IF2209 Derivatives Coursework: Analysis of Option Pricing Models

VerifiedAdded on 2023/06/15

|32

|6924

|137

Homework Assignment

AI Summary

This document presents a comprehensive solution to a derivatives coursework assignment, focusing on option pricing models and trading strategies. It begins with an analysis of put-call parity using linear regression to estimate parameters such as dividend yield and risk-free interest rate. The solution then delves into calculating implied volatility using the Black-Scholes-Merton model and Excel's Solver function, followed by an examination of the relationship between strike price and implied volatility, including quadratic fitting and outlier analysis. Furthermore, the coursework explores various option strategies like bull call spreads and seagull strategies, along with payoff calculations. The document also includes a two-period binomial model for European vanilla and digital options. The solution is supported by tables, figures, and regression analyses, providing a detailed and well-structured approach to understanding derivatives and option pricing. Desklib offers a wealth of similar solved assignments and past papers for students.

Page1 of32

Derivatives Coursework

Student Name: Student ID:

Unit Name: Unit ID:

Derivatives Coursework

Student Name: Student ID:

Unit Name: Unit ID:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page2 of32

Table of tables

Table 1: Regression analysis including R ................................................................................................ 3

Table2: Strike vs Cobs-Pobs linear line fit plot ........................................................................................ 5

Table3: K residual plot for Cobs-Pobs values .......................................................................................... 5

Table 4: Solution table for σimpl for given K .......................................................................................... 7

Table 5:σimpl for given K ....................................................................................................................

Table6: σimplvs strike rate K plot ...........................................................................................................

Table 7:ANOVA for quadratic fit for table 3 data ................................................................................... 9

Table 8: Regression analysis values excluding three outlier values ....................................................... 11

Table 9: Bull Spread Strategy.................................................................................................................

Table 10: Bull Spread Payoff matrix ......................................................................................................

Table 11: Seagull strategy values ...........................................................................................................

Table 12: Seagull payoff values .............................................................................................................

Table 13: Short put butterflypayoff values ............................................................................................. 1

Table 14: Two-period binomial modelwith European vanilla payoff values ......................................... 19

Table 15: Two-period binomial modelwith Digital payoff values ......................................................... 21

Table 16: Regression Analysis for Question 1 with residual output ...................................................... 26

Table 17: Question 2 Solution for implied volatility .............................................................................. 28

Table 18: Regression Analysis for Question 2 with outliers .................................................................. 30

Table 19: Residual values with outliers for Question 2 .......................................................................... 31

Table 20: Regression Analysis for Question 2 without outliers ............................................................. 31

Table 21: Black Scholes calculation for Question 3 ............................................................................... 32

Table of figures

Figure 1: Scatter plot excluding outliers 10

Figure 2: Bull spread graph ...................................................................................................................

Figure 3: Seagull payoff graph ...............................................................................................................

Figure 4: Residual Plot for Question 1 ................................................................................................... 2

Table of tables

Table 1: Regression analysis including R ................................................................................................ 3

Table2: Strike vs Cobs-Pobs linear line fit plot ........................................................................................ 5

Table3: K residual plot for Cobs-Pobs values .......................................................................................... 5

Table 4: Solution table for σimpl for given K .......................................................................................... 7

Table 5:σimpl for given K ....................................................................................................................

Table6: σimplvs strike rate K plot ...........................................................................................................

Table 7:ANOVA for quadratic fit for table 3 data ................................................................................... 9

Table 8: Regression analysis values excluding three outlier values ....................................................... 11

Table 9: Bull Spread Strategy.................................................................................................................

Table 10: Bull Spread Payoff matrix ......................................................................................................

Table 11: Seagull strategy values ...........................................................................................................

Table 12: Seagull payoff values .............................................................................................................

Table 13: Short put butterflypayoff values ............................................................................................. 1

Table 14: Two-period binomial modelwith European vanilla payoff values ......................................... 19

Table 15: Two-period binomial modelwith Digital payoff values ......................................................... 21

Table 16: Regression Analysis for Question 1 with residual output ...................................................... 26

Table 17: Question 2 Solution for implied volatility .............................................................................. 28

Table 18: Regression Analysis for Question 2 with outliers .................................................................. 30

Table 19: Residual values with outliers for Question 2 .......................................................................... 31

Table 20: Regression Analysis for Question 2 without outliers ............................................................. 31

Table 21: Black Scholes calculation for Question 3 ............................................................................... 32

Table of figures

Figure 1: Scatter plot excluding outliers 10

Figure 2: Bull spread graph ...................................................................................................................

Figure 3: Seagull payoff graph ...............................................................................................................

Figure 4: Residual Plot for Question 1 ................................................................................................... 2

