Desklib Assessment Workbook FNSACC504

VerifiedAdded on 2023/06/03

|27

|4589

|257

AI Summary

The Assessment Workbook FNSACC504 includes short answer questions, data conversion procedures, consolidation procedures, retail inventory method, journal entries, and monthly sales. It also has a pie chart showing the different car brands sold and a line graph showing the monthly sales trend.

Contribute Materials

Your contribution can guide someone’s learning journey. Share your

documents today.

Assessment Workbook – FNSACC504 1 | P a g e Version 3.0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

Assessment 1: Short Answer Questions

The objective of this section is to demonstrate 1.0 Compile data

Question 2

a. Give three (3) data conversion procedures and explain when you would use them to

compile data in accordance with organisational policy and procedures.

The following are the data conversion procedures:

Running the new system parallel to the old system. In this, both of the systems are run

parallel as against one another.

Phase in the new system. This includes the conversion of just location which contains

the data to migrate.

Direct changeover. This means converting the entire system into the new system

(Small business chron, 2018).

b. Give three (3) consolidation procedures used in accounting and explain used to

compile data in accordance with organisational policy and procedures.

The following are the 3 conversion procedures:

Consolidation: this is when a company (investor) holds more than 51% of the

share capital of the other company (investee). In such cases, both of the books

of the companies are combined as one.

Equity method: this is when an investee possess a minor ownership of the

share capital in the investee.

Assessment Workbook – FNSACC504 2 | P a g e Version 3.0

The objective of this section is to demonstrate 1.0 Compile data

Question 2

a. Give three (3) data conversion procedures and explain when you would use them to

compile data in accordance with organisational policy and procedures.

The following are the data conversion procedures:

Running the new system parallel to the old system. In this, both of the systems are run

parallel as against one another.

Phase in the new system. This includes the conversion of just location which contains

the data to migrate.

Direct changeover. This means converting the entire system into the new system

(Small business chron, 2018).

b. Give three (3) consolidation procedures used in accounting and explain used to

compile data in accordance with organisational policy and procedures.

The following are the 3 conversion procedures:

Consolidation: this is when a company (investor) holds more than 51% of the

share capital of the other company (investee). In such cases, both of the books

of the companies are combined as one.

Equity method: this is when an investee possess a minor ownership of the

share capital in the investee.

Assessment Workbook – FNSACC504 2 | P a g e Version 3.0

Equity pick up: this is when the cost method includes the recording of an

investment as an asset and also records the dividends as an income to the

investor (Corporate finance institute, 2018).

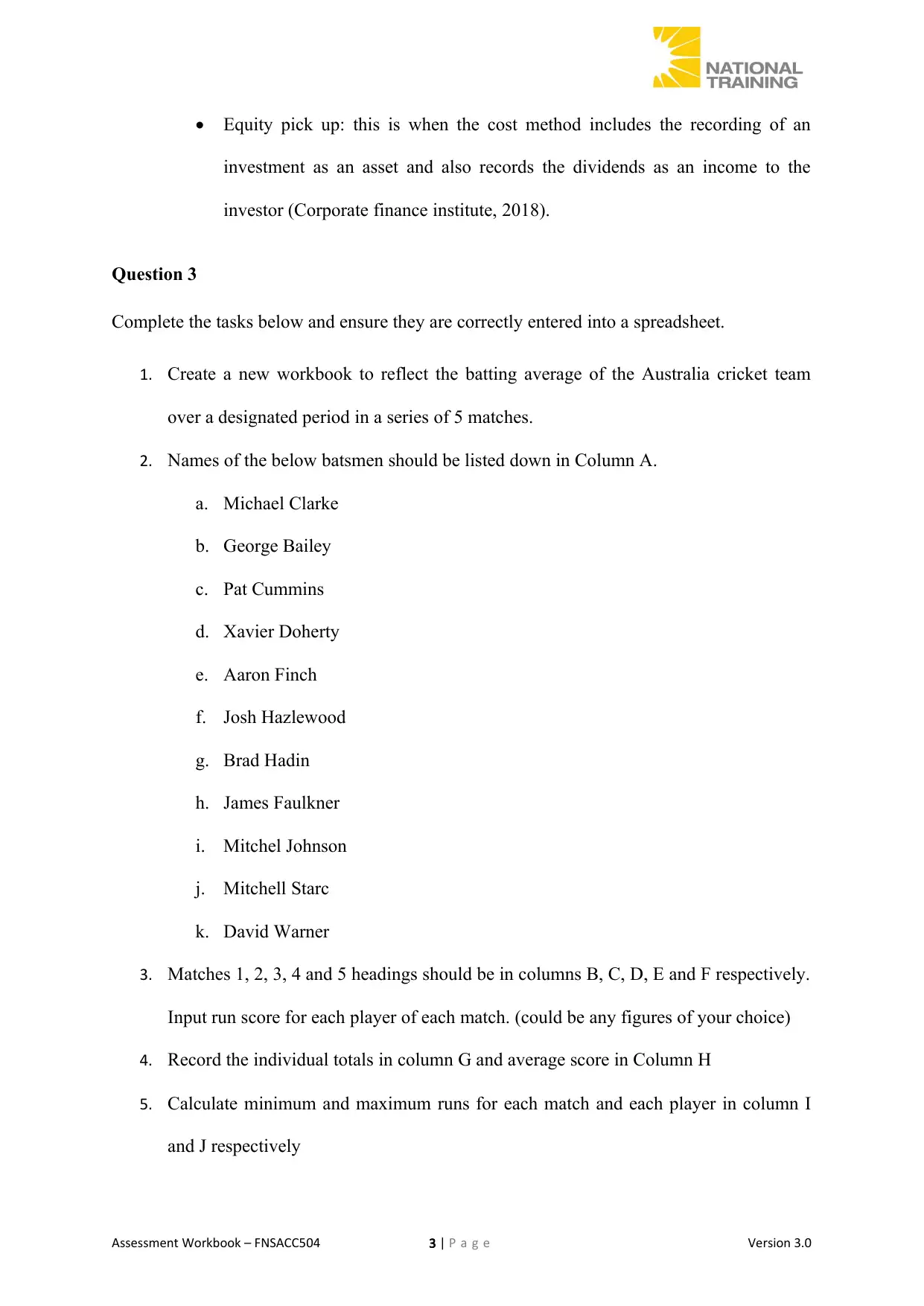

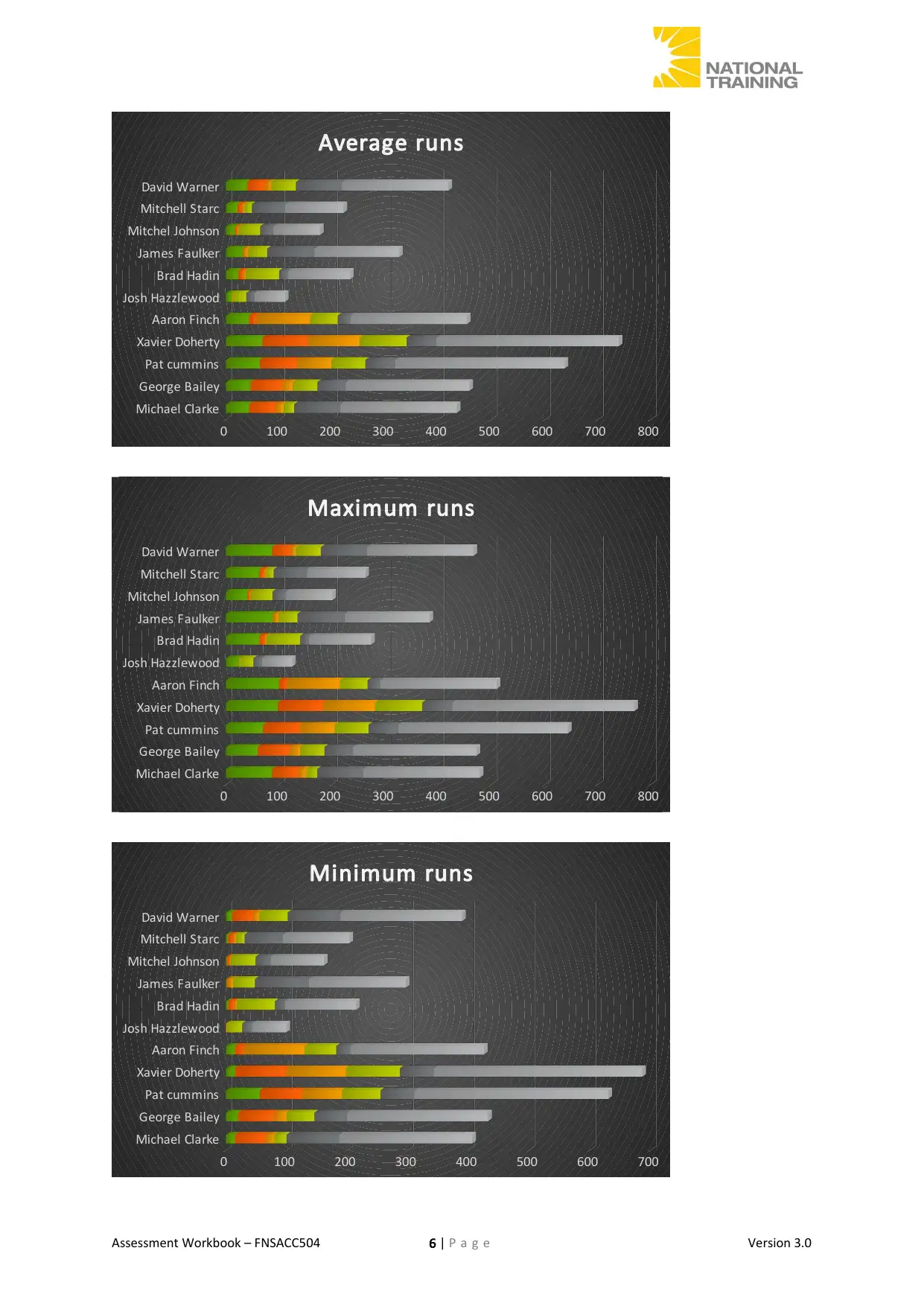

Question 3

Complete the tasks below and ensure they are correctly entered into a spreadsheet.

1. Create a new workbook to reflect the batting average of the Australia cricket team

over a designated period in a series of 5 matches.

2. Names of the below batsmen should be listed down in Column A.

a. Michael Clarke

b. George Bailey

c. Pat Cummins

d. Xavier Doherty

e. Aaron Finch

f. Josh Hazlewood

g. Brad Hadin

h. James Faulkner

i. Mitchel Johnson

j. Mitchell Starc

k. David Warner

3. Matches 1, 2, 3, 4 and 5 headings should be in columns B, C, D, E and F respectively.

Input run score for each player of each match. (could be any figures of your choice)

4. Record the individual totals in column G and average score in Column H

5. Calculate minimum and maximum runs for each match and each player in column I

and J respectively

Assessment Workbook – FNSACC504 3 | P a g e Version 3.0

investment as an asset and also records the dividends as an income to the

investor (Corporate finance institute, 2018).

