Changes and Development in Oil and Gas Retail Industries Report

VerifiedAdded on 2019/12/03

|15

|3768

|431

Report

AI Summary

This report provides a comprehensive overview of the development within the oil and gas retail industries, with a specific focus on the UK market. It meticulously examines recent trends and significant changes in the supply chain, highlighting the closure of petrol filling stations and the shift in ownership from traditional suppliers like BP and Shell to supermarkets such as Tesco, Sainsbury's, and Asda. The report analyzes changes in buyer behavior, emphasizing the importance of convenience and price, and how these factors influence consumer choices. It also assesses the impact of technology on the industry, including the introduction of new technologies and government regulations. Furthermore, the report incorporates illustrations and data to support its analysis, offering insights into market share, fuel prices, and the evolving dynamics of the oil and gas retail sector. The conclusion summarizes the key findings and provides a forward-looking perspective on the industry's future.

Development in Oil and Gas

Retail Industries

Retail Industries

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

TABLE OF CONTENTS

1.0 INTRODUCTION.....................................................................................................................4

2.0 RECENT TRENDS AND CHANGES WITHIN SUPPLY CHAIN OF UK PETROLEUM

RETAIL MARKET.........................................................................................................................4

3.0 CHANGES IN THE OWNERSHIP OF PETROL SUPPLIERS..............................................5

4.0 CHANGES IN BUYER BEHAVIOUR ................................................................................10

5.0 IMPACT OF TECHNOLOGY ...............................................................................................11

6.0 CONCLUSION .......................................................................................................................12

REFERENCES..............................................................................................................................13

1.0 INTRODUCTION.....................................................................................................................4

2.0 RECENT TRENDS AND CHANGES WITHIN SUPPLY CHAIN OF UK PETROLEUM

RETAIL MARKET.........................................................................................................................4

3.0 CHANGES IN THE OWNERSHIP OF PETROL SUPPLIERS..............................................5

4.0 CHANGES IN BUYER BEHAVIOUR ................................................................................10

5.0 IMPACT OF TECHNOLOGY ...............................................................................................11

6.0 CONCLUSION .......................................................................................................................12

REFERENCES..............................................................................................................................13

ILLUSTRATION INDEX

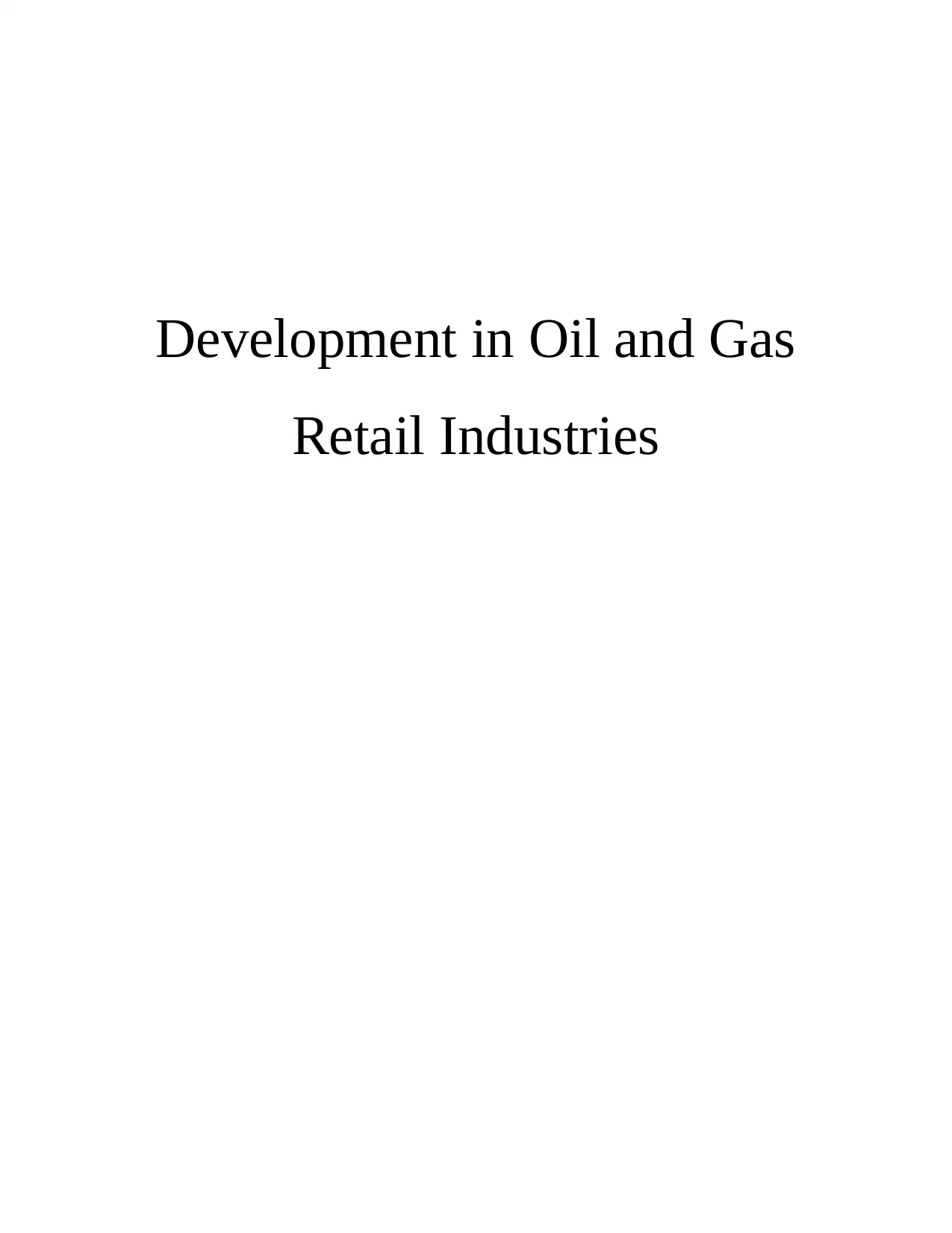

Illustration 1: Declining of PFS in past decades..............................................................................6

Illustration 2: Asda PFS...................................................................................................................7

