Financial Analysis of Debenhams Plc Investment Decision Report (MBA)

VerifiedAdded on 2023/06/10

Investment decision

Financial capital budgeting analysis

Name of the Student-

Student Id-

Paraphrase This Document

Organization is accompanied with the several set of activities in which several acts

are performed to achieve the certain goals and objectives. There are several factors which

might positively and negatively impact the future growth and effective business outcomes of

the Organizaiton. Ratio analysis assists in assessing the present and future business outcomes

and current business outlook. Currently, Debenhams Plc has been performing well in market.

Nonetheless, ratio analysis has reflected that company has decreased its profitability by 50%

since last three years and also maintained high financial leverage. Capital budgeting tool such

as NPV, IRR and Payback period has reflected that company may chose this project due to its

high NPV and increased business outcomes.

Executive Summary...............................................................................................................................1

Introduction...........................................................................................................................................1

Task 1....................................................................................................................................................1

Decription of Debenhams Plc............................................................................................................1

Current mid-term (3-5 years) outlook................................................................................................2

Financial ratio analysis of Debenhams Plc........................................................................................2

Liquidity ratio................................................................................................................................2

Profitability ratio...........................................................................................................................3

Efficiency ratio..............................................................................................................................4

Market based Ratio........................................................................................................................6

Interpret and assess Debenhams Plc’s performance in the most recent year and comparison of the

same with its last three year performance..........................................................................................8

Critically assess the company’s approach to working capital management.......................................9

Task-2..................................................................................................................................................10

Project financial investment project method..................................................................................10

Computation of the adjusted present value of the undertaken project..........................................10

Advantage and disadvantages of using the Adjusted present value in the project............................14

Using NPV evaluate the project using the Weighted Average Cost of Capital (WACC) assuming a

30% debt..........................................................................................................................................15

Recommendation.................................................................................................................................15

Conclusion...........................................................................................................................................16

References...........................................................................................................................................17

Appendix.............................................................................................................................................18

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

With the economic changes and ramified development, each and every company

needs to manage its financial performance and risk effectively with a view to sustainable

growth in the long run. It is analyzed that there are several financial tools which could be

used by company to analysis the financial performance such as ratio analysis, capital

budgeting, du pont analysis, top down analysis and bottom up analysis of company. In this

report, financial analysis of Debenhams Plc has been taken into consideration. This report

analyses the financial leverage, profitability, efficiency and market outlook of company since

last three years.

Task 1

Decription of Debenhams Plc

It is a British multinational retailer operating under a department store format in

United Kingdom Ireland with franchise stores in other countries. The main business of

company is to offer the goods and services to its clients from the retail stores. The current

stock price at which the shares of the company traded is DEB (LON) 12.75 GBX +0.79

(+6.61%). It reflects the positive outlook for the future profitability of the business. The last

year revenue of company was 234.17 billion GBP (2016) which increased by 12% as

compared to current mid-term (3-5 years). This company has future business sustainability to

achieve the market share to 25% in the Australia by expanding its business in long run

(Debenhams plc., 2017).

Current mid-term (3-5 years) outlook

Company has planned to issue share in market of £306.4 million to finance its

undertaken project. In addition to this, with the increasing profitability of the business since

last three years, company has elected projects which have been used by the board of

managers to expand its business. However, the raised capital from the issue of capital have

been planned to expand its multi retail stores in United Kingdom market. This company has

set up its mission to strengthen its market share in UK and other states as well. This

undertaken strategic plans and project which focuses on the customization of the products

and services offered in market will assist organization to meet its Current mid-term (3-5

Paraphrase This Document

leverage. It is considered that high financial leverage would be negative indicators for the

future growth and may result to destruction of business at the time of sluggish market

condition. It is analyzed that by increasing the overall share capital in business, company

could easily lower down the cost of capital of its business (Debenhams plc., 2016).

Financial ratio analysis of Debenhams Plc

This ratio analysis assists in setting up the relation between the two financial factors

of the business. This ratio is divided into five parts to assess the financial position of

company (Brigham, Ehrhardt, Nason, & Gessaroli, 2016).

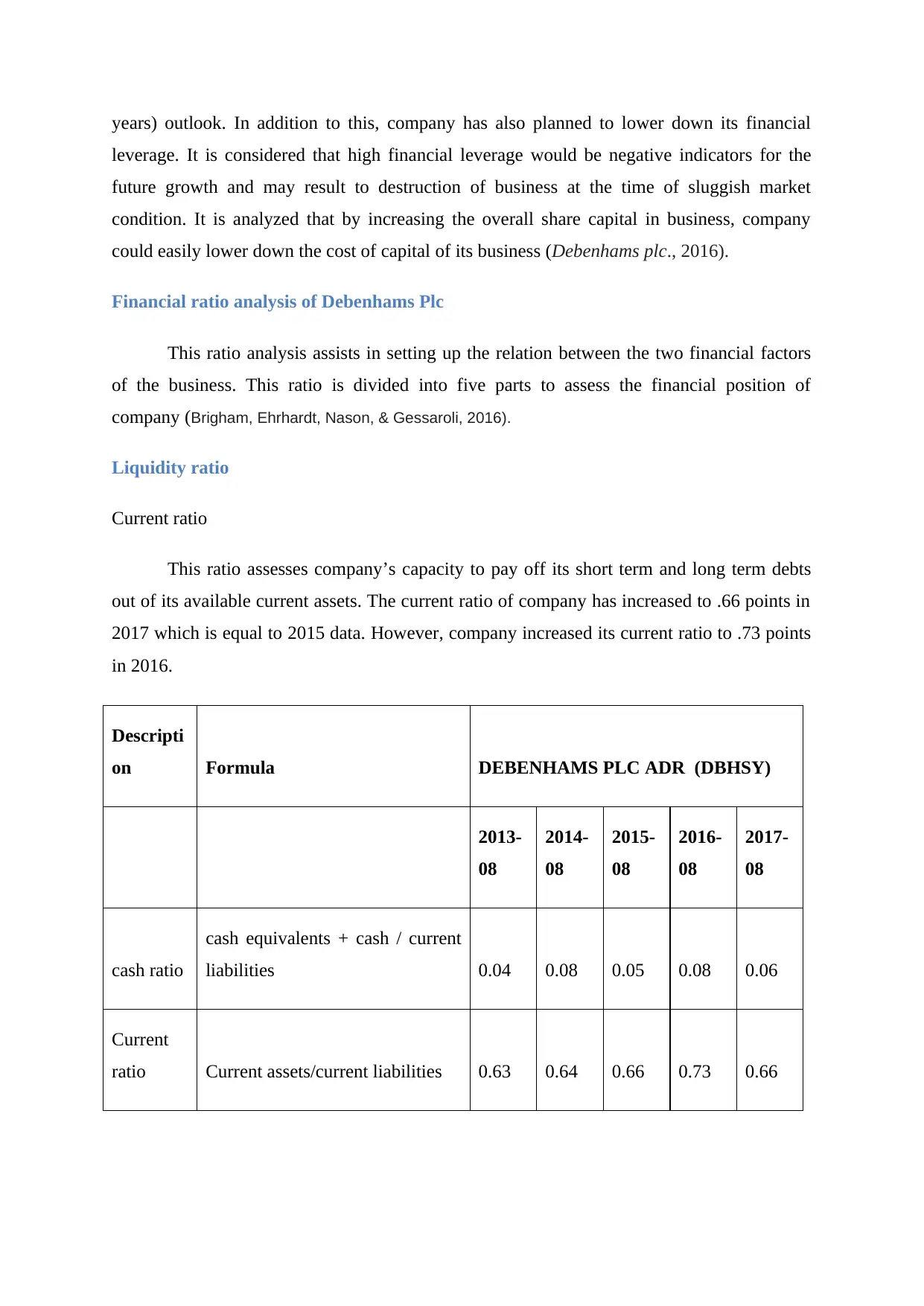

Liquidity ratio

Current ratio

This ratio assesses company’s capacity to pay off its short term and long term debts

out of its available current assets. The current ratio of company has increased to .66 points in

2017 which is equal to 2015 data. However, company increased its current ratio to .73 points

in 2016.

Descripti

on Formula DEBENHAMS PLC ADR (DBHSY)

