The Rise of Crypto Currencies and Their Impact on the World Economy

VerifiedAdded on 2023/06/12

|58

|15971

|382

AI Summary

This article discusses the concept of crypto currencies, factors affecting the market of crypto currencies, legal aspects of crypto currencies, economic aspects of crypto currencies, and risks in smart contracts. It also covers the research methodology, data analysis, and conclusion and recommendations. The subject is relevant to finance and economics, and the course code and college/university are not mentioned.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running head: IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

The rise of crypto currencies and their impact on the world economy

Name of the Student

Name of the University

Author’s Note

The rise of crypto currencies and their impact on the world economy

Name of the Student

Name of the University

Author’s Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

2

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Table of Contents

Chapter 2: Literature Review...........................................................................................................3

1.1 Concept of Crypto currencies................................................................................................3

Factors affecting market of crypto currencies.............................................................................6

Legal aspects of Crypto currencies..............................................................................................9

Economic aspect of crypto currencies.......................................................................................12

Risks in Smart Contract.............................................................................................................14

A network of micropayment channels can solve scalability.........................................................16

Hashedlocked Bidirectional Micropayment Channels..............................................................17

Hashed Timelock Contract (HTLC)..........................................................................................17

Protection and Security..............................................................................................................19

Chapter 3: Research methodology.................................................................................................21

3.0 Introduction..........................................................................................................................21

3.1 Research Philosophy............................................................................................................21

3.2 Research Approach..............................................................................................................22

3.3 Research Design..................................................................................................................23

3.4 Data Collection....................................................................................................................25

3.5 Sampling technique.............................................................................................................25

3.6 Data Collection instruments................................................................................................26

3.7 Data Analysis.......................................................................................................................27

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Table of Contents

Chapter 2: Literature Review...........................................................................................................3

1.1 Concept of Crypto currencies................................................................................................3

Factors affecting market of crypto currencies.............................................................................6

Legal aspects of Crypto currencies..............................................................................................9

Economic aspect of crypto currencies.......................................................................................12

Risks in Smart Contract.............................................................................................................14

A network of micropayment channels can solve scalability.........................................................16

Hashedlocked Bidirectional Micropayment Channels..............................................................17

Hashed Timelock Contract (HTLC)..........................................................................................17

Protection and Security..............................................................................................................19

Chapter 3: Research methodology.................................................................................................21

3.0 Introduction..........................................................................................................................21

3.1 Research Philosophy............................................................................................................21

3.2 Research Approach..............................................................................................................22

3.3 Research Design..................................................................................................................23

3.4 Data Collection....................................................................................................................25

3.5 Sampling technique.............................................................................................................25

3.6 Data Collection instruments................................................................................................26

3.7 Data Analysis.......................................................................................................................27

3

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

3.8 Ethical consideration...........................................................................................................27

3.9 Limitations...........................................................................................................................28

3.10 Summary............................................................................................................................29

Chapter 4: Data Analysis...............................................................................................................30

4.1 Introduction..........................................................................................................................30

4.2 Qualitative Analysis.............................................................................................................30

Chapter 5: Conclusion and Recommendations..............................................................................40

5.1 Conclusion...........................................................................................................................40

5.2 Recommendations................................................................................................................41

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

3.8 Ethical consideration...........................................................................................................27

3.9 Limitations...........................................................................................................................28

3.10 Summary............................................................................................................................29

Chapter 4: Data Analysis...............................................................................................................30

4.1 Introduction..........................................................................................................................30

4.2 Qualitative Analysis.............................................................................................................30

Chapter 5: Conclusion and Recommendations..............................................................................40

5.1 Conclusion...........................................................................................................................40

5.2 Recommendations................................................................................................................41

4

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Chapter 2: Literature Review

2.1 Concept of Crypto currencies

As remarked by Al-Bassam et al. (2017), crypto currencies have been gaining popularity

in all over the world in a rapid speed. Crypto currencies are depicted as digital currencies that

have no real existence in the market. It is an asset that can be only digitally transferred between

parties. Bit coins have been the cost used crypto currencies in the market. The bit coins have

been maintaining the digital currencies transfer in the market. The use of the digital currencies

have been maximizing the business of various companies in all over the world. Crypto currencies

have been maintaining the global transfer market in all over the world. The use of different

protocols have been implemented for the security of the crypto currencies in the market. As

demonstrated by Zheng, Xie and Wang (2016), the use of saturated market strategy in this

technology have been helping in maintaining the flexibility if the technology. The digital

amount can be transferred from one party to another with the help of the crypto currency

technology. Various financial institution have been researching in the technology of crypto

currencies in the world. Luu et al. (2016) argued that the gateway of crypto currencies have

simplified the tendency of the digital transfer of assets and financial documents all over the

world. A massive amount of money has been floating in the market increase in the businesses all

over the world. Therefore, the transfer of these money from one contender to anywhere have

been difficult through the normal transactions.

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Chapter 2: Literature Review

2.1 Concept of Crypto currencies

As remarked by Al-Bassam et al. (2017), crypto currencies have been gaining popularity

in all over the world in a rapid speed. Crypto currencies are depicted as digital currencies that

have no real existence in the market. It is an asset that can be only digitally transferred between

parties. Bit coins have been the cost used crypto currencies in the market. The bit coins have

been maintaining the digital currencies transfer in the market. The use of the digital currencies

have been maximizing the business of various companies in all over the world. Crypto currencies

have been maintaining the global transfer market in all over the world. The use of different

protocols have been implemented for the security of the crypto currencies in the market. As

demonstrated by Zheng, Xie and Wang (2016), the use of saturated market strategy in this

technology have been helping in maintaining the flexibility if the technology. The digital

amount can be transferred from one party to another with the help of the crypto currency

technology. Various financial institution have been researching in the technology of crypto

currencies in the world. Luu et al. (2016) argued that the gateway of crypto currencies have

simplified the tendency of the digital transfer of assets and financial documents all over the

world. A massive amount of money has been floating in the market increase in the businesses all

over the world. Therefore, the transfer of these money from one contender to anywhere have

been difficult through the normal transactions.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

5

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

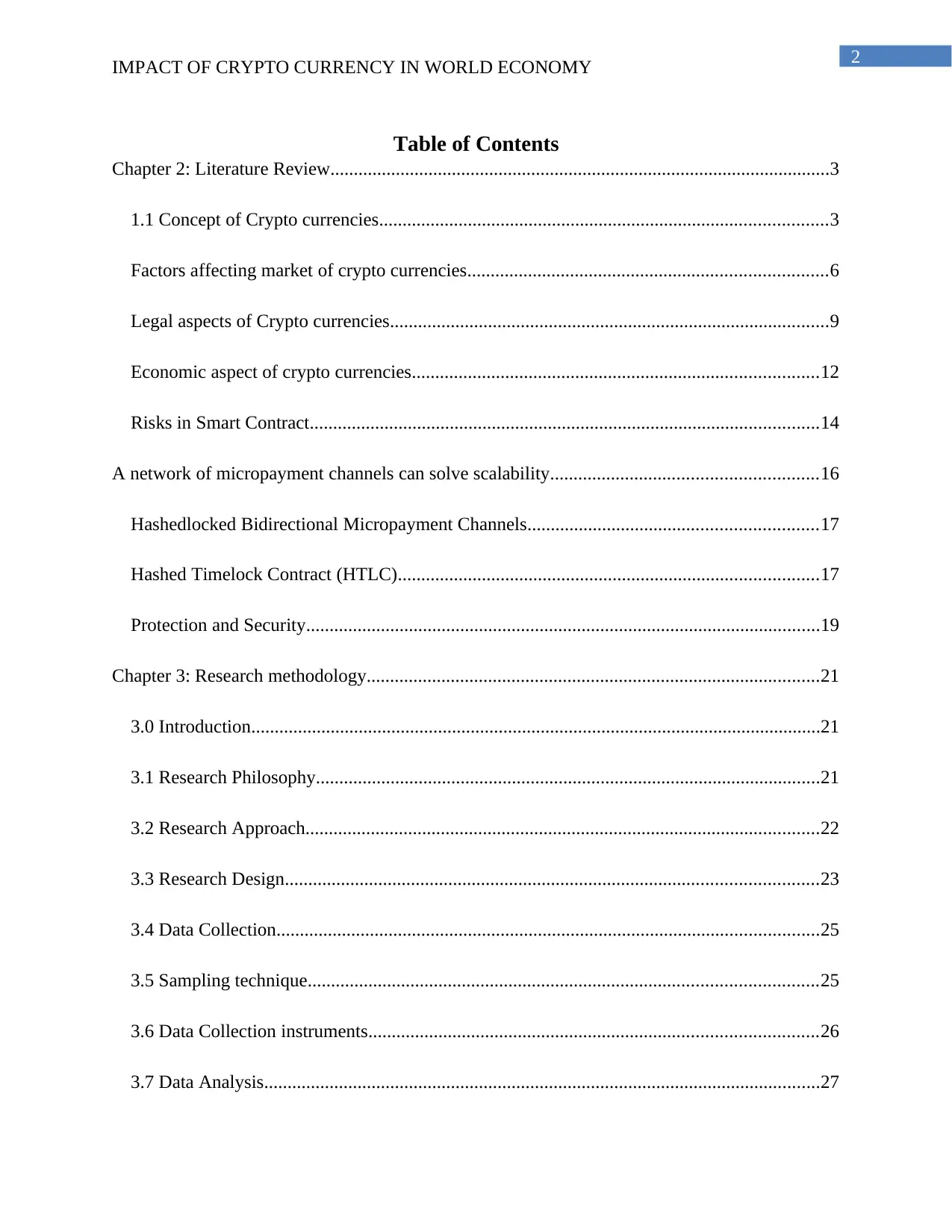

Figure 1: Blockchain Market in 2017

(Source: Lindman, Tuunainen and Rossi 2017)

As commented by Lindman, Tuunainen and Rossi (2017), banks from all over the world

have been facing difficulties on their server. Many times their server used to crash down due to

heavy traffic of transaction all over the worked. Therefore, huge amount of financial loss have

been faced by the companies in the market Therefore, there was a need of a platform for

transferring a huge amount of money and financial documents within a few seconds. This has

evolved the concept of crypto currency in the market. Atzei, Bartoletti and Cimoli (2017) said

that the use of digital currencies have been maintaining huge transaction of money between

parties or companies. The transaction of digital currencies have helped in companies in

maintaining a proper database of their or financial assets in the account. The real money is

converted into digital money and then transferred to other parties. This have helped in

maintaining a proper sequence of the transaction in the market. The use of the digital currencies

have been helping in providing transaction process of the currencies in the market. Bitcoin

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Figure 1: Blockchain Market in 2017

(Source: Lindman, Tuunainen and Rossi 2017)

As commented by Lindman, Tuunainen and Rossi (2017), banks from all over the world

have been facing difficulties on their server. Many times their server used to crash down due to

heavy traffic of transaction all over the worked. Therefore, huge amount of financial loss have

been faced by the companies in the market Therefore, there was a need of a platform for

transferring a huge amount of money and financial documents within a few seconds. This has

evolved the concept of crypto currency in the market. Atzei, Bartoletti and Cimoli (2017) said

that the use of digital currencies have been maintaining huge transaction of money between

parties or companies. The transaction of digital currencies have helped in companies in

maintaining a proper database of their or financial assets in the account. The real money is

converted into digital money and then transferred to other parties. This have helped in

maintaining a proper sequence of the transaction in the market. The use of the digital currencies

have been helping in providing transaction process of the currencies in the market. Bitcoin

6

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

technology have enhanced the level of the crypto currencies in the market. The use of bit coins

in the market have been maintaining various types of transaction in the market. The use of bit

coins have been helping banks in minimizing their pressure in the market. Bitcoin have been

helps in providing a centralized database to the customers. Adopters of Bitcoin technology have

been undermining the importance of money transaction in the market. The use of digital

currencies gave been maintaining currency pose of governments in different countries. However,

flat money transaction have been maintaining the importance of trust factor of the customers in

the market. However, maximum number of customers are investing their money in the crypto

currencies in order to increase their profit in the market.