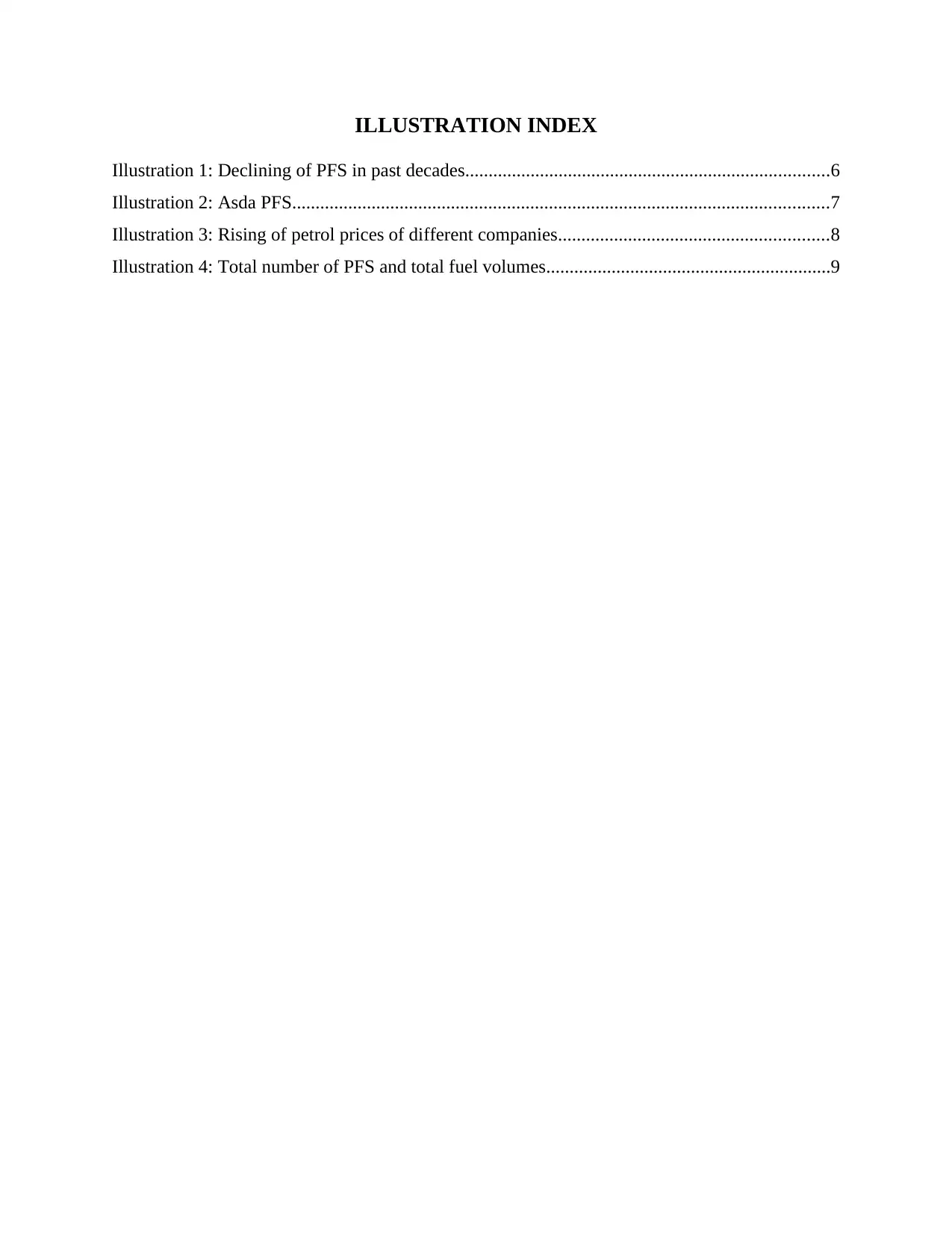

Illustration 3: Rising of petrol prices of different companies..........................................................8

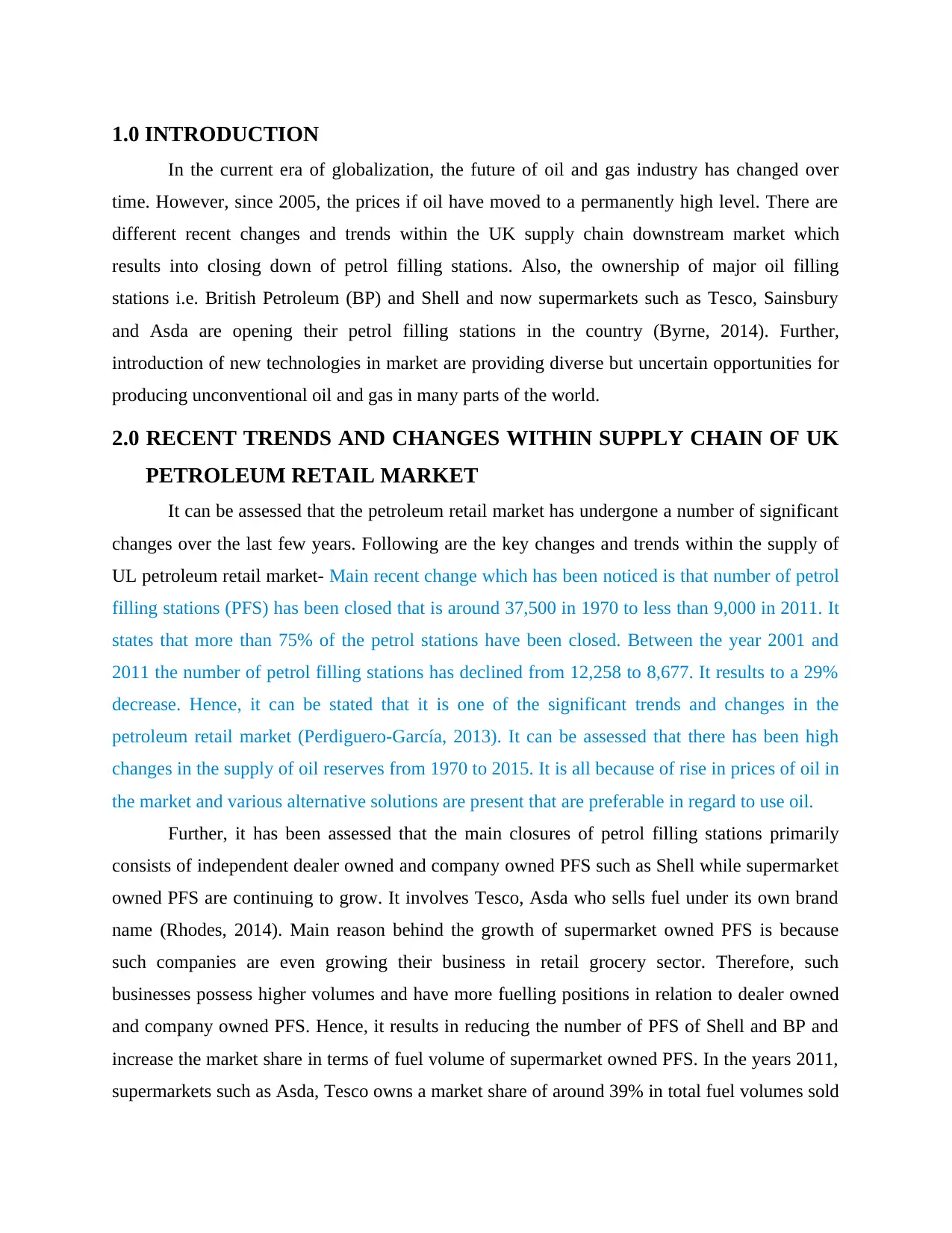

Illustration 4: Total number of PFS and total fuel volumes.............................................................9

Illustration 1: Declining of PFS in past decades..............................................................................6

Illustration 2: Asda PFS...................................................................................................................7

Illustration 3: Rising of petrol prices of different companies..........................................................8

Illustration 4: Total number of PFS and total fuel volumes.............................................................9

You're viewing a preview

Unlock full access by subscribing today!

1.0 INTRODUCTION

In the current era of globalization, the future of oil and gas industry has changed over

time. However, since 2005, the prices if oil have moved to a permanently high level. There are

different recent changes and trends within the UK supply chain downstream market which

results into closing down of petrol filling stations. Also, the ownership of major oil filling

stations i.e. British Petroleum (BP) and Shell and now supermarkets such as Tesco, Sainsbury

and Asda are opening their petrol filling stations in the country (Byrne, 2014). Further,

introduction of new technologies in market are providing diverse but uncertain opportunities for

producing unconventional oil and gas in many parts of the world.