Question 3

Complete the tasks below and ensure they are correctly entered into a spreadsheet.

1. Create a new workbook to reflect the batting average of the Australia cricket team

over a designated period in a series of 5 matches.

2. Names of the below batsmen should be listed down in Column A.

a. Michael Clarke

b. George Bailey

c. Pat Cummins

d. Xavier Doherty

e. Aaron Finch

f. Josh Hazlewood

g. Brad Hadin

h. James Faulkner

i. Mitchel Johnson

j. Mitchell Starc

k. David Warner

3. Matches 1, 2, 3, 4 and 5 headings should be in columns B, C, D, E and F respectively.

Input run score for each player of each match. (could be any figures of your choice)

4. Record the individual totals in column G and average score in Column H

5. Calculate minimum and maximum runs for each match and each player in column I

and J respectively

Assessment Workbook – FNSACC504 3 | P a g e Version 3.0

6. Use AutoFill wherever necessary.

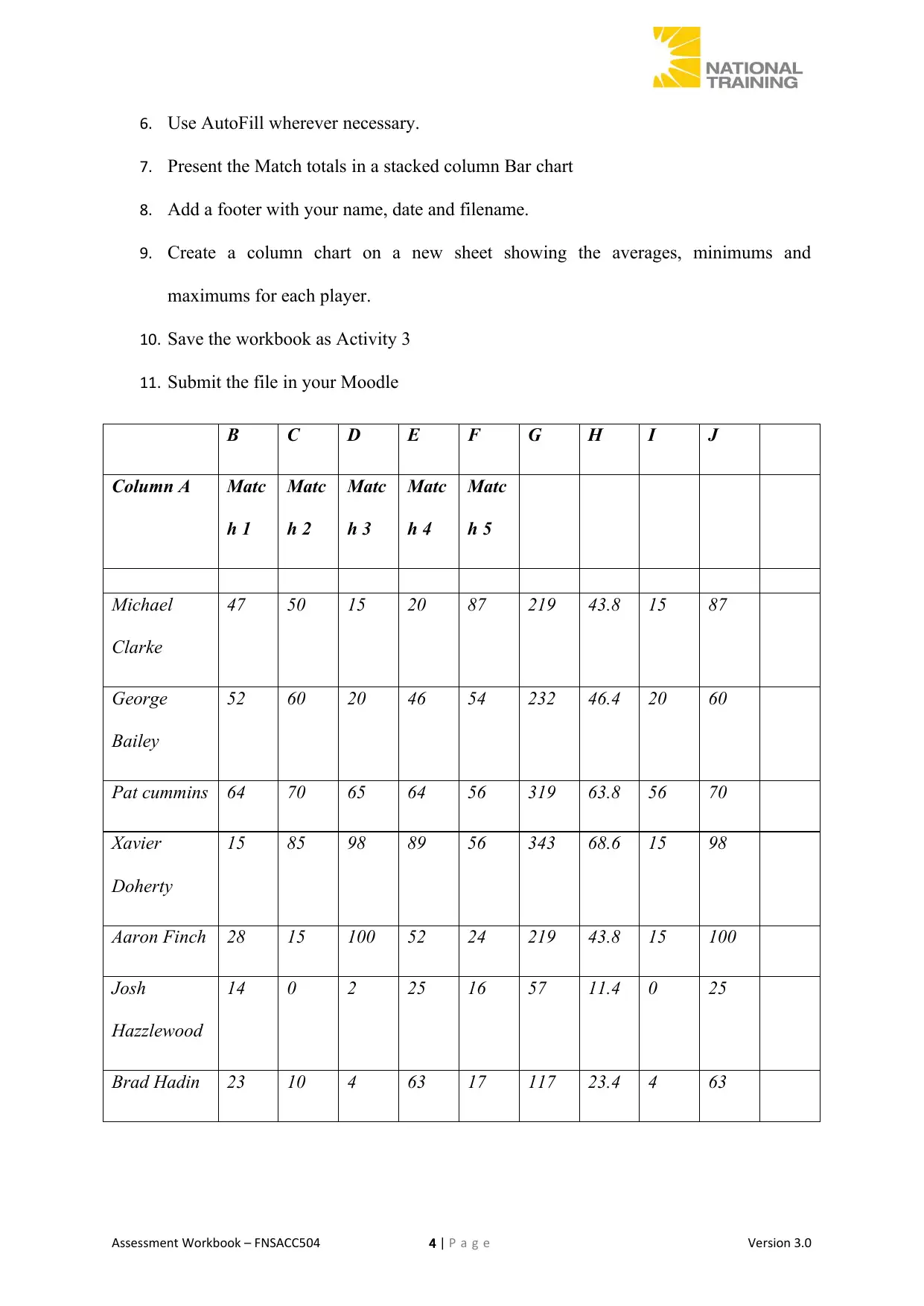

7. Present the Match totals in a stacked column Bar chart

8. Add a footer with your name, date and filename.

9. Create a column chart on a new sheet showing the averages, minimums and

maximums for each player.

10. Save the workbook as Activity 3

11. Submit the file in your Moodle

B C D E F G H I J

Column A Matc

h 1

Matc

h 2

Matc

h 3

Matc

h 4

Matc

h 5

Michael

Clarke

47 50 15 20 87 219 43.8 15 87

George

Bailey

52 60 20 46 54 232 46.4 20 60

Pat cummins 64 70 65 64 56 319 63.8 56 70

Xavier

Doherty

15 85 98 89 56 343 68.6 15 98

Aaron Finch 28 15 100 52 24 219 43.8 15 100

Josh

Hazzlewood

14 0 2 25 16 57 11.4 0 25

Brad Hadin 23 10 4 63 17 117 23.4 4 63

Assessment Workbook – FNSACC504 4 | P a g e Version 3.0

7. Present the Match totals in a stacked column Bar chart

8. Add a footer with your name, date and filename.

9. Create a column chart on a new sheet showing the averages, minimums and

maximums for each player.

10. Save the workbook as Activity 3

11. Submit the file in your Moodle

B C D E F G H I J

Column A Matc

h 1

Matc

h 2

Matc

h 3

Matc

h 4

Matc

h 5

Michael

Clarke

47 50 15 20 87 219 43.8 15 87

George

Bailey

52 60 20 46 54 232 46.4 20 60

Pat cummins 64 70 65 64 56 319 63.8 56 70

Xavier

Doherty

15 85 98 89 56 343 68.6 15 98

Aaron Finch 28 15 100 52 24 219 43.8 15 100

Josh

Hazzlewood

14 0 2 25 16 57 11.4 0 25

Brad Hadin 23 10 4 63 17 117 23.4 4 63

Assessment Workbook – FNSACC504 4 | P a g e Version 3.0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

James

Faulker

25 2 8 36 89 160 32 2 89

Mitchel

Johnson

16 4 2 41 25 88 17.6 2 41

Mitchell

Starc

20 9 4 14 63 110 22 4 63

David

Warner

21 35 10 47 87 200 40 10 87

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700

Total of runs

Assessment Workbook – FNSACC504 5 | P a g e Version 3.0

Faulker

25 2 8 36 89 160 32 2 89

Mitchel

Johnson

16 4 2 41 25 88 17.6 2 41

Mitchell

Starc

20 9 4 14 63 110 22 4 63

David

Warner

21 35 10 47 87 200 40 10 87

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700

Total of runs

Assessment Workbook – FNSACC504 5 | P a g e Version 3.0

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700 800

Average runs

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700 800

Maximum runs

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700

Minimum runs

Assessment Workbook – FNSACC504 6 | P a g e Version 3.0

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700 800

Average runs

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700 800

Maximum runs

Michael Clarke

George Bailey

Pat cummins

Xavier Doherty

Aaron Finch

Josh Hazzlewood

Brad Hadin

James Faulker

Mitchel Johnson

Mitchell Starc

David Warner

0 100 200 300 400 500 600 700

Minimum runs

Assessment Workbook – FNSACC504 6 | P a g e Version 3.0

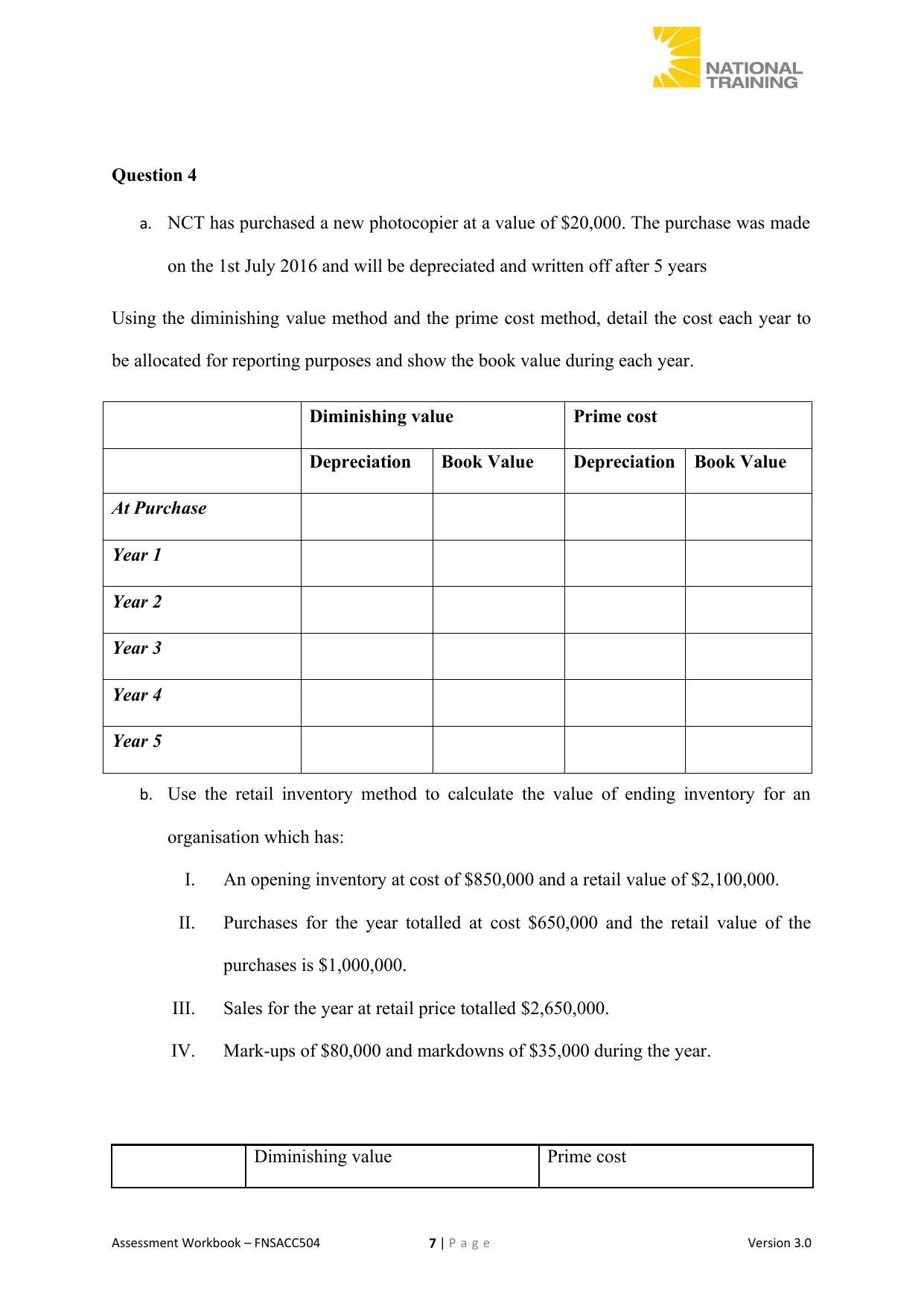

Question 4

a. NCT has purchased a new photocopier at a value of $20,000. The purchase was made

on the 1st July 2016 and will be depreciated and written off after 5 years

Using the diminishing value method and the prime cost method, detail the cost each year to

be allocated for reporting purposes and show the book value during each year.

