Financial Budgeting, Performance, and Risk Management Report

VerifiedAdded on 2020/05/08

|21

|2632

|37

Report

AI Summary

This report provides a comprehensive overview of the budgeting process, encompassing various aspects of financial planning and analysis. It begins with the development of key budgets such as sales, purchase, and expense budgets, followed by the creation of a budgeted income statement and production budget. The report also includes a performance report with a flexible budget and a cash budget. Further, it delves into the preparation of financial budgets, addressing the parameters of budgeted income statements, cash budgets, and balance sheets. The report also explores financial risks and strategies for mitigation, including asset-backed and credit risks. The report includes working notes for calculations. Additionally, the report addresses the pros and cons of budgeting, different budget types for manufacturing operations, and the role of a master budget, providing a well-rounded perspective on financial management.

DEVELOP AND MANAGE

A BUDGET

A BUDGET

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

Assessment Activity 1................................................................................................................1

TASK 1 SALES BUDGET........................................................................................................1

TASK 2 PURCHASE BUDGET...............................................................................................1

TASK 3 EXPENSE BUDGET...................................................................................................1

TASK 4 BUDGETED INCOME STATEMENT......................................................................3

TASK 5 PRODUCTION BUDGET..........................................................................................4

TASK 6 PERFORMANCE REPORT.......................................................................................5

Prepare flexible budget...........................................................................................................5

ASSESSMENT ACTIVITY 2...................................................................................................5

Prepare cash budget................................................................................................................5

ASSESSMENT ACTIVITY 3...................................................................................................7

Prepare financial budgets.......................................................................................................7

Assessment Activity 4................................................................................................................9

Question 1 List five pros and cons of the budgeting process.................................................9

Question 2 Identify different types of budgets required to run a manufacturing operation. 10

Question 3 Explain master budget........................................................................................11

Question 4 Explain financial risks and also identify strategies to overcome these risks.....11

REFERENCES.........................................................................................................................13

Assessment Activity 1................................................................................................................1

TASK 1 SALES BUDGET........................................................................................................1

TASK 2 PURCHASE BUDGET...............................................................................................1

TASK 3 EXPENSE BUDGET...................................................................................................1

TASK 4 BUDGETED INCOME STATEMENT......................................................................3

TASK 5 PRODUCTION BUDGET..........................................................................................4

TASK 6 PERFORMANCE REPORT.......................................................................................5

Prepare flexible budget...........................................................................................................5

ASSESSMENT ACTIVITY 2...................................................................................................5

Prepare cash budget................................................................................................................5

ASSESSMENT ACTIVITY 3...................................................................................................7

Prepare financial budgets.......................................................................................................7

Assessment Activity 4................................................................................................................9

Question 1 List five pros and cons of the budgeting process.................................................9

Question 2 Identify different types of budgets required to run a manufacturing operation. 10

Question 3 Explain master budget........................................................................................11

Question 4 Explain financial risks and also identify strategies to overcome these risks.....11

REFERENCES.........................................................................................................................13

