Detailed Analysis of Demand and Supply Factors in the Oil Market

VerifiedAdded on 2020/05/16

|7

|967

|103

Report

AI Summary

This report analyzes the demand and supply dynamics within the oil market, drawing insights from a CBS News article discussing rising oil prices amidst a slowing demand growth and anticipating economic slowdowns. The report highlights the role of OPEC supply, particularly from nations like the United Arab Emirates, operating at near-record levels. It examines the factors influencing oil prices, including increased demand from developing nations and production issues in countries like Iraq and Venezuela. The report further discusses shift factors such as rising oil intake in China and the impact of the European and U.S. economic conditions. It concludes by considering the implications of these factors on the equilibrium price and quantity, referencing IEA oil reports and global consumption patterns. This report provides a comprehensive overview of the complex interplay of supply and demand within the global oil market.

RUNNING HEAD: DEMAND AND SUPPLY 1

DEMAND AND SUPPLY

Student Name

Institute Name

DEMAND AND SUPPLY

Student Name

Institute Name

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DEMAND AND SUPPLY 2

Contents

Summary of the situation discussed in article............................................................................3

Supply and demand shift factors................................................................................................3

Effect on equilibrium price and quantity of the shift factor.......................................................4

Reference....................................................................................................................................6

Contents

Summary of the situation discussed in article............................................................................3

Supply and demand shift factors................................................................................................3

Effect on equilibrium price and quantity of the shift factor.......................................................4

Reference....................................................................................................................................6

DEMAND AND SUPPLY 3

Summary of the situation discussed in article

The article Cbsnews.com, 2016., talks about how the pricing of oil is slowly rising and how

the overall demand growth is slowing down. There are a lot of anticipations around the

economic slowdown. The studies also suggest that supply from OPEC are functioning at

almost near to set standards or record level because main suppliers like United Arab Emirates

are at the highest level (Baffes et al, 2015). The changes in the supply & demand and the

overall balance between them has been weighed on the prices of the oil. This new pressure on

the oil prices is further followed by a point of time when oil has been recovered from so

many layers covering the low times to become stable. In 2014, the prices of the oil were

rising however there was a major crash in price in the start of 2016. This is because of so

many factors that hit the prices consisting issues in the overall scale of the current economic

slowdown in several countries like China (Juvenal & Petrella, 2015).

