Comparison of Managerial Accounting Techniques

VerifiedAdded on 2022/12/30

|9

|1561

|1

AI Summary

This report compares and contrasts different types of managerial accounting techniques such as job order costing, process costing, activity-based costing, marginal costing, and target costing. It discusses the definition, application, and characteristics of each method, as well as their advantages and disadvantages. The report also provides examples and calculations to illustrate how each method is used in practice. Overall, it highlights the importance of cost calculation in determining profits and expenses for businesses.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

COSTING ESSAY

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Table of Contents

INTRODUCTION................................................................................................................................3

MAIN BODY.......................................................................................................................................3

Comparison and contrast differences types of managerial accounting techniques..........................3

CONCLUSION....................................................................................................................................8

REFERENCES.....................................................................................................................................9

INTRODUCTION................................................................................................................................3

MAIN BODY.......................................................................................................................................3

Comparison and contrast differences types of managerial accounting techniques..........................3

CONCLUSION....................................................................................................................................8

REFERENCES.....................................................................................................................................9

INTRODUCTION

Costing is branch of accounting which is used by personal to recognize cost of each process

of running their business activity. This report has been formulated to difference various methods

used by cost accountant through which they can calculate or measure cost required for operating

business. This report also differentiate and compare job order costing, process, marginal and target

costing in systematic way.

MAIN BODY

Comparison and contrast differences types of managerial accounting techniques.

Costing: This term is define as tool or systematic procedure which help in determine cost of

each business operation. There are various methods which use by cost accountant for calculate and

allocate theses cost on the basis of requirement of departments. Following are methods which

define below:

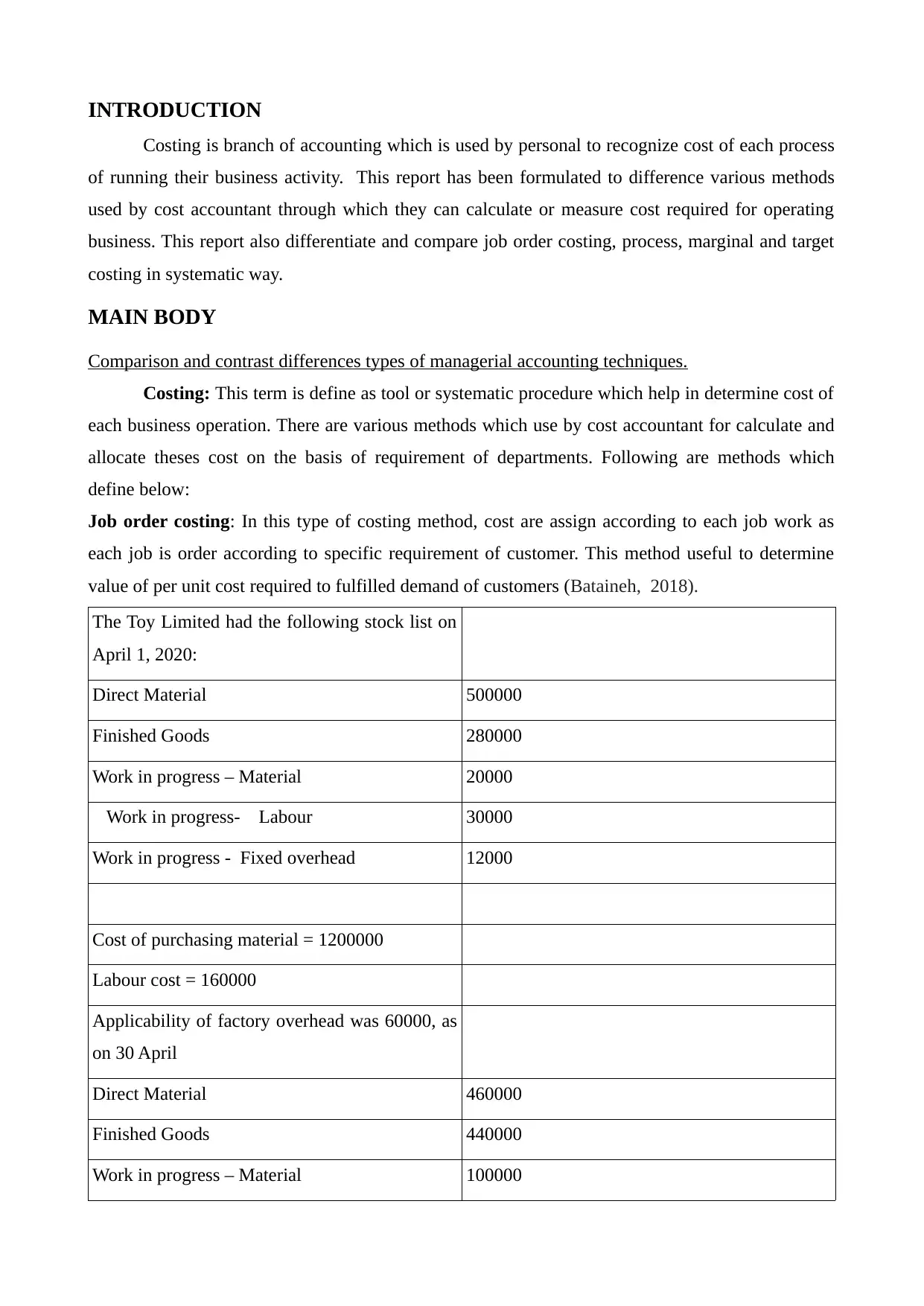

Job order costing: In this type of costing method, cost are assign according to each job work as

each job is order according to specific requirement of customer. This method useful to determine

value of per unit cost required to fulfilled demand of customers (Bataineh, 2018).

