Data Analytics & Business Intelligence Homework: Time Series

VerifiedAdded on 2023/06/14

|10

|1340

|269

Homework Assignment

AI Summary

This document presents a comprehensive solution to a data analytics and business intelligence assignment. It includes a time series analysis of black plastic demand using methods such as three-period moving average, simple exponential smoothing, Holt’s method, and Winter’s method to forecast demand for the four quarters of 2018. The analysis evaluates these methods using metrics like Mean Absolute Error (MAD), Root Mean Squared Error (RMSE), and Mean Absolute Percentage Error (MAPE) to determine the best forecasting method. Additionally, the solution covers logistic regression analysis of bank financial conditions, including the derivation of the estimated equation, prediction of financial weakness, interpretation of total expenses-to-assets ratio, and adjustment of cutoff values to reduce misclassification costs. The document includes relevant plots, tables, and references.

Running head: BUSINESS INTELLIGENCE AND DATA ANALYTICS

Business Intelligence and Data Analytics

Name

Course Number

Date

Faculty Name

Business Intelligence and Data Analytics

Name

Course Number

Date

Faculty Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYTICS AND BUSINESS INTELLIGENCE 2

Data Analytics and Business Intelligence

1. Time series analysis

a. Draw a scatterplot and interpret.

2013

2014

2015

2016

2017

0

2000

4000

6000

8000

10000

12000

14000

T i m e S e r i e s o f B l a c k P l a s ti c D e m a n d ( ' 0 0 0 l b s )

Year

Black Plastic Demand ('000lbs)

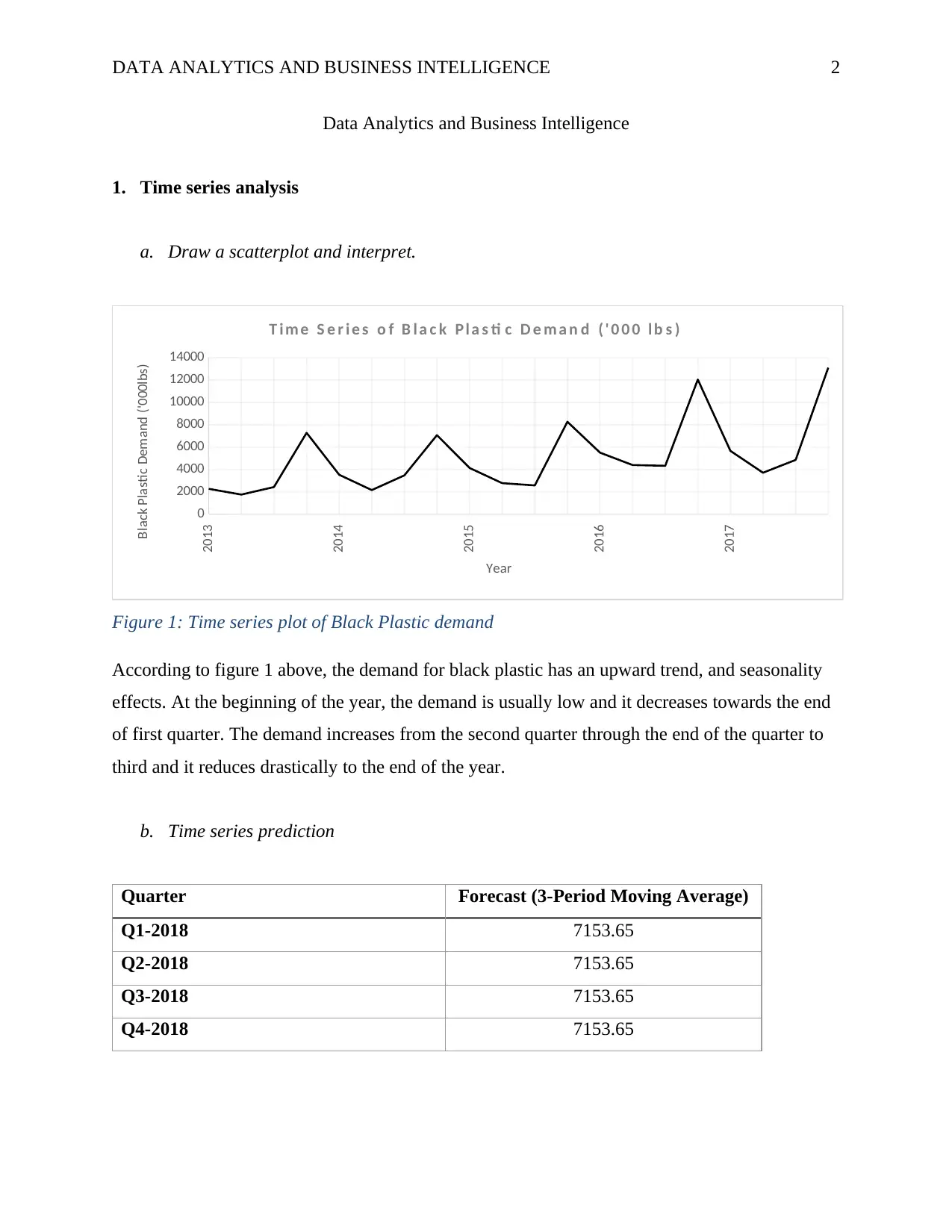

Figure 1: Time series plot of Black Plastic demand

According to figure 1 above, the demand for black plastic has an upward trend, and seasonality

effects. At the beginning of the year, the demand is usually low and it decreases towards the end

of first quarter. The demand increases from the second quarter through the end of the quarter to

third and it reduces drastically to the end of the year.

b. Time series prediction

Quarter Forecast (3-Period Moving Average)

Q1-2018 7153.65

Q2-2018 7153.65

Q3-2018 7153.65

Q4-2018 7153.65

Data Analytics and Business Intelligence

1. Time series analysis

a. Draw a scatterplot and interpret.