2.0 RECENT TRENDS AND CHANGES WITHIN SUPPLY CHAIN OF UK

PETROLEUM RETAIL MARKET

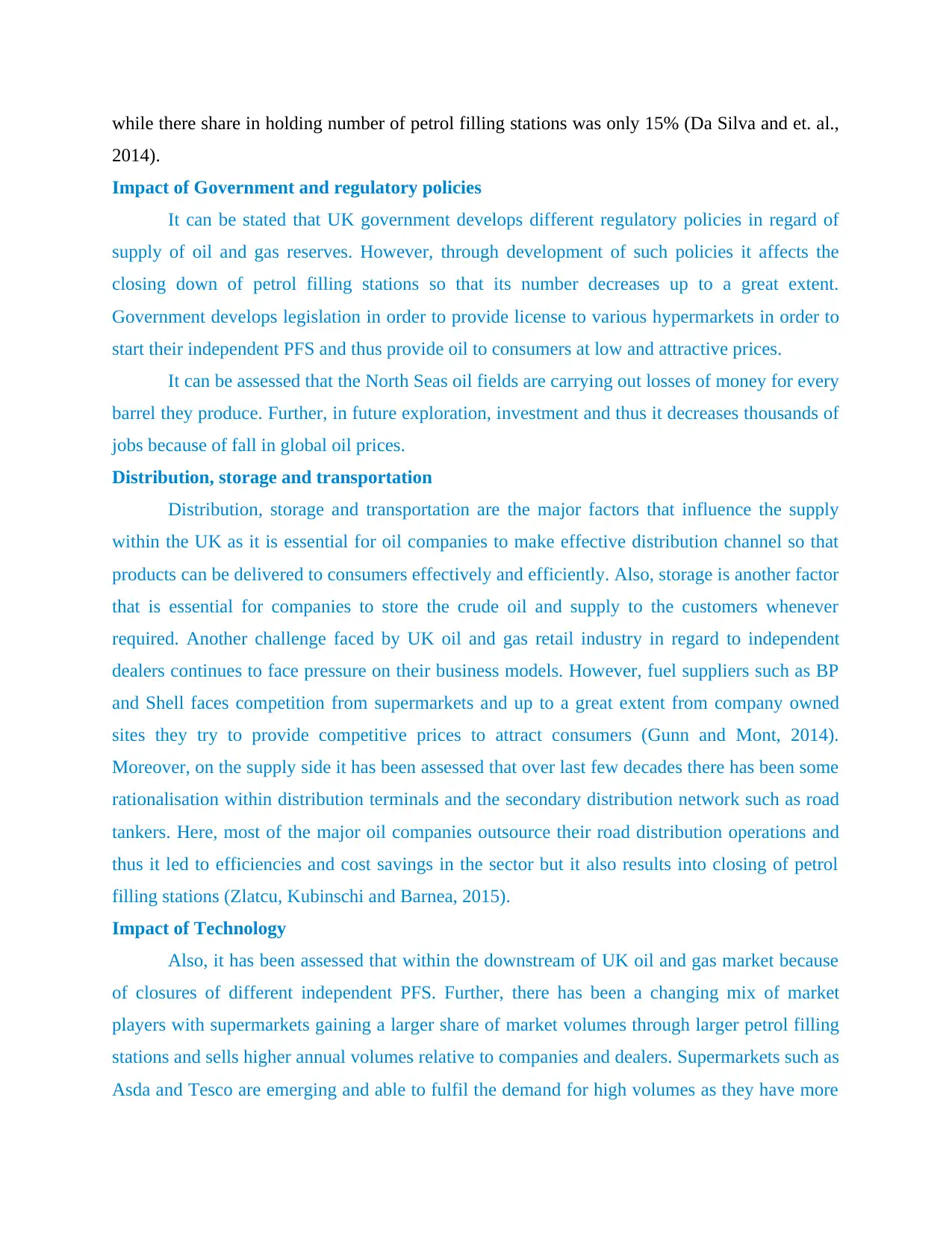

It can be assessed that the petroleum retail market has undergone a number of significant

changes over the last few years. Following are the key changes and trends within the supply of

UL petroleum retail market- Main recent change which has been noticed is that number of petrol

filling stations (PFS) has been closed that is around 37,500 in 1970 to less than 9,000 in 2011. It

states that more than 75% of the petrol stations have been closed. Between the year 2001 and

2011 the number of petrol filling stations has declined from 12,258 to 8,677. It results to a 29%

decrease. Hence, it can be stated that it is one of the significant trends and changes in the

petroleum retail market (Perdiguero-García, 2013). It can be assessed that there has been high

changes in the supply of oil reserves from 1970 to 2015. It is all because of rise in prices of oil in

the market and various alternative solutions are present that are preferable in regard to use oil.

Further, it has been assessed that the main closures of petrol filling stations primarily

consists of independent dealer owned and company owned PFS such as Shell while supermarket

owned PFS are continuing to grow. It involves Tesco, Asda who sells fuel under its own brand

name (Rhodes, 2014). Main reason behind the growth of supermarket owned PFS is because

such companies are even growing their business in retail grocery sector. Therefore, such

businesses possess higher volumes and have more fuelling positions in relation to dealer owned

and company owned PFS. Hence, it results in reducing the number of PFS of Shell and BP and

increase the market share in terms of fuel volume of supermarket owned PFS. In the years 2011,

supermarkets such as Asda, Tesco owns a market share of around 39% in total fuel volumes sold

In the current era of globalization, the future of oil and gas industry has changed over

time. However, since 2005, the prices if oil have moved to a permanently high level. There are

different recent changes and trends within the UK supply chain downstream market which

results into closing down of petrol filling stations. Also, the ownership of major oil filling

stations i.e. British Petroleum (BP) and Shell and now supermarkets such as Tesco, Sainsbury

and Asda are opening their petrol filling stations in the country (Byrne, 2014). Further,

introduction of new technologies in market are providing diverse but uncertain opportunities for

producing unconventional oil and gas in many parts of the world.

2.0 RECENT TRENDS AND CHANGES WITHIN SUPPLY CHAIN OF UK

PETROLEUM RETAIL MARKET

It can be assessed that the petroleum retail market has undergone a number of significant

changes over the last few years. Following are the key changes and trends within the supply of

UL petroleum retail market- Main recent change which has been noticed is that number of petrol

filling stations (PFS) has been closed that is around 37,500 in 1970 to less than 9,000 in 2011. It

states that more than 75% of the petrol stations have been closed. Between the year 2001 and

2011 the number of petrol filling stations has declined from 12,258 to 8,677. It results to a 29%

decrease. Hence, it can be stated that it is one of the significant trends and changes in the

petroleum retail market (Perdiguero-García, 2013). It can be assessed that there has been high

changes in the supply of oil reserves from 1970 to 2015. It is all because of rise in prices of oil in

the market and various alternative solutions are present that are preferable in regard to use oil.

Further, it has been assessed that the main closures of petrol filling stations primarily

consists of independent dealer owned and company owned PFS such as Shell while supermarket

owned PFS are continuing to grow. It involves Tesco, Asda who sells fuel under its own brand

name (Rhodes, 2014). Main reason behind the growth of supermarket owned PFS is because

such companies are even growing their business in retail grocery sector. Therefore, such

businesses possess higher volumes and have more fuelling positions in relation to dealer owned

and company owned PFS. Hence, it results in reducing the number of PFS of Shell and BP and

increase the market share in terms of fuel volume of supermarket owned PFS. In the years 2011,

supermarkets such as Asda, Tesco owns a market share of around 39% in total fuel volumes sold

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

while there share in holding number of petrol filling stations was only 15% (Da Silva and et. al.,

2014).

Impact of Government and regulatory policies

It can be stated that UK government develops different regulatory policies in regard of

supply of oil and gas reserves. However, through development of such policies it affects the

closing down of petrol filling stations so that its number decreases up to a great extent.

Government develops legislation in order to provide license to various hypermarkets in order to

start their independent PFS and thus provide oil to consumers at low and attractive prices.

It can be assessed that the North Seas oil fields are carrying out losses of money for every

barrel they produce. Further, in future exploration, investment and thus it decreases thousands of

jobs because of fall in global oil prices.

Distribution, storage and transportation

Distribution, storage and transportation are the major factors that influence the supply

within the UK as it is essential for oil companies to make effective distribution channel so that

products can be delivered to consumers effectively and efficiently. Also, storage is another factor

that is essential for companies to store the crude oil and supply to the customers whenever

required. Another challenge faced by UK oil and gas retail industry in regard to independent

dealers continues to face pressure on their business models. However, fuel suppliers such as BP

and Shell faces competition from supermarkets and up to a great extent from company owned

sites they try to provide competitive prices to attract consumers (Gunn and Mont, 2014).

Moreover, on the supply side it has been assessed that over last few decades there has been some

rationalisation within distribution terminals and the secondary distribution network such as road

tankers. Here, most of the major oil companies outsource their road distribution operations and

thus it led to efficiencies and cost savings in the sector but it also results into closing of petrol

filling stations (Zlatcu, Kubinschi and Barnea, 2015).

Impact of Technology

Also, it has been assessed that within the downstream of UK oil and gas market because

of closures of different independent PFS. Further, there has been a changing mix of market

players with supermarkets gaining a larger share of market volumes through larger petrol filling

stations and sells higher annual volumes relative to companies and dealers. Supermarkets such as

Asda and Tesco are emerging and able to fulfil the demand for high volumes as they have more

2014).

Impact of Government and regulatory policies

It can be stated that UK government develops different regulatory policies in regard of

supply of oil and gas reserves. However, through development of such policies it affects the

closing down of petrol filling stations so that its number decreases up to a great extent.

Government develops legislation in order to provide license to various hypermarkets in order to

start their independent PFS and thus provide oil to consumers at low and attractive prices.

It can be assessed that the North Seas oil fields are carrying out losses of money for every

barrel they produce. Further, in future exploration, investment and thus it decreases thousands of

jobs because of fall in global oil prices.

Distribution, storage and transportation

Distribution, storage and transportation are the major factors that influence the supply

within the UK as it is essential for oil companies to make effective distribution channel so that

products can be delivered to consumers effectively and efficiently. Also, storage is another factor

that is essential for companies to store the crude oil and supply to the customers whenever

required. Another challenge faced by UK oil and gas retail industry in regard to independent

dealers continues to face pressure on their business models. However, fuel suppliers such as BP

and Shell faces competition from supermarkets and up to a great extent from company owned

sites they try to provide competitive prices to attract consumers (Gunn and Mont, 2014).

