CRM Strategies for Growth: Analyzing Sampath Bank PLC Performance

VerifiedAdded on 2023/05/29

|33

|7714

|78

Report

AI Summary

This report provides an in-depth analysis of Sampath Bank PLC (SBPLC), focusing on the impact of Customer Relationship Management (CRM) on its growth, the influence of macro environmental factors (political and technological), and its approach to disruptive innovation. The report begins with an overview of SBPLC's background, including its size, products, services, customer base, and key competitors. It then examines how political instability and technological advancements have affected SBPLC, particularly in terms of non-performing assets and digital banking strategies. Furthermore, the report assesses SBPLC's innovation strategies, comparing them with competitors like Commercial Bank PLC, and evaluates the risks and impacts of various disruptive innovations. The report also includes an innovation audit analyzing culture, agility, skills, leadership, and resources for increasing competitive advantage through CRM, highlighting the need for improved research and development and decentralized decision-making.

0 | P a g e

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1 | P a g e

2 | P a g e

WORD COUNT – A1 – 2 PAGES

A2 & A3 - 1242

WORD COUNT – A1 – 2 PAGES

A2 & A3 - 1242

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3 | P a g e

Task 1 A - Organization Background

1. A.1 Organization Name: Sampath Bank PLC (SBPLC)

1. A.2 Organization Type

SBPLC is a privately owned commercial bank that is rapidly expanding. It’s a

public limited company that is listed in Colombo Stock Exchange. SBPLC was established in 1986 under the

Company Act No.30 of 1988.Furthermore, SBPLC was re-registered in accordance with companies act No.7 of

2007.

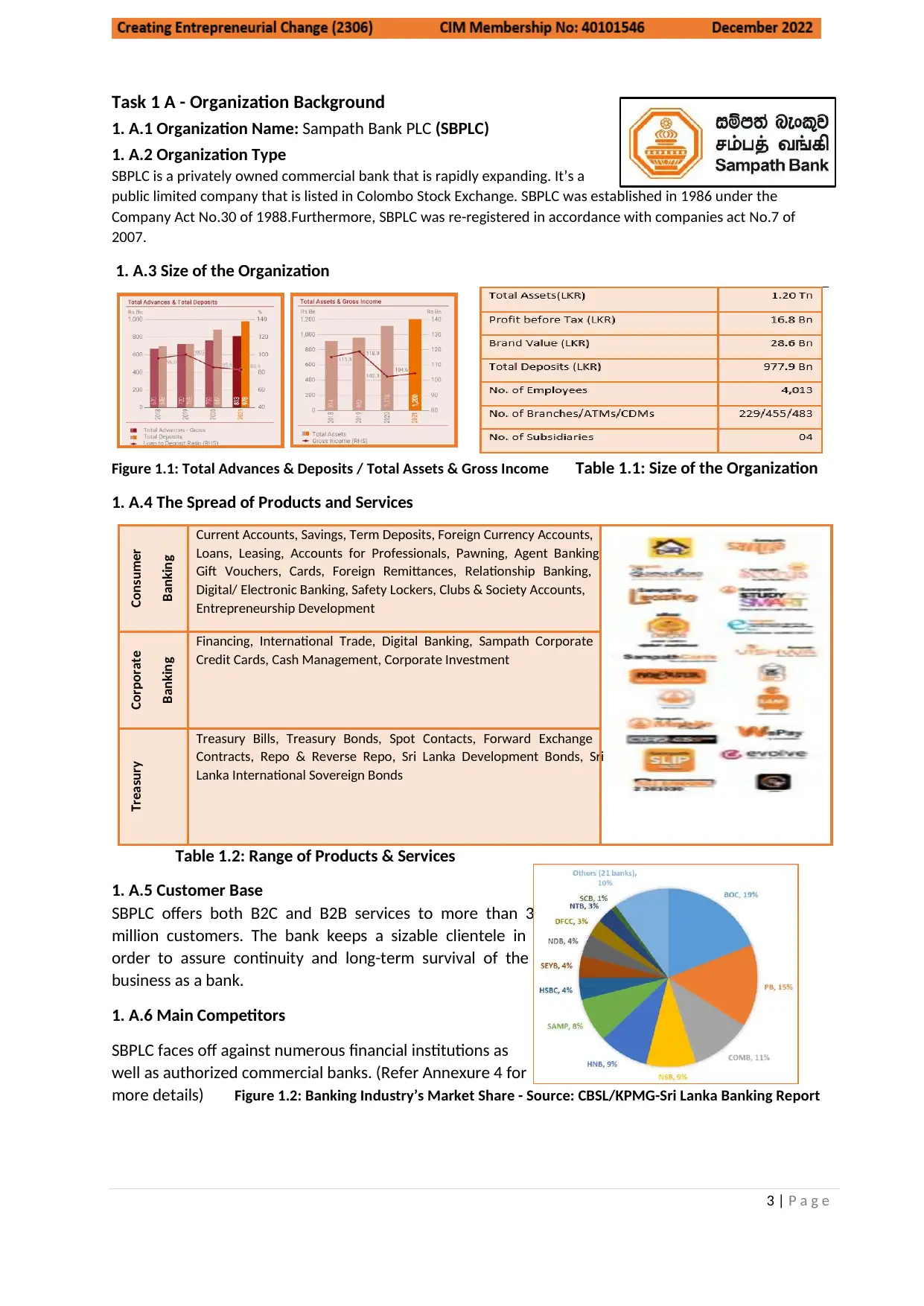

1. A.3 Size of the Organization

Figure 1.1: Total Advances & Deposits / Total Assets & Gross Income Table 1.1: Size of the Organization

1. A.4 The Spread of Products and Services

Table 1.2: Range of Products & Services

1. A.5 Customer Base

SBPLC offers both B2C and B2B services to more than 3

million customers. The bank keeps a sizable clientele in

order to assure continuity and long-term survival of the

business as a bank.

