Corporate Governance and Financial Regulation - Desklib

VerifiedAdded on 2023/06/11

|12

|3297

|258

AI Summary

This report discusses two relevant corporate governance theories - Agency Theory and Stewardship Theory, stakeholder analysis of Tesco Plc, evaluation of the board structure of the company and institutional investors of the company. The report also provides insights into the interest level, claims, expectations, perceived conflicts and how the company manages the same. The report is relevant for students pursuing courses in corporate governance and financial regulation.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Corporate Governance and

Financial Regulation

Financial Regulation

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION...........................................................................................................................2

MAIN BODY..................................................................................................................................2

Critically reviewing two relevant corporate governance theories...............................................2

Stakeholder Analysis of Tesco Plc..............................................................................................3

Evaluate the board structure of the company..............................................................................6

Institutional investors of the company.........................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES................................................................................................................................1

INTRODUCTION...........................................................................................................................2

MAIN BODY..................................................................................................................................2

Critically reviewing two relevant corporate governance theories...............................................2

Stakeholder Analysis of Tesco Plc..............................................................................................3

Evaluate the board structure of the company..............................................................................6

Institutional investors of the company.........................................................................................8

CONCLUSION................................................................................................................................9

REFERENCES................................................................................................................................1

INTRODUCTION

Corporate governance refers to the process, practices and system of rule and regulation which

deliver assistance in managing, directing and controlling the function of the organization in

effective as well as efficient manner. In the corporate governance the board of the director are

answerable for the governance of the organization. The present report is in context of the Tesco

plc UK based organization. The report will determine the corporate governance theories,

stakeholder, board structure and investors of the organization.

MAIN BODY

Critically reviewing two relevant corporate governance theories

The two most significant and relevant corporate governance theories discussed in the unit are as

follows:

Agency Theory: This is one of the best theory of corporate governance with the help of

which the relationship between agent and principal are easily understandable. Under this theory,

the corporations act as an agent of its shareholders because shareholders invest in corporate

ownership and also entrust their savings to management and director of company. For example,

Tesco Plc executives is agent and its shareholders are principal as per the agency theory and

company executives that work for the purpose of enhancing shareholder’s wealth (Kyere and

Ausloos, 2021).

Advantages of Agency theory:

It provides clear parameter to the corporate officers and board members on the basis of

which they can make strategic decision.

This theory helps in enhancing the wealth of shareholders the impact of which

shareholders are further ready to reinvest its return for future growth of business.

This theory also helps the companies to retain its executives or managers who have the

ability to risk their financial future for the better performance of company.

Disadvantages of Agency theory:

The conflicts between agent and principal arises such as between manager and

shareholder as the shareholders unable to monitor the actions taken by manager for

principal interest (Kyere and Ausloos, 2021).

Also, the self-interest of shareholder is a limitation of this theory.

Corporate governance refers to the process, practices and system of rule and regulation which

deliver assistance in managing, directing and controlling the function of the organization in

effective as well as efficient manner. In the corporate governance the board of the director are

answerable for the governance of the organization. The present report is in context of the Tesco

plc UK based organization. The report will determine the corporate governance theories,

stakeholder, board structure and investors of the organization.

MAIN BODY

Critically reviewing two relevant corporate governance theories

The two most significant and relevant corporate governance theories discussed in the unit are as

follows:

Agency Theory: This is one of the best theory of corporate governance with the help of

which the relationship between agent and principal are easily understandable. Under this theory,

the corporations act as an agent of its shareholders because shareholders invest in corporate

ownership and also entrust their savings to management and director of company. For example,

Tesco Plc executives is agent and its shareholders are principal as per the agency theory and

company executives that work for the purpose of enhancing shareholder’s wealth (Kyere and

Ausloos, 2021).

Advantages of Agency theory:

It provides clear parameter to the corporate officers and board members on the basis of

which they can make strategic decision.

This theory helps in enhancing the wealth of shareholders the impact of which

shareholders are further ready to reinvest its return for future growth of business.

This theory also helps the companies to retain its executives or managers who have the

ability to risk their financial future for the better performance of company.

Disadvantages of Agency theory:

The conflicts between agent and principal arises such as between manager and

shareholder as the shareholders unable to monitor the actions taken by manager for

principal interest (Kyere and Ausloos, 2021).

Also, the self-interest of shareholder is a limitation of this theory.

Stewardship Theory: This is a theory in which stewards are the company executives and

managers that are working for the shareholders. This theory of corporate governance is basically

an alternative to agency theory where steward need to protect and maximize the shareholders'

wealth via maximizing firm performance. It is because shareholders transfer or delegate their

trust (Marashdeh and et.al., 2021).

Advantages of stewardship theory:

This theory is helpful in understanding that the relation between manager and

shareholders are healthy or not.

It is also best for increasing the speed of decision-making and manager’s autonomy.

Further, it helps in minimizing the cost of monitoring and controlling of business

activities (Marashdeh and et.al., 2021).

Disadvantages of stewardship theory:

This theory required broad accountability which further require more time. Thus, time-

consuming is a drawback of this theory (Klettner, 2021).

Further, drawback or limitation of stewardship theory of corporate governance is such

that it requires more investment because of high cash outflow.