Moreover, on the supply side it has been assessed that over last few decades there has been some

rationalisation within distribution terminals and the secondary distribution network such as road

tankers. Here, most of the major oil companies outsource their road distribution operations and

thus it led to efficiencies and cost savings in the sector but it also results into closing of petrol

filling stations (Zlatcu, Kubinschi and Barnea, 2015).

Impact of Technology

Also, it has been assessed that within the downstream of UK oil and gas market because

of closures of different independent PFS. Further, there has been a changing mix of market

players with supermarkets gaining a larger share of market volumes through larger petrol filling

stations and sells higher annual volumes relative to companies and dealers. Supermarkets such as

Asda and Tesco are emerging and able to fulfil the demand for high volumes as they have more

storage capacity (Valadkhani, Smyth and Vahid, 2015). Further, government also introduces

effective technology such as oil tankers using bio gas fuel and do not uses oil or petrol that helps

in making cost effective supply. Another change introduced in the supply of UK petroleum

market is that there has been considerable fragmentation in the fuel supply chain over last few

years. It involves rationalisation of storage terminals, outsourcing of fuel road distribution

network and introducing innovative technology etc (Polemis and Fotis, 2014).

3.0 CHANGES IN THE OWNERSHIP OF PETROL SUPPLIERS

It has been identified that because of entry and growth of supermarkets in the fuel

retailing business it helps in providing tough competition to other major suppliers such as BP and

Shell. Hypermarkets such as Tesco and Asda own around 14% of petrol filling stations within

UK but they supply more than 40% of total road fuel volumes. Therefore, as compared to their

market share they are high in fuel volumes (Alderighi and Baudino, 2015). Thus, it puts

competitive pressures upon independent petrol filling stations such as Shell and oil companies

like BP. Within the last 1 decade, oil companies have decreased their market share in fuel

retailing. For instance, through a recent survey by the oil and gas industry, Tesco has recently

overcome BP as the largest retailer in terms of fuel volumes sold. It has been identified that PFS

owned by retail industries are consistent because of growth of supermarkets in the grocery

retailing business (Jones, Hillier and Comfort, 2015). Furthermore, retail businesses keep their

prices minimum as compared to BP and Shell and thus consumers prefer more to purchase fuel

from such hypermarkets owned PFS. Hypermarkets also introduce different attractive price

discounts at several times in order to attract customers and increase footfall within their retail

stores.

effective technology such as oil tankers using bio gas fuel and do not uses oil or petrol that helps

in making cost effective supply. Another change introduced in the supply of UK petroleum

market is that there has been considerable fragmentation in the fuel supply chain over last few

years. It involves rationalisation of storage terminals, outsourcing of fuel road distribution

network and introducing innovative technology etc (Polemis and Fotis, 2014).

3.0 CHANGES IN THE OWNERSHIP OF PETROL SUPPLIERS

It has been identified that because of entry and growth of supermarkets in the fuel

retailing business it helps in providing tough competition to other major suppliers such as BP and

Shell. Hypermarkets such as Tesco and Asda own around 14% of petrol filling stations within

UK but they supply more than 40% of total road fuel volumes. Therefore, as compared to their

market share they are high in fuel volumes (Alderighi and Baudino, 2015). Thus, it puts

competitive pressures upon independent petrol filling stations such as Shell and oil companies

like BP. Within the last 1 decade, oil companies have decreased their market share in fuel

retailing. For instance, through a recent survey by the oil and gas industry, Tesco has recently

overcome BP as the largest retailer in terms of fuel volumes sold. It has been identified that PFS

owned by retail industries are consistent because of growth of supermarkets in the grocery

retailing business (Jones, Hillier and Comfort, 2015). Furthermore, retail businesses keep their

prices minimum as compared to BP and Shell and thus consumers prefer more to purchase fuel

from such hypermarkets owned PFS. Hypermarkets also introduce different attractive price

discounts at several times in order to attract customers and increase footfall within their retail

stores.

You're viewing a preview

Unlock full access by subscribing today!

Illustration 1: Declining of PFS in past decades

(Source: Hood, Clarke and Clarke, 2015)

However, it has been assessed that if the prices of oil is decreasing day by day in in the

international market than also companies such as BP and Shell is enhancing their prices for fuel

because of high labour cost and other expenditures. Thus, it is another crucial recent change in

trends of supply chain. Due to regular increase in prices of fuel by BP and Shell consumers

shifted to hypermarket owners of fuel i.e. Asda, and Sainsbury's. They, provide fuel at low prices

and thus attract potential consumers.

Additionally, it has been identified that there are certain oil companies who have

expanded the fuel retailing market through focusing upon the upstream oil and gas production.

For instance, Total oil and gas company has recently disposed of its retail petrol filling station

network to Rontec while some of its PFS were sold to Shell. It is all because of decreasing in

consumer preference to fill the fuel from such independent owners and shift to hypermarket fuel

stations. Because companies like Asda and Tesco do not raise their fuel prices constantly and

provide relatively low cost prices to individuals in order to retail them for long term. The fuel

provided by supermarkets are good in the form of brand because they itself own a good brand

image in retail grocery store (Hood, Clarke and Clarke, 2015). Further, closing down of PFS

results into capital intensive because for every Pound 1 made by a PFS then they to give Pound 3

that involves cost of labour, wages etc. Thus, due to this PFS are not able to make profits and

results into closing down. Further, another reason of closing down number of PFS is that laws

(Source: Hood, Clarke and Clarke, 2015)

However, it has been assessed that if the prices of oil is decreasing day by day in in the

international market than also companies such as BP and Shell is enhancing their prices for fuel

because of high labour cost and other expenditures. Thus, it is another crucial recent change in

trends of supply chain. Due to regular increase in prices of fuel by BP and Shell consumers

shifted to hypermarket owners of fuel i.e. Asda, and Sainsbury's. They, provide fuel at low prices

and thus attract potential consumers.

Additionally, it has been identified that there are certain oil companies who have

expanded the fuel retailing market through focusing upon the upstream oil and gas production.

For instance, Total oil and gas company has recently disposed of its retail petrol filling station

network to Rontec while some of its PFS were sold to Shell. It is all because of decreasing in

consumer preference to fill the fuel from such independent owners and shift to hypermarket fuel

stations. Because companies like Asda and Tesco do not raise their fuel prices constantly and

provide relatively low cost prices to individuals in order to retail them for long term. The fuel

provided by supermarkets are good in the form of brand because they itself own a good brand

image in retail grocery store (Hood, Clarke and Clarke, 2015). Further, closing down of PFS

results into capital intensive because for every Pound 1 made by a PFS then they to give Pound 3

that involves cost of labour, wages etc. Thus, due to this PFS are not able to make profits and

results into closing down. Further, another reason of closing down number of PFS is that laws

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

and regulations and environmental standards are not appropriate that impacts the PFS closing

down.

Thus, expanding their business in oil and gas segment, it is essential for firm to undertake

competitive prices in order to attract potential buyers and enhance their sales of fuel volumes

which are increasing day by day as compared to Shell and BP. However, in the late 1980's the

growth of supermarket in fuel retailing has been noticed. Main aim of opening a PFS at a

supermarket location is to attract consumers to the main retail store. Therefore, company

provides various promotional offers such as discount on fuel and which can be availed while

shopping in the retail store (von Rosenstiel, Heuermann and Hüsig, 2015). Thus, such

promotions can help in benefiting retailers such as Asda, Tesco, Sainsbury and Morrisons.