The Toy Limited had the following stock list on

April 1, 2020:

Direct Material 500000

Finished Goods 280000

Work in progress – Material 20000

Work in progress- Labour 30000

Work in progress - Fixed overhead 12000

Cost of purchasing material = 1200000

Labour cost = 160000

Applicability of factory overhead was 60000, as

on 30 April

Direct Material 460000

Finished Goods 440000

Work in progress – Material 100000

Costing is branch of accounting which is used by personal to recognize cost of each process

of running their business activity. This report has been formulated to difference various methods

used by cost accountant through which they can calculate or measure cost required for operating

business. This report also differentiate and compare job order costing, process, marginal and target

costing in systematic way.

MAIN BODY

Comparison and contrast differences types of managerial accounting techniques.

Costing: This term is define as tool or systematic procedure which help in determine cost of

each business operation. There are various methods which use by cost accountant for calculate and

allocate theses cost on the basis of requirement of departments. Following are methods which

define below:

Job order costing: In this type of costing method, cost are assign according to each job work as

each job is order according to specific requirement of customer. This method useful to determine

value of per unit cost required to fulfilled demand of customers (Bataineh, 2018).

The Toy Limited had the following stock list on

April 1, 2020:

Direct Material 500000

Finished Goods 280000

Work in progress – Material 20000

Work in progress- Labour 30000

Work in progress - Fixed overhead 12000

Cost of purchasing material = 1200000

Labour cost = 160000

Applicability of factory overhead was 60000, as

on 30 April

Direct Material 460000

Finished Goods 440000

Work in progress – Material 100000

Work in progress- Labour 180000

Work in progress - Fixed overhead 80000

Calculate cost of placing job

Statement of Job Costing

WIP – Raw material 1240000

Labour cost = 1600000

Fixed overhead 600000

Finished Goods 3520000

Cost of goods sold 6960000

Process costing: This method is also known as continuous costing method. In this cost are assign

for large size of products. It is used to assign indirect and direct cost in manufacturing industries.

This method is used to calculate cost of each process of converting raw materiel into finished goods

(Defourny and et.al.2019).