Supply and demand shift factors

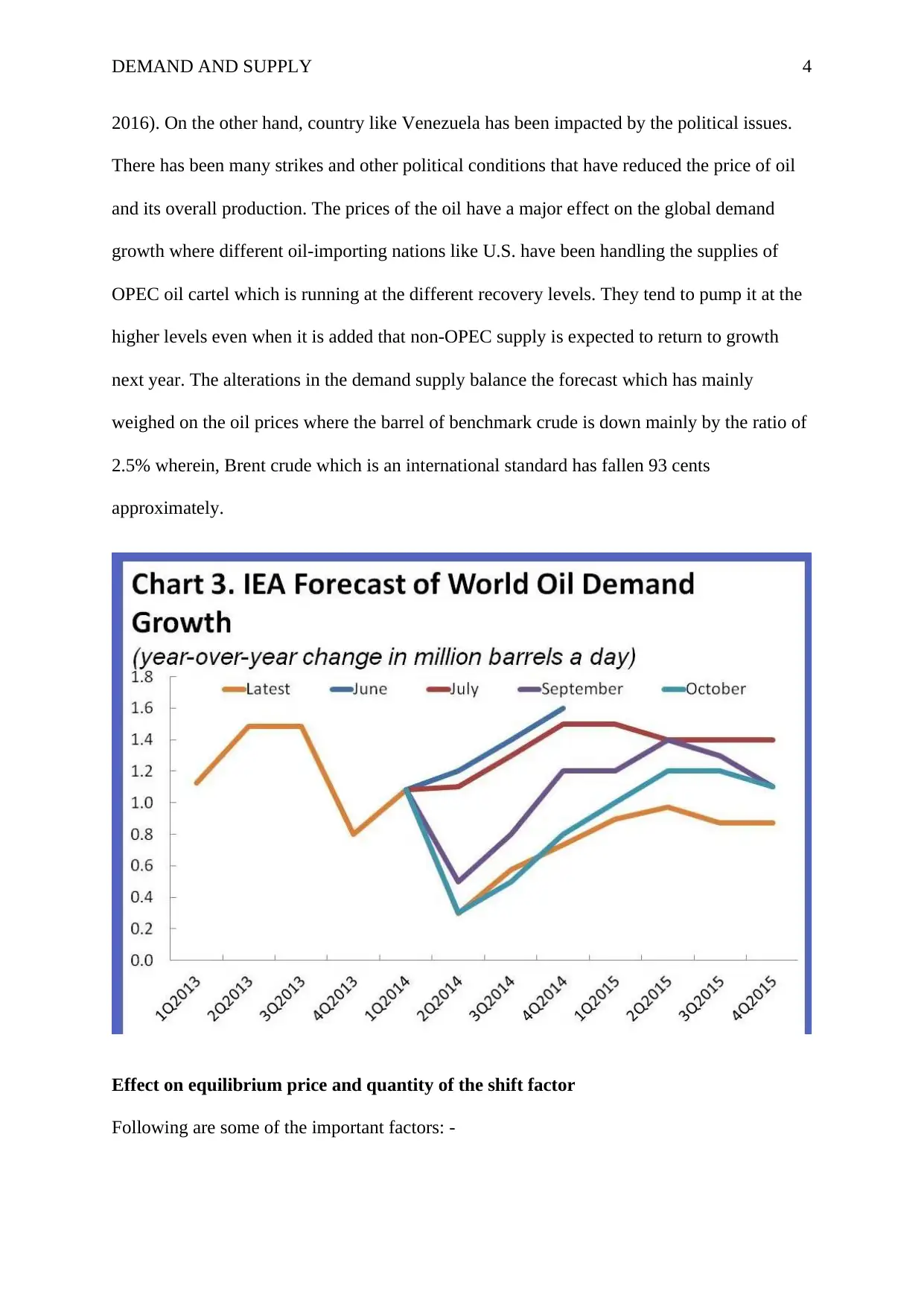

There are number of factors that are impacting the oil price in the global market. There is

rapid rise in the demand of oil which is of course one of the important factor. Back in the year

2004, the IEA (International Energy Agency), reports that demand of oil in world has

increased at a fast rate in past sixteen years. There are number of developing nations that are

continuing to expand and are more likely to follow the same kind of pattern which is also

rising for the overall demand for the energy (Kilian & Murphy, 2014).

At the same time there are many oil manufacturing nations that have already undergone so

many issues that have further impacted the overall ability to capitalise their complete capacity

like Iraq and Venezuela. There has been a lot of turmoil in Iraq which impacted the

production and the violence with low standard manufacturing techniques in the nation

previously, have damaged a lot and recovery is challenging (Taghizadeh-Hesary & Yoshino,

Summary of the situation discussed in article

The article Cbsnews.com, 2016., talks about how the pricing of oil is slowly rising and how

the overall demand growth is slowing down. There are a lot of anticipations around the

economic slowdown. The studies also suggest that supply from OPEC are functioning at

almost near to set standards or record level because main suppliers like United Arab Emirates

are at the highest level (Baffes et al, 2015). The changes in the supply & demand and the

overall balance between them has been weighed on the prices of the oil. This new pressure on

the oil prices is further followed by a point of time when oil has been recovered from so

many layers covering the low times to become stable. In 2014, the prices of the oil were

rising however there was a major crash in price in the start of 2016. This is because of so

many factors that hit the prices consisting issues in the overall scale of the current economic

slowdown in several countries like China (Juvenal & Petrella, 2015).

Supply and demand shift factors

There are number of factors that are impacting the oil price in the global market. There is

rapid rise in the demand of oil which is of course one of the important factor. Back in the year

2004, the IEA (International Energy Agency), reports that demand of oil in world has

increased at a fast rate in past sixteen years. There are number of developing nations that are

continuing to expand and are more likely to follow the same kind of pattern which is also

rising for the overall demand for the energy (Kilian & Murphy, 2014).

At the same time there are many oil manufacturing nations that have already undergone so

many issues that have further impacted the overall ability to capitalise their complete capacity

like Iraq and Venezuela. There has been a lot of turmoil in Iraq which impacted the

production and the violence with low standard manufacturing techniques in the nation

previously, have damaged a lot and recovery is challenging (Taghizadeh-Hesary & Yoshino,

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DEMAND AND SUPPLY 4

2016). On the other hand, country like Venezuela has been impacted by the political issues.

