Political & Economic Impact: Demonetization in India - 2016

VerifiedAdded on 2023/06/15

|23

|5392

|83

Report

AI Summary

This report provides a political risk assessment of the demonetization policy implemented in India in 2016. It begins with an introduction to political risk assessment and the concept of demonetization, followed by background information on previous demonetization efforts in India. The report then details the 2016 demonetization event, including the announcement, objectives, and implementation process. It explores the initial reactions, both supportive and critical, and analyzes the various impacts of demonetization on black money, terror funding, digital transactions, tax payments, GDP, and MSMEs. The report also estimates the threat to the government's stability and concludes with a summary of the key findings. The analysis considers the element of surprise, public reaction, and economic consequences in evaluating the political risks associated with the demonetization policy.

Running Head: Demonetization in India: 2016

Political Risk Assessment

Demonetization in India

Political Risk Assessment

Demonetization in India

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Demonetization in India: 2016 1

Contents

Introduction......................................................................................................................................1

Background......................................................................................................................................2

Demonetisation in India: 2016.........................................................................................................2

Initial reaction on Demonetization..................................................................................................4

Impact of Demonetization...............................................................................................................5

Estimation of threat........................................................................................................................11

Event Occurred as Surprise.......................................................................................................12

Threat to Government................................................................................................................13

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

Contents

Introduction......................................................................................................................................1

Background......................................................................................................................................2

Demonetisation in India: 2016.........................................................................................................2

Initial reaction on Demonetization..................................................................................................4

Impact of Demonetization...............................................................................................................5

Estimation of threat........................................................................................................................11

Event Occurred as Surprise.......................................................................................................12

Threat to Government................................................................................................................13

Conclusion.....................................................................................................................................16

References......................................................................................................................................17

Demonetization in India: 2016 2

Introduction

The paper is based on the recent past event that is relevant to the political risk assessment.

Political risk is a kind of risk that is confronted by corporations, investors, governments that

political decisions, conditions or events will considerably create the impact on the profitability of

a corporate businesses or the estimated worth of a given economic activity. The political risk

assessment deals with the evaluating and prioritizing of public, regulatory and political risks. The

aim is to manage these risks efficiently same like the companies who manage its own risk

(Zonis, et.al, 2011). The event that has been selected for the discussion is “Demonetization in

India”. Demonetization refers to as the act of stripping a currency unit of its position as a legal

tender. It takes places when the government decides to bring the variation in the countrywide

currency; the current form of currency is pulled from the flow in the market and gets replaced

with the new currency (notes and coins).

The reason behind the selection of the event of Demonetization in India is the economy of the

country and the importance of the event. Indian economy has held up better than other emerging

countries (Kepley, 2014). The government of India is mentioned to as a Union Government, it is

also known as the Central government which consists of 7 union territories with 28 states of the

nation. Moreover, there are 3 branches of India's government which are same to those of the U.S:

Judiciary, Executive and Legislative (Santander Trade Portal, 2018). Demonetisation in India

was one of the crucial decisions taken by the PM and the decision came us a sudden surprise for

the citizen of the country. Further, the paper will discuss the demonetization, how it came in

front of the citizen, and the details related to the demonetization that are essential for the

Introduction

The paper is based on the recent past event that is relevant to the political risk assessment.

Political risk is a kind of risk that is confronted by corporations, investors, governments that

political decisions, conditions or events will considerably create the impact on the profitability of

a corporate businesses or the estimated worth of a given economic activity. The political risk

assessment deals with the evaluating and prioritizing of public, regulatory and political risks. The

aim is to manage these risks efficiently same like the companies who manage its own risk

(Zonis, et.al, 2011). The event that has been selected for the discussion is “Demonetization in

India”. Demonetization refers to as the act of stripping a currency unit of its position as a legal

tender. It takes places when the government decides to bring the variation in the countrywide

currency; the current form of currency is pulled from the flow in the market and gets replaced

with the new currency (notes and coins).