Diminishing value Prime cost

Depreciation Book Value Depreciation Book Value

At Purchase

Year 1

Year 2

Year 3

Year 4

Year 5

b. Use the retail inventory method to calculate the value of ending inventory for an

organisation which has:

I. An opening inventory at cost of $850,000 and a retail value of $2,100,000.

II. Purchases for the year totalled at cost $650,000 and the retail value of the

purchases is $1,000,000.

III. Sales for the year at retail price totalled $2,650,000.

IV. Mark-ups of $80,000 and markdowns of $35,000 during the year.

Diminishing value Prime cost

Assessment Workbook – FNSACC504 7 | P a g e Version 3.0

a. NCT has purchased a new photocopier at a value of $20,000. The purchase was made

on the 1st July 2016 and will be depreciated and written off after 5 years

Using the diminishing value method and the prime cost method, detail the cost each year to

be allocated for reporting purposes and show the book value during each year.

Diminishing value Prime cost

Depreciation Book Value Depreciation Book Value

At Purchase

Year 1

Year 2

Year 3

Year 4

Year 5

b. Use the retail inventory method to calculate the value of ending inventory for an

organisation which has:

I. An opening inventory at cost of $850,000 and a retail value of $2,100,000.

II. Purchases for the year totalled at cost $650,000 and the retail value of the

purchases is $1,000,000.

III. Sales for the year at retail price totalled $2,650,000.

IV. Mark-ups of $80,000 and markdowns of $35,000 during the year.

Diminishing value Prime cost

Assessment Workbook – FNSACC504 7 | P a g e Version 3.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Depreciation

Book

Value

Depreciation

Book

Valu

e

At Purchase

Year 1 4000 16000 4000

1600

0

Year 2 3,200.00

12,800.0

0

4000

1200

0

Year 3 2,560.00

10,240.0

0

4000 8000

Year 4 2,048.00 8,192.00 4000 4000

Year 5 1,638.40 6,553.60 4000 0

Purchase Retail Cost to retail %

Opening

8,50,000.0

0

21,00,000.0

0

0.4

0

Purchases

6,50,000.0

0

10,00,000.0

0

Sales

26,50,000.0

0

Mark ups

80,000.0

0

Mark downs

35,000.0

0

Assessment Workbook – FNSACC504 8 | P a g e Version 3.0

Book

Value

Depreciation

Book

Valu

e

At Purchase

Year 1 4000 16000 4000

1600

0

Year 2 3,200.00

12,800.0

0

4000

1200

0

Year 3 2,560.00

10,240.0

0

4000 8000

Year 4 2,048.00 8,192.00 4000 4000

Year 5 1,638.40 6,553.60 4000 0

Purchase Retail Cost to retail %

Opening

8,50,000.0

0

21,00,000.0

0

0.4

0

Purchases

6,50,000.0

0

10,00,000.0

0

Sales

26,50,000.0

0

Mark ups

80,000.0

0

Mark downs

35,000.0

0

Assessment Workbook – FNSACC504 8 | P a g e Version 3.0

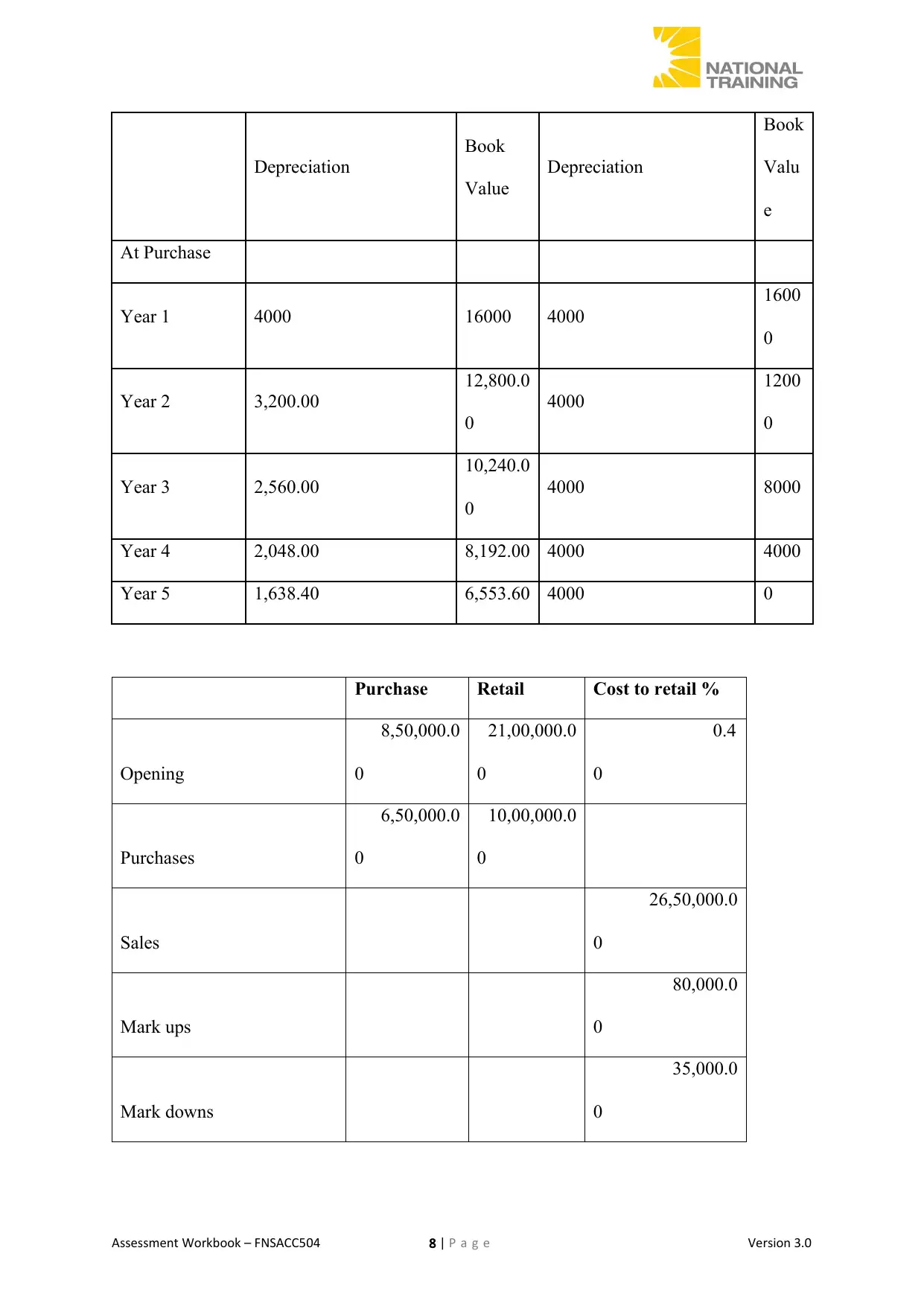

Particulars

Amounts in

$

Cost of beginning inventory

8,50,000.0

0

cost of purchases

6,50,000.0

0

Cost of goods available for

sale

15,00,000.0

0

Cost of sales during period

10,72,619.0

5

Cost of goods available for

sale

15,00,000.0

0

Less: cost of sales

10,72,619.0

5

Ending inventory

4,27,380.9

5

Question 5

Record the journal entries for the following transactions showing the effect on GST.

a. 01st Jan 2016 Purchased furniture from office works for 1650 GST inclusive.

Assessment Workbook – FNSACC504 9 | P a g e Version 3.0

Amounts in

$

Cost of beginning inventory

8,50,000.0

0

cost of purchases

6,50,000.0

0

Cost of goods available for

sale

15,00,000.0

0

Cost of sales during period

10,72,619.0

5

Cost of goods available for

sale

15,00,000.0

0

Less: cost of sales

10,72,619.0

5

Ending inventory

4,27,380.9

5

Question 5

Record the journal entries for the following transactions showing the effect on GST.

a. 01st Jan 2016 Purchased furniture from office works for 1650 GST inclusive.

Assessment Workbook – FNSACC504 9 | P a g e Version 3.0

01.01.2016 Furniture $1650

To Office works $1650

b. 31st Jan 2016 Purchased motor vehicle at a cost $30,000 Registration of the motor

vehicle was $730 from Essendon Mazda plus GST

31.01.2016 Motor vehicle $30,730

To Office works $30,730

c. 14th Feb 2016 sold items to a customer for $7000 plus GST. Payment terms are 30

days after the purchase

14.02.2016 Accounts receivables $7,000

To Sales revenue $7,000

Payment after 30 days

14.03.2016 Cash $7,000

To Accounts receivables $7,000

d. 20/03/2016 Paid supplier of stock purchased in cash for $15000 plus GST

20.03.2016 Accounts payable $15,000

Assessment Workbook – FNSACC504 10 | P a g e Version 3.0

To Office works $1650

b. 31st Jan 2016 Purchased motor vehicle at a cost $30,000 Registration of the motor

vehicle was $730 from Essendon Mazda plus GST

31.01.2016 Motor vehicle $30,730

To Office works $30,730

c. 14th Feb 2016 sold items to a customer for $7000 plus GST. Payment terms are 30

days after the purchase

14.02.2016 Accounts receivables $7,000

To Sales revenue $7,000

Payment after 30 days

14.03.2016 Cash $7,000

To Accounts receivables $7,000

d. 20/03/2016 Paid supplier of stock purchased in cash for $15000 plus GST

20.03.2016 Accounts payable $15,000

Assessment Workbook – FNSACC504 10 | P a g e Version 3.0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

