Comprehensive Report: Information Governance Policy for PFJ Bank

VerifiedAdded on 2021/02/19

|21

|5669

|21

Report

AI Summary

This report provides a detailed analysis of the information governance policy developed for PFJ Bank, a European retail bank. It examines the importance of cybersecurity, the role of the Financial Conduct Authority (FCA) and Prudential Regulation Authority (PRA) in regulating financial institutions, and the significance of various ISO standards like ISO 27000, 15489, 38500, 31000 and 22301. The report highlights the importance of information security, including confidentiality, integrity, and availability, and discusses the application of information governance in the financial sector. It covers key legislation such as the Financial Services and Markets Act 2000 and emphasizes risk management processes and implementation plans. The report also includes a proposed information governance policy outlining organizational approaches, procedures, controls, risk management strategies, and accountability measures, aimed at protecting client data and ensuring regulatory compliance.

DEVELOP AN

INFORMATION

GOVERNANCE

POLICY FOR PFJ

BANK

INFORMATION

GOVERNANCE

POLICY FOR PFJ

BANK

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Table of Contents

EXECUTIVE SUMMARY.............................................................................................................3

Overview..........................................................................................................................................3

Purpose.............................................................................................................................................3

Scope................................................................................................................................................3

Information security: Confidentiality, Integrity, Availability................................................3

Information Governance in the financial sector.....................................................................4

Financial conduct authority: ..................................................................................................4

Prudential regulation authority: .............................................................................................4

Policy..............................................................................................................................................5

Cyber security: .......................................................................................................................5

Related Standards, Policy and Processes.........................................................................................6

Financial services and markets act, 2000: .............................................................................6

International organisation for standardization (ISO): ............................................................6

National institute for standard and technology: .....................................................................6

Control objectives for information and technology: .............................................................7

Critical analysis and suitability: ISO Framework............................................................................7

Risk Management Process and Threat Modelling...........................................................................9

Implementation Plan......................................................................................................................11

The Policy......................................................................................................................................12

Introduction..........................................................................................................................12

Purpose of the Policy............................................................................................................12

Organization Approach to Information Governance............................................................12

Procedures............................................................................................................................13

Controls and Staff Guidance................................................................................................14

Risk Management.................................................................................................................14

Responsibility and Accountabilities.....................................................................................15

Conclusion.....................................................................................................................................15

REFERENCES..............................................................................................................................17

EXECUTIVE SUMMARY.............................................................................................................3

Overview..........................................................................................................................................3

Purpose.............................................................................................................................................3

Scope................................................................................................................................................3

Information security: Confidentiality, Integrity, Availability................................................3

Information Governance in the financial sector.....................................................................4

Financial conduct authority: ..................................................................................................4

Prudential regulation authority: .............................................................................................4

Policy..............................................................................................................................................5

Cyber security: .......................................................................................................................5

Related Standards, Policy and Processes.........................................................................................6

Financial services and markets act, 2000: .............................................................................6

International organisation for standardization (ISO): ............................................................6

National institute for standard and technology: .....................................................................6

Control objectives for information and technology: .............................................................7

Critical analysis and suitability: ISO Framework............................................................................7

Risk Management Process and Threat Modelling...........................................................................9

Implementation Plan......................................................................................................................11

The Policy......................................................................................................................................12

Introduction..........................................................................................................................12

Purpose of the Policy............................................................................................................12

Organization Approach to Information Governance............................................................12

Procedures............................................................................................................................13

Controls and Staff Guidance................................................................................................14

Risk Management.................................................................................................................14

Responsibility and Accountabilities.....................................................................................15

Conclusion.....................................................................................................................................15

REFERENCES..............................................................................................................................17

EXECUTIVE SUMMARY

The following report focused on corporate governance policy of PFJ retail banks and their

operations. It also emphasised the importance of cyber security and the principles followed by it.

Various acts have also been included like financial services and markets act, 2000 and prudential

regulation authority act that regulates the working of financial companies, investment banks and

insurance companies. The main objective of these acts are to ensure stability in the financial

markets of United Kingdom. Also, various ISO acts have been mentioned and their importance

has been stated in regulating the framework of all the companies of small, large and medium

scale.

Overview

PFJ is an European retail bank that mainly deals with investment banking and

consultancy service (Cherupelly, 2016). Headquartered in United Kingdom, the bank has

established a brand image mainly because of its safety and protective measures regarding the

information of their clients.

Purpose

In this digital environment, it has become imperative for every organization to protect their data

and information therefore for this purpose various acts and standards have been set up by the

government of United Kingdom to ensure smooth working of the companies. Various cyber

security principles have been established that emphasize on protection of intellectual data of an

organization and make sure that there are no unauthorized access into the website or digital

accounts of the company. The current study will highlight on the information governance policy

of PFJ bank, their strategy and other cyber security principles to protect the privacy of

intellectual and digital data of clients and customers.

Scope

Information security: Confidentiality, Integrity, Availability

Information security is concerned with protection of computer data and information from

viruses and hacking. It maintains the confidentiality, integrity and availability of data through

encryption and by using other security measures. The information security is widely used in

banks, financial institutions and stock exchange in order to protect the authenticity of data. For

3

The following report focused on corporate governance policy of PFJ retail banks and their

operations. It also emphasised the importance of cyber security and the principles followed by it.