Page3 of32

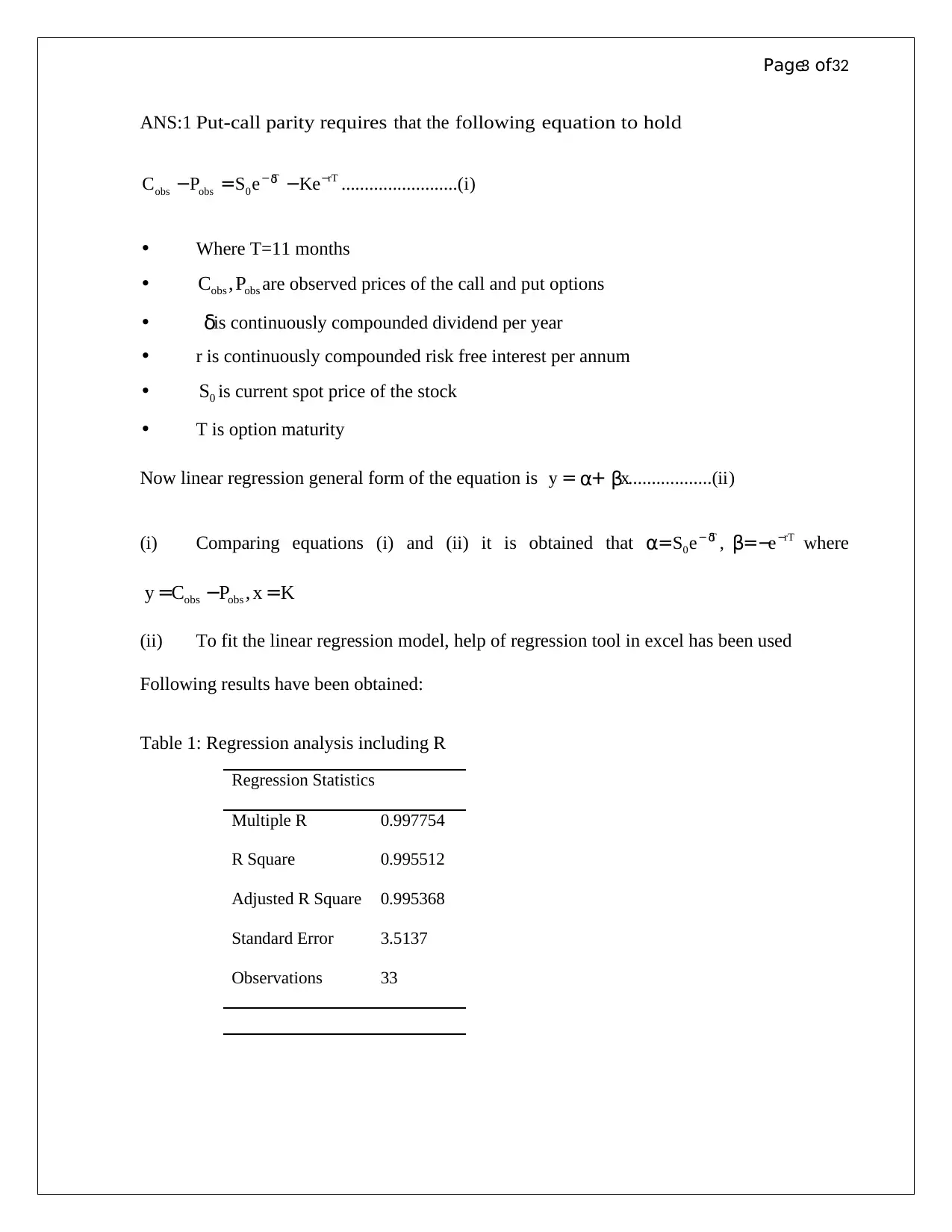

ANS:1 Put-call parity requires that the following equation to hold

).....(....................0 iKeeSPC rTT

obsobs

−− −=− δ

• Where T=11 months

• obsobs PC , are observed prices of the call and put options

• δis continuously compounded dividend per year

• r is continuously compounded risk free interest per annum

• 0S is current spot price of the stock

• T is option maturity

Now linear regression general form of the equation is )........(.......... iixy βα+=

(i) Comparing equations (i) and (ii) it is obtained that rTT eeS −− −== βα δ ,0 where

KxPCy obsobs =−= ,

(ii) To fit the linear regression model, help of regression tool in excel has been used

Following results have been obtained:

Table 1: Regression analysis including R

Regression Statistics

Multiple R 0.997754

R Square 0.995512

Adjusted R Square 0.995368

Standard Error 3.5137

Observations 33

ANS:1 Put-call parity requires that the following equation to hold

).....(....................0 iKeeSPC rTT

obsobs

−− −=− δ

• Where T=11 months

• obsobs PC , are observed prices of the call and put options

• δis continuously compounded dividend per year

• r is continuously compounded risk free interest per annum

• 0S is current spot price of the stock

• T is option maturity

Now linear regression general form of the equation is )........(.......... iixy βα+=

(i) Comparing equations (i) and (ii) it is obtained that rTT eeS −− −== βα δ ,0 where

KxPCy obsobs =−= ,

(ii) To fit the linear regression model, help of regression tool in excel has been used

Following results have been obtained:

Table 1: Regression analysis including R

Regression Statistics

Multiple R 0.997754

R Square 0.995512

Adjusted R Square 0.995368

Standard Error 3.5137

Observations 33

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

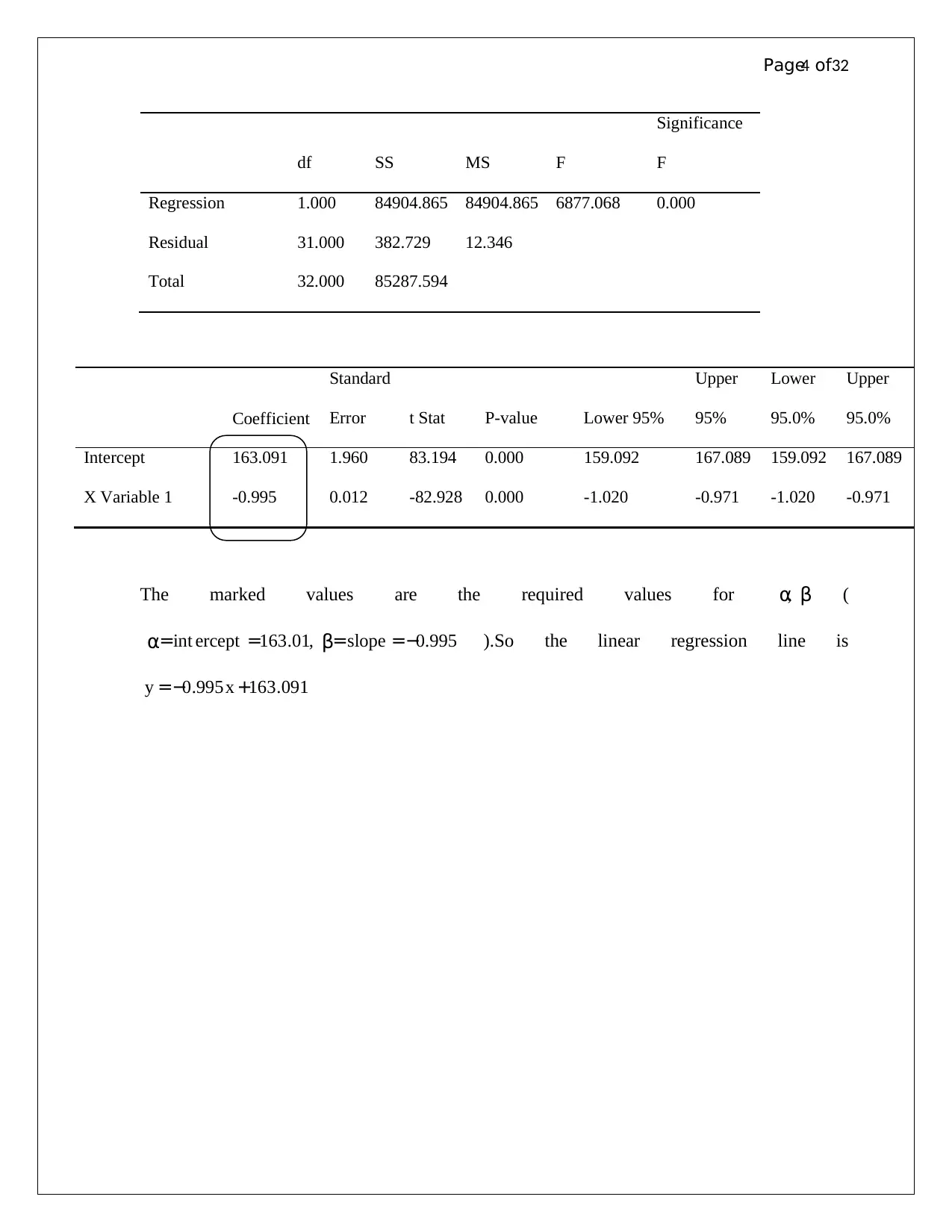

Page4 of32

The marked values are the required values for βα, (

995.0,01.163int −==== slopeercept βα ).So the linear regression line is

091.163995.0 +−= xy

df SS MS F

Significance

F

Regression 1.000 84904.865 84904.865 6877.068 0.000

Residual 31.000 382.729 12.346

Total 32.000 85287.594

Coefficient

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 163.091 1.960 83.194 0.000 159.092 167.089 159.092 167.089

X Variable 1 -0.995 0.012 -82.928 0.000 -1.020 -0.971 -1.020 -0.971

The marked values are the required values for βα, (

995.0,01.163int −==== slopeercept βα ).So the linear regression line is

091.163995.0 +−= xy

df SS MS F

Significance

F

Regression 1.000 84904.865 84904.865 6877.068 0.000

Residual 31.000 382.729 12.346

Total 32.000 85287.594

Coefficient

Standard

Error t Stat P-value Lower 95%

Upper

95%

Lower

95.0%

Upper

95.0%

Intercept 163.091 1.960 83.194 0.000 159.092 167.089 159.092 167.089

X Variable 1 -0.995 0.012 -82.928 0.000 -1.020 -0.971 -1.020 -0.971

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page5 of32

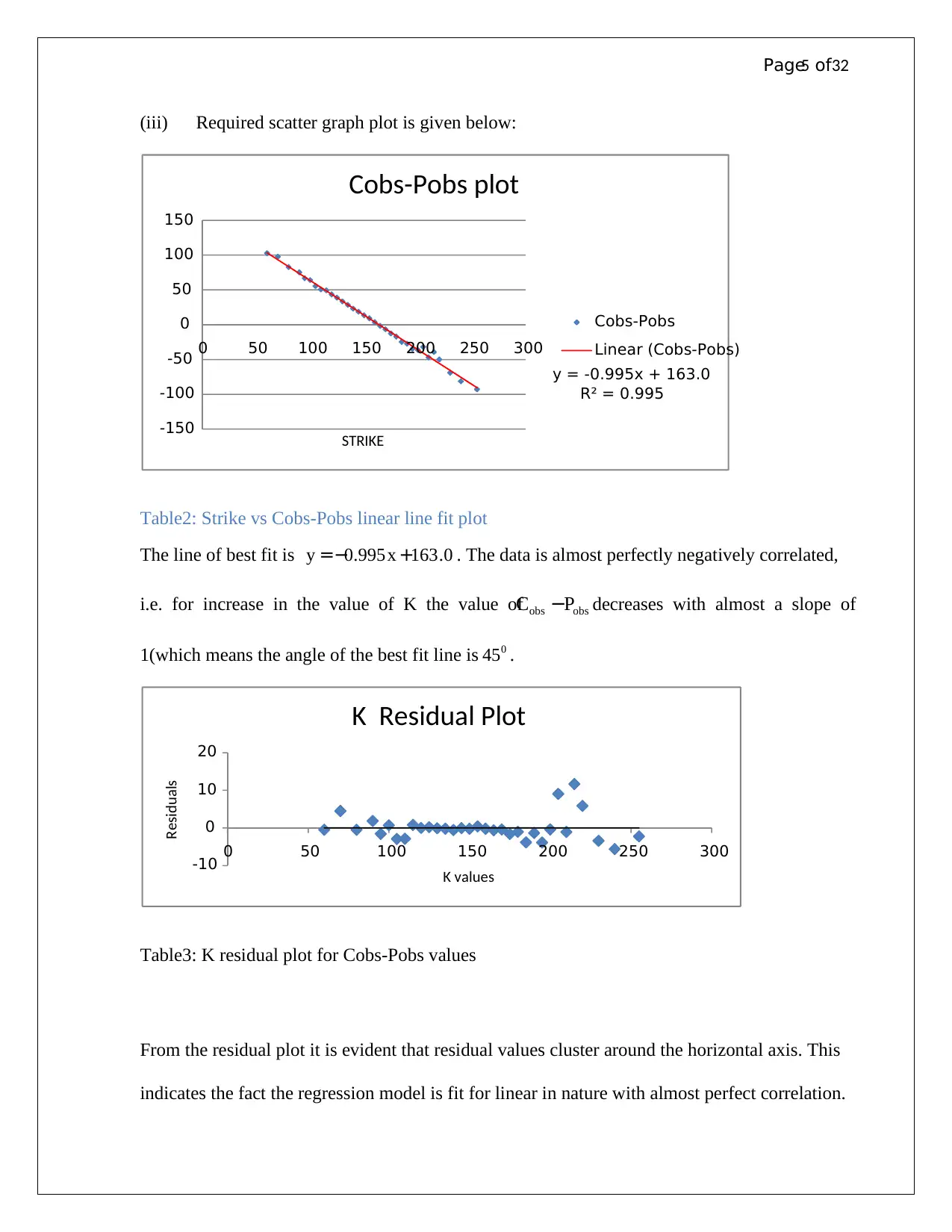

(iii) Required scatter graph plot is given below:

Table2: Strike vs Cobs-Pobs linear line fit plot

The line of best fit is 0.163995.0 +−= xy . The data is almost perfectly negatively correlated,

i.e. for increase in the value of K the value of obsobs PC − decreases with almost a slope of

1(which means the angle of the best fit line is 0

45 .

Table3: K residual plot for Cobs-Pobs values

From the residual plot it is evident that residual values cluster around the horizontal axis. This

indicates the fact the regression model is fit for linear in nature with almost perfect correlation.

y = -0.995x + 163.0

R² = 0.995

-150

-100

-50

0

50

100

150

0 50 100 150 200 250 300

STRIKE

Cobs-Pobs plot

Cobs-Pobs

Linear (Cobs-Pobs)

-10

0

10

20

0 50 100 150 200 250 300

Residuals

K values

K Residual Plot

(iii) Required scatter graph plot is given below:

Table2: Strike vs Cobs-Pobs linear line fit plot

The line of best fit is 0.163995.0 +−= xy . The data is almost perfectly negatively correlated,

i.e. for increase in the value of K the value of obsobs PC − decreases with almost a slope of

1(which means the angle of the best fit line is 0

45 .

