Financial Accounting Assignment: Time Value, Investment Appraisal

VerifiedAdded on 2023/06/14

|9

|1478

|308

Homework Assignment

AI Summary

This accounting assignment provides detailed solutions to problems related to the time value of money and investment appraisal. It covers calculations for future value, present value, and annuities. The assignment also includes an analysis of investment decisions using Net Present Value (NPV), Internal Rate of Return (IRR), and discounted payback period. Furthermore, it addresses the calculation of unit depletion rate for steam generators and computer controls, providing a comprehensive overview of essential accounting and finance concepts. Desklib offers a wealth of similar solved assignments and study resources for students.

Running head: ACCOUNTING

Accounting

Name of the Student:

Name of the University:

Author’s Note:

Accounting

Name of the Student:

Name of the University:

Author’s Note:

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

1ACCOUNTING

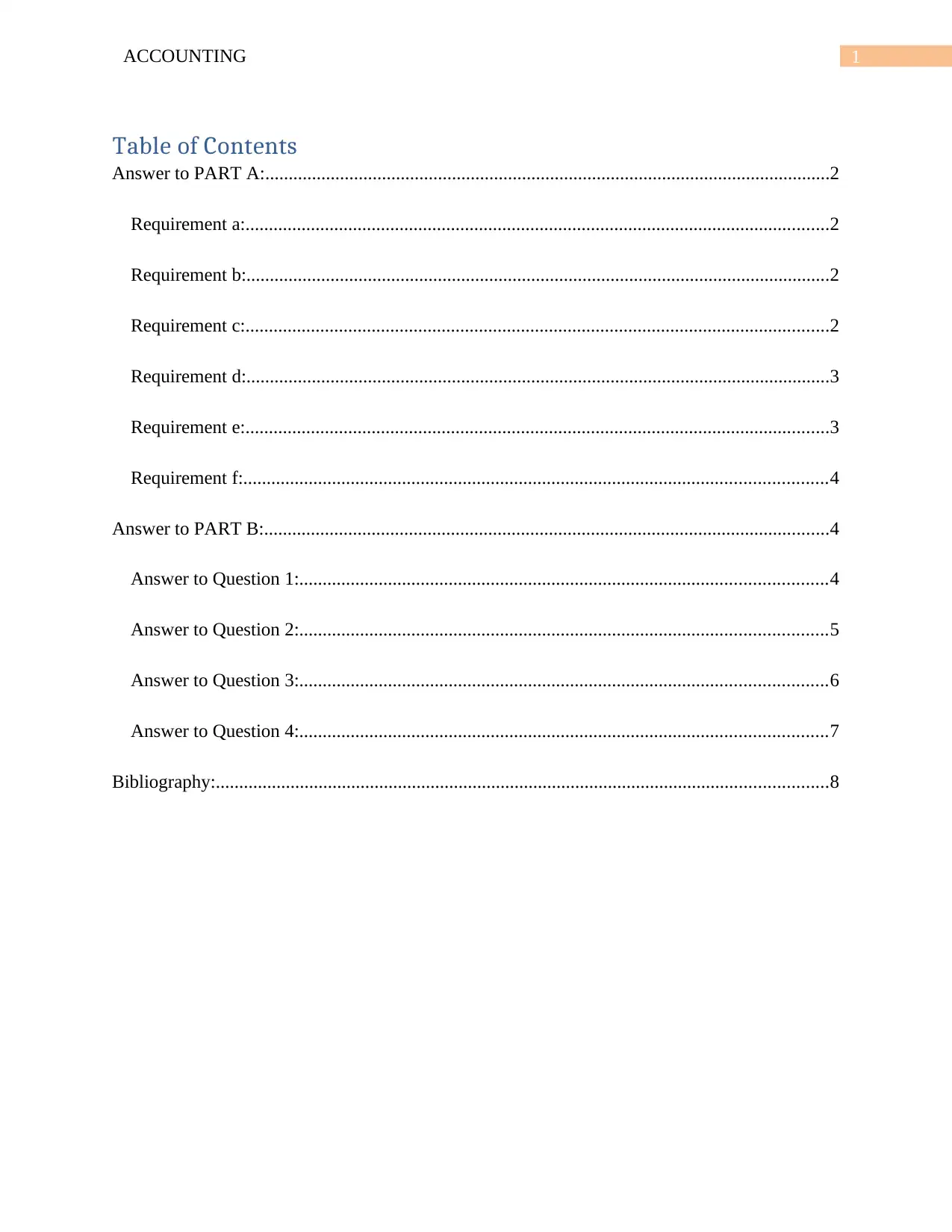

Table of Contents

Answer to PART A:.........................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................2

Requirement c:.............................................................................................................................2

Requirement d:.............................................................................................................................3

Requirement e:.............................................................................................................................3

Requirement f:.............................................................................................................................4

Answer to PART B:.........................................................................................................................4

Answer to Question 1:.................................................................................................................4

Answer to Question 2:.................................................................................................................5

Answer to Question 3:.................................................................................................................6

Answer to Question 4:.................................................................................................................7

Bibliography:...................................................................................................................................8

Table of Contents

Answer to PART A:.........................................................................................................................2

Requirement a:.............................................................................................................................2

Requirement b:.............................................................................................................................2

Requirement c:.............................................................................................................................2

Requirement d:.............................................................................................................................3

Requirement e:.............................................................................................................................3

Requirement f:.............................................................................................................................4

Answer to PART B:.........................................................................................................................4

Answer to Question 1:.................................................................................................................4

Answer to Question 2:.................................................................................................................5

Answer to Question 3:.................................................................................................................6

Answer to Question 4:.................................................................................................................7

Bibliography:...................................................................................................................................8

2ACCOUNTING

Answer to PART A:

