Critical Evaluation of Key Audit Matters in Independent Auditor's Report

VerifiedAdded on 2023/03/20

|22

|3759

|46

AI Summary

This paper critically analyzes and evaluates the key audit matters in the independent auditor's report. It discusses the importance of identifying audit matters, the revision of auditing standards, and analyzes key audit matters in selected banks.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN

THE INDEPENDENT AUDITORS REPORT

Critical evaluation and analysis of key audit matters in the independent auditors report

Name of the student

Name of the university

Student ID

Author note

THE INDEPENDENT AUDITORS REPORT

Critical evaluation and analysis of key audit matters in the independent auditors report

Name of the student

Name of the university

Student ID

Author note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Executive summary:

The paper evaluates the importance of identification of audit matters of the banking

organization. Such explanation has been done in light of introduction of the new auditing

standard that is “ASA 701 communicating key audit matters in the independent auditor

report”. In this regard, the failure of large investment bank has been discussed by reviewing

relevant journal articles. The objective and rationale of ASA 701 has been addressed along

with evaluating the revision of ASA 570. The banking organization that have been evaluated

for its key audit matters include ANZ bank, Commonwealth bank of Australia, Pendal group

limited, Bank of Queensland, Macquarie group limited and QBE Insurance group.

INDEPENDENT AUDITORS REPORT

Executive summary:

The paper evaluates the importance of identification of audit matters of the banking

organization. Such explanation has been done in light of introduction of the new auditing

standard that is “ASA 701 communicating key audit matters in the independent auditor

report”. In this regard, the failure of large investment bank has been discussed by reviewing

relevant journal articles. The objective and rationale of ASA 701 has been addressed along

with evaluating the revision of ASA 570. The banking organization that have been evaluated

for its key audit matters include ANZ bank, Commonwealth bank of Australia, Pendal group

limited, Bank of Queensland, Macquarie group limited and QBE Insurance group.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Table of Contents

Introduction:...............................................................................................................................4

Discussion:.................................................................................................................................4

Purpose of key audit matters:.....................................................................................................4

Determination and application of key audit matter:...................................................................5

Identifying issues of Lehman brother case:...............................................................................5

How key audit matters address the issues:.................................................................................6

Revision of ASA 570:................................................................................................................6

Importance of going concern issue in the auditor’s report:........................................................7

Analyzing the key audit matters in the independent auditor’s report of the chosen banks:.......7

Do key audit matters serve the purpose in the industry?...........................................................9

Conclusion:................................................................................................................................9

References list:.........................................................................................................................10

Appendix:.................................................................................................................................12

INDEPENDENT AUDITORS REPORT

Table of Contents

Introduction:...............................................................................................................................4

Discussion:.................................................................................................................................4

Purpose of key audit matters:.....................................................................................................4

Determination and application of key audit matter:...................................................................5

Identifying issues of Lehman brother case:...............................................................................5

How key audit matters address the issues:.................................................................................6

Revision of ASA 570:................................................................................................................6

Importance of going concern issue in the auditor’s report:........................................................7

Analyzing the key audit matters in the independent auditor’s report of the chosen banks:.......7

Do key audit matters serve the purpose in the industry?...........................................................9

Conclusion:................................................................................................................................9

References list:.........................................................................................................................10

Appendix:.................................................................................................................................12

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Introduction:

The study is undertaken to evaluate the key audit matters of the organizations selected

from the banking industry listed on the Australian stock exchange. Such analysis has been

conducted in respect of the introduction of new auditing standard “ASA 701 communicating

the key audit matters in the independent auditor report”. The introduction of the new

auditing standard was in the aftermath of financial crisis and was intended to fulfill the

lacking requirements of the old auditing standard which was cited to be the reason for the

failure of some of the organization (Czerney et al. 2019). In this regard, the case of Lehman

brother is explained by emphasizing on the failure of auditors to detect the defective

accounting policy that resulted in the downfall of organization.

Key audit matters are the matters that are considered to be essential by way of their

professional judgment in the auditing process of annual report of entities. The new standard

pertaining to the disclosure of key audit matters is applicable to the financial statements

verification and in the circumstances when it is decided by the auditors to communicate such

matters in the auditor’s report (Czerney et al. 2019). The organizations for which the

evaluation of key audit matters are done in the paper includes are chosen from the banking

industry and they include ANZ bank, Commonwealth bank of Australia, Pendal group

limited, Bank of Queensland, Macquarie group limited and QBE Insurance group.

Discussion:

Purpose of key audit matters:

The principle of incorporating the key audit matters for improving the communicative

value of report by making precision of the information using the key audit matters. Such

matters intend to provide the users of financial statements with additional information that

assist them in understanding the professional judgment of the auditors in preparation of the

auditor’s report. In addition to this, key audit matters also assist uses in gaining an

understanding of the noteworthy judgment along with the nature of entity. Moreover, a basis

is provided to the users with the help of disclosure of key audit matters for further engaging

with the governance people and management in relation to certain matters required in the

preparation of annual report. Communication of key audit matter is in the context of forming

an opinion by auditors on the financial statements as a whole and providing an insight into

the work of audit (auasb.gov.au 2019).

Determination and application of key audit matter:

Determination of key audit matters is done by the auditor by assessing the areas of

significant risks areas that has probability of being misstated materially. Significant judgment

is exercised by the auditors in relation to the areas of significant judgment made by the

management including the assumptions and estimates resulting in areas of high uncertainty.

Furthermore, for the identification of key audit matters, it is essential to engage with the

people entrusted with governance because the matters which are identified by such personnel

are considered as the matters of potential key audit matters. Users will be able to well

INDEPENDENT AUDITORS REPORT

Introduction:

The study is undertaken to evaluate the key audit matters of the organizations selected

from the banking industry listed on the Australian stock exchange. Such analysis has been

conducted in respect of the introduction of new auditing standard “ASA 701 communicating

the key audit matters in the independent auditor report”. The introduction of the new

auditing standard was in the aftermath of financial crisis and was intended to fulfill the

lacking requirements of the old auditing standard which was cited to be the reason for the

failure of some of the organization (Czerney et al. 2019). In this regard, the case of Lehman

brother is explained by emphasizing on the failure of auditors to detect the defective

accounting policy that resulted in the downfall of organization.

Key audit matters are the matters that are considered to be essential by way of their

professional judgment in the auditing process of annual report of entities. The new standard

pertaining to the disclosure of key audit matters is applicable to the financial statements

verification and in the circumstances when it is decided by the auditors to communicate such

matters in the auditor’s report (Czerney et al. 2019). The organizations for which the

evaluation of key audit matters are done in the paper includes are chosen from the banking

industry and they include ANZ bank, Commonwealth bank of Australia, Pendal group

limited, Bank of Queensland, Macquarie group limited and QBE Insurance group.

Discussion:

Purpose of key audit matters:

The principle of incorporating the key audit matters for improving the communicative

value of report by making precision of the information using the key audit matters. Such

matters intend to provide the users of financial statements with additional information that

assist them in understanding the professional judgment of the auditors in preparation of the

auditor’s report. In addition to this, key audit matters also assist uses in gaining an

understanding of the noteworthy judgment along with the nature of entity. Moreover, a basis

is provided to the users with the help of disclosure of key audit matters for further engaging

with the governance people and management in relation to certain matters required in the

preparation of annual report. Communication of key audit matter is in the context of forming

an opinion by auditors on the financial statements as a whole and providing an insight into

the work of audit (auasb.gov.au 2019).

Determination and application of key audit matter:

Determination of key audit matters is done by the auditor by assessing the areas of

significant risks areas that has probability of being misstated materially. Significant judgment

is exercised by the auditors in relation to the areas of significant judgment made by the

management including the assumptions and estimates resulting in areas of high uncertainty.

