Retail Financial Performance Analysis

VerifiedAdded on 2020/02/05

|24

|6240

|32

Report

AI Summary

This assignment requires an analysis of the financial performance of two UK-based retailers, Debanhams and Marks & Spencer. Students are tasked with evaluating their financial health by calculating and interpreting various financial ratios, including liquidity (working capital, current ratio), profitability, and efficiency (fixed assets turnover). The analysis spans multiple years (2012-2016) and incorporates data on revenue, fixed assets, liabilities, and WACC. The goal is to compare the performance of both companies and draw conclusions about their financial standing.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

CORPORATE FINANCIAL

STRATEGY

STRATEGY

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................1

(A) DISCOUNT RATES AND CAPITAL STRUCTURE.............................................................1

(i) Calculation of cost of debt (Kd), cost of equity (Ke) and weighted average cost of capital1

Cost of debt.............................................................................................................................1

Cost of equity.........................................................................................................................2

Wweighted average cost of capital.........................................................................................2

(ii) Critical assessment of capital structure & its repayment ability......................................3

(B) DIVIDEND POLICY................................................................................................................4

(i) Change in dividend over 5 historical years........................................................................5

(ii) Critical assessment of dividend pay-outs.........................................................................5

(iii) Critical analysis of dividend consistency........................................................................6

(C) VALUATION............................................................................................................................7

Static valuation multiples.......................................................................................................7

Absolute valuation method.....................................................................................................7

(D) DEBANHAMS POSITION IN THE CORPORATE LIFE CYCLE........................................8

(i) Revenue and profit growth................................................................................................8

(ii) Financing........................................................................................................................10

(iii) Free cash flow................................................................................................................10

(iv) Dividend payout ratio....................................................................................................11

(E) SHAREHOLDER VALUE PERFORMANCE.......................................................................12

Reapport Analysis................................................................................................................12

Revenue growth...............................................................................................................12

EBITDA margin..............................................................................................................12

Cash tax rate....................................................................................................................13

Working capital investment.............................................................................................13

INTRODUCTION...........................................................................................................................1

(A) DISCOUNT RATES AND CAPITAL STRUCTURE.............................................................1

(i) Calculation of cost of debt (Kd), cost of equity (Ke) and weighted average cost of capital1

Cost of debt.............................................................................................................................1

Cost of equity.........................................................................................................................2

Wweighted average cost of capital.........................................................................................2

(ii) Critical assessment of capital structure & its repayment ability......................................3

(B) DIVIDEND POLICY................................................................................................................4

(i) Change in dividend over 5 historical years........................................................................5

(ii) Critical assessment of dividend pay-outs.........................................................................5

(iii) Critical analysis of dividend consistency........................................................................6

(C) VALUATION............................................................................................................................7

Static valuation multiples.......................................................................................................7

Absolute valuation method.....................................................................................................7

(D) DEBANHAMS POSITION IN THE CORPORATE LIFE CYCLE........................................8

(i) Revenue and profit growth................................................................................................8

(ii) Financing........................................................................................................................10

(iii) Free cash flow................................................................................................................10

(iv) Dividend payout ratio....................................................................................................11

(E) SHAREHOLDER VALUE PERFORMANCE.......................................................................12

Reapport Analysis................................................................................................................12

Revenue growth...............................................................................................................12

EBITDA margin..............................................................................................................12

Cash tax rate....................................................................................................................13

Working capital investment.............................................................................................13

Fixed capital investment..................................................................................................13

Cost of capital..................................................................................................................14

Value/Growth/Duration/Terminal...................................................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

APPENDIX....................................................................................................................................18

Appendix 1...........................................................................................................................18

Appendix 2...........................................................................................................................18

Appendix 3...........................................................................................................................18

Appendix 4...........................................................................................................................19

Appendix 5...........................................................................................................................19

Cost of capital..................................................................................................................14

Value/Growth/Duration/Terminal...................................................................................14

CONCLUSION..............................................................................................................................14

REFERENCES..............................................................................................................................16

APPENDIX....................................................................................................................................18

Appendix 1...........................................................................................................................18

Appendix 2...........................................................................................................................18

Appendix 3...........................................................................................................................18

Appendix 4...........................................................................................................................19

Appendix 5...........................................................................................................................19

Index of Tables

Table 1 Calculation of cost of debt (Kd)..........................................................................................1

Table 2 Calculation of cost of equity (Ke).......................................................................................2

Table 3 Calculation of weighted average cost of capital (WACC).................................................2

Table 4 Debt to equity ratio and interest coverage ratio..................................................................3

Table 5 Dividend per share and total cash dividend........................................................................5

Table 6 Dividend pay-out ratio of Debanhams................................................................................6

Table 7 Required rate of return table for M&S...............................................................................8

Table 8 Equity value by using Gordon model.................................................................................8

Table 9 Percentage change in revenue and profit over last 5 years.................................................8

Table 10 Calculation of Debt and equity proportion in total capital.............................................10

Table 11 Calculation of FCF in last 5 year....................................................................................10

Table 12 Dividend payout ratio from FY2012 to FY2016............................................................11

Table 13 Calculation of Terminal value and enterprise value.......................................................14

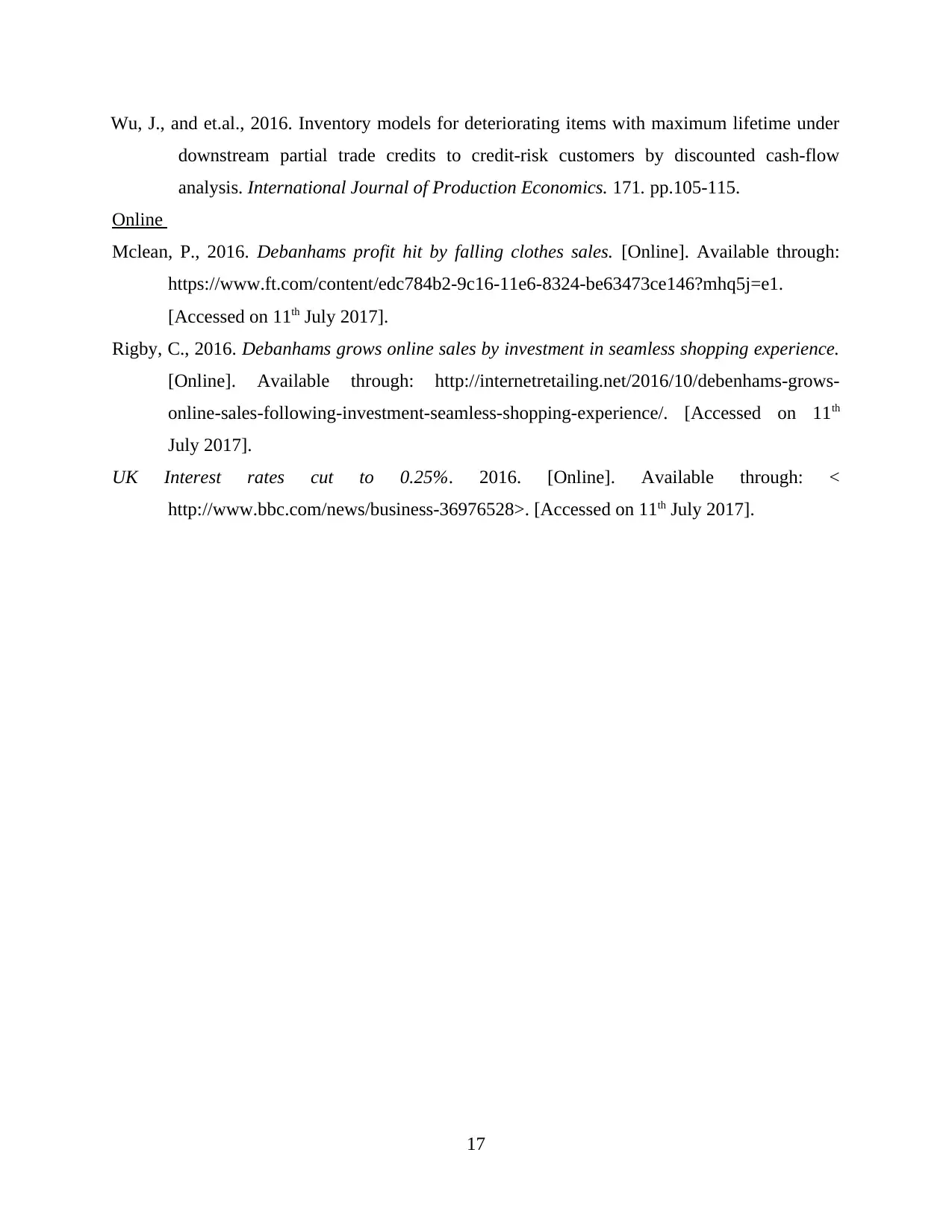

Table 14 Revenue growth of Debanhams and Marks and Spencer...............................................18

Table 15 EBITDA growth and EBITDA margin of Debanhams and M&S..................................18

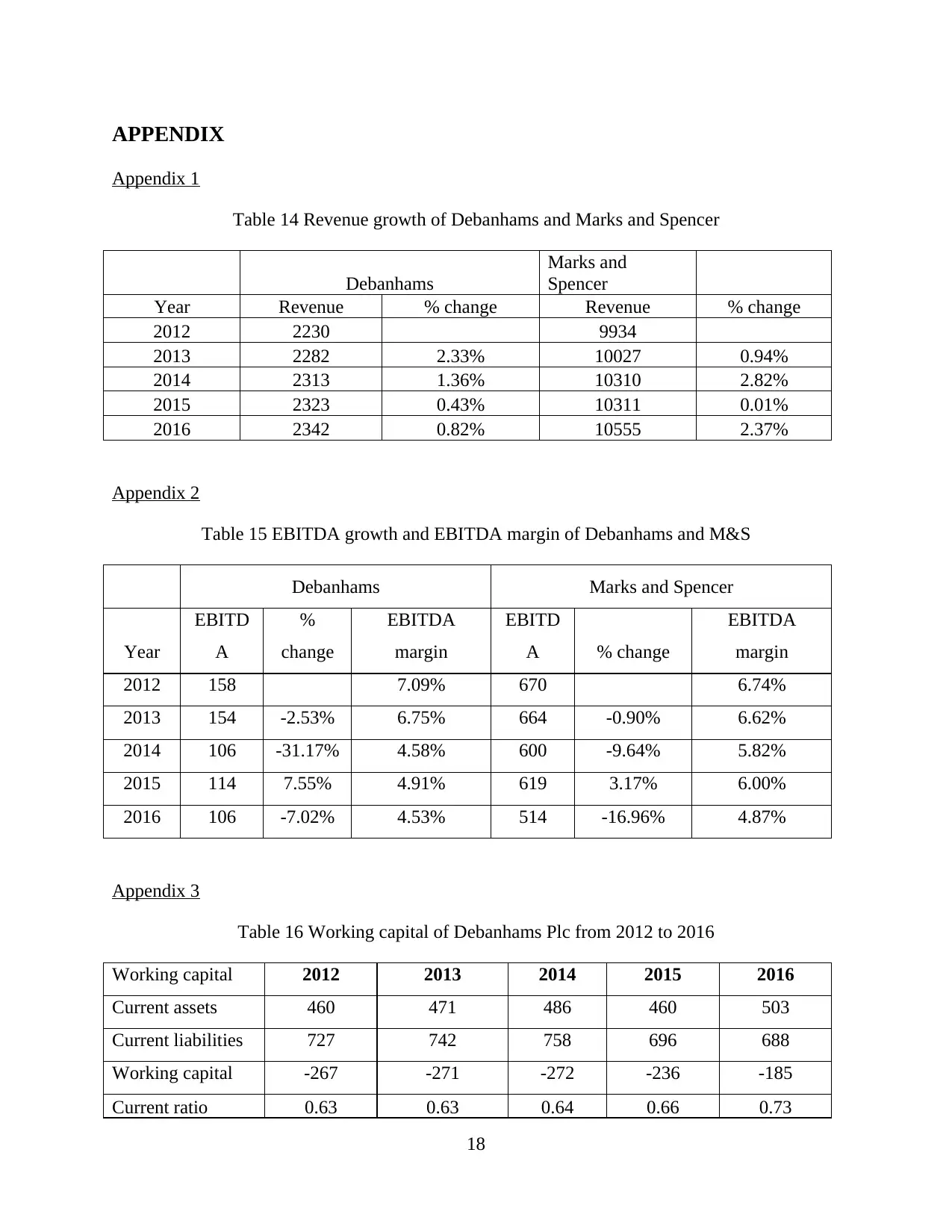

Table 16 Working capital of Debanhams Plc from 2012 to 2016.................................................18

Table 17 Fixed assets turnover ratio of Debanhams and M&S.....................................................19

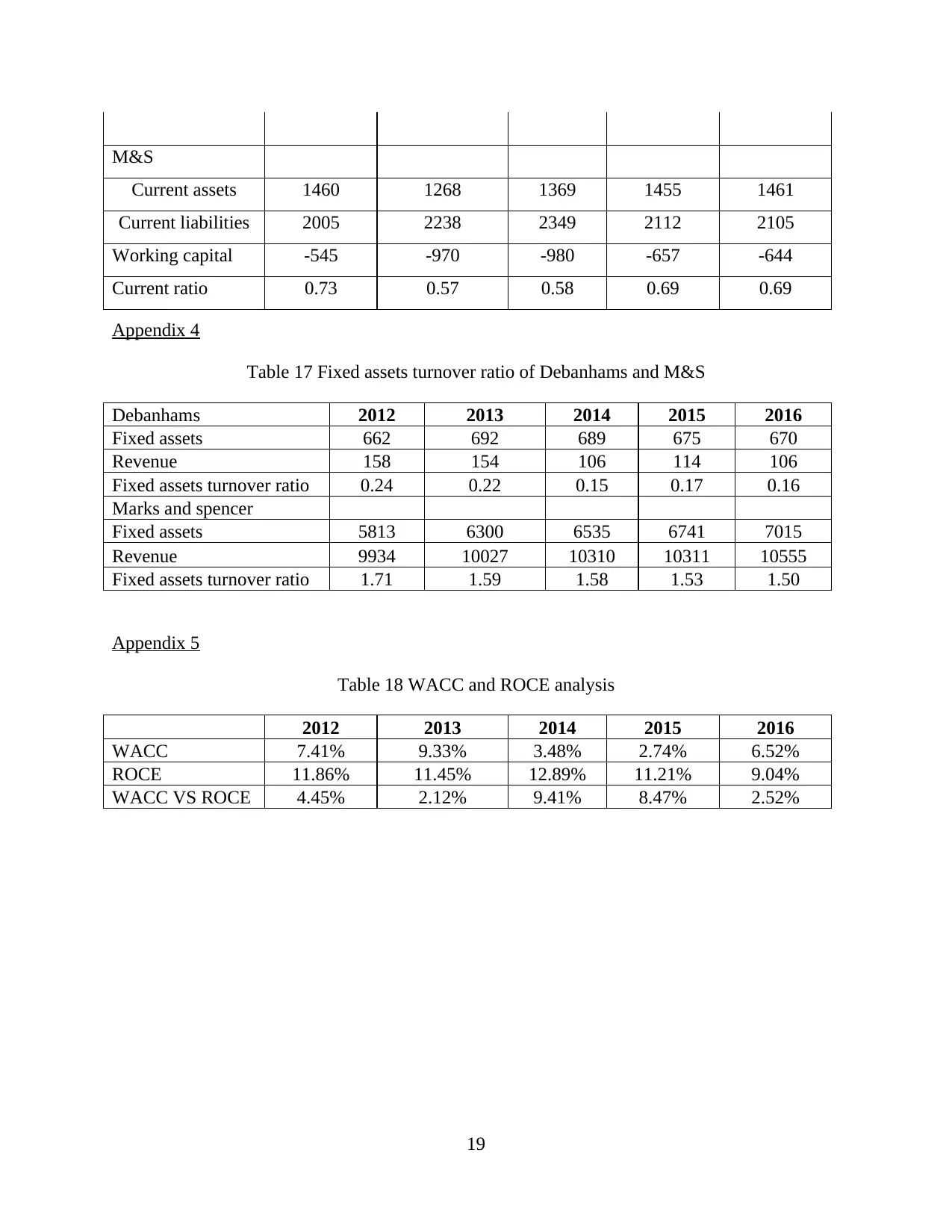

Table 18 WACC and ROCE analysis............................................................................................19

