Project Cash Flow and Loan Repayment Analysis

VerifiedAdded on 2020/06/04

|10

|1757

|36

AI Summary

This assignment presents a financial analysis of a project undertaken by Andromeda. It includes detailed cash flow projections from 2019 to 2024, demonstrating both the project's income and expenditures. Key financial metrics are calculated, including Net Present Value (NPV) and Internal Rate of Return (IRR). Additionally, the assignment meticulously examines loan repayment schedules for a $60 million principal at a 10% interest rate over six years. It shows the annual repayment structure and the impact on Andromeda's cash flow.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Corporate Financial Policy: Andromeda

Resources The Kimberley Metallica

Project

Resources The Kimberley Metallica

Project

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

TABLE OF CONTENTS

1Computation of NPV and IRR.......................................................................................................1

2 Computation of discount rate........................................................................................................1

3 Viability of project........................................................................................................................1

4 Measurement of impact on NPV caused by chaanges in different variables...............................1

5 Viability of project by considering interest and principal amount...............................................3

6 Price of Metallica when NPV value will be 0 and sufficiency of cash flows to meet debt

obligations........................................................................................................................................3

REFERENCES................................................................................................................................4

APPENDIX......................................................................................................................................5

Table 1Calculation of discount rate and cost of capital...................................................................1

1Computation of NPV and IRR.......................................................................................................1

2 Computation of discount rate........................................................................................................1

3 Viability of project........................................................................................................................1

4 Measurement of impact on NPV caused by chaanges in different variables...............................1

5 Viability of project by considering interest and principal amount...............................................3

6 Price of Metallica when NPV value will be 0 and sufficiency of cash flows to meet debt

obligations........................................................................................................................................3

REFERENCES................................................................................................................................4

APPENDIX......................................................................................................................................5

Table 1Calculation of discount rate and cost of capital...................................................................1

1Computation of NPV and IRR

Attached in appendix.

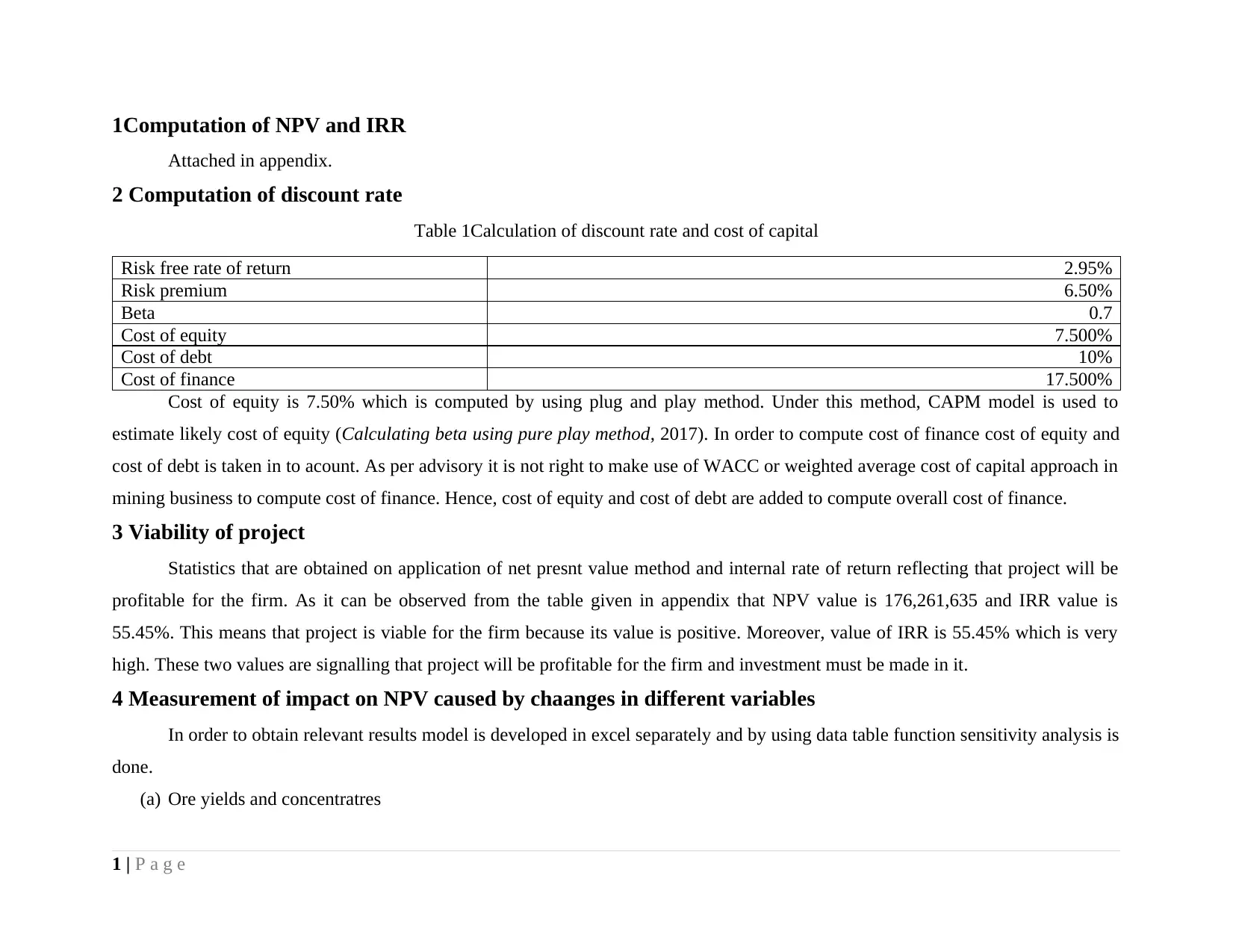

2 Computation of discount rate

Table 1Calculation of discount rate and cost of capital

Risk free rate of return 2.95%

Risk premium 6.50%

Beta 0.7

Cost of equity 7.500%

Cost of debt 10%

Cost of finance 17.500%

Cost of equity is 7.50% which is computed by using plug and play method. Under this method, CAPM model is used to