Various acts have also been included like financial services and markets act, 2000 and prudential

regulation authority act that regulates the working of financial companies, investment banks and

insurance companies. The main objective of these acts are to ensure stability in the financial

markets of United Kingdom. Also, various ISO acts have been mentioned and their importance

has been stated in regulating the framework of all the companies of small, large and medium

scale.

Overview

PFJ is an European retail bank that mainly deals with investment banking and

consultancy service (Cherupelly, 2016). Headquartered in United Kingdom, the bank has

established a brand image mainly because of its safety and protective measures regarding the

information of their clients.

Purpose

In this digital environment, it has become imperative for every organization to protect their data

and information therefore for this purpose various acts and standards have been set up by the

government of United Kingdom to ensure smooth working of the companies. Various cyber

security principles have been established that emphasize on protection of intellectual data of an

organization and make sure that there are no unauthorized access into the website or digital

accounts of the company. The current study will highlight on the information governance policy

of PFJ bank, their strategy and other cyber security principles to protect the privacy of

intellectual and digital data of clients and customers.

Scope

Information security: Confidentiality, Integrity, Availability

Information security is concerned with protection of computer data and information from

viruses and hacking. It maintains the confidentiality, integrity and availability of data through

encryption and by using other security measures. The information security is widely used in

banks, financial institutions and stock exchange in order to protect the authenticity of data. For

3

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

instance, it prevents modification and manipulation of messages before they reach the intended

recipient thus preserving the original information. PFJ bank uses digital signatures to improve

authenticity and prompts all the customers and staff members to prove their identity before they

are granted access to the confidential data. Thus, in this manner the privacy and confidentiality

of computer information is maintained.

Information Governance in the financial sector

Information governance is concerned with providing reliable data to a financial sector as it

would help them in making business decisions. It helps a business in identifying their goals and

objectives, role of employees in achieving it and their responsibilities as part of implementation

and integration of program. Information governance is widely used in the financial sector like

banks, accounting companies and consultancy firms (Bossong and Hegemann, 2016). PFJ banks

uses information governance to store, access and filter the data of its business clients which

further helps them in management of information systems. Information governance and cyber

security principles are an important aspect of every business. While information governance is

concerned with authenticity of data, cyber security principles focus on protection of the data.

Financial conduct authority:

The financial conduct authority is a financial regulatory body in the United Kingdom. It

is an autonomous body that regulates and controls the activities of financial companies and

ensure smooth working in the financial markets of the country. The major objectives of FCA

include protecting the rights of consumers, market integrity and promoting fair competition in

the financial market. The activities of PFJ banks are monitored and regulated by the FCA to

ensure that fair business activities are adopted by the banking company.

Prudential regulation authority:

The PRA is a successor of financial services authority (FSA) and its main objective is to

supervise the working of banks, financial institutions,, credit unions, investment firms and

insurance companies. The PRA supervises the financial companies on the basis of three factors

like

Judgement based approach: The judgement based approach states that whether the

financial companies are safe and sound which means that whether the organisations are

economically stable to provide facilities to the clients and policy holders.

4

recipient thus preserving the original information. PFJ bank uses digital signatures to improve

authenticity and prompts all the customers and staff members to prove their identity before they

are granted access to the confidential data. Thus, in this manner the privacy and confidentiality

of computer information is maintained.

Information Governance in the financial sector

Information governance is concerned with providing reliable data to a financial sector as it

would help them in making business decisions. It helps a business in identifying their goals and

objectives, role of employees in achieving it and their responsibilities as part of implementation

and integration of program. Information governance is widely used in the financial sector like

banks, accounting companies and consultancy firms (Bossong and Hegemann, 2016). PFJ banks

uses information governance to store, access and filter the data of its business clients which

further helps them in management of information systems. Information governance and cyber

security principles are an important aspect of every business. While information governance is

concerned with authenticity of data, cyber security principles focus on protection of the data.

Financial conduct authority:

The financial conduct authority is a financial regulatory body in the United Kingdom. It

is an autonomous body that regulates and controls the activities of financial companies and

ensure smooth working in the financial markets of the country. The major objectives of FCA

include protecting the rights of consumers, market integrity and promoting fair competition in

the financial market. The activities of PFJ banks are monitored and regulated by the FCA to

ensure that fair business activities are adopted by the banking company.

Prudential regulation authority:

The PRA is a successor of financial services authority (FSA) and its main objective is to

supervise the working of banks, financial institutions,, credit unions, investment firms and

insurance companies. The PRA supervises the financial companies on the basis of three factors

like

Judgement based approach: The judgement based approach states that whether the

financial companies are safe and sound which means that whether the organisations are

economically stable to provide facilities to the clients and policy holders.

4

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Forward looking approach: It means that the PRA evaluates the PFJ retail bank not only

against the current risks but also against the potential future risks (Zhang, 2019).

Focused approach: The major focus of PRA is on the companies that possess a great risk

on the stability of the UK stock market and can affect the economy of the country.