The reason behind the selection of the event of Demonetization in India is the economy of the

country and the importance of the event. Indian economy has held up better than other emerging

countries (Kepley, 2014). The government of India is mentioned to as a Union Government, it is

also known as the Central government which consists of 7 union territories with 28 states of the

nation. Moreover, there are 3 branches of India's government which are same to those of the U.S:

Judiciary, Executive and Legislative (Santander Trade Portal, 2018). Demonetisation in India

was one of the crucial decisions taken by the PM and the decision came us a sudden surprise for

the citizen of the country. Further, the paper will discuss the demonetization, how it came in

front of the citizen, and the details related to the demonetization that are essential for the

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Demonetization in India: 2016 3

assessment. The report also reflects the aspect that the event might be a threat of instability of

government (Dasgupta, 2016).

Background

This is not the initial time when the government of India took the step for the demonetization of

the bank notes. Demonetization took place in the year 1946 and 1978, both the time the decision

was formed with the motive to track the records related to the money and to extract the black

money (Mali, 2016). The country has a long-standing relationship with demonetization. In the

year 1978 on January 16th, 1, 000, 5, 000 and 10, 000 rupees notes were argued through a

regulation and it impacts the 0.6% of the overall current in the flow at that point of time. Before,

this incident India had practiced demonetization in 1946 of high-value currency. Both the time

when the demonetization tool place it has created the impact on the minuscule segment of the

economy and the society (Mali, 2016). Later, in October 1987, the government re-introduced the

Rs.500 notes and Rs.1000 notes. Moreover, after 1978 demonetization government of India

didn’t a step for the demonetization again in India till the year 2016. In 2016 the demonetization

tool place and this decision were taken by the respected Narendra Modi prime minister of India.

Demonetisation in India: 2016

Demonetisation is a milestone in the past of the Economy of India. It was a practice which might

have created the threat and terror in the thoughts of the individuals who are involved in the

unlawful and unauthorized happenings such as tax evasion or money laundering of any kind

(Khanna and Dharmapala, 2017). On November 8th, 2016, the respected Prime Minister of India,

Narendra Modi announced the stripping of 500 and 1,000 rupees notes and this will be

assessment. The report also reflects the aspect that the event might be a threat of instability of

government (Dasgupta, 2016).

Background

This is not the initial time when the government of India took the step for the demonetization of

the bank notes. Demonetization took place in the year 1946 and 1978, both the time the decision

was formed with the motive to track the records related to the money and to extract the black

money (Mali, 2016). The country has a long-standing relationship with demonetization. In the

year 1978 on January 16th, 1, 000, 5, 000 and 10, 000 rupees notes were argued through a

regulation and it impacts the 0.6% of the overall current in the flow at that point of time. Before,

this incident India had practiced demonetization in 1946 of high-value currency. Both the time

when the demonetization tool place it has created the impact on the minuscule segment of the

economy and the society (Mali, 2016). Later, in October 1987, the government re-introduced the

Rs.500 notes and Rs.1000 notes. Moreover, after 1978 demonetization government of India

didn’t a step for the demonetization again in India till the year 2016. In 2016 the demonetization

tool place and this decision were taken by the respected Narendra Modi prime minister of India.

Demonetisation in India: 2016

Demonetisation is a milestone in the past of the Economy of India. It was a practice which might

have created the threat and terror in the thoughts of the individuals who are involved in the

unlawful and unauthorized happenings such as tax evasion or money laundering of any kind

(Khanna and Dharmapala, 2017). On November 8th, 2016, the respected Prime Minister of India,

Narendra Modi announced the stripping of 500 and 1,000 rupees notes and this will be

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Demonetization in India: 2016 4