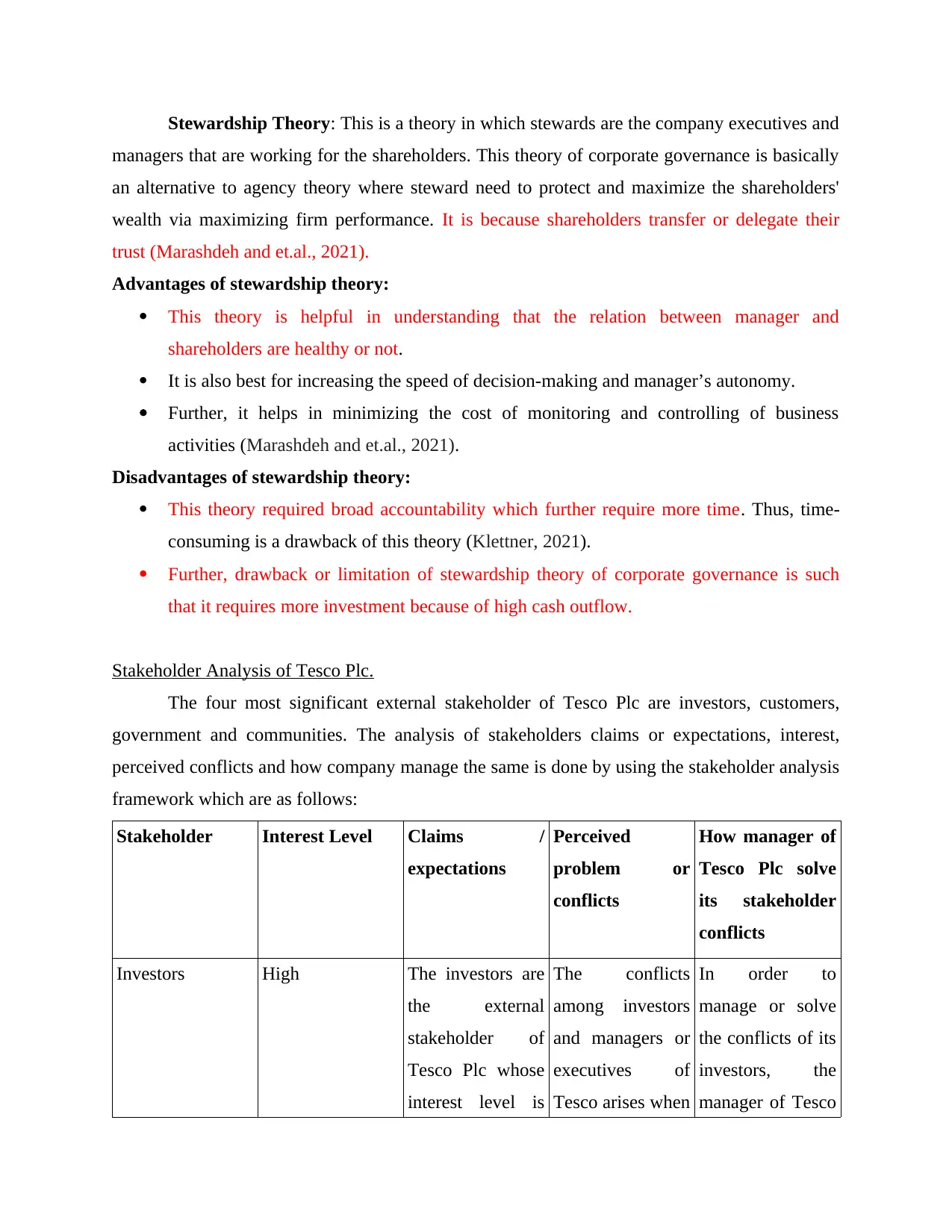

Stakeholder Analysis of Tesco Plc.

