Decision Support Tools for Desklib Online Library

VerifiedAdded on 2023/06/05

|13

|2143

|479

AI Summary

This article discusses decision support tools and their applications in making effective decisions. It includes solved assignments, essays, and dissertations on decision support tools. The article covers topics such as utility function, investment decisions, market analysis, simulation, regression analysis, and break-even analysis. The content is relevant for students pursuing courses in business, management, and economics.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Running Head: DECISION SUPPORT TOOLS

Decision Support Tools

Name of the Student

Name of the University

Author Note

Decision Support Tools

Name of the Student

Name of the University

Author Note

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

1DECISION SUPPORT TOOLS

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer 3..........................................................................................................................................5

Answer 4..........................................................................................................................................7

Answer 5........................................................................................................................................11

References......................................................................................................................................13

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................4

Answer 3..........................................................................................................................................5

Answer 4..........................................................................................................................................7

Answer 5........................................................................................................................................11

References......................................................................................................................................13

2DECISION SUPPORT TOOLS

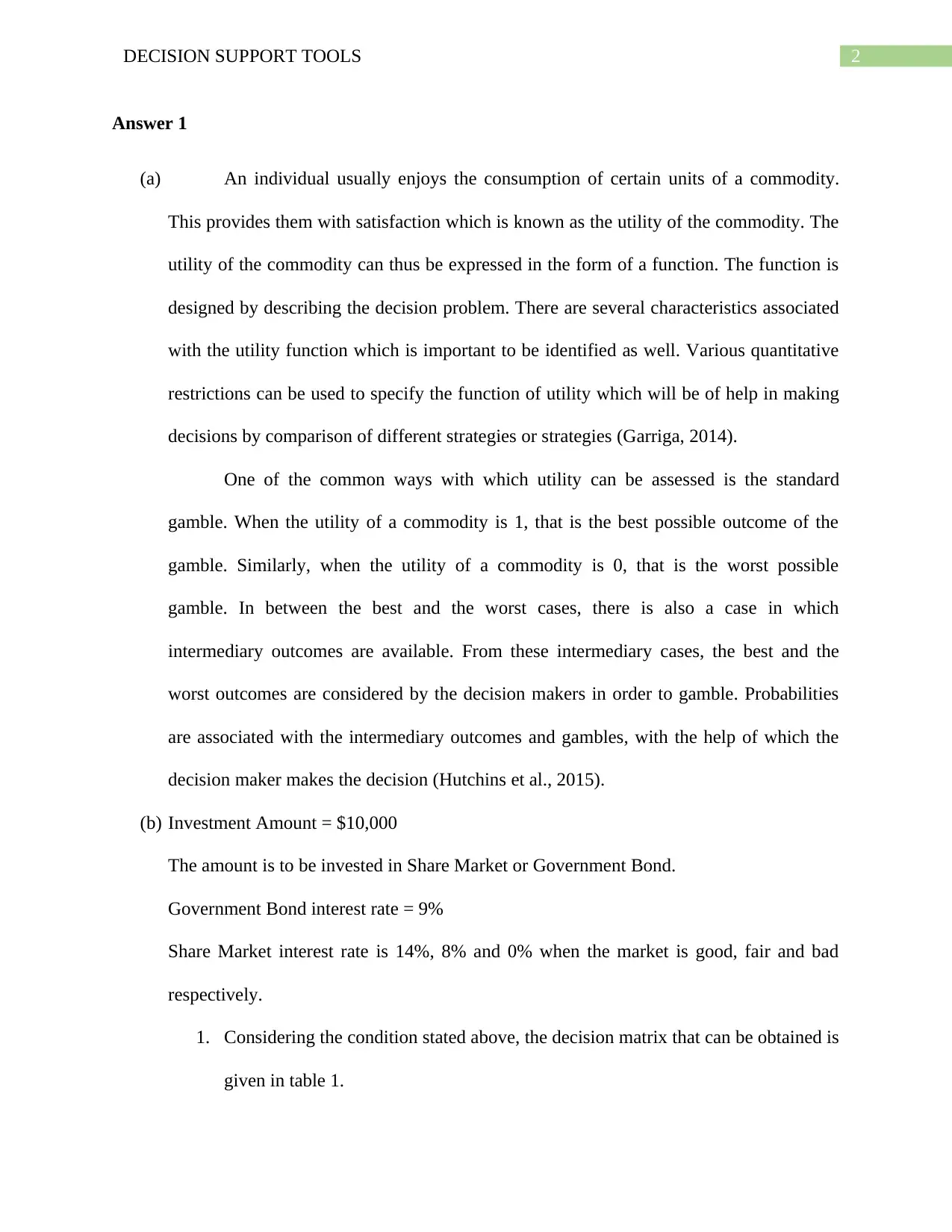

Answer 1

(a) An individual usually enjoys the consumption of certain units of a commodity.

This provides them with satisfaction which is known as the utility of the commodity. The

utility of the commodity can thus be expressed in the form of a function. The function is

designed by describing the decision problem. There are several characteristics associated

with the utility function which is important to be identified as well. Various quantitative

restrictions can be used to specify the function of utility which will be of help in making

decisions by comparison of different strategies or strategies (Garriga, 2014).

One of the common ways with which utility can be assessed is the standard

gamble. When the utility of a commodity is 1, that is the best possible outcome of the

gamble. Similarly, when the utility of a commodity is 0, that is the worst possible

gamble. In between the best and the worst cases, there is also a case in which

intermediary outcomes are available. From these intermediary cases, the best and the

worst outcomes are considered by the decision makers in order to gamble. Probabilities

are associated with the intermediary outcomes and gambles, with the help of which the

decision maker makes the decision (Hutchins et al., 2015).

(b) Investment Amount = $10,000

The amount is to be invested in Share Market or Government Bond.

Government Bond interest rate = 9%

Share Market interest rate is 14%, 8% and 0% when the market is good, fair and bad

respectively.

1. Considering the condition stated above, the decision matrix that can be obtained is

given in table 1.

Answer 1

(a) An individual usually enjoys the consumption of certain units of a commodity.

This provides them with satisfaction which is known as the utility of the commodity. The

utility of the commodity can thus be expressed in the form of a function. The function is

designed by describing the decision problem. There are several characteristics associated

with the utility function which is important to be identified as well. Various quantitative

restrictions can be used to specify the function of utility which will be of help in making

decisions by comparison of different strategies or strategies (Garriga, 2014).

One of the common ways with which utility can be assessed is the standard

gamble. When the utility of a commodity is 1, that is the best possible outcome of the

gamble. Similarly, when the utility of a commodity is 0, that is the worst possible

gamble. In between the best and the worst cases, there is also a case in which

intermediary outcomes are available. From these intermediary cases, the best and the

worst outcomes are considered by the decision makers in order to gamble. Probabilities

are associated with the intermediary outcomes and gambles, with the help of which the

decision maker makes the decision (Hutchins et al., 2015).

(b) Investment Amount = $10,000

The amount is to be invested in Share Market or Government Bond.

Government Bond interest rate = 9%

Share Market interest rate is 14%, 8% and 0% when the market is good, fair and bad

respectively.

1. Considering the condition stated above, the decision matrix that can be obtained is

given in table 1.