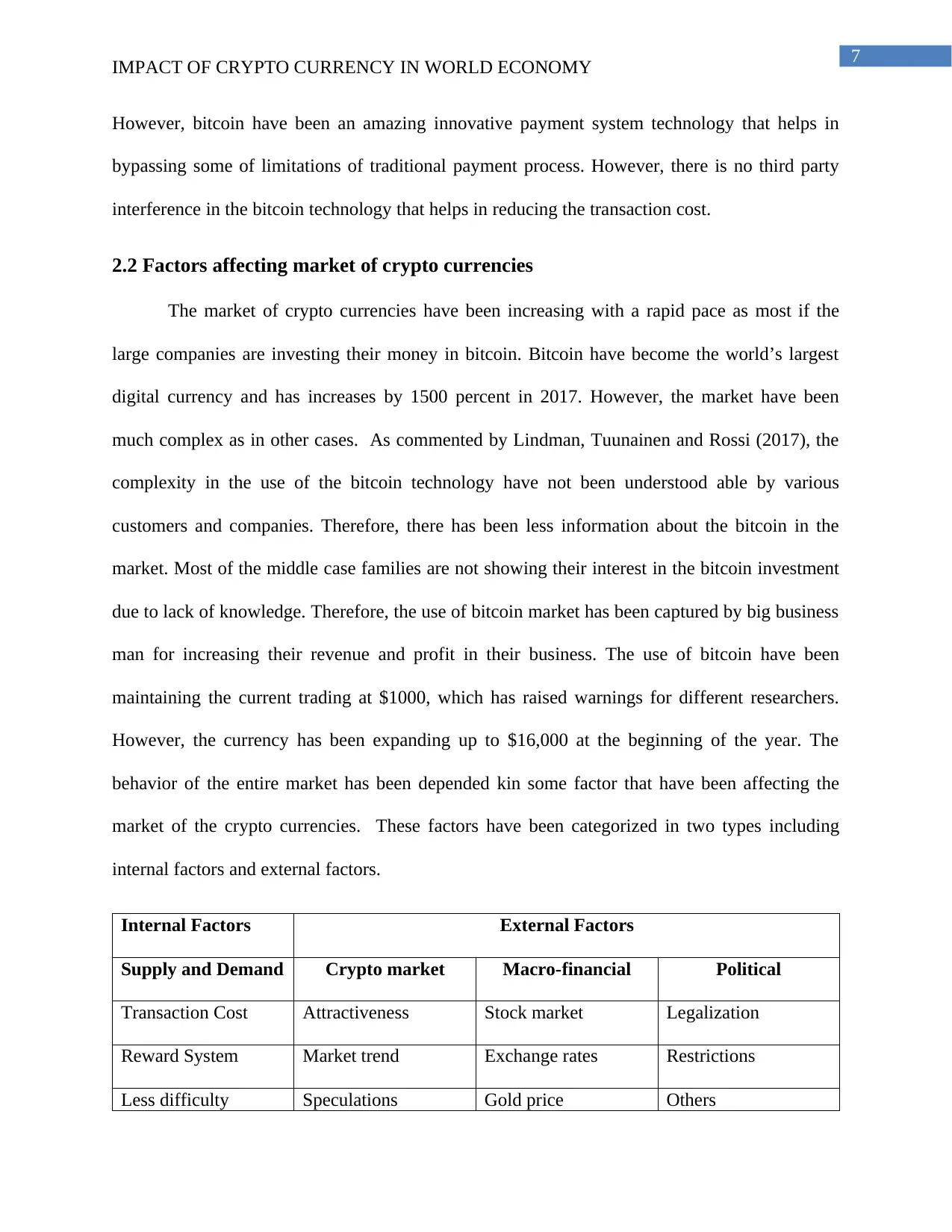

Figure 2: Blockchain growth

(Source: Research-doc.credit-suisse.com, 2018)

There are approximately 7.5 million bitcoin existing in the market and 50 bitcoin are

awarded in every 10 minutes. Therefore, by 2030, the number of bit coins in the market have

been estimated to be 21 million. These have guaranteed the programming protocols for the

managing communities for manipulating the powers of the officials. The valuation of the bitcoin

have been maintaining the technological background of different currencies in the world.

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

technology have enhanced the level of the crypto currencies in the market. The use of bit coins

in the market have been maintaining various types of transaction in the market. The use of bit

coins have been helping banks in minimizing their pressure in the market. Bitcoin have been

helps in providing a centralized database to the customers. Adopters of Bitcoin technology have

been undermining the importance of money transaction in the market. The use of digital

currencies gave been maintaining currency pose of governments in different countries. However,

flat money transaction have been maintaining the importance of trust factor of the customers in

the market. However, maximum number of customers are investing their money in the crypto

currencies in order to increase their profit in the market.

Figure 2: Blockchain growth

(Source: Research-doc.credit-suisse.com, 2018)

There are approximately 7.5 million bitcoin existing in the market and 50 bitcoin are

awarded in every 10 minutes. Therefore, by 2030, the number of bit coins in the market have

been estimated to be 21 million. These have guaranteed the programming protocols for the

managing communities for manipulating the powers of the officials. The valuation of the bitcoin

have been maintaining the technological background of different currencies in the world.

7

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

However, bitcoin have been an amazing innovative payment system technology that helps in

bypassing some of limitations of traditional payment process. However, there is no third party

interference in the bitcoin technology that helps in reducing the transaction cost.

2.2 Factors affecting market of crypto currencies

The market of crypto currencies have been increasing with a rapid pace as most if the

large companies are investing their money in bitcoin. Bitcoin have become the world’s largest

digital currency and has increases by 1500 percent in 2017. However, the market have been

much complex as in other cases. As commented by Lindman, Tuunainen and Rossi (2017), the

complexity in the use of the bitcoin technology have not been understood able by various

customers and companies. Therefore, there has been less information about the bitcoin in the

market. Most of the middle case families are not showing their interest in the bitcoin investment

due to lack of knowledge. Therefore, the use of bitcoin market has been captured by big business

man for increasing their revenue and profit in their business. The use of bitcoin have been

maintaining the current trading at $1000, which has raised warnings for different researchers.

However, the currency has been expanding up to $16,000 at the beginning of the year. The

behavior of the entire market has been depended kin some factor that have been affecting the

market of the crypto currencies. These factors have been categorized in two types including

internal factors and external factors.

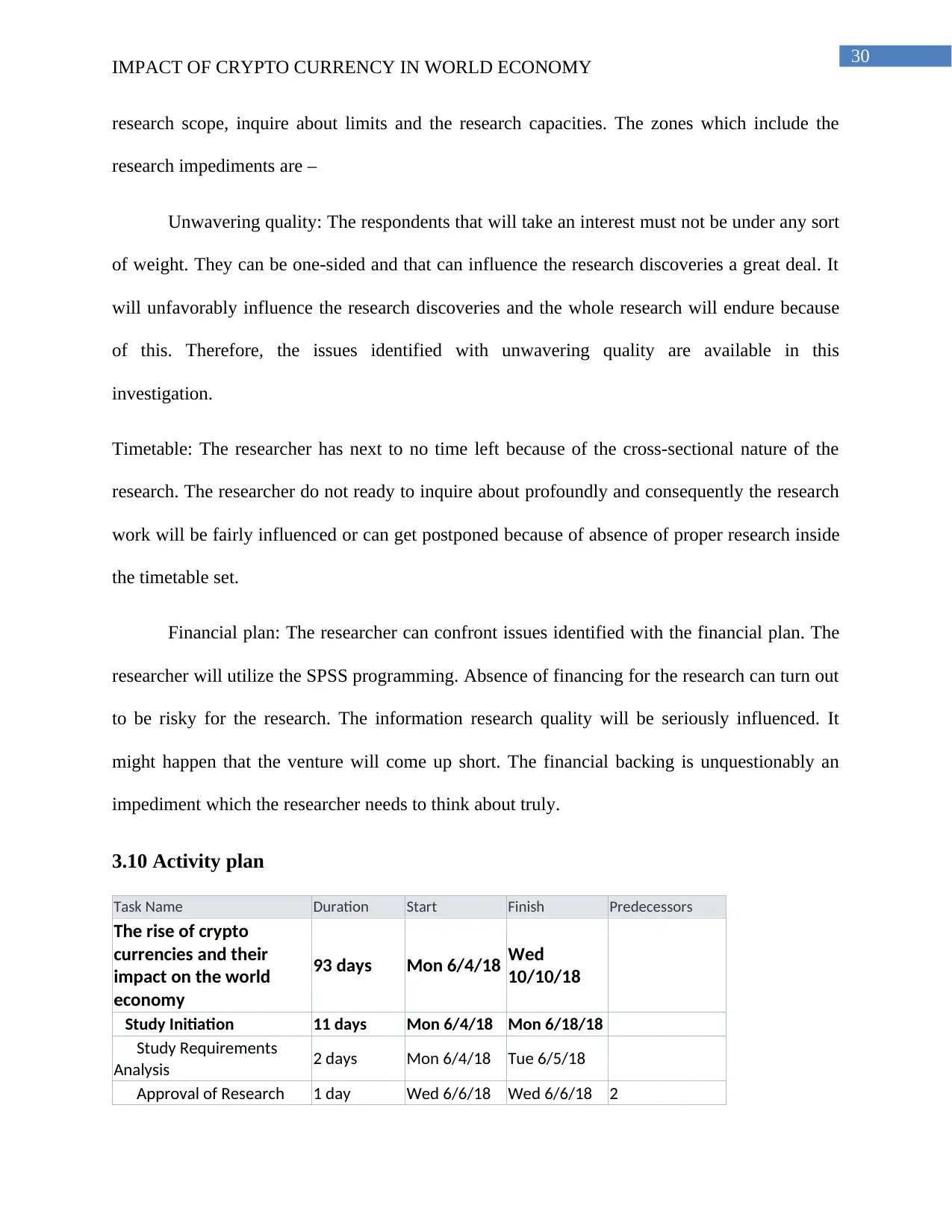

Internal Factors External Factors

Supply and Demand Crypto market Macro-financial Political

Transaction Cost Attractiveness Stock market Legalization

Reward System Market trend Exchange rates Restrictions

Less difficulty Speculations Gold price Others

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

However, bitcoin have been an amazing innovative payment system technology that helps in

bypassing some of limitations of traditional payment process. However, there is no third party

interference in the bitcoin technology that helps in reducing the transaction cost.