2013

2014

2015

2016

2017

0

2000

4000

6000

8000

10000

12000

14000

T i m e S e r i e s o f B l a c k P l a s ti c D e m a n d ( ' 0 0 0 l b s )

Year

Black Plastic Demand ('000lbs)

Figure 1: Time series plot of Black Plastic demand

According to figure 1 above, the demand for black plastic has an upward trend, and seasonality

effects. At the beginning of the year, the demand is usually low and it decreases towards the end

of first quarter. The demand increases from the second quarter through the end of the quarter to

third and it reduces drastically to the end of the year.

b. Time series prediction

Quarter Forecast (3-Period Moving Average)

Q1-2018 7153.65

Q2-2018 7153.65

Q3-2018 7153.65

Q4-2018 7153.65

DATA ANALYTICS AND BUSINESS INTELLIGENCE 3

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

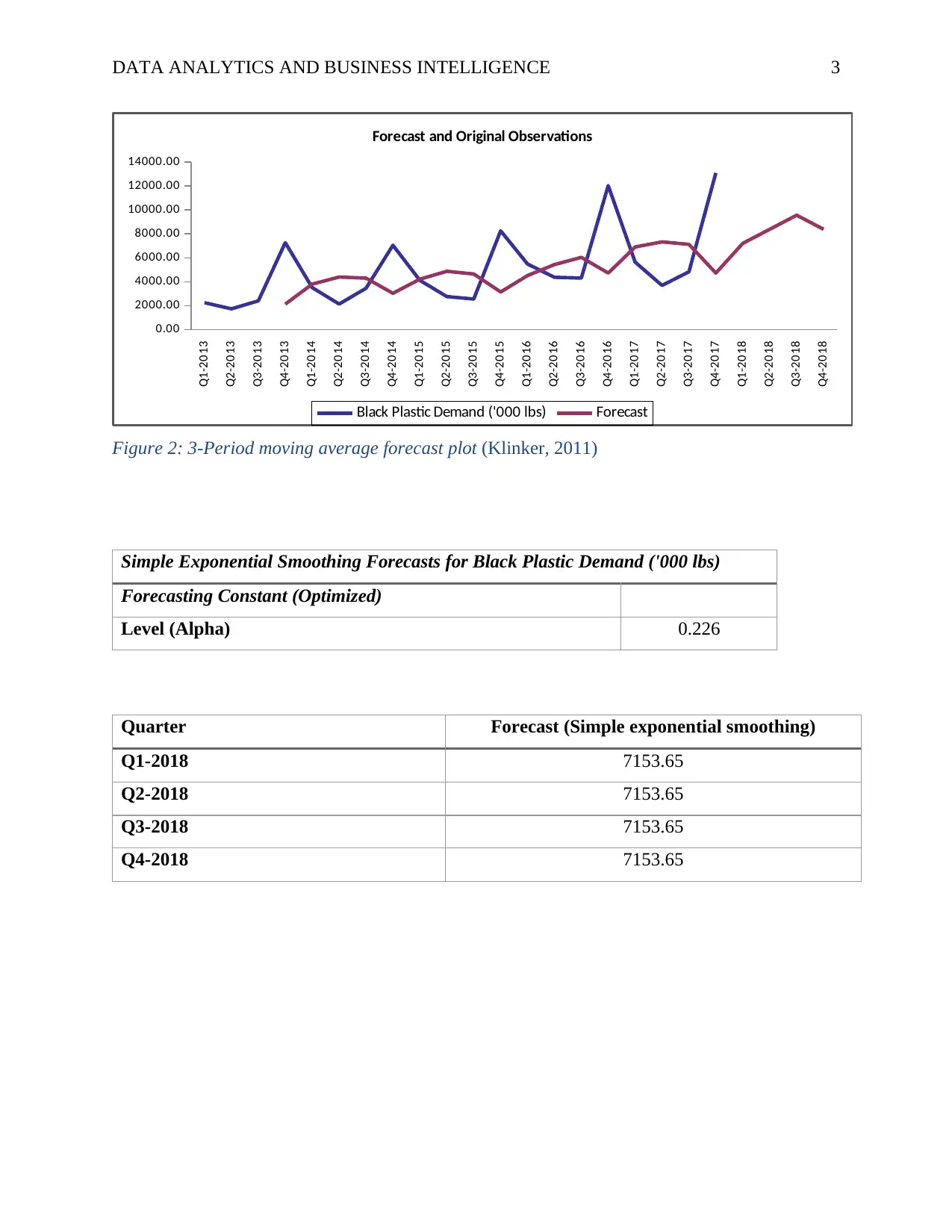

Figure 2: 3-Period moving average forecast plot (Klinker, 2011)

