Solved: Quantitative Methods in Finance University Assignment

VerifiedAdded on 2023/06/08

|15

|1289

|491

Homework Assignment

AI Summary

This assignment solution covers various quantitative methods applied in finance. It includes calculations for absolute and relative changes in time series data, average discrete and continuous monthly returns, and solving quadratic equations using discriminant analysis and Excel Solver. The assignment also addresses calculus problems involving derivatives and integration, along with linear and quadratic approximations of functions. Furthermore, it delves into present value calculations, bond valuation, and portfolio construction, providing detailed steps and explanations for each problem. The solutions are supported by graphs and tables generated using Excel, illustrating the application of these methods in financial analysis.

Running Head: QUANTITATIVE METHODS IN FINANCE

Quantitative Methods in Finance

Name of the Student

Name of the University

Student ID

Quantitative Methods in Finance

Name of the Student

Name of the University

Student ID

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1QUANTITATIVE METHODS IN FINANCE

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................2

Answer 3..........................................................................................................................................2

Answer 4..........................................................................................................................................7

Answer 5..........................................................................................................................................8

Answer 6..........................................................................................................................................9

Answer 7........................................................................................................................................11

Answer 8........................................................................................................................................12

Answer 9........................................................................................................................................13

Table of Contents

Answer 1..........................................................................................................................................2

Answer 2..........................................................................................................................................2

Answer 3..........................................................................................................................................2

Answer 4..........................................................................................................................................7

Answer 5..........................................................................................................................................8

Answer 6..........................................................................................................................................9

Answer 7........................................................................................................................................11

Answer 8........................................................................................................................................12

Answer 9........................................................................................................................................13

2QUANTITATIVE METHODS IN FINANCE

Answer 1

(a) Absolute amount= yt − yt −1

(b) Relative amount (r )= yt− yt −1

yt −1

×100 %

(c) Constant elasticity(e)= yt− yt−1

yt −1

(d) log ∆ y −log yt =R

log ∆ y −log yt =E

Answer 2

a)

Share Price Market

Index

Date Rit Rmt. Return Rit Return Market

17-Aug $1.55 1,175.00

17-Sep $2.10 1,200.00 35.48% 2.13%

17-Oct $2.45 1,305.00 16.67% 8.75%

17-Nov $2.85 1,505.00 16.33% 15.33%

Discrete Returns 22.83% 8.73%

Average continuous monthly 21.29% 6.58%

b) The stock has over performed the market, as the total returns of the share is higher than the

market index.

c) The beta of the stock is relevantly higher, which increases the risk from investment, where

investment in the stock is not advisable.

Answer 3

Answer 1

(a) Absolute amount= yt − yt −1

(b) Relative amount (r )= yt− yt −1

yt −1

×100 %

(c) Constant elasticity(e)= yt− yt−1

yt −1

(d) log ∆ y −log yt =R

log ∆ y −log yt =E

Answer 2

a)

Share Price Market

Index

Date Rit Rmt. Return Rit Return Market

17-Aug $1.55 1,175.00

17-Sep $2.10 1,200.00 35.48% 2.13%

17-Oct $2.45 1,305.00 16.67% 8.75%

17-Nov $2.85 1,505.00 16.33% 15.33%

Discrete Returns 22.83% 8.73%

Average continuous monthly 21.29% 6.58%

b) The stock has over performed the market, as the total returns of the share is higher than the

market index.

c) The beta of the stock is relevantly higher, which increases the risk from investment, where

investment in the stock is not advisable.

Answer 3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3QUANTITATIVE METHODS IN FINANCE