To Cash $15,000

The objective of this section is to demonstrate 2.0 Prepare reports

Question 6

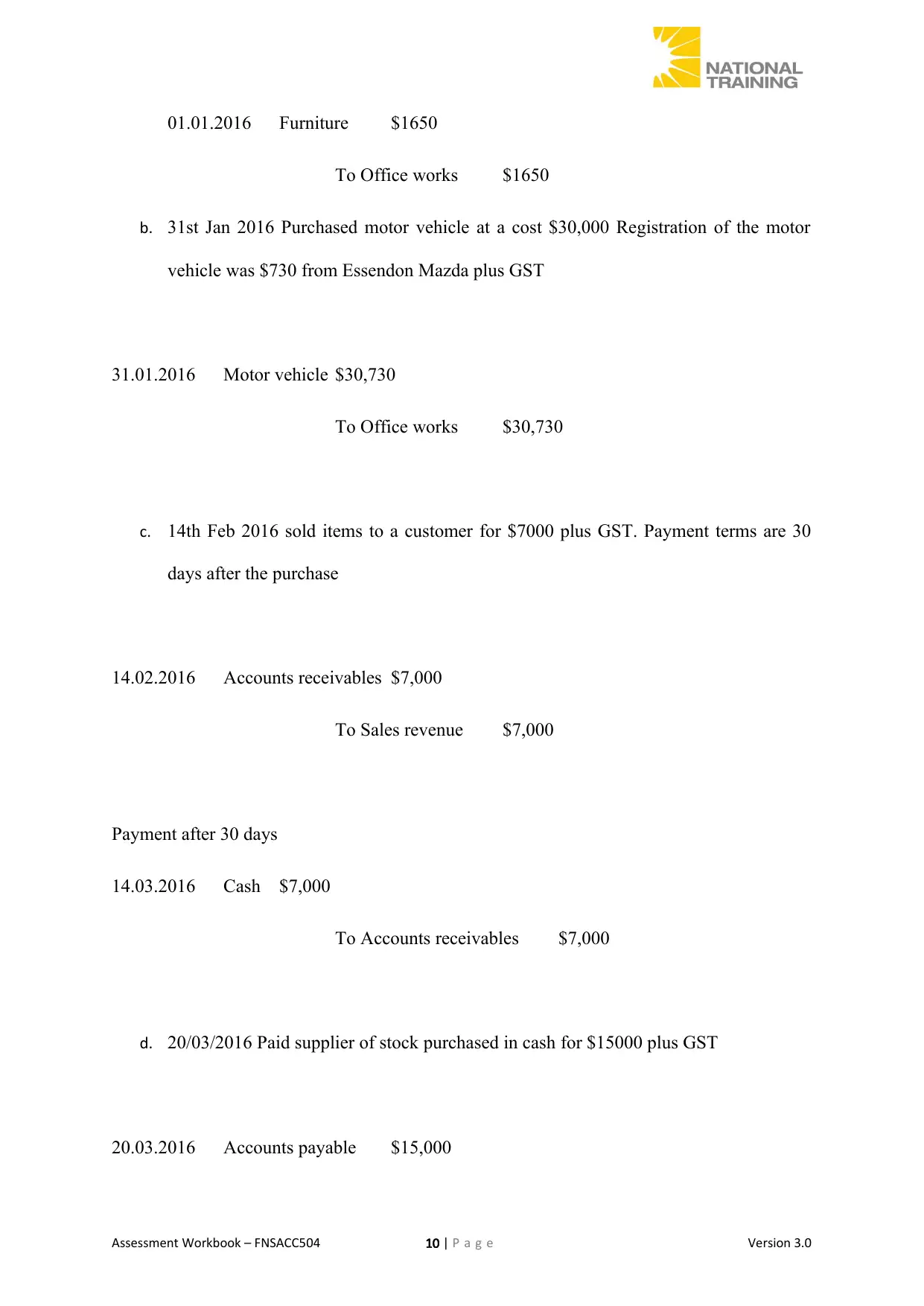

The information above represents the number of cars sold in the year 2015 by National

Motors Company, a car dealer.

a. Present the information of the different car brands sold in a pie chart. Name the chart

as Car Brands and represent the data in Percentages

ar

ran

Jan Feb Mar Apr May June July Aug Sep Oct Nov Dec

lfa

ome

1.89% 3.85% 0.00% 2.08% 8.47% 5.00% 2.63% 3.13% 5.88% 4.69% 4.17% 7.55%

udi 9.43%

15.38

%

19.44

%

12.50

%

15.25

%

13.33

% 7.89% 7.81% 8.82% 6.25% 9.72%

15.09

%

Assessment Workbook – FNSACC504 11 | P a g e Version 3.0

The objective of this section is to demonstrate 2.0 Prepare reports

Question 6

The information above represents the number of cars sold in the year 2015 by National

Motors Company, a car dealer.

a. Present the information of the different car brands sold in a pie chart. Name the chart