Simple Exponential Smoothing Forecasts for Black Plastic Demand ('000 lbs)

Forecasting Constant (Optimized)

Level (Alpha) 0.226

Quarter Forecast (Simple exponential smoothing)

Q1-2018 7153.65

Q2-2018 7153.65

Q3-2018 7153.65

Q4-2018 7153.65

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

Figure 2: 3-Period moving average forecast plot (Klinker, 2011)

Simple Exponential Smoothing Forecasts for Black Plastic Demand ('000 lbs)

Forecasting Constant (Optimized)

Level (Alpha) 0.226

Quarter Forecast (Simple exponential smoothing)

Q1-2018 7153.65

Q2-2018 7153.65

Q3-2018 7153.65

Q4-2018 7153.65

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DATA ANALYTICS AND BUSINESS INTELLIGENCE 4

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

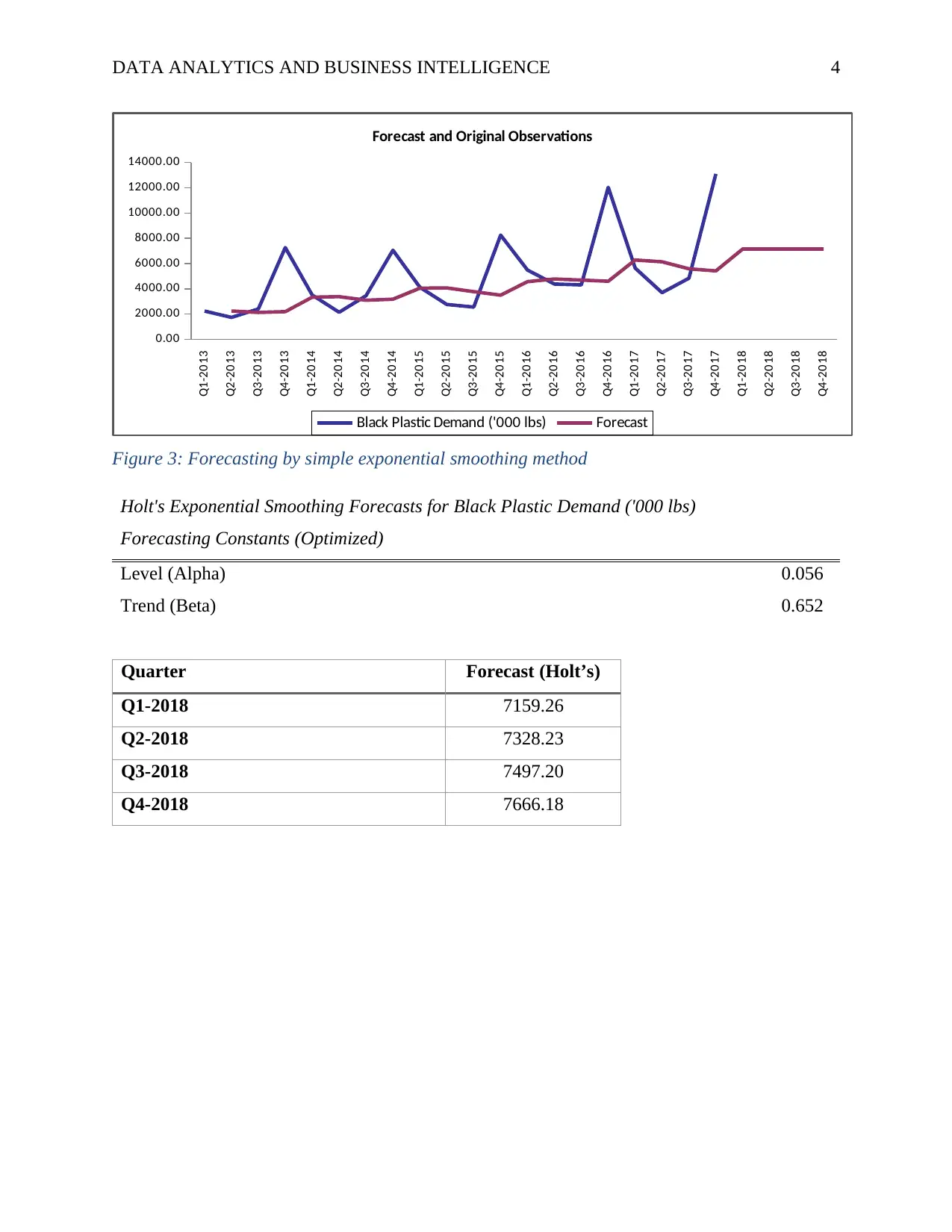

Figure 3: Forecasting by simple exponential smoothing method

Holt's Exponential Smoothing Forecasts for Black Plastic Demand ('000 lbs)

Forecasting Constants (Optimized)

Level (Alpha) 0.056

Trend (Beta) 0.652

Quarter Forecast (Holt’s)

Q1-2018 7159.26

Q2-2018 7328.23

Q3-2018 7497.20

Q4-2018 7666.18

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

Figure 3: Forecasting by simple exponential smoothing method

Holt's Exponential Smoothing Forecasts for Black Plastic Demand ('000 lbs)

Forecasting Constants (Optimized)

Level (Alpha) 0.056

Trend (Beta) 0.652

Quarter Forecast (Holt’s)