2013-

08

2014-

08

2015-

08

2016-

08

2017-

08

cash ratio

cash equivalents + cash / current

liabilities 0.04 0.08 0.05 0.08 0.06

Current

ratio Current assets/current liabilities 0.63 0.64 0.66 0.73 0.66

Ratio

Current assets-Inventory/current

liabilities 0.15 0.18 0.18 0.26 0.19

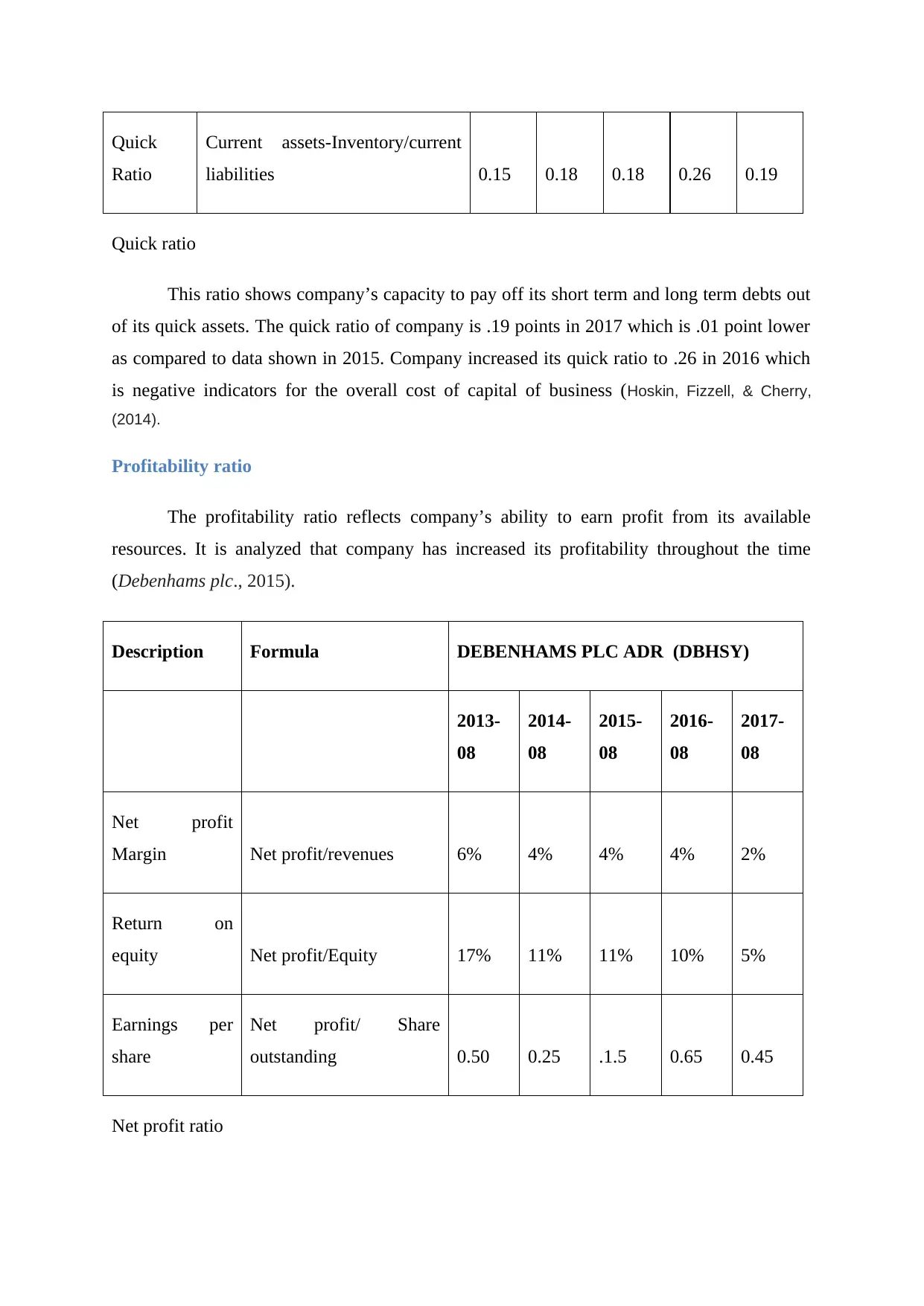

Quick ratio

This ratio shows company’s capacity to pay off its short term and long term debts out

of its quick assets. The quick ratio of company is .19 points in 2017 which is .01 point lower

as compared to data shown in 2015. Company increased its quick ratio to .26 in 2016 which

is negative indicators for the overall cost of capital of business (Hoskin, Fizzell, & Cherry,

(2014).

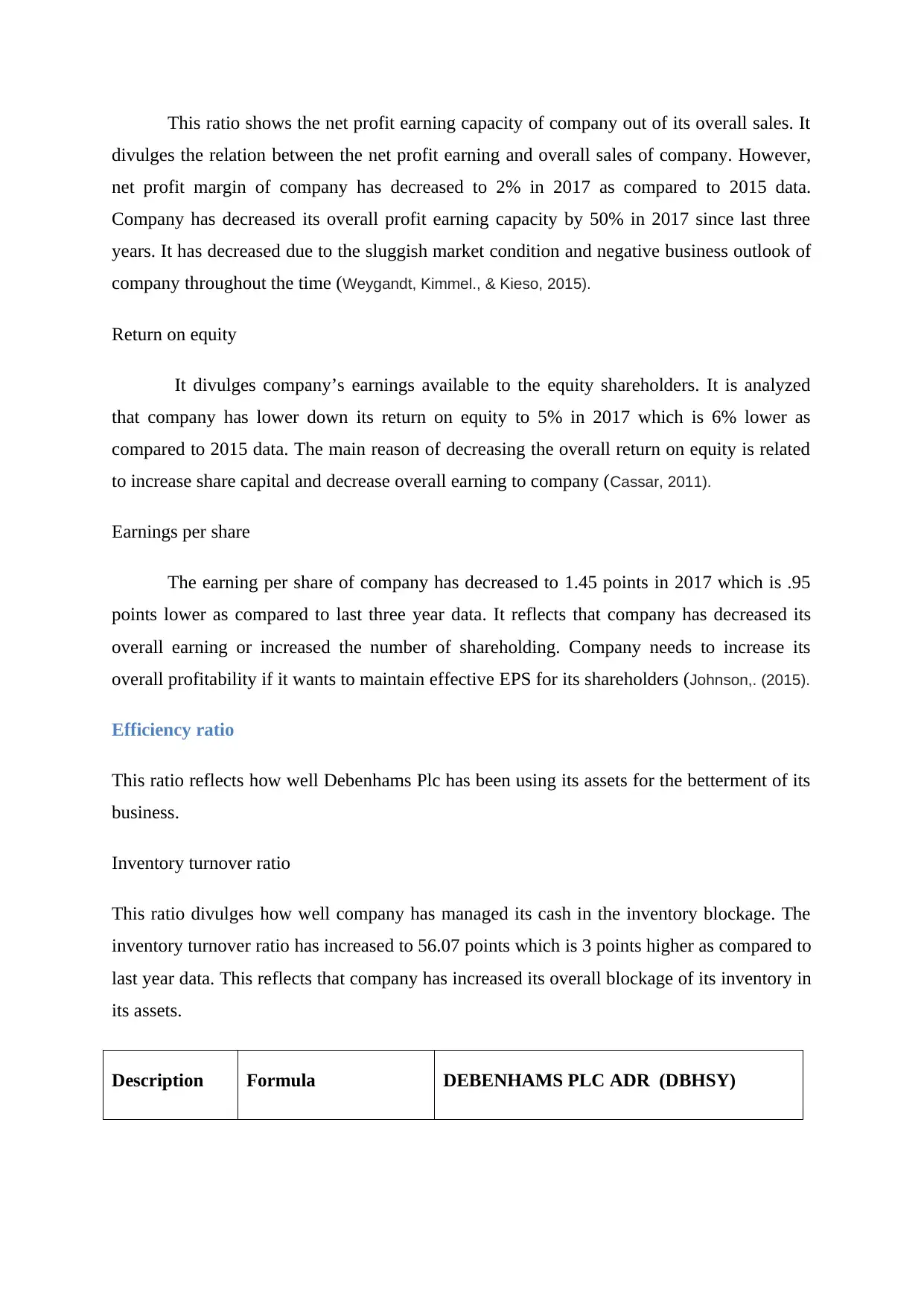

Profitability ratio

The profitability ratio reflects company’s ability to earn profit from its available

resources. It is analyzed that company has increased its profitability throughout the time

(Debenhams plc., 2015).

Description Formula DEBENHAMS PLC ADR (DBHSY)

2013-

08

2014-

08

2015-

08

2016-

08

2017-

08

Net profit

Margin Net profit/revenues 6% 4% 4% 4% 2%

Return on

equity Net profit/Equity 17% 11% 11% 10% 5%

Earnings per

share

Net profit/ Share

outstanding 0.50 0.25 .1.5 0.65 0.45

Net profit ratio

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

divulges the relation between the net profit earning and overall sales of company. However,

net profit margin of company has decreased to 2% in 2017 as compared to 2015 data.

Company has decreased its overall profit earning capacity by 50% in 2017 since last three

years. It has decreased due to the sluggish market condition and negative business outlook of

company throughout the time (Weygandt, Kimmel., & Kieso, 2015).

Return on equity

It divulges company’s earnings available to the equity shareholders. It is analyzed

that company has lower down its return on equity to 5% in 2017 which is 6% lower as

compared to 2015 data. The main reason of decreasing the overall return on equity is related

to increase share capital and decrease overall earning to company (Cassar, 2011).

Earnings per share

The earning per share of company has decreased to 1.45 points in 2017 which is .95

points lower as compared to last three year data. It reflects that company has decreased its

overall earning or increased the number of shareholding. Company needs to increase its

overall profitability if it wants to maintain effective EPS for its shareholders (Johnson,. (2015).