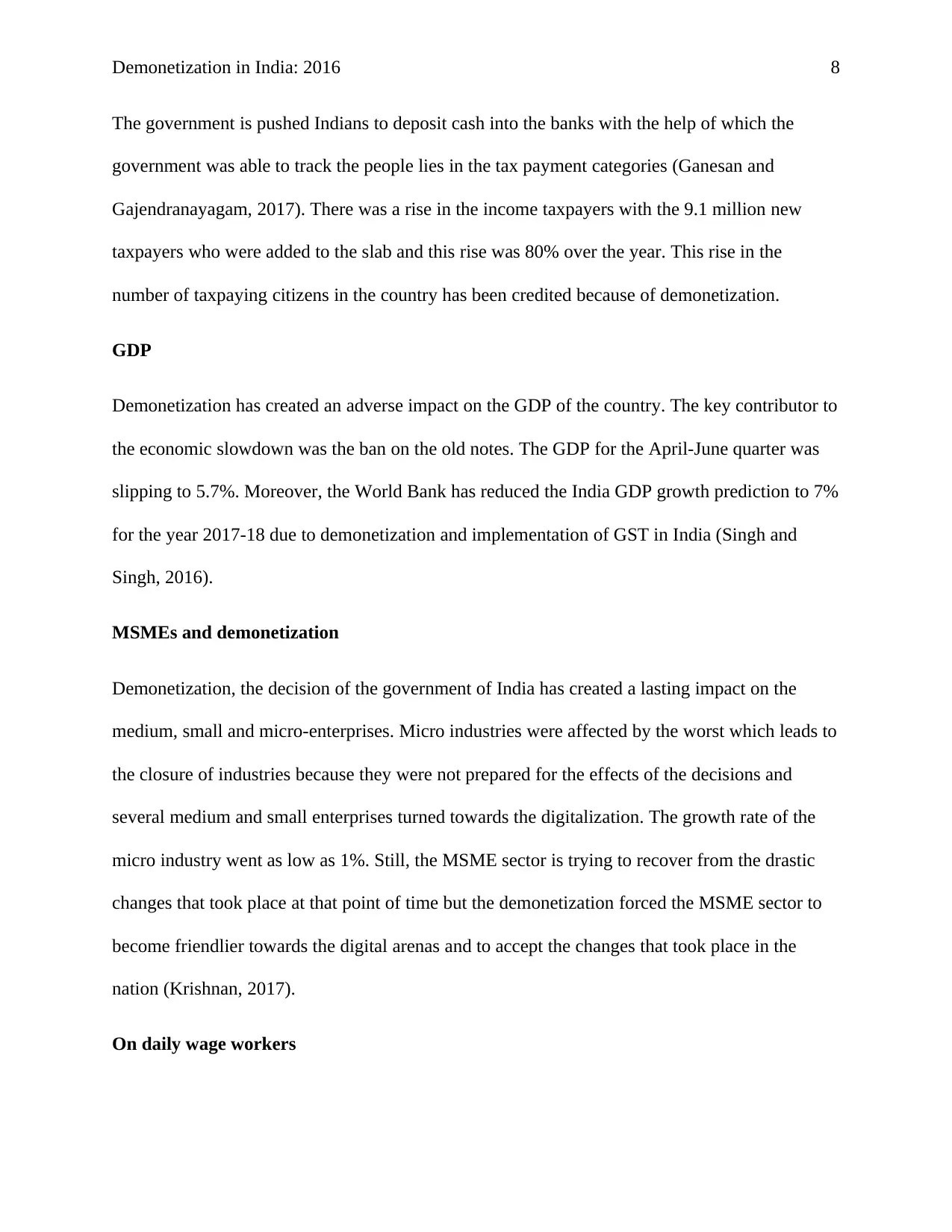

implemented from midnight (Kumar, 2016). The planning of demonetizing of notes was initiated

6-10 months earlier before it was announced by the government. The decision was kept as a

confidential with only 10 people being aware of the fact. The printing of new notes of Rupee 500

and 2000 was initiated from May 2016. Moreover, the union cabinet was not aware of the

planning they get known when the PM Narendra Modi called for the meeting on 8th November

2016 (BGR, 2017). PM selected notes of 500 and 1000 because these notes accounted for 86% of

the nation’s cash hoard by worth. The government of India has given time till 31st December

2016 to the citizen of country to credit their old currency notes in banks to convert them in the

new currency notes of 500 and 2000 rupees (Shepard, 2017).

