HI6026 - AGL Energy Limited: Audit Risk & ASX Governance Report

VerifiedAdded on 2023/06/13

|11

|2608

|431

Report

AI Summary

This report provides an overview of AGL Energy Limited's adherence to the Australian Securities Exchange (ASX) corporate governance principles and its risk assessment procedures. It examines how AGL Energy implements these principles, focusing on management oversight, board structure, ethical conduct, corporate reporting integrity, timely disclosure, security holder rights, risk management, and remuneration practices. The report also assesses the company's risk assessment strategies, considering the nature of the entity, market overview, business strategy, and financial ratios. Key risk factors, such as asset safety, wholesale energy market optimization, reputational risk, and technical risk, are identified along with the mitigation actions taken by the company to ensure reliable financial information.

Audit Assurance Compliance

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Executive Summary

The report has been developed for providing an understanding of the corporate

governance principles developed by Australian Securities Exchange (ASX). Also, it provides an

analysis of the risk assessment procedures that should be used by the entities listed on ASX to

identify and mitigate the audit risk. The ASX listed entity selected for the purpose is AGL

Energy Limited, an Australian listed public entity involved in development and retailing of

electricity and gas for residential and commercial use. It has been assessed from the overall

report that AGL Energy Limited has developed and established corporate governance statement

in accordance with ASX principle and recommendations. Also, it has implemented effective

strategies for reducing the audit risk to ensure that materialistic information presented to the end-

users is reliable and accurate.

The report has been developed for providing an understanding of the corporate

governance principles developed by Australian Securities Exchange (ASX). Also, it provides an

analysis of the risk assessment procedures that should be used by the entities listed on ASX to

identify and mitigate the audit risk. The ASX listed entity selected for the purpose is AGL

Energy Limited, an Australian listed public entity involved in development and retailing of

electricity and gas for residential and commercial use. It has been assessed from the overall

report that AGL Energy Limited has developed and established corporate governance statement

in accordance with ASX principle and recommendations. Also, it has implemented effective

strategies for reducing the audit risk to ensure that materialistic information presented to the end-

users is reliable and accurate.

Contents

ASX Corporate Governance Principles.........................................................................................................4

Development of a Solid Framework for Management & Oversight.........................................................4

Maintaining an Effective Board Structuring to Add Value.......................................................................4

Ethical and Responsible Way of Acting....................................................................................................5

Presence of Integrity in Corporate Reporting..........................................................................................5

Timely & Balanced Disclosure..................................................................................................................5

Respect the Rights of Security Holders....................................................................................................6

Recognition and Management of Risk.....................................................................................................6

Fair & Responsible Remuneration...........................................................................................................6

Risk Assessment..........................................................................................................................................7

Nature of Entity.......................................................................................................................................7

Market Overview & Business Strategy.....................................................................................................7

Computation of Income Statement and Balance Sheet ratio..................................................................7

Audit Risk & Potential Steps Taken for Its Reduction..............................................................................8

Conclusion...................................................................................................................................................9

References.................................................................................................................................................10

ASX Corporate Governance Principles.........................................................................................................4

Development of a Solid Framework for Management & Oversight.........................................................4

Maintaining an Effective Board Structuring to Add Value.......................................................................4

Ethical and Responsible Way of Acting....................................................................................................5

Presence of Integrity in Corporate Reporting..........................................................................................5

Timely & Balanced Disclosure..................................................................................................................5

Respect the Rights of Security Holders....................................................................................................6

Recognition and Management of Risk.....................................................................................................6

Fair & Responsible Remuneration...........................................................................................................6

Risk Assessment..........................................................................................................................................7

Nature of Entity.......................................................................................................................................7

Market Overview & Business Strategy.....................................................................................................7

Computation of Income Statement and Balance Sheet ratio..................................................................7

Audit Risk & Potential Steps Taken for Its Reduction..............................................................................8

Conclusion...................................................................................................................................................9

References.................................................................................................................................................10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

ASX Corporate Governance Principles

ASX has developed the corporate governance principles and recommendations that the

business entities listed on ASX need to comply for developing their corporate governance

statement. The analysis of the corporate governance statement of AGL Energy in accordance

with ASX rules is carried out as follows:

Development of a Solid Framework for Management & Oversight

As per ASX Corporate Governance Statement (CGS), the business corporations of

Australia listed on ASX need to develop the respective roles and responsibilities of the board and

management. AGL Energy Limited has established a solid framework for management and

Board as analyzed from its corporate governance statement. The role of Board is to be

responsible for the governance of the company and protecting the interests of the shareholders.