estimate likely cost of equity (Calculating beta using pure play method, 2017). In order to compute cost of finance cost of equity and

cost of debt is taken in to acount. As per advisory it is not right to make use of WACC or weighted average cost of capital approach in

mining business to compute cost of finance. Hence, cost of equity and cost of debt are added to compute overall cost of finance.

3 Viability of project

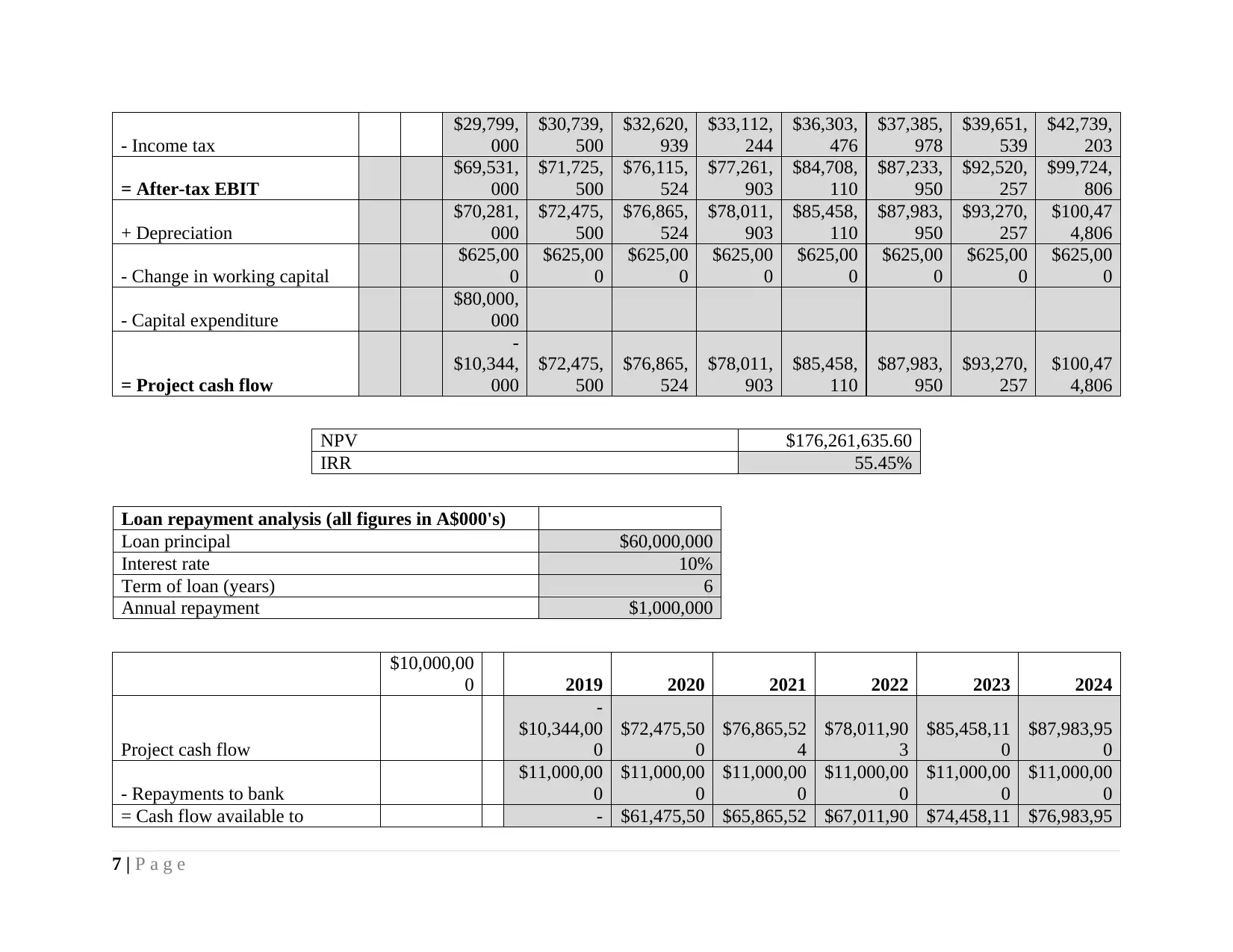

Statistics that are obtained on application of net presnt value method and internal rate of return reflecting that project will be

profitable for the firm. As it can be observed from the table given in appendix that NPV value is 176,261,635 and IRR value is

55.45%. This means that project is viable for the firm because its value is positive. Moreover, value of IRR is 55.45% which is very

high. These two values are signalling that project will be profitable for the firm and investment must be made in it.

4 Measurement of impact on NPV caused by chaanges in different variables

In order to obtain relevant results model is developed in excel separately and by using data table function sensitivity analysis is

done.

(a) Ore yields and concentratres

1 | P a g e

Attached in appendix.