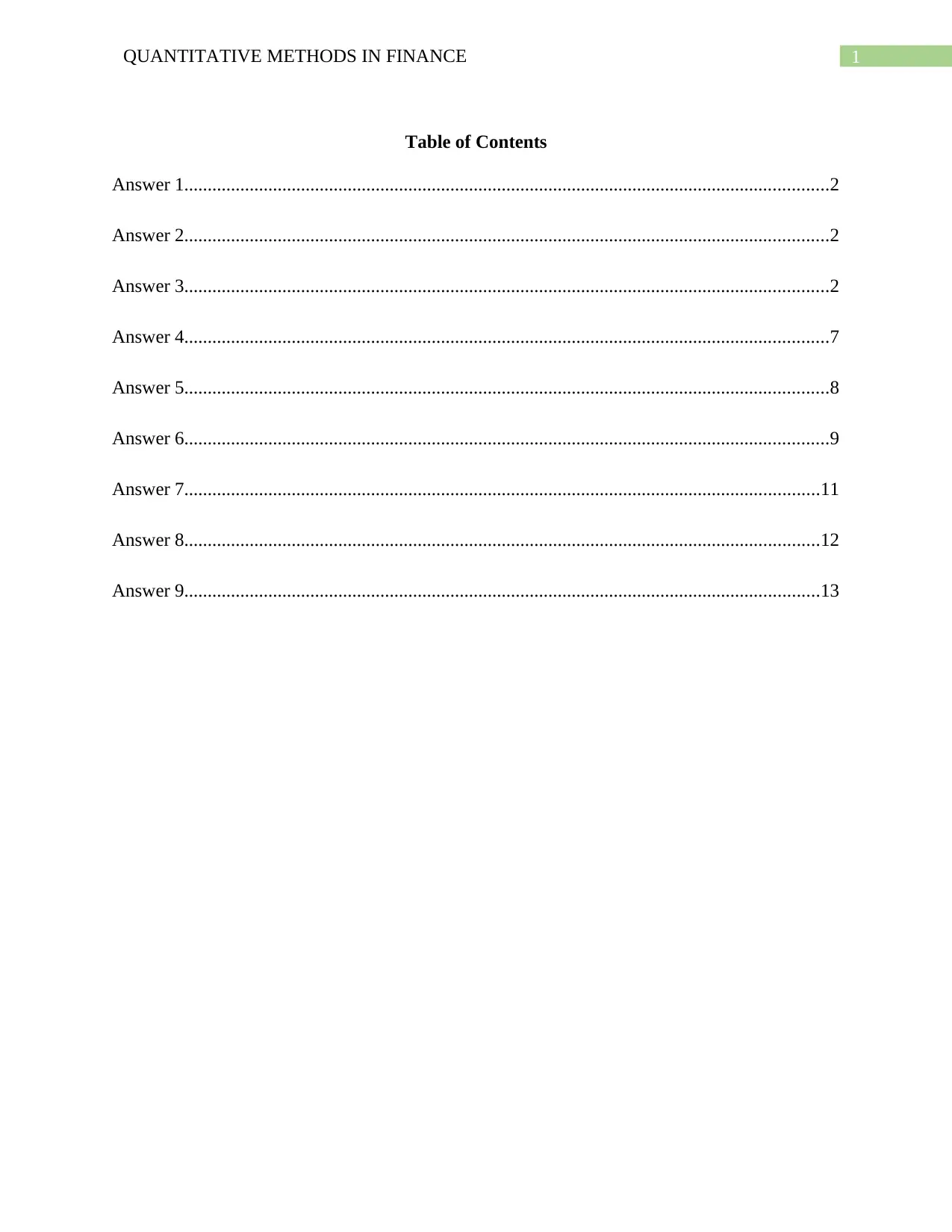

(a) 200 x2−10 x+350=0

→ 20 x2−x +35=0

Discriminant =( −1 ) 2−4 ×20 × 35=−2799

2 x2 +20 x +5=0

Discriminant = ( 20 ) 2−4 × 2×5=360

6 x2+5 x−20=0

Discriminant = ( 5 ) 2−4 × 6×(−20)=505

(b) For the first equation, the value of the discriminant is < 0. Thus, the equation has

imaginary roots.

For the second equation, the discriminant is > 0. Thus, the roots of the equation are real,

distinct and irrational.

For the third equation, the discriminant is > 0. Thus, the roots of the equation are real,

distinct and irrational.

