Netflix: Analyzing Debt Recapitalization and Financial Distress Costs

VerifiedAdded on 2023/03/20

Paraphrase This Document

• INTRODUCTION

• Debt recapitalisation

• Estimating financial distress costs

• CONCLUSION

• REFERENCES

• Recapitalisation financial leverage is one of the

crucial approach by the company.

• The present report deals with Netflix Organisation

which is engaged in business of online streaming of

various shows and is planning for debt

recapitalisation.

• The results could be such that it may lend

organisation to bankruptcy if debt is not timely paid.

• Moreover, report discusses about agency costs and

estimation of cost of financial distress is made as

well.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

• The financial distress may be caused due to change in the

capital structure of the company.

• Netflix Organisation which is engaged in providing live

streaming of shows to customers.

• The debt recapitalisation decision will inject financial distress

in quite adverse manner.

• The term financial distress means that firm may face difficulty

in paying off obligations which becomes due.

• Inability of business to pay liabilities will raise various issues

in which bankruptcy is major problem for the company.

Paraphrase This Document

• Netflix debt recapitalisation will evolve negatives to it.

• Recapitalisation means that firm will raise funds from debt only

and equity will be reduced up to high extent.

• This will raise burden of paying liabilities along with the interest

on it.

• Firm will be fully dependent on debt to carry on operational

activities and as such, chances of bankruptcy may be evolved

which is the negative sign for the company.

• It will be unable to pay timely payments to various parties

involved in the process and moreover, creditors will call for

making outstanding payments.

• Debt recapitalisation will also have negative effect on

agency costs.

• This will eventually increase financial distress of the

company in adverse way.

• Agency cost arises from the conflicting agreement of

shareholders and management in the company.

• In simple words, principal and agent do not meet at

the same point for the betterment of the company.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

• This disagreement of between these two parties will

have adverse effect on the investors of the company.

• Netflix Organisation has investment in optimum

quantum and as such, conflicting situation of

management and shareholders will have serious

repercussions on investors.

• The investment will become low and value of

Netflix's stock will also decline causing into

reduction in earning price of shares quite adversely.

Paraphrase This Document

• The major example of agency cost is that if management do

not agree to take on project as if it fails, business may be

doomed in loss.

• On the other hand, shareholders will take risk because if

project succeeds nicely, there earnings will be maximised.

• Thus, conflict arises between them which affects firm in the

bad manner.

• The above example of shareholder maximisation value is of

monitoring costs which fall under type of agency costs.

• Bonding cost also rises when agent commits that he will stay

with the company even if it is acquired by another company.

• Thus, agency costs rises because of debt recapitalisation and

Netflix Company will incur agency costs up to high extent.

• Moreover, company will also have financial distress quite

adversely.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

• Financial distress costs have negative effect on the

company as more of the debt is utilised and equity is

reduced up to high extent.

• Financial distress may have serious repercussions as

firm gradually increases debt structure in the financial

leverage.

• This results into paying more liabilities and also

payment obligations are hiked and to be paid within

stipulated time frame.