1. A.6 Main Competitors

SBPLC faces off against numerous financial institutions as

well as authorized commercial banks. (Refer Annexure 4 for

more details) Figure 1.2: Banking Industry’s Market Share - Source: CBSL/KPMG-Sri Lanka Banking Report

Consumer

Banking

Current Accounts, Savings, Term Deposits, Foreign Currency Accounts,

Loans, Leasing, Accounts for Professionals, Pawning, Agent Banking,

Gift Vouchers, Cards, Foreign Remittances, Relationship Banking,

Digital/ Electronic Banking, Safety Lockers, Clubs & Society Accounts,

Entrepreneurship Development

Corporate

Banking Financing, International Trade, Digital Banking, Sampath Corporate

Credit Cards, Cash Management, Corporate Investment

Treasury

Treasury Bills, Treasury Bonds, Spot Contacts, Forward Exchange

Contracts, Repo & Reverse Repo, Sri Lanka Development Bonds, Sri

Lanka International Sovereign Bonds

Task 1 A - Organization Background

1. A.1 Organization Name: Sampath Bank PLC (SBPLC)

1. A.2 Organization Type

SBPLC is a privately owned commercial bank that is rapidly expanding. It’s a

public limited company that is listed in Colombo Stock Exchange. SBPLC was established in 1986 under the

Company Act No.30 of 1988.Furthermore, SBPLC was re-registered in accordance with companies act No.7 of

2007.

1. A.3 Size of the Organization

Figure 1.1: Total Advances & Deposits / Total Assets & Gross Income Table 1.1: Size of the Organization

1. A.4 The Spread of Products and Services

Table 1.2: Range of Products & Services

1. A.5 Customer Base

SBPLC offers both B2C and B2B services to more than 3

million customers. The bank keeps a sizable clientele in

order to assure continuity and long-term survival of the

business as a bank.

1. A.6 Main Competitors

SBPLC faces off against numerous financial institutions as

well as authorized commercial banks. (Refer Annexure 4 for

more details) Figure 1.2: Banking Industry’s Market Share - Source: CBSL/KPMG-Sri Lanka Banking Report

Consumer

Banking

Current Accounts, Savings, Term Deposits, Foreign Currency Accounts,

Loans, Leasing, Accounts for Professionals, Pawning, Agent Banking,

Gift Vouchers, Cards, Foreign Remittances, Relationship Banking,

Digital/ Electronic Banking, Safety Lockers, Clubs & Society Accounts,

Entrepreneurship Development

Corporate

Banking Financing, International Trade, Digital Banking, Sampath Corporate

Credit Cards, Cash Management, Corporate Investment

Treasury

Treasury Bills, Treasury Bonds, Spot Contacts, Forward Exchange

Contracts, Repo & Reverse Repo, Sri Lanka Development Bonds, Sri

Lanka International Sovereign Bonds

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4 | P a g e

Table 1.4: Key Stakeholders

1. A.7 Key Stakeholders

An important factor affecting a bank's growth rate and stability is establishing solid relationships with all

of the important stakeholders connected to the bank. According to Mendelow's Theory (1991), a bank's

stakeholders can directly affect its operations at both low and high levels of interest and power.

1. A.8 Key Customer Segment

SBPLC is mainly focusing on the retail banking sector which is low-cost and highly profitable. Whereas the

other corporate sector can be defined as highly demanded and high cost to maintain. Hence this study

will be focusing on the retail customer segment. This segmentation was done based on the share of wallet

or how often they are doing business with the bank.

1. A.9 Theme Chosen & Rationale for Choice

ACHIEVEING GROWTH BY EFFECTIVE CUSTOMER RELATIONSHIP MANAGEMENT

In the private sector for the past two decades, SBPLC has been competing with the top three commercial

banks thanks to its highly regarded and distinctive customer service standards. Customer Relationship

Management (CRM) is essential for gaining a competitive edge in the banking and financial sector because

the primary services, interest rates, and loan rates are similar and also regulated by the Central Bank. As

a result, SBPLC must focus on Fintech innovations like virtual assistants, AI Chatbots, and Biometric

Identifications to capture the clients that are being lost as a result of the celebration by offering superior

customer relationship management to the existing and potential important customers. Customer

relationship management is still at the core of how customers are seen (Bernd Schmitt & Lia

Zarantonello,2013). Since the SBPLC has already impacted how customers perceive businesses,