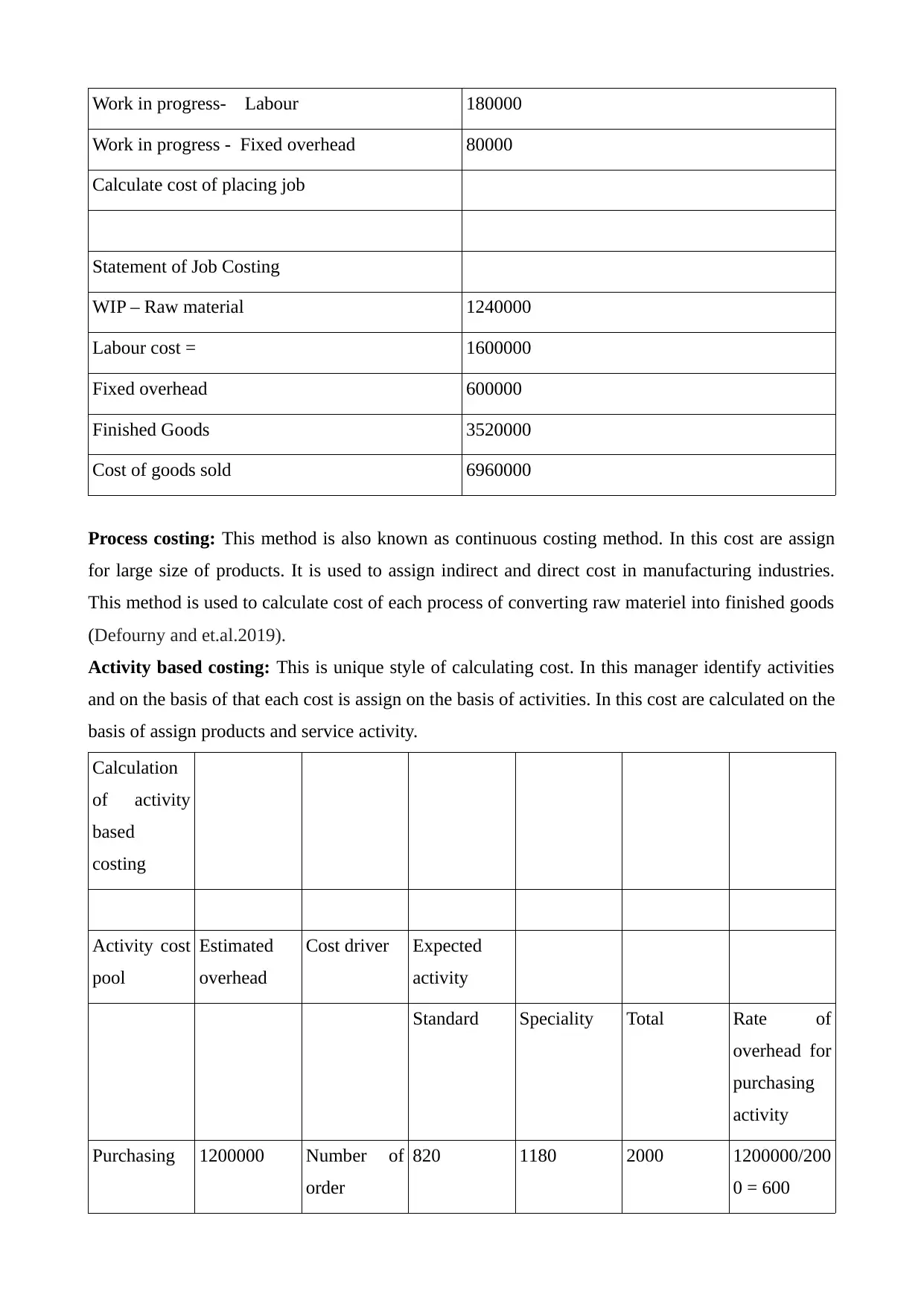

Activity based costing: This is unique style of calculating cost. In this manager identify activities

and on the basis of that each cost is assign on the basis of activities. In this cost are calculated on the

basis of assign products and service activity.