Paraphrase This Document

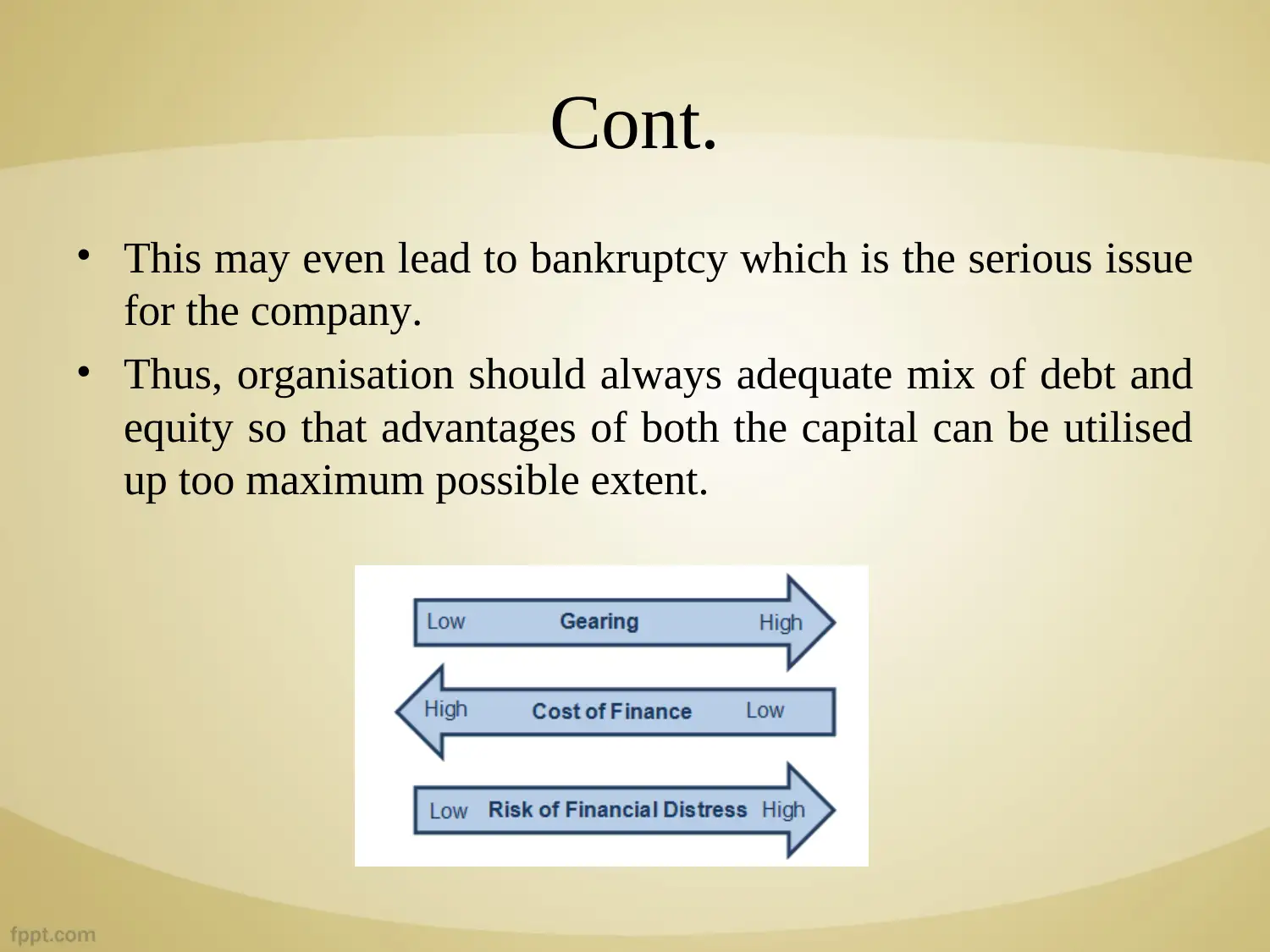

• This may even lead to bankruptcy which is the serious issue

for the company.

• Thus, organisation should always adequate mix of debt and

equity so that advantages of both the capital can be utilised

up too maximum possible extent.

• In this relation, it is required to estimate costs of

financial distress so that risk may be minimised quite

effectively.

• The financial distress also rises from the issue of

bond and as such, risks gets doubled.

• Cost of financial distress can be easily calculated

when bond is issued by the company.

• Netflix Company is changing capital structure and as

such, major funds will be raised from issuing of bond.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

• For analysing financial distress cost, it is required that

firm should analyse present value of cash inflows

such as calculating NPV (Net Present Value).

• This is the main challenge to company to arrive at

NPV to assess cost of financial distress.

• The research approach is to find out default rates to

effectively estimate probability of cost of financial

distress and attaining risk free rate to find out

eradicate such costs.

Paraphrase This Document

• For estimating financial distress, firm's annual report

is required.

• From that total amount of debt needs to be arrived at.

• Next step is to determine, interest rates paid by

organisation which are not under financial distress.

• The firms are AAA credit ratings one.

• Thus, for analysing cost of debt, it is required that

these firms rate of interest which they pay on issue of

bonds are assessed.

• After analysing, Netflix Organisation can easily

determine such cost.

• For estimation purpose only, there is 6 % interest rate

which are paid to investors for AAA rating.

• Next step is to compute weighted average cost of

debt.

• If company has 10,00,000 in borrowings and interest

rate is 2,50,000 is raised to 8 % and remaining

7,50,000 is raised to 10%.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

• Thus, weighted average cost can be calculated by finding loan

% and multiplying by interest rate (Donker, Ng and Shao,

2018).

• In this estimation case, 2,50,000 has 2% and remaining

investment has total of 7.5%.

• Now adding these two, total interest rate is 9.5%. Original rate

was 6% and now increased one is cost of financial distress

which is 3.5 %.

• Now, Netflix Organisation has 10,00,000 of borrowings and

financial distress is 3.5%.

• Thus, in terms of currency, total cost is 10,00,000 * 3.5% =

3,50,000.

Paraphrase This Document

• Hereby it can be concluded that debt recapitalisation

should be effectively done by the firm.

• This is required so that company may not lend in

bankruptcy and as such, debt paying capacity should

be strong enough.

• Agency and financial distress costs are required to be

calculated so that risks can be assessed and managed

in the best possible way.

D'Mello, R., Gruskin, M. and Kulchania, M., 2018. Shareholders valuation of long-

term debt and decline in firms' leverage ratio. Journal of Corporate Finance. 48.

pp.352-374.

Donker, H., Ng, A. and Shao, P., 2018. Borrower Distress and the Efficiency of

Relationship Banking. Journal of Banking & Finance.

Kopecky, and et.al, 2018. Revisiting M&M with Taxes: An Alternative Equilibrating

Process. International Journal of Financial Studies. 6(1). p.10.

Sadiq, R. and et.al, 2018. Effect of Recapitalization on Banks’ Financial Performance

in Nigeria. International Journal of Contemporary Research and Review. 9(01).

Online

Wilkinson, 2013 Financial Distress Costs [Online] Available

Through:<https://strategiccfo.com/financial-distress-costs/>

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.