2 Computation of discount rate

Table 1Calculation of discount rate and cost of capital

Risk free rate of return 2.95%

Risk premium 6.50%

Beta 0.7

Cost of equity 7.500%

Cost of debt 10%

Cost of finance 17.500%

Cost of equity is 7.50% which is computed by using plug and play method. Under this method, CAPM model is used to

estimate likely cost of equity (Calculating beta using pure play method, 2017). In order to compute cost of finance cost of equity and

cost of debt is taken in to acount. As per advisory it is not right to make use of WACC or weighted average cost of capital approach in

mining business to compute cost of finance. Hence, cost of equity and cost of debt are added to compute overall cost of finance.

3 Viability of project

Statistics that are obtained on application of net presnt value method and internal rate of return reflecting that project will be

profitable for the firm. As it can be observed from the table given in appendix that NPV value is 176,261,635 and IRR value is

55.45%. This means that project is viable for the firm because its value is positive. Moreover, value of IRR is 55.45% which is very

high. These two values are signalling that project will be profitable for the firm and investment must be made in it.

4 Measurement of impact on NPV caused by chaanges in different variables

In order to obtain relevant results model is developed in excel separately and by using data table function sensitivity analysis is

done.

(a) Ore yields and concentratres

1 | P a g e

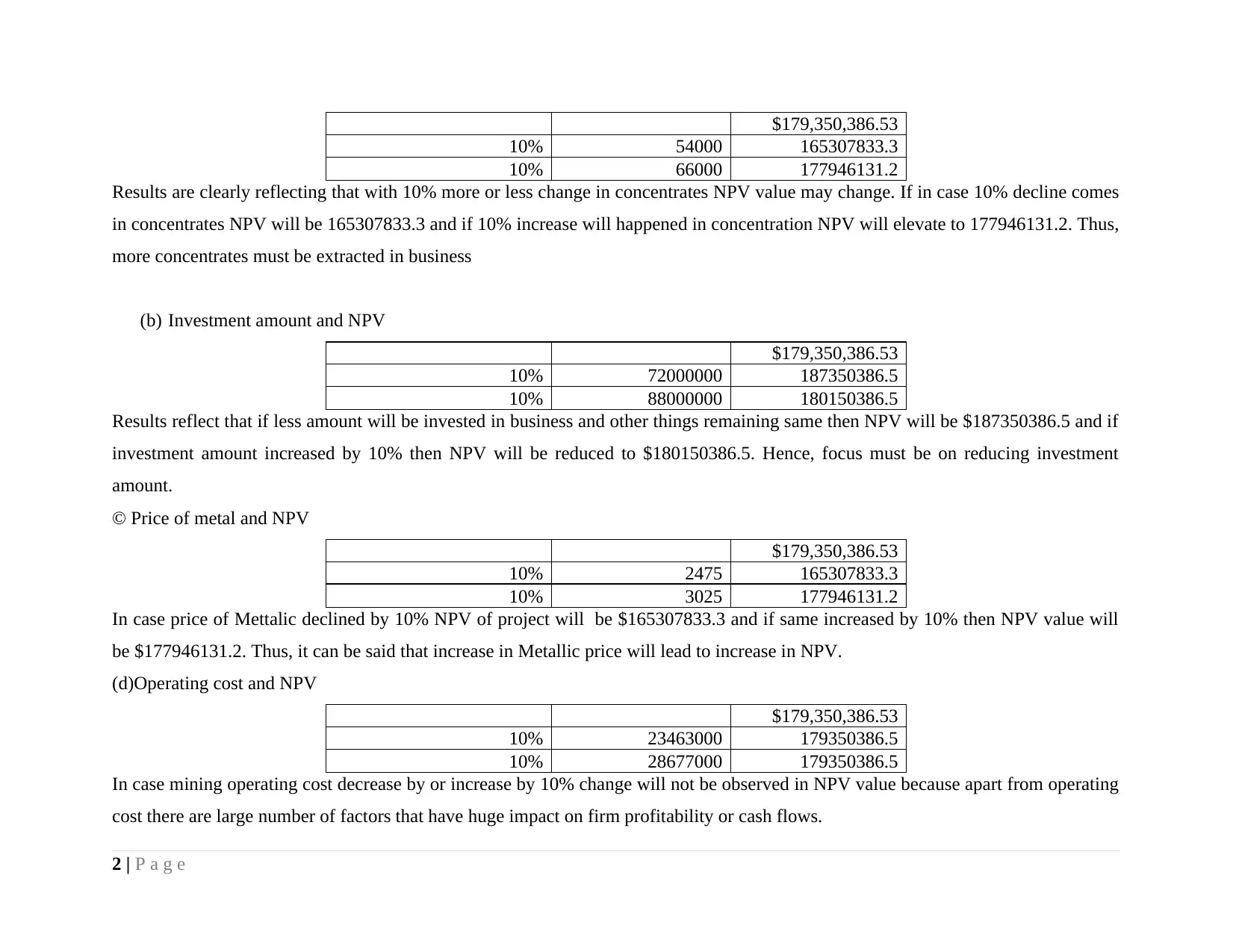

$179,350,386.53

10% 54000 165307833.3

10% 66000 177946131.2

Results are clearly reflecting that with 10% more or less change in concentrates NPV value may change. If in case 10% decline comes

in concentrates NPV will be 165307833.3 and if 10% increase will happened in concentration NPV will elevate to 177946131.2. Thus,

more concentrates must be extracted in business

(b) Investment amount and NPV

$179,350,386.53

10% 72000000 187350386.5

10% 88000000 180150386.5

Results reflect that if less amount will be invested in business and other things remaining same then NPV will be $187350386.5 and if

investment amount increased by 10% then NPV will be reduced to $180150386.5. Hence, focus must be on reducing investment

amount.

