FINM202 Financial Management: Portfolio Risk, Return & Governance

VerifiedAdded on 2023/06/12

|8

|1701

|258

Report

AI Summary

This report provides an analysis of risk and return for portfolios and delves into corporate governance principles. The report begins with a financial analysis of Company A and Company B, examining operating leverage, return on equity, return on assets, and financial leverage. It highlights the importance of financial managers in maintaining ethical corporate governance, using Westpac as an example. The report also addresses the principal-agent problem and discusses how corporate governance can mitigate conflicts of interest between shareholders and management. Effective corporate governance measures, such as the structure of the board of directors, are explored as means to maximize shareholder wealth and enhance a company's reputation. The crucial role of financial managers in ensuring financial reporting integrity and ethical conduct is emphasized.

qwertyuiopasdfghjklzxcvbnmqw

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmrtyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqw

Financial management

ertyuiopasdfghjklzxcvbnmqwert

yuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmqwertyuiopasdfghjklzxcv

bnmqwertyuiopasdfghjklzxcvbn

mqwertyuiopasdfghjklzxcvbnmq

wertyuiopasdfghjklzxcvbnmqwer

tyuiopasdfghjklzxcvbnmqwertyui

opasdfghjklzxcvbnmqwertyuiopa

sdfghjklzxcvbnmqwertyuiopasdf

ghjklzxcvbnmqwertyuiopasdfghj

klzxcvbnmqwertyuiopasdfghjklz

xcvbnmrtyuiopasdfghjklzxcvbnm

qwertyuiopasdfghjklzxcvbnmqw

Financial management

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate governance

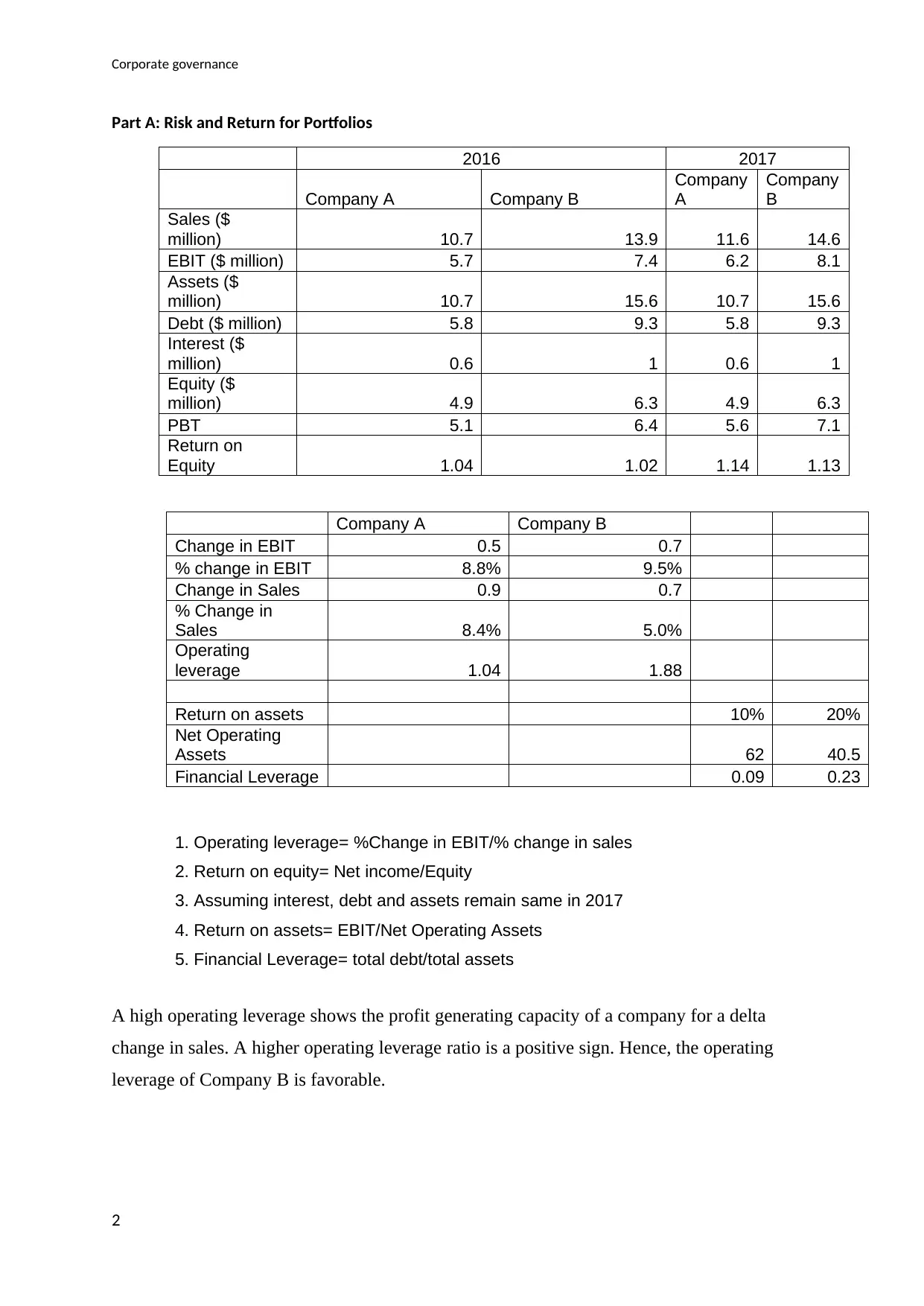

Part A: Risk and Return for Portfolios

2016 2017

Company A Company B

Company

A

Company

B

Sales ($

million) 10.7 13.9 11.6 14.6

EBIT ($ million) 5.7 7.4 6.2 8.1

Assets ($

million) 10.7 15.6 10.7 15.6

Debt ($ million) 5.8 9.3 5.8 9.3

Interest ($

million) 0.6 1 0.6 1

Equity ($

million) 4.9 6.3 4.9 6.3

PBT 5.1 6.4 5.6 7.1

Return on

Equity 1.04 1.02 1.14 1.13

Company A Company B

Change in EBIT 0.5 0.7

% change in EBIT 8.8% 9.5%

Change in Sales 0.9 0.7

% Change in

Sales 8.4% 5.0%

Operating

leverage 1.04 1.88

Return on assets 10% 20%

Net Operating

Assets 62 40.5

Financial Leverage 0.09 0.23

1. Operating leverage= %Change in EBIT/% change in sales

2. Return on equity= Net income/Equity

3. Assuming interest, debt and assets remain same in 2017