2.2 Factors affecting market of crypto currencies

The market of crypto currencies have been increasing with a rapid pace as most if the

large companies are investing their money in bitcoin. Bitcoin have become the world’s largest

digital currency and has increases by 1500 percent in 2017. However, the market have been

much complex as in other cases. As commented by Lindman, Tuunainen and Rossi (2017), the

complexity in the use of the bitcoin technology have not been understood able by various

customers and companies. Therefore, there has been less information about the bitcoin in the

market. Most of the middle case families are not showing their interest in the bitcoin investment

due to lack of knowledge. Therefore, the use of bitcoin market has been captured by big business

man for increasing their revenue and profit in their business. The use of bitcoin have been

maintaining the current trading at $1000, which has raised warnings for different researchers.

However, the currency has been expanding up to $16,000 at the beginning of the year. The

behavior of the entire market has been depended kin some factor that have been affecting the

market of the crypto currencies. These factors have been categorized in two types including

internal factors and external factors.

Internal Factors External Factors

Supply and Demand Crypto market Macro-financial Political

Transaction Cost Attractiveness Stock market Legalization

Reward System Market trend Exchange rates Restrictions

Less difficulty Speculations Gold price Others

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

8

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Coins Circulation Interest rate

Forks rule changes Others

Table 1: Factors affecting market of crypto currencies

There have been rise in the market of the crypto currencies all over the world. These

have affected trading practices of the market. There has been a rise in the shift of the market

from traditional process to modern approach of the transaction. As commented by Guo and

Liang (2016), the use of the bitcoin technology has helped in changing the traditional process of

money transfer through bank and other investing funds. This shift have been helped in

maintaining a fast and secure transaction of digital currencies in the market. The use of digital

currencies have helped in maintaining the speed of the transfer of financial assets through digital

mode. The crypto currency have been creating revolutionary changes in the transaction process

of companies in the market. The block chain technology have been a new creation of this

technology that might help in maintaining transaction market.

However, the decentralization and anonymity of transaction have been offering plenty of

advantages to the crypto currencies, these facture have been affecting the market. Various illegal

activities have been generated in the market for tracking the digital currencies. Kothapalli,

Miller and Borisov (2017) specified that there are various security protocols implemented for

securing data and information about the digital currencies of various companies. However, there

have been various risks and threats involved in the bitcoin technology. The financial

departments of various companies have been researching in the security level of this technology.

These researchers have been maintaining a keen look to the happening and process of the crypto

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Coins Circulation Interest rate

Forks rule changes Others

Table 1: Factors affecting market of crypto currencies

There have been rise in the market of the crypto currencies all over the world. These

have affected trading practices of the market. There has been a rise in the shift of the market

from traditional process to modern approach of the transaction. As commented by Guo and

Liang (2016), the use of the bitcoin technology has helped in changing the traditional process of

money transfer through bank and other investing funds. This shift have been helped in

maintaining a fast and secure transaction of digital currencies in the market. The use of digital

currencies have helped in maintaining the speed of the transfer of financial assets through digital

mode. The crypto currency have been creating revolutionary changes in the transaction process

of companies in the market. The block chain technology have been a new creation of this

technology that might help in maintaining transaction market.

However, the decentralization and anonymity of transaction have been offering plenty of

advantages to the crypto currencies, these facture have been affecting the market. Various illegal

activities have been generated in the market for tracking the digital currencies. Kothapalli,

Miller and Borisov (2017) specified that there are various security protocols implemented for

securing data and information about the digital currencies of various companies. However, there

have been various risks and threats involved in the bitcoin technology. The financial

departments of various companies have been researching in the security level of this technology.

These researchers have been maintaining a keen look to the happening and process of the crypto

9

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

currencies policy. The exchange of bitcoin in the market have been increasing in daily times.

The popularity of the technology have been increasing in the market due to the investment of

various customers and companies in the market. Zhang et al. (2016) determined that the digital

amount can be transferred from one party to another with the help of the crypto currency

technology. Various financial institution have been researching in the technology of crypto

currencies in the world. The gateway of crypto currencies have simplified the tendency of the

digital transfer of assets and financial documents all over the world. As commented by Swan

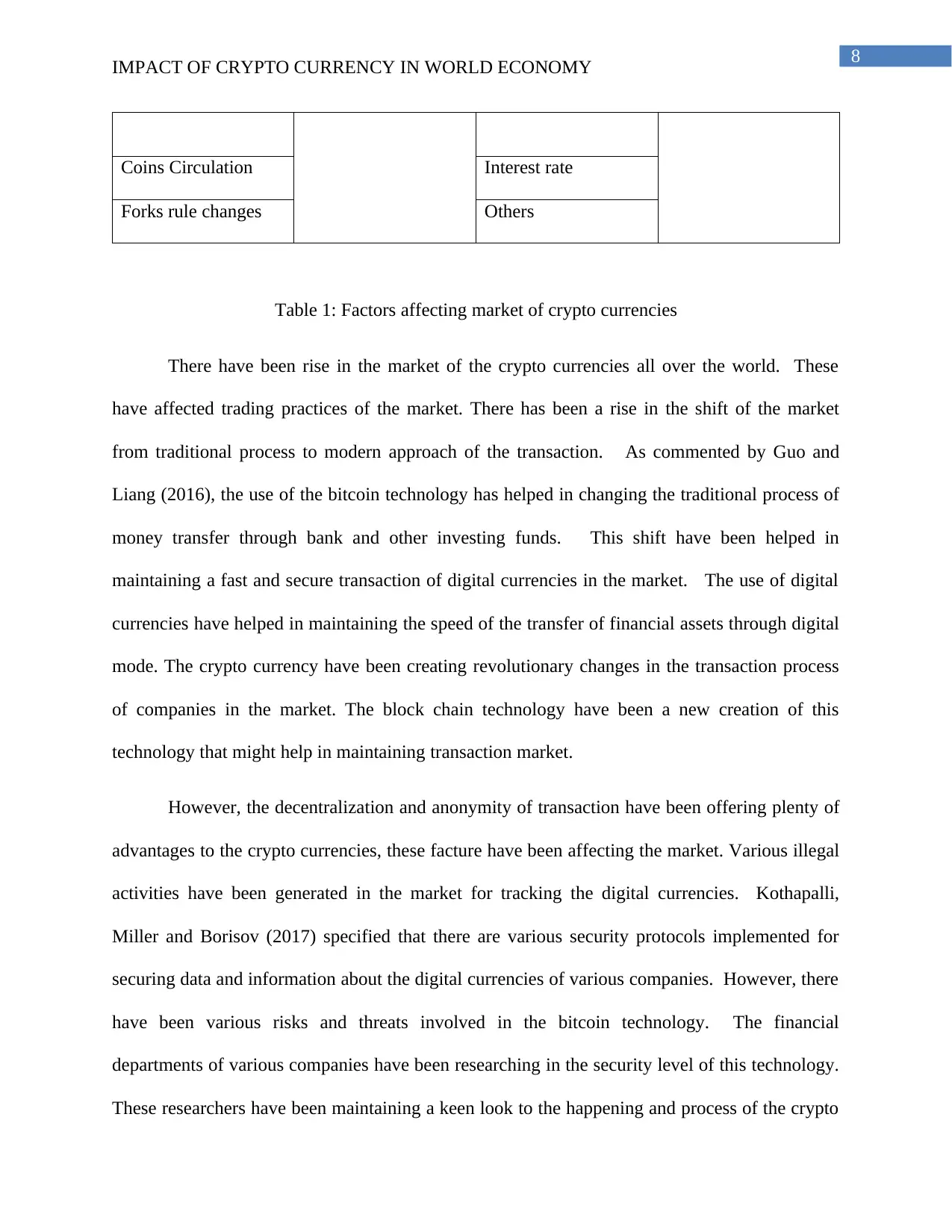

(2015), a massive amount of money has been floating in the market due to the increase in the

businesses all over the world. Bitcoin was begun in 2008 suggested as the main blockchain

innovation. However, blockchain began a test for building up a stage for computerized exchange

of cash and other monetary resources (Kosba et al. 2016). Blockchain has receivedmuch

consideration in market because of rise in bitcoin esteem. Alongside this, Smart Contract has

been in light for various exchange of advanced resources and contracts (Christidis and

Devetsikiotis 2016). Smart contract requires consideration in straightforwardness amid exchange

among parties associated with an agreement.