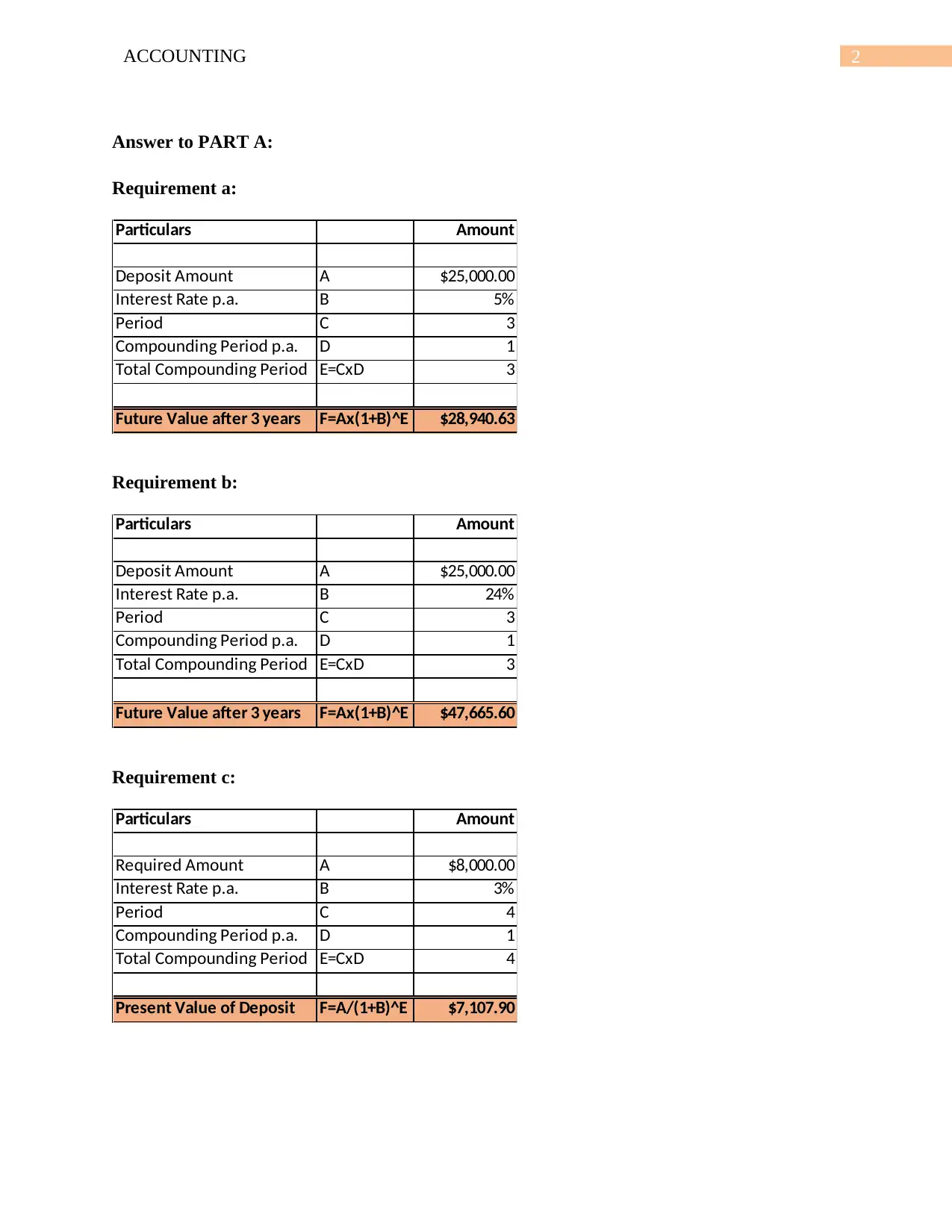

Requirement a:

Particulars Amount

Deposit Amount A $25,000.00

Interest Rate p.a. B 5%

Period C 3

Compounding Period p.a. D 1

Total Compounding Period E=CxD 3

Future Value after 3 years F=Ax(1+B)^E $28,940.63

Requirement b:

Particulars Amount

Deposit Amount A $25,000.00

Interest Rate p.a. B 24%

Period C 3

Compounding Period p.a. D 1

Total Compounding Period E=CxD 3

Future Value after 3 years F=Ax(1+B)^E $47,665.60

Requirement c:

Particulars Amount

Required Amount A $8,000.00

Interest Rate p.a. B 3%

Period C 4

Compounding Period p.a. D 1

Total Compounding Period E=CxD 4

Present Value of Deposit F=A/(1+B)^E $7,107.90

Answer to PART A:

Requirement a:

Particulars Amount

Deposit Amount A $25,000.00

Interest Rate p.a. B 5%

Period C 3

Compounding Period p.a. D 1

Total Compounding Period E=CxD 3

Future Value after 3 years F=Ax(1+B)^E $28,940.63

Requirement b:

Particulars Amount

Deposit Amount A $25,000.00

Interest Rate p.a. B 24%

Period C 3

Compounding Period p.a. D 1

Total Compounding Period E=CxD 3

Future Value after 3 years F=Ax(1+B)^E $47,665.60

Requirement c:

Particulars Amount

Required Amount A $8,000.00

Interest Rate p.a. B 3%

Period C 4

Compounding Period p.a. D 1

Total Compounding Period E=CxD 4

Present Value of Deposit F=A/(1+B)^E $7,107.90

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

3ACCOUNTING

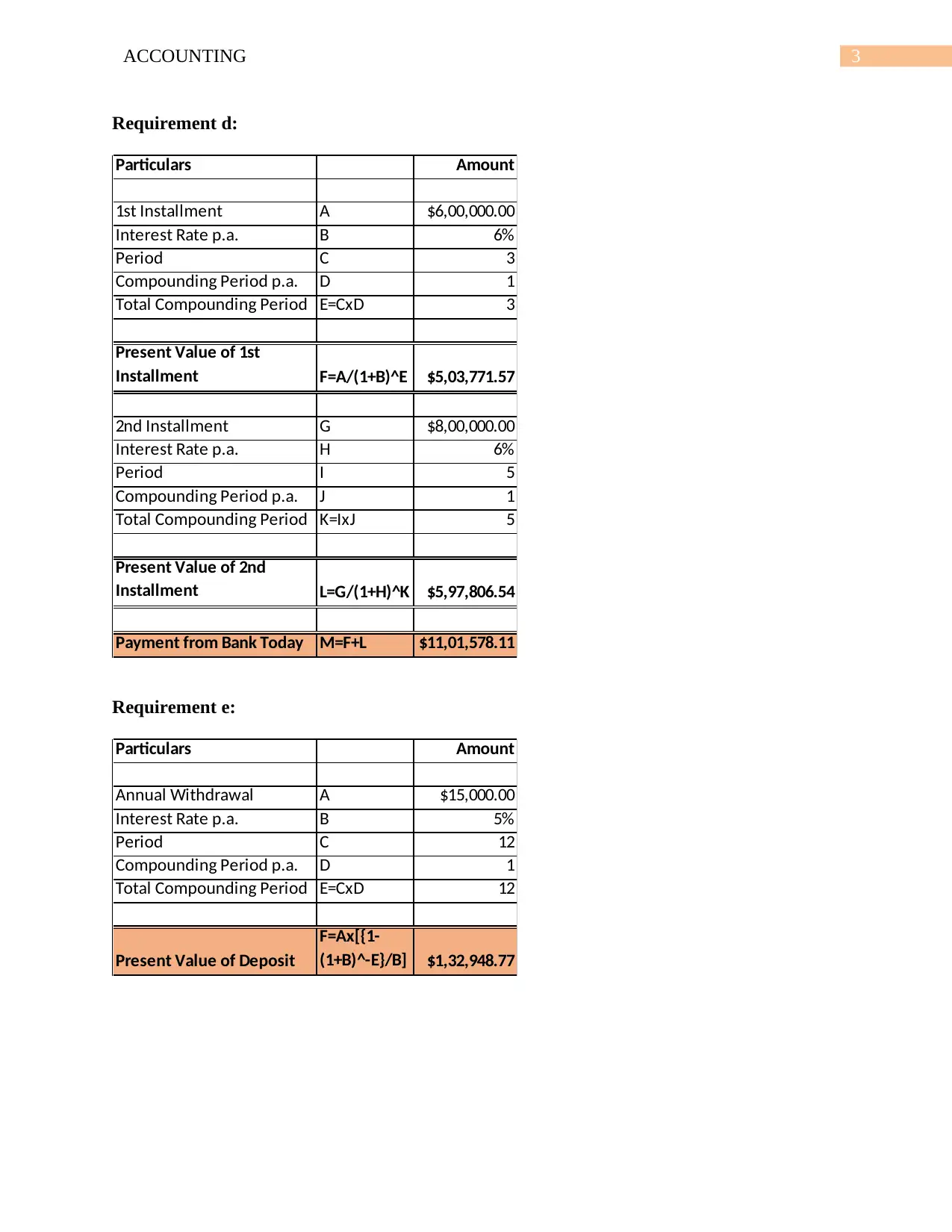

Requirement d:

Particulars Amount

1st Installment A $6,00,000.00

Interest Rate p.a. B 6%

Period C 3

Compounding Period p.a. D 1

Total Compounding Period E=CxD 3

Present Value of 1st

Installment F=A/(1+B)^E $5,03,771.57

2nd Installment G $8,00,000.00

Interest Rate p.a. H 6%

Period I 5

Compounding Period p.a. J 1

Total Compounding Period K=IxJ 5

Present Value of 2nd

Installment L=G/(1+H)^K $5,97,806.54

Payment from Bank Today M=F+L $11,01,578.11

Requirement e:

Particulars Amount

Annual Withdrawal A $15,000.00

Interest Rate p.a. B 5%

Period C 12

Compounding Period p.a. D 1

Total Compounding Period E=CxD 12

Present Value of Deposit

F=Ax[{1-

(1+B)^-E}/B] $1,32,948.77

Requirement d:

Particulars Amount

1st Installment A $6,00,000.00

Interest Rate p.a. B 6%

Period C 3

Compounding Period p.a. D 1

Total Compounding Period E=CxD 3

Present Value of 1st

Installment F=A/(1+B)^E $5,03,771.57

2nd Installment G $8,00,000.00

Interest Rate p.a. H 6%

Period I 5

Compounding Period p.a. J 1

Total Compounding Period K=IxJ 5

Present Value of 2nd

Installment L=G/(1+H)^K $5,97,806.54

Payment from Bank Today M=F+L $11,01,578.11

Requirement e:

Particulars Amount

Annual Withdrawal A $15,000.00

Interest Rate p.a. B 5%

Period C 12

Compounding Period p.a. D 1

Total Compounding Period E=CxD 12

Present Value of Deposit

F=Ax[{1-

(1+B)^-E}/B] $1,32,948.77

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

4ACCOUNTING

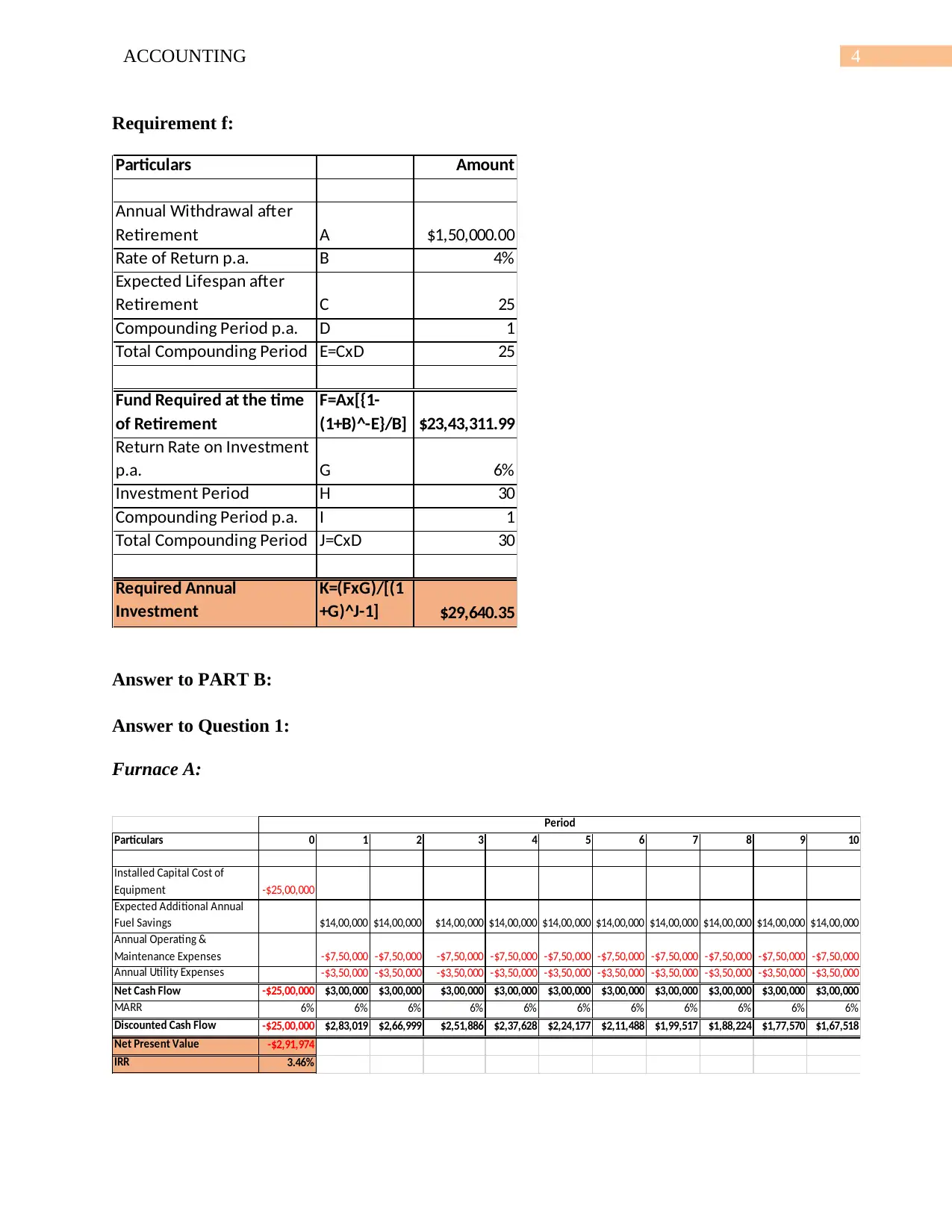

Requirement f:

Particulars Amount

Annual Withdrawal after

Retirement A $1,50,000.00

Rate of Return p.a. B 4%

Expected Lifespan after

Retirement C 25

Compounding Period p.a. D 1

Total Compounding Period E=CxD 25

Fund Required at the time

of Retirement

F=Ax[{1-

(1+B)^-E}/B] $23,43,311.99

Return Rate on Investment

p.a. G 6%

Investment Period H 30

Compounding Period p.a. I 1

Total Compounding Period J=CxD 30

Required Annual

Investment

K=(FxG)/[(1

+G)^J-1] $29,640.35

Answer to PART B:

Answer to Question 1:

Furnace A:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Installed Capital Cost of

Equipment -$25,00,000

Expected Additional Annual

Fuel Savings $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000

Annual Operating &

Maintenance Expenses -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000

Annual Utility Expenses -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000

Net Cash Flow -$25,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000

MARR 6% 6% 6% 6% 6% 6% 6% 6% 6% 6% 6%

Discounted Cash Flow -$25,00,000 $2,83,019 $2,66,999 $2,51,886 $2,37,628 $2,24,177 $2,11,488 $1,99,517 $1,88,224 $1,77,570 $1,67,518

Net Present Value -$2,91,974

IRR 3.46%

Period

Requirement f:

Particulars Amount

Annual Withdrawal after

Retirement A $1,50,000.00

Rate of Return p.a. B 4%

Expected Lifespan after

Retirement C 25

Compounding Period p.a. D 1

Total Compounding Period E=CxD 25

Fund Required at the time

of Retirement

F=Ax[{1-

(1+B)^-E}/B] $23,43,311.99

Return Rate on Investment

p.a. G 6%

Investment Period H 30

Compounding Period p.a. I 1

Total Compounding Period J=CxD 30

Required Annual

Investment

K=(FxG)/[(1

+G)^J-1] $29,640.35

Answer to PART B:

Answer to Question 1:

Furnace A:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Installed Capital Cost of

Equipment -$25,00,000

Expected Additional Annual

Fuel Savings $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000 $14,00,000

Annual Operating &

Maintenance Expenses -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000 -$7,50,000

Annual Utility Expenses -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000 -$3,50,000

Net Cash Flow -$25,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000 $3,00,000

MARR 6% 6% 6% 6% 6% 6% 6% 6% 6% 6% 6%

Discounted Cash Flow -$25,00,000 $2,83,019 $2,66,999 $2,51,886 $2,37,628 $2,24,177 $2,11,488 $1,99,517 $1,88,224 $1,77,570 $1,67,518