4. Return on assets= EBIT/Net Operating Assets

5. Financial Leverage= total debt/total assets

A high operating leverage shows the profit generating capacity of a company for a delta

change in sales. A higher operating leverage ratio is a positive sign. Hence, the operating

leverage of Company B is favorable.

2

Part A: Risk and Return for Portfolios

2016 2017

Company A Company B

Company

A

Company

B

Sales ($

million) 10.7 13.9 11.6 14.6

EBIT ($ million) 5.7 7.4 6.2 8.1

Assets ($

million) 10.7 15.6 10.7 15.6

Debt ($ million) 5.8 9.3 5.8 9.3

Interest ($

million) 0.6 1 0.6 1

Equity ($

million) 4.9 6.3 4.9 6.3

PBT 5.1 6.4 5.6 7.1

Return on

Equity 1.04 1.02 1.14 1.13

Company A Company B

Change in EBIT 0.5 0.7

% change in EBIT 8.8% 9.5%

Change in Sales 0.9 0.7

% Change in

Sales 8.4% 5.0%

Operating

leverage 1.04 1.88

Return on assets 10% 20%

Net Operating

Assets 62 40.5

Financial Leverage 0.09 0.23

1. Operating leverage= %Change in EBIT/% change in sales

2. Return on equity= Net income/Equity

3. Assuming interest, debt and assets remain same in 2017

4. Return on assets= EBIT/Net Operating Assets

5. Financial Leverage= total debt/total assets

A high operating leverage shows the profit generating capacity of a company for a delta

change in sales. A higher operating leverage ratio is a positive sign. Hence, the operating

leverage of Company B is favorable.

2

Corporate governance

However, a higher financial leverage ratio indicates an increased interest bearing of the

company which negatively affects the earnings per share of the company. Company A enjoys

a favorable financial leverage.

3

However, a higher financial leverage ratio indicates an increased interest bearing of the

company which negatively affects the earnings per share of the company. Company A enjoys

a favorable financial leverage.

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate governance

Part – B

Corporate governance is regarded as a set of procedures, rules, and laws that impact a

company’s operations and the decisions made by its managers. It involves balancing the

interests of various stakeholders like customers, shareholders, etc. Moreover, it is also a

relevant function of a public company. In Australia, the importance of corporate governance

is guided under ASX Corporate Governance Principles and Recommendations. When it

comes to financial managers, they have a far greater and better responsibility for maintaining

moral corporate governance measures in companies.