The major responsibility of Board is to develop and continually review the strategic direction,

business plan and budget of the long-term goals and objectives of the company. The Board has

assigned the role of the key management personnel (KMP) to monitor and regulate the daily

operational activities of the company. The performance of the Board is continually reviewed and

monitors through assessing the performance of its individual directors by the board itself in

support of an independent consultant. The review process sis carried out in support of the

director’s and members of the executive team of the Board. Board has also developed a

remuneration committee to asses the performance of the management people during the tie of

making decisions over their incentives and rewards (Fleckner and Hopt, 2013).

Maintaining an Effective Board Structuring to Add Value

The business entities listed on ASX need to develop an effective board structure having

diverse skills and competencies by appointing and recruiting a team of qualified personnel’s.

This is required so that Bard members possess high expertise to ensure that its roles and

responsibilities are carried out adequately. AGL Energy Limited has also maintained an adequate

board structure comprising eight non-executive directors, managing director and Chief Executive

Officer (CEO). The Board Skill Matrix provided in the corporate governance statement has

provided a detailed description of the necessary skills and expertise possessed by the Board

ASX has developed the corporate governance principles and recommendations that the

business entities listed on ASX need to comply for developing their corporate governance

statement. The analysis of the corporate governance statement of AGL Energy in accordance

with ASX rules is carried out as follows:

Development of a Solid Framework for Management & Oversight

As per ASX Corporate Governance Statement (CGS), the business corporations of

Australia listed on ASX need to develop the respective roles and responsibilities of the board and

management. AGL Energy Limited has established a solid framework for management and

Board as analyzed from its corporate governance statement. The role of Board is to be

responsible for the governance of the company and protecting the interests of the shareholders.

The major responsibility of Board is to develop and continually review the strategic direction,

business plan and budget of the long-term goals and objectives of the company. The Board has

assigned the role of the key management personnel (KMP) to monitor and regulate the daily

operational activities of the company. The performance of the Board is continually reviewed and

monitors through assessing the performance of its individual directors by the board itself in

support of an independent consultant. The review process sis carried out in support of the

director’s and members of the executive team of the Board. Board has also developed a

remuneration committee to asses the performance of the management people during the tie of

making decisions over their incentives and rewards (Fleckner and Hopt, 2013).

Maintaining an Effective Board Structuring to Add Value

The business entities listed on ASX need to develop an effective board structure having

diverse skills and competencies by appointing and recruiting a team of qualified personnel’s.

This is required so that Bard members possess high expertise to ensure that its roles and

responsibilities are carried out adequately. AGL Energy Limited has also maintained an adequate

board structure comprising eight non-executive directors, managing director and Chief Executive

Officer (CEO). The Board Skill Matrix provided in the corporate governance statement has

provided a detailed description of the necessary skills and expertise possessed by the Board

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

members to carry out its roles and responsibilities (2017 Corporate Governance Statement,

2017).

Ethical and Responsible Way of Acting

AGL has developed and established its sound and effective corporate governance policies

for ensuring that it carries out its business operations in an ethical and responsible way. Its code

of conduct has stated the responsibility of its directors, employees and contractors as per the

ethical standards of confidentiality, integrity and honesty. The company has developed an ethical

panel for overseeing the application of the Code of Conduct and ensures whether the operations

are carried out as per ethical guidelines. The employees are provided training as per the rules and

policies of Code of Conduct in their induction program. The company has also developed a

compliance management policy for ensuring that it carries out all its operations activities as per

the standard rules and regulations (2017 Corporate Governance Statement, 2017).

