ACCT6004 Management Accounting: Costing Concepts and Scenario Analysis

VerifiedAdded on 2023/06/09

|11

|1333

|423

Report

AI Summary

This report analyzes the costing concepts applied to the case of J&B Sports, a sports uniform manufacturer. It begins with an executive summary and introduction, then delves into the categorization of different costs, including variable, fixed, step, and mixed costs, within the business. The report then presents a scenario analysis, calculating operating profit, determining the number of units sold, and projecting profits under different scenarios, such as varying sales volumes and the implementation of an advertising campaign. The analysis includes detailed calculations and recommendations for the firm's financial strategies, concluding with a recommendation to undertake the advertising campaign. The report uses references from various accounting texts and journals to support its findings.

Running Head: Costing Concepts

Cost Management Accounting

Cost Management Accounting

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Costing Concepts 1

Executive summary:

In this report, the case of J&B Sports is being analyzed. The firm is indulged in the business of

manufacturing club soccer uniforms such as jerseys, shorts, socks and jackets. There are different

sort of costs incurred as a part of business. In this report the overall cost is bifurcated among

various categories such as variable cost, fixed cost, step cost and mixed cost. Further, the

analysis of the case has suggested that the firm has sold total of 51975 units in the current year

and has attained a profit of $ 39900.

Executive summary:

In this report, the case of J&B Sports is being analyzed. The firm is indulged in the business of

manufacturing club soccer uniforms such as jerseys, shorts, socks and jackets. There are different

sort of costs incurred as a part of business. In this report the overall cost is bifurcated among

various categories such as variable cost, fixed cost, step cost and mixed cost. Further, the

analysis of the case has suggested that the firm has sold total of 51975 units in the current year

and has attained a profit of $ 39900.

Costing Concepts 2

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Costing Concepts 3

Introduction:

J & B Sports is a sports uniform manufacturing concern. The present case deals with only one

product segment of the firm and i.e. Jerseys. The different scenario cases of sales and costs are

analyzed in the present case.

Part 1

Bifurcation of different costs of the business:

The variable costs are those costs that changes with the change in the level of production units.

In the present case, costs of goods sold and cost of price tags that attached to the Jerseys are

variable costs because of the fact that these costs are easily allocable to each unit manufactured

by the firm (Hansen, Mowen & Guan, 2007). Along with this, the sales commission which is

paid as a certain percentage of sales is also a variable cost as it will vary with the change in the

level of sales quantity of Jerseys. The payroll cost of $ 5000 which is paid on the monthly basis

to the staff of the J&B sports is a fixed amount and it does not change with the change in the

level of production and hence it will be classified as fixed cost (Horngren, 2002). Therefore, the

overall payroll cost must be classified as semi-variable or mixed cost. Further, the rental cost of

credit card processing equipment and website hosting cost is also of fixed nature as it will remain

same irrespective of the quantum of production undertaken by the firm. The inventory insurance

cost of the firm must be classified as the step cost as it will change within the different range of

sales quantity and not with the change in the every single unit (Horngren, 2002).

a) Mixed Cost

Introduction:

J & B Sports is a sports uniform manufacturing concern. The present case deals with only one

product segment of the firm and i.e. Jerseys. The different scenario cases of sales and costs are

analyzed in the present case.

Part 1

Bifurcation of different costs of the business:

The variable costs are those costs that changes with the change in the level of production units.

In the present case, costs of goods sold and cost of price tags that attached to the Jerseys are

variable costs because of the fact that these costs are easily allocable to each unit manufactured

by the firm (Hansen, Mowen & Guan, 2007). Along with this, the sales commission which is

paid as a certain percentage of sales is also a variable cost as it will vary with the change in the

level of sales quantity of Jerseys. The payroll cost of $ 5000 which is paid on the monthly basis

to the staff of the J&B sports is a fixed amount and it does not change with the change in the

level of production and hence it will be classified as fixed cost (Horngren, 2002). Therefore, the

overall payroll cost must be classified as semi-variable or mixed cost. Further, the rental cost of

credit card processing equipment and website hosting cost is also of fixed nature as it will remain

same irrespective of the quantum of production undertaken by the firm. The inventory insurance

cost of the firm must be classified as the step cost as it will change within the different range of

sales quantity and not with the change in the every single unit (Horngren, 2002).