A financial manager undertakes a wide variety of functions associated with sustainability and

health of a company. He is responsible for the creation of financial reports, establishment of

strategies, direct investment activities, and policies for long-term financial objectives of a

company. Moreover, in relation to corporate governance, this is a pivotal role in the financial

success of a company. Financial managers are under an obligation to make sure that they

evaluate the financial segments of a company because it allows them fulfilling the

requirements of effective corporate governance (Deegan, 2011). In addition, such evaluation

comprises of understanding financial details in a way that proper information about the

operating results of a company can be easily facilitated (Harrison & Colle, 2010). This can in

turn allow adherence to the corporate governance principles of the company. For example,

considering the financial sector company Westpac of Australia, it can be seen that the

evaluation of financial information from the financial statements can assist the company in

safeguarding integrity for financial reporting throughout its operations. Nevertheless, it can

be said that the finance manager of Westpac is primarily responsible to assist the CEO of the

company in management of financial resources and in reviewing, drafting, and updating the

primary governance procedures and policies. Moreover, in relation to Westpac, it can be seen

that the financial manager should hit the ground running with accessible and ready expertise

4

Part – B

Corporate governance is regarded as a set of procedures, rules, and laws that impact a

company’s operations and the decisions made by its managers. It involves balancing the

interests of various stakeholders like customers, shareholders, etc. Moreover, it is also a

relevant function of a public company. In Australia, the importance of corporate governance

is guided under ASX Corporate Governance Principles and Recommendations. When it

comes to financial managers, they have a far greater and better responsibility for maintaining

moral corporate governance measures in companies.

A financial manager undertakes a wide variety of functions associated with sustainability and

health of a company. He is responsible for the creation of financial reports, establishment of

strategies, direct investment activities, and policies for long-term financial objectives of a

company. Moreover, in relation to corporate governance, this is a pivotal role in the financial

success of a company. Financial managers are under an obligation to make sure that they

evaluate the financial segments of a company because it allows them fulfilling the

requirements of effective corporate governance (Deegan, 2011). In addition, such evaluation

comprises of understanding financial details in a way that proper information about the

operating results of a company can be easily facilitated (Harrison & Colle, 2010). This can in

turn allow adherence to the corporate governance principles of the company. For example,

considering the financial sector company Westpac of Australia, it can be seen that the

evaluation of financial information from the financial statements can assist the company in

safeguarding integrity for financial reporting throughout its operations. Nevertheless, it can

be said that the finance manager of Westpac is primarily responsible to assist the CEO of the

company in management of financial resources and in reviewing, drafting, and updating the

primary governance procedures and policies. Moreover, in relation to Westpac, it can be seen

that the financial manager should hit the ground running with accessible and ready expertise

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate governance

to be used efficiently as the company’s Chief Financial Officer (CFO) or as a part of financial

experts’ team within the ranks of office of CFO. This is the reason why financial managers in

navigating the global marketplace efficiently, find themselves in a technology-oriented and

deluge of real time information that assists them in catering the knowledge demands of

investment bankers, investors, employees, traders, brokers, etc who are liable to know certain

companies, their goods and services, and the market wherein they function (Mudashiru et. al,

2014).

Financial managers are also responsible for maintaining ethical or moral standards in relation

to evaluation of financial aspects of a company. This is the reason why the CFO of Westpac

Ltd follow a strict guideline for complying with effective reporting requirements. Moreover,

as a financial professional, the managers are liable to themselves, their clients, and to the

public as well. This facilitates in the fulfilment of corporate governance principle of acting

ethically and responsibly on the part of the company. For example, the general manager

group audit of Westpac pursues a direct reporting line to the board audit committee’s

chairman and an administrative line to the company’s CFO (Westpac Bank, 2017).

It must also be noted that in bigger organizations like Westpac, a conflict of interest may

arise betwixt the shareholders and the management, thereby resulting in an agency problem.

In simple words, risk bearing ownership function and managerial control function are two

different functions undertaken by different parties and sometimes financial managers tend to

involve in activities that enhances their own return instead of others (Westpac Bank, 2017).