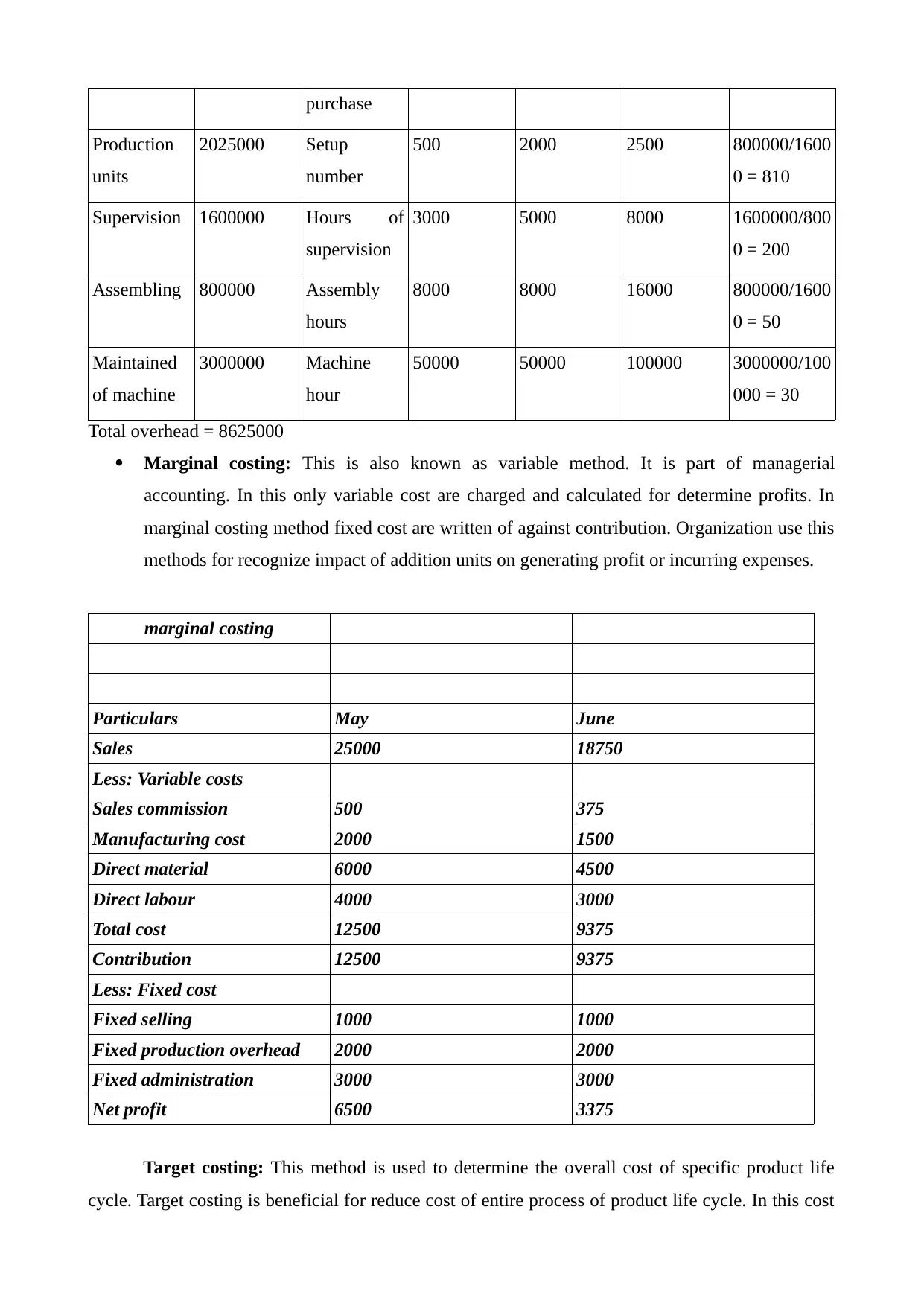

Calculation

of activity

based

costing

Activity cost

pool

Estimated

overhead

Cost driver Expected

activity

Standard Speciality Total Rate of

overhead for

purchasing

activity

Purchasing 1200000 Number of

order

820 1180 2000 1200000/200

0 = 600

Work in progress - Fixed overhead 80000

Calculate cost of placing job

Statement of Job Costing

WIP – Raw material 1240000

Labour cost = 1600000

Fixed overhead 600000

Finished Goods 3520000

Cost of goods sold 6960000

Process costing: This method is also known as continuous costing method. In this cost are assign

for large size of products. It is used to assign indirect and direct cost in manufacturing industries.

This method is used to calculate cost of each process of converting raw materiel into finished goods

(Defourny and et.al.2019).

Activity based costing: This is unique style of calculating cost. In this manager identify activities

and on the basis of that each cost is assign on the basis of activities. In this cost are calculated on the

basis of assign products and service activity.