as Car Brands and represent the data in Percentages

ar

ran

Jan Feb Mar Apr May June July Aug Sep Oct Nov Dec

lfa

ome

1.89% 3.85% 0.00% 2.08% 8.47% 5.00% 2.63% 3.13% 5.88% 4.69% 4.17% 7.55%

udi 9.43%

15.38

%

19.44

%

12.50

%

15.25

%

13.33

% 7.89% 7.81% 8.82% 6.25% 9.72%

15.09

%

Assessment Workbook – FNSACC504 11 | P a g e Version 3.0

azd 18.87

%

23.08

%

22.22

%

12.50

%

13.56

%

15.00

%

28.95

%

21.88

%

17.65

%

25.00

%

31.94

%

20.75

%

oyot 28.30

%

19.23

%

27.78

%

47.92

%

18.64

%

35.00

%

26.32

%

18.75

%

32.35

%

31.25

%

29.17

%

33.96

%

ord

18.87

%

21.15

%

22.22

%

20.83

%

37.29

%

26.67

%

26.32

%

40.63

%

25.00

%

25.00

%

23.61

%

18.87

%

issa 22.64

%

17.31

% 8.33% 4.17% 6.78% 5.00% 7.89% 7.81%

10.29

% 7.81% 1.39% 3.77%

otal 1 1 1 1 1 1 1 1 1 1 1 1

Save the workbook as workbook as activity 6 and submit it with this assessment

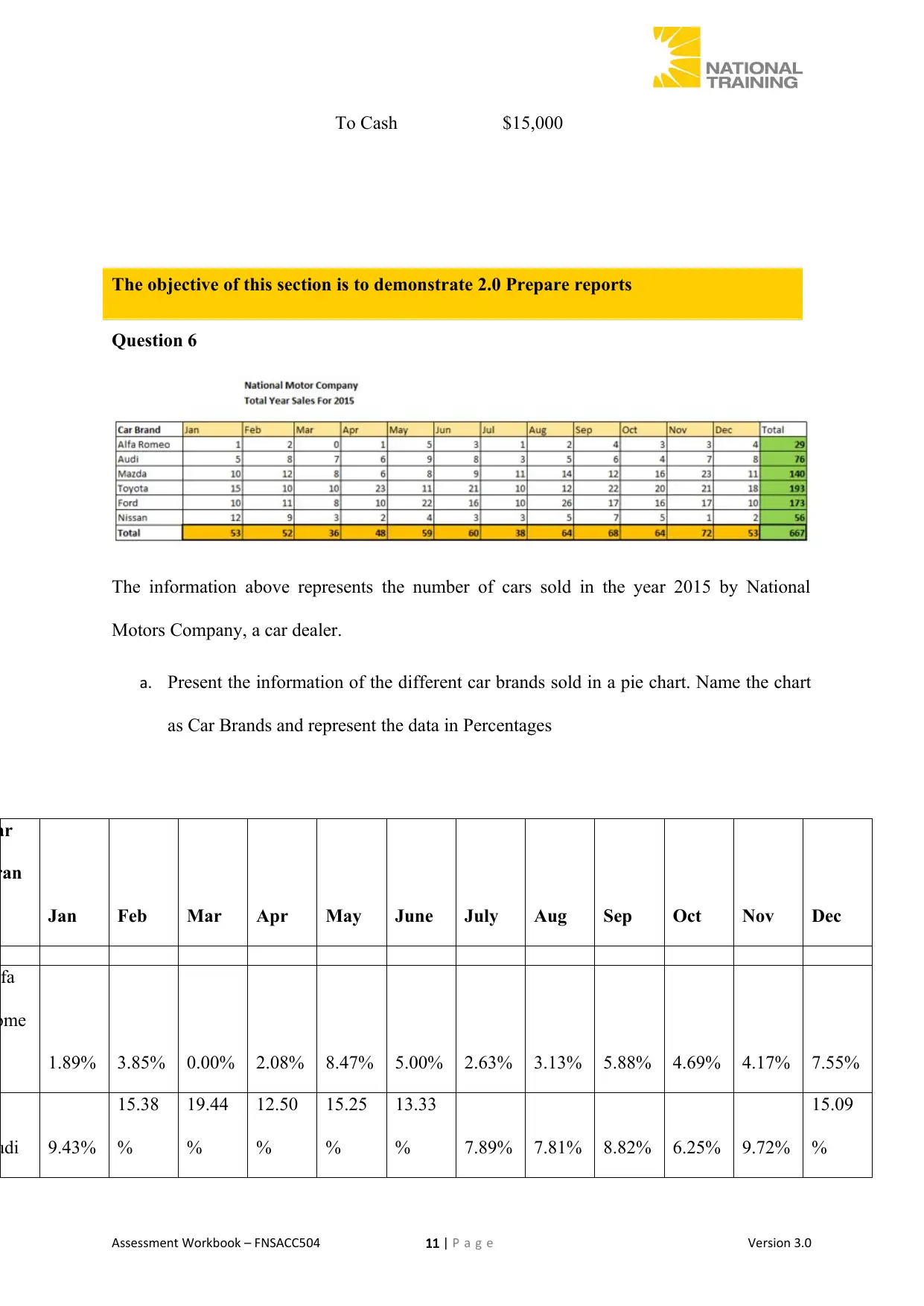

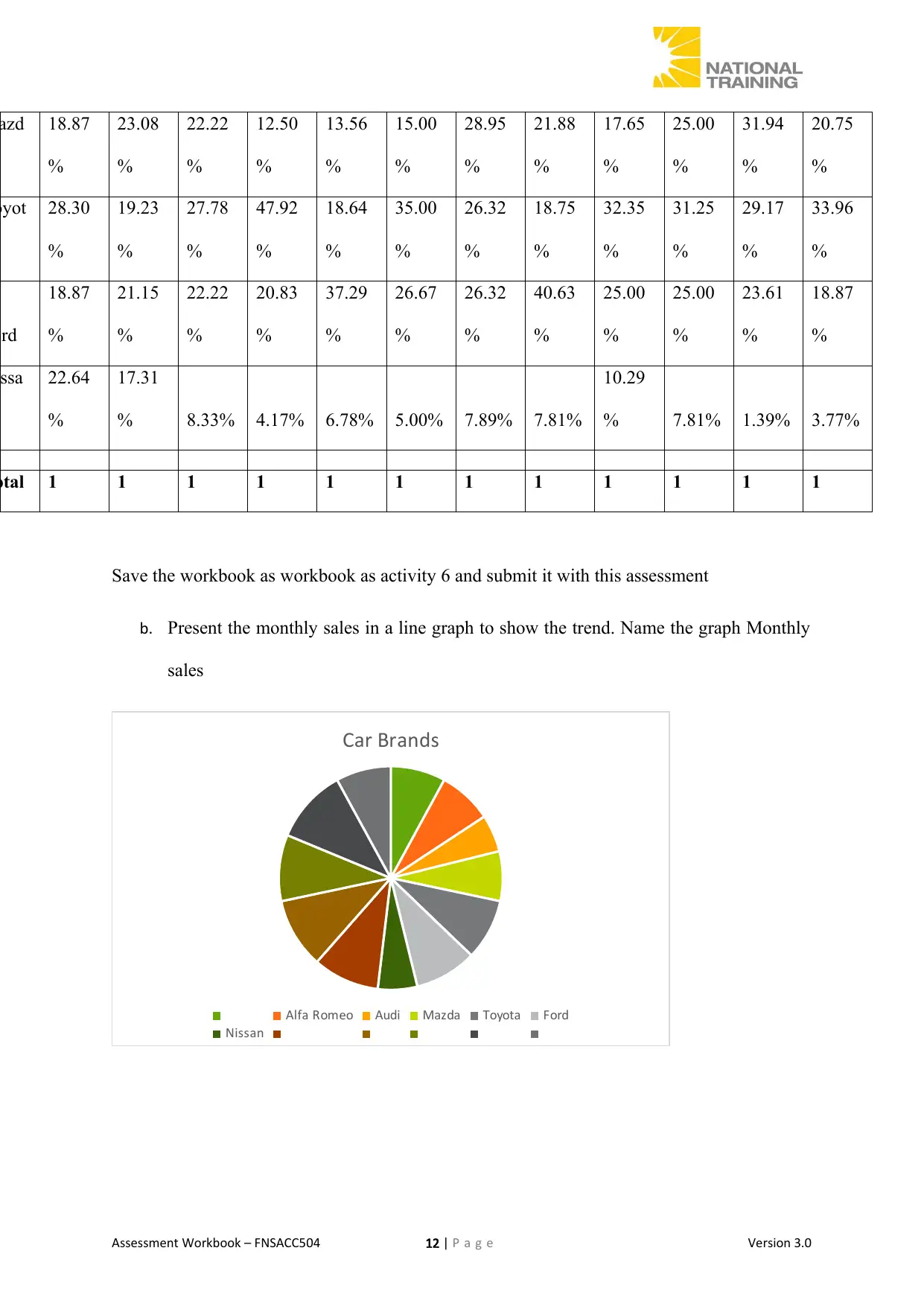

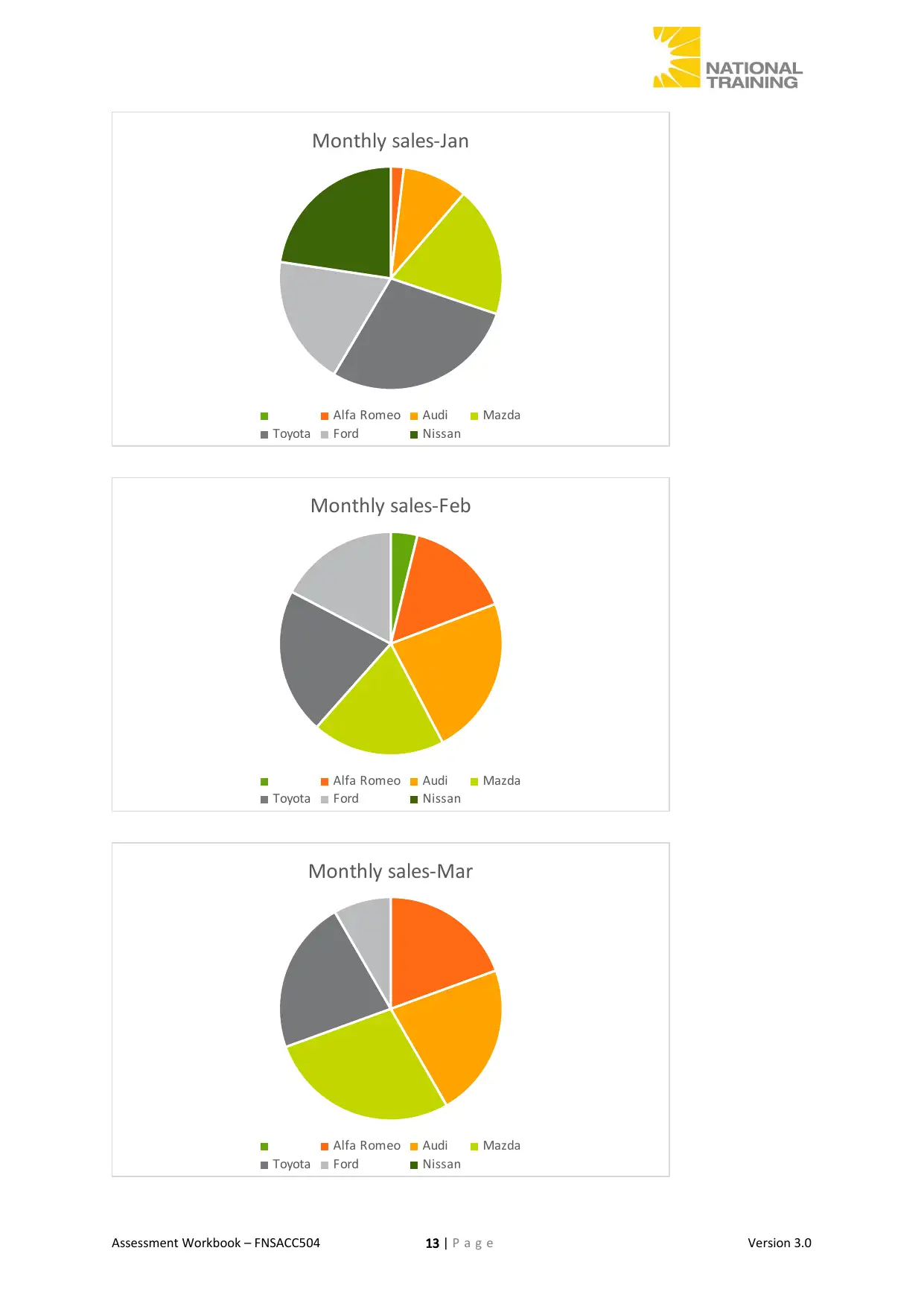

b. Present the monthly sales in a line graph to show the trend. Name the graph Monthly

sales

Car Brands

Alfa Romeo Audi Mazda Toyota Ford

Nissan

Assessment Workbook – FNSACC504 12 | P a g e Version 3.0

%

23.08

%

22.22

%

12.50

%

13.56

%

15.00

%

28.95

%

21.88

%

17.65

%

25.00

%

31.94

%

20.75

%

oyot 28.30

%

19.23

%

27.78

%

47.92

%

18.64

%

35.00

%

26.32

%

18.75

%

32.35

%

31.25

%

29.17

%

33.96

%

ord

18.87

%

21.15

%

22.22

%

20.83

%

37.29

%

26.67

%

26.32

%

40.63

%

25.00

%

25.00

%

23.61

%

18.87

%

issa 22.64

%

17.31

% 8.33% 4.17% 6.78% 5.00% 7.89% 7.81%

10.29

% 7.81% 1.39% 3.77%

otal 1 1 1 1 1 1 1 1 1 1 1 1

Save the workbook as workbook as activity 6 and submit it with this assessment

b. Present the monthly sales in a line graph to show the trend. Name the graph Monthly

sales

Car Brands

Alfa Romeo Audi Mazda Toyota Ford

Nissan

Assessment Workbook – FNSACC504 12 | P a g e Version 3.0

Monthly sales-Jan

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Feb

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Mar

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Assessment Workbook – FNSACC504 13 | P a g e Version 3.0

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Feb

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Mar

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Assessment Workbook – FNSACC504 13 | P a g e Version 3.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

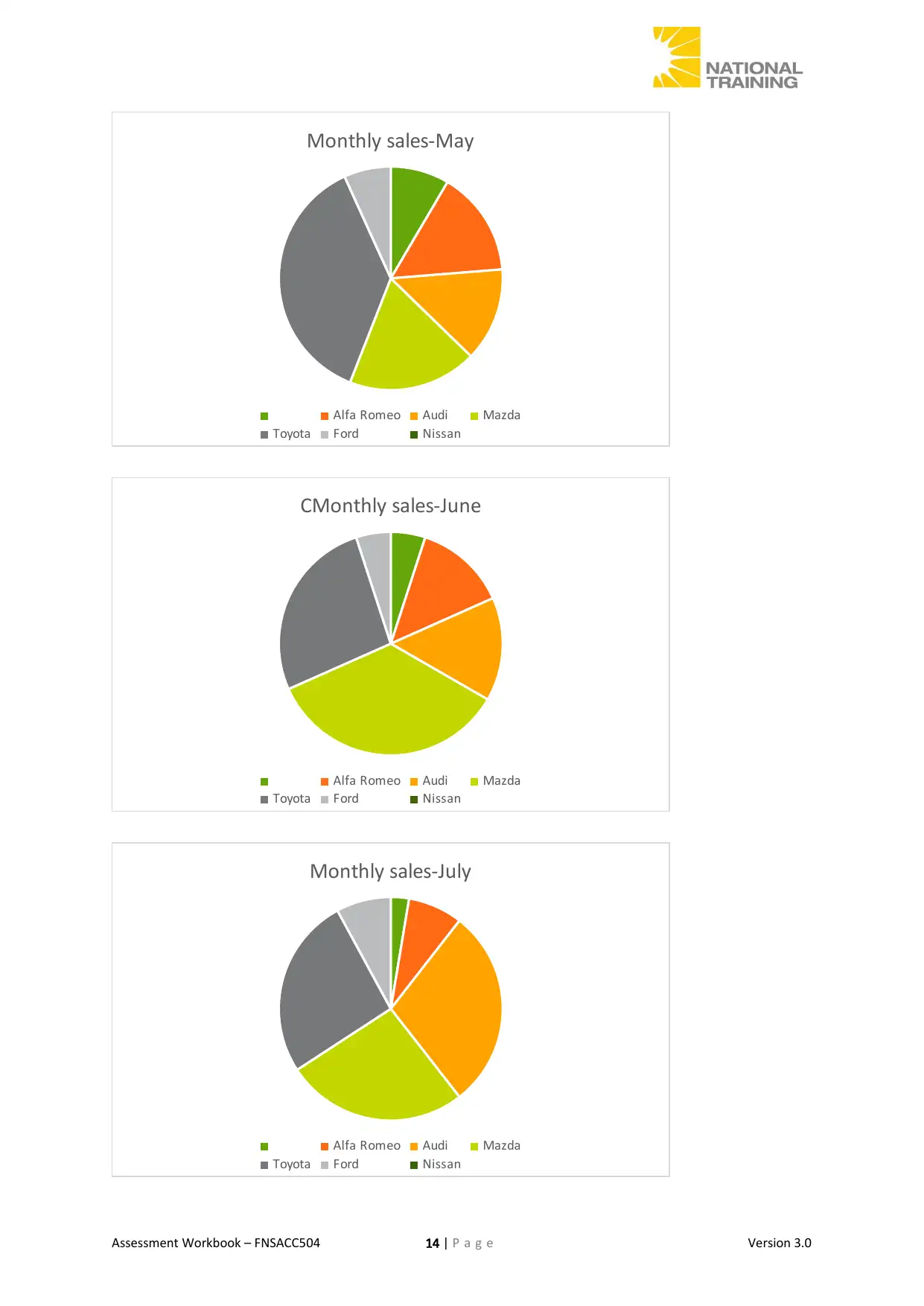

Monthly sales-May

Alfa Romeo Audi Mazda

Toyota Ford Nissan

CMonthly sales-June

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-July

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Assessment Workbook – FNSACC504 14 | P a g e Version 3.0