3DECISION SUPPORT TOOLS

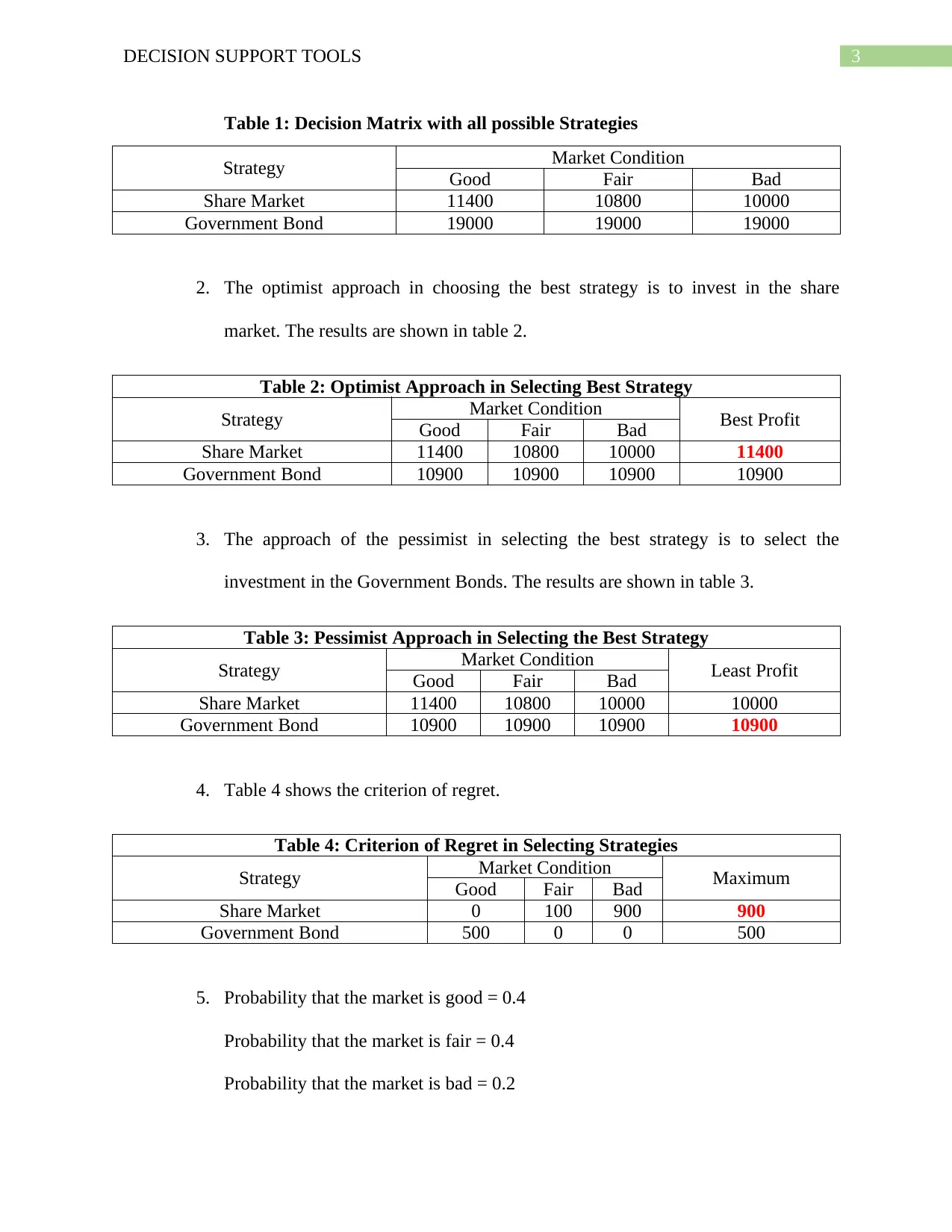

Table 1: Decision Matrix with all possible Strategies

Strategy Market Condition

Good Fair Bad

Share Market 11400 10800 10000

Government Bond 19000 19000 19000

2. The optimist approach in choosing the best strategy is to invest in the share

market. The results are shown in table 2.

Table 2: Optimist Approach in Selecting Best Strategy

Strategy Market Condition Best Profit

Good Fair Bad

Share Market 11400 10800 10000 11400

Government Bond 10900 10900 10900 10900

3. The approach of the pessimist in selecting the best strategy is to select the

investment in the Government Bonds. The results are shown in table 3.

Table 3: Pessimist Approach in Selecting the Best Strategy

Strategy Market Condition Least Profit

Good Fair Bad

Share Market 11400 10800 10000 10000

Government Bond 10900 10900 10900 10900

4. Table 4 shows the criterion of regret.

Table 4: Criterion of Regret in Selecting Strategies

Strategy Market Condition Maximum

Good Fair Bad

Share Market 0 100 900 900

Government Bond 500 0 0 500

5. Probability that the market is good = 0.4

Probability that the market is fair = 0.4

Probability that the market is bad = 0.2

Table 1: Decision Matrix with all possible Strategies

Strategy Market Condition

Good Fair Bad

Share Market 11400 10800 10000

Government Bond 19000 19000 19000

2. The optimist approach in choosing the best strategy is to invest in the share

market. The results are shown in table 2.

Table 2: Optimist Approach in Selecting Best Strategy

Strategy Market Condition Best Profit

Good Fair Bad

Share Market 11400 10800 10000 11400

Government Bond 10900 10900 10900 10900

3. The approach of the pessimist in selecting the best strategy is to select the

investment in the Government Bonds. The results are shown in table 3.