Presence of Integrity in Corporate Reporting

The business entities as per ASX rules also need to have a presence of rigorous process

for verifying and safeguarding the integrity in the corporate reporting. AGL Energy Limited

board holds the responsibility of approving the financial statements accuracy to the Board before

these are disclosed to the end-users. Board also provides assurance that the financial statements

are developed as per the accounting standards and the opinions are developed on the basis of

effective system of risk management and internal control (2017 Corporate Governance

Statement, 2017).

Timely & Balanced Disclosure

As per ASX principle, the company also places strong emphasis on providing timely and

relevant information to the stakeholders impacting the prices of its securities. The company has

established a Market Disclosure Committee who holds the responsibility for providing market

sensitive information to the ASX. In addition to this, it also makes disclosures about its financial

performance in the financial statements and non-financial information in the sustainability report

on an annual basis (2017 Corporate Governance Statement, 2017). Therefore, the company has

maintained appropriate procedures and policies to provide timely and balanced disclosure of

relevant information to the end-users for facilitating in decision-making (Bazley, Hancock and

Robinson, 2014).

2017).

Ethical and Responsible Way of Acting

AGL has developed and established its sound and effective corporate governance policies

for ensuring that it carries out its business operations in an ethical and responsible way. Its code

of conduct has stated the responsibility of its directors, employees and contractors as per the

ethical standards of confidentiality, integrity and honesty. The company has developed an ethical

panel for overseeing the application of the Code of Conduct and ensures whether the operations

are carried out as per ethical guidelines. The employees are provided training as per the rules and

policies of Code of Conduct in their induction program. The company has also developed a

compliance management policy for ensuring that it carries out all its operations activities as per

the standard rules and regulations (2017 Corporate Governance Statement, 2017).

Presence of Integrity in Corporate Reporting

The business entities as per ASX rules also need to have a presence of rigorous process

for verifying and safeguarding the integrity in the corporate reporting. AGL Energy Limited

board holds the responsibility of approving the financial statements accuracy to the Board before

these are disclosed to the end-users. Board also provides assurance that the financial statements

are developed as per the accounting standards and the opinions are developed on the basis of

effective system of risk management and internal control (2017 Corporate Governance

Statement, 2017).

Timely & Balanced Disclosure

As per ASX principle, the company also places strong emphasis on providing timely and

relevant information to the stakeholders impacting the prices of its securities. The company has

established a Market Disclosure Committee who holds the responsibility for providing market

sensitive information to the ASX. In addition to this, it also makes disclosures about its financial

performance in the financial statements and non-financial information in the sustainability report

on an annual basis (2017 Corporate Governance Statement, 2017). Therefore, the company has

maintained appropriate procedures and policies to provide timely and balanced disclosure of

relevant information to the end-users for facilitating in decision-making (Bazley, Hancock and

Robinson, 2014).

Respect the Rights of Security Holders

ASX listed entities also need to protect the rights of security holders through providing

them all the appropriate information and authority to exercise there rights (ASX Corporate

Governance Council, 2014). The company has also developed Securities Dealing Policy

outlining the rights of the employees who may deal in the company securities. The policy has

implemented rules against the use of derivatives by directors, executives and employees to any

unvested securities. Also, it has developed an investor relation program for improving the

communication flow between the investors. The program is developed to provide information to

the shareholders about all the relevant information related to their issues or concerns. It conducts

investor briefings, asset tours and webcaster all the events that can impact the materialistic

information. It also regular conducts meeting with the shareholder representative bodies for

developing an understanding of the expectations of the market on important topics such as ESG

and remuneration (2017 Corporate Governance Statement, 2017).