Q1-2018 7159.26

Q2-2018 7328.23

Q3-2018 7497.20

Q4-2018 7666.18

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYTICS AND BUSINESS INTELLIGENCE 5

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

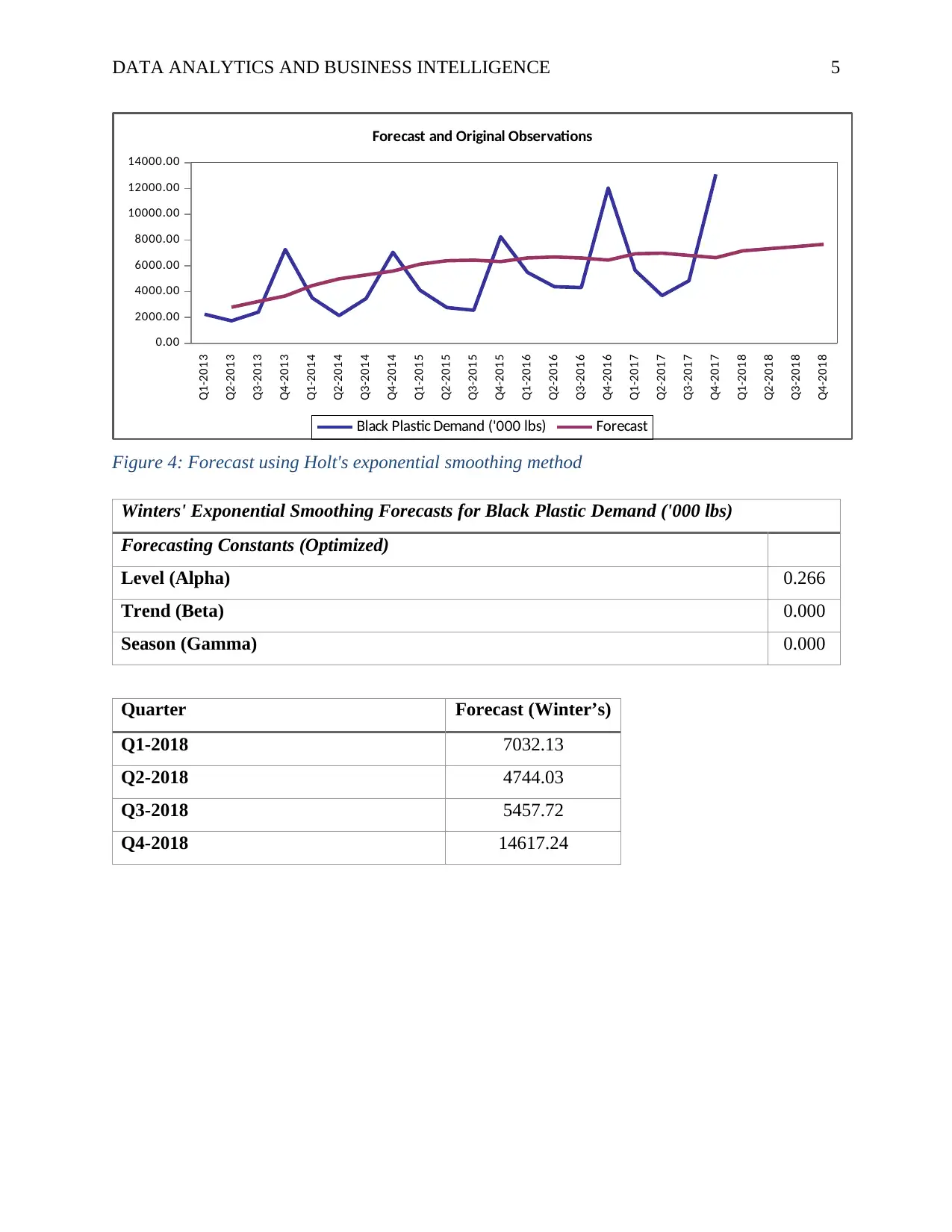

Figure 4: Forecast using Holt's exponential smoothing method

Winters' Exponential Smoothing Forecasts for Black Plastic Demand ('000 lbs)

Forecasting Constants (Optimized)

Level (Alpha) 0.266

Trend (Beta) 0.000

Season (Gamma) 0.000

Quarter Forecast (Winter’s)

Q1-2018 7032.13

Q2-2018 4744.03

Q3-2018 5457.72

Q4-2018 14617.24

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

Figure 4: Forecast using Holt's exponential smoothing method

Winters' Exponential Smoothing Forecasts for Black Plastic Demand ('000 lbs)

Forecasting Constants (Optimized)

Level (Alpha) 0.266

Trend (Beta) 0.000

Season (Gamma) 0.000

Quarter Forecast (Winter’s)