Policy

Cyber security:

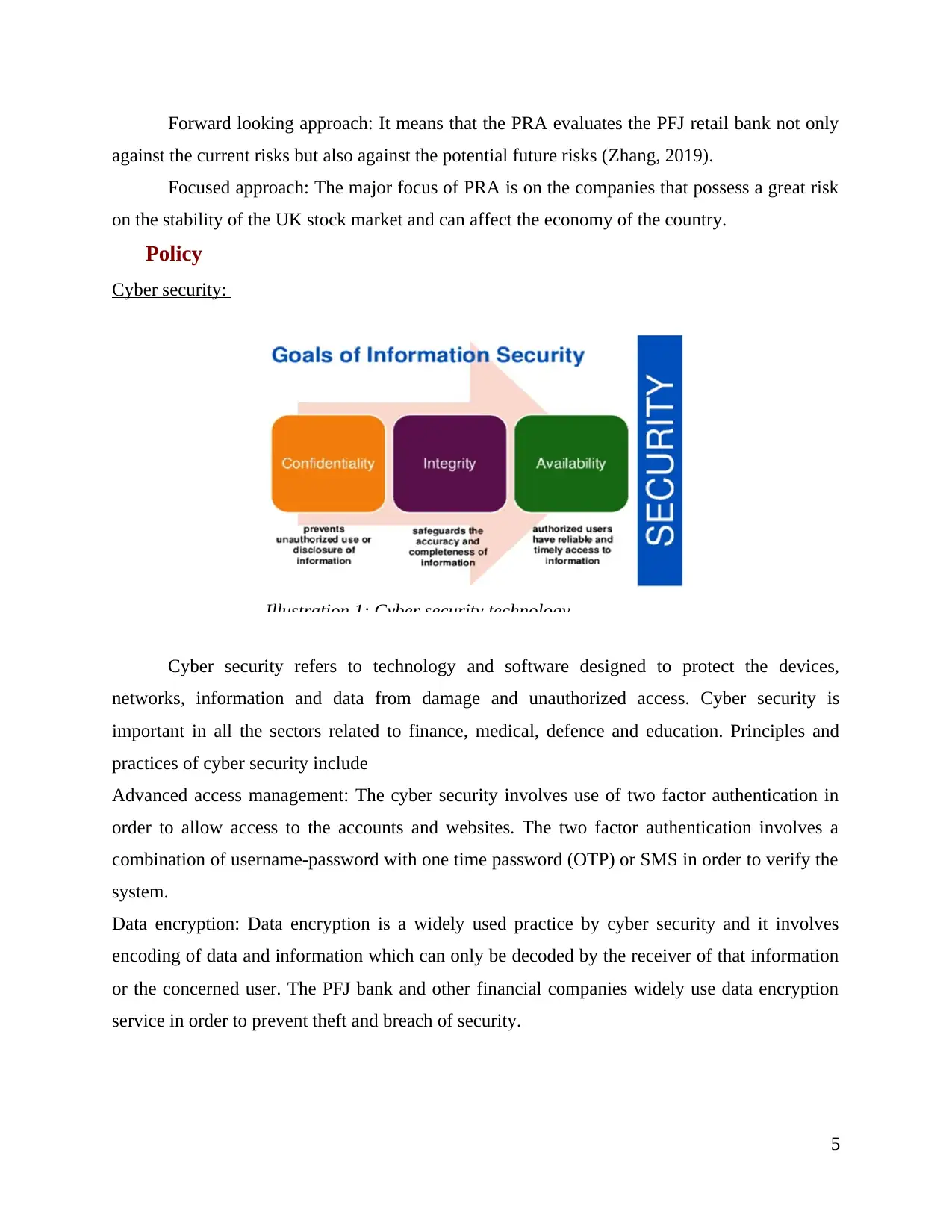

Cyber security refers to technology and software designed to protect the devices,

networks, information and data from damage and unauthorized access. Cyber security is

important in all the sectors related to finance, medical, defence and education. Principles and

practices of cyber security include

Advanced access management: The cyber security involves use of two factor authentication in

order to allow access to the accounts and websites. The two factor authentication involves a

combination of username-password with one time password (OTP) or SMS in order to verify the

system.

Data encryption: Data encryption is a widely used practice by cyber security and it involves

encoding of data and information which can only be decoded by the receiver of that information

or the concerned user. The PFJ bank and other financial companies widely use data encryption

service in order to prevent theft and breach of security.

5

Illustration 1: Cyber security technology

against the current risks but also against the potential future risks (Zhang, 2019).

Focused approach: The major focus of PRA is on the companies that possess a great risk

on the stability of the UK stock market and can affect the economy of the country.

Policy

Cyber security:

Cyber security refers to technology and software designed to protect the devices,

networks, information and data from damage and unauthorized access. Cyber security is

important in all the sectors related to finance, medical, defence and education. Principles and

practices of cyber security include

Advanced access management: The cyber security involves use of two factor authentication in

order to allow access to the accounts and websites. The two factor authentication involves a

combination of username-password with one time password (OTP) or SMS in order to verify the

system.

Data encryption: Data encryption is a widely used practice by cyber security and it involves

encoding of data and information which can only be decoded by the receiver of that information

or the concerned user. The PFJ bank and other financial companies widely use data encryption

service in order to prevent theft and breach of security.

5

Illustration 1: Cyber security technology

Related Standards, Policy and Processes.