ASSESSMENT ACTIVITY 1

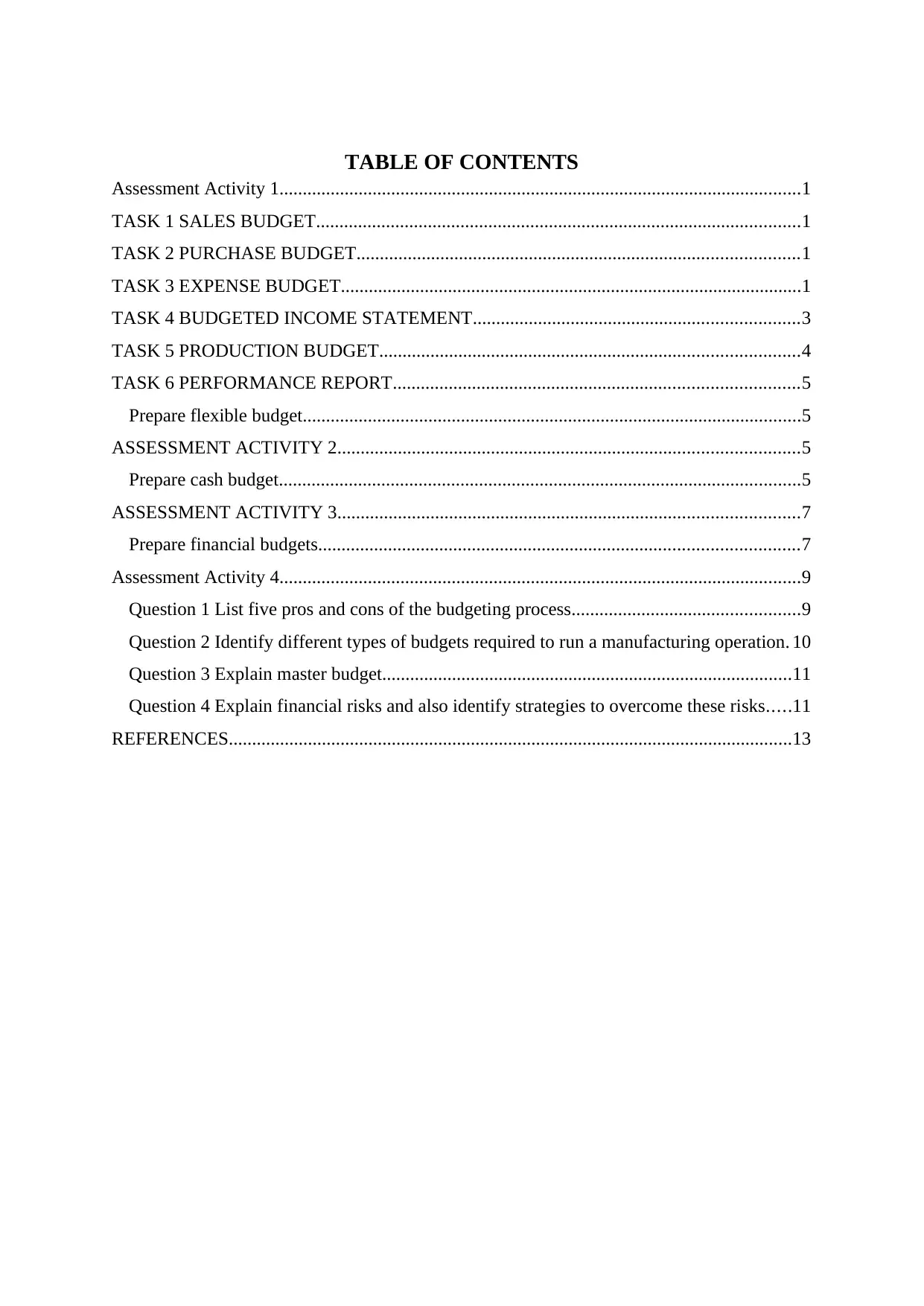

TASK 1 SALES BUDGET

Particulars Sydney Melbourne Brisbane

Gold

coast Adelaide Perth

No. of sales 740 680 620 710 550 420

Average price 260 220 200 190 180 170

Sales 192400 149600 124000 134900 99000 71400

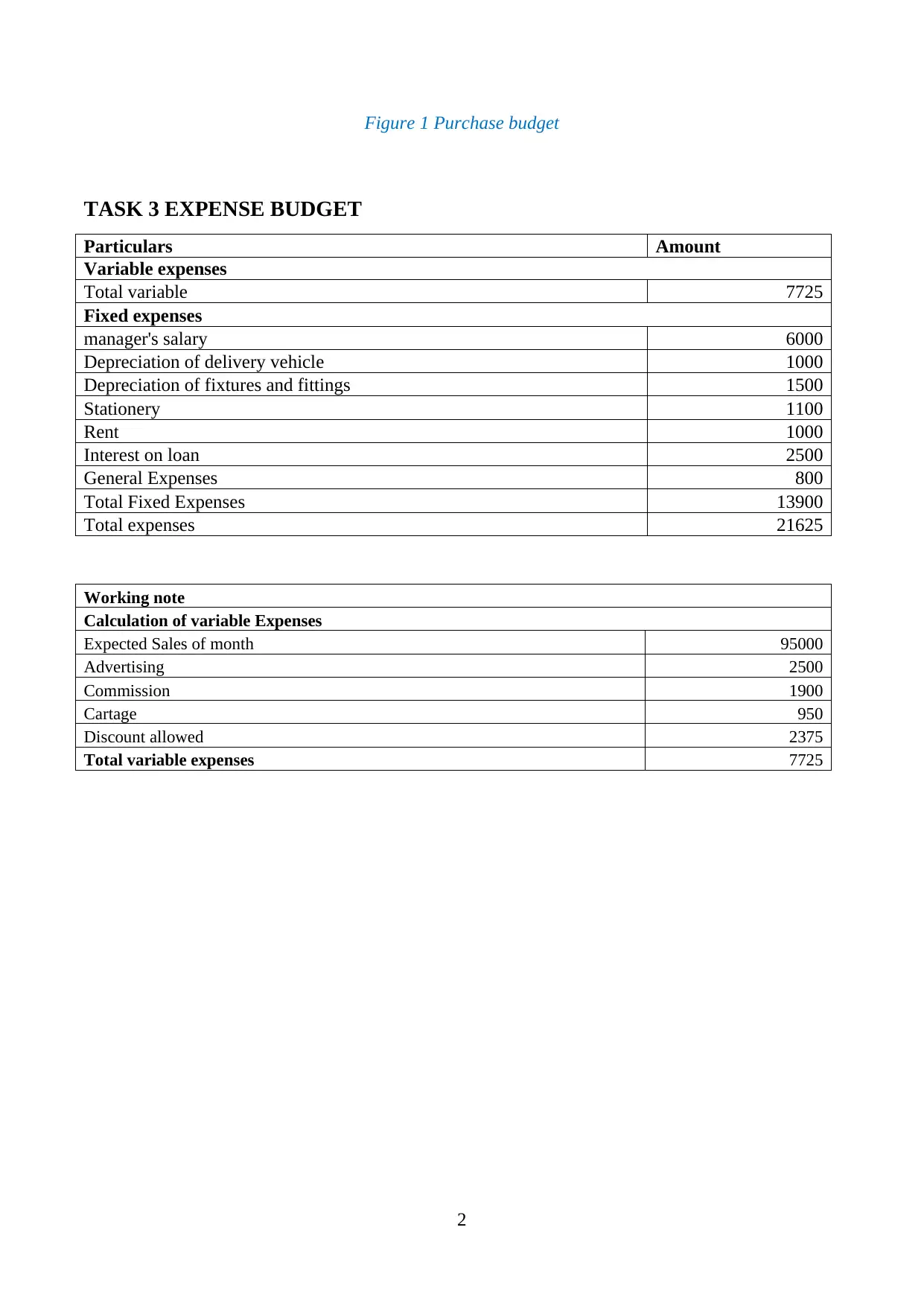

TASK 2 PURCHASE BUDGET

Particulars October November December

Budgeted sales 120000 140000 250000

Opening inventory 144000 252000 450000

Closing inventory 252000 450000 225000

Purchase 12000 -58000 475000

Working note

Particulars October November December January

Budgeted sales 120000 140000 250000 125000

Expected sales 144000 168000 300000 150000

Closing stock 252000 450000 225000

1

TASK 1 SALES BUDGET

Particulars Sydney Melbourne Brisbane

Gold

coast Adelaide Perth

No. of sales 740 680 620 710 550 420

Average price 260 220 200 190 180 170