© Price of metal and NPV

$179,350,386.53

10% 2475 165307833.3

10% 3025 177946131.2

In case price of Mettalic declined by 10% NPV of project will be $165307833.3 and if same increased by 10% then NPV value will

be $177946131.2. Thus, it can be said that increase in Metallic price will lead to increase in NPV.

(d)Operating cost and NPV

$179,350,386.53

10% 23463000 179350386.5

10% 28677000 179350386.5

In case mining operating cost decrease by or increase by 10% change will not be observed in NPV value because apart from operating

cost there are large number of factors that have huge impact on firm profitability or cash flows.

2 | P a g e

10% 54000 165307833.3

10% 66000 177946131.2

Results are clearly reflecting that with 10% more or less change in concentrates NPV value may change. If in case 10% decline comes

in concentrates NPV will be 165307833.3 and if 10% increase will happened in concentration NPV will elevate to 177946131.2. Thus,

more concentrates must be extracted in business

(b) Investment amount and NPV

$179,350,386.53

10% 72000000 187350386.5

10% 88000000 180150386.5

Results reflect that if less amount will be invested in business and other things remaining same then NPV will be $187350386.5 and if

investment amount increased by 10% then NPV will be reduced to $180150386.5. Hence, focus must be on reducing investment

amount.

© Price of metal and NPV

$179,350,386.53

10% 2475 165307833.3

10% 3025 177946131.2

In case price of Mettalic declined by 10% NPV of project will be $165307833.3 and if same increased by 10% then NPV value will

be $177946131.2. Thus, it can be said that increase in Metallic price will lead to increase in NPV.

(d)Operating cost and NPV

$179,350,386.53

10% 23463000 179350386.5

10% 28677000 179350386.5

In case mining operating cost decrease by or increase by 10% change will not be observed in NPV value because apart from operating

cost there are large number of factors that have huge impact on firm profitability or cash flows.