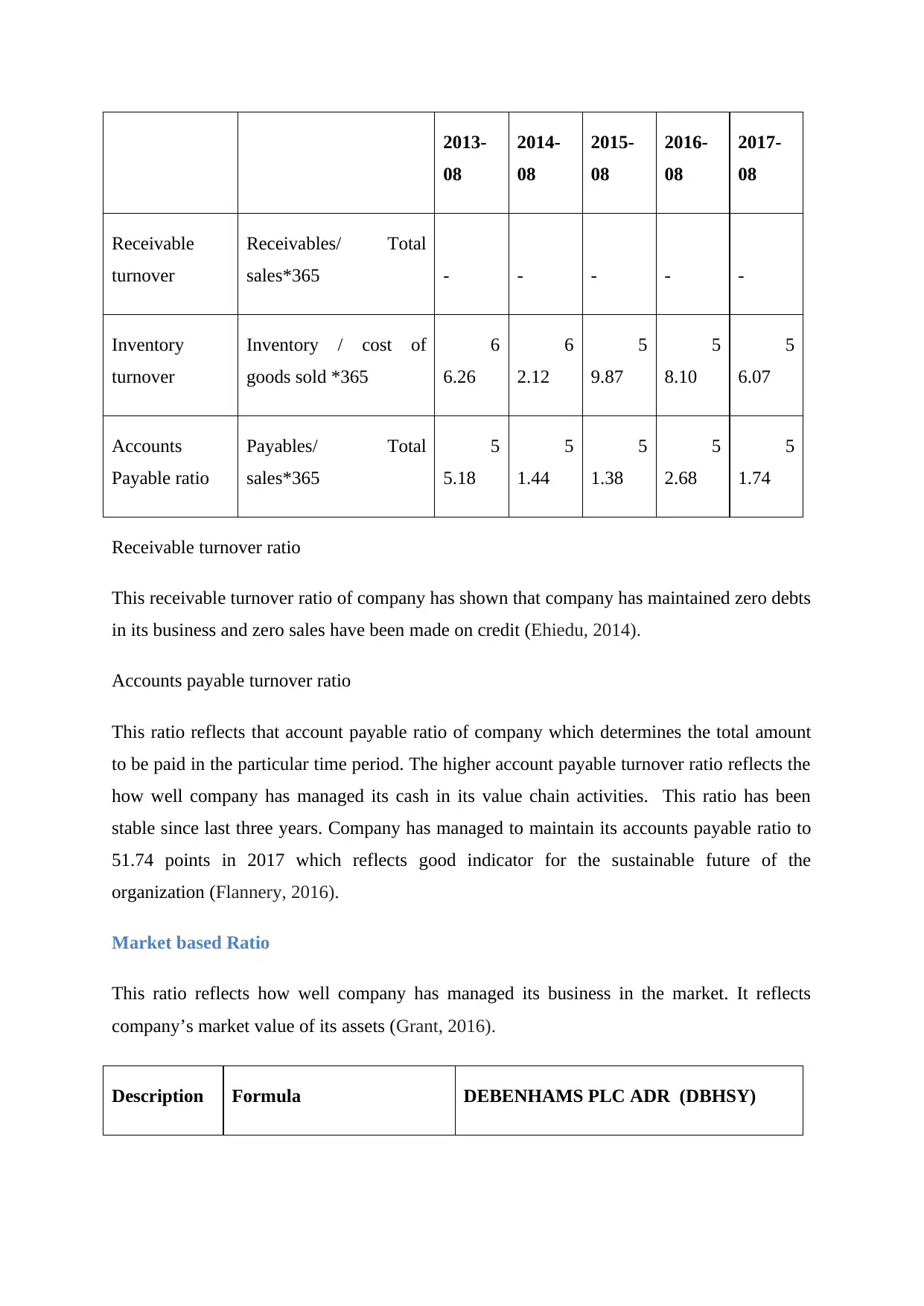

Efficiency ratio

This ratio reflects how well Debenhams Plc has been using its assets for the betterment of its

business.

Inventory turnover ratio

This ratio divulges how well company has managed its cash in the inventory blockage. The

inventory turnover ratio has increased to 56.07 points which is 3 points higher as compared to

last year data. This reflects that company has increased its overall blockage of its inventory in

its assets.

Description Formula DEBENHAMS PLC ADR (DBHSY)

Paraphrase This Document

08

2014-

08

2015-

08

2016-

08

2017-

08

Receivable

turnover

Receivables/ Total

sales*365 - - - - -

Inventory

turnover

Inventory / cost of

goods sold *365

6

6.26

6

2.12

5

9.87

5

8.10

5

6.07

Accounts

Payable ratio

Payables/ Total

sales*365

5

5.18

5

1.44

5

1.38

5

2.68

5

1.74

Receivable turnover ratio

This receivable turnover ratio of company has shown that company has maintained zero debts

in its business and zero sales have been made on credit (Ehiedu, 2014).

Accounts payable turnover ratio

This ratio reflects that account payable ratio of company which determines the total amount

to be paid in the particular time period. The higher account payable turnover ratio reflects the

how well company has managed its cash in its value chain activities. This ratio has been

stable since last three years. Company has managed to maintain its accounts payable ratio to

51.74 points in 2017 which reflects good indicator for the sustainable future of the

organization (Flannery, 2016).

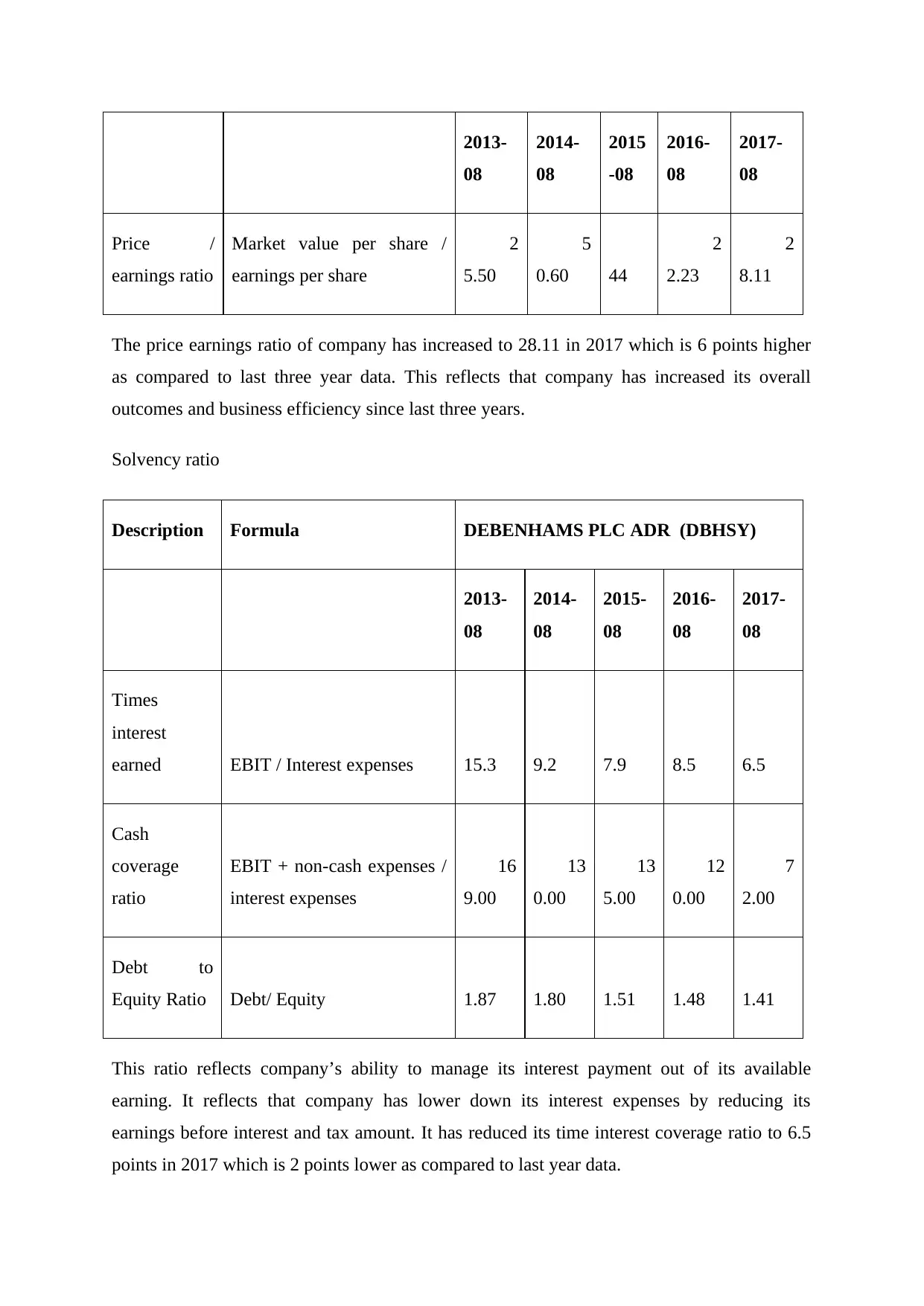

Market based Ratio

This ratio reflects how well company has managed its business in the market. It reflects

company’s market value of its assets (Grant, 2016).

Description Formula DEBENHAMS PLC ADR (DBHSY)

08

2014-

08

2015

-08

2016-

08

2017-

08

Price /

earnings ratio

Market value per share /

earnings per share

2

5.50

5

0.60 44

2

2.23

2

8.11

The price earnings ratio of company has increased to 28.11 in 2017 which is 6 points higher

as compared to last three year data. This reflects that company has increased its overall

outcomes and business efficiency since last three years.

Solvency ratio

Description Formula DEBENHAMS PLC ADR (DBHSY)

2013-

08

2014-

08

2015-

08

2016-

08

2017-

08

Times

interest

earned EBIT / Interest expenses 15.3 9.2 7.9 8.5 6.5

Cash

coverage

ratio

EBIT + non-cash expenses /

interest expenses

16

9.00

13

0.00

13

5.00

12

0.00

7

2.00

Debt to

Equity Ratio Debt/ Equity 1.87 1.80 1.51 1.48 1.41

This ratio reflects company’s ability to manage its interest payment out of its available

earning. It reflects that company has lower down its interest expenses by reducing its

earnings before interest and tax amount. It has reduced its time interest coverage ratio to 6.5

points in 2017 which is 2 points lower as compared to last year data.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

indicator for its business.

The debt to equity ratio of company has also decreased to 1.41 point which is .10 points

lower as compared to last three year data. Company has managed its debt portion higher

which might lower down its overall costing and increases the financial leverage of its

business. Company should lower down its debt portion by increasing its equity capital.

This ratio has reflected that company has lower down its earning capacity throughout the time

and decreased its overall outcomes. In addition to this, company needs to manage its business

by increasing the overall outcomes and efficiency of the business. It has shown that company

needs to focus on lower down the overall debt portion in its business and increasing the

overall equity portion in its business (Jordan, 2014).