There has been many strikes and other political conditions that have reduced the price of oil

and its overall production. The prices of the oil have a major effect on the global demand

growth where different oil-importing nations like U.S. have been handling the supplies of

OPEC oil cartel which is running at the different recovery levels. They tend to pump it at the

higher levels even when it is added that non-OPEC supply is expected to return to growth

next year. The alterations in the demand supply balance the forecast which has mainly

weighed on the oil prices where the barrel of benchmark crude is down mainly by the ratio of

2.5% wherein, Brent crude which is an international standard has fallen 93 cents

approximately.

Effect on equilibrium price and quantity of the shift factor

Following are some of the important factors: -

2016). On the other hand, country like Venezuela has been impacted by the political issues.

There has been many strikes and other political conditions that have reduced the price of oil

and its overall production. The prices of the oil have a major effect on the global demand

growth where different oil-importing nations like U.S. have been handling the supplies of

OPEC oil cartel which is running at the different recovery levels. They tend to pump it at the

higher levels even when it is added that non-OPEC supply is expected to return to growth

next year. The alterations in the demand supply balance the forecast which has mainly

weighed on the oil prices where the barrel of benchmark crude is down mainly by the ratio of

2.5% wherein, Brent crude which is an international standard has fallen 93 cents

approximately.

Effect on equilibrium price and quantity of the shift factor

Following are some of the important factors: -

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

DEMAND AND SUPPLY 5

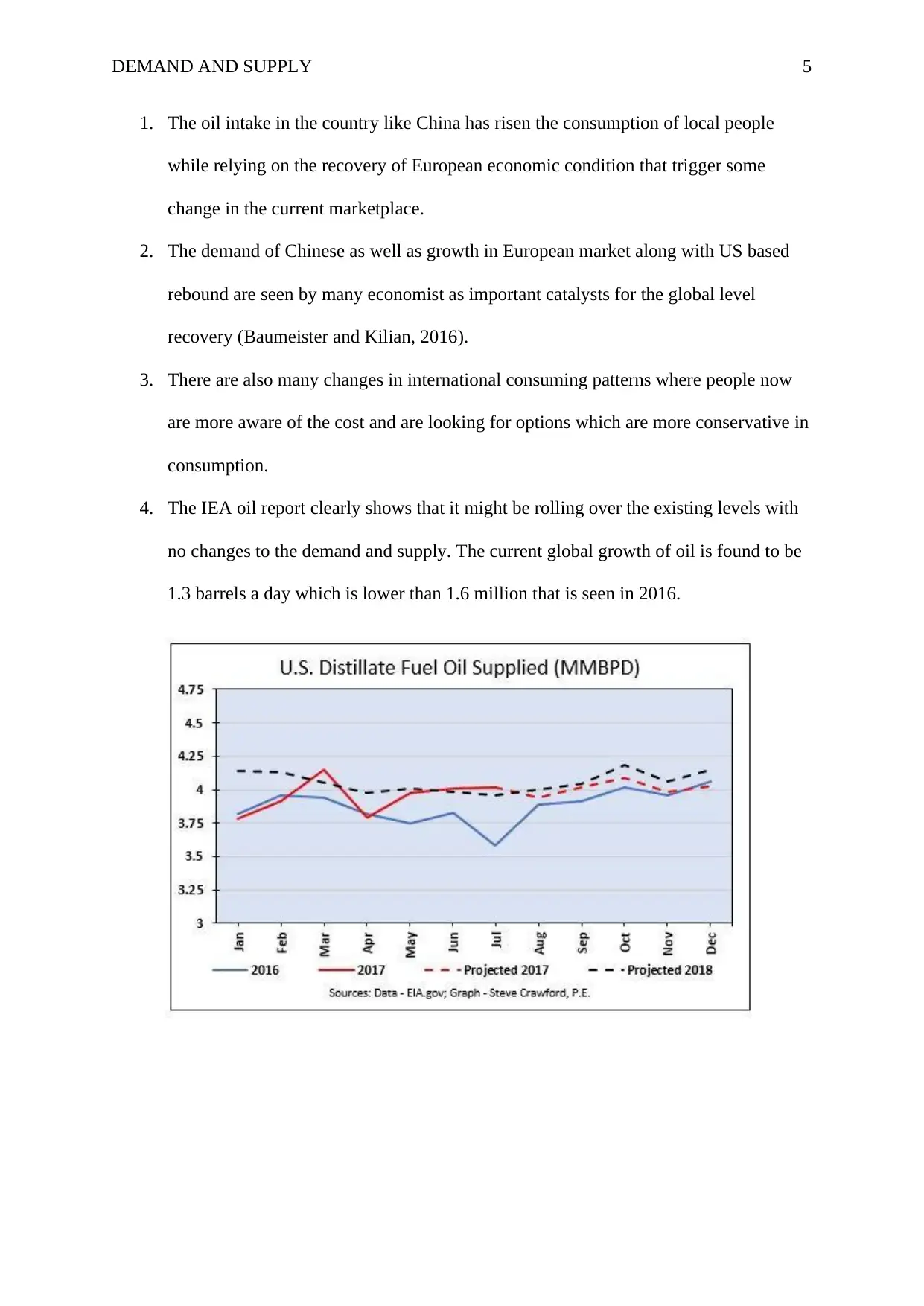

1. The oil intake in the country like China has risen the consumption of local people

while relying on the recovery of European economic condition that trigger some

change in the current marketplace.

2. The demand of Chinese as well as growth in European market along with US based

rebound are seen by many economist as important catalysts for the global level

recovery (Baumeister and Kilian, 2016).

3. There are also many changes in international consuming patterns where people now

are more aware of the cost and are looking for options which are more conservative in

consumption.