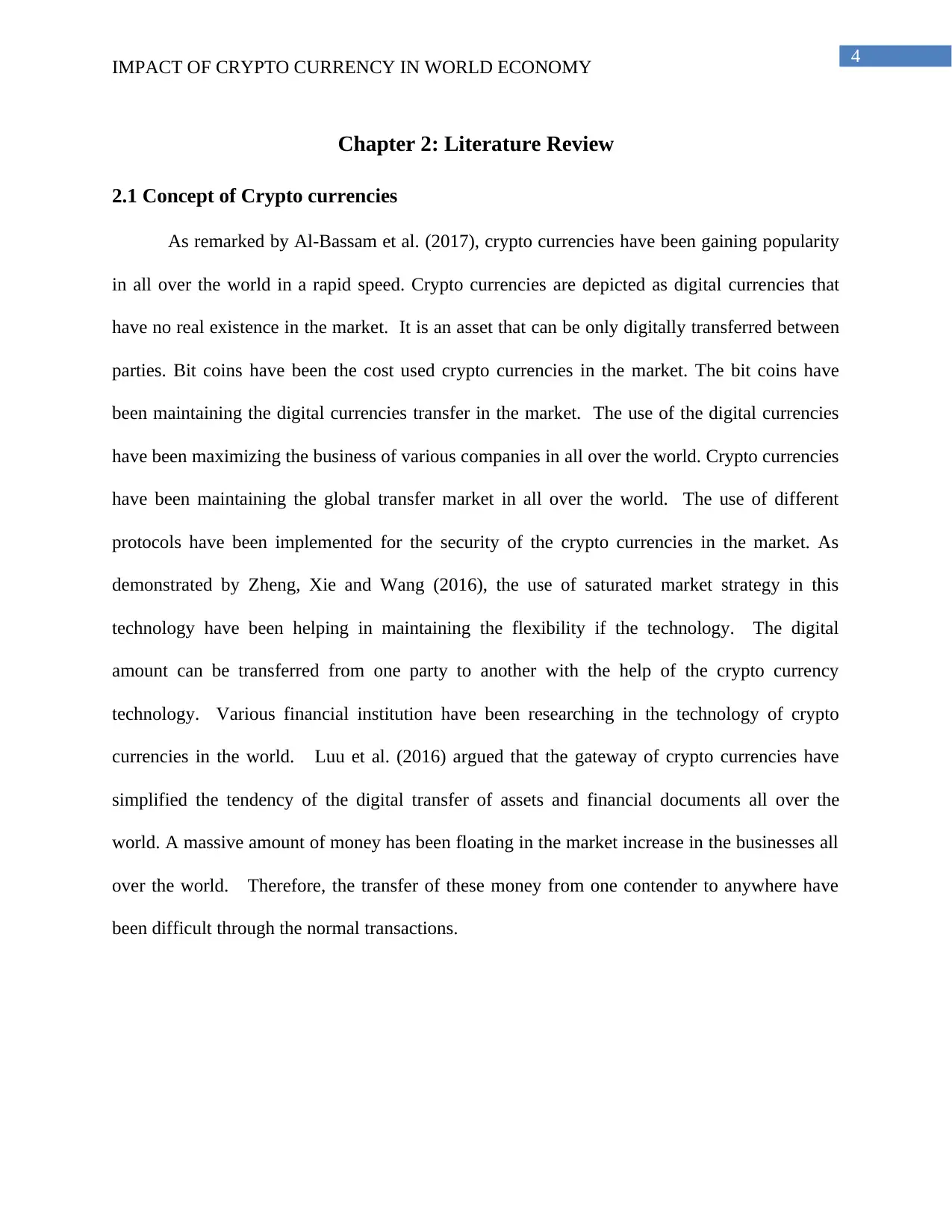

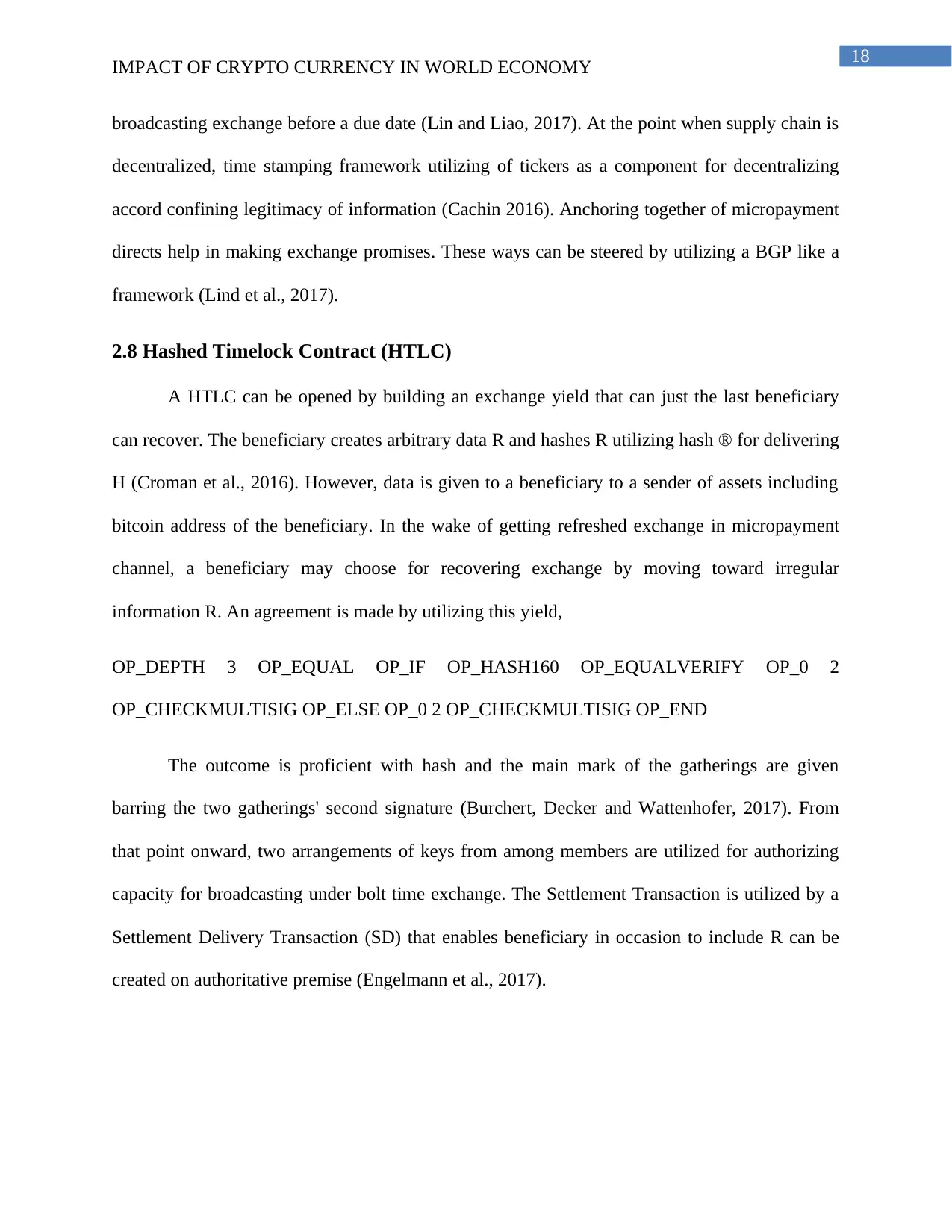

Figure 3: Execution of smart contract on blockchain

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

currencies policy. The exchange of bitcoin in the market have been increasing in daily times.

The popularity of the technology have been increasing in the market due to the investment of

various customers and companies in the market. Zhang et al. (2016) determined that the digital

amount can be transferred from one party to another with the help of the crypto currency

technology. Various financial institution have been researching in the technology of crypto

currencies in the world. The gateway of crypto currencies have simplified the tendency of the

digital transfer of assets and financial documents all over the world. As commented by Swan

(2015), a massive amount of money has been floating in the market due to the increase in the

businesses all over the world. Bitcoin was begun in 2008 suggested as the main blockchain

innovation. However, blockchain began a test for building up a stage for computerized exchange

of cash and other monetary resources (Kosba et al. 2016). Blockchain has receivedmuch

consideration in market because of rise in bitcoin esteem. Alongside this, Smart Contract has

been in light for various exchange of advanced resources and contracts (Christidis and

Devetsikiotis 2016). Smart contract requires consideration in straightforwardness amid exchange

among parties associated with an agreement.

Figure 3: Execution of smart contract on blockchain

10

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

(Source: Christidis and Devetsikiotis 2016, pp. 2297)

As commented by Lindman, Tuunainen and Rossi (2017), advanced resources have been

utilized by different organizations everywhere throughout the world. In this way, Smart contracts

have possessed the capacity to pick up its significance on the planet showcase. In any case,

blockchain contains cryptographic decentralized database set up (Luu et al. 2016). Along these

lines, all clients of blockchain can get to every one of information and data put away in database.

This may make a few impediments for this innovation. Private and essential data identified with

the people can be barged in by outsider. This have made issues in security of budgetary records

and cash for the organization (Peters and Panayi 2016). The security of these information and

data is a noteworthy hazard in this unique circumstance.

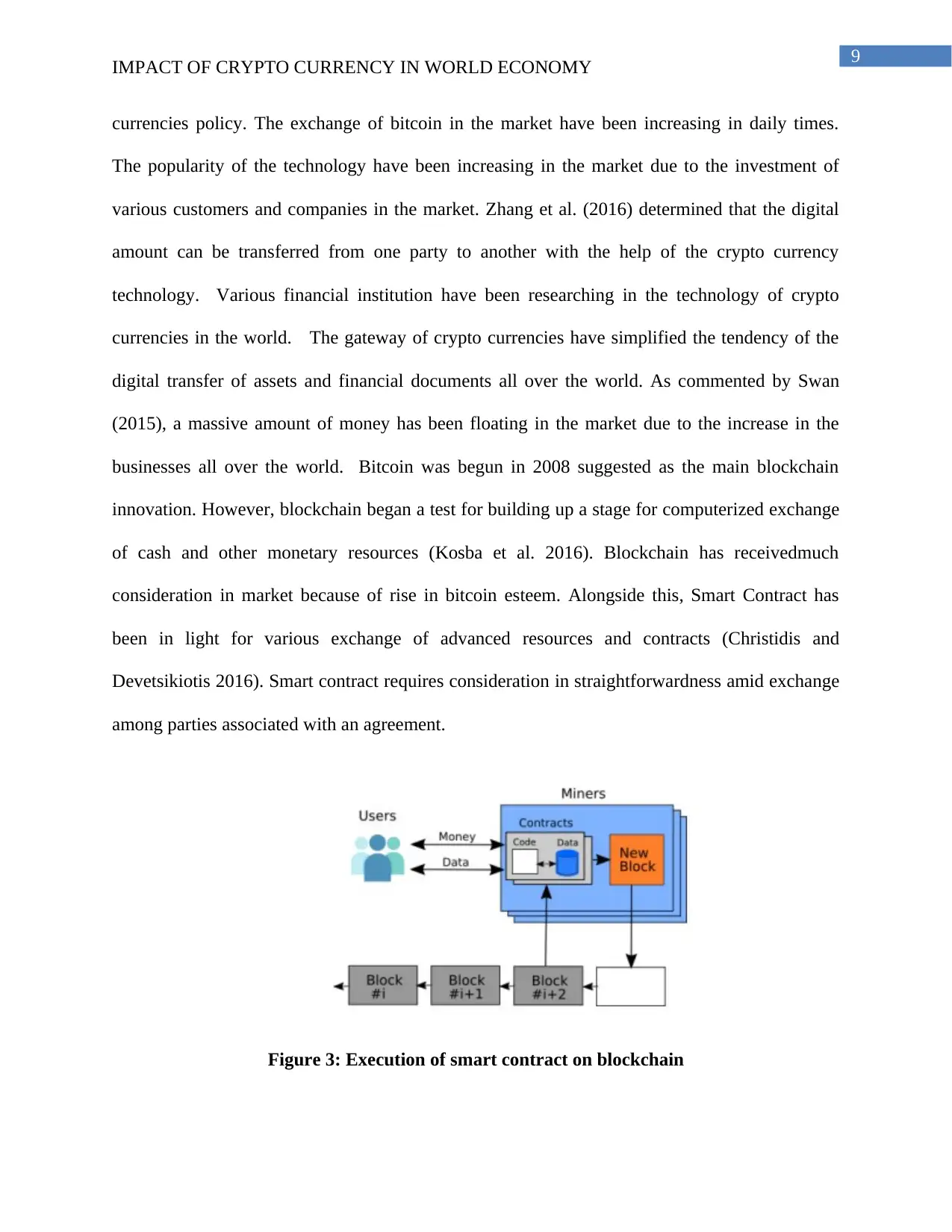

2.3 Legal aspects of Crypto currencies

Cryptographic forms of money has been characterized with private cash inside the group

cash. In the vast majority of the nations, legitimate exchanges have been kept up the

administration. Along these lines, government have been working for legitimizing installments

through cryptographic forms of money. As commented by Swan (2015), digital forms of money

raise various lawful issues with the impact that their clients are presented to a critical legitimate

hazard. The first and fundamental issue is to set up the lawful idea of cryptographic money (for

the most part three strategies for legitimate direction can be recognized common law, managerial

law, and criminal law). In any case one ought to talk about and decide if digital currency ought to

be seen consistently inside system of every one of techniques for the lawful control. The path of

the digital money framework is an exceptional record of exchanges. This is known as a

blockchain. In the Bitcoin framework, there is nothing which would compare to legitimate

delicate money, which is particular to money. The "wallets" of the clients of digital money