Net Present Value -$2,91,974

IRR 3.46%

Period

5ACCOUNTING

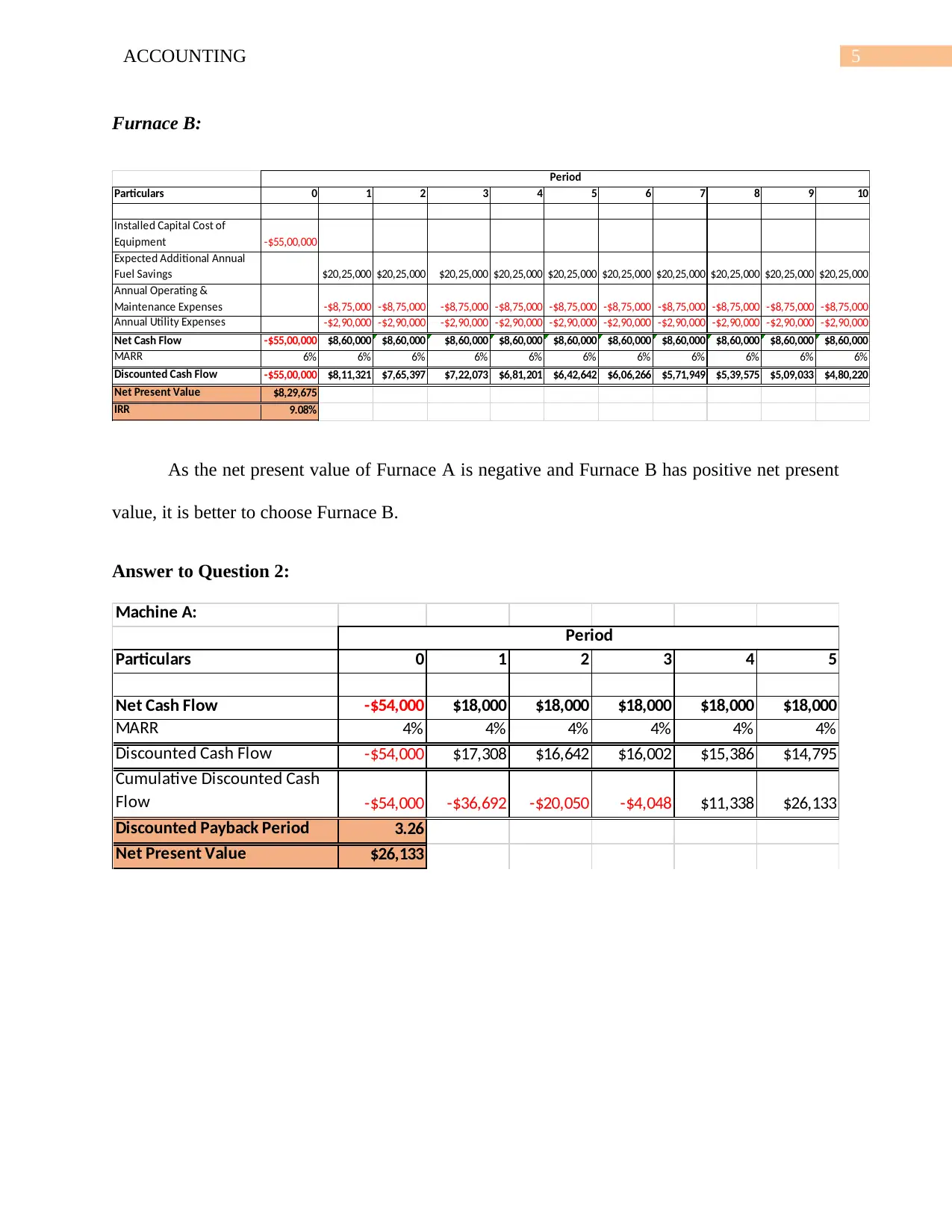

Furnace B:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Installed Capital Cost of

Equipment -$55,00,000

Expected Additional Annual

Fuel Savings $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000

Annual Operating &

Maintenance Expenses -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000

Annual Utility Expenses -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000

Net Cash Flow -$55,00,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000

MARR 6% 6% 6% 6% 6% 6% 6% 6% 6% 6% 6%

Discounted Cash Flow -$55,00,000 $8,11,321 $7,65,397 $7,22,073 $6,81,201 $6,42,642 $6,06,266 $5,71,949 $5,39,575 $5,09,033 $4,80,220

Net Present Value $8,29,675

IRR 9.08%

Period

As the net present value of Furnace A is negative and Furnace B has positive net present

value, it is better to choose Furnace B.