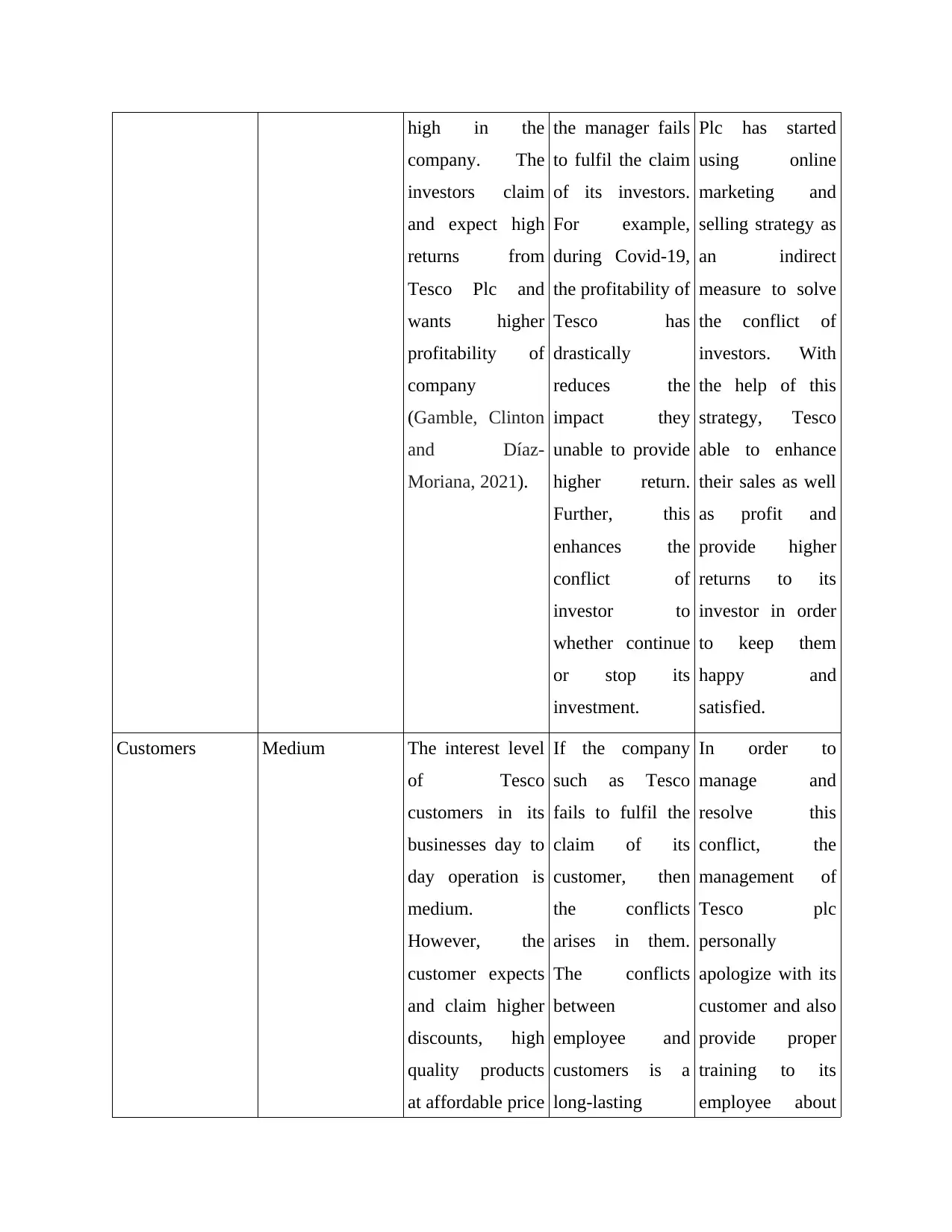

The four most significant external stakeholder of Tesco Plc are investors, customers,

government and communities. The analysis of stakeholders claims or expectations, interest,

perceived conflicts and how company manage the same is done by using the stakeholder analysis

framework which are as follows:

Stakeholder Interest Level Claims /

expectations

Perceived

problem or

conflicts

How manager of

Tesco Plc solve

its stakeholder

conflicts

Investors High The investors are

the external

stakeholder of

Tesco Plc whose

interest level is

The conflicts

among investors

and managers or

executives of

Tesco arises when

In order to

manage or solve

the conflicts of its

investors, the

manager of Tesco

managers that are working for the shareholders. This theory of corporate governance is basically

an alternative to agency theory where steward need to protect and maximize the shareholders'

wealth via maximizing firm performance. It is because shareholders transfer or delegate their

trust (Marashdeh and et.al., 2021).

Advantages of stewardship theory:

This theory is helpful in understanding that the relation between manager and

shareholders are healthy or not.

It is also best for increasing the speed of decision-making and manager’s autonomy.

Further, it helps in minimizing the cost of monitoring and controlling of business

activities (Marashdeh and et.al., 2021).

Disadvantages of stewardship theory:

This theory required broad accountability which further require more time. Thus, time-

consuming is a drawback of this theory (Klettner, 2021).

Further, drawback or limitation of stewardship theory of corporate governance is such

that it requires more investment because of high cash outflow.

Stakeholder Analysis of Tesco Plc.

The four most significant external stakeholder of Tesco Plc are investors, customers,

government and communities. The analysis of stakeholders claims or expectations, interest,

perceived conflicts and how company manage the same is done by using the stakeholder analysis

framework which are as follows:

Stakeholder Interest Level Claims /

expectations

Perceived

problem or

conflicts

How manager of

Tesco Plc solve

its stakeholder

conflicts

Investors High The investors are

the external

stakeholder of

Tesco Plc whose

interest level is

The conflicts

among investors

and managers or

executives of

Tesco arises when

In order to

manage or solve

the conflicts of its

investors, the

manager of Tesco

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

high in the

company. The

investors claim

and expect high

returns from

Tesco Plc and

wants higher

profitability of

company

(Gamble, Clinton

and Díaz-

Moriana, 2021).

the manager fails

to fulfil the claim

of its investors.

For example,

during Covid-19,

the profitability of

Tesco has

drastically

reduces the

impact they

unable to provide

higher return.

Further, this

enhances the

conflict of

investor to

whether continue

or stop its

investment.

Plc has started

using online

marketing and

selling strategy as

an indirect

measure to solve

the conflict of

investors. With

the help of this

strategy, Tesco

able to enhance

their sales as well

as profit and

provide higher

returns to its

investor in order

to keep them

happy and

satisfied.

Customers Medium The interest level

of Tesco

customers in its

businesses day to

day operation is

medium.

However, the

customer expects

and claim higher

discounts, high

quality products

at affordable price

If the company

such as Tesco

fails to fulfil the

claim of its

customer, then

the conflicts

arises in them.