Index of Figures

Figure 1 Debt to equity ratio for 5 years..........................................................................................4

Figure 2 Debanhams dividend per share from FY2013 to FY2017................................................5

Figure 3 Debanham revenue and profitability from 2012 to 2016.................................................9

Figure 4 Debt and equity composition of Debanhams..................................................................10

Figure 5 Debanhams and Marks and Spencer' sales performance.................................................12

Table 1 Calculation of cost of debt (Kd)..........................................................................................1

Table 2 Calculation of cost of equity (Ke).......................................................................................2

Table 3 Calculation of weighted average cost of capital (WACC).................................................2

Table 4 Debt to equity ratio and interest coverage ratio..................................................................3

Table 5 Dividend per share and total cash dividend........................................................................5

Table 6 Dividend pay-out ratio of Debanhams................................................................................6

Table 7 Required rate of return table for M&S...............................................................................8

Table 8 Equity value by using Gordon model.................................................................................8

Table 9 Percentage change in revenue and profit over last 5 years.................................................8

Table 10 Calculation of Debt and equity proportion in total capital.............................................10

Table 11 Calculation of FCF in last 5 year....................................................................................10

Table 12 Dividend payout ratio from FY2012 to FY2016............................................................11

Table 13 Calculation of Terminal value and enterprise value.......................................................14

Table 14 Revenue growth of Debanhams and Marks and Spencer...............................................18

Table 15 EBITDA growth and EBITDA margin of Debanhams and M&S..................................18

Table 16 Working capital of Debanhams Plc from 2012 to 2016.................................................18

Table 17 Fixed assets turnover ratio of Debanhams and M&S.....................................................19

Table 18 WACC and ROCE analysis............................................................................................19

Index of Figures

Figure 1 Debt to equity ratio for 5 years..........................................................................................4

Figure 2 Debanhams dividend per share from FY2013 to FY2017................................................5

Figure 3 Debanham revenue and profitability from 2012 to 2016.................................................9

Figure 4 Debt and equity composition of Debanhams..................................................................10

Figure 5 Debanhams and Marks and Spencer' sales performance.................................................12

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

INTRODUCTION

In today’s era, establishments are facing number of financial challenges due to volatile

external market conditions. Funds are the key requirement for every enterprises regardless their

size and nature of business because none of the entity can run their daily activities without

enough financial resources. Therefore, in every organization, Certified Financial Officer (CFO)

is responsible to handle, monitor and administrate financial functions. They make policies &

plans to procure required capital to finance their operations and put control over its use for

paying off their monetary obligations and financial commitment. Debanhams is a UK-based

multinational retailer which is operating in the fashion industry. Its product portfolio covers

designer cloth, accessories, cosmetics, home & furniture products, electrical equipments and

gifts & toys. The report here purposes at examining its corporate financial strategy through the

analysis of weighted average cost of capital and capital structure. Moreover, dividend policy and

stock valuation will be made using valuation multiples and absolute valuation technique. Lastly,

it will make evaluation of its position under the corporate life cycle i.e. start-up, growth, maturity

and decline through revenue & profit, financing structure, free cash flow and dividend decisions.

(A) DISCOUNT RATES AND CAPITAL STRUCTURE

(i) Calculation of cost of debt (Kd), cost of equity (Ke) and weighted average cost of capital

Cost of debt

On debt capital, Debanhams is liable to pay financial costs in the terms of interest to the

lenders, called cost of debt (Kd) (Benito, Guillamón and Bastida, 2016). On such payment, tax

shield benefits are available to the company because in UK, tax authority, Her Majesty Revenue

& Custom (HMRC) provide tax deductions to the amount of interest paid on loan. Hence, cost of

debt is calculated using below mentioned formula:

Cost of debt (Kd) = Interest/Net debt*(1-tax rate)

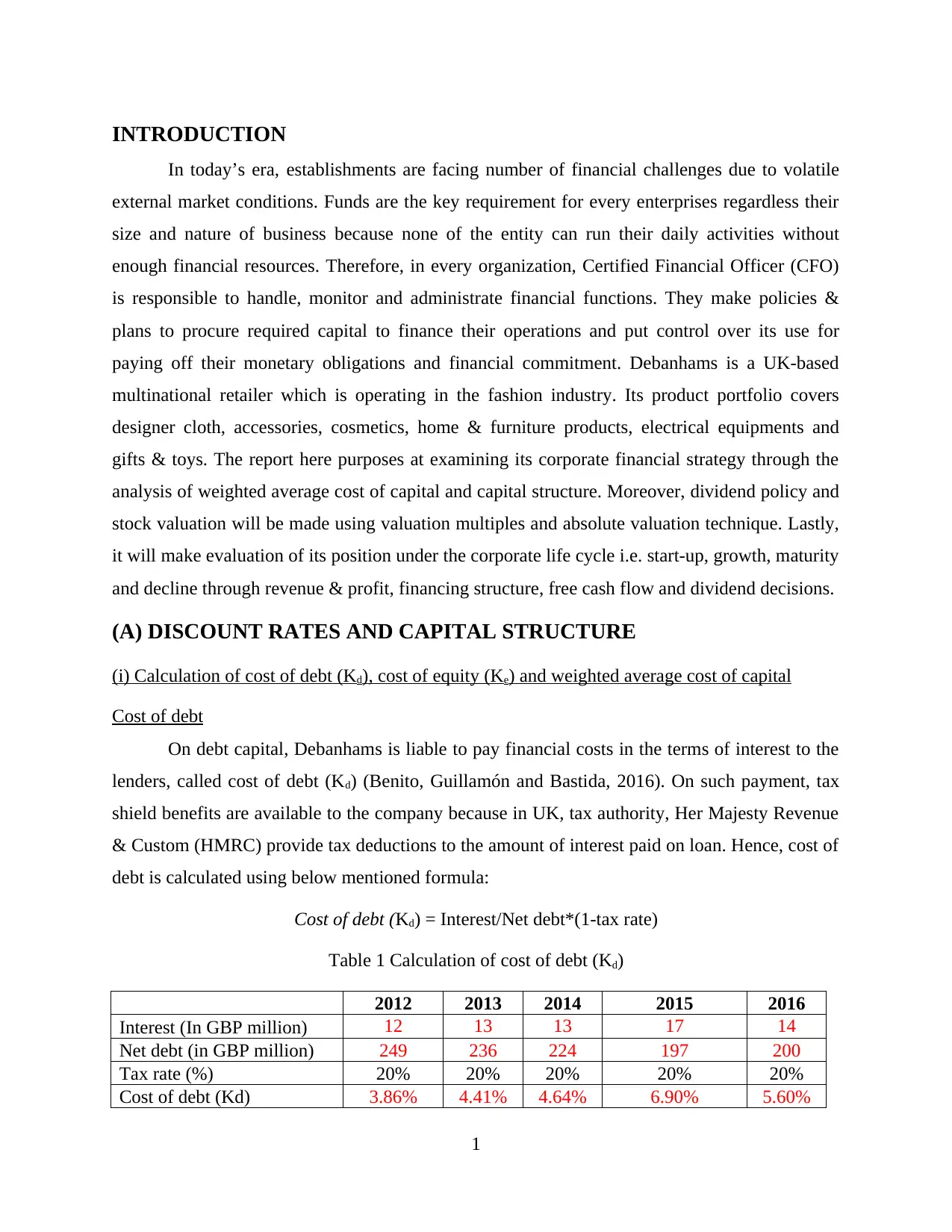

Table 1 Calculation of cost of debt (Kd)

2012 2013 2014 2015 2016

Interest (In GBP million) 12 13 13 17 14

Net debt (in GBP million) 249 236 224 197 200

Tax rate (%) 20% 20% 20% 20% 20%

Cost of debt (Kd) 3.86% 4.41% 4.64% 6.90% 5.60%

1

In today’s era, establishments are facing number of financial challenges due to volatile

external market conditions. Funds are the key requirement for every enterprises regardless their

size and nature of business because none of the entity can run their daily activities without

enough financial resources. Therefore, in every organization, Certified Financial Officer (CFO)

is responsible to handle, monitor and administrate financial functions. They make policies &

plans to procure required capital to finance their operations and put control over its use for

paying off their monetary obligations and financial commitment. Debanhams is a UK-based

multinational retailer which is operating in the fashion industry. Its product portfolio covers

designer cloth, accessories, cosmetics, home & furniture products, electrical equipments and

gifts & toys. The report here purposes at examining its corporate financial strategy through the

analysis of weighted average cost of capital and capital structure. Moreover, dividend policy and

stock valuation will be made using valuation multiples and absolute valuation technique. Lastly,

it will make evaluation of its position under the corporate life cycle i.e. start-up, growth, maturity

and decline through revenue & profit, financing structure, free cash flow and dividend decisions.

(A) DISCOUNT RATES AND CAPITAL STRUCTURE

(i) Calculation of cost of debt (Kd), cost of equity (Ke) and weighted average cost of capital

Cost of debt

On debt capital, Debanhams is liable to pay financial costs in the terms of interest to the

lenders, called cost of debt (Kd) (Benito, Guillamón and Bastida, 2016). On such payment, tax

shield benefits are available to the company because in UK, tax authority, Her Majesty Revenue

& Custom (HMRC) provide tax deductions to the amount of interest paid on loan. Hence, cost of

debt is calculated using below mentioned formula:

Cost of debt (Kd) = Interest/Net debt*(1-tax rate)

Table 1 Calculation of cost of debt (Kd)

2012 2013 2014 2015 2016

Interest (In GBP million) 12 13 13 17 14

Net debt (in GBP million) 249 236 224 197 200

Tax rate (%) 20% 20% 20% 20% 20%

Cost of debt (Kd) 3.86% 4.41% 4.64% 6.90% 5.60%

1

In UK, corporate tax rate is 20% as per which, Debanhams is accountable to pay 20% tax

on their pre-tax profit every year. From the results drawn above, it is seen that from FY 2012 to

FY 2015, cost of debt shows an increasing trend as it was 3.86% increased to 4.41%, 4.64% and

6.90% respectively. Over the period, interest payment shows a declining trend because of

reduction in debt through repayment to the lenders. However, in 2016, it dropped down to 5.60%

due to cut in interest rates charged by Bank of England (BOE) from 0.25% to 0.50% so as to

avoid possible recession due to Brexit (separation of UK from European Union) (UK Interest

rates cut to 0.25%, 2016).

Cost of equity

Unlike debt, there is no liability for the Debanhams to pay a fixed or certain rate of

dividend regularly to the shareholders in return for the capital they provided to the entity.

Moreover, tax deductions are also unavailable on dividend payment (Goldmann, 2017).

Cost of equity (Ke) = Risk free rate + beta (market return-risk free return)

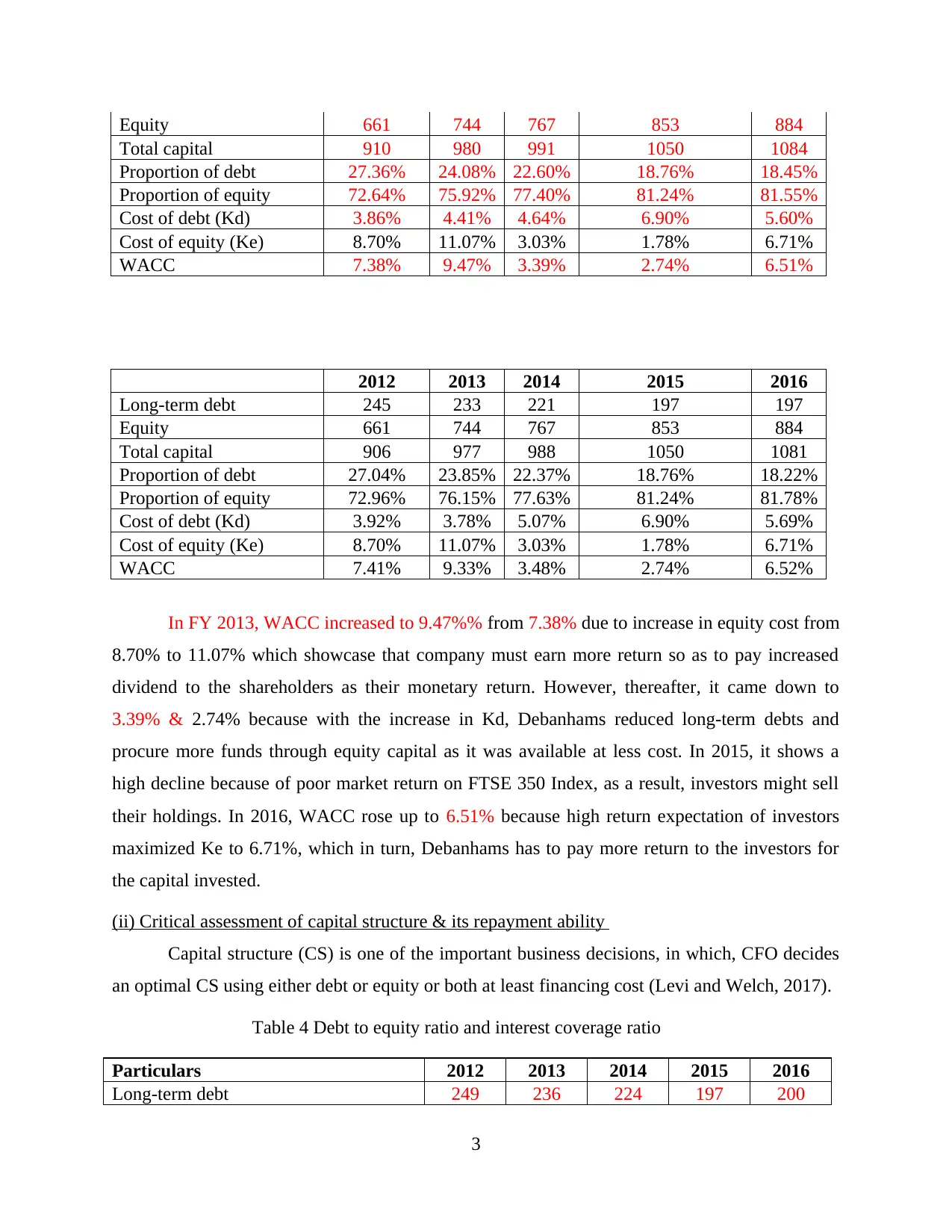

Table 2 Calculation of cost of equity (Ke)

2012 2013 2014 2015 2016

Risk free return (Rf) 3.95% 3.95% 3.95% 3.95% 3.95%

Beta 0.59 0.62 0.67 0.68 0.72

Market return (Rm) 12.01% 15.44% 2.57% 0.77% 7.76%

Risk premium 8.06% 11.49% -1.38% -3.18% 3.81%

Cost of equity (Ke) 8.70% 11.07% 3.03% 1.78% 6.71%

As per the results, it can be seen that in 2013, Ke grown to 11.07% due to increase in beta

and market return to 15.44%. However, afterwards in 2014 and 2015, it dropped to 3.03% and

1.78% due to declined market return on FTSE 350 Index whilst in next year, it grown up to

6.71% because of high return expectations of investors as they demanded more dividend on their

capital.