Sales 192400 149600 124000 134900 99000 71400

TASK 2 PURCHASE BUDGET

Particulars October November December

Budgeted sales 120000 140000 250000

Opening inventory 144000 252000 450000

Closing inventory 252000 450000 225000

Purchase 12000 -58000 475000

Working note

Particulars October November December January

Budgeted sales 120000 140000 250000 125000

Expected sales 144000 168000 300000 150000

Closing stock 252000 450000 225000

1

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Figure 1 Purchase budget

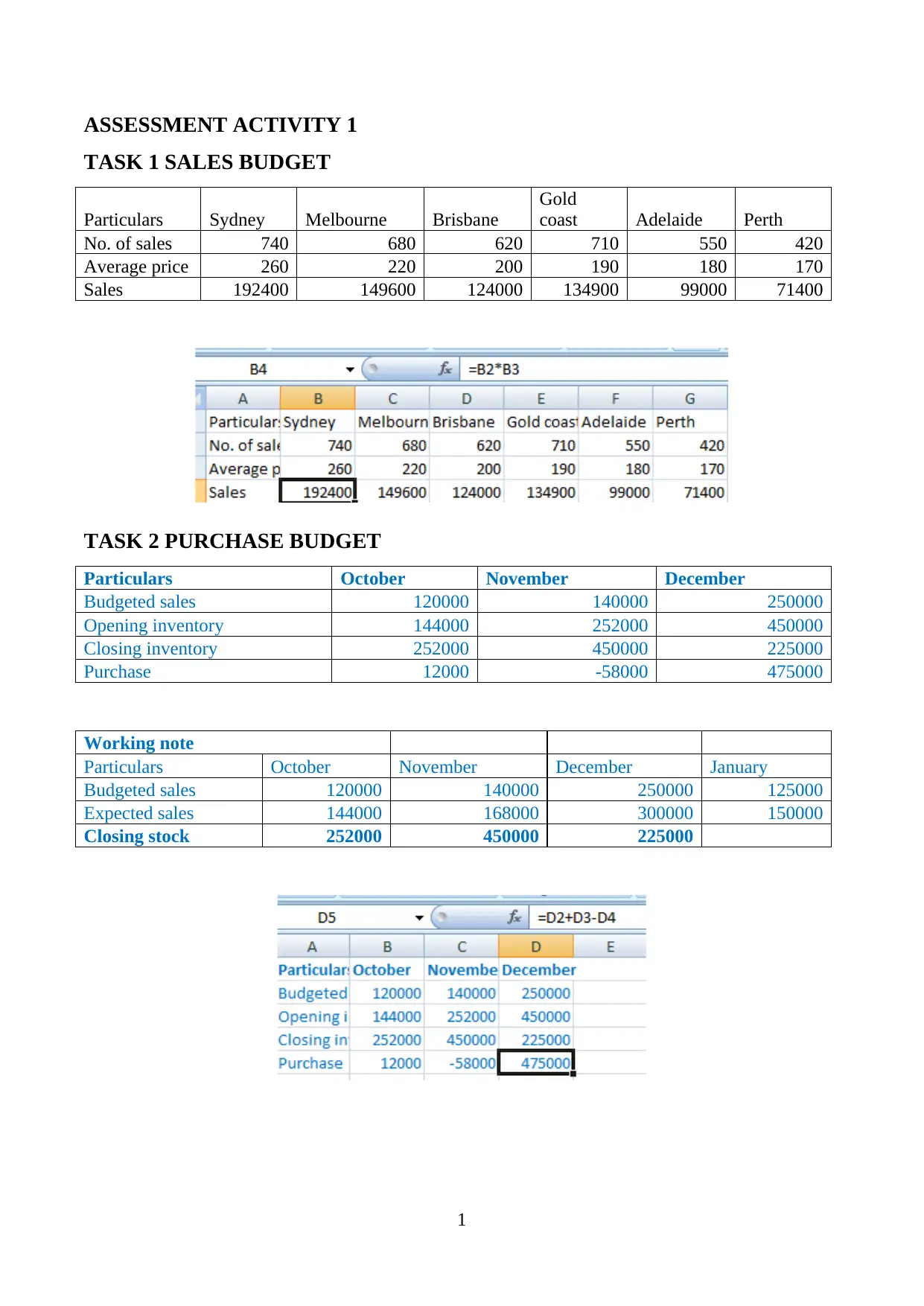

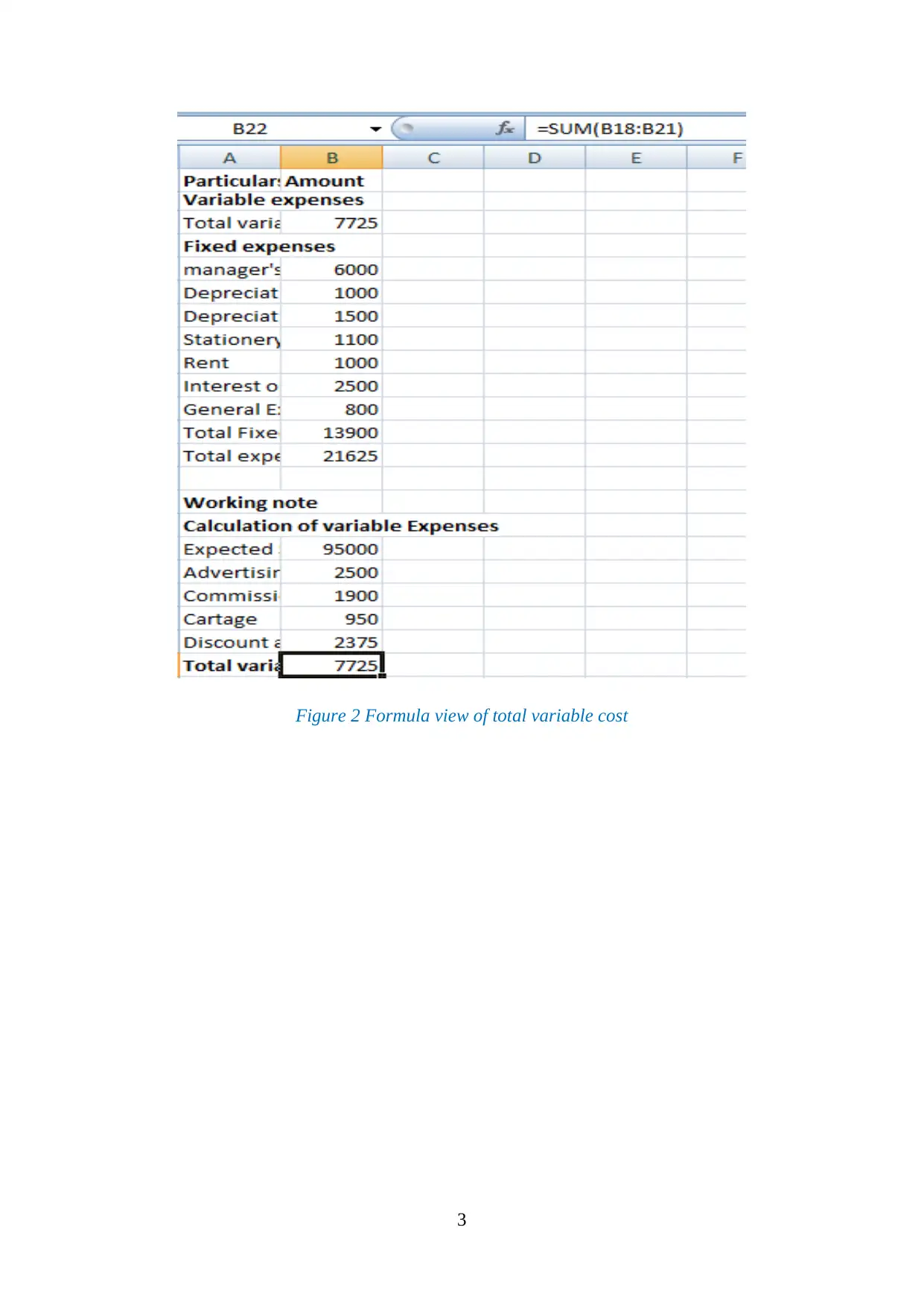

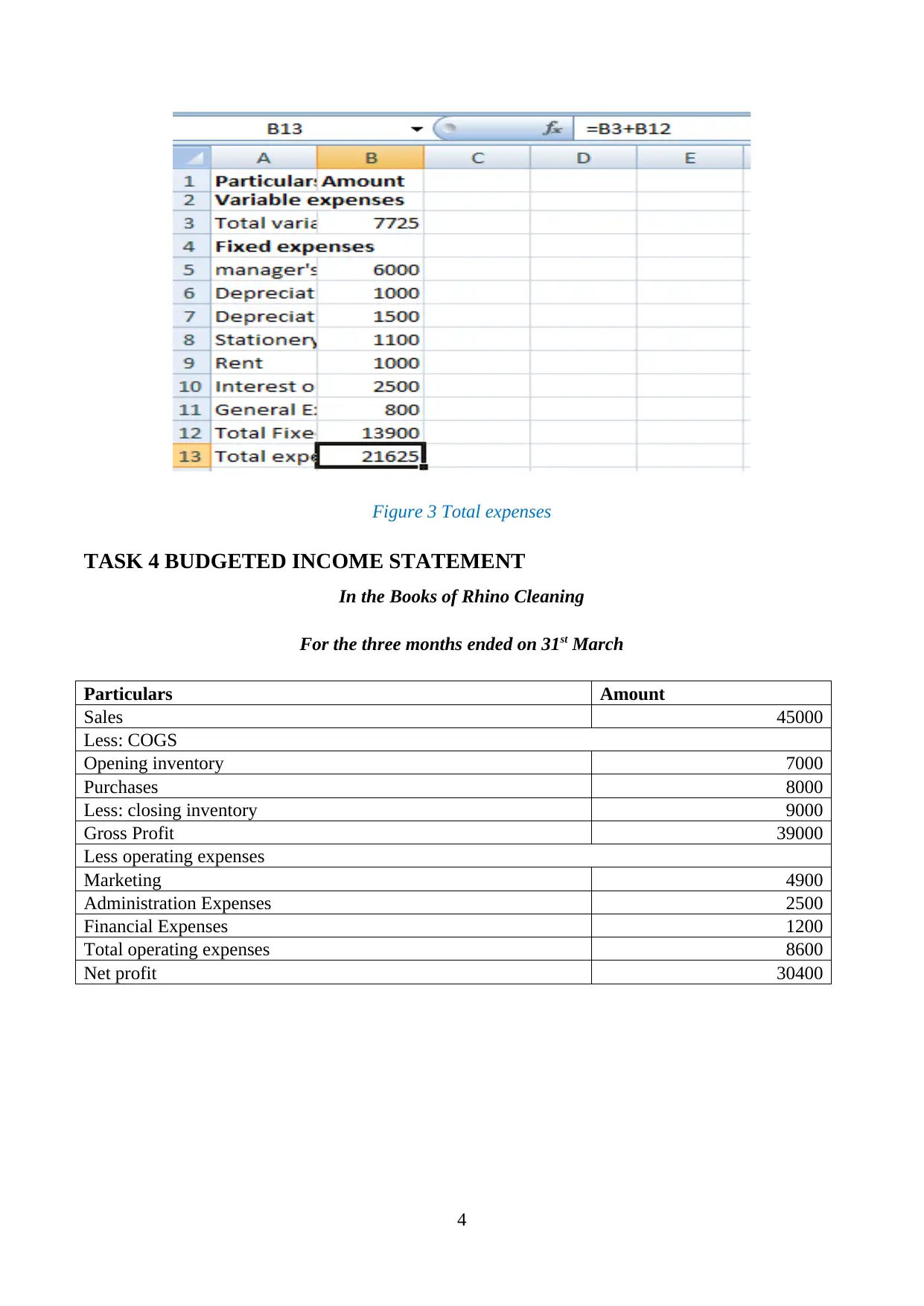

TASK 3 EXPENSE BUDGET

Particulars Amount

Variable expenses

Total variable 7725

Fixed expenses

manager's salary 6000

Depreciation of delivery vehicle 1000

Depreciation of fixtures and fittings 1500

Stationery 1100

Rent 1000

Interest on loan 2500

General Expenses 800

Total Fixed Expenses 13900

Total expenses 21625

Working note

Calculation of variable Expenses

Expected Sales of month 95000

Advertising 2500

Commission 1900

Cartage 950

Discount allowed 2375

Total variable expenses 7725

2

TASK 3 EXPENSE BUDGET

Particulars Amount

Variable expenses

Total variable 7725

Fixed expenses

manager's salary 6000

Depreciation of delivery vehicle 1000

Depreciation of fixtures and fittings 1500

Stationery 1100

Rent 1000

Interest on loan 2500

General Expenses 800

Total Fixed Expenses 13900

Total expenses 21625

Working note

Calculation of variable Expenses

Expected Sales of month 95000

Advertising 2500

Commission 1900

Cartage 950

Discount allowed 2375

Total variable expenses 7725

2

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Figure 2 Formula view of total variable cost