Recognition and Management of Risk

The corporate governance statement developed by AGL also has described the nature of

its risk management. It faces wide variety of risks due to nature of its operations such as

economic, environmental, sustainability and financial risks. As such, the company has developed

and implemented an effective risk management framework that determines the role of different

personnel in regard to monitoring and controlling the risks. It has implemented risk management

principles in its strategy development process so that daily risk can be successfully managed and

controlled. The framework has also established risk management standard to provide guidelines

to the employees about the ways of conducting risk assessment so that the identified risk can be

mitigated properly (O'Donnell & Perkins, 2011).

Fair & Responsible Remuneration

ASX listed entities also need to maintain an adequate remuneration structure for

attracting, retaining and motivating high quality senior executives to align their interests with

value creation for security holders. The Board has developed and appointed a remuneration

committee working actively to provide fair remuneration to its senior executives (2017 Corporate

Governance Statement, 2017). The remuneration structure comprises of fixed and variable

remuneration part comprising of short term and long-term incentive plans (Plessis, McConvill

and Bagaric, 2005).

ASX listed entities also need to protect the rights of security holders through providing

them all the appropriate information and authority to exercise there rights (ASX Corporate

Governance Council, 2014). The company has also developed Securities Dealing Policy

outlining the rights of the employees who may deal in the company securities. The policy has

implemented rules against the use of derivatives by directors, executives and employees to any

unvested securities. Also, it has developed an investor relation program for improving the

communication flow between the investors. The program is developed to provide information to

the shareholders about all the relevant information related to their issues or concerns. It conducts

investor briefings, asset tours and webcaster all the events that can impact the materialistic

information. It also regular conducts meeting with the shareholder representative bodies for

developing an understanding of the expectations of the market on important topics such as ESG

and remuneration (2017 Corporate Governance Statement, 2017).

Recognition and Management of Risk

The corporate governance statement developed by AGL also has described the nature of

its risk management. It faces wide variety of risks due to nature of its operations such as

economic, environmental, sustainability and financial risks. As such, the company has developed

and implemented an effective risk management framework that determines the role of different

personnel in regard to monitoring and controlling the risks. It has implemented risk management

principles in its strategy development process so that daily risk can be successfully managed and

controlled. The framework has also established risk management standard to provide guidelines

to the employees about the ways of conducting risk assessment so that the identified risk can be

mitigated properly (O'Donnell & Perkins, 2011).

Fair & Responsible Remuneration

ASX listed entities also need to maintain an adequate remuneration structure for

attracting, retaining and motivating high quality senior executives to align their interests with

value creation for security holders. The Board has developed and appointed a remuneration

committee working actively to provide fair remuneration to its senior executives (2017 Corporate

Governance Statement, 2017). The remuneration structure comprises of fixed and variable

remuneration part comprising of short term and long-term incentive plans (Plessis, McConvill

and Bagaric, 2005).

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Risk Assessment

Auditors adopt the use of risk assessment procedures for analyzing the reliability of

financial information presented to them. This is important because the overall results from audit

of an entity depends whether the information provided is materialistic correct or not

(International Standard On Auditing 315, 2009). The Auditing and Assurance Standard Board

(AUSAB) has issued Auditing Standard ASA 520 to develop the analytical procedures for

improving the auditor efficiency through evaluating the nature of its operations, business

strategy, reliability of financial statements and the risk assessment process used by an entity to

identify and mitigate the financial risk (Putra, 2010). The risk assessment procedure that can be

used for identifying and controlling the audit risk in AGL Energy Limited can be described as

follows:

Nature of Entity

AGL is an Australian listed public company having ownership of large number of

shareholders who are mainly Australian investment companies. The company is listed on ASX

and has developed its corporate governance statement as per the standards and recommendations

of ASX. The financial transactions are carried out as per AASB and Corporations principles and

standards (AGL Energy Limited: Annual Report, 2017). It adopts AASB 124 in related party

disclosures such as KMP related party for defining the transactions involving transfer of

resources or services between the company and its related party (Auditing and Assurance

Standards Board, 2009).

Market Overview & Business Strategy

The company provides its gas and electricity services to about 3.6 million customers

across Australia. The strategic aim of the company is to meet the energy needs of people across

Australia through development of the country’s largest electricity generation portfolio (AGL

Energy Limited: Our Company. 2017).