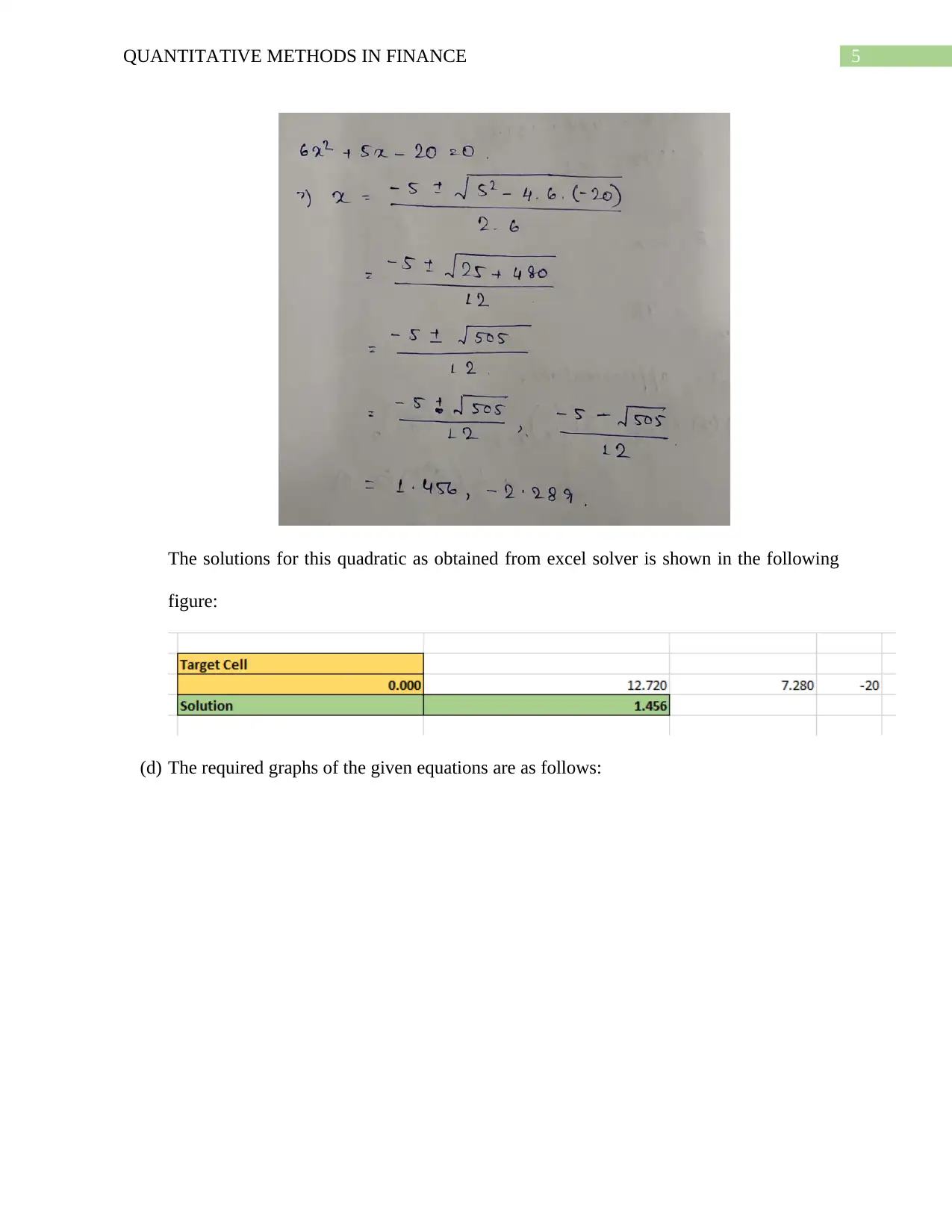

(c) It can be seen from solver analysis that 200 x2−10 x+350=0 has no solution.

(a) 200 x2−10 x+350=0

→ 20 x2−x +35=0

Discriminant =( −1 ) 2−4 ×20 × 35=−2799

2 x2 +20 x +5=0

Discriminant = ( 20 ) 2−4 × 2×5=360

6 x2+5 x−20=0

Discriminant = ( 5 ) 2−4 × 6×(−20)=505

(b) For the first equation, the value of the discriminant is < 0. Thus, the equation has

imaginary roots.

For the second equation, the discriminant is > 0. Thus, the roots of the equation are real,

distinct and irrational.

For the third equation, the discriminant is > 0. Thus, the roots of the equation are real,

distinct and irrational.

(c) It can be seen from solver analysis that 200 x2−10 x+350=0 has no solution.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4QUANTITATIVE METHODS IN FINANCE

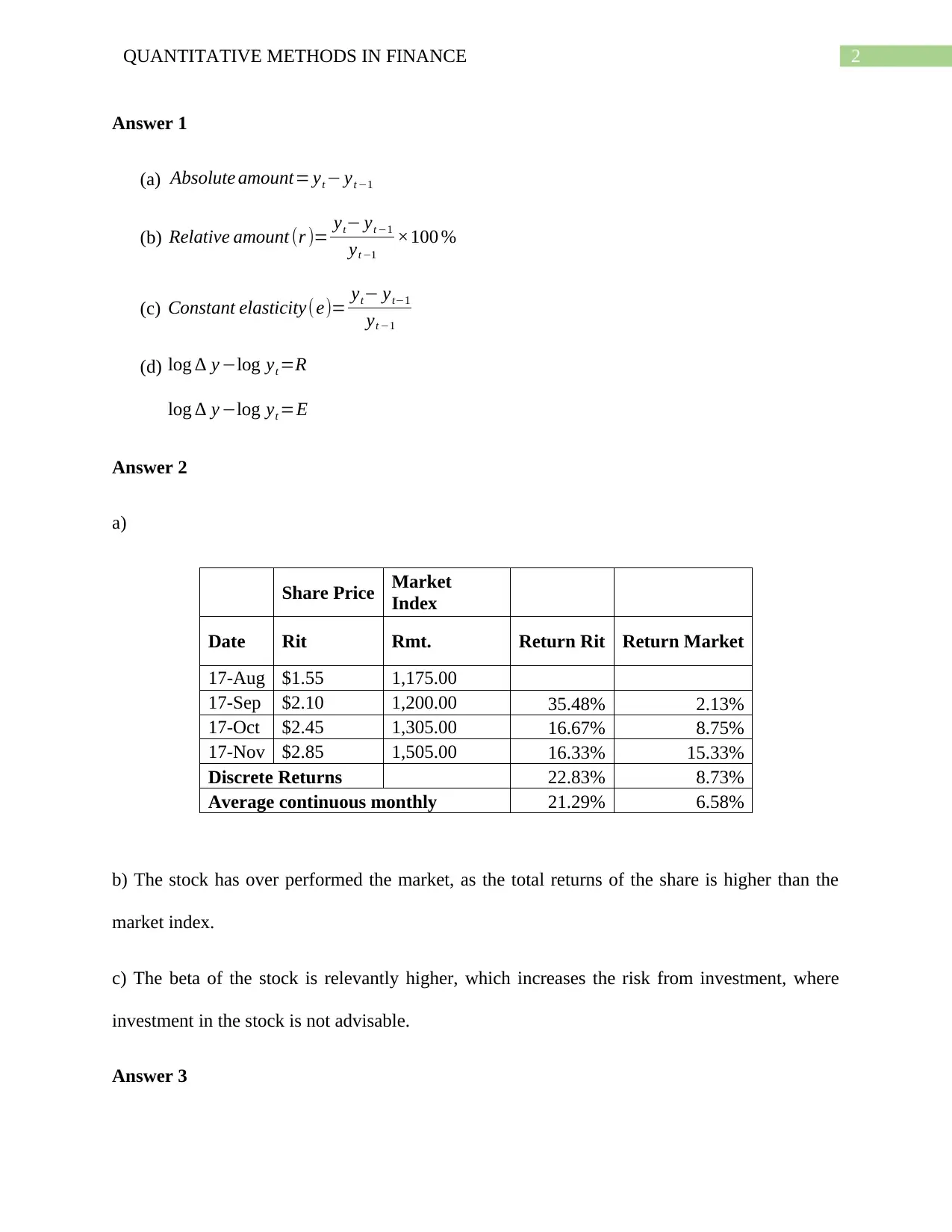

The solution for the quadratic equation 2 x2 +20 x +5=0 is shown with the following

calculations:

The solutions for this quadratic as obtained from excel solver is shown in the following

figure:

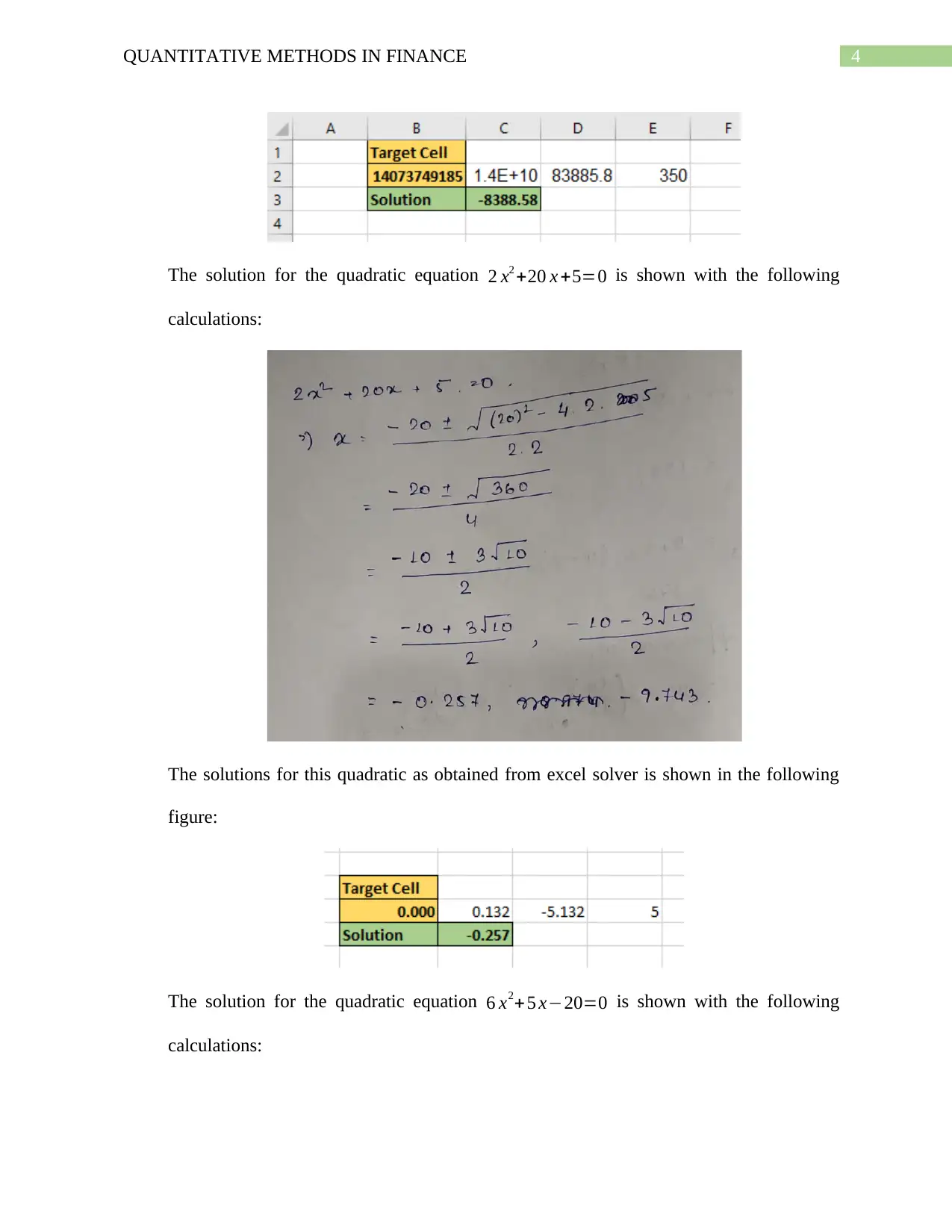

The solution for the quadratic equation 6 x2+ 5 x−20=0 is shown with the following

calculations:

The solution for the quadratic equation 2 x2 +20 x +5=0 is shown with the following

calculations:

The solutions for this quadratic as obtained from excel solver is shown in the following

figure:

The solution for the quadratic equation 6 x2+ 5 x−20=0 is shown with the following

calculations:

5QUANTITATIVE METHODS IN FINANCE

The solutions for this quadratic as obtained from excel solver is shown in the following

figure:

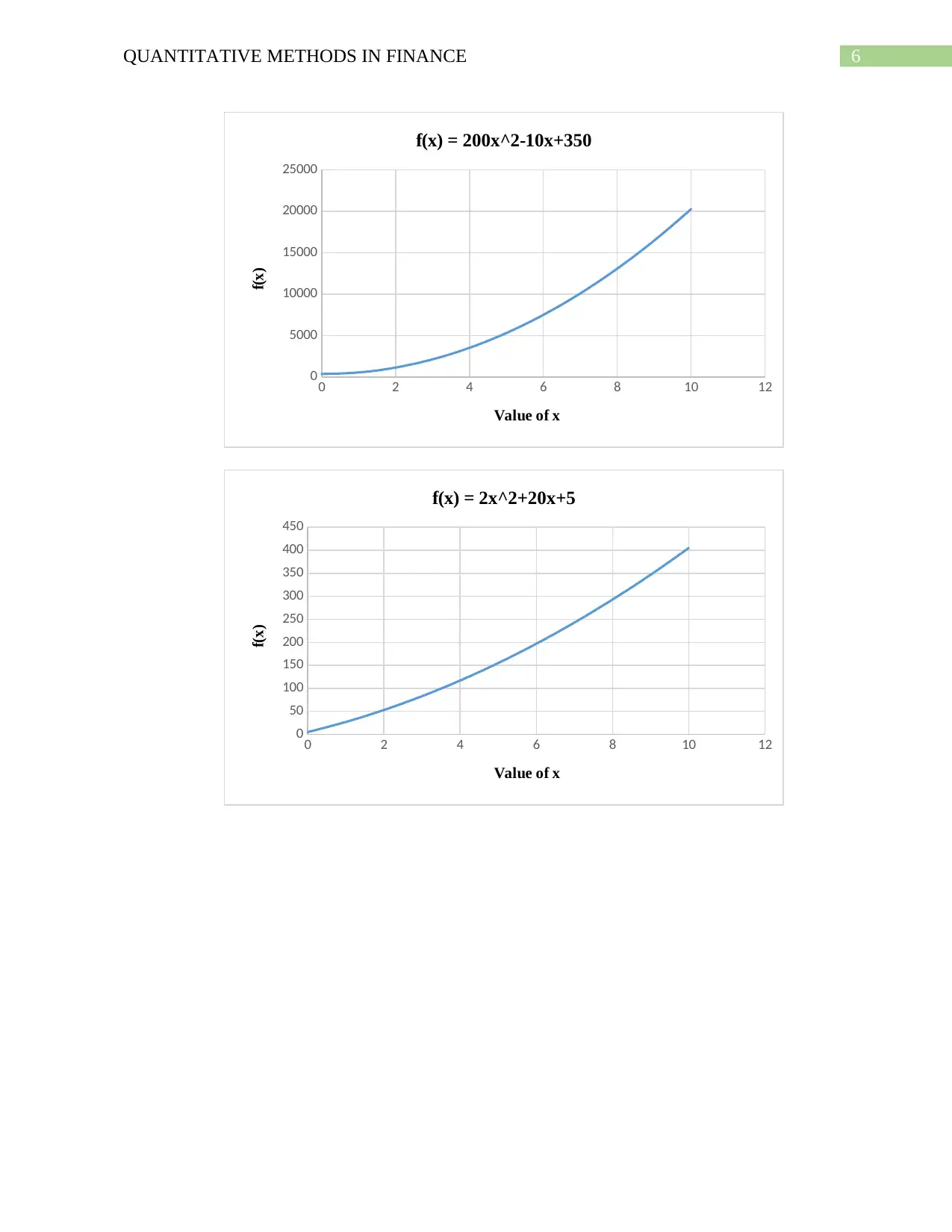

(d) The required graphs of the given equations are as follows:

The solutions for this quadratic as obtained from excel solver is shown in the following

figure:

(d) The required graphs of the given equations are as follows:

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6QUANTITATIVE METHODS IN FINANCE

0 2 4 6 8 10 12

0

5000

10000

15000

20000

25000

f(x) = 200x^2-10x+350

Value of x

f(x)

0 2 4 6 8 10 12

0

50

100

150

200

250

300

350

400

450

f(x) = 2x^2+20x+5

Value of x

f(x)

0 2 4 6 8 10 12

0

5000

10000

15000

20000

25000

f(x) = 200x^2-10x+350

Value of x

f(x)

0 2 4 6 8 10 12

0

50

100

150

200

250

300

350

400

450

f(x) = 2x^2+20x+5

Value of x

f(x)

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7QUANTITATIVE METHODS IN FINANCE