Illustration 2: Asda PFS

(Source: Abdelrehim, Maltby and Toms, 2015)

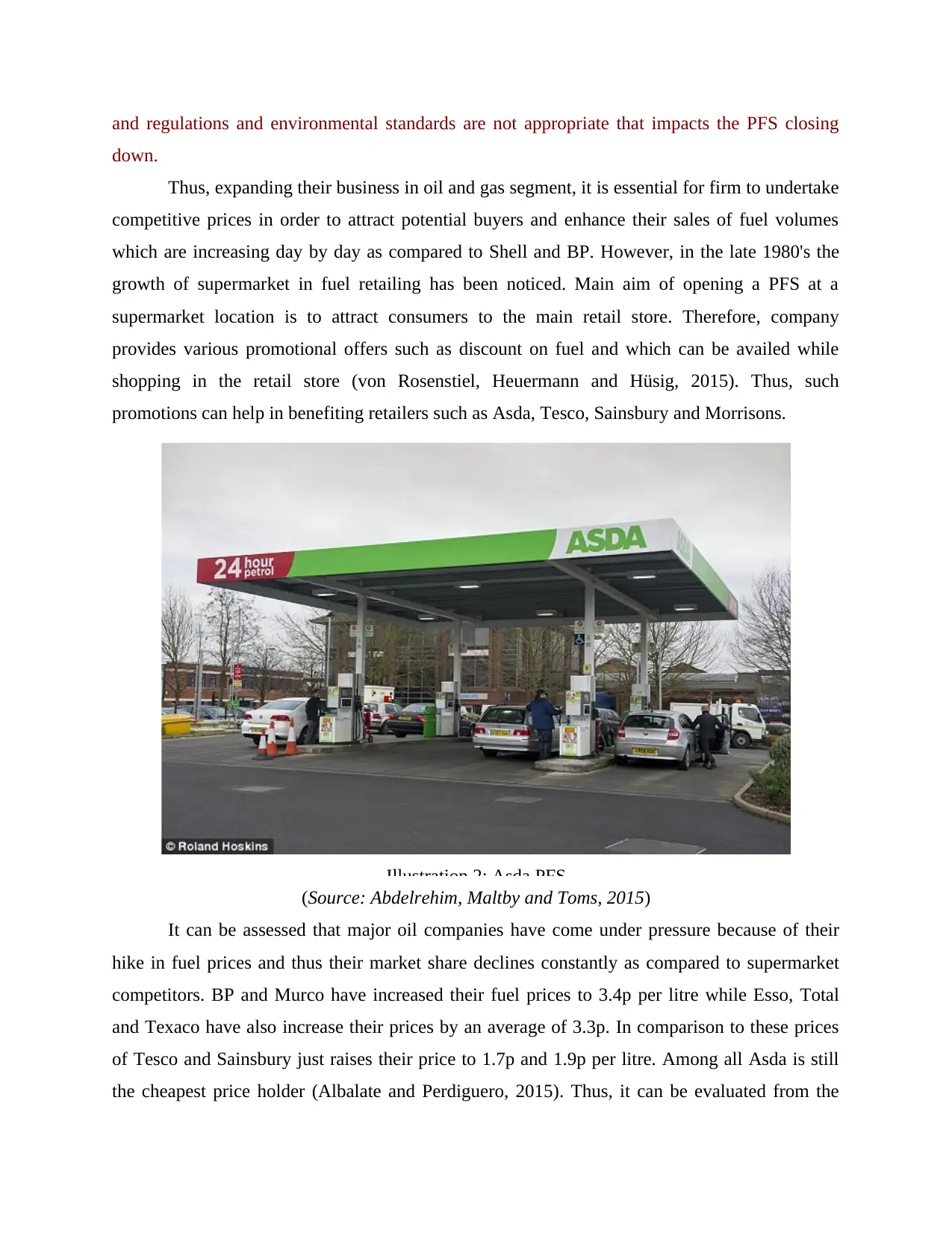

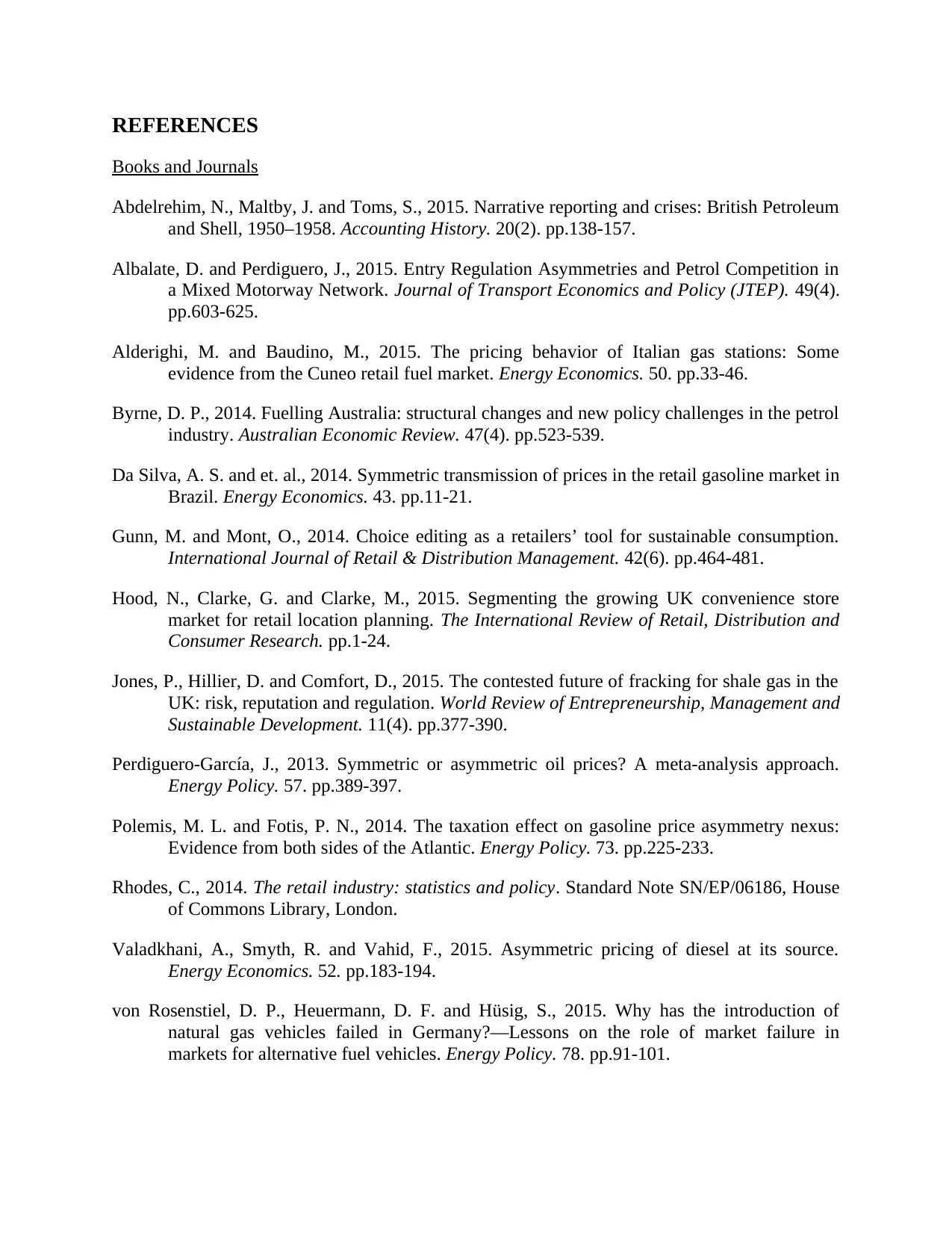

It can be assessed that major oil companies have come under pressure because of their

hike in fuel prices and thus their market share declines constantly as compared to supermarket

competitors. BP and Murco have increased their fuel prices to 3.4p per litre while Esso, Total

and Texaco have also increase their prices by an average of 3.3p. In comparison to these prices

of Tesco and Sainsbury just raises their price to 1.7p and 1.9p per litre. Among all Asda is still

the cheapest price holder (Albalate and Perdiguero, 2015). Thus, it can be evaluated from the

down.

Thus, expanding their business in oil and gas segment, it is essential for firm to undertake

competitive prices in order to attract potential buyers and enhance their sales of fuel volumes

which are increasing day by day as compared to Shell and BP. However, in the late 1980's the

growth of supermarket in fuel retailing has been noticed. Main aim of opening a PFS at a

supermarket location is to attract consumers to the main retail store. Therefore, company

provides various promotional offers such as discount on fuel and which can be availed while

shopping in the retail store (von Rosenstiel, Heuermann and Hüsig, 2015). Thus, such

promotions can help in benefiting retailers such as Asda, Tesco, Sainsbury and Morrisons.

Illustration 2: Asda PFS

(Source: Abdelrehim, Maltby and Toms, 2015)

It can be assessed that major oil companies have come under pressure because of their

hike in fuel prices and thus their market share declines constantly as compared to supermarket

competitors. BP and Murco have increased their fuel prices to 3.4p per litre while Esso, Total

and Texaco have also increase their prices by an average of 3.3p. In comparison to these prices

of Tesco and Sainsbury just raises their price to 1.7p and 1.9p per litre. Among all Asda is still

the cheapest price holder (Albalate and Perdiguero, 2015). Thus, it can be evaluated from the

below table that there are different oil companies providing different price range for fuel. But it

shows that hypermarket owners provide fuel at relatively low prices as compared to other

independent owners such as BP and Shell. Therefore, consumers are more likely to purchase fuel

from PFS of Asda. Tesco and Salisbury because they also provide attractive discount prices to

attract potential consumers to visit their retail store and enhance the sales of grocery as well

(Wang, 2015).