Table3: K residual plot for Cobs-Pobs values

From the residual plot it is evident that residual values cluster around the horizontal axis. This

indicates the fact the regression model is fit for linear in nature with almost perfect correlation.

y = -0.995x + 163.0

R² = 0.995

-150

-100

-50

0

50

100

150

0 50 100 150 200 250 300

STRIKE

Cobs-Pobs plot

Cobs-Pobs

Linear (Cobs-Pobs)

-10

0

10

20

0 50 100 150 200 250 300

Residuals

K values

K Residual Plot

Page6 of32

Now for 40.1650 =S and T=11/12, 995.0,01.163 −== βα following calculations can be

performed:

0158.0

40.165

01.163

ln*

11

12

ln*

1

ln

0

0

0

0

==>

−==>

−==>

=−>−=

==>

=

−

−

δ

δ

α

δ

α

δ

α

α

δ

δ

ST

S

T

e

S

eS

T

T

And

00547.0

)995.0ln(*

11

12

)ln(*

1

)ln(

==>

−==>

−=−=>

−=−=>

−= −

r

r

T

r

rT

e rT

β

β

β

Now for 40.1650 =S and T=11/12, 995.0,01.163 −== βα following calculations can be

performed:

0158.0

40.165

01.163

ln*

11

12

ln*

1

ln

0

0

0

0

==>

−==>

−==>

=−>−=

==>

=

−

−

δ

δ

α

δ

α

δ

α

α

δ

δ

ST

S

T

e

S

eS

T

T

And

00547.0

)995.0ln(*

11

12

)ln(*

1

)ln(

==>

−==>

−=−=>

−=−=>

−= −

r

r

T

r

rT

e rT

β

β

β

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page7 of32

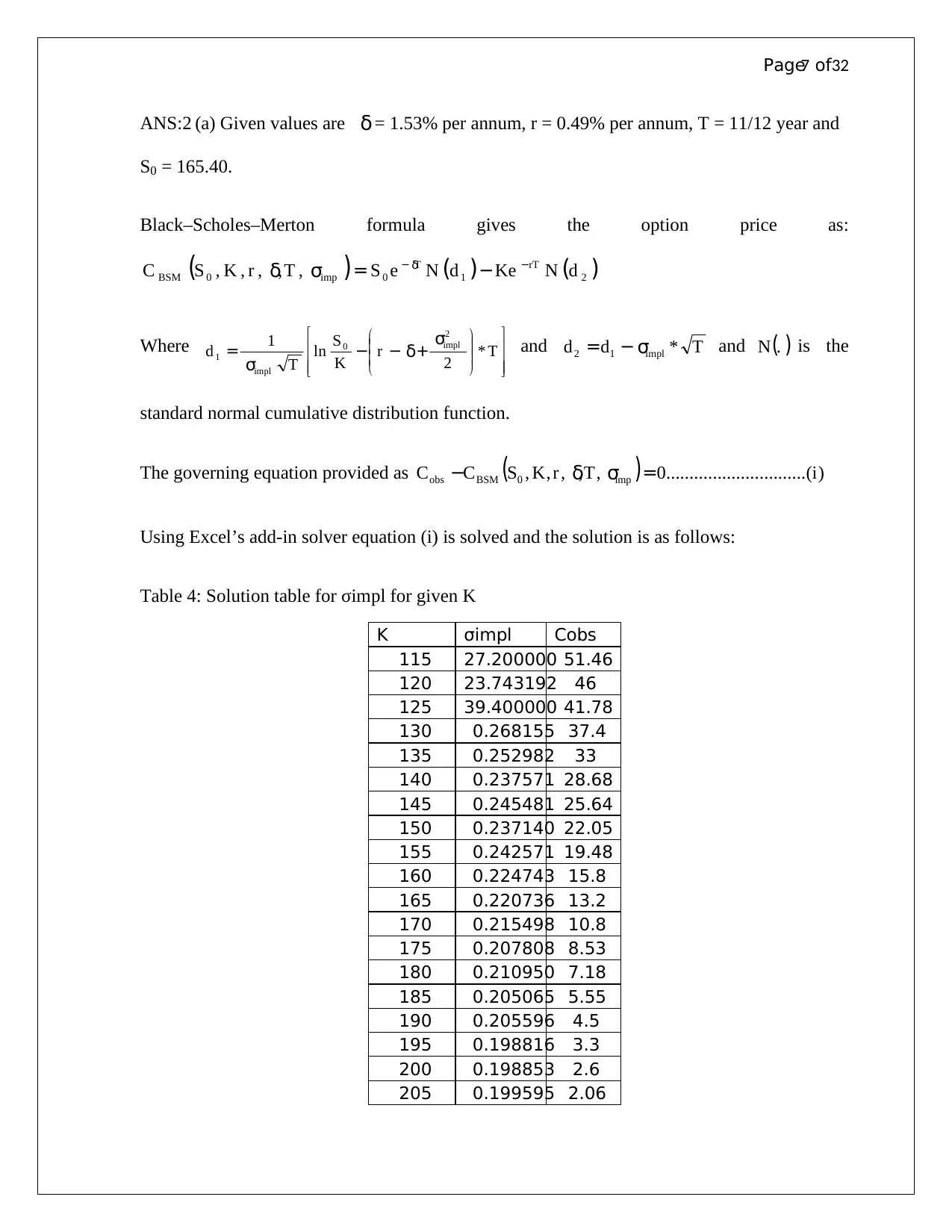

ANS:2 (a) Given values are δ = 1.53% per annum, r = 0.49% per annum, T = 11/12 year and

S0 = 165.40.

Black–Scholes–Merton formula gives the option price as:

( ) ( ) ( )2100 ,,,,, dNKedNeSTrKSC rTT

impBSM

−− −= δ

σδ

Where

+−−= Tr

K

S

T

d impl

impl

*

2

ln

1 2

0

1

σ

δ

σ

and Tdd impl *12 σ−= and ( ).N is the

standard normal cumulative distribution function.