Bank regulations are designed and framed by government which allows commercial banks like

PFJ to operate in a certain environment and follow some guidelines and rules and regulations. It

also creates transparency between banking institutions and the parties with whom the business is

conducted. Regulatory framework includes various frameworks and code of conduct in order to

clarify the gaps between actual and standardized working.

Financial services and markets act, 2000:

The financial services and markets act, 2000 created the FSA and it regulates and monitors the

financial firms, investment banks and insurance companies to ensure smooth working of the

businesses. The benefits of the act includes reduction in financial crimes by people, maintaining

the confidence and trust of general public in the financial market and also it promotes the

understanding of public in the financial system of the United Kingdom. On the other hand

TRIPUNOSKA (2019) argues that, the weakness includes slow investigation of the cases that

further leads to loss of funds for the general public and also it causes negative impact on

companies like the act restricts the flexibility of the organisations to operate freely and

sometimes intervention.

International organisation for standardization (ISO):

The ISO is an international body that provides documents which state that the products are fit to

use for the purpose specified. In the view point of Nielsen ( 2016), the ISO standards are

extremely beneficial not only for consumers but also for the businesses as it helps businesses in

increasing customer satisfaction by providing good quality products and services. As a result, it

improves brand image of the company and makes it easy for them to access new markets

whereas the Nedzel (2018), argues that ISO standards cannot be reliable because it is an

autonomous body and not government owned therefore it cannot be completely relied upon.

National institute for standard and technology:

The NIST is a non-regulatory body of the United States that focus on promoting innovation and

increasing the level of competition among various industries. The main objective of NIST is to

develop information security standards and guideline. Providing customized cyber security

services according to the needs and wants of company, managing the risks associated with the

security services and taking actions accordingly are some of the benefits of NIST.

6

Bank regulations are designed and framed by government which allows commercial banks like

PFJ to operate in a certain environment and follow some guidelines and rules and regulations. It

also creates transparency between banking institutions and the parties with whom the business is

conducted. Regulatory framework includes various frameworks and code of conduct in order to

clarify the gaps between actual and standardized working.

Financial services and markets act, 2000:

The financial services and markets act, 2000 created the FSA and it regulates and monitors the

financial firms, investment banks and insurance companies to ensure smooth working of the

businesses. The benefits of the act includes reduction in financial crimes by people, maintaining

the confidence and trust of general public in the financial market and also it promotes the

understanding of public in the financial system of the United Kingdom. On the other hand

TRIPUNOSKA (2019) argues that, the weakness includes slow investigation of the cases that

further leads to loss of funds for the general public and also it causes negative impact on

companies like the act restricts the flexibility of the organisations to operate freely and

sometimes intervention.

International organisation for standardization (ISO):

The ISO is an international body that provides documents which state that the products are fit to

use for the purpose specified. In the view point of Nielsen ( 2016), the ISO standards are

extremely beneficial not only for consumers but also for the businesses as it helps businesses in

increasing customer satisfaction by providing good quality products and services. As a result, it

improves brand image of the company and makes it easy for them to access new markets

whereas the Nedzel (2018), argues that ISO standards cannot be reliable because it is an

autonomous body and not government owned therefore it cannot be completely relied upon.

National institute for standard and technology:

The NIST is a non-regulatory body of the United States that focus on promoting innovation and

increasing the level of competition among various industries. The main objective of NIST is to

develop information security standards and guideline. Providing customized cyber security

services according to the needs and wants of company, managing the risks associated with the

security services and taking actions accordingly are some of the benefits of NIST.

6

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Control objectives for information and technology:

The COBIT is a framework created by ISACA(Information systems audit and control

association) and its main objective is to meet the regulatory compliance of a business, its risk

management policies and merging the IT strategy with goals and objectives of organisation.

According to Mekonenn (2016), the COBIT is a potential for financial companies and

investment banks like PFJ as it uses technology in an efficient manner to promote excellence

and also minimizes the risk related to IT and software. On the other hand, the weakness of

COBIT involves that it requires time to implement and cannot achieve goals and objectives

within a short period of time.

Critical analysis and suitability: ISO Framework

PFJ bank information governance policy: The governance policy of PFJ banks

includes protecting the interests of shareholder, investors, clients and other stakeholders

by complying with the code of conduct and all the rules and regulations of various acts

like Financial services and markets act, 2000 and Prudential regulation authority act.

ISO 27000: The ISO 27000 of information security management standards is a

framework to provide best practices in the field of information technology. It has a broad

scope and the standards are applicable to all sizes of organisations. There are other

standards like ISO 27001 and 27002 in order to mention the changes in the field of

technology in different industries. In the view point of Gunay (2016), the PFJ bank

comply with all the statutory requirements and regulations of the ISO standards.

However, Cherupelly (2016) has stated that the financial banks and insurance companies

do not take ISO 27000 standards as they believe its is very costly to implement in the

business but they do not understand that the cost of implementing this approach is much

cheaper than the actual cost of dealing with the aftermath of such incidents like theft of

data, breaching of confidentiality, frauds and manipulation in accounts.