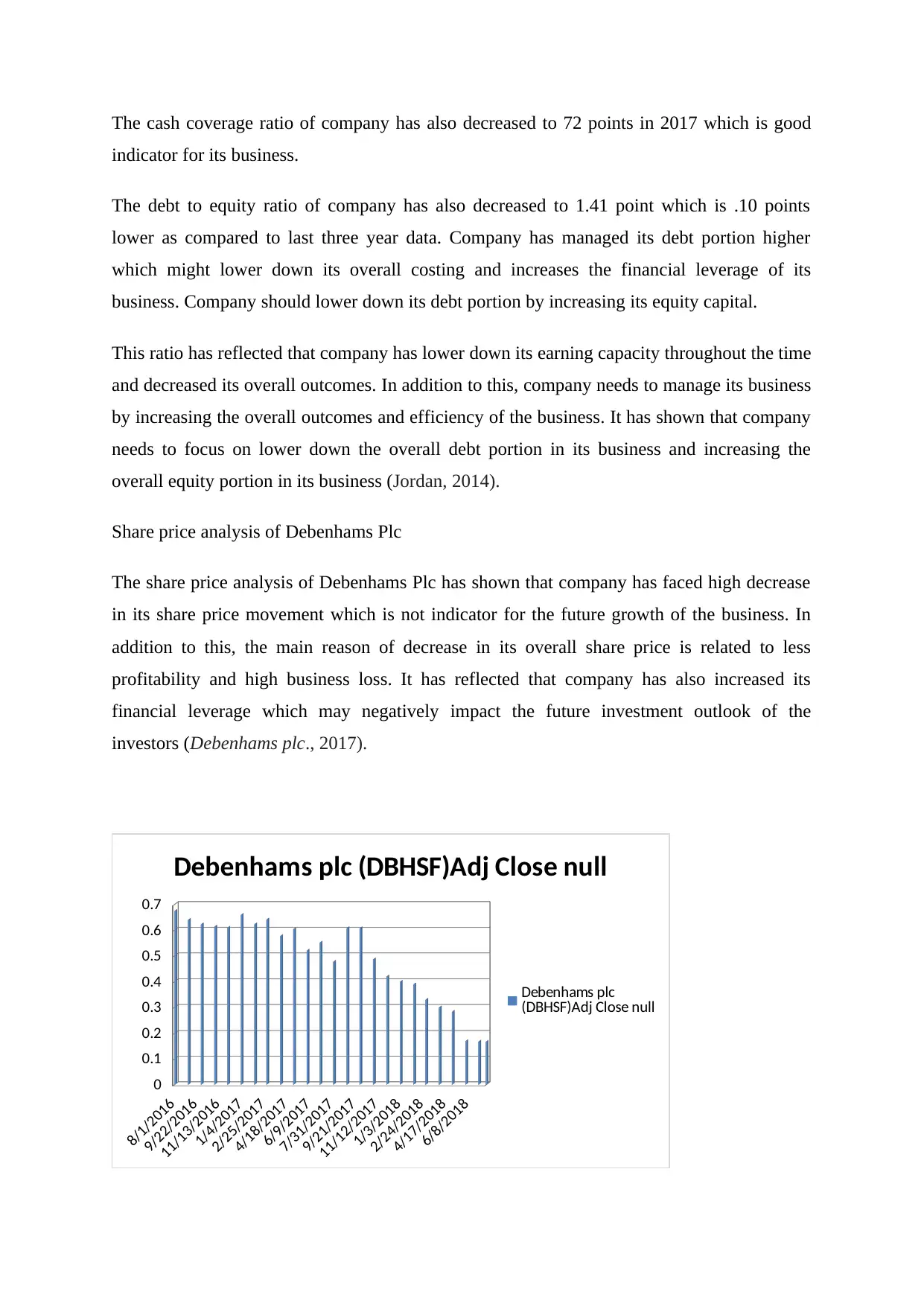

Share price analysis of Debenhams Plc

The share price analysis of Debenhams Plc has shown that company has faced high decrease

in its share price movement which is not indicator for the future growth of the business. In

addition to this, the main reason of decrease in its overall share price is related to less

profitability and high business loss. It has reflected that company has also increased its

financial leverage which may negatively impact the future investment outlook of the

investors (Debenhams plc., 2017).

8/1/2016

9/22/2016

11/13/2016

1/4/2017

2/25/2017

4/18/2017

6/9/2017

7/31/2017

9/21/2017

11/12/2017

1/3/2018

2/24/2018

4/17/2018

6/8/2018

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

Debenhams plc (DBHSF)Adj Close null

Debenhams plc

(DBHSF)Adj Close null

Paraphrase This Document

Interpret and assess Debenhams Plc’s performance in the most recent year and

comparison of the same with its last three year performance.

After analyzing all the details, it could be inferred that company has maintained high

debt to equity ratio which might be negative indicator for the future growth of the business.

However, in 2017, Debenhams Plc has faced high financial leverage which might be negative

for the future sustainability of the business due to sluggish market condition. It is further

observed that company could easily lower down its financial leverage by decreasing its debt

portion or increasing its overall equity capital. In addition to this, the profitability of company

has also gone down with the drastic rate since last three years. The profit earning capacity of

company has decreased by 50% since last three year which is not good indicator for the

future growth of the organization. In addition to this, efficiency ratio of company has also

gone down with the drastic rate which reflects that company failed to manage its capital in

the business and faced high loss due to high cost of capital. The solvency ratio has also

divulged that company might face destruction in its business if the EBIT of company fails to

meet its overall interest payment. This level of decrease in its overall profitability and

solvency might negatively impact the business functioning of organization (Bloomberg,

2017).

Critically assess the company’s approach to working capital management

The working capital is the amount of difference between the current assets and current

liabilities of company. It is analyzed that company has invested less capital in its current

assets which might be negative indicator for the future growth of the organization. Company

has increased its current ratio to .73 points in 2016 which reflects that company has increased

its overall investment in current assets and may negatively impact the future growth of the

business. In addition to this, company’s approach to working capital management has

reflected that company has been increasing its working capital by increasing the investment

in its current assets. It reflects that company is planning to strengthen the future sustainability

of business by increasing the overall outcomes and efficiency throughout the time. It is

further observed that with the increase in the capital blockage in its inventories, company

might face issue of high cost of capital. It will not only increase the overall costing of its

business.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Project financial investment project method

In this part, the assessment of the available project will be analyzed by using the project

investment technique such as NPV, IRR and other capital budgeting decisions.

Project summary

Project outlay- initial investment= £10, 00,000

Life span of the project= 3 years

Debt capacity= 30% of the overall project cost

Annual interest charges= 12%

Available resources to finance project

£3, 00,000

Addition cost for this finance= 2% of £3, 00,000= £6,000

Debt issuance cost = 1%

Tax rate= 19%

In this report, adjusted present value, net present value, weighted average cost of capital of

the business have been used to assess the financial viability of the undertaken project of the

business.

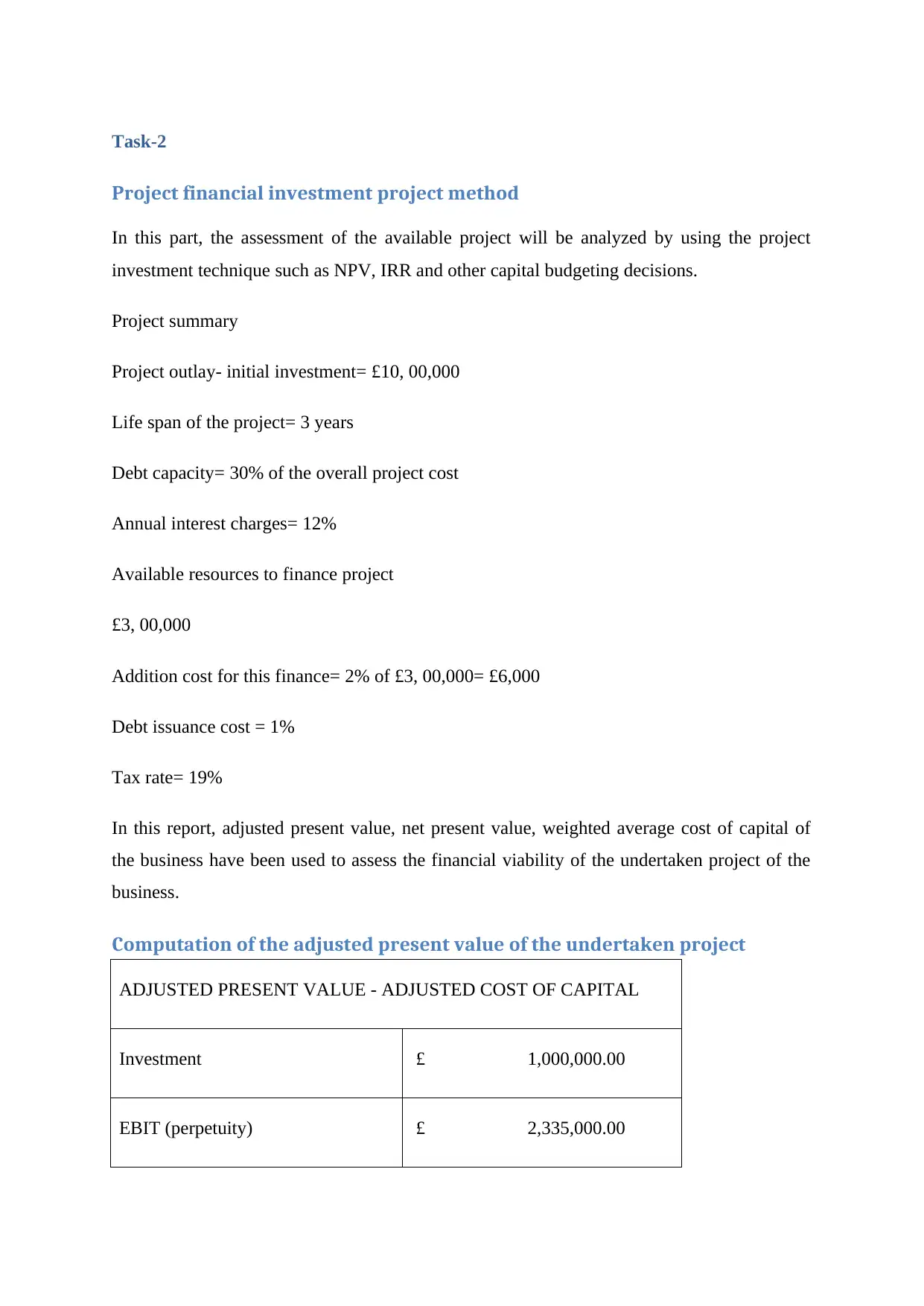

Computation of the adjusted present value of the undertaken project

ADJUSTED PRESENT VALUE - ADJUSTED COST OF CAPITAL

Investment £ 1,000,000.00

EBIT (perpetuity) £ 2,335,000.00

Paraphrase This Document

Cost of capital if 30% debt rA 1.13%

Debt capacity L = Debt / PV 10.38%

Cost of debt rD 0.0032

This table reflects that the cost of debt of company is .0032 which is determined on the basis

of cost of debt after deducting the tax expenses.