3

3

Figure 3 Total expenses

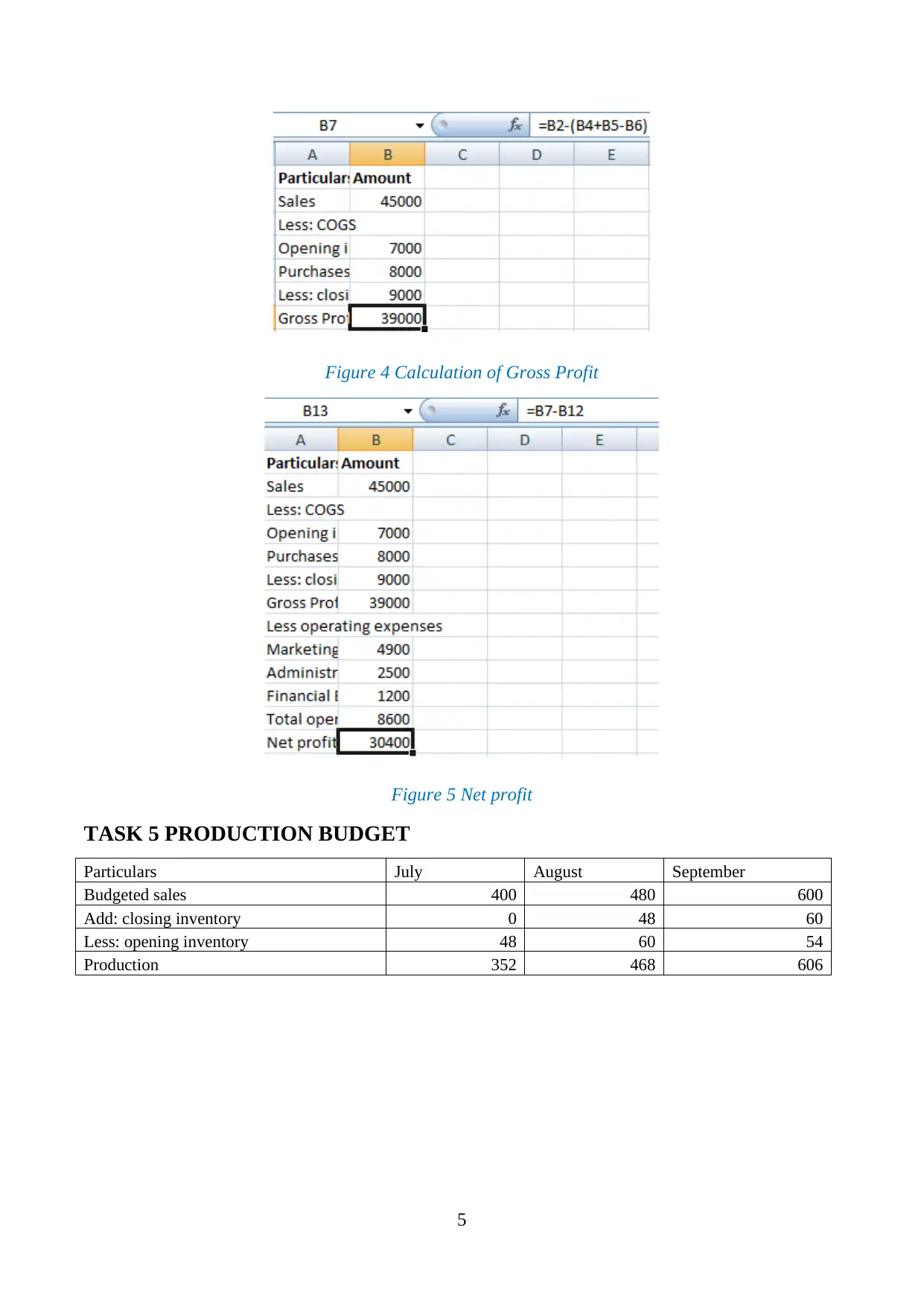

TASK 4 BUDGETED INCOME STATEMENT

In the Books of Rhino Cleaning

For the three months ended on 31st March

Particulars Amount

Sales 45000

Less: COGS

Opening inventory 7000

Purchases 8000

Less: closing inventory 9000

Gross Profit 39000

Less operating expenses

Marketing 4900

Administration Expenses 2500

Financial Expenses 1200

Total operating expenses 8600

Net profit 30400

4

TASK 4 BUDGETED INCOME STATEMENT

In the Books of Rhino Cleaning

For the three months ended on 31st March

Particulars Amount

Sales 45000

Less: COGS

Opening inventory 7000

Purchases 8000

Less: closing inventory 9000

Gross Profit 39000

Less operating expenses

Marketing 4900

Administration Expenses 2500

Financial Expenses 1200

Total operating expenses 8600

Net profit 30400

4

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

Figure 4 Calculation of Gross Profit

Figure 5 Net profit

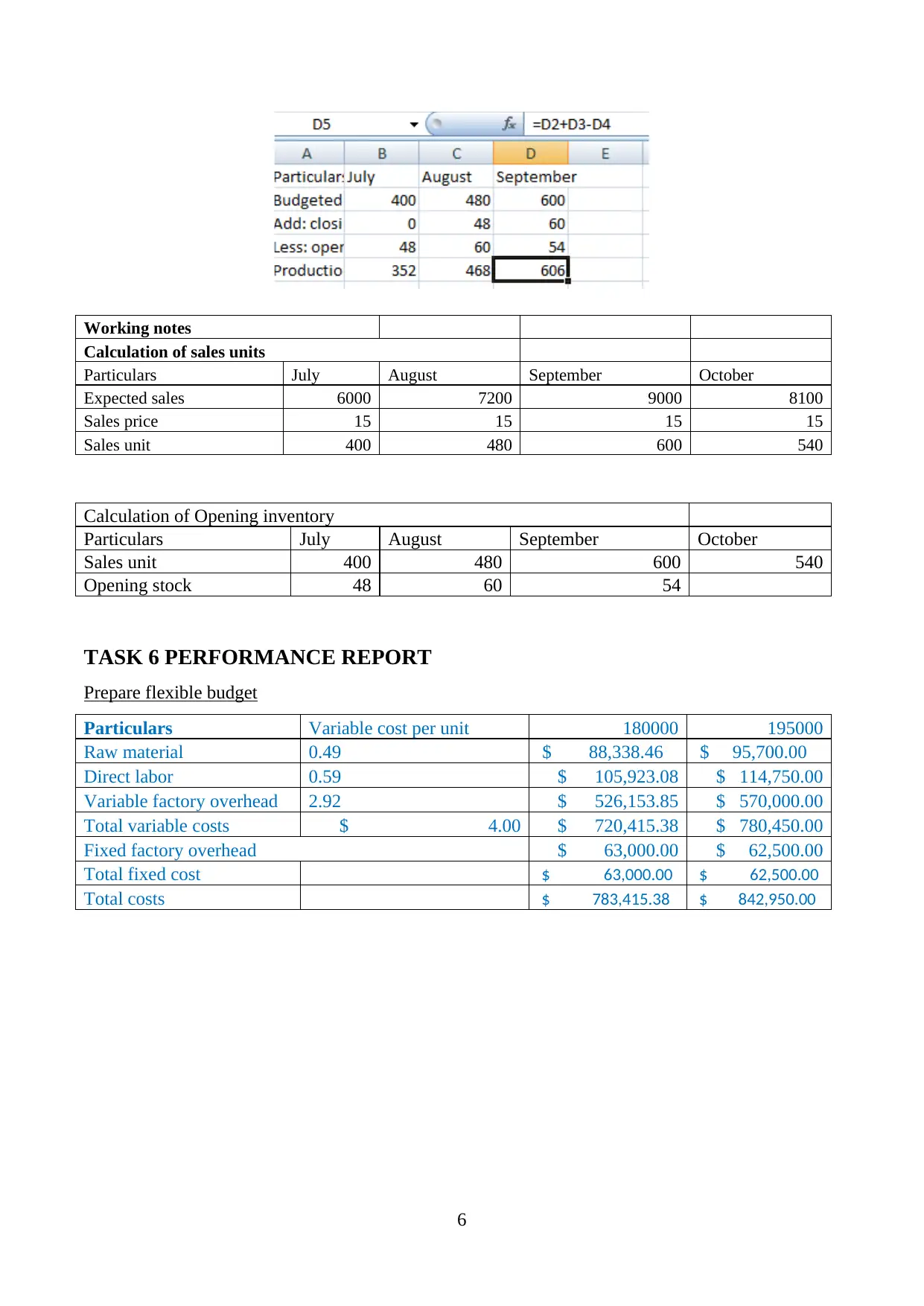

TASK 5 PRODUCTION BUDGET

Particulars July August September

Budgeted sales 400 480 600

Add: closing inventory 0 48 60

Less: opening inventory 48 60 54

Production 352 468 606

5

Figure 5 Net profit

TASK 5 PRODUCTION BUDGET

Particulars July August September

Budgeted sales 400 480 600

Add: closing inventory 0 48 60

Less: opening inventory 48 60 54

Production 352 468 606

5

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Working notes

Calculation of sales units

Particulars July August September October

Expected sales 6000 7200 9000 8100

Sales price 15 15 15 15

Sales unit 400 480 600 540

Calculation of Opening inventory

Particulars July August September October

Sales unit 400 480 600 540

Opening stock 48 60 54

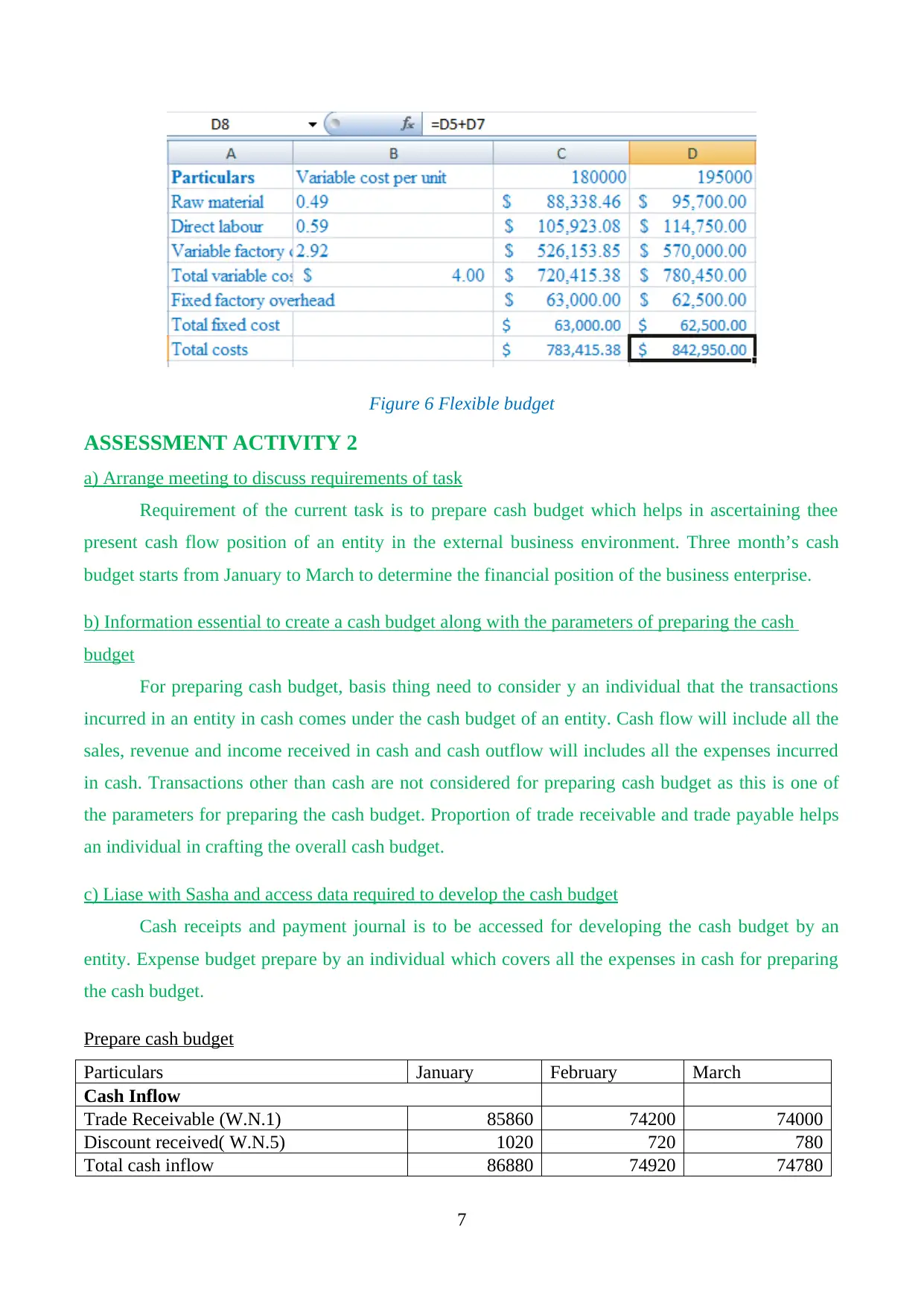

TASK 6 PERFORMANCE REPORT

Prepare flexible budget

Particulars Variable cost per unit 180000 195000

Raw material 0.49 $ 88,338.46 $ 95,700.00

Direct labor 0.59 $ 105,923.08 $ 114,750.00

Variable factory overhead 2.92 $ 526,153.85 $ 570,000.00

Total variable costs $ 4.00 $ 720,415.38 $ 780,450.00

Fixed factory overhead $ 63,000.00 $ 62,500.00

Total fixed cost $ 63,000.00 $ 62,500.00

Total costs $ 783,415.38 $ 842,950.00

6

Calculation of sales units

Particulars July August September October

Expected sales 6000 7200 9000 8100

Sales price 15 15 15 15

Sales unit 400 480 600 540

Calculation of Opening inventory

Particulars July August September October

Sales unit 400 480 600 540

Opening stock 48 60 54

TASK 6 PERFORMANCE REPORT

Prepare flexible budget

Particulars Variable cost per unit 180000 195000

Raw material 0.49 $ 88,338.46 $ 95,700.00

Direct labor 0.59 $ 105,923.08 $ 114,750.00

Variable factory overhead 2.92 $ 526,153.85 $ 570,000.00

Total variable costs $ 4.00 $ 720,415.38 $ 780,450.00

Fixed factory overhead $ 63,000.00 $ 62,500.00

Total fixed cost $ 63,000.00 $ 62,500.00