Key Benefits

Boost profitability by increasing more customer involvement

Continuous Customer Acquisition

Improve Customer Loyalty Plus retention

Lower Cost on Marketing

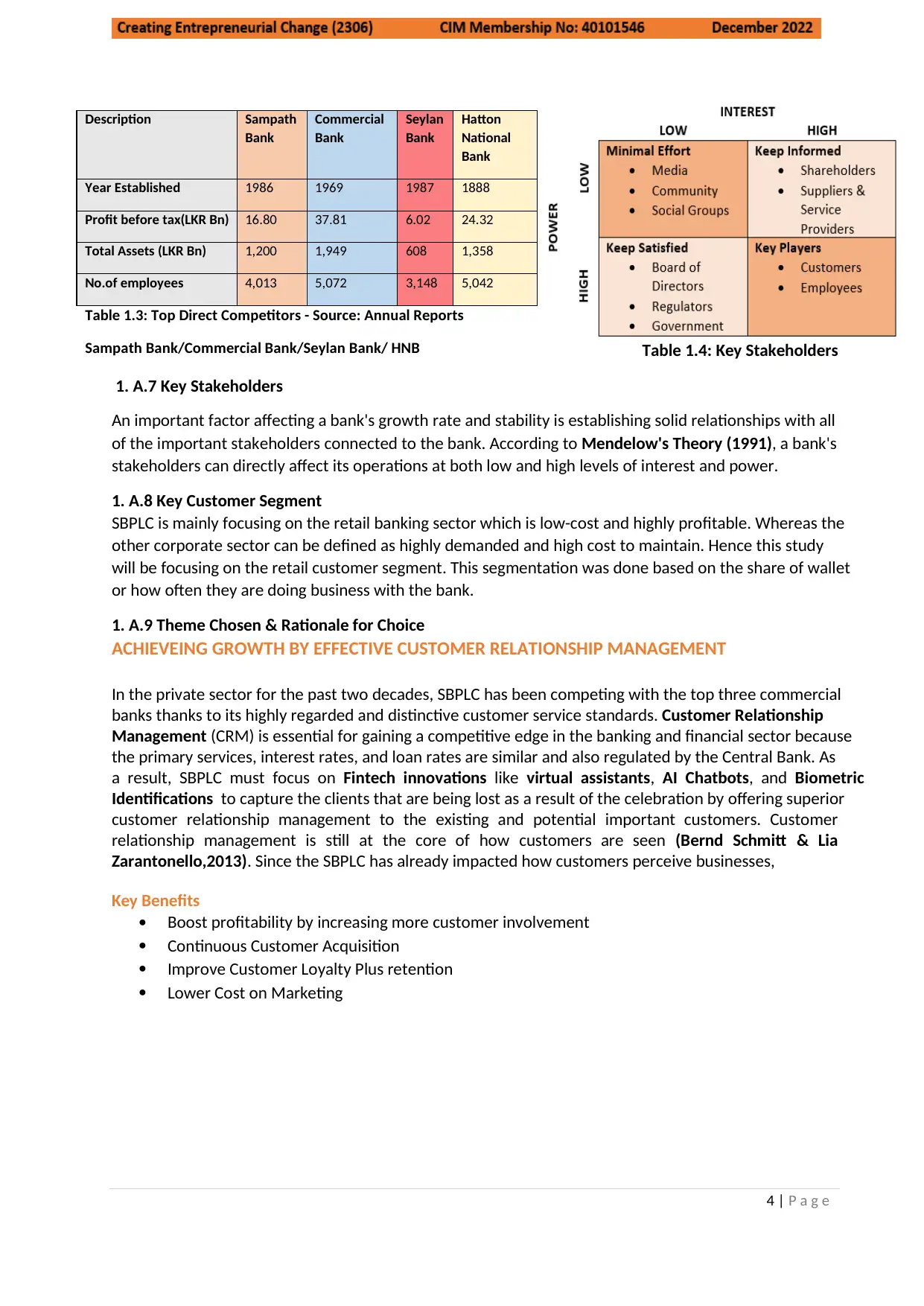

Description Sampath

Bank

Commercial

Bank

Seylan

Bank

Hatton

National

Bank

Year Established 1986 1969 1987 1888

Profit before tax(LKR Bn) 16.80 37.81 6.02 24.32

Total Assets (LKR Bn) 1,200 1,949 608 1,358

No.of employees 4,013 5,072 3,148 5,042

Table 1.3: Top Direct Competitors - Source: Annual Reports

Sampath Bank/Commercial Bank/Seylan Bank/ HNB

Table 1.4: Key Stakeholders

1. A.7 Key Stakeholders

An important factor affecting a bank's growth rate and stability is establishing solid relationships with all

of the important stakeholders connected to the bank. According to Mendelow's Theory (1991), a bank's

stakeholders can directly affect its operations at both low and high levels of interest and power.

1. A.8 Key Customer Segment

SBPLC is mainly focusing on the retail banking sector which is low-cost and highly profitable. Whereas the

other corporate sector can be defined as highly demanded and high cost to maintain. Hence this study

will be focusing on the retail customer segment. This segmentation was done based on the share of wallet

or how often they are doing business with the bank.

1. A.9 Theme Chosen & Rationale for Choice

ACHIEVEING GROWTH BY EFFECTIVE CUSTOMER RELATIONSHIP MANAGEMENT

In the private sector for the past two decades, SBPLC has been competing with the top three commercial

banks thanks to its highly regarded and distinctive customer service standards. Customer Relationship

Management (CRM) is essential for gaining a competitive edge in the banking and financial sector because

the primary services, interest rates, and loan rates are similar and also regulated by the Central Bank. As

a result, SBPLC must focus on Fintech innovations like virtual assistants, AI Chatbots, and Biometric

Identifications to capture the clients that are being lost as a result of the celebration by offering superior

customer relationship management to the existing and potential important customers. Customer

relationship management is still at the core of how customers are seen (Bernd Schmitt & Lia

Zarantonello,2013). Since the SBPLC has already impacted how customers perceive businesses,

Key Benefits

Boost profitability by increasing more customer involvement

Continuous Customer Acquisition

Improve Customer Loyalty Plus retention

Lower Cost on Marketing

Description Sampath

Bank

Commercial

Bank

Seylan

Bank

Hatton

National

Bank

Year Established 1986 1969 1987 1888

Profit before tax(LKR Bn) 16.80 37.81 6.02 24.32

Total Assets (LKR Bn) 1,200 1,949 608 1,358

No.of employees 4,013 5,072 3,148 5,042

Table 1.3: Top Direct Competitors - Source: Annual Reports

Sampath Bank/Commercial Bank/Seylan Bank/ HNB

5 | P a g e

Task 1 B – The Impact of Macro Environmental Factors to SBPLC

The two aspects of macro-environment that have been identified as having an impact, as discussed in

Appendix-01 PESTLE Analysis. Political Environment and Technological Environment, in particular,

have had a significant impact on SBPLC over the past five years.