Table 3: Pessimist Approach in Selecting the Best Strategy

Strategy Market Condition Least Profit

Good Fair Bad

Share Market 11400 10800 10000 10000

Government Bond 10900 10900 10900 10900

4. Table 4 shows the criterion of regret.

Table 4: Criterion of Regret in Selecting Strategies

Strategy Market Condition Maximum

Good Fair Bad

Share Market 0 100 900 900

Government Bond 500 0 0 500

5. Probability that the market is good = 0.4

Probability that the market is fair = 0.4

Probability that the market is bad = 0.2

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

4DECISION SUPPORT TOOLS

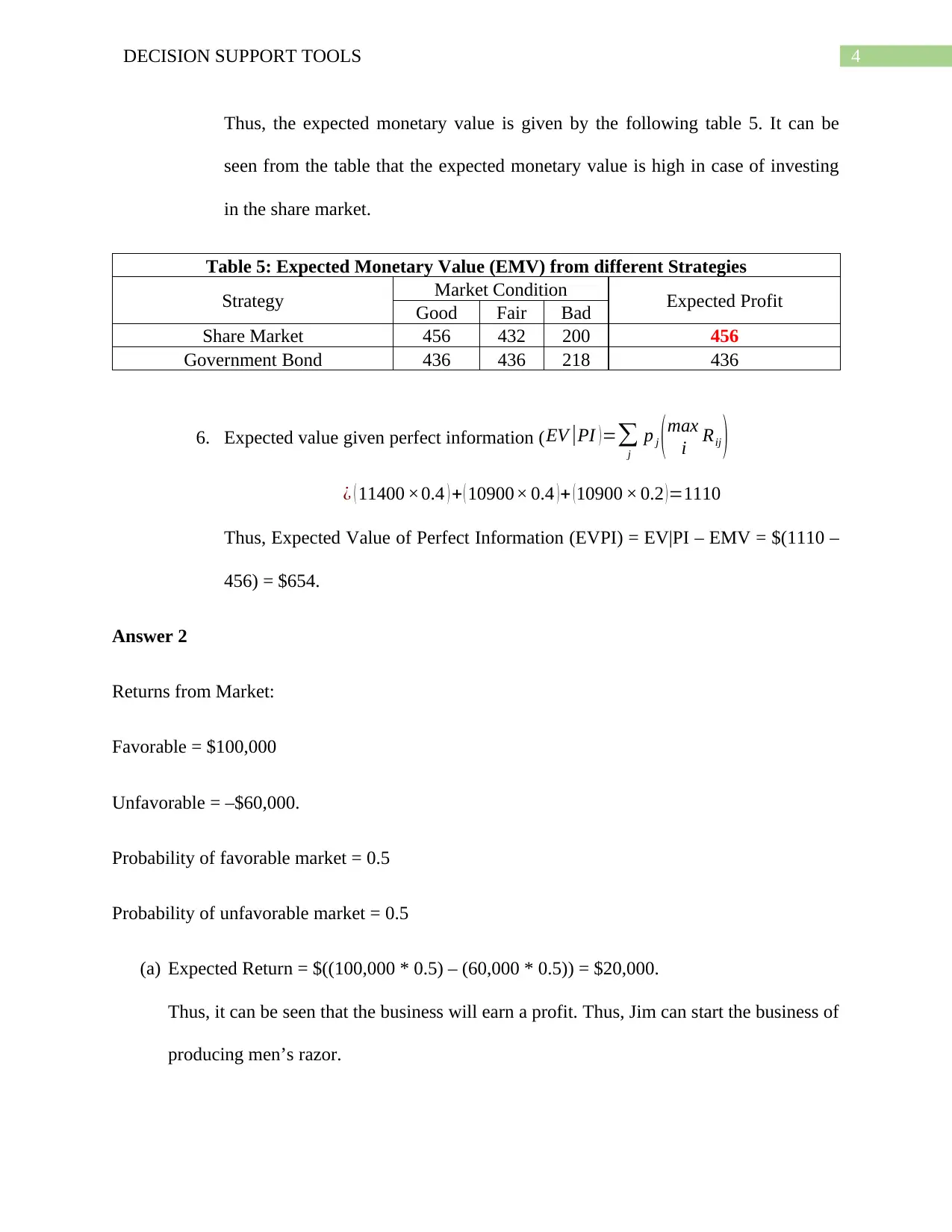

Thus, the expected monetary value is given by the following table 5. It can be

seen from the table that the expected monetary value is high in case of investing

in the share market.

Table 5: Expected Monetary Value (EMV) from different Strategies

Strategy Market Condition Expected Profit

Good Fair Bad

Share Market 456 432 200 456

Government Bond 436 436 218 436

6. Expected value given perfect information ( EV |PI ) =∑

j

p j ( max

i Rij )

¿ ( 11400 ×0.4 ) + ( 10900× 0.4 )+ (10900 × 0.2 )=1110

Thus, Expected Value of Perfect Information (EVPI) = EV|PI – EMV = $(1110 –

456) = $654.

Answer 2

Returns from Market:

Favorable = $100,000

Unfavorable = –$60,000.

Probability of favorable market = 0.5

Probability of unfavorable market = 0.5

(a) Expected Return = $((100,000 * 0.5) – (60,000 * 0.5)) = $20,000.

Thus, it can be seen that the business will earn a profit. Thus, Jim can start the business of

producing men’s razor.

Thus, the expected monetary value is given by the following table 5. It can be

seen from the table that the expected monetary value is high in case of investing

in the share market.

Table 5: Expected Monetary Value (EMV) from different Strategies

Strategy Market Condition Expected Profit

Good Fair Bad

Share Market 456 432 200 456

Government Bond 436 436 218 436

6. Expected value given perfect information ( EV |PI ) =∑

j

p j ( max

i Rij )

¿ ( 11400 ×0.4 ) + ( 10900× 0.4 )+ (10900 × 0.2 )=1110

Thus, Expected Value of Perfect Information (EVPI) = EV|PI – EMV = $(1110 –

456) = $654.

Answer 2

Returns from Market:

Favorable = $100,000

Unfavorable = –$60,000.

Probability of favorable market = 0.5

Probability of unfavorable market = 0.5

(a) Expected Return = $((100,000 * 0.5) – (60,000 * 0.5)) = $20,000.

Thus, it can be seen that the business will earn a profit. Thus, Jim can start the business of

producing men’s razor.

5DECISION SUPPORT TOOLS

(b) Probability of favorable market depending on the track record of his friend = (0.5 * 0.7) +

(0.5 * 0.3) = 0.5. Therefore, the probability of unfavorable market = (1 – 0.5) = 0.5.

(c) The required posterior probability = (0.3 * 0.5) = 0.15.

(d) Expected net gain / loss = $((100,000 * 0.5) + (– 60,000 * 0.5)) – $5,000 = $15,000.

Engagement of friend has decreased the expected profit margin but there is still

profit from the business. Engaging the friend is thus a better choice as his engagement

will provide the market conditions more accurately.