Illustration 3: Rising of petrol prices of different companies

(Source: Mitchell, 2012)

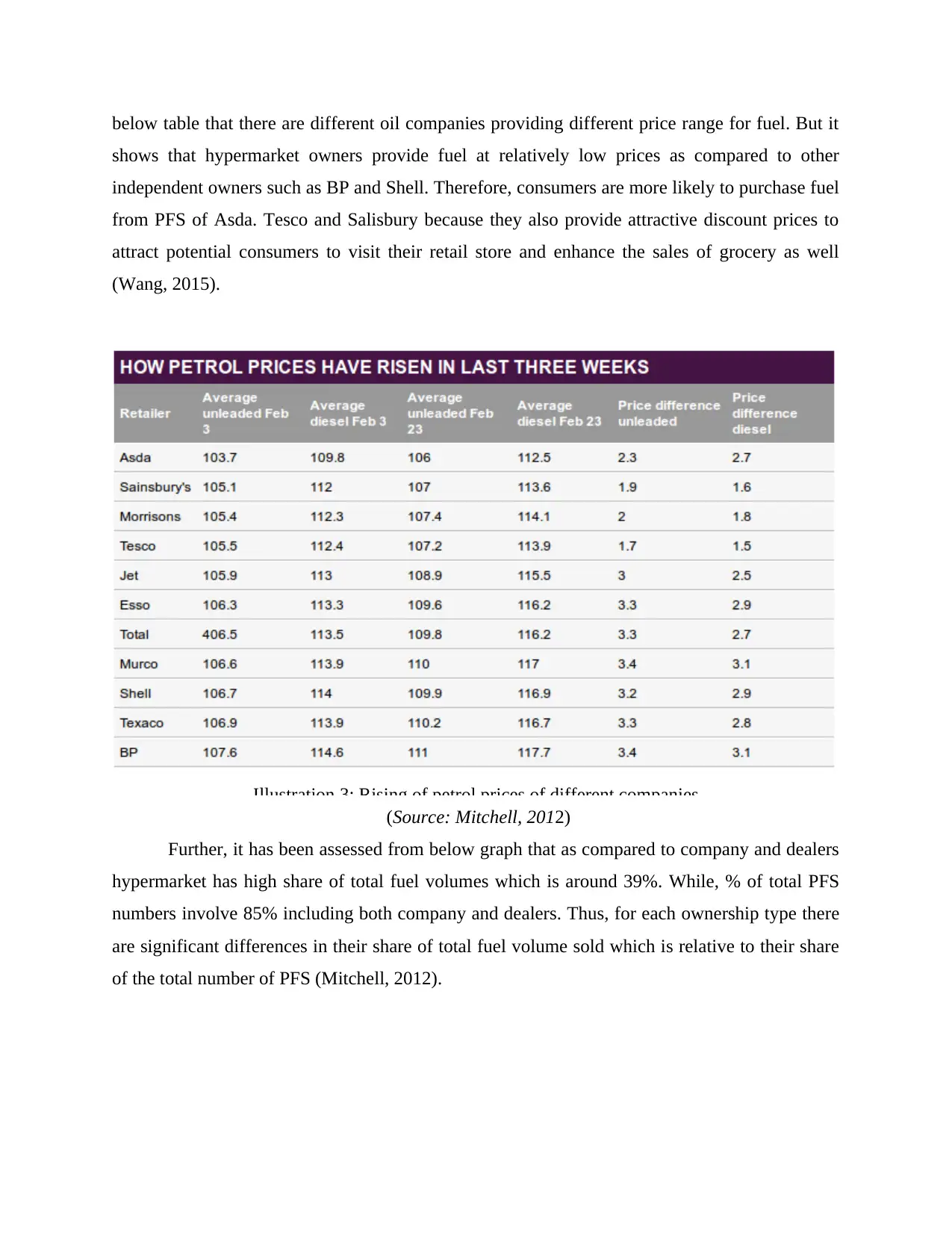

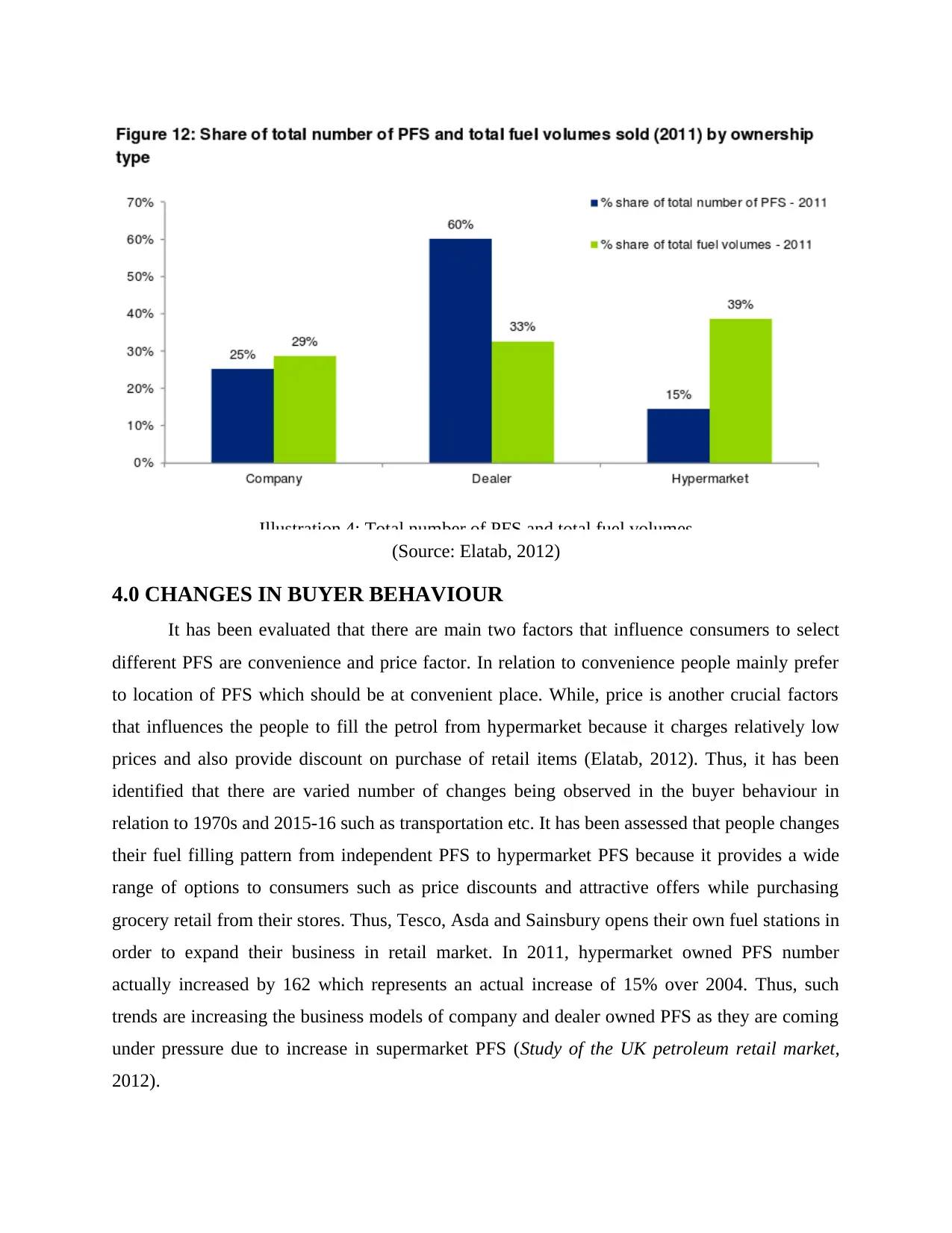

Further, it has been assessed from below graph that as compared to company and dealers

hypermarket has high share of total fuel volumes which is around 39%. While, % of total PFS

numbers involve 85% including both company and dealers. Thus, for each ownership type there

are significant differences in their share of total fuel volume sold which is relative to their share

of the total number of PFS (Mitchell, 2012).

shows that hypermarket owners provide fuel at relatively low prices as compared to other

independent owners such as BP and Shell. Therefore, consumers are more likely to purchase fuel

from PFS of Asda. Tesco and Salisbury because they also provide attractive discount prices to

attract potential consumers to visit their retail store and enhance the sales of grocery as well

(Wang, 2015).