Total costs $ 783,415.38 $ 842,950.00

6

Figure 6 Flexible budget

ASSESSMENT ACTIVITY 2

a) Arrange meeting to discuss requirements of task

Requirement of the current task is to prepare cash budget which helps in ascertaining thee

present cash flow position of an entity in the external business environment. Three month’s cash

budget starts from January to March to determine the financial position of the business enterprise.

b) Information essential to create a cash budget along with the parameters of preparing the cash

budget

For preparing cash budget, basis thing need to consider y an individual that the transactions

incurred in an entity in cash comes under the cash budget of an entity. Cash flow will include all the

sales, revenue and income received in cash and cash outflow will includes all the expenses incurred

in cash. Transactions other than cash are not considered for preparing cash budget as this is one of

the parameters for preparing the cash budget. Proportion of trade receivable and trade payable helps

an individual in crafting the overall cash budget.

c) Liase with Sasha and access data required to develop the cash budget

Cash receipts and payment journal is to be accessed for developing the cash budget by an

entity. Expense budget prepare by an individual which covers all the expenses in cash for preparing

the cash budget.

Prepare cash budget

Particulars January February March

Cash Inflow

Trade Receivable (W.N.1) 85860 74200 74000

Discount received( W.N.5) 1020 720 780

Total cash inflow 86880 74920 74780

7

ASSESSMENT ACTIVITY 2

a) Arrange meeting to discuss requirements of task

Requirement of the current task is to prepare cash budget which helps in ascertaining thee

present cash flow position of an entity in the external business environment. Three month’s cash

budget starts from January to March to determine the financial position of the business enterprise.

b) Information essential to create a cash budget along with the parameters of preparing the cash

budget

For preparing cash budget, basis thing need to consider y an individual that the transactions

incurred in an entity in cash comes under the cash budget of an entity. Cash flow will include all the

sales, revenue and income received in cash and cash outflow will includes all the expenses incurred

in cash. Transactions other than cash are not considered for preparing cash budget as this is one of

the parameters for preparing the cash budget. Proportion of trade receivable and trade payable helps

an individual in crafting the overall cash budget.

c) Liase with Sasha and access data required to develop the cash budget

Cash receipts and payment journal is to be accessed for developing the cash budget by an

entity. Expense budget prepare by an individual which covers all the expenses in cash for preparing

the cash budget.