Wweighted average cost of capital

WACC = Debt/(debt +Equity)*Kd + Equity/(debt + Equity)*(Ke)

Table 3 Calculation of weighted average cost of capital (WACC)

2012 2013 2014 2015 2016

Long-term debt 249 236 224 197 200

2

on their pre-tax profit every year. From the results drawn above, it is seen that from FY 2012 to

FY 2015, cost of debt shows an increasing trend as it was 3.86% increased to 4.41%, 4.64% and

6.90% respectively. Over the period, interest payment shows a declining trend because of

reduction in debt through repayment to the lenders. However, in 2016, it dropped down to 5.60%

due to cut in interest rates charged by Bank of England (BOE) from 0.25% to 0.50% so as to

avoid possible recession due to Brexit (separation of UK from European Union) (UK Interest

rates cut to 0.25%, 2016).

Cost of equity

Unlike debt, there is no liability for the Debanhams to pay a fixed or certain rate of

dividend regularly to the shareholders in return for the capital they provided to the entity.

Moreover, tax deductions are also unavailable on dividend payment (Goldmann, 2017).

Cost of equity (Ke) = Risk free rate + beta (market return-risk free return)

Table 2 Calculation of cost of equity (Ke)

2012 2013 2014 2015 2016

Risk free return (Rf) 3.95% 3.95% 3.95% 3.95% 3.95%

Beta 0.59 0.62 0.67 0.68 0.72

Market return (Rm) 12.01% 15.44% 2.57% 0.77% 7.76%

Risk premium 8.06% 11.49% -1.38% -3.18% 3.81%

Cost of equity (Ke) 8.70% 11.07% 3.03% 1.78% 6.71%

As per the results, it can be seen that in 2013, Ke grown to 11.07% due to increase in beta

and market return to 15.44%. However, afterwards in 2014 and 2015, it dropped to 3.03% and

1.78% due to declined market return on FTSE 350 Index whilst in next year, it grown up to

6.71% because of high return expectations of investors as they demanded more dividend on their

capital.

Wweighted average cost of capital

WACC = Debt/(debt +Equity)*Kd + Equity/(debt + Equity)*(Ke)

Table 3 Calculation of weighted average cost of capital (WACC)

2012 2013 2014 2015 2016

Long-term debt 249 236 224 197 200

2

Equity 661 744 767 853 884

Total capital 910 980 991 1050 1084

Proportion of debt 27.36% 24.08% 22.60% 18.76% 18.45%

Proportion of equity 72.64% 75.92% 77.40% 81.24% 81.55%

Cost of debt (Kd) 3.86% 4.41% 4.64% 6.90% 5.60%

Cost of equity (Ke) 8.70% 11.07% 3.03% 1.78% 6.71%

WACC 7.38% 9.47% 3.39% 2.74% 6.51%

2012 2013 2014 2015 2016

Long-term debt 245 233 221 197 197

Equity 661 744 767 853 884

Total capital 906 977 988 1050 1081

Proportion of debt 27.04% 23.85% 22.37% 18.76% 18.22%

Proportion of equity 72.96% 76.15% 77.63% 81.24% 81.78%

Cost of debt (Kd) 3.92% 3.78% 5.07% 6.90% 5.69%

Cost of equity (Ke) 8.70% 11.07% 3.03% 1.78% 6.71%

WACC 7.41% 9.33% 3.48% 2.74% 6.52%

In FY 2013, WACC increased to 9.47%% from 7.38% due to increase in equity cost from

8.70% to 11.07% which showcase that company must earn more return so as to pay increased

dividend to the shareholders as their monetary return. However, thereafter, it came down to

3.39% & 2.74% because with the increase in Kd, Debanhams reduced long-term debts and

procure more funds through equity capital as it was available at less cost. In 2015, it shows a

high decline because of poor market return on FTSE 350 Index, as a result, investors might sell

their holdings. In 2016, WACC rose up to 6.51% because high return expectation of investors

maximized Ke to 6.71%, which in turn, Debanhams has to pay more return to the investors for

the capital invested.

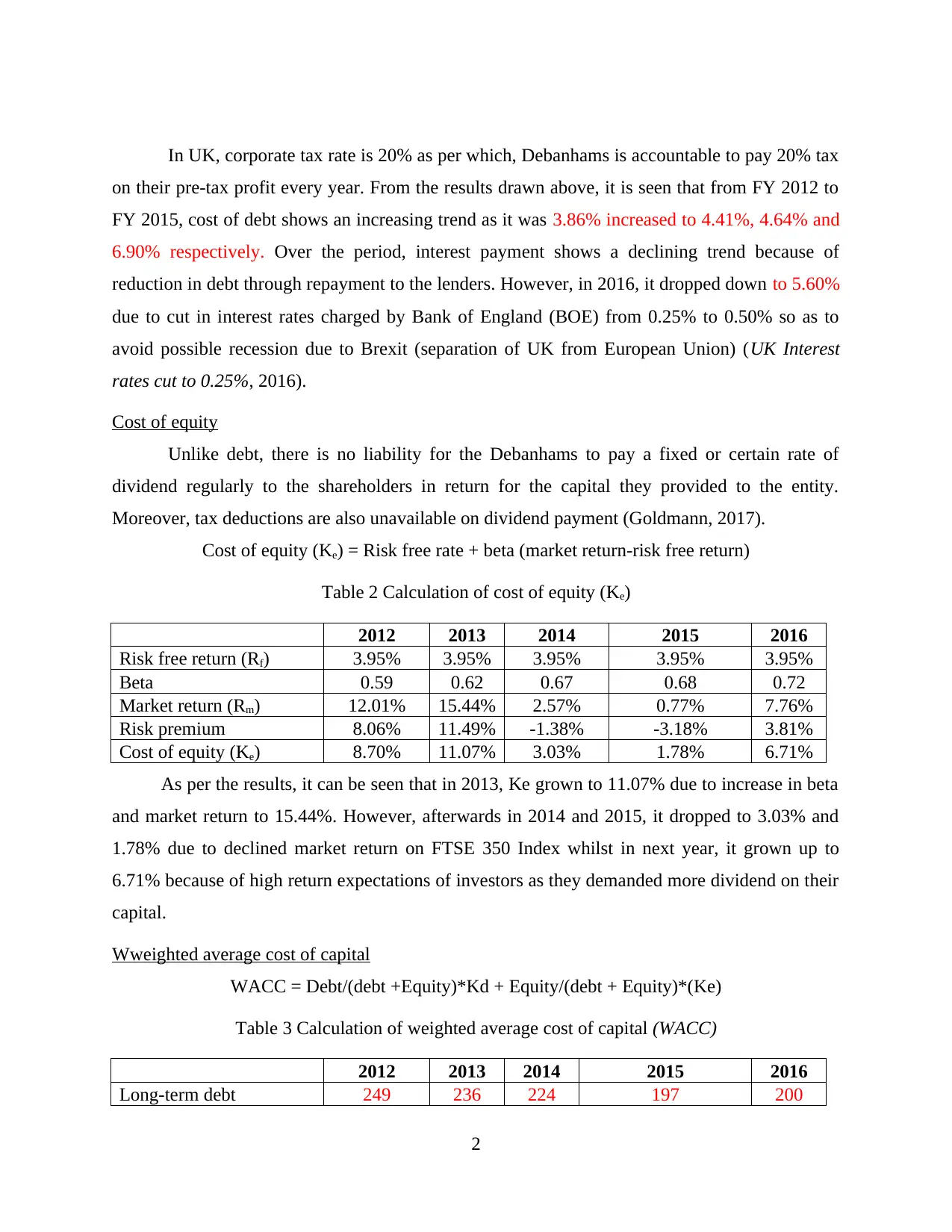

(ii) Critical assessment of capital structure & its repayment ability

Capital structure (CS) is one of the important business decisions, in which, CFO decides

an optimal CS using either debt or equity or both at least financing cost (Levi and Welch, 2017).

Table 4 Debt to equity ratio and interest coverage ratio

Particulars 2012 2013 2014 2015 2016

Long-term debt 249 236 224 197 200

3

Total capital 910 980 991 1050 1084

Proportion of debt 27.36% 24.08% 22.60% 18.76% 18.45%

Proportion of equity 72.64% 75.92% 77.40% 81.24% 81.55%

Cost of debt (Kd) 3.86% 4.41% 4.64% 6.90% 5.60%

Cost of equity (Ke) 8.70% 11.07% 3.03% 1.78% 6.71%

WACC 7.38% 9.47% 3.39% 2.74% 6.51%

2012 2013 2014 2015 2016

Long-term debt 245 233 221 197 197

Equity 661 744 767 853 884

Total capital 906 977 988 1050 1081

Proportion of debt 27.04% 23.85% 22.37% 18.76% 18.22%

Proportion of equity 72.96% 76.15% 77.63% 81.24% 81.78%

Cost of debt (Kd) 3.92% 3.78% 5.07% 6.90% 5.69%

Cost of equity (Ke) 8.70% 11.07% 3.03% 1.78% 6.71%

WACC 7.41% 9.33% 3.48% 2.74% 6.52%

In FY 2013, WACC increased to 9.47%% from 7.38% due to increase in equity cost from

8.70% to 11.07% which showcase that company must earn more return so as to pay increased

dividend to the shareholders as their monetary return. However, thereafter, it came down to

3.39% & 2.74% because with the increase in Kd, Debanhams reduced long-term debts and

procure more funds through equity capital as it was available at less cost. In 2015, it shows a

high decline because of poor market return on FTSE 350 Index, as a result, investors might sell

their holdings. In 2016, WACC rose up to 6.51% because high return expectation of investors

maximized Ke to 6.71%, which in turn, Debanhams has to pay more return to the investors for

the capital invested.

(ii) Critical assessment of capital structure & its repayment ability

Capital structure (CS) is one of the important business decisions, in which, CFO decides

an optimal CS using either debt or equity or both at least financing cost (Levi and Welch, 2017).

Table 4 Debt to equity ratio and interest coverage ratio

Particulars 2012 2013 2014 2015 2016

Long-term debt 249 236 224 197 200

3

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Equity 661 744 767 853 884

Total capital 910 980 991 1050 1084

Debt to equity ratio 0.38 0.32 0.29 0.23 0.23

Interest 12 13 13 17 14

Earnings before interest and taxes

(EBIT) 175 155 124 134 119

Interest coverage ratio 14.58 11.92 9.54 7.88 8.50

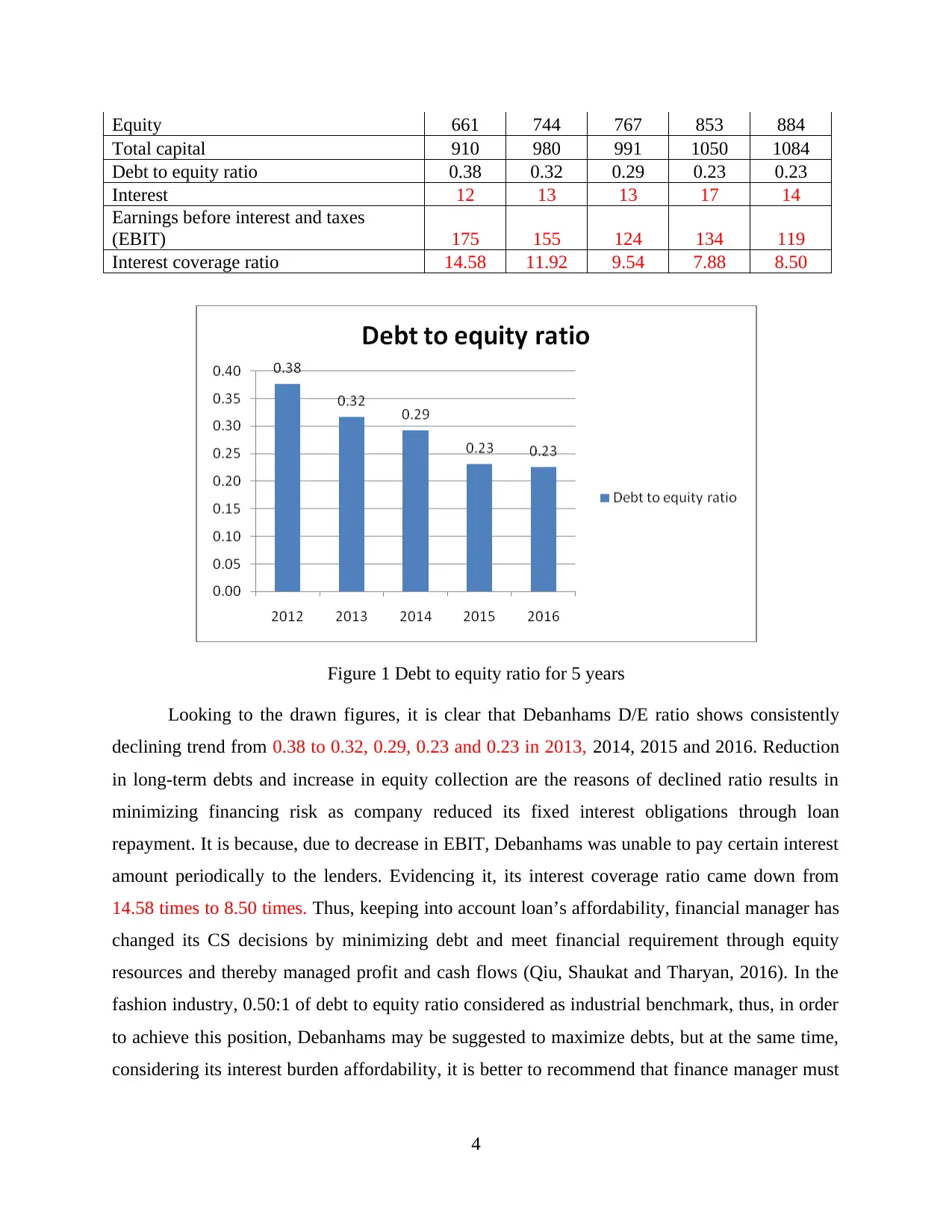

Figure 1 Debt to equity ratio for 5 years

Looking to the drawn figures, it is clear that Debanhams D/E ratio shows consistently

declining trend from 0.38 to 0.32, 0.29, 0.23 and 0.23 in 2013, 2014, 2015 and 2016. Reduction

in long-term debts and increase in equity collection are the reasons of declined ratio results in

minimizing financing risk as company reduced its fixed interest obligations through loan

repayment. It is because, due to decrease in EBIT, Debanhams was unable to pay certain interest

amount periodically to the lenders. Evidencing it, its interest coverage ratio came down from

14.58 times to 8.50 times. Thus, keeping into account loan’s affordability, financial manager has

changed its CS decisions by minimizing debt and meet financial requirement through equity

resources and thereby managed profit and cash flows (Qiu, Shaukat and Tharyan, 2016). In the

fashion industry, 0.50:1 of debt to equity ratio considered as industrial benchmark, thus, in order

to achieve this position, Debanhams may be suggested to maximize debts, but at the same time,

considering its interest burden affordability, it is better to recommend that finance manager must

4

Total capital 910 980 991 1050 1084

Debt to equity ratio 0.38 0.32 0.29 0.23 0.23

Interest 12 13 13 17 14

Earnings before interest and taxes

(EBIT) 175 155 124 134 119

Interest coverage ratio 14.58 11.92 9.54 7.88 8.50

Figure 1 Debt to equity ratio for 5 years

Looking to the drawn figures, it is clear that Debanhams D/E ratio shows consistently

declining trend from 0.38 to 0.32, 0.29, 0.23 and 0.23 in 2013, 2014, 2015 and 2016. Reduction

in long-term debts and increase in equity collection are the reasons of declined ratio results in

minimizing financing risk as company reduced its fixed interest obligations through loan

repayment. It is because, due to decrease in EBIT, Debanhams was unable to pay certain interest

amount periodically to the lenders. Evidencing it, its interest coverage ratio came down from

14.58 times to 8.50 times. Thus, keeping into account loan’s affordability, financial manager has

changed its CS decisions by minimizing debt and meet financial requirement through equity

resources and thereby managed profit and cash flows (Qiu, Shaukat and Tharyan, 2016). In the

fashion industry, 0.50:1 of debt to equity ratio considered as industrial benchmark, thus, in order

to achieve this position, Debanhams may be suggested to maximize debts, but at the same time,

considering its interest burden affordability, it is better to recommend that finance manager must

4

look towards maximizing its EBIT to improve interest coverage ratio and thereby gather money

through debt collections for improving its solvency position.