2 | P a g e

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

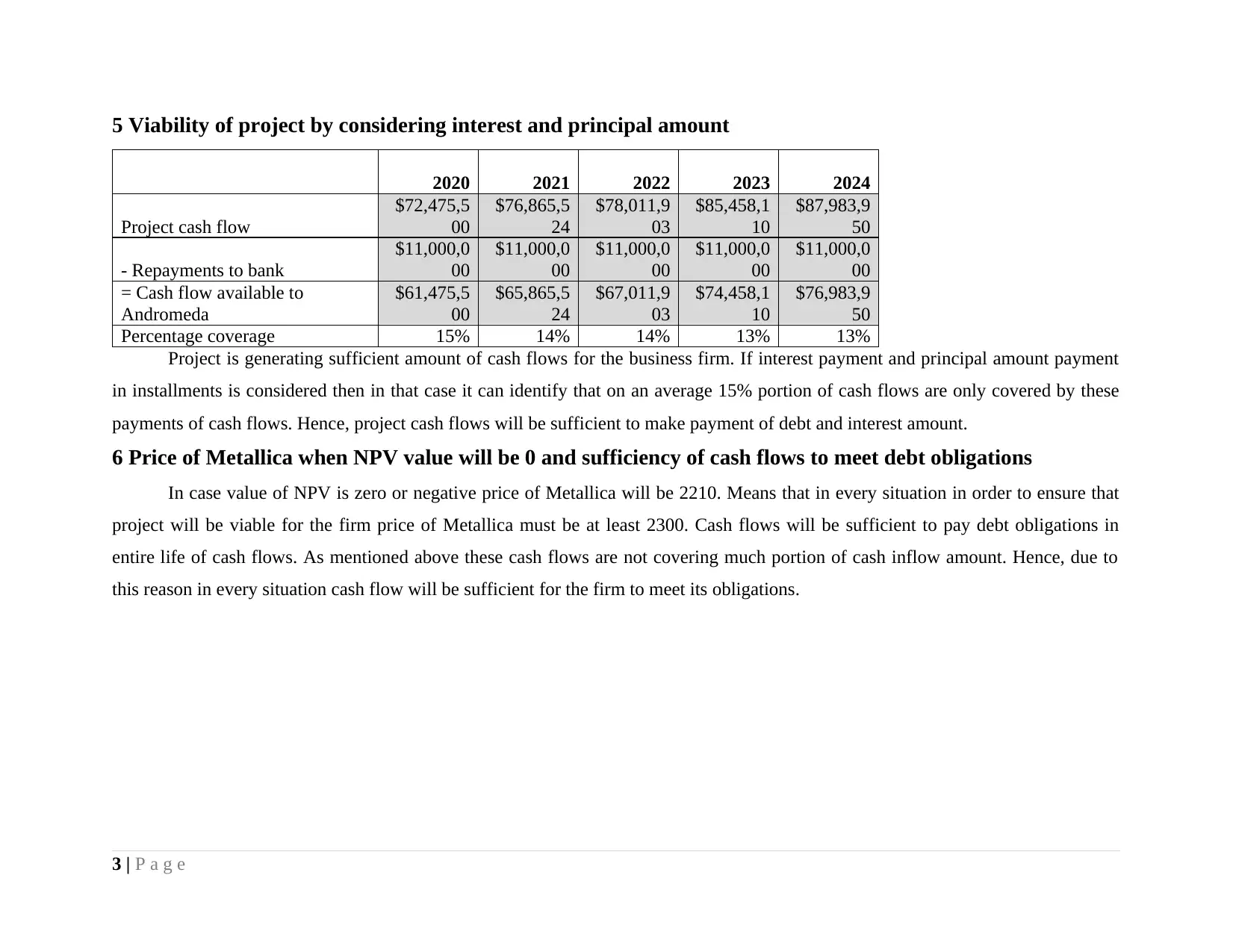

5 Viability of project by considering interest and principal amount

2020 2021 2022 2023 2024

Project cash flow

$72,475,5

00

$76,865,5

24

$78,011,9

03

$85,458,1

10

$87,983,9

50

- Repayments to bank

$11,000,0

00

$11,000,0

00

$11,000,0

00

$11,000,0

00

$11,000,0

00

= Cash flow available to

Andromeda

$61,475,5

00

$65,865,5

24

$67,011,9

03

$74,458,1

10

$76,983,9

50

Percentage coverage 15% 14% 14% 13% 13%

Project is generating sufficient amount of cash flows for the business firm. If interest payment and principal amount payment

in installments is considered then in that case it can identify that on an average 15% portion of cash flows are only covered by these

payments of cash flows. Hence, project cash flows will be sufficient to make payment of debt and interest amount.

6 Price of Metallica when NPV value will be 0 and sufficiency of cash flows to meet debt obligations

In case value of NPV is zero or negative price of Metallica will be 2210. Means that in every situation in order to ensure that

project will be viable for the firm price of Metallica must be at least 2300. Cash flows will be sufficient to pay debt obligations in

entire life of cash flows. As mentioned above these cash flows are not covering much portion of cash inflow amount. Hence, due to

this reason in every situation cash flow will be sufficient for the firm to meet its obligations.

3 | P a g e

2020 2021 2022 2023 2024

Project cash flow

$72,475,5

00

$76,865,5

24

$78,011,9

03

$85,458,1

10

$87,983,9

50

- Repayments to bank

$11,000,0

00

$11,000,0

00

$11,000,0

00

$11,000,0

00

$11,000,0

00

= Cash flow available to

Andromeda

$61,475,5

00

$65,865,5

24

$67,011,9

03

$74,458,1

10

$76,983,9

50

Percentage coverage 15% 14% 14% 13% 13%

Project is generating sufficient amount of cash flows for the business firm. If interest payment and principal amount payment

in installments is considered then in that case it can identify that on an average 15% portion of cash flows are only covered by these

payments of cash flows. Hence, project cash flows will be sufficient to make payment of debt and interest amount.

6 Price of Metallica when NPV value will be 0 and sufficiency of cash flows to meet debt obligations

In case value of NPV is zero or negative price of Metallica will be 2210. Means that in every situation in order to ensure that

project will be viable for the firm price of Metallica must be at least 2300. Cash flows will be sufficient to pay debt obligations in

entire life of cash flows. As mentioned above these cash flows are not covering much portion of cash inflow amount. Hence, due to

this reason in every situation cash flow will be sufficient for the firm to meet its obligations.

3 | P a g e

REFERENCES

Online

Calculating beta using pure play method, 2017. [Online]. Available through:< http://financetrain.com/calculating-beta-using-pure-

play-method/>. [Accessed on 29th September 2017].

4 | P a g e

Online

Calculating beta using pure play method, 2017. [Online]. Available through:< http://financetrain.com/calculating-beta-using-pure-

play-method/>. [Accessed on 29th September 2017].