Factors Description

Political

Environment

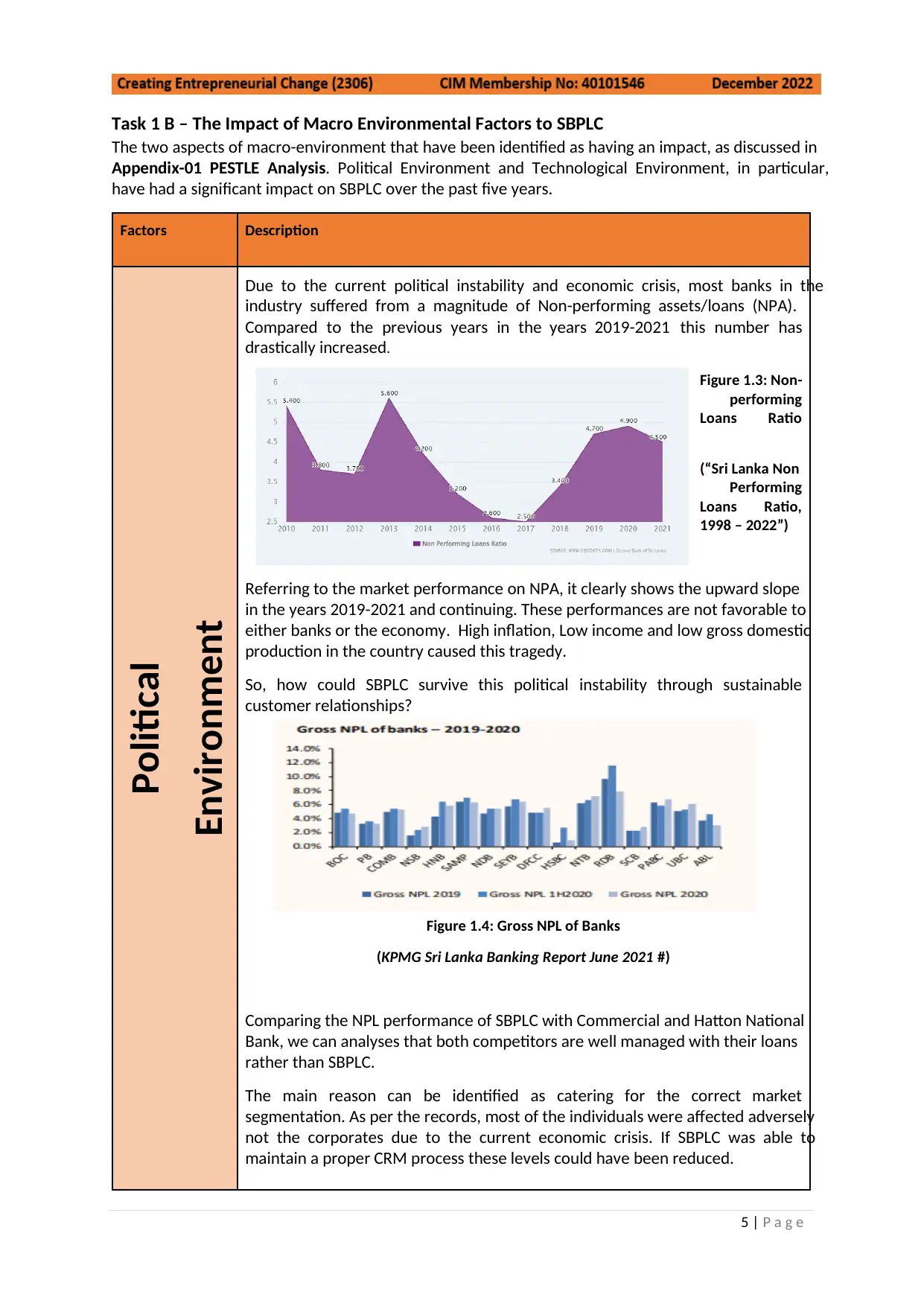

Due to the current political instability and economic crisis, most banks in the

industry suffered from a magnitude of Non-performing assets/loans (NPA).

Compared to the previous years in the years 2019-2021 this number has

drastically increased.

Figure 1.3: Non-

performing

Loans Ratio

(“Sri Lanka Non

Performing

Loans Ratio,

1998 – 2022”)

Referring to the market performance on NPA, it clearly shows the upward slope

in the years 2019-2021 and continuing. These performances are not favorable to

either banks or the economy. High inflation, Low income and low gross domestic

production in the country caused this tragedy.

So, how could SBPLC survive this political instability through sustainable

customer relationships?

Figure 1.4: Gross NPL of Banks

(KPMG Sri Lanka Banking Report June 2021 #)

Comparing the NPL performance of SBPLC with Commercial and Hatton National

Bank, we can analyses that both competitors are well managed with their loans

rather than SBPLC.

The main reason can be identified as catering for the correct market

segmentation. As per the records, most of the individuals were affected adversely

not the corporates due to the current economic crisis. If SBPLC was able to

maintain a proper CRM process these levels could have been reduced.

Task 1 B – The Impact of Macro Environmental Factors to SBPLC

The two aspects of macro-environment that have been identified as having an impact, as discussed in

Appendix-01 PESTLE Analysis. Political Environment and Technological Environment, in particular,

have had a significant impact on SBPLC over the past five years.

Factors Description

Political

Environment

Due to the current political instability and economic crisis, most banks in the

industry suffered from a magnitude of Non-performing assets/loans (NPA).

Compared to the previous years in the years 2019-2021 this number has

drastically increased.

Figure 1.3: Non-

performing

Loans Ratio

(“Sri Lanka Non

Performing

Loans Ratio,

1998 – 2022”)

Referring to the market performance on NPA, it clearly shows the upward slope

in the years 2019-2021 and continuing. These performances are not favorable to

either banks or the economy. High inflation, Low income and low gross domestic

production in the country caused this tragedy.

So, how could SBPLC survive this political instability through sustainable

customer relationships?

Figure 1.4: Gross NPL of Banks

(KPMG Sri Lanka Banking Report June 2021 #)

Comparing the NPL performance of SBPLC with Commercial and Hatton National

Bank, we can analyses that both competitors are well managed with their loans

rather than SBPLC.

The main reason can be identified as catering for the correct market

segmentation. As per the records, most of the individuals were affected adversely

not the corporates due to the current economic crisis. If SBPLC was able to

maintain a proper CRM process these levels could have been reduced.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6 | P a g e

Technology

Environment

SBPLC can be identified as the pioneer in Fin-tech developments. It has developed

and introduced so many digital products compared to other competitors.

Source: (“Sampath Bank recognized with top honors for its innovative IT

solutions”)

As per the technical norms and definitions technology innovation should be

placed to achieve sustainability. For example, SBPLC has tons of digital products

at the present. The thing is, it is not important who are the first to introduce a

product is but who is continuing that better.

In this report, the marketing consultant wants to show that having tons of

alternatives for the same requirement makes customers confused. For example,

a customer can choose Sampath Vishwa for online payments as well as Sampath

“PayEasy” to do the same job. In terms of cost, Sampath bank has developed two

digital platforms for the same requirement which increase banks' costs and

customer confusion.

Some might argue that the sustainable growth of a company relies on technology

development. But, should also focus on customer requirements before

introducing a product. Because, in Sri Lanka, digital literacy is around 34.3%.

(“Lanka's Computer Literacy increases to 34.3%”)

Hence, before introducing a product to a market proper market research needs

to be done. Technology should be a user-friendly and hassle-free one-tap

solution for customers. Through a proper CRM process loyalty and long-term,

consumer relationships can be a build-up. From my perspective, this is why for

the last five years the Sri Lankan banking industry has underperformed in the

digital banking industry.

Technology

Environment

SBPLC can be identified as the pioneer in Fin-tech developments. It has developed

and introduced so many digital products compared to other competitors.

Source: (“Sampath Bank recognized with top honors for its innovative IT

solutions”)

As per the technical norms and definitions technology innovation should be

placed to achieve sustainability. For example, SBPLC has tons of digital products

at the present. The thing is, it is not important who are the first to introduce a

product is but who is continuing that better.