Prepare cash budget

Particulars January February March

Cash Inflow

Trade Receivable (W.N.1) 85860 74200 74000

Discount received( W.N.5) 1020 720 780

Total cash inflow 86880 74920 74780

7

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

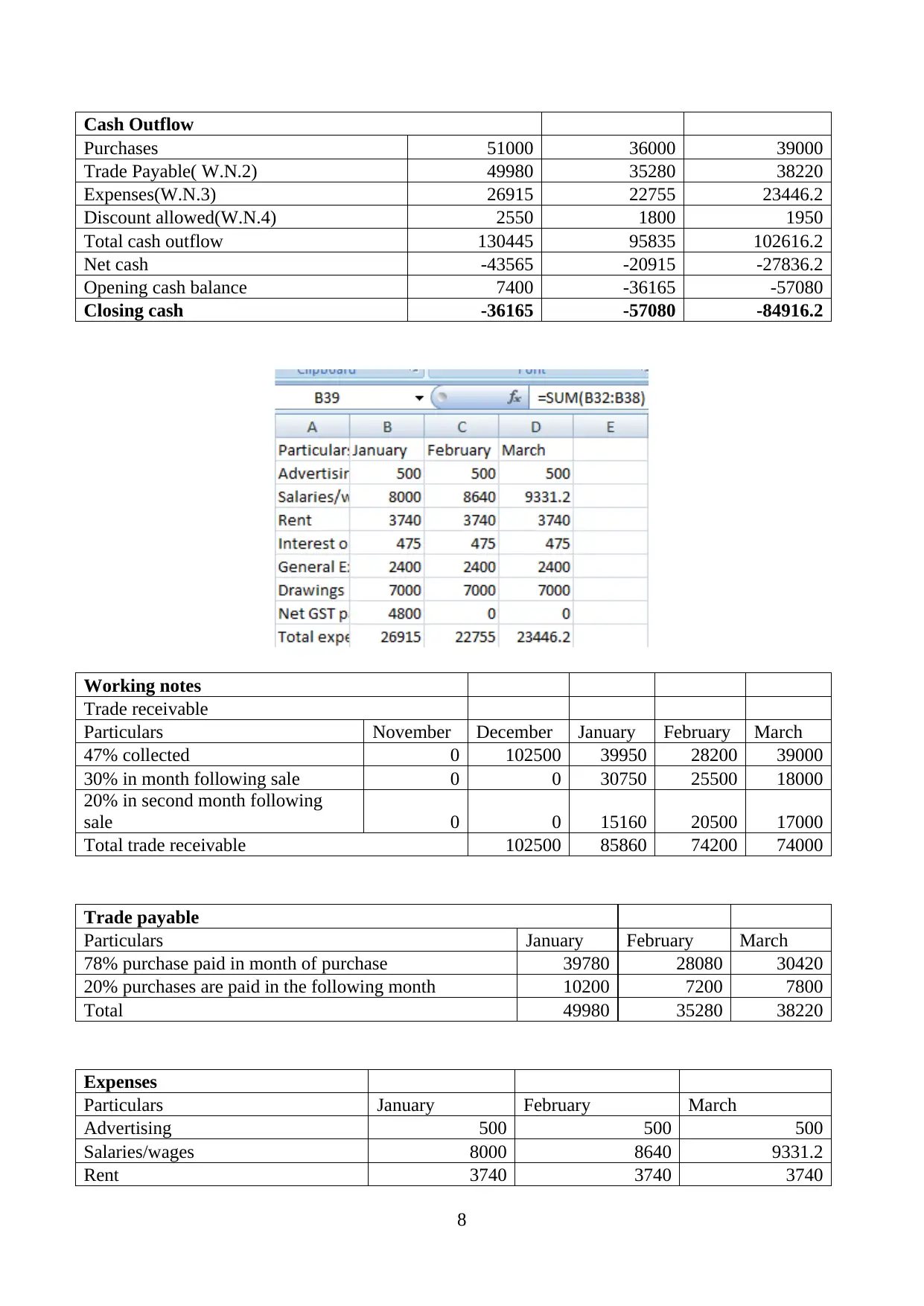

Cash Outflow

Purchases 51000 36000 39000

Trade Payable( W.N.2) 49980 35280 38220

Expenses(W.N.3) 26915 22755 23446.2

Discount allowed(W.N.4) 2550 1800 1950

Total cash outflow 130445 95835 102616.2

Net cash -43565 -20915 -27836.2

Opening cash balance 7400 -36165 -57080

Closing cash -36165 -57080 -84916.2

Working notes

Trade receivable

Particulars November December January February March

47% collected 0 102500 39950 28200 39000

30% in month following sale 0 0 30750 25500 18000

20% in second month following

sale 0 0 15160 20500 17000

Total trade receivable 102500 85860 74200 74000

Trade payable

Particulars January February March

78% purchase paid in month of purchase 39780 28080 30420

20% purchases are paid in the following month 10200 7200 7800

Total 49980 35280 38220

Expenses

Particulars January February March

Advertising 500 500 500

Salaries/wages 8000 8640 9331.2

Rent 3740 3740 3740

8

Purchases 51000 36000 39000

Trade Payable( W.N.2) 49980 35280 38220

Expenses(W.N.3) 26915 22755 23446.2

Discount allowed(W.N.4) 2550 1800 1950

Total cash outflow 130445 95835 102616.2

Net cash -43565 -20915 -27836.2

Opening cash balance 7400 -36165 -57080

Closing cash -36165 -57080 -84916.2

Working notes

Trade receivable

Particulars November December January February March

47% collected 0 102500 39950 28200 39000

30% in month following sale 0 0 30750 25500 18000

20% in second month following

sale 0 0 15160 20500 17000

Total trade receivable 102500 85860 74200 74000

Trade payable

Particulars January February March

78% purchase paid in month of purchase 39780 28080 30420

20% purchases are paid in the following month 10200 7200 7800

Total 49980 35280 38220

Expenses

Particulars January February March

Advertising 500 500 500

Salaries/wages 8000 8640 9331.2

Rent 3740 3740 3740

8

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Interest on mortgage 475 475 475

General Expenses 2400 2400 2400

Drawings 7000 7000 7000

Net GST payable 4800 0 0

Total expenses 26915 22755 23446.2

Discount allowed

Particulars January February March

Sales 85000 60000 65000

Discount allowed 2550 1800 1950

Discount received

Particulars January February March

Purchases 51000 36000 39000

Discount received 1020 720 780

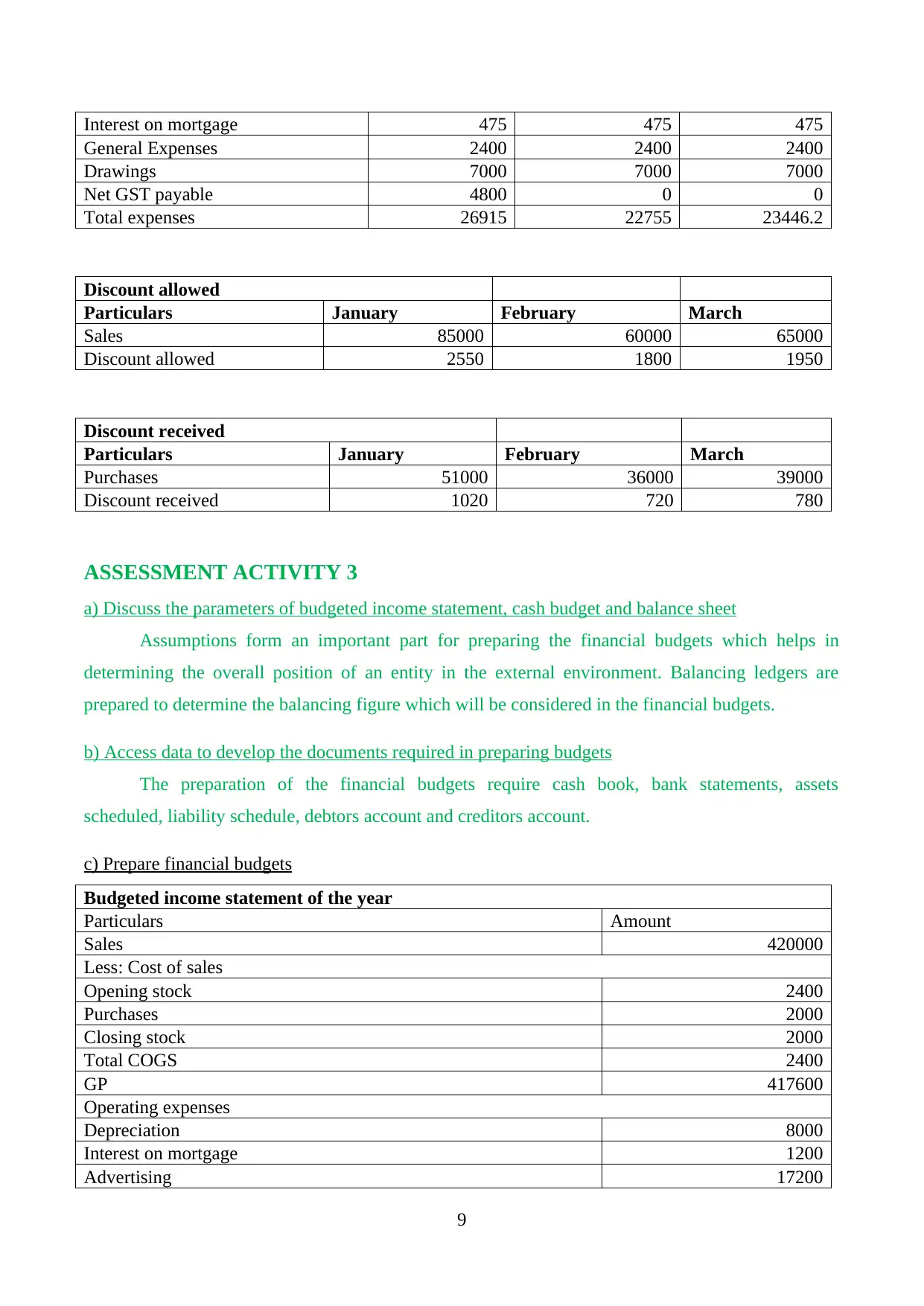

ASSESSMENT ACTIVITY 3

a) Discuss the parameters of budgeted income statement, cash budget and balance sheet

Assumptions form an important part for preparing the financial budgets which helps in

determining the overall position of an entity in the external environment. Balancing ledgers are

prepared to determine the balancing figure which will be considered in the financial budgets.