Q1-2018 7032.13

Q2-2018 4744.03

Q3-2018 5457.72

Q4-2018 14617.24

DATA ANALYTICS AND BUSINESS INTELLIGENCE 6

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

16000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

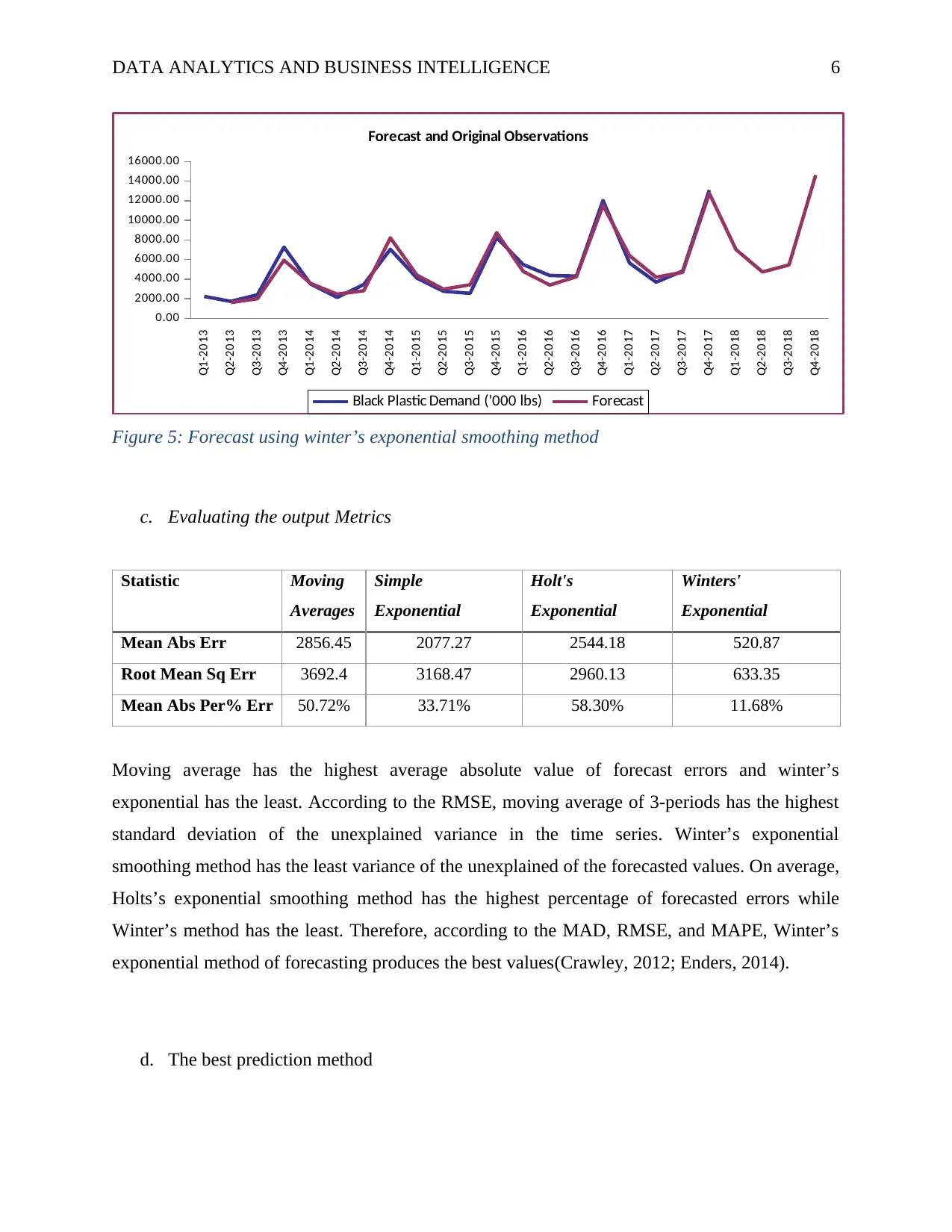

Figure 5: Forecast using winter’s exponential smoothing method

c. Evaluating the output Metrics

Statistic Moving

Averages

Simple

Exponential

Holt's

Exponential

Winters'

Exponential

Mean Abs Err 2856.45 2077.27 2544.18 520.87

Root Mean Sq Err 3692.4 3168.47 2960.13 633.35

Mean Abs Per% Err 50.72% 33.71% 58.30% 11.68%

Moving average has the highest average absolute value of forecast errors and winter’s

exponential has the least. According to the RMSE, moving average of 3-periods has the highest

standard deviation of the unexplained variance in the time series. Winter’s exponential

smoothing method has the least variance of the unexplained of the forecasted values. On average,

Holts’s exponential smoothing method has the highest percentage of forecasted errors while

Winter’s method has the least. Therefore, according to the MAD, RMSE, and MAPE, Winter’s

exponential method of forecasting produces the best values(Crawley, 2012; Enders, 2014).

d. The best prediction method

Q1-2013

Q2-2013

Q3-2013

Q4-2013

Q1-2014

Q2-2014

Q3-2014

Q4-2014

Q1-2015

Q2-2015

Q3-2015

Q4-2015

Q1-2016

Q2-2016

Q3-2016

Q4-2016

Q1-2017

Q2-2017

Q3-2017

Q4-2017

Q1-2018

Q2-2018

Q3-2018

Q4-2018

0.00

2000.00

4000.00

6000.00

8000.00

10000.00

12000.00

14000.00

16000.00

Forecast and Original Observations

Black Plastic Demand ('000 lbs) Forecast

Figure 5: Forecast using winter’s exponential smoothing method

c. Evaluating the output Metrics

Statistic Moving

Averages

Simple

Exponential

Holt's

Exponential

Winters'