Alfa Romeo Audi Mazda

Toyota Ford Nissan

CMonthly sales-June

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-July

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Assessment Workbook – FNSACC504 14 | P a g e Version 3.0

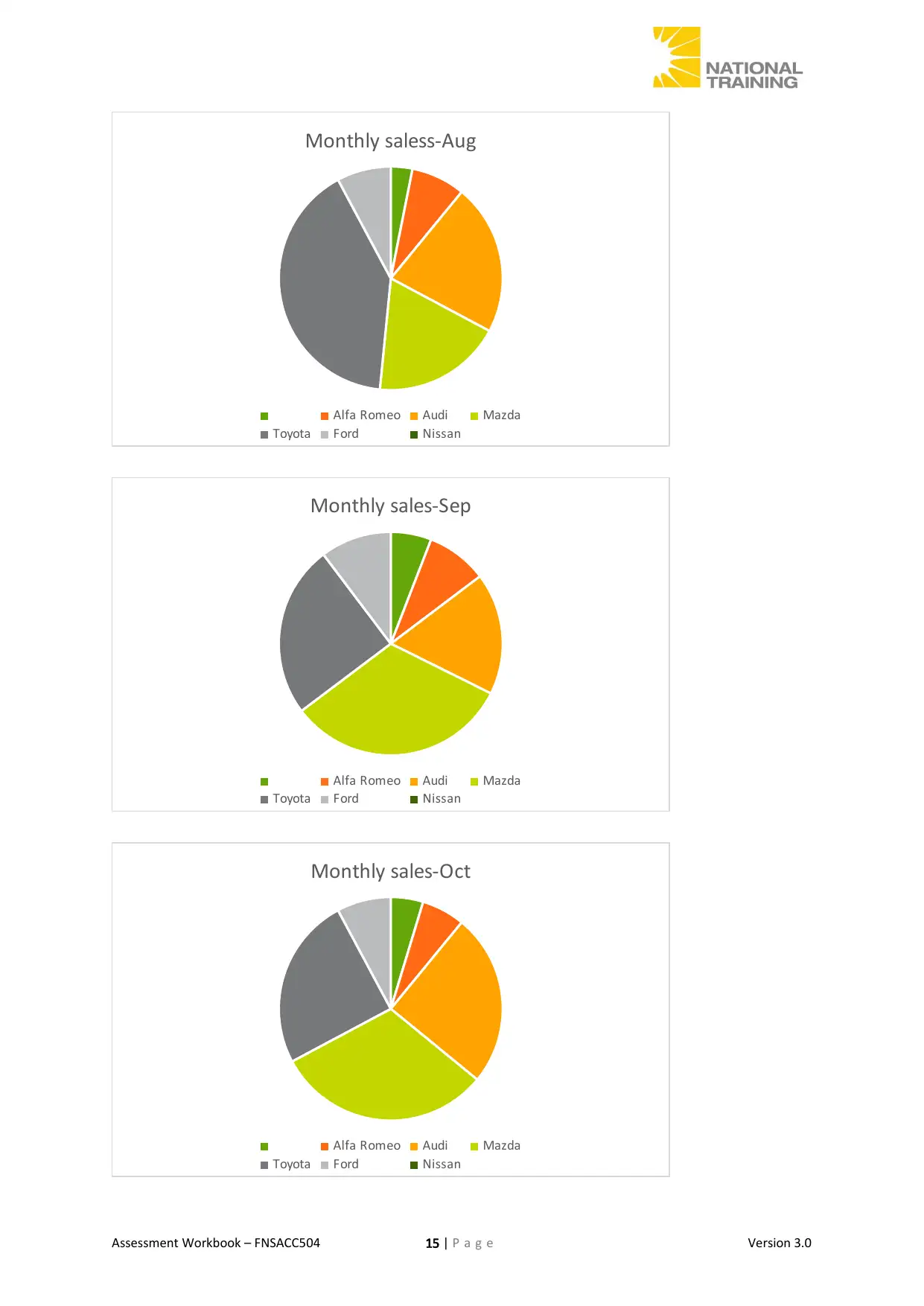

Monthly saless-Aug

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Sep

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Oct

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Assessment Workbook – FNSACC504 15 | P a g e Version 3.0

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Sep

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Oct

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Assessment Workbook – FNSACC504 15 | P a g e Version 3.0

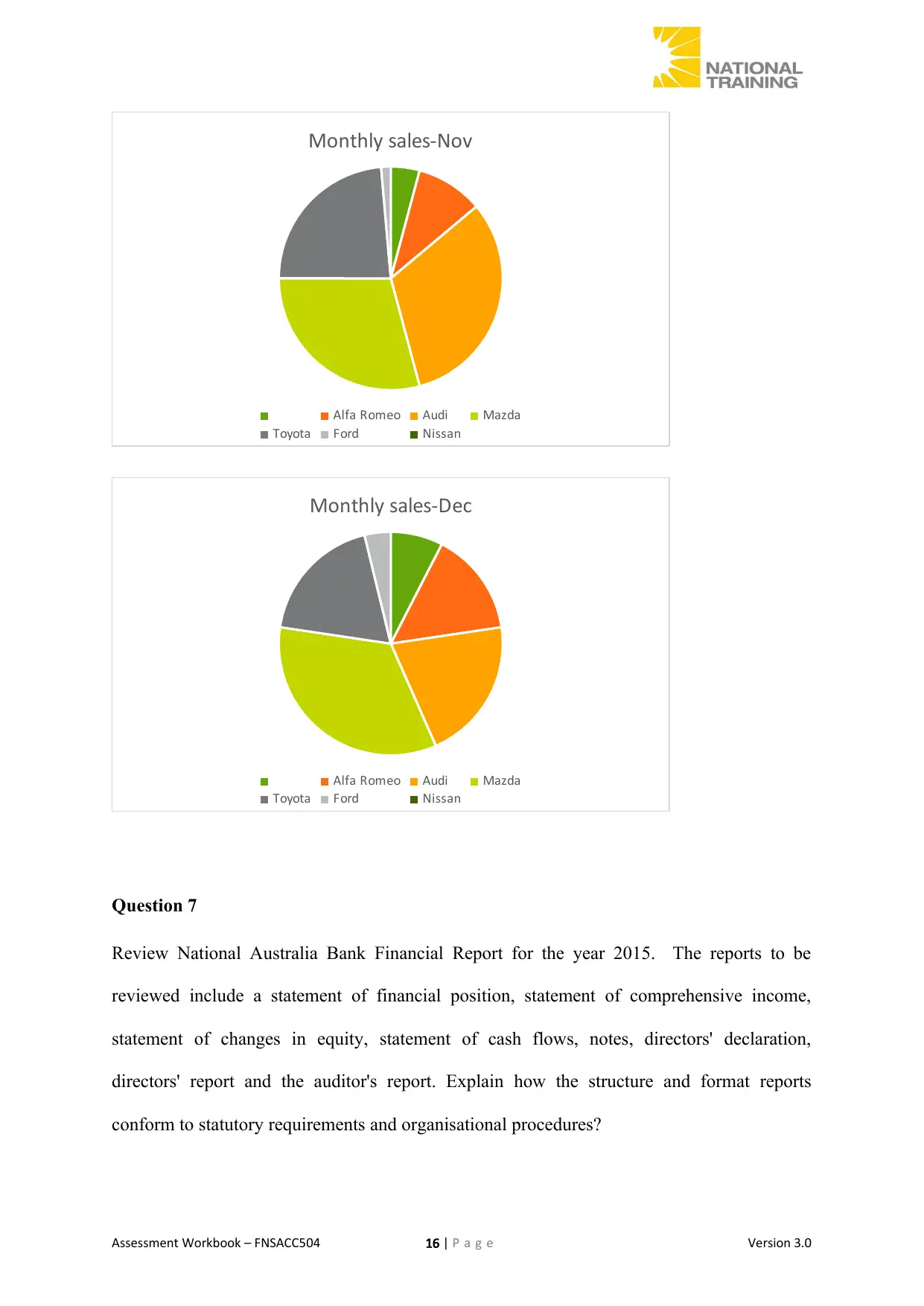

Monthly sales-Nov

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Dec

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Question 7

Review National Australia Bank Financial Report for the year 2015. The reports to be

reviewed include a statement of financial position, statement of comprehensive income,

statement of changes in equity, statement of cash flows, notes, directors' declaration,

directors' report and the auditor's report. Explain how the structure and format reports

conform to statutory requirements and organisational procedures?

Assessment Workbook – FNSACC504 16 | P a g e Version 3.0

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Monthly sales-Dec

Alfa Romeo Audi Mazda

Toyota Ford Nissan

Question 7

Review National Australia Bank Financial Report for the year 2015. The reports to be

reviewed include a statement of financial position, statement of comprehensive income,

statement of changes in equity, statement of cash flows, notes, directors' declaration,

directors' report and the auditor's report. Explain how the structure and format reports

conform to statutory requirements and organisational procedures?

Assessment Workbook – FNSACC504 16 | P a g e Version 3.0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The financial statements of the company comprises of Income statement, statement of

comprehensive income, Balance Sheet, Condensed cash flow statement, Statement of

changes in equity along with notes to these financial statements.

These confirm with the requirements as have been laid down in the Corporations Act 2001

along with the accounting standards and the interpretations as have been laid down by the

Australian Standards of Accounting.

Question 8

How do you ensure statements and data are error free, comprehensive and comply with

statutory requirements and organisational procedures?

An investor would not be in a position to ascertain whether the financial statements prepared

have bene prepared as per the relevant standards and that they are free from any material

misstatement, hence, an auditor steps in. he is the one that conducts an audit and ascertains if

the relevant provisions of the relevant standards have been followed and if these are free from

any material misstatement.

The objective of this section is to demonstrate

FNSACC504 Prepare financial reports for corporate entities

Question 9

What are a BAS and IAS? how should an organisation’s policies and procedures be aligned

to adhere to statutory reporting requirements?

Assessment Workbook – FNSACC504 17 | P a g e Version 3.0

comprehensive income, Balance Sheet, Condensed cash flow statement, Statement of

changes in equity along with notes to these financial statements.