The conflicts

between

employee and

customers is a

long-lasting

In order to

manage and

resolve this

conflict, the

management of

Tesco plc

personally

apologize with its

customer and also

provide proper

training to its

employee about

company. The

investors claim

and expect high

returns from

Tesco Plc and

wants higher

profitability of

company

(Gamble, Clinton

and Díaz-

Moriana, 2021).

the manager fails

to fulfil the claim

of its investors.

For example,

during Covid-19,

the profitability of

Tesco has

drastically

reduces the

impact they

unable to provide

higher return.

Further, this

enhances the

conflict of

investor to

whether continue

or stop its

investment.

Plc has started

using online

marketing and

selling strategy as

an indirect

measure to solve

the conflict of

investors. With

the help of this

strategy, Tesco

able to enhance

their sales as well

as profit and

provide higher

returns to its

investor in order

to keep them

happy and

satisfied.

Customers Medium The interest level

of Tesco

customers in its

businesses day to

day operation is

medium.

However, the

customer expects

and claim higher

discounts, high

quality products

at affordable price

If the company

such as Tesco

fails to fulfil the

claim of its

customer, then

the conflicts

arises in them.

The conflicts

between

employee and

customers is a

long-lasting

In order to

manage and

resolve this

conflict, the

management of

Tesco plc

personally

apologize with its

customer and also

provide proper

training to its

employee about

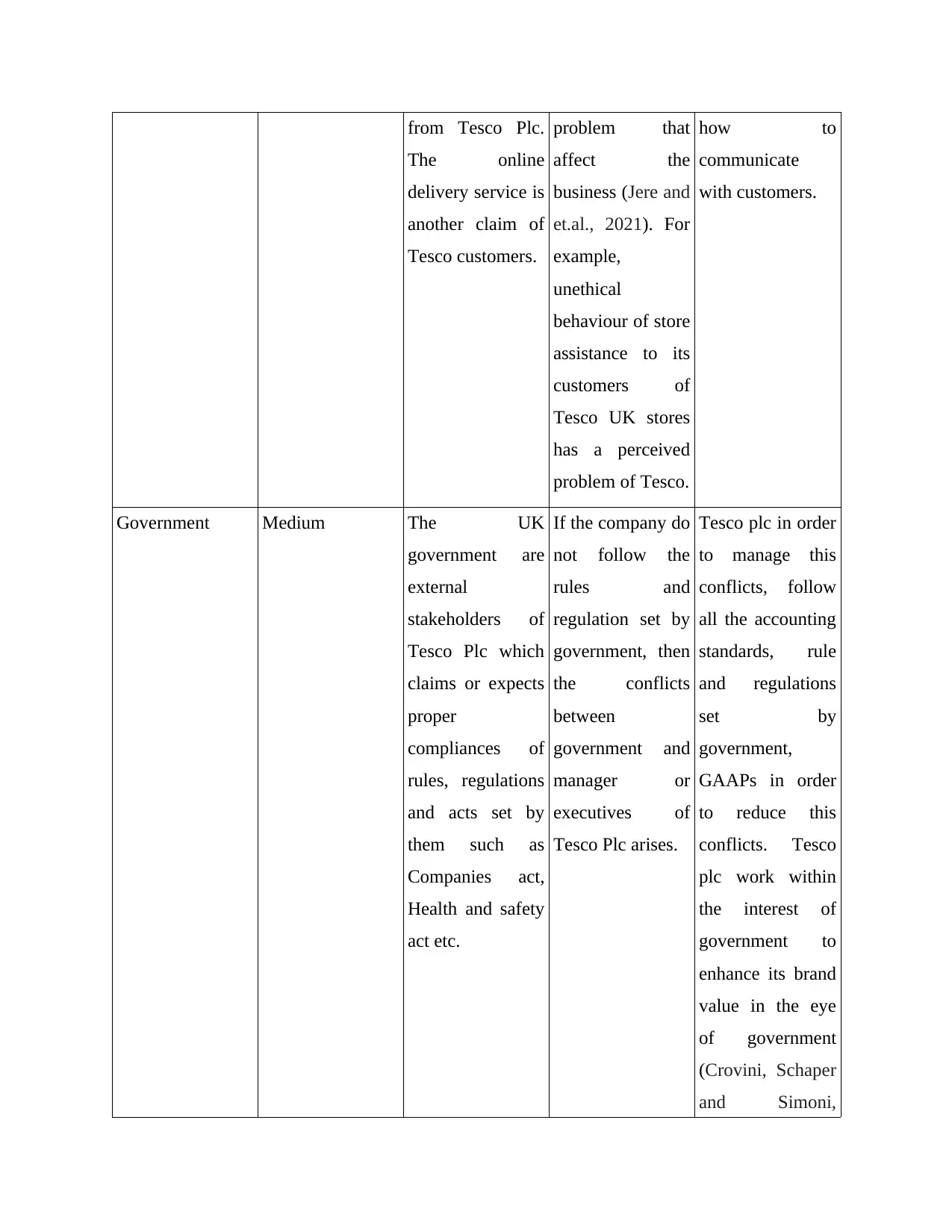

from Tesco Plc.