The governing equation provided as ( ) )(..............................0,,,,,0 iTrKSCC impBSMobs =− σδ

Using Excel’s add-in solver equation (i) is solved and the solution is as follows:

Table 4: Solution table for σimpl for given K

K σimpl Cobs

115 27.200000 51.46

120 23.743192 46

125 39.400000 41.78

130 0.268155 37.4

135 0.252982 33

140 0.237571 28.68

145 0.245481 25.64

150 0.237140 22.05

155 0.242571 19.48

160 0.224743 15.8

165 0.220736 13.2

170 0.215498 10.8

175 0.207808 8.53

180 0.210950 7.18

185 0.205065 5.55

190 0.205596 4.5

195 0.198816 3.3

200 0.198853 2.6

205 0.199595 2.06

ANS:2 (a) Given values are δ = 1.53% per annum, r = 0.49% per annum, T = 11/12 year and

S0 = 165.40.

Black–Scholes–Merton formula gives the option price as:

( ) ( ) ( )2100 ,,,,, dNKedNeSTrKSC rTT

impBSM

−− −= δ

σδ

Where

+−−= Tr

K

S

T

d impl

impl

*

2

ln

1 2

0

1

σ

δ

σ

and Tdd impl *12 σ−= and ( ).N is the

standard normal cumulative distribution function.

The governing equation provided as ( ) )(..............................0,,,,,0 iTrKSCC impBSMobs =− σδ

Using Excel’s add-in solver equation (i) is solved and the solution is as follows:

Table 4: Solution table for σimpl for given K

K σimpl Cobs

115 27.200000 51.46

120 23.743192 46

125 39.400000 41.78

130 0.268155 37.4

135 0.252982 33

140 0.237571 28.68

145 0.245481 25.64

150 0.237140 22.05

155 0.242571 19.48

160 0.224743 15.8

165 0.220736 13.2

170 0.215498 10.8

175 0.207808 8.53

180 0.210950 7.18

185 0.205065 5.55

190 0.205596 4.5

195 0.198816 3.3

200 0.198853 2.6

205 0.199595 2.06

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page8 of32

K σimpl Cobs

210 0.203694 1.73

215 0.206262 1.42

220 0.203330 1.04

230 0.202240 0.6

240 0.202373 0.35

255 0.210170 0.2

Note: Detailed calculations attached in the Appendix

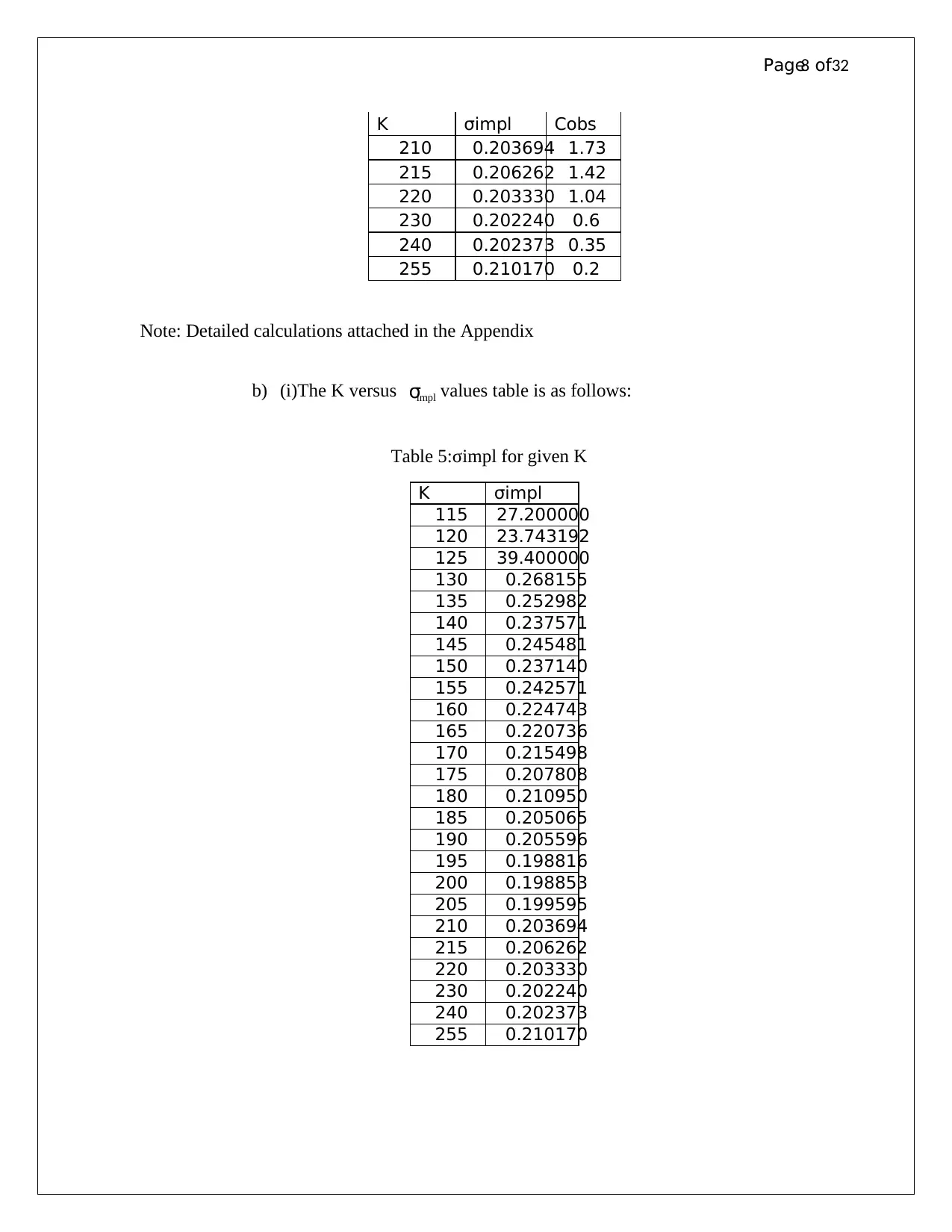

b) (i)The K versus implσ values table is as follows:

Table 5:σimpl for given K

K σimpl

115 27.200000

120 23.743192

125 39.400000

130 0.268155

135 0.252982

140 0.237571

145 0.245481

150 0.237140

155 0.242571

160 0.224743

165 0.220736

170 0.215498

175 0.207808

180 0.210950

185 0.205065

190 0.205596

195 0.198816

200 0.198853

205 0.199595

210 0.203694

215 0.206262

220 0.203330

230 0.202240

240 0.202373

255 0.210170

K σimpl Cobs

210 0.203694 1.73

215 0.206262 1.42

220 0.203330 1.04

230 0.202240 0.6

240 0.202373 0.35

255 0.210170 0.2

Note: Detailed calculations attached in the Appendix

b) (i)The K versus implσ values table is as follows:

Table 5:σimpl for given K

K σimpl

115 27.200000

120 23.743192

125 39.400000

130 0.268155

135 0.252982

140 0.237571

145 0.245481

150 0.237140

155 0.242571

160 0.224743

165 0.220736

170 0.215498

175 0.207808

180 0.210950

185 0.205065

190 0.205596

195 0.198816

200 0.198853

205 0.199595

210 0.203694

215 0.206262

220 0.203330

230 0.202240

240 0.202373

255 0.210170

Page9 of32

The graphical plot between K and implσ is as follows:

Table6: σimplvs strike rate K plot

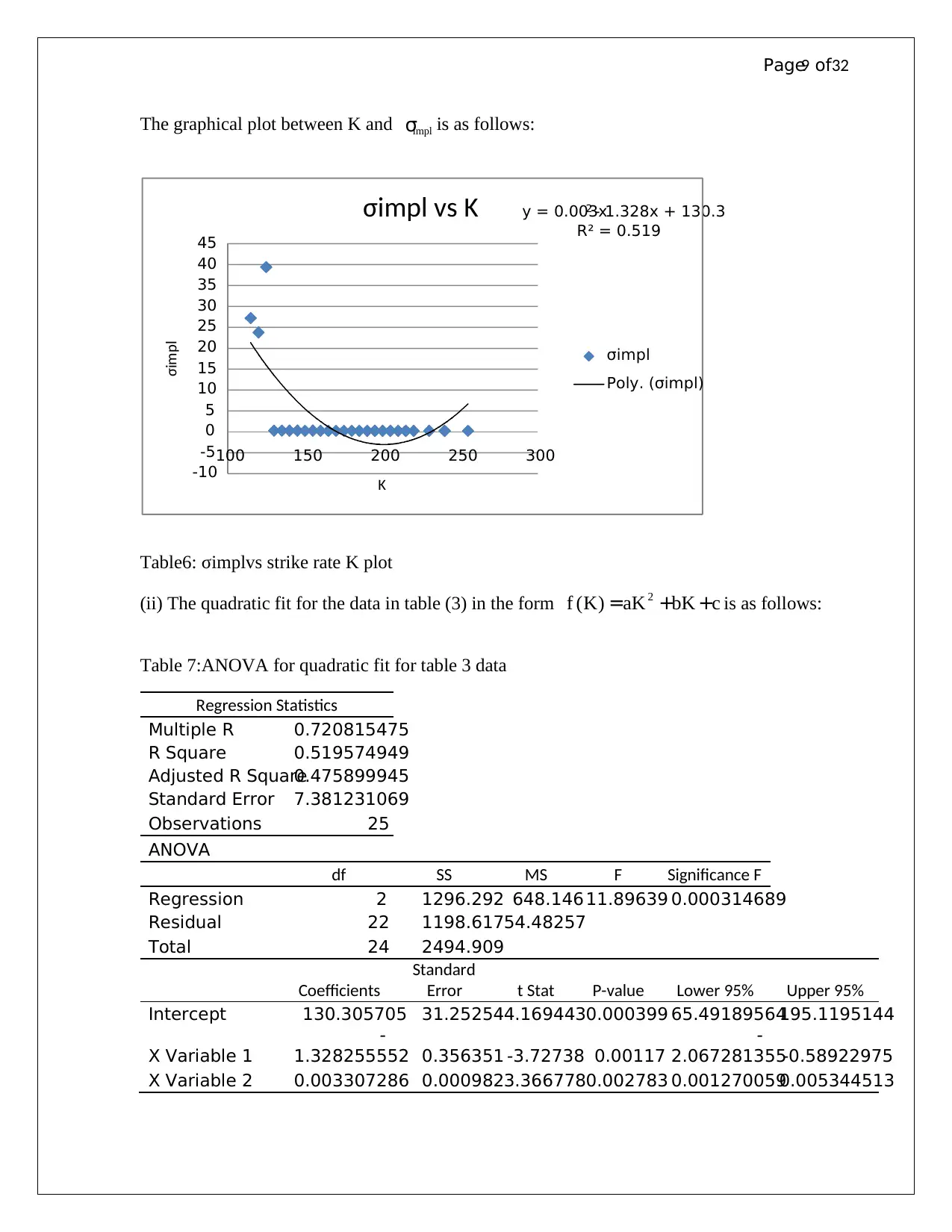

(ii) The quadratic fit for the data in table (3) in the form cbKaKKf ++= 2

)( is as follows:

Table 7:ANOVA for quadratic fit for table 3 data

Regression Statistics

Multiple R 0.720815475

R Square 0.519574949

Adjusted R Square0.475899945

Standard Error 7.381231069

Observations 25

ANOVA

df SS MS F Significance F

Regression 2 1296.292 648.146 11.89639 0.000314689

Residual 22 1198.61754.48257

Total 24 2494.909

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept 130.305705 31.252544.1694430.000399 65.49189564195.1195144

X Variable 1

-

1.328255552 0.356351 -3.72738 0.00117

-

2.067281355-0.58922975

X Variable 2 0.003307286 0.0009823.3667780.002783 0.0012700590.005344513

y = 0.003x2 - 1.328x + 130.3

R² = 0.519

-10

-5

0

5

10

15

20

25

30

35

40

45

100 150 200 250 300

σimpl

K

σimpl vs K

σimpl

Poly. (σimpl)

The graphical plot between K and implσ is as follows:

Table6: σimplvs strike rate K plot

(ii) The quadratic fit for the data in table (3) in the form cbKaKKf ++= 2

)( is as follows:

Table 7:ANOVA for quadratic fit for table 3 data

Regression Statistics

Multiple R 0.720815475

R Square 0.519574949

Adjusted R Square0.475899945

Standard Error 7.381231069

Observations 25

ANOVA

df SS MS F Significance F

Regression 2 1296.292 648.146 11.89639 0.000314689

Residual 22 1198.61754.48257

Total 24 2494.909

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept 130.305705 31.252544.1694430.000399 65.49189564195.1195144