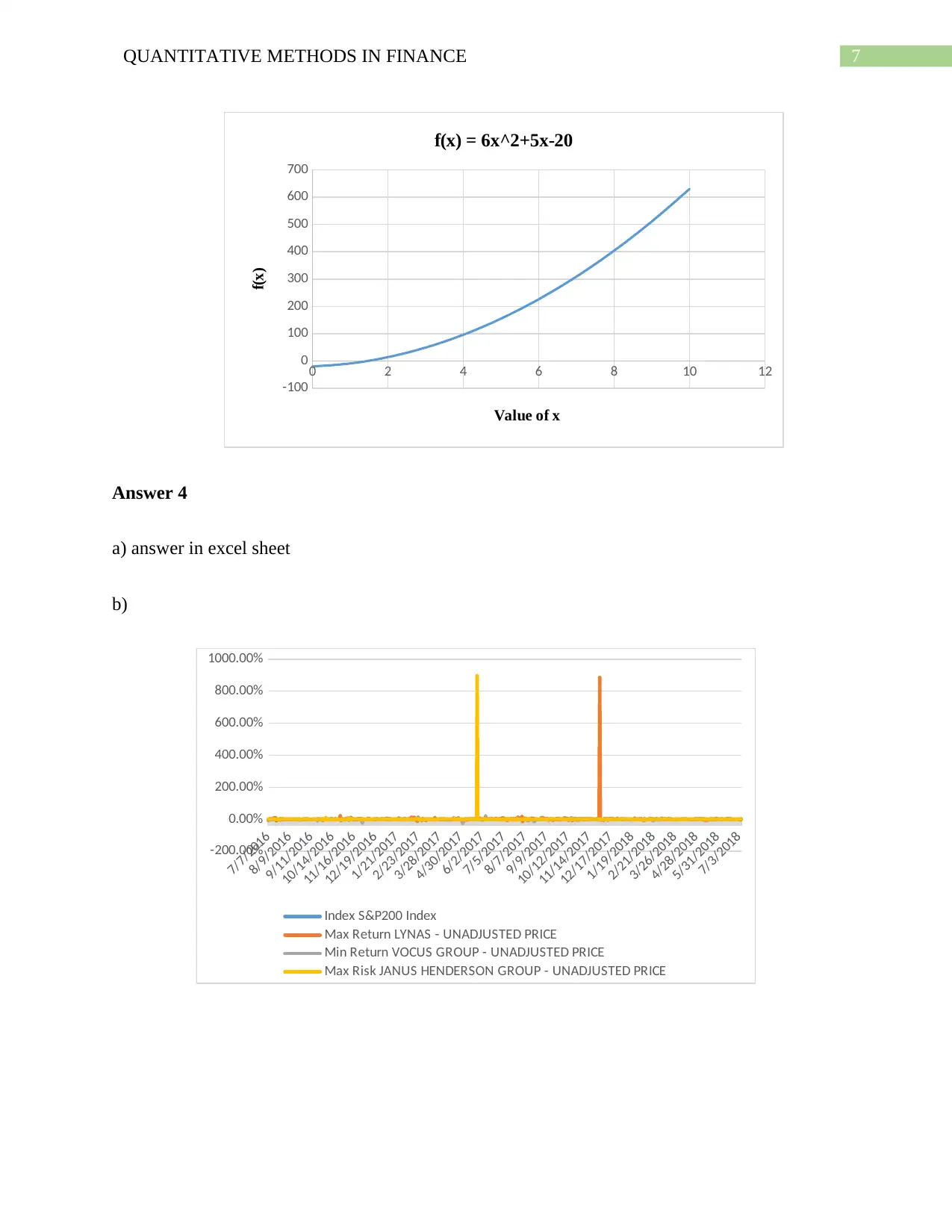

0 2 4 6 8 10 12

-100

0

100

200

300

400

500

600

700

f(x) = 6x^2+5x-20

Value of x

f(x)

Answer 4

a) answer in excel sheet

b)

7/7/2016

8/9/2016

9/11/2016

10/14/2016

11/16/2016

12/19/2016

1/21/2017

2/23/2017

3/28/2017

4/30/2017

6/2/2017

7/5/2017

8/7/2017

9/9/2017

10/12/2017

11/14/2017

12/17/2017

1/19/2018

2/21/2018

3/26/2018

4/28/2018

5/31/2018

7/3/2018

-200.00%

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

Index S&P200 Index

Max Return LYNAS - UNADJUSTED PRICE

Min Return VOCUS GROUP - UNADJUSTED PRICE

Max Risk JANUS HENDERSON GROUP - UNADJUSTED PRICE

0 2 4 6 8 10 12

-100

0

100

200

300

400

500

600

700

f(x) = 6x^2+5x-20

Value of x

f(x)

Answer 4

a) answer in excel sheet

b)

7/7/2016

8/9/2016

9/11/2016

10/14/2016

11/16/2016

12/19/2016

1/21/2017

2/23/2017

3/28/2017

4/30/2017

6/2/2017

7/5/2017

8/7/2017

9/9/2017

10/12/2017

11/14/2017

12/17/2017

1/19/2018

2/21/2018

3/26/2018

4/28/2018

5/31/2018

7/3/2018

-200.00%

0.00%

200.00%

400.00%

600.00%

800.00%

1000.00%

Index S&P200 Index

Max Return LYNAS - UNADJUSTED PRICE

Min Return VOCUS GROUP - UNADJUSTED PRICE

Max Risk JANUS HENDERSON GROUP - UNADJUSTED PRICE

8QUANTITATIVE METHODS IN FINANCE

c) The returns provided by the stocks is relevantly higher than the current index, which is

depicted the above graph. The major limitation of raw data is the unreliability of the data, which

can be manipulated by individuals for porting abnormal returns.