a) Mixed Cost

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Costing Concepts 4

b) Fixed Cost

c) Variable Cost

d) Variable Cost

e) Step Cost

f) Fixed Cost

Part 2): Scenario Analysis

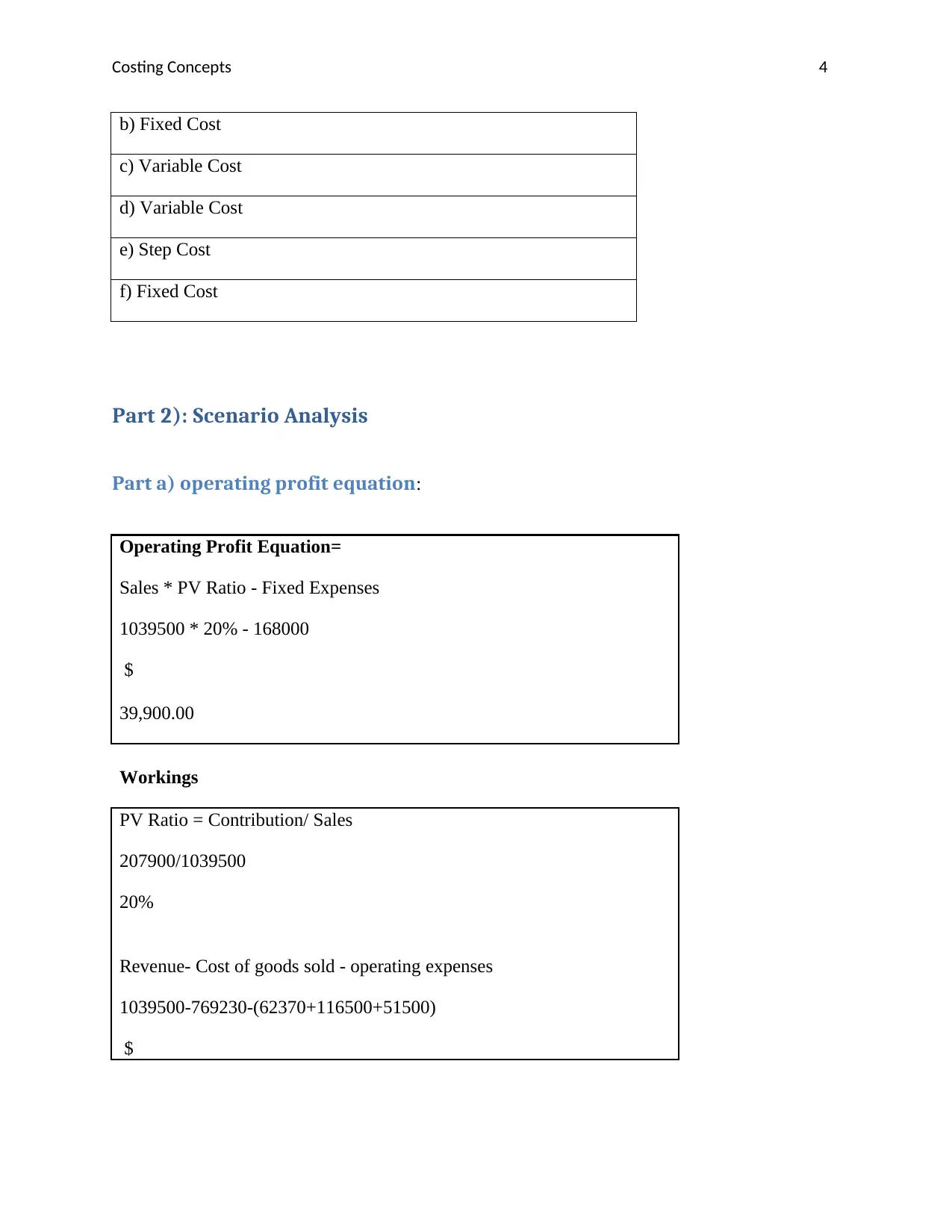

Part a) operating profit equation:

Operating Profit Equation=

Sales * PV Ratio - Fixed Expenses

1039500 * 20% - 168000

$

39,900.00

Workings

PV Ratio = Contribution/ Sales

207900/1039500

20%

Revenue- Cost of goods sold - operating expenses

1039500-769230-(62370+116500+51500)

$

b) Fixed Cost

c) Variable Cost

d) Variable Cost

e) Step Cost

f) Fixed Cost

Part 2): Scenario Analysis

Part a) operating profit equation:

Operating Profit Equation=

Sales * PV Ratio - Fixed Expenses

1039500 * 20% - 168000

$

39,900.00

Workings

PV Ratio = Contribution/ Sales

207900/1039500

20%

Revenue- Cost of goods sold - operating expenses

1039500-769230-(62370+116500+51500)

$

Costing Concepts 5

39,900.00

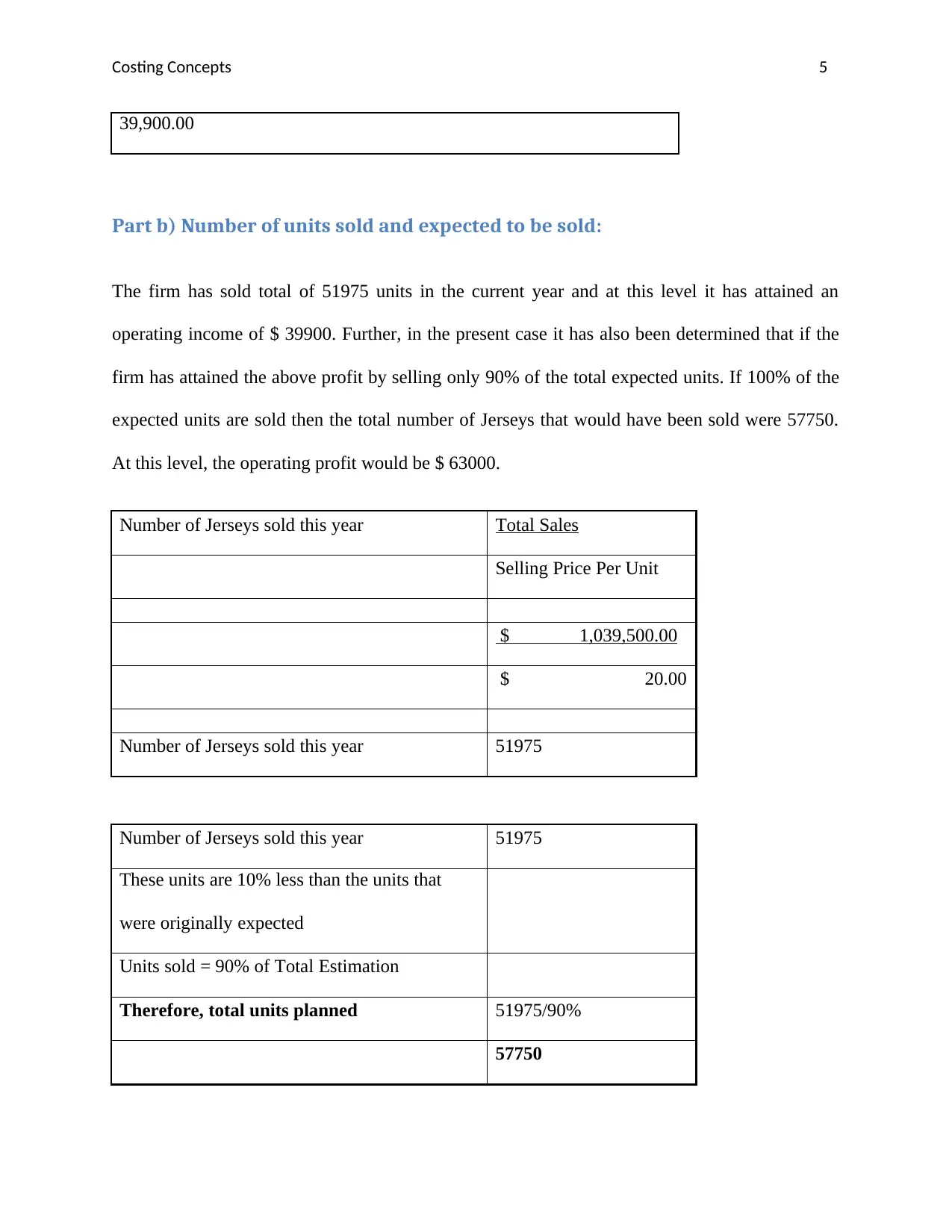

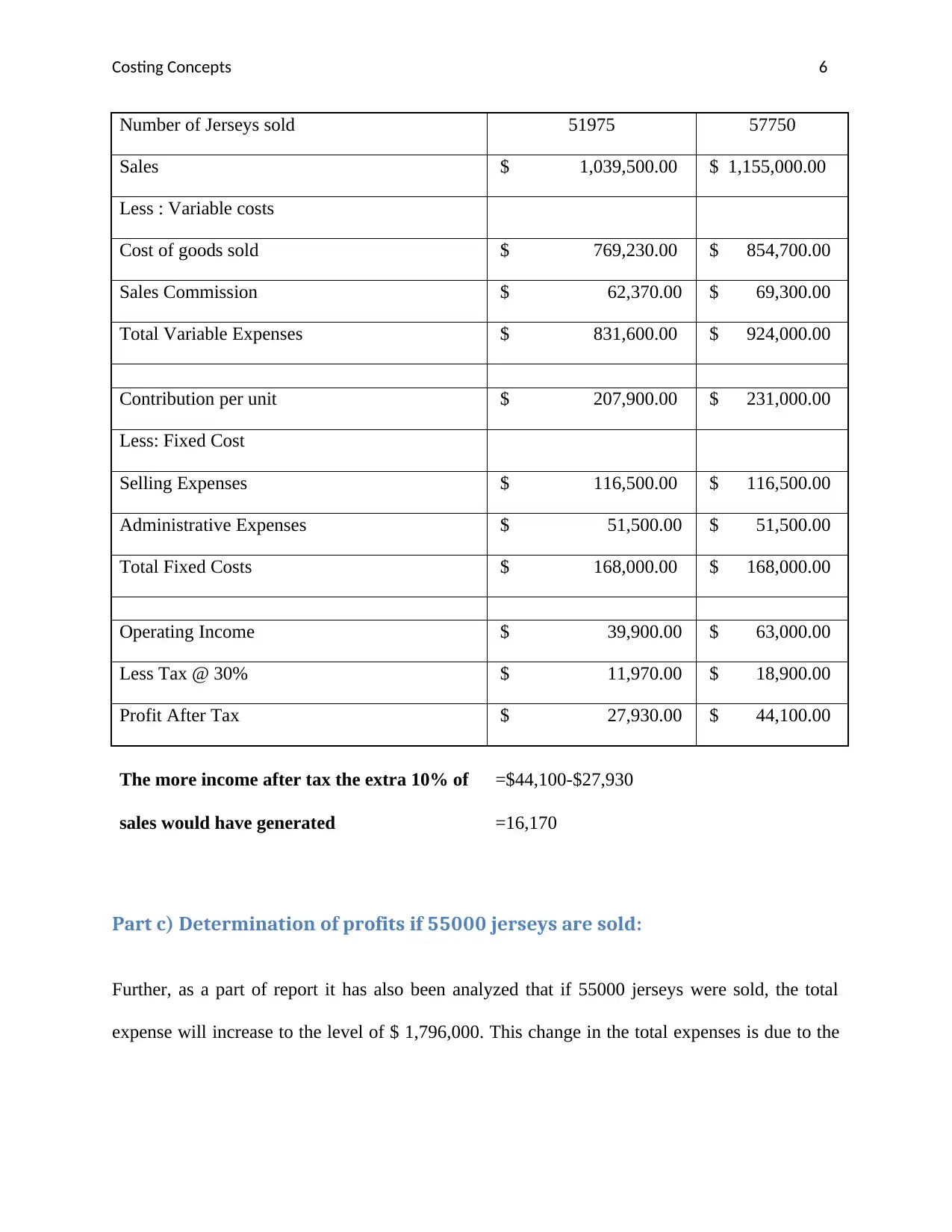

Part b) Number of units sold and expected to be sold:

The firm has sold total of 51975 units in the current year and at this level it has attained an

operating income of $ 39900. Further, in the present case it has also been determined that if the

firm has attained the above profit by selling only 90% of the total expected units. If 100% of the

expected units are sold then the total number of Jerseys that would have been sold were 57750.