This facilitates in the principal-agent problem betwixt shareholders and financial managers

wherein considering the discretion of decision-making, such financial managers may engage

in non-value maximizing behaviour (Kruger, 2015). Therefore, it is the role of financial

managers to avoid such scenario because substantial costs emerge from such divergence of

interests betwixt two parties. This can be facilitated through corporate governance as it can

5

to be used efficiently as the company’s Chief Financial Officer (CFO) or as a part of financial

experts’ team within the ranks of office of CFO. This is the reason why financial managers in

navigating the global marketplace efficiently, find themselves in a technology-oriented and

deluge of real time information that assists them in catering the knowledge demands of

investment bankers, investors, employees, traders, brokers, etc who are liable to know certain

companies, their goods and services, and the market wherein they function (Mudashiru et. al,

2014).

Financial managers are also responsible for maintaining ethical or moral standards in relation

to evaluation of financial aspects of a company. This is the reason why the CFO of Westpac

Ltd follow a strict guideline for complying with effective reporting requirements. Moreover,

as a financial professional, the managers are liable to themselves, their clients, and to the

public as well. This facilitates in the fulfilment of corporate governance principle of acting

ethically and responsibly on the part of the company. For example, the general manager

group audit of Westpac pursues a direct reporting line to the board audit committee’s

chairman and an administrative line to the company’s CFO (Westpac Bank, 2017).

It must also be noted that in bigger organizations like Westpac, a conflict of interest may

arise betwixt the shareholders and the management, thereby resulting in an agency problem.

In simple words, risk bearing ownership function and managerial control function are two

different functions undertaken by different parties and sometimes financial managers tend to

involve in activities that enhances their own return instead of others (Westpac Bank, 2017).

This facilitates in the principal-agent problem betwixt shareholders and financial managers

wherein considering the discretion of decision-making, such financial managers may engage

in non-value maximizing behaviour (Kruger, 2015). Therefore, it is the role of financial

managers to avoid such scenario because substantial costs emerge from such divergence of

interests betwixt two parties. This can be facilitated through corporate governance as it can

5

Corporate governance

assist in reducing such costs. Besides, in public companies like Westpac, the problem of

principal-agent can be effectively accounted for by corporate governance as it facilitates in

acting as a device to safeguard the interests of investors and shareholders through contractual

connections with the company (Mudashiru et. al, 2014). Further, control strategies are

required to minimize divergence of interests betwixt both parties. Besides, corporate

governance can play a key role in becoming the widest control strategy for effective usage of

corporate resources (Kruger, 2015). It acts as a hybrid of both external and internal control

mechanisms with a perspective of attaining effective utilization of resources.

In order to remove the agency problem for maximization of wealth of shareholders, the most

effective and simple means of corporate governance measure can be attributed to the

structure of board of directors of a company. Such board of directors are responsible for

overseeing the strategic direction of the company with the primary goal of safeguarding the

interests of shareholders. Hence, board of directors is liable for setting corporate goals that is

aimed at enhancing long-term value for the shareholders (Goodstein, 2011). For such

purpose, the board is liable to monitor the progress of the company by reviewing the

management’s performance so that punishment or rewards can be offered to the management.

Hence, the success of the board in addressing its fiduciary duties and working with the

management can be expected to maximize the wealth of shareholders, thereby removing the

agency problem prevailing betwixt the management and shareholders (Edward & Moutchnik,

2013). Therefore, corporate governance can be easily adopted by public companies like

Westpac to get rid of agency problems for attaining shareholder wealth maximization.

Corporate governance plays a key role in enhancing the reputation and goodwill of

companies as it emphasizes use of ethical and moral measures for attainment of

organizational objectives. Besides, the agency problem persisting betwixt the management

and shareholders hamper the smooth flow of operations and corporate governance can be

6

assist in reducing such costs. Besides, in public companies like Westpac, the problem of

principal-agent can be effectively accounted for by corporate governance as it facilitates in

acting as a device to safeguard the interests of investors and shareholders through contractual

connections with the company (Mudashiru et. al, 2014). Further, control strategies are

required to minimize divergence of interests betwixt both parties. Besides, corporate

governance can play a key role in becoming the widest control strategy for effective usage of

corporate resources (Kruger, 2015). It acts as a hybrid of both external and internal control

mechanisms with a perspective of attaining effective utilization of resources.