Furthermore, for the identification of key audit matters, it is essential to engage with the

people entrusted with governance because the matters which are identified by such personnel

are considered as the matters of potential key audit matters. Users will be able to well

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

understand the audit with the help of announcement of key audit matters irrespective of the

auditors expressing adverse or qualified opinion on the financial statements of company

(auasb.gov.au 2019).

Identifying issues of Lehman brother case:

The case of Lehman brothers is discussed with respect to the auditing issues faced by

the organization and their failure of disclose the defective accounting policy of excess

borrowing and misrepresentation of earning capacity of organization. The unforeseen

collapse of large investment bank is partially attributable to the ineffective and weak auditing

practices adopted by the company under the guideline of the old auditing standard that did

not mandated the revealing of the identified key audit matters. The audit report issued did not

make accurate projections of the long term sustainability of the business in light of

uncertainties and risks (Dodo 2017). Moreover, the transactions relating to the repurchase

agreements under the Repo 105 was failed to be disclosed by the auditor. The financing of

daily operations of the firm with the help of Repo markets and the ability of the company to

settle down its Repo positions should have been investigated. The firm would have been

placed in a opposition to manage its accounts and balance sheet that responded to the

fluctuations of market had the external auditing been effective (Cordoş and Fülöp 2015).

Therefore, it can be inferred that the issue surrounding the collapse of the investment bank

was that the risk associated with excess borrowing was not anticipated and accounted for by

auditors and an unqualified audit report was issued by the auditors regarding its financial

position.

How key audit matters address the issues:

From the analysis of the case of Lehman brothers, it is quite evident that there exist a

relationship between the development of new auditing standard and collapse of the large

investment banking firm. The development of ASA 701 was due to the failure of such some

corporate organizations and subsequently the financial crisis. Issues faced by the bank that

was not accounted for previously could have been addressed with the introduction of ASA

701. The high repo transactions which the firm was involved into could be revealed along

with concealing of high financial leverage of bank indicating that the company has borrowed

in excess of its capacity and would have adequately anticipated its downfall. Some of the key

audit matters of the Lehman brothers such as subprime borrowings, Repo 105 and earning

capacity could be communicated to the people charged with governance and management and

accordingly a qualified audit opinion would be issued that provides investors with relevant

view of the financial report (Bédard et al. 2016). Therefore, the shareholders would have

made strategic investment decision under the new auditing standard.

Revision of ASA 570:

Under the ASA 570 revision, it is required by the auditors to evaluate the

appropriateness of the assumptions and accounting of going concern of company the financial

statements compilation. Auditors are accountable for accounting for the issues associated

with going concern and its impact on the financial report. The reporting entity ability to

continue as going concern should be assessed by the auditors as per the auditing standard of

Australia. It is the responsibility of the auditors to obtain sufficient and appropriate audit

INDEPENDENT AUDITORS REPORT

understand the audit with the help of announcement of key audit matters irrespective of the

auditors expressing adverse or qualified opinion on the financial statements of company

(auasb.gov.au 2019).

Identifying issues of Lehman brother case:

The case of Lehman brothers is discussed with respect to the auditing issues faced by

the organization and their failure of disclose the defective accounting policy of excess

borrowing and misrepresentation of earning capacity of organization. The unforeseen

collapse of large investment bank is partially attributable to the ineffective and weak auditing

practices adopted by the company under the guideline of the old auditing standard that did

not mandated the revealing of the identified key audit matters. The audit report issued did not

make accurate projections of the long term sustainability of the business in light of

uncertainties and risks (Dodo 2017). Moreover, the transactions relating to the repurchase

agreements under the Repo 105 was failed to be disclosed by the auditor. The financing of

daily operations of the firm with the help of Repo markets and the ability of the company to

settle down its Repo positions should have been investigated. The firm would have been

placed in a opposition to manage its accounts and balance sheet that responded to the

fluctuations of market had the external auditing been effective (Cordoş and Fülöp 2015).

Therefore, it can be inferred that the issue surrounding the collapse of the investment bank

was that the risk associated with excess borrowing was not anticipated and accounted for by

auditors and an unqualified audit report was issued by the auditors regarding its financial

position.

How key audit matters address the issues:

From the analysis of the case of Lehman brothers, it is quite evident that there exist a

relationship between the development of new auditing standard and collapse of the large

investment banking firm. The development of ASA 701 was due to the failure of such some

corporate organizations and subsequently the financial crisis. Issues faced by the bank that

was not accounted for previously could have been addressed with the introduction of ASA

701. The high repo transactions which the firm was involved into could be revealed along

with concealing of high financial leverage of bank indicating that the company has borrowed

in excess of its capacity and would have adequately anticipated its downfall. Some of the key

audit matters of the Lehman brothers such as subprime borrowings, Repo 105 and earning

capacity could be communicated to the people charged with governance and management and

accordingly a qualified audit opinion would be issued that provides investors with relevant

view of the financial report (Bédard et al. 2016). Therefore, the shareholders would have

made strategic investment decision under the new auditing standard.

Revision of ASA 570:

Under the ASA 570 revision, it is required by the auditors to evaluate the

appropriateness of the assumptions and accounting of going concern of company the financial

statements compilation. Auditors are accountable for accounting for the issues associated

with going concern and its impact on the financial report. The reporting entity ability to

continue as going concern should be assessed by the auditors as per the auditing standard of

Australia. It is the responsibility of the auditors to obtain sufficient and appropriate audit

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

evidence for ascertaining whether there any uncertainty prevails about the ability of entity to

continue as going concern. However, there are some inherent limitations the liability of the

auditors for predicting the future conditions or events. Therefore, if the reference to the

material uncertainty about the liability of entity to continue as going concern is not present,

the auditor report in such case cannot provide guarantee on the ability of the entity to

continue as going concern (Brunelli 2018).

Importance of going concern issue in the auditor’s report:

The entity’s ability to prolong as going concern is considered to be important for the

auditors. This is because of the fact that existence any material uncertainty that create a

uncertainty on the company’s ability to continue as going concern would be treated as key

audit matters. Therefore, as per the revised ASA 570, such material uncertainty should be

reported by the auditor in their audit report as key audit matter. In the absence of any

appropriate and sufficient audit evidence regarding the accounting policy for evaluating the

position of entity as going concern, it is not necessary that the auditors will issue an

unqualified and adverse audit opinion on the financial position of the company. However, it

is important for the auditors to conduct an assessment about the going concern issue by

obtaining appropriate and sufficient audit evidence regarding the same (Tsay and Chen

2015). Therefore, auditors are supposed to make conclusion on the going concern ability of

the firm by addressing the matter is the section of key audit report.

Analyzing the key audit matters in the independent auditor’s report of the chosen

banks:

The analysis of the companies in the banking sector is done in this sector by

evaluating their key audit matters in the audit report. The quality of audit is vital for the users

and quality of audit is supported by the recent requirement of communicating key audit

matters and thereby responding to growing demand of stakeholders and investors by gaining

an insight into the auditing process (Zang 2019). The banking companies that have been

chosen for analysis of the key audit matter include ANZ bank, Commonwealth bank of

Australia, Pendal group limited, Bank of Queensland, Macquarie group limited and QBE

Insurance group.

Analyzing the financial report of Macquarie group limited, it is deduced that the audit

opinion on the financial statements of company is formed by auditors by accounting for the

matters that are of significant important in the auditing of financial statements. The audit

matters that are identified by the auditors are related to account such as valuation of financial

liabilities and assets, IT control and system, provision for loss and deferred tax liabilities and

assets. Moreover, all the identified key audit matters have been adequately addressed by

auditors using the appropriate technique and adopting the analytical procedures and sampling

plan as per the suitability of account (Static.macquarie.com 2019).

The auditor of Bank of Queensland has obtained appropriate and sufficient audit

evidence on the basis of which formation of opinion on financial information is done.