X Variable 1

-

1.328255552 0.356351 -3.72738 0.00117

-

2.067281355-0.58922975

X Variable 2 0.003307286 0.0009823.3667780.002783 0.0012700590.005344513

y = 0.003x2 - 1.328x + 130.3

R² = 0.519

-10

-5

0

5

10

15

20

25

30

35

40

45

100 150 200 250 300

σimpl

K

σimpl vs K

σimpl

Poly. (σimpl)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Page10 of32

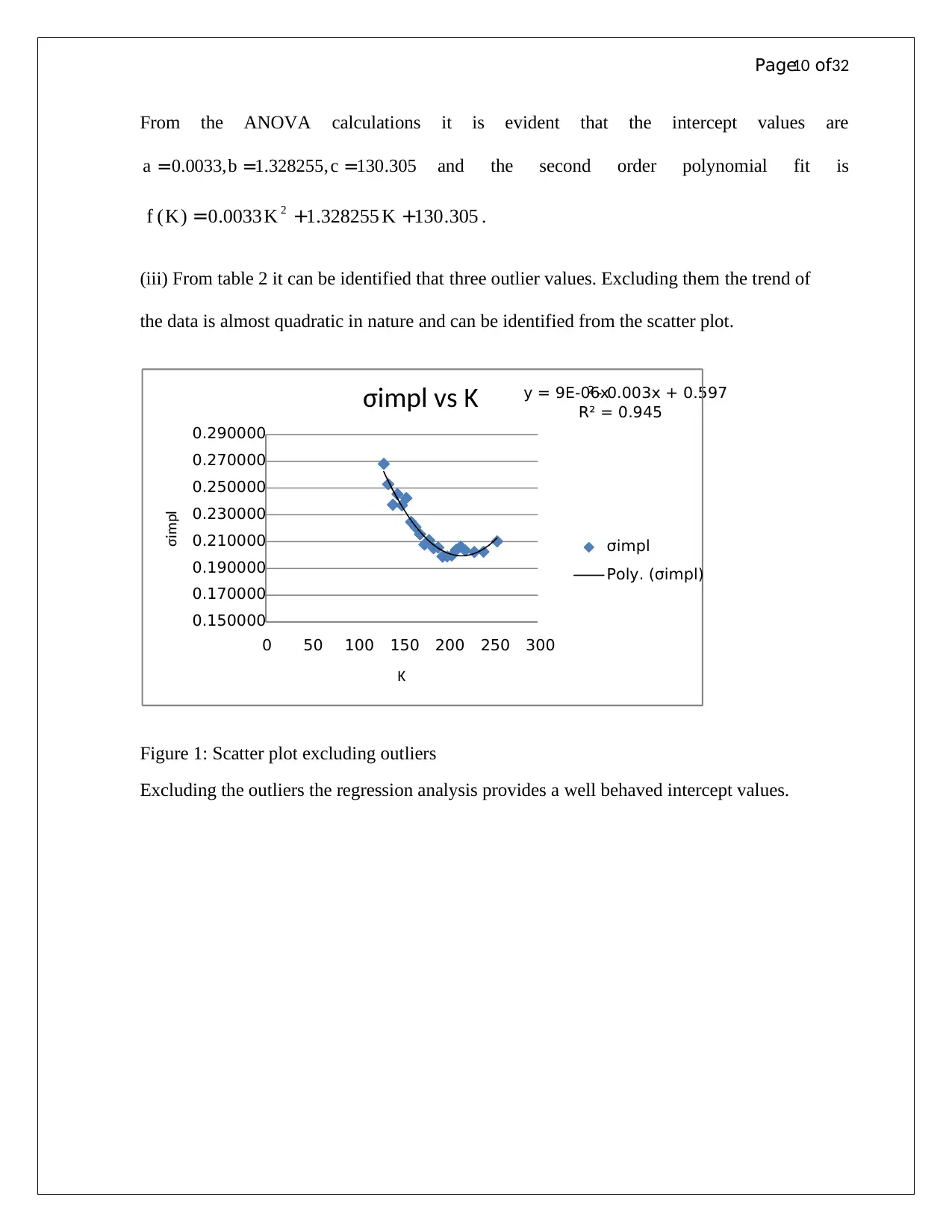

From the ANOVA calculations it is evident that the intercept values are

305.130,328255.1,0033.0 === cba and the second order polynomial fit is

305.130328255.10033.0)( 2 ++= KKKf .

(iii) From table 2 it can be identified that three outlier values. Excluding them the trend of

the data is almost quadratic in nature and can be identified from the scatter plot.

Figure 1: Scatter plot excluding outliers

Excluding the outliers the regression analysis provides a well behaved intercept values.

y = 9E-06x2 - 0.003x + 0.597

R² = 0.945

0.150000

0.170000

0.190000

0.210000

0.230000

0.250000

0.270000

0.290000

0 50 100 150 200 250 300

σimpl

K

σimpl vs K

σimpl

Poly. (σimpl)

From the ANOVA calculations it is evident that the intercept values are

305.130,328255.1,0033.0 === cba and the second order polynomial fit is

305.130328255.10033.0)( 2 ++= KKKf .

(iii) From table 2 it can be identified that three outlier values. Excluding them the trend of

the data is almost quadratic in nature and can be identified from the scatter plot.

Figure 1: Scatter plot excluding outliers

Excluding the outliers the regression analysis provides a well behaved intercept values.