Answer 3

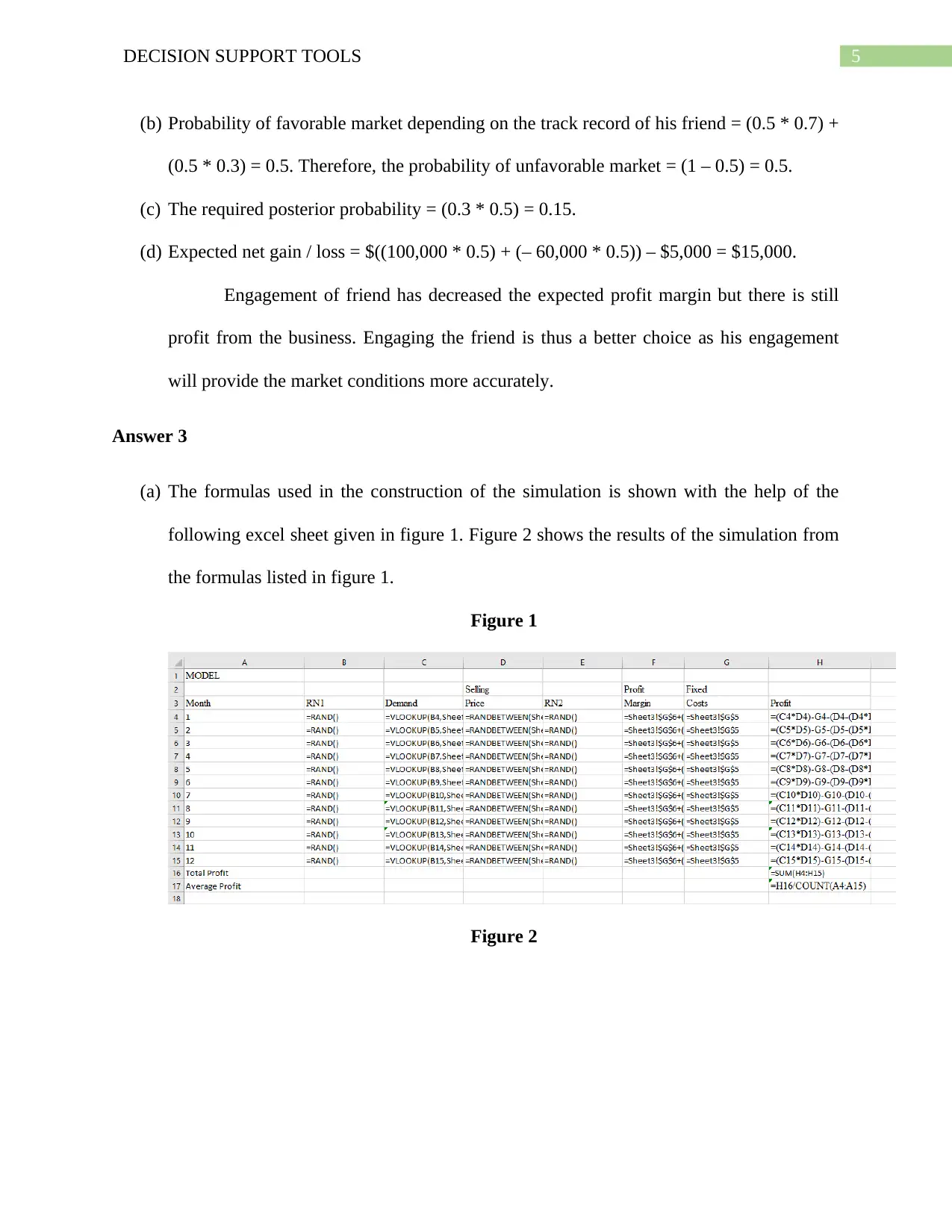

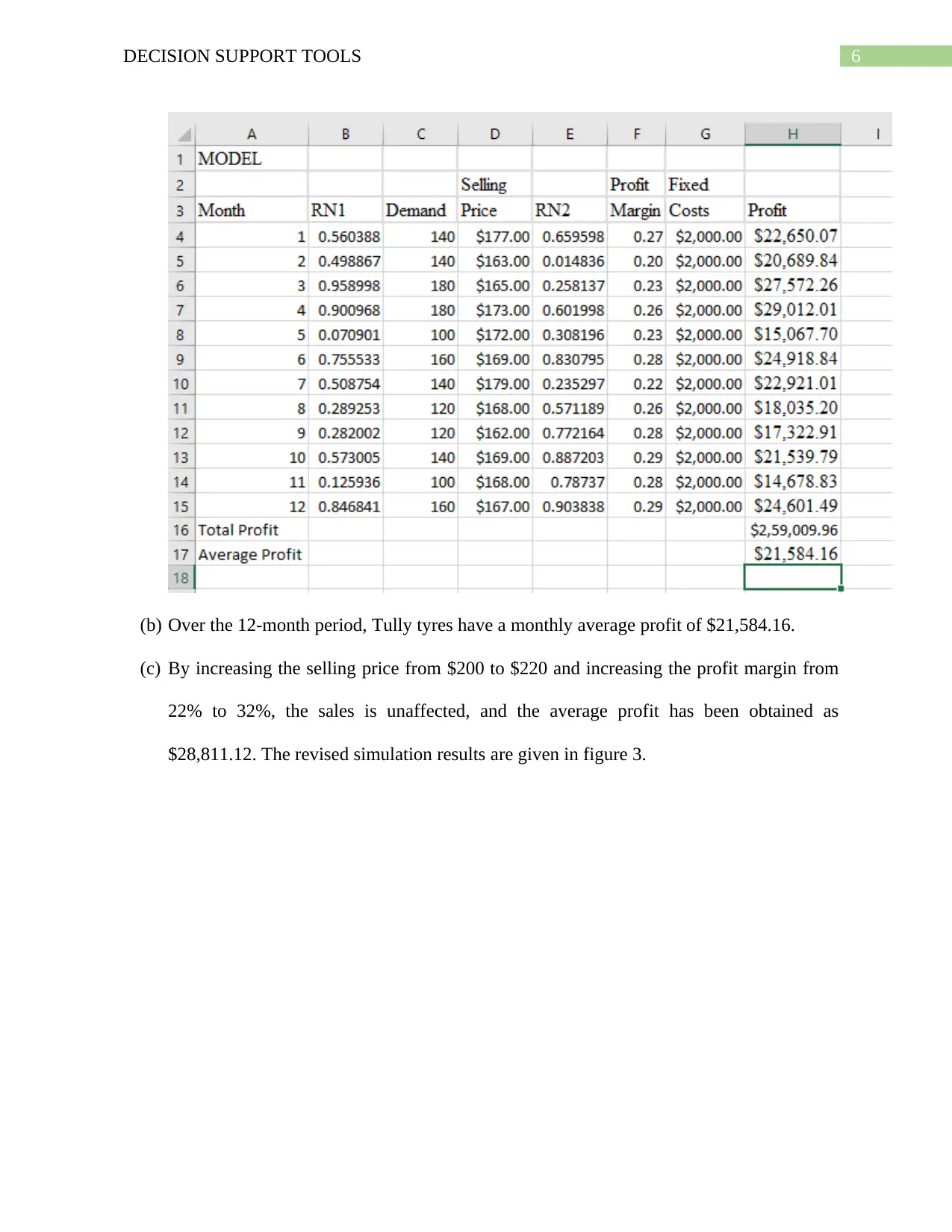

(a) The formulas used in the construction of the simulation is shown with the help of the

following excel sheet given in figure 1. Figure 2 shows the results of the simulation from

the formulas listed in figure 1.

Figure 1

Figure 2

(b) Probability of favorable market depending on the track record of his friend = (0.5 * 0.7) +

(0.5 * 0.3) = 0.5. Therefore, the probability of unfavorable market = (1 – 0.5) = 0.5.

(c) The required posterior probability = (0.3 * 0.5) = 0.15.

(d) Expected net gain / loss = $((100,000 * 0.5) + (– 60,000 * 0.5)) – $5,000 = $15,000.

Engagement of friend has decreased the expected profit margin but there is still

profit from the business. Engaging the friend is thus a better choice as his engagement

will provide the market conditions more accurately.

Answer 3

(a) The formulas used in the construction of the simulation is shown with the help of the

following excel sheet given in figure 1. Figure 2 shows the results of the simulation from

the formulas listed in figure 1.

Figure 1

Figure 2

6DECISION SUPPORT TOOLS

(b) Over the 12-month period, Tully tyres have a monthly average profit of $21,584.16.

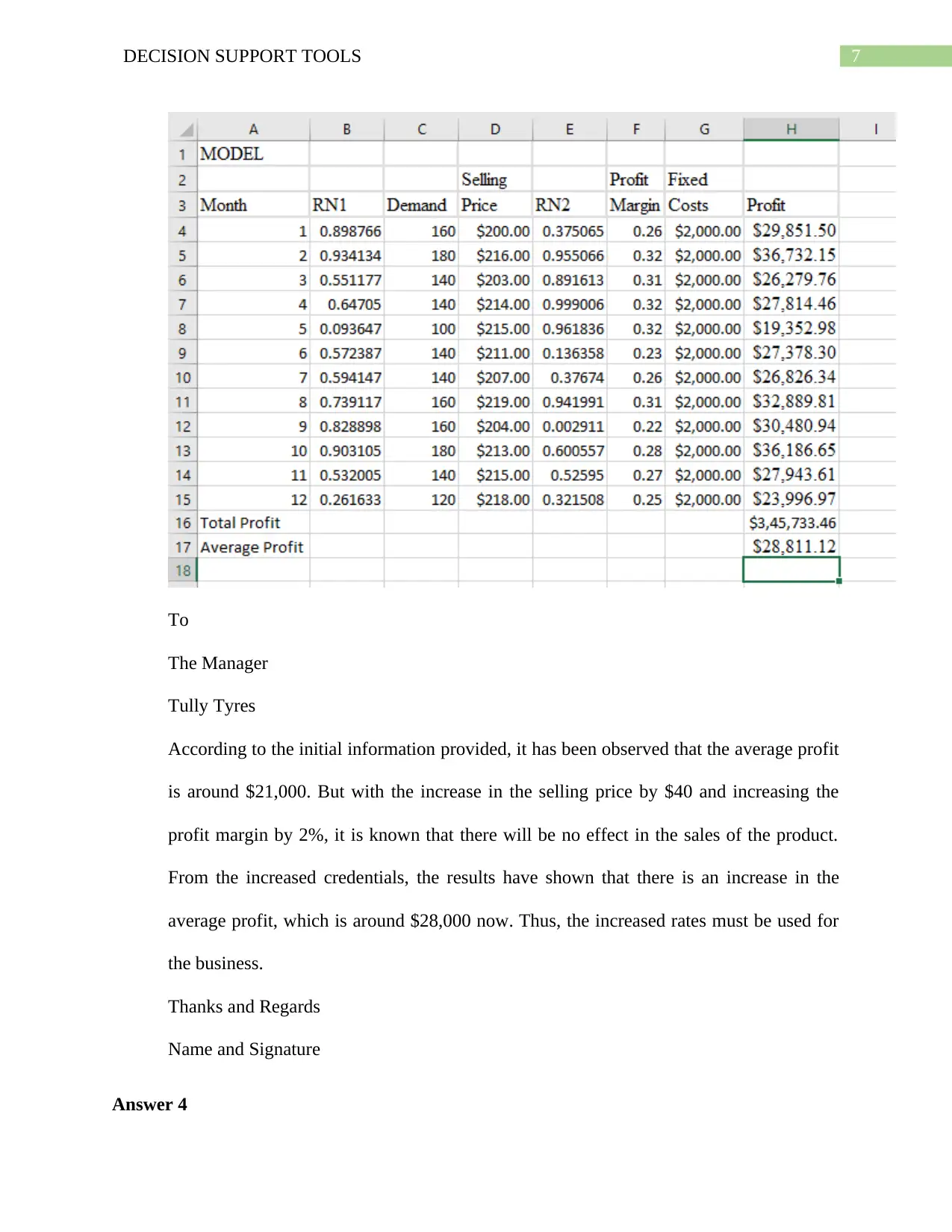

(c) By increasing the selling price from $200 to $220 and increasing the profit margin from

22% to 32%, the sales is unaffected, and the average profit has been obtained as

$28,811.12. The revised simulation results are given in figure 3.

