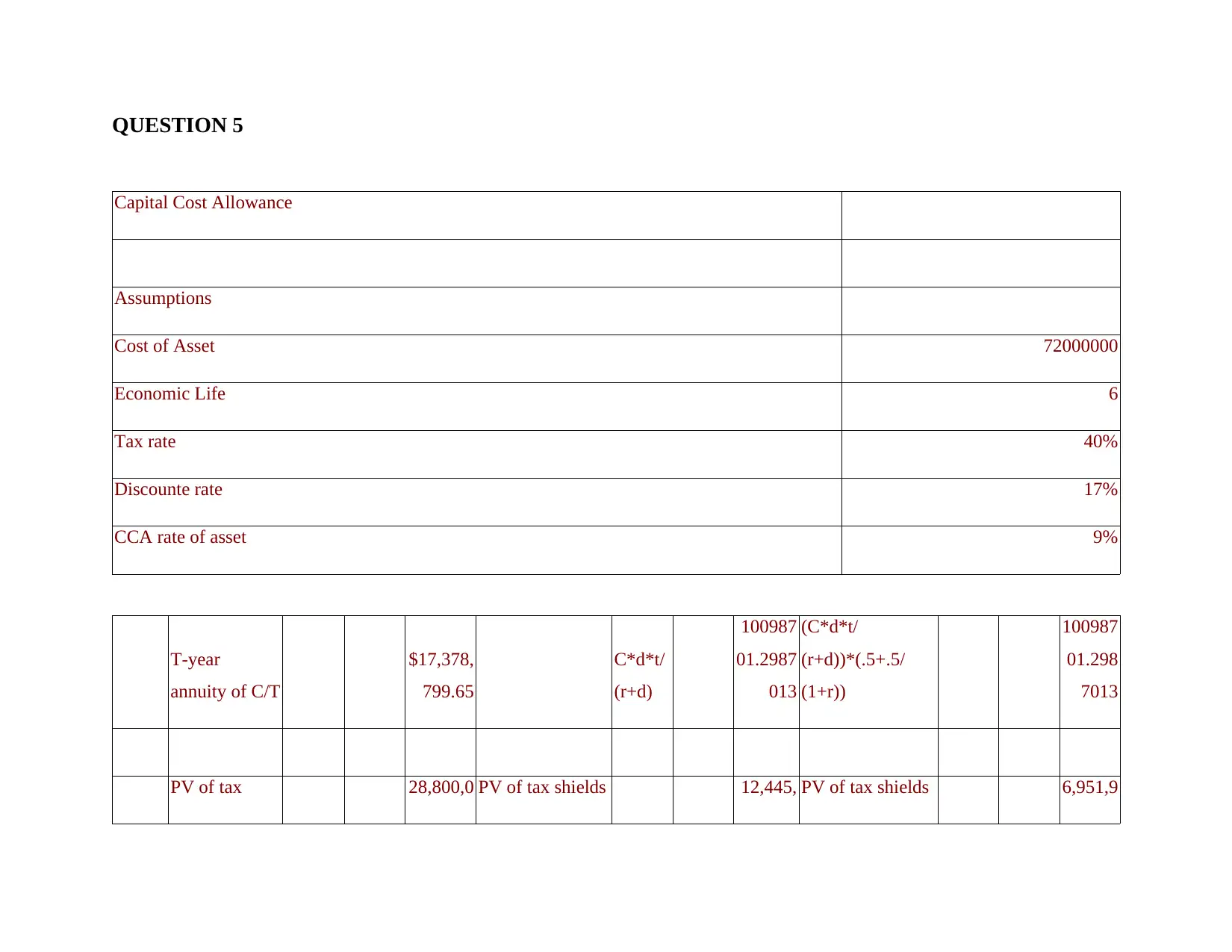

QUESTION 5

Capital Cost Allowance

Assumptions

Cost of Asset 72000000

Economic Life 6

Tax rate 40%

Discounte rate 17%

CCA rate of asset 9%

T-year

annuity of C/T

$17,378,

799.65

C*d*t/

(r+d)