Identification of key audit matters for the consolidated entity are done for the bank in relation

to the account such as valuation of goodwill, collective and specific impairment provisions

for advances and loans, fair value measurements for financial instruments, intangible

computer software valuation and system and control of IT. All the key audit matters have

been addressed by adopting the appropriate sampling plan and according to the requirement

of the auditing standard. Auditing procedures also involved assessing the effectiveness of the

INDEPENDENT AUDITORS REPORT

evidence for ascertaining whether there any uncertainty prevails about the ability of entity to

continue as going concern. However, there are some inherent limitations the liability of the

auditors for predicting the future conditions or events. Therefore, if the reference to the

material uncertainty about the liability of entity to continue as going concern is not present,

the auditor report in such case cannot provide guarantee on the ability of the entity to

continue as going concern (Brunelli 2018).

Importance of going concern issue in the auditor’s report:

The entity’s ability to prolong as going concern is considered to be important for the

auditors. This is because of the fact that existence any material uncertainty that create a

uncertainty on the company’s ability to continue as going concern would be treated as key

audit matters. Therefore, as per the revised ASA 570, such material uncertainty should be

reported by the auditor in their audit report as key audit matter. In the absence of any

appropriate and sufficient audit evidence regarding the accounting policy for evaluating the

position of entity as going concern, it is not necessary that the auditors will issue an

unqualified and adverse audit opinion on the financial position of the company. However, it

is important for the auditors to conduct an assessment about the going concern issue by

obtaining appropriate and sufficient audit evidence regarding the same (Tsay and Chen

2015). Therefore, auditors are supposed to make conclusion on the going concern ability of

the firm by addressing the matter is the section of key audit report.

Analyzing the key audit matters in the independent auditor’s report of the chosen

banks:

The analysis of the companies in the banking sector is done in this sector by

evaluating their key audit matters in the audit report. The quality of audit is vital for the users

and quality of audit is supported by the recent requirement of communicating key audit

matters and thereby responding to growing demand of stakeholders and investors by gaining

an insight into the auditing process (Zang 2019). The banking companies that have been

chosen for analysis of the key audit matter include ANZ bank, Commonwealth bank of

Australia, Pendal group limited, Bank of Queensland, Macquarie group limited and QBE

Insurance group.

Analyzing the financial report of Macquarie group limited, it is deduced that the audit

opinion on the financial statements of company is formed by auditors by accounting for the

matters that are of significant important in the auditing of financial statements. The audit

matters that are identified by the auditors are related to account such as valuation of financial

liabilities and assets, IT control and system, provision for loss and deferred tax liabilities and

assets. Moreover, all the identified key audit matters have been adequately addressed by

auditors using the appropriate technique and adopting the analytical procedures and sampling

plan as per the suitability of account (Static.macquarie.com 2019).

The auditor of Bank of Queensland has obtained appropriate and sufficient audit

evidence on the basis of which formation of opinion on financial information is done.

Identification of key audit matters for the consolidated entity are done for the bank in relation

to the account such as valuation of goodwill, collective and specific impairment provisions

for advances and loans, fair value measurements for financial instruments, intangible

computer software valuation and system and control of IT. All the key audit matters have

been addressed by adopting the appropriate sampling plan and according to the requirement

of the auditing standard. Auditing procedures also involved assessing the effectiveness of the

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

internal control system (Boq.com.au 2019). In addition to this, the reason why the accounts

are considered to have material impact is explained by referring to the relevant notes to

financial statements.