(b) Over the 12-month period, Tully tyres have a monthly average profit of $21,584.16.

(c) By increasing the selling price from $200 to $220 and increasing the profit margin from

22% to 32%, the sales is unaffected, and the average profit has been obtained as

$28,811.12. The revised simulation results are given in figure 3.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7DECISION SUPPORT TOOLS

To

The Manager

Tully Tyres

According to the initial information provided, it has been observed that the average profit

is around $21,000. But with the increase in the selling price by $40 and increasing the

profit margin by 2%, it is known that there will be no effect in the sales of the product.

From the increased credentials, the results have shown that there is an increase in the

average profit, which is around $28,000 now. Thus, the increased rates must be used for

the business.

Thanks and Regards

Name and Signature

Answer 4

To

The Manager

Tully Tyres

According to the initial information provided, it has been observed that the average profit

is around $21,000. But with the increase in the selling price by $40 and increasing the

profit margin by 2%, it is known that there will be no effect in the sales of the product.

From the increased credentials, the results have shown that there is an increase in the

average profit, which is around $28,000 now. Thus, the increased rates must be used for

the business.

Thanks and Regards

Name and Signature

Answer 4

8DECISION SUPPORT TOOLS

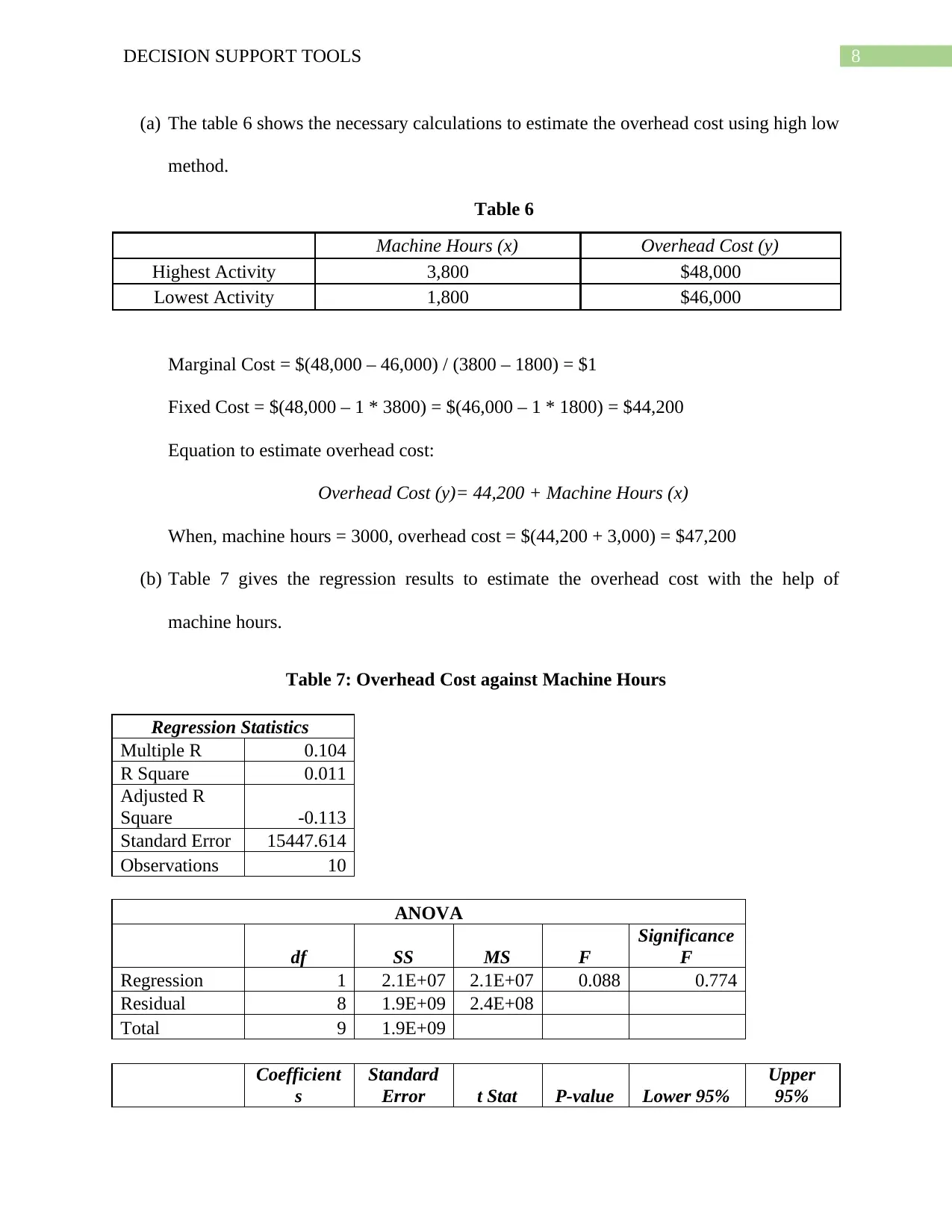

(a) The table 6 shows the necessary calculations to estimate the overhead cost using high low

method.

Table 6

Machine Hours (x) Overhead Cost (y)

Highest Activity 3,800 $48,000

Lowest Activity 1,800 $46,000

Marginal Cost = $(48,000 – 46,000) / (3800 – 1800) = $1

Fixed Cost = $(48,000 – 1 * 3800) = $(46,000 – 1 * 1800) = $44,200

Equation to estimate overhead cost:

Overhead Cost (y)= 44,200 + Machine Hours (x)

When, machine hours = 3000, overhead cost = $(44,200 + 3,000) = $47,200

(b) Table 7 gives the regression results to estimate the overhead cost with the help of

machine hours.

Table 7: Overhead Cost against Machine Hours

Regression Statistics

Multiple R 0.104

R Square 0.011

Adjusted R

Square -0.113

Standard Error 15447.614

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 1 2.1E+07 2.1E+07 0.088 0.774

Residual 8 1.9E+09 2.4E+08

Total 9 1.9E+09

Coefficient

s

Standard

Error t Stat P-value Lower 95%

Upper

95%

(a) The table 6 shows the necessary calculations to estimate the overhead cost using high low

method.

Table 6

Machine Hours (x) Overhead Cost (y)

Highest Activity 3,800 $48,000

Lowest Activity 1,800 $46,000

Marginal Cost = $(48,000 – 46,000) / (3800 – 1800) = $1

Fixed Cost = $(48,000 – 1 * 3800) = $(46,000 – 1 * 1800) = $44,200

Equation to estimate overhead cost:

Overhead Cost (y)= 44,200 + Machine Hours (x)

When, machine hours = 3000, overhead cost = $(44,200 + 3,000) = $47,200

(b) Table 7 gives the regression results to estimate the overhead cost with the help of

machine hours.