Exponential

Mean Abs Err 2856.45 2077.27 2544.18 520.87

Root Mean Sq Err 3692.4 3168.47 2960.13 633.35

Mean Abs Per% Err 50.72% 33.71% 58.30% 11.68%

Moving average has the highest average absolute value of forecast errors and winter’s

exponential has the least. According to the RMSE, moving average of 3-periods has the highest

standard deviation of the unexplained variance in the time series. Winter’s exponential

smoothing method has the least variance of the unexplained of the forecasted values. On average,

Holts’s exponential smoothing method has the highest percentage of forecasted errors while

Winter’s method has the least. Therefore, according to the MAD, RMSE, and MAPE, Winter’s

exponential method of forecasting produces the best values(Crawley, 2012; Enders, 2014).

d. The best prediction method

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DATA ANALYTICS AND BUSINESS INTELLIGENCE 7

Winter’s exponential smoothing method provides the best forecast for black plastic demand

because it factors the trend and seasonality in the forecasting calculation. It also has the least

percentage of forecasting errors, RMSE and the mean absolute errors. Also, observing the plots

for the four forecasting methods, Winter’s methods seem to have factored the trend and

seasonality effects on the data(Hor, Watson, & Majithia, 2006).

2. Logistic Regression

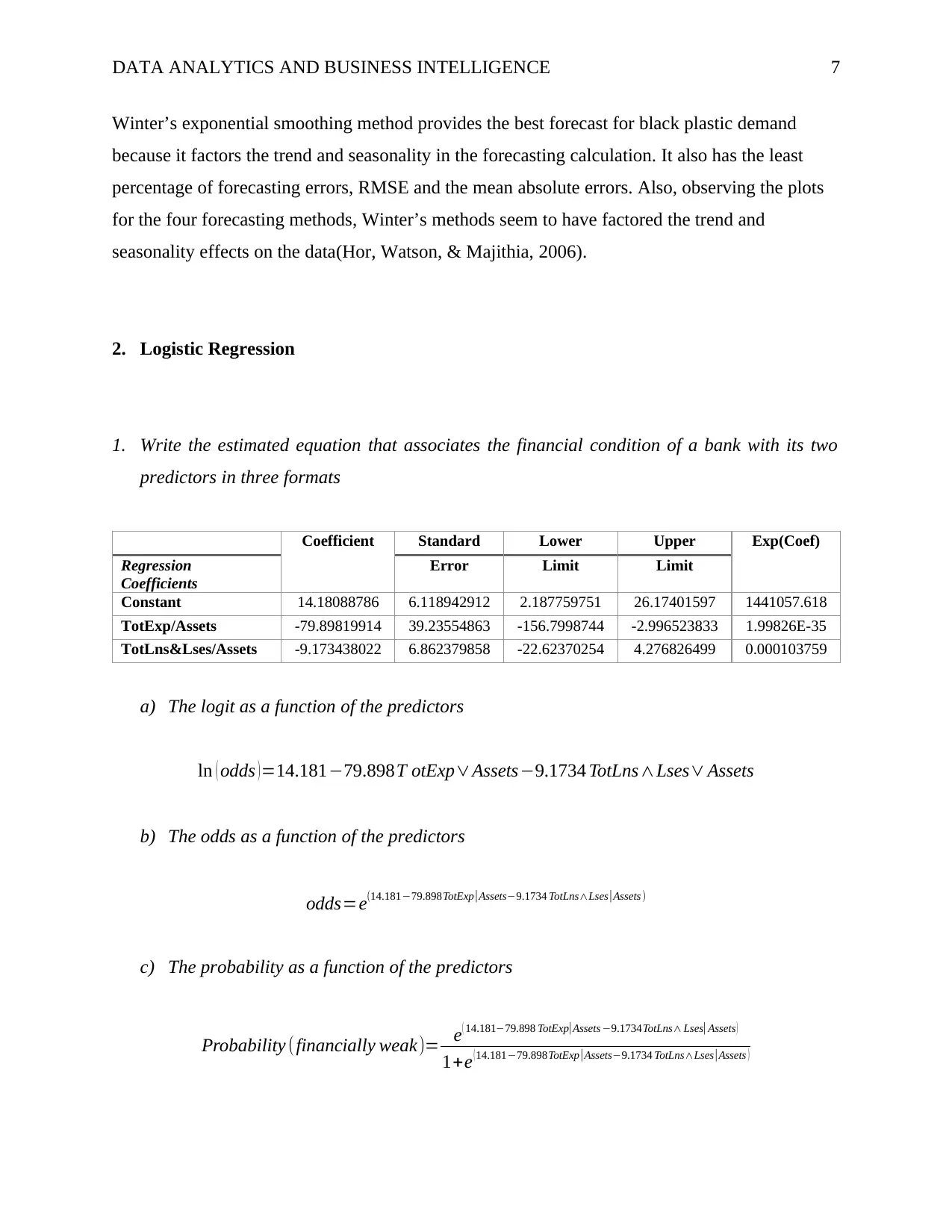

1. Write the estimated equation that associates the financial condition of a bank with its two

predictors in three formats

Coefficient Standard Lower Upper Exp(Coef)