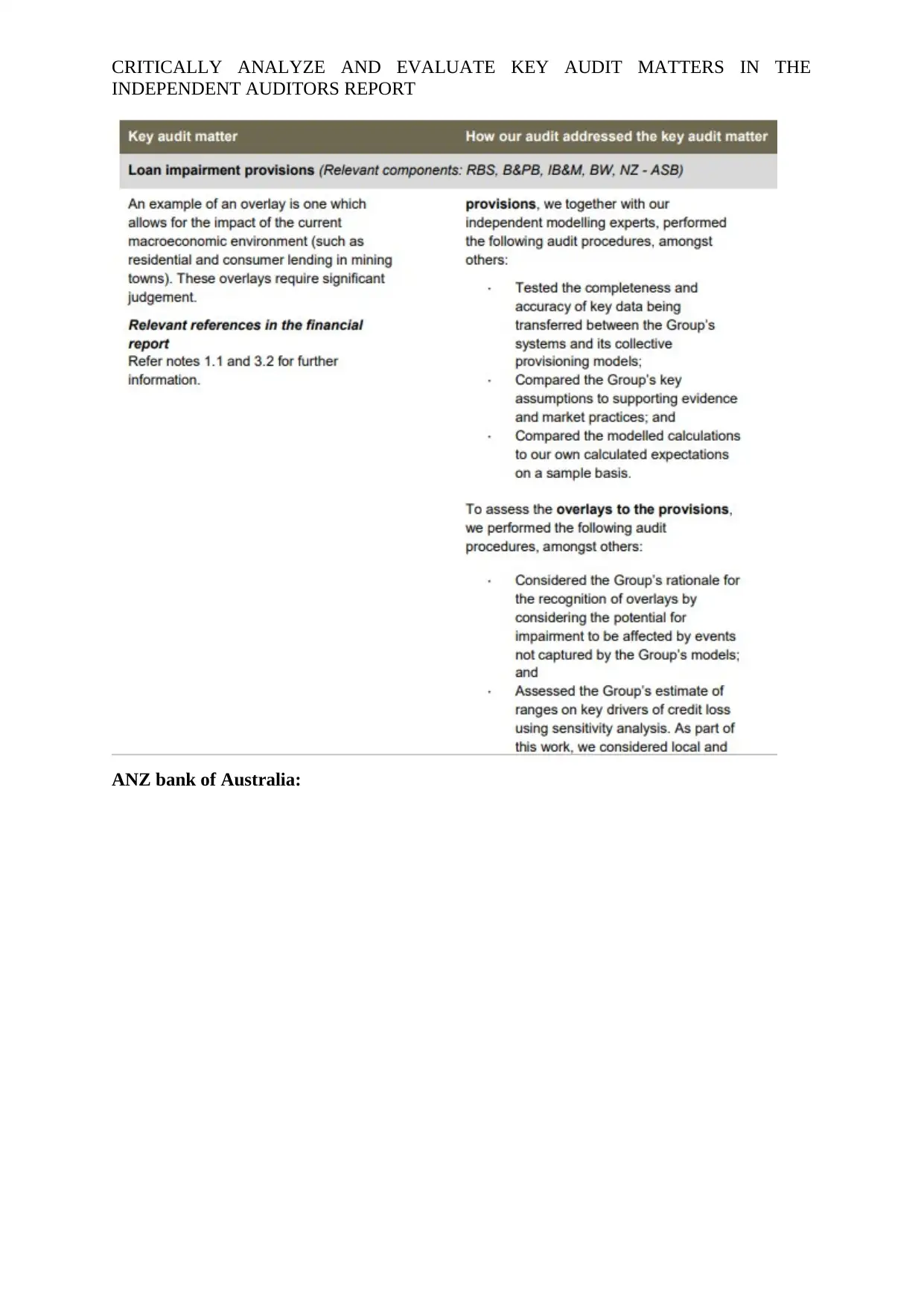

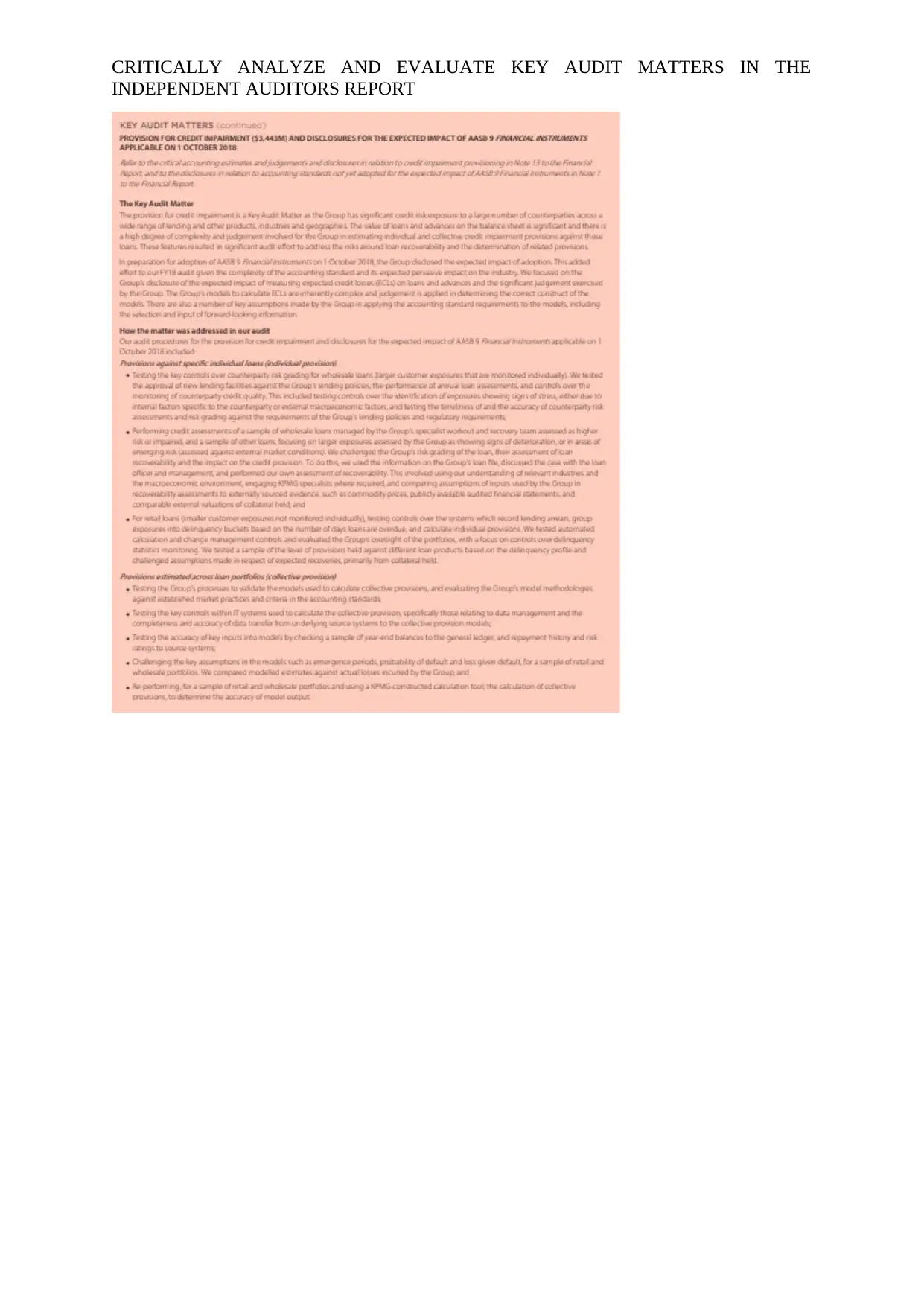

For the ANZ bank, auditors have made a detailed description of the key audit matters

identified in a separate section. All such matters are addressed in the context of auditing the

financial statements as a whole. Key audit matters include customer remediation provision,

credit impairment provisions and disclosures of impact of AASB 9 financial instruments. In

addition to this, there was also other account that was assessed for materiality such as

accounting for divestments, valuation at fair value relation to financial instruments and IT

control and system. Moreover, there was also a detailed description of how such matters were

addressed in the report. Such method includes adopting the sampling plans, testing the key

controls and analytical procedures that are appropriate to the account (Shareholder.anz.com

2019).