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

(Source: Christidis and Devetsikiotis 2016, pp. 2297)

As commented by Lindman, Tuunainen and Rossi (2017), advanced resources have been

utilized by different organizations everywhere throughout the world. In this way, Smart contracts

have possessed the capacity to pick up its significance on the planet showcase. In any case,

blockchain contains cryptographic decentralized database set up (Luu et al. 2016). Along these

lines, all clients of blockchain can get to every one of information and data put away in database.

This may make a few impediments for this innovation. Private and essential data identified with

the people can be barged in by outsider. This have made issues in security of budgetary records

and cash for the organization (Peters and Panayi 2016). The security of these information and

data is a noteworthy hazard in this unique circumstance.

2.3 Legal aspects of Crypto currencies

Cryptographic forms of money has been characterized with private cash inside the group

cash. In the vast majority of the nations, legitimate exchanges have been kept up the

administration. Along these lines, government have been working for legitimizing installments

through cryptographic forms of money. As commented by Swan (2015), digital forms of money

raise various lawful issues with the impact that their clients are presented to a critical legitimate

hazard. The first and fundamental issue is to set up the lawful idea of cryptographic money (for

the most part three strategies for legitimate direction can be recognized common law, managerial

law, and criminal law). In any case one ought to talk about and decide if digital currency ought to

be seen consistently inside system of every one of techniques for the lawful control. The path of

the digital money framework is an exceptional record of exchanges. This is known as a

blockchain. In the Bitcoin framework, there is nothing which would compare to legitimate

delicate money, which is particular to money. The "wallets" of the clients of digital money

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

11

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

framework store just the data (joins) demonstrating where, in the individual obstructs, the

exchange affirmation can be found. There is no "development" between the wallet of one Bitcoin

"holder" (or a holder of some other cryptographic money) to the purported wallet of the

following Bitcoin "holder" – the main thing that progressions are the connections (pointers of the

place in the blocks). Accordingly the digital forms of money (e.g. Bitcoins or Litecoins),

characterized independently, and not as a framework, are just records in the record, i.e. the

blockchain. These records speak to a Secondary esteem. For accommodation, the idea of fiscal

unit comprehended as a dynamic measure of significant worth can be connected to these records

(Cachin 2016). From the perspective of common law, the cryptographic forms of money can be

viewed as a "measure of significant worth other than cash", unless the gatherings to the

understanding have stipulated that the measure of the advantage will be resolved by the

concurred measure of significant worth, i.e. a particular cryptocurrency.

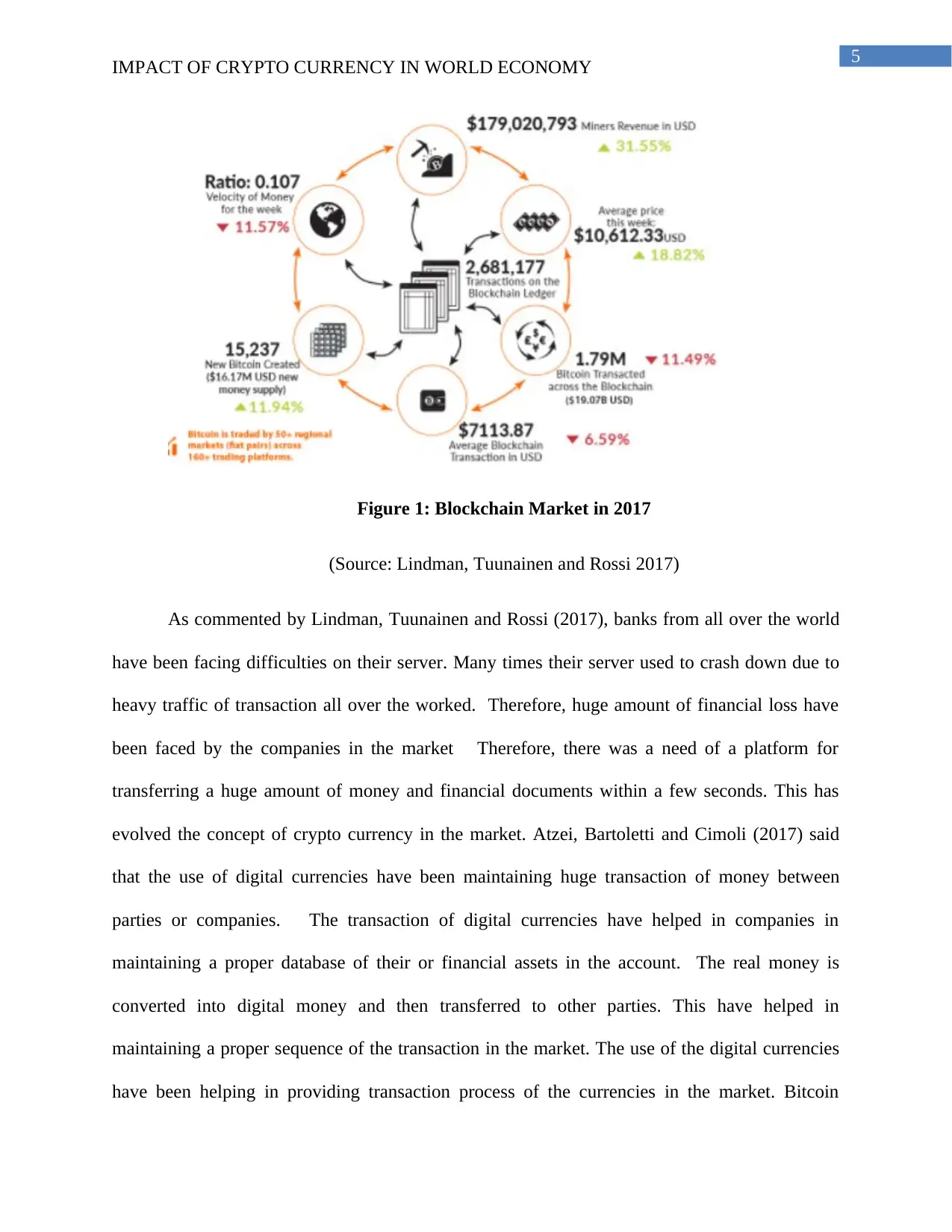

Figure 4: Working of Blockchain Cryptography

(Source: (Bloq.com, 2018)

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

framework store just the data (joins) demonstrating where, in the individual obstructs, the

exchange affirmation can be found. There is no "development" between the wallet of one Bitcoin

"holder" (or a holder of some other cryptographic money) to the purported wallet of the

following Bitcoin "holder" – the main thing that progressions are the connections (pointers of the

place in the blocks). Accordingly the digital forms of money (e.g. Bitcoins or Litecoins),

characterized independently, and not as a framework, are just records in the record, i.e. the

blockchain. These records speak to a Secondary esteem. For accommodation, the idea of fiscal

unit comprehended as a dynamic measure of significant worth can be connected to these records

(Cachin 2016). From the perspective of common law, the cryptographic forms of money can be

viewed as a "measure of significant worth other than cash", unless the gatherings to the

understanding have stipulated that the measure of the advantage will be resolved by the

concurred measure of significant worth, i.e. a particular cryptocurrency.

Figure 4: Working of Blockchain Cryptography

(Source: (Bloq.com, 2018)

12

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

This approach compares to the view of digital money as a theoretical measure of

significant worth, that is the financial unit. Moreover, the digital currency (when thought about

exclusively) ought to be perceived as a property right and a sort of property. This property right

is spoken to by a record in the record, i.e. the blockchain. Arrangement of advances in

cryptographic money may raise some debate. A different, yet vital in social terms, is the issue of

buyer insurance, which ends up clear even with a cursory research of the operational practices of

the business people working in the digital currency framework. We ought to consider whether to

subject cryptographic forms of money to legitimate control representing installment

administrations. Christidis and Devetsikiotis (2016) commented that while on account of

installments utilizing an installment account there is a moderately clear division of duties

between the installment benefit client and supplier, as set out in the arrangements of the PSD

Directive and the arrangements of national law of the EU Member States, for exchanges utilizing

cryptographic money, since there is no substance running the digital money framework, such

division does not exist at all and the clients bear the whole duty regarding effectively leading

exchanges based on general tenets of common law.

As commented by Mougayar (2016), under the present condition of law, while making

digital currency exchanges, it is not conceivable to apply the PSD Directive (and, thus, no

Member States' arrangements executing the Directive) since this kind of exchanges falls outside

both material and individual extent of the Directive. Also, it gives the idea that the application,

regardless of whether just incomplete or "relating to", of the PSD Directive (or really another

PSD2 Directive6 ) may introduce enormous issues hard to overcome, if simply because there is

no element in the digital currency framework comparable to the installment administrations

supplier. The similitude of the blockchain to an installment record (and furthermore to a ledger

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

This approach compares to the view of digital money as a theoretical measure of

significant worth, that is the financial unit. Moreover, the digital currency (when thought about

exclusively) ought to be perceived as a property right and a sort of property. This property right

is spoken to by a record in the record, i.e. the blockchain. Arrangement of advances in

cryptographic money may raise some debate. A different, yet vital in social terms, is the issue of

buyer insurance, which ends up clear even with a cursory research of the operational practices of

the business people working in the digital currency framework. We ought to consider whether to

subject cryptographic forms of money to legitimate control representing installment

administrations. Christidis and Devetsikiotis (2016) commented that while on account of

installments utilizing an installment account there is a moderately clear division of duties

between the installment benefit client and supplier, as set out in the arrangements of the PSD

Directive and the arrangements of national law of the EU Member States, for exchanges utilizing

cryptographic money, since there is no substance running the digital money framework, such

division does not exist at all and the clients bear the whole duty regarding effectively leading

exchanges based on general tenets of common law.