Table 7: Overhead Cost against Machine Hours

Regression Statistics

Multiple R 0.104

R Square 0.011

Adjusted R

Square -0.113

Standard Error 15447.614

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 1 2.1E+07 2.1E+07 0.088 0.774

Residual 8 1.9E+09 2.4E+08

Total 9 1.9E+09

Coefficient

s

Standard

Error t Stat P-value Lower 95%

Upper

95%

9DECISION SUPPORT TOOLS

Intercept 59198.785 21473.783 2.757 0.025 9680.152

108717.4

17

MH -2.304 7.774 -0.296 0.774 -20.230 15.621

The model developed is insignificant as the significance F is more than the level

of significance (0.05). Thus, Machine hours is not a good predictor of overhead cost.

Table 8 gives the regression results to estimate the overhead cost with the help of batches.

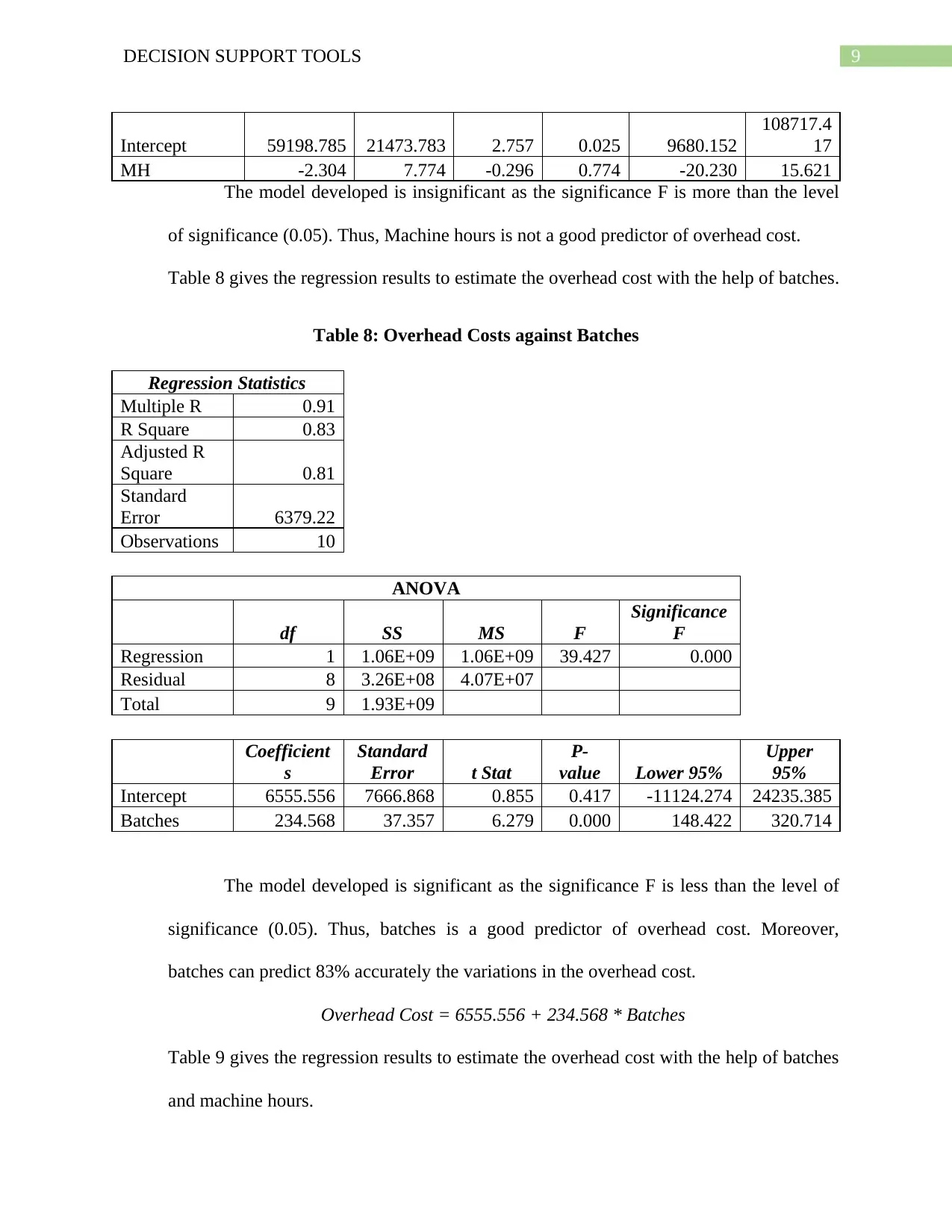

Table 8: Overhead Costs against Batches

Regression Statistics

Multiple R 0.91

R Square 0.83

Adjusted R

Square 0.81

Standard

Error 6379.22

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 1 1.06E+09 1.06E+09 39.427 0.000

Residual 8 3.26E+08 4.07E+07

Total 9 1.93E+09

Coefficient

s

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 6555.556 7666.868 0.855 0.417 -11124.274 24235.385

Batches 234.568 37.357 6.279 0.000 148.422 320.714

The model developed is significant as the significance F is less than the level of

significance (0.05). Thus, batches is a good predictor of overhead cost. Moreover,

batches can predict 83% accurately the variations in the overhead cost.

Overhead Cost = 6555.556 + 234.568 * Batches

Table 9 gives the regression results to estimate the overhead cost with the help of batches

and machine hours.

Intercept 59198.785 21473.783 2.757 0.025 9680.152

108717.4

17

MH -2.304 7.774 -0.296 0.774 -20.230 15.621

The model developed is insignificant as the significance F is more than the level

of significance (0.05). Thus, Machine hours is not a good predictor of overhead cost.

Table 8 gives the regression results to estimate the overhead cost with the help of batches.

Table 8: Overhead Costs against Batches

Regression Statistics

Multiple R 0.91

R Square 0.83

Adjusted R

Square 0.81

Standard

Error 6379.22

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 1 1.06E+09 1.06E+09 39.427 0.000

Residual 8 3.26E+08 4.07E+07

Total 9 1.93E+09

Coefficient

s

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 6555.556 7666.868 0.855 0.417 -11124.274 24235.385

Batches 234.568 37.357 6.279 0.000 148.422 320.714

The model developed is significant as the significance F is less than the level of

significance (0.05). Thus, batches is a good predictor of overhead cost. Moreover,

batches can predict 83% accurately the variations in the overhead cost.

Overhead Cost = 6555.556 + 234.568 * Batches

Table 9 gives the regression results to estimate the overhead cost with the help of batches

and machine hours.