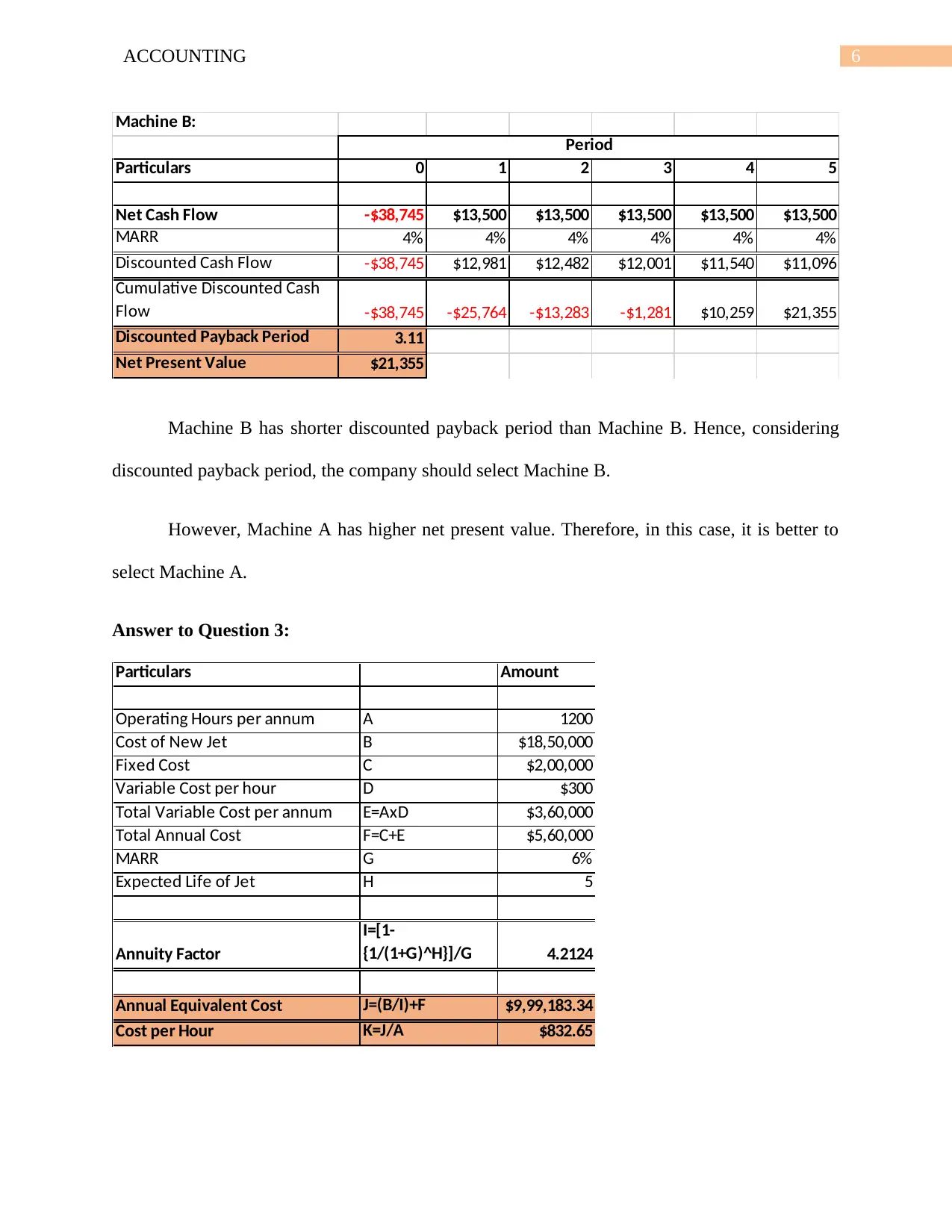

Answer to Question 2:

Machine A:

Particulars 0 1 2 3 4 5

Net Cash Flow -$54,000 $18,000 $18,000 $18,000 $18,000 $18,000

MARR 4% 4% 4% 4% 4% 4%

Discounted Cash Flow -$54,000 $17,308 $16,642 $16,002 $15,386 $14,795

Cumulative Discounted Cash

Flow -$54,000 -$36,692 -$20,050 -$4,048 $11,338 $26,133

Discounted Payback Period 3.26

Net Present Value $26,133

Period

Furnace B:

Particulars 0 1 2 3 4 5 6 7 8 9 10

Installed Capital Cost of

Equipment -$55,00,000

Expected Additional Annual

Fuel Savings $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000 $20,25,000

Annual Operating &

Maintenance Expenses -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000 -$8,75,000

Annual Utility Expenses -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000 -$2,90,000

Net Cash Flow -$55,00,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000 $8,60,000

MARR 6% 6% 6% 6% 6% 6% 6% 6% 6% 6% 6%

Discounted Cash Flow -$55,00,000 $8,11,321 $7,65,397 $7,22,073 $6,81,201 $6,42,642 $6,06,266 $5,71,949 $5,39,575 $5,09,033 $4,80,220

Net Present Value $8,29,675

IRR 9.08%

Period

As the net present value of Furnace A is negative and Furnace B has positive net present

value, it is better to choose Furnace B.

Answer to Question 2:

Machine A:

Particulars 0 1 2 3 4 5

Net Cash Flow -$54,000 $18,000 $18,000 $18,000 $18,000 $18,000

MARR 4% 4% 4% 4% 4% 4%

Discounted Cash Flow -$54,000 $17,308 $16,642 $16,002 $15,386 $14,795

Cumulative Discounted Cash

Flow -$54,000 -$36,692 -$20,050 -$4,048 $11,338 $26,133

Discounted Payback Period 3.26

Net Present Value $26,133

Period

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

6ACCOUNTING

Machine B:

Particulars 0 1 2 3 4 5

Net Cash Flow -$38,745 $13,500 $13,500 $13,500 $13,500 $13,500

MARR 4% 4% 4% 4% 4% 4%

Discounted Cash Flow -$38,745 $12,981 $12,482 $12,001 $11,540 $11,096

Cumulative Discounted Cash

Flow -$38,745 -$25,764 -$13,283 -$1,281 $10,259 $21,355

Discounted Payback Period 3.11

Net Present Value $21,355

Period

Machine B has shorter discounted payback period than Machine B. Hence, considering

discounted payback period, the company should select Machine B.

However, Machine A has higher net present value. Therefore, in this case, it is better to

select Machine A.