(B) DIVIDEND POLICY

Dividend policies are the guideline that is used by the Debanhams management to make

dividend distribution decisions for the investors (Lundholm and O'keefe, 2011).

(i) Change in dividend over 5 historical years

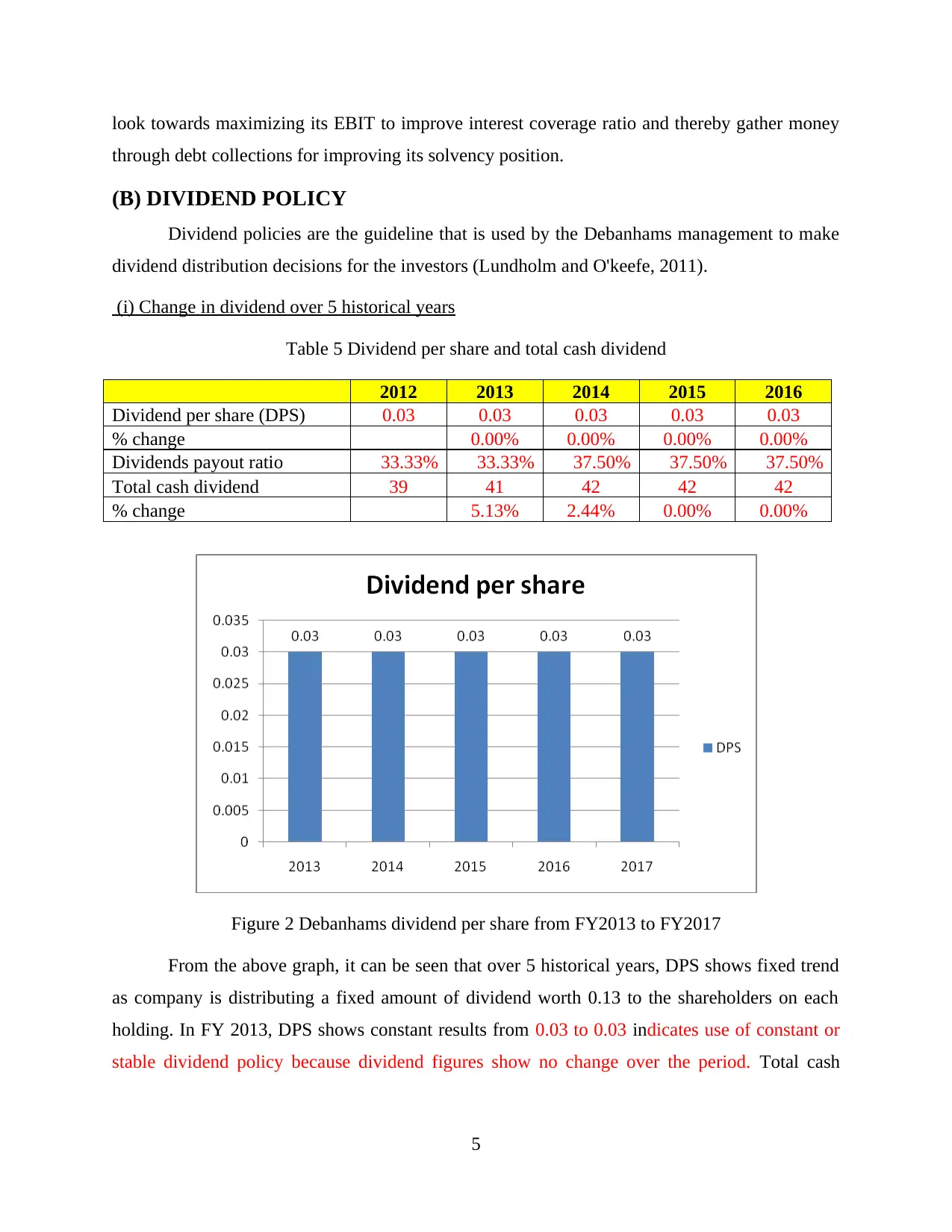

Table 5 Dividend per share and total cash dividend

2012 2013 2014 2015 2016

Dividend per share (DPS) 0.03 0.03 0.03 0.03 0.03

% change 0.00% 0.00% 0.00% 0.00%

Dividends payout ratio 33.33% 33.33% 37.50% 37.50% 37.50%

Total cash dividend 39 41 42 42 42

% change 5.13% 2.44% 0.00% 0.00%

Figure 2 Debanhams dividend per share from FY2013 to FY2017

From the above graph, it can be seen that over 5 historical years, DPS shows fixed trend

as company is distributing a fixed amount of dividend worth 0.13 to the shareholders on each

holding. In FY 2013, DPS shows constant results from 0.03 to 0.03 indicates use of constant or

stable dividend policy because dividend figures show no change over the period. Total cash

5

through debt collections for improving its solvency position.

(B) DIVIDEND POLICY

Dividend policies are the guideline that is used by the Debanhams management to make

dividend distribution decisions for the investors (Lundholm and O'keefe, 2011).

(i) Change in dividend over 5 historical years

Table 5 Dividend per share and total cash dividend

2012 2013 2014 2015 2016

Dividend per share (DPS) 0.03 0.03 0.03 0.03 0.03

% change 0.00% 0.00% 0.00% 0.00%

Dividends payout ratio 33.33% 33.33% 37.50% 37.50% 37.50%

Total cash dividend 39 41 42 42 42

% change 5.13% 2.44% 0.00% 0.00%

Figure 2 Debanhams dividend per share from FY2013 to FY2017

From the above graph, it can be seen that over 5 historical years, DPS shows fixed trend

as company is distributing a fixed amount of dividend worth 0.13 to the shareholders on each

holding. In FY 2013, DPS shows constant results from 0.03 to 0.03 indicates use of constant or

stable dividend policy because dividend figures show no change over the period. Total cash

5

dividend in 2013 and 2014 shows £2m and £1m annual increase by 5.13% and 2.44% and

afterwards, it remains constant to £42m.

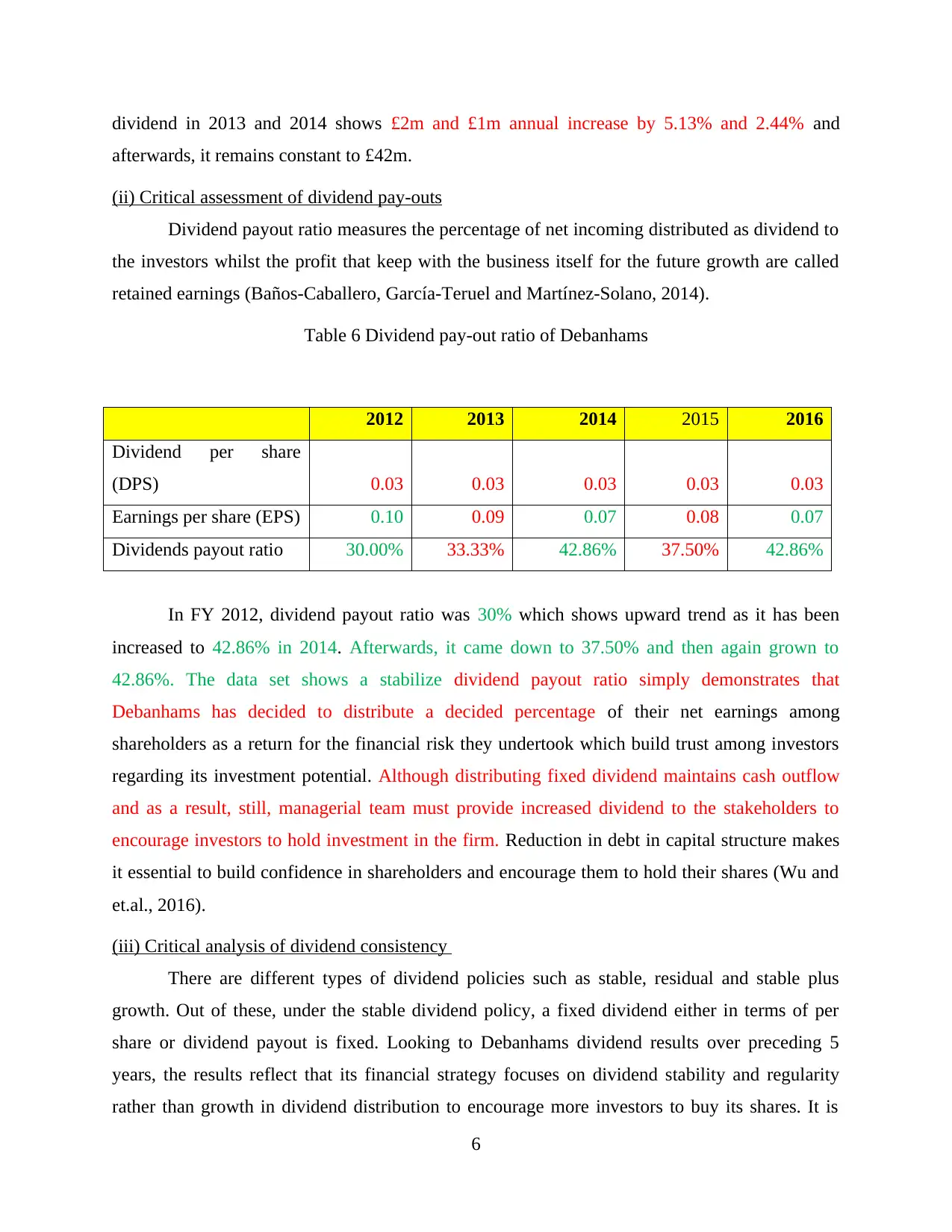

(ii) Critical assessment of dividend pay-outs

Dividend payout ratio measures the percentage of net incoming distributed as dividend to

the investors whilst the profit that keep with the business itself for the future growth are called

retained earnings (Baños-Caballero, García-Teruel and Martínez-Solano, 2014).

Table 6 Dividend pay-out ratio of Debanhams

2012 2013 2014 2015 2016

Dividend per share

(DPS) 0.03 0.03 0.03 0.03 0.03

Earnings per share (EPS) 0.10 0.09 0.07 0.08 0.07

Dividends payout ratio 30.00% 33.33% 42.86% 37.50% 42.86%

In FY 2012, dividend payout ratio was 30% which shows upward trend as it has been

increased to 42.86% in 2014. Afterwards, it came down to 37.50% and then again grown to

42.86%. The data set shows a stabilize dividend payout ratio simply demonstrates that

Debanhams has decided to distribute a decided percentage of their net earnings among

shareholders as a return for the financial risk they undertook which build trust among investors

regarding its investment potential. Although distributing fixed dividend maintains cash outflow

and as a result, still, managerial team must provide increased dividend to the stakeholders to

encourage investors to hold investment in the firm. Reduction in debt in capital structure makes

it essential to build confidence in shareholders and encourage them to hold their shares (Wu and

et.al., 2016).

(iii) Critical analysis of dividend consistency

There are different types of dividend policies such as stable, residual and stable plus

growth. Out of these, under the stable dividend policy, a fixed dividend either in terms of per

share or dividend payout is fixed. Looking to Debanhams dividend results over preceding 5

years, the results reflect that its financial strategy focuses on dividend stability and regularity

rather than growth in dividend distribution to encourage more investors to buy its shares. It is

6

afterwards, it remains constant to £42m.

(ii) Critical assessment of dividend pay-outs

Dividend payout ratio measures the percentage of net incoming distributed as dividend to

the investors whilst the profit that keep with the business itself for the future growth are called

retained earnings (Baños-Caballero, García-Teruel and Martínez-Solano, 2014).

Table 6 Dividend pay-out ratio of Debanhams

2012 2013 2014 2015 2016

Dividend per share

(DPS) 0.03 0.03 0.03 0.03 0.03

Earnings per share (EPS) 0.10 0.09 0.07 0.08 0.07

Dividends payout ratio 30.00% 33.33% 42.86% 37.50% 42.86%

In FY 2012, dividend payout ratio was 30% which shows upward trend as it has been

increased to 42.86% in 2014. Afterwards, it came down to 37.50% and then again grown to

42.86%. The data set shows a stabilize dividend payout ratio simply demonstrates that

Debanhams has decided to distribute a decided percentage of their net earnings among

shareholders as a return for the financial risk they undertook which build trust among investors

regarding its investment potential. Although distributing fixed dividend maintains cash outflow

and as a result, still, managerial team must provide increased dividend to the stakeholders to

encourage investors to hold investment in the firm. Reduction in debt in capital structure makes

it essential to build confidence in shareholders and encourage them to hold their shares (Wu and

et.al., 2016).

(iii) Critical analysis of dividend consistency

There are different types of dividend policies such as stable, residual and stable plus

growth. Out of these, under the stable dividend policy, a fixed dividend either in terms of per

share or dividend payout is fixed. Looking to Debanhams dividend results over preceding 5

years, the results reflect that its financial strategy focuses on dividend stability and regularity

rather than growth in dividend distribution to encourage more investors to buy its shares. It is

6

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

because, it pays fixed DPS to the investors at 0.03(3p) at a total cash dividend of £42m. Thus, it

becomes clear that the dividend policy is in line with the payment consistency, in which, a fixed

rate of DPS has paid by the company to the investors to build trust among them (Pfister and

Schwaiger, 2016). This policy has been used because irregularity in distribution lose

shareholders faith in company’s investment potential whereas growth in dividend makes it really

tough for the company to pay high dividend in harder times like in the situation of net loss or

lack of adequate return.