In this report, the marketing consultant wants to show that having tons of

alternatives for the same requirement makes customers confused. For example,

a customer can choose Sampath Vishwa for online payments as well as Sampath

“PayEasy” to do the same job. In terms of cost, Sampath bank has developed two

digital platforms for the same requirement which increase banks' costs and

customer confusion.

Some might argue that the sustainable growth of a company relies on technology

development. But, should also focus on customer requirements before

introducing a product. Because, in Sri Lanka, digital literacy is around 34.3%.

(“Lanka's Computer Literacy increases to 34.3%”)

Hence, before introducing a product to a market proper market research needs

to be done. Technology should be a user-friendly and hassle-free one-tap

solution for customers. Through a proper CRM process loyalty and long-term,

consumer relationships can be a build-up. From my perspective, this is why for

the last five years the Sri Lankan banking industry has underperformed in the

digital banking industry.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7 | P a g e

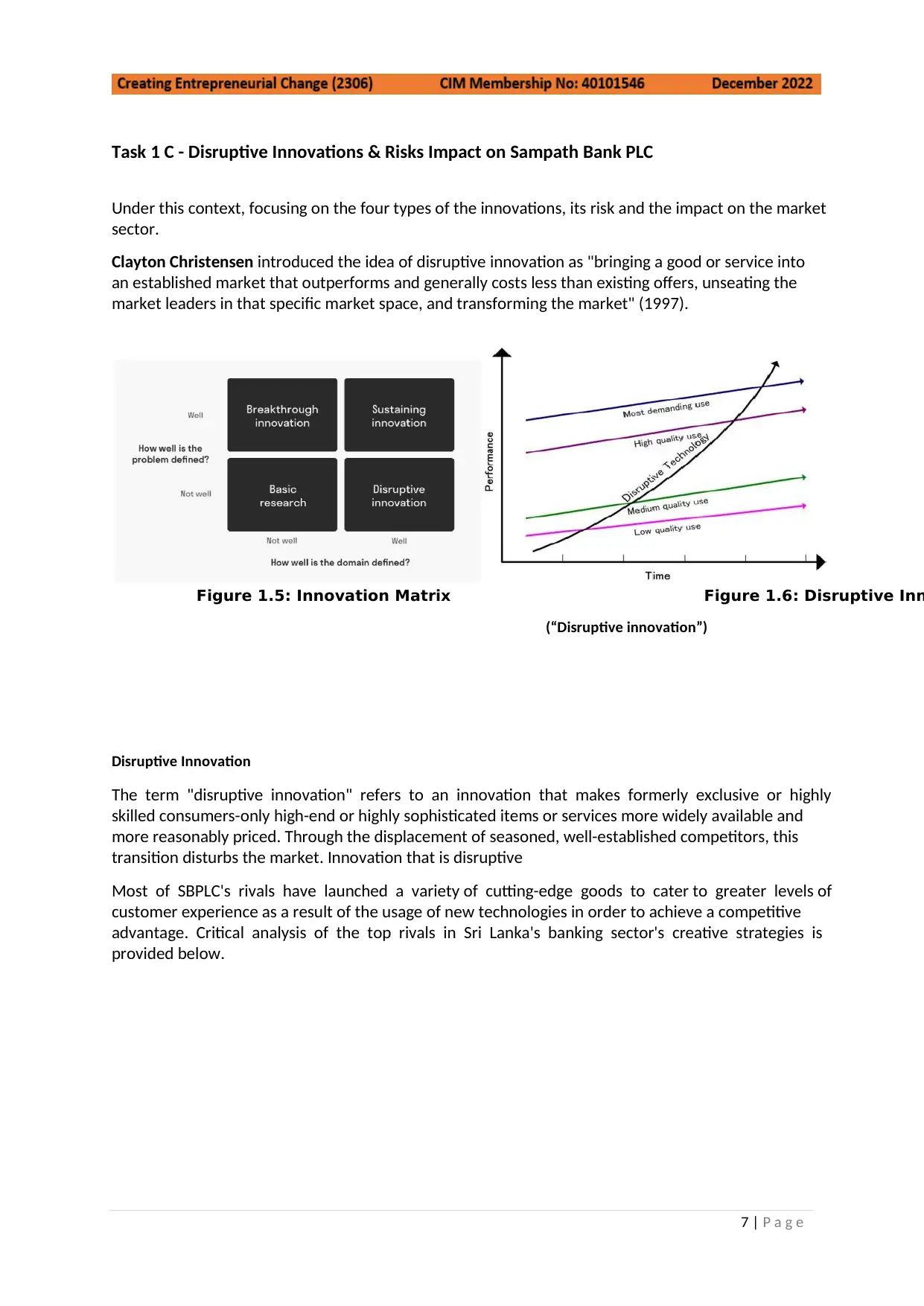

Task 1 C - Disruptive Innovations & Risks Impact on Sampath Bank PLC

Under this context, focusing on the four types of the innovations, its risk and the impact on the market

sector.

Clayton Christensen introduced the idea of disruptive innovation as "bringing a good or service into

an established market that outperforms and generally costs less than existing offers, unseating the

market leaders in that specific market space, and transforming the market" (1997).

Figure 1.5: Innovation Matrix Figure 1.6: Disruptive Inn

(“Disruptive innovation”)

Disruptive Innovation

The term "disruptive innovation" refers to an innovation that makes formerly exclusive or highly

skilled consumers-only high-end or highly sophisticated items or services more widely available and

more reasonably priced. Through the displacement of seasoned, well-established competitors, this

transition disturbs the market. Innovation that is disruptive

Most of SBPLC's rivals have launched a variety of cutting-edge goods to cater to greater levels of

customer experience as a result of the usage of new technologies in order to achieve a competitive

advantage. Critical analysis of the top rivals in Sri Lanka's banking sector's creative strategies is

provided below.

Task 1 C - Disruptive Innovations & Risks Impact on Sampath Bank PLC

Under this context, focusing on the four types of the innovations, its risk and the impact on the market

sector.

Clayton Christensen introduced the idea of disruptive innovation as "bringing a good or service into

an established market that outperforms and generally costs less than existing offers, unseating the

market leaders in that specific market space, and transforming the market" (1997).