In case of the Base NPV, this project will give the net present value

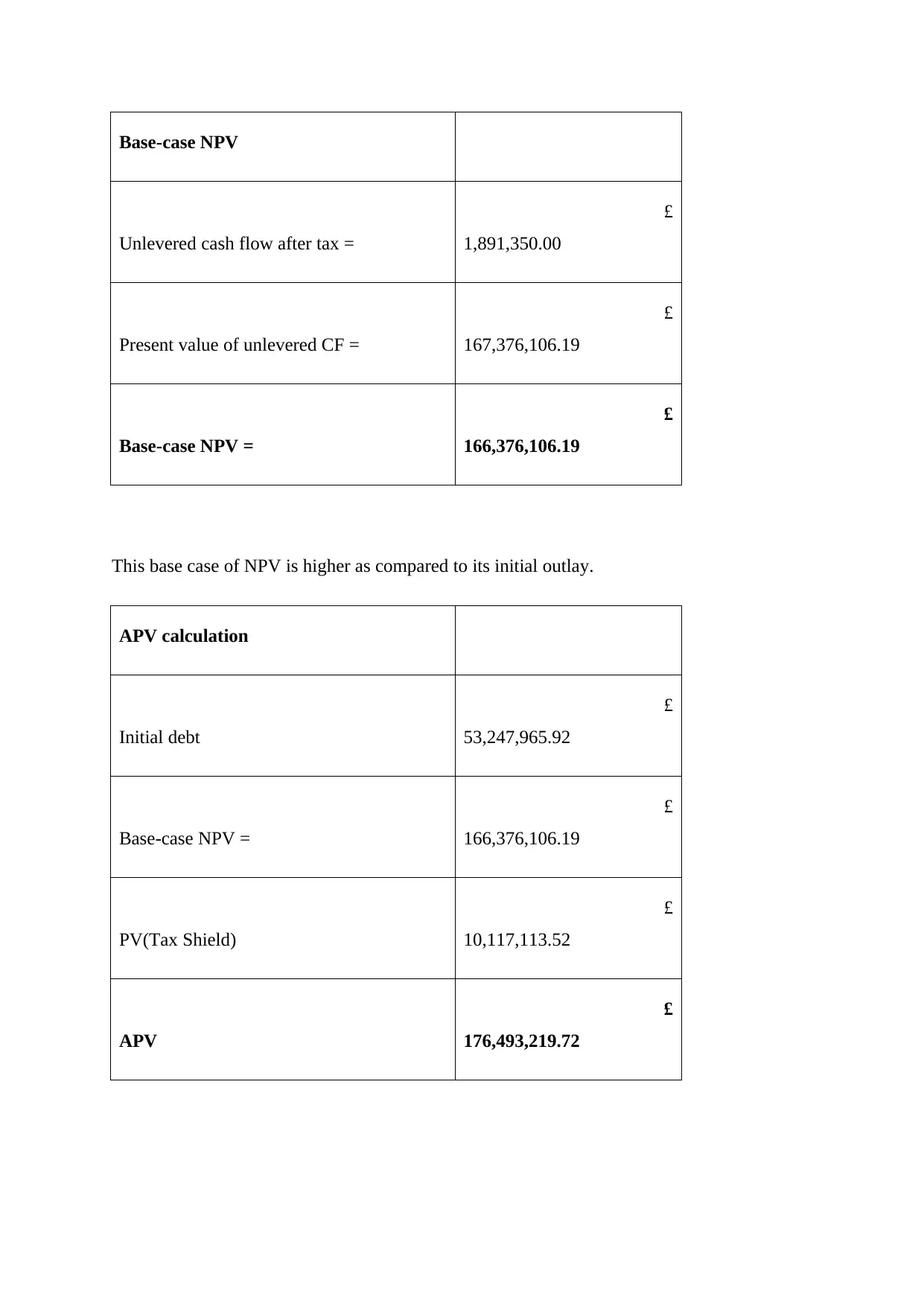

Base-case NPV

Unlevered cash flow after tax = 1,891,350

Present value of unlevered CF = 167,376,106

Base-case NPV = 166,376,106

After evaluating the base case and NPV of company, following the Miles Ezzel formula, it is

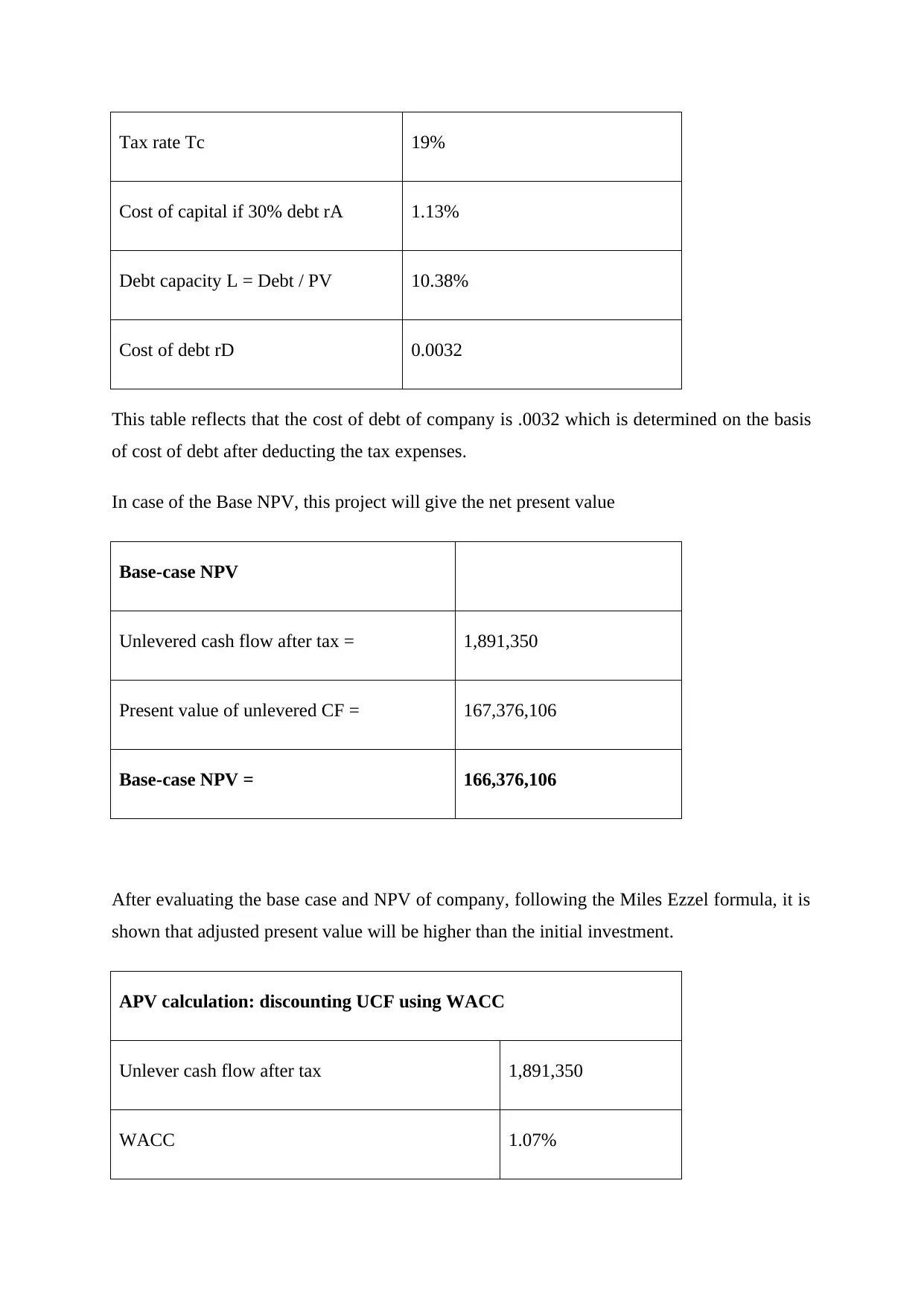

shown that adjusted present value will be higher than the initial investment.

APV calculation: discounting UCF using WACC

Unlever cash flow after tax 1,891,350

WACC 1.07%

Investment 1,000,000

APV 176,493,220

This shows that company should accept this project.