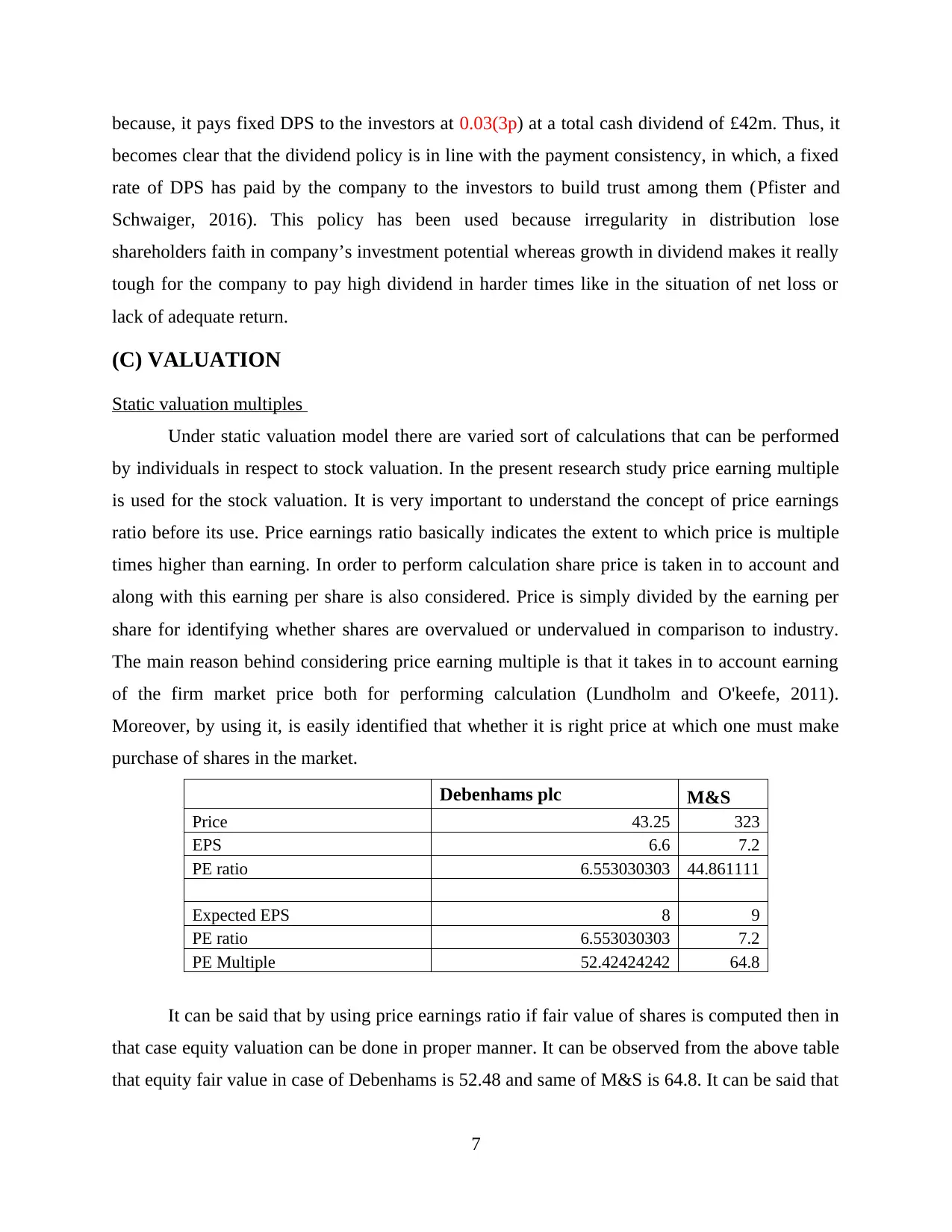

(C) VALUATION

Static valuation multiples

Under static valuation model there are varied sort of calculations that can be performed

by individuals in respect to stock valuation. In the present research study price earning multiple

is used for the stock valuation. It is very important to understand the concept of price earnings

ratio before its use. Price earnings ratio basically indicates the extent to which price is multiple

times higher than earning. In order to perform calculation share price is taken in to account and

along with this earning per share is also considered. Price is simply divided by the earning per

share for identifying whether shares are overvalued or undervalued in comparison to industry.

The main reason behind considering price earning multiple is that it takes in to account earning

of the firm market price both for performing calculation (Lundholm and O'keefe, 2011).

Moreover, by using it, is easily identified that whether it is right price at which one must make

purchase of shares in the market.

Debenhams plc M&S

Price 43.25 323

EPS 6.6 7.2

PE ratio 6.553030303 44.861111

Expected EPS 8 9

PE ratio 6.553030303 7.2

PE Multiple 52.42424242 64.8

It can be said that by using price earnings ratio if fair value of shares is computed then in

that case equity valuation can be done in proper manner. It can be observed from the above table

that equity fair value in case of Debenhams is 52.48 and same of M&S is 64.8. It can be said that

7

becomes clear that the dividend policy is in line with the payment consistency, in which, a fixed

rate of DPS has paid by the company to the investors to build trust among them (Pfister and

Schwaiger, 2016). This policy has been used because irregularity in distribution lose

shareholders faith in company’s investment potential whereas growth in dividend makes it really

tough for the company to pay high dividend in harder times like in the situation of net loss or

lack of adequate return.

(C) VALUATION

Static valuation multiples

Under static valuation model there are varied sort of calculations that can be performed

by individuals in respect to stock valuation. In the present research study price earning multiple

is used for the stock valuation. It is very important to understand the concept of price earnings

ratio before its use. Price earnings ratio basically indicates the extent to which price is multiple

times higher than earning. In order to perform calculation share price is taken in to account and

along with this earning per share is also considered. Price is simply divided by the earning per

share for identifying whether shares are overvalued or undervalued in comparison to industry.

The main reason behind considering price earning multiple is that it takes in to account earning

of the firm market price both for performing calculation (Lundholm and O'keefe, 2011).

Moreover, by using it, is easily identified that whether it is right price at which one must make

purchase of shares in the market.

Debenhams plc M&S

Price 43.25 323

EPS 6.6 7.2

PE ratio 6.553030303 44.861111

Expected EPS 8 9

PE ratio 6.553030303 7.2

PE Multiple 52.42424242 64.8

It can be said that by using price earnings ratio if fair value of shares is computed then in

that case equity valuation can be done in proper manner. It can be observed from the above table

that equity fair value in case of Debenhams is 52.48 and same of M&S is 64.8. It can be said that

7

there is no significant difference between share price of both companies and it can be said that

shares are fairly valued. It can be said that this approach is very useful as task of identifying

value of equity is very easy in case of this method.

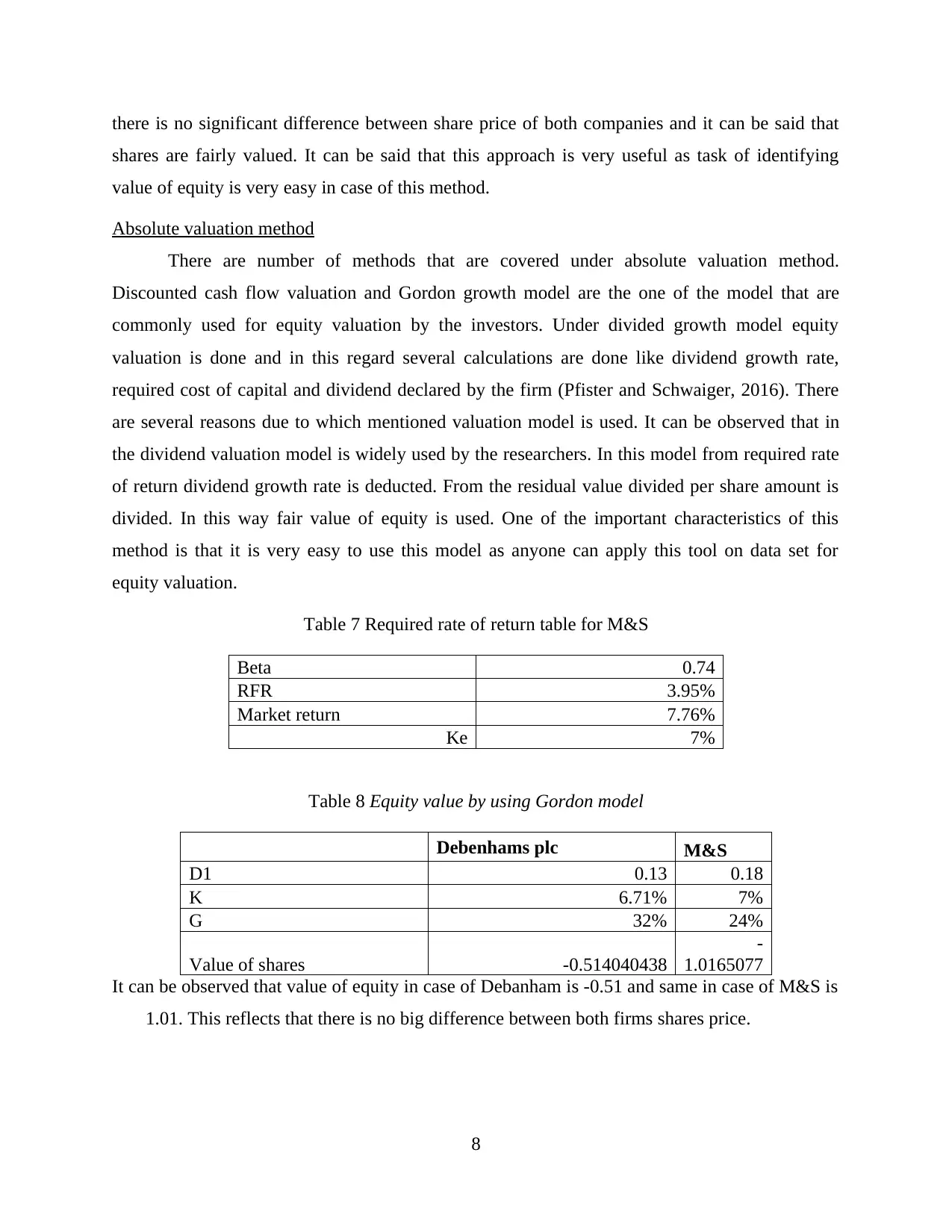

Absolute valuation method

There are number of methods that are covered under absolute valuation method.

Discounted cash flow valuation and Gordon growth model are the one of the model that are

commonly used for equity valuation by the investors. Under divided growth model equity

valuation is done and in this regard several calculations are done like dividend growth rate,

required cost of capital and dividend declared by the firm (Pfister and Schwaiger, 2016). There

are several reasons due to which mentioned valuation model is used. It can be observed that in

the dividend valuation model is widely used by the researchers. In this model from required rate

of return dividend growth rate is deducted. From the residual value divided per share amount is

divided. In this way fair value of equity is used. One of the important characteristics of this

method is that it is very easy to use this model as anyone can apply this tool on data set for

equity valuation.

Table 7 Required rate of return table for M&S

Beta 0.74

RFR 3.95%

Market return 7.76%

Ke 7%

Table 8 Equity value by using Gordon model

Debenhams plc M&S

D1 0.13 0.18

K 6.71% 7%

G 32% 24%

Value of shares -0.514040438

-

1.0165077

It can be observed that value of equity in case of Debanham is -0.51 and same in case of M&S is

1.01. This reflects that there is no big difference between both firms shares price.

8

shares are fairly valued. It can be said that this approach is very useful as task of identifying

value of equity is very easy in case of this method.

Absolute valuation method

There are number of methods that are covered under absolute valuation method.

Discounted cash flow valuation and Gordon growth model are the one of the model that are

commonly used for equity valuation by the investors. Under divided growth model equity

valuation is done and in this regard several calculations are done like dividend growth rate,

required cost of capital and dividend declared by the firm (Pfister and Schwaiger, 2016). There

are several reasons due to which mentioned valuation model is used. It can be observed that in

the dividend valuation model is widely used by the researchers. In this model from required rate

of return dividend growth rate is deducted. From the residual value divided per share amount is

divided. In this way fair value of equity is used. One of the important characteristics of this

method is that it is very easy to use this model as anyone can apply this tool on data set for

equity valuation.

Table 7 Required rate of return table for M&S

Beta 0.74

RFR 3.95%

Market return 7.76%

Ke 7%

Table 8 Equity value by using Gordon model

Debenhams plc M&S

D1 0.13 0.18

K 6.71% 7%

G 32% 24%

Value of shares -0.514040438

-

1.0165077

It can be observed that value of equity in case of Debanham is -0.51 and same in case of M&S is

1.01. This reflects that there is no big difference between both firms shares price.

8

(D) DEBANHAMS POSITION IN THE CORPORATE LIFE CYCLE

(i) Revenue and profit growth

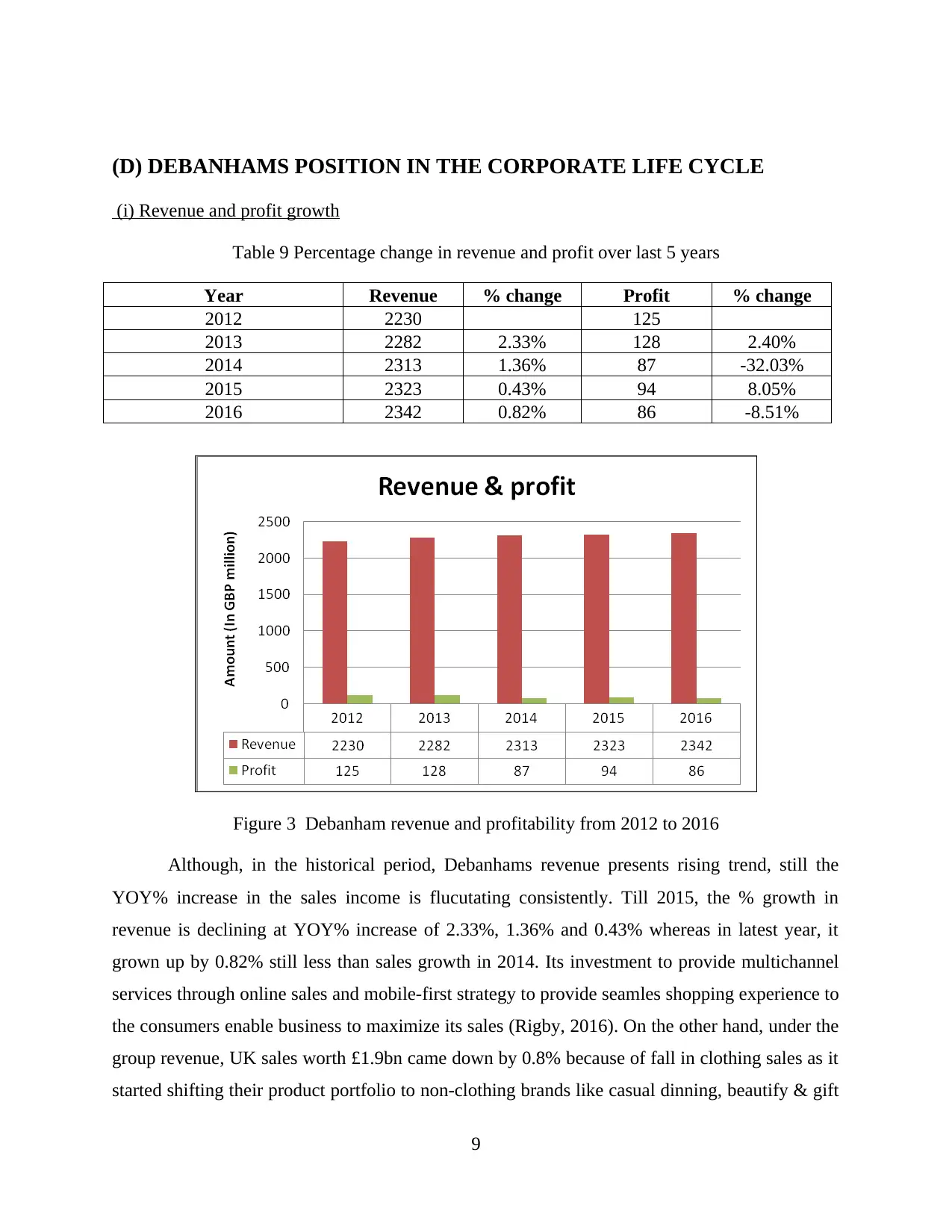

Table 9 Percentage change in revenue and profit over last 5 years

Year Revenue % change Profit % change

2012 2230 125

2013 2282 2.33% 128 2.40%

2014 2313 1.36% 87 -32.03%

2015 2323 0.43% 94 8.05%

2016 2342 0.82% 86 -8.51%

Figure 3 Debanham revenue and profitability from 2012 to 2016

Although, in the historical period, Debanhams revenue presents rising trend, still the