At this level, the operating profit would be $ 63000.

Number of Jerseys sold this year Total Sales

Selling Price Per Unit

$ 1,039,500.00

$ 20.00

Number of Jerseys sold this year 51975

Number of Jerseys sold this year 51975

These units are 10% less than the units that

were originally expected

Units sold = 90% of Total Estimation

Therefore, total units planned 51975/90%

57750

39,900.00

Part b) Number of units sold and expected to be sold:

The firm has sold total of 51975 units in the current year and at this level it has attained an

operating income of $ 39900. Further, in the present case it has also been determined that if the

firm has attained the above profit by selling only 90% of the total expected units. If 100% of the

expected units are sold then the total number of Jerseys that would have been sold were 57750.

At this level, the operating profit would be $ 63000.

Number of Jerseys sold this year Total Sales

Selling Price Per Unit

$ 1,039,500.00

$ 20.00

Number of Jerseys sold this year 51975

Number of Jerseys sold this year 51975

These units are 10% less than the units that

were originally expected

Units sold = 90% of Total Estimation

Therefore, total units planned 51975/90%

57750

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Costing Concepts 6

Number of Jerseys sold 51975 57750

Sales $ 1,039,500.00 $ 1,155,000.00

Less : Variable costs

Cost of goods sold $ 769,230.00 $ 854,700.00

Sales Commission $ 62,370.00 $ 69,300.00

Total Variable Expenses $ 831,600.00 $ 924,000.00

Contribution per unit $ 207,900.00 $ 231,000.00

Less: Fixed Cost

Selling Expenses $ 116,500.00 $ 116,500.00

Administrative Expenses $ 51,500.00 $ 51,500.00

Total Fixed Costs $ 168,000.00 $ 168,000.00

Operating Income $ 39,900.00 $ 63,000.00

Less Tax @ 30% $ 11,970.00 $ 18,900.00

Profit After Tax $ 27,930.00 $ 44,100.00

The more income after tax the extra 10% of

sales would have generated

=$44,100-$27,930

=16,170

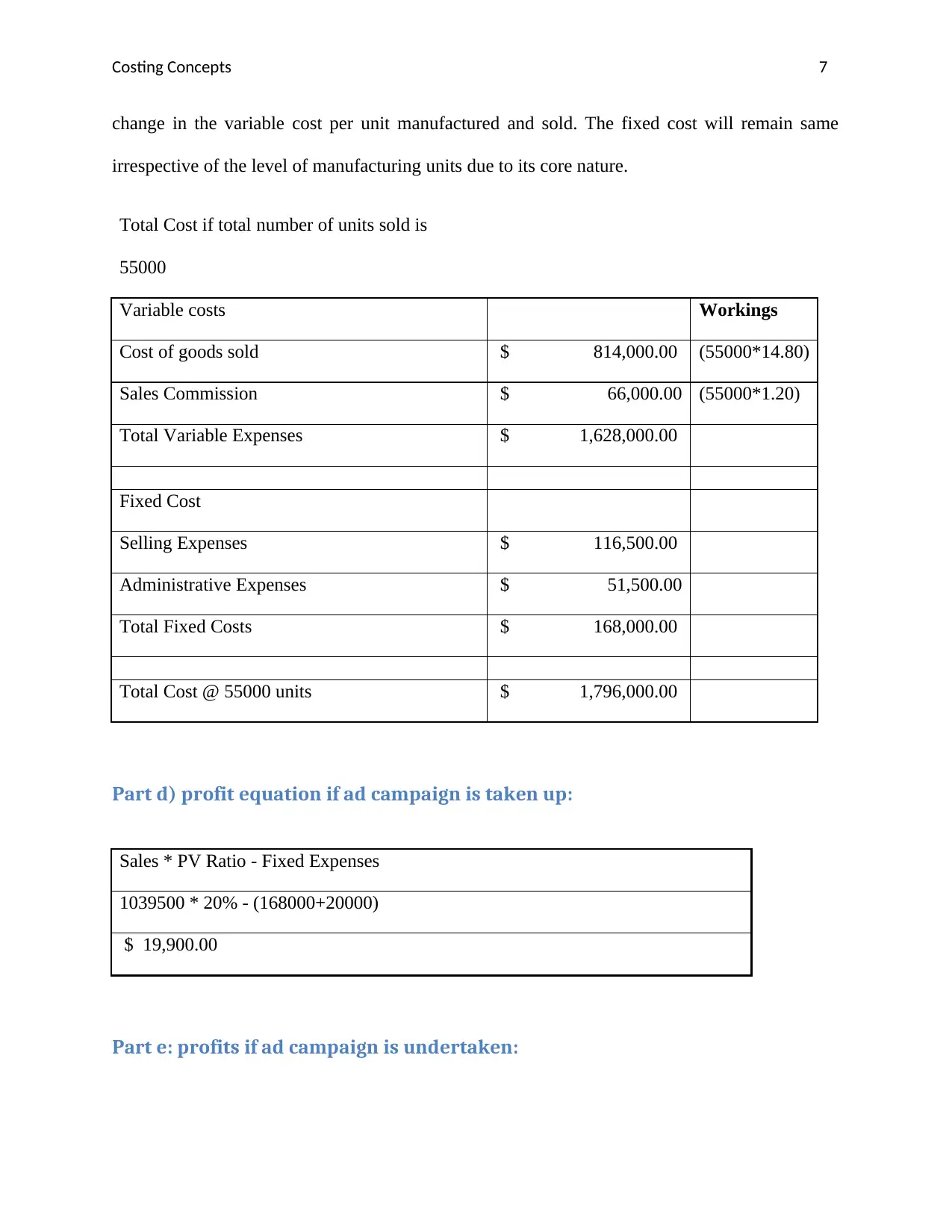

Part c) Determination of profits if 55000 jerseys are sold:

Further, as a part of report it has also been analyzed that if 55000 jerseys were sold, the total

expense will increase to the level of $ 1,796,000. This change in the total expenses is due to the

Number of Jerseys sold 51975 57750

Sales $ 1,039,500.00 $ 1,155,000.00

Less : Variable costs

Cost of goods sold $ 769,230.00 $ 854,700.00

Sales Commission $ 62,370.00 $ 69,300.00

Total Variable Expenses $ 831,600.00 $ 924,000.00

Contribution per unit $ 207,900.00 $ 231,000.00

Less: Fixed Cost

Selling Expenses $ 116,500.00 $ 116,500.00

Administrative Expenses $ 51,500.00 $ 51,500.00

Total Fixed Costs $ 168,000.00 $ 168,000.00

Operating Income $ 39,900.00 $ 63,000.00

Less Tax @ 30% $ 11,970.00 $ 18,900.00

Profit After Tax $ 27,930.00 $ 44,100.00

The more income after tax the extra 10% of

sales would have generated

=$44,100-$27,930

=16,170

Part c) Determination of profits if 55000 jerseys are sold:

Further, as a part of report it has also been analyzed that if 55000 jerseys were sold, the total

expense will increase to the level of $ 1,796,000. This change in the total expenses is due to the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Costing Concepts 7

change in the variable cost per unit manufactured and sold. The fixed cost will remain same

irrespective of the level of manufacturing units due to its core nature.

Total Cost if total number of units sold is

55000

Variable costs Workings

Cost of goods sold $ 814,000.00 (55000*14.80)

Sales Commission $ 66,000.00 (55000*1.20)

Total Variable Expenses $ 1,628,000.00

Fixed Cost

Selling Expenses $ 116,500.00

Administrative Expenses $ 51,500.00

Total Fixed Costs $ 168,000.00

Total Cost @ 55000 units $ 1,796,000.00

Part d) profit equation if ad campaign is taken up:

Sales * PV Ratio - Fixed Expenses

1039500 * 20% - (168000+20000)

$ 19,900.00

Part e: profits if ad campaign is undertaken:

change in the variable cost per unit manufactured and sold. The fixed cost will remain same

irrespective of the level of manufacturing units due to its core nature.