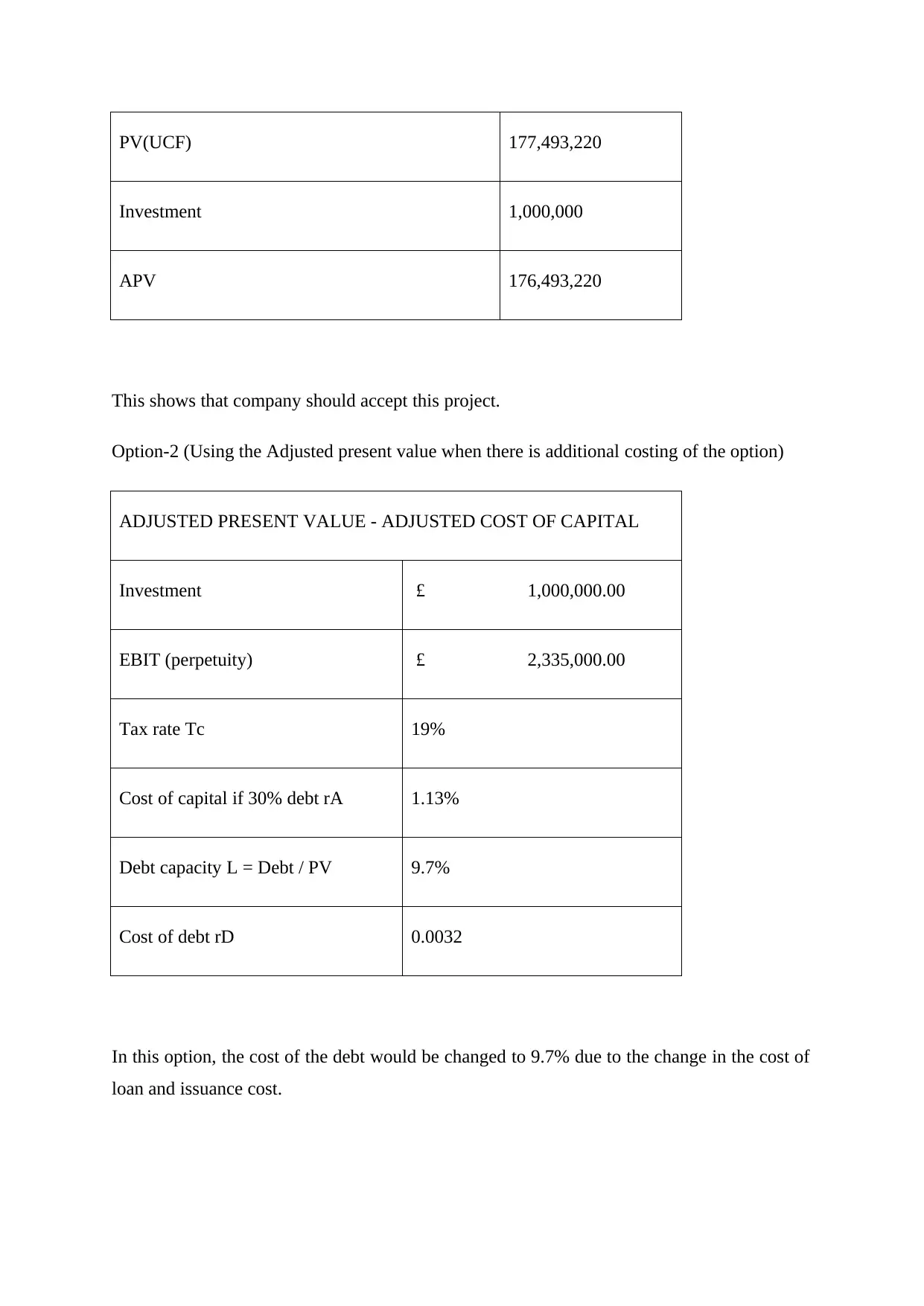

Option-2 (Using the Adjusted present value when there is additional costing of the option)

ADJUSTED PRESENT VALUE - ADJUSTED COST OF CAPITAL

Investment £ 1,000,000.00

EBIT (perpetuity) £ 2,335,000.00

Tax rate Tc 19%

Cost of capital if 30% debt rA 1.13%

Debt capacity L = Debt / PV 9.7%

Cost of debt rD 0.0032

In this option, the cost of the debt would be changed to 9.7% due to the change in the cost of

loan and issuance cost.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Unlevered cash flow after tax =

£

1,891,350.00

Present value of unlevered CF =

£

167,376,106.19

Base-case NPV =

£

166,376,106.19

This base case of NPV is higher as compared to its initial outlay.

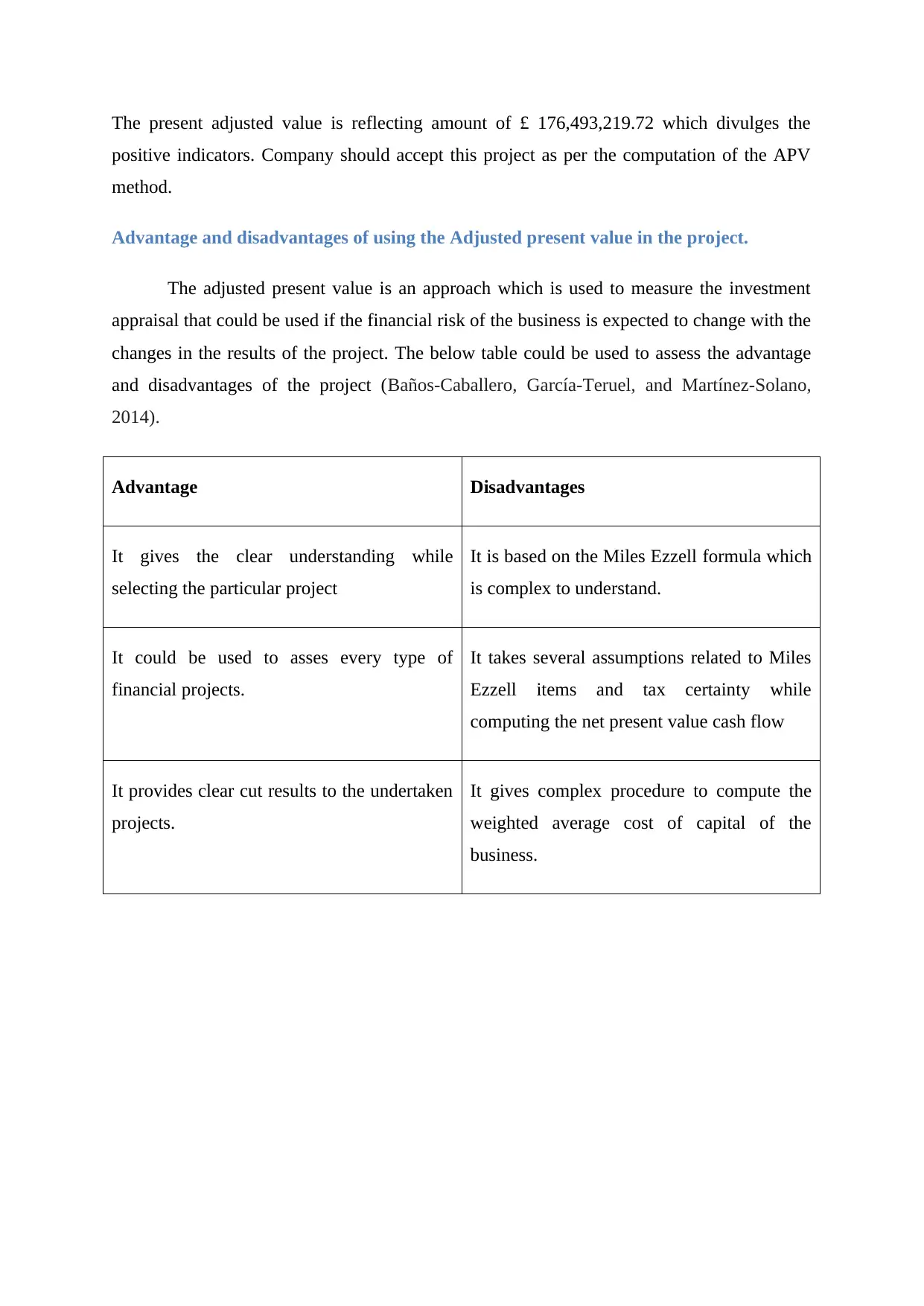

APV calculation

Initial debt

£

53,247,965.92

Base-case NPV =

£

166,376,106.19

PV(Tax Shield)

£

10,117,113.52

APV

£

176,493,219.72

Paraphrase This Document

positive indicators. Company should accept this project as per the computation of the APV

method.