ISO 30300/15489_Records Management: The ISO 15489 mainly emphasises on record

management and systematic control of the creation, receipt, maintenance, use and

disposition of records, including the processes for capturing and maintaining evidence

and other information related to business practices. It is a potential tool for banking

companies like PFJ bank as it provides them with complete information related to their

data and information so that it saves the time and cost of company.

7

The COBIT is a framework created by ISACA(Information systems audit and control

association) and its main objective is to meet the regulatory compliance of a business, its risk

management policies and merging the IT strategy with goals and objectives of organisation.

According to Mekonenn (2016), the COBIT is a potential for financial companies and

investment banks like PFJ as it uses technology in an efficient manner to promote excellence

and also minimizes the risk related to IT and software. On the other hand, the weakness of

COBIT involves that it requires time to implement and cannot achieve goals and objectives

within a short period of time.

Critical analysis and suitability: ISO Framework

PFJ bank information governance policy: The governance policy of PFJ banks

includes protecting the interests of shareholder, investors, clients and other stakeholders

by complying with the code of conduct and all the rules and regulations of various acts

like Financial services and markets act, 2000 and Prudential regulation authority act.

ISO 27000: The ISO 27000 of information security management standards is a

framework to provide best practices in the field of information technology. It has a broad

scope and the standards are applicable to all sizes of organisations. There are other

standards like ISO 27001 and 27002 in order to mention the changes in the field of

technology in different industries. In the view point of Gunay (2016), the PFJ bank

comply with all the statutory requirements and regulations of the ISO standards.

However, Cherupelly (2016) has stated that the financial banks and insurance companies

do not take ISO 27000 standards as they believe its is very costly to implement in the

business but they do not understand that the cost of implementing this approach is much

cheaper than the actual cost of dealing with the aftermath of such incidents like theft of

data, breaching of confidentiality, frauds and manipulation in accounts.

ISO 30300/15489_Records Management: The ISO 15489 mainly emphasises on record

management and systematic control of the creation, receipt, maintenance, use and

disposition of records, including the processes for capturing and maintaining evidence

and other information related to business practices. It is a potential tool for banking

companies like PFJ bank as it provides them with complete information related to their

data and information so that it saves the time and cost of company.

7

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

ISO 38500_corporate governance for IT: The ISO 38500 deals with governance of

management processes and decision related to company's information and

communication services. The main objective of ISO 38500 is to align IT governance with

corporate governance. According to the Bossong and Hegemann (2016), it provides legal

framework for effective governance of IT and guides PFJ bank to follow the legal,

regulatory and ethical duties as mentioned in the act in order to ensure the smooth

working of their business and to protect the interests of the stakeholders.

ISO 31000_ Risk management: The ISO 31000 risk management provides guidelines

and frameworks to manage risk. It can be utilized by any company irrespective of its size,

shape and industry. In the view point of Ali and Kamal ( 2016), the ISO 31000 has

helped PFJ bank in identifying their strengths and weaknesses, opportunities and

potential threats. Also, the act provides various ways to minimize the risks for PFJ firm

and help them in achieving goals and objectives effectively and efficiently.

ISO 22301/22313_Business continuity: ISO 22301 mainly focuses on certain standards

and security requirements that help in recovering the disasters and focus on business

continuity management systems. The standard's main focus is to recover a business

immediately from unfortunate incidents. Elements of business continuity are

Resilience: It is concerned with the ability of a business to incessantly adopt disruptions

while maintaining the business operations smoothly. For instance, cyber attacks, power shortage

and other fraudulent activities must be dealt with at the same time of managing the business.

Recovery: Recovery is concerned with backing up all the data and information that has

been lost during the incident. The main objective is to recover the data on the basis of priority

which means that important and essential data must be backed up in the beginning itself.

Contingency: Contingency is concerned with future uncertainties that can arise in the

business. The ISO 22301 maintains the guidelines to be followed by the business in case of any

uncertain events which further helps in reducing the overall burden on companies.

ISO 27001 guarantee CIA: It is the best practice framework mainly recognized for

information security management system (ISMS). According to the Edwin and Timothy

(2016), this regulation is the most important for PFJ retail bank as it not only helps

technically but also provides business control and management procedures to evaluate the

8

management processes and decision related to company's information and

communication services. The main objective of ISO 38500 is to align IT governance with

corporate governance. According to the Bossong and Hegemann (2016), it provides legal

framework for effective governance of IT and guides PFJ bank to follow the legal,

regulatory and ethical duties as mentioned in the act in order to ensure the smooth

working of their business and to protect the interests of the stakeholders.

ISO 31000_ Risk management: The ISO 31000 risk management provides guidelines

and frameworks to manage risk. It can be utilized by any company irrespective of its size,

shape and industry. In the view point of Ali and Kamal ( 2016), the ISO 31000 has

helped PFJ bank in identifying their strengths and weaknesses, opportunities and

potential threats. Also, the act provides various ways to minimize the risks for PFJ firm

and help them in achieving goals and objectives effectively and efficiently.

ISO 22301/22313_Business continuity: ISO 22301 mainly focuses on certain standards

and security requirements that help in recovering the disasters and focus on business

continuity management systems. The standard's main focus is to recover a business

immediately from unfortunate incidents. Elements of business continuity are

Resilience: It is concerned with the ability of a business to incessantly adopt disruptions

while maintaining the business operations smoothly. For instance, cyber attacks, power shortage

and other fraudulent activities must be dealt with at the same time of managing the business.