As commented by Mougayar (2016), under the present condition of law, while making

digital currency exchanges, it is not conceivable to apply the PSD Directive (and, thus, no

Member States' arrangements executing the Directive) since this kind of exchanges falls outside

both material and individual extent of the Directive. Also, it gives the idea that the application,

regardless of whether just incomplete or "relating to", of the PSD Directive (or really another

PSD2 Directive6 ) may introduce enormous issues hard to overcome, if simply because there is

no element in the digital currency framework comparable to the installment administrations

supplier. The similitude of the blockchain to an installment record (and furthermore to a ledger

13

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

utilized for installment exchanges) is not coincidental, as it is the result of the profoundly set

ideological suppositions implanted in digital currency conspires (the production of an installment

framework that would be another option to official frameworks in view of records held by the

banks). Without a doubt the fundamental target of the digital currency framework is to empower

one to make installments for merchandise and enterprises; nonetheless, the blockchain likewise

serves to "gather" dynamic esteem that is financial units of a specific cryptographic money. As

commented by Guo and Liang (2016), inside the estimation of a specific digital money, the

framework likewise has a depositary work. Furthermore, maybe this, and not just making

installments, speaks to a genuinely progressive viewpoint the digital money conveys to present

day times – it "turns on its head" our comprehension of the store taking movement, which is after

all the very idea of managing an account. Banks have an imposing business model on this

movement (another issue is to what degree this restraining infrastructure can right now be

defended and kept up), which is exhibited by the way that lone an element fit for meeting the

necessities recommended by law can run store taking action, else it is culpable under criminal

law (Nugent, Upton and Cimpoesu 2016).

2.4 Economic aspect of crypto currencies

In the monetary viewpoint the references to the thought behind the rise of virtual cash can

be found in different strands of the financial hypothesis. The idea of virtual cash can generally be

found in the perspectives spoke to by the types of the Austrian School of Economics11, which

concentrated on business cycles and the hypothesis of cash. They trusted that cash intercessions

were the reason for the event of business cycles. Over the top development of credit activated by

partial hold keeping money prompts expanded cash supply and misleadingly low loan costs.

Business visionaries consider it to be a flag and settle on choices which are regularly inconsistent

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

utilized for installment exchanges) is not coincidental, as it is the result of the profoundly set

ideological suppositions implanted in digital currency conspires (the production of an installment

framework that would be another option to official frameworks in view of records held by the

banks). Without a doubt the fundamental target of the digital currency framework is to empower

one to make installments for merchandise and enterprises; nonetheless, the blockchain likewise

serves to "gather" dynamic esteem that is financial units of a specific cryptographic money. As

commented by Guo and Liang (2016), inside the estimation of a specific digital money, the

framework likewise has a depositary work. Furthermore, maybe this, and not just making

installments, speaks to a genuinely progressive viewpoint the digital money conveys to present

day times – it "turns on its head" our comprehension of the store taking movement, which is after

all the very idea of managing an account. Banks have an imposing business model on this

movement (another issue is to what degree this restraining infrastructure can right now be

defended and kept up), which is exhibited by the way that lone an element fit for meeting the

necessities recommended by law can run store taking action, else it is culpable under criminal

law (Nugent, Upton and Cimpoesu 2016).

2.4 Economic aspect of crypto currencies

In the monetary viewpoint the references to the thought behind the rise of virtual cash can

be found in different strands of the financial hypothesis. The idea of virtual cash can generally be

found in the perspectives spoke to by the types of the Austrian School of Economics11, which

concentrated on business cycles and the hypothesis of cash. They trusted that cash intercessions

were the reason for the event of business cycles. Over the top development of credit activated by

partial hold keeping money prompts expanded cash supply and misleadingly low loan costs.

Business visionaries consider it to be a flag and settle on choices which are regularly inconsistent

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

14

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

with shoppers' inclinations, subsequently offering ascend to an emergency. Christidis and

Devetsikiotis (2016) commented that as per the Austrian School, the solution for the financial

researchers' having to an extreme degree an excessive amount of carefulness over cash control is

the deserting of the partial hold managing an account framework and come back to the highest

quality level, which would, as a result, prompt smoothing business cycles12 . In this unique

situation, Friedrich Hayek's publication13 gives a huge commitment to the hypothesis of cash,

where the researcher advocates the evacuation of the states' imposing business model over the

issuance of cash. He additionally recommends that business banks as private substances ought to

have the privilege to issue non-interest bearing declarations in light of their own trademarks.

These declarations would be available to rivalry and offered at variable trade rates.

Declarations with stable trade rates would drive the weaker and less steady ones unavailable for

general use. Thus, that would take into account the making of a viable framework in which just

stable money would work (as Hayek saw it, authentications). The above proposition were

reflected in the plan of the BTC virtual cash. This cash is seen as a decent beginning stage to end

the national banks' imposing business model over the issuance of cash. At the same time, the

BTC conspire is to go about as balance to the present cash in view of the partial save managing

an account while in the meantime it draws on the old best quality level. Moreover, an imperative

explanation for the development of cryptographic forms of money was the desire to make a

framework taking into account fast and shoddy exchanges, having no requirement for an

outsider. Crosby et al. (2016) argued that, it draws on the idea of e-cash by D. Chaum14 from

1982, later on created in various studies. The development the digital forms of money acquainted

is the arrangement with the issue of twofold spending. The standard arrangement – utilized by

conventional installment frameworks of genuine economies - includes trusted outsiders, e.g. a

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

with shoppers' inclinations, subsequently offering ascend to an emergency. Christidis and

Devetsikiotis (2016) commented that as per the Austrian School, the solution for the financial

researchers' having to an extreme degree an excessive amount of carefulness over cash control is

the deserting of the partial hold managing an account framework and come back to the highest

quality level, which would, as a result, prompt smoothing business cycles12 . In this unique

situation, Friedrich Hayek's publication13 gives a huge commitment to the hypothesis of cash,

where the researcher advocates the evacuation of the states' imposing business model over the

issuance of cash. He additionally recommends that business banks as private substances ought to

have the privilege to issue non-interest bearing declarations in light of their own trademarks.

These declarations would be available to rivalry and offered at variable trade rates.

Declarations with stable trade rates would drive the weaker and less steady ones unavailable for

general use. Thus, that would take into account the making of a viable framework in which just

stable money would work (as Hayek saw it, authentications). The above proposition were

reflected in the plan of the BTC virtual cash. This cash is seen as a decent beginning stage to end

the national banks' imposing business model over the issuance of cash. At the same time, the

BTC conspire is to go about as balance to the present cash in view of the partial save managing

an account while in the meantime it draws on the old best quality level. Moreover, an imperative

explanation for the development of cryptographic forms of money was the desire to make a

framework taking into account fast and shoddy exchanges, having no requirement for an

outsider. Crosby et al. (2016) argued that, it draws on the idea of e-cash by D. Chaum14 from

1982, later on created in various studies. The development the digital forms of money acquainted

is the arrangement with the issue of twofold spending. The standard arrangement – utilized by

conventional installment frameworks of genuine economies - includes trusted outsiders, e.g. a

15

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

bank which checks the rightness of exchanges made. The digital currency exchange depends on

the shared system (P2P) utilized for instance in a record trade convention. All exchanges directed

by the clients are made open and their confirmation is done by the framework's clients

themselves. The arrangement of issues on how digital forms of money work is as yet a current

marvel which, up until now, has not in actuality been portrayed in writing (Christidis and

Devetsikiotis 2016). In addition, the accessible distributions ordinarily center on innovative,

cryptographic or legitimate aspects16, overlooking the financial strand. The first and more far

reaching study on the monetary impacts of the advancement of cryptographic forms of money

was the report by European Central Bank titled "Virtual Currency Schemes"17,published in

October. Despite the fact that the paper was worried about a more extensive wonder of virtual

money, (cryptographic money being only one compose), still, it gave critical discoveries on

potential impacts of the dispersion of the methods for installment at issue, as will be clarified

promote in this paper. The improvement of cryptographic forms of money denotes its start with

the dispatch of Bitcoin as a virtual cash made in 2008 by a developer (or a gathering of software

engineers) covered up

2.5 Risks in Smart Contract

As remarked by Al-Bassam et al. (2017), smart Contracts have diverse restrictions much

of the time. The utilization of the blockchain advanced innovation have decentralized database.

In this manner, this makes issue for the clients as all data can be received to by client of smart

contract. This corrupts security of information and data put away in database server. The general

population block chains can be received to by anybody in the database (Idelberger et al. 2016). In

this manner, security of people in general block chain is least. Block chain can be utilized by

various bans for quick exchange of cash carefully. In this way, it makes an abnormal state chance

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

bank which checks the rightness of exchanges made. The digital currency exchange depends on

the shared system (P2P) utilized for instance in a record trade convention. All exchanges directed

by the clients are made open and their confirmation is done by the framework's clients

themselves. The arrangement of issues on how digital forms of money work is as yet a current

marvel which, up until now, has not in actuality been portrayed in writing (Christidis and

Devetsikiotis 2016). In addition, the accessible distributions ordinarily center on innovative,

cryptographic or legitimate aspects16, overlooking the financial strand. The first and more far

reaching study on the monetary impacts of the advancement of cryptographic forms of money

was the report by European Central Bank titled "Virtual Currency Schemes"17,published in

October. Despite the fact that the paper was worried about a more extensive wonder of virtual

money, (cryptographic money being only one compose), still, it gave critical discoveries on

potential impacts of the dispersion of the methods for installment at issue, as will be clarified

promote in this paper. The improvement of cryptographic forms of money denotes its start with

the dispatch of Bitcoin as a virtual cash made in 2008 by a developer (or a gathering of software

engineers) covered up

2.5 Risks in Smart Contract

As remarked by Al-Bassam et al. (2017), smart Contracts have diverse restrictions much

of the time. The utilization of the blockchain advanced innovation have decentralized database.

In this manner, this makes issue for the clients as all data can be received to by client of smart

contract. This corrupts security of information and data put away in database server. The general

population block chains can be received to by anybody in the database (Idelberger et al. 2016). In

this manner, security of people in general block chain is least. Block chain can be utilized by

various bans for quick exchange of cash carefully. In this way, it makes an abnormal state chance

16

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

amid the exchange of cash to other record. The loss of cash and budgetary archives can be a

noteworthy risks engaged with the blockchain innovation.

As remarked by Bartoletti and Pompianu (2017), supply chains are not adequate fir the enormous

information idea. Along these lines, it cannot hold huge volumes of information a period.