Regression

Coefficients

Error Limit Limit

Constant 14.18088786 6.118942912 2.187759751 26.17401597 1441057.618

TotExp/Assets -79.89819914 39.23554863 -156.7998744 -2.996523833 1.99826E-35

TotLns&Lses/Assets -9.173438022 6.862379858 -22.62370254 4.276826499 0.000103759

a) The logit as a function of the predictors

ln ( odds ) =14.181−79.898T otExp∨Assets−9.1734 TotLns∧Lses∨ Assets

b) The odds as a function of the predictors

odds=e(14.181−79.898TotExp |Assets−9.1734 TotLns∧Lses |Assets )

c) The probability as a function of the predictors

Probability (financially weak)= e( 14.181−79.898 TotExp| Assets −9.1734TotLns∧ Lses| Assets )

1+e ( 14.181−79.898TotExp | Assets−9.1734 TotLns∧Lses| Assets )

Winter’s exponential smoothing method provides the best forecast for black plastic demand

because it factors the trend and seasonality in the forecasting calculation. It also has the least

percentage of forecasting errors, RMSE and the mean absolute errors. Also, observing the plots

for the four forecasting methods, Winter’s methods seem to have factored the trend and

seasonality effects on the data(Hor, Watson, & Majithia, 2006).

2. Logistic Regression

1. Write the estimated equation that associates the financial condition of a bank with its two

predictors in three formats

Coefficient Standard Lower Upper Exp(Coef)

Regression

Coefficients

Error Limit Limit

Constant 14.18088786 6.118942912 2.187759751 26.17401597 1441057.618

TotExp/Assets -79.89819914 39.23554863 -156.7998744 -2.996523833 1.99826E-35

TotLns&Lses/Assets -9.173438022 6.862379858 -22.62370254 4.276826499 0.000103759

a) The logit as a function of the predictors

ln ( odds ) =14.181−79.898T otExp∨Assets−9.1734 TotLns∧Lses∨ Assets

b) The odds as a function of the predictors

odds=e(14.181−79.898TotExp |Assets−9.1734 TotLns∧Lses |Assets )

c) The probability as a function of the predictors

Probability (financially weak)= e( 14.181−79.898 TotExp| Assets −9.1734TotLns∧ Lses| Assets )

1+e ( 14.181−79.898TotExp | Assets−9.1734 TotLns∧Lses| Assets )