Recovery: Recovery is concerned with backing up all the data and information that has

been lost during the incident. The main objective is to recover the data on the basis of priority

which means that important and essential data must be backed up in the beginning itself.

Contingency: Contingency is concerned with future uncertainties that can arise in the

business. The ISO 22301 maintains the guidelines to be followed by the business in case of any

uncertain events which further helps in reducing the overall burden on companies.

ISO 27001 guarantee CIA: It is the best practice framework mainly recognized for

information security management system (ISMS). According to the Edwin and Timothy

(2016), this regulation is the most important for PFJ retail bank as it not only helps

technically but also provides business control and management procedures to evaluate the

8

risk assessment. ISO 27001 has helped PFJ company in planning, generated leadership

qualities within employees, provided support through resources and funds, informed

about risk assessment during operations, monitored the banking performance

continuously and helped in taking corrective actions accordingly.

Risk Management Process and Threat Modelling

Risk Management Process is basically implemented in the organization so that they can

pre-analyse the potential risks and formulate plans and strategies accordingly. Since PFJ bank

intends to provide security to its clients regarding the important papers and data that they might

store with the bank, they can manage the risk using three steps:-

Risk Assessment & Analysis:- Assessing risk involves analysis of the extent to which an

organization is exposed to risk and for PFJ, holding documents of significance importance on

behalf of their client, exposes them to a wide variety of risks associated.

Risk Evaluation:- The risks which have been identified are then categorized on the basis of

different criteria i.e. importance, legality, cost and benefits, system requirements etc. PFJ bank,

in the basis of the importance that a client holds has categorized the emphasis that they lay on

giving security to the documents of clients.

Risk Treatment:- In this last stage, the organization implements those policies which will help

them in minimizing the risks associated and PFJ bank intends to formulate a governance policy

that will help them in securing those documents.

Risk Assessment: Risk assessment is concerned with identification of potential hazards that

could affect the smooth working of an organization. Risk assessment uses various tools and

techniques to identify the threats and provide various measures to minimize their affect on the

working of the organisation.

9

qualities within employees, provided support through resources and funds, informed

about risk assessment during operations, monitored the banking performance

continuously and helped in taking corrective actions accordingly.

Risk Management Process and Threat Modelling

Risk Management Process is basically implemented in the organization so that they can

pre-analyse the potential risks and formulate plans and strategies accordingly. Since PFJ bank

intends to provide security to its clients regarding the important papers and data that they might

store with the bank, they can manage the risk using three steps:-

Risk Assessment & Analysis:- Assessing risk involves analysis of the extent to which an

organization is exposed to risk and for PFJ, holding documents of significance importance on

behalf of their client, exposes them to a wide variety of risks associated.

Risk Evaluation:- The risks which have been identified are then categorized on the basis of

different criteria i.e. importance, legality, cost and benefits, system requirements etc. PFJ bank,

in the basis of the importance that a client holds has categorized the emphasis that they lay on

giving security to the documents of clients.

Risk Treatment:- In this last stage, the organization implements those policies which will help

them in minimizing the risks associated and PFJ bank intends to formulate a governance policy

that will help them in securing those documents.

Risk Assessment: Risk assessment is concerned with identification of potential hazards that

could affect the smooth working of an organization. Risk assessment uses various tools and

techniques to identify the threats and provide various measures to minimize their affect on the

working of the organisation.