(Source: Dutta, 2017)

The objective of the decision was to root out counterfeit currency, curb inflation, removal of

black money and terror-funding, fight tax evasion and to enhance the cashless processor system

in Indian economy. Narendra Modi shared the same reason with the general public for the

demonetization (Dutta, 2017). The government had followed the standard process after

announcing for the demonetization on 8th November 2016.

implemented from midnight (Kumar, 2016). The planning of demonetizing of notes was initiated

6-10 months earlier before it was announced by the government. The decision was kept as a

confidential with only 10 people being aware of the fact. The printing of new notes of Rupee 500

and 2000 was initiated from May 2016. Moreover, the union cabinet was not aware of the

planning they get known when the PM Narendra Modi called for the meeting on 8th November

2016 (BGR, 2017). PM selected notes of 500 and 1000 because these notes accounted for 86% of

the nation’s cash hoard by worth. The government of India has given time till 31st December

2016 to the citizen of country to credit their old currency notes in banks to convert them in the

new currency notes of 500 and 2000 rupees (Shepard, 2017).

(Source: Dutta, 2017)

The objective of the decision was to root out counterfeit currency, curb inflation, removal of

black money and terror-funding, fight tax evasion and to enhance the cashless processor system

in Indian economy. Narendra Modi shared the same reason with the general public for the

demonetization (Dutta, 2017). The government had followed the standard process after

announcing for the demonetization on 8th November 2016.

Demonetization in India: 2016 5

Exchange of old notes: - The RBI offered the time period of 50 days to the public to

deposit their old currency in banks. The banks also kept the limit of 4,000 per person

from the 8th to 13th November which later on increased by 4,500 from 14th to 17th

November but later on the amount reduced to 2,000 as maximum number of people

started visiting banks and at a time it was not possible for the banks to maintain the cash

among all. At airports, the facility of exchange of notes was offered to foreign tourists

and to travelers accounting to Rs.5, 000 to each person.

Limits on Withdrawal of cash: - RBI also imposed the restriction on the withdrawals of

cash from the bank from 10, 000 rupees for a day and to 20, 000 rupees for a week from

10th to 13th November. Later the daily limits reduced to 2,000 rupees for a day till 14th

November and 2,500 rupees for a single day till December 31st, 2016. On 1st January

2017, the limit was increased to 4,500 for a day. The RBI removed all the withdrawal

limits from the saving bank accounts.

Initial reaction on Demonetization

Support

The decision of demonetization faced the mixed reaction from the different persons. Some of the

people belong to the banking and finance field appreciated the decision taken by the government.

Though, some opposed the decision considering the problems which lead to the demonetization.

The large international response on the demonetization was positive because they believe that

this is the move with the help of which the government can break down the corruption in the

nation (Sinha and Rai, 2016). International monetary fund presented the support for the decision

taken by the Prime Minister Narendra Modi for the betterment of the nation.

Exchange of old notes: - The RBI offered the time period of 50 days to the public to

deposit their old currency in banks. The banks also kept the limit of 4,000 per person

from the 8th to 13th November which later on increased by 4,500 from 14th to 17th

November but later on the amount reduced to 2,000 as maximum number of people

started visiting banks and at a time it was not possible for the banks to maintain the cash

among all. At airports, the facility of exchange of notes was offered to foreign tourists

and to travelers accounting to Rs.5, 000 to each person.

Limits on Withdrawal of cash: - RBI also imposed the restriction on the withdrawals of

cash from the bank from 10, 000 rupees for a day and to 20, 000 rupees for a week from

10th to 13th November. Later the daily limits reduced to 2,000 rupees for a day till 14th

November and 2,500 rupees for a single day till December 31st, 2016. On 1st January

2017, the limit was increased to 4,500 for a day. The RBI removed all the withdrawal

limits from the saving bank accounts.