YOY% increase in the sales income is flucutating consistently. Till 2015, the % growth in

revenue is declining at YOY% increase of 2.33%, 1.36% and 0.43% whereas in latest year, it

grown up by 0.82% still less than sales growth in 2014. Its investment to provide multichannel

services through online sales and mobile-first strategy to provide seamles shopping experience to

the consumers enable business to maximize its sales (Rigby, 2016). On the other hand, under the

group revenue, UK sales worth £1.9bn came down by 0.8% because of fall in clothing sales as it

started shifting their product portfolio to non-clothing brands like casual dinning, beautify & gift

9

(i) Revenue and profit growth

Table 9 Percentage change in revenue and profit over last 5 years

Year Revenue % change Profit % change

2012 2230 125

2013 2282 2.33% 128 2.40%

2014 2313 1.36% 87 -32.03%

2015 2323 0.43% 94 8.05%

2016 2342 0.82% 86 -8.51%

Figure 3 Debanham revenue and profitability from 2012 to 2016

Although, in the historical period, Debanhams revenue presents rising trend, still the

YOY% increase in the sales income is flucutating consistently. Till 2015, the % growth in

revenue is declining at YOY% increase of 2.33%, 1.36% and 0.43% whereas in latest year, it

grown up by 0.82% still less than sales growth in 2014. Its investment to provide multichannel

services through online sales and mobile-first strategy to provide seamles shopping experience to

the consumers enable business to maximize its sales (Rigby, 2016). On the other hand, under the

group revenue, UK sales worth £1.9bn came down by 0.8% because of fall in clothing sales as it

started shifting their product portfolio to non-clothing brands like casual dinning, beautify & gift

9

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

items (Mclean, 2016). In contrast, international sales revenue rose up by 0.9% and came to

£409.8 million. However, looking to profitability, it can be seen that in FY 2013 and 2015,

results reported favorable changes @ 2.40% and 8.05% whilst in FY 2013 and 2016, results are

negative at 32.03% and 8.51% decline in bottom line. Exceptional costs worth £12.4m on

business restructuring declined profit before tax by 10.4% and came to £105.8m.

(ii) Financing

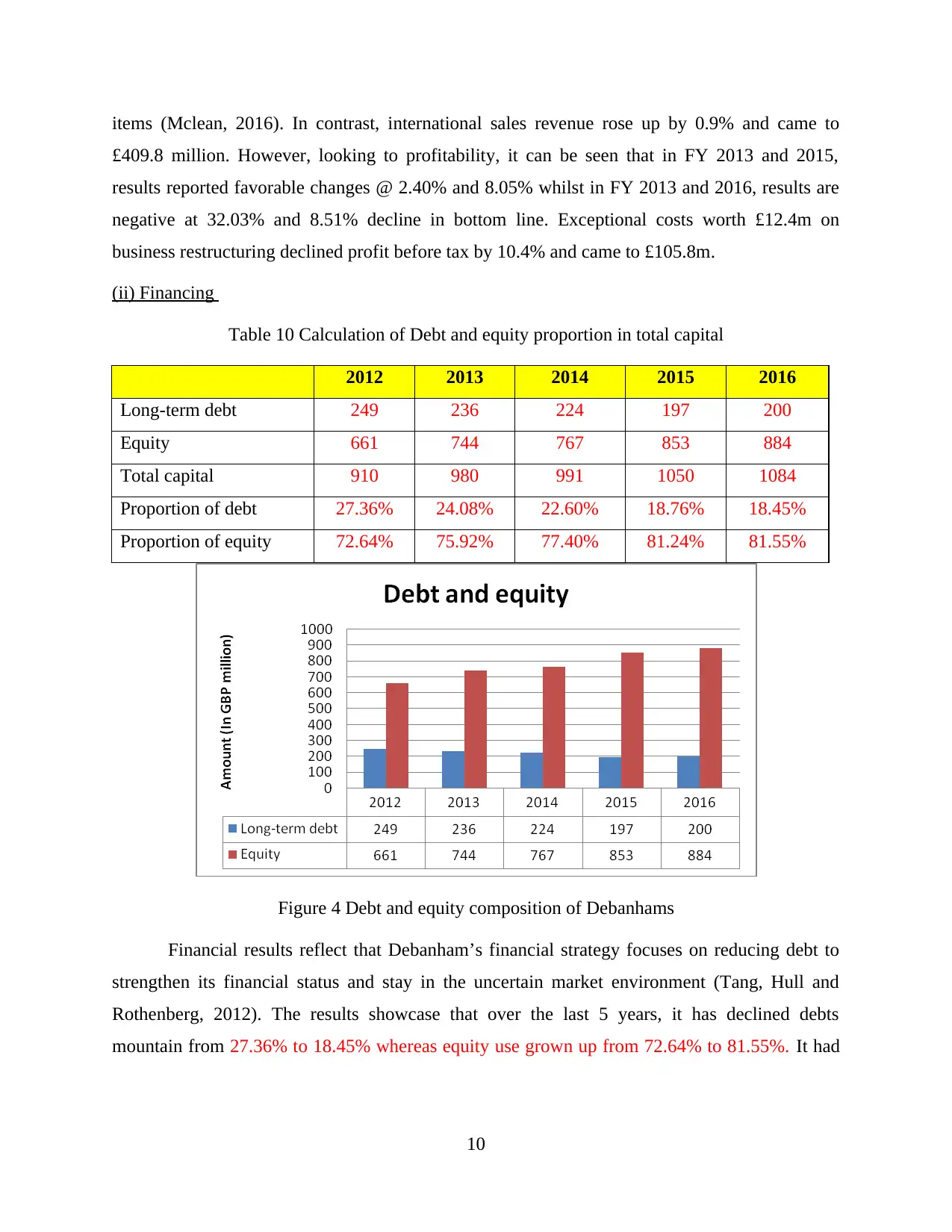

Table 10 Calculation of Debt and equity proportion in total capital

2012 2013 2014 2015 2016

Long-term debt 249 236 224 197 200

Equity 661 744 767 853 884

Total capital 910 980 991 1050 1084

Proportion of debt 27.36% 24.08% 22.60% 18.76% 18.45%

Proportion of equity 72.64% 75.92% 77.40% 81.24% 81.55%

Figure 4 Debt and equity composition of Debanhams

Financial results reflect that Debanham’s financial strategy focuses on reducing debt to

strengthen its financial status and stay in the uncertain market environment (Tang, Hull and

Rothenberg, 2012). The results showcase that over the last 5 years, it has declined debts

mountain from 27.36% to 18.45% whereas equity use grown up from 72.64% to 81.55%. It had

10

£409.8 million. However, looking to profitability, it can be seen that in FY 2013 and 2015,

results reported favorable changes @ 2.40% and 8.05% whilst in FY 2013 and 2016, results are

negative at 32.03% and 8.51% decline in bottom line. Exceptional costs worth £12.4m on

business restructuring declined profit before tax by 10.4% and came to £105.8m.

(ii) Financing

Table 10 Calculation of Debt and equity proportion in total capital

2012 2013 2014 2015 2016

Long-term debt 249 236 224 197 200

Equity 661 744 767 853 884

Total capital 910 980 991 1050 1084

Proportion of debt 27.36% 24.08% 22.60% 18.76% 18.45%

Proportion of equity 72.64% 75.92% 77.40% 81.24% 81.55%

Figure 4 Debt and equity composition of Debanhams

Financial results reflect that Debanham’s financial strategy focuses on reducing debt to

strengthen its financial status and stay in the uncertain market environment (Tang, Hull and

Rothenberg, 2012). The results showcase that over the last 5 years, it has declined debts

mountain from 27.36% to 18.45% whereas equity use grown up from 72.64% to 81.55%. It had

10

collected funds via equity resources to minimize its indebtedness as it had confidence in the

investment potential (Saleem and Rehman, 2011).

(iii) Free cash flow

Table 11 Calculation of FCF in last 5 year

2012 2013 2014 2015 2016

Operating cash flow 202 199 207 218 214

CAPEX -119 -133 -128 -133 -127

Free cash flow 83 66 79 85 87

Revenue 2230 2282 2313 2323 2342

FCF/Revenue 3.72% 2.89% 3.42% 3.66% 3.71%

In FY 2012, FCF was £83m improved to £87m in 2016, however, the percentage of FCF

on revenue has been repoerted to 3.71% which is slightly higher than preceeding year still less

than that of FY 2012 as it was 3.72%. Rising CAPEX on property, plant and investment as well

as intangible assets & declined cash inflow from operating activities due to sales reduction are

the reasons of such occurrence.

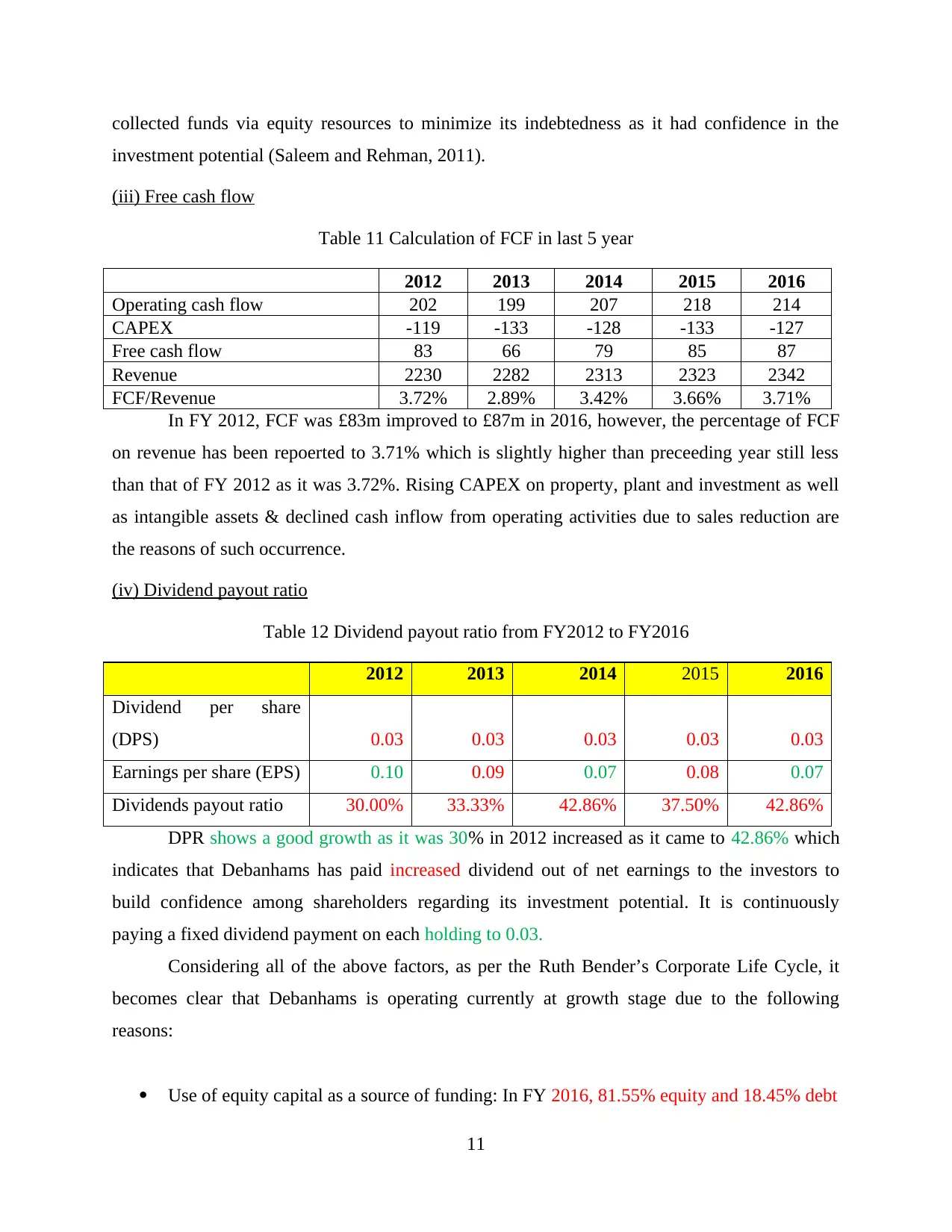

(iv) Dividend payout ratio

Table 12 Dividend payout ratio from FY2012 to FY2016

2012 2013 2014 2015 2016

Dividend per share

(DPS) 0.03 0.03 0.03 0.03 0.03

Earnings per share (EPS) 0.10 0.09 0.07 0.08 0.07

Dividends payout ratio 30.00% 33.33% 42.86% 37.50% 42.86%

DPR shows a good growth as it was 30% in 2012 increased as it came to 42.86% which

indicates that Debanhams has paid increased dividend out of net earnings to the investors to

build confidence among shareholders regarding its investment potential. It is continuously

paying a fixed dividend payment on each holding to 0.03.

Considering all of the above factors, as per the Ruth Bender’s Corporate Life Cycle, it

becomes clear that Debanhams is operating currently at growth stage due to the following

reasons:

Use of equity capital as a source of funding: In FY 2016, 81.55% equity and 18.45% debt

11

investment potential (Saleem and Rehman, 2011).

(iii) Free cash flow

Table 11 Calculation of FCF in last 5 year

2012 2013 2014 2015 2016

Operating cash flow 202 199 207 218 214

CAPEX -119 -133 -128 -133 -127

Free cash flow 83 66 79 85 87

Revenue 2230 2282 2313 2323 2342

FCF/Revenue 3.72% 2.89% 3.42% 3.66% 3.71%

In FY 2012, FCF was £83m improved to £87m in 2016, however, the percentage of FCF

on revenue has been repoerted to 3.71% which is slightly higher than preceeding year still less

than that of FY 2012 as it was 3.72%. Rising CAPEX on property, plant and investment as well

as intangible assets & declined cash inflow from operating activities due to sales reduction are

the reasons of such occurrence.

(iv) Dividend payout ratio

Table 12 Dividend payout ratio from FY2012 to FY2016

2012 2013 2014 2015 2016

Dividend per share

(DPS) 0.03 0.03 0.03 0.03 0.03

Earnings per share (EPS) 0.10 0.09 0.07 0.08 0.07

Dividends payout ratio 30.00% 33.33% 42.86% 37.50% 42.86%

DPR shows a good growth as it was 30% in 2012 increased as it came to 42.86% which

indicates that Debanhams has paid increased dividend out of net earnings to the investors to

build confidence among shareholders regarding its investment potential. It is continuously

paying a fixed dividend payment on each holding to 0.03.