Illustration 3: Rising of petrol prices of different companies

(Source: Mitchell, 2012)

Further, it has been assessed from below graph that as compared to company and dealers

hypermarket has high share of total fuel volumes which is around 39%. While, % of total PFS

numbers involve 85% including both company and dealers. Thus, for each ownership type there

are significant differences in their share of total fuel volume sold which is relative to their share

of the total number of PFS (Mitchell, 2012).

You're viewing a preview

Unlock full access by subscribing today!

Illustration 4: Total number of PFS and total fuel volumes

(Source: Elatab, 2012)

4.0 CHANGES IN BUYER BEHAVIOUR

It has been evaluated that there are main two factors that influence consumers to select

different PFS are convenience and price factor. In relation to convenience people mainly prefer

to location of PFS which should be at convenient place. While, price is another crucial factors

that influences the people to fill the petrol from hypermarket because it charges relatively low

prices and also provide discount on purchase of retail items (Elatab, 2012). Thus, it has been

identified that there are varied number of changes being observed in the buyer behaviour in

relation to 1970s and 2015-16 such as transportation etc. It has been assessed that people changes

their fuel filling pattern from independent PFS to hypermarket PFS because it provides a wide

range of options to consumers such as price discounts and attractive offers while purchasing

grocery retail from their stores. Thus, Tesco, Asda and Sainsbury opens their own fuel stations in

order to expand their business in retail market. In 2011, hypermarket owned PFS number

actually increased by 162 which represents an actual increase of 15% over 2004. Thus, such

trends are increasing the business models of company and dealer owned PFS as they are coming

under pressure due to increase in supermarket PFS (Study of the UK petroleum retail market,

2012).

(Source: Elatab, 2012)

4.0 CHANGES IN BUYER BEHAVIOUR

It has been evaluated that there are main two factors that influence consumers to select

different PFS are convenience and price factor. In relation to convenience people mainly prefer

to location of PFS which should be at convenient place. While, price is another crucial factors

that influences the people to fill the petrol from hypermarket because it charges relatively low

prices and also provide discount on purchase of retail items (Elatab, 2012). Thus, it has been

identified that there are varied number of changes being observed in the buyer behaviour in

relation to 1970s and 2015-16 such as transportation etc. It has been assessed that people changes

their fuel filling pattern from independent PFS to hypermarket PFS because it provides a wide

range of options to consumers such as price discounts and attractive offers while purchasing

grocery retail from their stores. Thus, Tesco, Asda and Sainsbury opens their own fuel stations in

order to expand their business in retail market. In 2011, hypermarket owned PFS number

actually increased by 162 which represents an actual increase of 15% over 2004. Thus, such

trends are increasing the business models of company and dealer owned PFS as they are coming

under pressure due to increase in supermarket PFS (Study of the UK petroleum retail market,

2012).

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Moreover, it also changes buyer behaviour pattern as earlier they have no option either to

purchase fuel from Shell or BP but in recent time hypermarket such as Tesco, Asda and

Sainsbury also started their fuel stations that attracted customers because of high discounts and

schemes. Also, because of economic recession prevailing in the country, consumers are using

public mode of transportation that decreases the demand of fuel consumption. Thus, it declines

the number of PFS and thus breakdown in 2004 and 2011 (Byrne, 2014). However, there has

been a significant change in the petroleum retailing market in 2011-2012. Due to decline in

buying behaviour of consumers, Total one of the major fuel retailer sold its company owned

petrol filling station network to Rontec by the end of 2011. Consumers buyer behaviour patterns

also changes in the mix of fuel consumed between petrol and diesel due to the increasing number

of diesel vehicles in UK. The major costs that involve fuel transportation i.e. to a terminal or

depot, storage and distribution to PFS and the cost of operating a PFS (Rhodes, 2014).

5.0 IMPACT OF TECHNOLOGY

It has been assessed that average fuel consumption of vehicles is a crucial factor that

drives total volumes of retail fuels in the market. Thus, new car fuel consumption has been

improving over the last 10 years as care manufacturing firms are developing new technologies \

in order to reduce the overall level of carbon emission. Further, companies are also introducing

improvements in vehicle technology and thus introduce electric vehicles that also reduces oil

demand in market (Da Silva and et. al., 2014). Also, introducing innovative fuel efficient

products in the auto mobile sector leads to improve the market share and thus enhance the sales

and profitability. Moreover, there are huge technological changes such as mainly in relation to

CO2 and taxation in regard to improve the vehicle technology and thus introduce electric

vehicles in result to decrease the oil demand. Japan and China are working on such factors in

order to develop innovative technology so that oil consumption can be minimized in order to

safeguard the natural reserves. Japan is working effectively in order to enhance the fuel

efficiency standards based on the weight so that hybrid electric vehicle are now becoming the

new trend setter for the coming years (Polemis and Fotis, 2014).

Thus, introducing such innovative technology helps in reduces approximately 2% of fuel

consumption. Further, developing effective policy option in order to focus on efficiency

standards also helps in creating employment in the vehicle manufacturing sector and thus

supports the role of European automotive industry in regard to develop technologies for the

purchase fuel from Shell or BP but in recent time hypermarket such as Tesco, Asda and

Sainsbury also started their fuel stations that attracted customers because of high discounts and

schemes. Also, because of economic recession prevailing in the country, consumers are using

public mode of transportation that decreases the demand of fuel consumption. Thus, it declines

the number of PFS and thus breakdown in 2004 and 2011 (Byrne, 2014). However, there has

been a significant change in the petroleum retailing market in 2011-2012. Due to decline in

buying behaviour of consumers, Total one of the major fuel retailer sold its company owned

petrol filling station network to Rontec by the end of 2011. Consumers buyer behaviour patterns

also changes in the mix of fuel consumed between petrol and diesel due to the increasing number

of diesel vehicles in UK. The major costs that involve fuel transportation i.e. to a terminal or

depot, storage and distribution to PFS and the cost of operating a PFS (Rhodes, 2014).

5.0 IMPACT OF TECHNOLOGY

It has been assessed that average fuel consumption of vehicles is a crucial factor that

drives total volumes of retail fuels in the market. Thus, new car fuel consumption has been

improving over the last 10 years as care manufacturing firms are developing new technologies \

in order to reduce the overall level of carbon emission. Further, companies are also introducing

improvements in vehicle technology and thus introduce electric vehicles that also reduces oil

demand in market (Da Silva and et. al., 2014). Also, introducing innovative fuel efficient

products in the auto mobile sector leads to improve the market share and thus enhance the sales

and profitability. Moreover, there are huge technological changes such as mainly in relation to

CO2 and taxation in regard to improve the vehicle technology and thus introduce electric

vehicles in result to decrease the oil demand. Japan and China are working on such factors in

order to develop innovative technology so that oil consumption can be minimized in order to

safeguard the natural reserves. Japan is working effectively in order to enhance the fuel

efficiency standards based on the weight so that hybrid electric vehicle are now becoming the

new trend setter for the coming years (Polemis and Fotis, 2014).

Thus, introducing such innovative technology helps in reduces approximately 2% of fuel

consumption. Further, developing effective policy option in order to focus on efficiency

standards also helps in creating employment in the vehicle manufacturing sector and thus

supports the role of European automotive industry in regard to develop technologies for the

future so that transportation can be enhanced (Zlatcu, Kubinschi and Barnea, 2015).Thus,

companies are focusing upon improving the technology of automobiles so that they can provide

fuel efficient or electric vehicles to consumers in order to decrease the rate of fuel consumption

and thus it ultimately decrease the demand of oil and fuel in market which affects the companies

such as Shell and BP.

6.0 CONCLUSION

It can be concluded from the study that recent trends and changes within the supply chain

of UK petroleum retail market has adverse effect upon the oil and gas industry. Also, it has been

identified the major supplier of fuel i.e. Shell and BP market share has been declining in

comparison of hypermarkets owned PFS i.e. Asda and Tesco. The behaviour of consumers have

changed over time because Shell and BP changes their price on a constant basis while Asda and

Tesco keeps a lower price structure in order to enhance the sales and profitability. They also

provide attractive offers and discounts to influence customer towards the retail store.

companies are focusing upon improving the technology of automobiles so that they can provide

fuel efficient or electric vehicles to consumers in order to decrease the rate of fuel consumption

and thus it ultimately decrease the demand of oil and fuel in market which affects the companies

such as Shell and BP.