Initial reaction on Demonetization

Support

The decision of demonetization faced the mixed reaction from the different persons. Some of the

people belong to the banking and finance field appreciated the decision taken by the government.

Though, some opposed the decision considering the problems which lead to the demonetization.

The large international response on the demonetization was positive because they believe that

this is the move with the help of which the government can break down the corruption in the

nation (Sinha and Rai, 2016). International monetary fund presented the support for the decision

taken by the Prime Minister Narendra Modi for the betterment of the nation.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Demonetization in India: 2016 6

Criticism

The decision also faced the criticism from the different chief ministers of the Indian states. These

chief ministers had protested against the decision in their states because they found it as the

hardship to the common people. Earlier when the decision was announced all the people

supported and respected it because they believed that this is the single way to weed the black

money. Later, when the people found the complications in the process then they were against the

decision taken by the Government. Considering the opinion of the general public, some people

believe that this is the way through which the government can make the nation strong but some

people found it not effective (Tharoor, 2016).

The public had opposed the decision because they faced certain problems such as standing in

long queue for the exchange of currency, limitation on the amount of withdrawal from ATM,

Long queues in ATM, no cash at the nearest ATMs and many others. These problems lead to the

death of old and aged people affected the marriage arrangements, business investments, no cash

available for the day to day expenses of the household. Moreover, the hospitals denied accepting

the old money from their patients which results in the death of the people. Shortage of cash in

India not only created the impact on the businesses but also on agriculture and on households.

Farmers were not able to get enough funds for the purchasing seeds, fertilisers, and pesticides

that are essential for conducting the activity of agriculture (Ramya, 2016).

Impact of Demonetization

Demonetization has created both positive and negative impact on the nation. Some of the

impacts of Demonetization have been discussed below: -

Demonetization and Black Money

Criticism

The decision also faced the criticism from the different chief ministers of the Indian states. These

chief ministers had protested against the decision in their states because they found it as the

hardship to the common people. Earlier when the decision was announced all the people

supported and respected it because they believed that this is the single way to weed the black

money. Later, when the people found the complications in the process then they were against the

decision taken by the Government. Considering the opinion of the general public, some people

believe that this is the way through which the government can make the nation strong but some

people found it not effective (Tharoor, 2016).

The public had opposed the decision because they faced certain problems such as standing in

long queue for the exchange of currency, limitation on the amount of withdrawal from ATM,

Long queues in ATM, no cash at the nearest ATMs and many others. These problems lead to the

death of old and aged people affected the marriage arrangements, business investments, no cash

available for the day to day expenses of the household. Moreover, the hospitals denied accepting

the old money from their patients which results in the death of the people. Shortage of cash in

India not only created the impact on the businesses but also on agriculture and on households.

Farmers were not able to get enough funds for the purchasing seeds, fertilisers, and pesticides

that are essential for conducting the activity of agriculture (Ramya, 2016).

Impact of Demonetization

Demonetization has created both positive and negative impact on the nation. Some of the

impacts of Demonetization have been discussed below: -

Demonetization and Black Money

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Demonetization in India: 2016 7

The reason behind the support of the people towards the decision of prime minister was bringing

the problems of demonetization towards the end. Though, the RBI stated that 99% of the money

was deposited back into the bank. According to the opinion of the financial advisor, the hoarders

of black money do not hold it into the cash (Ghosh, 2017).

Terror funding and Demonetization

Demonetization had a significant role in terror funding by increasing the hurdles in terror

funding. Some of the terrorist organizations were known for using the fake currency for

providing the funding to their projects and according to the government, this problem can be

resolved with the help of the process of demonetization (Shirley, 2017). Moreover, the income

tax department of India has seized Rs.474.37 Crores in the form of old and new currency at the

time of demonetization. Though, there were no facts that the money that is seized at the time of

demonetization belong to terror funding or not.