Calculation

of activity

based

costing

Activity cost

pool

Estimated

overhead

Cost driver Expected

activity

Standard Speciality Total Rate of

overhead for

purchasing

activity

Purchasing 1200000 Number of

order

820 1180 2000 1200000/200

0 = 600

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

purchase

Production

units

2025000 Setup

number

500 2000 2500 800000/1600

0 = 810

Supervision 1600000 Hours of

supervision

3000 5000 8000 1600000/800

0 = 200

Assembling 800000 Assembly

hours

8000 8000 16000 800000/1600

0 = 50

Maintained

of machine

3000000 Machine

hour

50000 50000 100000 3000000/100

000 = 30

Total overhead = 8625000

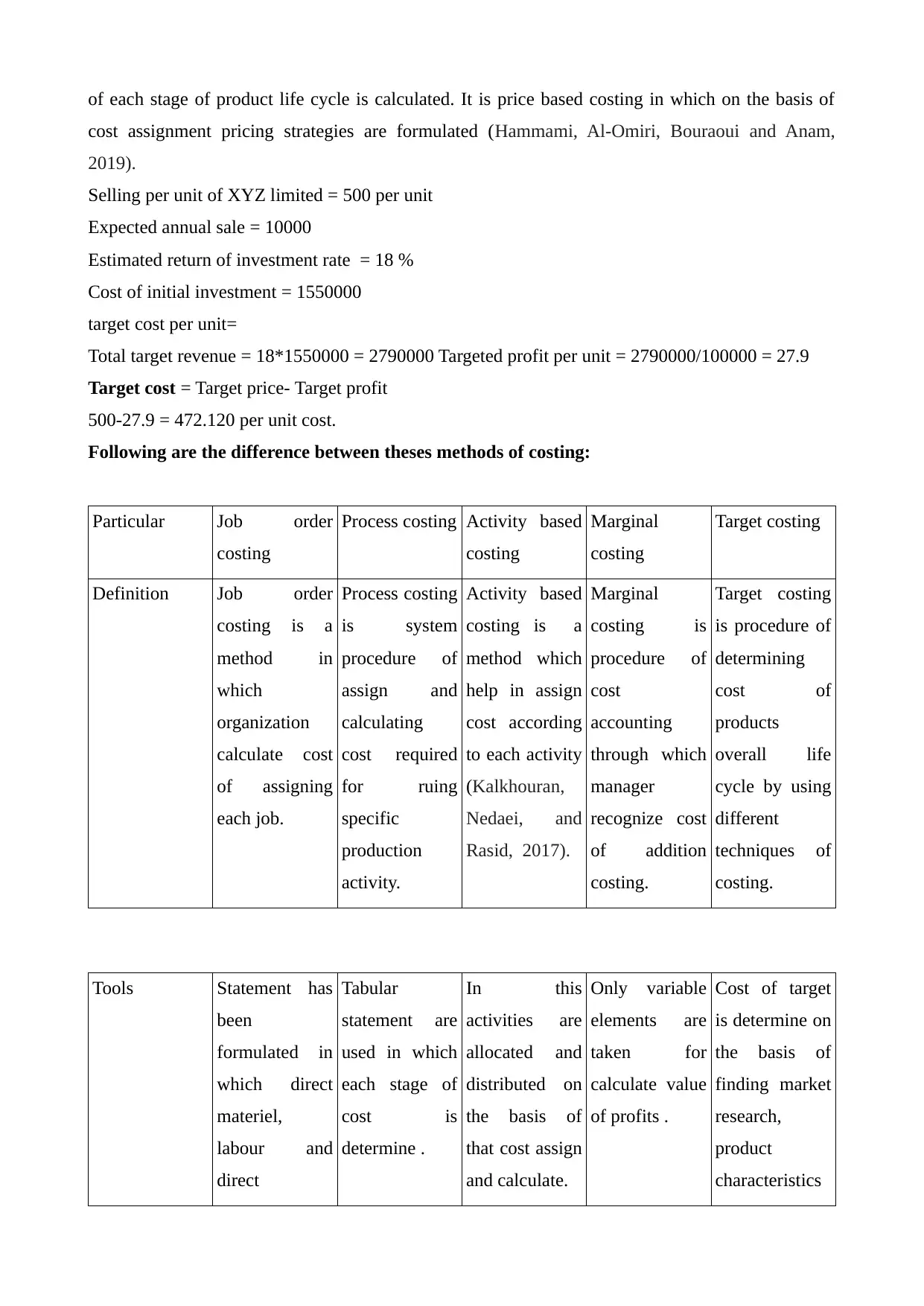

Marginal costing: This is also known as variable method. It is part of managerial

accounting. In this only variable cost are charged and calculated for determine profits. In

marginal costing method fixed cost are written of against contribution. Organization use this

methods for recognize impact of addition units on generating profit or incurring expenses.

marginal costing

Particulars May June

Sales 25000 18750

Less: Variable costs

Sales commission 500 375

Manufacturing cost 2000 1500

Direct material 6000 4500

Direct labour 4000 3000

Total cost 12500 9375

Contribution 12500 9375

Less: Fixed cost

Fixed selling 1000 1000

Fixed production overhead 2000 2000

Fixed administration 3000 3000

Net profit 6500 3375

Target costing: This method is used to determine the overall cost of specific product life

cycle. Target costing is beneficial for reduce cost of entire process of product life cycle. In this cost

Production

units

2025000 Setup

number

500 2000 2500 800000/1600

0 = 810

Supervision 1600000 Hours of

supervision

3000 5000 8000 1600000/800

0 = 200

Assembling 800000 Assembly

hours

8000 8000 16000 800000/1600

0 = 50

Maintained

of machine

3000000 Machine

hour

50000 50000 100000 3000000/100

000 = 30

Total overhead = 8625000

Marginal costing: This is also known as variable method. It is part of managerial

accounting. In this only variable cost are charged and calculated for determine profits. In

marginal costing method fixed cost are written of against contribution. Organization use this

methods for recognize impact of addition units on generating profit or incurring expenses.

marginal costing

Particulars May June

Sales 25000 18750

Less: Variable costs

Sales commission 500 375

Manufacturing cost 2000 1500

Direct material 6000 4500

Direct labour 4000 3000

Total cost 12500 9375

Contribution 12500 9375

Less: Fixed cost

Fixed selling 1000 1000

Fixed production overhead 2000 2000

Fixed administration 3000 3000

Net profit 6500 3375

Target costing: This method is used to determine the overall cost of specific product life

cycle. Target costing is beneficial for reduce cost of entire process of product life cycle. In this cost

of each stage of product life cycle is calculated. It is price based costing in which on the basis of

cost assignment pricing strategies are formulated (Hammami, Al-Omiri, Bouraoui and Anam,

2019).

Selling per unit of XYZ limited = 500 per unit

Expected annual sale = 10000

Estimated return of investment rate = 18 %

Cost of initial investment = 1550000

target cost per unit=

Total target revenue = 18*1550000 = 2790000 Targeted profit per unit = 2790000/100000 = 27.9

Target cost = Target price- Target profit

500-27.9 = 472.120 per unit cost.