4 | P a g e

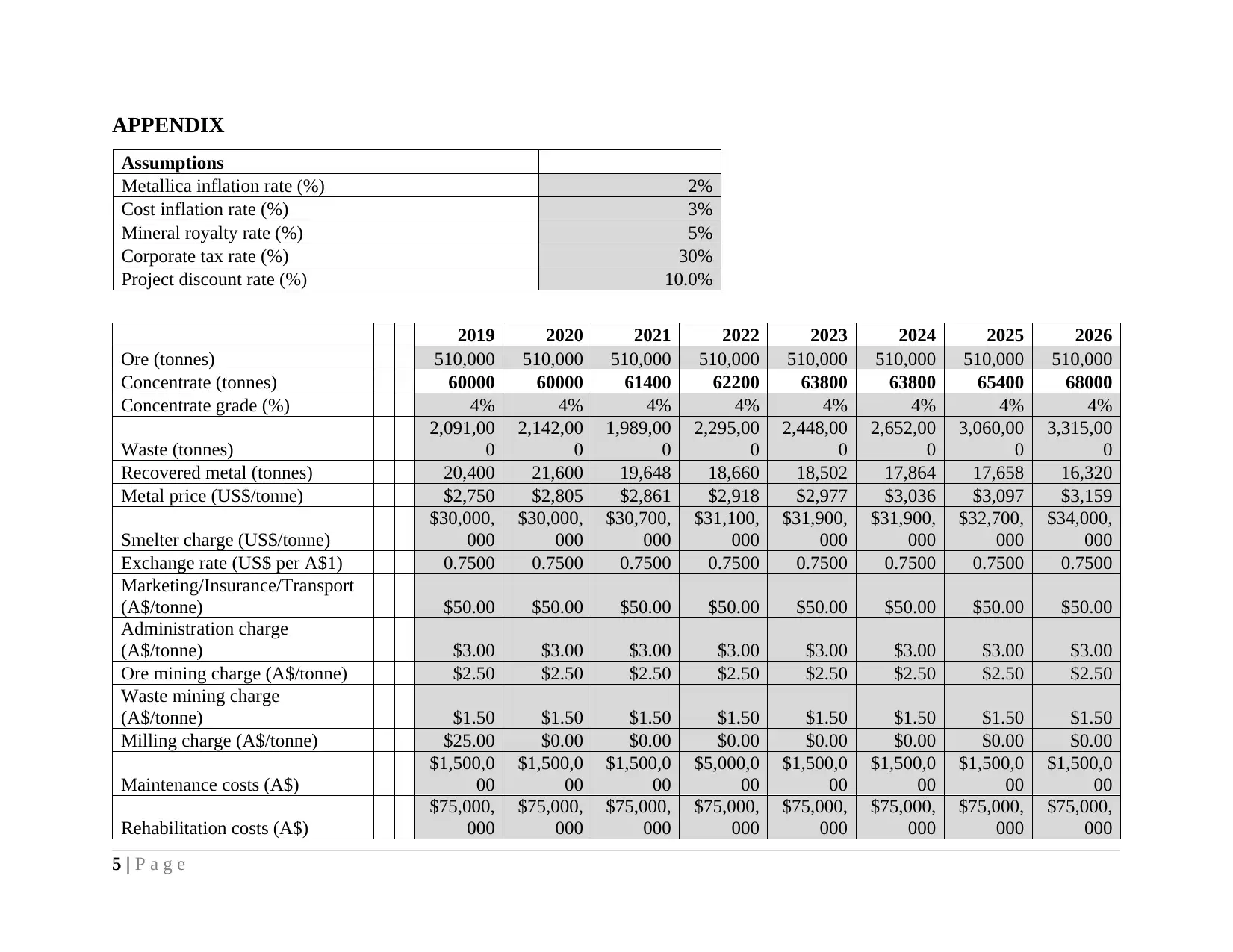

APPENDIX

Assumptions

Metallica inflation rate (%) 2%

Cost inflation rate (%) 3%

Mineral royalty rate (%) 5%

Corporate tax rate (%) 30%

Project discount rate (%) 10.0%

2019 2020 2021 2022 2023 2024 2025 2026

Ore (tonnes) 510,000 510,000 510,000 510,000 510,000 510,000 510,000 510,000

Concentrate (tonnes) 60000 60000 61400 62200 63800 63800 65400 68000

Concentrate grade (%) 4% 4% 4% 4% 4% 4% 4% 4%

Waste (tonnes)

2,091,00

0

2,142,00

0

1,989,00

0

2,295,00

0

2,448,00

0

2,652,00

0

3,060,00

0

3,315,00

0

Recovered metal (tonnes) 20,400 21,600 19,648 18,660 18,502 17,864 17,658 16,320

Metal price (US$/tonne) $2,750 $2,805 $2,861 $2,918 $2,977 $3,036 $3,097 $3,159

Smelter charge (US$/tonne)

$30,000,

000

$30,000,

000

$30,700,

000

$31,100,

000

$31,900,

000

$31,900,

000

$32,700,

000

$34,000,

000

Exchange rate (US$ per A$1) 0.7500 0.7500 0.7500 0.7500 0.7500 0.7500 0.7500 0.7500

Marketing/Insurance/Transport

(A$/tonne) $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00

Administration charge

(A$/tonne) $3.00 $3.00 $3.00 $3.00 $3.00 $3.00 $3.00 $3.00

Ore mining charge (A$/tonne) $2.50 $2.50 $2.50 $2.50 $2.50 $2.50 $2.50 $2.50

Waste mining charge

(A$/tonne) $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50

Milling charge (A$/tonne) $25.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

Maintenance costs (A$)

$1,500,0

00

$1,500,0

00

$1,500,0

00

$5,000,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

Rehabilitation costs (A$)

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

5 | P a g e

Assumptions

Metallica inflation rate (%) 2%

Cost inflation rate (%) 3%

Mineral royalty rate (%) 5%

Corporate tax rate (%) 30%

Project discount rate (%) 10.0%

2019 2020 2021 2022 2023 2024 2025 2026

Ore (tonnes) 510,000 510,000 510,000 510,000 510,000 510,000 510,000 510,000

Concentrate (tonnes) 60000 60000 61400 62200 63800 63800 65400 68000

Concentrate grade (%) 4% 4% 4% 4% 4% 4% 4% 4%

Waste (tonnes)

2,091,00

0

2,142,00

0

1,989,00

0

2,295,00

0

2,448,00

0

2,652,00

0

3,060,00

0

3,315,00

0

Recovered metal (tonnes) 20,400 21,600 19,648 18,660 18,502 17,864 17,658 16,320

Metal price (US$/tonne) $2,750 $2,805 $2,861 $2,918 $2,977 $3,036 $3,097 $3,159

Smelter charge (US$/tonne)

$30,000,

000

$30,000,

000

$30,700,

000

$31,100,

000

$31,900,

000

$31,900,

000

$32,700,

000

$34,000,

000

Exchange rate (US$ per A$1) 0.7500 0.7500 0.7500 0.7500 0.7500 0.7500 0.7500 0.7500

Marketing/Insurance/Transport

(A$/tonne) $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00 $50.00

Administration charge

(A$/tonne) $3.00 $3.00 $3.00 $3.00 $3.00 $3.00 $3.00 $3.00

Ore mining charge (A$/tonne) $2.50 $2.50 $2.50 $2.50 $2.50 $2.50 $2.50 $2.50

Waste mining charge

(A$/tonne) $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50 $1.50

Milling charge (A$/tonne) $25.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00 $0.00