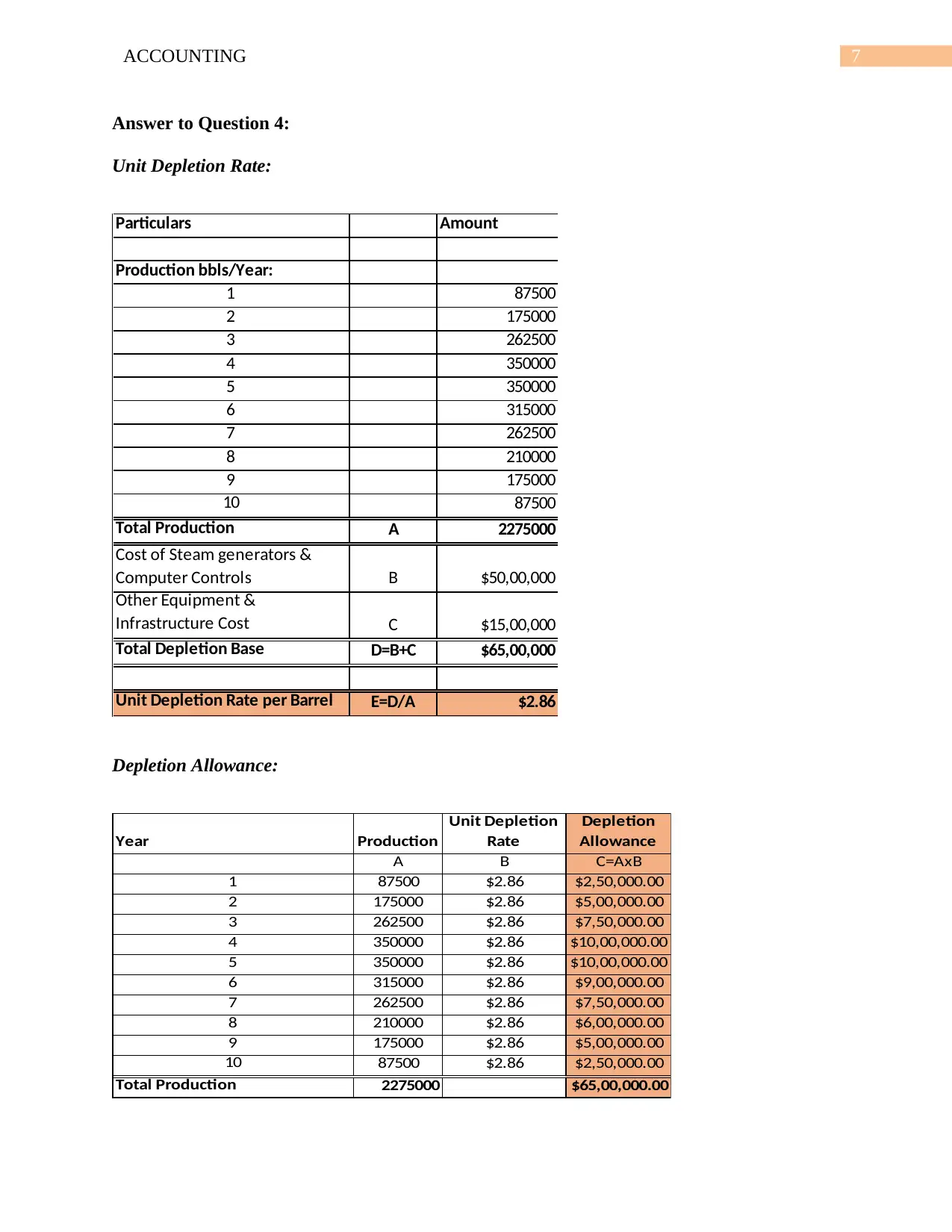

Answer to Question 3:

Particulars Amount

Operating Hours per annum A 1200

Cost of New Jet B $18,50,000

Fixed Cost C $2,00,000

Variable Cost per hour D $300

Total Variable Cost per annum E=AxD $3,60,000

Total Annual Cost F=C+E $5,60,000

MARR G 6%

Expected Life of Jet H 5

Annuity Factor

I=[1-

{1/(1+G)^H}]/G 4.2124

Annual Equivalent Cost J=(B/I)+F $9,99,183.34

Cost per Hour K=J/A $832.65

Machine B:

Particulars 0 1 2 3 4 5

Net Cash Flow -$38,745 $13,500 $13,500 $13,500 $13,500 $13,500

MARR 4% 4% 4% 4% 4% 4%

Discounted Cash Flow -$38,745 $12,981 $12,482 $12,001 $11,540 $11,096

Cumulative Discounted Cash

Flow -$38,745 -$25,764 -$13,283 -$1,281 $10,259 $21,355

Discounted Payback Period 3.11

Net Present Value $21,355

Period

Machine B has shorter discounted payback period than Machine B. Hence, considering

discounted payback period, the company should select Machine B.

However, Machine A has higher net present value. Therefore, in this case, it is better to

select Machine A.

Answer to Question 3:

Particulars Amount

Operating Hours per annum A 1200

Cost of New Jet B $18,50,000

Fixed Cost C $2,00,000

Variable Cost per hour D $300

Total Variable Cost per annum E=AxD $3,60,000

Total Annual Cost F=C+E $5,60,000

MARR G 6%

Expected Life of Jet H 5

Annuity Factor

I=[1-

{1/(1+G)^H}]/G 4.2124

Annual Equivalent Cost J=(B/I)+F $9,99,183.34

Cost per Hour K=J/A $832.65

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

7ACCOUNTING

Answer to Question 4:

Unit Depletion Rate:

Particulars Amount

Production bbls/Year:

1 87500

2 175000

3 262500

4 350000

5 350000

6 315000

7 262500

8 210000

9 175000

10 87500

Total Production A 2275000

Cost of Steam generators &

Computer Controls B $50,00,000

Other Equipment &

Infrastructure Cost C $15,00,000

Total Depletion Base D=B+C $65,00,000

Unit Depletion Rate per Barrel E=D/A $2.86

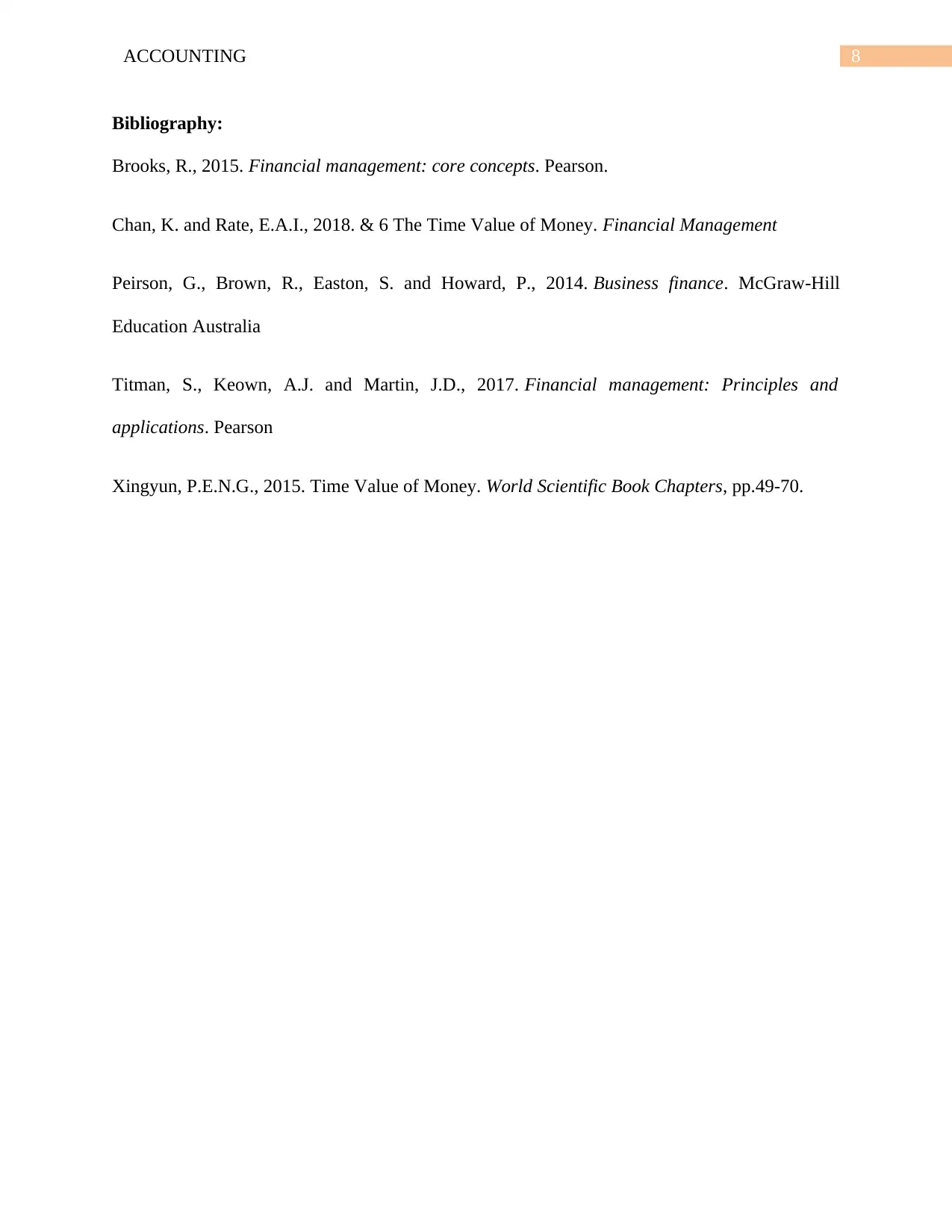

Depletion Allowance:

Year Production

Unit Depletion

Rate

Depletion

Allowance

A B C=AxB

1 87500 $2.86 $2,50,000.00

2 175000 $2.86 $5,00,000.00

3 262500 $2.86 $7,50,000.00

4 350000 $2.86 $10,00,000.00

5 350000 $2.86 $10,00,000.00

6 315000 $2.86 $9,00,000.00

7 262500 $2.86 $7,50,000.00

8 210000 $2.86 $6,00,000.00

9 175000 $2.86 $5,00,000.00

10 87500 $2.86 $2,50,000.00

Total Production 2275000 $65,00,000.00

Answer to Question 4:

Unit Depletion Rate:

Particulars Amount

Production bbls/Year:

1 87500

2 175000

3 262500

4 350000

5 350000

6 315000

7 262500

8 210000

9 175000

10 87500

Total Production A 2275000

Cost of Steam generators &

Computer Controls B $50,00,000

Other Equipment &

Infrastructure Cost C $15,00,000

Total Depletion Base D=B+C $65,00,000

Unit Depletion Rate per Barrel E=D/A $2.86

Depletion Allowance:

Year Production

Unit Depletion

Rate

Depletion

Allowance

A B C=AxB

1 87500 $2.86 $2,50,000.00

2 175000 $2.86 $5,00,000.00

3 262500 $2.86 $7,50,000.00

4 350000 $2.86 $10,00,000.00

5 350000 $2.86 $10,00,000.00

6 315000 $2.86 $9,00,000.00

7 262500 $2.86 $7,50,000.00

8 210000 $2.86 $6,00,000.00

9 175000 $2.86 $5,00,000.00

10 87500 $2.86 $2,50,000.00

Total Production 2275000 $65,00,000.00

8ACCOUNTING

Bibliography:

Brooks, R., 2015. Financial management: core concepts. Pearson.

Chan, K. and Rate, E.A.I., 2018. & 6 The Time Value of Money. Financial Management

Peirson, G., Brown, R., Easton, S. and Howard, P., 2014. Business finance. McGraw-Hill

Education Australia

Titman, S., Keown, A.J. and Martin, J.D., 2017. Financial management: Principles and

applications. Pearson

Xingyun, P.E.N.G., 2015. Time Value of Money. World Scientific Book Chapters, pp.49-70.

Bibliography:

Brooks, R., 2015. Financial management: core concepts. Pearson.

Chan, K. and Rate, E.A.I., 2018. & 6 The Time Value of Money. Financial Management

Peirson, G., Brown, R., Easton, S. and Howard, P., 2014. Business finance. McGraw-Hill

Education Australia

Titman, S., Keown, A.J. and Martin, J.D., 2017. Financial management: Principles and

applications. Pearson

Xingyun, P.E.N.G., 2015. Time Value of Money. World Scientific Book Chapters, pp.49-70.

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 9

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.