Answer 5

(a) y=10+ 5 x +x−2

dy

dx = d

dx ( 10+5 x+ x−2 )

→ dy

dx =5−2 x−3

(b) y=(21 x+x0 .5 ). (0. 33 x+ x5 )

(c) y= x2− e-2x

2 + e(-3x) + ln(25x-2)

c) The returns provided by the stocks is relevantly higher than the current index, which is

depicted the above graph. The major limitation of raw data is the unreliability of the data, which

can be manipulated by individuals for porting abnormal returns.

Answer 5

(a) y=10+ 5 x +x−2

dy

dx = d

dx ( 10+5 x+ x−2 )

→ dy

dx =5−2 x−3

(b) y=(21 x+x0 .5 ). (0. 33 x+ x5 )

(c) y= x2− e-2x

2 + e(-3x) + ln(25x-2)

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

9QUANTITATIVE METHODS IN FINANCE

(d) ∫5

10

20x+18x8

dx

Answer 6

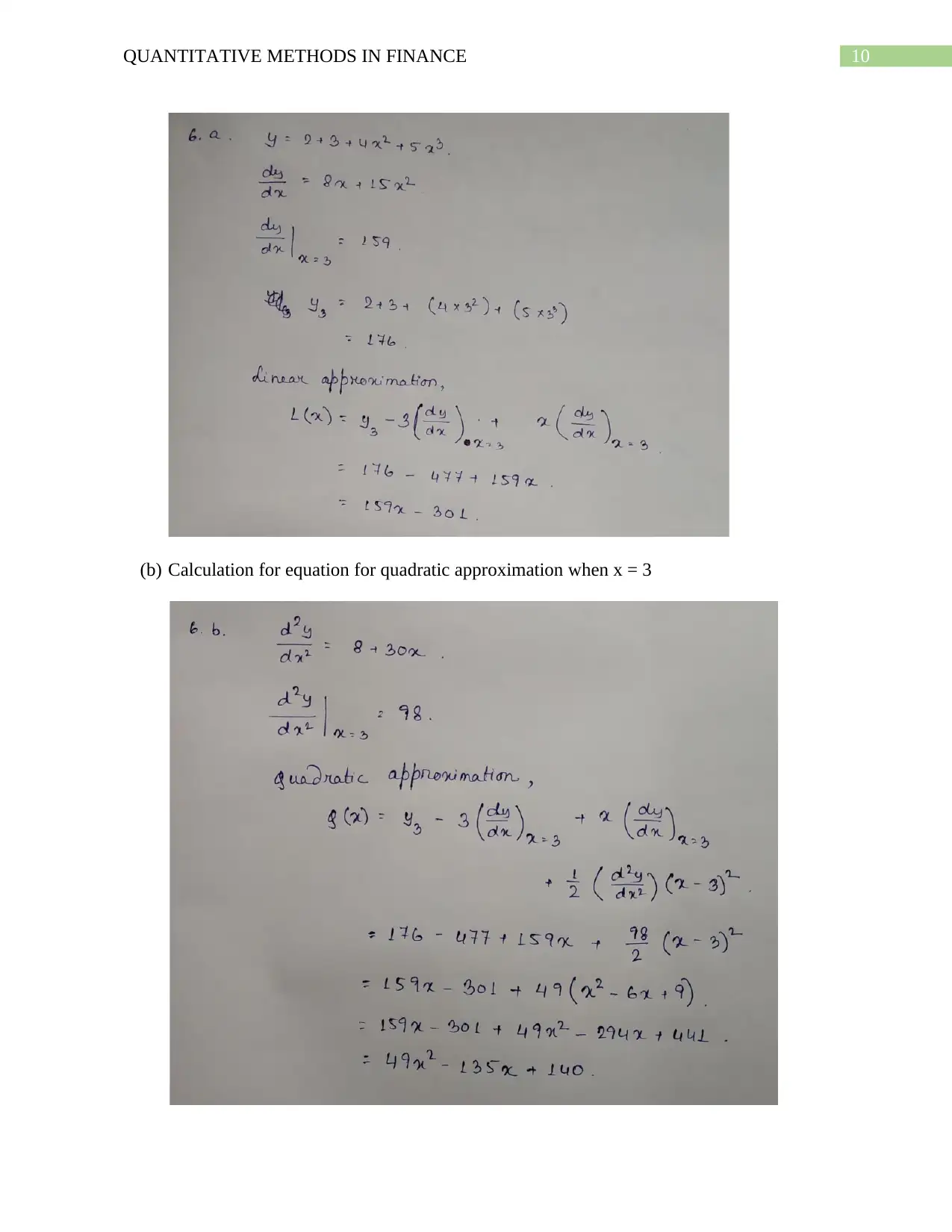

(a) Calculation for equation for linear approximation when x = 3.