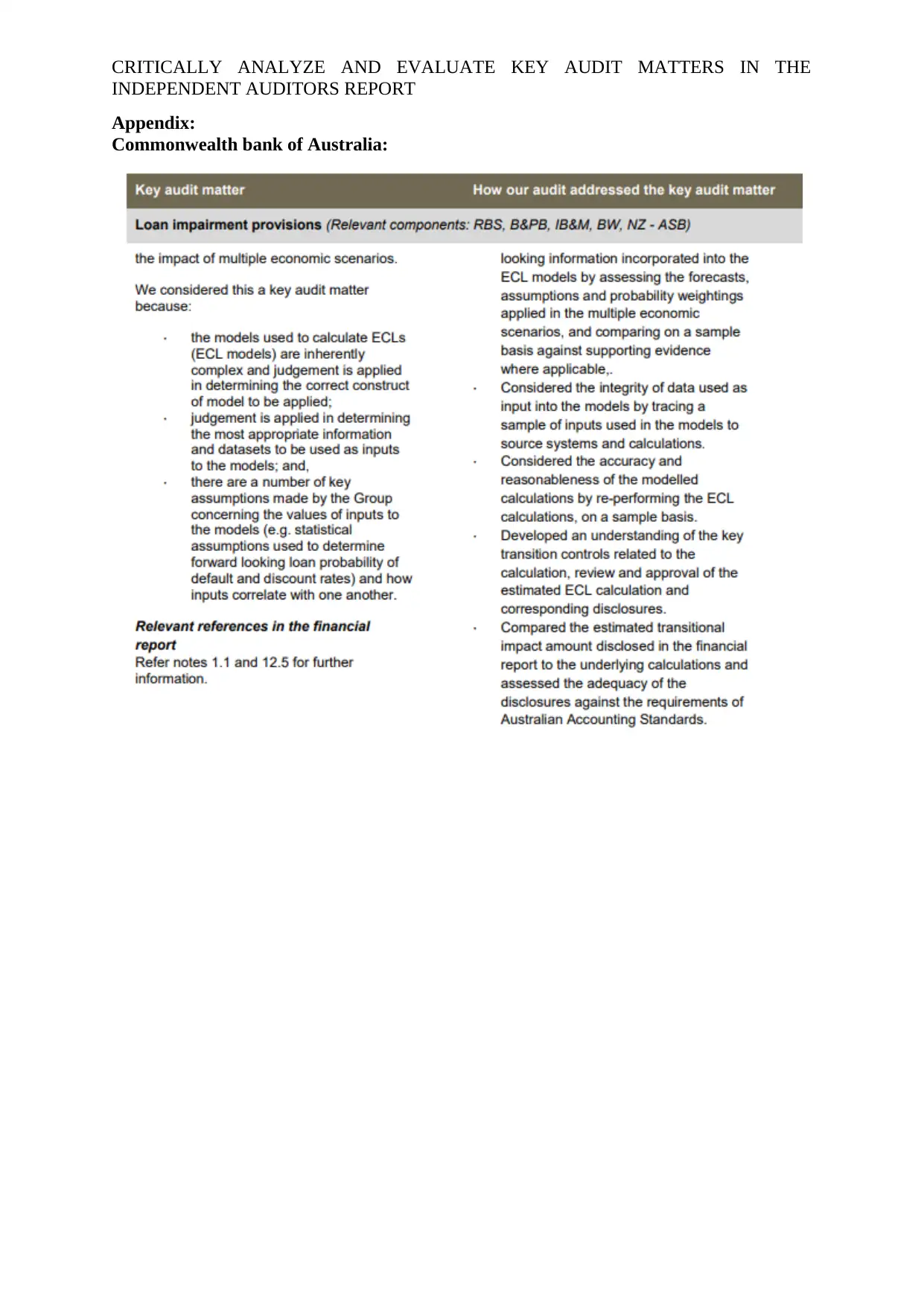

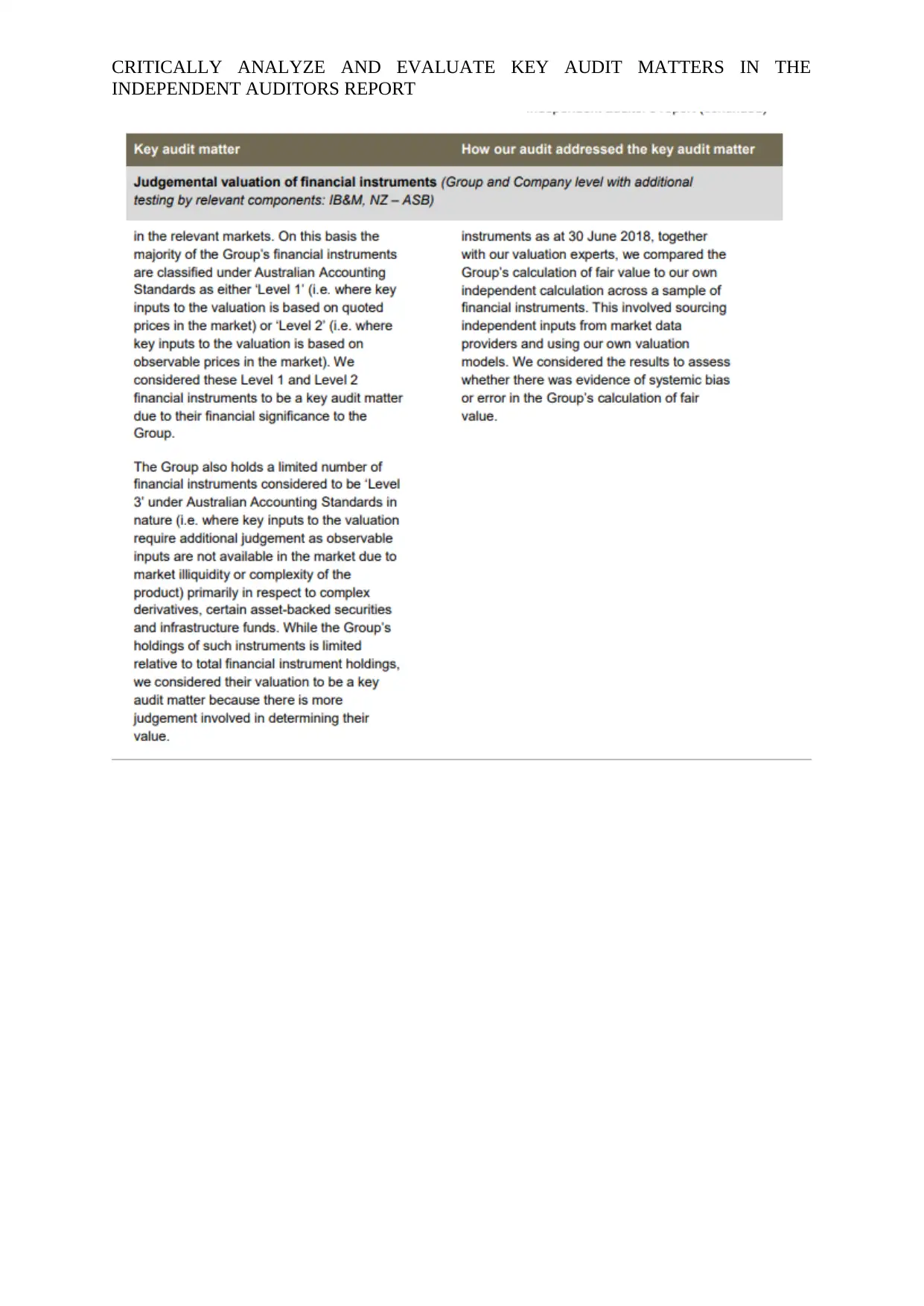

Identification of key audit matters by the auditors of Commonwealth bank relates to

the company and the group as a whole with the exception to the valuation of liabilities of

insurance policy holders that is related only to the group. The comment on the outcome of the

procedures of auditing is made in the context of key audit matter. The key audit matters

identified are provision for loan impairment, judgment involved in the valuation if financial

instruments, regular action and conduct risk provisions and the insurance policyholder

liabilities valuation and financial reporting information in relation to IT control and system

(Commbank.com.au 2019). Furthermore, it has been observed that the assessment of such

accounts is done in reference to the requirements of the applicable accounting standard.

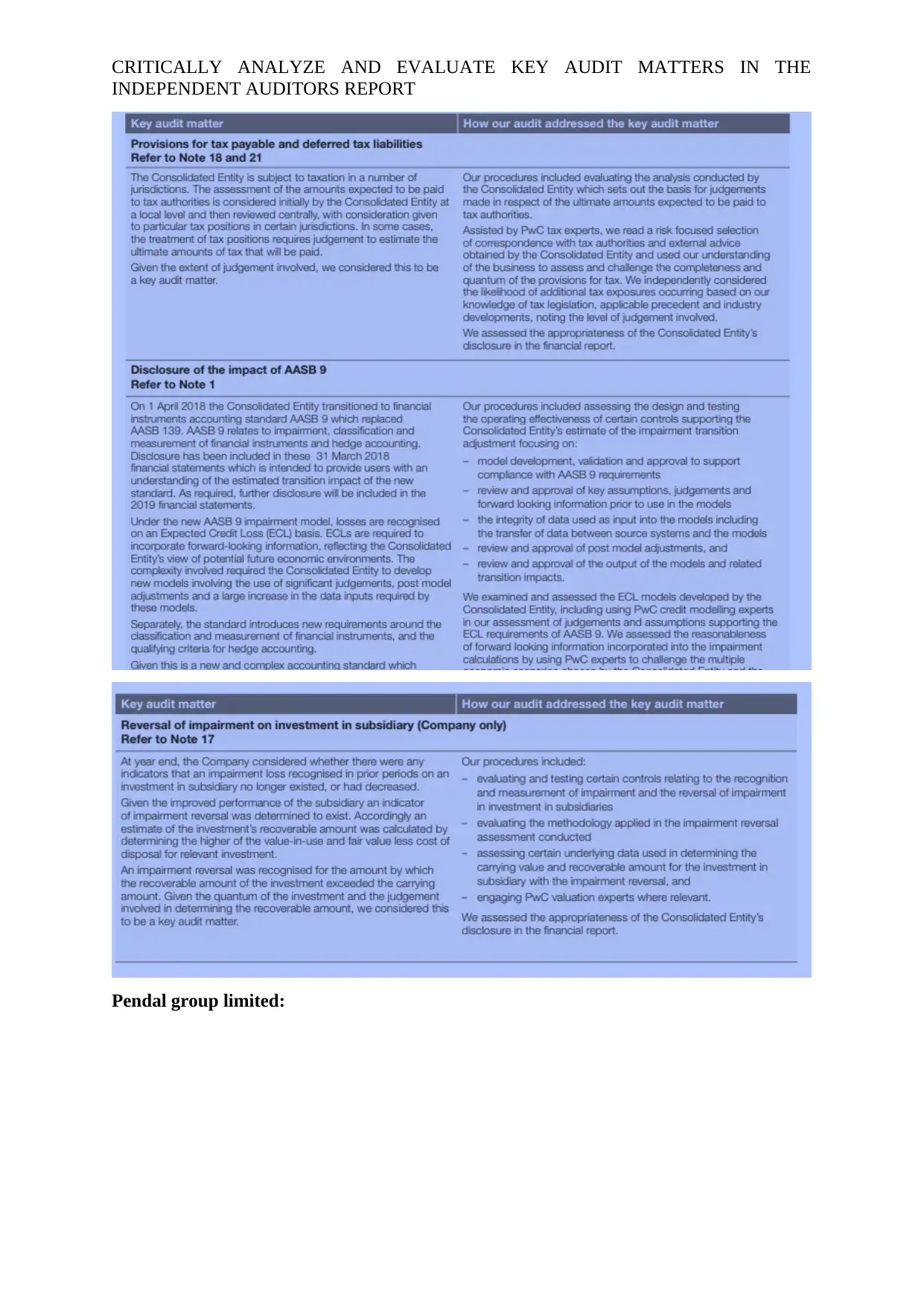

Key audit matters identified by the auditors of Pendal group limited have made

disclosure to the audit committee and the accounts for which materiality have been accounted

such as fee revenue recognition, investment management contracts, intangible assets moving

value and accounting for remuneration scheme of employees. All the key audit matters have

been addressed by adopting the analytical procedures such as testing the mathematical

accuracy and assessing the key estimates, assumptions and judgment made by management

(pendalgroup.com 2019). Some of the recent report concerning the recognition of fees has

also been tested for evaluation.