Figure 1.5: Innovation Matrix Figure 1.6: Disruptive Inn

(“Disruptive innovation”)

Disruptive Innovation

The term "disruptive innovation" refers to an innovation that makes formerly exclusive or highly

skilled consumers-only high-end or highly sophisticated items or services more widely available and

more reasonably priced. Through the displacement of seasoned, well-established competitors, this

transition disturbs the market. Innovation that is disruptive

Most of SBPLC's rivals have launched a variety of cutting-edge goods to cater to greater levels of

customer experience as a result of the usage of new technologies in order to achieve a competitive

advantage. Critical analysis of the top rivals in Sri Lanka's banking sector's creative strategies is

provided below.

8 | P a g e

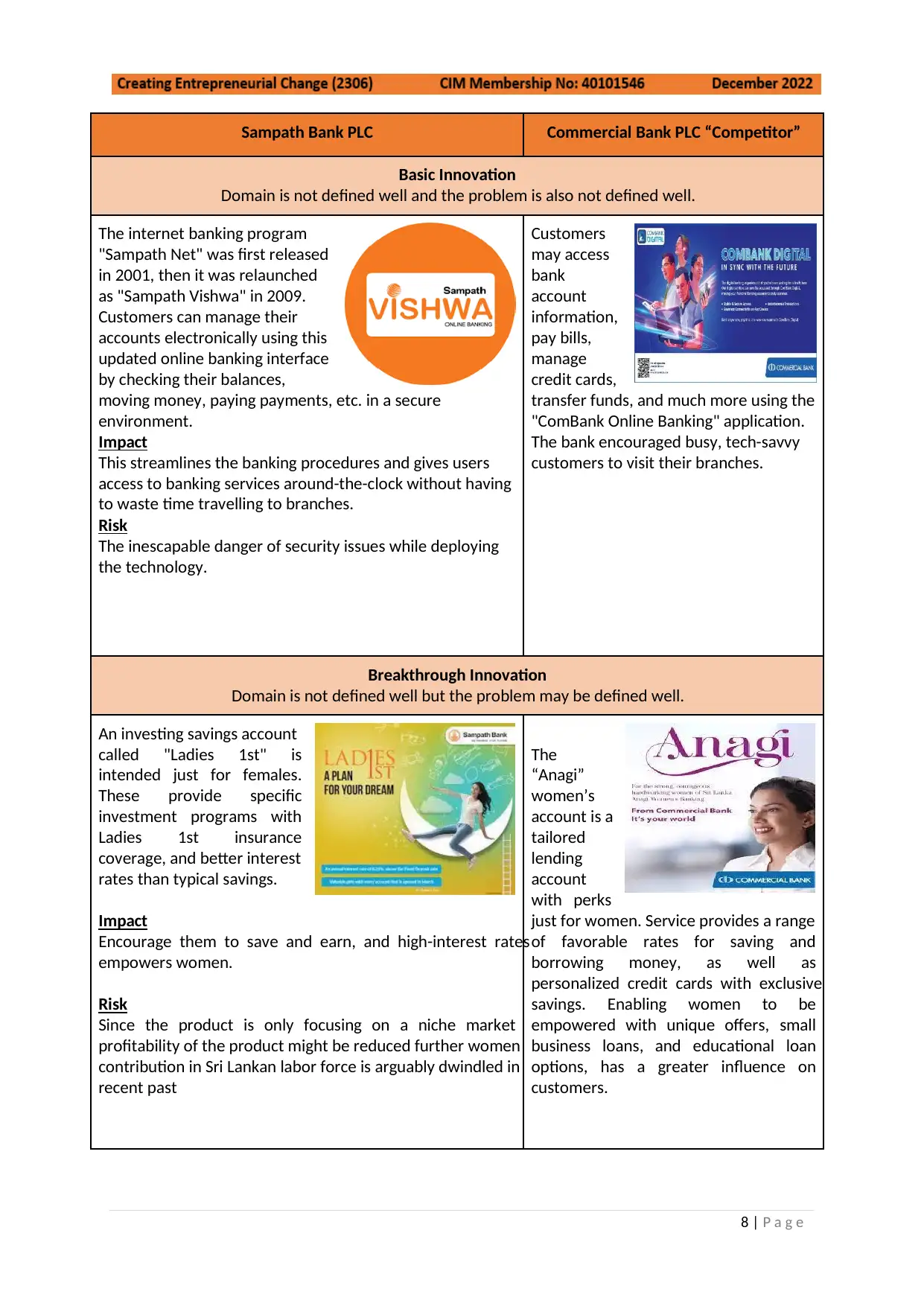

Sampath Bank PLC Commercial Bank PLC “Competitor”

Basic Innovation

Domain is not defined well and the problem is also not defined well.

The internet banking program

"Sampath Net" was first released

in 2001, then it was relaunched

as "Sampath Vishwa" in 2009.

Customers can manage their

accounts electronically using this

updated online banking interface

by checking their balances,

moving money, paying payments, etc. in a secure

environment.

Impact

This streamlines the banking procedures and gives users

access to banking services around-the-clock without having

to waste time travelling to branches.

Risk

The inescapable danger of security issues while deploying

the technology.

Customers

may access

bank

account

information,

pay bills,

manage

credit cards,

transfer funds, and much more using the

"ComBank Online Banking" application.

The bank encouraged busy, tech-savvy

customers to visit their branches.

Breakthrough Innovation

Domain is not defined well but the problem may be defined well.

An investing savings account

called "Ladies 1st" is

intended just for females.

These provide specific

investment programs with

Ladies 1st insurance

coverage, and better interest

rates than typical savings.

Impact

Encourage them to save and earn, and high-interest rates

empowers women.

Risk

Since the product is only focusing on a niche market

profitability of the product might be reduced further women

contribution in Sri Lankan labor force is arguably dwindled in

recent past

The

“Anagi”

women’s

account is a

tailored

lending

account

with perks

just for women. Service provides a range

of favorable rates for saving and

borrowing money, as well as

personalized credit cards with exclusive

savings. Enabling women to be

empowered with unique offers, small

business loans, and educational loan

options, has a greater influence on

customers.

Sampath Bank PLC Commercial Bank PLC “Competitor”

Basic Innovation

Domain is not defined well and the problem is also not defined well.

The internet banking program

"Sampath Net" was first released

in 2001, then it was relaunched

as "Sampath Vishwa" in 2009.

Customers can manage their

accounts electronically using this

updated online banking interface

by checking their balances,

moving money, paying payments, etc. in a secure

environment.

Impact

This streamlines the banking procedures and gives users

access to banking services around-the-clock without having

to waste time travelling to branches.