Digital India

The government of India want to see the development of the country and want to push India

towards a cashless economy. Demonetization forced the people to shift towards the digital

transactions for day to day activities. This activity came into existence at the time of

demonetization only later on with the increase in the cash flow in the market public started

making the use of the cash instead of apps or digital wallets (Singhal, 2017).

This activity of the government welcomed the risk of cyber crimes in India as a maximum

number of people was becoming digitalized which gave the chance to cybercriminal to hack the

account details and to grab their details.

Tax payments

The reason behind the support of the people towards the decision of prime minister was bringing

the problems of demonetization towards the end. Though, the RBI stated that 99% of the money

was deposited back into the bank. According to the opinion of the financial advisor, the hoarders

of black money do not hold it into the cash (Ghosh, 2017).

Terror funding and Demonetization

Demonetization had a significant role in terror funding by increasing the hurdles in terror

funding. Some of the terrorist organizations were known for using the fake currency for

providing the funding to their projects and according to the government, this problem can be

resolved with the help of the process of demonetization (Shirley, 2017). Moreover, the income

tax department of India has seized Rs.474.37 Crores in the form of old and new currency at the

time of demonetization. Though, there were no facts that the money that is seized at the time of

demonetization belong to terror funding or not.

Digital India

The government of India want to see the development of the country and want to push India

towards a cashless economy. Demonetization forced the people to shift towards the digital

transactions for day to day activities. This activity came into existence at the time of

demonetization only later on with the increase in the cash flow in the market public started

making the use of the cash instead of apps or digital wallets (Singhal, 2017).

This activity of the government welcomed the risk of cyber crimes in India as a maximum

number of people was becoming digitalized which gave the chance to cybercriminal to hack the

account details and to grab their details.

Tax payments

Demonetization in India: 2016 8

The government is pushed Indians to deposit cash into the banks with the help of which the

government was able to track the people lies in the tax payment categories (Ganesan and

Gajendranayagam, 2017). There was a rise in the income taxpayers with the 9.1 million new

taxpayers who were added to the slab and this rise was 80% over the year. This rise in the

number of taxpaying citizens in the country has been credited because of demonetization.

GDP

Demonetization has created an adverse impact on the GDP of the country. The key contributor to

the economic slowdown was the ban on the old notes. The GDP for the April-June quarter was

slipping to 5.7%. Moreover, the World Bank has reduced the India GDP growth prediction to 7%

for the year 2017-18 due to demonetization and implementation of GST in India (Singh and

Singh, 2016).

MSMEs and demonetization

Demonetization, the decision of the government of India has created a lasting impact on the

medium, small and micro-enterprises. Micro industries were affected by the worst which leads to

the closure of industries because they were not prepared for the effects of the decisions and

several medium and small enterprises turned towards the digitalization. The growth rate of the

micro industry went as low as 1%. Still, the MSME sector is trying to recover from the drastic

changes that took place at that point of time but the demonetization forced the MSME sector to

become friendlier towards the digital arenas and to accept the changes that took place in the

nation (Krishnan, 2017).

On daily wage workers

The government is pushed Indians to deposit cash into the banks with the help of which the

government was able to track the people lies in the tax payment categories (Ganesan and

Gajendranayagam, 2017). There was a rise in the income taxpayers with the 9.1 million new

taxpayers who were added to the slab and this rise was 80% over the year. This rise in the

number of taxpaying citizens in the country has been credited because of demonetization.

GDP

Demonetization has created an adverse impact on the GDP of the country. The key contributor to

the economic slowdown was the ban on the old notes. The GDP for the April-June quarter was

slipping to 5.7%. Moreover, the World Bank has reduced the India GDP growth prediction to 7%

for the year 2017-18 due to demonetization and implementation of GST in India (Singh and

Singh, 2016).