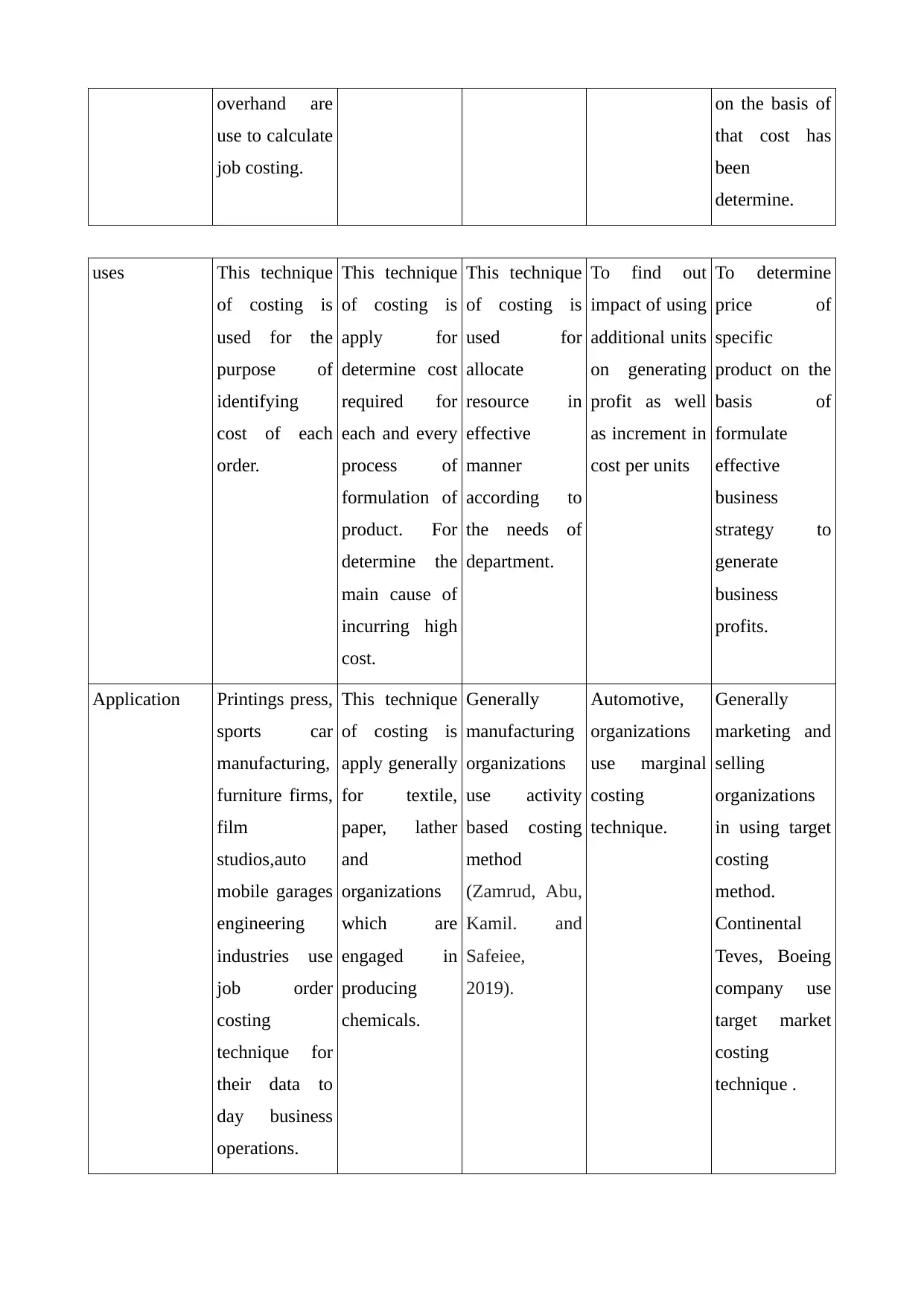

Following are the difference between theses methods of costing:

Particular Job order

costing

Process costing Activity based

costing

Marginal

costing

Target costing

Definition Job order

costing is a

method in

which

organization

calculate cost

of assigning

each job.

Process costing

is system

procedure of

assign and

calculating

cost required

for ruing

specific

production

activity.

Activity based

costing is a

method which

help in assign

cost according

to each activity

(Kalkhouran,

Nedaei, and

Rasid, 2017).

Marginal

costing is

procedure of

cost

accounting

through which

manager

recognize cost

of addition

costing.

Target costing

is procedure of

determining

cost of

products

overall life

cycle by using

different

techniques of

costing.

Tools Statement has

been

formulated in

which direct

materiel,

labour and

direct

Tabular

statement are

used in which

each stage of

cost is

determine .

In this

activities are

allocated and

distributed on

the basis of

that cost assign

and calculate.

Only variable

elements are

taken for

calculate value

of profits .

Cost of target

is determine on

the basis of

finding market

research,

product

characteristics

cost assignment pricing strategies are formulated (Hammami, Al-Omiri, Bouraoui and Anam,

2019).

Selling per unit of XYZ limited = 500 per unit

Expected annual sale = 10000

Estimated return of investment rate = 18 %

Cost of initial investment = 1550000

target cost per unit=

Total target revenue = 18*1550000 = 2790000 Targeted profit per unit = 2790000/100000 = 27.9

Target cost = Target price- Target profit

500-27.9 = 472.120 per unit cost.

Following are the difference between theses methods of costing:

Particular Job order

costing

Process costing Activity based

costing

Marginal

costing

Target costing

Definition Job order

costing is a

method in

which

organization

calculate cost

of assigning

each job.

Process costing

is system

procedure of

assign and

calculating

cost required

for ruing

specific

production

activity.

Activity based

costing is a

method which

help in assign

cost according

to each activity

(Kalkhouran,

Nedaei, and

Rasid, 2017).

Marginal

costing is

procedure of

cost

accounting

through which

manager

recognize cost

of addition

costing.

Target costing

is procedure of

determining

cost of

products

overall life

cycle by using

different

techniques of

costing.

Tools Statement has

been

formulated in

which direct

materiel,

labour and

direct

Tabular

statement are

used in which

each stage of

cost is

determine .

In this

activities are

allocated and

distributed on

the basis of

that cost assign

and calculate.

Only variable

elements are

taken for

calculate value

of profits .

Cost of target

is determine on

the basis of

finding market

research,

product

characteristics

overhand are

use to calculate

job costing.

on the basis of

that cost has

been

determine.

uses This technique

of costing is

used for the

purpose of

identifying

cost of each

order.

This technique

of costing is

apply for

determine cost

required for

each and every

process of

formulation of

product. For

determine the

main cause of

incurring high

cost.