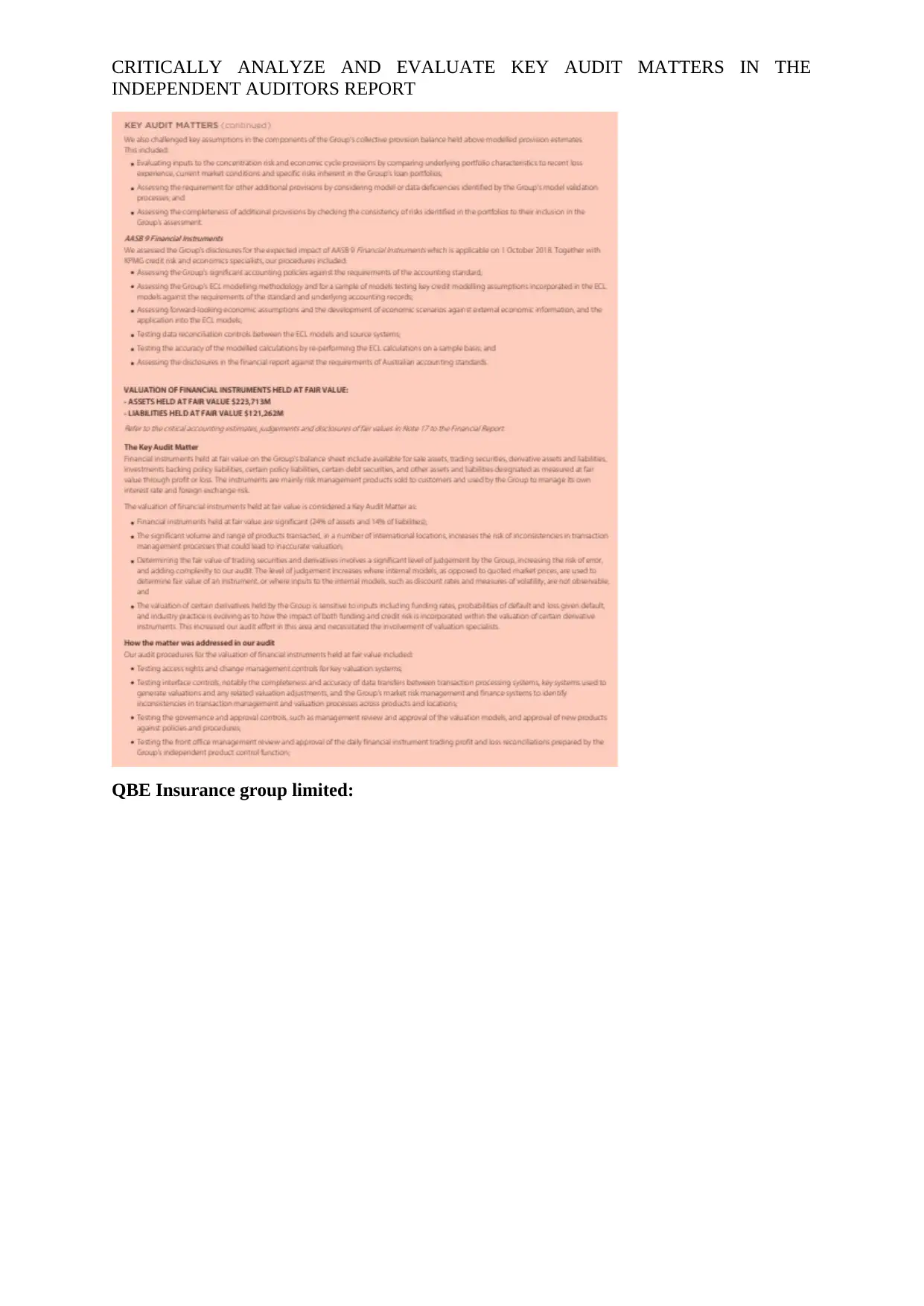

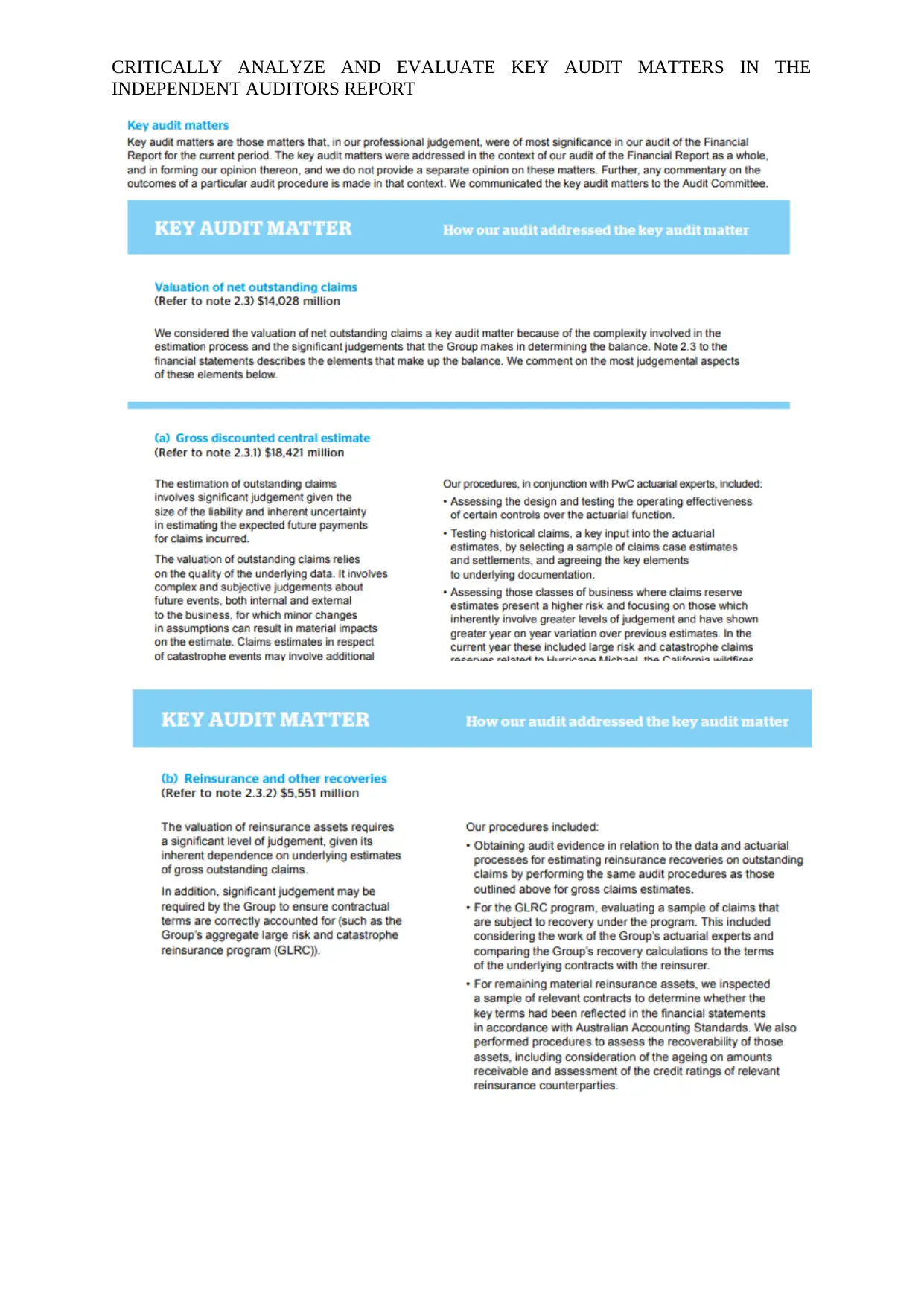

The auditors of QBE Insurance group have presented in a separate section with such