The online

delivery service is

another claim of

Tesco customers.

problem that

affect the

business (Jere and

et.al., 2021). For

example,

unethical

behaviour of store

assistance to its

customers of

Tesco UK stores

has a perceived

problem of Tesco.

how to

communicate

with customers.

Government Medium The UK

government are

external

stakeholders of

Tesco Plc which

claims or expects

proper

compliances of

rules, regulations

and acts set by

them such as

Companies act,

Health and safety

act etc.

If the company do

not follow the

rules and

regulation set by

government, then

the conflicts

between

government and

manager or

executives of

Tesco Plc arises.

Tesco plc in order

to manage this

conflicts, follow

all the accounting

standards, rule

and regulations

set by

government,

GAAPs in order

to reduce this

conflicts. Tesco

plc work within

the interest of

government to

enhance its brand

value in the eye

of government

(Crovini, Schaper

and Simoni,

The online

delivery service is

another claim of

Tesco customers.

problem that

affect the

business (Jere and

et.al., 2021). For

example,

unethical

behaviour of store

assistance to its

customers of

Tesco UK stores

has a perceived

problem of Tesco.

how to

communicate

with customers.

Government Medium The UK

government are

external

stakeholders of

Tesco Plc which

claims or expects

proper

compliances of

rules, regulations

and acts set by

them such as

Companies act,

Health and safety

act etc.

If the company do

not follow the

rules and

regulation set by

government, then

the conflicts

between

government and

manager or

executives of

Tesco Plc arises.

Tesco plc in order

to manage this

conflicts, follow

all the accounting

standards, rule

and regulations

set by

government,

GAAPs in order

to reduce this

conflicts. Tesco

plc work within

the interest of

government to

enhance its brand

value in the eye

of government

(Crovini, Schaper

and Simoni,

2021).

Local

Communities

High The expectation

and claim of local

communities

from Tesco is that

they carry out the

business in

sustainable

manner without

harming

environment. It is

because the local

community have

high interest in

day to day

operation of

business

(Chkanikova and

Sroufe, 2021).

The concern or

problem of local

community with

the Tesco

manager or

executive is that

whether the kill

animals or not in

order to produce

bags and cloths.

The conflict

between manager

of Tesco and

local community

arises when they

produce do not

adopt sustainable

strategy and do

not donate for

society welfare.

In order to reduce

or avoid this

conflicts, the

management of

Tesco Plc

removes one and

half billions of

plastic and also

banned wet wipes

containing

plastics. Further,

Tesco has also

distributed 82%

of its unsold food

in the UK in meet

the needs of its

community and

society

stakeholder.

Evaluate the board structure of the company

Tesco is the British multinational organization which is leading the market of United Kingdom in

effective as well as efficient manner. The organization is selling retail product and services to the

customers in order to satisfy them in an appropriate manner. The organisation is continuously

generating the profit from domestic as well as international marketplace. The organization

follows the Hierarchical organizational structure which is considered as the organization chain of

command. With the assistance of the organizational structure, the company is able to define the

authority. The board of director of Tesco plc includes five committees such as audit, corporate

social responsibility, nomination, remuneration, and disclosure committees. Furthermore, the

Local

Communities

High The expectation

and claim of local

communities

from Tesco is that

they carry out the

business in

sustainable

manner without

harming

environment. It is

because the local

community have

high interest in

day to day

operation of

business

(Chkanikova and

Sroufe, 2021).

The concern or

problem of local

community with

the Tesco

manager or

executive is that

whether the kill

animals or not in

order to produce

bags and cloths.

The conflict

between manager

of Tesco and

local community

arises when they

produce do not

adopt sustainable

strategy and do

not donate for

society welfare.

In order to reduce

or avoid this

conflicts, the

management of

Tesco Plc

removes one and

half billions of

plastic and also

banned wet wipes

containing

plastics. Further,

Tesco has also

distributed 82%

of its unsold food

in the UK in meet

the needs of its

community and

society

stakeholder.

Evaluate the board structure of the company

Tesco is the British multinational organization which is leading the market of United Kingdom in

effective as well as efficient manner. The organization is selling retail product and services to the

customers in order to satisfy them in an appropriate manner. The organisation is continuously

generating the profit from domestic as well as international marketplace. The organization

follows the Hierarchical organizational structure which is considered as the organization chain of

command. With the assistance of the organizational structure, the company is able to define the

authority. The board of director of Tesco plc includes five committees such as audit, corporate

social responsibility, nomination, remuneration, and disclosure committees. Furthermore, the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

board of director is consisted of the 10 members in the Tesco plc. With the assistance of the

hierarchical structure the management clarify the role and responsibility to the people in the

effective as well as efficient manner (Zaman, and et.al 2022). Furthermore, it provides help in

representing different manager’s duty and responsible personality in adequate manner. For

instance, the members of the Tesco are represented into four management layers which consist

of different manger as per their department such as regional, store, food trading, non- food,

personnel, fresh food section, ambient food section, electrical section, clothing section manager

etc. This structure is largely followed by the multinational organization.