These confirm with the requirements as have been laid down in the Corporations Act 2001

along with the accounting standards and the interpretations as have been laid down by the

Australian Standards of Accounting.

Question 8

How do you ensure statements and data are error free, comprehensive and comply with

statutory requirements and organisational procedures?

An investor would not be in a position to ascertain whether the financial statements prepared

have bene prepared as per the relevant standards and that they are free from any material

misstatement, hence, an auditor steps in. he is the one that conducts an audit and ascertains if

the relevant provisions of the relevant standards have been followed and if these are free from

any material misstatement.

The objective of this section is to demonstrate

FNSACC504 Prepare financial reports for corporate entities

Question 9

What are a BAS and IAS? how should an organisation’s policies and procedures be aligned

to adhere to statutory reporting requirements?

Assessment Workbook – FNSACC504 17 | P a g e Version 3.0

These are the activity statements that are lodged with an ATO. There are mainly 2 types of

statements, one being a business activity statement and the other being an instalment activity

statement.

Any company must keep of all of the relevant transactions that have been entered during the

current year in the most utmost efficient way (Rozhaley, 2018).

Question 10

Some of the ethical issues that the board of Governance in an organisation face are conflict of

interest, confidentiality and disclosure requirements. Explain how the above ethical issues

could be resolved or avoided.

There are some of the ethical issues that the board of directors face when it comes to carrying

of the duties. These are solved by appointing an independent director in the board. There is a

specific composition of the board of directors. This is due to the reason that there are some of

the conflicts of interest that only and independent director could solve since he is not

associated with any of the parties.

Assessment 2: Project

The objective of this section is to demonstrate

FNSACC504 Prepare financial reports for corporate entities

Project

Research the NAB Annual Financial report for 2015. Prepare a report 2000 words answering

these questions:

Question 1

To whom is this report disseminated and how does this take place?

Assessment Workbook – FNSACC504 18 | P a g e Version 3.0

statements, one being a business activity statement and the other being an instalment activity

statement.

Any company must keep of all of the relevant transactions that have been entered during the

current year in the most utmost efficient way (Rozhaley, 2018).

Question 10

Some of the ethical issues that the board of Governance in an organisation face are conflict of

interest, confidentiality and disclosure requirements. Explain how the above ethical issues

could be resolved or avoided.

There are some of the ethical issues that the board of directors face when it comes to carrying

of the duties. These are solved by appointing an independent director in the board. There is a

specific composition of the board of directors. This is due to the reason that there are some of

the conflicts of interest that only and independent director could solve since he is not

associated with any of the parties.

Assessment 2: Project

The objective of this section is to demonstrate

FNSACC504 Prepare financial reports for corporate entities

Project

Research the NAB Annual Financial report for 2015. Prepare a report 2000 words answering

these questions:

Question 1

To whom is this report disseminated and how does this take place?

Assessment Workbook – FNSACC504 18 | P a g e Version 3.0

The annual report of the company is addressed to the shareholders of the company and the

annual report is circulated amongst the shareholders. And any issues and the profitability of

the company are discussed in the shareholders meeting.

Question 2

Why might these recipients need or want the information contained in the annual report?

There are many users of these financial statements which have been listed below:

The management of the company uses these reports to ascertain the profitability,

liquidity along with the cash flows of the company each and every month.

The competitors of the company uses these statements which are competing as against

the business so that they are able to gain an access to the financial statements. The

competitors use this information for the purposes of evaluating the financial

conditions of its rivals.

The customers. The customers need this information to know the financial ability of

the supplier to remain in the business sin the near future and whether the company

would be able to provide enough goods or the services as are required in the stated

contract.

The employees. They need to know the facts that are contained in the documents. This

could be used for the purposes of increasing the level of engagement and

understanding of an employee.

The government. This is used for the purposes of determining the amounts of the

taxes that are paid by the company

Assessment Workbook – FNSACC504 19 | P a g e Version 3.0

annual report is circulated amongst the shareholders. And any issues and the profitability of

the company are discussed in the shareholders meeting.

Question 2

Why might these recipients need or want the information contained in the annual report?

There are many users of these financial statements which have been listed below:

The management of the company uses these reports to ascertain the profitability,

liquidity along with the cash flows of the company each and every month.

The competitors of the company uses these statements which are competing as against

the business so that they are able to gain an access to the financial statements. The

competitors use this information for the purposes of evaluating the financial

conditions of its rivals.

The customers. The customers need this information to know the financial ability of

the supplier to remain in the business sin the near future and whether the company

would be able to provide enough goods or the services as are required in the stated

contract.

The employees. They need to know the facts that are contained in the documents. This

could be used for the purposes of increasing the level of engagement and

understanding of an employee.

The government. This is used for the purposes of determining the amounts of the

taxes that are paid by the company

Assessment Workbook – FNSACC504 19 | P a g e Version 3.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Investment analysis. This is done so that the outsiders could analysis the financial

statements to decide as to whether the securities of the company should be purchased

or not.

Investors. They would want to know and understand the performance of the company.

This is so because they would want to know how safe their investment is.

Lenders. They would want to know whether the company would be able to pay back

the loans that they have given to the company.

Rating agency. They would require to review the financial statements so that they

could rate the company.

Suppliers. They would want to know whether the company should be given credit nor

not.

Unions. They would want to deicide and evaluate the ability of the company to decide

the compensation and the benefits to the union members (Bragg, 2018).

Question 3

Explain whether NAB has met the disclosure requirements about the organisation’s financial

activities during the year.

The financial statements of the company comprises of Income statement, statement of

comprehensive income, Balance Sheet, Condensed cash flow statement, Statement of

changes in equity along with notes to these financial statements.

Assessment Workbook – FNSACC504 20 | P a g e Version 3.0

statements to decide as to whether the securities of the company should be purchased

or not.

Investors. They would want to know and understand the performance of the company.

This is so because they would want to know how safe their investment is.

Lenders. They would want to know whether the company would be able to pay back

the loans that they have given to the company.

Rating agency. They would require to review the financial statements so that they

could rate the company.

Suppliers. They would want to know whether the company should be given credit nor

not.

Unions. They would want to deicide and evaluate the ability of the company to decide

the compensation and the benefits to the union members (Bragg, 2018).

Question 3

Explain whether NAB has met the disclosure requirements about the organisation’s financial

activities during the year.

The financial statements of the company comprises of Income statement, statement of

comprehensive income, Balance Sheet, Condensed cash flow statement, Statement of

changes in equity along with notes to these financial statements.

Assessment Workbook – FNSACC504 20 | P a g e Version 3.0

These confirm with the requirements as have been laid down in the Corporations Act 2001

along with the accounting standards and the interpretations as have been laid down by the

Australian Standards of Accounting.

Question 4

Is there any evidence that those within the organisation used consolidation or conversion

procedures to analyse the financial data which was available?

There is as such no evidence with regard to this fact.

Question 5

Has the NAB disclosed any asset or liability valuations? If so, what do they indicate?

Yes, the company has disclosed some of the facts about the valuations of the assets or the

liabilities.

The Annual report of the company states that as per AASB 9, the group had adopted AASB 9

which deals with the hedge accounting requirements. The company has adopted the AASB 9

which has resulted in few of the changes in the policies of the company. The financial assets

of the company have been valued at the amortised cost or the fair value. This is dependent on

the business model of the company for the purposes of managing the financial assets and also

on the contractual cash flow of these financial assets. The financial assets has been measured

at the amortised cost only and only if the following conditions are met:

When the asset is held for the purposes of holding the assets to collect the cash flows

Assessment Workbook – FNSACC504 21 | P a g e Version 3.0

along with the accounting standards and the interpretations as have been laid down by the

Australian Standards of Accounting.

Question 4

Is there any evidence that those within the organisation used consolidation or conversion

procedures to analyse the financial data which was available?

There is as such no evidence with regard to this fact.

Question 5

Has the NAB disclosed any asset or liability valuations? If so, what do they indicate?

Yes, the company has disclosed some of the facts about the valuations of the assets or the

liabilities.

The Annual report of the company states that as per AASB 9, the group had adopted AASB 9

which deals with the hedge accounting requirements. The company has adopted the AASB 9

which has resulted in few of the changes in the policies of the company. The financial assets

of the company have been valued at the amortised cost or the fair value. This is dependent on

the business model of the company for the purposes of managing the financial assets and also

on the contractual cash flow of these financial assets. The financial assets has been measured

at the amortised cost only and only if the following conditions are met:

When the asset is held for the purposes of holding the assets to collect the cash flows

Assessment Workbook – FNSACC504 21 | P a g e Version 3.0

When there are some of the contractual terms of the financial assets that represents the

contractual cash flows that are mainly comprise of the payments of the principal and

interest.

With regard to the financial liabilities, the Annual report of the company states the fact that

these are measured at either the amortised cost of the FVTPL. The criteria to designate the

financial liability at FVTPL is through the way of applying the fair value option which

remains unchanged.

The company chose to select the option of fair value for the purposes of some of the financial

liabilities and these are also classified as the deposits and other such borrowings which are

accounted for at the amortised cost.

There are few of the changes in the impairment of assets as well. The AASB 9 which deals

with the requirements with regard to the impairment of assets are based upon the expected

credit loss model which replaces the incurred loss methodology under the AASB 139. There

are key changes in the accounting policy of the impairment of the financial assets as well

which have bene listed below:

The company applies the 3 stage approach for the purposes of measuring the expected credit

losses on the debt instruments that have been accounted for at the amortised cost and the

FVOCI. The assets migrate through the following listed stages that are based upon the credit

quality sine their initial recognition.

The first stage is 12 months which is there for the exposure wherein there is a major increase

in the credit risk since the initial recognition and which are not credit impaired upon

origination. This is the portion of the lifetime, ECL is connected with the profitability of all

of the default events that takes place within the period of 12 months.

Assessment Workbook – FNSACC504 22 | P a g e Version 3.0

contractual cash flows that are mainly comprise of the payments of the principal and

interest.

With regard to the financial liabilities, the Annual report of the company states the fact that

these are measured at either the amortised cost of the FVTPL. The criteria to designate the

financial liability at FVTPL is through the way of applying the fair value option which

remains unchanged.

The company chose to select the option of fair value for the purposes of some of the financial

liabilities and these are also classified as the deposits and other such borrowings which are

accounted for at the amortised cost.

There are few of the changes in the impairment of assets as well. The AASB 9 which deals

with the requirements with regard to the impairment of assets are based upon the expected

credit loss model which replaces the incurred loss methodology under the AASB 139. There

are key changes in the accounting policy of the impairment of the financial assets as well

which have bene listed below:

The company applies the 3 stage approach for the purposes of measuring the expected credit

losses on the debt instruments that have been accounted for at the amortised cost and the

FVOCI. The assets migrate through the following listed stages that are based upon the credit

quality sine their initial recognition.