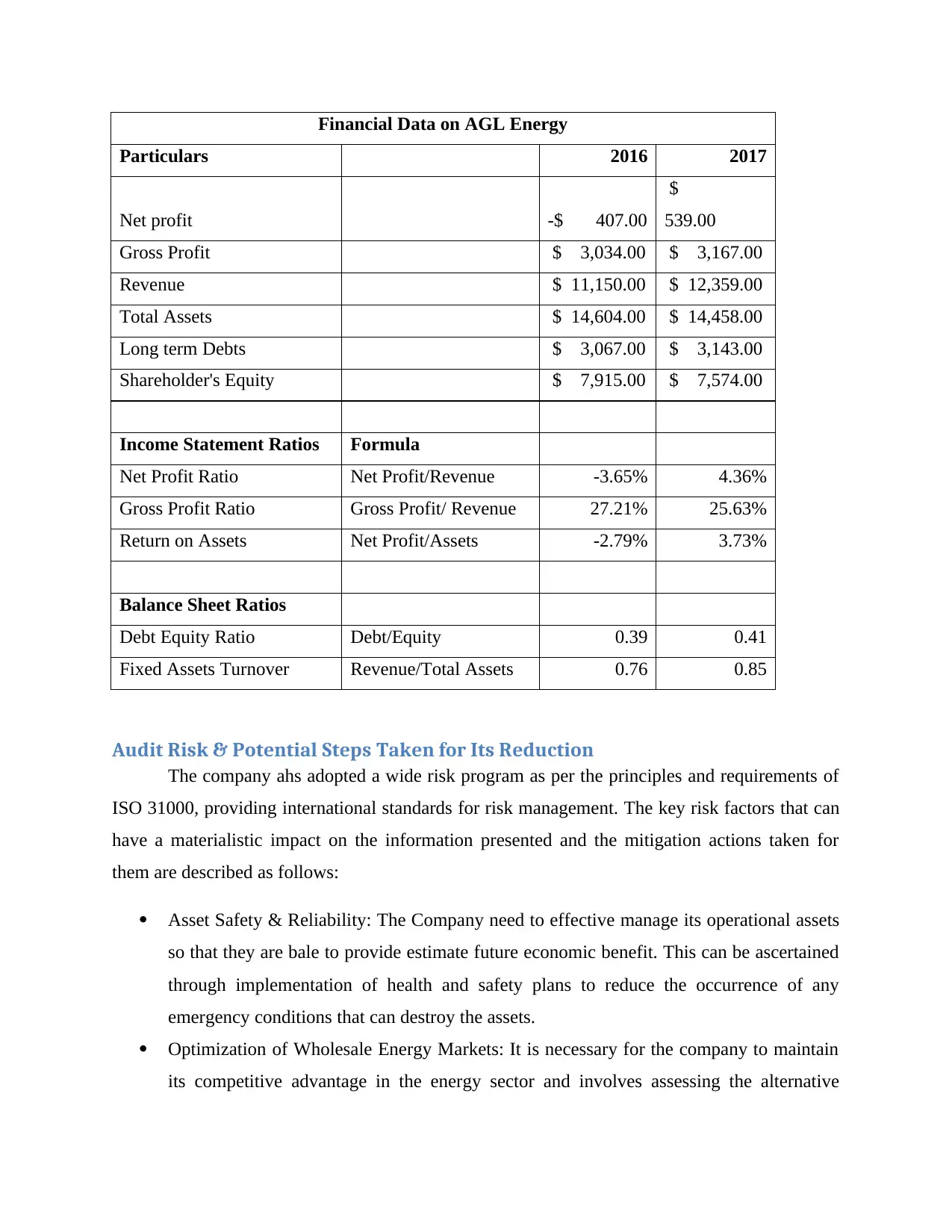

Computation of Income Statement and Balance Sheet ratio

The company develops its common-size financial statement as per AASB and

Corporations Act 2001 accounting standards and regulations. The financial growth and condition

of the company can be assed through calculation of key income statement and balance sheet ratio

as follows:

Auditors adopt the use of risk assessment procedures for analyzing the reliability of

financial information presented to them. This is important because the overall results from audit

of an entity depends whether the information provided is materialistic correct or not

(International Standard On Auditing 315, 2009). The Auditing and Assurance Standard Board

(AUSAB) has issued Auditing Standard ASA 520 to develop the analytical procedures for

improving the auditor efficiency through evaluating the nature of its operations, business

strategy, reliability of financial statements and the risk assessment process used by an entity to

identify and mitigate the financial risk (Putra, 2010). The risk assessment procedure that can be

used for identifying and controlling the audit risk in AGL Energy Limited can be described as

follows:

Nature of Entity

AGL is an Australian listed public company having ownership of large number of

shareholders who are mainly Australian investment companies. The company is listed on ASX

and has developed its corporate governance statement as per the standards and recommendations

of ASX. The financial transactions are carried out as per AASB and Corporations principles and

standards (AGL Energy Limited: Annual Report, 2017). It adopts AASB 124 in related party

disclosures such as KMP related party for defining the transactions involving transfer of

resources or services between the company and its related party (Auditing and Assurance

Standards Board, 2009).

Market Overview & Business Strategy

The company provides its gas and electricity services to about 3.6 million customers

across Australia. The strategic aim of the company is to meet the energy needs of people across

Australia through development of the country’s largest electricity generation portfolio (AGL

Energy Limited: Our Company. 2017).

Computation of Income Statement and Balance Sheet ratio

The company develops its common-size financial statement as per AASB and

Corporations Act 2001 accounting standards and regulations. The financial growth and condition

of the company can be assed through calculation of key income statement and balance sheet ratio

as follows:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Financial Data on AGL Energy

Particulars 2016 2017

Net profit -$ 407.00

$

539.00

Gross Profit $ 3,034.00 $ 3,167.00

Revenue $ 11,150.00 $ 12,359.00

Total Assets $ 14,604.00 $ 14,458.00

Long term Debts $ 3,067.00 $ 3,143.00

Shareholder's Equity $ 7,915.00 $ 7,574.00

Income Statement Ratios Formula

Net Profit Ratio Net Profit/Revenue -3.65% 4.36%

Gross Profit Ratio Gross Profit/ Revenue 27.21% 25.63%

Return on Assets Net Profit/Assets -2.79% 3.73%

Balance Sheet Ratios

Debt Equity Ratio Debt/Equity 0.39 0.41

Fixed Assets Turnover Revenue/Total Assets 0.76 0.85

Audit Risk & Potential Steps Taken for Its Reduction

The company ahs adopted a wide risk program as per the principles and requirements of

ISO 31000, providing international standards for risk management. The key risk factors that can

have a materialistic impact on the information presented and the mitigation actions taken for

them are described as follows:

Asset Safety & Reliability: The Company need to effective manage its operational assets

so that they are bale to provide estimate future economic benefit. This can be ascertained

through implementation of health and safety plans to reduce the occurrence of any

emergency conditions that can destroy the assets.

Optimization of Wholesale Energy Markets: It is necessary for the company to maintain

its competitive advantage in the energy sector and involves assessing the alternative

Particulars 2016 2017

Net profit -$ 407.00

$

539.00

Gross Profit $ 3,034.00 $ 3,167.00

Revenue $ 11,150.00 $ 12,359.00

Total Assets $ 14,604.00 $ 14,458.00

Long term Debts $ 3,067.00 $ 3,143.00

Shareholder's Equity $ 7,915.00 $ 7,574.00

Income Statement Ratios Formula

Net Profit Ratio Net Profit/Revenue -3.65% 4.36%

Gross Profit Ratio Gross Profit/ Revenue 27.21% 25.63%

Return on Assets Net Profit/Assets -2.79% 3.73%

Balance Sheet Ratios

Debt Equity Ratio Debt/Equity 0.39 0.41

Fixed Assets Turnover Revenue/Total Assets 0.76 0.85

Audit Risk & Potential Steps Taken for Its Reduction

The company ahs adopted a wide risk program as per the principles and requirements of

ISO 31000, providing international standards for risk management. The key risk factors that can

have a materialistic impact on the information presented and the mitigation actions taken for

them are described as follows:

Asset Safety & Reliability: The Company need to effective manage its operational assets

so that they are bale to provide estimate future economic benefit. This can be ascertained

through implementation of health and safety plans to reduce the occurrence of any

emergency conditions that can destroy the assets.