In this organizational structure the manager of Tesco company is able to allocate the resources,

rewards, offer and bonuses to the workers of the organization. Due to the structure the employees

are able to report the right and responsible person of the company. The structure of the

organization connects the workers, stakeholders and multiple workers with the company vision

and mission. Moreover, it will be easy for the workers to clarify the career path and give

opportunity to make decision on the behalf of the organization. Basically, it is the process of

empowering the employees or the working personality of the organizations individually

(Greuning, and Brajovic-Bratanovic S 2022). Due to the structure of the company the members

of the Tesco enjoy the flexibility of supply chain and worked in the coordination with the proper

alignment of resources in particular time period. The members of the Tesco which is listed in the

organizational structure make sure that the work will be done as per the aim and objective of the

organization. In context to that the manager of the organization performs the function effectively

and efficiently. Along with that, it maximizes the working condition with different responsibility.

Due to this organizational structure, the management of the company such as Tesco able to

deliver information of the assets as soon it will be purchased by company. Also, it is one of the

best structure that has bring coordination and cooperation among the people working in Tesco

company. Moreover, the higher authority under this hierarchy structure collects the daily update

from the subordinate in order to increase the productivity and profitability of the company. This

structure of the company plays essential role in the controlling and managing the function of the

enterprises. It also delivers competitive advantages in the marketplace.

Institutional investors of the company

The institutional investor refers to the company or the enterprises that invest the money in the

marketplace on the behalf of the public. The mutual fund, pension. Hedge funds and endowment

hierarchical structure the management clarify the role and responsibility to the people in the

effective as well as efficient manner (Zaman, and et.al 2022). Furthermore, it provides help in

representing different manager’s duty and responsible personality in adequate manner. For

instance, the members of the Tesco are represented into four management layers which consist

of different manger as per their department such as regional, store, food trading, non- food,

personnel, fresh food section, ambient food section, electrical section, clothing section manager

etc. This structure is largely followed by the multinational organization.

In this organizational structure the manager of Tesco company is able to allocate the resources,

rewards, offer and bonuses to the workers of the organization. Due to the structure the employees

are able to report the right and responsible person of the company. The structure of the

organization connects the workers, stakeholders and multiple workers with the company vision

and mission. Moreover, it will be easy for the workers to clarify the career path and give

opportunity to make decision on the behalf of the organization. Basically, it is the process of

empowering the employees or the working personality of the organizations individually

(Greuning, and Brajovic-Bratanovic S 2022). Due to the structure of the company the members

of the Tesco enjoy the flexibility of supply chain and worked in the coordination with the proper

alignment of resources in particular time period. The members of the Tesco which is listed in the

organizational structure make sure that the work will be done as per the aim and objective of the

organization. In context to that the manager of the organization performs the function effectively

and efficiently. Along with that, it maximizes the working condition with different responsibility.

Due to this organizational structure, the management of the company such as Tesco able to

deliver information of the assets as soon it will be purchased by company. Also, it is one of the

best structure that has bring coordination and cooperation among the people working in Tesco

company. Moreover, the higher authority under this hierarchy structure collects the daily update

from the subordinate in order to increase the productivity and profitability of the company. This

structure of the company plays essential role in the controlling and managing the function of the

enterprises. It also delivers competitive advantages in the marketplace.

Institutional investors of the company

The institutional investor refers to the company or the enterprises that invest the money in the

marketplace on the behalf of the public. The mutual fund, pension. Hedge funds and endowment

are considering the best illustration of the organization. With the assistance of the institutional

investor of the company the Tesco is able to lead the market and obtain the great image in the

domestic as we well as international marketplace.

The major shareholders of the organization are BlackRock. Inc., fidelity international (FIL

Limited), Norges Bank and Schroder’s plc. The BlackRock is a British multinational investment

management organization which is situated in the New York, US ( Bhagat, and Bolton, B2019).

The aim of the organization is to deliver the financial help to the large numbers of the people

who are belongs to different market segments. The organization is one of the leading company

all over the world with the asset value of US$1000000 crores. The BlackRock. Inc. is holding

the highest share of the Tesco organization that is 6.64% in the current period of time. The

company invest gross amount on the behalf of the potential customers of the organization. Along

with that the company provide long term sustainability in the business. In order to increase the

value in the marketplace the company promote corporate governance which help in building long

term and healthy business relationship with the customers.

Another one is fidelity international (FIL Limited) which is having the 3.04 % shareholding in

Tesco organization. It is the private limited company which is located in the London, United

Kingdom. The company offers the investment management services to private and institutional

investor which involves mutual fund, pension as well as fund platform. The organization is

renowned for the purpose of investing the money in shares of different companies all over the

world in the effective as well as efficient manner. In order to provide the effective services and

satisfy the numbers of the employees in various market the company is working with 8500+

skilled and knowledgeable employees. With the services of the company the various

organization is able to accomplish the short as well as long term goal in the adequate manner

( Nofsinger, Sulaeman, and Varma, 2019) .

Norges Bank is the central bank of the Norway which provide financial stability and prices

stability to the organization and customers. Basically, bank provide the economic stability in

continental and non-continental marketplace. In context to that the company adopted various

policy and procedure which is associated with the organization. The company also provide the

investment to the Tesco by holding the shares 3.06% as per the records of November 2021. The

organization is delivering the transparency in the marketplace by the disclosure rules. The aim of

investor of the company the Tesco is able to lead the market and obtain the great image in the

domestic as we well as international marketplace.