Maintenance costs (A$)

$1,500,0

00

$1,500,0

00

$1,500,0

00

$5,000,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

Rehabilitation costs (A$)

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

$75,000,

000

5 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

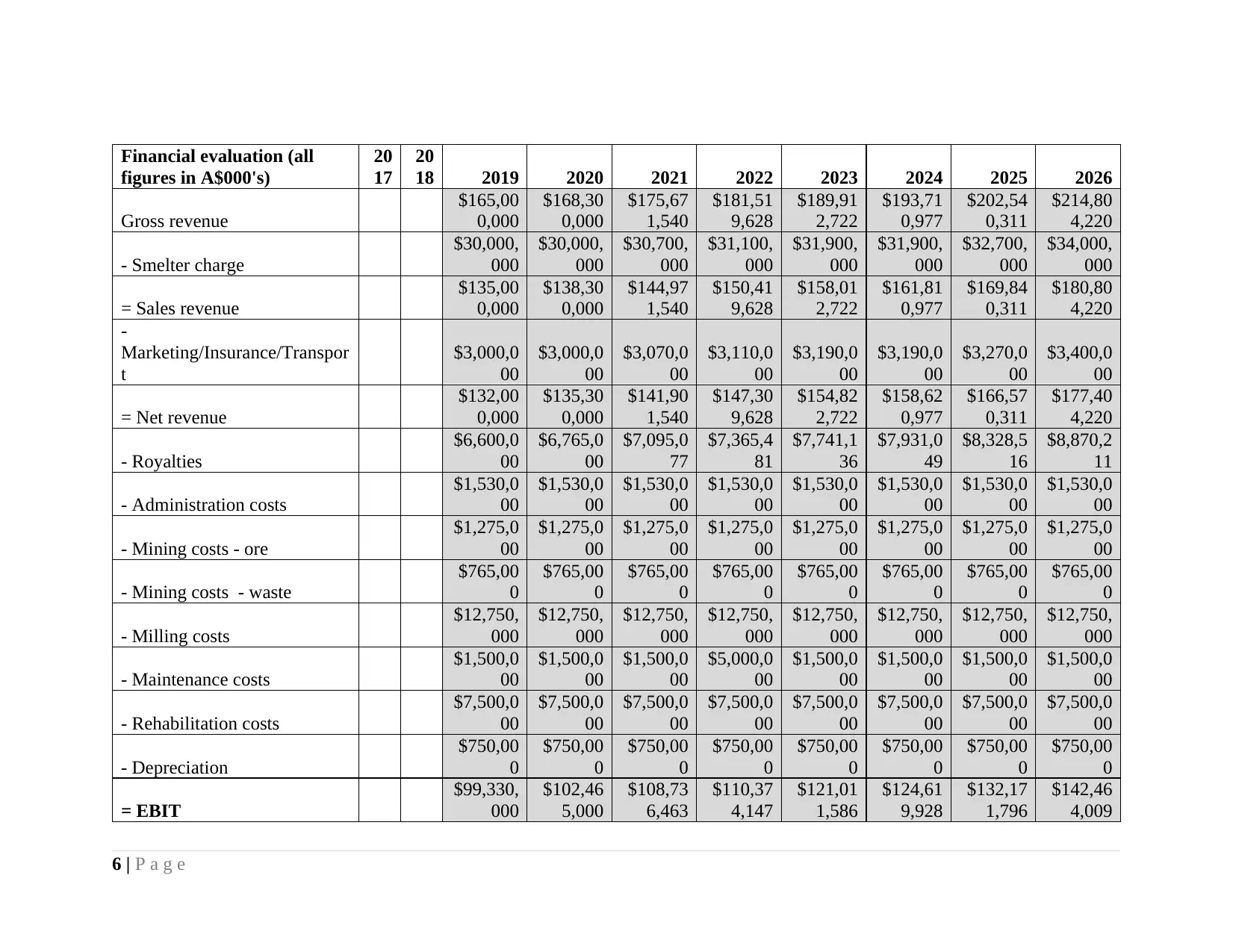

Financial evaluation (all

figures in A$000's)

20

17

20

18 2019 2020 2021 2022 2023 2024 2025 2026

Gross revenue

$165,00

0,000

$168,30

0,000

$175,67

1,540

$181,51

9,628

$189,91

2,722

$193,71

0,977

$202,54

0,311

$214,80

4,220

- Smelter charge

$30,000,

000

$30,000,

000

$30,700,

000

$31,100,

000

$31,900,

000

$31,900,

000

$32,700,

000

$34,000,

000

= Sales revenue

$135,00

0,000

$138,30

0,000

$144,97

1,540

$150,41

9,628

$158,01

2,722

$161,81

0,977

$169,84

0,311

$180,80

4,220

-

Marketing/Insurance/Transpor

t

$3,000,0

00

$3,000,0

00

$3,070,0

00

$3,110,0

00

$3,190,0

00

$3,190,0

00

$3,270,0

00

$3,400,0

00

= Net revenue

$132,00

0,000

$135,30

0,000

$141,90

1,540

$147,30

9,628

$154,82

2,722

$158,62

0,977

$166,57

0,311

$177,40

4,220

- Royalties

$6,600,0

00

$6,765,0

00

$7,095,0

77

$7,365,4

81

$7,741,1

36

$7,931,0

49

$8,328,5

16

$8,870,2

11

- Administration costs

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

- Mining costs - ore

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

- Mining costs - waste

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

- Milling costs

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

- Maintenance costs

$1,500,0

00

$1,500,0

00

$1,500,0

00

$5,000,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

- Rehabilitation costs

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

- Depreciation

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

= EBIT

$99,330,

000

$102,46

5,000

$108,73

6,463

$110,37

4,147

$121,01

1,586

$124,61

9,928

$132,17

1,796

$142,46

4,009

6 | P a g e

figures in A$000's)