Total Cost if total number of units sold is

55000

Variable costs Workings

Cost of goods sold $ 814,000.00 (55000*14.80)

Sales Commission $ 66,000.00 (55000*1.20)

Total Variable Expenses $ 1,628,000.00

Fixed Cost

Selling Expenses $ 116,500.00

Administrative Expenses $ 51,500.00

Total Fixed Costs $ 168,000.00

Total Cost @ 55000 units $ 1,796,000.00

Part d) profit equation if ad campaign is taken up:

Sales * PV Ratio - Fixed Expenses

1039500 * 20% - (168000+20000)

$ 19,900.00

Part e: profits if ad campaign is undertaken:

Costing Concepts 8

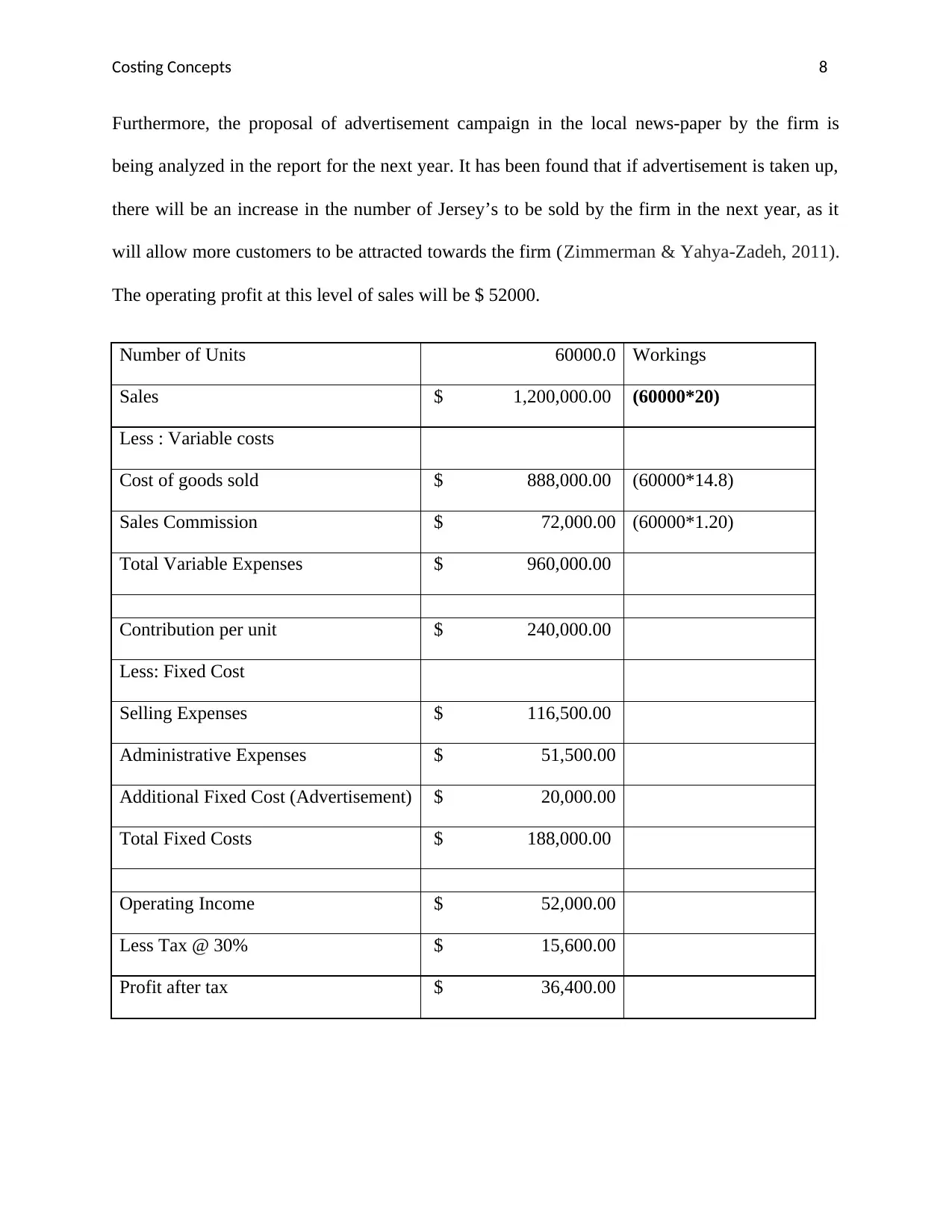

Furthermore, the proposal of advertisement campaign in the local news-paper by the firm is