matters comprising of valuation of goodwill, adequacy probability, IT system and control,

investment valuation, valuation on the net outstanding claims and recoverability of deferred

tax assets. In addition to this, a detailed disclosure is presented by the auditors such as why

the accounts are treated to be material and it provided an explanation by referring to the notes

to financial statements (Qbe2018.qreports.com.au 2019). There has been the development of

adequate audit procedures in relation to all accounts and the opinion has been formed

accordingly by obtaining adequate audit evidence.

From the analysis of all the key audit matters of companies selected, it can be

observed that all such matters have been identified with respect to the preparation of the

financial report and for the group as a whole. However no auditors have provided a separate

opinion on all the key audit matters identified but there is a separate presentation of the key

audit matters.

INDEPENDENT AUDITORS REPORT

internal control system (Boq.com.au 2019). In addition to this, the reason why the accounts

are considered to have material impact is explained by referring to the relevant notes to

financial statements.

For the ANZ bank, auditors have made a detailed description of the key audit matters

identified in a separate section. All such matters are addressed in the context of auditing the

financial statements as a whole. Key audit matters include customer remediation provision,

credit impairment provisions and disclosures of impact of AASB 9 financial instruments. In

addition to this, there was also other account that was assessed for materiality such as

accounting for divestments, valuation at fair value relation to financial instruments and IT

control and system. Moreover, there was also a detailed description of how such matters were

addressed in the report. Such method includes adopting the sampling plans, testing the key

controls and analytical procedures that are appropriate to the account (Shareholder.anz.com

2019).

Identification of key audit matters by the auditors of Commonwealth bank relates to

the company and the group as a whole with the exception to the valuation of liabilities of

insurance policy holders that is related only to the group. The comment on the outcome of the

procedures of auditing is made in the context of key audit matter. The key audit matters

identified are provision for loan impairment, judgment involved in the valuation if financial

instruments, regular action and conduct risk provisions and the insurance policyholder

liabilities valuation and financial reporting information in relation to IT control and system

(Commbank.com.au 2019). Furthermore, it has been observed that the assessment of such

accounts is done in reference to the requirements of the applicable accounting standard.

Key audit matters identified by the auditors of Pendal group limited have made

disclosure to the audit committee and the accounts for which materiality have been accounted

such as fee revenue recognition, investment management contracts, intangible assets moving

value and accounting for remuneration scheme of employees. All the key audit matters have

been addressed by adopting the analytical procedures such as testing the mathematical

accuracy and assessing the key estimates, assumptions and judgment made by management

(pendalgroup.com 2019). Some of the recent report concerning the recognition of fees has

also been tested for evaluation.

The auditors of QBE Insurance group have presented in a separate section with such

matters comprising of valuation of goodwill, adequacy probability, IT system and control,

investment valuation, valuation on the net outstanding claims and recoverability of deferred

tax assets. In addition to this, a detailed disclosure is presented by the auditors such as why

the accounts are treated to be material and it provided an explanation by referring to the notes

to financial statements (Qbe2018.qreports.com.au 2019). There has been the development of

adequate audit procedures in relation to all accounts and the opinion has been formed

accordingly by obtaining adequate audit evidence.

From the analysis of all the key audit matters of companies selected, it can be

observed that all such matters have been identified with respect to the preparation of the

financial report and for the group as a whole. However no auditors have provided a separate

opinion on all the key audit matters identified but there is a separate presentation of the key

audit matters.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Do key audit matters serve the purpose in the industry?

The revised auditing standard was introduced to bring transparency in the financial

information presented by different entities. Auditors has presented and informed about the

key audit matters in accordance with the requirements of the ASA 701 in the independent

auditor report. Identification of such matters would assist the users in gaining an

understanding the nature of entity and any existence of any material account that would have

impact on their investment decision making process. There is an enhancement in the

information transparency as the matters have been communicated and accordingly the

opinion has been made by auditors. Moreover, all the key matters are addressed by

developing the appropriate analytical procedures so that the materiality of the identified

accounts has been addressed.

Conclusion:

The paper addresses the impact of communicating the key audit matters that is

communicated as per the requirements of new auditing standard. The auditors create an

emphasis on such matters based on the professional judgment, by disclosing such accounts

that can have material impact on the process of making decision. It is therefore required by

the auditors to communicate and identify such matters in the auditor report. Furthermore, in

the current study, the importance of going concern issue has been accounted by auditors and

have been ascertained that issue of going concern is regarded as key audit matters and hence

should adequately assessed by auditors by gathering appropriate evidence.

INDEPENDENT AUDITORS REPORT

Do key audit matters serve the purpose in the industry?

The revised auditing standard was introduced to bring transparency in the financial

information presented by different entities. Auditors has presented and informed about the

key audit matters in accordance with the requirements of the ASA 701 in the independent

auditor report. Identification of such matters would assist the users in gaining an

understanding the nature of entity and any existence of any material account that would have

impact on their investment decision making process. There is an enhancement in the

information transparency as the matters have been communicated and accordingly the

opinion has been made by auditors. Moreover, all the key matters are addressed by

developing the appropriate analytical procedures so that the materiality of the identified

accounts has been addressed.

Conclusion:

The paper addresses the impact of communicating the key audit matters that is

communicated as per the requirements of new auditing standard. The auditors create an

emphasis on such matters based on the professional judgment, by disclosing such accounts

that can have material impact on the process of making decision. It is therefore required by

the auditors to communicate and identify such matters in the auditor report. Furthermore, in

the current study, the importance of going concern issue has been accounted by auditors and

have been ascertained that issue of going concern is regarded as key audit matters and hence

should adequately assessed by auditors by gathering appropriate evidence.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

References list:

Annual-report-2018.pendalgroup.com., 2019. [online] Available at: https://annual-report-

2018.pendalgroup.com/uploads/Pendal_FinancialStatements2018.pdf [Accessed 23 May

2019].

Auasb.gov.au., 2019. [online] Available at:

https://www.auasb.gov.au/admin/file/content102/c3/ASA_701_2015.pdf [Accessed 23 May

2019].

Auasb.gov.au., 2019. [online] Available at:

https://www.auasb.gov.au/admin/file/content102/c3/ASA_570_2015.pdf [Accessed 23 May

2019].

Bédard, J., Coram, P., Espahbodi, R. and Mock, T.J., 2016. Does recent academic research

support changes to audit reporting standards?. Accounting Horizons, 30(2), pp.255-275.

Boq.com.au., 2019. [online] Available at:

https://www.boq.com.au/content/dam/boq/files/shareholder-centre/financial-results/2018/

FY2018_Annual_Report.pdf [Accessed 23 May 2019].