20

17

20

18 2019 2020 2021 2022 2023 2024 2025 2026

Gross revenue

$165,00

0,000

$168,30

0,000

$175,67

1,540

$181,51

9,628

$189,91

2,722

$193,71

0,977

$202,54

0,311

$214,80

4,220

- Smelter charge

$30,000,

000

$30,000,

000

$30,700,

000

$31,100,

000

$31,900,

000

$31,900,

000

$32,700,

000

$34,000,

000

= Sales revenue

$135,00

0,000

$138,30

0,000

$144,97

1,540

$150,41

9,628

$158,01

2,722

$161,81

0,977

$169,84

0,311

$180,80

4,220

-

Marketing/Insurance/Transpor

t

$3,000,0

00

$3,000,0

00

$3,070,0

00

$3,110,0

00

$3,190,0

00

$3,190,0

00

$3,270,0

00

$3,400,0

00

= Net revenue

$132,00

0,000

$135,30

0,000

$141,90

1,540

$147,30

9,628

$154,82

2,722

$158,62

0,977

$166,57

0,311

$177,40

4,220

- Royalties

$6,600,0

00

$6,765,0

00

$7,095,0

77

$7,365,4

81

$7,741,1

36

$7,931,0

49

$8,328,5

16

$8,870,2

11

- Administration costs

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

$1,530,0

00

- Mining costs - ore

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

$1,275,0

00

- Mining costs - waste

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

$765,00

0

- Milling costs

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

$12,750,

000

- Maintenance costs

$1,500,0

00

$1,500,0

00

$1,500,0

00

$5,000,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

$1,500,0

00

- Rehabilitation costs

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

$7,500,0

00

- Depreciation

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

$750,00

0

= EBIT

$99,330,

000

$102,46

5,000

$108,73

6,463

$110,37

4,147

$121,01

1,586

$124,61

9,928

$132,17

1,796

$142,46

4,009

6 | P a g e

- Income tax

$29,799,

000

$30,739,

500

$32,620,

939

$33,112,

244

$36,303,

476

$37,385,

978

$39,651,

539

$42,739,

203

= After-tax EBIT

$69,531,

000

$71,725,

500

$76,115,

524

$77,261,

903

$84,708,

110

$87,233,

950

$92,520,

257

$99,724,

806

+ Depreciation

$70,281,

000

$72,475,

500

$76,865,

524

$78,011,

903

$85,458,

110

$87,983,

950

$93,270,

257

$100,47

4,806

- Change in working capital

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

- Capital expenditure

$80,000,

000

= Project cash flow

-

$10,344,

000

$72,475,

500

$76,865,

524

$78,011,

903

$85,458,

110

$87,983,

950

$93,270,

257

$100,47

4,806

NPV $176,261,635.60

IRR 55.45%

Loan repayment analysis (all figures in A$000's)

Loan principal $60,000,000

Interest rate 10%

Term of loan (years) 6

Annual repayment $1,000,000

$10,000,00

0 2019 2020 2021 2022 2023 2024

Project cash flow

-

$10,344,00

0

$72,475,50

0

$76,865,52

4

$78,011,90

3

$85,458,11

0

$87,983,95

0

- Repayments to bank

$11,000,00

0

$11,000,00

0

$11,000,00

0

$11,000,00

0

$11,000,00

0

$11,000,00

0

= Cash flow available to - $61,475,50 $65,865,52 $67,011,90 $74,458,11 $76,983,95

7 | P a g e

$29,799,

000

$30,739,

500

$32,620,

939

$33,112,

244

$36,303,

476

$37,385,

978

$39,651,

539

$42,739,

203

= After-tax EBIT

$69,531,

000

$71,725,

500

$76,115,

524

$77,261,

903

$84,708,

110

$87,233,

950

$92,520,

257

$99,724,

806

+ Depreciation

$70,281,

000

$72,475,

500

$76,865,

524

$78,011,

903

$85,458,

110

$87,983,

950

$93,270,

257

$100,47

4,806

- Change in working capital

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

$625,00

0

- Capital expenditure

$80,000,

000

= Project cash flow

-

$10,344,

000

$72,475,

500

$76,865,

524

$78,011,

903

$85,458,

110

$87,983,

950

$93,270,

257

$100,47

4,806

NPV $176,261,635.60

IRR 55.45%

Loan repayment analysis (all figures in A$000's)

Loan principal $60,000,000

Interest rate 10%

Term of loan (years) 6

Annual repayment $1,000,000

$10,000,00

0 2019 2020 2021 2022 2023 2024

Project cash flow

-

$10,344,00

0

$72,475,50

0

$76,865,52

4

$78,011,90

3

$85,458,11

0

$87,983,95

0

- Repayments to bank

$11,000,00

0

$11,000,00

0

$11,000,00

0

$11,000,00

0

$11,000,00

0

$11,000,00

0

= Cash flow available to - $61,475,50 $65,865,52 $67,011,90 $74,458,11 $76,983,95

7 | P a g e

Andromeda

$21,344,00

0 0 4 3 0 0

8 | P a g e

$21,344,00

0 0 4 3 0 0

8 | P a g e

1 out of 10

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.