In order to remove the agency problem for maximization of wealth of shareholders, the most

effective and simple means of corporate governance measure can be attributed to the

structure of board of directors of a company. Such board of directors are responsible for

overseeing the strategic direction of the company with the primary goal of safeguarding the

interests of shareholders. Hence, board of directors is liable for setting corporate goals that is

aimed at enhancing long-term value for the shareholders (Goodstein, 2011). For such

purpose, the board is liable to monitor the progress of the company by reviewing the

management’s performance so that punishment or rewards can be offered to the management.

Hence, the success of the board in addressing its fiduciary duties and working with the

management can be expected to maximize the wealth of shareholders, thereby removing the

agency problem prevailing betwixt the management and shareholders (Edward & Moutchnik,

2013). Therefore, corporate governance can be easily adopted by public companies like

Westpac to get rid of agency problems for attaining shareholder wealth maximization.

Corporate governance plays a key role in enhancing the reputation and goodwill of

companies as it emphasizes use of ethical and moral measures for attainment of

organizational objectives. Besides, the agency problem persisting betwixt the management

and shareholders hamper the smooth flow of operations and corporate governance can be

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Corporate governance

easily implemented by companies to maximize shareholders’ wealth (Manoharan, 2011).

Moreover, the role played by financial managers in relation to corporate governance is also

crucial as they assist the Chief Executive Officer of a company in the management of

financial resources, thereby reflecting integrity in financial reporting.

7

easily implemented by companies to maximize shareholders’ wealth (Manoharan, 2011).

Moreover, the role played by financial managers in relation to corporate governance is also

crucial as they assist the Chief Executive Officer of a company in the management of

financial resources, thereby reflecting integrity in financial reporting.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Corporate governance

References

Deegan, C. M. (2011) In Financial accounting theory. North Ryde, N.S.W: McGraw-Hill

Edward F & Moutchnik, A. (2013). Stakeholder management and CSR: questions and

answers. Oxford Press

Goodstein, E. (2011). Ethics and Economics, Economics and the Environment. Wiley

Harrison, W & Colle, D. (2010). Stakeholder Theory, State of the Art. Cambridge University

Press

Kruger, P., 2015, ‘Corporate goodness and shareholder wealth’, Journal of Financial

economics. [online]. 115(2), pp. 304-329. Available from:

https://EconPapers.repec.org/RePEc:eee:jfinec:v:115:y:2015:i:2:p:304-329 [Accessed 7 May

2018]

Manoharan, T.N. (2011). Financial Statement Fraud and Corporate Governance, The

George Washington University.

Mudashiru, A., Bakare, I.A. and Babatunde, Y. (2014) Good Corporate Governance and

Organisational Performance: An Empirical Analysis. International Journal of Humanities

and Social Science. [online]. 4(7), p. 170-178. Available from:

http://www.ijhssnet.com/journals/Vol_4_No_7_1_May_2014/22.pdf [Accessed 7 May 2018]

Westpac Bank. (2017) Westpac Bank Corporate governance Statement 2017 [online].

Available from: https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/

2017_Westpac_Corporate_Governance_Statement.pdf [Accessed 7 May 2018]

8

References

Deegan, C. M. (2011) In Financial accounting theory. North Ryde, N.S.W: McGraw-Hill

Edward F & Moutchnik, A. (2013). Stakeholder management and CSR: questions and

answers. Oxford Press

Goodstein, E. (2011). Ethics and Economics, Economics and the Environment. Wiley

Harrison, W & Colle, D. (2010). Stakeholder Theory, State of the Art. Cambridge University

Press

Kruger, P., 2015, ‘Corporate goodness and shareholder wealth’, Journal of Financial

economics. [online]. 115(2), pp. 304-329. Available from:

https://EconPapers.repec.org/RePEc:eee:jfinec:v:115:y:2015:i:2:p:304-329 [Accessed 7 May

2018]

Manoharan, T.N. (2011). Financial Statement Fraud and Corporate Governance, The

George Washington University.

Mudashiru, A., Bakare, I.A. and Babatunde, Y. (2014) Good Corporate Governance and

Organisational Performance: An Empirical Analysis. International Journal of Humanities

and Social Science. [online]. 4(7), p. 170-178. Available from:

http://www.ijhssnet.com/journals/Vol_4_No_7_1_May_2014/22.pdf [Accessed 7 May 2018]

Westpac Bank. (2017) Westpac Bank Corporate governance Statement 2017 [online].

Available from: https://www.westpac.com.au/content/dam/public/wbc/documents/pdf/aw/ic/

2017_Westpac_Corporate_Governance_Statement.pdf [Accessed 7 May 2018]

8

1 out of 8

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.