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DATA ANALYTICS AND BUSINESS INTELLIGENCE 8

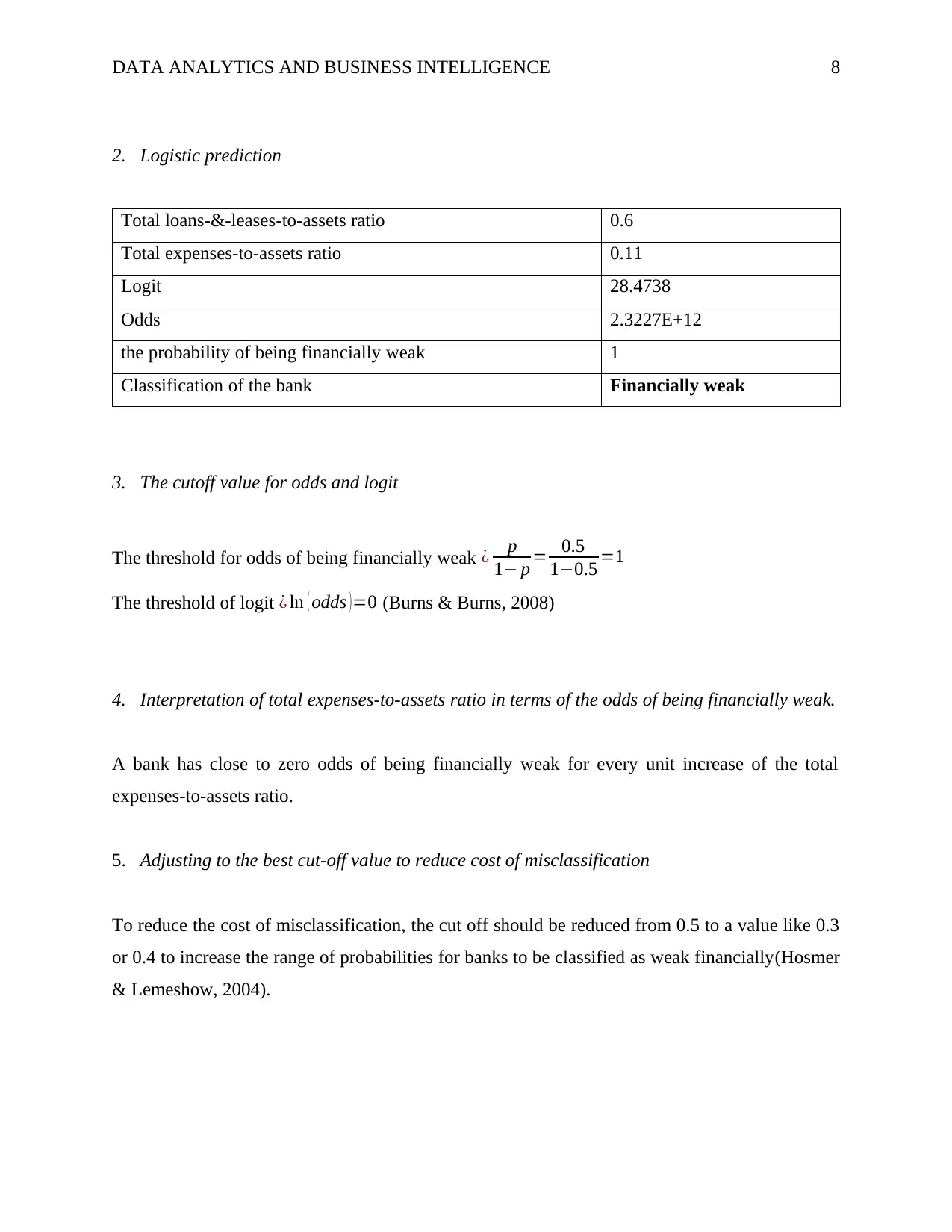

2. Logistic prediction

Total loans-&-leases-to-assets ratio 0.6

Total expenses-to-assets ratio 0.11

Logit 28.4738

Odds 2.3227E+12

the probability of being financially weak 1

Classification of the bank Financially weak

3. The cutoff value for odds and logit

The threshold for odds of being financially weak ¿ p

1− p = 0.5

1−0.5 =1

The threshold of logit ¿ ln ( odds )=0 (Burns & Burns, 2008)

4. Interpretation of total expenses-to-assets ratio in terms of the odds of being financially weak.

A bank has close to zero odds of being financially weak for every unit increase of the total

expenses-to-assets ratio.

5. Adjusting to the best cut-off value to reduce cost of misclassification

To reduce the cost of misclassification, the cut off should be reduced from 0.5 to a value like 0.3

or 0.4 to increase the range of probabilities for banks to be classified as weak financially(Hosmer

& Lemeshow, 2004).

2. Logistic prediction

Total loans-&-leases-to-assets ratio 0.6

Total expenses-to-assets ratio 0.11

Logit 28.4738

Odds 2.3227E+12

the probability of being financially weak 1

Classification of the bank Financially weak

3. The cutoff value for odds and logit

The threshold for odds of being financially weak ¿ p

1− p = 0.5

1−0.5 =1

The threshold of logit ¿ ln ( odds )=0 (Burns & Burns, 2008)

4. Interpretation of total expenses-to-assets ratio in terms of the odds of being financially weak.

A bank has close to zero odds of being financially weak for every unit increase of the total

expenses-to-assets ratio.

5. Adjusting to the best cut-off value to reduce cost of misclassification

To reduce the cost of misclassification, the cut off should be reduced from 0.5 to a value like 0.3

or 0.4 to increase the range of probabilities for banks to be classified as weak financially(Hosmer

& Lemeshow, 2004).

DATA ANALYTICS AND BUSINESS INTELLIGENCE 9

References

Burns, R. P., & Burns, R. (2008). Chapter 24 Logistic Regression. Business Research Methods

and Statistics Using SPSS, (Chapter 25), 344–354. Retrieved from

http://books.google.com/books?

hl=en&lr=&id=bPvCRzBou3gC&oi=fnd&pg=PR5&dq=Business+

Research+Methods+and+Statistics+using+SPSS&ots=evyQoeCAur&sig=oR9vX

qT9KivGjvQzYZFufAWO5bU

Crawley, M. J. (2012). Time Series Analysis. The R Book, 785–808.

https://doi.org/10.1002/9781118448908.ch24

Enders, W. (2014). Applied Econometric Time Series. Technometrics (Vol. 46).

https://doi.org/10.1198/tech.2004.s813

Hor, C.-L., Watson, S. J., & Majithia, S. (2006). Time series analysis. Transmission and

Distribution (Former Title), 142(3), 614. https://doi.org/10.1007/SpringerReference_6246

Hosmer, D. W., & Lemeshow, S. (2004). Applied Logistic Regression Second Edition. Applied

Logistic Regression. https://doi.org/10.1002/0471722146

Klinker, F. (2011). Exponential moving average versus moving exponential average.

Mathematische Semesterberichte, 58(1), 97–107. https://doi.org/10.1007/s00591-010-0080-

References

Burns, R. P., & Burns, R. (2008). Chapter 24 Logistic Regression. Business Research Methods

and Statistics Using SPSS, (Chapter 25), 344–354. Retrieved from

http://books.google.com/books?

hl=en&lr=&id=bPvCRzBou3gC&oi=fnd&pg=PR5&dq=Business+

Research+Methods+and+Statistics+using+SPSS&ots=evyQoeCAur&sig=oR9vX

qT9KivGjvQzYZFufAWO5bU

Crawley, M. J. (2012). Time Series Analysis. The R Book, 785–808.

https://doi.org/10.1002/9781118448908.ch24

Enders, W. (2014). Applied Econometric Time Series. Technometrics (Vol. 46).

https://doi.org/10.1198/tech.2004.s813

Hor, C.-L., Watson, S. J., & Majithia, S. (2006). Time series analysis. Transmission and

Distribution (Former Title), 142(3), 614. https://doi.org/10.1007/SpringerReference_6246

Hosmer, D. W., & Lemeshow, S. (2004). Applied Logistic Regression Second Edition. Applied

Logistic Regression. https://doi.org/10.1002/0471722146

Klinker, F. (2011). Exponential moving average versus moving exponential average.

Mathematische Semesterberichte, 58(1), 97–107. https://doi.org/10.1007/s00591-010-0080-

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DATA ANALYTICS AND BUSINESS INTELLIGENCE 10

8

8

1 out of 10

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.