MSMEs and demonetization

Demonetization, the decision of the government of India has created a lasting impact on the

medium, small and micro-enterprises. Micro industries were affected by the worst which leads to

the closure of industries because they were not prepared for the effects of the decisions and

several medium and small enterprises turned towards the digitalization. The growth rate of the

micro industry went as low as 1%. Still, the MSME sector is trying to recover from the drastic

changes that took place at that point of time but the demonetization forced the MSME sector to

become friendlier towards the digital arenas and to accept the changes that took place in the

nation (Krishnan, 2017).

On daily wage workers

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Demonetization in India: 2016 9

A key percentage of Workers in India are part of the relaxed economy which means they make

use of money to fulfil their expenditures. The lacks of cash in the nation made them jobless as

the employer were not able to make payment on a daily basis. Conferring to CMIE’s Consumer

Pyramids Household Surveys (CPHS), more than 1.5 million Indian workers lost their jobs

throughout the last quarter of the fiscal year 2016-2017. The predicted employment at the time of

demonetization was only 405 million as equalled to the 406.5 million throughout the earlier 4

months (Kumar, 2017).

(Source: Sanilkumar, 2017)

Quantitative analysis of the Overall Impact

Considering the statistics, printed in the handbook of statistics on economy of India by RBI,

GDP at the Marketplace declined by 1% comparing it with the previous financial year. The table

A key percentage of Workers in India are part of the relaxed economy which means they make

use of money to fulfil their expenditures. The lacks of cash in the nation made them jobless as

the employer were not able to make payment on a daily basis. Conferring to CMIE’s Consumer

Pyramids Household Surveys (CPHS), more than 1.5 million Indian workers lost their jobs

throughout the last quarter of the fiscal year 2016-2017. The predicted employment at the time of

demonetization was only 405 million as equalled to the 406.5 million throughout the earlier 4

months (Kumar, 2017).

(Source: Sanilkumar, 2017)

Quantitative analysis of the Overall Impact

Considering the statistics, printed in the handbook of statistics on economy of India by RBI,

GDP at the Marketplace declined by 1% comparing it with the previous financial year. The table

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Demonetization in India: 2016

10

which is given below also reflects that the GDP lost its growth line of 4 years in the fiscal year

2016-2017. In the year 2012-2013, there was a rise in the growth rate of GDP from 5.46 to

8.01% in the year 2015-2016.

(Source: Kumar, 2017)