being analyzed in the report for the next year. It has been found that if advertisement is taken up,

there will be an increase in the number of Jersey’s to be sold by the firm in the next year, as it

will allow more customers to be attracted towards the firm (Zimmerman & Yahya-Zadeh, 2011).

The operating profit at this level of sales will be $ 52000.

Number of Units 60000.0 Workings

Sales $ 1,200,000.00 (60000*20)

Less : Variable costs

Cost of goods sold $ 888,000.00 (60000*14.8)

Sales Commission $ 72,000.00 (60000*1.20)

Total Variable Expenses $ 960,000.00

Contribution per unit $ 240,000.00

Less: Fixed Cost

Selling Expenses $ 116,500.00

Administrative Expenses $ 51,500.00

Additional Fixed Cost (Advertisement) $ 20,000.00

Total Fixed Costs $ 188,000.00

Operating Income $ 52,000.00

Less Tax @ 30% $ 15,600.00

Profit after tax $ 36,400.00

Furthermore, the proposal of advertisement campaign in the local news-paper by the firm is

being analyzed in the report for the next year. It has been found that if advertisement is taken up,

there will be an increase in the number of Jersey’s to be sold by the firm in the next year, as it

will allow more customers to be attracted towards the firm (Zimmerman & Yahya-Zadeh, 2011).

The operating profit at this level of sales will be $ 52000.

Number of Units 60000.0 Workings

Sales $ 1,200,000.00 (60000*20)

Less : Variable costs

Cost of goods sold $ 888,000.00 (60000*14.8)

Sales Commission $ 72,000.00 (60000*1.20)

Total Variable Expenses $ 960,000.00

Contribution per unit $ 240,000.00

Less: Fixed Cost

Selling Expenses $ 116,500.00

Administrative Expenses $ 51,500.00

Additional Fixed Cost (Advertisement) $ 20,000.00

Total Fixed Costs $ 188,000.00

Operating Income $ 52,000.00

Less Tax @ 30% $ 15,600.00

Profit after tax $ 36,400.00

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Costing Concepts 9

Conclusion:

It is recommended to the firm must take up the advertisement campaign as it will increase the

profits after tax by $ 8740 after recovering the cost of advertisement too.

Conclusion:

It is recommended to the firm must take up the advertisement campaign as it will increase the

profits after tax by $ 8740 after recovering the cost of advertisement too.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Costing Concepts 10

References:

Hansen, D., Mowen, M., & Guan, L. (2007). Cost management: accounting and control.

Cengage Learning.

Horngren, C. T., Bhimani, A., Datar, S. M., Foster, G., & Horngren, C. T. (2002). Management

and cost accounting. Harlow: Financial Times/Prentice Hall.

Horngren, C. T., Sundem, G. L., Stratton, W. O., Burgstahler, D., & Schatzberg, J.

(2002). Introduction to Management Accounting: Chapters 1-19. Prentice Hall.

Zimmerman, J. L., & Yahya-Zadeh, M. (2011). Accounting for decision making and

control. Issues in Accounting Education, 26(1), 258-259.

References:

Hansen, D., Mowen, M., & Guan, L. (2007). Cost management: accounting and control.

Cengage Learning.

Horngren, C. T., Bhimani, A., Datar, S. M., Foster, G., & Horngren, C. T. (2002). Management

and cost accounting. Harlow: Financial Times/Prentice Hall.

Horngren, C. T., Sundem, G. L., Stratton, W. O., Burgstahler, D., & Schatzberg, J.

(2002). Introduction to Management Accounting: Chapters 1-19. Prentice Hall.

Zimmerman, J. L., & Yahya-Zadeh, M. (2011). Accounting for decision making and

control. Issues in Accounting Education, 26(1), 258-259.

1 out of 11

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.