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

10DECISION SUPPORT TOOLS

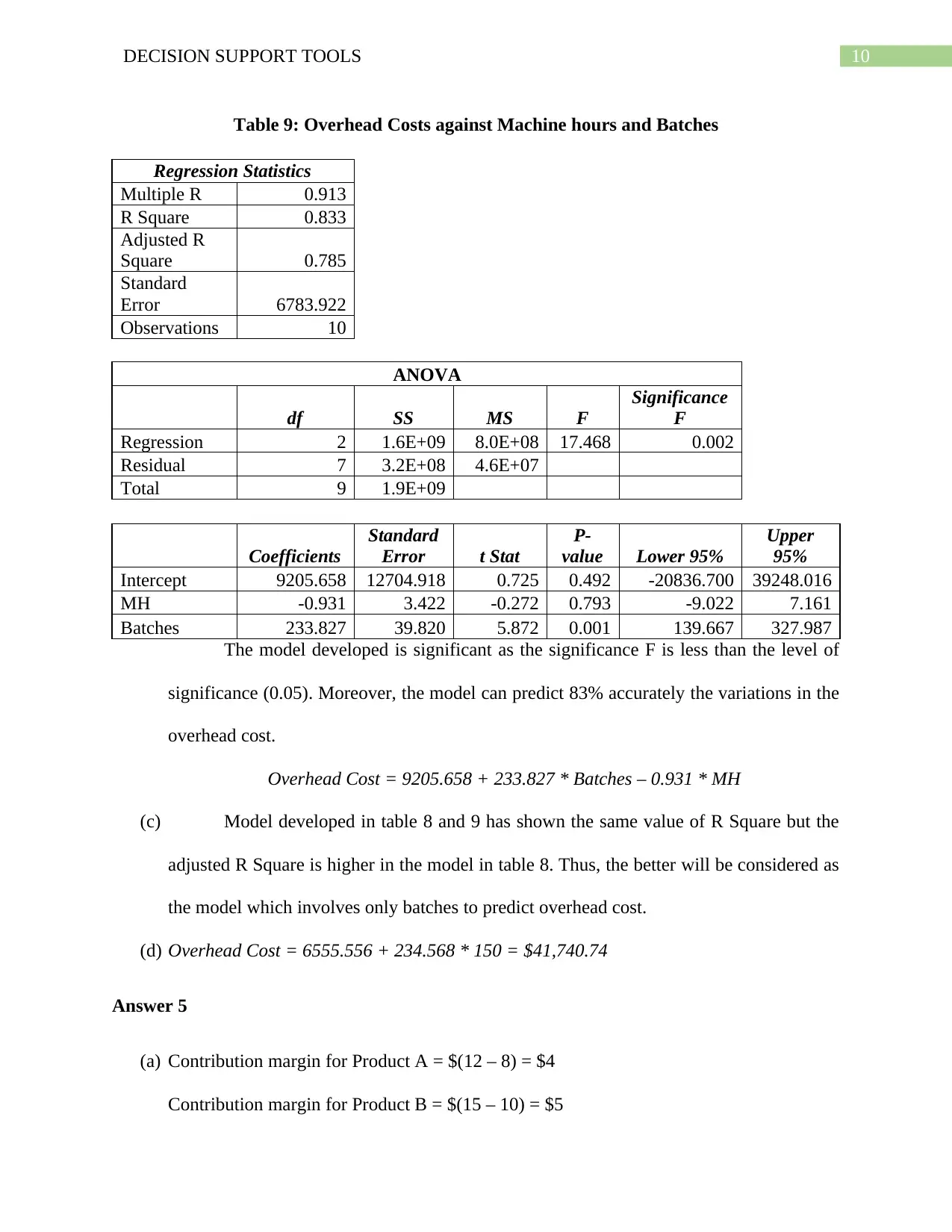

Table 9: Overhead Costs against Machine hours and Batches

Regression Statistics

Multiple R 0.913

R Square 0.833

Adjusted R

Square 0.785

Standard

Error 6783.922

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 2 1.6E+09 8.0E+08 17.468 0.002

Residual 7 3.2E+08 4.6E+07

Total 9 1.9E+09

Coefficients

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 9205.658 12704.918 0.725 0.492 -20836.700 39248.016

MH -0.931 3.422 -0.272 0.793 -9.022 7.161

Batches 233.827 39.820 5.872 0.001 139.667 327.987

The model developed is significant as the significance F is less than the level of

significance (0.05). Moreover, the model can predict 83% accurately the variations in the

overhead cost.

Overhead Cost = 9205.658 + 233.827 * Batches – 0.931 * MH

(c) Model developed in table 8 and 9 has shown the same value of R Square but the

adjusted R Square is higher in the model in table 8. Thus, the better will be considered as

the model which involves only batches to predict overhead cost.

(d) Overhead Cost = 6555.556 + 234.568 * 150 = $41,740.74

Answer 5

(a) Contribution margin for Product A = $(12 – 8) = $4

Contribution margin for Product B = $(15 – 10) = $5

Table 9: Overhead Costs against Machine hours and Batches

Regression Statistics

Multiple R 0.913

R Square 0.833

Adjusted R

Square 0.785

Standard

Error 6783.922

Observations 10

ANOVA

df SS MS F

Significance

F

Regression 2 1.6E+09 8.0E+08 17.468 0.002

Residual 7 3.2E+08 4.6E+07

Total 9 1.9E+09

Coefficients

Standard

Error t Stat

P-

value Lower 95%

Upper

95%

Intercept 9205.658 12704.918 0.725 0.492 -20836.700 39248.016

MH -0.931 3.422 -0.272 0.793 -9.022 7.161

Batches 233.827 39.820 5.872 0.001 139.667 327.987

The model developed is significant as the significance F is less than the level of

significance (0.05). Moreover, the model can predict 83% accurately the variations in the

overhead cost.

Overhead Cost = 9205.658 + 233.827 * Batches – 0.931 * MH

(c) Model developed in table 8 and 9 has shown the same value of R Square but the

adjusted R Square is higher in the model in table 8. Thus, the better will be considered as

the model which involves only batches to predict overhead cost.

(d) Overhead Cost = 6555.556 + 234.568 * 150 = $41,740.74

Answer 5

(a) Contribution margin for Product A = $(12 – 8) = $4

Contribution margin for Product B = $(15 – 10) = $5

11DECISION SUPPORT TOOLS

(b) For Product B, break even = (5000 / 5) = 1000 units

(c) For Product A, break even = (5000 / 4) = 1250 units

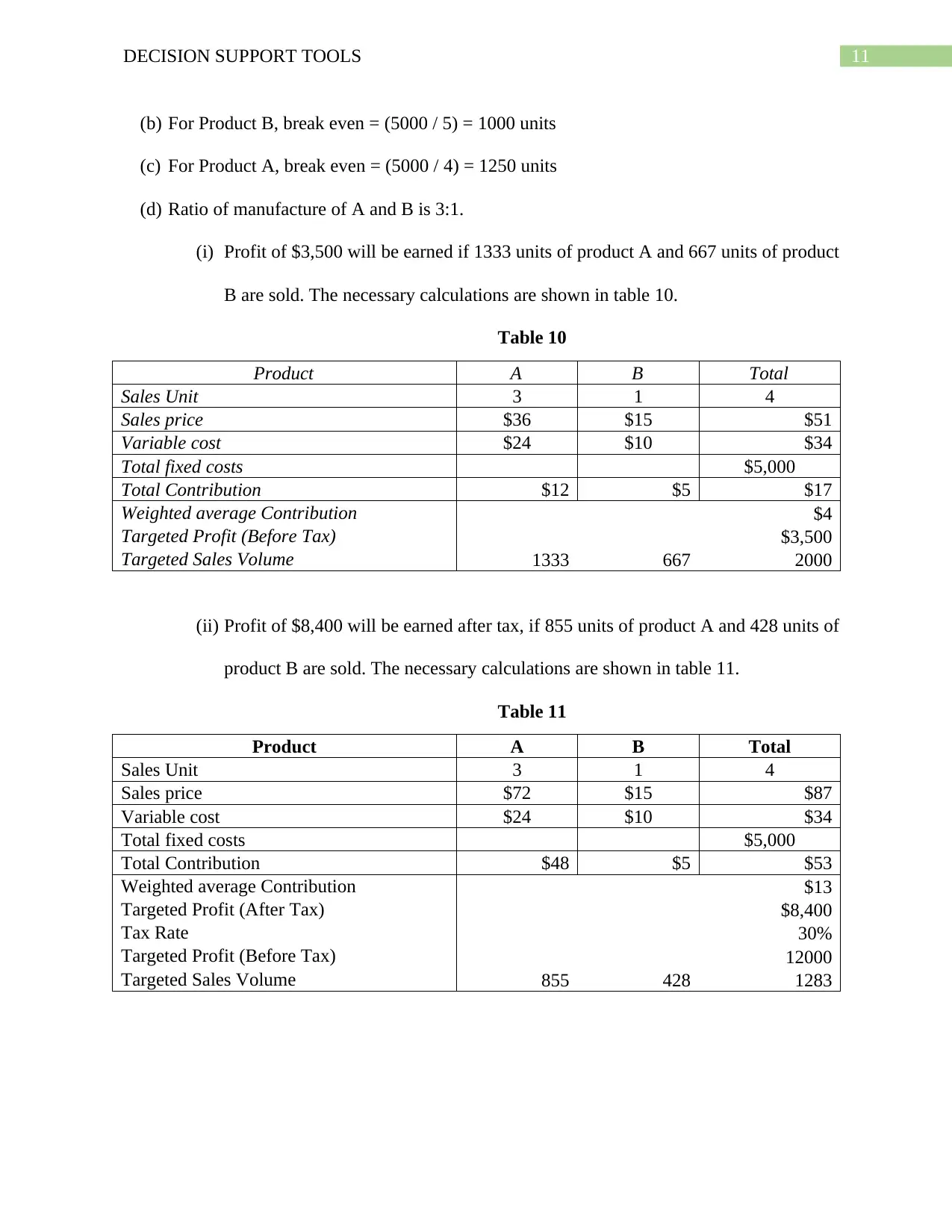

(d) Ratio of manufacture of A and B is 3:1.