Risk

The inescapable danger of security issues while deploying

the technology.

Customers

may access

bank

account

information,

pay bills,

manage

credit cards,

transfer funds, and much more using the

"ComBank Online Banking" application.

The bank encouraged busy, tech-savvy

customers to visit their branches.

Breakthrough Innovation

Domain is not defined well but the problem may be defined well.

An investing savings account

called "Ladies 1st" is

intended just for females.

These provide specific

investment programs with

Ladies 1st insurance

coverage, and better interest

rates than typical savings.

Impact

Encourage them to save and earn, and high-interest rates

empowers women.

Risk

Since the product is only focusing on a niche market

profitability of the product might be reduced further women

contribution in Sri Lankan labor force is arguably dwindled in

recent past

The

“Anagi”

women’s

account is a

tailored

lending

account

with perks

just for women. Service provides a range

of favorable rates for saving and

borrowing money, as well as

personalized credit cards with exclusive

savings. Enabling women to be

empowered with unique offers, small

business loans, and educational loan

options, has a greater influence on

customers.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9 | P a g e

The disruptive Innovation

Domain is defined well but the problem may not be defined well.

"igift" is a ground-breaking idea

created internally utilizing the

most recent, widely

acknowledged blockchain

technology to build a

framework to support person-

to-person gifting. The first bank

in Sri Lanka to create and offer a blockchain-based banking

service is SBPLC.

Impact

By enabling all SBPLC account holders to give gifts to anyone

on their smartphone's contact list, this redefines how Sri

Lanka marks significant occasions.

Risk

There are dangers associated with using technological

services, such as those related to information technology

and security.

The first

institution to

use

tokenization in

a commercial

bank.

International

Bank introduces payment gateway

services (MPGS) in Sri Lanka in

conjunction with Mastercard. Through

the use of tokenization, the bank may

provide merchants with a safe and

affordable option to conduct card-on-file

transactions.

This one-click online shopping complies

fully with PCI-DSS requirements for

payment card industry data security.

As a result, it lessens the chance of actual

card numbers being disclosed and fraud

exposure.

Sustaining Innovation

Domain is defined well and the problem may be defined well.

In Sri Lanka, SBPLC introduced

the first virtual teller machine.

Impact

The necessity for information from local branches is greatly

reduced and can handle about 90% of routine banking

transactions. This increases productivity and efficiency and,

eventually, results in significant cost savings for the bank.

Risk

Significant staff job losses, enormous capital expenditures,

and a lack of customer interest in cutting-edge technologies

The Bank's

innovative

actions

relating to

the just-

ended

fiscal year included the introduction of

"Flash," Sri Lanka's first completely

functional computerized bank account.

As a consequence, 36% more customers

used Online Banking.

The disruptive Innovation

Domain is defined well but the problem may not be defined well.

"igift" is a ground-breaking idea

created internally utilizing the

most recent, widely

acknowledged blockchain

technology to build a

framework to support person-

to-person gifting. The first bank

in Sri Lanka to create and offer a blockchain-based banking

service is SBPLC.

Impact

By enabling all SBPLC account holders to give gifts to anyone

on their smartphone's contact list, this redefines how Sri

Lanka marks significant occasions.

Risk

There are dangers associated with using technological

services, such as those related to information technology

and security.

The first

institution to

use

tokenization in

a commercial

bank.

International

Bank introduces payment gateway

services (MPGS) in Sri Lanka in

conjunction with Mastercard. Through

the use of tokenization, the bank may

provide merchants with a safe and

affordable option to conduct card-on-file

transactions.

This one-click online shopping complies

fully with PCI-DSS requirements for

payment card industry data security.

As a result, it lessens the chance of actual

card numbers being disclosed and fraud

exposure.

Sustaining Innovation

Domain is defined well and the problem may be defined well.

In Sri Lanka, SBPLC introduced

the first virtual teller machine.

Impact

The necessity for information from local branches is greatly

reduced and can handle about 90% of routine banking

transactions. This increases productivity and efficiency and,

eventually, results in significant cost savings for the bank.

Risk

Significant staff job losses, enormous capital expenditures,

and a lack of customer interest in cutting-edge technologies

The Bank's

innovative

actions

relating to

the just-

ended

fiscal year included the introduction of

"Flash," Sri Lanka's first completely

functional computerized bank account.

As a consequence, 36% more customers

used Online Banking.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10 | P a g e