100987

01.2987

013

(C*d*t/

(r+d))*(.5+.5/

(1+r))

100987

01.298

7013

PV of tax 28,800,0 PV of tax shields 12,445, PV of tax shields 6,951,9

Capital Cost Allowance

Assumptions

Cost of Asset 72000000

Economic Life 6

Tax rate 40%

Discounte rate 17%

CCA rate of asset 9%

T-year

annuity of C/T

$17,378,

799.65

C*d*t/

(r+d)

100987

01.2987

013

(C*d*t/

(r+d))*(.5+.5/

(1+r))

100987

01.298

7013

PV of tax 28,800,0 PV of tax shields 12,445, PV of tax shields 6,951,9

shields 00.00 365.54 48.18

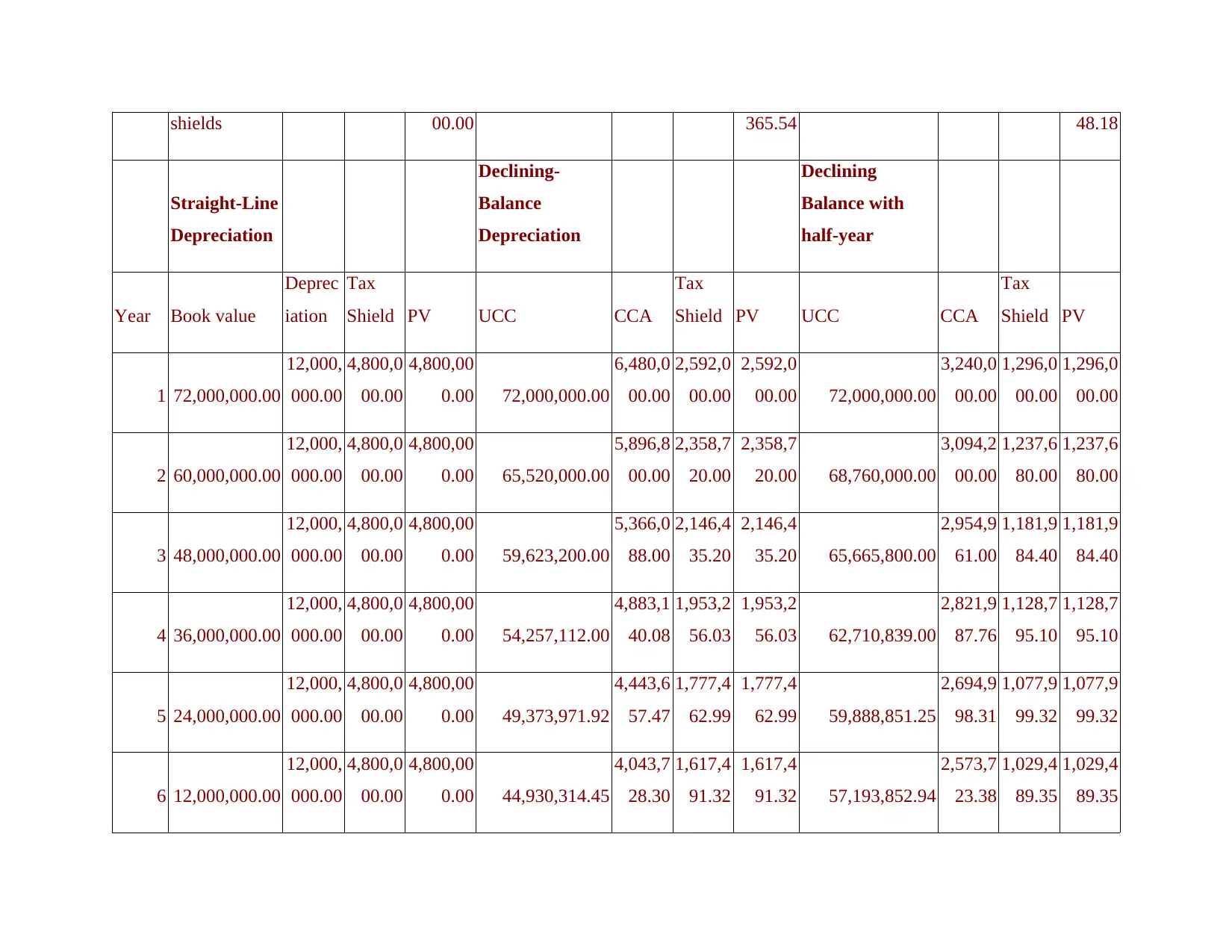

Straight-Line

Depreciation

Declining-

Balance

Depreciation

Declining

Balance with

half-year

Year Book value

Deprec

iation

Tax

Shield PV UCC CCA

Tax

Shield PV UCC CCA

Tax

Shield PV

1 72,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 72,000,000.00

6,480,0

00.00

2,592,0

00.00

2,592,0

00.00 72,000,000.00

3,240,0

00.00

1,296,0

00.00

1,296,0

00.00

2 60,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 65,520,000.00

5,896,8

00.00

2,358,7

20.00

2,358,7

20.00 68,760,000.00

3,094,2

00.00

1,237,6

80.00

1,237,6

80.00

3 48,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 59,623,200.00

5,366,0

88.00

2,146,4

35.20

2,146,4

35.20 65,665,800.00

2,954,9

61.00

1,181,9

84.40

1,181,9

84.40

4 36,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 54,257,112.00

4,883,1

40.08

1,953,2

56.03

1,953,2

56.03 62,710,839.00

2,821,9

87.76

1,128,7

95.10

1,128,7

95.10

5 24,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 49,373,971.92

4,443,6

57.47

1,777,4

62.99

1,777,4