The major shareholders of the organization are BlackRock. Inc., fidelity international (FIL

Limited), Norges Bank and Schroder’s plc. The BlackRock is a British multinational investment

management organization which is situated in the New York, US ( Bhagat, and Bolton, B2019).

The aim of the organization is to deliver the financial help to the large numbers of the people

who are belongs to different market segments. The organization is one of the leading company

all over the world with the asset value of US$1000000 crores. The BlackRock. Inc. is holding

the highest share of the Tesco organization that is 6.64% in the current period of time. The

company invest gross amount on the behalf of the potential customers of the organization. Along

with that the company provide long term sustainability in the business. In order to increase the

value in the marketplace the company promote corporate governance which help in building long

term and healthy business relationship with the customers.

Another one is fidelity international (FIL Limited) which is having the 3.04 % shareholding in

Tesco organization. It is the private limited company which is located in the London, United

Kingdom. The company offers the investment management services to private and institutional

investor which involves mutual fund, pension as well as fund platform. The organization is

renowned for the purpose of investing the money in shares of different companies all over the

world in the effective as well as efficient manner. In order to provide the effective services and

satisfy the numbers of the employees in various market the company is working with 8500+

skilled and knowledgeable employees. With the services of the company the various

organization is able to accomplish the short as well as long term goal in the adequate manner

( Nofsinger, Sulaeman, and Varma, 2019) .

Norges Bank is the central bank of the Norway which provide financial stability and prices

stability to the organization and customers. Basically, bank provide the economic stability in

continental and non-continental marketplace. In context to that the company adopted various

policy and procedure which is associated with the organization. The company also provide the

investment to the Tesco by holding the shares 3.06% as per the records of November 2021. The

organization is delivering the transparency in the marketplace by the disclosure rules. The aim of

providing fund to deliver the support to the current as well as future generation in contributing in

the economic condition of the nation. Most of the fund the company willing to invest in the

equity, bond, real estate, and infrastructure for renewable energy.

The last major stakeholder of the Tesco company is Schroders plc which is holding the shares of

4.99. It is the British multinational organization which is established in 1804 in the London. It is

renowned as the largest banking and asset management company of the United Kingdom. The

company offers the innovative and creative solution to the potential clients of the organization.

In order to fulfil the diverse need of the company the Schroders designed wide range of

investment for the high net worth organization which also includes Tesco by putting in the centre

during the planning and organizing process of the company-(sensio-López, Cabeza-García, and

González-Álvarez,2018).

Basically, Tesco is having excellent hold over the stocks of the company. The investors of the

company look out the stock of the institution in the marketplace and sell out at the same period

of time in order to acquire profit in effective as well as efficient manner. The Tesco is having the

largest stockholder which is named as Cullen Capital Management LLC which owned the shares

of 3,595,326. The Tesco plc is holding the mutual funds in stock market.

CONCLUSION

From the above report it will be concluded that in the organizational function and structure of the

company the corporate governance plays major role. with the assistance of the analysation, it can

be reflected the company can achieve all height of success all over the globe if cooperate

governances is well structures or in perfect manner. With the assistance of the investor the

organization is able to perform better as the investors are providing financial support to the

organization. Due to that the company is able to increase the productivity and profitability in the

marketplace. In context to that the company can used the corporate governance theories which

are named as agency theory and steward theory. The report shades a light on the investor or the

stakeholders of the organization which is investors, customer, government and local

the economic condition of the nation. Most of the fund the company willing to invest in the

equity, bond, real estate, and infrastructure for renewable energy.

The last major stakeholder of the Tesco company is Schroders plc which is holding the shares of

4.99. It is the British multinational organization which is established in 1804 in the London. It is

renowned as the largest banking and asset management company of the United Kingdom. The

company offers the innovative and creative solution to the potential clients of the organization.

In order to fulfil the diverse need of the company the Schroders designed wide range of

investment for the high net worth organization which also includes Tesco by putting in the centre

during the planning and organizing process of the company-(sensio-López, Cabeza-García, and

González-Álvarez,2018).

Basically, Tesco is having excellent hold over the stocks of the company. The investors of the

company look out the stock of the institution in the marketplace and sell out at the same period

of time in order to acquire profit in effective as well as efficient manner. The Tesco is having the

largest stockholder which is named as Cullen Capital Management LLC which owned the shares

of 3,595,326. The Tesco plc is holding the mutual funds in stock market.

CONCLUSION

From the above report it will be concluded that in the organizational function and structure of the

company the corporate governance plays major role. with the assistance of the analysation, it can

be reflected the company can achieve all height of success all over the globe if cooperate

governances is well structures or in perfect manner. With the assistance of the investor the

organization is able to perform better as the investors are providing financial support to the

organization. Due to that the company is able to increase the productivity and profitability in the

marketplace. In context to that the company can used the corporate governance theories which

are named as agency theory and steward theory. The report shades a light on the investor or the

stakeholders of the organization which is investors, customer, government and local

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

communities (asensio-lópez, cabeza-garcía, and gonzález-álvarez, 2018). apart from that the

company is having major stakeholder such as blackrock. Inc., fidelity international (fil limited),

Norges bank and Nchroder’s plc. They are holding the shares of the Tesco and delivering the

competition in the marketplace.

company is having major stakeholder such as blackrock. Inc., fidelity international (fil limited),

Norges bank and Nchroder’s plc. They are holding the shares of the Tesco and delivering the

competition in the marketplace.