Optimization of Wholesale Energy Markets: It is necessary for the company to maintain

its competitive advantage in the energy sector and involves assessing the alternative

opportunities of obtaining gas supply such as LNG. It also involves advanced

management techniques in order to comply with the government regulations. The

company is placing continued focus on its gas contracting and transportation strategy to

meet the energy requirements of its customers continually (AGL Energy Limited: Annual

Report, 2017).

Reputational Risk: The company operations can be largely impacted by the political and

economic uncertainty in the market that can have an impact on energy price to a large

extent. The company has to mange reputation risk by identification of the diverse

requirements of its stakeholders and promoting positive engagement with them. The

company as such has developed a public policy leadership for placing focus on the

engagement of stakeholders and meeting their requirements appropriately.

Technical risk: The Company also needs to implement proper policies for data and IT

security management for protecting the data integrity. This is necessary so that

information presented to the auditors is confidential and protected through he use of

appropriate private polices. The company in this context has adopted a Data &

Information Governance policy for collection, management, storage and protection of

data integrity (AGL Energy Limited: Annual Report, 2017).

Conclusion

It can be said from the overall discussion held in the report that ASX listed entities need

to maintain an effective corporate governance and risk management structure for complying

effectively with the laws ad regulations of ASX. AGL Energy Limited has developed its

corporate governance statement as per the principle of ASX to ensure its sustainable growth and

development. It has also adopted an effective risk management procedure to identify the material

risk and development of consecutive mitigation plans for risk reduction.

management techniques in order to comply with the government regulations. The

company is placing continued focus on its gas contracting and transportation strategy to

meet the energy requirements of its customers continually (AGL Energy Limited: Annual

Report, 2017).

Reputational Risk: The company operations can be largely impacted by the political and

economic uncertainty in the market that can have an impact on energy price to a large

extent. The company has to mange reputation risk by identification of the diverse

requirements of its stakeholders and promoting positive engagement with them. The

company as such has developed a public policy leadership for placing focus on the

engagement of stakeholders and meeting their requirements appropriately.

Technical risk: The Company also needs to implement proper policies for data and IT

security management for protecting the data integrity. This is necessary so that

information presented to the auditors is confidential and protected through he use of

appropriate private polices. The company in this context has adopted a Data &

Information Governance policy for collection, management, storage and protection of

data integrity (AGL Energy Limited: Annual Report, 2017).

Conclusion

It can be said from the overall discussion held in the report that ASX listed entities need

to maintain an effective corporate governance and risk management structure for complying

effectively with the laws ad regulations of ASX. AGL Energy Limited has developed its

corporate governance statement as per the principle of ASX to ensure its sustainable growth and

development. It has also adopted an effective risk management procedure to identify the material

risk and development of consecutive mitigation plans for risk reduction.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

References

2017 Corporate Governance Statement. (2017). AGL Energy Limited. Retrieved 26 April, 2018,

from https://www.agl.com.au/-/media/AGL/About-AGL/Documents/Who-We-Are/AGL-

2017-Corporate-Governance-Statement.PDF?

la=en&hash=7905AAC3A15D638CF7EF500483F9CDE3C8B2D7AC

AGL Energy Limited. (2017). Annual Report. Retrieved 26 April, 2018, from

https://www.agl.com.au/-/media/AGL/About-AGL/Documents/Media-Center/ASX-and-

Media-Releases/2017/170825-AGL-207-Annual-Report-ASX.pdf?