Considering all of the above factors, as per the Ruth Bender’s Corporate Life Cycle, it

becomes clear that Debanhams is operating currently at growth stage due to the following

reasons:

Use of equity capital as a source of funding: In FY 2016, 81.55% equity and 18.45% debt

11

Low level of business profitability: In FY 2016, 3.67% net margin

Nominal dividend payout: Stable dividend policy as over last 4 year DPS is fixed to

0.03(3pence)

Normal growth in FCF as currently it is 3.71% which was previously reported to 3.66%

(E) SHAREHOLDER VALUE PERFORMANCE

Reapport Analysis

Revenue growth

Appendix 1

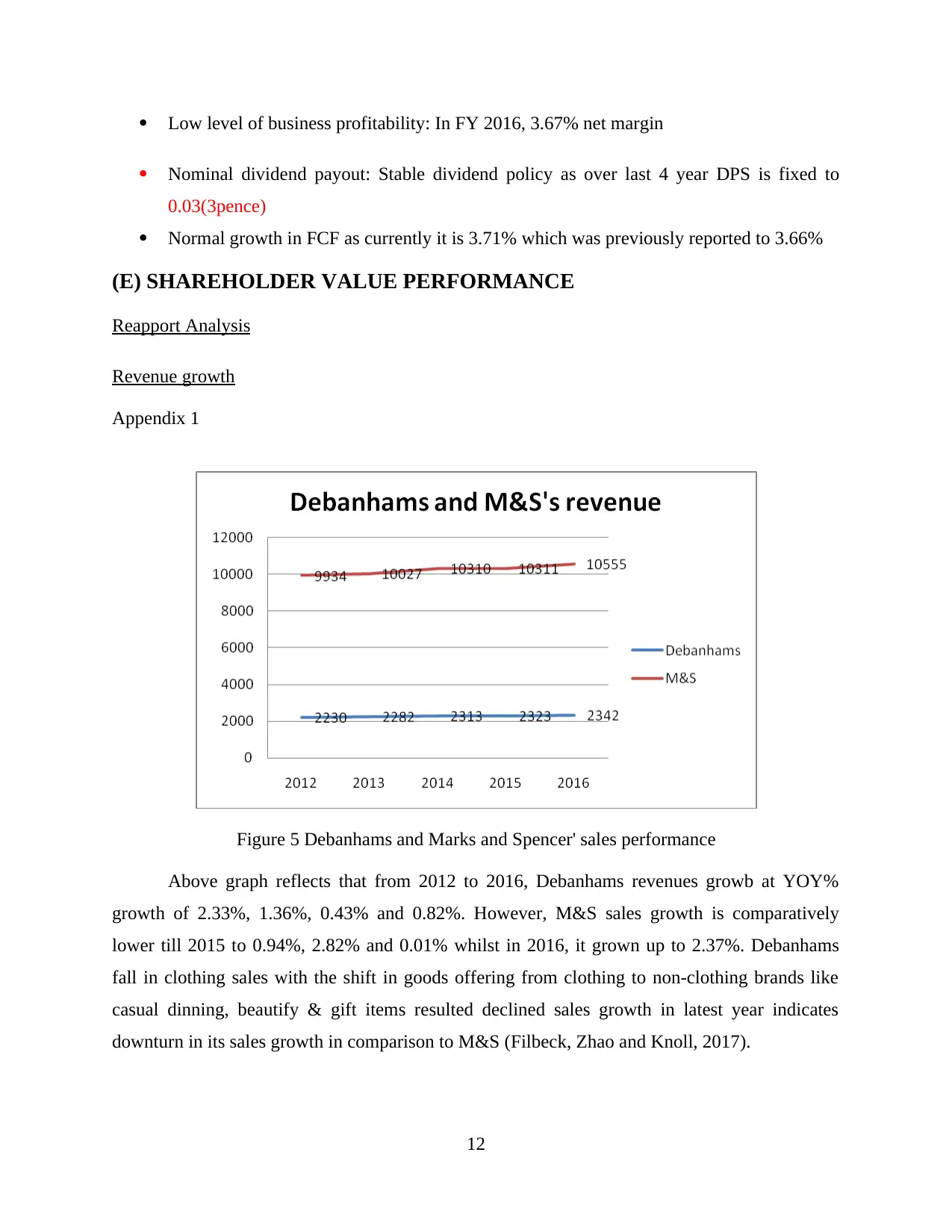

Figure 5 Debanhams and Marks and Spencer' sales performance

Above graph reflects that from 2012 to 2016, Debanhams revenues growb at YOY%

growth of 2.33%, 1.36%, 0.43% and 0.82%. However, M&S sales growth is comparatively

lower till 2015 to 0.94%, 2.82% and 0.01% whilst in 2016, it grown up to 2.37%. Debanhams

fall in clothing sales with the shift in goods offering from clothing to non-clothing brands like

casual dinning, beautify & gift items resulted declined sales growth in latest year indicates

downturn in its sales growth in comparison to M&S (Filbeck, Zhao and Knoll, 2017).

12

Nominal dividend payout: Stable dividend policy as over last 4 year DPS is fixed to

0.03(3pence)

Normal growth in FCF as currently it is 3.71% which was previously reported to 3.66%

(E) SHAREHOLDER VALUE PERFORMANCE

Reapport Analysis

Revenue growth

Appendix 1

Figure 5 Debanhams and Marks and Spencer' sales performance

Above graph reflects that from 2012 to 2016, Debanhams revenues growb at YOY%

growth of 2.33%, 1.36%, 0.43% and 0.82%. However, M&S sales growth is comparatively

lower till 2015 to 0.94%, 2.82% and 0.01% whilst in 2016, it grown up to 2.37%. Debanhams

fall in clothing sales with the shift in goods offering from clothing to non-clothing brands like

casual dinning, beautify & gift items resulted declined sales growth in latest year indicates

downturn in its sales growth in comparison to M&S (Filbeck, Zhao and Knoll, 2017).

12

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

EBITDA margin

Appendix 2

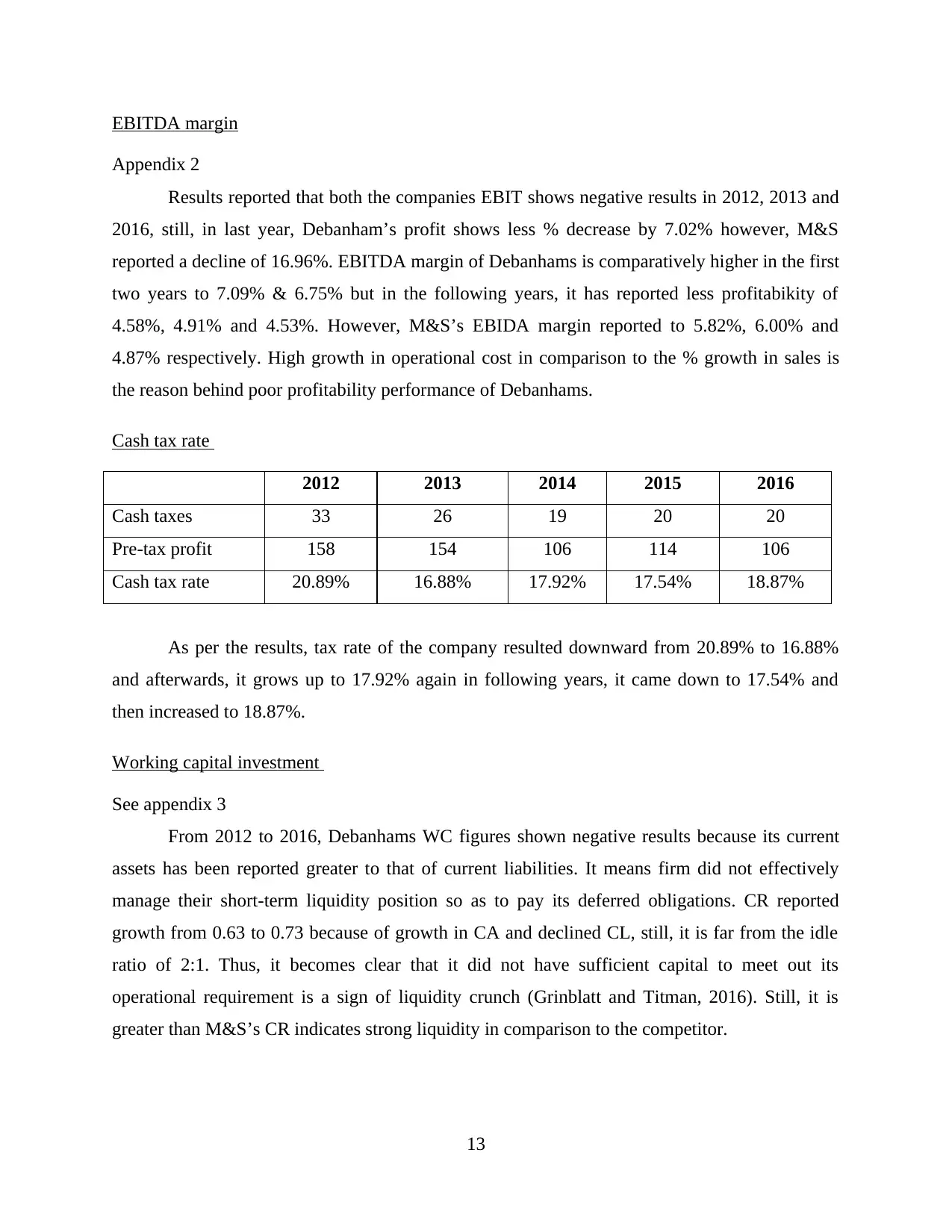

Results reported that both the companies EBIT shows negative results in 2012, 2013 and

2016, still, in last year, Debanham’s profit shows less % decrease by 7.02% however, M&S

reported a decline of 16.96%. EBITDA margin of Debanhams is comparatively higher in the first

two years to 7.09% & 6.75% but in the following years, it has reported less profitabikity of

4.58%, 4.91% and 4.53%. However, M&S’s EBIDA margin reported to 5.82%, 6.00% and

4.87% respectively. High growth in operational cost in comparison to the % growth in sales is

the reason behind poor profitability performance of Debanhams.

Cash tax rate

2012 2013 2014 2015 2016

Cash taxes 33 26 19 20 20

Pre-tax profit 158 154 106 114 106

Cash tax rate 20.89% 16.88% 17.92% 17.54% 18.87%

As per the results, tax rate of the company resulted downward from 20.89% to 16.88%

and afterwards, it grows up to 17.92% again in following years, it came down to 17.54% and

then increased to 18.87%.

Working capital investment

See appendix 3

From 2012 to 2016, Debanhams WC figures shown negative results because its current

assets has been reported greater to that of current liabilities. It means firm did not effectively

manage their short-term liquidity position so as to pay its deferred obligations. CR reported

growth from 0.63 to 0.73 because of growth in CA and declined CL, still, it is far from the idle

ratio of 2:1. Thus, it becomes clear that it did not have sufficient capital to meet out its

operational requirement is a sign of liquidity crunch (Grinblatt and Titman, 2016). Still, it is

greater than M&S’s CR indicates strong liquidity in comparison to the competitor.

13

Appendix 2

Results reported that both the companies EBIT shows negative results in 2012, 2013 and

2016, still, in last year, Debanham’s profit shows less % decrease by 7.02% however, M&S

reported a decline of 16.96%. EBITDA margin of Debanhams is comparatively higher in the first

two years to 7.09% & 6.75% but in the following years, it has reported less profitabikity of

4.58%, 4.91% and 4.53%. However, M&S’s EBIDA margin reported to 5.82%, 6.00% and

4.87% respectively. High growth in operational cost in comparison to the % growth in sales is

the reason behind poor profitability performance of Debanhams.

Cash tax rate

2012 2013 2014 2015 2016

Cash taxes 33 26 19 20 20

Pre-tax profit 158 154 106 114 106

Cash tax rate 20.89% 16.88% 17.92% 17.54% 18.87%

As per the results, tax rate of the company resulted downward from 20.89% to 16.88%

and afterwards, it grows up to 17.92% again in following years, it came down to 17.54% and

then increased to 18.87%.

Working capital investment

See appendix 3

From 2012 to 2016, Debanhams WC figures shown negative results because its current

assets has been reported greater to that of current liabilities. It means firm did not effectively

manage their short-term liquidity position so as to pay its deferred obligations. CR reported

growth from 0.63 to 0.73 because of growth in CA and declined CL, still, it is far from the idle

ratio of 2:1. Thus, it becomes clear that it did not have sufficient capital to meet out its

operational requirement is a sign of liquidity crunch (Grinblatt and Titman, 2016). Still, it is

greater than M&S’s CR indicates strong liquidity in comparison to the competitor.

13

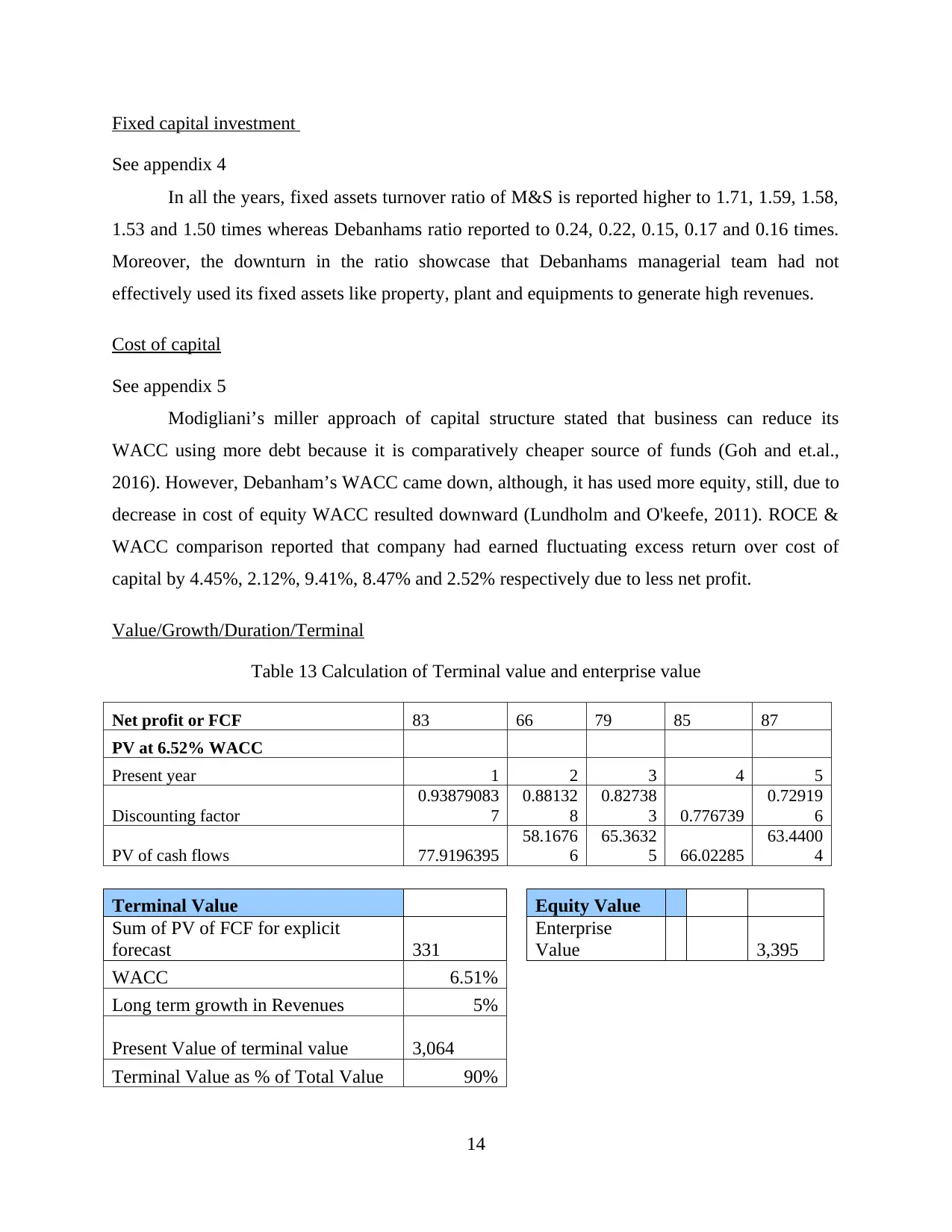

Fixed capital investment

See appendix 4

In all the years, fixed assets turnover ratio of M&S is reported higher to 1.71, 1.59, 1.58,

1.53 and 1.50 times whereas Debanhams ratio reported to 0.24, 0.22, 0.15, 0.17 and 0.16 times.