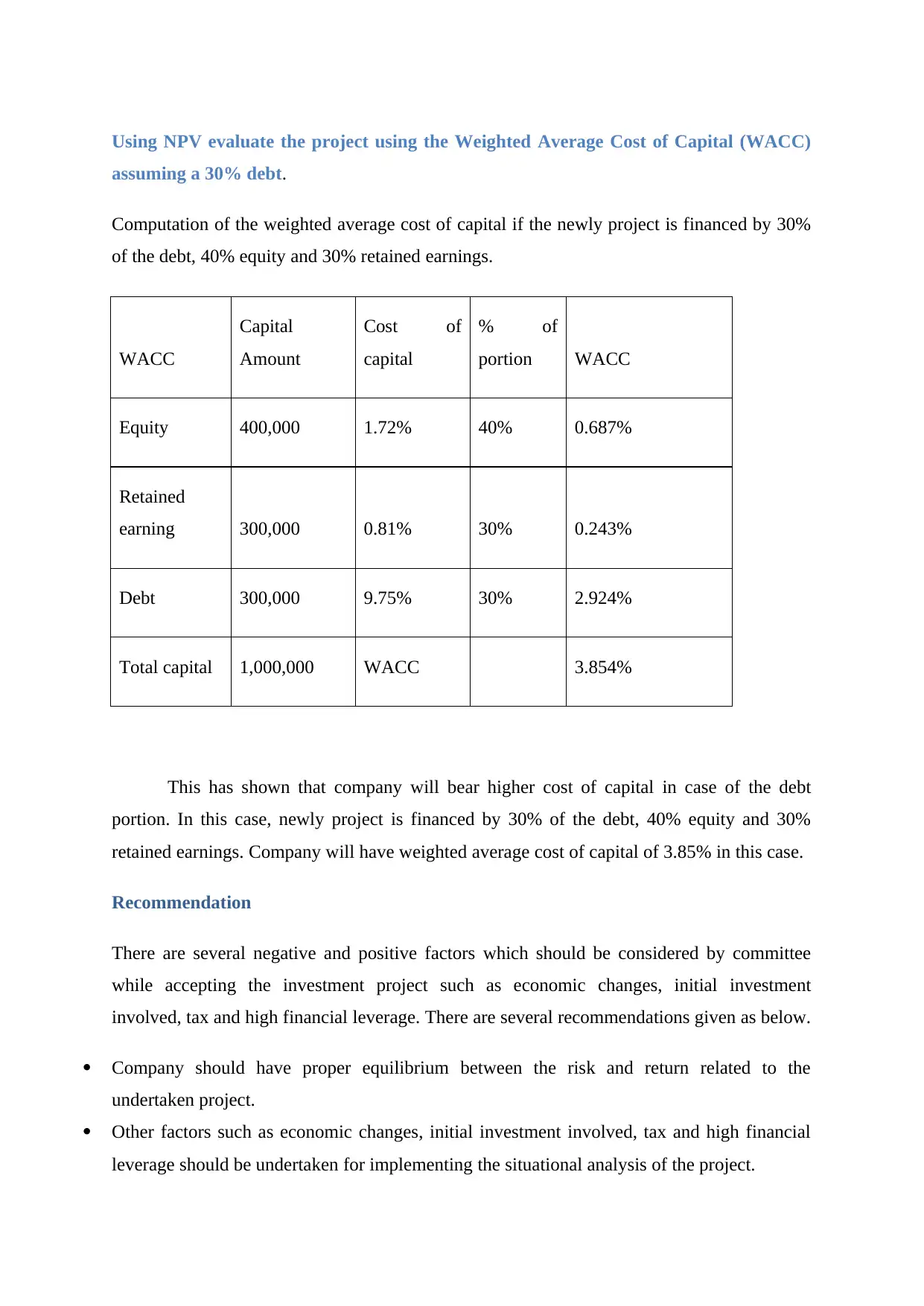

Advantage and disadvantages of using the Adjusted present value in the project.

The adjusted present value is an approach which is used to measure the investment

appraisal that could be used if the financial risk of the business is expected to change with the

changes in the results of the project. The below table could be used to assess the advantage

and disadvantages of the project (Baños-Caballero, García-Teruel, and Martínez-Solano,

2014).

Advantage Disadvantages

It gives the clear understanding while

selecting the particular project

It is based on the Miles Ezzell formula which

is complex to understand.

It could be used to asses every type of

financial projects.

It takes several assumptions related to Miles

Ezzell items and tax certainty while

computing the net present value cash flow

It provides clear cut results to the undertaken

projects.

It gives complex procedure to compute the

weighted average cost of capital of the

business.

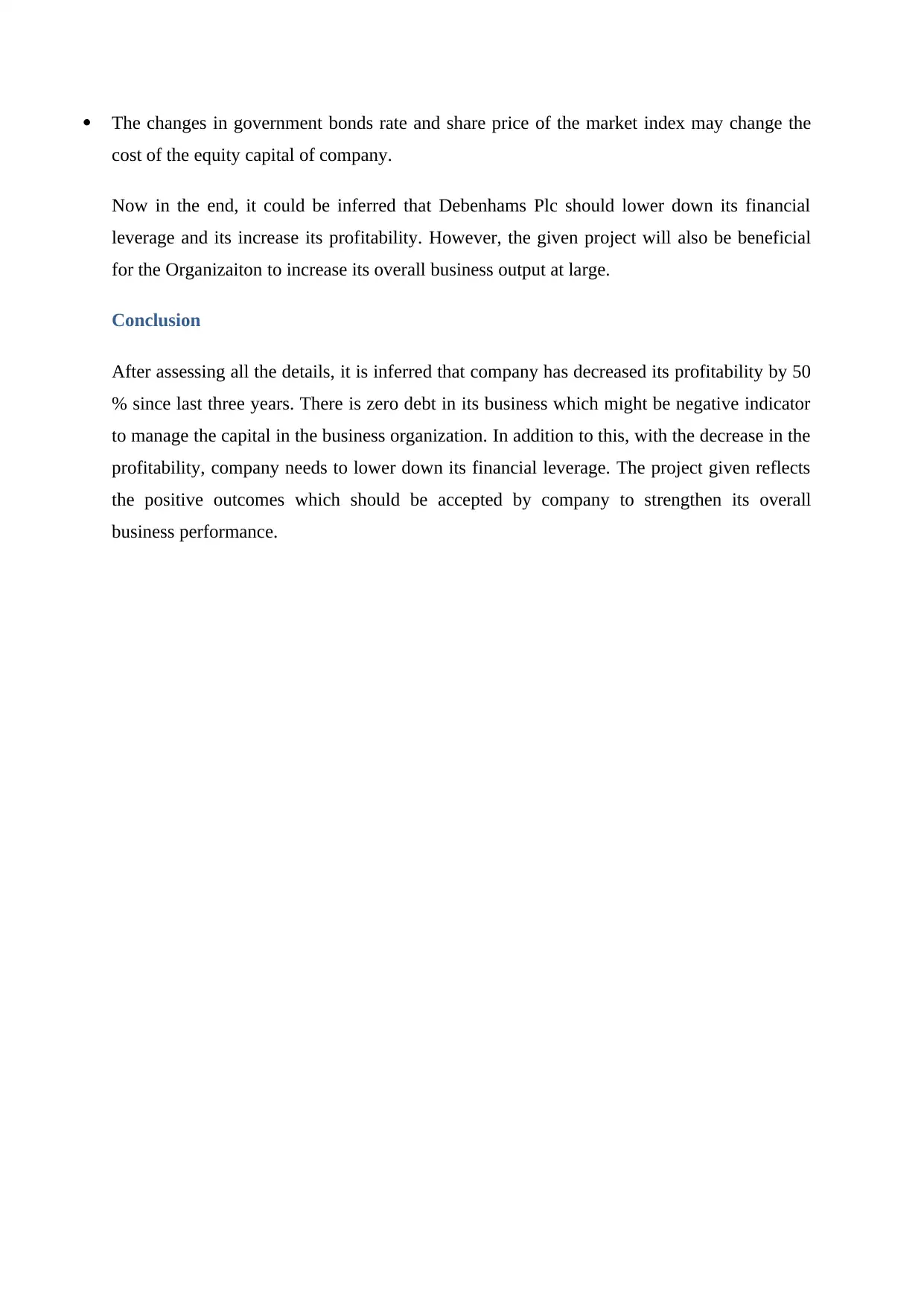

assuming a 30% debt.

Computation of the weighted average cost of capital if the newly project is financed by 30%

of the debt, 40% equity and 30% retained earnings.

WACC

Capital

Amount

Cost of

capital

% of

portion WACC

Equity 400,000 1.72% 40% 0.687%

Retained

earning 300,000 0.81% 30% 0.243%

Debt 300,000 9.75% 30% 2.924%

Total capital 1,000,000 WACC 3.854%

This has shown that company will bear higher cost of capital in case of the debt

portion. In this case, newly project is financed by 30% of the debt, 40% equity and 30%

retained earnings. Company will have weighted average cost of capital of 3.85% in this case.

Recommendation

There are several negative and positive factors which should be considered by committee

while accepting the investment project such as economic changes, initial investment

involved, tax and high financial leverage. There are several recommendations given as below.

Company should have proper equilibrium between the risk and return related to the

undertaken project.

Other factors such as economic changes, initial investment involved, tax and high financial

leverage should be undertaken for implementing the situational analysis of the project.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

cost of the equity capital of company.

Now in the end, it could be inferred that Debenhams Plc should lower down its financial

leverage and its increase its profitability. However, the given project will also be beneficial

for the Organizaiton to increase its overall business output at large.

Conclusion

After assessing all the details, it is inferred that company has decreased its profitability by 50

% since last three years. There is zero debt in its business which might be negative indicator

to manage the capital in the business organization. In addition to this, with the decrease in the

profitability, company needs to lower down its financial leverage. The project given reflects

the positive outcomes which should be accepted by company to strengthen its overall

business performance.