Brasel, K., Doxey, M.M., Grenier, J.H. and Reffett, A., 2016. Risk disclosure preceding

negative outcomes: The effects of reporting critical audit matters on judgments of auditor

liability. The Accounting Review, 91(5), pp.1345-1362.

Brunelli, S., 2018. The Firm’Going Concern in the Contemporary Era. In Audit Reporting for

Going Concern Uncertainty (pp. 1-25). Springer, Cham.

Commbank.com.au., 2019. [online] Available at:

https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/results/

fy18/cba-annual-report-2018.pdf [Accessed 23 May 2019].

Cordoş, G.S. and Fülöp, M.T., 2015. Understanding audit reporting changes: introduction of

Key Audit Matters. Accounting & Management Information Systems/Contabilitate si

Informatica de Gestiune, 14(1).

Cordoş, G.S., 2015. Implications of the current exposure draft on audit

reporting. Management Intercultural, (33), pp.61-70.

Czerney, K., Schmidt, J.J. and Thompson, A.M., 2019. Do investors respond to explanatory

language included in unqualified audit reports?. Contemporary Accounting Research, 36(1),

pp.198-229.

Dodo, A.A., 2017. Corporate collapse and the role of audit committees: A case study of

Lehman Brothers. World Journal of social sciences, 7(1), pp.19-29.

Dosdall, H. and Rom-Jensen, B.Z., 2017. Letting Lehman Go: Critique, Social Change, and

the Demise of Lehman Brothers. Historical Social Research/Historische Sozialforschung,

pp.196-217.

Gaynor, L.M., Kelton, A.S., Mercer, M. and Yohn, T.L., 2016. Understanding the relation

between financial reporting quality and audit quality. Auditing: A Journal of Practice &

Theory, 35(4), pp.1-22.

INDEPENDENT AUDITORS REPORT

References list:

Annual-report-2018.pendalgroup.com., 2019. [online] Available at: https://annual-report-

2018.pendalgroup.com/uploads/Pendal_FinancialStatements2018.pdf [Accessed 23 May

2019].

Auasb.gov.au., 2019. [online] Available at:

https://www.auasb.gov.au/admin/file/content102/c3/ASA_701_2015.pdf [Accessed 23 May

2019].

Auasb.gov.au., 2019. [online] Available at:

https://www.auasb.gov.au/admin/file/content102/c3/ASA_570_2015.pdf [Accessed 23 May

2019].

Bédard, J., Coram, P., Espahbodi, R. and Mock, T.J., 2016. Does recent academic research

support changes to audit reporting standards?. Accounting Horizons, 30(2), pp.255-275.

Boq.com.au., 2019. [online] Available at:

https://www.boq.com.au/content/dam/boq/files/shareholder-centre/financial-results/2018/

FY2018_Annual_Report.pdf [Accessed 23 May 2019].

Brasel, K., Doxey, M.M., Grenier, J.H. and Reffett, A., 2016. Risk disclosure preceding

negative outcomes: The effects of reporting critical audit matters on judgments of auditor

liability. The Accounting Review, 91(5), pp.1345-1362.

Brunelli, S., 2018. The Firm’Going Concern in the Contemporary Era. In Audit Reporting for

Going Concern Uncertainty (pp. 1-25). Springer, Cham.

Commbank.com.au., 2019. [online] Available at:

https://www.commbank.com.au/content/dam/commbank/about-us/shareholders/pdfs/results/

fy18/cba-annual-report-2018.pdf [Accessed 23 May 2019].

Cordoş, G.S. and Fülöp, M.T., 2015. Understanding audit reporting changes: introduction of

Key Audit Matters. Accounting & Management Information Systems/Contabilitate si

Informatica de Gestiune, 14(1).

Cordoş, G.S., 2015. Implications of the current exposure draft on audit

reporting. Management Intercultural, (33), pp.61-70.

Czerney, K., Schmidt, J.J. and Thompson, A.M., 2019. Do investors respond to explanatory

language included in unqualified audit reports?. Contemporary Accounting Research, 36(1),

pp.198-229.

Dodo, A.A., 2017. Corporate collapse and the role of audit committees: A case study of

Lehman Brothers. World Journal of social sciences, 7(1), pp.19-29.

Dosdall, H. and Rom-Jensen, B.Z., 2017. Letting Lehman Go: Critique, Social Change, and

the Demise of Lehman Brothers. Historical Social Research/Historische Sozialforschung,

pp.196-217.

Gaynor, L.M., Kelton, A.S., Mercer, M. and Yohn, T.L., 2016. Understanding the relation

between financial reporting quality and audit quality. Auditing: A Journal of Practice &

Theory, 35(4), pp.1-22.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

George-Silviu, C. and Melinda-Timea, F., 2015. New audit reporting challenges: auditing the

going concern basis of accounting. Procedia Economics and Finance, 32, pp.216-224.

Qbe2018.qreports.com.au., 2019. Retrieved 23 May 2019, from

https://qbe2018.qreports.com.au/xresources/pdf/qbe18-annual-report-complete.pdf

Shareholder.anz.com. 2019. [online] Available at:

https://shareholder.anz.com/sites/default/files/anz_2018_annual_report_final.pdf [Accessed

23 May 2019].

Static.macquarie.com., 2019. [online] Available at:

https://static.macquarie.com/dafiles/Internet/mgl/global/shared/about/investors/results/

2018/Macquarie-Group-FY18-Annual-Report.pdf? [Accessed 23 May 2019].

Tsay, B.Y. and Chen, S., 2015. The Going Concern Assumption: Critical Issues for

Auditors. The CPA Journal, 85(12), p.46.

Zang, H., 2019. Case Study: The Development of Shareholder Activism in Japan since the

Lehman Shock. The Journal of Investing, pp.joi-2019.

INDEPENDENT AUDITORS REPORT

George-Silviu, C. and Melinda-Timea, F., 2015. New audit reporting challenges: auditing the

going concern basis of accounting. Procedia Economics and Finance, 32, pp.216-224.

Qbe2018.qreports.com.au., 2019. Retrieved 23 May 2019, from

https://qbe2018.qreports.com.au/xresources/pdf/qbe18-annual-report-complete.pdf

Shareholder.anz.com. 2019. [online] Available at:

https://shareholder.anz.com/sites/default/files/anz_2018_annual_report_final.pdf [Accessed

23 May 2019].

Static.macquarie.com., 2019. [online] Available at:

https://static.macquarie.com/dafiles/Internet/mgl/global/shared/about/investors/results/

2018/Macquarie-Group-FY18-Annual-Report.pdf? [Accessed 23 May 2019].

Tsay, B.Y. and Chen, S., 2015. The Going Concern Assumption: Critical Issues for

Auditors. The CPA Journal, 85(12), p.46.

Zang, H., 2019. Case Study: The Development of Shareholder Activism in Japan since the

Lehman Shock. The Journal of Investing, pp.joi-2019.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Appendix:

Commonwealth bank of Australia:

INDEPENDENT AUDITORS REPORT

Appendix:

Commonwealth bank of Australia:

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

ANZ bank of Australia:

INDEPENDENT AUDITORS REPORT

ANZ bank of Australia:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

QBE Insurance group limited:

INDEPENDENT AUDITORS REPORT

QBE Insurance group limited:

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Macquarie group limited:

INDEPENDENT AUDITORS REPORT

Macquarie group limited:

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Pendal group limited:

INDEPENDENT AUDITORS REPORT

Pendal group limited:

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

Bank of Queensland:

INDEPENDENT AUDITORS REPORT

Bank of Queensland:

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

CRITICALLY ANALYZE AND EVALUATE KEY AUDIT MATTERS IN THE

INDEPENDENT AUDITORS REPORT

INDEPENDENT AUDITORS REPORT

1 out of 22

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.