Moreover, the downturn in the ratio showcase that Debanhams managerial team had not

effectively used its fixed assets like property, plant and equipments to generate high revenues.

Cost of capital

See appendix 5

Modigliani’s miller approach of capital structure stated that business can reduce its

WACC using more debt because it is comparatively cheaper source of funds (Goh and et.al.,

2016). However, Debanham’s WACC came down, although, it has used more equity, still, due to

decrease in cost of equity WACC resulted downward (Lundholm and O'keefe, 2011). ROCE &

WACC comparison reported that company had earned fluctuating excess return over cost of

capital by 4.45%, 2.12%, 9.41%, 8.47% and 2.52% respectively due to less net profit.

Value/Growth/Duration/Terminal

Table 13 Calculation of Terminal value and enterprise value

Net profit or FCF 83 66 79 85 87

PV at 6.52% WACC

Present year 1 2 3 4 5

Discounting factor

0.93879083

7

0.88132

8

0.82738

3 0.776739

0.72919

6

PV of cash flows 77.9196395

58.1676

6

65.3632

5 66.02285

63.4400

4

Terminal Value Equity Value

Sum of PV of FCF for explicit

forecast 331

Enterprise

Value 3,395

WACC 6.51%

Long term growth in Revenues 5%

Present Value of terminal value 3,064

Terminal Value as % of Total Value 90%

14

See appendix 4

In all the years, fixed assets turnover ratio of M&S is reported higher to 1.71, 1.59, 1.58,

1.53 and 1.50 times whereas Debanhams ratio reported to 0.24, 0.22, 0.15, 0.17 and 0.16 times.

Moreover, the downturn in the ratio showcase that Debanhams managerial team had not

effectively used its fixed assets like property, plant and equipments to generate high revenues.

Cost of capital

See appendix 5

Modigliani’s miller approach of capital structure stated that business can reduce its

WACC using more debt because it is comparatively cheaper source of funds (Goh and et.al.,

2016). However, Debanham’s WACC came down, although, it has used more equity, still, due to

decrease in cost of equity WACC resulted downward (Lundholm and O'keefe, 2011). ROCE &

WACC comparison reported that company had earned fluctuating excess return over cost of

capital by 4.45%, 2.12%, 9.41%, 8.47% and 2.52% respectively due to less net profit.

Value/Growth/Duration/Terminal

Table 13 Calculation of Terminal value and enterprise value

Net profit or FCF 83 66 79 85 87

PV at 6.52% WACC

Present year 1 2 3 4 5

Discounting factor

0.93879083

7

0.88132

8

0.82738

3 0.776739

0.72919

6

PV of cash flows 77.9196395

58.1676

6

65.3632

5 66.02285

63.4400

4

Terminal Value Equity Value

Sum of PV of FCF for explicit

forecast 331

Enterprise

Value 3,395

WACC 6.51%

Long term growth in Revenues 5%

Present Value of terminal value 3,064

Terminal Value as % of Total Value 90%

14

As per the results, Enterprise value is determined at 3,395 at a terminal value of 3064m

which is equal to 90% of the total value.

CONCLUSION

On the basis of above discussion it is concluded that equity valuation techniques are

useful and they help managers in taking investment related decisions in prudent manner. In the

current report, Gordon model and PE multiple are used for valuation of equity. It is concluded

that by using these methods valuation of equity is done in proper manner. Purchase decisions

cannot be made only on the basis of up and down that happened in share price. It is very

important to identify the fair value of shares by using these valuation methods. It can be said that

there is significant importance of valuation methods for investors.

15

which is equal to 90% of the total value.

CONCLUSION

On the basis of above discussion it is concluded that equity valuation techniques are

useful and they help managers in taking investment related decisions in prudent manner. In the

current report, Gordon model and PE multiple are used for valuation of equity. It is concluded

that by using these methods valuation of equity is done in proper manner. Purchase decisions

cannot be made only on the basis of up and down that happened in share price. It is very

important to identify the fair value of shares by using these valuation methods. It can be said that

there is significant importance of valuation methods for investors.

15

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

REFERENCES

Books and Journals

Baños-Caballero, S., García-Teruel, P. J. and Martínez-Solano, P., 2014. Working capital

management, corporate performance, and financial constraints. Journal of Business

Research. 67(3). pp.332-338.

Benito, B., Guillamón, M. D. and Bastida, F., 2016. The Impact of Transparency on the Cost of

Sovereign Debt in Times of Economic Crisis. Financial Accountability & Management.

32(3). pp.309-334.

Filbeck, G., Zhao, X. and Knoll, R., 2017. An analysis of working capital efficiency and

shareholder return. Review of Quantitative Finance and Accounting. 48(1). pp.265-288.

Goh, B. W., and et.al., 2016. The effect of corporate tax avoidance on the cost of equity. The

Accounting Review. 91(6). pp.1647-1670.

Goldmann, K., 2017. Financial Liquidity and Profitability Management in Practice of Polish

Business. In Financial Environment and Business Development. Springer International

Publishing. (pp. 103-112).

Grinblatt, M. and Titman, S., 2016. Financial markets & corporate strategy.

Levi, Y. and Welch, I., 2017. Best Practice for Cost-of-Capital Estimates. Journal of Financial

and Quantitative Analysis. 52(2). pp.427-463.

Lundholm, R. and O'keefe, T., 2011. Reconciling value estimates from the discounted cash flow

model and the residual income model. Contemporary Accounting Research. 18(2).

pp.311-335.

Pfister, B. and Schwaiger, M., 2016. Assessing the Impact of Corporate Reputation on Firms’

Cost of Debt: An Empirical Study of German DAX 30 Companies. In Marketing

Challenges in a Turbulent Business Environment. Springer, Cham. (pp. 45-46).

Qiu, Y., Shaukat, A. and Tharyan, R., 2016. Environmental and social disclosures: Link with

corporate financial performance. The British Accounting Review. 48(1). pp.102-116.

Saleem, Q. and Rehman, R. U., 2011. Impacts of liquidity ratios on profitability.

Interdisciplinary Journal of Research in Business. 1(7). pp.95-98.

Tang, Z., Hull, C. E. and Rothenberg, S., 2012. How corporate social responsibility engagement

strategy moderates the CSR–financial performance relationship. Journal of

Management Studies. 49(7). pp.1274-1303.

16

Books and Journals

Baños-Caballero, S., García-Teruel, P. J. and Martínez-Solano, P., 2014. Working capital

management, corporate performance, and financial constraints. Journal of Business

Research. 67(3). pp.332-338.

Benito, B., Guillamón, M. D. and Bastida, F., 2016. The Impact of Transparency on the Cost of

Sovereign Debt in Times of Economic Crisis. Financial Accountability & Management.

32(3). pp.309-334.

Filbeck, G., Zhao, X. and Knoll, R., 2017. An analysis of working capital efficiency and

shareholder return. Review of Quantitative Finance and Accounting. 48(1). pp.265-288.

Goh, B. W., and et.al., 2016. The effect of corporate tax avoidance on the cost of equity. The

Accounting Review. 91(6). pp.1647-1670.

Goldmann, K., 2017. Financial Liquidity and Profitability Management in Practice of Polish

Business. In Financial Environment and Business Development. Springer International

Publishing. (pp. 103-112).

Grinblatt, M. and Titman, S., 2016. Financial markets & corporate strategy.

Levi, Y. and Welch, I., 2017. Best Practice for Cost-of-Capital Estimates. Journal of Financial

and Quantitative Analysis. 52(2). pp.427-463.

Lundholm, R. and O'keefe, T., 2011. Reconciling value estimates from the discounted cash flow

model and the residual income model. Contemporary Accounting Research. 18(2).

pp.311-335.

Pfister, B. and Schwaiger, M., 2016. Assessing the Impact of Corporate Reputation on Firms’

Cost of Debt: An Empirical Study of German DAX 30 Companies. In Marketing

Challenges in a Turbulent Business Environment. Springer, Cham. (pp. 45-46).

Qiu, Y., Shaukat, A. and Tharyan, R., 2016. Environmental and social disclosures: Link with

corporate financial performance. The British Accounting Review. 48(1). pp.102-116.

Saleem, Q. and Rehman, R. U., 2011. Impacts of liquidity ratios on profitability.

Interdisciplinary Journal of Research in Business. 1(7). pp.95-98.

Tang, Z., Hull, C. E. and Rothenberg, S., 2012. How corporate social responsibility engagement

strategy moderates the CSR–financial performance relationship. Journal of

Management Studies. 49(7). pp.1274-1303.

16

Wu, J., and et.al., 2016. Inventory models for deteriorating items with maximum lifetime under

downstream partial trade credits to credit-risk customers by discounted cash-flow

analysis. International Journal of Production Economics. 171. pp.105-115.

Online

Mclean, P., 2016. Debanhams profit hit by falling clothes sales. [Online]. Available through:

https://www.ft.com/content/edc784b2-9c16-11e6-8324-be63473ce146?mhq5j=e1.

[Accessed on 11th July 2017].

Rigby, C., 2016. Debanhams grows online sales by investment in seamless shopping experience.

[Online]. Available through: http://internetretailing.net/2016/10/debenhams-grows-

online-sales-following-investment-seamless-shopping-experience/. [Accessed on 11th

July 2017].

UK Interest rates cut to 0.25%. 2016. [Online]. Available through: <

http://www.bbc.com/news/business-36976528>. [Accessed on 11th July 2017].

17

downstream partial trade credits to credit-risk customers by discounted cash-flow

analysis. International Journal of Production Economics. 171. pp.105-115.

Online

Mclean, P., 2016. Debanhams profit hit by falling clothes sales. [Online]. Available through:

https://www.ft.com/content/edc784b2-9c16-11e6-8324-be63473ce146?mhq5j=e1.

[Accessed on 11th July 2017].

Rigby, C., 2016. Debanhams grows online sales by investment in seamless shopping experience.

[Online]. Available through: http://internetretailing.net/2016/10/debenhams-grows-

online-sales-following-investment-seamless-shopping-experience/. [Accessed on 11th

July 2017].

UK Interest rates cut to 0.25%. 2016. [Online]. Available through: <

http://www.bbc.com/news/business-36976528>. [Accessed on 11th July 2017].

17

APPENDIX

Appendix 1

Table 14 Revenue growth of Debanhams and Marks and Spencer

Debanhams

Marks and

Spencer

Year Revenue % change Revenue % change

2012 2230 9934

2013 2282 2.33% 10027 0.94%

2014 2313 1.36% 10310 2.82%

2015 2323 0.43% 10311 0.01%

2016 2342 0.82% 10555 2.37%

Appendix 2

Table 15 EBITDA growth and EBITDA margin of Debanhams and M&S

Debanhams Marks and Spencer

Year

EBITD

A

%

change

EBITDA

margin

EBITD

A % change

EBITDA

margin

2012 158 7.09% 670 6.74%

2013 154 -2.53% 6.75% 664 -0.90% 6.62%

2014 106 -31.17% 4.58% 600 -9.64% 5.82%

2015 114 7.55% 4.91% 619 3.17% 6.00%

2016 106 -7.02% 4.53% 514 -16.96% 4.87%

Appendix 3

Table 16 Working capital of Debanhams Plc from 2012 to 2016

Working capital 2012 2013 2014 2015 2016

Current assets 460 471 486 460 503

Current liabilities 727 742 758 696 688

Working capital -267 -271 -272 -236 -185

Current ratio 0.63 0.63 0.64 0.66 0.73

18

Appendix 1

Table 14 Revenue growth of Debanhams and Marks and Spencer

Debanhams

Marks and

Spencer

Year Revenue % change Revenue % change

2012 2230 9934

2013 2282 2.33% 10027 0.94%

2014 2313 1.36% 10310 2.82%

2015 2323 0.43% 10311 0.01%

2016 2342 0.82% 10555 2.37%

Appendix 2

Table 15 EBITDA growth and EBITDA margin of Debanhams and M&S

Debanhams Marks and Spencer

Year

EBITD

A

%

change

EBITDA

margin

EBITD

A % change

EBITDA

margin

2012 158 7.09% 670 6.74%

2013 154 -2.53% 6.75% 664 -0.90% 6.62%

2014 106 -31.17% 4.58% 600 -9.64% 5.82%

2015 114 7.55% 4.91% 619 3.17% 6.00%

2016 106 -7.02% 4.53% 514 -16.96% 4.87%

Appendix 3

Table 16 Working capital of Debanhams Plc from 2012 to 2016

Working capital 2012 2013 2014 2015 2016

Current assets 460 471 486 460 503

Current liabilities 727 742 758 696 688

Working capital -267 -271 -272 -236 -185

Current ratio 0.63 0.63 0.64 0.66 0.73

18

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

M&S

Current assets 1460 1268 1369 1455 1461

Current liabilities 2005 2238 2349 2112 2105

Working capital -545 -970 -980 -657 -644

Current ratio 0.73 0.57 0.58 0.69 0.69

Appendix 4

Table 17 Fixed assets turnover ratio of Debanhams and M&S

Debanhams 2012 2013 2014 2015 2016

Fixed assets 662 692 689 675 670

Revenue 158 154 106 114 106

Fixed assets turnover ratio 0.24 0.22 0.15 0.17 0.16

Marks and spencer

Fixed assets 5813 6300 6535 6741 7015

Revenue 9934 10027 10310 10311 10555

Fixed assets turnover ratio 1.71 1.59 1.58 1.53 1.50

Appendix 5

Table 18 WACC and ROCE analysis

2012 2013 2014 2015 2016

WACC 7.41% 9.33% 3.48% 2.74% 6.52%

ROCE 11.86% 11.45% 12.89% 11.21% 9.04%

WACC VS ROCE 4.45% 2.12% 9.41% 8.47% 2.52%

19

Current assets 1460 1268 1369 1455 1461

Current liabilities 2005 2238 2349 2112 2105

Working capital -545 -970 -980 -657 -644

Current ratio 0.73 0.57 0.58 0.69 0.69

Appendix 4

Table 17 Fixed assets turnover ratio of Debanhams and M&S

Debanhams 2012 2013 2014 2015 2016

Fixed assets 662 692 689 675 670

Revenue 158 154 106 114 106

Fixed assets turnover ratio 0.24 0.22 0.15 0.17 0.16

Marks and spencer

Fixed assets 5813 6300 6535 6741 7015

Revenue 9934 10027 10310 10311 10555

Fixed assets turnover ratio 1.71 1.59 1.58 1.53 1.50

Appendix 5

Table 18 WACC and ROCE analysis

2012 2013 2014 2015 2016

WACC 7.41% 9.33% 3.48% 2.74% 6.52%

ROCE 11.86% 11.45% 12.89% 11.21% 9.04%

WACC VS ROCE 4.45% 2.12% 9.41% 8.47% 2.52%

19

20

1 out of 24

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.