62.99 59,888,851.25

2,694,9

98.31

1,077,9

99.32

1,077,9

99.32

6 12,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 44,930,314.45

4,043,7

28.30

1,617,4

91.32

1,617,4

91.32 57,193,852.94

2,573,7

23.38

1,029,4

89.35

1,029,4

89.35

Straight-Line

Depreciation

Declining-

Balance

Depreciation

Declining

Balance with

half-year

Year Book value

Deprec

iation

Tax

Shield PV UCC CCA

Tax

Shield PV UCC CCA

Tax

Shield PV

1 72,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 72,000,000.00

6,480,0

00.00

2,592,0

00.00

2,592,0

00.00 72,000,000.00

3,240,0

00.00

1,296,0

00.00

1,296,0

00.00

2 60,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 65,520,000.00

5,896,8

00.00

2,358,7

20.00

2,358,7

20.00 68,760,000.00

3,094,2

00.00

1,237,6

80.00

1,237,6

80.00

3 48,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 59,623,200.00

5,366,0

88.00

2,146,4

35.20

2,146,4

35.20 65,665,800.00

2,954,9

61.00

1,181,9

84.40

1,181,9

84.40

4 36,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 54,257,112.00

4,883,1

40.08

1,953,2

56.03

1,953,2

56.03 62,710,839.00

2,821,9

87.76

1,128,7

95.10

1,128,7

95.10

5 24,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 49,373,971.92

4,443,6

57.47

1,777,4

62.99

1,777,4

62.99 59,888,851.25

2,694,9

98.31

1,077,9

99.32

1,077,9

99.32

6 12,000,000.00

12,000,

000.00

4,800,0

00.00

4,800,00

0.00 44,930,314.45

4,043,7

28.30

1,617,4

91.32

1,617,4

91.32 57,193,852.94

2,573,7

23.38

1,029,4

89.35

1,029,4

89.35

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.