Accordingly, this makes natural confinements for the blockchain with a specific end goal to

make gigantic repetition into vast number of hubs. However, huge information can be executed

in blockchain by the utilization of the meta-information. The smart contracts are changeless

contracts that makes cryptographic wonder in verifiable exchange. Supply chain advancements

abbreviate the span of numerous organizations with a specific end goal to process different

business congruity designs (Sergey and Hobor 2017). In this way, these private designs can be

received to however different gatherings, as they are incorporated into Smart contract

understanding. The blockchain innovation make a consistent inheritance framework that makes a

holographic impact in the smart contract.

However, benefit level assertions between parties associated with keen contracts make a

provider organize for observing it. Bhargavan et al. (2016) remarked that in this way, the

utilization of keen contracts make chances in giving secure and dependable administrations to

the person. Along these lines, leaving strategies and laws should be enhanced so as to keep up a

plan of action inside the keen contracts.

The Bitcoin goes about as an installment stage for world money exchanges (Frantz and

Nowostawski 2016). In any case, every hub of bitcoin arrange knows each and every exchange

all around that aides in enveloping system for worldwide cash exchange (Seigneur, D'Hautefort

and Ballocchi, 2017). The installment utilizing Visa is approx. 45,000 pinnacle exchange for

each second on a system. In any case, bitcoin permits 7 exchanges for each second with a 1-

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

amid the exchange of cash to other record. The loss of cash and budgetary archives can be a

noteworthy risks engaged with the blockchain innovation.

As remarked by Bartoletti and Pompianu (2017), supply chains are not adequate fir the enormous

information idea. Along these lines, it cannot hold huge volumes of information a period.

Accordingly, this makes natural confinements for the blockchain with a specific end goal to

make gigantic repetition into vast number of hubs. However, huge information can be executed

in blockchain by the utilization of the meta-information. The smart contracts are changeless

contracts that makes cryptographic wonder in verifiable exchange. Supply chain advancements

abbreviate the span of numerous organizations with a specific end goal to process different

business congruity designs (Sergey and Hobor 2017). In this way, these private designs can be

received to however different gatherings, as they are incorporated into Smart contract

understanding. The blockchain innovation make a consistent inheritance framework that makes a

holographic impact in the smart contract.

However, benefit level assertions between parties associated with keen contracts make a

provider organize for observing it. Bhargavan et al. (2016) remarked that in this way, the

utilization of keen contracts make chances in giving secure and dependable administrations to

the person. Along these lines, leaving strategies and laws should be enhanced so as to keep up a

plan of action inside the keen contracts.

The Bitcoin goes about as an installment stage for world money exchanges (Frantz and

Nowostawski 2016). In any case, every hub of bitcoin arrange knows each and every exchange

all around that aides in enveloping system for worldwide cash exchange (Seigneur, D'Hautefort

and Ballocchi, 2017). The installment utilizing Visa is approx. 45,000 pinnacle exchange for

each second on a system. In any case, bitcoin permits 7 exchanges for each second with a 1-

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

17

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

megabyte supply breaking point. On a normal of 300 bytes for each bitcoin exchange for

boundless block estimate, it is equivalent to crest Visa exchange volume of 45000/tps and almost

to 8 gigabytes for every bitcoin supply (Roos et al., 2017). For accomplishing higher than 45,000

exchanges for every second utilizing Bitcoin, conduction exchange off the bitcoin is required.

Christidis and Devetsikiotis (2016) commented that distinctive micropayments are sent parallel

between two gatherings for empowering any size of installments. Bitcoin needs to determine the

issue identified with block measure centralization influences containing huge supply certainly

and making trusted caretakers for higher charges (Croman et al., 2016).

2.6 A network of micropayment channels can solve scalability

As of late, bitcoin has overwhelmed to micropayments for actualizing offloading

exchange to an overseer. The outsider overseers hold coins and refresh client adjust by

permitting stores and withdrawals (Poon and Dryja, 2015). Right now, the bitcoin

administrations are utilizing overseer display for local bitcoin to scale to billions of clients. In

this manner, a framework has been proposed for an exchange in Bitcoin in micropayment

channels without custodial danger of robbery (Eberhardt and Tai, 2017).

Micropayment channels make a connection between two selected gatherings. An

expansive system of channel all bitcoin clients are incorporated into the diagram that has just a

single direct in bitcoin blockchain (Poon and Dryja, 2015). This aides in making close limitless

measure of exchange inside the system.

2.7 Hashedlocked Bidirectional Micropayment Channels

Micropayment diverts help in allowing deferral exchange rate or broadcasting of time.

The agreements that are authorized by creating obligation regarding a solitary gathering for

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

megabyte supply breaking point. On a normal of 300 bytes for each bitcoin exchange for

boundless block estimate, it is equivalent to crest Visa exchange volume of 45000/tps and almost

to 8 gigabytes for every bitcoin supply (Roos et al., 2017). For accomplishing higher than 45,000

exchanges for every second utilizing Bitcoin, conduction exchange off the bitcoin is required.

Christidis and Devetsikiotis (2016) commented that distinctive micropayments are sent parallel

between two gatherings for empowering any size of installments. Bitcoin needs to determine the

issue identified with block measure centralization influences containing huge supply certainly

and making trusted caretakers for higher charges (Croman et al., 2016).

2.6 A network of micropayment channels can solve scalability

As of late, bitcoin has overwhelmed to micropayments for actualizing offloading

exchange to an overseer. The outsider overseers hold coins and refresh client adjust by

permitting stores and withdrawals (Poon and Dryja, 2015). Right now, the bitcoin

administrations are utilizing overseer display for local bitcoin to scale to billions of clients. In

this manner, a framework has been proposed for an exchange in Bitcoin in micropayment

channels without custodial danger of robbery (Eberhardt and Tai, 2017).

Micropayment channels make a connection between two selected gatherings. An

expansive system of channel all bitcoin clients are incorporated into the diagram that has just a

single direct in bitcoin blockchain (Poon and Dryja, 2015). This aides in making close limitless

measure of exchange inside the system.

2.7 Hashedlocked Bidirectional Micropayment Channels

Micropayment diverts help in allowing deferral exchange rate or broadcasting of time.

The agreements that are authorized by creating obligation regarding a solitary gathering for

18

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

broadcasting exchange before a due date (Lin and Liao, 2017). At the point when supply chain is

decentralized, time stamping framework utilizing of tickers as a component for decentralizing

accord confining legitimacy of information (Cachin 2016). Anchoring together of micropayment

directs help in making exchange promises. These ways can be steered by utilizing a BGP like a

framework (Lind et al., 2017).

2.8 Hashed Timelock Contract (HTLC)

A HTLC can be opened by building an exchange yield that can just the last beneficiary

can recover. The beneficiary creates arbitrary data R and hashes R utilizing hash ® for delivering

H (Croman et al., 2016). However, data is given to a beneficiary to a sender of assets including

bitcoin address of the beneficiary. In the wake of getting refreshed exchange in micropayment

channel, a beneficiary may choose for recovering exchange by moving toward irregular

information R. An agreement is made by utilizing this yield,

OP_DEPTH 3 OP_EQUAL OP_IF OP_HASH160 OP_EQUALVERIFY OP_0 2

OP_CHECKMULTISIG OP_ELSE OP_0 2 OP_CHECKMULTISIG OP_END

The outcome is proficient with hash and the main mark of the gatherings are given

barring the two gatherings' second signature (Burchert, Decker and Wattenhofer, 2017). From

that point onward, two arrangements of keys from among members are utilized for authorizing

capacity for broadcasting under bolt time exchange. The Settlement Transaction is utilized by a

Settlement Delivery Transaction (SD) that enables beneficiary in occasion to include R can be

created on authoritative premise (Engelmann et al., 2017).

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

broadcasting exchange before a due date (Lin and Liao, 2017). At the point when supply chain is

decentralized, time stamping framework utilizing of tickers as a component for decentralizing

accord confining legitimacy of information (Cachin 2016). Anchoring together of micropayment

directs help in making exchange promises. These ways can be steered by utilizing a BGP like a

framework (Lind et al., 2017).

2.8 Hashed Timelock Contract (HTLC)

A HTLC can be opened by building an exchange yield that can just the last beneficiary

can recover. The beneficiary creates arbitrary data R and hashes R utilizing hash ® for delivering

H (Croman et al., 2016). However, data is given to a beneficiary to a sender of assets including

bitcoin address of the beneficiary. In the wake of getting refreshed exchange in micropayment

channel, a beneficiary may choose for recovering exchange by moving toward irregular

information R. An agreement is made by utilizing this yield,

OP_DEPTH 3 OP_EQUAL OP_IF OP_HASH160 OP_EQUALVERIFY OP_0 2

OP_CHECKMULTISIG OP_ELSE OP_0 2 OP_CHECKMULTISIG OP_END

The outcome is proficient with hash and the main mark of the gatherings are given

barring the two gatherings' second signature (Burchert, Decker and Wattenhofer, 2017). From

that point onward, two arrangements of keys from among members are utilized for authorizing

capacity for broadcasting under bolt time exchange. The Settlement Transaction is utilized by a

Settlement Delivery Transaction (SD) that enables beneficiary in occasion to include R can be

created on authoritative premise (Engelmann et al., 2017).