This technique

of costing is

used for

allocate

resource in

effective

manner

according to

the needs of

department.

To find out

impact of using

additional units

on generating

profit as well

as increment in

cost per units

To determine

price of

specific

product on the

basis of

formulate

effective

business

strategy to

generate

business

profits.

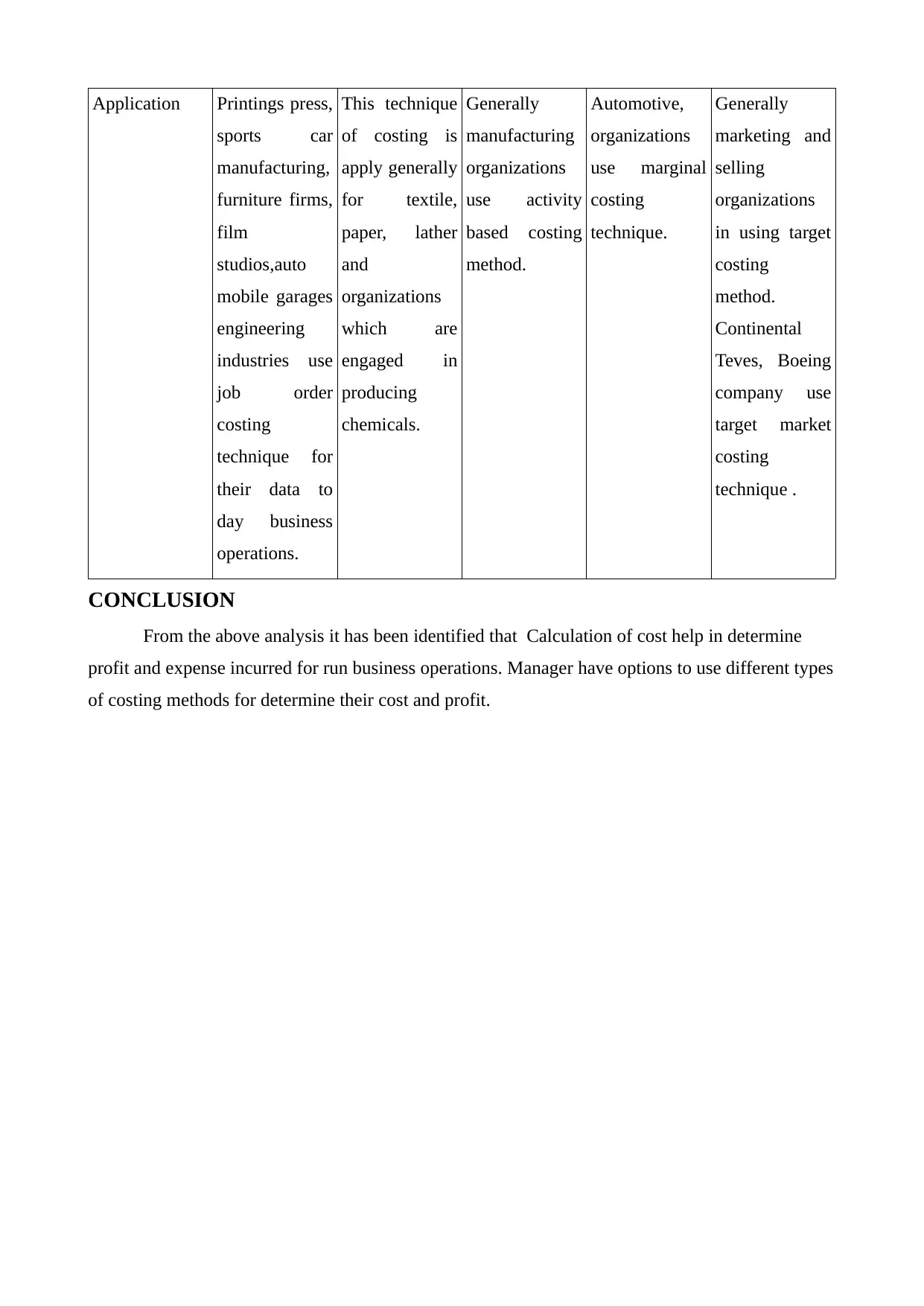

Application Printings press,

sports car

manufacturing,

furniture firms,

film

studios,auto

mobile garages

engineering

industries use

job order

costing

technique for

their data to

day business

operations.

This technique

of costing is

apply generally

for textile,

paper, lather

and

organizations

which are

engaged in

producing

chemicals.

Generally

manufacturing

organizations

use activity

based costing

method

(Zamrud, Abu,

Kamil. and

Safeiee,

2019).

Automotive,

organizations

use marginal

costing

technique.

Generally

marketing and

selling

organizations

in using target

costing

method.

Continental

Teves, Boeing

company use

target market

costing

technique .

use to calculate

job costing.

on the basis of

that cost has

been

determine.

uses This technique

of costing is

used for the

purpose of

identifying

cost of each

order.

This technique

of costing is

apply for

determine cost

required for

each and every

process of

formulation of

product. For

determine the

main cause of

incurring high

cost.