(d) ∫5

10

20x+18x8

dx

Answer 6

(a) Calculation for equation for linear approximation when x = 3.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

10QUANTITATIVE METHODS IN FINANCE

(b) Calculation for equation for quadratic approximation when x = 3

(b) Calculation for equation for quadratic approximation when x = 3

11QUANTITATIVE METHODS IN FINANCE

(c) The graph showing the function with its linear and quadratic approximation is given

below:

0 1 2 3 4 5 6

-400

-200

0

200

400

600

800

Linear and Quadratic approximation of a Function

f(x) L(x) Q(x)

Values of x

f(x), L(x) and Q(x)

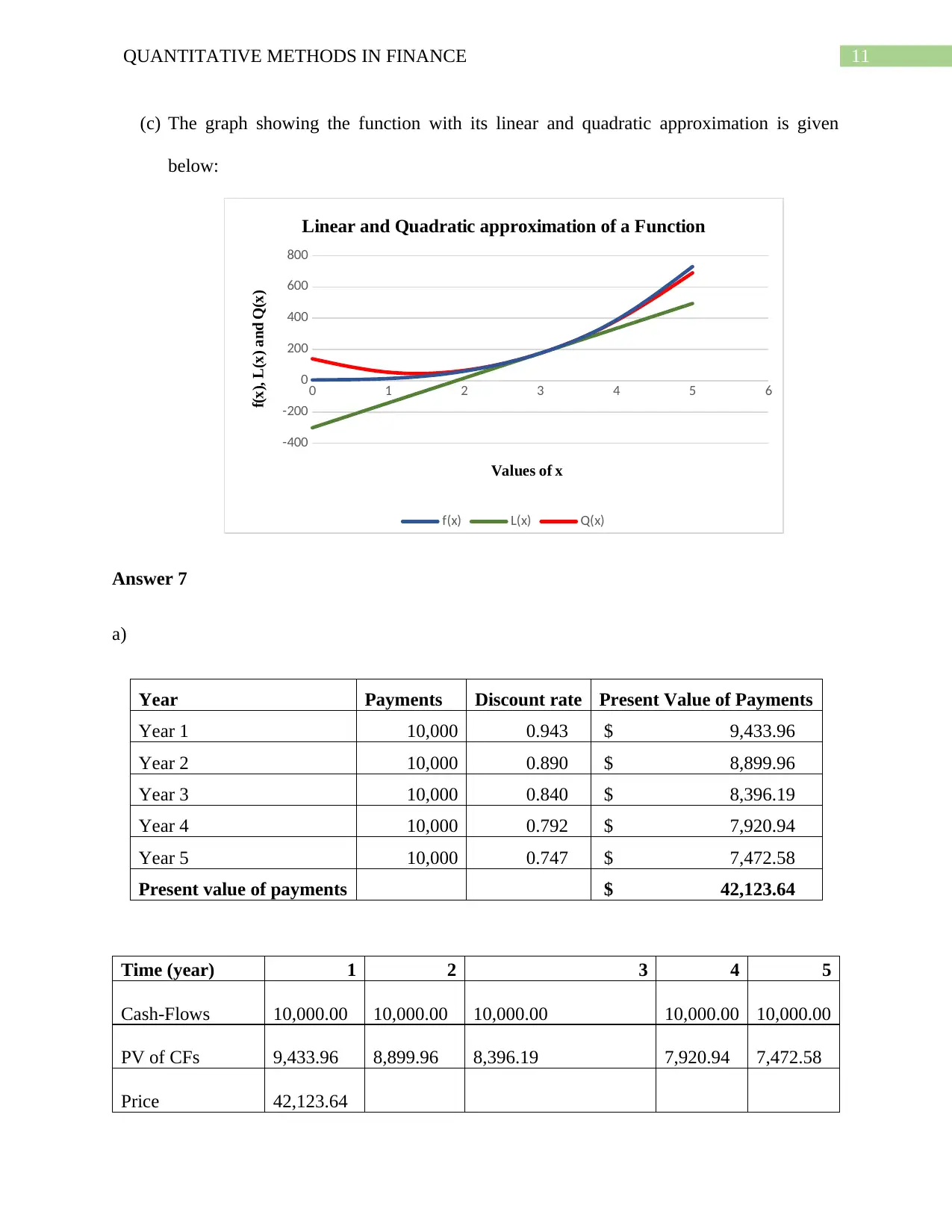

Answer 7

a)

Year Payments Discount rate Present Value of Payments

Year 1 10,000 0.943 $ 9,433.96

Year 2 10,000 0.890 $ 8,899.96

Year 3 10,000 0.840 $ 8,396.19

Year 4 10,000 0.792 $ 7,920.94

Year 5 10,000 0.747 $ 7,472.58

Present value of payments $ 42,123.64

Time (year) 1 2 3 4 5

Cash-Flows 10,000.00 10,000.00 10,000.00 10,000.00 10,000.00

PV of CFs 9,433.96 8,899.96 8,396.19 7,920.94 7,472.58

Price 42,123.64

(c) The graph showing the function with its linear and quadratic approximation is given

below:

0 1 2 3 4 5 6

-400

-200

0

200

400

600

800

Linear and Quadratic approximation of a Function

f(x) L(x) Q(x)

Values of x

f(x), L(x) and Q(x)

Answer 7

a)

Year Payments Discount rate Present Value of Payments

Year 1 10,000 0.943 $ 9,433.96

Year 2 10,000 0.890 $ 8,899.96

Year 3 10,000 0.840 $ 8,396.19

Year 4 10,000 0.792 $ 7,920.94

Year 5 10,000 0.747 $ 7,472.58

Present value of payments $ 42,123.64

Time (year) 1 2 3 4 5

Cash-Flows 10,000.00 10,000.00 10,000.00 10,000.00 10,000.00

PV of CFs 9,433.96 8,899.96 8,396.19 7,920.94 7,472.58

Price 42,123.64

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2025 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.