19

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

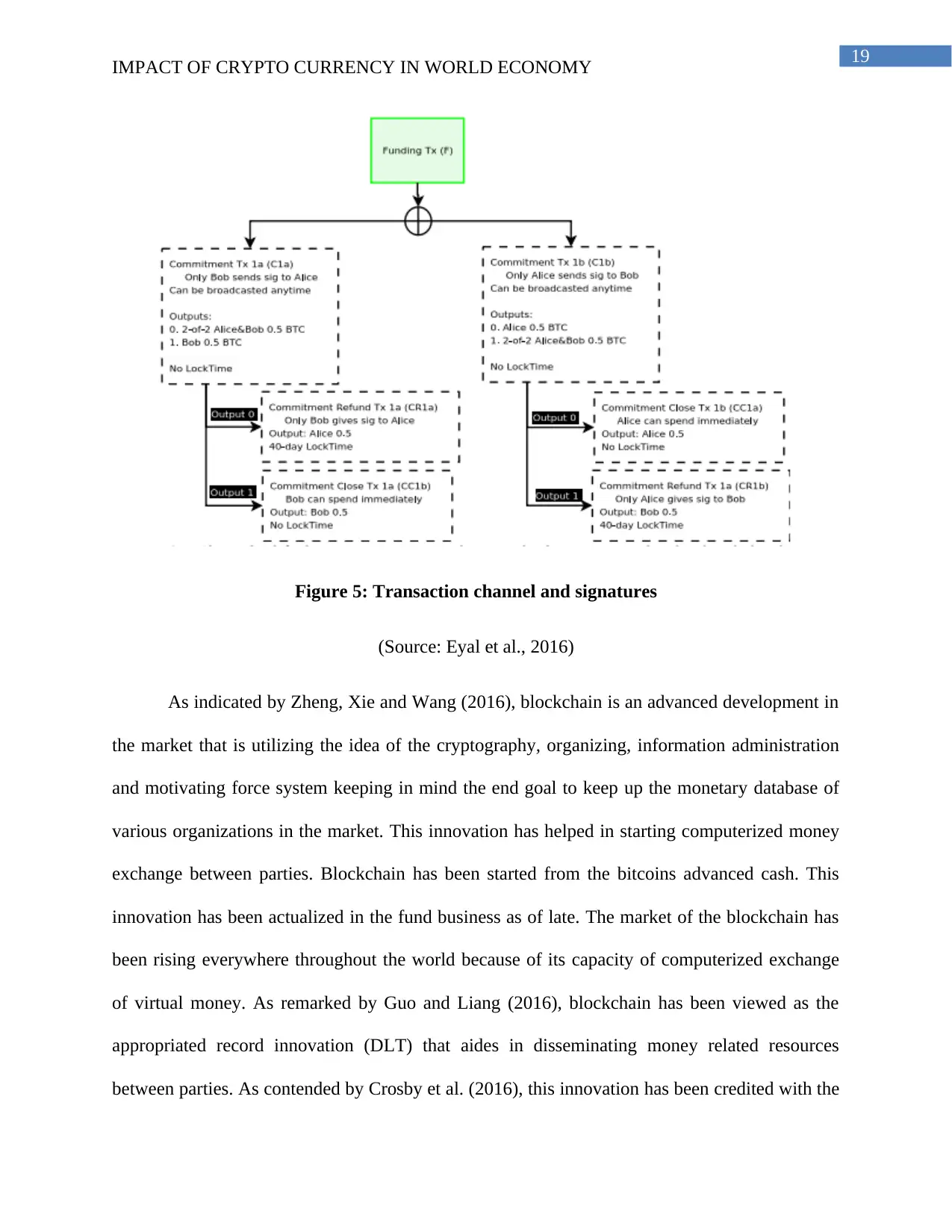

Figure 5: Transaction channel and signatures

(Source: Eyal et al., 2016)

As indicated by Zheng, Xie and Wang (2016), blockchain is an advanced development in

the market that is utilizing the idea of the cryptography, organizing, information administration

and motivating force system keeping in mind the end goal to keep up the monetary database of

various organizations in the market. This innovation has helped in starting computerized money

exchange between parties. Blockchain has been started from the bitcoins advanced cash. This

innovation has been actualized in the fund business as of late. The market of the blockchain has

been rising everywhere throughout the world because of its capacity of computerized exchange

of virtual money. As remarked by Guo and Liang (2016), blockchain has been viewed as the

appropriated record innovation (DLT) that aides in disseminating money related resources

between parties. As contended by Crosby et al. (2016), this innovation has been credited with the

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Figure 5: Transaction channel and signatures

(Source: Eyal et al., 2016)

As indicated by Zheng, Xie and Wang (2016), blockchain is an advanced development in

the market that is utilizing the idea of the cryptography, organizing, information administration

and motivating force system keeping in mind the end goal to keep up the monetary database of

various organizations in the market. This innovation has helped in starting computerized money

exchange between parties. Blockchain has been started from the bitcoins advanced cash. This

innovation has been actualized in the fund business as of late. The market of the blockchain has

been rising everywhere throughout the world because of its capacity of computerized exchange

of virtual money. As remarked by Guo and Liang (2016), blockchain has been viewed as the

appropriated record innovation (DLT) that aides in disseminating money related resources

between parties. As contended by Crosby et al. (2016), this innovation has been credited with the

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

20

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

most elevated risks association of the fund business. The virtual cash has no record in the

database and an outsider merchant to store the data of the gatherings. As indicated by a review,

more than 90 enterprises have executed documented in excess of 2500 licenses against

blockchain innovation everywhere throughout the world (Croman et al., 2016).

As remarked by Lindman, Tuunainen and Rossi (2017), there is an absence of

administrative lucidity in the blockchain innovation. The administrative structure of the supply

Chain innovation has been frail including the private system of the gatherings. The protection of

the gatherings incorporated into the blockchain innovation has been confronting different

security breaks over the web. As commented by Guo and Liang (2016), the programmers

everywhere throughout the world are focusing on these online exchanges of advanced money

among the gatherings. The counter Clearing house and Product (CCP) has been directing these

exchange all over the world. However, these associations are not ok for the online exchange of

advanced money (Levy 2017).

2.9 Protection and Security

As remarked by Swan (2015), the utilization of the block chains has been developing

everywhere throughout the world. The protection and security of the monetary records and

resources have not been kept up by the innovation. There have been various instances of hacking

and information breaking over the web that has been accounted for. Blockchain utilizes a mutual

database that contains all information and data of different gatherings. As remarked by

Mougayar (2016), this innovation gives a fast exchange of advanced money. Crosby et al. (2016)

argued that, this idea has limited protection and security of information and data of gatherings

associated with the agreement. Hence, this innovation has abnormal state chances in the fund

business.

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

most elevated risks association of the fund business. The virtual cash has no record in the

database and an outsider merchant to store the data of the gatherings. As indicated by a review,

more than 90 enterprises have executed documented in excess of 2500 licenses against

blockchain innovation everywhere throughout the world (Croman et al., 2016).

As remarked by Lindman, Tuunainen and Rossi (2017), there is an absence of

administrative lucidity in the blockchain innovation. The administrative structure of the supply

Chain innovation has been frail including the private system of the gatherings. The protection of

the gatherings incorporated into the blockchain innovation has been confronting different

security breaks over the web. As commented by Guo and Liang (2016), the programmers

everywhere throughout the world are focusing on these online exchanges of advanced money

among the gatherings. The counter Clearing house and Product (CCP) has been directing these

exchange all over the world. However, these associations are not ok for the online exchange of

advanced money (Levy 2017).

2.9 Protection and Security

As remarked by Swan (2015), the utilization of the block chains has been developing

everywhere throughout the world. The protection and security of the monetary records and

resources have not been kept up by the innovation. There have been various instances of hacking

and information breaking over the web that has been accounted for. Blockchain utilizes a mutual

database that contains all information and data of different gatherings. As remarked by

Mougayar (2016), this innovation gives a fast exchange of advanced money. Crosby et al. (2016)

argued that, this idea has limited protection and security of information and data of gatherings

associated with the agreement. Hence, this innovation has abnormal state chances in the fund

business.

21

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Behavioral and value-based risks

As remarked by Lindman, Tuunainen and Rossi (2017), exchanges in blockchain

innovation have been a colossal risks for the financial researchers. The back business has been

confronting a ton of misfortune in the market due not the innovation. However, According to me,

blockchain need to utilize an incorporated database rather than the common database. As

remarked by Atzei, Bartoletti and Cimoli (2017), the firewall of the innovation has been feeble.

This has caused the assortment of digital assaults in the database. The absence of the outsider

speculators has made issues for financial researchers, as there is no part to track their budgetary

resources.

As remarked by Guo and Liang (2016), blockchain is not putting away the Big Data

innovation. As per me, appropriation of Big Data innovation may help in limiting these risks and

risks in the blockchain. The monstrous repetition of the innovation has been making issues in the

security of monetary information and data of the organizations. As remarked by Swan (2015),

rather than putting away information on the blockchain, a metadata can be made for keeping up

the record of the gatherings included. As remarked by Guo and Liang (2016), this can guarantee

a trustworthiness checking if the information and data gave in the metadata.

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Behavioral and value-based risks

As remarked by Lindman, Tuunainen and Rossi (2017), exchanges in blockchain

innovation have been a colossal risks for the financial researchers. The back business has been

confronting a ton of misfortune in the market due not the innovation. However, According to me,

blockchain need to utilize an incorporated database rather than the common database. As

remarked by Atzei, Bartoletti and Cimoli (2017), the firewall of the innovation has been feeble.

This has caused the assortment of digital assaults in the database. The absence of the outsider

speculators has made issues for financial researchers, as there is no part to track their budgetary

resources.

As remarked by Guo and Liang (2016), blockchain is not putting away the Big Data

innovation. As per me, appropriation of Big Data innovation may help in limiting these risks and

risks in the blockchain. The monstrous repetition of the innovation has been making issues in the

security of monetary information and data of the organizations. As remarked by Swan (2015),

rather than putting away information on the blockchain, a metadata can be made for keeping up

the record of the gatherings included. As remarked by Guo and Liang (2016), this can guarantee

a trustworthiness checking if the information and data gave in the metadata.

22

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Chapter 3: Research methodology

3.0 Introduction

This section centers around the philosophy utilized as a part of the research. Research

procedures are regard, legitimate and fair block of the research. It incorporates theoretical issues,

numerical and trial systems of research. The researcher has chosen positivism logic with

deductive approach. Information has been gathered from essential sources by expressive design.

3.1 Research Philosophy

As per Flick (2015), research philosophy are of three sorts including Positivism,

Interpretivism and Realism. The positivism logic manages learning incorporated into the

destinations and gathers information and data experimentally. In this way, researcher has utilized

positivism logic in this research. This has helped in creating theory of research. Information is

gathered through quantitative and secondary strategies. Positivism logic manages the

quantifiable information prompting factual investigation. The research logic helps in social affair

itemized data on the research point. The researcher talks about that research reasoning is useful

in representing the suspicion methods attempted by a researcher while completing the research.

The reasoning procedure can differ while doing a specific research along these lines it is supreme

need to receive a specific rationality for the research. The research reasoning must be compelling

and should be in proper arrangement. As argued by Crosby et al. (2016), Epistemology is a block

of reasoning and normal types of epistemology are positivism, realism and the interpretativism.

Positivism is a theory subject that helps with evaluating the concealed realities and the

information logically. The positivism approach tries to segregate the transcendentalism with the

goal that the research information can be assembled and watched well. Interpretativism is one

IMPACT OF CRYPTO CURRENCY IN WORLD ECONOMY

Chapter 3: Research methodology

3.0 Introduction

This section centers around the philosophy utilized as a part of the research. Research

procedures are regard, legitimate and fair block of the research. It incorporates theoretical issues,

numerical and trial systems of research. The researcher has chosen positivism logic with

deductive approach. Information has been gathered from essential sources by expressive design.

3.1 Research Philosophy

As per Flick (2015), research philosophy are of three sorts including Positivism,

Interpretivism and Realism. The positivism logic manages learning incorporated into the

destinations and gathers information and data experimentally. In this way, researcher has utilized

positivism logic in this research. This has helped in creating theory of research. Information is

gathered through quantitative and secondary strategies. Positivism logic manages the

quantifiable information prompting factual investigation. The research logic helps in social affair

itemized data on the research point. The researcher talks about that research reasoning is useful

in representing the suspicion methods attempted by a researcher while completing the research.

The reasoning procedure can differ while doing a specific research along these lines it is supreme