y = 9E-06x2 - 0.003x + 0.597

R² = 0.945

0.150000

0.170000

0.190000

0.210000

0.230000

0.250000

0.270000

0.290000

0 50 100 150 200 250 300

σimpl

K

σimpl vs K

σimpl

Poly. (σimpl)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Page11 of32

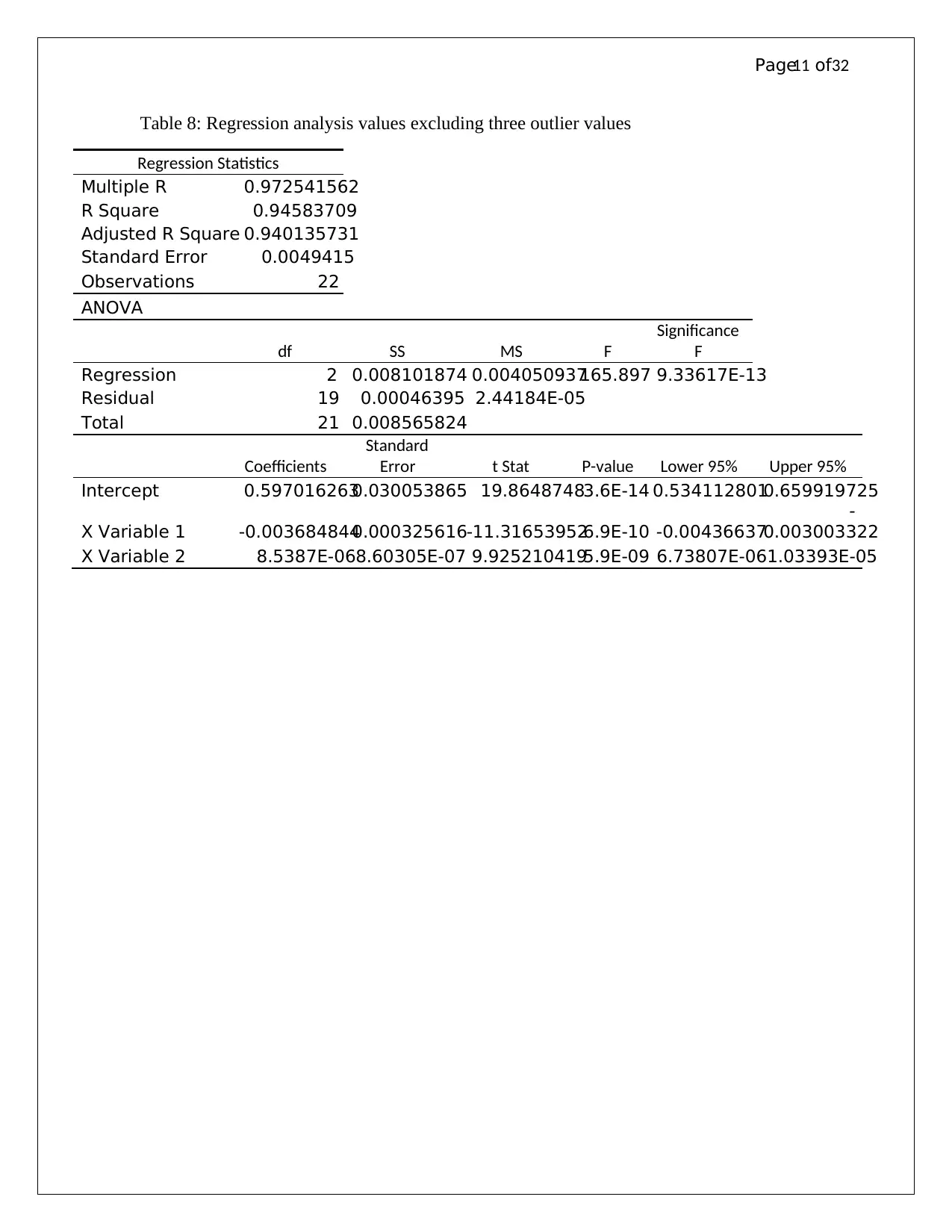

Table 8: Regression analysis values excluding three outlier values

Regression Statistics

Multiple R 0.972541562

R Square 0.94583709

Adjusted R Square 0.940135731

Standard Error 0.0049415

Observations 22

ANOVA

df SS MS F

Significance

F

Regression 2 0.008101874 0.004050937165.897 9.33617E-13

Residual 19 0.00046395 2.44184E-05

Total 21 0.008565824

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept 0.5970162630.030053865 19.86487483.6E-14 0.5341128010.659919725

X Variable 1 -0.0036848440.000325616-11.316539526.9E-10 -0.00436637

-

0.003003322

X Variable 2 8.5387E-068.60305E-07 9.9252104195.9E-09 6.73807E-061.03393E-05

Table 8: Regression analysis values excluding three outlier values

Regression Statistics

Multiple R 0.972541562

R Square 0.94583709

Adjusted R Square 0.940135731

Standard Error 0.0049415

Observations 22

ANOVA

df SS MS F

Significance

F

Regression 2 0.008101874 0.004050937165.897 9.33617E-13

Residual 19 0.00046395 2.44184E-05

Total 21 0.008565824

Coefficients

Standard

Error t Stat P-value Lower 95% Upper 95%

Intercept 0.5970162630.030053865 19.86487483.6E-14 0.5341128010.659919725

X Variable 1 -0.0036848440.000325616-11.316539526.9E-10 -0.00436637

-

0.003003322

X Variable 2 8.5387E-068.60305E-07 9.9252104195.9E-09 6.73807E-061.03393E-05

Page12 of32

ANS:3

(a) Given data values yearTKKyearryearS impl 1,80,70,/%8,/%35,70 210 ====== σ

Black–Scholes–Merton formula gives the option price as:

( ) ( ) ( )2100 ,,,,, dNKedNeSTrKSC rTT

impBSM

−− −= δ

σδ

Where

+−−= Tr

K

S

T

d impl

impl

*

2

ln

1 2

0

1

σ

δ

σ

and Tdd impl *12 σ−= and ( ).N is the

standard normal cumulative distribution function.

Now for 70=K ,

40357.0

1*

2

35.0*35.0

008.0

70

70

ln

1*35.0

1

1

1

==>

+−+=

d

d

Hence )05357.0(1*35.0040357.02 =−=d

So,

( ) ( ) ( )

)

(1282.12)05357.0(70040357.07035.0,1,0,08.0,70,70 08.00

value

timeNeNeC BSM =−= −−

Now for 80=K ,

022053.0

1*

2

35.0*35.0

008.0

80

70

ln

1*35.0

1

1

1

==>

+−+=

d

d

Hence )327946.0(1*35.0022053.02 =−=d

Now,

( ) ( ) ( )

)(

18.8)327946.0(80022053.07035.0,1,0,08.0,80,70 08.00

valuetime

NeNeC BSM =−= −−

Note: The C(BSM) value got evaluated in Excel using the above formulae.

ANS:3

(a) Given data values yearTKKyearryearS impl 1,80,70,/%8,/%35,70 210 ====== σ

Black–Scholes–Merton formula gives the option price as:

( ) ( ) ( )2100 ,,,,, dNKedNeSTrKSC rTT

impBSM

−− −= δ

σδ

Where

+−−= Tr

K

S

T

d impl

impl

*

2

ln

1 2

0

1

σ

δ

σ

and Tdd impl *12 σ−= and ( ).N is the

standard normal cumulative distribution function.

Now for 70=K ,

40357.0

1*

2

35.0*35.0

008.0

70

70

ln

1*35.0

1

1

1

==>

+−+=

d

d

Hence )05357.0(1*35.0040357.02 =−=d

So,

( ) ( ) ( )

)

(1282.12)05357.0(70040357.07035.0,1,0,08.0,70,70 08.00

value

timeNeNeC BSM =−= −−

Now for 80=K ,

022053.0

1*

2

35.0*35.0

008.0

80

70

ln

1*35.0

1

1

1

==>

+−+=

d

d

Hence )327946.0(1*35.0022053.02 =−=d

Now,

( ) ( ) ( )

)(

18.8)327946.0(80022053.07035.0,1,0,08.0,80,70 08.00

valuetime

NeNeC BSM =−= −−

Note: The C(BSM) value got evaluated in Excel using the above formulae.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 32

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.