Paraphrase This Document

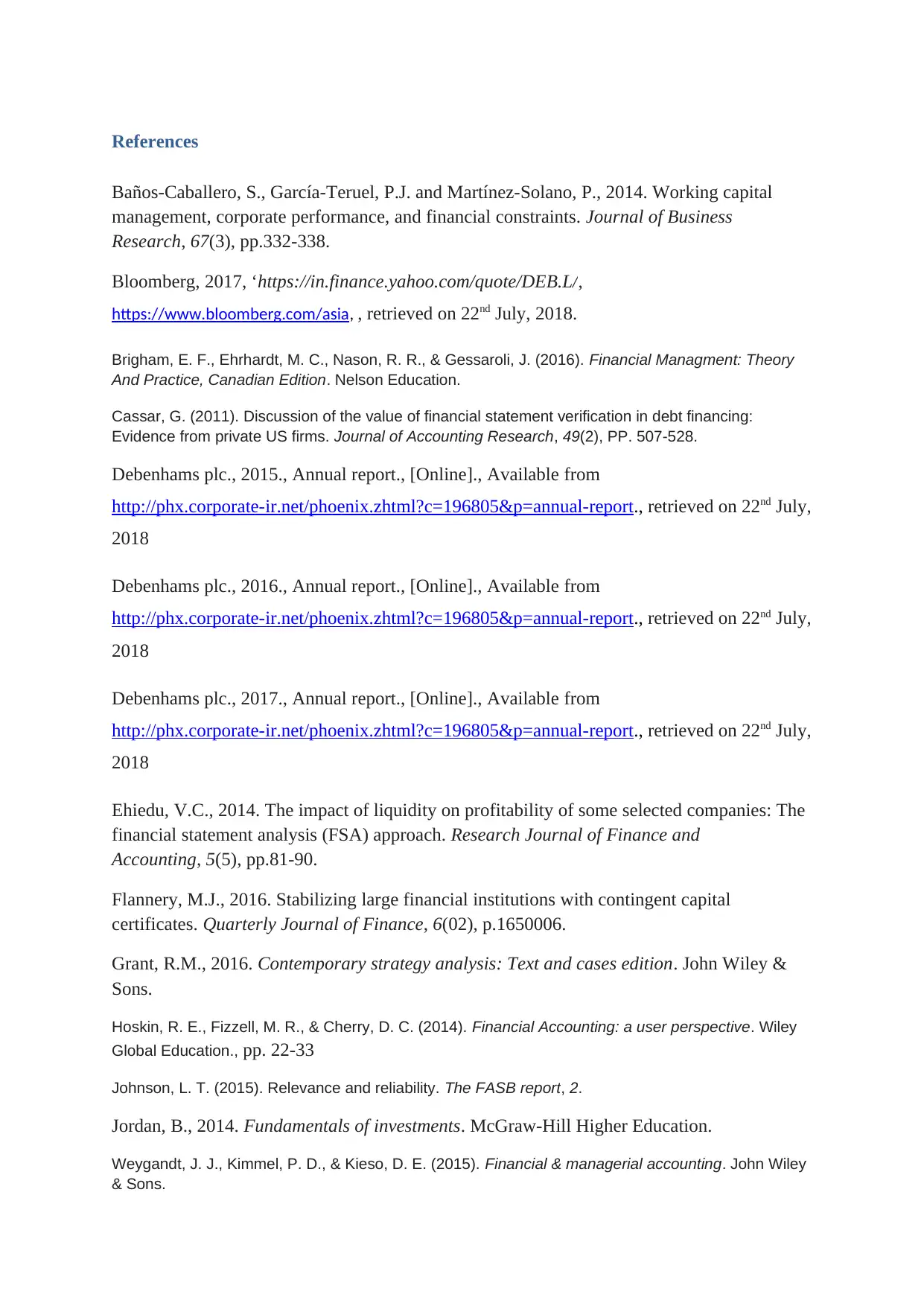

Baños-Caballero, S., García-Teruel, P.J. and Martínez-Solano, P., 2014. Working capital

management, corporate performance, and financial constraints. Journal of Business

Research, 67(3), pp.332-338.

Bloomberg, 2017, ‘https://in.finance.yahoo.com/quote/DEB.L/,

https://www.bloomberg.com/asia, , retrieved on 22nd July, 2018.

Brigham, E. F., Ehrhardt, M. C., Nason, R. R., & Gessaroli, J. (2016). Financial Managment: Theory

And Practice, Canadian Edition. Nelson Education.

Cassar, G. (2011). Discussion of the value of financial statement verification in debt financing:

Evidence from private US firms. Journal of Accounting Research, 49(2), PP. 507-528.

Debenhams plc., 2015., Annual report., [Online]., Available from

http://phx.corporate-ir.net/phoenix.zhtml?c=196805&p=annual-report., retrieved on 22nd July,

2018

Debenhams plc., 2016., Annual report., [Online]., Available from

http://phx.corporate-ir.net/phoenix.zhtml?c=196805&p=annual-report., retrieved on 22nd July,

2018

Debenhams plc., 2017., Annual report., [Online]., Available from

http://phx.corporate-ir.net/phoenix.zhtml?c=196805&p=annual-report., retrieved on 22nd July,

2018

Ehiedu, V.C., 2014. The impact of liquidity on profitability of some selected companies: The

financial statement analysis (FSA) approach. Research Journal of Finance and

Accounting, 5(5), pp.81-90.

Flannery, M.J., 2016. Stabilizing large financial institutions with contingent capital

certificates. Quarterly Journal of Finance, 6(02), p.1650006.

Grant, R.M., 2016. Contemporary strategy analysis: Text and cases edition. John Wiley &

Sons.

Hoskin, R. E., Fizzell, M. R., & Cherry, D. C. (2014). Financial Accounting: a user perspective. Wiley

Global Education., pp. 22-33

Johnson, L. T. (2015). Relevance and reliability. The FASB report, 2.

Jordan, B., 2014. Fundamentals of investments. McGraw-Hill Higher Education.

Weygandt, J. J., Kimmel, P. D., & Kieso, D. E. (2015). Financial & managerial accounting. John Wiley

& Sons.

on 22nd July, 2018

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

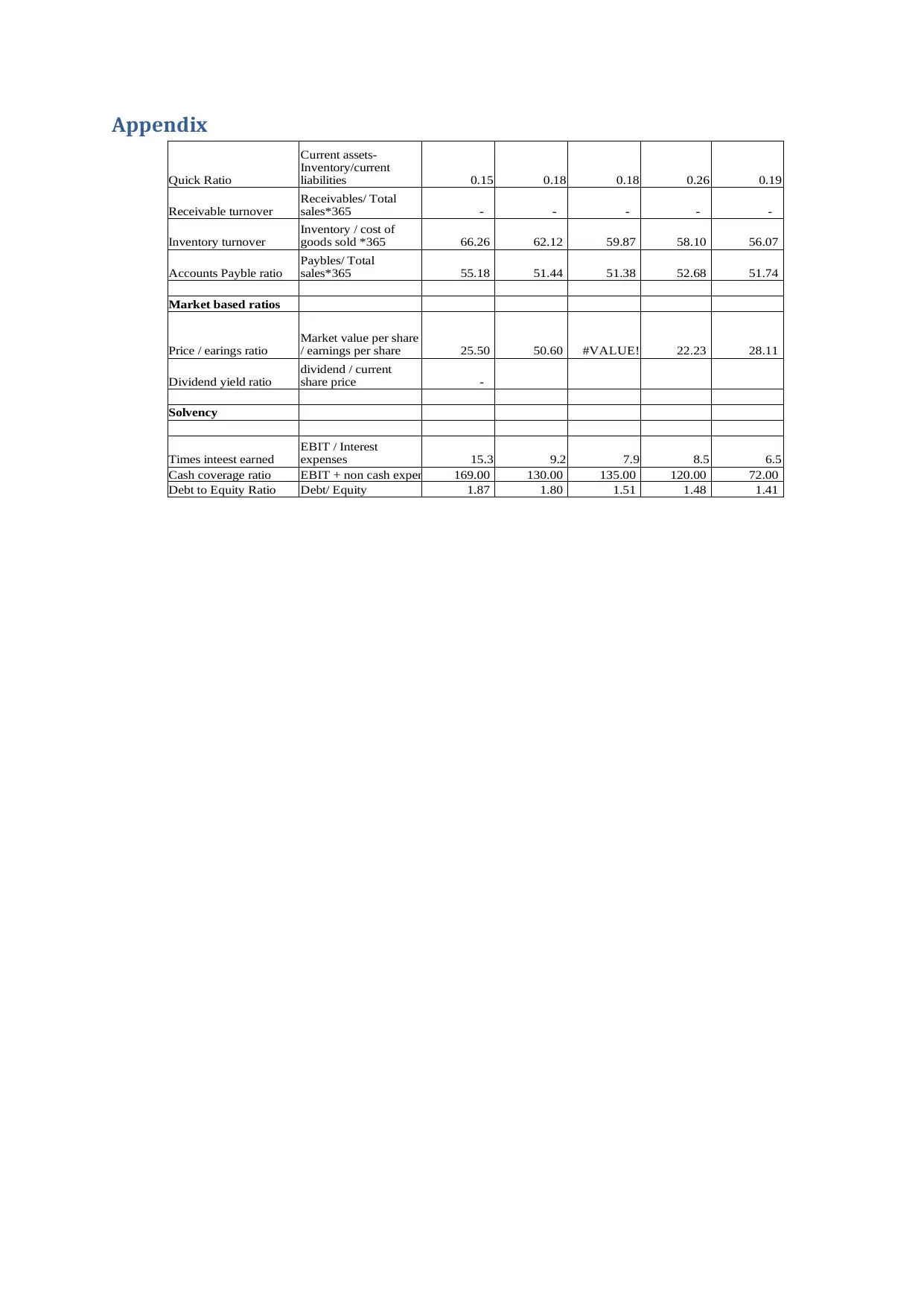

Quick Ratio 0.15 0.18 0.18 0.26 0.19

Receivable turnover - - - - -

Inventory turnover 66.26 62.12 59.87 58.10 56.07

Accounts Payble ratio 55.18 51.44 51.38 52.68 51.74

Market based ratios

Price / earings ratio 25.50 50.60 #VALUE! 22.23 28.11

Dividend yield ratio -

Solvency

Times inteest earned 15.3 9.2 7.9 8.5 6.5

Cash coverage ratio EBIT + non cash expense 169.00 130.00 135.00 120.00 72.00

Debt to Equity Ratio Debt/ Equity 1.87 1.80 1.51 1.48 1.41

Current assets-

Inventory/current

liabilities

Receivables/ Total

sales*365

Inventory / cost of

goods sold *365

Paybles/ Total

sales*365

Market value per share

/ earnings per share

dividend / current

share price

EBIT / Interest

expenses

Paraphrase This Document

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

© 2024 | Zucol Services PVT LTD | All rights reserved.