b) Access data to develop the documents required in preparing budgets

The preparation of the financial budgets require cash book, bank statements, assets

scheduled, liability schedule, debtors account and creditors account.

c) Prepare financial budgets

Budgeted income statement of the year

Particulars Amount

Sales 420000

Less: Cost of sales

Opening stock 2400

Purchases 2000

Closing stock 2000

Total COGS 2400

GP 417600

Operating expenses

Depreciation 8000

Interest on mortgage 1200

Advertising 17200

9

General Expenses 2400 2400 2400

Drawings 7000 7000 7000

Net GST payable 4800 0 0

Total expenses 26915 22755 23446.2

Discount allowed

Particulars January February March

Sales 85000 60000 65000

Discount allowed 2550 1800 1950

Discount received

Particulars January February March

Purchases 51000 36000 39000

Discount received 1020 720 780

ASSESSMENT ACTIVITY 3

a) Discuss the parameters of budgeted income statement, cash budget and balance sheet

Assumptions form an important part for preparing the financial budgets which helps in

determining the overall position of an entity in the external environment. Balancing ledgers are

prepared to determine the balancing figure which will be considered in the financial budgets.

b) Access data to develop the documents required in preparing budgets

The preparation of the financial budgets require cash book, bank statements, assets

scheduled, liability schedule, debtors account and creditors account.

c) Prepare financial budgets

Budgeted income statement of the year

Particulars Amount

Sales 420000

Less: Cost of sales

Opening stock 2400

Purchases 2000

Closing stock 2000

Total COGS 2400

GP 417600

Operating expenses

Depreciation 8000

Interest on mortgage 1200

Advertising 17200

9

Office expenses 7600

Rates and taxes 3800

Bank charges 300

Commission on sales 4900

Motor vehicle expenses 9600

Salaries and wages 35200

Total expenses 87800

Net Profit 329800

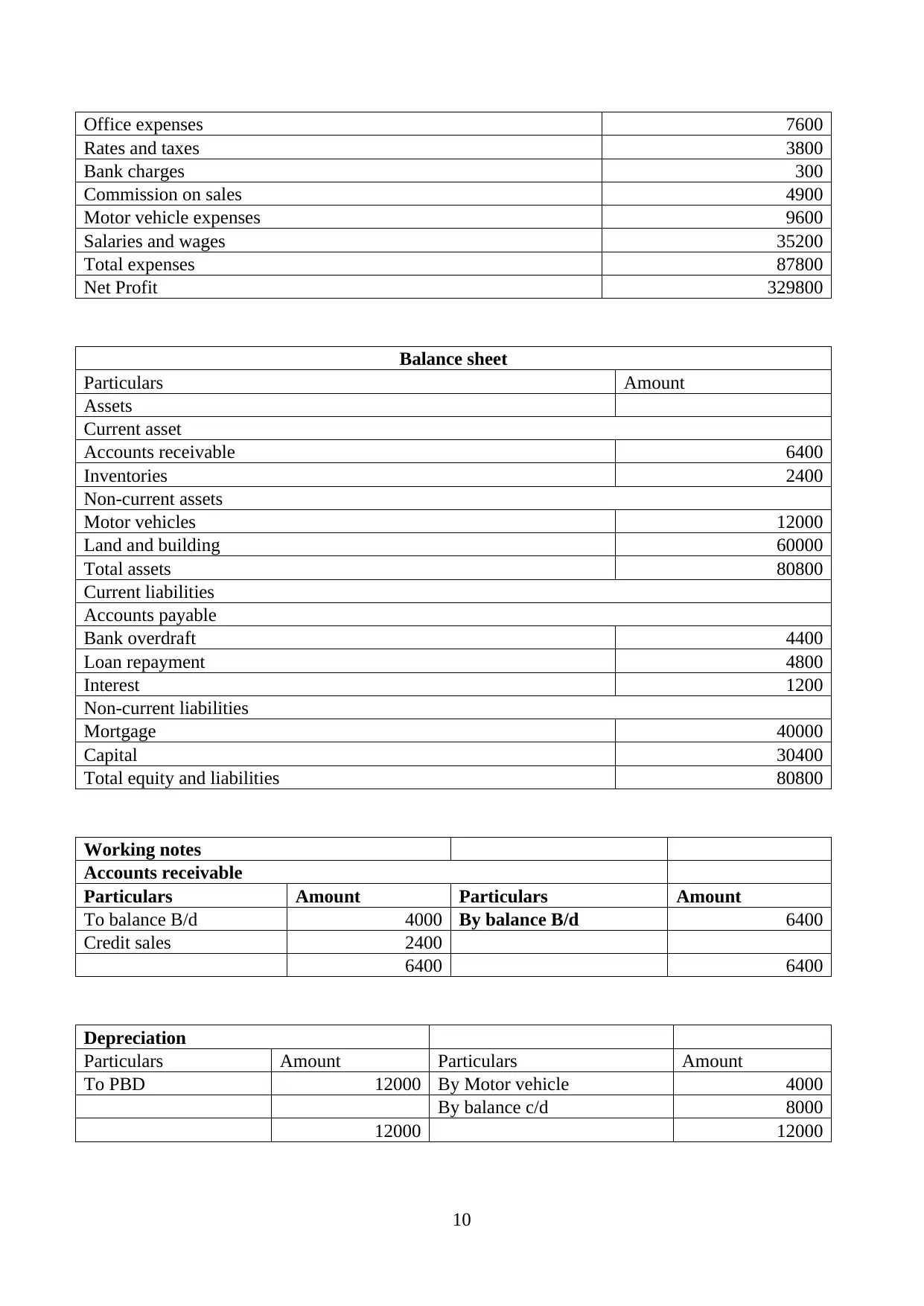

Balance sheet

Particulars Amount

Assets

Current asset

Accounts receivable 6400

Inventories 2400

Non-current assets

Motor vehicles 12000

Land and building 60000

Total assets 80800

Current liabilities

Accounts payable

Bank overdraft 4400

Loan repayment 4800

Interest 1200

Non-current liabilities

Mortgage 40000

Capital 30400

Total equity and liabilities 80800

Working notes

Accounts receivable

Particulars Amount Particulars Amount

To balance B/d 4000 By balance B/d 6400

Credit sales 2400

6400 6400

Depreciation

Particulars Amount Particulars Amount

To PBD 12000 By Motor vehicle 4000

By balance c/d 8000

12000 12000

10

Rates and taxes 3800

Bank charges 300

Commission on sales 4900

Motor vehicle expenses 9600

Salaries and wages 35200

Total expenses 87800

Net Profit 329800

Balance sheet

Particulars Amount

Assets

Current asset

Accounts receivable 6400

Inventories 2400

Non-current assets

Motor vehicles 12000

Land and building 60000

Total assets 80800

Current liabilities

Accounts payable

Bank overdraft 4400

Loan repayment 4800

Interest 1200

Non-current liabilities

Mortgage 40000

Capital 30400

Total equity and liabilities 80800

Working notes

Accounts receivable

Particulars Amount Particulars Amount

To balance B/d 4000 By balance B/d 6400

Credit sales 2400

6400 6400

Depreciation

Particulars Amount Particulars Amount

To PBD 12000 By Motor vehicle 4000

By balance c/d 8000

12000 12000

10

⊘ This is a preview!⊘

Do you want full access?

Subscribe today to unlock all pages.

Trusted by 1+ million students worldwide

1 out of 21

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

Copyright © 2020–2026 A2Z Services. All Rights Reserved. Developed and managed by ZUCOL.