The first stage is 12 months which is there for the exposure wherein there is a major increase

in the credit risk since the initial recognition and which are not credit impaired upon

origination. This is the portion of the lifetime, ECL is connected with the profitability of all

of the default events that takes place within the period of 12 months.

Assessment Workbook – FNSACC504 22 | P a g e Version 3.0

Secure Best Marks with AI Grader

Need help grading? Try our AI Grader for instant feedback on your assignments.

The second stage is that of a lifetime ECL which is there for the credit exposures that have a

major increase in the credit risk since the initial recognition but they are also not credit

impaired.

The stage 3 deals with the credit impaired financial assets that have been assessed as the

credit impaired when there are one or more of the events that have some detrimental impact

on the estimated future cash flows for the company in respect of the assets that has occurred.

This uses the same criteria which is followed under the AASB 139 which deals with some of

the specific provisions of the group which remains unchanged. For the financial assets that

have been credit impaired, a lifetime ECL has bene recognised and the amount of the interest

revenue is calculated by the way of applying the effective interest rate to the amortised cost

instead of the gross carrying amount.

At each of the reporting dates, the company assess these credit risks for the financial assets

since the initial recognition by the way of comparing the risk of default which occurs over the

expected life between the date of reporting and the date of initial recognition.

Question 6

Is there any indication of any discrepancies, unusual features of queries about the financial

data? Describe.

The following are some of the changes that have been reported during the current year:

The assets that were held to maturity and that were available for sale have been

removed. There is a new category that has bene introduced in respect of the financial

assets that have bene measured at the fair value through the statement of other

comprehensive income. This is applicable to all of the debt instruments with the

contractual cash flow characteristics that are the sole payments of the principal and

Assessment Workbook – FNSACC504 23 | P a g e Version 3.0

major increase in the credit risk since the initial recognition but they are also not credit

impaired.

The stage 3 deals with the credit impaired financial assets that have been assessed as the

credit impaired when there are one or more of the events that have some detrimental impact

on the estimated future cash flows for the company in respect of the assets that has occurred.

This uses the same criteria which is followed under the AASB 139 which deals with some of

the specific provisions of the group which remains unchanged. For the financial assets that

have been credit impaired, a lifetime ECL has bene recognised and the amount of the interest

revenue is calculated by the way of applying the effective interest rate to the amortised cost

instead of the gross carrying amount.

At each of the reporting dates, the company assess these credit risks for the financial assets

since the initial recognition by the way of comparing the risk of default which occurs over the

expected life between the date of reporting and the date of initial recognition.

Question 6

Is there any indication of any discrepancies, unusual features of queries about the financial

data? Describe.

The following are some of the changes that have been reported during the current year:

The assets that were held to maturity and that were available for sale have been

removed. There is a new category that has bene introduced in respect of the financial

assets that have bene measured at the fair value through the statement of other

comprehensive income. This is applicable to all of the debt instruments with the

contractual cash flow characteristics that are the sole payments of the principal and

Assessment Workbook – FNSACC504 23 | P a g e Version 3.0

the interest and which is in the business model. The objective of the same was to

achieve the collection of the contractual cash flows and the selling of the financial

assets. A majority of the debt instruments of the company were classified in this

category. There was also another category of asset that was introduced, by the name

of non-traded equity investments that have been measured at FVOCI.

A majority portion of the equity instruments of the company. As on the date of

transition, the company decided to revoke the previous fair value option which

included being measured at some of the specific lending portfolios through the fair

values through the profit or loss. These were the portfolios that were accounted for at

the amortised costs.

Question 7

Examine the financial summaries for information about the financial status of the

organisation. Explain the profit trends from the previous financial year and give a summary

The net profit attributable to the owners of the company has increased by 19.7% when

compared with the previous year. The revenue of the company has increased by 4%. This

excludes all of the gains from the legal settlement and the UK Commercial real estate loan

portfolio.

The expenses of the company have fallen by 1% but this rate excludes some of the specific

items and the foreign exchange rates impact. The asset quality of the company has improved

when compared with the previous year. The company has raised about $26.5 billion from the

wholesale funding during the year 2015.

In the nutshell, the net profit of the company has improved.

Assessment Workbook – FNSACC504 24 | P a g e Version 3.0

achieve the collection of the contractual cash flows and the selling of the financial

assets. A majority of the debt instruments of the company were classified in this

category. There was also another category of asset that was introduced, by the name

of non-traded equity investments that have been measured at FVOCI.

A majority portion of the equity instruments of the company. As on the date of

transition, the company decided to revoke the previous fair value option which

included being measured at some of the specific lending portfolios through the fair

values through the profit or loss. These were the portfolios that were accounted for at

the amortised costs.

Question 7

Examine the financial summaries for information about the financial status of the

organisation. Explain the profit trends from the previous financial year and give a summary

The net profit attributable to the owners of the company has increased by 19.7% when

compared with the previous year. The revenue of the company has increased by 4%. This

excludes all of the gains from the legal settlement and the UK Commercial real estate loan

portfolio.

The expenses of the company have fallen by 1% but this rate excludes some of the specific

items and the foreign exchange rates impact. The asset quality of the company has improved

when compared with the previous year. The company has raised about $26.5 billion from the

wholesale funding during the year 2015.

In the nutshell, the net profit of the company has improved.

Assessment Workbook – FNSACC504 24 | P a g e Version 3.0

Question 8

What sorts of recommendations are made and what suggestions are made regarding business

activities for the upcoming year? Are they constructive?

The following are some of the suggestions that the company would follow:

The company in the upcoming years would focus even more on the customer

segments. This means that the micro, small and the medium sized customers would be

prioritised.

The company has made some substantial progress in improving the customer

experiences and it would continue to do this moving forward too.

The group also drives in some improved performances and execution.

The people of the group also drive in performance and accelerate execution of the

efficient business activities too.

Question 9

Is the structure and format of the report clear and conform to statutory requirements and

organisational Procedures?

Yes, the structure and the format conforms to the statutory requirements of the relevant rules

and procedures. This is stated in the basis of preparation section of the Annual report which

states that it has bene prepared as per the relevant Australian Accounting Standards of the

year 2001.

Question 10

Has the organisation complied with its statutory requirements? Explain.

Assessment Workbook – FNSACC504 25 | P a g e Version 3.0

What sorts of recommendations are made and what suggestions are made regarding business

activities for the upcoming year? Are they constructive?

The following are some of the suggestions that the company would follow:

The company in the upcoming years would focus even more on the customer

segments. This means that the micro, small and the medium sized customers would be

prioritised.

The company has made some substantial progress in improving the customer

experiences and it would continue to do this moving forward too.

The group also drives in some improved performances and execution.

The people of the group also drive in performance and accelerate execution of the

efficient business activities too.

Question 9

Is the structure and format of the report clear and conform to statutory requirements and

organisational Procedures?

Yes, the structure and the format conforms to the statutory requirements of the relevant rules

and procedures. This is stated in the basis of preparation section of the Annual report which

states that it has bene prepared as per the relevant Australian Accounting Standards of the

year 2001.

Question 10

Has the organisation complied with its statutory requirements? Explain.

Assessment Workbook – FNSACC504 25 | P a g e Version 3.0

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Yes, the financial statements of the confirm with the requirements as have been laid down in

the Corporations Act 2001 along with the accounting standards and the interpretations as

have been laid down by the Australian Standards of Accounting.

Access NAB’s 2014 Financial reports and

Compare the two reports and comment on whether or not the projections from the 2014

report were accurate.

In the Annual report of the year 2014, the company had projected that in the year 2015, the

group would focus on maintaining the strong Australian and New Zealand franchisee which

would concentrate on the improving of the customer experience, focus on the attractive

customer segments in the country of Australia, build a culture of accountability, performance

and delivery. It also would maintain the banking essentials of the financial statements and

also would run off low returning assets (NAB Annual report, 2015).

Assessment Workbook – FNSACC504 26 | P a g e Version 3.0

the Corporations Act 2001 along with the accounting standards and the interpretations as

have been laid down by the Australian Standards of Accounting.

Access NAB’s 2014 Financial reports and

Compare the two reports and comment on whether or not the projections from the 2014

report were accurate.

In the Annual report of the year 2014, the company had projected that in the year 2015, the

group would focus on maintaining the strong Australian and New Zealand franchisee which

would concentrate on the improving of the customer experience, focus on the attractive

customer segments in the country of Australia, build a culture of accountability, performance

and delivery. It also would maintain the banking essentials of the financial statements and

also would run off low returning assets (NAB Annual report, 2015).

Assessment Workbook – FNSACC504 26 | P a g e Version 3.0

References:

Bragg, S. and Bragg, S. (2018). Users of financial statements. [online] AccountingTools.

Available at: https://www.accountingtools.com/articles/users-of-financial-statements.html

[Accessed 26 Oct. 2018].

Corporate Finance Institute. (2018). Consolidation Method - Accounting for Majority Control

Investments. [online] Available at:

https://corporatefinanceinstitute.com/resources/knowledge/accounting/consolidation-method/

[Accessed 26 Oct. 2018].

Ltd, R. (2018). Business and Instalment Activity Statements | Roz Lahey Accounting

Brisbane. [online] Rozlahey.com.au. Available at: http://rozlahey.com.au/services/bas-and-

ias [Accessed 26 Oct. 2018].

Nab.com.au. (2018). Annual report 2015. [online] Available at:

https://www.nab.com.au/content/dam/nabrwd/documents/reports/corporate/annual-financial-

report-2015.pdf [Accessed 26 Oct. 2018].

Smallbusiness.chron.com. (2018). Accounting Information System Conversion Methods.

[online] Available at: https://smallbusiness.chron.com/accounting-information-system-

conversion-methods-34569.html [Accessed 26 Oct. 2018].

Assessment Workbook – FNSACC504 27 | P a g e Version 3.0

Bragg, S. and Bragg, S. (2018). Users of financial statements. [online] AccountingTools.

Available at: https://www.accountingtools.com/articles/users-of-financial-statements.html

[Accessed 26 Oct. 2018].

Corporate Finance Institute. (2018). Consolidation Method - Accounting for Majority Control

Investments. [online] Available at:

https://corporatefinanceinstitute.com/resources/knowledge/accounting/consolidation-method/

[Accessed 26 Oct. 2018].

Ltd, R. (2018). Business and Instalment Activity Statements | Roz Lahey Accounting

Brisbane. [online] Rozlahey.com.au. Available at: http://rozlahey.com.au/services/bas-and-

ias [Accessed 26 Oct. 2018].

Nab.com.au. (2018). Annual report 2015. [online] Available at:

https://www.nab.com.au/content/dam/nabrwd/documents/reports/corporate/annual-financial-

report-2015.pdf [Accessed 26 Oct. 2018].

Smallbusiness.chron.com. (2018). Accounting Information System Conversion Methods.

[online] Available at: https://smallbusiness.chron.com/accounting-information-system-

conversion-methods-34569.html [Accessed 26 Oct. 2018].

Assessment Workbook – FNSACC504 27 | P a g e Version 3.0

1 out of 27

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.