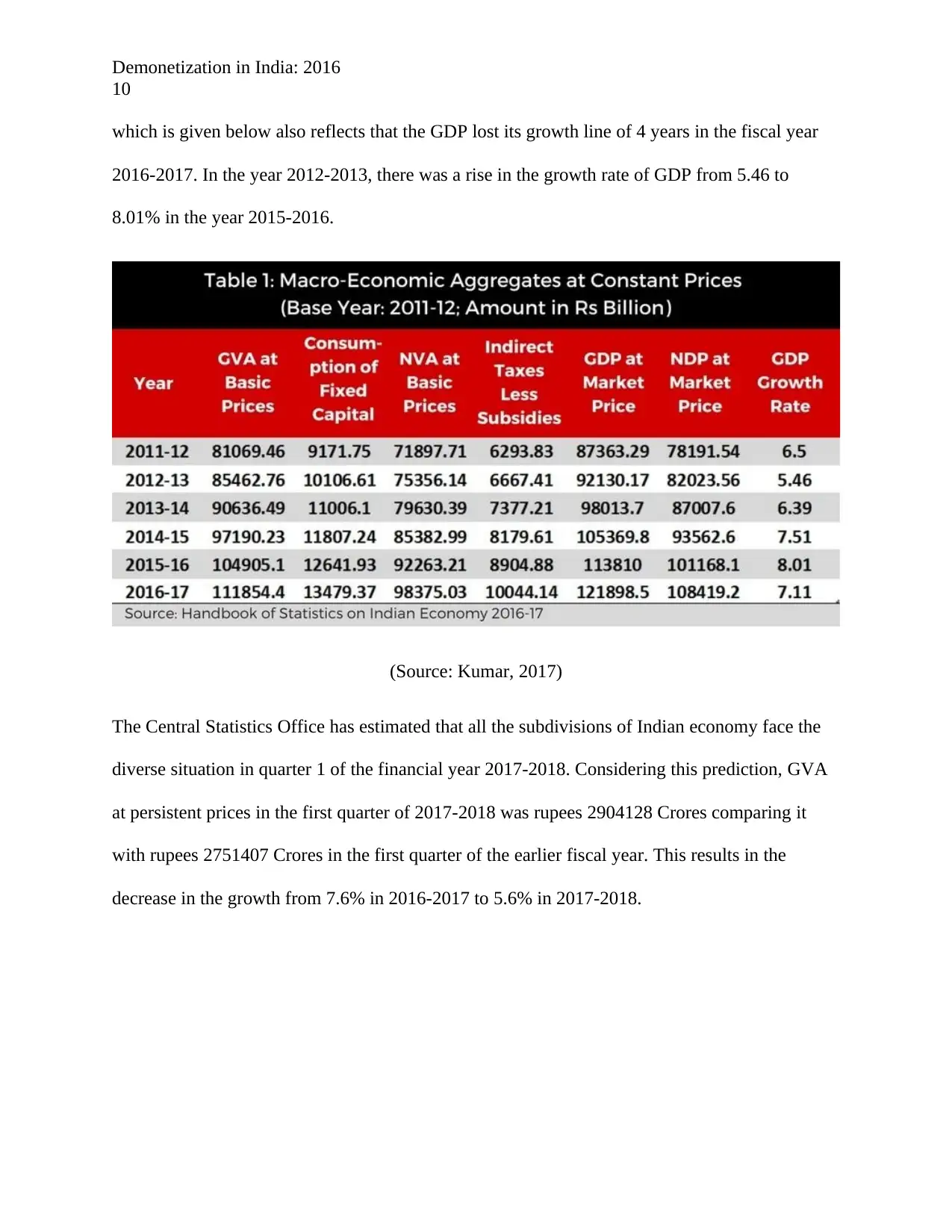

The Central Statistics Office has estimated that all the subdivisions of Indian economy face the

diverse situation in quarter 1 of the financial year 2017-2018. Considering this prediction, GVA

at persistent prices in the first quarter of 2017-2018 was rupees 2904128 Crores comparing it

with rupees 2751407 Crores in the first quarter of the earlier fiscal year. This results in the

decrease in the growth from 7.6% in 2016-2017 to 5.6% in 2017-2018.

10

which is given below also reflects that the GDP lost its growth line of 4 years in the fiscal year

2016-2017. In the year 2012-2013, there was a rise in the growth rate of GDP from 5.46 to

8.01% in the year 2015-2016.

(Source: Kumar, 2017)

The Central Statistics Office has estimated that all the subdivisions of Indian economy face the

diverse situation in quarter 1 of the financial year 2017-2018. Considering this prediction, GVA

at persistent prices in the first quarter of 2017-2018 was rupees 2904128 Crores comparing it

with rupees 2751407 Crores in the first quarter of the earlier fiscal year. This results in the

decrease in the growth from 7.6% in 2016-2017 to 5.6% in 2017-2018.

Demonetization in India: 2016

11

(Source: Kumar, 2017)

There is numerous sector present in the economy of India such as Constructive, Agriculture,

fishing and forestry which hire an enormous regular wage labours and have liquidity preference

observers a failure in the growth (Thakur and Kaur, 2017). Manufacturing is one of the most

significant indicators that contribute to the economic development and employment that has

11

(Source: Kumar, 2017)

There is numerous sector present in the economy of India such as Constructive, Agriculture,

fishing and forestry which hire an enormous regular wage labours and have liquidity preference

observers a failure in the growth (Thakur and Kaur, 2017). Manufacturing is one of the most

significant indicators that contribute to the economic development and employment that has

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 23

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.