6.0 CONCLUSION

It can be concluded from the study that recent trends and changes within the supply chain

of UK petroleum retail market has adverse effect upon the oil and gas industry. Also, it has been

identified the major supplier of fuel i.e. Shell and BP market share has been declining in

comparison of hypermarkets owned PFS i.e. Asda and Tesco. The behaviour of consumers have

changed over time because Shell and BP changes their price on a constant basis while Asda and

Tesco keeps a lower price structure in order to enhance the sales and profitability. They also

provide attractive offers and discounts to influence customer towards the retail store.

You're viewing a preview

Unlock full access by subscribing today!

REFERENCES

Books and Journals

Abdelrehim, N., Maltby, J. and Toms, S., 2015. Narrative reporting and crises: British Petroleum

and Shell, 1950–1958. Accounting History. 20(2). pp.138-157.

Albalate, D. and Perdiguero, J., 2015. Entry Regulation Asymmetries and Petrol Competition in

a Mixed Motorway Network. Journal of Transport Economics and Policy (JTEP). 49(4).

pp.603-625.

Alderighi, M. and Baudino, M., 2015. The pricing behavior of Italian gas stations: Some

evidence from the Cuneo retail fuel market. Energy Economics. 50. pp.33-46.

Byrne, D. P., 2014. Fuelling Australia: structural changes and new policy challenges in the petrol

industry. Australian Economic Review. 47(4). pp.523-539.

Da Silva, A. S. and et. al., 2014. Symmetric transmission of prices in the retail gasoline market in

Brazil. Energy Economics. 43. pp.11-21.

Gunn, M. and Mont, O., 2014. Choice editing as a retailers’ tool for sustainable consumption.

International Journal of Retail & Distribution Management. 42(6). pp.464-481.

Hood, N., Clarke, G. and Clarke, M., 2015. Segmenting the growing UK convenience store

market for retail location planning. The International Review of Retail, Distribution and

Consumer Research. pp.1-24.

Jones, P., Hillier, D. and Comfort, D., 2015. The contested future of fracking for shale gas in the

UK: risk, reputation and regulation. World Review of Entrepreneurship, Management and

Sustainable Development. 11(4). pp.377-390.

Perdiguero-García, J., 2013. Symmetric or asymmetric oil prices? A meta-analysis approach.

Energy Policy. 57. pp.389-397.

Polemis, M. L. and Fotis, P. N., 2014. The taxation effect on gasoline price asymmetry nexus:

Evidence from both sides of the Atlantic. Energy Policy. 73. pp.225-233.

Rhodes, C., 2014. The retail industry: statistics and policy. Standard Note SN/EP/06186, House

of Commons Library, London.

Valadkhani, A., Smyth, R. and Vahid, F., 2015. Asymmetric pricing of diesel at its source.

Energy Economics. 52. pp.183-194.

von Rosenstiel, D. P., Heuermann, D. F. and Hüsig, S., 2015. Why has the introduction of

natural gas vehicles failed in Germany?—Lessons on the role of market failure in

markets for alternative fuel vehicles. Energy Policy. 78. pp.91-101.

Books and Journals

Abdelrehim, N., Maltby, J. and Toms, S., 2015. Narrative reporting and crises: British Petroleum

and Shell, 1950–1958. Accounting History. 20(2). pp.138-157.

Albalate, D. and Perdiguero, J., 2015. Entry Regulation Asymmetries and Petrol Competition in

a Mixed Motorway Network. Journal of Transport Economics and Policy (JTEP). 49(4).

pp.603-625.

Alderighi, M. and Baudino, M., 2015. The pricing behavior of Italian gas stations: Some

evidence from the Cuneo retail fuel market. Energy Economics. 50. pp.33-46.

Byrne, D. P., 2014. Fuelling Australia: structural changes and new policy challenges in the petrol

industry. Australian Economic Review. 47(4). pp.523-539.

Da Silva, A. S. and et. al., 2014. Symmetric transmission of prices in the retail gasoline market in

Brazil. Energy Economics. 43. pp.11-21.

Gunn, M. and Mont, O., 2014. Choice editing as a retailers’ tool for sustainable consumption.

International Journal of Retail & Distribution Management. 42(6). pp.464-481.

Hood, N., Clarke, G. and Clarke, M., 2015. Segmenting the growing UK convenience store

market for retail location planning. The International Review of Retail, Distribution and

Consumer Research. pp.1-24.

Jones, P., Hillier, D. and Comfort, D., 2015. The contested future of fracking for shale gas in the

UK: risk, reputation and regulation. World Review of Entrepreneurship, Management and

Sustainable Development. 11(4). pp.377-390.

Perdiguero-García, J., 2013. Symmetric or asymmetric oil prices? A meta-analysis approach.

Energy Policy. 57. pp.389-397.

Polemis, M. L. and Fotis, P. N., 2014. The taxation effect on gasoline price asymmetry nexus:

Evidence from both sides of the Atlantic. Energy Policy. 73. pp.225-233.

Rhodes, C., 2014. The retail industry: statistics and policy. Standard Note SN/EP/06186, House

of Commons Library, London.

Valadkhani, A., Smyth, R. and Vahid, F., 2015. Asymmetric pricing of diesel at its source.

Energy Economics. 52. pp.183-194.

von Rosenstiel, D. P., Heuermann, D. F. and Hüsig, S., 2015. Why has the introduction of

natural gas vehicles failed in Germany?—Lessons on the role of market failure in

markets for alternative fuel vehicles. Energy Policy. 78. pp.91-101.

Paraphrase This Document

Need a fresh take? Get an instant paraphrase of this document with our AI Paraphraser

Wang, Z., 2015. Supermarkets and gasoline: An empirical study of bundled discounts. Resources

for the Future Discussion Paper. pp.15-44.

Zlatcu, I., Kubinschi, M. and Barnea, D., 2015. Fuel Price Volatility and Asymmetric

Transmission of Crude Oil Price Changes to Fuel Prices. Theoretical and Applied

Economics. 22(4). pp.33-44.

Online

Elatab, M., 2012. 5 trends in oil and gas technology, and why you should care. [Online].

Available through: <http://venturebeat.com/2012/03/28/5-trends-in-oil-gas-technology-

and-why-you-should-care/>. [Accessed on 21st March 2016].

Mitchell, J., 2012. What Next for the Oil and Gas Industry? [Online]. Available through:

<https://www.chathamhouse.org/sites/files/chathamhouse/public/Research/Energy,

%20Environment%20and%20Development/1012pr_oilgas.pdf>. [Accessed on 21st

March 2016].

Study of the UK petroleum retail market, 2012. [Online]. Available through:

<http://www.ukpia.com/docs/default-source/download/UK_Petroleum_Retail_Market_St

udy_Final_Report_v3_STC.pdf?sfvrsn=0>. [Accessed on 21st March 2016].

for the Future Discussion Paper. pp.15-44.

Zlatcu, I., Kubinschi, M. and Barnea, D., 2015. Fuel Price Volatility and Asymmetric

Transmission of Crude Oil Price Changes to Fuel Prices. Theoretical and Applied

Economics. 22(4). pp.33-44.

Online

Elatab, M., 2012. 5 trends in oil and gas technology, and why you should care. [Online].

Available through: <http://venturebeat.com/2012/03/28/5-trends-in-oil-gas-technology-

and-why-you-should-care/>. [Accessed on 21st March 2016].

Mitchell, J., 2012. What Next for the Oil and Gas Industry? [Online]. Available through:

<https://www.chathamhouse.org/sites/files/chathamhouse/public/Research/Energy,

%20Environment%20and%20Development/1012pr_oilgas.pdf>. [Accessed on 21st

March 2016].

Study of the UK petroleum retail market, 2012. [Online]. Available through:

<http://www.ukpia.com/docs/default-source/download/UK_Petroleum_Retail_Market_St

udy_Final_Report_v3_STC.pdf?sfvrsn=0>. [Accessed on 21st March 2016].

You're viewing a preview

Unlock full access by subscribing today!

1 out of 15

Related Documents

Your All-in-One AI-Powered Toolkit for Academic Success.

+13062052269

info@desklib.com

Available 24*7 on WhatsApp / Email

![[object Object]](/_next/static/media/star-bottom.7253800d.svg)

Unlock your academic potential

© 2024 | Zucol Services PVT LTD | All rights reserved.