9

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

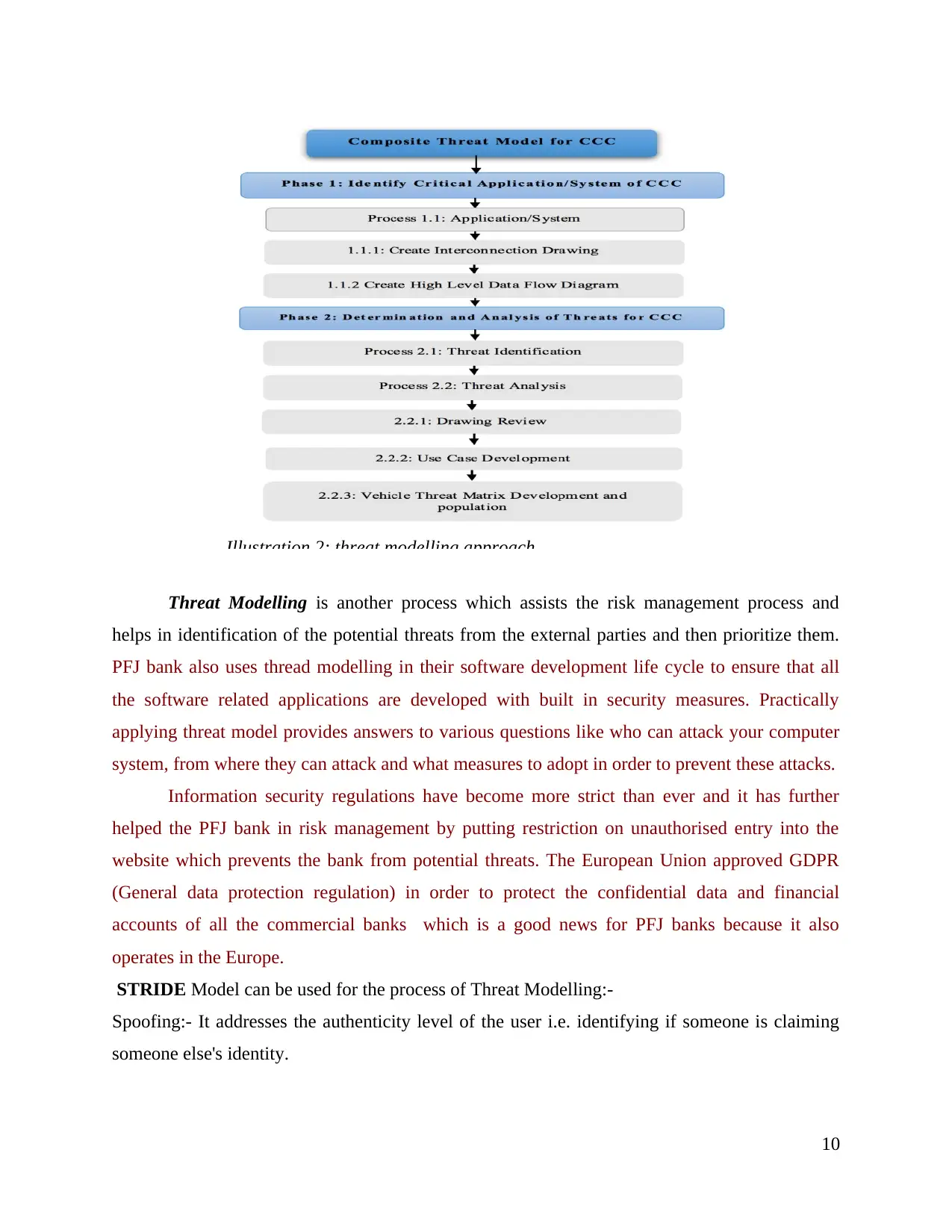

Threat Modelling is another process which assists the risk management process and

helps in identification of the potential threats from the external parties and then prioritize them.

PFJ bank also uses thread modelling in their software development life cycle to ensure that all

the software related applications are developed with built in security measures. Practically

applying threat model provides answers to various questions like who can attack your computer

system, from where they can attack and what measures to adopt in order to prevent these attacks.

Information security regulations have become more strict than ever and it has further

helped the PFJ bank in risk management by putting restriction on unauthorised entry into the

website which prevents the bank from potential threats. The European Union approved GDPR

(General data protection regulation) in order to protect the confidential data and financial

accounts of all the commercial banks which is a good news for PFJ banks because it also

operates in the Europe.

STRIDE Model can be used for the process of Threat Modelling:-

Spoofing:- It addresses the authenticity level of the user i.e. identifying if someone is claiming

someone else's identity.

10

Illustration 2: threat modelling approach

helps in identification of the potential threats from the external parties and then prioritize them.

PFJ bank also uses thread modelling in their software development life cycle to ensure that all

the software related applications are developed with built in security measures. Practically

applying threat model provides answers to various questions like who can attack your computer

system, from where they can attack and what measures to adopt in order to prevent these attacks.

Information security regulations have become more strict than ever and it has further

helped the PFJ bank in risk management by putting restriction on unauthorised entry into the

website which prevents the bank from potential threats. The European Union approved GDPR

(General data protection regulation) in order to protect the confidential data and financial

accounts of all the commercial banks which is a good news for PFJ banks because it also

operates in the Europe.

STRIDE Model can be used for the process of Threat Modelling:-

Spoofing:- It addresses the authenticity level of the user i.e. identifying if someone is claiming

someone else's identity.

10

Illustration 2: threat modelling approach

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Tampering:- This involves modification of the data when the exchange process takes place

between the user and the application.

Repudiation:- It signifies the extent up-to which the attacker can deny or repudiate the fact that

any action or event has been performed i.e. how well was the attacker able to clean up his

activities.

Information Disclosure:- This addresses the illegal breaches, leaking of confidential data and

gaining unauthorized access to data.

Denial of Service:- When a particular software is made unavailable or denied access to its

legitimate users, it is categorised under this.

Elevation of Privilege:- Unauthorized access to those software which are not available for

everyone and contain crucial information comes under this category.

PFJ bank can implement STRIDE model in the governance policy that they intend to

form as this will help them in identifying and removing those security gaps that might exist in

the system.

Implementation Plan

After successful design of the framework, it needs to be implemented through appropriate

steps and methodology which are sequentially followed so that the formulated plan can be

implemented correctly. This can be done through following sequence of steps:-

Strategy:- After distributing the roles to the employees and educating them about their roles and

responsibilities, the next step is to evaluate the strategy. In this step, before its implementation,

the strategy is once again studied and evaluated. It goes through various management levels so

that different individuals can study the plan and ensure that the strategy formulated for IT

governance is efficient and productive. This practice basically helps in formulating a strategy

which will fulfil the purpose and also take into account the ethical aspect of accountability i.e.

transparency so that no malpractices takes place.