(i) Profit of $3,500 will be earned if 1333 units of product A and 667 units of product

B are sold. The necessary calculations are shown in table 10.

Table 10

Product A B Total

Sales Unit 3 1 4

Sales price $36 $15 $51

Variable cost $24 $10 $34

Total fixed costs $5,000

Total Contribution $12 $5 $17

Weighted average Contribution $4

Targeted Profit (Before Tax) $3,500

Targeted Sales Volume 1333 667 2000

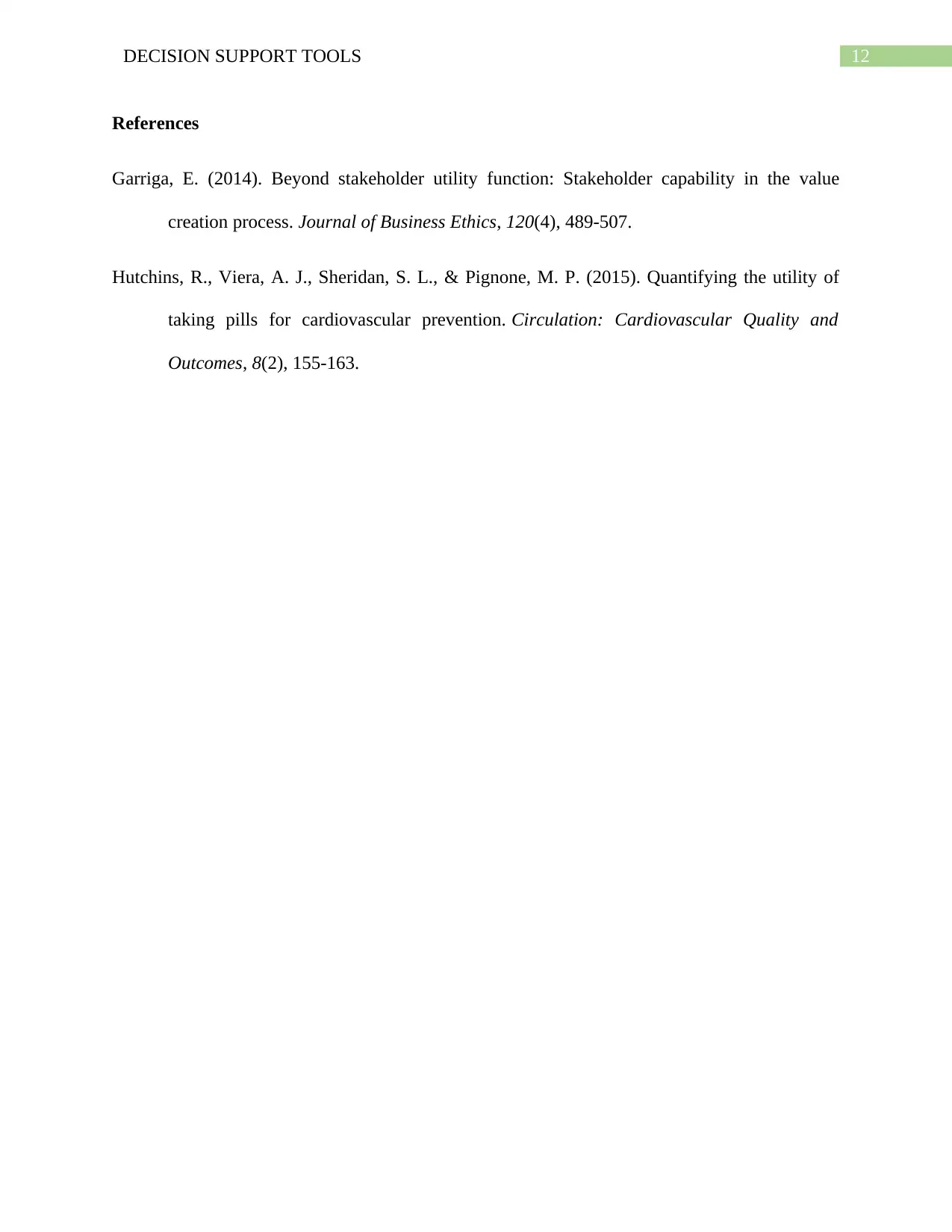

(ii) Profit of $8,400 will be earned after tax, if 855 units of product A and 428 units of

product B are sold. The necessary calculations are shown in table 11.

Table 11

Product A B Total

Sales Unit 3 1 4

Sales price $72 $15 $87

Variable cost $24 $10 $34

Total fixed costs $5,000

Total Contribution $48 $5 $53

Weighted average Contribution $13

Targeted Profit (After Tax) $8,400

Tax Rate 30%

Targeted Profit (Before Tax) 12000

Targeted Sales Volume 855 428 1283

(b) For Product B, break even = (5000 / 5) = 1000 units

(c) For Product A, break even = (5000 / 4) = 1250 units

(d) Ratio of manufacture of A and B is 3:1.

(i) Profit of $3,500 will be earned if 1333 units of product A and 667 units of product

B are sold. The necessary calculations are shown in table 10.

Table 10

Product A B Total

Sales Unit 3 1 4

Sales price $36 $15 $51

Variable cost $24 $10 $34

Total fixed costs $5,000

Total Contribution $12 $5 $17

Weighted average Contribution $4

Targeted Profit (Before Tax) $3,500

Targeted Sales Volume 1333 667 2000

(ii) Profit of $8,400 will be earned after tax, if 855 units of product A and 428 units of

product B are sold. The necessary calculations are shown in table 11.

Table 11

Product A B Total

Sales Unit 3 1 4

Sales price $72 $15 $87

Variable cost $24 $10 $34

Total fixed costs $5,000

Total Contribution $48 $5 $53

Weighted average Contribution $13

Targeted Profit (After Tax) $8,400

Tax Rate 30%

Targeted Profit (Before Tax) 12000

Targeted Sales Volume 855 428 1283

12DECISION SUPPORT TOOLS

References

Garriga, E. (2014). Beyond stakeholder utility function: Stakeholder capability in the value

creation process. Journal of Business Ethics, 120(4), 489-507.

Hutchins, R., Viera, A. J., Sheridan, S. L., & Pignone, M. P. (2015). Quantifying the utility of

taking pills for cardiovascular prevention. Circulation: Cardiovascular Quality and

Outcomes, 8(2), 155-163.

References

Garriga, E. (2014). Beyond stakeholder utility function: Stakeholder capability in the value

creation process. Journal of Business Ethics, 120(4), 489-507.

Hutchins, R., Viera, A. J., Sheridan, S. L., & Pignone, M. P. (2015). Quantifying the utility of

taking pills for cardiovascular prevention. Circulation: Cardiovascular Quality and

Outcomes, 8(2), 155-163.

1 out of 13

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.