la=en&hash=013E1C115D580D678CA009DF3D256C8C511F655C

AGL Energy Limited. (2017). Our Company. Retrieved 26 April, 2018, from

https://www.agl.com.au/about-agl/who-we-are/our-company

ASX Corporate Governance Council. (2014). Retrieved 26 April, 2018, from

https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-

recommendations-3rd-edn.pdf

Auditing and Assurance Standards Board. (2009). Auditing Standard ASA 520 Analytical

Procedures. Retrieved 26 April, 2018, from

http://www.auasb.gov.au/admin/file/content102/c3/ASA_520_27-10-09.pdf

Bazley, M., Hancock, P. and Robinson, P. (2014). Contemporary Accounting PDF. Cengage

Learning Australia.

Fleckner, A. and Hopt, K. (2013). Comparative Corporate Governance: A Functional and

International Analysis. Cambridge University Press.

International Standard On Auditing 315. (2009). Retrieved 26 April, 2018, from

http://www.ifac.org/system/files/downloads/a017-2010-iaasb-handbook-isa-315.pdf

O'Donnell, Ed & Perkins, D. (2011). Assessing Risk with Analytical Procedures: Do

Systems-Thinking Tools Help Auditors Focus on Diagnostic Patterns? Auditing;

Sarasota 30 (4), pp. 273-283.

Plessis, J., McConvill, J. and Bagaric, M. (2005). Principles of Contemporary Corporate

Governance. Cambridge University Press.

Putra, L. (2010). The Use Of Analytical Procedures In Auditing. Retrieved 26 April, 2018, from

http://accounting-financial-tax.com/2010/04/the-use-of-analytical-procedures-in-auditing/

2017 Corporate Governance Statement. (2017). AGL Energy Limited. Retrieved 26 April, 2018,

from https://www.agl.com.au/-/media/AGL/About-AGL/Documents/Who-We-Are/AGL-

2017-Corporate-Governance-Statement.PDF?

la=en&hash=7905AAC3A15D638CF7EF500483F9CDE3C8B2D7AC

AGL Energy Limited. (2017). Annual Report. Retrieved 26 April, 2018, from

https://www.agl.com.au/-/media/AGL/About-AGL/Documents/Media-Center/ASX-and-

Media-Releases/2017/170825-AGL-207-Annual-Report-ASX.pdf?

la=en&hash=013E1C115D580D678CA009DF3D256C8C511F655C

AGL Energy Limited. (2017). Our Company. Retrieved 26 April, 2018, from

https://www.agl.com.au/about-agl/who-we-are/our-company

ASX Corporate Governance Council. (2014). Retrieved 26 April, 2018, from

https://www.asx.com.au/documents/asx-compliance/cgc-principles-and-

recommendations-3rd-edn.pdf

Auditing and Assurance Standards Board. (2009). Auditing Standard ASA 520 Analytical

Procedures. Retrieved 26 April, 2018, from

http://www.auasb.gov.au/admin/file/content102/c3/ASA_520_27-10-09.pdf

Bazley, M., Hancock, P. and Robinson, P. (2014). Contemporary Accounting PDF. Cengage

Learning Australia.

Fleckner, A. and Hopt, K. (2013). Comparative Corporate Governance: A Functional and

International Analysis. Cambridge University Press.

International Standard On Auditing 315. (2009). Retrieved 26 April, 2018, from

http://www.ifac.org/system/files/downloads/a017-2010-iaasb-handbook-isa-315.pdf

O'Donnell, Ed & Perkins, D. (2011). Assessing Risk with Analytical Procedures: Do

Systems-Thinking Tools Help Auditors Focus on Diagnostic Patterns? Auditing;

Sarasota 30 (4), pp. 273-283.

Plessis, J., McConvill, J. and Bagaric, M. (2005). Principles of Contemporary Corporate

Governance. Cambridge University Press.

Putra, L. (2010). The Use Of Analytical Procedures In Auditing. Retrieved 26 April, 2018, from

http://accounting-financial-tax.com/2010/04/the-use-of-analytical-procedures-in-auditing/

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.