Acquisition:- After a strategy is finalised, the personnel that needs to be hired is identified and

selected. However, at the time of appointment, it is not always necessary that the quality of

personnel required is available in the company. Further, apart from the personnel acquisition, the

management of PFJ bank should also focus on achievement of smaller aims and objectives (Ali,

Green and Robb, 2015).

11

between the user and the application.

Repudiation:- It signifies the extent up-to which the attacker can deny or repudiate the fact that

any action or event has been performed i.e. how well was the attacker able to clean up his

activities.

Information Disclosure:- This addresses the illegal breaches, leaking of confidential data and

gaining unauthorized access to data.

Denial of Service:- When a particular software is made unavailable or denied access to its

legitimate users, it is categorised under this.

Elevation of Privilege:- Unauthorized access to those software which are not available for

everyone and contain crucial information comes under this category.

PFJ bank can implement STRIDE model in the governance policy that they intend to

form as this will help them in identifying and removing those security gaps that might exist in

the system.

Implementation Plan

After successful design of the framework, it needs to be implemented through appropriate

steps and methodology which are sequentially followed so that the formulated plan can be

implemented correctly. This can be done through following sequence of steps:-

Strategy:- After distributing the roles to the employees and educating them about their roles and

responsibilities, the next step is to evaluate the strategy. In this step, before its implementation,

the strategy is once again studied and evaluated. It goes through various management levels so

that different individuals can study the plan and ensure that the strategy formulated for IT

governance is efficient and productive. This practice basically helps in formulating a strategy

which will fulfil the purpose and also take into account the ethical aspect of accountability i.e.

transparency so that no malpractices takes place.

Acquisition:- After a strategy is finalised, the personnel that needs to be hired is identified and

selected. However, at the time of appointment, it is not always necessary that the quality of

personnel required is available in the company. Further, apart from the personnel acquisition, the

management of PFJ bank should also focus on achievement of smaller aims and objectives (Ali,

Green and Robb, 2015).

11

Performance:- After it has been ensured that all the necessary staff is available with the bank

and they have been assigned their roles and duties in implementation of the plan, the

management evaluates the performance of the governance system as well as the employees.

Conformance:- Conformance is the last important aspect in implementation process where the

management ensures that the plan is being implemented in the method through which it was

formulated and further, it is also analysed that whether tasks which were assigned to the

employees are being fulfilled as per the roles and responsibilities.

Human Behaviour- Acceptable User Policy (AUP) document is used by PFJ bank which they

get filled by the employees. It sates the constraints and limitations within which the employees or

other users are allowed to operate (Gregory and et.al., 2018). This will increase the authenticity

of the governance system and limit its access.

The Policy

Introduction

PFJ bank has garnered the trust of its clients because of quality of services that they have

provided. However, over the time there is a large quantity of sensitive information which the

bank has accumulated. The management of bank needs to ensure that this information is

protected and there are no leaks or other unethical activities which might lead to questions on the

integrity on banks operations. The management can begin by analysing the risk associated with

formulation and implementation of such governance plan.

Purpose of the Policy

By developing an appropriate governance policy, the PFJ bank intends to widen the

loyalty of its customers and provide a security to the important papers containing sensitive

information that the clients get deposited with the bank.

Organization Approach to Information Governance

PFJ, in order to formulate healthy relationships, management and employees at their

personal level also need to ensure that ethics and morale act as the basis for foundation of such

human relations (Van Grembergen, and De Haes,2018).

Principle of Benevolence:- This principle states that as per the cyber ethics, one individual must

help out other individual when the need occurs. In this case, while forming partnerships, it is

essential that the professionals that are already employed in PFJ bank give the required

12

and they have been assigned their roles and duties in implementation of the plan, the

management evaluates the performance of the governance system as well as the employees.

Conformance:- Conformance is the last important aspect in implementation process where the

management ensures that the plan is being implemented in the method through which it was

formulated and further, it is also analysed that whether tasks which were assigned to the

employees are being fulfilled as per the roles and responsibilities.

Human Behaviour- Acceptable User Policy (AUP) document is used by PFJ bank which they

get filled by the employees. It sates the constraints and limitations within which the employees or

other users are allowed to operate (Gregory and et.al., 2018). This will increase the authenticity

of the governance system and limit its access.

The Policy

Introduction

PFJ bank has garnered the trust of its clients because of quality of services that they have

provided. However, over the time there is a large quantity of sensitive information which the

bank has accumulated. The management of bank needs to ensure that this information is

protected and there are no leaks or other unethical activities which might lead to questions on the

integrity on banks operations. The management can begin by analysing the risk associated with

formulation and implementation of such governance plan.

Purpose of the Policy

By developing an appropriate governance policy, the PFJ bank intends to widen the

loyalty of its customers and provide a security to the important papers containing sensitive

information that the clients get deposited with the bank.

Organization Approach to Information Governance

PFJ, in order to formulate healthy relationships, management and employees at their

personal level also need to ensure that ethics and morale act as the basis for foundation of such

human relations (Van Grembergen, and De Haes,2018).

Principle of Benevolence:- This principle states that as per the cyber ethics, one individual must

help out other individual when the need occurs. In this case, while forming partnerships, it is

essential that the professionals that are already employed in PFJ bank give the required

12

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.