This technique

of costing is

used for

allocate

resource in

effective

manner

according to

the needs of

department.

To find out

impact of using

additional units

on generating

profit as well

as increment in

cost per units

To determine

price of

specific

product on the

basis of

formulate

effective

business

strategy to

generate

business

profits.

Application Printings press,

sports car

manufacturing,

furniture firms,

film

studios,auto

mobile garages

engineering

industries use

job order

costing

technique for

their data to

day business

operations.

This technique

of costing is

apply generally

for textile,

paper, lather

and

organizations

which are

engaged in

producing

chemicals.

Generally

manufacturing

organizations

use activity

based costing

method

(Zamrud, Abu,

Kamil. and

Safeiee,

2019).

Automotive,

organizations

use marginal

costing

technique.

Generally

marketing and

selling

organizations

in using target

costing

method.

Continental

Teves, Boeing

company use

target market

costing

technique .

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Application Printings press,

sports car

manufacturing,

furniture firms,

film

studios,auto

mobile garages

engineering

industries use

job order

costing

technique for

their data to

day business

operations.

This technique

of costing is

apply generally

for textile,

paper, lather

and

organizations

which are

engaged in

producing

chemicals.

Generally

manufacturing

organizations

use activity

based costing

method.

Automotive,

organizations

use marginal

costing

technique.

Generally

marketing and

selling

organizations

in using target

costing

method.

Continental

Teves, Boeing

company use

target market

costing

technique .

CONCLUSION

From the above analysis it has been identified that Calculation of cost help in determine

profit and expense incurred for run business operations. Manager have options to use different types

of costing methods for determine their cost and profit.

sports car

manufacturing,

furniture firms,

film

studios,auto

mobile garages

engineering

industries use

job order

costing

technique for

their data to

day business

operations.

This technique

of costing is

apply generally

for textile,

paper, lather

and

organizations

which are

engaged in

producing

chemicals.

Generally

manufacturing

organizations

use activity

based costing

method.

Automotive,

organizations

use marginal

costing

technique.

Generally

marketing and

selling

organizations

in using target

costing

method.

Continental

Teves, Boeing

company use

target market

costing

technique .

CONCLUSION

From the above analysis it has been identified that Calculation of cost help in determine

profit and expense incurred for run business operations. Manager have options to use different types

of costing methods for determine their cost and profit.

REFERENCES

Books and journals

Bataineh, A., 2018. Applicability of activity-based costing in the Jordanian hospitality

industry. International Journal of Economics and Business Research,15(4). pp.475-489.

Defourny, et.al. 2019. National costs and resource requirements of external beam radiotherapy: A

time-driven activity-based costing model from the ESTRO-HERO project. Radiotherapy

and Oncology, 138. pp.187-194.

Hammami, H., Al-Omiri, M., Bouraoui, T. and Anam, O.A., 2019. TARGET COSTING:

ADOPTION AND ITS RELATIONSHIPS WITH COMPETITION INTENSITY,

INTENDED STRATEGY AND FIRM SIZE. Asia-Pacific Management Accounting

Journal.14(3). pp.223-250.

Kalkhouran, A. A., Nedaei, B.H. and Rasid, S.Z.A., 2017. An exploratory investigation of an

integrated model of costing practices in small and medium-sized enterprises. International

Journal of Managerial and Financial Accounting, 9(4). pp.338-360.

Zamrud, N. F., Abu, M. Y., Kamil, N. N. N. M. and Safeiee, F. L. M., 2019, August. A comparative

study of product costing by using activity-based costing (ABC) and time-driven activity-

based costing (TDABC) method. In Proceedings of the International Manufacturing

Engineering Conference & The Asia Pacific Conference on Manufacturing Systems (pp.

171-178). Springer, Singapore.

Books and journals

Bataineh, A., 2018. Applicability of activity-based costing in the Jordanian hospitality

industry. International Journal of Economics and Business Research,15(4). pp.475-489.

Defourny, et.al. 2019. National costs and resource requirements of external beam radiotherapy: A

time-driven activity-based costing model from the ESTRO-HERO project. Radiotherapy

and Oncology, 138. pp.187-194.

Hammami, H., Al-Omiri, M., Bouraoui, T. and Anam, O.A., 2019. TARGET COSTING:

ADOPTION AND ITS RELATIONSHIPS WITH COMPETITION INTENSITY,

INTENDED STRATEGY AND FIRM SIZE. Asia-Pacific Management Accounting

Journal.14(3). pp.223-250.

Kalkhouran, A. A., Nedaei, B.H. and Rasid, S.Z.A., 2017. An exploratory investigation of an

integrated model of costing practices in small and medium-sized enterprises. International

Journal of Managerial and Financial Accounting, 9(4). pp.338-360.

Zamrud, N. F., Abu, M. Y., Kamil, N. N. N. M. and Safeiee, F. L. M., 2019, August. A comparative

study of product costing by using activity-based costing (ABC) and time-driven activity-

based costing (TDABC) method. In Proceedings of the International Manufacturing

Engineering Conference & The Asia Pacific Conference on Manufacturing Systems (pp.

171-178). Springer, Singapore.

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.