WORD COUNT – 1830

WORD COUNT – 1830

11 | P a g e

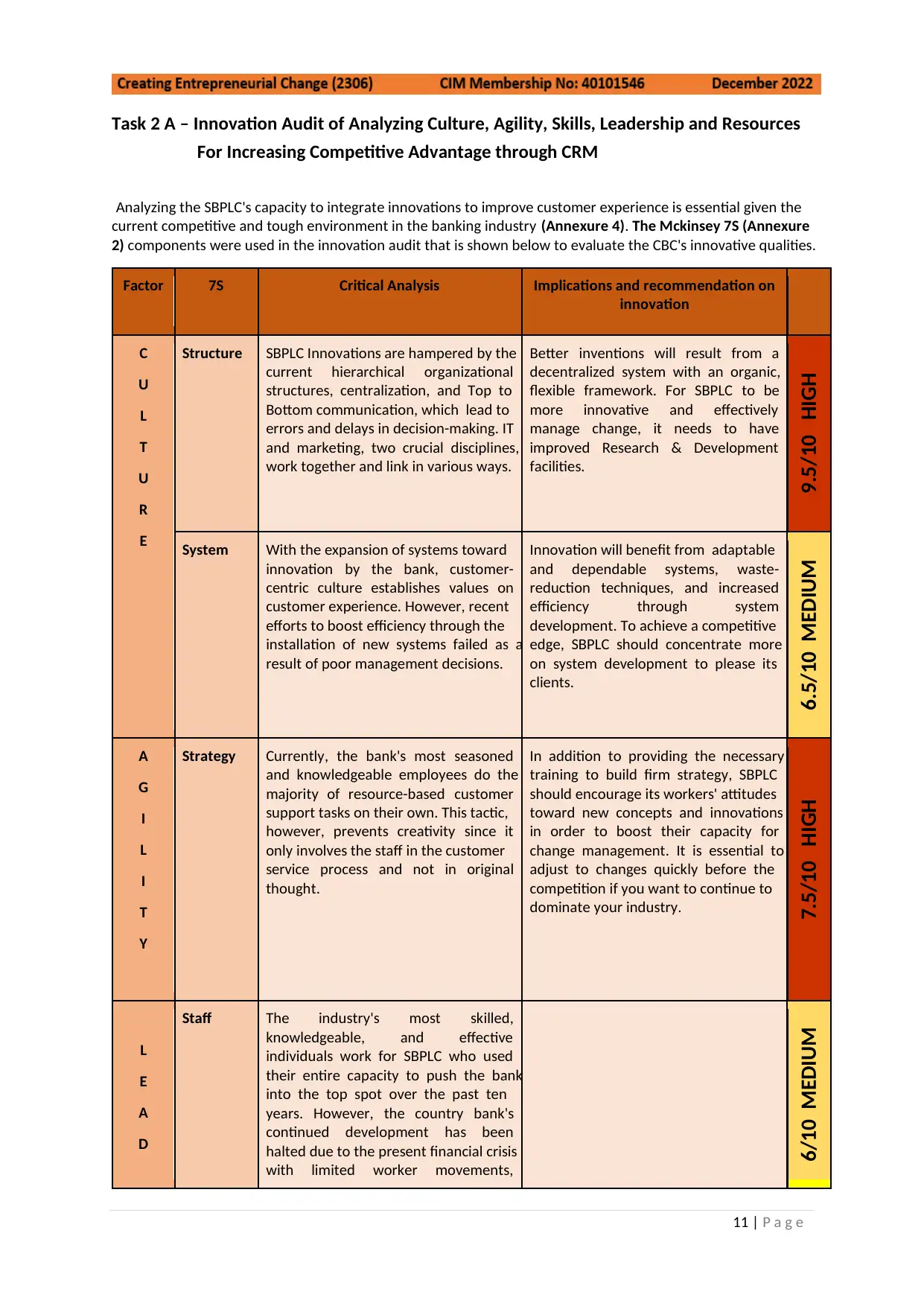

Task 2 A – Innovation Audit of Analyzing Culture, Agility, Skills, Leadership and Resources

For Increasing Competitive Advantage through CRM

Analyzing the SBPLC's capacity to integrate innovations to improve customer experience is essential given the

current competitive and tough environment in the banking industry (Annexure 4). The Mckinsey 7S (Annexure

2) components were used in the innovation audit that is shown below to evaluate the CBC's innovative qualities.

Factor 7S Critical Analysis Implications and recommendation on

innovation

C

U

L

T

U

R

E

Structure SBPLC Innovations are hampered by the

current hierarchical organizational

structures, centralization, and Top to

Bottom communication, which lead to

errors and delays in decision-making. IT

and marketing, two crucial disciplines,

work together and link in various ways.

Better inventions will result from a

decentralized system with an organic,

flexible framework. For SBPLC to be

more innovative and effectively

manage change, it needs to have

improved Research & Development

facilities.

9.5/10 HIGH

System With the expansion of systems toward

innovation by the bank, customer-

centric culture establishes values on

customer experience. However, recent

efforts to boost efficiency through the

installation of new systems failed as a

result of poor management decisions.

Innovation will benefit from adaptable

and dependable systems, waste-

reduction techniques, and increased

efficiency through system

development. To achieve a competitive

edge, SBPLC should concentrate more

on system development to please its

clients.

6.5/10 MEDIUM

A

G

I

L

I

T

Y

Strategy Currently, the bank's most seasoned

and knowledgeable employees do the

majority of resource-based customer

support tasks on their own. This tactic,

however, prevents creativity since it

only involves the staff in the customer

service process and not in original

thought.

In addition to providing the necessary

training to build firm strategy, SBPLC

should encourage its workers' attitudes

toward new concepts and innovations

in order to boost their capacity for

change management. It is essential to

adjust to changes quickly before the

competition if you want to continue to

dominate your industry.

7.5/10 HIGH

L

E

A

D

Staff The industry's most skilled,

knowledgeable, and effective

individuals work for SBPLC who used

their entire capacity to push the bank

into the top spot over the past ten

years. However, the country bank's

continued development has been

halted due to the present financial crisis

with limited worker movements,

6/10 MEDIUM

Task 2 A – Innovation Audit of Analyzing Culture, Agility, Skills, Leadership and Resources

For Increasing Competitive Advantage through CRM

Analyzing the SBPLC's capacity to integrate innovations to improve customer experience is essential given the

current competitive and tough environment in the banking industry (Annexure 4). The Mckinsey 7S (Annexure

2) components were used in the innovation audit that is shown below to evaluate the CBC's innovative qualities.

Factor 7S Critical Analysis Implications and recommendation on

innovation

C

U

L

T

U

R

E

Structure SBPLC Innovations are hampered by the

current hierarchical organizational

structures, centralization, and Top to

Bottom communication, which lead to

errors and delays in decision-making. IT

and marketing, two crucial disciplines,

work together and link in various ways.

Better inventions will result from a

decentralized system with an organic,

flexible framework. For SBPLC to be

more innovative and effectively

manage change, it needs to have

improved Research & Development

facilities.

9.5/10 HIGH

System With the expansion of systems toward

innovation by the bank, customer-

centric culture establishes values on

customer experience. However, recent

efforts to boost efficiency through the

installation of new systems failed as a

result of poor management decisions.

Innovation will benefit from adaptable

and dependable systems, waste-

reduction techniques, and increased

efficiency through system

development. To achieve a competitive

edge, SBPLC should concentrate more

on system development to please its

clients.

6.5/10 MEDIUM

A

G

I

L

I

T

Y

Strategy Currently, the bank's most seasoned

and knowledgeable employees do the

majority of resource-based customer

support tasks on their own. This tactic,

however, prevents creativity since it

only involves the staff in the customer

service process and not in original

thought.

In addition to providing the necessary

training to build firm strategy, SBPLC

should encourage its workers' attitudes

toward new concepts and innovations

in order to boost their capacity for

change management. It is essential to

adjust to changes quickly before the

competition if you want to continue to

dominate your industry.

7.5/10 HIGH

L

E

A

D

Staff The industry's most skilled,

knowledgeable, and effective

individuals work for SBPLC who used

their entire capacity to push the bank

into the top spot over the past ten

years. However, the country bank's

continued development has been

halted due to the present financial crisis

with limited worker movements,

6/10 MEDIUM

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 33

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.