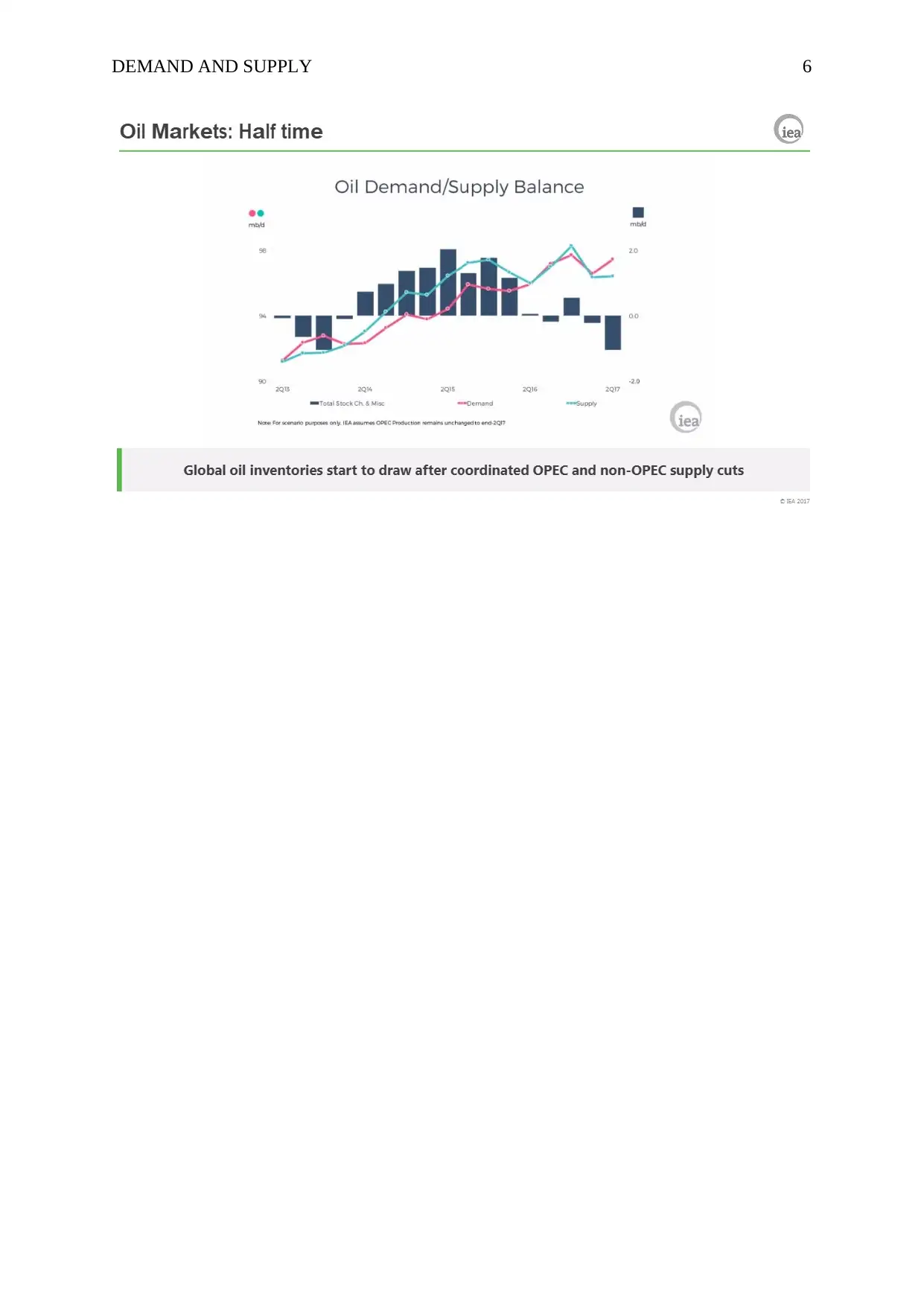

4. The IEA oil report clearly shows that it might be rolling over the existing levels with

no changes to the demand and supply. The current global growth of oil is found to be

1.3 barrels a day which is lower than 1.6 million that is seen in 2016.

1. The oil intake in the country like China has risen the consumption of local people

while relying on the recovery of European economic condition that trigger some

change in the current marketplace.

2. The demand of Chinese as well as growth in European market along with US based

rebound are seen by many economist as important catalysts for the global level

recovery (Baumeister and Kilian, 2016).

3. There are also many changes in international consuming patterns where people now

are more aware of the cost and are looking for options which are more conservative in

consumption.

4. The IEA oil report clearly shows that it might be rolling over the existing levels with

no changes to the demand and supply. The current global growth of oil is found to be

1.3 barrels a day which is lower than 1.6 million that is seen in 2016.

DEMAND AND SUPPLY 6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

DEMAND AND SUPPLY 7

Bibliography

Baffes, J., Kose, M. A., Ohnsorge, F., & Stocker, M. (2015). The great plunge in oil prices:

Causes, consequences, and policy responses.

Baumeister, C. and Kilian, L., (2016). Forty years of oil price fluctuations: Why the price of

oil may still surprise us. Journal of Economic Perspectives, 30(1), pp.139-60.

Cbsnews.com. (2016). Oil supply will outrun demand into 2017. [online] Available at:

https://www.cbsnews.com/news/oil-supply-will-keep-outrunning-demand-into-2017/

Juvenal, L., & Petrella, I. (2015). Speculation in the oil market. Journal of Applied

Econometrics, 30(4), 621-649.

Kilian, L., & Murphy, D. P. (2014). The role of inventories and speculative trading in the

global market for crude oil. Journal of Applied Econometrics, 29(3), 454-478.

Taghizadeh-Hesary, F., & Yoshino, N. (2016). Which side of the economy is affected more

by oil prices: Supply or demand?. In Monetary Policy and the Oil Market (pp. 29-53).

Springer, Tokyo.

Bibliography

Baffes, J., Kose, M. A., Ohnsorge, F., & Stocker, M. (2015). The great plunge in oil prices:

Causes, consequences, and policy responses.

Baumeister, C. and Kilian, L., (2016). Forty years of oil price fluctuations: Why the price of

oil may still surprise us. Journal of Economic Perspectives, 30(1), pp.139-60.

Cbsnews.com. (2016). Oil supply will outrun demand into 2017. [online] Available at:

https://www.cbsnews.com/news/oil-supply-will-keep-outrunning-demand-into-2017/

Juvenal, L., & Petrella, I. (2015). Speculation in the oil market. Journal of Applied

Econometrics, 30(4), 621-649.

Kilian, L., & Murphy, D. P. (2014). The role of inventories and speculative trading in the

global market for crude oil. Journal of Applied Econometrics, 29(3), 454-478.

Taghizadeh-Hesary, F., & Yoshino, N. (2016). Which side of the economy is affected more

by oil prices: Supply or demand?. In Monetary Policy and the Oil Market (pp. 29-53).

Springer, Tokyo.

1 out of 7

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.