REFERENCES

Books and journals

Alshabibi, B., 2021. The Role of Institutional Investors in Improving Board of Director

Attributes around the World. Journal of Risk and Financial Management, 14(4), p.166.

Asensio-López, D., Cabeza-García, L. and González-Álvarez, N., 2018. Corporate governance

and innovation: A theoretical review. European Journal of Management and Business

Economics.

Bhagat, S. and Bolton, B., 2019. Corporate governance and firm performance: The

sequel. Journal of Corporate Finance, 58, pp.142-168.

Chkanikova, O. and Sroufe, R., 2021. Third-party sustainability certifications in food retailing:

Certification design from a sustainable supply chain management perspective. Journal

of Cleaner Production. 282. p.124344.

Crovini, C., Schaper, S. and Simoni, L., 2021. Dynamic accountability and the role of risk

reporting during a global pandemic. Accounting, Auditing & Accountability Journal.

Dyck, A., Lins, K.V., Roth, L. and Wagner, H.F., 2019. Do institutional investors drive corporate

social responsibility? International evidence. Journal of Financial Economics, 131(3),

pp.693-714.

Gamble, J. R., Clinton, E. and Díaz-Moriana, V., 2021. Broadening the business model

construct: Exploring how family-owned SMEs co-create value with external

stakeholders. Journal of Business Research. 130. pp.646-657.

Greuning, H.V. and Brajovic-Bratanovic, S., 2022. Analyzing banking risk: a framework for

assessing corporate governance and risk management.

Jere, A. K. and et.al., 2021. Food waste and its effect on green retailing in South Africa. African

Journal of Business and Economic Research. 16(3). p.93.

Klettner, A., 2021. Stewardship codes and the role of institutional investors in corporate

governance: an international comparison and typology. British Journal of

Management. 32(4). pp.988-1006.

Kyere, M. and Ausloos, M., 2021. Corporate governance and firms financial performance in the

United Kingdom. International Journal of Finance & Economics. 26(2). pp.1871-1885.

Marashdeh, Z. and et.al., 2021. Agency theory and the Jordanian corporate environment: why a

single theory is not enough. Academy of Accounting and Financial Studies

Journal. 25(5). pp.1-15.

Nofsinger, J.R., Sulaeman, J. and Varma, A., 2019. Institutional investors and corporate social

responsibility. Journal of Corporate Finance, 58, pp.700-725.

Zaman, and et.al 2022. Corporate governance meets corporate social responsibility: Mapping the

interface. Business & Society, 61(3), pp.690-752.

1

Books and journals

Alshabibi, B., 2021. The Role of Institutional Investors in Improving Board of Director

Attributes around the World. Journal of Risk and Financial Management, 14(4), p.166.

Asensio-López, D., Cabeza-García, L. and González-Álvarez, N., 2018. Corporate governance

and innovation: A theoretical review. European Journal of Management and Business

Economics.

Bhagat, S. and Bolton, B., 2019. Corporate governance and firm performance: The

sequel. Journal of Corporate Finance, 58, pp.142-168.

Chkanikova, O. and Sroufe, R., 2021. Third-party sustainability certifications in food retailing:

Certification design from a sustainable supply chain management perspective. Journal

of Cleaner Production. 282. p.124344.

Crovini, C., Schaper, S. and Simoni, L., 2021. Dynamic accountability and the role of risk

reporting during a global pandemic. Accounting, Auditing & Accountability Journal.

Dyck, A., Lins, K.V., Roth, L. and Wagner, H.F., 2019. Do institutional investors drive corporate

social responsibility? International evidence. Journal of Financial Economics, 131(3),

pp.693-714.

Gamble, J. R., Clinton, E. and Díaz-Moriana, V., 2021. Broadening the business model

construct: Exploring how family-owned SMEs co-create value with external

stakeholders. Journal of Business Research. 130. pp.646-657.

Greuning, H.V. and Brajovic-Bratanovic, S., 2022. Analyzing banking risk: a framework for

assessing corporate governance and risk management.

Jere, A. K. and et.al., 2021. Food waste and its effect on green retailing in South Africa. African

Journal of Business and Economic Research. 16(3). p.93.

Klettner, A., 2021. Stewardship codes and the role of institutional investors in corporate

governance: an international comparison and typology. British Journal of

Management. 32(4). pp.988-1006.

Kyere, M. and Ausloos, M., 2021. Corporate governance and firms financial performance in the

United Kingdom. International Journal of Finance & Economics. 26(2). pp.1871-1885.

Marashdeh, Z. and et.al., 2021. Agency theory and the Jordanian corporate environment: why a

single theory is not enough. Academy of Accounting and Financial Studies

Journal. 25(5). pp.1-15.

Nofsinger, J.R., Sulaeman, J. and Varma, A., 2019. Institutional investors and corporate social

responsibility. Journal of Corporate Finance, 58, pp.700-725.

Zaman, and et.al 2022. Corporate governance meets corporate social responsibility: Mapping the

interface. Business & Society, 61(3), pp.690-752.

1

1 out of 12

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.